| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| | |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| |

| MANAGEMENT INVESTMENT COMPANIES |

| |

| Investment Company Act file number 811- 22303 |

| |

| John Hancock Collateral Investment Trust |

| (Exact name of registrant as specified in charter) |

| |

| 601 Congress Street, Boston, Massachusetts 02210 |

| (Address of principal executive offices) (Zip code) |

| |

| Michael J. Leary |

| Treasurer |

| | |

| 601 Congress Street |

| |

| Boston, Massachusetts 02210 |

| |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: 617-663-4490 |

| |

| Date of fiscal year end: | December 31 |

| |

| Date of reporting period: | December 31, 2012 |

ITEM 1. REPORTS TO STOCKHOLDERS.

John Hancock Collateral Investment Trust

Table of Contents

| |

| Management’s discussion of Fund Performance | Page 3 |

| A look at performance | Page 4 |

| Your expenses | Page 5 |

| Portfolio Summary | Page 6 |

| Portfolio of Investments | Page 7 |

| Financial Statements | Page 12 |

| Financial Highlights | Page 15 |

| Notes to financial statements | Page 16 |

| Auditors’ report | Page 20 |

| Shareholder Action | Page 21 |

| Trustees and Officers | Page 22 |

| More information | Page 24 |

Management’s discussion of

Fund performance

by John Hancock Asset Management a division of Manulife Asset Management (US)

LLC

During 2012, the U.S. economy experienced a continued period of slow yet positive growth. Additionally, collective accommodative policies by the world’s major central banks helped to decrease volatility in the global markets. One indicator of this change was seen in the three-month level for the London Interbank Offered Rate (LIBOR), a benchmark used to determine rates in various debt instruments. More than doubling in 2011 due to European debt concerns, LIBOR nearly reversed the entire move, beginning 2012 at 0.58% and consistently decreasing to end the year at 0.31%. Over the course of the year, the U.S. Federal Reserve (Fed) maintained its federal funds rate (the rate banks charge each other for overnight loans) at its historical low range of 0.00% to 0.25%. The Fed has stated that it will remain in this low range as long as the unemployment rate remains above 6.5% (currently 7.8% as of December 31, 2012) and inflation remains within 0.50% of its 2.00% target.

For the year ended December 31, 2012, John Hancock Collateral Investment Trust (the “Fund”) returned 0.32%. As of December 31, 2012, the seven-day net yield was 0.28%. As Europe debt concerns abated and global liquidity conditions improved, the Fund began to invest in less floating-rate debt. At year end, the Fund held approximately 37% of its holdings in floating-rate debt, down from 45% at the previous year end. Additionally, the Fund ended the year with a weighted average maturity of 81 days, slightly extending out the yield curve in an effort to offset the impact of decreasing yields. The Fund continued to allocate a large percentage, approximately 40%, to short-term corporate bonds, which offer incremental yield over the other various money market debt instruments.

This commentary reflects the view of the Fund’s portfolio management team through the end of the period discussed in this report. The team’s statements reflect its own opinions. As such, they are in no way guarantees of future events or results and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

Past performance is no guarantee of future results.

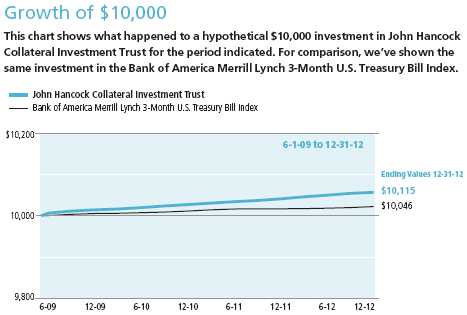

A look at performance

For the period ended December 31, 2012

| | | | | | | | | |

| | Average annual total returns (%) | | Cumulative total returns (%) | |

|

| 1-year | 5-year | 10-year | Since

inception1 | | 1-year | 5-year | 10-year | Since

inception1 |

| John Hancock Collateral | | | | | | | | | |

| Investment Trust | 0.32 | — | — | 0.32 | | 0.32 | — | — | 1.15 |

Performance figures assume all distributions are reinvested.

The expense ratio of the Fund is set forth according to the Financial Highlights of the Fund’s annual report dated December 31, 2011. The net expenses equal the gross expenses of 0.05%.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown.

The performance table above and the chart below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. Each month the index is rebalanced and the issue selected is the outstanding U.S. Treasury Bill that matures closest to, but not beyond 3 months from the rebalancing date.

It is not possible to invest directly in an index. Index figures do not reflect sales charges or direct expenses, which would have resulted in lower values if they did.

1 From 6-1-09.

|

| Annual report | Collateral Investment Trust |

Your expenses

These examples are intended to help you understand your ongoing operating expenses of investing in the Fund so you can compare these costs with the ongoing costs of investing in other mutual funds.

Understanding your fund expenses

As a shareholder of the Fund, you incur two types of costs:

• Transaction costs which include sales charges (loads) on purchases or redemptions (if applicable), minimum account fee charge, etc.

• Ongoing operating expenses including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your fund’s actua l ongoing operating expenses, and is based on your fund’s actual return. It assumes an account value of $1,000.00 on July 1, 2012 with the same investment held until December 31, 2012.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 7-1-12 | on 12-31-12 | period ended 12-31-121 |

|

| Shares | $1,000.00 | $1,001.40 | $0.30 |

|

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at December 31, 2012 by $1,000.00, then multiply it by the “expenses paid” from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

Example

[ My account value $8,600.00 / $1,000.00 = 8.6 ] x $[ “expenses paid” from table ] = My actual expenses

Hypothetical example for comparison purposes

This table allows you to compare your fund’s ongoin g operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed 5% annualized return before expenses (which is not your fund’s actual return). It assumes an account value of $1,000.00 on July 1, 2012, with the same investment held until December 31, 2012. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses. Please remember that these hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 7-1-12 | on 12-31-12 | period ended 12-31-121 |

|

| Shares | $1,000.00 | $1,024.80 | $0.31 |

|

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund's annualized expense ratio of 0.06%, for the Fund's shares, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

| | |

| Portfolio Summary | | |

| Top 10 Issuers1 | Yield* | Percentage of Net Assets (43.6% |

| | | of Net Assets on 12-31-12) |

| Federal Home Loan Bank | | |

| 04/30/13 to 08/18/14 | 0.140 to 0.290% | 6.6% |

| Federal Farm Credit Bank | | |

| 06/11/13 to 07/21/14 | 0.190 to 0.270% | 5.4% |

| Bank of Nova Scotia | | |

| 01/02/13 to 01/03/13 | 0.020 to 0.120% | 4.9% |

| Toyota Motor Credit Corp. | | |

| 01/14/13 to 08/12/13 | 0.421 to 1.375% | 4.7% |

| Bank of Tokyo-Mitsubishi UFJ, Ltd. | | |

| 01/02/13 to 09/11/13 | 0.170 to 2.600% | 4.6% |

| Deutsche Bank | | |

| 01/11/13 to 08/23/13 | 0.590 to 2.375% | 4.0% |

| Wells Fargo & Company | | |

| 01/31/13 | 4.375% | 3.5% |

| Jupiter Securitization Company LLC | | |

| 03/06/13 to 04/29/13 | 0.210 to 0.280% | 3.4% |

| Electricite de France SA | | |

| 01/25/13 to 01/15/14 | 0.300 to 0.800% | 3.3% |

| Chariot Funding LLC | | |

| 02/01/13 to 04/01/13 | 0.200 to 0.300% | 3.2% |

| | | |

| Sector Composition1,2 | | | |

| Financials | | | |

| Commercial Banks | 28.6% | | |

| Diversified Financial Services | 12.0% | | |

| Capital Markets | 6.5% | | |

| Consumer Finance | 2.9% | | |

| U.S. Government Agency Obligations | 13.1% | | |

| Consumer Discretionary | 9.2% | | |

| Asset Backed Securities | 6.4% | | |

| Consumer Staples | 6.2% | | |

| Industrials | 5.2% | | |

| Health Care | 4.7% | | |

| Utilities | 3.3% | | |

| Materials | 0.4% | | |

| Information Technology | 0.1% | | |

| Repurchase Agreement & Other | 1.4% | | |

| | | |

| | | |

| Portfolio Composition1,2 | | | |

| Corporate Interest-Bearing Obligations | 40.3% | | |

| Commercial Paper | 35.1% | | |

| U.S. Government Agency Obligations | 13.1% | | |

| Asset Backed Securities | 6.4% | | |

| Certificates of Deposit | 3.7% | | |

| Repurchase Agreement & Other | 1.4% | | |

1 As a percentage of net assets on 12-31-12.

2 Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

* Yield represents the annualized yield at the date of purchase, the stated coupon rate or, for floating rate securities, the rate at period end.

John Hancock Collateral Investment Trust

As of 12-31-12

Portfolio of Investments

| | | |

| Maturity Date | Yield* (%) | Par value | Value |

|

| Asset Backed Securities 6.4% | | | $326,558,323 |

|

| (Cost $326,532,281) | | | |

| | | | |

| Americredit Automobile Receivables Trust, Series 2012-5, | | | |

| Class A1 | | | |

| 12/09/13 | 0.270 | $53,611,647 | 53,620,600 |

| | | | |

| CNH Equipment Trust, Series 2012-C, Class A1 | | | |

| 10/15/13 | 0.230 | 29,333,158 | 29,333,158 |

| | | | |

| CNH Equipment Trust, Series 2012-D, Class A1 | | | |

| 12/16/13 | 0.250 | 18,191,865 | 18,191,865 |

| | | | |

| Ford Credit Auto Owner Trust, Series 2012-C, Class A1 (S) | | | |

| 08/15/13 | 0.272 | 3,957,422 | 3,957,774 |

| | | | |

| Ford Credit Auto Owner Trust, Series 2012-D, Class A1 (S) | | | |

| 12/15/13 | 0.220 | 11,373,922 | 11,373,922 |

| | | |

| Honda Auto Receivables Owner Trust, Series 2012-2, Class | | |

| A1 | | | |

| 05/15/13 | 0.301 | 718,199 | 718,208 |

| Honda Auto Receivables Owner Trust, Series 2012-3, Class | | |

| A1 | | | |

| 08/15/13 | 0.289 | 14,592,891 | 14,592,687 |

| Honda Auto Receivables Owner Trust, Series 2012-4, Class | | |

| A1 | | | |

| 10/18/13 | 0.230 | 37,153,001 | 37,153,001 |

| | | | |

| Hyundai Auto Receivables Trust, Series 2012-B, Class A1 | | | |

| 07/15/13 | 0.293 | 22,347,789 | 22,353,621 |

| | | | |

| John Deere Owner Trust, Series 2012-B, Class A1 | | | |

| 09/16/13 | 0.267 | 39,409,920 | 39,426,788 |

| | | | |

| Mercedes-Benz Auto Receivables Trust, Series 2012-1, | | | |

| Class A1 | | | |

| 09/16/13 | 0.230 | 27,812,448 | 27,809,833 |

| | | | |

| Nissan Auto Lease Trust, Series 2012-B, Class A1 | | | |

| 10/15/13 | 0.250 | 20,969,805 | 20,969,805 |

| | | |

| Nissan Auto Receivables Owner Trust, Series 2012-B, Class | | |

| A1 | | | |

| 08/15/13 | 0.263 | 47,060,214 | 47,057,061 |

| |

| Commercial Paper 35.1% | | | $1,787,586,472 |

|

| (Cost $1,787,279,081) | | | |

| | | | |

| Anheuser-Busch InBev Worldwide, Inc. | | | |

| 01/11/13 to 02/22/13 | 0.260 to 0.310 | 118,000,000 | 117,977,600 |

| | | | |

| Bank of Nova Scotia | | | |

| 01/02/13 to 01/03/13 | 0.020 to 0.120 | 250,000,000 | 249,998,400 |

| | | | |

| Bank of Tokyo-Mitsubishi UFJ, Ltd. | | | |

| 01/02/13 | 0.170 | 83,000,000 | 82,999,170 |

| | | | |

| Barclays U.S. Funding LLC | | | |

| 01/02/13 | 0.150 | 50,000,000 | 49,999,800 |

| | | | |

| Caisse Centrale Desjardins du Quebec | | | |

| 01/07/13 to 01/18/13 | 0.190 | 54,000,000 | 53,996,630 |

| | | | |

| Cargill Global Funding PLC | | | |

| 01/03/13 to 01/08/13 | 0.140 to 0.160 | 37,000,000 | 36,999,030 |

John Hancock Collateral Investment Trust

As of 12-31-12

Portfolio of Investments

| | | |

| Maturity Date | Yield* (%) | Par value | Value |

|

| Commercial Paper (continued) | | | |

|

| Chariot Funding LLC | | | |

| 02/01/13 to 04/01/13 | 0.200 to 0.300 | $165,000,000 | $164,970,900 |

| | | | |

| CPPIB Capital, Inc. | | | |

| 01/02/13 | 0.100 | 150,000,000 | 149,999,550 |

| | | | |

| Deutsche Bank Financial LLC | | | |

| 07/12/13 to 08/23/13 | 0.590 to 0.620 | 175,000,000 | 174,513,750 |

| | | | |

| Electricite de France SA | | | |

| 01/25/13 to 01/15/14 | 0.300 to 0.800 | 167,700,000 | 167,132,129 |

| | | | |

| JPMorgan Chase & Company | | | |

| 01/25/13 | 0.600 | 15,000,000 | 14,999,250 |

| | | | |

| Jupiter Securitization Company LLC | | | |

| 03/06/13 to 04/29/13 | 0.210 to 0.280 | 175,500,000 | 175,416,485 |

| | | | |

| National Rural Utilities Cooperative Finance Corp. | | | |

| 02/04/13 | 0.180 | 4,300,000 | 4,299,140 |

| | | | |

| Nestle Capital Corp. | | | |

| 01/02/13 to 08/27/13 | 0.010 to 0.330 | 47,750,000 | 47,713,648 |

| | | | |

| Old Line Funding LLC | | | |

| 02/04/13 to 03/12/13 | 0.200 to 0.300 | 132,610,000 | 132,594,270 |

| | | | |

| State Street Corp. | | | |

| 01/11/13 | 0.300 | 50,000,000 | 49,997,500 |

| | | | |

| Thunder Bay Funding LLC | | | |

| 01/03/13 to 02/04/13 | 0.150 to 0.200 | 68,992,000 | 68,981,620 |

| | | | |

| Toyota Motor Credit Corp. | | | |

| 01/18/13 | 0.520 | 25,000,000 | 24,999,000 |

| | | | |

| Unilever Capital Corp. | | | |

| 01/17/13 | 0.450 | 20,000,000 | 19,998,600 |

| |

| Corporate Interest-Bearing Obligations 40.3% | | | $2,054,248,186 |

|

| (Cost $2,054,519,619) | | | |

| | | | |

| American Honda Finance Corp. (P)(S) | | | |

| 11/08/13 to 12/05/13 | 0.331 to 0.340 | 101,500,000 | 101,481,763 |

| | | | |

| American Honda Finance Corp. (S) | | | |

| 04/02/13 | 4.625 | 35,000,000 | 35,363,755 |

| | | | |

| Anheuser-Busch InBev Worldwide, Inc. (P) | | | |

| 03/26/13 | 1.040 | 14,201,000 | 14,227,116 |

| | | | |

| ANZ New Zealand International, Ltd. (S) | | | |

| 07/19/13 | 6.200 | 70,003,000 | 71,820,419 |

| | | | |

| Bank of Tokyo-Mitsubishi UFJ, Ltd. (S) | | | |

| 01/22/13 to 09/11/13 | 1.600 to 2.600 | 153,640,000 | 154,002,509 |

| | | | |

| Barclays Bank PLC | | | |

| 01/23/13 | 2.500 | 4,000,000 | 4,004,980 |

| | | | |

| BHP Billiton Finance USA, Ltd. | | | |

| 04/15/13 | 4.800 | 8,576,000 | 8,683,457 |

| | | | |

| Caisse Centrale Desjardins du Quebec (S) | | | |

| 09/16/13 | 1.700 | 28,256,000 | 28,469,983 |

| | | | |

| Canadian Imperial Bank of Commerce | | | |

| 09/13/13 | 1.450 | 30,550,000 | 30,782,608 |

John Hancock Collateral Investment Trust

As of 12-31-12

Portfolio of Investments

| | | |

| Maturity Date | Yield* (%) | Par value | Value |

|

| Corporate Interest-Bearing Obligations (continued) | | | |

|

| Caterpillar Financial Services Corp. | | | |

| 12/20/13 | 1.550 | $7,500,000 | $7,579,695 |

| | | | |

| Caterpillar, Inc. (P) | | | |

| 05/21/13 | 0.482 | 61,280,000 | 61,343,915 |

| | | | |

| Credit Suisse New York | | | |

| 05/15/13 | 5.000 | 73,092,000 | 74,295,314 |

| | | | |

| Deutsche Bank AG | | | |

| 01/11/13 | 2.375 | 30,180,000 | 30,194,788 |

| | | | |

| EI du Pont de Nemours & Company | | | |

| 07/15/13 | 5.000 | 13,192,000 | 13,519,201 |

| | | | |

| General Electric Capital Corp. (P) | | | |

| 03/20/13 to 06/19/13 | 0.336 to 1.212 | 81,445,000 | 81,590,926 |

| | | | |

| General Electric Capital Corp. | | | |

| 01/08/13 to 09/16/13 | 1.875 to 4.800 | 49,221,000 | 49,519,533 |

| | | | |

| General Electric Company | | | |

| 02/01/13 | 5.000 | 17,500,000 | 17,566,675 |

| | | | |

| IBM Corp. | | | |

| 10/15/13 | 6.500 | 3,908,000 | 4,098,112 |

| | | | |

| John Deere Capital Corp. (P) | | | |

| 10/04/13 | 0.705 | 2,750,000 | 2,758,740 |

| | | | |

| John Deere Capital Corp. | | | |

| 04/03/13 to 06/17/13 | 1.875 to 4.500 | 26,858,000 | 27,126,496 |

| | | | |

| Johnson & Johnson (P) | | | |

| 05/15/13 | 0.310 | 140,000,000 | 140,145,180 |

| | | | |

| JPMorgan Chase & Company (P) | | | |

| 09/30/13 | 1.061 | 5,012,000 | 5,037,962 |

| | | | |

| JPMorgan Chase & Company | | | |

| 05/01/13 | 4.750 | 5,088,000 | 5,161,435 |

| | | | |

| JPMorgan Chase Bank NA (P) | | | |

| 05/17/13 | 0.395 | 3,300,000 | 3,299,363 |

| | | | |

| National Australia Bank, Ltd. (P)(S) | | | |

| 01/08/13 | 0.831 | 44,350,000 | 44,352,883 |

| | | | |

| National Australia Bank, Ltd. (S) | | | |

| 01/08/13 to 06/12/13 | 2.500 to 5.350 | 23,450,000 | 23,837,559 |

| | | | |

| National Rural Utilities Cooperative Finance Corp. (P) | | | |

| 08/09/13 | 0.410 | 118,817,000 | 118,810,465 |

| | | | |

| PepsiCo, Inc. (P) | | | |

| 05/10/13 | 0.390 | 78,010,000 | 78,056,650 |

| | | | |

| PepsiCo, Inc. | | | |

| 02/15/13 | 4.650 | 2,310,000 | 2,322,636 |

| | | | |

| Rabobank Nederland NV (P)(S) | | | |

| 02/04/13 | 0.463 | 13,000,000 | 12,999,350 |

| | | | |

| Sanofi (P) | | | |

| 03/28/13 | 0.510 | 99,905,000 | 99,976,432 |

| | | | |

| Target Corp. (P) | | | |

| 01/11/13 | 0.377 | 91,245,000 | 91,254,125 |

John Hancock Collateral Investment Trust

As of 12-31-12

Portfolio of Investments

| | | |

| Maturity Date | Yield* (%) | Par value | Value |

|

| Corporate Interest-Bearing Obligations (continued) | | | |

|

| The Boeing Company | | | |

| 02/15/13 | 5.125 | $18,120,000 | $18,220,077 |

| | | | |

| Toyota Motor Credit Corp. (P) | | | |

| 01/14/13 to 04/19/13 | 0.421 to 0.540 | 208,500,000 | 208,596,557 |

| | | | |

| Toyota Motor Credit Corp. | | | |

| 08/12/13 | 1.375 | 4,200,000 | 4,225,045 |

| | | | |

| U.S. Bancorp | | | |

| 06/14/13 to 09/13/13 | 1.375 to 2.000 | 18,006,000 | 18,124,126 |

| | | | |

| Wachovia Corp. (P) | | | |

| 05/01/13 | 2.083 | 19,260,000 | 19,370,803 |

| | | | |

| Wachovia Corp. | | | |

| 05/01/13 | 5.500 | 45,493,000 | 46,249,321 |

| | | | |

| Wells Fargo & Company | | | |

| 01/31/13 | 4.375 | 179,982,000 | 180,516,906 |

| | | | |

| Westpac Banking Corp. (P)(S) | | | |

| 04/08/13 | 0.855 | 82,030,000 | 82,150,666 |

| | | | |

| Westpac Banking Corp. (P) | | | |

| 12/09/13 | 1.041 | 3,045,000 | 3,064,190 |

| | | | |

| Westpac Securities NZ, Ltd. (S) | | | |

| 01/28/13 | 2.625 | 30,000,000 | 30,046,470 |

| |

| U.S. Government & Agency Obligations 13.1% | | | $666,332,367 |

|

| (Cost $666,269,419) | | | |

| | | | |

| Federal Farm Credit Bank (P) | | | |

| 06/11/13 to 07/21/14 | 0.190 to 0.270 | 276,220,000 | 276,237,669 |

| | | | |

| Federal Home Loan Bank (P) | | | |

| 04/30/13 to 08/18/14 | 0.140 to 0.290 | 277,005,000 | 277,052,649 |

| | | | |

| Federal Home Loan Bank | | | |

| 06/10/13 | 0.280 | 60,400,000 | 60,416,550 |

| | | | |

| Federal Home Loan Mortgage Corp. (P) | | | |

| 01/10/13 | 0.280 | 38,000,000 | 38,001,482 |

| | | | |

| Federal National Mortgage Association (P) | | | |

| 06/23/14 | 0.360 | 14,600,000 | 14,624,017 |

| |

| Certificate of Deposit 3.7% | | | $191,035,510 |

|

| (Cost $191,014,371) | | | |

| | | | |

| Bank of Montreal (P) | | | |

| 06/21/13 | 0.431 | 16,000,000 | 16,013,760 |

| | | | |

| Credit Suisse New York (P) | | | |

| 07/25/13 | 0.815 | 25,000,000 | 24,997,250 |

| | | | |

| Royal Bank of Canada | | | |

| 01/02/13 | 0.050 | 100,000,000 | 100,000,000 |

| | | | |

| Royal Bank of Canada (P) | | | |

| 06/13/13 | 0.490 | 50,000,000 | 50,024,500 |

John Hancock Collateral Investment Trust

As of 12-31-12

Portfolio of Investments

| | | |

| | | Par value | Value |

|

| |

| Repurchase Agreement 1.2% | | | $63,400,000 |

|

| (Cost $63,400,000) | | | |

| |

| Repurchase Agreement with State Street Corp. dated 12-31-12 at | | | |

| 0.010% to be repurchased at $63,400,035 on 1-2-13, collateralized by | | | |

| $30,190,000 Federal Home Loan Bank, 0.370% due 8-9-13 (valued at | | | |

| $30,265,475, including interest) and $34,180,000 U.S. Treasury | | | |

| Notes, 0.750% due 8-15-13 (valued at $34,404,323, including interest) | | $63,400,000 | 63,400,000 |

| |

| |

| Total investments (Cost $5,089,014,771)† 99.8% | | | $5,089,160,858 |

|

| |

| Other assets and liabilities, net 0.2% | | | $11,279,390 |

|

| |

| Total net assets 100.0% | | $5,100,440,248 |

|

The percentage shown for each investment category is the total value of that category as a percentage of the net assets of the Fund.

* Yield represents either the annualized yield at the date of purchase, the stated coupon rate or, for floating rate securities, the rate at period end.

(P) Variable rate obligation. The coupon rate shown represents the rate at period end.

(S) These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration. Rule 144A securities amounted to $599,857,053 or 11.8% of the Fund's net assets as of 12-31-12.

† At 12-31-12, the aggregate cost of investment securities for federal income tax purposes was $5,089,014,771. Net unrealized appreciation aggregated $146,087, of which $836,273 related to appreciated investment securities and $690,186 related to depreciated investment securities.

John Hancock Collateral Investment Trust

Statement of Assets and Liabilities — December 31, 2012

| | | |

| Assets | | | |

| | |

| Investments, at value (Cost $5,089,014,771) | $5,089,160,858 | | |

| Cash | 36,145 | | |

| Interest receivable | 12,453,033 | | |

| Other receivables and prepaid expenses | 61,999 | | |

| | | | |

| Total assets | 5,101,712,035 | | |

| | | |

| | | |

| Liabilities | | | |

| | |

| Distributions payable | 1,216,082 | | |

| Payable to affiliates | | | |

| Chief compliance officer fees | 8,854 | | |

| Transfer agent fees | 8,629 | | |

| Trustees' fees | 19,140 | | |

| Other liabilities and accrued expenses | 19,082 | | |

| | | | |

| Total liabilities | 1,271,787 | | |

| | | | |

| Net assets | $5,100,440,248 | | |

| | | |

| Net assets consist of | | | |

| | |

| Paid-in capital | $5,100,514,009 | | |

| Accumulated distributions in excess of net | | | |

| investment income | (218,048) | | |

| Accumulated net realized gain (loss) on | | | |

| investments | (1,800) | | |

| Net unrealized appreciation (depreciation) on | | | |

| investments | 146,087 | | |

| | | | |

| Net assets | $5,100,440,248 | | |

| | | |

| | | |

| Net asset value per share | | | |

| | |

| Based on 509,667,158 shares of beneficial | | | |

| interest outstanding — unlimited number of | | | |

| shares authorized with no par value | $10.01 | | |

See notes to financial statements.

John Hancock Collateral Investment Trust

Statement of Operations — For the year ended December 31, 2012

| | | |

| Investment income | | | |

| | |

| Interest | $21,012,907 | | |

| | | | |

| Expenses | | | |

| | |

| Investment management fees | 1,871,265 | | |

| Administrative services fees | 300,000 | | |

| Transfer agent fees | 100,000 | | |

| Trustees' fees | 108,530 | | |

| Professional fees | 154,397 | | |

| Custodian fees | 420,050 | | |

| Chief compliance officer fees | 35,000 | | |

| Other | 74,456 | | |

| | | | |

| Total expenses | 3,063,698 | | |

| | | |

| Net investment income | 17,949,209 | | |

| | | |

| | | |

| Realized and unrealized gain (loss) | | | |

| | |

| | | |

| Net realized gain (loss) on Investments | | | |

| | (1,254) | | |

| Change in net unrealized appreciation | | | |

| (depreciation) on Investments | 296,583 | | |

| Net realized and unrealized gain | 295,329 | | |

| | | |

| Increase in net assets from operations | $18,244,538 | | |

See notes to financial statements.

John Hancock Collateral Investment Trust

Statements of Changes in Net Assets

| | |

| | Year ended | Year ended |

| | 12/31/12 | 12/31/11 |

| |

| Increase (decrease) in net assets | | |

|

| From operations | | |

| Net investment income | $17,949,209 | $16,762,044 |

| Net realized gain (loss) | (1,254) | 302,933 |

| Change in net unrealized appreciation | | |

| (depreciation) | 296,583 | (1,026) |

| | | |

| Increase in net assets resulting from | | |

| operations | 18,244,538 | 17,063,951 |

| |

| Distributions to shareholders | | |

| From net investment income | (17,952,776) | (16,769,079) |

| |

| From net realized gain | — | (218,792) |

| | | |

| Total distributions | (17,952,776) | (16,987,871) |

| | | |

| From Fund share transactions | (38,783,448) | (1,616,723,875) |

| |

| Total decrease | (38,491,686) | (1,616,647,795) |

| | | |

| Net assets | | |

|

| Beginning of year | 5,138,931,934 | 6,755,579,729 |

| End of year | $5,100,440,248 | $5,138,931,934 |

| | | |

| Accumulated distributions in excess of net | | |

| investment income | ($218,048) | ($240,229) |

See notes to financial statements.

John Hancock Collateral Investment Trust

Financial Highlights (For a share outstanding throughout the period)

| | | | |

| Period ended | | | | |

| | 12-31-12 | 12-31-11 | 12-31-10 | 12-31-091 |

| Per share operating performance | | | | |

|

| Net asset value, beginning of period | $10.01 | $10.01 | $10.01 | $10.00 |

| Net investment income2 | 0.03 | 0.03 | 0.03 | 0.02 |

| Net realized and unrealized gain (loss) on | | | | |

| investments | — 3 | — 3 | — 3 | 0.01 |

| Total from investment operations | 0.03 | 0.03 | 0.03 | 0.03 |

| |

| Less distributions | | | | |

| From net investment income | (0.03) | (0.03) | (0.03) | (0.02) |

| | | 3 | | |

| From net realized gain | — | — | — | — |

| | | | | |

| Total distributions | (0.03) | (0.03) | (0.03) | (0.02) |

| |

| Net asset value, end of period | $10.01 | $10.01 | $10.01 | $10.01 |

| |

| Total return (%) | 0.32 | 0.28 | 0.27 | 0.294 |

| |

| Ratios and supplemental data | | | | |

|

| Net assets, end of period (in millions) | $5,100 | $5,139 | $6,756 | $4,901 |

| Ratios (as a percentage of average net | | | | |

| assets): | | | | |

| Expenses | 0.06 | 0.05 | 0.06 | 0.095 |

| Net investment income | 0.34 | 0.27 | 0.27 | 0.295 |

| Portfolio turnover (%)6 | 109 | 91 | 153 | 51 |

1 The inception date is 6-1-09.

2 Based on the average daily shares outstanding.

3 Less than $0.005 per share.

4 Not annualized.

5 Annualized.

6 The calculation of portfolio turnover excludes amounts from all securities whose maturities or expiration dates at the time of

acquisition were one year or less, which represents a significant amount of the investments held by the Fund.

See notes to financial statements

John Hancock Collateral Investment Trust

Notes to financial statements

Note 1 - Organization

John Hancock Collateral Investment Trust (the Fund) is a Massachusetts business trust organized on May 19, 2009. The Fund is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the 1940 Act). Most of the current investors in the Fund are investment companies advised by affiliates of John Hancock Asset Management, a division of Manulife Asset Management (US) LLC, the Fund’s investment adviser (the Adviser). The Fund serves primarily as an investment vehicle for cash received as collateral by such affiliated funds for participation in securities lending.

The investment objective of the Fund is to seek current income, while maintaining adequate liquidity, safeguarding the return of principal and minimizing risk of default. The Fund invests only in U.S. dollar denominated securities rated, at the time of investment, within the two highest short-term credit categories and their unrated equivalents. The Fund’s net asset value (NAV) varies daily.

Note 2 - Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates and those differences could be significant. Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security valuation. Investments are stated at value as of the close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. In order to value the securities, the Fund uses the following valuation techniques: Debt obligations are valued based on the evaluated prices provided by an independent pricing service, which utilizes both dealer-supplied and electronic data processing techniques, taking into account factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data. Certain securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Certain short-term securities are valued at amortized cost. Other portfolio securities and assets, where reliable market quotations are not available, are valued at fair value as determined in good faith by the Fund’s Pricing Committee following procedures estab lished by the Board of Trustees, which include price verification procedures. The frequency with which these fair valuation procedures are used cannot be predicted.

The Fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities. Level 2 includes securities valued using other significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these inputs are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the Fund’s own assumptions in determining the fair value of investments. Factors used in determining value may include market or issuer specific events or trends, changes in interest rates and credit quality. The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. As of December 31, 2012, all investments

are categorized as Level 2 under the hierarchy described above.

Repurchase agreements. The Fund may enter into repurchase agreements. When the Fund enters into a repurchase agreement, it receives collateral, which is held in a segregated account by the Fund’s custodian. The collateral amount is marked-to-market and monitored on a daily basis to ensure that the collateral held is in an amount not less than the principal amount of the repurchase agreement plus any accrued interest. In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the collateral value may decline.

Security transactions and related investment income. Investment security transactions are recorded as of the date of purchase, sale or maturity. Interest income includes coupon interest and amortization/accretion of premiums/discounts on debt securities. Debt obligations may be placed in a non-accrual status and related interest income may be reduced by stopping current accruals and writing off interest receivable when the collection of all or a portion of interest has become doubtful. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation

Expenses. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Federal income taxes. The Fund intends to continue to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

Under the Regulated Investment Company Modernization Act of 2010, the Fund is permitted to carry forward capital losses for an unlimited period. Capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

For federal income tax purposes, as of December 31, 2012, the Fund has a $1,800 short term capital loss carryforward available to offset future net realized capital gains.

As of December 31, 2012, the Fund had no uncertain tax positions that would require financial statement recognition, derecognition or disclosure. The Fund’s federal tax returns are subject to examination by the Internal Revenue Service for a period of three years.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The Fund generally declares dividends daily and pays them monthly. Capital gain distributions, net of fees paid to the Fund’s securities lending agent, if any, are distributed annually. The tax character of distributions for the years ended December 31, 2012 and December 31, 2011 was as follows.

| | | | |

| | December 31, 2012 | December 31, 2011 | | |

| | |

| Ordinary Income | $17,952,776 | $16,987,871 | | |

| | |

As of December 31, 2012, the components of distributable earnings on a tax basis consisted of $154,784 of undistributed ordinary income.

Such distributions and distributable earnings, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences, if any, will reverse in a subsequent period. The Fund had no material book-tax differences at December 31, 2012.

New accounting pronouncement. In December 2011, the Financial Accounting Standards Board issued Accounting Standards Update No. 2011-11 (ASU 2011-11), Disclosures about Offsetting Assets and Liabilities. The update creates new disclosure requirements requiring entities to disclose both gross and net information for derivatives and other financial instruments that are either offset in the Statement of assets and liabilities or subject to an enforceable master netting arrangement or similar agreement. The disclosure requirements are effective for annual reporting periods beginning on or after January 1, 2013 and interim periods within those annual periods. ASU 2011-11 may result in additional disclosure relating to the presentation of derivatives and certain other financial instruments.

Note 3 - Guarantees and indemnifications

Under the Fund’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss from such claims is considered remote.

Note 4 - Fees and transactions with affiliates

The Adviser serves as investment adviser for the Fund. John Hancock Funds, LLC (the Placement Agent) performs services related to the offering and sale of shares of the Fund. The Adviser and the Placement Agent are indirect wholly owned subsidiaries of Manulife Financial Corporation.

Management fee. The Fund has an investment management contract with the Adviser. Under the investment management contract, the Fund pays a daily management fee to the Adviser at the annual rate of: (a) 0.05% of the first $1,500,000,000 of the Fund’s average daily net assets and (b) 0.03% of the Fund’s average daily net assets in excess of $1,500,000,000.

The investment management fees incurred for the year ended December 31, 2012 were equivalent to an annual effective rate of 0.036% of the Fund’s average daily net assets.

Administrative services. The Fund has an Administrative Services Agreement with John Hancock Advisers, LLC (JHA), an affiliate of the Adviser, under which JHA provides accounting, valuation, financial reporting and certain other services. The Fund pays such affiliate monthly in arrears for these services at an annual rate of 0.02% of the Fund’s average daily net assets, up to a maximum of $300,000 annually. The administrative service fees incurred for the year ended December 31, 2012 were equivalent to an annual effective rate of 0.006% of the Fund’s average daily net assets.

Chief Compliance Officer services. The Fund has contracted with the Adviser and the Fund’s Chief Compliance Officer (CCO) to provide certain services, including on going evaluation of the Fund’s policies and procedures under the federal securities laws. In addition, the CCO will provide annual reporting to the Board of Trustees detailing the results of this review. The Fund pays an annual flat rate of $35,000 to the Adviser, paid monthly in arrears, for these services.

Trustee expenses. The Fund compensates each Trustee who is not an employee of the Adviser or its affiliates.

Transfer agent fees. The Fund has a transfer agent agreement with John Hancock Signature Services, Inc. (the Transfer Agent), an affiliate of the Adviser. Monthly, the Fund pays the Transfer Agent a fee which is based on an annual rate of $100,000. The Fund also pays certain out-of-pocket expenses to the Transfer Agent.

Note 5 - Fund share transactions

Transactions in Fund shares for the years ended December 31, 2012 and December 31, 2011 were as follows:

| | | | |

| | Year ended | Year ended |

| | 12/31/12 | 12/31/11 |

| |

|

| | Shares | Amount | Shares | Amount |

| Common shares | | | | |

| Sold | 3,416,114,926 | $34,188,708,856 | 3,947,565,032 | $39,502,092,386 |

| Repurchased | (3,419,994,001) | (34,227,492,304) | (4,109,108,537) | (41,118,816,261) |

| Net decrease | (3,879,075) | ($38,783,448) | (161,543,505) | ($1,616,723,875) |

| |

|

Note 6 - Purchase and sale of securities

Purchases and proceeds from sales or maturities of securities, other than short-term securities, during the year ended December 31, 2012, aggregated $2,133,100,948 and $1,979,428,622, respectively.

Auditors’ report

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of John Hancock Collateral Investment Trust:

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of John Hancock Collateral Investment Trust (the "Fund") at December 31, 2012, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fund's management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2012 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

February 20, 2013

Shareholder Action (unaudited)

On December 12, 2012, the shareholders of John Hancock Collateral Investment Trust unanimously approved the election of the following three individuals as members of the Board of Trustees.

| | |

| | TOTAL SHARES | |

| | APPROVING THE | |

| | NOMINEE | |

| |

| |

| William P. Callan, Jr. | 516,326,204 | |

| John A. Frabotta | 516,326,204 | |

| Harlan D. Platt | 516,326,204 | |

Trustees and Officers

This chart provides information about the Trustees and Officers of John Hancock Collateral Investment Trust. Officers elected by the Trustees manage the day-to-day operations of the Fund and execute policies formulated by the Trustees.

Independent Trustees

| | |

| Name, Year of Birth | Trustee | Number of |

| Position(s) held with Fund | of the | John Hancock |

| Principal occupation(s) and other | Fund | funds overseen |

| directorships during past 5 years | since1 | by Trustee |

| |

| Harlan D. Platt,2 Born: 1950 | 2009 | 1 |

|

| Chairman | | |

| Professor of Finance, Northeastern University College of Business Administration (since 1980); Director, |

| Republic Financial Corporation (since 2005); Advisory Board Member, Millennium Custodial Trust, 2010– |

| Present; Director and Audit Committee Member, CypressTree Alternative Income Fund Inc. (2003–2004); |

| Director and Audit Committee Member, Prospect Street Debt Strategies Fund Inc. (1999–2003); Director |

| and Audit Committee Chairman, VSI Enterprises, Inc. (1998–2000); Director and Audit Committee |

| Member, Prospect Street High Income Portfolio Inc. (1988–2000). | | |

|

| |

| John A. Frabotta,2 Born: 1942 | 2009 | 1 |

|

| Trustee | | |

| Retired. Former founding partner and Chief Investment Officer of Cypress Tree Investment Management, |

| LLC (1988–2009); Head of High Yield Research at Merrill Lynch, Pierce, Fenner & Smith (1979–1988). |

| |

| Non-Independent Trustee3 | | |

| | | |

| Name, Year of Birth | Trustee | Number of |

| Position(s) held with Fund | of the | John Hancock |

| Principal occupation(s) and other | Fund | funds overseen |

| directorships during past 5 years | since1 | by Trustee |

| |

| William P. Callan, Jr., Born: 1961 | 2012 | 1 |

|

| President (1993–2012), Declaration Management & Research LLC (“Declaration”), an independent |

| wholly owned subsidiary of Manulife. Mr. Callan helped form Declaration in 1989. Prior to joining |

| Declaration, Mr. Callan was a Vice President and member of the Mortgage Products Group of Merrill |

| Lynch Capital Markets, starting his career there in 1984. | | |

| |

| Principal officers who are not Trustees* | | |

| |

| Name, Year of Birth | | Officer |

| Position(s) held with Fund | | of the |

| Principal occupation(s) and other | | Fund |

| directorships during past 5 years | | since |

| |

| Barry H. Evans, Born: 1960 | | 2009 |

|

| President and Chief Executive Officer | | |

| Barry Evans is the President, Chief Investment Officer, Global Fixed Income & Country Head, US at |

| John Hancock Asset Management a division of Manulife Asset Management (US) LLC (JHAM). He |

| is responsible for all US and international fixed income strategies managed by JHAM, some of which |

| incorporate exposure to high yield and emerging market debt asset classes. He is a member of the firm’s |

| Senior Investment Policy Committee. Mr. Evans began his career in the financial industry in 1986 when he |

| joined John Hancock Advisers, the sister firm of JHAM. | | |

Collateral Investment Trust | Annual report

Principal officers who are not Trustees (continued)

| |

| Name, Year of Birth | Officer |

| Position(s) held with Fund | of the |

| Principal occupation(s) and other | Fund |

| directorships during past 5 years | since |

| |

| Carolyn M. Flanagan, Born: 1967 | 2009 |

|

| Secretary and Chief Legal Officer | |

| Carolyn M. Flanagan is a vice president and the general counsel at JHAM. She provides legal support for |

| the firm’s mutual fund and institutional investment management business. Ms. Flanagan also serves as a |

| member of the firm’s Senior Investment Policy Committee. Prior to joining the firm, Ms. Flanagan served |

| as vice president and counsel at Wellington Management Company, LLP, and prior to that assistant vice |

| president and counsel at State Street Bank and Trust Company. She is a member of the Massachusetts, |

| Florida, and District of Columbia Bars. | |

|

| |

| William E. Corson, Born: 1956 | 2009 |

|

| Chief Compliance Officer | |

| William E. Corson is a vice president and the chief compliance officer at JHAM, charged with oversight |

| of all compliance related activities. Mr. Corson also serves as a member of the firm’s Senior Investment |

| Policy Committee. Prior to joining the firm, Mr. Corson held chief compliance officer roles at Aladdin |

| Capital Management, Pyramis Global Advisors (the institutional investment management firm of Fidelity |

| Investments), and Lee Munder Capital Management. Earlier, he spent over 10 years at Investors Bank and |

| Trust, where he was responsible for trust division operations and client service. He is a member of the |

| Massachusetts Bar. | |

|

| |

| Charles A. Rizzo, Born: 1957 | 2009 |

|

| Chief Financial Officer | |

| Vice President, John Hancock Financial Services (since 2008); Senior Vice President, John Hancock | |

| Advisers, LLC and John Hancock Investment Management Services, LLC (since 2008); Chief Financial |

| Officer, John Hancock retail funds, John Hancock Funds II and John Hancock Variable Insurance | |

| Trust (since 2007). | |

|

| |

| Michael J. Leary, Born: 1965 | 2009 |

|

| Treasurer | |

| Assistant Vice President, John Hancock Financial Services (since 2007); Treasurer, John Hancock | |

| Funds II and John Hancock Variable Insurance Trust (since 2009); Treasurer, John Hancock retail funds |

| (2009–2010); Vice President, John Hancock Advisers, LLC and John Hancock Investment Management |

| Services, LLC (since 2007); Assistant Treasurer, John Hancock retail funds (2007–2009 & 2010), | |

| John Hancock Funds II and John Hancock Variable Insurance Trust (2007–2009) and John Hancock |

| Funds III (since 2009). | |

The business address for Harlan D. Platt, John A. Frabotta, William P. Callan, Jr., Barry H. Evans, Carolyn M. Flanagan and William E. Corson is 101 Huntington Avenue, Boston, Massachusetts 02199. The business address for Charles A. Rizzo and Michael J. Leary is 601 Congress Street, Boston, Massachusetts 02210.

Part B of the Fund’s registration statement includes additional information about members of the Board of Trustees of the Fund and is available without charge, upon request, by calling 1-800-225-5291.

1 Each Trustee serves until resignation, retirement age or until his or her successor is elected.

2 Member of Audit Committee.

3 Non-Independent Trustees hold positions with the Fund’s investment adviser, underwriter and certain other affiliates.

* The officers are elected annually by the Board of Trustees.

|

| Annual report | Collateral Investment Trust |

More information

| |

| Trustees | Investment adviser |

| Harlan D. Platt* | Manulife Asset Management (US) LLC |

| John A. Frabotta* | |

| William P. Callan, Jr.† | |

| *Member of the Audit Committee | Placement agent |

| †Non-Independent Trustee | John Hancock Funds, LLC |

| |

| Officers | Custodian |

| Barry H. Evans | State Street Bank and Trust Company |

| President and Chief Executive Officer | |

| Carolyn M. Flanagan | Transfer agent |

| Secretary and Chief Legal Officer | John Hancock Signature Services, Inc. |

| William E. Corson | |

| Chief Compliance Officer | Legal counsel |

| Charles A. Rizzo | Skadden, Arps, Slate, Meagher & Flom LLP |

| Chief Financial Officer | |

| Michael J. Leary | Independent registered public accounting firm |

| Treasurer | PricewaterhouseCoopers LLP |

| | |

| |

| |

| | The report is certified under the Sarbanes-Oxley Act, |

| | which requires mutual funds and other public companies |

| | to affirm that, to the best of their knowledge, the information |

| | in their financial reports is fairly and accurately stated in |

| | all material respects. |

| |

| |

The Fund's proxy voting policies and procedures are available upon request without charge. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available (i) without charge, upon request; and (ii) on the SEC's website at http://www.sec.gov. Requests should be made by calling [1-800-225-5292].

The Fund’s complete list of portfolio holdings, for the first and third fiscal quarters, is filed with the SEC on Form N-Q. The Fund’s Form N-Q is available on the SEC’s Web site, www.sec.gov, and can be reviewed and copied (for a fee) at the SEC’s Public Reference Room in Washington, DC. Call 1-800-SEC-0330 to receive information on the operation of the SEC's Public Reference Room.

ITEM 2. CODE OF ETHICS.

As of the end of the year, December 31, 2012, the registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, that applies to its Chief Executive Officer, Chief Financial Officer and Treasurer (respectively, the principal executive officer, the principal financial officer and the principal accounting officer, the “Senior Financial Officers”). A copy of the code of ethics is filed as an exhibit to this Form N-CSR.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

The Trustees have determined that a member of the audit committee, Mr. John Frabotta, is an audit committee financial expert. Mr. Frabotta is an independent trustee by virtue of being not an "interested" person of the Trust (as defined under the Investment Company Act of 1940, as amended) whose sole compensation from the Trust is his Trustees' fees.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

(a) Audit Fees

The aggregate fees billed for professional services rendered by the principal accountant(s) for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant(s) in connection with statutory and regulatory filings or engagements amounted to $54,693 for the fiscal year ended December 31, 2012 and $52,737 for the fiscal year ended December 31, 2011 for John Hancock Collateral Investment Trust. These fees were billed to the registrant and were approved by the registrant’s audit committee.

(b) Audit-Related Services

Audit-related service fees amounted to $1,853 for the fiscal year ended December 31, 2012 and $1,110 for the fiscal year ended December 31, 2011 for John Hancock Collateral Investment Trust billed to the registrant or to the registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant ("control affiliates").

(c) Tax Fees

The aggregate fees billed for professional services rendered by the principal accountant(s) for the tax compliance, tax advice and tax planning (“tax fees”) amounted to $2,785 for the fiscal year ended December 31, 2012 and $2,704 for the fiscal year ended December 31, 2011 for John Hancock Collateral Investment Trust. The nature of the services comprising the tax fees was the review of the registrant’s tax returns and tax distribution requirements. These fees were billed to the registrant and were approved by the registrant’s audit committee.

(d) All Other Fees

Other fees amounted to $24 for the fiscal year ended December 31, 2012 and $22 for the fiscal year ended December 31, 2011 for John Hancock Collateral Investment Trust billed to the registrant or to the control affiliates.

(e)(1) Audit Committee Pre-Approval Policies and Procedures:

The trust’s Audit Committee must pre-approve all audit and non-audit services provided by the independent registered public accounting firm (the “Auditor”) relating to the operations or financial reporting of the funds. Prior to the commencement of any audit or non-audit services to a fund, the Audit Committee reviews the services to determine whether they are appropriate and permissible under applicable law.

The trust’s Audit Committee has adopted policies and procedures to, among other purposes, provide a framework for the Committee’s consideration of audit-related and non-audit services by the Auditor. The policies and procedures require that any audit-related and non-audit service

provided by the Auditor and any non-audit service provided by the Auditor to a fund service provider that relates directly to the operations and financial reporting of a fund are subject to approval by the Audit Committee before such service is provided. Audit-related services provided by the Auditor that are expected to exceed $10,000 per instance/per fund are subject to specific pre-approval by the Audit Committee. Tax services provided by the Auditor that are expected to exceed $10,000 per instance/per fund are subject to specific pre-approval by the Audit Committee.

All audit services, as well as the audit-related and non-audit services that are expected to exceed the amounts stated above, must be approved in advance of provision of the service by formal resolution of the Audit Committee. At the regularly scheduled Audit Committee meetings, the Committee reviews a report summarizing the services, including fees, provided by the Auditor.

(e)(2) Services approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X:

Audit-Related Fees, Tax Fees and All Other Fees:

There were no amounts that were approved by the Audit Committee pursuant to the de minimis exception under Rule 2-01 of Regulation S-X.

(f) According to the registrant’s principal accountant, for the fiscal year ended December 31, 2012, the percentage of hours spent on the audit of the registrant's financial statements for the most recent fiscal year that were attributed to work performed by persons who were not full-time, permanent employees of principal accountant was less than 50%.

(g) The aggregate non-audit fees billed by the registrant's accountant(s) for services rendered to the registrant and rendered to the registrant's control affiliates of the registrant was $2,875,551 for the fiscal year ended December 31, 2012 and $2,522,973 for the fiscal year ended December 31, 2011.

(h) The audit committee of the registrant has considered the non-audit services provided by the registrant’s principal accountant(s) to the control affiliates and has determined that the services that were not pre-approved are compatible with maintaining the principal accountant(s)' independence.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

The registrant has a separately-designated standing audit committee comprised of independent trustees. The members of the audit committee are as follows:

Harlan D. Platt - Chairman

John A. Frabotta

ITEM 6. SCHEDULE OF INVESTMENTS.

(a) Not applicable.

(b) Not applicable.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

Not applicable.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

Not applicable.

ITEM 11. CONTROLS AND PROCEDURES.

(a) Based upon their evaluation of the registrant's disclosure controls and procedures as conducted within 90 days of the filing date of this Form N-CSR, the registrant's principal executive officer and principal financial officer have concluded that those disclosure controls and procedures provide reasonable assurance that the material information required to be disclosed by the registrant on this report is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms.

(b) There were no changes in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal half-year (the registrant's second fiscal half-year in the case of an annual report) that have materially affected, or are reasonably likely to materially affect, the registrant's internal control over financial reporting.

ITEM 12. EXHIBITS.

(a)(1) See attached Code of Ethics.

(a)(2) Separate certifications for the registrant's principal executive officer and principal financial officer, as required by Section 302 of the Sarbanes-Oxley Act of 2002 and Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(b) Separate certifications for the registrant's principal executive officer and principal financial officer, as required by 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, and Rule 30a-2(b) under the Investment Company Act of 1940, are attached. The certifications furnished pursuant to this paragraph are not deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liability of that section. Such certifications are not deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Registrant specifically incorporates them by reference.

(c) Contact person at the registrant.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

| John Hancock Collateral Investment Trust |

| |

| By: | /s/ Barry H. Evans |

| | ------------------------------ |

| | Barry H. Evans |

| | President and Chief Executive Officer |

| |

| |

| Date: | February 20, 2013 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| |

| By: | /s/ Barry H. Evans |

| | ------------------------------ |

| | Barry H. Evans |

| | President and Chief Executive Officer |

| |

| |

| Date: | February 20, 2013 |

| |

| |

| By: | /s/ Charles A. Rizzo |

| | -------------------------------- |

| | Charles A. Rizzo |

| | Chief Financial Officer |

| |

| |

| |

| Date: | February 20, 2013 |