This report and the financial statements contained herein are submitted for the general information of the shareholders of the Matisse Discounted Closed-End Fund Strategy (the “Fund”). The Fund’s shares are not deposits or obligations of, or guaranteed by, any depository institution. The Fund’s shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested. Neither the Fund nor the Fund’s distributor is a bank.

The Matisse Discounted Closed-End Fund Strategy is distributed by Capital Investment Group, Inc., Member FINRA/SIPC, 100 E. Six Forks Road, Suite 200, Raleigh, NC, 27609. There is no affiliation between the Matisse Discounted Closed-End Fund Strategy, including its principals, and Capital Investment Group, Inc.

(Unaudited)

Dear MDCEX Shareholder:

Enclosed please find the Annual Report for the Matisse Discounted Closed-End Fund Strategy (MDCEX; hereafter the “Fund”) for the period ending March 31st, 2021. The Fund formally launched on October 31st, 2012.

What a difference a year makes! As we wrote this annual letter one year ago, the global financial markets had just fallen sharply, and discounts on closed-end funds had widened dramatically, as investors panicking about COVID-19 sold just about everything. At the widest point (March 18th, 2020), discounts in the Fund’s underlying portfolio averaged 31%, and the average closed-end fund was trading at a 21% discount. Oil prices were in the tank. The Fund’s performance---both on an absolute and relative basis---was lagging its benchmarks.

Fast forward to today:

| • | Major stock markets have jumped 80+% from those March 2020 lows, with small caps, energy, and tech stocks leading the way. |

| • | Oil prices are near multi-year highs, over $60 a barrel, and many other commodities are at or near new records. |

•

| The US economy is likely in its fourth straight quarter of strong recovery, with first quarter GDP clocking in at over 6%, and the unemployment rate back down to 6% (a level it took until late 2014 to move below coming out of the 2008/2009 recession) even with many retail establishments still at least partially closed due to COVID-19 restrictions. |

•

| Democrats are now in control of both the executive and legislative branches, and the rate of government spending---already high coming into 2021---looks set to gap even higher, with tax cuts for the middle class, stimulus checks, and trillions in infrastructure spending. |

•

| Though the Fund’s portfolio remains very attractively discounted---at 17.5% as of quarter end---the average closed-end fund is now slightly less discounted than its long-run average discount. |

In brief, we believe the reopening trade is alive and well, as pent-up demand from the American consumer---juiced by government largesse and perpetually low interest rates---is driving up profits, prices, and asset values simultaneously.

As you can see from the nearby table, the Fund performed very well over the past 12 months, both absolutely and in relative terms. Digging into this further, we find that we benefitted from the reversal of nearly all the factors that negatively impacted us from 3/31/19-3/31/20.

Specifically, from 3/31/20-3/31/21:

| 1. | Most closed-end fund discounts narrowed and NAVs increased. For the 12-month period, the average closed-end fund saw its discount narrow by 4.7%. Our trading and fund selection (which has led our discount-movement-attributed performance to exceed the closed-end fund universe’s in 80% of rolling quarters since we launched the Fund) was a strong positive factor, as discount movement/capture within the Fund contributed 822 bps to our total return. |

| 2. | Offsetting the benefit from closed-end fund discounts and trading, our exposures to Foreign and Value were a negative, as the Russell 1000 Value lost to the Russell 1000 Growth by about 7 percentage points, and the MSCI EAFE index lost to the S&P 500 by about 12 percentage points for the period 3/31/20-3/31/21. Ballpark, our overweight to these areas cost us approximately 2 percentage points of relative performance. It is worth noting that, for the second half of the period (9/30/20-3/31/21), Value beat Growth and the MSCI EAFE beat the S&P 500, as the reopening trade took firmer hold. |

| 3. | Our exposure to the Energy sector, unlike 3/31/19-3/31/20, was a major positive factor. A strong rebound in oil prices helped lead to a 78% gain for large-cap energy names, and a 99% gain for MLPs from 3/31/20-3/31/21. Discounts on our MLP CEFs narrowed considerably (though they remain extremely attractive at over a 20% discount), adding to the performance contribution. Our energy and commodity holdings as a group contributed about 10 percentage points to our return for the 12 months. |

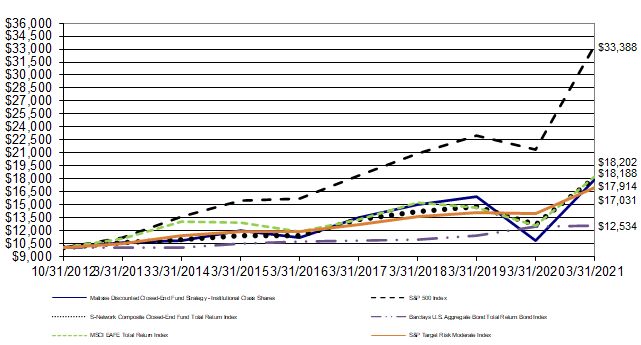

Average Annual Total Returns

Period ended March 31, 2021 | One Year | Five Year Annualized | Annualized Since Inception 10/31/2012 |

| MDCEX |

+64.68%

| +9.73% | +7.17% |

S&P 500 Index | +56.35% | +16.28% | +15.40% |

S-Network Composite Closed-End Fund Total Return Index | +43.58% | +9.81% | +7.36% |

S&P Target Risk Moderate Index | +21.79% | +7.50% | +6.53% |

MSCI EAFE Total Return Index | +44.57% | +8.85% | +7.33% |

Barclays US Aggregate Bond Total Return Index | +0.71% | +3.10% | +2.72% |

The performance information quoted represents past performance, which is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data current to the most recent month-end by calling 1-800-773-3863. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions.

The Total Annual Fund Operating Expense for the Fund as disclosed in the prospectus is 3.48% dated August 1, 2020. The Total Annual Fund Operating Expense is required to include expenses incurred indirectly by the Fund through its investments in closed-end funds and other investment companies. The Advisor has entered into an expense limitation agreement with the Fund under which it has agreed to waive or reduce its fees and to assume other expenses of the Fund, if necessary, in an amount that limits the Fund’s annual operating expenses (exclusive of (i) any 12b-1 fees; (ii) any front-end or contingent deferred loads; (iii) brokerage fees and commissions, (iv) acquired fund fees and expenses; (v) fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including, for example, option and swap fees and expenses); (vi) borrowing costs (such as interest and dividend expense on securities sold short); (vii) taxes; and (viii) extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees and contractual indemnification of Fund service providers (other than the Advisor)) to not more than 1.25% of the average daily net assets of the Fund. The Expense Limitation Agreement runs through July 31, 2021 and may be terminated by the Board of Trustees of the Fund at any time. “Acquired Fund Fees and Expenses” include expenses incurred indirectly by the Fund through its investments in closed-end funds and other investment companies, do not affect a Fund’s actual operating costs, and therefore are not included in the Fund’s financial statements, which provide a clearer picture of a Fund’s actual operating costs. The Advisor cannot recoup from the fund any amounts paid to the Advisor under the expense limitation agreement. However, net annual operating expenses for the Fund may exceed those contemplated by the waiver due to expenses that are not waived under the Expense Limitation Agreement.

Management Outlook

Right now, we continue to maintain a highly diversified portfolio with 77 holdings as of quarter-end. We began tactically increasing the Fund’s energy exposure during the second half of 2020, which now stands at 15% of the overall portfolio. Healthcare, financial services, and consumer cyclical are our next largest equity sectors, each at 9% to 10% of our portfolio. Overall, our equity exposure is right at 80%, with about one-third of that foreign.

Although the underlying portfolio of the Fund is full of closed-end funds whose discounts are still large (both in absolute terms and compared to their long-term average discount levels), we are slowly building some cash in the Fund given that discount opportunities are neither as large (nor as common) as they were throughout much of 2020. As we move forward with this process, we expect to eventually hold somewhat fewer names (perhaps 50-60 instead of 70-80), and we expect to potentially realize some long-term gains on holdings whose discounts have narrowed substantially.

To provide more color – going forward we intend to focus on reducing downside volatility by building some cash (and possibly hedging the Fund’s portfolio in various ways), so that we are prepared with more cash to potentially take advantage of any compelling discount opportunities that may arise. We believe this more conservative and cautious approach is appropriate given that most of our shareholders place MDCEX into a tactical, opportunistic bucket. After such a significant performance run-up over the last 12 months, we are now willing to give up some upside return at the expense of having more cash or for the cost of hedging. We believe that this adjusted approach may help reduce stress for our shareholders, and potentially help them avoid making any poor decisions around investment timing.

Historically speaking, discount tops in the closed-end fund market have typically manifested as long periods of meandering, narrower-than-average discounts followed by a sharp discount blowout which has tended to coincide with downside volatility across several other risk markets. Discount bottoms, on the other hand, have tended to be sharp and short-lived, and have typically been marked by major socio-economic events (the tech wreck of the early 2000s, the mortgage crisis of 2008, and the more recent COVID-19 crisis). Our primary takeaway is that holding much more than 20% cash within the Fund is not usually a wise decision. We have explored other ways to hedge the Fund as well, and may implement some of them, at low levels, at various points going forward (if or when we feel discounts are very unattractive).

But note this is not the situation we find ourselves in today. While the average discount in the entire CEF universe is 3.8% as of quarter-end (compared to a trailing 10-year average discount of 5.4%), we do not believe we are near a discount top. As a point of emphasis, the average closed-end fund discount in the entire universe has been narrower than 3.8% approximately one-third of the time. So, we believe there is still room for discounts to run barring any significant market changes. Consider that the average discount to NAV in the underlying portfolio of the Fund is 17.5% as of quarter-end.

We have previously noted and continue to believe that one important advantage for closed-end funds, in general (as we consider the overall outlook for the Fund) is today’s low interest rates. Back in 2008, the 10-year US treasury yield never fell below 2.00%. As of quarter-end, the 10-year US treasury yield was 1.74%. More importantly, the Fed has committed itself to zero rates for the foreseeable future, even stating explicitly that they will allow inflation to run above two percent “for a time” (should that ever come to pass). In our view, the structural advantages of closed-end funds (easy and cheap borrowing paired with high and largely sustainable cash distributions) will eventually be found by an increasing number of investors who ignore closed-end funds now. Investors desire yield, and closed-end funds may eventually become a mainstream and common option to satisfy investor’s income needs. If this trend is realized, then discounts could ultimately narrow for secular reasons for years to come. In our opinion, it makes closed-end fund investing that much more exciting.

Despite COVID-19, the US stock market had a great year in 2020 and has continued to move higher in 2021 (as it anticipates the reopening of the economy). The forward PE of the S&P 500 now stands at 24, well above its average of 18 over the past 30 years (and the trailing PE is an astonishing 33). The open question is whether the strong economic growth that could occur in the second half of 2021 (due to the anticipated reopening of the economy, along with record-low interest rates that could persist for many years) is sufficient to support stock prices at current levels or potentially drive them higher.

Our largest position continues to be Pershing Square Holdings, an 8.7% position for the Fund at quarter-end. This closed-end fund’s shares trade overseas (London and Amsterdam), but it is managed by US hedge fund manager Bill Ackman and contains mostly high-quality US stocks. Despite excellent underlying performance (a 110% at-NAV return over the past two years, helped by some timely March 2020 hedging), fund and manager share purchases, and a regular quarterly dividend, the fund still traded at a very high 27% discount to NAV at quarter-end. We expect this discount will not persist for long.

There are other, similar deals across the Fund’s underlying portfolio, including one trading at less than half of its NAV.

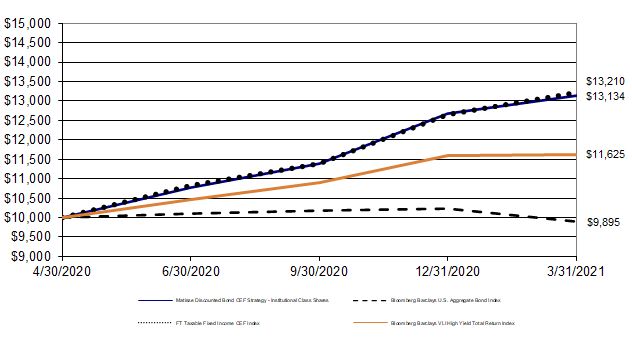

A New Fund in the Matisse Funds Family

Effective April 30th, 2020, Matisse launched our second mutual fund, the Matisse Discounted Bond CEF Strategy (MDFIX). Within it, we apply our discount-focused strategy to Bond CEFs specifically. See the new Fund’s prospectus for more information. We appreciate your interest in, and investment in, the Fund. We’ll continue to keep you updated on the important developments we see in the misunderstood, retail-dominated world of closed-end funds. Check out https://matissefunds.com/ for updates, and feel free to contact us at 503-210-3005 to discuss the Matisse Discounted Closed-End Fund Strategy and our investment approach.

Sincerely,

|  |

Eric Boughton, CFA

Portfolio Manager

Matisse Funds

| Bryn Torkelson Founder & CIO

Matisse Funds

|

(RCMAT0321008)

1. Organization and Significant Accounting Policies

The Matisse Discounted Closed-End Fund Strategy (“Fund”) is a series of the Starboard Investment Trust (“Trust”). The Trust is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Fund is a separate diversified series of the Trust.

The Fund’s investment advisor, Deschutes Portfolio Strategies, LLC, dba Matisse Capital, (the “Advisor”), seeks to achieve the Fund’s investment objective of long-term capital appreciation and income by investing in unaffiliated closed-end funds that pay regular periodic cash distributions, the interests of which typically trade at substantial discounts relative to their underlying net asset values. The Fund will invest, under normal circumstances, at least 80% of net assets, plus borrowings, for investment purposes, in discounted closed-end funds.

The following is a summary of significant accounting policies consistently followed by the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund follows the accounting and reporting guidance in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification 946 “Financial Services – Investment Companies,” and Financial Accounting Standards Update (“ASU”) 2013-08.

Investment Valuation

The Fund’s investments in securities are carried at fair value. Securities listed on an exchange or quoted on a national market system are valued at the last sales price as of 4:00 p.m. Eastern Time. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. Other securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the mean of the most recent bid and ask prices. Instruments with maturities of 60 days or less are valued at amortized cost, which approximates market value. Investments in open-end investment companies are valued at their respective net asset values as reported by such investment companies. Securities and assets for which representative market quotations are not readily available (e.g., if the exchange on which the security is principally traded closes early or if trading of the particular security is halted during the day and does not resume prior to the Fund’s net asset value calculation) or which cannot be accurately valued using the Fund’s normal pricing procedures are valued at fair value as determined in good faith under policies approved by the Trustees. A security’s “fair value” price may differ from the price next available for that security using the Fund’s normal pricing procedures. The shares of many closed-end investment companies, after their initial public offering, frequently trade at a price per share, which is different than the net asset value per share. The difference represents a market premium or market discount of such shares. There can be no assurances that the market discount or market premium on shares of any closed-end investment company purchased by the Funds will not change.

Fair Value Measurement

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

Level 1: Unadjusted quoted prices in active markets for identical securities

Level 2: Other significant observable inputs (including quoted prices for similar securities, interest rates, credit risk, etc.)

Level 3: Significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments)

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

Matisse Discounted Closed-End Fund Strategy

|

|

Notes to Financial Statements

|

|

As of March 31, 2021

|

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following table summarizes the inputs as of March 31, 2021 for the Fund’s investments measured at fair value:

| | | |

| Investments in Securities (a) | | Total | | Level 1 | | Level 2 | | Level 3 |

Closed-End Funds | $ | 328,181,386 | $ | 328,181,386 | $ | - | $ | - |

Exchange-Traded Products | | 4,156,000 | | 4,156,000 | | - | | - |

Preferred Stock | | 5,576,187 | | 5,576,187 | | - | | - |

Short-Term Investment | | 751,805 | | 751,805 | | - | | - |

| Total Assets | $ | 338,665,378 | $ | 338,665,378 | $ | - | $ | - |

| | | | | | | | | |

| (a) | The Fund had no Level 3 securities as of the fiscal year ended March 31, 2021. |

Investment Transactions and Investment Income

Investment transactions are accounted for as of the date purchased or sold (trade date). Dividend income is recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded as soon as the Fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date. Gains and losses are determined on the identified cost basis, which is the same basis used for federal income tax purposes.

Distributions

The Fund may declare and distribute dividends from net investment income, if any, quarterly. Distributions from capital gains, if any, are generally declared and distributed annually. Dividends and distributions to shareholders are recorded on ex-date.

Expenses

The Fund bears expenses incurred specifically on its behalf as well as a portion of general expenses, which are allocated according to methods reviewed annually by the Trustees.

Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in the net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes

No provision for income taxes is included in the accompanying financial statements, as the Fund intends to distribute to shareholders all taxable investment income and realized gains and otherwise comply with Subchapter M of the Internal Revenue Code applicable to regulated investment companies.

Because the underlying funds have varied expense and fee levels and the Fund may own different proportions of underlying funds at different times, the amount of fees and expense incurred indirectly by the Fund will vary.

Risk Considerations

Closed-End Fund Risk. Closed-end funds involve investment risks different from those associated with other investment companies. First, the shares of closed-end funds frequently trade at a premium or discount relative to their net asset value. When the Fund purchases shares of a closed-end fund at a discount to its net asset value, there can be no assurance that the discount will decrease, and it is possible that the discount may increase and affect whether the Fund will a realize gain or loss on the investment. Second, many closed-end funds use leverage, or borrowed money, to try to increase returns. Leverage is a speculative technique and its use by a closed-end fund entails greater risk and leads to a more volatile share price. If a close-end fund uses leverage, increases and decreases in the value of its share price will be magnified. The closed-end fund will also have to pay interest or dividends on its leverage, reducing the closed-end fund's return. Third, many closedend funds have a policy of distributing a fixed percentage of net assets regardless of the fund’s actual interest income and capital gains. Consequently, distributions by a closed-end fund may include a return of capital, which would reduce the fund’s net asset value and its earnings capacity. Finally, closed-end funds are allowed to invest in a greater amount of illiquid securities than open-end mutual funds. Investments in illiquid securities pose risks related to uncertainty in valuations, volatile market prices, and limitations on resale that may have an adverse effect on the ability of the fund to dispose of the securities promptly or at reasonable prices. Fund of Funds Risk. The Fund is a “fund of funds.” The term “fund of funds” is typically used to describe investment companies, such as the Fund, whose principal investment strategy involves investing in other investment companies, including closed-end funds and money market mutual funds. Investments in other funds subject the Fund to additional operating and management fees and expenses. For instance, investors in the Fund will indirectly bear fees and expenses charged by the funds in which the Fund invests, in addition to the Fund’s direct fees and expenses. The Fund’s performance depends in part upon the performance of the funds’ investment advisor, the strategies and instruments used by the funds, and the Advisor's ability to select funds and effectively allocate Fund assets among them.

Matisse Discounted Closed-End Fund Strategy

|

|

Notes to Financial Statements

|

|

As of March 31, 2021

|

Fund of Funds Risk. The Fund is a “fund of funds.” The term “fund of funds” is typically used to describe investment companies, such as the Fund, whose principal investment strategy involves investing in other investment companies, including closed-end funds and money market mutual funds. Investments in other funds subject the Fund to additional operating and management fees and expenses. For instance, investors in the Fund will indirectly bear fees and expenses charged by the funds in which the Fund invests, in addition to the Fund’s direct fees and expenses. The Fund’s performance depends in part upon the performance of the funds’ investment advisor, the strategies and instruments used by the funds, and the Advisor's ability to select funds and effectively allocate Fund assets among them.

COVID-19 and Other Infectious Illnesses Risk. An outbreak of infectious respiratory illness caused by a novel coronavirus known as COVID-19 was first detected in China in December 2019 and has now been detected globally. COVID-19 has resulted in travel restrictions, closed international borders, enhanced health screenings at ports of entry and elsewhere, disruption of and delays in healthcare service preparation and delivery, prolonged quarantines, cancellations, supply chain disruptions, and lower consumer demand, as well as general concern and uncertainty. The impact of COVID-19, and other infectious illness outbreaks that may arise in the future, could adversely affect the economies of many countries or the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. In addition, the impact of infectious illnesses in emerging market countries may be greater due to generally less established healthcare systems. Public health crises caused by the COVID-19 outbreak, or other infectious illness outbreaks that may arise in the future, may exacerbate other pre-existing political, social and economic risks in certain countries or globally. As such, issuers of debt securities with operations, productions, offices, and/or personnel in (or other exposure to) areas affected with the virus may experience significant disruptions to their business and/or holdings. The potential impact on the credit markets may include market illiquidity, defaults and bankruptcies, among other consequences, particularly on issuers in the airline, travel and leisure and retail sectors. The extent to which COVID-19 or other infectious illnesses will affect the Fund, the Fund’s service providers’ and/or issuer’s operations and results will depend on future developments, which are highly uncertain and cannot be predicted, including new information that may emerge concerning the severity of COVID19 or other infectious illnesses and the actions taken to contain COVID-19 or other infectious illnesses. Economies and financial markets throughout the world are becoming increasingly interconnected. As a result, whether or not the Fund invests in securities of issuers located in or with significant exposure to countries experiencing economic, political and/or financial difficulties, the value and liquidity of the Fund’s investments may be negatively affected by such events. If there is a significant decline in the value of the Fund’s portfolio, this may impact the Fund’s asset coverage levels for certain kinds of derivatives and other portfolio transactions. The duration of the COVID-19 outbreak, or any other infectious illness outbreak that may arise in the future, and its impact on the global economy cannot be determined with certainty.

Matisse Discounted Closed-End Fund Strategy

|

|

Notes to Financial Statements

|

|

As of March 31, 2021

|

2. Transactions with Related Parties and Service Providers

Advisor

The Fund pays a monthly fee to the Advisor calculated at the annual rate of 0.99% of the Fund’s average daily net assets. For the fiscal year ended March 31, 2021, $2,556,521 in advisory fees were incurred, $9 of which were waived by the Advisor.

The Advisor has entered into a contractual agreement (the “Expense Limitation Agreement”) with the Trust, on behalf of the Fund, under which it has agreed to waive or reduce its fees and to assume other expenses of the Fund, if necessary, in amounts that limit the Fund’s total operating expenses (exclusive of (i) any front-end or contingent deferred loads; (ii) brokerage fees and commissions; (iii) acquired fund fees and expenses; (iv) fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including, for example, option and swap fees and expenses); (v) borrowing costs (such as interest and dividend expense on securities sold short); (vi) taxes and (vii) extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees and contractual indemnification of Fund service providers (other than the Advisor)) to not more than 1.25% of the average daily net assets of the Fund. The current term of the Expense Limitation Agreement remains in effect until July 31, 2021. While there can be no assurance that the Expense Limitation Agreement will continue after that date, it is expected to continue from year-to-year thereafter. The Advisor cannot recoup from the Fund any expenses paid by the Advisor under the Expense Limitation Agreement.

Administrator

The Fund pays a monthly fee to the Fund’s administrator, The Nottingham Company (“the Administrator”), based upon the average daily net assets of the Fund and calculated at the annual rates as shown in the schedule below which is subject to a minimum of $2,000 per month. The Administrator also receives a fee to procure and pay the Fund’s custodian, additional compensation for fund accounting and recordkeeping services, and additional compensation for certain costs involved with the daily valuation of securities and as reimbursement for out-of-pocket expenses. The Administrator also receives a miscellaneous compensation fee for peer group, comparative analysis, and compliance support totaling $350 per month. As of March 31, 2021, the Administrator received $4,668 in miscellaneous expenses.

Matisse Discounted Closed-End Fund Strategy

|

|

Notes to Financial Statements

|

|

As of March 31, 2021

|

A breakdown of these fees is provided in the following table:

| Administration Fees* | Custody Fees* | | Fund Accounting Fees (asset-based fee) | Blue Sky Administration

Fees (annual) |

Average Net Assets | Annual Rate | Average Net Assets | Annual Rate |

(Average monthly)

|

Net Assets |

Annual Rate

| Per state |

| First $100 million | 0.100% | First $200 million | 0.020% | $2,250 | First $50 million | 0.02% | $150 |

| Next $100 million | 0.090% | Over $200 million | 0.009% | $500/ additional class | Next $50 million | 0.015% | |

| Next $100 million | 0.080% | | | | Over $100 million | 0.01% | |

| Next $100 million | 0.070% | | *Minimum monthly fees of $2,000 and $417 for Administration and Custody, respectively. |

| Next $100 million | 0.060% | |

| Over $500 million | 0.050% | |

| Over $750 million | 0.040% | | |

| Over $1 billion | 0.030% | | |

The Fund incurred $241,496 in administration fees, $60,254 in custody fees, and $52,750 in fund accounting fees for the fiscal year ended March 31, 2021.

Compliance Services

The Nottingham Company, Inc. serves as the Trust’s compliance services provider including services as the Trust’s Chief Compliance Officer. The Nottingham Company, Inc. is entitled to receive customary fees from the Fund for its services pursuant to the Compliance Services Agreement with the Fund.

Transfer Agent

Nottingham Shareholder Services, LLC (“Transfer Agent”) serves as transfer, dividend paying, and shareholder servicing agent for the Fund. For its services, the Transfer Agent is entitled to receive compensation from the Fund pursuant to the Transfer Agent’s fee arrangements with the Fund.

Distributor

Capital Investment Group, Inc. (the “Distributor”) serves as the Fund’s principal underwriter and distributor. For its services, the Distributor is entitled to receive compensation from the Fund pursuant to the Distributor’s fee arrangements with the Fund.

3. Trustees and Officers

The Trust is governed by the Board of Trustees, which is responsible for the management and supervision of the Fund. The Trustees meet periodically throughout the year to review contractual agreements with companies that furnish services to the Fund; review performance of the Advisor and the Fund; and oversee activities of the Fund. Officers of the Trust and Trustees who are interested persons of the Trust or the Advisor will receive no salary or fees from the Trust. Each Trustee who is not an “interested person” of the Trust or the Advisor within the meaning of the Investment Company Act of 1940, as amended (the “Independent Trustee”) receives $2,000 per series per year, $200 per meeting attended, and $500 per series per special meeting related to contract renewal issues. The Trust reimburses each Trustee and officer of the Trust for his or her travel and other expenses related to attendance of Board meetings. The Trust reimbursed each Trustee and officer of the Trust for his or her travel and other expenses related to attendance of Board meetings. Additional fees were incurred during the year as special meetings were necessary in addition to the regularly scheduled meetings of the Board of Trustees. Certain officers of the Trust may also be officers of the Administrator.

Matisse Discounted Closed-End Fund Strategy

|

|

Notes to Financial Statements

|

|

As of March 31, 2021

|

4. Purchases and Sales of Investment Securities

For the fiscal year ended March 31, 2021, the aggregate cost of purchases and proceeds from sales of investment securities (excluding short-term securities) were as follows:

| Purchases of Securities | Proceeds from Sales of Securities |

| $172,199,268 | $110,447,927 |

5. Federal Income Tax

Distributions are determined in accordance with Federal income tax regulations, which may differ from GAAP, and, therefore, may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. The general ledger is adjusted for permanent book/tax differences to reflect tax character but is not adjusted for temporary differences.

Management has reviewed the Fund’s tax positions to be taken on the federal income tax returns during the open years ended March 31, 2018 through March 31, 2021 and determined that the Fund does not have a liability for uncertain tax positions. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the fiscal year, the Fund did not incur any interest or penalties.

Distributions during the year or period ended were characterized for tax purposes as follows:

| | March 31, 2021

| March 31, 2020 |

Ordinary Income

| $ 29,772,933 | $ 4,669,512 |

Tax-Exempt Income

| 23,695 | 10,812 |

Long-Term Capital Gain

| -

| 2,645,141 |

Total Distribution

| $ 29,796,628

| $ 7,325,465 |

At March 31, 2021, the tax-basis cost of investments and components of distributable earnings were as follows:

| | | |

Cost of Investments | $ | 270,198,417 |

| | | |

Unrealized Appreciation | | 69,344,891 |

Unrealized Depreciation | | (877,930) |

Net Unrealized Appreciation | $ | 68,466,961 |

| | | |

Ordinary Income Spillback | | 14,069,491 |

Long-Term Capital Gain Spillback | | 2,816,241 |

Distributable Earnings | $ | 85,352,693 |

| | | |

Matisse Discounted Closed-End Fund Strategy

|

|

Notes to Financial Statements

|

|

As of March 31, 2021

|

6. Beneficial Ownership

The beneficial ownership, either directly or indirectly, of 25% or more of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a)(9) of the Investment Company Act of 1940. As of March 31, 2021, Pershing LLC held 75.45% of the Fund. The Fund has no knowledge as to whether all or any portion of the shares of record owned by Pershing LLC are also owned beneficially.

7. Commitments and Contingencies

Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Trust entered into contracts with its service providers, on behalf of the Fund, and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. The Fund expects risk of loss to be remote.

8. Borrowings

The Fund established a borrowing agreement with Interactive Brokers LLC for investment purposes subject to the limitations of the 1940 Act for borrowings by registered investment companies.

Interest is based on the Federal Funds rate plus 1.50% on the first $100,000, the Federal Funds rate plus 1.00% on the next $900,000, the Federal Funds rate plus 0.50% on balances between $1,000,000 and $3,000,000, and the Federal Funds rate plus 0.30% on balances greater than $3,000,000. The average borrowing during the fiscal year ended March 31, 2021 was $3,089,125, and the average interest rate during the same period was 1.07%.

Interest expense is charged directly to the Fund based upon actual amounts borrowed by the Fund. The Fund had $15,744,824 in borrowings as of the fiscal year ended March 31, 2021. Total interest expense for the fiscal year was $61,720 as reflected in the Statement of Operations.

9. Subsequent Events

In accordance with GAAP, management has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date of issuance of these financial statements. Management has concluded there are no additional matters, other than those noted above, requiring recognition or disclosure.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of Starboard Investment Trust

and the Shareholders of Matisse Discounted Closed-End Fund Strategy

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Matisse Discounted Closed-End Fund Strategy, a series of shares of beneficial interest in Starboard Investment Trust (the “Fund”), including the schedule of investments, as of March 31, 2021, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the five-year period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of March 31, 2021, and the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended and its financial highlights for each of the years in the five-year period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities law and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risk of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of March 31, 2021 by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

BBD, LLP

We have served as the auditor of one or more of the Funds in the Starboard Investment Trust since 2012.

Philadelphia, Pennsylvania

May 26, 2021

Matisse Discounted Closed-End Fund Strategy

|

|

Additional Information

(Unaudited)

|

|

As of March 31, 2021

|

| 1. | Proxy Voting Policies and Voting Record |

A copy of the Advisor’s Proxy Voting and Disclosure Policy is included as Appendix B to the Fund’s Statement of Additional Information and is available, without charge, upon request, by calling 800-773-3863, and on the website of the Securities and Exchange Commission (“SEC”) at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available (1) without charge, upon request, by calling the Fund at the number above and (2) on the SEC’s website at http://www.sec.gov.

| 2. | Quarterly Portfolio Holdings |

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Forms N-PORT are available on the SEC’s website at http://www.sec.gov. You may also obtain copies without charge, upon request, by calling the Fund at 800-773-3863.

We are required to advise you within 60 days of the Fund’s fiscal year-end regarding federal tax status of certain distributions received by shareholders during each fiscal year. The following information is provided for the Fund’s fiscal year ended March 31, 2021.

During the fiscal year, the Fund paid $29,796,628 in income distributions but no long-term capital gain distributions.

Dividend and distributions received by retirement plans such as IRAs, Keogh-type plans, and 403(b) plans need not be reported as taxable income. However, many retirement plans may need this information for their annual information meeting.

| 4. | Schedule of Shareholder Expenses |

As a shareholder of the Fund, you incur ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from October 1, 2020 through March 31, 2020.

Actual Expenses – The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (e.g., an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes – The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Matisse Discounted Closed-End Fund Strategy

|

|

Additional Information

(Unaudited)

|

|

As of March 31, 2021

|

| Institutional Class Shares | Beginning Account Value October 1, 2020 | Ending Account Value March 31, 2021 | Expenses Paid During Period* |

Actual Hypothetical (5% annual return before expenses) | | | |

| $1,000.00 | $1,319.90 | $7.11 |

| $1,000.00 | $1,018.80 | $6.19 |

*Expenses are equal to the average account value over the period multiplied by the Fund’s annualized net expense ratio of 1.23%, multiplied by the number of days in the most recent period divided by the number of days in the fiscal year (to reflect the six month period).

5. Information about Trustees and Officers

The business and affairs of the Fund and the Trust are managed under the direction of the Board of Trustees of the Trust. Information concerning the Trustees and officers of the Trust and Fund is set forth below. Generally, each Trustee and officer serves an indefinite term or until certain circumstances such as their resignation, death, or otherwise as specified in the Trust’s organizational documents. Any Trustee may be removed at a meeting of shareholders by a vote meeting the requirements of the Trust’s organizational documents. The Statement of Additional Information of the Fund includes additional information about the Trustees and officers and is available, without charge, upon request by calling the Fund toll-free at 800-773-3863. The address of each Trustee and officer, unless otherwise indicated below, is 116 South Franklin Street, Rocky Mount, North Carolina 27804. The Independent Trustees each received aggregate compensation of $3,533 during the fiscal year ended March 31, 2021 from the Fund for their services to the Fund and Trust.

Matisse Discounted Closed-End Fund Strategy

|

|

Additional Information

(Unaudited)

|

|

As of March 31, 2021

|

Name and

Date of Birth | Position

held with

Funds or Trust | Length

of Time Served | Principal Occupation

During Past 5 Years | Number of Portfolios in Fund Complex Overseen by Trustee | Other Directorships

Held by Trustee

During Past 5 Years |

| Independent Trustees |

James H. Speed, Jr.

(06/1953) | Independent Trustee, Chairman | Trustee since 7/09, Chair since 5/12 | Retired Executive/Private Investor. | 12 | Independent Trustee of the Brown Capital Management Mutual Funds for all its series from 2011 to present, Hillman Capital Management Investment Trust for all its series from 2009 to present, Centaur Mutual Funds Trust for all its series from 2013 to present, Chesapeake Investment Trust for all its series from 2016 to present, Leeward Investment Trust for all its series from 2018 to present, and WST Investment Trust for all its series from 2013 to present, (all registered investment companies). Member of Board of Directors of Communities in Schools of N.C. from 2001 to present. Member of Board of Directors of Investors Title Company from 2010 to present. Member of Board of Directors of AAA Carolinas from 2011 to present. Previously, member of Board of Directors of M&F Bancorp Mechanics & Farmers Bank from 2009 to 2019. Previously, member of Board of Visitors of North Carolina Central University School of Business from 1990 to 2016. Previously, Board of Directors of NC Mutual Life Insurance Company from 2004 to 2016. Previously, President and CEO of North Carolina Mutual Life Insurance Company from 2003 to 2015. |

Theo H. Pitt, Jr.

(04/1936) | Independent Trustee | Since 9/10 | Senior Partner, Community Financial Institutions Consulting (financial consulting) since 1999. | 12 | Independent Trustee of World Funds Trust for all its series from 2013 to present, Chesapeake Investment Trust for all its series from 2002 to present, Leeward Investment Trust for all its series from 2011 to present, and Hillman Capital Management Investment Trust for all its series from 2000 to present (all registered investment companies). Senior Partner of Community Financial Institutions Consulting from 1997 to present. Previously, Partner at Pikar Properties from 2001 to 2017. |

Michael G. Mosley

(01/1953) | Independent Trustee | Since 7/10 | Owner of Commercial Realty Services (real estate) since 2004. | 12 | None. |

J. Buckley Strandberg

(03/1960) | Independent Trustee | Since 7/09 | President of Standard Insurance and Realty since 1982. | 12 | None. |

Matisse Discounted Closed-End Fund Strategy

|

|

Additional Information

(Unaudited)

|

|

As of March 31, 2021

|

Name and

Date of Birth | Position held with

Funds or Trust | Length

of Time Served | Principal Occupation

During Past 5 Years |

Officers

|

Katherine M. Honey

(09/1973) | President and Principal Executive Officer | Since 05/15 | President of The Nottingham Company since 2018. EVP of The Nottingham Company from 2008 to 2018. |

Ashley H. Lanham (03/1984) | Treasurer, Assistant Secretary, Principal Accounting Officer and Principal Financial Officer | Since 05/15 | Director of Fund Administration, The Nottingham Company since 2008. |

Tracie A. Coop

(12/1976) | Secretary | Since 12/19 | General Counsel, The Nottingham Company since 2019. Formerly, Vice President and Managing Counsel, State Street Bank and Trust Company from 2015 to 2019. Formerly, General Counsel for Santander Asset Management USA, LLC from 2013 to 2015. |

Matthew Baskir

(07/1979) | Chief Compliance Officer | Since 04/20 | Compliance Director, The Nottingham Company, Inc., since 2020. Formerly, Consultant at National Regulatory Services from 2019 to 2020. Formerly, Counsel at Financial Industry Regulatory Authority (FINRA), Member Supervision from 2016-2019. Formerly Counsel at FINRA, Market Regulation Enforcement from 2014 – 2016. |