| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

|

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| |

| Investment Company Act file number 811- 22303 |

| |

| John Hancock Collateral Investment Trust |

| (Exact name of registrant as specified in charter) |

| |

| 601 Congress Street, Boston, Massachusetts 02210 |

| (Address of principal executive offices) (Zip code) |

| |

| Michael J. Leary |

| Treasurer |

| |

| 601 Congress Street |

| |

| Boston, Massachusetts 02210 |

| |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: 617-663-4490 |

| |

| Date of fiscal year end: | December 31 |

| |

| |

| Date of reporting period: | June 30, 2009 |

ITEM 1. REPORT TO SHAREHOLDERS.

Expense example

These examples are intended to help you understand your ongoing operating expenses.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

▪ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

▪ Ongoing operating expenses including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your fund’s actual ongoing operating expenses, and is based on your fund’s actual return. It assumes an account value of $1,000.00 on June 1, 2009 with the same investment held until June 30, 2009.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 6-1-09 | on 6-30-09 | period ended 6-30-091 |

|

| Common shares | $1,000.00 | $1,001.30 | $0.10 |

|

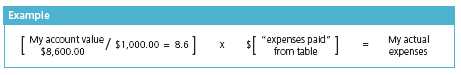

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at June 30, 2009, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

| |

| Semiannual report | Collateral Investment Trust | 1 |

Expense example

Hypothetical example for comparison purposes

This table allows you to compare your fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not your fund’s actual return). It assumes an account value of $1,000.00 on January 1, 2009 with the same investment held until June 30, 2009. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 1-1-09 | on 6-30-09 | period ended 6-30-091,2 |

|

| Common shares | $1,000.00 | $1,024.20 | $0.60 |

|

Remember, these examples do not include any transaction costs, such as sales charges; therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund's annualized expense ratio of 0.12%, which includes organizational fees, for the Fund’s shares, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

2 The annualized expense ratio, not including organizational fees, which were 0.02%, was 0.10%. The hypothetical ending value and expenses paid, not including organizational fees, would be $1,024.30 and $0.50, using this ratio for the period ended June 30, 2009.

| |

| 2 | Collateral Investment Trust | Semiannual report |

Portfolio summary

| | | | |

| Top 10 holdings1 | | | | |

|

| BASF Finance Europe NV | 4.3% | | Societe Generale North America, | |

| | 0.160%, 7-1-09 | 2.4% |

| Wells Fargo & Co. | 3.4% | |

|

| | Societe Generale North America, | |

| BNP Paribas | 3.2% | | 0.140%, 7-1-09 | 2.4% |

| |

|

| Jupiter Securitization Co., LLC | 2.7% | | Abbey National NA, LLC | 2.4% |

| |

|

| Procter & Gamble | | | IBM International Group Capital, LLC | 2.4% |

| International Funding | 2.5% | |

|

| | Bank of America Corp. | 2.4% |

| |

|

| |

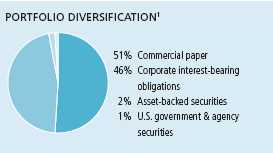

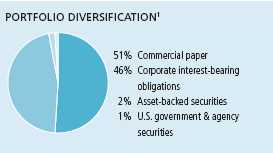

| Sector composition1,2 | | | | |

|

| Financials | 75% | | Information technology | 4% |

| |

|

| Telecommunication services | 9% | | Mortgage bonds | 2% |

| |

|

| Consumer staples | 4% | | Industrials | 1% |

| |

|

| Consumer discretionary | 4% | | Materials | 1% |

| |

|

1 As a percentage of net assets on June 30, 2009.

2 Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

| |

| Semiannual report | Collateral Investment Trust | 3 |

F I N A N C I A L S T A T E M E N T S

Fund’s investments

Securities owned by the Fund on 6-30-09 (unaudited)

| | | | | |

| | | | Maturity | Par value | |

| Issuer | Rate | | date | (000) | Value |

|

| Asset backed securities 1.64% | | | | | $34,020,213 |

| (Cost $34,000,000) | | | | | |

| | | | | |

| Asset Backed Securities 1.64% | | | | | 34,020,213 |

|

| BMW Vehicle Lease Trust, | | | | | |

| Ser 2009-01 | 0.792% | | 06-15-10 | $16,000 | 16,008,019 |

|

| John Deere Owner Trust, | | | | | |

| Ser 2009-A | 1.132 | | 07-02-10 | 8,000 | 8,007,504 |

|

| Nissan Auto Lease Trust, | | | | | |

| Ser 2009-A | 1.043 | | 06-15-10 | 10,000 | 10,004,690 |

| |

| | | | Maturity | Par value | |

| Issuer | Rate | | date | (000) | Value |

|

| Commercial paper 50.96% | | | | | $1,057,229,850 |

| (Cost $1,057,284,713) | | | | | |

| | | | | | |

| Asset Backed — Finance 12.71% | | | | | 263,710,388 |

|

| CAFCO, LLC | 0.350% | | 08-28-09 | $25,000 | 24,976,750 |

|

| CAFCO, LLC | 0.280 | | 07-17-09 | 20,000 | 19,993,800 |

|

| CAFCO, LLC | 0.270 | | 07-17-09 | 30,000 | 29,990,700 |

|

| Govco, LLC | 0.350 | | 08-21-09 | 20,000 | 19,983,600 |

|

| Govco, LLC | 0.300 | | 08-05-09 | 45,000 | 44,972,100 |

|

| Old Line Funding, LLC | 0.270 | | 07-06-09 | 20,000 | 19,998,000 |

|

| Ranger Funding Co., LLC | 0.270 | | 07-14-09 | 15,828 | 15,826,101 |

|

| Ranger Funding Co., LLC | 0.270 | | 07-15-09 | 32,250 | 32,245,808 |

|

| Yorktown Capital, LLC | 0.280 | | 07-20-09 | 25,102 | 25,092,963 |

|

| Yorktown Capital, LLC | 0.250 | | 07-01-09 | 20,000 | 19,999,600 |

|

| Yorktown Capital, LLC | 0.250 | | 07-15-09 | 10,632 | 10,630,966 |

| | | | | | |

| Asset Backed — Loan Receivables 7.38% | | | | 152,981,482 |

|

| Falcon Asset Securitization Co., LLC | 0.280 | | 07-23-09 | 20,020 | 20,011,592 |

|

| Falcon Asset Securitization Co., LLC | 0.260 | | 07-23-09 | 23,000 | 22,990,340 |

|

| Falcon Asset Securitization Co., LLC | 0.250 | | 07-08-09 | 25,000 | 24,996,500 |

|

| Jupiter Securitization Co., LLC | 0.280 | | 07-15-09 | 55,000 | 54,985,150 |

|

| Park Avenue Receivables Corp. | 0.280 | | 07-08-09 | 30,000 | 29,997,900 |

| | | | | | |

| Banks — Foreign 7.67% | | | | | 159,197,604 |

|

| Abbey National NA, LLC | 0.150 | | 07-02-09 | 50,000 | 49,999,500 |

|

| Abbey National NA, LLC | 0.150 | | 07-14-09 | 35,000 | 34,998,104 |

|

| BNP Paribas | 0.070 | | 07-01-09 | 67,200 | 67,200,000 |

|

| BNP Paribas Finance, Inc. | 0.090 | | 07-01-09 | 7,000 | 7,000,000 |

See notes to financial statements

| |

| 4 | Collateral Investment Trust | Semiannual report |

F I N A N C I A L S T A T E M E N T S

| | | | | |

| | | | Maturity | Par value | |

| Issuer | Rate | | date | (000) | Value |

| Banks — U.S. 10.12% | | | | | $210,000,000 |

|

| Societe Generale North America | 0.160% | | 07-01-09 | $50,000 | 50,000,000 |

|

| Societe Generale North America | 0.140 | | 07-01-09 | 50,000 | 50,000,000 |

|

| UBS Finance Delaware, LLC | 0.160 | | 07-01-09 | 40,000 | 40,000,000 |

|

| Wells Fargo & Co. | 0.050 | | 07-01-09 | 70,000 | 70,000,000 |

| | | | | | |

| Finance — Auto Loans 8.09% | | | | | 167,835,811 |

|

| American Honda Finance Corp. | 0.600 | | 07-16-09 | 25,600 | 25,597,184 |

|

| American Honda Finance Corp. | 0.450 | | 09-09-09 | 10,000 | 9,991,000 |

|

| American Honda Finance Corp. | 0.330 | | 07-20-09 | 15,000 | 14,997,900 |

|

| American Honda Finance Corp. | 0.600 | | 07-09-09 | 16,000 | 15,999,040 |

|

| American Honda Finance Corp. | 0.680 | | 07-09-09 | 25,000 | 24,998,500 |

|

| BMW US Capital, LLC | 1.300 | | 07-07-09 | 15,000 | 14,999,100 |

|

| BMW US Capital, LLC | 1.300 | | 07-13-09 | 30,000 | 29,996,400 |

|

| BMW US Capital, LLC | 1.250 | | 07-06-09 | 25,000 | 24,998,750 |

|

| BMW US Capital, LLC | 0.600 | | 07-01-09 | 6,258 | 6,257,937 |

| | | | | | |

| Telecommunications 4.99% | | | | | 103,504,565 |

|

| Bellsouth Corp. | 4.200 | | 09-15-09 | 2,500 | 2,513,435 |

|

| Verizon Communications, Inc. | 0.380 | | 07-06-09 | 20,000 | 19,999,000 |

|

| Verizon Communications, Inc. | 0.330 | | 07-13-09 | 14,000 | 13,998,320 |

|

| Verizon Communications, Inc. | 0.340 | | 07-08-09 | 25,000 | 24,998,250 |

|

| Verizon Communications, Inc. | 0.300 | | 07-13-09 | 30,000 | 29,996,400 |

|

| Verizon Communications, Inc. | 0.280 | | 07-15-09 | 12,000 | 11,999,160 |

| |

| | | | Maturity | Par value | |

| Issuer | Rate | | date | (000) | Value |

|

| Corporate interest-bearing obligations 45.70% | | | | $948,239,503 |

| (Cost $946,141,428) | | | | | |

| | | | | | |

| Banks — U.S. 10.23% | | | | | 212,348,905 |

|

| Bank of America Corp. (C)(P) | 0.809% | | 06-22-12 | $11,000 | 11,104,093 |

|

| Bank of America Corp. (C)(P) | 0.659 | | 09-13-10 | 19,000 | 19,055,347 |

|

| Bank of America Corp. (P) | 1.239 | | 07-30-09 | 49,000 | 48,983,389 |

|

| Citibank NA (C)(P) | 1.016 | | 05-07-12 | 16,000 | 15,961,168 |

|

| Citigroup, Inc. (C)(P) | 1.121 | | 12-09-11 | 22,340 | 22,751,391 |

|

| Huntington National Bank (C)(P) | 1.068 | | 06-01-12 | 18,000 | 18,277,938 |

|

| PNC Funding Corp. (C) | 0.797 | | 04-01-12 | 10,000 | 10,087,200 |

|

| Union Bank NA (C)(P) | 0.824 | | 03-16-12 | 6,000 | 6,054,984 |

|

| US Bank NA (P) | 0.445 | | 07-02-09 | 25,000 | 25,000,000 |

|

| Wachovia Bank NA (P) | 0.380 | | 08-10-09 | 25,000 | 24,981,775 |

|

| Wells Fargo & Co. (C)(P) | 0.849 | | 06-15-12 | 10,000 | 10,091,620 |

| | | | | | |

| Chemicals 1.01% | | | | | 20,945,096 |

|

| EI Du Pont de Nemours & Co. | 4.125 | | 04-30-10 | 20,500 | 20,945,096 |

| | | | | | |

| Computer Hardware 0.34% | | | | | 7,049,420 |

|

| IBM Corp. | 4.250 | | 09-15-09 | 7,000 | 7,049,420 |

| | | | | | |

| Diversified Financial Services 11.15% | | | | | 231,390,365 |

|

| BASF Finance Europe NV (P)(S) | 1.117 | | 07-20-09 | 90,000 | 89,936,730 |

|

| General Electric Capital Corp. (C)(P) | 0.839 | | 03-12-12 | 10,000 | 10,068,490 |

See notes to financial statements

| |

| Semiannual report | Collateral Investment Trust | 5 |

F I N A N C I A L S T A T E M E N T S

| | | | | |

| | | | Maturity | Par value | |

| Issuer | Rate | | date | (000) | Value |

| Diversified Financial Services (continued) | | | | |

|

| General Electric Capital Corp. (C)(P) | 0.728% | | 03-11-11 | $8,000 | $8,027,896 |

|

| General Electric Capital Corp. | 3.750 | | 12-15-09 | 5,000 | 5,042,565 |

|

| General Electric Capital Corp. (P) | 0.669 | | 03-12-10 | 12,400 | 12,284,370 |

|

| General Electric Capital Corp. (P) | 1.122 | | 10-26-09 | 17,900 | 17,897,011 |

|

| General Electric Capital Corp. (P) | 0.355 | | 07-24-09 | 10,000 | 9,998,940 |

|

| IBM International Group Capital, LLC (P) | 1.394 | | 07-29-09 | 49,000 | 49,047,187 |

|

| IBM International Group Capital, LLC (P)(S) | 0.901 | | 09-25-09 | 19,000 | 19,010,146 |

|

| State Street Bank & Trust Co. (C)(P) | 0.829 | | 09-15-11 | 10,000 | 10,077,030 |

| | | | | | |

| Finance — Auto Loans 1.93% | | | | | 39,958,018 |

|

| American Honda Finance Corp. (P)(S) | 1.006 | | 02-09-10 | 9,000 | 8,967,690 |

|

| Toyota Motor Credit Corp. (P) | 0.600 | | 09-09-09 | 31,000 | 30,990,328 |

| | | | | | |

| Health Care Supplies 3.93% | | | | | 81,497,292 |

|

| Procter & Gamble Co. (P) | 0.663 | | 09-09-09 | 3,000 | 3,001,011 |

|

| Procter & Gamble International Funding (P) | 1.224 | | 02-08-10 | 19,500 | 19,501,950 |

|

| Procter & Gamble International | | | | | |

| Funding (P)(S) | 1.176 | | 07-06-09 | 52,000 | 52,002,808 |

|

| Procter & Gamble International Funding (P) | 0.996 | | 05-07-10 | 7,000 | 6,991,523 |

| | | | | | |

| Investment Banking & Brokerage 11.62% | | | | 241,107,907 |

|

| Bear Stearns Cos., Inc. (P) | 1.392 | | 07-16-09 | 20,000 | 20,006,960 |

|

| Citigroup Funding, Inc. (C)(P) | 0.898 | | 03-30-12 | 13,000 | 12,992,967 |

|

| Citigroup Funding, Inc. (C)(P) | 1.139 | | 07-30-10 | 16,000 | 16,065,232 |

|

| Goldman Sachs Group, Inc. (C)(P) | 1.206 | | 11-09-11 | 24,000 | 24,245,400 |

|

| Goldman Sachs Group, Inc. (P) | 0.934 | | 11-16-09 | 17,460 | 17,444,094 |

|

| Goldman Sachs Group, Inc. (C)(P) | 0.829 | | 03-15-12 | 12,000 | 12,110,088 |

|

| JPMorgan Chase & Co. (P) | 0.859 | | 06-15-12 | 28,000 | 28,313,964 |

|

| JPMorgan Chase & Co. (C)(P) | 0.741 | | 02-23-11 | 7,000 | 7,013,104 |

|

| JPMorgan Chase & Co. (C)(P) | 0.854 | | 12-26-12 | 25,000 | 25,250,025 |

|

| JPMorgan Chase & Co. (P) | 1.176 | | 11-19-09 | 22,000 | 22,033,066 |

|

| Morgan Stanley (C)(P) | 1.236 | | 02-10-12 | 23,000 | 23,253,759 |

|

| Morgan Stanley (C)(P) | 0.959 | | 06-20-12 | 20,000 | 20,269,400 |

|

| Morgan Stanley (C)(P) | 0.829 | | 03-13-12 | 12,000 | 12,109,848 |

| | | | | | |

| Machinery — Construction & Mining 1.12% | | | | 23,318,337 |

|

| Caterpillar Financial Services Corp. (P) | 1.199 | | 10-09-09 | 11,100 | 11,100,999 |

|

| Caterpillar Financial Services Corp. (P) | 1.006 | | 08-11-09 | 12,210 | 12,217,338 |

| | | | | | |

| Telecommunications 4.37% | | | | | 90,624,163 |

|

| AT&T, Inc. (P) | 1.116 | | 02-05-10 | 47,167 | 47,200,159 |

|

| Bellsouth Corp. | 4.200 | | 09-15-09 | 16,026 | 16,112,124 |

|

| SBC Communications, Inc. | 4.125 | | 09-15-09 | 27,175 | 27,311,880 |

See notes to financial statements

| |

| 6 | Collateral Investment Trust | Semiannual report |

F I N A N C I A L S T A T E M E N T S

| | | | | |

| | | | Maturity | Par value | |

| Issuer | Rate | | date | (000) | Value |

| U.S. Government & agency securities 1.64% | | | | $34,000,000 |

|

| (Cost $34,000,000) | | | | | |

| Thrifts & Mortgage Finance 1.64% | | | | | 34,000,000 |

|

| Federal Home Loan Bank | 0.010% | | 07-01-09 | $34,000 | 34,000,000 |

| | | | | | |

| Total investments (Cost $2,071,426,141)† 99.94% | | $2,073,489,566 |

|

Other assets and liabilities, net 0.06% | $1,185,688 |

|

| Total net assets 100.00% | $2,074,675,254 |

|

The percentage shown for each investment category is the total value of that category as a percentage of the net assets applicable to common shareholders.

(C) These securities are issued under the Temporary Liquidity Guarantee Program and are issued by Federal Deposit Insurance Corporation. These securities amounted to $294,866,980 or 14.21% of net assets of the Fund as of June 30, 2009.

(P) Variable rate obligation. The coupon rate shown represents the rate at period end.

(S) These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration.

† At June 30, 2009, the aggregate cost of investment securities for federal income tax purposes was $2,071,426,141. Net unrealized appreciation aggregated $2,063,425, of which $2,513,993 related to appreciated investment securities and $450,568 related to depreciated investment securities.

See notes to financial statements

| |

| Semiannual report | Collateral Investment Trust | 7 |

F I N A N C I A L S T A T E M E N T S

Financial statements

Statement of assets and liabilities 6-30-09 (unaudited)

| |

| Assets | |

|

| Investments, at value (Cost $2,071,426,141) | $2,073,489,566 |

| Cash | 38,417 |

| Receivable for fund shares sold | 50,578,696 |

| Interest receivable | 2,045,745 |

| | |

| Total assets | 2,126,152,424 |

| |

| Liabilities | |

|

| Payable for fund shares repurchased | 50,578,696 |

| Distributions payable | 635,847 |

| Payable for organizational fees | 213,529 |

| Payables to affiliates | |

| Chief compliance officer fees | 2,741 |

| Transfer agent fees | 8,249 |

| Trustees’ fees | 2,055 |

| Other liabilities and accrued expenses | 36,053 |

| | |

| Total liabilities | 51,477,170 |

| |

| Net assets | |

|

| Capital paid-in | $2,072,621,544 |

| Accumulated distributions in excess of net investment income | (9,715) |

| Net unrealized appreciation (depreciation) on investments | 2,063,425 |

| | |

| Net assets | $2,074,675,254 |

| |

| Net asset value per share | |

|

| Based on 207,243,874 shares of beneficial interest outstanding — | |

| Unlimited number of shares authorized with no par value. | $10.01 |

See notes to financial statements

| |

| 8 | Collateral Investment Trust | Semiannual report |

F I N A N C I A L S T A T E M E N T S

Statement of operations For the period ended 6-30-09 (unaudited)1

| |

| Investment income | |

|

| Interest | $1,116,080 |

| |

| Expenses | |

|

| Investment management fees (Note 5) | 72,716 |

| Transfer agent fees | 8,249 |

| Accounting and legal services fees (Note 5) | 31,802 |

| Trustees’ fees (Note 6) | 2,055 |

| Professional fees | 10,167 |

| Custodian fees | 21,781 |

| Organizational fees (Note 2) | 332,500 |

| Chief compliance officer fees (Note 5) | 2,741 |

| Miscellaneous | 7,933 |

| | |

| Total expenses | 489,944 |

| | |

| Net investment income | 626,136 |

| |

| Realized and unrealized gain (loss) | |

|

| Change in net unrealized appreciation (depreciation) on investments | 2,063,425 |

| | |

| Increase in net assets from operations | $2,689,561 |

1 Period from 6-01-09 (commencement of operations) to 6-30-09. Unaudited.

See notes to financial statements

| |

| Semiannual report | Collateral Investment Trust | 9 |

F I N A N C I A L S T A T E M E N T S

Statements of changes in net assets

| |

| | Period |

| | ended |

| | 6-30-09 |

| | (Unaudited)1 |

| Increase (decrease) in net assets | |

|

| From operations | |

| Net investment income | $626,136 |

| Change in net unrealized appreciation (depreciation) | 2,063,425 |

| | |

| Increase in net assets resulting from operations | 2,689,561 |

| | |

| Distributions to shareholders | |

| From net investment income | (635,851) |

| | |

| From Fund share transactions (Note 7) | 2,072,621,544 |

| | |

| Total increase | 2,074,675,254 |

|

| Net assets | |

|

| Beginning of period | — |

| End of period | $2,074,675,254 |

| Accumulated distributions in excess of net investment income | ($9,715) |

1 Period from 6-01-09 (commencement of operations) to 6-30-09. Unaudited.

See notes to financial statements

| |

| 10 | Collateral Investment Trust | Semiannual report |

F I N A N C I A L S T A T E M E N T S

Financial highlights

The Financial Highlights show how the Fund’s net asset value for a share has changed since the end of the previous period.

| |

| COMMON SHARES Period ended | 6-30-091 |

| Per share operating performance | |

|

| Net asset value, beginning of period | $10.00 |

| Net investment income2 | —3 |

| Net realized and unrealized gain on investments | 0.01 |

| Total from investment operations | 0.01 |

| Less distributions | |

| From net investment income | —3 |

| Net asset value, end of period | $10.01 |

| Total return (%)4 | 0.135 |

| |

| Ratios and supplemental data | |

|

| Net assets, end of period (in millions) | $2,075 |

| Ratios (as a percentage of average net assets): | |

| Expenses | 0.126 |

| Net investment income | 0.396 |

| |

1 Period from 6-01-09 (commencement of operations) to 6-30-09. Unaudited.

2 Based on the average of the shares outstanding.

3 Less than $0.005 per share.

4 Assumes dividend reinvestment.

5 Not annualized.

6 All expenses have been annualized except organizational fees, which were 0.02% of average net assets. This expense decreased the net investment income by less than $0.01 and the net investment income ratio by 0.02%.

See notes to financial statements

| |

| Semiannual report | Collateral Investment Trust | 11 |

Notes to financial statements (unaudited)

Note 1

Organization

John Hancock Collateral Investment Trust (the Fund) is a Massachusetts business trust organized on May 19, 2009. The Fund is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the 1940 Act). The Fund is the successor to John Hancock Cash Investment Trust (CIT). The Fund acquired all the assets and liabilities of CIT in a non-taxable exchange for shares of the Fund. The Fund commenced operations on June 1, 2009 upon the completion of this transaction. The Fund is only open to affiliated funds of the John Hancock complex and serves as an investment for cash collateral received by the affiliated funds for securities lending.

The investment objective of the Fund is to maximize income, while maintaining adequate liquidity, safeguarding the return of principal and minimizing risk of default. The Fund invests only in U.S. dollar denominated securities rated within the two highest short-term credit categories and their unrated equivalents. However, the Fund is not a money market fund and does not seek to maintain a stable share price.

Note 2

Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. The following summarizes the significant accounting policies of the Fund:

Security valuation

Investments are stated at value as of the close of the regular trading on the New York Stock Exchange (NYSE), normally at 4:00 p.m., Eastern Time. Debt obligations, including short term debt investments, are valued based on the evaluated prices provided by an independent pricing service, which utilizes both dealer-supplied and electronic data processing techniques, which take into account factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data as well as broker quotes. Securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Debt obligations, for which there are no prices available from an independent pricing service, are valued based on broker quotes or fair valued as determined in good faith by the Fund’s pricing committee in accordance with procedures adopted by the Board of Trustees.

Fair value measurements

The Fund uses a three-tier hierarchy to prioritize the assumptions, referred to as inputs, used in valuation techniques to measure fair value. The three-tier hierarchy of inputs and the valuation techniques used are summarized below:

Level 1 — Exchange traded prices in active markets for identical securities. This technique is used for exchange-traded domestic common and preferred equities, certain foreign equities, warrants, rights, options and futures. In addition, investment companies, including mutual funds, are valued using this technique.

Level 2 — Prices determined using significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk. Prices for securities valued using these techniques are received from independent pricing vendors and are based on an evaluation of the inputs described. These techniques are used for certain domestic preferred equities, certain foreign equities, unlisted rights and warrants, and fixed income securities. Also, over-the-counter derivative contracts, including swaps, foreign forward currency contracts, and certain options use these techniques.

Level 3 — Prices determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable, such as when there is little or no market activity

| |

| 12 | Collateral Investment Trust | Semiannual report |

for an investment, unobservable inputs may be used. Unobservable inputs reflect the Fund’s Pricing Committee’s own assumptions about the factors that market participants would use in pricing an investment and would be based on the best information available. Securities using this technique are generally thinly traded or privately placed, and may be valued using broker quotes, which may not only use observable or unobservable inputs but may also include the use of the brokers’ own judgments about the assumptions that market participants would use.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Funds’ investments as of June 30, 2009, by major security category or security type.

| | | | |

| Investment in Securities | LEVEL 1 | LEVEL 2 | LEVEL 3 | TOTALS |

|

| Asset Backed Securities | — | $34,020,213 | — | $34,020,213 |

| Commercial Paper | — | 1,095,619,040 | — | 1,095,619,040 |

| Corporate Interest- | — | 909,850,313 | — | 909,850,313 |

| Bearing Obligations | | | | |

| Short-term | — | 34,000,000 | — | 34,000,000 |

|

|

| Totals | — | $2,073,489,566 | — | $2,073,489,566 |

Security transactions and related

investment income

Investment security transactions are recorded as of the date of purchase, sale or maturity. Interest income is accrued as earned. Discounts/premiums are accreted/amortized for financial reporting purposes. Non-cash dividends are recorded at the fair market value of the securities received. Debt obligations may be placed in a non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receiv ables when the collection of all or a portion of interest has become doubtful. The Fund uses identified cost method for determining realized gain or loss on investments for both financial sta tement and federal income tax reporting purposes.

Expenses

Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Organization fees

Fees incurred by the Fund in connection with its organization are expensed.

Federal income taxes

The Fund qualifies as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

As of June 30, 2009, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition, or disclosure.

Distribution of income and gains

The Fund records distributions to shareholders from net investment income and net realized gains, if any, on the ex-dividend date. The Fund generally declares dividends daily and pays them monthly. Capital gain distributions, if any, are distributed annually.

Note 3

Risks and uncertainties —

fixed income risk

Fixed income including short-term money market investments or debt instruments are subject to credit and interest rate risk and involve some risk of default in connection with principal and interest payments.

| |

| Semiannual report | Collateral Investment Trust | 13 |

Note 4

Guarantees and indemnifications

Under the Fund’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

Note 5

Management fee and transactions with

affiliates and others

The Fund has an investment management contract with MFC Global Investment Management (U.S.), LLC (the Adviser). Under the investment management contract, the Fund pays a daily management fee to the Adviser equivalent, on an annual basis, to the sum of: (a) 0.05% of the first $1,500,000,000 of the Fund’s average daily net asset value and (b) 0.03% of the Fund’s daily net asset value in excess of $1,500,000,000.

The investment management fees incurred for the period ended June 30, 2009, were equivalent to an annual effective rate of 0.045% of the Fund’s average daily net assets.

The Fund has an agreement with the Adviser and affiliates to perform necessary tax, accounting, compliance, legal and other administrative services of the Fund. The Fund pays the Adviser for these services at a rate of 0.02% (annualized) of the Fund’s average daily net assets, up to a maximum of $400,000 annually. The accounting and legal service fees incurred for the period ended June 30, 2009, were $31,802.

The Fund has contracted with the Adviser’s Chief Compliance Office (CCO) to provide CCO services, including development and review of the Fund’s policies and procedures. In addition, the CCO will provide annual reporting to the Board of Trustees detailing the results of this review. The Fund pays an annual flat rate of $35,000 to the Adviser, paid monthly in arrears, for these services. The CCO fees incurred for the period ended June 30, 2009, were equivalent to an annual effective rate of less than 0.01% of the Fund’s average daily net assets.

Note 6 Trustees’ fees

The Trust compensates each Trustee who is not an employee of the Adviser or its affiliates. Total Trustees’ expenses are allocated to the Trust based on its average daily net asset value.

Note 7

Trust share transactions

The listing illustrates the number of Fund shares sold, acquired in reorganization and repurchased during the period ended June 30, 2009 along with the corresponding dollar value:

| | |

| | Period ended 6-30-091 |

|

| | Shares | Amount |

| Common shares | | |

| | |

| Sold | 210,383,801 | $2,105,215,129 |

| Issued in reorganization | 175,181,953 | 1,751,819,527 |

| Repurchased | (178,321,880) | (1,784,413,112) |

| Net increase | 207,243,874 | $2,072,621,544 |

|

| Net increase | 207,243,874 | $2,072,621,544 |

| 1 Period from 6-01-09 (commencement of operations) to 6-30-09. Unaudited. | | |

| |

| 14 | Collateral Investment Trust | Semiannual report |

Note 8 Reorganization

On June 1, 2009, CIT was closed and all assets and liabilities of the Trust were exchanged for shares in the Fund. The acquisition was accounted for as a tax-free exchange of 175,181,953 shares of the Fund for the net assets of CIT, which amounted to $1,751,819,527.

Note 9 Subsequent events

The Fund has adopted the provisions of Statement of Financial Accounting Standards No. 165, Subsequent Events (FAS 165). The objective of FAS 165 is to establish general standards of accounting for and disclosure of events that occur after the balance sheet date but before financial statements are issued or are available to be issued.

For the period ended June 30, 2009, Management has evaluated subsequent events until August 27, 2009, which is the date the financial statements were available to be issued. As of August 27, 2009, there were no material events that required adjustments or additional disclosures within the financial statements.

| |

| Semiannual report | Collateral Investment Trust | 15 |

Evaluation of Advisory Agreement by

the Board of Trustees

This section describes the evaluation by the Board of Trustees of the Investment Management Contract (the “Advisory Agreement”) between John Hancock Collateral Investment (the “Trust”) and MFC Global Investment Management (U.S.), LLC (the “Adviser”).

Evaluation by the Board of Trustees

The Board, including the Trust’s Independent Trustee, is responsible for selecting the Trust’s Adviser, and approving the Advisory Agreement and any amendments to the Advisory Agreement. The Board considered the fact that the Trust is a new investment company and had not commenced operations prior to the Board’s appointment of the Adviser to manage the Trust. In that context, the Board evaluated the Trust’s advisory arrangement, giving due consideration to the factors listed below. The Board may also consider other factors (including conditions and trends prevailing generally in the economy, the securities markets and the industry) and did not treat any single factor as determinative, and each Trustee may attribute different weights to different factors. The Board was furnished with an analysis of its fiduciary obligations in connection with its evaluation and, throughout the evaluation process, the Board is assisted by counsel for the Trust. The fact ors considered by the Board included:

1. the nature, extent and quality of the services to be provided by the Adviser to the Trust;

2. the investment performance of the Trust;

3. the extent to which economies of scale would be realized as the Trust grows and whether fee levels reflect these economies of scale for the benefit of Trust shareholders;

4. the costs of the services to be provided and the profits to be realized by the Adviser and its affiliates; and

5. comparative services rendered and comparative advisory fee rates.

The Board believes that information relating to all of these factors is relevant to its evaluation of the Trust’s Advisory Agreement.

Approval of Advisory Agreement

At its meeting on May 27, 2009, the Board, including the Independent Trustee, approved the Advisory Agreement. In giving its initial approval of the Advisory Agreement, and with reference to the factors that it considered relevant as set out above, the Board:

(1) (a) considered the high value to the Trust of its new relationship with the Adviser, the skills and competency with which the Adviser managed the affairs of similar funds, particularly the experience and performance of the Adviser in acting as discretionary sub-adviser to an unregistered fund that merged with the Trust immediately prior to the Trust’s commencement of operations, and the qualifications of the Adviser’s personnel,

(b) considered the Adviser’s compliance policies and procedures, and

(c) considered the Adviser’s administrative capabilities, including its ability to supervise the other service providers for the Trust and to draw upon the resources of its affiliated companies and concluded that the Adviser may reasonably be expected to perform its services under the Advisory Agreement;

(2) noted that as the Trust had not commenced operations prior to the approval of the Advisory Agreement that the Trust had no investment performance to be considered as of the date of the board meeting, however, the Trust gave consideration to the Adviser’s performance in managing a predecessor unregistered fund;

(3) reviewed the Trust’s advisory fee structure and the incorporation therein of a fee breakpoint in the advisory fees charged and concluded that, although economies of scale cannot be measured with precision, the advisory fee breakpoint would allow economies of scale if those Trust grows;

| |

| 16 | Collateral Investment Trust | Semiannual report |

(4) (a) reviewed an analysis presented by the Adviser regarding the projected net profitability to the Adviser attributable to its management of the Trust, and noted that affiliated service providers were providing their services based upon their estimated cost,

(b) reviewed the projected profitability of the Adviser’s relationship with the Trust in terms of the total amount of annual advisory fees it is projected to receive with respect to the Trust and whether the Adviser has the financial ability to provide a high level of services to the Trust,

(5) reviewed comparative information with respect to the advisory fee rates for similar funds and accounts managed by third parties and concluded that the Trust’s advisory fees are generally within a competitive range of those incurred by other comparable funds. In this regard, the Board took into account management’s discussion with respect to the advisory fee structure and its comparability to what the Adviser would charge to other clients for similar services. The Board also generally took into account the level and quality of services that the Adviser is capable of providing, as well as the other factors considered.

| |

| Semiannual report | Collateral Investment Trust | 17 |

More information

| |

| Trustees | Investment adviser |

| Barry H. Evans† | MFC Global Investment Management |

| Harlan D. Platt* | (U.S.), LLC |

| Frank Saeli† | |

| *Member of the Audit Committee | Placement agent |

| †Non-Independent Trustee | John Hancock Funds, LLC |

| | |

| Officers | Custodian |

| Barry H. Evans | State Street Bank and Trust Company |

| President and Chief Executive Officer | |

| | Transfer agent |

| Carolyn M. Flanagan | John Hancock Signature Services, Inc. |

| Secretary and Chief Legal Officer | |

| | Legal counsel |

| William E. Corson | Wilmer Cutler Pickering Hale and Dorr LLP |

| Chief Compliance Officer | |

| | |

| Michael J. Leary | |

| Treasurer | |

| | |

| Charles A. Rizzo | |

| Chief Financial Officer | |

| | |

| Diane Landers | |

| Chief Administrative Officer | |

The Fund’s proxy voting policies and procedures, as well as the Fund’s proxy voting record for the most recent twelve month period ended June 30, are available free of charge on the Securities and Exchange Commission (SEC) Website at www.sec.gov or on our Website.

The Fund’s complete list of portfolio holdings, for the first and third fiscal quarters, is filed with the SEC on Form N-Q. The Fund’s Form N-Q is available on our Website and the SEC’s Website, www.sec.gov, and can be reviewed and copied (for a fee) at the SEC’s Public Reference Room in Washington, DC. Call 1-800-SEC-0330 to receive information on the operation of the SEC’s Public Reference Room.

We make this information on your fund, as well as monthly portfolio holdings, and other fund details available on our Website www.jhfunds.com or by calling 1-800-225-5291.

| | |

| You can also contact us: | | |

| 1-800-225-5291 | Regular mail: | Express mail: |

| jhfunds.com | John Hancock Signature Services, Inc. | John Hancock Signature Services, Inc. |

| | P.O. Box 9510 | Mutual Fund Image Operations |

| | Portsmouth, NH 03802-9510 | 164 Corporate Drive |

| | | Portsmouth, NH 03801 |

| |

| 18 | Collateral Investment Trust | Semiannual report |

1-800-225-5291

1-800-554-6713 TDD

1-800-338-8080 EASI-Line

www.jhfunds.com

Now available: electronic delivery

www.jhfunds.com/edelivery

| |

| This report is for the information of the shareholders of John Hancock Collateral Investment Trust. | 305SA 6/09 |

| It is not authorized for distribution to prospective investors unless preceded or accompanied by a prospectus. | 8/09 |

ITEM 2. CODE OF ETHICS.

Not applicable.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable.

ITEM 6. SCHEDULE OF INVESTMENTS.

| (a) | Not applicable. |

| (b) | Not applicable. |

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

Not applicable.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

Not applicable.

ITEM 11. CONTROLS AND PROCEDURES.

(a) Based upon their evaluation of the registrant's disclosure controls and procedures as conducted within 90 days of the filing date of this Form N-CSR, the registrant's principal executive officer and principal financial officer have concluded that those disclosure controls and procedures provide reasonable assurance that the material information required to be disclosed by the registrant on this report is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms.

(b) There were no changes in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal half-year (the registrant's second fiscal half-year in the case of an annual report) that have materially affected, or are reasonably likely to materially affect, the registrant's internal control over financial reporting.

ITEM 12. EXHIBITS.

(a) Separate certifications for the registrant's principal executive officer and principal financial officer, as required by Section 302 of the Sarbanes-Oxley Act of 2002 and Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(b) Separate certifications for the registrant's principal executive officer and principal financial officer, as required by 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, and Rule 30a-2(b) under the Investment Company Act of 1940, are attached. The certifications furnished pursuant to this paragraph are not deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liability of that section. Such certifications are not deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Registrant specifically incorporates them by reference.

| (c) | Contact person at the registrant. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

John Hancock Collateral Investment Trust

By: /s/ Barry H. Evans

-------------------------------------

Barry H. Evans

President and Chief Executive Officer

Date: August 10, 2009

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: /s/ Barry H. Evans

-------------------------------------

Barry H. Evans

President and Chief Executive Officer

Date: August 10, 2009

By: /s/ Charles A. Rizzo

-------------------------------------

Charles A. Rizzo

Chief Financial Officer

Date: August 10, 2009