UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 23, 2020

ALTIMAR ACQUISITION CORPORATION

(Exact name of registrant as specified in its charter)

| | | | |

| Cayman Islands | | 001-39653 | | 98-1554235 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| |

40 West 57th Street 33rd Floor New York, NY | | 10019 |

| (Address of principal executive offices) | | (Zip Code) |

(212) 287-6767

Registrant’s telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Units, each consisting of one Class A Ordinary Share, $0.0001 par value, and one-third of one redeemable warrant | | ATACU | | New York Stock Exchange |

| Class A Ordinary Shares included as part of the units | | ATAC | | New York Stock Exchange |

| Redeemable warrants included as part of the units, each whole warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 | | ATACW | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On December 23, 2020 Owl Rock, Dyal and Altimar (each as defined under Item 8.01) held a joint investor conference call to discuss the transaction disclosed under Item 8.01. A copy of the transcript of the investor call is furnished as Exhibit 99.2 hereto and incorporated by reference into this Item 7.01. A copy of the presentation that Altimar, Owl Rock and Dyal prepared for use in connection with various meetings and conferences with investors is furnished as Exhibit 99.3 hereto and incorporated by reference into this Item 7.01.

The foregoing (including Exhibit 99.1) is being furnished pursuant to Item 7.01 and will not be deemed to be filed for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor will it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act.

Item 8.01. Other Events.

On December 23, 2020, Altimar Acquisition Corporation (NYSE: ATAC) (“Altimar”) announced that it had entered into a definitive business combination agreement with Owl Rock Capital Group (“Owl Rock”) and the Dyal Capital Partners (“Dyal”) division of Neuberger Berman Group LLC to form Blue Owl Capital Inc. (“Blue Owl”), a publicly-traded alternative asset management firm with over $45.0 billion in assets under management. A copy of the press release announcing the transaction is furnished as Exhibit 99.1 hereto.

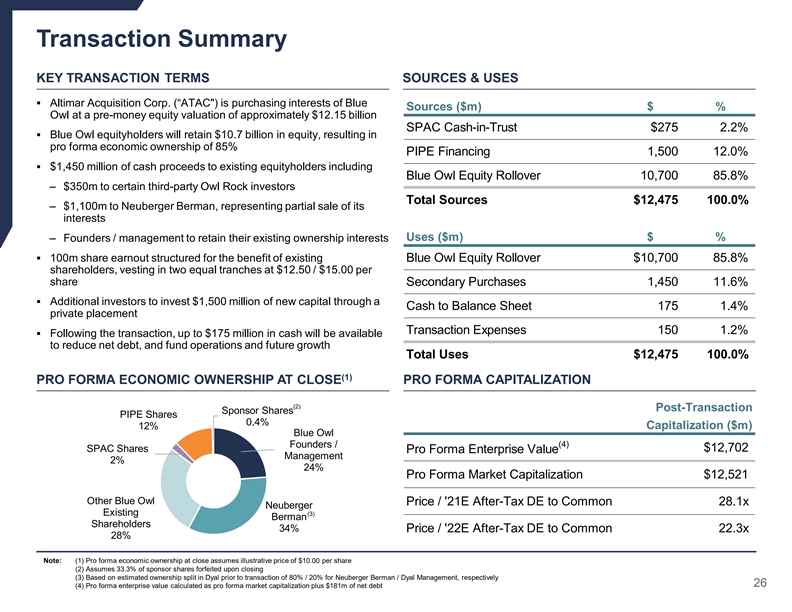

Pursuant to the transaction, Altimar, which currently holds $275 million in cash in trust, will combine with Blue Owl at an estimated $12.5 billion pro forma equity value. Cash proceeds in connection with the transaction will be funded through a combination of Altimar’s cash in trust and a $1.5 billion fully committed, oversubscribed, common stock private investment in public equity at $10.00 per share.

The information in this Item 8.01 and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

Additional Information and Where to Find It

Altimar intends to file a registration statement on Form S-4 with the Securities and Exchange Commission (the “SEC”), which will include a proxy statement and a prospectus of Altimar, and each party will file other documents with the SEC regarding the proposed transaction. A definitive proxy statement/prospectus will also be sent to the stockholders of Altimar, seeking any required stockholder approval. Before making any voting or investment decision, investors and security holders of Altimar are urged to carefully read the entire registration statement and proxy statement/prospectus, when they become available, and any other relevant documents filed with the SEC, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction. The documents filed by Altimar with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by Altimar may be obtained free of charge from Altimar at www.altimarspac.com. Alternatively, these documents, when available, can be obtained free of charge from Altimar upon written request to Altimar Acquisition Corp., 40 West 57th Street, New York, New York 10019, Attn: Secretary, or by calling 212-287-6767.

Forward Looking Statements

Certain statements made in this Current Report on Form 8-K, and oral statements made from time to time by representatives of the Company are “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Statements regarding the proposed business combination and expectations regarding the combined business are “forward looking statements.” In addition, words such as “estimates,” “projects,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “would,” “should,” “future,” “propose,” “target,” “goal,” “objective,” “outlook” and variations of these

words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside Altimar’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors, among others, that may affect actual results or outcomes include: the inability of Altimar to complete the contemplated transactions with Owl Rock and Dyal; the risk that the approval of the stockholders of Altimar for the proposed business combination is not obtained; the inability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things, the amount of funds available in Altimar’s trust account following any redemptions by Altimar’s stockholders; the ability to meet the NYSE’s listing standards following the consummation of the transactions contemplated by the proposed business combination; costs related to the proposed business combination; and those factors discussed in Altimar’s prospectus, dated October 22, 2020 under the heading “Risk Factors,” and other documents of Altimar filed, or to be filed, with the SEC. Altimar does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Participants in the Solicitation

Altimar and certain of its respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Altimar, in favor of the approval of the business combination. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the registration statement and the proxy statement/prospectus and other relevant documents filed with the SEC when they become available. Free copies of these documents may be obtained as described in the preceding paragraph.

Non-Solicitation

The disclosure herein is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the potential transaction and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of Altimar, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a definitive document.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

| | |

Exhibit

Number | | Description |

| |

| 99.1 | | Press Release, dated December 23, 2020. |

| |

| 99.2 | | Investor Call Transcript, dated December 23, 2020. |

| |

| 99.3 | | Investor Presentation, dated December 23, 2020 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: December 23, 2020

| | |

| ALTIMAR ACQUISITION CORPORATION |

| |

| By: | | /s/ Tom Wasserman |

| Name: | | Tom Wasserman |

| Title: | | Chief Executive Officer |

Exhibit 99.1

Owl Rock Capital Group and Dyal Capital Partners Execute Definitive Business Combination Agreement to Form Blue Owl Capital and List on NYSE via a Business Combination with Altimar Acquisition Corporation

| | • | | Owl Rock and Dyal to combine to form Blue Owl, a differentiated alternative asset manager with industry leading Direct Lending and GP Capital Solutions businesses |

| | • | | Combined firm to manage over $45.0 billion in assets |

| | • | | Blue Owl to become publicly listed through a business combination with Altimar, a SPAC sponsored by an affiliate of HPS Investment Partners (NYSE:ATAC) |

| | • | | Blue Owl is expected to be listed on the NYSE under the ticker symbol “OWL” following the expected close of the transaction in the first half of 2021 |

| | • | | Transaction expected to provide approximately $1.8 billion in gross proceeds, comprised of Altimar’s $275 million of cash held in trust (assuming no redemptions) and a $1.5 billion fully committed, oversubscribed, common stock PIPE at $10.00 per share, including investments from ICONIQ Capital, CH Investment Partners, Koch Companies Defined Benefit Master Trust, the Federated Hermes Kaufmann Funds, and Liberty Mutual Investments |

| | • | | The founders and senior managers of Blue Owl will retain their equity stakes through the combined entity’s transition into a publicly listed company, promoting continued alignment |

NEW YORK – December 23, 2020—Owl Rock Capital Group (“Owl Rock”) and the Dyal Capital Partners (“Dyal”) division of Neuberger Berman Group LLC (“Neuberger Berman”) today announced they entered into a definitive business combination agreement with Altimar Acquisition Corporation (NYSE: ATAC) (“Altimar”) to form Blue Owl Capital Inc. (“Blue Owl”), an alternative asset management firm with over $45.0 billion in assets under management.

Blue Owl will enter the public market through a business combination with Altimar, a special purpose acquisition company sponsored by an affiliate of HPS Investment Partners, LLC. The combined entity is expected to have a post-transaction market capitalization of approximately $12.5 billion. As a result of the transaction, Blue Owl is expected to be listed on the NYSE under the new ticker “OWL”.

The new firm’s main business will focus on two of the fastest growing areas of alternative asset management: Direct Lending, where Owl Rock is one of the leading private credit providers to middle and upper middle market businesses backed by top-tier financial sponsors, and GP Capital Solutions, where Dyal has been a leader and innovator since its founding. The Owl Rock and Dyal businesses will be autonomous but complementary. By bringing together two preeminent businesses in their respective fields, Blue Owl will be positioned as a differentiated provider of holistic solutions to the alternative asset management community. Each business will be led by its current long-tenured management, and its respective investment teams will continue to employ the disciplined investment philosophies that they have delivered since inception.

Doug Ostrover, co-founder of Owl Rock, will serve as Chief Executive Officer of Blue Owl. On the announcement of the strategic combination, he stated: “Blue Owl’s expertise, agility and scale, supported by a substantial permanent capital base, will enable us to offer a holistic platform of capital solutions to private equity firms and privately held businesses. We believe this will broaden and deepen our relationships and provide us with unrivaled access to compelling investment opportunities. In addition, this permanent capital base will allow Blue Owl to continue to strongly grow its business in a consistent and predictable manner. The foundation of our success is the trust our clients and partners place in us based on our experience, investment approach, and commitment to serving them. We look forward to solidifying our position as the capital partner and investment manager of choice for our stakeholders.”

Michael Rees, Dyal founder, and Marc Lipschultz, Owl Rock co-founder, will be co-Presidents of Blue Owl. Rees said: “Our businesses will combine robust growth and a strong margin profile with a high level of earnings visibility and stability, offering investors a compelling way to access the alternative asset management industry.” Lipschultz added: “By building on this strong foundation, we believe we are well positioned to continue to expand our current platforms and pursue new, complementary business lines to provide differentiated sources of returns for our investors.”

George Walker, Chairman and Chief Executive Officer of Neuberger Berman, added: “This partnership is a clear and natural fit. Neuberger Berman, as a meaningful shareholder, looks forward to seeing Blue Owl continue to grow as an industry leader. Moreover, Neuberger Berman has the privilege of continuing to manage $80 billion in alternatives distinct from the Dyal business, and our culture of innovation from which Dyal began will continue to help us deliver for clients in the years to come.”

Upon completion of the transaction, Blue Owl will be a stand-alone firm and Owl Rock and Dyal founders, alongside Neuberger Berman, will own meaningful equity positions in Blue Owl.

Blue Owl is expected to combine these strengths:

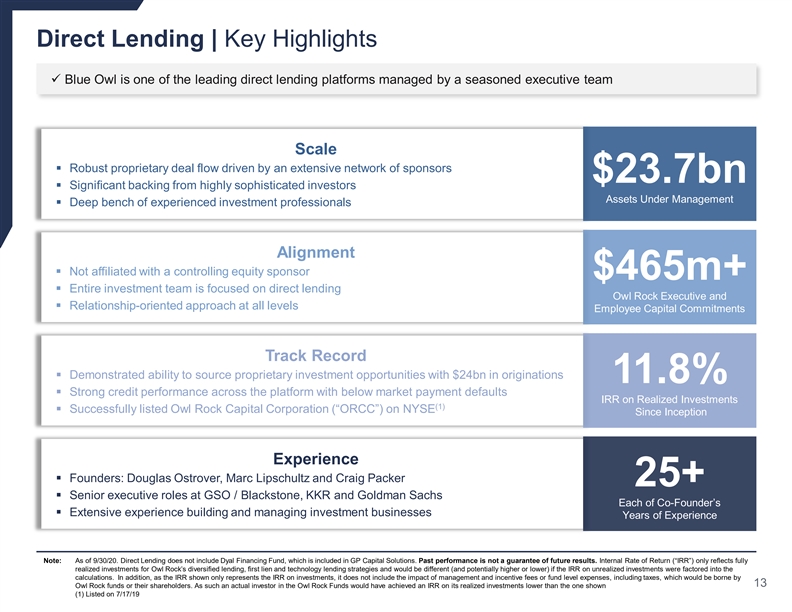

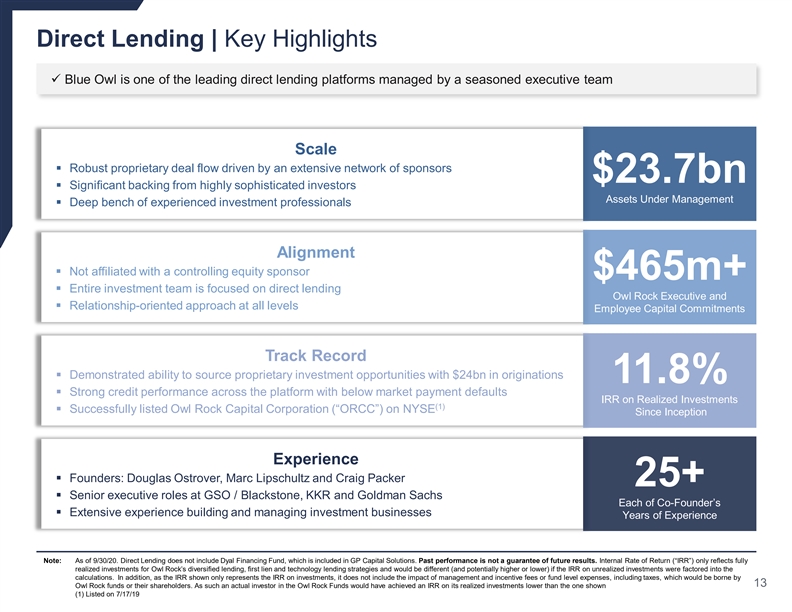

Owl Rock Direct Lending Highlights:

| | • | | Scaled direct lending business with $23.7 billion in assets under management as of September 30, 2020 |

| | • | | Focused on lending to middle- and upper-middle-market, private equity-sponsored companies |

| | • | | Technology lending strategy capitalizing on the large and growing demand for technology products and services |

| | • | | Led by an investment team dedicated to direct lending |

| | • | | Demonstrated ability to source proprietary investment opportunities with $24 billion in originations since inception |

| | • | | Industry-leading credit performance historically and throughout the COVID-19 pandemic |

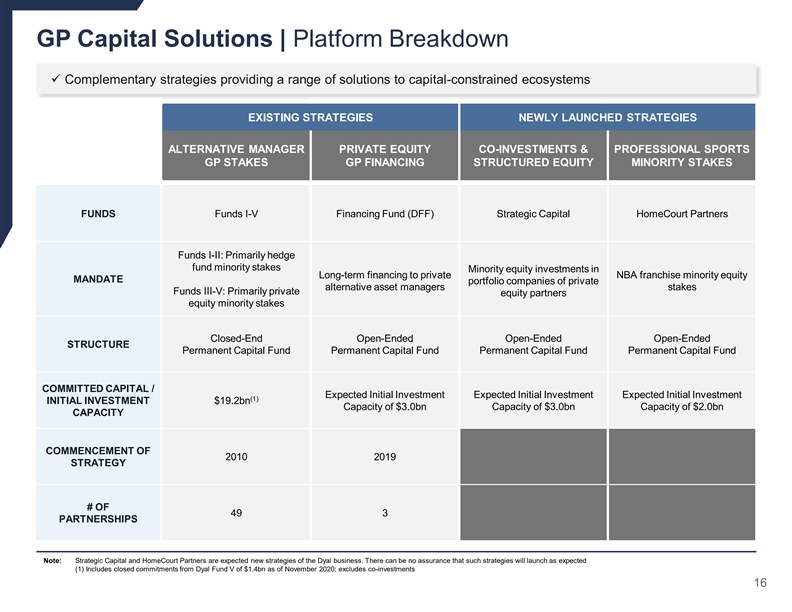

Dyal GP Capital Solutions Platform Highlights:

| | • | | Industry leading GP capital solutions business with a proven track record, having completed 57 transactions with 49 GPs to date |

| | • | | Deep and extensive relationships across the alternative asset management ecosystem |

| | • | | Large permanent capital base totaling $23.3 billion in assets under management (as of November 30, 2020) promotes the formation of strong, value-added partnerships |

| | • | | Unique Business Services Platform assists GPs in the portfolio with a leading set of strategic and capital raising advisory services |

| | • | | Led by founder Michael Rees and a senior management team that has an average of 18 years of experience and more than a decade of working together in the GP Capital Solutions business |

Blue Owl management believes it will have a uniquely attractive financial profile due to its combination of strong growth and margins with a focus on permanent capital and fee related earnings (“FRE”). Specifically, the firm will have over $45.0 billion in combined assets under management, 92% of which would be permanent capital, and initially will derive its distributable earnings from FRE, which allows for enhanced predictability of earnings. Blue Owl will be well positioned to grow its asset base and distributable earnings due to the complementary client relationships and skillsets of Dyal and Owl Rock, which we believe will further enable new product expansion.

We believe investors in Blue Owl sponsored funds will benefit from a strategic combination without disruption to the service they receive or the investment programs they rely upon. Investment strategies, processes and teams for the company’s funds will remain consistent, while expecting that their investors will gain from the combined company’s expanded platform, broadened and deepened relationships across the alternative asset management landscape, and a broader range of expertise across the firm.

Owl Rock Capital Corporation (“ORCC”), Owl Rock Capital Corporation II, Owl Rock Capital Corporation III, Owl Rock Technology Finance Corp. and Owl Rock Core Income Corp. (the “Owl Rock BDCs”) will continue to be led by their Chief Executive Officer and Owl Rock co-founder, Craig Packer, and will not undertake any change to their investment strategies, team or process from this transaction. This includes ORCC, which is publicly traded under the “ORCC” ticker.

The closing of the transaction will result in a change of control of the registered investment adviser (the “Owl Rock Advisers”) to each of the Owl Rock BDCs under the Investment Company Act of 1940, as amended (“1940 Act”), and will require the assignment of each Owl Rock BDC’s current investment advisory agreement in accordance with the 1940 Act. As a result, each BDC’s shareholders will be asked to approve an amended and restated investment advisory agreement between such Owl Rock BDC and the applicable Owl Rock Adviser, which will replace its current investment advisory agreement upon the consummation of the transaction. All material terms will remain unchanged from the Owl Rock BDCs’ current investment advisory agreements, and such agreements, if approved by the applicable Owl Rock BDCs’ shareholders, will become effective upon the closing of the transaction.

Transaction Overview

Pursuant to the transaction, Altimar, which currently holds $275 million in cash in trust, will combine with Blue Owl at an estimated $12.5 billion pro forma equity value at closing. Assuming no redemptions by Altimar’s existing public stockholders, the existing equityholders of Owl Rock and Dyal (including Neuberger Berman) will hold approximately 85% of Blue Owl immediately following the closing of the business combination. The founders and senior managers of Blue Owl will retain their equity stakes immediately following the transaction, promoting continued alignment with the combined company’s public investors and clients.

Cash proceeds in connection with the transaction will be funded through a combination of Altimar’s cash in trust and a $1.5 billion fully committed, oversubscribed, common stock private investment in public equity (“PIPE”) at $10.00 per share, including commitments from leading investors including ICONIQ Capital, CH Investment Partners, Koch Companies Defined Benefit Master Trust, the Federated Hermes Kaufmann Funds, and Liberty Mutual Investments.

The board of directors for each of Altimar and Neuberger Berman, as well as the Executive Committee of Owl Rock, have unanimously approved the proposed transaction. Completion of the proposed transaction is subject to approvals of Altimar’s stockholders, the equityholders of each of the Owl Rock BDCs to the assignment of its advisory agreement, as discussed above, and Dyal-sponsored fund’s limited partners, in addition to other customary closing conditions, including a registration statement being declared effective by the Securities and Exchange Commission. The transaction is expected to be completed in the first half of 2021.

Management and Board of Directors

Upon completion of the strategic combination, Blue Owl will be led by Doug Ostrover (Owl Rock co-founder) as Chief Executive Officer. The senior management team will also include Michael Rees (founder of Dyal) and Marc Lipschultz (Owl Rock co-founder) as co-Presidents and Alan Kirshenbaum as Chief Financial Officer. Craig Packer (Owl Rock co-founder) will continue as Chief Executive Officer of the Owl Rock BDCs.

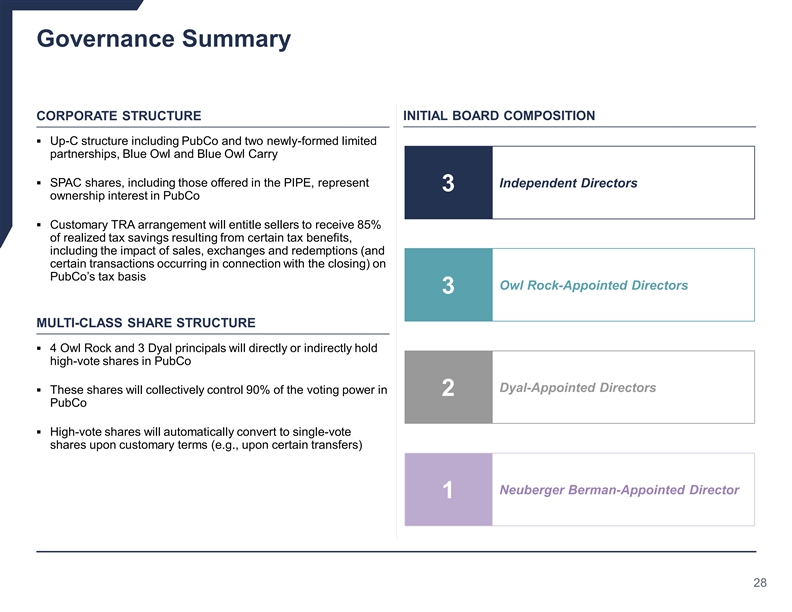

Blue Owl’s nine-person board of directors will be initially composed of three independent directors, three Owl Rock-appointed directors, two Dyal-appointed directors and one Neuberger Berman-appointed director.

Advisors

Perella Weinberg Partners LP, Goldman Sachs & Co. LLC and BofA Securities, Inc. are serving as financial advisors and Kirkland & Ellis LLP is serving as legal counsel to Owl Rock.

Ardea Partners LP is serving as financial advisor for Neuberger Berman and Dyal. Skadden, Arps, Slate, Meagher & Flom LLP is serving as legal counsel to Neuberger Berman. Additionally, Citigroup and UBS are serving as advisors to Neuberger Berman. Evercore Group LLC is serving as financial advisor and Fried, Frank, Harris, Shriver & Jacobson LLP is serving as legal counsel to Dyal.

J.P. Morgan Securities LLC is serving as exclusive financial advisor and Paul, Weiss, Rifkind, Wharton & Garrison LLP is serving as legal counsel to Altimar Acquisition Corporation.

Goldman Sachs & Co. LLC and J.P. Morgan Securities LLC acted as joint placement agents on the PIPE.

Investor Conference Call Information

An investor call and presentation discussing the transaction is available at the link below:

https://dpregister.com/sreg/10150767/dfccfb54ba

Participant Dial In (Toll Free): 1-866-777-2509

Participant International Dial In: 1-412-317-5413

A transcript of the call will also be filed by Altimar with the SEC.

On the call, the presenters will be reviewing an investor presentation, which will be filed with the SEC as an exhibit to a Current Report on Form 8-K prior to the call, and available on the SEC website at www.sec.gov.

About Altimar Acquisition Corporation

Altimar Acquisition Corporation is a special purpose acquisition company sponsored by Altimar Sponsor, LLC, an affiliate of HPS Investment Partners, LLC, formed for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. For more information, visit www.altimarspac.com.

About Owl Rock

Owl Rock Capital Group, together with its subsidiaries, is a New York-based direct lending platform with approximately $23.7 billion of assets under management as of September 30, 2020. Owl Rock’s platform consists of multiple investment funds and products including business development companies (“BDCs”). Owl Rock is comprised of a team of seasoned investment professionals with significant and diverse experience from some of the world’s leading investment firms and financial institutions. Owl Rock’s relationship-oriented approach to investing seeks to provide companies with sizeable commitments to facilitate transactions and support their growth needs with certainty, speed and transparency throughout the entire investment process.

About Dyal Capital

Dyal Capital seeks to acquire minority equity stakes in and provide financing to established alternative asset managers. With over a decade of experience transacting with institutional financial firms, Dyal has completed over 50 equity and debt transactions and manages approximately $23.3 billion in aggregate capital commitments as of November 30, 2020. Central to Dyal’s success is our Business Services Platform (the “BSP”). The BSP is a team that provides strategic support to underlying management company partners in various areas, primarily including capital strategy and advisory services. Part of Neuberger Berman, the Dyal team is located in New York, London, and Hong Kong.

About Neuberger Berman

Neuberger Berman Group LLC, founded in 1939, is a private, independent, employee-owned investment manager. The firm manages a range of strategies—including equity, fixed income, quantitative and multi-asset class, private equity, real estate and hedge funds—on behalf of institutions, advisors and individual investors globally. With offices in 24 countries, Neuberger Berman’s diverse team has over 2,300 professionals. For six consecutive years, the company has been named first or second in Pensions & Investments Best Places to Work in Money Management survey (among those with 1,000 employees or more). In 2020, the PRI named Neuberger Berman a Leader, a designation awarded to fewer than 1% of investment firms for excellence in Environmental, Social and Governance (ESG) practices. The PRI also awarded Neuberger Berman an A+ in every eligible category for its approach to ESG integration across asset classes. The firm manages $374 billion in client assets as of September 30, 2020, including $103 billion in alternative assets.

Important Additional Information and Where to Find It

This communication is being made in respect of the proposed business combination transaction involving Altimar and Blue Owl. Altimar intends to file a registration statement on Form S-4 with the Securities and Exchange Commission (the “SEC”), which will include a proxy statement and a prospectus of Altimar, and each party will file other documents with the SEC regarding the proposed transaction. A definitive proxy statement/prospectus will also be sent to the stockholders of Altimar, seeking any required stockholder approval. Before making any voting or investment decision, investors and security holders of Altimar are urged to carefully read the entire registration statement and proxy statement/prospectus, when they become available, and any other relevant documents filed with the SEC, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction. The documents filed by Altimar with the

SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by Altimar may be obtained free of charge from Altimar at www.altimarspac.com. Alternatively, these documents, when available, can be obtained free of charge from Altimar upon written request to Altimar Acquisition Corp., 40 West 57th Street, New York, New York 10019, Attn: Secretary, or by calling 212-287-6767.

In connection with the proposed transaction which will result in the change in control of the Owl Rock Advisers, the applicable Owl Rock BDCs intend to file proxy statements in preliminary and definitive form with the Securities and Exchange Commission (the “SEC”) that will contain important information about the proposed transaction and related matters, and deliver a copy of the proxy statement to its shareholders. Investors of the Owl Rock BDCs are urged to read the definitive proxy statement and other relevant documents carefully and in their entirety when they become available because they will contain important information about the proposed transaction and related matters. Investors may obtain a free copy of these materials when they are available, and other documents filed by the Owl Rock BDCs, with the SEC at the SEC’s website at www.sec.gov or at Owl Rock’s website at www.owlrock.com or www.owlrock.com/proxy/ or, for Owl Rock Capital Corporation, at www.owlrockcapitalcorporation.com. Investors and security holders may also obtain free copies of the proxy statement and other documents filed with the SEC from the Owl Rock BDCs by contacting Investor Relations at (212) 651-4705.

Participants in the Solicitation

Altimar and certain of its respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Altimar, in favor of the approval of the business combination. For information regarding Altimar’s directors and executive officers, please see Altimar’s final prospectus related to its initial public offering filed with the SEC on October 23, 2020. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the registration statement and the proxy statement/prospectus and other relevant documents filed with the SEC when they become available. Free copies of these documents may be obtained as described in the preceding section.

The applicable Owl Rock BDCs and their directors, executive officers, employees and other persons certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders or shareholders of the applicable Owl Rock BDCs’ common stock in respect of the change in control Transaction. For information regarding the Owl Rock BDCs’ directors and executive officers, please see: Owl Rock Capital Corporation’s definitive proxy statement filed with the SEC on April 17, 2020, in connection with its 2020 annual meeting of shareholders; Owl Rock Capital Corporation II’s definitive proxy statement filed with the SEC on April 17, 2020, in connection with its 2020 annual meeting of shareholders; Owl Rock Technology Finance Corp.’s definitive proxy statement filed with the SEC on April 17, 2020, in connection with its 2020 annual meeting of shareholders; and Owl Rock Capital Corporation III’s registration statement on Form 10 filed with the SEC on July 17, 2020. Other information regarding persons who may be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC when they become available.

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of any securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such other jurisdiction.

Forward-Looking Statements

Certain statements made in this press release, and oral statements made from time to time by representatives of Owl Rock, Dyal and Neuberger Berman are “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Statements regarding the potential combination and expectations regarding the combined business are forward-looking statements. In addition, words such as “estimates,” “projects,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “would,” “should,” “future,” “propose,” “target,” “goal,” “objective,” “outlook” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the control of the parties, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements.

In addition to factors previously disclosed in Altimar’s reports filed with the SEC, including its registration statement on Form S-1 filed in connection with its initial public offering, and those identified elsewhere in this communication, important factors that could cause actual results and outcomes to differ materially from those indicated in the forward-looking statements include, among others, the following: (i) the inability of the parties to enter into a definitive agreement with respect to the potential combination or to complete the contemplated transactions; (ii) matters discovered by any of the parties as they complete their respective due diligence investigation of the other parties; (iii) the risk that requisite regulatory, corporate and other approvals and consents for the potential transaction are not obtained or are delayed; (iv) the inability to recognize the anticipated benefits of the proposed combination; (v) delays in signing or closing a transaction; (vi) difficulties, delays or unanticipated costs in integrating the operations or personnel of Owl Rock and Dyal; (vii) unexpected costs resulting from the transaction; (viii) changes in general economic conditions, including as a result of the COVID-19 pandemic and (ix) regulatory conditions and developments. Forward-looking statements speak only as of the date they are made, and none of Owl Rock, Dyal or Neuberger Berman undertakes any obligation, and expressly disclaims any obligation, to update, alter or otherwise revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Readers should carefully review the statements set forth in the reports, which Altimar has filed or will file from time to time with the SEC.

Non-GAAP Financial Measures

This press release includes references to fee related earnings, or FRE, which is a supplemental measure that is not required by, or prepared in accordance with, accounting principles generally accepted in the United States (“GAAP”).

FRE is used to assess core operating performance by determining whether recurring revenue is sufficient to cover operating expenses and to generate profits. FRE is derived from and reconciled to, but not equivalent to, its most directly comparable GAAP measure of Net Income (Loss) Before Income Taxes. FRE differs from income before taxes computed in accordance with GAAP as it excludes performance income, performance related compensation, investment net gains (losses) and certain other items that we believe are not indicative of our core operating performance. We use FRE as a non-GAAP measure to assess and track our performance. FRE is not a measurement of our financial performance under GAAP and should be considered in addition to, and not in lieu of, the results of operations which are derived in accordance with GAAP.

Altimar Contact

Prosek Partners

Mike Geller

mgeller@prosek.com

Owl Rock and Dyal Contacts

Prosek Partners

David Wells / Andy Merrill / Josh Clarkson / Emily Goldberg

dwells@prosek.com / amerrill@prosek.com / jclarkson@prosek.com / egoldberg@prosek.com

Exhibit 99.2

|

Call Announcing Owl Rock Capital Group and Dyal Capital Partners Enter Definitive Business Combination Agreement with Altimar Acquisition Corporation to Form Blue Owl Capital, Inc. |

|

Wednesday, December 23, 2020 |

PARTICIPANTS Douglas Ostrover - Co-Founder Owl Rock Marc Lipschultz - Co-Founder Owl Rock Michael Rees - Founder Dyal Capital Alan Kirshenbaum - Chief Financial Officer, Owl Rock Tom Wasserman - Chief Executive Officer, Altimar Acquisition Corporation Scott Kapnick - Chief Executive Officer, HPS Investment Partners |

The following is a transcript of a recording of a presentation posted on December 23, 2020. This transcript should be read in conjunction with, and is qualified in all respects by, the written material accompanying that presentation, which was furnished as Exhibit 99.3 to Altimar Acquisition Corporation’s Current Report on Form 8-K filed with the Securities and Exchange Commission on December 23, 2020.

Operator

Welcome to the call announcing that Owl Rock Capital Group and Dyal Capital Partners have entered into a definitive business combination agreement with Altimar Acquisition Corporation to form Blue Owl Capital, Inc. and list on the New York Stock Exchange.

Before we begin, I would like to note that this call may contain forward-looking statements, including Blue Owl’s expectations of future financial and business performance and conditions, the industry outlook, and the timing and completion of the transaction.

Forward-looking statements are inherently subject to risks, uncertainties, and assumptions, and they are not guarantees of performance. I encourage you to read the press release issued today, the accompanying presentation that is available on Altimar’s website, and filings with the SEC for a discussion of the risks that can affect business combination and the business of Blue Owl after completion of the proposed transaction.

All participants will be in a listen-only mode. I would now like to turn the conference over to Doug Ostrover, Co-Founder of Owl Rock, who will serve at Chief Executive Officer of Blue Owl. Please go ahead.

Doug Ostrover

Good morning, everyone. Thank you for joining us today. This is an exciting day for us, and we appreciate you taking the time to learn more about Blue Owl. I want to thank the HPS Altimar team for their commitment and partnership, as well as the world-class group of institutional investors who committed an additional $1.5 billion of capital to the transaction.

I’d like to start off by explaining why I think Blue Owl is a truly differentiated alternative asset manager. We are a business that is focused exclusively on the private markets. We have two major lines of business. We are one of the largest players in the direct lending markets, and we are the single largest manager of GP solutions. I am confident that Blue Owl’s expertise, agility and scale, underpinned by a substantial permanent capital base, will enable us to offer a platform of capital solutions and, in turn, provide us with unrivaled access to compelling investment opportunities.

On page three, what I tried to do is describe to you a few of the attributes that I hope you and your team will find attractive. First, and this is probably the most important point, our capital base is permanent. We have on the slide approximately $50 billion of assets. We believe in the very near future that will be almost $60 billion.

It’s important to understand that $60 billion is permanent. It will not go down. You will hear a lot of alternative managers talk about their net assets grew by X. We don’t have this phenomenon. Our assets start at $50 billion to $60 billion, and they will only grow from there.

Call Announcing Owl Rock Capital Group and Dyal Capital Partners Enter Definitive Business

Combination Agreement with Altimar Acquisition Corporation to Form Blue Owl Capital, Inc.

Wednesday, December 23, 2020

2

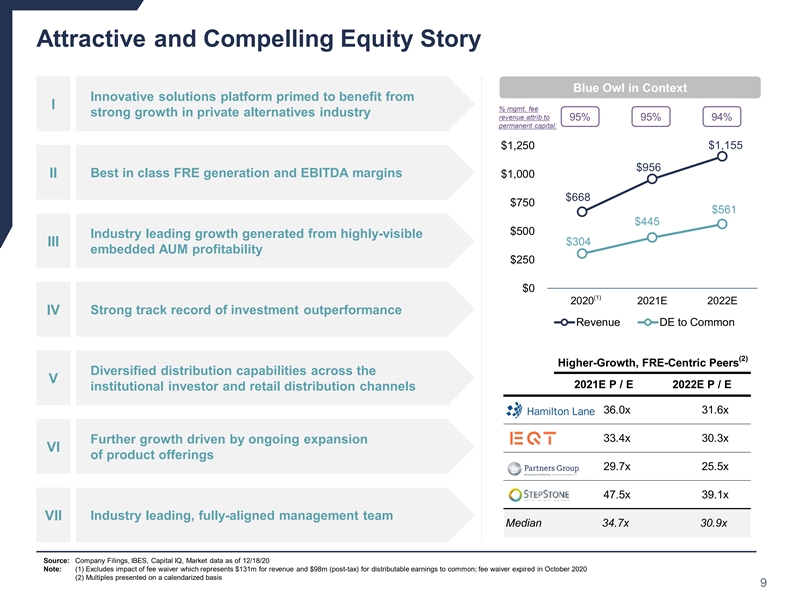

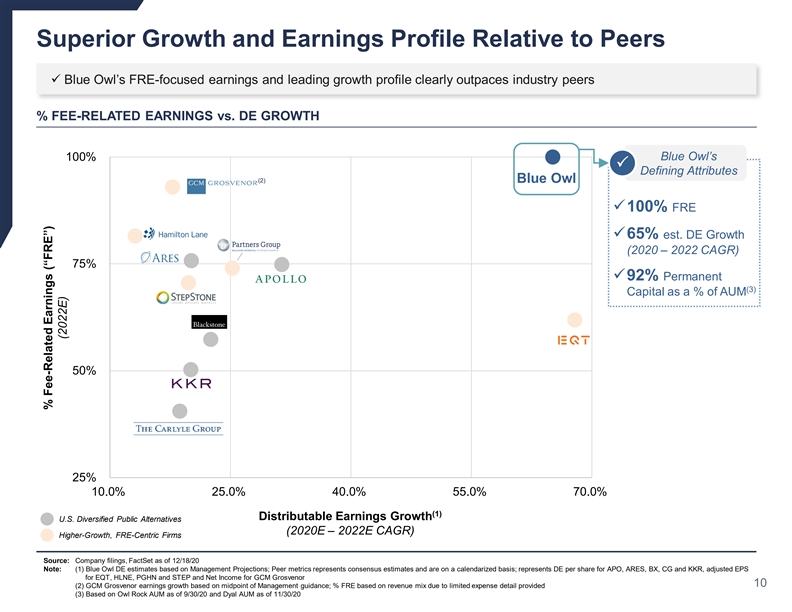

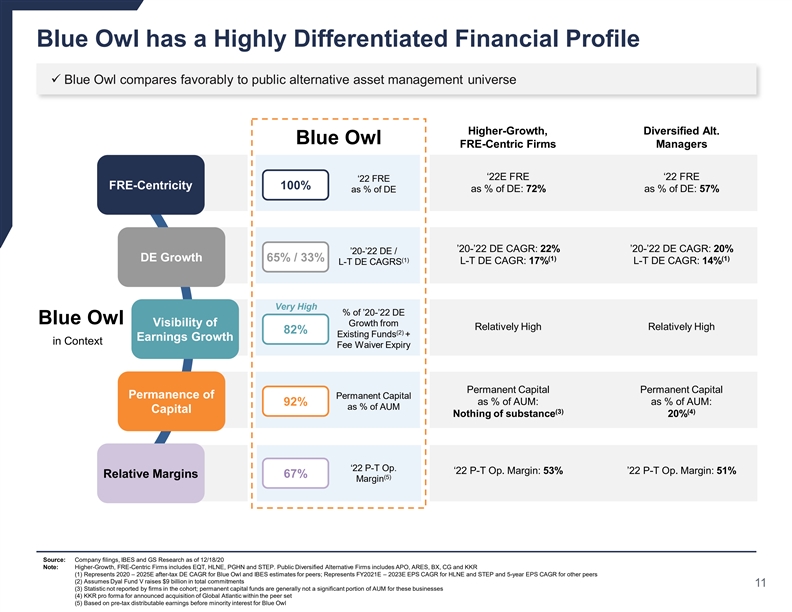

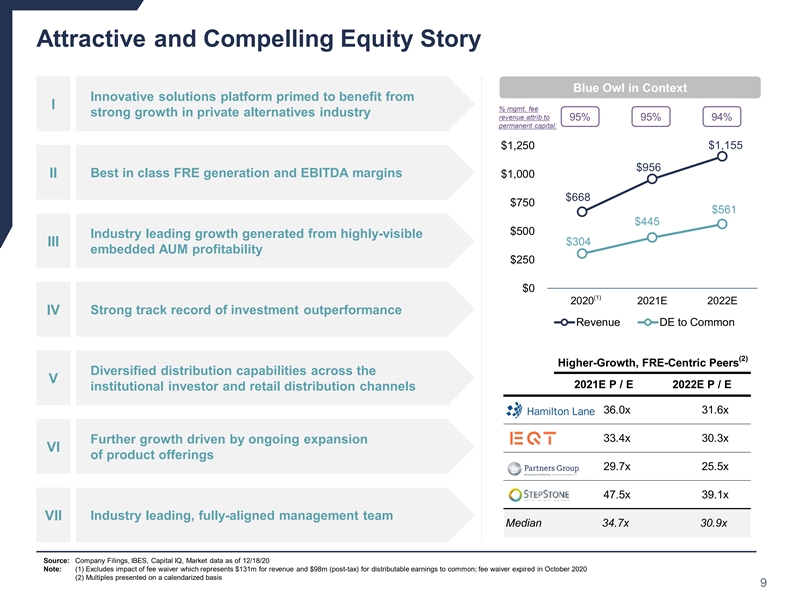

Secondly, our distributable earnings are 100% from FRE. Our profit margins are best in class. You’ll see that our growth over the next two years is the highest in the industry, and it’s primarily from funds raised but not yet deployed.

We’ll also take a moment to talk about some of our growth initiatives that are not in our projections. And then finally, we have a leadership team with a proven record of success. On the right-hand side of the slide, you can see how we compared to the best traded names in the alternative space. Whether it’s FRE, pretax margins, or our growth rate, you will see all of these metrics are best in class.

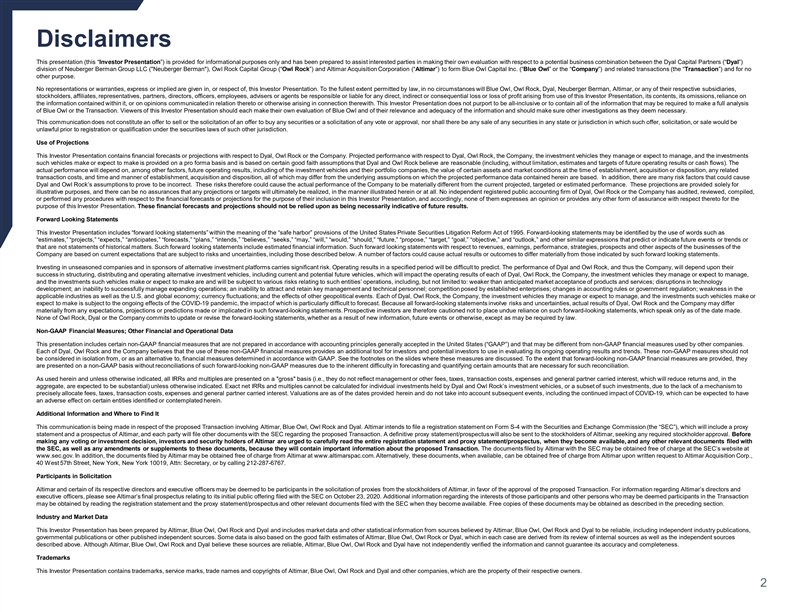

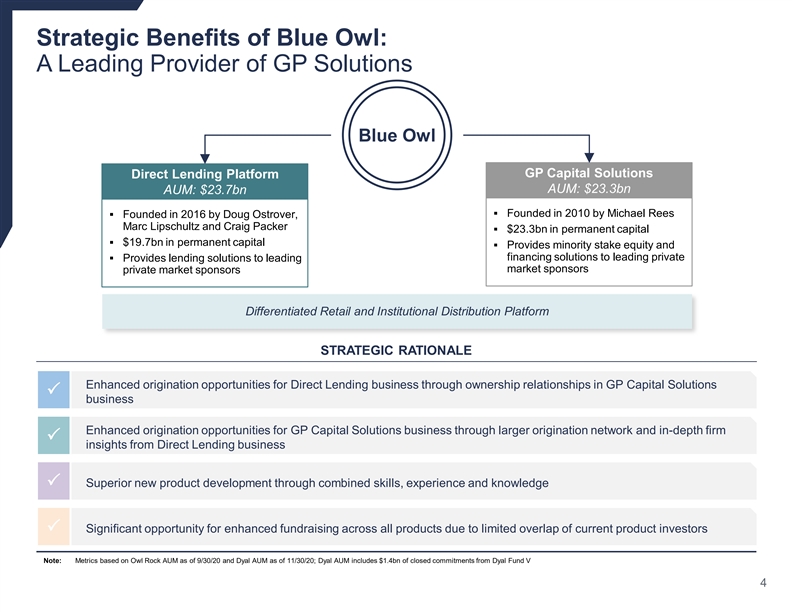

The next slide is an overview of what our business looks like and the strategic rationale behind the combination of Owl Rock and Dyal. As I said earlier, we have two major lines of business that make up Blue Owl. On the left, we have the direct lending side, Owl Rock, which is the business that I co-founded with Marc Lipschultz and Craig Packer in 2016. Our direct lending platform provides lending solutions to leading private market sponsors. This side of the business has $23.7 billion in assets under management, $19.7 billion of which is permanent capital.

The other side of the business, Dyal, which is GP Capital Solutions, was founded by Michael Rees in 2010. This side of the business provides minority stake equity and financing solutions to leading private market sponsors. The GP Capital Solutions side has $23.3 billion in assets under management, 100% of which is permanent capital.

By bringing these two businesses together, Blue Owl will be positioned as a differentiated provider of solutions to the alternative asset management community. The two businesses of Blue Owl will be autonomous but complementary. There will be enhanced origination opportunities for our direct lending businesses through ownership relationships in our GP Cap Solutions businesses. There will also be enhanced origination opportunities for the GP Capital Solutions business through our large origination network and in-depth firm insights.

Additionally, both sides of the business bring together investment veterans and experienced professionals who can work together to develop new, superior products for our clients. And lastly, there is significant opportunity for enhanced fundraising across all products due to limited overlap of our current product investors.

So, my goal today is to present you to the team, let us walk into the business, and show you that this combination of permanent capital combined with very high growth, it should allow us not day one but over the near term to hopefully trade equal or at a premium to all of the names you see on the page on the right-hand side.

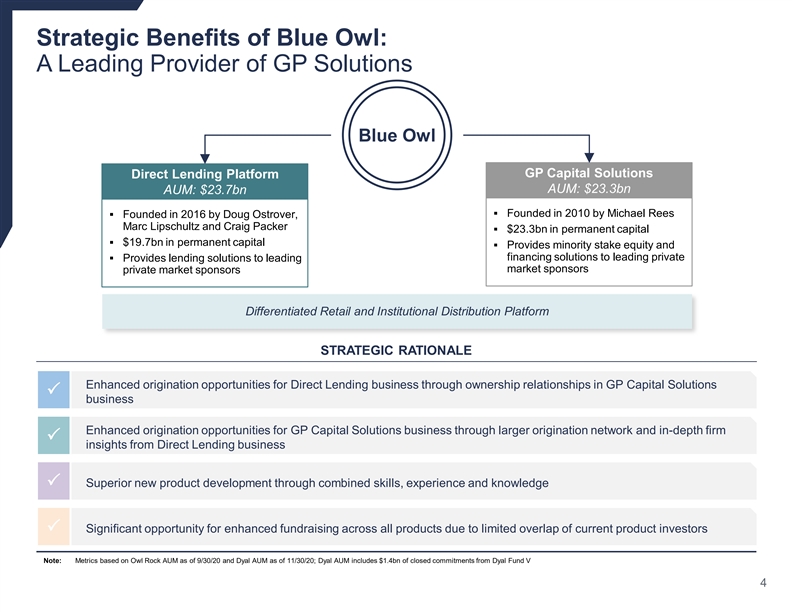

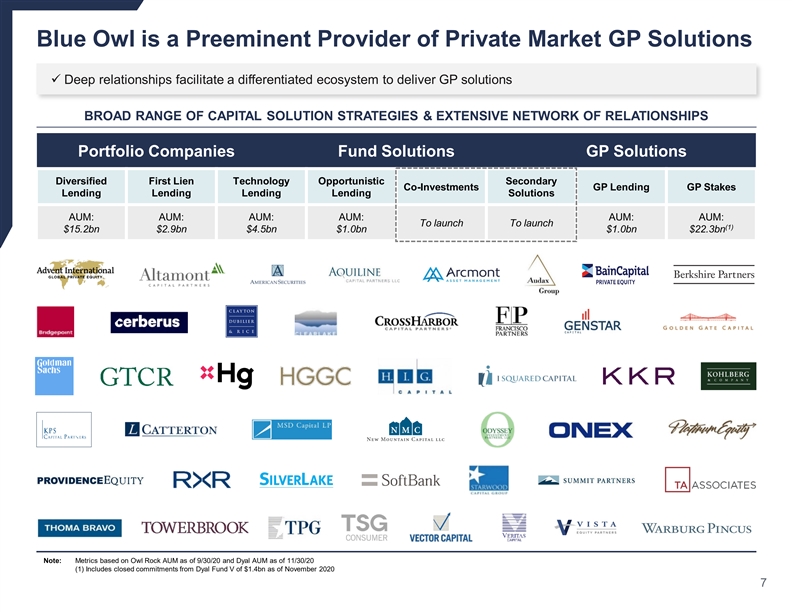

Let’s move forward for a moment. So, as I mentioned, we have one of the largest pools of permanent capital focused on the needs of the private marketplace. It’s important to remember we look at ourselves as a solutions provider. And what this slide is meant to show you is obviously some of the PE firms we work with and, in the middle of the page, some of the solutions we offer.

What we’re trying to do is we’re trying to meet all of the needs, whether it be a PE firm or a VC firm or a debt firm. Our goal is to have a pool of capital to meet whatever the needs are of those firms. You can see in the boxes we have two products we hope to go after in the near term, and co-investments is a great example of something that we are in the process of creating. I like to think about it, for our originators and for our stakes teams, just another tool in the toolshed.

Call Announcing Owl Rock Capital Group and Dyal Capital Partners Enter Definitive Business

Combination Agreement with Altimar Acquisition Corporation to Form Blue Owl Capital, Inc.

Wednesday, December 23, 2020

3

On the debt side, we call on well over 600 private equity firms. We talk to many of these firms on a weekly basis. We are presented with co-invest constantly. On the stakes side of the business, these are firms--we have founder level relationships and we see a lot of proprietary ideas from them. I can tell you that we believe we can build one of the largest co-invest businesses in the industry. And I have to be honest. I’d be disappointed if we didn’t become one of the largest managers in this asset class in the next three years.

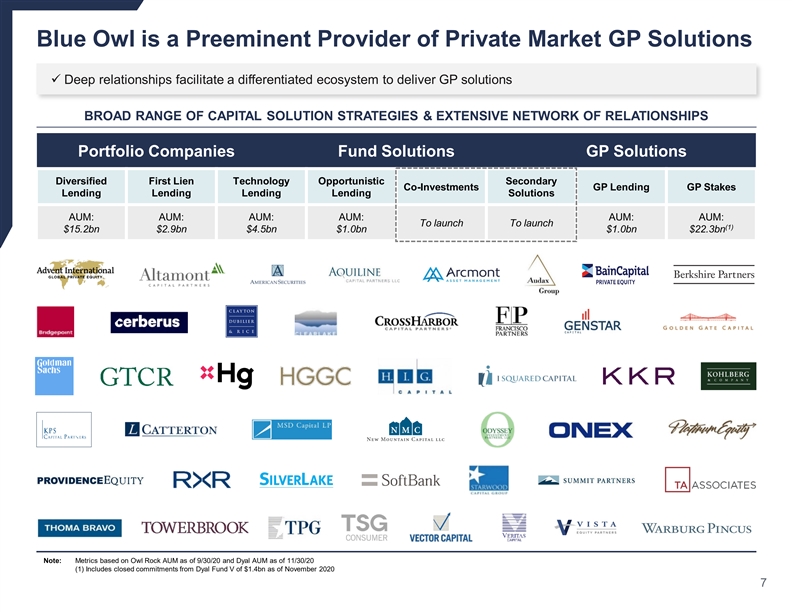

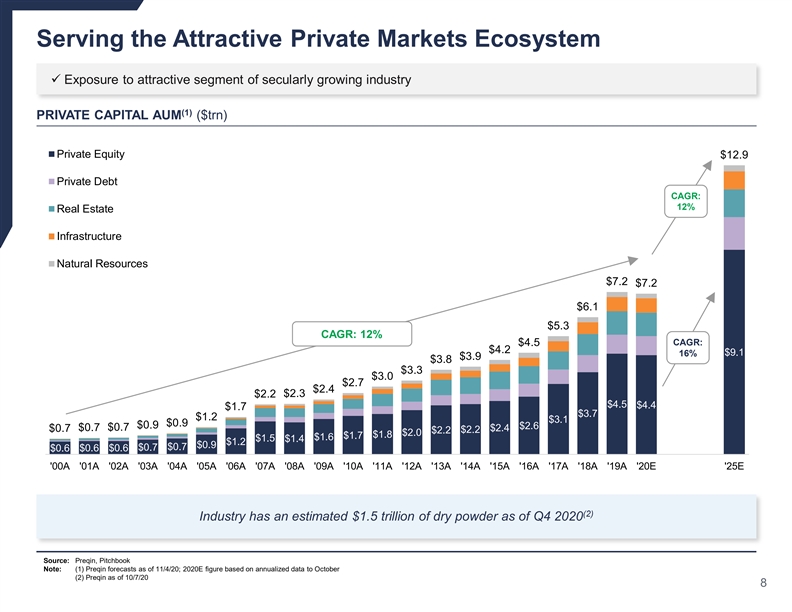

So, I’m not going to spend too much time on this page. I think many of you have probably seen something similar, but I think it’s important to realize that we have tremendous tailwinds in both private equity and the private debt sectors. What the slide is meant to show you is Preqin is forecasting 16% growth in basically both of these asset classes. And I think as a team at Blue Owl we believe those numbers could be light.

Most of you are aware we have a 10 year Treasury that is well below 1%. But what you may not be focused on is that 80% of investment-grade debt today trades below 1%. 50% of high-yield yields under 4%. And because of this phenomenon, we expect a substantial amount of capital to continue to flow into the alternative asset sector. Remember, our products, they generate meaningful current income as well as they offer attractive upside. And so, we’re confident that we will continue to get more than our fair share as these assets continue to grow.

This is a very important story and begins to tell why we’re so excited about our equity story. If you think about what we’ve created, we’ve created a very large pool of permanent capital. That pool of capital will generate meaningful revenue for the foreseeable future. In other words, it’s certainty of cash flow.

What that means to shareholders, a certainty of high dividends and growing dividends, and then you combine that with meaningful growth and we think we have something that’s truly unique. We believe we have all the best attributes of the most highly valued alts firms that you see on the bottom right-hand page, but our capital base is permanent.

Also, I think it’s important to keep in mind we’re very well positioned in our respective businesses. And as we go through this, you’ll see we’ve shown that we have the ability, if a meaningful opportunity exists, to innovate and create interesting new products for our investors. I want to highlight just three bullets.

The second bullet, first of all it says best in class FRE generation and EBITDA margins; the third bullet, industry-leading growth generated from highly visible embedded AUM profitability. And the fifth bullet is something I really want to spend a few moments on. When you take a look at our LP roster, it’s a blue-chip roster of investors, and we’d be happy to share that with any of you.

But you’ll also see we mention our retail distribution channel. We often refer to this as our hidden gem. We have built out--we have spent tens of millions of dollars building out a retail distribution channel that we believe is--that is best in class and can compete with anyone in the marketplace. Just to give you an idea how powerful this is, Blackstone, pre-COVID in their retail channel, was bringing in over $1 billion a month in the non-traded REIT space. We are getting ready to launch a comparable product but in the credit space.

Call Announcing Owl Rock Capital Group and Dyal Capital Partners Enter Definitive Business

Combination Agreement with Altimar Acquisition Corporation to Form Blue Owl Capital, Inc.

Wednesday, December 23, 2020

4

Now, we’re not expecting to bring in $1 billion a month, but we do think it’s reasonable that we could bring in $200 million, $250 million a month. You should know that those numbers are not in our projections. When I go through numbers, when Alan, our CFO goes through numbers, none of that is in there, yet we think we could generate $2.5 billion to $3 billion a year through retail.

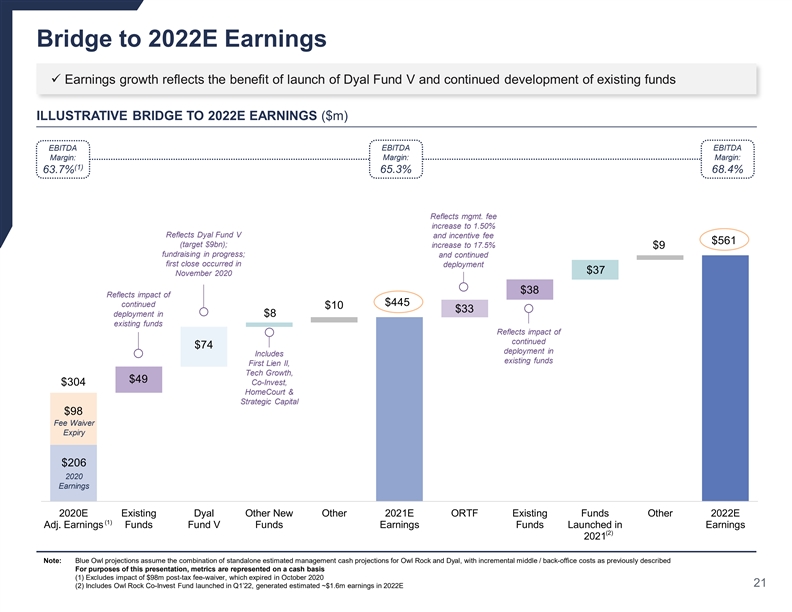

I think if you look to the right and the upper right-hand side, the light blue bar is meant to just show you our after-tax profit. You can see it’s going from about $300 million to $560 million; a couple points I want to make on that. Almost all of that, and Alan will walk you through this, comes from money that has been raised but not yet deployed.

The other thing I want to point out is we think $560 million is a conservative number. You will see we have some fee waivers rolling off and capital in the ground. With no growth, we believe we should generate well over $600 million of net income, so we think that is a highly achievable number.

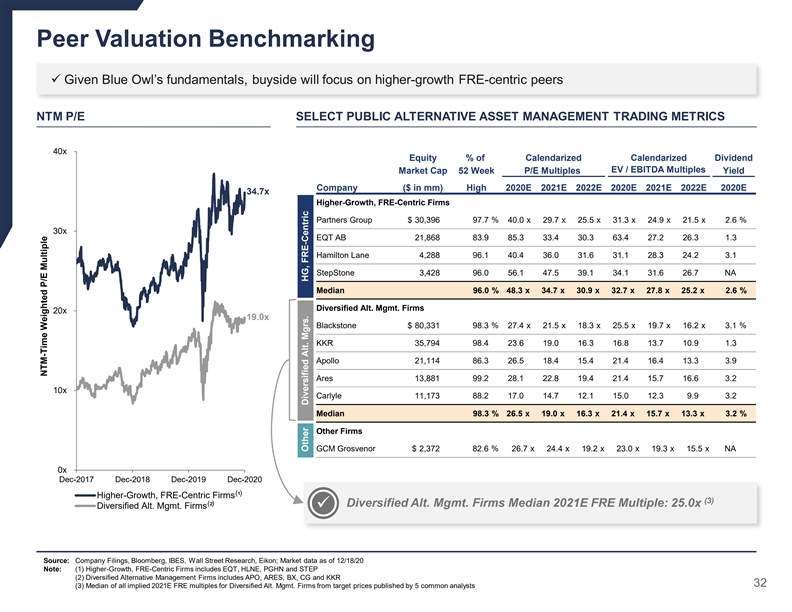

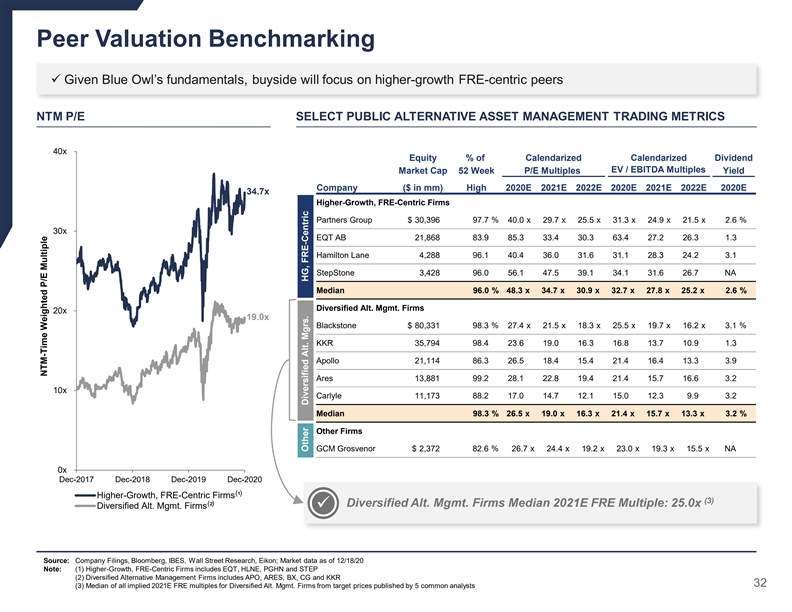

You can see down below Hamilton Lane, EQT Partners Group, StepStone, all incredible firms, and they’re trading in and around 30x ’22 P/E. Now, we’re not expecting to come out and trade and price at 30x. We will come at a very nice discount to that. But we feel highly confident, as we continue to go through this, you’ll see that we should trade at least in line with those firms and, hopefully over time, trade at a premium to those firms.

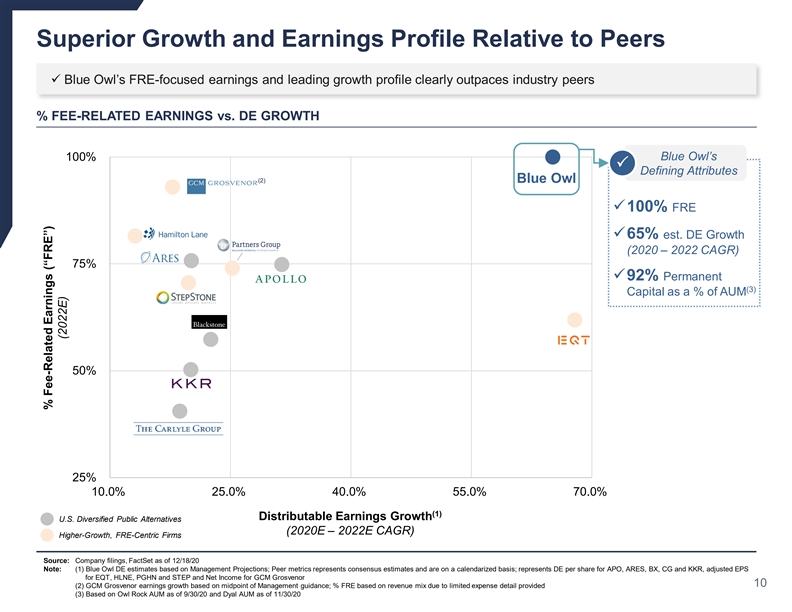

So, this is a slide I think that speaks for itself, but I think it’s pretty compelling. You can see in the upper right-hand quadrant Blue Owl, in terms a fee related earnings and growth, is heads and tails above its peers; 100% FRE, 65% growth over the next few years. But what’s not on this chart which really differentiates us is 91% of our capital is permanent.

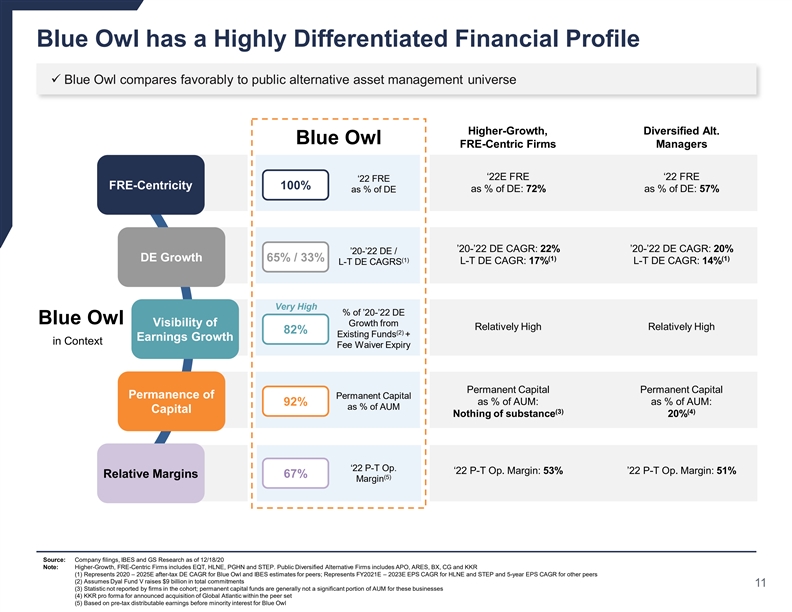

This is really, I think, a very important slide to understand the story. On the right-hand side are what we refer to as the diversified managers. These are incredible firms, but you should know that a big part of their distributable earnings come from carry. And the market puts a premium on fee related income and they discount carry. You can see in the middle are the firms I just referenced. And a larger percent of their distributable earnings come from fee-related earnings, and they trade at a premium.

Now, all the way to the left, take a look at Blue Owl. Our FRE as a percentage of our distributable earnings is 100%. Our growth over the next two years is 65%; our long-term growth 33%. That compares to the middle column, 23% and 17%, and to the more established firms’ short-term growth of 20%, longer-term 14%. So, we believe we’ll have a large premium. We should earn a premium because of that growth.

Our visibility of earnings; you’ll hear from the team shortly 82% of the growth over the next two years will come from existing funds and some early fee waivers that will be expiring or have expired. You can see versus our peers they also have relatively high visibility, but I don’t think it’s at 82%. Permanence of capital, 91%; you can see the middle column, nothing of substance, and the firms on the right are at 20%.

I think this is a really important column, and that’s because if you listen to the earnings calls of virtually every alternative manager, one of the things they all stress is they want to increase the amount of permanent capital they have. And so, we are starting light years ahead of our peers. And then on margins, you can see we’re at 67% versus 53% for the higher growth FRE centric firms and 50% for the alts managers.

Call Announcing Owl Rock Capital Group and Dyal Capital Partners Enter Definitive Business

Combination Agreement with Altimar Acquisition Corporation to Form Blue Owl Capital, Inc.

Wednesday, December 23, 2020

5

So, we’re really excited about what we’ve built. And now, why don’t we take a moment and go into our lines of business? Marc, I’ll hand it off to you.

Marc Lipschultz

Thank you, Doug. I’m Marc Lipschultz, co-founder and co-president of Blue Owl. Let me talk to you just a bit about the direct lending side of our business.

So, as Doug talked about, we’ve really achieved a distinctive level of scale in this business. With nearly $24 billion of assets and growing just in our direct lending line, we’re really in a specifically capable position of delivering solutions for just about any private equity or non-sponsor financing need.

We really believe in what we do. We have a lot of our own capital in it. We’ll come onto this later, but in point of fact in this offering we, the co-founders and the management team, are not selling a single share of stock. We are big believers in what Doug just talked to you about.

Very importantly, we deliver results for our investors. And we intend to deliver that for you as an investor if you should join us. But for our existing investors in our products, we have delivered an 11.8% realized return. Contextualize that to Doug’s earlier comments and I think it helps us all understand why alternatives are this inexorable force driving through the system.

In a world of sub 1% investment grade in Treasuries and 4% for high-yield, we offer a substantial premium for a modest increment of risk. And I think that is what has been attractive and will continue to attract people to this particular component of the private markets asset arena.

Just breaking down our products a little further, I’m not going to go through each product but I’m going to make an observation about the spectrum of products that you see. They are all organic products. They’re all built on identifying a need in the marketplace. We see an opportunity, we see a way we can deliver a distinctive value proposition, and we build a product into it.

And we’ve been able to do this very, very successfully, and we expect fully to be able to continue to do so. Doug talked about co-investments, for example, as another block if you look along this is spectrum. But we have our diversified lending business, and then we observe from the platform opportunities like first lien lending, the safest part of the leveraged lending landscape, and we see actually it’s very thinly occupied by alternative providers. So, we said let’s quit the business there in one of the safest arenas where we can generate attractive returns for investors.

Technology; we were very, very early to focus in on the incredibly attractive credit attributes of software businesses. We today manage the largest software dedicated, technology dedicated direct lending product in the world. And we see enormous opportunity. This has been an area of tremendous success for us. We are really married to and growing with the technology sector writ large and many of the sponsors that serve this sector.

Call Announcing Owl Rock Capital Group and Dyal Capital Partners Enter Definitive Business

Combination Agreement with Altimar Acquisition Corporation to Form Blue Owl Capital, Inc.

Wednesday, December 23, 2020

6

And now we can move forward opportunistically, providing solutions when things are more complex, when there’s a need to bridge through the chasm, for example, of a pandemic like we have now, and providing a way for owners of businesses to get from here to the brighter future.

So, this is really an array that will continue to grow really over to the right as we go up and down. We should be able to deliver new products and better solutions and high returns for our investors, and that allows us to deliver high returns for you.

With that, I am going to turn it over to my good friend and co-president and co-founder, Michael Rees.

Michael Rees

Hello, everyone. My name is Michael Rees. And I am the co-president of Blue Owl and the founder of Dyal Capital, and lead our team that focuses on GP Capital Solutions.

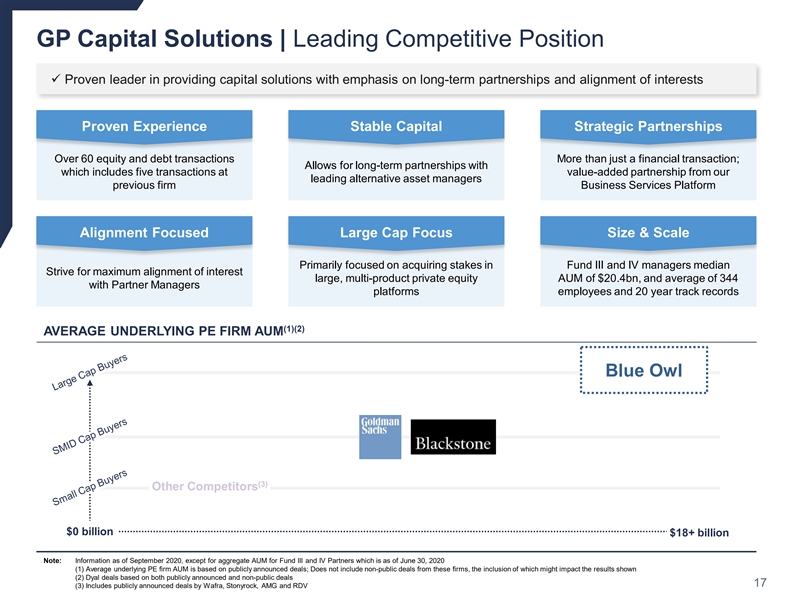

For the last decade, this team has focused on providing capital and strategic relationships to some of the best alternative managers in the industry. Over this time, we have made 50 plus minority equity investments into the management companies of these leading firms or provided long-term debt financing at the GP level.

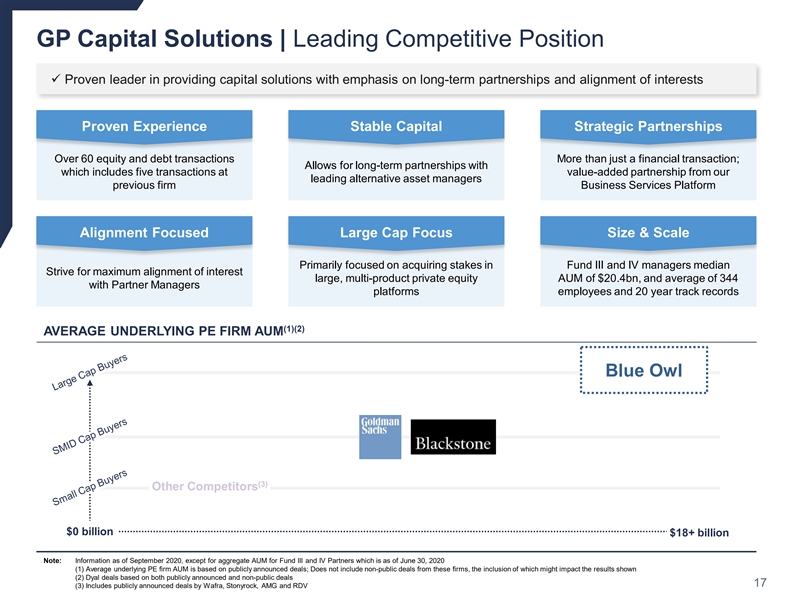

This is a relatively new field that has grown up throughout the alternatives industry, and we believe we are the leader in the space. We’re certainly the leader by size, market share, and prominence within the industry. We run $23 billion of permanent capital and are in the process of raising our fifth minority stakes fund, and are continuing to deploy our permanent capital debt financing fund.

Within this area of GP Capital Solutions, many of the industry’s leading buyout firms, real estate firms, infrastructure, VC, or private credit firms are often looking for a capital partner. They’re looking to find someone to invest permanent capital into their business so that they can initiate growth initiatives, they can put more money into their funds alongside their investors, and also they’d like to add a partner that doesn’t just bring capital but brings a strategic angle as well.

We, within this business of GP Capital Solutions, have an industry-leading team of 34 people. And they work with each of our underlying GP partners in a myriad of areas, helping these businesses become institutional, more institutional, and to continue the growth trajectory that many of them are on. Our team was founded over 10 years ago, and we have a tremendous amount of experience focusing on this very specialized portion of the alternatives industry.

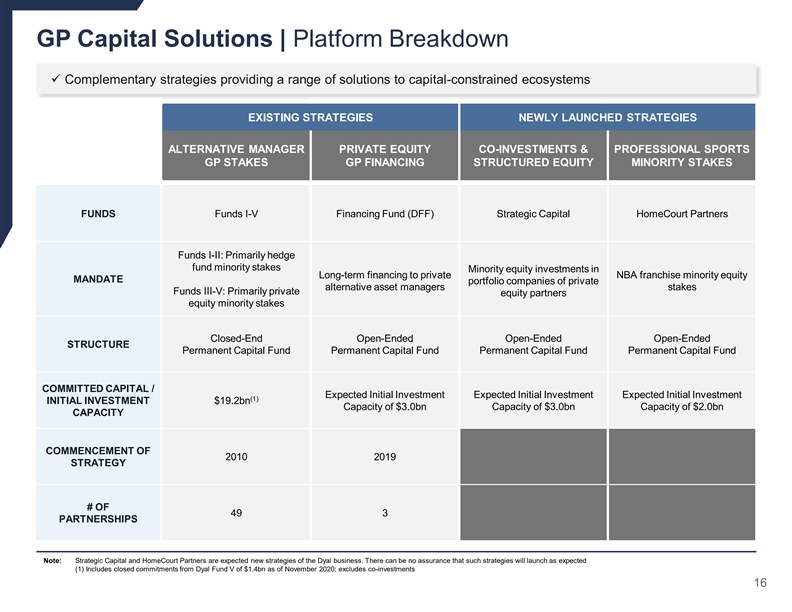

Moving on, you can see the layout of our business. The largest component is in the first column, our five funds that are permanent capital in nature and take permanent investments, capital investments, in minority stakes in the leading money managers throughout the alternative space. Those funds aggregate to about $19 billion in total commitments. And as I mentioned, we’re in the process of raising our fifth permanent capital fund. In that, we have 49 underlying partners.

As we have continued to make those type of minority stake investments, many of our partners have asked us if we could also provide long-term debt financing. Surprising, but many banks and other financial institutions cannot lend to a duration that meets the needs of these firms. So, we can lend through that vehicle to a tenor of 10 or even 15 years. We continue to deploy that capital, and that is the fastest growing part of our business at the moment.

Call Announcing Owl Rock Capital Group and Dyal Capital Partners Enter Definitive Business

Combination Agreement with Altimar Acquisition Corporation to Form Blue Owl Capital, Inc.

Wednesday, December 23, 2020

7

As Doug alluded to at the outset of this meeting, we do think there is a tremendous opportunity in the co-investment and structured equity space. Across all of the embedded GP relationships in the Blue Owl business, we think we can come with many arrows in our quiver to help with these types of co-investments and structured deals to provide some element of liquidity to our very best partners in some of the deals that they have within their portfolio where they’re not looking for a full monetization and they want some strategic capital from a known and trusted party. And oftentimes who better to look to than a minority stake owner in the overall complex?

And finally, we’re proud to be a partner, an exclusive partner, with the NBA, the National Basketball Association, where we’re the only approved buyer of a portfolio of minority equity stakes in the 30 teams in the NBA. That business is just being launched, and we’re hoping to have our first closing in the not-too-distant future. And we think we can grow certainly a very attractive basketball strategy off of this platform, but also possibly expand to a broader sports business that could have tremendous upside. None of that extra growth is embedded in the financials that we’re presenting today.

And then just to highlight some of the key attributes of this GP Capital Solutions business, as I mentioned, we believe we are the market leader. We focus on the best blue-chip firms throughout the industry that are the biggest and we believe have the longest staying power. This provides to our investors a very attractive long-term stream of income and really separates us from two very prominent players in the space, Blackstone and Goldman Sachs, but who focus on smaller or midsize firms. We believe we are really a standout competitor within this space, as is evidenced by our growth, the number of partners that we have, and our market share.

I will now turn it over to Alan, who will take you through the Blue Owl financials.

Alan Kirshenbaum

Thank you, Michael. I am Alan Kirshenbaum. I am the chief financial officer of Blue Owl.

What you see here is two already scaled businesses coming together. You’ll see, starting at the top on the revenue line, the management fee, a very consistent up and to the right management fee line. You’ll see considerable growth over the projection period here, and that translates to considerable growth in distributable earnings toward the bottom of the page. You’ll see, as Doug mentioned earlier in the presentation, a best in class FRE and EBITDA business here.

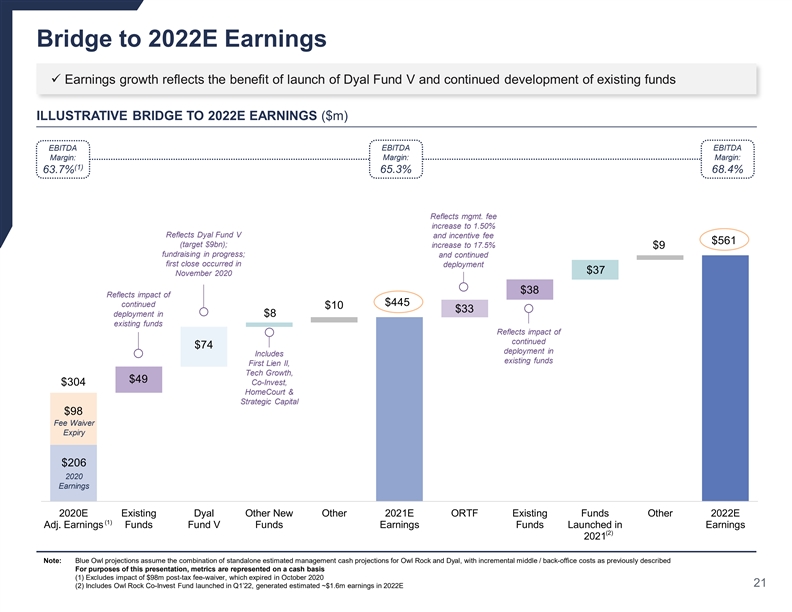

We have a significant amount of earnings power that’s embedded in our business. And this slide really maps that out. So, what we’re showing here is that our distributable earnings of $304 million on the left side of the slide will grow, of course subject to the execution of putting our existing capital to work, to over $600 million of distributable earnings with no new products.

And so, what you’ll see here is $145 million of that growth is due to just deployment of our existing capital; again, the execution of putting our capital (inaudible). You’ll see $83 million is driven by finishing the fundraising for fund V, and then you’ll see $71 million is already embedded in our products, the fee rate increases. And that all contributes to the $602 million, so a significant amount, again, of earnings power embedded in our business. And to be clear, incremental fund raise from new product launches, which is not on this page, only accelerates the embedded up and to the right growth.

On the next slide, I’ll show you a bridge of our distributable earnings over the next two years. We’re bridging from the $304 million of distributable earnings in 2022 to, right in the middle of the page, the $445 million. And what I would point out here is only $8 million of that $445 million of DE is driven by other new funds, new product launches. And then to bridge from the $445 million to the $561 million in 2022, only $37 million of that is driven by new fund launches. So, as you can see, there is a very significant amount of earnings power embedded in our business.

Call Announcing Owl Rock Capital Group and Dyal Capital Partners Enter Definitive Business

Combination Agreement with Altimar Acquisition Corporation to Form Blue Owl Capital, Inc.

Wednesday, December 23, 2020

8

You’ll see on the top left corner organic AUM growth, so very strong CAGRs for AUM growth. You’ll see in the bottom right very strong CAGRs for DE growth. Our total revenues, again Doug touched on this, is 100% FRE business. And considerable up and to the right growth here driven by that, again, embedded power of--earnings power of our business, and then best in class EBITDA margin of 65% to 70%.

Tom Wasserman

Hi, everyone. This is Tom Wasserman, CEO of Altimar Acquisition Corporation. By way of background, Altimar is a $275 million special purpose acquisition company sponsored by HPS Investment Partners who went public in late October.

And I think the number one thing that I and our board want to convey in this call is just how excited we are to be working with the founders of Blue Owl and bringing a company of this quality to the market. And between Doug and Michael and Marc and Alan, we just couldn’t have hoped to find a better set of command leaders.

As a repeat SPAC sponsor, we firmly believe this transaction has all the qualities of a long-term compounding equity story. Between the top-tier founders that I previously mentioned and their alignment with the shareholders, a differentiated set of high-margin products that both Michael and Marc just walked you through, and really what’s a massive and growing total addressable market, between all of those we think we’re delivering exactly what long-term holders are looking for.

Additionally, the one thing we always look for in every investment that we make as a firm is an ability to add real value to the situation. And I think my colleague, Scott Kapnick, is going to walk you through just exactly how we’re going to do that.

Scott Kapnick

Thanks, Tom. It’s Scott Kapnick. I’m the CEO of HPS. And I would just like to add that, given who we are, HPS is really uniquely qualified as a SPAC sponsor to partner with the Blue Owl team and to add real tangible value.

We know the business because we’re in the business. We have deep and long-term relationships with the principals of Blue Owl. And you’ve heard from them today very eloquently about the strength of the world-class franchise they’ve built.

We also believe there will be several opportunities to work and partner with the business, as we have a series of complementary strategies and partners and relationships. I do truly believe they’ve built a world-class franchise. At Dyal, we’ve known them for years, given their investment in the direct lending business we know.

And I really think they’ve highlighted really well today two very important things, one on growth. And you heard Doug articulate it on page 8 and again Alan on page 18 and page 19. Near term earnings growth of this combined entity is just very significant.

Call Announcing Owl Rock Capital Group and Dyal Capital Partners Enter Definitive Business

Combination Agreement with Altimar Acquisition Corporation to Form Blue Owl Capital, Inc.

Wednesday, December 23, 2020

9

And we think that the longer term growth, which was also really well articulated by Michael, this is a carve-out from Neuberger and there are lots of opportunities that come from that. Michael articulated those, but also the discussion around the retail franchise here that they have built, bringing alts to the masses. That is a huge TAM and long-term just a very large opportunity, and they are ahead of really everyone in the space.

Alan Kirshenbaum

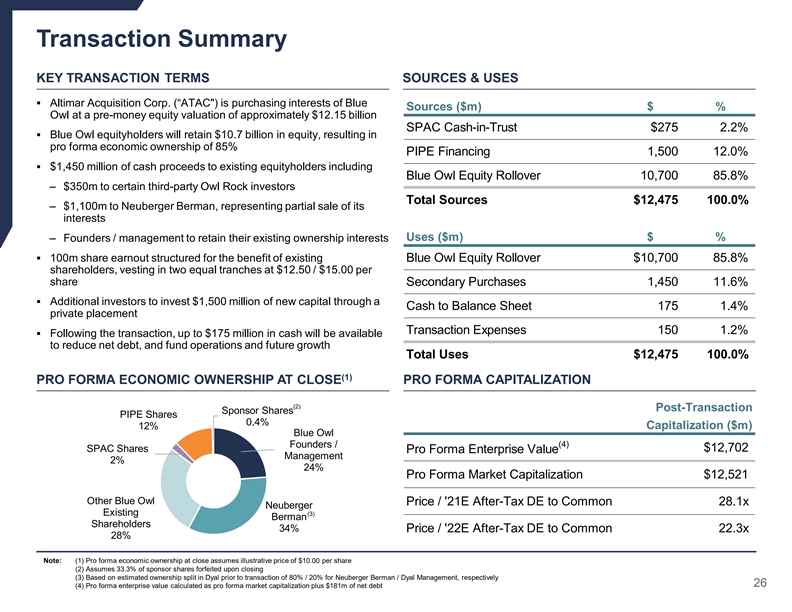

Okay. So, picking up on the next slide, the transaction summary slide, you can see I’ll start with the key transaction terms on the top left part of the slide. We come in at a pre-money equity valuation of $12.15 billion. We will retain $10.7 billion in equity. That’s a pro forma economic ownership of 85%.

It’s important to note, and I’ll note it again when we get to the bottom, but we are not selling a single share. Owners are retaining 100%, not taking any money off the table as a result of this transaction.

You’ll see the sources and uses here of the $1.45 billion on the left side of the page. That is $350 million going to third party Owl Rock investors, not the management team, and $1.1 billion to Neuberger, which is representing a partial sale of its interest. And again, we’re noting here that we have and are retaining all of our existing ownership interest, so we have a very significant matching up of alignment here.

A hundred million share earn-out, so that’ll go in two equal tranches at $12.50 and $15.00 per share. And I mentioned the $1.5 billion, the biggest part of the sources and uses, that’s coming through the private placements. And then in the bottom left corner, you can see the pro forma economic ownership. 24% will remain with Blue Owl management and founders.

I covered the sources and uses on the right side of the page. We have the SPAC, the PIPE, and then our existing equity rollover. That’s the $12.5 billion. And then you can see the uses right below that, which I just talked through a moment ago.

In the bottom right corner, the pro forma cap, we have a pro forma enterprise value of $12.7 billion, a pro forma market cap of $12.5 billion, and then you can see the 2022 earnings of 22 times. The comps right now are at or over 30x. When you look back to earlier in the discussion, the FRE centric high growth peers of ours all trading at or around or above 30x. And so, we’re coming out at a significant discount to that at 22x.

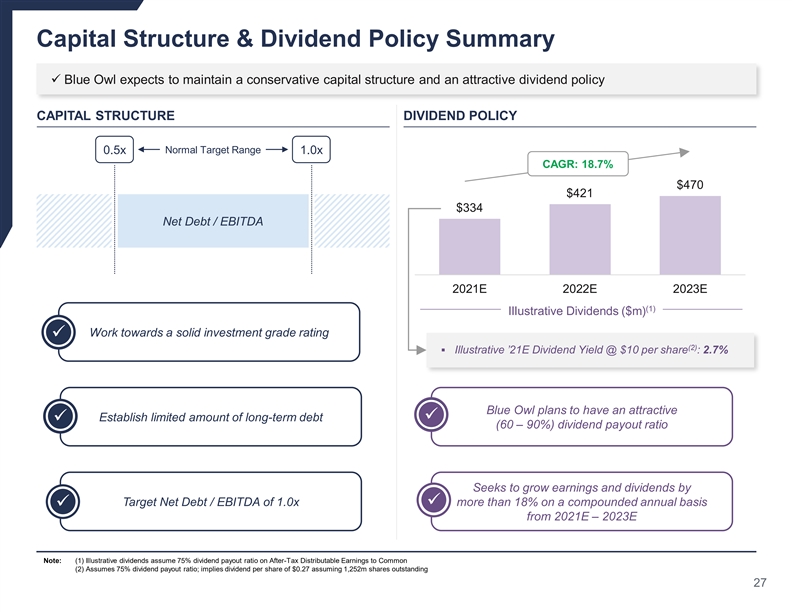

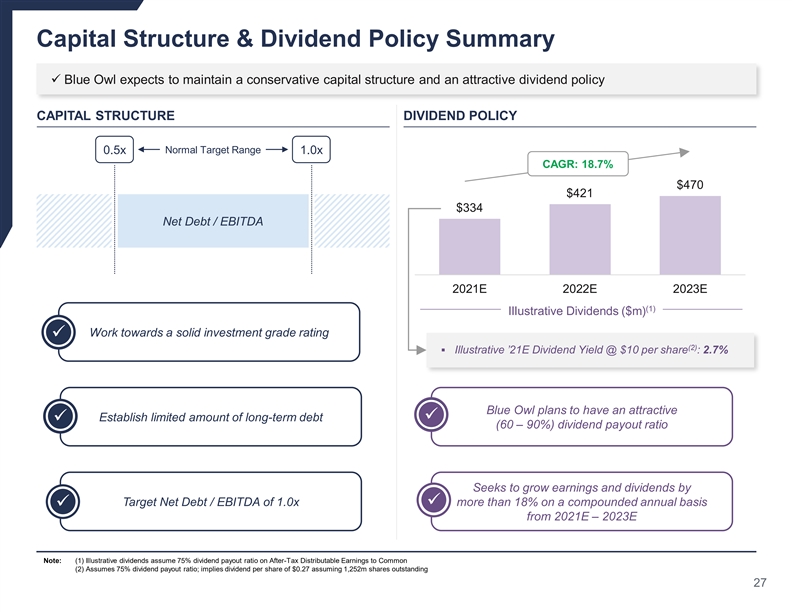

We intend to target net debt to EBITDA of approximately 1.0x. We do expect to go out and begin dialogues with the rating agencies, and so we think that we can create a very cost efficient, a very low levered cap structure here.

And on the dividend policy, we expect to pay a meaningful dividend that we believe can grow significantly over time. So, you can see here some pretty strong CAGR estimates based on the illustrative dividends that we included here on the right side of the slide.

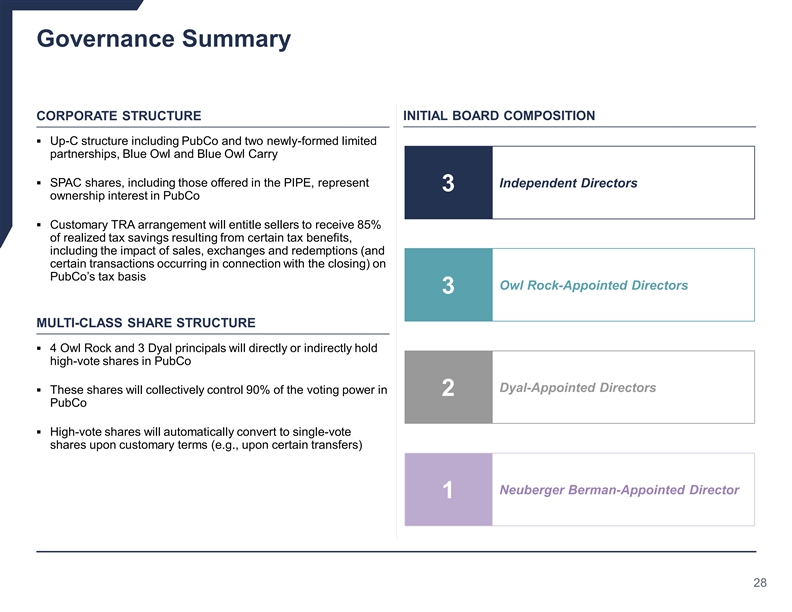

And then wrapping up with our governance, corporate structure will be an Up-C structure, including a pub co and two new limited partnerships. The SPAC shares represent ownership interest in the pub co. And we will put in place and have in place a customary TRA arrangement that’ll be 85%.

Call Announcing Owl Rock Capital Group and Dyal Capital Partners Enter Definitive Business

Combination Agreement with Altimar Acquisition Corporation to Form Blue Owl Capital, Inc.

Wednesday, December 23, 2020

10

We will have a multi share class structure where seven of us will hold high vote shares in the pub co, and these shares will control approximately 90% of the voting power in the pub co. And the high vote shares will automatically convert, as you can see at the bottom, to single vote shares upon customary terms.

And then our board composition will be three independent directors, three Owl Rock appointed directors, two Dyal appointed directors, and one Neuberger appointed director.

And with that, we’ll wrap up the presentation.

Important Additional Information and Where to Find It

This communication is being made in respect of the proposed business combination transaction involving Altimar and Blue Owl. Altimar intends to file a registration statement on Form S-4 with the Securities and Exchange Commission (the “SEC”), which will include a proxy statement and a prospectus of Altimar, and each party will file other documents with the SEC regarding the proposed transaction. A definitive proxy statement/prospectus will also be sent to the stockholders of Altimar, seeking any required stockholder approval. Before making any voting or investment decision, investors and security holders of Altimar are urged to carefully read the entire registration statement and proxy statement/prospectus, when they become available, and any other relevant documents filed with the SEC, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction. The documents filed by Altimar with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by Altimar may be obtained free of charge from Altimar at www.altimarspac.com. Alternatively, these documents, when available, can be obtained free of charge from Altimar upon written request to Altimar Acquisition Corp., 40 West 57th Street, New York, New York 10019, Attn: Secretary, or by calling 212-287-6767.

Participants in the Solicitation

Altimar and certain of its respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Altimar, in favor of the approval of the business combination. For information regarding Altimar’s directors and executive officers, please see Altimar’s final prospectus related to its initial public offering filed with the SEC on October 23, 2020. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the registration statement and the proxy statement/prospectus and other relevant documents filed with the SEC when they become available. Free copies of these documents may be obtained as described in the preceding section.

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of any securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such other jurisdiction.

Forward Looking Statements

Certain statements made in this communication, and oral statements made from time to time by representatives of Altimar are “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Statements regarding the proposed business combination and expectations regarding the combined business are “forward looking statements.” In addition, words such as “estimates,” “projects,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “would,” “should,” “future,” “propose,” “target,” “goal,” “objective,” “outlook” and variations of these words or similar expressions (or the negative versions of such words or expressions)

Call Announcing Owl Rock Capital Group and Dyal Capital Partners Enter Definitive Business

Combination Agreement with Altimar Acquisition Corporation to Form Blue Owl Capital, Inc.

Wednesday, December 23, 2020

11

are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside Altimar’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors, among others, that may affect actual results or outcomes include: the inability of Altimar to complete the contemplated transactions with Owl Rock Capital Group and Dyal Capital Partners; the risk that the approval of the stockholders of Altimar for the proposed business combination is not obtained; the inability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things, the amount of funds available in Altimar’s trust account following any redemptions by Altimar’s stockholders; the ability to meet the NYSE’s listing standards following the consummation of the transactions contemplated by the proposed business combination; costs related to the proposed business combination; and those factors discussed in Altimar’s prospectus, dated October 22, 2020 under the heading “Risk Factors,” and other documents of Altimar filed, or to be filed, with the SEC. Altimar does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Call Announcing Owl Rock Capital Group and Dyal Capital Partners Enter Definitive Business

Combination Agreement with Altimar Acquisition Corporation to Form Blue Owl Capital, Inc.

Wednesday, December 23, 2020

12

Exhibit 99.3 Blue Owl Overview December 2020Exhibit 99.3 Blue Owl Overview December 2020