This report and the financial statements contained herein are submitted for the general information of the shareholders of the Sector Rotation Fund (the “Fund”). The Fund’s shares are not deposits or obligations of, or guaranteed by, any depository institution. The Fund’s shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested. Neither the Fund nor the Fund’s distributor is a bank.

The Sector Rotation Fund is distributed by Capital Investment Group, Inc., Member FINRA/SIPC, 100 E. Six Forks Road, Suite 200, Raleigh, NC, 27609. There is no affiliation between the Sector Rotation Fund, including its principals, and Capital Investment Group, Inc.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports, as permitted by regulations adopted by the Securities and Exchange Commission. Instead, the reports will be made available on the Fund’s website at https://www.nottinghamco.com/fundpages/Sector, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by clicking Enroll at https://www.nottinghamco.com/fundpages/Sector.

You may, notwithstanding the availability of shareholder reports online, elect to receive all future shareholder reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with a Fund, you can call 800-773-3863 to let the Fund know you wish to continue receiving paper copies of your shareholder reports.

Letter to Shareholders

(Unaudited)

For the fiscal year ended September 30, 2020, the return of the S&P 500 Index was 15.15%, and the return of the Sector Rotation Fund was 8.04%. I think it is important to also report that the Fund’s peer group (Tactical Allocation) had a composite return of 3.93% during the same time period. The Fund’s performance was driven by the consumer discretionary, information technology, industrials, and the health care sectors. The Fund held just under 15% of its net assets in money markets and precious metals. Both these sectors have a long history of capital preservation during periods of high uncertainty. I believe the Covid-19 pandemic and US Presidential election fall into the “high uncertainty” category.

2020: Fortunately, Unfortunately

When I wrote that 2019 was “a roller coaster of a year, thanks in great part to policy shifts and politics,” I had no idea what was coming. None of us did. And, if 2019 was a roller coaster, what does that make 2020? Bear with me as I try to recap it in 1,000 words. It will be a wild ride, and for guidance I will channel Michael Foreman’s children’s book Fortunately, Unfortunately, which follows the lucky and unlucky adventures of a young boy using alternating statements.

The year got off to a promising start, with the Chinese trade war seemingly in the rear window, relative quiet in the Middle East, and a plethora of New Year’s resolutions waiting to be broken.

Unfortunately…

Australia was burning. Wildfires destroyed an estimated 46 million acres and 5,900 buildings (including 2,779 homes), killed dozens of people, and allegedly drove some endangered species to extinction.

Fortunately…

Politics quieted down with impeachment proceedings failing as the Senate voted for acquittal. Meanwhile, across the pond, Boris Johnson’s Brexit deal was approved by parliament, and Great Britain left the European Union.

Unfortunately…

Reports of a novel coronavirus started coming in from China. Images of workers clad in hazmat suits spraying chemicals on empty streets spooked the populace.

Fortunately…

China is always releasing viruses, isn’t it? No big deal.

Unfortunately…

It was a big deal. In early February the Trump administration began closing borders. People began changing their behavior, with mobility trackers showing more and more staying home.

Fortunately…

By mid-March, most of the United States (and the world) was under stay-at-home orders. We were flattening the curve!

Economies were collapsing. The U.S. unemployment rate rose to 14.7% in April 2020. Oh, and the Russia-Saudi Arabia oil-price war lowered oil prices even further than a lack of demand did. Stock markets worldwide crashed, with most reporting their largest one-week declines since the 2008 financial crisis. The volatility continued through March, when we experienced not just one “Black Monday” but two.

Fortunately…

By mid-April, COVID-19 cases and deaths in the United States had peaked (according to Healthdata.org). The U.S. Federal Reserve had come to the rescue with an array of actions designed to limit the economic damage from the pandemic, including up to $2.3 trillion in lending to support households, employers, financial markets, and state and local governments. Congress, meanwhile, passed the largest economic stimulus legislation in American history, a $2 trillion package called the CARES Act.

Unfortunately…

In May, just when things were looking up, protestors flocked to the streets to protest the killing of George Floyd by Minneapolis police officers. Many protests turned violent. A number of businesses, already suffering from the economic impact of the COVID-19 pandemic, were further harmed by vandalism and looting; the resulting property damage cost an estimated $550 million.

Meanwhile, curfews instated by local governments also restricted access to many downtown to essential workers, lowering economic output. This sharply exacerbated the COVID-19 recession.

Fortunately…

The Democratic Party narrowed its field of presidential candidates, selecting Joe Biden as its nominee in August. With that choice made, politics could quiet down.

Unfortunately…

Not really. With most of the country still under some form of stay-at-home order, the populace became (even more) divided, with some demanding strict adherence to state-by-state lockdown orders and masking requirements, and others objecting to the infringement of civil liberties. Meanwhile, police killed more people who may or may not have been doing things they should not have been doing, depending on who you asked. There were more protests, riots, and lootings.

Fortunately…

The economy seemed to be picking up steam, with the unemployment rate dropping to 7.9% in September. Predictions of a V-shaped recovery were seemingly coming to fruition.

Unfortunately…

U.S. Supreme Court Justice Ruth Bader Ginsberg, a women’s rights icon and champion of Roe v. Wade, passed away.

Fortunately…

After a week of mourning, Donald Trump nominated Amy Coney Barrett to replace Ginsberg, which would surely reduce uncertainty in such a trying time.

Unfortunately…

Many people objected to Barrett’s nomination given the proximity to the election. There were more protests, riots, and lootings.

Fortunately…

It could all be hashed out reasonably in a presidential debate. Oh, wait—that’s another “unfortunately.” Also in the “maybe fortunately, maybe unfortunately” category, depending on whom you asked, Donald Trump contracted COVID-19, then recovered, then went back to the White House sooner than he maybe should have, except maybe he was faking it the whole time, according to a person who may or may not be qualified to comment…

I give up.

The main point is that’s a lot of uncertainty. It’s no wonder that the CBOE Volatility Index (VIX) jumped around as much as it did throughout the year. Most recently (as of this writing), the VIX had surged by around 12% after Trump tested positive for COVID-19. The increase came as global risk markets plummeted and investors shifted money into so-called “safe-haven” assets. In 2020 fashion, however, markets were assuaged by Trump’s speedy recovery.

While much investor attention was focused on the wild volatility in the equity markets, the bond market also experienced heightened volatility not seen since 2008. Investors seeking safety propelled U.S. Treasury prices higher, and (because bond prices and yields move in the opposite direction) yields fell to historic lows. How low? The yield on the benchmark 10-year Treasury note plummeted from a high of 1.92% at the beginning of the year to an intraday low of just 0.32% on March 9.

As we enter the final quarter of the year, the U.S. economy is still struggling, with the latest gross domestic product (GDP) figures showing an annualized decline of 31.4% in the second quarter. Third quarter data isn’t out yet, though it should look better. And the markets certainly fared better, with the S&P 500 Index returning around 5% year to date as of early October.

But what most people want to know is if we’re heading for a recovery or a longer recession (or even depression). There are a few different directions the American economy could head in 2021. But with a presidential election—one that is likely to be complicated by delays and allegations of fraud due to mail-in voting—less than 30 days away as of this writing, anything could change at any time. That’s why I’m inclined to say less rather than more about the future of the economy and markets.

I will say this, however: The investments that satisfied investors over the past one to five years likely won’t satisfy investors over the next one to five years, regardless of who is elected and what chaos the remainder of 2020 brings. That’s why I’m always looking at the economy and markets from five miles up. This broad view helps me identify sectors that show the strongest signs of growth over the next three to 12 months at any point in time.

As always, I appreciate the trust you have placed in me. I will continue to work hard every day to maintain that trust.

Mark Anthony Grimaldi,

Portfolio Manager and Author

(RCSEC1020001)

| Sector Rotation Fund | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Performance Update (Unaudited) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

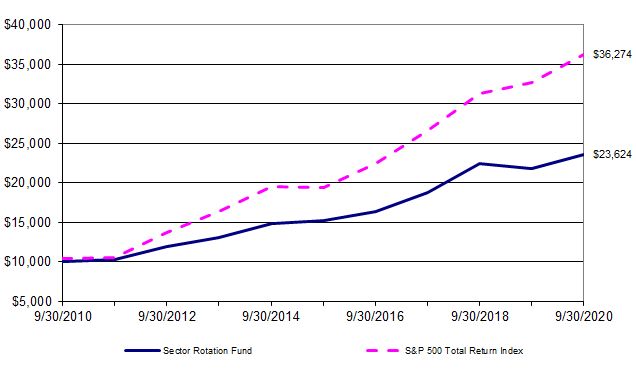

| For the period ended September 30, 2010 through September 30, 2020 | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Comparison of the Change in Value of a $10,000 Investment | | | | | | | | |

This graph assumes an initial investment of $10,000 and the reinvestment of dividends and capital gains distributions. All dividends and distributions are reinvested. This graph depicts the performance of the Sector Rotation Fund versus the S&P 500 Total Return Index. It is important to note that the Fund is a professionally managed mutual fund while the index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only. |

| | | | | | | | | | | | | | | | | | | | |

| | Average Annual Total Returns | |

| | | | | | | | | | | | | | | | | | | | |

| | | As of | | | | | | | | | One | | Five | | Ten | | |

| | | September 30, 2020 | | | | | | | Year | | Year | | Year | | |

| | | Sector Rotation Fund | | | | | | | 8.04% | | 9.23% | | 8.96% | | |

| | | S&P 500 Total Return Index | | | | | | | 15.15% | | 14.15% | | 13.74% | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | (Continued) |

| Sector Rotation Fund | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Performance Update (Unaudited) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| For the period ended September 30, 2010 through September 30, 2020 | | | | |

Performance quoted in the previous graph represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. The Advisor has entered into an Expense Limitation Agreement with the Trust, on behalf of the Fund, under which it has agreed to waive or reduce its fees and to assume other expenses of the Fund, if necessary, in amounts that limit the Fund’s total operating expenses (exclusive of (i) any front-end or contingent deferred loads; (ii) brokerage fees and commissions, (iii) acquired fund fees and expenses; (iv) fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including, for example, option and swap fees and expenses); (v) borrowing costs (such as interest and dividend expense on securities sold short); (vi) taxes; and (vii) extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees and contractual indemnification of Fund service providers (other than the Advisor)) to not more than 2.14% of the average daily net assets of the Fund for the current fiscal year. The Expense Limitation Agreement remains in effect through January 31, 2021. The Expense Limitation Agreement may be terminated by the Board of Trustees of the Trust at any time. Without the waiver, the expenses would be 2.26% per the Fund’s most recent prospectus dated February 1, 2020. An investor may obtain performance data, current to the most recent month-end, by visiting ncfunds.com. |

| | | | | | | | | | | | | | | | | | | | |

| The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of distributions. |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Sector Rotation Fund

|

Notes to Financial Statements

|

As of September 30, 2020

|

1. Organization and Significant Accounting Policies

The Sector Rotation Fund (“Fund”) is a series of the Starboard Investment Trust (“Trust”). The Trust is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as an open-end management investment company. The Fund is a separate, non-diversified series of the Trust.

The Fund commenced operations on December 31, 2009 as a series of the World Funds Trust (“WFT”). Shareholders approved the reorganization of the Fund as a series of the Trust at a special meeting on June 22, 2011. The reorganization occurred on June 27, 2011. Effective November 29, 2010, the Fund changed its name from the Navigator Fund to the Sector Rotation Fund.

The investment objective of the Fund is to seek to achieve capital appreciation. The Fund utilizes a sector rotation strategy which evaluates the relative strength and momentum of different sectors of the economy in order to identify short-term investment opportunities. Under normal circumstances, the Fund invests in exchange-traded funds (“ETFs”). An ETF is an open-end investment company that holds a portfolio of investments designed to track a particular market segment or underlying index.

The following is a summary of significant accounting policies consistently followed by the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund follows the accounting and reporting guidance in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification 946 “Financial Services – Investment Companies,” and Financial Accounting Standards Update (“ASU”) 2013-08.

Investment Valuation

The Fund’s investments in securities are carried at fair value. Securities listed on an exchange or quoted on a national market system are valued at the last sales price as of 4:00 p.m. Eastern Time. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. Other securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the most recent bid price. Instruments with maturities of 60 days or less are valued at amortized cost, which approximates market value. Securities and assets for which representative market quotations are not readily available (e.g., (i) an exchange-traded portfolio security is so thinly traded that there have been no transactions for that security over an extended period of time or the validity of a market quotation received is questionable; (ii) the exchange on which the portfolio security is principally traded closes early; or (iii) trading of the portfolio security is halted during the day and does not resume prior to the Fund’s NAV calculation) or which cannot be accurately valued using the Fund’s normal pricing procedures are valued at fair value as determined in good faith under policies approved by the Trustees. A security’s “fair value” price may differ from the price next available for that security using the Fund’s normal pricing procedures.

Fair Value Measurement

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

Level 1: quoted prices in active markets for identical securities

Level 2: other significant observable inputs (including quoted prices for similar securities, interest rates, credit risk, etc.)

Level 3: significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments)

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

Sector Rotation Fund

|

Notes to Financial Statements

|

As of September 30, 2020

|

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following table summarizes the inputs as of September 30, 2020 for the Fund’s assets measured at fair value:

| Sector Rotation Fund | | |

| Investments in Securities (a) | | Total | | Level 1 | | Level 2 | | Level 3 |

| Assets | | | | | | | | |

Exchange-Traded Funds* | $ | 23,418,870 | $ | 23,418,870 | $ | - | $ | - |

Short-Term Investment | | 1,853,100 | | 1,853,100 | | - | | - |

| Total | $ | 25,271,970 | $ | 25,271,970 | $ | - | $ | - |

| | | | | | | | | |

| (a) | The Fund had no Level 3 holdings during the fiscal year ended September 30, 2020. |

*Refer to Schedule of Investments for breakdown by Industry.

Investment Transactions and Investment Income

Investment transactions are accounted for as of the date purchased or sold (trade date). Dividend income is recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded as soon as the Fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums using the effective interest method. Gains and losses are determined on the identified cost basis, which is the same basis used for federal income tax purposes.

Expenses

The Fund is responsible for all expenses incurred specifically on its behalf as well as a portion of Trust level expenses, which are allocated according to methods reviewed annually by the Trustees.

Distributions

The Fund may declare and distribute dividends from net investment income (if any) annually. Distributions from capital gains (if any) are generally declared and distributed annually. Dividends and distributions to shareholders are recorded on ex-date.

Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in the net assets from operations during the reported period. Actual results could differ from those estimates.

Federal Income Taxes

No provision for income taxes is included in the accompanying financial statements, as the Fund intends to distribute to shareholders all taxable investment income and realized gains and otherwise comply with Subchapter M of the Internal Revenue Code applicable to regulated investment companies.

| 2. | Transactions with Related Parties and Service Providers |

Advisor

The Fund pays a monthly fee to Grimaldi Portfolio Solutions, Inc. (the “Advisor”) calculated at the annual rate of 1.00% of the Fund’s average daily net assets.

Sector Rotation Fund

|

Notes to Financial Statements

|

As of September 30, 2020

|

The Advisor has entered into a contractual agreement (the “Expense Limitation Agreement”) with the Trust, on behalf of the Fund, under which it has agreed to waive or reduce its fees and to assume other expenses of the Fund, if necessary, in amounts that limit the Fund’s total operating expenses (exclusive of (i) any front-end or contingent deferred loads; (ii) brokerage fees and commissions; (iii) acquired fund fees and expenses; (iv) fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including, for example, option and swap fees and expenses); (v) borrowing costs (such as interest and dividend expense on securities sold short); (vi) taxes and (vii) extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees and contractual indemnification of Fund service providers (other than the Advisor)) to not more than 2.14%. The Expense Limitation Agreement runs through January 31, 2021 and may be terminated by the Board at any time. The Advisor cannot recoup from the Fund any amounts paid by the Advisor under the Expense Limitation Agreement.

For the fiscal year ended September 30, 2020, $246,337 in advisory fees were incurred, and no fees were waived by the Advisor.

Administrator

The Fund pays a monthly fee to The Nottingham Company (the “Administrator”) based upon the average daily net assets of the Fund and calculated at the annual rates shown in the schedule below subject to a minimum of $2,000 per month. The Administrator also receives a fee as to procure and pay the Fund’s custodian, as additional compensation for fund accounting and recordkeeping services, and additional compensation for certain costs involved with the daily valuation of securities and as reimbursement for out-of-pocket expenses. The Administrator also receives a miscellaneous compensation fee for peer group, comparative analysis, and compliance support totaling $350 per month. As of September 30, 2020, the Administrator received $4,199 in miscellaneous reporting expenses.

A breakdown of the fees is provided in the following table:

| Administration Fees* | Custody Fees* | Fund Accounting Fees (minimum monthly) | Fund Accounting Fees (asset- based fee) | Blue Sky Administration Fees (annual) |

Average Net Assets | Annual Rate | Average Net Assets | Annual Rate |

| First $250 million | 0.100% | First $200 million | 0.020% | $2,250 | 0.01% | $150 per state |

| Next $250 million | 0.080% | Over $200 million | 0.009% | | | |

| Next $250 million | 0.060% | | | | | |

| Next $250 million | 0.050% | *Minimum monthly fees of $2,000 and $417 for Administration and Custody, respectively. |

| Next $1 billion | 0.040% |

| Over $2 billion | 0.035% |

The Fund incurred $29,909 in administration fees, $8,949 in custody fees, and $29,547 in fund accounting fees for the fiscal year ended September 30, 2020.

Compliance Services

For the fiscal period from October 1, 2019 through March 30, 2020, Cipperman Compliance Services, LLC provided services as the Trust’s Chief Compliance Officer. Cipperman Compliance Services, LLC was entitled to receive customary fees from the Fund for their services pursuant to the Compliance Services Agreement with the Fund.

Effective April 1, 2020, The Nottingham Company, Inc. serves as the Trust’s compliance services provider including services as the Trust’s Chief Compliance Officer. The Nottingham Company, Inc. is entitled to receive customary fees from the Fund for its services pursuant to the Compliance Services Agreement with the Fund.

Transfer Agent

Nottingham Shareholder Services, LLC (“Transfer Agent”) serves as transfer, dividend paying, and shareholder servicing agent for the Fund. For its services, the Transfer Agent is entitled to receive compensation from the Fund pursuant to the Transfer Agent’s fee arrangements with the Fund. The Fund incurred $20,999 in transfer agent fees during the fiscal year ended September 30, 2020.

Sector Rotation Fund

|

Notes to Financial Statements

|

As of September 30, 2020

|

Distributor

Capital Investment Group, Inc. (the “Distributor”) serves as the Fund’s principal underwriter and distributor. The Distributor receives $5,000 per year paid in monthly installments for services provided and expenses assumed. This expense is included in the shareholder fulfillment expenses on the Statement of Operations.

3. Trustees and Officers

The Trust is governed by the Board of Trustees, which is responsible for the management and supervision of the Fund. The Trustees meet periodically throughout the year to review contractual agreements with companies that furnish services to the Fund; review performance of the Advisor and the Fund; and oversee activities of the Fund. Officers of the Trust and Trustees who are interested persons of the Trust or the Advisor will receive no salary or fees from the Trust. Each Trustee who is not an “interested person” of the Trust or the Advisor within the meaning of the Investment Company Act of 1940, as amended (the “Independent Trustee”) receives $2,000 per series per year, $200 per meeting attended, and $500 per series per special meeting related to contract renewal issues. The Trust reimburses each Trustee and officer of the Trust for his or her travel and other expenses related to attendance of Board meetings. Prior to April 1, 2020, the Independent Trustees received $2,000 each year from the Fund plus $500 per meeting for any special meeting held for the Fund. The Trust reimbursed each Trustee and officer of the Trust for his or her travel and other expenses related to attendance of Board meetings. Additional fees were incurred during the year as special meetings were necessary in addition to the regularly scheduled meetings of the Board of Trustees.

Certain officers of the Trust may also be officers of the Administrator.

4. Distribution and Service Fees

The Trustees, including a majority of the Trustees who are not “interested persons” of the Trust as defined in the 1940 Act and who have no direct or indirect financial interest in such plan or in any agreement related to such plan, adopted a distribution plan pursuant to Rule 12b-1 of the 1940 Act (the “Plan”). The 1940 Act regulates the manner in which a regulated investment company may assume expenses of distributing and promoting the sales of its shares and servicing of its shareholder accounts. The Plan provides that the Fund may incur certain expenses, which may not exceed 0.25% per annum of the average daily net assets of the Fund for each year elapsed subsequent to adoption of the Plan, for payment to the Distributor and others for items such as advertising expenses, selling expenses, commissions, travel or other expenses reasonably intended to result in sales of shares of the Fund or support servicing of shareholder accounts. For the fiscal year ended September 30, 2020, $61,584 in distribution and service fees were incurred by the Fund.

5. Purchases and Sales of Investment Securities

For the fiscal year ended September 30, 2020, the aggregate cost of purchases and proceeds from sales of investment securities (excluding short-term securities) were as follows:

| Purchases of Securities | Proceeds from Sales of Securities |

| $63,446,286 | $64,960,769 |

There were no long-term purchases or sales of U.S Government Obligations during the fiscal year ended September 30, 2020.

6. Federal Income Tax

Distributions are determined in accordance with Federal income tax regulations, which differ from GAAP, and, therefore, may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

Sector Rotation Fund

|

Notes to Financial Statements

|

As of September 30, 2020

|

Management reviewed the Fund’s tax positions taken or to be taken on federal income tax returns for the open tax years of September 30, 2017 through September 30, 2020 and determined that the Fund does not have a liability for uncertain tax positions. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period, the Fund did not incur any interest or penalties.

Distributions during the fiscal years ended were characterized for tax purposes as follows:

| |

September 30, 2020 | September 30, 2019 |

Net Investment Income | $ - | $ 745,370 |

Long-Term Capital Gain | $ 2,072,001 | $ 1,395,172 |

Reclassifications relate primarily to differing book/tax treatment of ordinary net investment loss and have no impact on the net assets of the Fund. For the fiscal year ended September 30, 2020, the following reclassifications were necessary:

Paid-in-Capital | $ (207,084) |

Distributable Earnings | 207,084 |

At September 30, 2020, the tax-basis cost of investments and components of distributable earnings were as follows:

Cost of Investments | $ | 19,491,813 |

| | | |

Unrealized Appreciation | | 5,878,879 |

Unrealized Depreciation | | (98,722) |

Net Unrealized Appreciation | | 5,780,157 |

| | | |

Undistributed Capital Gains | | 319,713 |

Distributable Earnings | $ | 6,099,870 |

| | | |

7. Beneficial Ownership

The beneficial ownership, either directly or indirectly, of 25% or more of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a)(9) of the Investment Company Act of 1940. As of September 30, 2020, Charles Schwab held 86.55% of the Fund. The Fund has no knowledge as to whether all or any portion of the shares owned of record by Charles Schwab are also owned beneficially.

8. Commitments and Contingencies

Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Trust entered into contracts with its service providers, on behalf of the Fund, and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. The Fund expects risk of loss to be remote.

Sector Rotation Fund

|

Notes to Financial Statements

|

As of September 30, 2020

|

9. Subsequent Events

Management is currently evaluating the impact of the COVID-19 virus on the financial services industry and has concluded that, while it is reasonably possible that the virus could have a negative effect on the fair value of the Fund’s investments and results of operations, the specific impact is not readily determinable as of the date of these financial statements. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

In accordance with GAAP, management has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date of issuance of these financial statements. Management has concluded there are no additional matters, other than those noted above, requiring recognition or disclosure.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of Starboard Investment Trust

and the Shareholders of the Sector Rotation Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Sector Rotation Fund, a series of shares of beneficial interest in Starboard Investment Trust (the “Fund”), including the schedule of investments, as of September 30, 2020, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the five-year period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of September 30, 2020, and the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended and its financial highlights for each of the years in the five-year period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities law and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risk of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2020 by correspondence with the custodian and broker. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

BBD, LLP

We have served as the auditor of one or more of the Funds in the Starboard Investment Trust since 2012.

Philadelphia, Pennsylvania

November 23, 2020

Sector Rotation Fund

|

Additional Information

(Unaudited)

|

As of September 30, 2020

|

1.

| Proxy Voting Policies and Voting Record |

A copy of the Advisor’s Proxy and Corporate Action Voting Policies and Procedures is included as Appendix B to the Fund’s Statement of Additional Information and is available, without charge, upon request, by calling 800-773-3863, and on the website of the Securities and Exchange Commission (“SEC”) at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (1) without charge, upon request, by calling the Fund at the number above and (2) on the SEC’s website at http://www.sec.gov.

2.

| Quarterly Portfolio Holdings |

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Form N-PORT is available on the SEC’s website at http://www.sec.gov. You may also obtain copies without charge, upon request, by calling the Fund at 800-773-3863.

We are required to advise you within 60 days of the Fund’s fiscal year-end regarding the federal tax status of certain distributions received by shareholders during each fiscal year. The following information is provided for the Fund’s fiscal year ended September 30, 2020.

During the fiscal period, no income distributions were paid from the Fund, but $2,072,001 in long-term capital gain distributions were paid from the Fund.

Dividend and distributions received by retirement plans such as IRAs, Keogh-type plans, and 403(b) plans need not be reported as taxable income. However, many retirement plans may need this information for their annual information meeting.

4.

| Schedule of Shareholder Expenses |

As a shareholder of the Fund, you incur ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2020 through September 30, 2020.

Actual Expenses – The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (e.g., an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes – The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Sector Rotation Fund

|

Additional Information

(Unaudited)

|

As of September 30, 2020

|

Sector Rotation Fund | Beginning Account Value April 1, 2020 | Ending Account Value September 30, 2020 |

Expenses Paid During Period* |

Actual Hypothetical (5% annual return before expenses) | | | |

| $1,000.00 | $1,290.90 | $12.26 |

| $1,000.00 | $1,014.30 | $10.78 |

*Expenses are equal to the average account value over the period multiplied by the Fund’s annualized expense ratio of 2.14%, multiplied by 183/366 (to reflect the one-half year period).

5.

| Approval of Investment Advisory Agreement |

In connection with the regular Board meeting held on March 12, 2020, the Board, including a majority of the Independent Trustees, discussed the approval of a management agreement between the Trust and the Advisor, with respect to the Fund (the "Investment Advisory Agreement"). The Trustees were assisted by legal counsel throughout the review process. The Trustees relied upon the advice of legal counsel and their own business judgment in determining the material factors to be considered in evaluating the Investment Advisory Agreement and the weight to be given to each factor considered. The conclusions reached by the Trustees were based on a comprehensive evaluation of all of the information provided and were not the result of any one factor. Moreover, each Trustee may have afforded different weight to the various factors in reaching his conclusions with respect to the approval of the Investment Advisory Agreement. In connection with their deliberations regarding approval of the Investment Advisory Agreement, the Trustees reviewed materials prepared by the Advisor.

In deciding on whether to approve the renewal of the Investment Advisory Agreement, the Trustees considered numerous factors, including:

| (i) | Nature, Extent, and Quality of Services. The Trustees considered the responsibilities of the Advisor under the Investment Advisory Agreement. The Trustees reviewed the services being provided by the Advisor to the Fund including, without limitation, the quality of its investment advisory services since the Advisor began managing the Fund (including research and recommendations with respect to portfolio securities); its procedures for formulating investment recommendations and assuring compliance with the Fund’s investment objectives, policies and limitations; its coordination of services for the Fund among the Fund’s service providers; and its efforts to promote the Fund, grow the Fund’s assets, and assist in the distribution of Fund shares (although no portion of the investment advisory fee was targeted to pay distribution expenses). The Trustees evaluated the Advisor’s staffing, personnel, and methods of operating; the education and experience of the Advisor’s personnel; the Advisor’s compliance program; and the financial condition of the Advisor. It was noted that there had been no change in personnel. |

After reviewing the foregoing information and further information in the memorandum from the Advisor (e.g., descriptions of the Advisor’s business, compliance program, and Form ADV), the Board concluded that the nature, extent, and quality of the services provided by the Advisor were satisfactory and adequate for the Fund.

| (ii) | Performance. The Trustees compared the performance of the Fund with the performance of comparable funds with similar strategies managed by other investment advisers, and applicable peer group data (e.g., Morningstar/Lipper peer group average). The Trustees also considered the consistency of the Advisor’s management of the Fund with its investment objective, policies, and limitations. It was noted that the Fund outperformed its peer group and category for all periods. |

After reviewing the investment performance of the Fund, the Advisor’s experience managing the Fund, the historical investment performance, and other factors, the Board concluded that the investment performance of the Fund and the Advisor was satisfactory.

Sector Rotation Fund

|

Additional Information

(Unaudited)

|

As of September 30, 2020

|

| (iii) | Fees and Expenses. The Trustees noted the management fees for the Fund under the Investment Advisory Agreement. The Trustees then compared the advisory fee and expense ratio of the Fund to other comparable funds, noting that the management fee and the expense ratio were higher than the average of the peer group and category. The Board noted however, that the Fund’s performance as a 5-star fund commands a higher management fee. The Advisor advised the fund had not yet reached economies of scale and that the fees would be in line with the peer group average once a sufficient level of assets under management was achieved. |

Following this comparison, and upon further consideration and discussion of the foregoing, the Board concluded that the fees to be paid to the Advisor were not unreasonable in relation to the nature and quality of the services provided by the Advisor and that they reflected charges that were within a range of what could have been negotiated at arm’s length.

(iv) | Profitability. The Board reviewed the Advisor’s profitability analysis in connection with its management of the Fund over the past twelve months. The Board noted that the Advisor realized a profit for the prior twelve months of operations. After discussion, the Trustees concluded that the Advisor’s level of profitability was not excessive. |

| (v) | Economies of Scale. In this regard, the Trustees reviewed the Fund’s operational history and noted that the size of the Fund had not provided an opportunity to realize economies of scale. The Trustees then reviewed the Fund’s fee arrangements for breakpoints or other provisions that would allow the Fund’s shareholders to benefit from economies of scale in the future as the Fund grows. The Trustees determined that the maximum management fee would stay the same regardless of the Fund’s asset levels but noted the Advisor’s willingness to consider breakpoints in the future as assets grow. |

Conclusion. Having reviewed and discussed in depth such information from the Advisor as the Trustees believed to be reasonably necessary to evaluate the terms of the Investment Advisory Agreement and as assisted by the advice of legal counsel, the Trustees concluded that renewal of the Investment Advisory Agreement was in the best interest of the shareholders of the Fund.

6.

| Information about Trustees and Officers |

The business and affairs of the Fund and the Trust are managed under the direction of the Board of Trustees of the Trust. Information concerning the Trustees and officers of the Trust and Fund is set forth below. Generally, each Trustee and officer serves an indefinite term or until certain circumstances such as their resignation, death, or otherwise as specified in the Trust’s organizational documents. Any Trustee may be removed at a meeting of shareholders by a vote meeting the requirements of the Trust’s organizational documents. The Statement of Additional Information of the Funds includes additional information about the Trustees and officers and is available, without charge, upon request by calling the Funds toll-free at 1-800-773-3863. The address of each Trustee and officer, unless otherwise indicated below, is 116 South Franklin Street, Rocky Mount, North Carolina 27804. The Independent Trustees each received aggregate compensation of $3,738 during the fiscal year ended September 30, 2020 for their services to the Funds and Trust.

Sector Rotation Fund

|

Additional Information

(Unaudited)

|

As of September 30, 2020

|

Name and

Date of Birth | Position

held with

Funds or Trust | Length

of Time Served | Principal Occupation

During Past 5 Years | Number of Portfolios in Fund Complex Overseen by Trustee | Other Directorships

Held by Trustee

During Past 5 Years |

| Independent Trustees |

James H. Speed, Jr.

(06/1953) | Independent Trustee, Chairman | Trustee since 7/09, Chair since 5/12 | Previously President and CEO of NC Mutual Life Insurance Company (insurance company) from 2003 to 2015. | 12 | Independent Trustee of the Brown Capital Management Mutual Funds for all its series from 2011 to present, Hillman Capital Management Investment Trust for all its series from 2009 to present, Centaur Mutual Funds Trust for all its series from 2013 to present, Chesapeake Investment Trust for all its series from 2016 to present, Leeward Investment Trust for all its series from 2018 to present, and WST Investment Trust for all its series from 2013 to present, (all registered investment companies). Member of Board of Directors of Communities in Schools of N.C. from 2001 to present. Member of Board of Directors of Investors Title Company from 2010 to present. Member of Board of Directors of AAA Carolinas from 2011 to present. Previously, member of Board of Directors of M&F Bancorp Mechanics & Farmers Bank from 2009 to 2019. Previously, member of Board of Visitors of North Carolina Central University School of Business from 1990 to 2016. Previously, Board of Directors of NC Mutual Life Insurance Company from 2004 to 2016. Previously, President and CEO of North Carolina Mutual Life Insurance Company from 2003 to 2015. |

Theo H. Pitt, Jr.

(04/1936) | Independent Trustee | Since 9/10 | Senior Partner, Community Financial Institutions Consulting (financial consulting) since 1999. | 12 | Independent Trustee of World Funds Trust for all its series from 2013 to present, Chesapeake Investment Trust for all its series from 2002 to present, Leeward Investment Trust for all its series from 2011 to present, and Hillman Capital Management Investment Trust for all its series from 2000 to present (all registered investment companies). Senior Partner of Community Financial Institutions Consulting from 1997 to present. Previously, Partner at Pikar Properties from 2001 to 2017. |

Michael G. Mosley

(01/1953) | Independent Trustee | Since 7/10 | Owner of Commercial Realty Services (real estate) since 2004. | 12 | None. |

J. Buckley Strandberg

(03/1960) | Independent Trustee | Since 7/09 | President of Standard Insurance and Realty since 1982. | 12 | None. |

Sector Rotation Fund

|

Additional Information

(Unaudited)

|

As of September 30, 2020

|

Name and

Date of Birth | Position held with

Funds or Trust | Length

of Time Served | Principal Occupation

During Past 5 Years |

| Officers |

Katherine M. Honey

(09/1973) | President and Principal Executive Officer | Since 05/15 | President of The Nottingham Company since 2018. EVP of The Nottingham Company from 2008 to 2018. |

Ashley H. Lanham (03/1984) | Treasurer, Assistant Secretary, Principal Accounting Officer and Principal Financial Officer | Since 05/15 | Director of Fund Administration, The Nottingham Company since 2008. |

Tracie A. Coop

(12/1976) | Secretary | Since 12/19 | General Counsel, The Nottingham Company since 2019. Formerly, Vice President and Managing Counsel, State Street Bank and Trust Company from 2015 to 2019. Formerly, General Counsel for Santander Asset Management USA, LLC from 2013 to 2015. |

Matthew Baskir

(07/1979) | Chief Compliance Officer | Since 04/20 | Compliance Director, The Nottingham Company, Inc., since 2020. Formerly, Consultant at National Regulatory Services from 2019 to 2020. Formerly, Counsel at Financial Industry Regulatory Authority (FINRA), Member Supervision from 2016-2019. Formerly Counsel at FINRA, Market Regulation Enforcement from 2014 – 2016. |