This report and the financial statements contained herein are submitted for the general information of the shareholders of the Nebraska Fund (the "Fund"). The Fund's shares are not deposits or obligations of, or guaranteed by, any depository institution. The Fund's shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested. Neither the Fund nor the Fund's distributor is a bank.

The Nebraska Fund is distributed by Capital Investment Group, Inc., Member FINRA/SIPC, 100 E. Six Forks Road, Suite 200, Raleigh, NC 27609. There is no affiliation between the Nebraska Fund, including its principals, and Capital Investment Group, Inc.

Dear Investor,

We appreciate the opportunity to present to you the annual report for the period ending May 31st, 2018.

The Nebraska Fund was rebalanced in September 2017 with a new portfolio strategy investing in common equity shares of companies with headquarters in Nebraska, and in companies with at least 50% of their revenues or profits for goods produced or sold, investments made, or services performed in Nebraska. The state of Nebraska offers a business-friendly environment for companies from a diverse industry composition from financial services to technology and railroads. In addition to Nebraska's pro-business climate, the state continually ranks among the highest for quality of life.

Macro Commentary

As we enter the mid-point of 2018 the equity markets have transitioned from a period of historically record low volatility in 2017 to a current market characterized as choppy and more volatile. The VIX (CBOE Volatility Index), which measures the equity markets expectations of 30-day volatility had remained at a historically very low level for 2017. However, in February of 2018, volatility finally returned with the VIX spiking dramatically over 50 points, and the Dow Jones Industrial Avg and the S&P 500 both incurring a 10% drawdown from the January highs. The sell-off was driven by Fed chief Jerome Powell's comments on the strength of the economy and potential inflation. Market participants viewed these comments as an indication that a sudden inflation spike will cause the Fed to cool the economy off by aggressively raising rates. The Dow Jones incurred two 1,000+ point drops in February, and the S&P 500 incurred three drops greater than 2%. The sharp moves lower in February proved to be a typical bull market correction as the market has slowly moved higher since the February lows.

The equity markets will look to the second half of 2018 with tailwinds from strong expected corporate earnings balancing potential risks to the economy including US trade/tariff wars, yield curve flattening, and rising short term interest rates. On the positive side, S&P 500 earnings numbers and estimates appear to be weathering the trade battles. For the S&P 500 index total Q2 earnings are expected to be up +19% from the same period last year on +8.1% higher revenues. Earnings growth in the last earnings season (Q1 2018) reached its highest level in more than 7 years at +24.6% on +8.7% revenue gains. For full-year 2018, total earnings for the S&P 500 index are expected to be up +20.2% on +6.1% higher revenues. With the backdrop of robust expected earnings for the entirety of 2018, we've seen P/E multiple compression, which may signal that US equities should have positive performance in the second half of 2018. Risks to this scenario will likely center around US trade wars and rising short term interest rates causing a potential yield curve inversion. The Trump administration has given no indication that it plans to back down from trade disputes, and it appears the main targets (China, the EU, Canada) are taking the same approach. The total implemented tariffs year to date are around $85 billion, which represents 2.9% of imports and 0.4% of U.S. GDP – currently not recessionary numbers but growing nonetheless. The hundreds of billions of additional tariffs in the news, at this stage, are only a little more than threats, investigations into business practices, or tweets. It is unclear whether these threats will become actual tariffs. However, as more tariffs become implemented, and more time passes without resolutions or new trade arrangements, the higher the likelihood that these tariffs become permanent. As the tariffs continue to cause global concerns, the Fed has continued on its trajectory of gradually raising short term interest rates causing the yield curve to flatten and increasing the risk of a policy error and curve inversion. Historically, an inverted yield curve has been a reliable predictor of recessions. The economy is expanding, inflation is slightly below normal, and the labor market is very tight and the Fed is likely to continue raising rates through 2018. But the Fed's real challenge will be to continue "normalizing" rates without moving too fast, which may be made more difficult with the trade variable now in play. Because of its focus on equity investments, the Nebraska Fund has benefited from these strong tailwinds of solid economic growth, low inflation, and positive earning fundamentals during the period.

With markets today surrounded with heightened geopolitical risks, tariff wars, and uncertainty with rising US interest rates in our view it will be prudent to avoid unnecessary risks and maintain a disciplined investment philosophy. We believe we are entering a late stage bull market period where risk management and the effective use of tactical risk management will serve investors well and help them meet their goals.

Market and Fund Performance Recap

As a recap for market performance as of May 31st, the S&P 500 is up 2.02% from the beginning of 2018, and on a total return basis, the Barclays U.S. Aggregate Bond index is down -1.50%. US small cap and mid cap equities have outperformed large cap and growth has outperformed value. The YTD% returns for international developed markets have been slightly positive with the S&P Global BMI up 0.67% since the beginning of 2018 through the end of May. High Yield bonds continue to offer attractive income and yields with a slight negative return YTD. The BofA Merrill Lynch US High Yield Index was down -0.91% for the year through the end of May.

Nebraska Fund

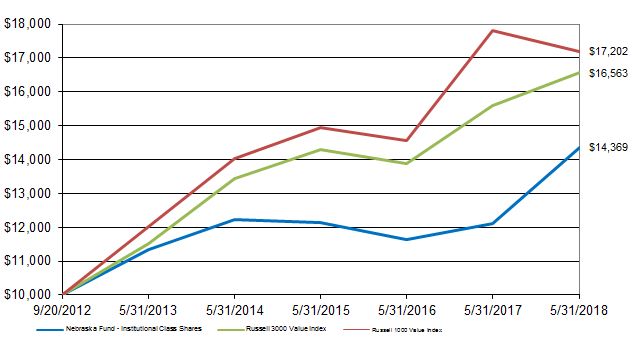

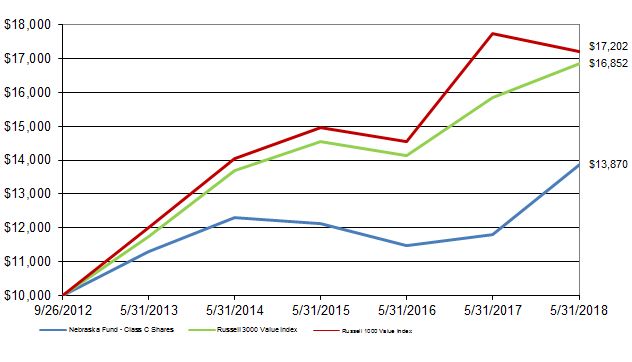

For the fiscal year ended May 31, 2018 in the Nebraska Fund, the return on the Institutional Class Shares was 18.76%, and the return on the Class C Shares was 17.43%. This compares to 6.25% for the Russell 3000 Value Index and 5.69% for the Russell 1000 Value Index over the same period. Note on September 29, 2017, the Fund's Principal Investment Strategies changed to reflect the Fund will invest primarily in common stock of publicly-traded companies that either are domiciled in Nebraska or that are economically tied to Nebraska. Performance prior to September 29, 2017 is based on the prior investment strategy utilized by the Fund.

Summary

Cavalier has designed our suite of products to be suitable for investors seeking the capture of benchmark-like performance in up markets along with the comfort of having a safety net of downside protection built into each Fund offering to reduce asset loss in bear markets. Cavalier Funds are built around the concept that investors can experience benchmark results over a full market cycle, when compared to a static asset allocation, or buy-and- hold investing, with less fear and panic during times of market duress. As markets climb higher and may reach new highs in 2018, our goal at Cavalier is to deliver investment products that can achieve market returns in bull markets and tactically seek to manage risk and downside volatility when markets eventually move into bear market territory.

Thank you for the continued opportunity to serve you.

Greg Rutherford | Scott Wetherington |

| | |

| Cavalier Investments, LLC | Cavalier Investments, LLC |

Disclosures:

The performance information quoted above represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling the Funds at 800-773-3863. Fee waivers and expense reimbursements have positively impacted the Funds' performance.

(RCNEB0718001)

| Nebraska Fund - Institutional Class Shares | | | | | | | | | | |

| Performance Update (Unaudited) | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| For the period from September 20, 2012 (Date of Initial Public Investment) through May 31, 2018 |

| | | | | | | | | | | | | | | | | | |

| Comparison of the Change in Value of a $10,000 Investment | | | | | | | | |

Nebraska Fund

Notes to Financial Statements

As of May 31, 2018

1. Organization and Significant Accounting Policies

The Nebraska Fund (the "Fund"), formerly known as the Cavalier Dividend Income Fund, is a series of the Starboard Investment Trust ("Trust"). The Trust is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended ("1940 Act"), as an open-end management investment company. The Fund is a separate, non-diversified series of the Trust.

On August 7, 2017, the name change of the Fund from the Cavalier Dividend Income Fund to the Nebraska Fund was approved via written consent by a majority of the Independent Trustees of the Starboard Investment Trust. The name change became effective on September 29, 2017.

The Fund currently has an unlimited number of authorized shares, which are divided into three classes – Institutional Class Shares, Class C Shares, and Class A Shares. Each class of shares has equal rights to assets of the Fund, and the classes are identical except for differences in ongoing distribution and service fees. The Class C Shares and Class A Shares are subject to distribution plan fees as described in Note 4. The Fund's Class C Shares are sold without an initial sales charge; however, they are subject to a contingent deferred sales charge of 1.00% paid to Capital Investment Group, Inc. (the "Distributor"). The Class A Shares are subject to an initial sales charge of 4.50%. Income, expenses (other than distribution and service fees), and realized and unrealized gains or losses on investments are allocated to each class of shares based upon its relative net assets. All classes have equal voting privileges, except where otherwise required by law or when the Trustees determine that the matter to be voted on affects only the interests of the shareholders of a particular class. Class C Shares held longer than seven years will automatically convert into Institutional Class Shares. The Institutional Class Shares commenced operations on September 20, 2012. The Class C Shares commenced operations on September 26, 2012. The Class A Shares became effective September 29, 2017, but as of May 31, 2018, the Class A Shares had not yet commenced operations.

The investment objective of the Fund is to seek equity income and capital appreciation. The Fund seeks to achieve its investment objective of equity income and capital appreciation by investing primarily in common stock of publicly-traded Domiciled Companies and Economic Companies. The Domiciled Companies have their headquarters located in Nebraska and are among the top 15 largest companies by market capitalization. The Economic Companies are those that, during a company's most recent fiscal year, derived at least 50% of their revenues or profits from goods produced or sold, investments made, or services performed in Nebraska.

The following is a summary of significant accounting policies consistently followed by the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America ("GAAP"). The Fund follows the accounting and reporting guidance in the Financial Accounting Standards Board ("FASB") Accounting Standards Codification 946 "Financial Services – Investment Companies," and Financial Accounting Standards Update ("ASU") 2013-08.

Investment Valuation

Securities listed on an exchange or quoted on a national market system are valued at the last sales price as of 4:00 p.m. Eastern Time. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. Other securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the mean of the most recent bid and ask prices. Instruments with maturities of 60 days or less are valued at amortized cost, which approximates market value. Investments in open-end companies are valued at their respective net asset values as reported by such investment companies. Securities and assets for which representative market quotations are not readily available (e.g. if the exchange on which a security is principally traded closes early or if trading of the particular security is halted during the day and does not resume prior to the Fund's net asset value calculation), or which cannot be accurately valued using the Fund's normal pricing procedures, are valued at fair value as determined in good faith under policies approved by the Board of Trustees (the "Trustees"). A security's "fair value" price may differ from the price next available for that security using the Fund's normal pricing procedures.

(Continued)

Nebraska Fund

Notes to Financial Statements

As of May 31, 2018

Fair Value Measurement

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

Level 1: quoted prices in active markets for identical securities

Level 2: other significant observable inputs (including quoted prices for similar securities, interest rates, credit risk, etc.)

Level 3: significant unobservable inputs (including the Fund's own assumptions in determining fair value of investments)

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following table summarizes the inputs as of May 31, 2018 for the Fund's assets measured at fair value:

| | | |

| Investments in Securities (a) | | Total | | Level 1 | | Level 2 | | Level 3 |

| Assets | | | | | | | | |

| Common Stocks* | $ | 7,636,632 | $ | 7,636,632 | $ | - | $ | - |

| Exchange-Traded Product | | 365,433 | | 365,433 | | - | | - |

| Limited Partnerships | | 576,382 | | 576,382 | | - | | - |

| Short-Term Investment | | 239,323 | | 239,323 | | - | | - |

| Total Assets | $ | 8,817,770 | $ | 8,817,770 | $ | - | $ | - |

| | | | | | | | | |

| (a) | The Fund had no transfers into or out of Level 1, 2, or 3 during the fiscal year ended May 31, 2018. The Fund did not hold any Level 3 securities during the period. The Fund recognizes transfers at the end of the reporting period. |

*Refer to Schedule of Investments for breakdown by Sector.

Investment Transactions and Investment Income

Investment transactions are accounted for as of the date purchased or sold (trade date). Dividend income is recorded on the ex-dividend date. Interest income is recorded on the accrual basis and includes accretion and amortization of discounts and premiums. Gains and losses are determined on the identified cost basis, which is the same basis used for federal income tax purposes.

Expenses

The Fund bears expenses incurred specifically on its behalf as well as a portion of general expenses, which are allocated according to methods reviewed annually by the Trustees.

Distributions

The Fund will distribute its income and realized gains to its shareholders every year. Income dividends paid by the Fund derived from net investment income, if any, will be paid at least annually. Capital gains distributions, if any, will also be paid at least annually. Dividends and distributions to shareholders are recorded on ex-date.

(Continued)

Nebraska Fund

Notes to Financial Statements

As of May 31, 2018

Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in the net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes

No provision for income taxes is included in the accompanying financial statements, as the Fund intends to distribute to shareholders all taxable investment income and realized gains and otherwise continue to comply with Subchapter M of the Internal Revenue Code applicable to regulated investment companies.

2. Transactions with Related Parties and Service Providers

Advisor

The Fund pays a monthly fee to Cavalier Investments, LLC (the "Advisor"), calculated at the annual rate of 0.90% of the Fund's average daily net assets.

The Advisor has entered into a contractual agreement (the "Expense Limitation Agreement") with the Trust, on behalf of the Fund, under which it has agreed to waive or reduce its fees and to assume other expenses of the Fund, if necessary, in amounts that limit the Fund's total operating expenses (exclusive of those expenses and other expenditures which are capitalized in accordance with generally accepted accounting principles, acquired fund fees and expenses, other extraordinary expenses not incurred in the ordinary course of the Fund's business, expenses related to proxy filings for the shareholder meetings of the Fund, and amounts, if any, payable pursuant to a plan adopted in accordance with Rule 12b-1 under the Investment Company Act of 1940) to not more than 0.99% of the average daily net assets of the Fund for the current fiscal year. The current term of the Expense Limitation Agreement remains in effect until October 1, 2018. While there can be no assurance that the Expense Limitation Agreement will continue after that date, it is expected to continue from year-to-year thereafter.

For the fiscal year ended May 31, 2018, $41,504 in advisory fees were incurred, all of which were waived by the Advisor and $182,347 were reimbursed by the Advisor to the Fund.

There shall be no recoupment of fees waived or reimbursed by the Advisor.

Administrator

The Fund pays a monthly fee to The Nottingham Company (the "Administrator") based upon the average daily net assets of the Fund and calculated at the annual rates as shown in the schedule below subject to a minimum of $2,000 per month. The Administrator also receives a fee as to procure and pay the Fund's custodian, as additional compensation for fund accounting and recordkeeping services, and additional compensation for certain costs involved with the daily valuation of securities and as reimbursement for out-of-pocket expenses. Effective September 7, 2017, the Administrator also receives a miscellaneous compensation fee for peer group, comparative analysis, and compliance support totaling $150 per month. As of May 31, 2018, the Administrator received $1,200 in miscellaneous expenses.

Nebraska Fund

Notes to Financial Statements

As of May 31, 2018

A breakdown of the fees is provided in the following table:

| Administration Fees* | Custody Fees* | Fund Accounting Fees (minimum monthly) | Fund Accounting Fees (asset- based fee) | Blue Sky Administration Fees (annual) |

Average Net Assets | Annual Rate | Average Net Assets | Annual Rate |

| First $250 million | 0.100% | First $200 million | 0.020% | $2,250 | 0.01% | $150 per state |

| Next $250 million | 0.080% | Over $200 million | 0.009% | ($500/month each | | |

| Next $250 million | 0.060% | | | additional class) | | |

| Next $250 million | 0.050% | *Minimum monthly fees of $2,000 and $417 for Administration and Custody, respectively. |

| Next $1 billion | 0.040% |

| Over $2 billion | 0.035% |

The Fund incurred $23,999 in administration fees, $6,120 in custody fees, and $33,461 in fund accounting fees for the fiscal year ended May 31, 2018.

Compliance Services

Cipperman Compliance Services, LLC provides services as the Trust's Chief Compliance Officer. Cipperman Compliance Services, LLC is entitled to receive customary fees from the Fund for their services pursuant to the Compliance Services agreement with the Fund.

Transfer Agent

Nottingham Shareholder Services, LLC ("Transfer Agent") serves as transfer, dividend paying, and shareholder servicing agent for the Fund. For its services, the Transfer Agent is entitled to receive compensation from the Fund pursuant to the Transfer Agent's fee arrangements with the Fund. The Fund incurred $27,500 in transfer agent fees for the fiscal year ended May 31, 2018.

Distributor

Capital Investment Group, Inc. (the "Distributor") serves as the Fund's principal underwriter and distributor. For its services, the Distributor is entitled to receive compensation from the Fund pursuant to the Distributor's fee arrangements with the Fund.

3. Trustees and Officers

The Board of Trustees is responsible for the management and supervision of the Fund. The Trustees approve all significant agreements between the Trust, on behalf of the Fund, and those companies that furnish services to the Fund; review performance of the Advisor and the Fund; and oversee activities of the Fund. Officers of the Trust and Trustees who are interested persons of the Trust or the Advisor will receive no salary or fees from the Trust. Trustees who are not "interested persons" of the Trust or the Advisor within the meaning of the 1940 Act (the "Independent Trustees") receive $2,000 each year from each Fund. The Trust will reimburse each Trustee and officer of the Trust for his or her travel and other expenses relating to attendance of Board meetings. Additional fees may also be incurred during the year as special meetings are necessary in addition to the regularly scheduled meetings of the Board of Trustees.

Certain officers of the Trust may also be officers of the Administrator.

4. Distribution and Service Fees

The Board of Trustees, including a majority of the Independent Trustees, adopted a distribution and service plan pursuant to Rule 12b-1 of the 1940 Act (the "Plan") for the Class C Shares and the Class A Shares. The 1940 Act regulates the manner in which a registered investment company may assume costs of distributing and promoting the sales of its shares and servicing of its shareholder accounts. The Plan provides that each Fund may incur certain costs, which may not exceed 1.00% per annum of the average daily net assets of the Class C Shares and 0.25% annum of the average daily net assets of the Class A Shares for each year elapsed subsequent to adoption of the Plan, for payment to the Distributor and others for items such as advertising expenses, selling expenses, commissions, travel, or other expenses reasonably intended to result in sales of Class C Shares and Class A Shares or servicing of Class C and Class A shareholder accounts.

(Continued)

Nebraska Fund

Notes to Financial Statements

As of May 31, 2018

The Class C Shares incurred $826 in Distribution and Service Fees during the fiscal year ended May 31, 2018. As of May 31, 2018, the Class A Shares had not yet commenced operations.

5. Purchases and Sales of Investment Securities

For the fiscal year ended May 31, 2018, the aggregate cost of purchases and proceeds from sales of investment securities (excluding short-term securities) were as follows:

| Purchases of Securities | Proceeds from Sales of Securities |

| $9,079,555 | $1,688,979 |

There were no long-term purchases or sales of U.S Government Obligations during the fiscal year ended May 31, 2018.

6. Federal Income Tax

Distributions are determined in accordance with Federal income tax regulations, which differ from GAAP, and, therefore, may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character, but are not adjusted for temporary differences.

Management reviewed the Fund's tax positions to be taken on federal income tax returns for the open tax years of May 31, 2015 through May 31, 2018 and determined that the Fund does not have a liability for uncertain tax positions. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the fiscal year ended May 31, 2018, the Fund did not incur any interest or penalties.

Distributions during the year ended were characterized for tax purposes as follows:

| | | | May 31, 2018 | May 31, 2017 |

| Ordinary Income | $ 35,663 | $ 4,020 |

| Return of Capital | - | 6,747 |

| Long-Term Capital Gain | - | - |

Nebraska Fund

Notes to Financial Statements

As of May 31, 2018

At May 31, 2018, the tax-basis cost of investments and components of distributable earnings were as follows:

| Cost of Investments | $ | 8,497,025 |

| | | |

| Unrealized Appreciation | $ | 510,069 |

| Unrealized Depreciation | | (189,324) |

| Net Unrealized Appreciation | $ | 320,745 |

| | | |

| Undistributed Ordinary Income | | 216 |

| Capital Loss Carryforward | | (68,032) |

| | | |

| Distributable Earnings | $ | 252,929 |

| | | |

The difference between components of distributable earnings on a tax basis and the amounts reflected in the Statement of Assets and Liabilities are primarily due to distributions paid during the fiscal year. The Fund has a capital loss carryforward of $68,032, of which $4,590 is short-term in nature and $63,442 is long-term in nature, and have no expiration.

7. Concentration of Risk

As of May 31, 2018, the percentage of net assets invested in the Financials sector was 25.58%. As of May 31, 2018, the percentage of net assets invested in the Industrials sector was 32.10%.

8. Commitments and Contingencies

Under the Trust's organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Trust entered into contracts with its service providers, on behalf of the Fund, and others that provide for general indemnifications. The Fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. The Fund expects risk of loss to be remote.

9. Subsequent Events

In accordance with GAAP, management has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date of issuance of these financial statements.

Distributions

Per share distributions during the subsequent period were as follows:

Class | Record Date | Pay Date | Ordinary Income |

| | | | |

| Institutional | 7/26/2018 | 7/27/2018 | $0.01253 |

| Class C | 7/26/2018 | 7/27/2018 | 0.00057 |

| | | | |

Management has concluded there are no additional matters, other than those noted above, requiring recognition or disclosure.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of Starboard Investment Trust

and the Shareholders of Nebraska Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Nebraska Fund (formerly, Cavalier Dividend Income Fund), a series of shares of beneficial interest in Starboard Investment Trust (the "Fund"), including the schedule of investments, as of May 31, 2018, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the five-year period then ended, and the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of May 31, 2018, and the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended and its financial highlights for each of the years in the five-year period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Fund in accordance with the U.S. federal securities law and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risk of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of May 31, 2018 by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

BBD, LLP

We have served as the auditor of one or more of the Funds in the Starboard Investment Trust since 2012.

Philadelphia, Pennsylvania

July 30, 2018

Nebraska Fund

Additional Information (Unaudited)

As of May 31, 2018

1. Proxy Voting Policies and Voting Record

A copy of the Trust's Proxy Voting and Disclosure Policy and the Advisor's Disclosure Policy are included as Appendix B to the Fund's Statement of Additional Information and are available, without charge, upon request, by calling 800-773-3863, and on the website of the Securities and Exchange Commission ("SEC") at sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (1) without charge, upon request, by calling the Fund at the number above and (2) on the SEC's website at sec.gov.

2. Quarterly Portfolio Holdings

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund's Form N-Q is available on the SEC's website at sec.gov. You may review and make copies at the SEC's Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 800-SEC-0330. You may also obtain copies without charge, upon request, by calling the Fund at 800-773-3863.

3. Tax Information

We are required to advise you within 60 days of the Fund's fiscal year-end regarding the federal tax status of certain distributions received by shareholders during each fiscal year. The following information is provided for the Fund's fiscal year ended May 31, 2018.

During the fiscal year ended May 31, 2018, the Fund paid $35,663 in income distributions but no long-term capital gains distributions.

Dividend and distributions received by retirement plans such as IRAs, Keogh-type plans, and 403(b) plans need not be reported as taxable income. However, many retirement plans may need this information for their annual information meeting.

4. Schedule of Shareholder Expenses

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including contingent deferred sales charges on Class C Shares; and (2) ongoing costs, including management fees; distribution [and/or service] (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from December 1, 2017 through May 31, 2018.

Actual Expenses – The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (e.g., an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes – The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

(Continued)

Nebraska Fund

Additional Information (Unaudited)

As of May 31, 2018

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Nebraska Fund -Institutional Class Shares | Beginning Account Value December 1, 2017 | Ending Account Value May 31, 2018 | Expenses Paid During Period* |

Actual Hypothetical (5% annual return before expenses) | | | |

| $1,000.00 | $1,029.00 | $4.99 |

| $1,000.00 | $1,020.02 | $4.97 |

*Expenses are equal to the average account value over the period multiplied by the Fund's annualized expense ratio of 0.99%, multiplied by 182/365 (to reflect the one-half year period).

| Nebraska Fund – Class C Shares | Beginning Account Value December 1, 2017 | Ending Account Value May 31, 2018 | Expenses Paid During Period* |

Actual Hypothetical (5% annual return before expenses) | | | |

| $1,000.00 | $1,023.80 | $10.02 |

| $1,000.00 | $1,015.03 | $ 9.98 |

*Expenses are equal to the average account value over the period multiplied by the Fund's annualized expense ratio of 1.99%, multiplied by 182/365 (to reflect the one-half year period).

5. Approval of Investment Advisory Agreement and Sub-Advisory Agreement

In connection with the special Board meeting held on April 20, 2018, the Board, including a majority of the Independent Trustees, discussed the approval of (i) an interim management agreement pursuant to Rule 15a-4 of the Investment Company Act of 1940 and (ii) a new management agreement, each between the Trust and the Advisor, with respect to the Fund, which is included in the term "Funds" below (together, the "Investment Advisory Agreement").

The Trustees were assisted by legal counsel throughout the review process. The Trustees relied upon the advice of legal counsel and their own business judgment in determining the material factors to be considered in evaluating the Investment Advisory Agreement and the weight to be given to each factor considered. The conclusions reached by the Trustees were based on a comprehensive evaluation of all of the information provided and were not the result of any one factor. Moreover, each Trustee may have afforded different weight to the various factors in reaching his conclusions with respect to the approval of the Investment Advisory Agreement. In connection with their deliberations regarding approval of the Investment Advisory Agreement, the Trustees reviewed materials prepared by the Advisor.

In deciding on whether to approve the Investment Advisory Agreement, the Trustees considered numerous factors, including:

| (i) | The nature, extent, and quality of the services provided by the Advisor. In considering the nature, extent, and quality of the services provided by the Advisor, the Trustees considered the responsibilities of the Advisor under the Investment Advisory Agreement, as well as the nature, extent, and quality of the services provided by the Advisor to the Funds under the proposed Investment Advisory Agreement. In that regard, the Trustees reviewed the services to be provided by the Advisor to the Funds, including, without limitation, the anticipated quality of its investment advisory services. The Board considered the potential for disruption that could result from appointing an investment advisor other than the Advisor. The Board noted the backgrounds of the investment personnel of the Advisor who would be responsible for the day-to-day management of each Fund. The Board also considered the Advisor's efforts to promote the Funds, grow the assets of the Funds, and otherwise assist in the distribution of the Funds' shares. The information reviewed by the Board included the services to be provided by the Advisor (including the relevant personnel responsible for these services and their experience); the advisory fee for each Fund as compared to fees charged to comparable funds; the advisory fee for each Fund as compared to the advisory fee charged to each Fund under the prior advisory agreement. |

(Continued)

Nebraska Fund

Additional Information (Unaudited)

As of May 31, 2018

After reviewing the foregoing information and further information in the memorandum from the Advisor (e.g., descriptions of the Advisor's business, the Advisor's compliance programs, and the Advisor's registration documents on file with the Securities and Exchange Commission), the Board of Trustees concluded that the nature, extent, and quality of the services provided by the Advisor would be satisfactory and adequate for the Funds.

| (ii) | The investment performance of the Funds and Advisor. In considering the investment performance of the Funds and Advisor, the Trustees noted that the Funds' prior performance was attributable in part to the Funds' prior investment advisor. Thus, the ability of the Trustees to consider the investment performance of the Funds with respect to the Advisor was limited. In that regard, the Trustees noted that the Advisor was only responsible for approximately one year of the Funds' performance. Given these circumstances, the Trustees reviewed the performance of the Funds, as the Advisor would seek to continue the methodologies previously utilized in managing the Funds. The Trustees also considered the industry experience of the Advisor's personnel. It was noted that the Funds' performance since inception was similar to and comparable to its peers, outperforming some and underperforming others. Thus, after considering the Funds' investment performance since inception and the experience of the Advisor's personnel and other factors, the Board concluded that the investment performance of the Funds and the Advisor was satisfactory. |

| (iii) | The costs of the services to be provided and profits to be realized by the Advisor and its affiliates from the relationship with the Funds. In considering the costs of the services to be provided and profits to be realized by the Advisor and its affiliates from the relationship with the Funds, including any indirect benefits derived by the Advisor from the relationship with the Funds, the Trustees first noted that management fees for certain of the Funds under the Agreement would be increased. The Trustees considered the ability of the Advisor to operate the Funds economically under the current and proposed management fees. The Trustees also noted that while the proposed management fees for certain Funds would increase, the expense ratios for those Funds would generally remain the same or decrease, due to changes in how the Funds were managed (reduced acquired fund fees and expenses) or to the Expense Limitation Agreement with the Advisor. |

In considering the profitability of the Advisor in providing the services contemplated under the Investment Advisory Agreement, the Board of Trustees considered the nature of the services to be provided by the Advisor. In particular, the Trustees noted that, as presented at the Board Meeting, the Advisor would be responsible for pursuing the Funds' investment strategies by using the methodologies described in the Funds' prospectus.

The Trustees reviewed and discussed the financial stability and profitability of the Advisor. The Trustees considered that the Advisor had only commenced operations approximately one year ago. The Board considered that the Advisor provided historic and pro forma financial statements and other information bearing on financial viability, potential profitability, and other financial considerations. The Board also considered whether the Advisor would be well capitalized going forward based on the commitments of its owners. The Board noted that the overall management fee structure reflects an appropriate level of sharing of any economies of scale under current circumstances. The Board also considered any indirect benefits expected to be realized by the Advisor and its affiliates from its relationship with the Funds. The Trustees then compared the fees and expenses of the Funds (including the management fee) to other funds comparable in terms of the type of the Funds, the nature of their investment strategies, and their style of investment management, among other factors. It was noted that the proposed management fee would be similar to or higher than those of the comparable funds and the expense ratio under the proposed Investment Advisory Agreement would be comparable to those of the comparable funds. The Trustees pointed out that the Funds were smaller than the industry average and most of the comparable funds that had been identified.

Following this comparison and upon further consideration and discussion of the foregoing, the Board of Trustees concluded that the fees to be paid to the Advisor by the Funds were fair and reasonable in relation to the nature and quality of the services provided by the Advisor and that they reflected charges that were within a range of what could have been negotiated at arm's length.

(Continued)

Nebraska Fund

Additional Information (Unaudited)

As of May 31, 2018

| (iv) | The extent to which economies of scale would be realized as the Funds grow and whether the advisory fee levels reflect these economies of scale for the benefit of the Funds' investors. The Trustees reviewed the Funds' fee arrangement with the Advisor in order to evaluate the extent to which economies of scale would be realized as the Funds grow and whether the advisory fee levels reflect these economies of scale for the benefit of the Funds' investors. The Trustees reviewed the fee arrangements for breakpoints or other provisions that would allow the Funds' shareholders to benefit from economies of scale as the Funds grow. The Trustees determined that the maximum management fee would stay the same when the Funds reach higher asset levels and, therefore, did not reflect economies of scale. The Trustees noted that, given the Funds' asset levels, economies of scale were unlikely to be achievable in the near future. It was pointed out that breakpoints in the advisory fee could be reconsidered in the future. The Trustees noted that the Funds will benefit from economies of scale under the agreement with the Funds' administrator since it utilized breakpoints. The Trustees also noted that the Advisor was contractually bound to limit the Funds' expenses through an Expense Limitation Agreement. The Trustees noted the one-year term of the Expense Limitation Agreement but also noted that the Advisor intended to renew the Expense Limitation Agreement in the future. The Trustees determined that these arrangements provided potential savings for the benefit of the Funds' investors. Following further discussion of the Funds' asset levels, expectations for growth, and fee levels, the Board of Trustees determined that the Funds' fee arrangements were fair and reasonable at the present time in relation to the nature and quality of the services provided by the Advisor. |

| (v) | The Advisor's practices regarding brokerage and portfolio transactions. In considering the Advisor's practices regarding brokerage and portfolio transactions, the Trustees considered the Advisor's standards, and performance in utilizing those standards, for seeking best execution for Fund portfolio transactions. The Trustees also considered the projected portfolio turnover rate for the Funds; the method and basis for selecting and evaluating the broker-dealers used; the process by which evaluations are made of the overall reasonableness of commissions paid; the method and basis for selecting and evaluating the broker-dealers used; any anticipated allocation of portfolio business to persons affiliated with the Advisor; and the extent to which the Funds allocate portfolio business to broker-dealers who provide research, statistical, or other services (soft dollars). After further review and discussion, the Board of Trustees determined that the Advisor's practices regarding brokerage and portfolio transactions were satisfactory. |

| (vi) | The Advisor's practices regarding conflicts of interest. In considering the Advisor's practices regarding conflicts of interest, the Trustees evaluated the potential for conflicts of interest and considered such matters as the experience and ability of the advisory personnel assigned to the Funds; the basis of decisions to buy or sell securities for the Funds; and the substance and administration of the Advisor's code of ethics. Following further consideration and discussion, the Board of Trustees indicated that the Advisor's standards and practices relating to the identification and mitigation of possible conflicts of interests were satisfactory. |

Conclusion. Having reviewed and discussed in depth such information from the Advisor as the Trustees believed to be reasonably necessary to evaluate the terms of the Investment Advisory Agreement and as assisted by the advice of legal counsel, the Trustees concluded that approval of the Investment Advisory Agreement was in the best interest of the shareholders of the Fund.

6. Information about Trustees and Officers

The business and affairs of the Fund and the Trust are managed under the direction of the Board of Trustees of the Trust. Information concerning the Trustees and officers of the Trust and Fund is set forth below. Generally, each Trustee and officer serves an indefinite term or until certain circumstances such as their resignation, death, or otherwise as specified in the Trust's organizational documents. Any Trustee may be removed at a meeting of shareholders by a vote meeting the requirements of the Trust's organizational documents. The Statement of Additional Information of the Fund includes additional information about the Trustees and officers and is available, without charge, upon request by calling the Fund toll-free at 800-773-3863. The address of each Trustee and officer, unless otherwise indicated below, is 116 South Franklin Street, Rocky Mount, North Carolina 27804. The Independent Trustees each received aggregate compensation of $2,015 during the fiscal year ended May 31, 2018 from the Fund for their services to the Fund and Trust.

(Continued)

Nebraska Fund

Additional Information (Unaudited)

As of May 31, 2018

Name, Age

and Address | Position

held with

Fund or Trust | Length of Time Served | Principal Occupation

During Past 5 Years | Number of Portfolios in Fund Complex Overseen by Trustee | Other Directorships

Held by Trustee

During Past 5 Years |

| Independent Trustees |

James H. Speed, Jr.

Date of Birth: 06/1953 | Independent Trustee, Chairman | Trustee since 7/09, Chair since 5/12 | Previously President and CEO of NC Mutual Insurance Company (insurance company) from 2003 to 2015. | 16 | Independent Trustee of the Brown Capital Management Mutual Funds for its four series, Hillman Capital Management Investment Trust for its one series, Centaur Mutual Funds Trust for its one series, Chesapeake Investment Trust for its one series and WST Investment Trust for its two series (all registered investment companies). Member of Board of Directors of M&F Bancorp. Member of Board of Directors of Investors Title Company. Previously, Board of Directors of NC Mutual Life Insurance Company. |

Theo H. Pitt, Jr.

Date of Birth: 04/1936 | Independent Trustee | Since 9/10 | Senior Partner, Community Financial Institutions Consulting (financial consulting) since 1999; Partner, Pikar Properties (real estate) since 2001. | 16 | Independent Trustee of World Funds Trust for its twenty-eight series, Chesapeake Investment Trust for its one series, DGHM Investment Trust for its one series, Leeward Investment Trust for its two series and Hillman Capital Management Investment Trust for its one series (all registered investment companies). |

Michael G. Mosley

Date of Birth: 01/1953 | Independent Trustee | Since 7/10 | Owner of Commercial Realty Services (real estate) since 2004. | 16 | None. |

J. Buckley Strandberg

Date of Birth: 03/1960 | Independent Trustee | Since 7/09 | President of Standard Insurance and Realty since 1982. | 16 | None. |

| Other Officers |

Katherine M. Honey

Date of Birth: 09/1973 | President and Principal Executive Officer | Since 05/15 | EVP of The Nottingham Company since 2008. | n/a | n/a |

Ashley E. Harris Date of Birth: 03/1984 | Treasurer, Assistant Secretary and Principal Financial Officer | Since 05/15 | Fund Accounting Manager and Financial Reporting, The Nottingham Company since 2008. | n/a | n/a |

Nebraska Fund

Additional Information (Unaudited)

As of May 31, 2018

Name, Age

and Address | Position

held with

Fund or Trust | Length of Time Served | Principal Occupation

During Past 5 Years | Number of Portfolios in Fund Complex Overseen by Trustee | Other Directorships

Held by Trustee

During Past 5 Years |

Stacey Gillespie Date of Birth: 05/1974 | Chief Compliance Officer | Since 03/16 | Compliance Director, Cipperman Compliance Services, LLC (09/15-present). Formerly, Chief Compliance Officer of Boenning & Scattergood, Inc. (2013-2015) and Director of Investment Compliance at Boenning & Scattergood, Inc. (2007-2013). | n/a | n/a |

Item 2. CODE OF ETHICS.