“Software” means all computer software, applications, and programs (and all versions, releases, fixes, upgrades and updates thereto, as applicable), including software compilations, development tools, compilers, files, scripts, manuals, design notes, programmers’ notes, architecture, application programming interfaces, mobile applications, algorithms, data, databases, and compilations of data, comments, user interfaces, menus, buttons, icons, and other items and documentation related thereto or associated therewith as well as any foreign language versions, fixes, upgrades, updates, enhancements, new versions, previous versions, new releases and previous releases thereof, in each case, whether in source code, object code or human readable form.

“Specified Equity” means any Equity Securities issued by (i) any Subsidiary of the Buyer, (ii) any PubCo Fund (as defined in the Investor Rights Agreement) or (iii) any Subsidiary of any Opal Carry Aggregator (or any successors thereto) or any Opal Performance Fee Aggregator (as defined in the Investor Rights Agreement) (or any successors thereto) to any Person (other than, directly or indirectly, to a Key Professional or his Affiliates or (solely in the case of the immediately following clauses (a) and (c)) any employee, manager or officer of the Buyer or any of its Subsidiaries or his or her Affiliates) (a) as a rebate or incentive to a third party investor that is not a Related Party (as defined in the Investor Rights Agreement) making a capital commitment in any fund, business development company or account sponsored or managed by the Buyer or any of its Subsidiaries, including a seed or foundation investor, (b) to new hires or reassigned employees who are primarily dedicated to a new business line not previously engaged in by PubCo or its Subsidiaries (and, with respect to any reassigned employees, for which a replacement hire is made for such Person’s former position within a reasonable period of time), or (c) to a third party that is not a Related Party in connection with a bona fide arm’s length joint venture or bona fide arm’s length arrangement with a third party service provider.

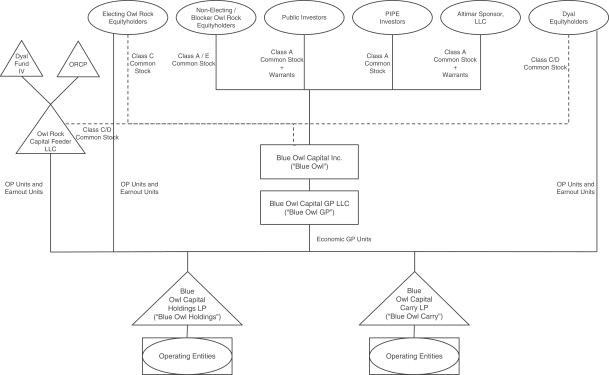

“Sponsor” means Altimar Sponsor LLC, a Delaware limited liability company.

“Sponsor Related Party Transaction” has the meaning set forth in Section 7.19.

“Straddle Period” means any taxable period that begins on or before (but does not end on) the Closing Date.

“Subscription Agreement” means a Contract executed by an Equity Financing Source on or before the date of this Agreement with respect to the PIPE Financing.

“Subsidiaries” of any Person means any entity (a) of which 50% or more of the outstanding share capital, voting securities or other voting equity interests are owned, directly or indirectly, by such Person, (b) of which such Person is entitled to elect, directly or indirectly, at least 50% of the board of directors (or managers) or similar governing body of such entity or (c) if such entity is a limited partnership or limited liability company, of which such Person or one of its Subsidiaries is a general partner or managing member or has the power to direct the policies, management or affairs. Notwithstanding the foregoing, none of the Diamond Funds, the Opal Funds, any FIC Subsidiary, or the Excluded Diamond Assets, or any accounts, funds, vehicles or other client advised or sub-advised by the Nephrite Group or the Opal Family (as applicable) (or any portfolio company or other investment of any of the foregoing) shall be a Subsidiary of any member of the Nephrite Group or Opal Family, respectively, for purposes of this Agreement.

“Tax” or “Taxes” means all United States federal, state and local, non-U.S., and other net or gross income, net or gross receipts, net or gross proceeds, payroll, employment, excise, severance, stamp, occupation, windfall or excess profits, profits, customs, capital stock, withholding, social security, unemployment, disability, real property, personal property (tangible and intangible), sales, use, commercial rent, transfer, value added, alternative or add-on minimum, capital gains, user, leasing, lease, natural resources, ad valorem, franchise, gaming license, capital, estimated, goods and services, fuel, interest equalization, registration, recording, premium, turnover, environmental or other taxes, charges, duties, fees, levies or other governmental charges of any kind whatsoever, including all interest, penalties, assessments and additions imposed with respect to the foregoing, imposed by (or otherwise payable to) any Governmental Entity, and, in each case, whether disputed or not, whether payable directly or by withholding and whether or not requiring the filing of a Tax Return.

C-36