UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

[ x ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedDecember 31, 2012

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to _____________

Commission file number:000-54333

XCELMOBILITY INC.

(Exact name of registrant as specified in its charter)

| NEVADA | 98-0561888 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| 303 Twin Dolphins Drive | |

| Suite 600, Redwood City | |

| California | 94065 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code:(650) 632-4210

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [ x ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes [ ] No [ x ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [ x ] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ x ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [ x ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [ x ]

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2012 was approximately $4,902,524 based upon the closing price of $0.16 per share reported for such date on the Over-the-Counter Bulletin Board maintained by the NASD. Shares of common stock held by each officer and director and by each person who is known to own 10% of more of the outstanding Common Stock have been excluded in that such persons may be deemed to be affiliates of the Company. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| Common Stock | Outstanding at March 27, 2013 |

| Common Stock, $.001 par value per share | 60,940,781 shares |

DOCUMENTS INCORPORATED BY REFERENCE:None.

XCELMOBILITY INC.

TABLE OF CONTENTS

PART I

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some discussions in this Annual Report on Form 10-K contain forward-looking statements that have been made pursuant to the provisions of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties and relate to future events or future financial performance. A number of important factors could cause our actual results to differ materially from those expressed in any forward-looking statements made by us in this Form 10-K. Forward-looking statements are often identified by words such as “believe,” “expect,” “estimate,” “anticipate,” “intend,” “project,” “plans,” “seek” and similar expressions or words which, by their nature, refer to future events. In some cases, you can also identify forward-looking statements by terminology such as “may,” “will,” “should,” “plans,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology.

These forward-looking statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” below that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. In addition, you are directed to factors discussed in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section as well as those discussed elsewhere in this Form 10-K.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results. However, readers should carefully review the risk factors set forth in other reports or documents the Company files from time to time with the Securities and Exchange Commission (the “SEC”), particularly the Company’s Quarterly Reports on Form 10-Q and any Current Reports on Form 8-K. All written and oral forward-looking statements made subsequent to the date of this report and attributable to us or persons acting on our behalf are expressly qualified in their entirety by this section.

As used in this Annual Report on Form 10-K, references to “dollars” and “$” are to United States dollars and, unless otherwise indicated, references to “we,” “our,” “us,” “Xcel,” “XCLL,” the “Company” or the “Registrant” refer to XcelMobility Inc., a Nevada corporation and its wholly owned subsidiaries, CC Mobility Limited (“CC Mobility”), a company organized under the laws of Hong Kong, Shenzhen CC Power Investment Consulting Co. Ltd. (“CC Investment”), a company organized under the laws of the People’s Republic of China, and a wholly-owned subsidiary of CC Mobility, and Shenzhen CC Power Corporation (“CC Power”), a company organized under the laws of the People’s Republic of China.

ITEM 1.BUSINESS.

Background and Overview

We were incorporated in the state of Nevada on December 27, 2007 under the name “Advanced Messaging Solutions, Inc.” On March 29, 2011, we amended our Articles of Incorporation to change our name from “Advanced Messaging Solutions, Inc.” to “XcelMobility Inc.” and we effected a 35-for-1 forward stock split of all of our issued and outstanding shares of common stock.

On July 5, 2011, we entered into a voluntary share exchange agreement (the “Exchange Agreement”) with Shenzhen CC Power Corporation, a company organized under the laws of the People’s Republic of China (PRC) (“CC Power”), CC Mobility Limited, a company organized under the laws of Hong Kong (“CC Mobility”) and the shareholders of CC Mobility. Pursuant to the closing of the transactions contemplated under the Exchange Agreement, on August 30, 2011, we issued 30,300,000 shares of our common stock to the shareholders of CC Mobility representing 50.5% of our issued and outstanding common stock in exchange for 100% of the issued and outstanding capital stock of CC Mobility (the “Exchange Transaction”). As a result of the Exchange Transaction, CC Mobility became our wholly-owned subsidiary and we control the business and operations of CC Power.

1

Through CC Mobility and CC Power, we are developing and marketing mobile applications for mobile devices that utilize cellular networks to connect to the Internet and hardware/software products to increase the speed of Virtual Private Networks. Our strategy is global in scope, but we are focusing our efforts at this time on the large mobile market of China. CC Power’s principal activity is the design, testing sale and support of software to support mobile Internet applications on cellular phones, smartphones, tablets and mobile computers in China. The principal products marketed by CC Power include the Mach 5 Accelerator and Mach5 LBS for location based applications. In order to support CC Power products, we have built a series of server locations throughout China. CC Power sells its products to corporations directly, to individual users via our Mach5.cn website and retail locations, through distribution agents and through all three mobile phone carriers in China.

In April 2012, we entered into an Exclusive Indonesian Supply Contract with ZTE Corp. (the “Supply Contract”). ZTE Corp. is a leading global provider and Original Equipment Manufacturer (OEM) of telecommunications equipment and network solutions. The Supply Contract provides that we will be the exclusive supplier of high speed USB modems for ZTE Corp. for sale in Indonesia. The initial order is for a minimum of 100,000 units with additional orders anticipated to follow once the initial test market is completed.

In July 2012, we surpassed over 1.5 million subscribers in Asia. In August 2012, we signed a strategic partnership agreement with Tokyo-based Unified Communications, Inc. (“UCI”), which includes the launch of its Mach 5 LBS (Location Based Service). The Mach 5 LBS is slated to become a featured product and optional component of our Mach 5 browser accelerator product line and offers a GPS tracking-based platform that enables application developers to collect and review significant user analytics that offer major impacts for retail marketing.

We are currently deriving revenue from the sale of our internet accelerator software, and we believe we can increase our revenues by expanding marketing efforts to broaden our product offering to include software sales directly to mobile device manufacturers and to provide application sales and enhanced products directly to consumers.

In order to expand our sales efforts, we have created an enterprise portal branded under our flagship Mach 5 banner to offer our customers direct access to our products. The website, http://www.mach5.cn/en/, connects potential resellers, developers and consumers with our revenue-generating 3rd party applications, games and specialty content. As we introduce new products to the China market, we can immediately share them with the industry through our online product portal and we believe this can maximize our sales opportunities.

2

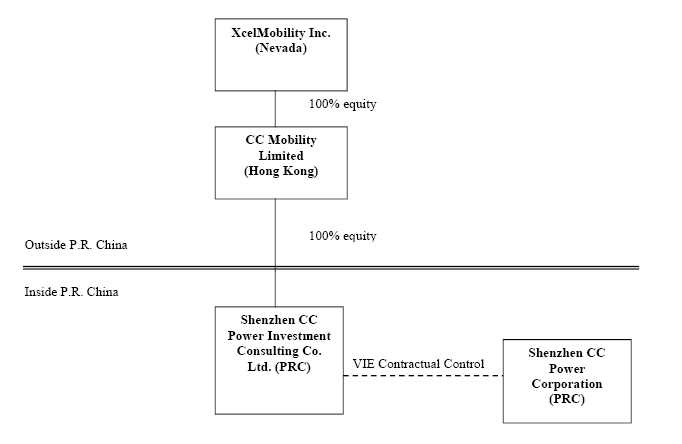

Corporate Structure

As a result of the Exchange Transaction, the organizational structure of the Registrant is as follows:

3

CC Mobility Limited was incorporated on May 3, 2011 under the laws of Hong Kong as a limited liability company.

Shenzhen CC Power Investment Consulting Co. Ltd., a wholly-owned subsidiary of CC Mobility, was incorporated on July 27, 2011 under the laws of the People’s Republic of China as a wholly foreign owned limited liability company.

Shenzhen CC Power Corporation is a Chinese enterprise incorporated on March 13, 2003 under the laws of the PRC.

CC Power is owned entirely by Xili Wang (the “CC Power Shareholder”), who is also our Chief Financial Officer and Secretary. CC Power maintains all the licenses and approvals necessary to operate its business in the PRC.

PRC law places certain restrictions on roundtrip investments through the acquisition of a PRC entity by PRC residents. To comply with these restrictions, in conjunction with the Exchange Transaction, we (via our wholly-owned subsidiary, CC Investment), entered into and consummated certain contractual arrangements with CC Power and/or the CC Power Shareholder pursuant to which we provide CC Power with exclusive technology consulting and management services. Through these contractual arrangements, we have the ability to substantially influence CC Power’s daily operations and financial affairs, appoint its directors and senior executives, and approve all matters requiring board and/or shareholder approval. These contractual arrangements enable us to control CC Power and operate our business in the PRC through CC Power and we are considered the primary beneficiary of CC Power. Accordingly, our consolidated financial statements reflect the results of operations, assets and liabilities of CC Power.

On August 22, 2011, our subsidiary, CC Investment, entered into the following contractual arrangements with CC Power and/or the CC Power Shareholder, each of which is enforceable and valid in accordance with the laws of the PRC:

Entrusted Management Agreement. Pursuant to the Entrusted Management Agreement among CC Power, CC Investment, and the CC Power Shareholder, CC Investment agrees to provide, and CC Power agrees to accept, exclusive management services provided by CC Investment. Such management services include but are not limited to financial management, business management, marketing management, human resource management and internal control of CC Power. The Entrusted Management Agreement will remain in effect until the acquisition of all assets or equity of CC Power by CC Investment is complete (as more fully described in the Exclusive Purchase Option Agreement below).

Technical Services Agreement. Pursuant to the Technical Services Agreement among CC Power, CC Investment, and the CC Power Shareholder, CC Investment agrees to provide, and CC Power agrees to accept, exclusive technical services provided by CC Investment. Such technical services include but are not limited to software, computer system, data analysis, training and other technical services. CC Investment shall be entitled to charge CC Power service fees equivalent to CC Power’s total net income. The Technical Service Agreement will remain in effect until the acquisition of all assets or equity of CC Power by CC Investment is complete (as more fully described in the Exclusive Purchase Option Agreement below).

Exclusive Purchase Option Agreement.Under the Exclusive Purchase Option Agreement among CC Power, CC Investment, and the CC Power Shareholder, the CC Power Shareholder granted CC Investment an irrevocable and exclusive purchase option to acquire CC Power’s equity and/or assets at a nominal consideration. CC Investment may exercise the purchase option at any time.

Loan Agreement. Under the Loan Agreement between CC Investment and the CC Power Shareholder, CC Investment agreed to lend RMB 10,000,000 to the CC Power Shareholder, to be used solely for the operations of CC Power.

Equity Pledge Agreement.Under the Equity Pledge Agreement among CC Investment and the CC Power Shareholder, the CC Power Shareholder pledged all of its equity interests in CC Power, including the proceeds thereof, to guarantee all of CC Investment’s rights and benefits under the Entrusted Management Agreement, the Technical Service Agreement, the Exclusive Purchase Option Agreement and the Loan Agreement. Prior to termination of this Equity Pledge Agreement, the pledged equity interests cannot be transferred without CC Investment’s prior consent. The CC Power Shareholder covenants to CC Investment that among other things, it will only appoint/elect the candidates for the directors of CC Power nominated by CC Investment.

4

Subsidiaries

As a result of the Exchange Transaction, CC Investment and (via a contractual relationship) CC Power are wholly-owned subsidiaries of our subsidiary CC Mobility. CC Power does not have any subsidiaries.

Strategy

We are a provider of mobile internet software technology and application services. Our mission is to provide better mobile internet experience to billions of users around the world. We operate a mobile internet hub through CC Mobility and CC Power where we are developing mobile applications directly for mobile devices that utilize cellular networks to connect to the Internet and hardware/software products to increase the speed of Virtual Private Networks. Our primary market is the large and growing mobile internet market in China.

We have grown our user base by offering our Mach 5 Xcelerator product free of charge to the growing number of mobile users in China. The Mach 5 product has the look and feel of a desktop browser but loads and processes material over the cellular Internet (e.g., websites, videos, pictures, etc.) significantly faster than conventional browsers that come with mobile devices. This enables us to develop and acquire other mobile software that will leverage off the speed and performance of the Mach 5 product line. In order to support CC Power’s products, we have built a series of server locations throughout China and have created an online product portal. Management believes it has the opportunity to grow significant revenues from operations in China if we successfully execute our business and financial objectives.

China Strategy

In China, CC Power is utilizing the license granted by the PRC to provide mobile Internet services to corporations and individuals. Since 2008, CC Power has been actively test marketing products throughout China. A large network of servers has been put in place to support all Mach 5 products. CC Power also has in place agreements with all three of China’s cellular carriers (China Mobile, China Telecom and China Unicom) in several of China’s provinces that allow CC Power to market to the carrier’s subscribers via mail, email, text messaging and other means to introduce CC Power products. These agreements are entered into in the ordinary course of CC Power’s business as each and every province in the PRC where CC Power operates requires a separate agreement with each of the three main cellular carriers. These three carriers currently have an estimated subscriber base of over 1 billion users, per the chart below. CC Power has established revenue sharing arrangements with each carrier in the ordinary course of business on a province by province basis.

| Cellular Carrier | Subscribers |

| China Mobile | 661 Million |

| China Unicom | 298 Million |

| China Telecom | 126 Million |

| Total | 1,085 Million |

CC Power has attracted over 1.7 million subscribers. CC Power has found that the best method of marketing to the price sensitive Chinese market is to offer a base product for free and a superior product for a small fee (equivalent to approximately $0.50 per month). For cell phone OEMs that preinstall the Mach 5 software in the phone, CC Power will provide a free trial version of Mach 5.

In addition to marketing products through China’s three cellular carriers, CC Power is also working with cell phone manufacturers to embed the Mach 5 product in phones at the factory. In 2011, CC Power has entered into agreements to provide high-speed USB Modems with ZTE (to supply China Unicom) and Shenzhen Mobile (to supply China Mobile).

5

Japan Strategy

We are in the process of expanding into Japan through the utilization of a strategic partner. CC Power has a strategic, contractual relationship with Unified Communications Inc., a Tokyo-based company with relationships throughout Japan, including with the largest cellular phone carriers, mobile device manufacturers and retailers.

South Korea Strategy

The South Korea market is very similar to the Japanese cellular market. In South Korea, we will follow the same sales and marketing strategy as used in Japan. We are actively looking for sales and marketing partner(s) in Korea.

Customers

The Company currently has a customer base of approximately 1.7 million end users within China using our service free of charge with approximately 30,000 fee-paying enterprise customers. With our key products fully tested and approved by large cellular carriers in China and Japan, we believe that we will be able to grow our customer base and revenues in 2013.

Technology

Utilizing our proprietary data compression technology, we provide products for mobile Internet users, which includes products for traditional cell phones, smartphones and PC access to the Internet through mobile phones.

CC Power’s line of Mach 5 products are being used by over 1 million Chinese mobile phone users. The Mach 5 Web enables users to take their full PC web browsing experience to their mobile devices. Mach 5 LBS enables location-based services for smartphones equipped with GPS technology.

Many of our Mach 5 products require a large powerful network to run our applications. We have strategically located powerful computer servers around the country to ensure consistent service and availability.

6

We have spent considerable time, effort and financial resources building a powerful computer server network throughout China.

Intellectual Property

CC Power has developed unique intellectual property for its service. The centerpiece of CC Power’s technology is compression algorithms that enable data to be passed from computers to phones. The compression software couples with high speed servers to accelerate data between a phone and the source of data. Management believes this technology is unique. CC Power has significant intellectual property that we believe provides a competitive advantage over competitors and new entrants to the market. We employ the following mechanisms to protect our intellectual property:

| 1. | Control of Source Code: CC Power protects its intellectual property by not allowing others to use its source code. | |

| 2. | Trade Secret Agreements: All employees are bound by trade secret agreements. |

Copyrights

CC Power has copyrights to the following software applications in China, where it believes the majority of its customer base will be generated in the next few years.

| 1. | Software Copyright Applications: CC Power has registered 3 software applications for copyright in China. | ||

| a. | Mach 5 Internet acceleration software V.6.0, Register number: 2007SR09253, by National copyright administration of People’s Public of China. | ||

| b. | Mach 5 Enterprise acceleration software V.3.3, Register number: 2009SR058767, by National copyright administration of People’s Public of China. | ||

7

| c. | Mach 5 Web Browser software V.1.1.44.13, Register number: 2010SR001089, by National copyright administration of People’s Public of China. | |||

| d. | CC Power LBS (location based service) software V.1.0. Register number: 2013SR008345, by National copyright administration of People’s Republic of China. | |||

| 2. | Licenses: CC Power also has obtained several licenses available only to Chinese companies from the PRC Ministry of Industry and technology and local Police Public Safety Departments (international website licenses). These licenses include the following: | |||

“Software Enterprise Recognition Certificate,” issued by Shenzhen Science Technology & Information Bureau on May 30, 2008, granted to Shenzhen CC Power Corporation. | ||||

“PRC Value-Added Telecommunication Service Operation License,” issued by the PRC Ministry of Industry and Information Technology on March 11, 2008 to Shenzhen CC Power Corporation, which will expire on January 7, 2018. | ||||

Awards

CC Power has also received the following awards and/or special recognitions:

“Certificate of Honor,” issued by Beijing World of Telecommunication Magazine, Beijing Telecommunication Technology Magazine and Telecommunication Science Magazine in October 2007, granted to Shenzhen CC Power Corporation, indicating that the “MACH 5 Wireless Web Accelerator” Solution was awarded the Excellent Solution in the “Election of 2007 The 100 Most Successful Solutions in PRC Telecommunication Industry.”

“Certificate of Honor,” issued by Beijing World of Telecommunication Magazine, Beijing Telecommunication Technology Magazine and Telecommunication Science Magazine in October 2009, granted to Shenzhen CC Power Corporation, indicating that the “MACH 5 Mobile Browser” Solution was awarded the Excellent Solution in the “Election of 2009 The 100 Most Successful Solutions in PRC Telecommunication Industry – Judges Choice Award.”

Recognition by Information Week Magazine, noting Shenzhen CC Power Corporation was included on its 2008 list of “The 100 Best PRC Commercial Technology Companies.”

We will continue to evaluate the business benefits in pursuing patents and copyrights in the future. We currently protect all of our development work with confidentiality agreements with our engineers, employees and any outside contractors. However, third parties may, in an unauthorized manner, attempt to use, copy or otherwise obtain and market or distribute our intellectual property or technology or otherwise develop a product with the same functionality as our service. Policing unauthorized use of intellectual property rights is difficult, and nearly impossible on a worldwide basis. Therefore, we cannot be certain that the steps we have taken or will take in the future will prevent misappropriation of our technology or intellectual property, particularly in foreign countries where we do business or where our service is sold or used, where the laws may not protect proprietary rights as fully as do the laws of the United States or where the enforcement of such laws is not common or effective.

Products and Distribution

Products for Mobile Devices

The Mach 5 Xcelerator product provides us with a unique opportunity in China. Currently there are a limited number of Chinese applications available to the Chinese market, with few in the Chinese language. In 2012, we opened an applications store (“App Store”), where Chinese applications, games and content can be downloaded and utilized by Mach 5 subscribers. We will work directly with proven application and game providers to modify applications to the Chinese language. Content will be provided from the existing Chinese media. Our App Store resembles App Stores currently provided by Apple and Google but is targeted at the growing mobile phone user market in China.

8

Our current suite of products and services includes:

Mach 5 Accelerator for Mobile Phones or PC

The Mach 5 Accelerator accelerates internet access through proprietary text and image compression, content caching, and other network optimizations. It supports all wireless internet connections such as GPRS, CDMA, 2G, 3G and WiFi, etc. as well as 56K dial-up and any other low-speed or unstable internet connections. A number of acceleration servers have been installed across China, Hong Kong and Japan. Without the need of any new hardware installation, customers can use the services by downloading and installing Mach 5 with a valid user account.

- fast web and email acceleration technology

- patented acceleration, compression and network optimization

- employed by more than 2,200 service providers in over 50 countries

- approved by independent testing provider VeriTest USA

- acceleration up to 5 times certified by China Unicom

- simple installation and user friendly interface

Mach 5 Web Browser for Mobile

Mach 5 Web for Mobile enables users to take their full PC web browsing experience to their mobile devices. Featured websites and Rich Internet Applications (RIA), such as YouTube, Facebook, Google Apps, Google Maps, Yellow Pages Map and many others with Flash, AJAX, JavaScript, ActiveX, Web 2.0 and more, are easily accessed. YouTube videos and other compatible videos are Full-Screen supported.

9

With the latest remote processing technologies, Mach 5 Web requires just minimal bandwidth and hardware resources to quickly access full websites and heavy web-based applications.

Mach 5 Enterprise

Mach 5 for Enterprise offers a secure, customized total solution to corporations with mobility needs. Web-based Office Applications “OA,” such as ERP, CRM and MIS etc. can be supported natively by our Mach 5 Web Browser without the need of additional porting process to different mobile platforms. Enterprises are able to deploy BYOD, “Bring Your Own Device” with confidence that Mach 5 connects to companies’ intra-networks via secured internet session or more secured VPN.

Mach 5 LBS

Mach 5 LBS is a GPS/GSM/LBS application that can plug in on social networks. The application collects friend information from every major social network to map locations, and allows a user to share location-based information, photographs, and personal content. But, unlike other applications, Mach 5 LBS gives a user the power of GPS/GSM/LBS technology on its mobile phone - yet, all of the location information is private and never available to anyone out of the user’s network. Family and friends can also find each other around the world without location drop-offs on the map.

Following are features available to subscribers of Mach 5 LBS service:

| - | Locate all friends on street/satellite maps and communicate with them directly. |

| - | Find family, friends, objects, media or points of interest close to user location. |

| - | Geotag and share photos, videos and Points of Interest with friends. |

| - | Establish a “Net of Care” by adding trusted family and friends from all user social networks into a user network of care providers. |

| - | Track the location history of people, pets and possession being cared for. |

| - | Move and assign small tracking devices to different people and possessions as needed. |

| - | Communicate instantly with care providers and the person having the problems. Track the location history of people, pets and possession being cared for. |

| - | Care providers are alerted right-away in case of a problem via their mobile-phone, social network or SMS. (can show location on map for selected phones) |

| - | Remote configuration and control of tracking devices. |

| - | Send alert message to phone and display location on map. |

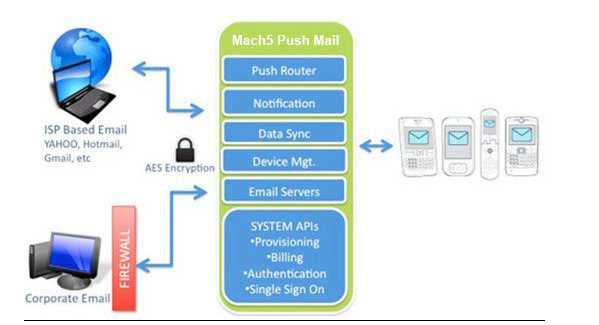

Mach 5 Push Mail

We provide real push-event technology, making mobile email notification work similar to SMS. Emails are delivered directly into a user’s email inbox, no clients to install, and no periodic checking required.

CC Power Documents transcoding allows images to be scaled, optimized and compressed automatically to suit individual mobile phones while documents (.pdf, .doc) are converted to text resulting in, we believe, a quick, cost-efficient and reliable email service. All content that has been optimized and adjusted in any way is stored in its original format in the users’ web mail. There, users can access and download copies of their unaltered original documents and pictures when accessed from a computer.

10

Virtual Private Network Product

A virtual private network (VPN) is a network that uses a public telecommunication infrastructure, such as the Internet, to provide remote offices or individual users with secure access to their organization’s network. A virtual private network can be contrasted with an expensive system of owned or leased lines that can only be used by one organization. The goal of a VPN is to provide the organization with the same capabilities, but at a much lower cost.

A VPN works by using the shared public infrastructure while maintaining privacy through security procedures and tunneling protocols, such as the Layer Two Tunneling Protocol. In effect, the protocols, by encrypting data at the sending end and decrypting it at the receiving end, send the data through a “tunnel” that cannot be “entered” by data that is not properly encrypted. An additional level of security involves encrypting, not only the data, but also the originating and receiving network addresses.

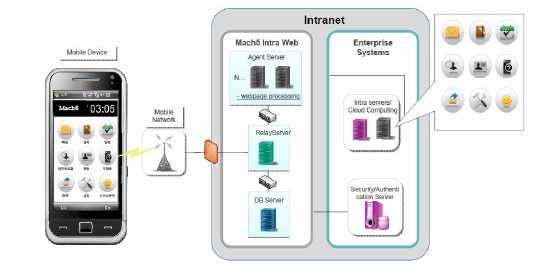

The XcelMobility Enterprise VPL - Mach 5 Intra Web

11

We have developed an enterprise solution for VPN which is branded the Mach 5 Intra Web. We believe we have an opportunity to seize a significant portion of the enterprise VPN market as the demand for mobile and cloud computing capabilities is increasing significantly as companies adopt mobile technology in their operations to enhance efficiency, increase productivity and strengthen customer relationships. Companies are facing the following challenges in implementing and managing mobile platforms:

- linking time critical work flow and information to existing internal operating systems that are not accessible from mobile devices;

- the cost of frequent client application upgrades and the maintenance of current mobile solutions; and

- reluctance to implement a mobile intranet platform adoption due to lack of IT resources.

We offer an enterprise solution for VPN owners that we believe provides the following benefits:

- flexibility for various businesses by being more cost efficient, easy to implement (plug and play), high level of security and is expandable;

- web based intranet applications through mobile devices with PC like experience;

- various sub systems to support PC line UX on Mobile environment;

- architecture offers easy integration and expandability;

- various enterprise work force applications using its server-based full browser technology increasing speed and accuracy;

- the flexibility to support various policies and environments (security, geographical regions, device platforms) set by users;

- easy expandability through Sub Systems;

- multimedia content support for videos, live broadcasts and social media; and

- proven solutions with low maintenance.

Products in Development

We plan to enhance our technology for location-based services in 2013 and provide localization and marketing for third party products including:

12

Mobile gaming: One of the largest and fastest growing areas of the mobile Internet is gaming. With the new devices with high resolution screens and power processors complex gaming has come to the mobile arena.

Mobile marketing: Location-based mobile marketing is a new and growing application for the mobile Internet.

Mobile Social Networking: One of the fastest growing applications of the mobile Internet is social networking.

Distribution

We provide mobile phone and Internet products through monthly subscriptions to large cell phone carriers and OEM partners. We deliver our products through a powerful and sophisticated network of servers that are located throughout China and Hong Kong

We market our products through 3 distribution channels:

Data Packages and Application Add-ons for Cellular Carriers

The 3 largest cellular carriers in Japan and China have agreed to market Mach 5 Xcelerator and Security to their customers on a revenue sharing basis (the revenue split is driven by how aggressively the carrier will market the Mach 5 product). Carriers can maintain the Xcel Mach 5 brand or private label the product as their own. We are currently in the process of negotiating test market arrangements with these 3 cellular carriers to determine the most effective way to promote and sell these products. In all of these scenarios, the cellular carrier will collect the fees from their subscribers and remit our portion monthly.

Three marketing techniques that have been proven in the U.S. will be utilized and tested by these carriers. These include:

Free 2 to 3 month trial of the Mach 5 Xcelerator. Once the trial period is over, the user will be presented the option to purchase the product for a term or on a month by month basis (negative billing option - the user will have to unsubscribe).

Offering users an advanced “speed data package” which utilizes the Mach 5 Xcelerator and sells at a slight premium ($1.00 to $5.00 per month or discounted for a fixed term) over data packages without the product.

Offering Mach 5 Xcelerator or Security as an add-on product as many U.S. carriers do with data packages, call display, voice mail and other options. As an add-on to a monthly package, Mach 5 Xcelerator or Security would be made available for a monthly fee of $1.00 to $5.00.

Embedded Software on Mobile Devices Shipped from the Factory

While this option is not as profitable to us, it does ensure that the product is widely distributed. Cellular manufacturers can embed Mach 5 Xcelerator or Security on the mobile device at the factory so that it comes pre-installed with the product. Manufacturers can maintain the Xcel Mach 5 brand or private label the product as their own. As the average life of a smartphone is approximately 30 months, the revenue cycle is assumed to be the same. We are now in discussions with several manufacturers to embed the Mach 5 software in their mobile devices.

Websites and Prepayment Cards

We currently have test websites to offer our products in Japan, China and Hong Kong. These sites offer the Mach 5 range of products. These websites along with pre-paid Mach 5 Xcelerator cards (available in test locations of Chinese cellular carriers) have generated over 1.7 million users. As this was primarily a test of the product, the vast majority of the 1.7 million users are utilizing the Mach 5 Xcelertaor free of charge. The Company’s Chinese, Japanese and Hong Kong websites are in the process of being upgraded and re-formatted for a more contemporary look and image.

13

Industry

Personal mobile communications and computing have advanced dramatically with the continuous build out of advanced mobile infrastructure and the introduction of increasingly sophisticated portable smart devices. Wireless technology and mobile Internet have allowed for increased interaction and collaboration among users beyond what can be achieved through the traditional Internet. This increased level of connectivity has created increasing demand for advanced mobile Internet services particularly in China, which has the largest mobile user population in the world. According to the Shanghai Daily which cited the report from Ministry of Industry and Information Technology, China mobile phone users hit 1 billion at the end of February 2012. With this large user population, consumer trends in the mobile industry in China often lead those in the rest of the world. The popularity of mobile services in China and globally has led to the development of a broad ecosystem of industry participants, including content providers, application developers, platform providers and device manufacturers, as users increasingly seek to enhance their mobile experience beyond voice communication.

Drivers of Demand for Mobile Internet Services

Early mobile services were primarily based on SMS technology and were largely focused on user entertainment. These included ring tones, games, screen wallpapers and other applications and such services have been widely popular, particularly in China. Advancements in 3G adoption and mobile technology have led to the development of a new generation of advanced services based on mobile Internet technology which address the need for more effective and efficient use of mobile devices. With the increasing adoption of smartphones, tablets and other 3G-enabled networked devices, mobile Internet services will become increasingly popular in users’ daily lives.

Adoption of 3G Networks

Advances in bandwidth provided by 3G mobile networks have created the necessary infrastructure for mass adoption of mobile Internet services. As mobile users increasingly adopting 3G networks worldwide the market opportunity for mobile services continues to expand. The number of 3G subscribers worldwide is projected to grow at a CAGR of 18% from 2009 to 2014 to reach over 2.0 billion users. In China, the number of Internet users has reached 564 million users, with 75% on a mobile device as of December 2012, according to CNNIC.

Popularity of Mobile Devices with Increased Functionality Based on Multiple Platforms

User adoption of 3G networks has generated increasing demand for advanced mobile devices with the necessary features to leverage mobile Internet services. As mobile devices evolve, they incorporate an ever-increasing range of functions at lower cost, which address a broadening array of users’ business and personal needs. Examples of such mobile devices include wireless-enabled personal computers, tablets and smartphones which provide a converging range of functionality. Smartphones, in particular, which offer advanced computing and networking capability in compact form factors, have gained increasing popularity. The worldwide shipments of smartphones are expected to exceed that of personal computers in 2013, according to Gartner.

The Mobile Internet Services Industry

With the introduction of 3G networks, wireless carriers have actively promoted cooperation among mobile industry participants to develop mobile Internet services. A number of significant industry advancements have helped to define the mobile Internet computing paradigm. Users are increasingly accessing mobile Internet services through specially designed mobile applications installed on devices which provide users with convenient access to specific services. Given the form factors of mobile devices, mobile applications provide user-friendly interfaces through which users can interact with mobile Internet services. In addition, many mobile applications incorporate a cloud platform as a means to expand the capability of mobile Internet services beyond the computing power available from individual mobile devices.

14

Smartphones And Mobile Applications

In order to fully leverage the increasing computing power of smartphones and other mobile devices, developers have created a large universe of mobile applications to fulfill growing user requirements. The emergence of mobile application stores, such as those run by Apple, Research in Motion, Nokia, Google and GetJar, also provide direct channels for developers to distribute mobile applications.

Flurry Mobile Data

Growth in mobile application products and services is directly related to the growth in the Smartphone market. Today, China is the largest smartphone market with a growth rate of over 400% in 2012 (Flurry Mobile).

Popular mobile applications include the following:

| (i) | Connectivity applications, such as email, instant messenger, GPS navigation, remote access. |

| (ii) | Business applications, such as mobile banking, stock monitoring and trading, document processing and calendar planning. |

| (iii) | Life-style applications, such as ecommerce, bill payment, health monitoring, digital reading, and social- networking. |

15

| (iv) | Entertainment applications, such as news, games, multimedia player, photo and video editor. |

Competition

There are three main competitors in China for high speed data services and products:

I-accele Corporation–www.i-accele.com

I-accele Corporation, which was established in Japan in 2002, is a global provider of software solutions that accelerate and optimize data services over wireless and wire line networks. I-accele range of products for Wireless operators, ISPs, and Enterprises, allows corporate customers and individual end-users of all networks to benefit from accelerated and rich data services, without changing the applications or devices they use, and without compromising their security needs. Several carriers and vendors in Japan, China and Malaysia have selected I-accele products to optimize their data applications, and I-accele is currently extending its product distribution in the Asia market.

UC Web–www.ucweb.com

UC focuses on serving faster, more stable and flexible Internet experience to users. In April 2004, UC launched its core product UC Browser, which now runs on almost any mobile platform - Android, iOS, BlackBerry OS, Symbian, WinCE, bada, Java, MTK, Brew etc. More than 3000 phone models in 200 brands can perfectly support UC Browser. With UC Browser, mobile users can easily get online service, such as web news, web games, e-commerce, and so forth. By March 2011, UC Browser have served more than 150 countries and areas, and got more than 700 million downloads. Per month, 200 million users visits 60 billion pages through UC Browser, which ranked 1st in the world.

Onayo

Onayo is a direct competitor with a core product centered on compression software for mobile devices to increase speed and reduce bandwidth. It was founded in 2010 and has its head office in Ramat, Israel. It focuses on reducing the cost of data plans for retail customers by utilizing data compression technology. It currently uses a free revenue model.

Seasonality

Our business is not subject to seasonality.

Government Regulation

Overview

The PRC government has imposed extensive and stringent measures to regulate the telecommunications and software development industries. The State Council of the PRC, or the State Council, the Ministry of Industry and Information Technology, or the MIIT (formerly the Ministry of Information Industry, or the MII), and other relevant authorities in the PRC have issued various regulations with respect to the telecommunications and software development industries. This section summarizes the principal PRC laws and regulations relevant to our business and operations.

Business license

Any company that conducts business in the PRC must have a business license that covers a particular type of work. Our business license covers our present business to design, develop, and produce mobile Internet software. Prior to expanding our business beyond that of our business license, we are required to apply and receive approval from the PRC government.

16

Employment laws

We are subject to laws and regulations governing our relationship with our employees, including: wage and hour requirements, working and safety conditions, citizenship requirements, work permits and travel restrictions. These include local labor laws and regulations, which may require substantial resources for compliance. China’s National Labor Law, which became effective on January 1, 1995, and China’s National Labor Contract Law, which became effective on January 1, 2008, permit workers in both state and private enterprises in China to bargain collectively. The National Labor Law and the National Labor Contract Law provide for collective contracts to be developed through collaboration between the labor union (or worker representatives in the absence of a union) and management that specify such matters as working conditions, wage scales, and hours of work. The laws also permit workers and employers in all types of enterprises to sign individual contracts, which are to be drawn up in accordance with the collective contract.

Regulation on the Telecommunications Industry

Types of Telecommunications Services

On September 25, 2000, the State Council issued the Regulations on Telecommunications of the PRC, or the Regulations on Telecommunications, which became effective on September 25, 2000 and which regulates the telecommunications industry and other related activities and services within the PRC. The MIIT regulates the telecommunications industry on a national level while the provincial-level communications administrative bureaus, or the CABs, supervise and regulate the telecommunications industry in their respective administrative regions. The Regulations on Telecommunications classifies telecommunications services into two main categories: (1) core telecommunications services and (2) value-added telecommunications services, and further divides each main category into several sub-categories. According to the Catalog for Classification of Telecommunications Businesses, which became effective on April 1, 2003, our business operates under the provision of information services through mobile networks and the Internet, thus fitting into the category of value-added telecommunications services.

Value-added Telecommunications Services

Providers of value-added telecommunications services in the PRC are subject to examination and approval from, and require licenses issued by, the MIIT or the relevant CABs. Pursuant to the Regulation on Telecommunications, to provide value-added telecommunications services in more than two provinces, autonomous regions or centrally administered municipalities, the value-added telecommunication service provider shall obtain the Transregional Value-added Telecommunication Business Operation License from the MIIT; to provide value-added telecommunications services within one province, autonomous region or centrally administered municipality, the value-added telecommunication service provider shall obtain the Value-Added Telecommunication Business Operation License from relevant CABs. On March 1, 2009, the MIIT issued the Administrative Measures for Licensing of Telecommunications Business Operations which set forth the basic requirements for a license to provide value-added telecommunications services in the PRC. Such requirements mainly include the following:

the applicant is a duly incorporated company;

the applicant has necessary funds and professional staff suitable for its business activities;

the applicant has the reputation or capability of providing customers with long-term services;

to operate value-added telecommunications services business across multiple provinces, autonomous regions or centrally administered municipalities, the applicant shall have a minimum registered capital of RMB10,000,000; to operate value-added telecommunications services business within a single province, autonomous region or centrally administered municipality, the applicant shall have a minimum registered capital of RMB1,000,000;

17

the applicant has necessary premises, facilities and technical scheme; and

the applicant and its major capital contributors and business managers have no record of violating rules on telecommunication supervision and administration during the past three years.

We have obtained the China Value-Added Telecommunications Business License permitted by the MII (B2-20080062) and the China Value-Added Telecommunications Business License permitted by the Guangdong Provincial Communications Authority (B2-20050598). These are the only value-added telecommunications business licenses that we currently require to operate our business in the PRC.

Short Message Services

On April 15, 2004, the MII issued the Notice on Certain Issues Regarding Regulating Short Message Services which specifies that only those telecommunications services providers that hold specific short message service licenses may provide such services in the PRC. The notice also requires short message services providers to censor the contents of short messages, to automatically collect information such as the time that short messages are sent and received and the telephone numbers or codes of the sending and receiving terminals and to keep such records for five months within the time each short message is delivered.

Telecommunications Networks Code Number Resources

On January 29, 2003, the MII issued the Administrative Measures on Telecommunications Networks Code Number Resources to administer the code number resources including mobile communications network code number. According to the administrative measures, the entity shall apply to the MII for a code number to be used in the interprovincial operations and shall apply to the relevant CAB for a separate code number for intra-provincial operations. The administrative measures specify the qualifications for a code number, required application materials and application procedures.

Specifications for Telecommunications Services

On March 13, 2005, the MII issued the Specifications for Telecommunications Services specifying the telecommunications service qualities to which all telecommunications service providers in the PRC should conform. It also requires all telecommunications services providers to establish a sound service quality management system and make periodical reports to the relevant telecommunications authorities.

Foreign Investments in Value-added Telecommunications Services Industry

Foreign direct investment in telecommunications services industry in China is regulated under Regulations on the Administration of Foreign-Invested Telecommunications Enterprises, or the FITE Regulations. The FITE Regulations were issued by the State Council on December 11, 2001 and amended by the State Council on September 10, 2008. According to the FITE Regulations, foreign investors’ ultimate equity interests in any entity providing value-added telecommunications services in the PRC may not exceed 50%. A foreign investor must demonstrate a good track record and prior experience in providing value-added telecommunications services outside the PRC prior to acquiring any equity interest in any value-added telecommunications services business in the PRC.

On July 13 2006, the MII issued the Notice Regarding Strengthening the Administration of Foreign Investment in Operating Value-Added Telecommunications Businesses, or the MII Notice, which prohibits value-added telecommunications services operation license holders, including Trans-regional Value-added Telecommunications Services Operation License and Telecommunications Value-added Services Operation License holders, from leasing, transferring or selling their licenses to any foreign investors in any manner, or providing any resources, premises or facilities to any foreign investors for illegal operation of telecommunications services business in the PRC. The MII Notice also requires that, (1) value-added telecommunications services operation license holders or their shareholders must directly own the domain names and trademarks used by such license holders in their daily operations; (2) each license holder must have necessary facilities for its approved business operations and maintain such facilities in the regions specified by its license; and (3) all value-added telecommunications service providers are required to maintain network and Internet security in accordance with the standards set forth in relevant PRC regulations. If a license holder fails to comply with the requirements in the MII Notice and fails to remedy such non-compliance within a designated period, the MIIT or relevant CABs may take administrative actions against such license holder, including revocation of their valued-added telecommunications services operation licenses. We provide our services through our controlled affiliated entity that owns Value-added Telecommunications Services Operation Licenses. We believe our controlled affiliated entity is in compliance with the MII Notice.

18

Regulations Concerning the Software Development Industry

Software Products

On March 1, 2009, the MIIT issued the Administrative Measures for Software Products, or the Measures for Software Products, to regulate the development, production, sale, and import and export of software products, including computer software, software embedded in information systems and equipments, and computer software provided in conjunction with other information or technology services. Any entity or individual shall not develop, produce, sell and import or export any software product which infringes upon the intellectual property rights of third parties, contains computer viruses, endangers computer system security, is not in compliance with the software standard specification of the PRC, or contains contents prohibited under PRC laws and regulations. To that end, for any software products, the Measures for Software Products require registration and filing with the provincial level software registration institutions authorized to accept and review software products registration applications. Once accepted for review, the software product registration application shall be filed with and publicly announced by the MIIT, and if no objection is received within a seven-working-day publication period, a software registration number and a software product registration certificate will be granted. A software registration certificate is valid for five years and may be renewed upon expiration. We have obtained a Software Company Certification, as issued by the Technology and Information Bureau of Shenzhen City (R2007-0033).

Software Enterprises

A PRC enterprise that develops one or more software products and meets the Certifying Standards and Administrative Measures for Software Enterprises (Proposed), promulgated by the MII, Ministry of Education, Ministry of Science and Technology and the State Administration of Taxation, or the SAT on October 16, 2000, can be certified as a “software enterprise.” The certification standards for software enterprises include the following:

the applicant shall be an enterprise established in PRC which engages in the business of computer software development and production, system integration, application service, etc., and whose operating revenue is primarily derived from the above referenced business activities;

the enterprise develops one or more software products or possesses one or more intellectual property rights of software products, or provides technical services such as computer information system integration that has passed qualification and grade certification;

the proportion of technical staff in the work of software development and technical service shall be no less than 50% of the total staff in the enterprise;

the applicant shall possess relevant technical equipments and premises necessary for developing software and providing relevant services;

the applicant shall possess methods and ability to safeguard the qualify of the software products and the technical services;

19

the development fund for software technique and products shall be above 8% of the enterprise’s annual software income; and

the annual sale income of software shall be more than 35% of the total annual income of the enterprise, with the income of self-developed software more than 50% of the software sales income;

the enterprise has clearly-established ownership, standardized management and complies with disciplines and laws.

Enterprises that qualified as “software enterprises” are entitled to certain preferential treatments in the PRC. According to the Circular on Relevant Taxation Policies for Encouraging the Development of the Software and Integrate Circuit Industries (Circular No. 25) (2000) by the Ministry of Finance, the General Administration of Customs and the State Administration of Taxation, or the SAT, newly-established software manufacturing enterprises (i.e. those established after July 1, 2000) may be exempt from income tax in the first two years of profitability and enjoy 50% income taxes reduction for the next three years, such policy is known as the “Two Free, Three Half” preferential policy. On February 22, 2008, the Ministry of Finance and SAT promulgated the Notice on Several Preferential Policies in Respect of Enterprise Income Tax, or the Notice 2008 No. 1, which reiterated that a software production enterprise newly established within China may, upon certification, enjoy the Two Free, Three Half preferential treatment. On April 24, 2009, the Ministry of Finance and SAT promulgated the Notice on Several Issues Relevant to the Implementation of the Preferential Policies on Enterprise Income Tax, which states that, the software production enterprises and the integrated circuit production enterprises established prior to the end of 2007 may, upon certification, enjoy the preferential policies on the enterprise income tax reductions and exemptions within specified periods as provided in the Notice 2008 No. 1. An enterprise which became profitable in or before 2007 and started enjoying the enterprise income tax reductions and exemptions within specified periods may continue to enjoy the relevant preferential treatment from 2008 until the expiration of the specified periods. According to the Circular on Relevant Policies for Further Encouraging the Development of the Software and Integrate Circuit Industries (Circular No. 4) (2011) issued by the State Council on January 28, 2011, the software production enterprises and the integrated circuit production enterprises may, upon certification, enjoy the “Two Free, Three Half” preferential policy from the year of profitability prior to December 31, 2017, until the expiration of the specified periods.

Foreign Investments in Software Development Industry

According to the Catalogue of Industries for Guiding Foreign Investment amended in December 2011, foreign investment is encouraged in the software development and production sector. As such, there are no restrictions on foreign investment in the software development industry in the PRC aside from business licenses and other permits that every software development entity in the PRC must obtain.

Regulations on Internet Domain Name and Content

Internet Domain Name

Internet domain names in the PRC are regulated by the Administrative Measures on the PRC Internet Domain Name, which were promulgated by the MII and which came into effect on December 20, 2004, and the Implementation Rules of Registration of Domain Name, which were promulgated by PRC’s domain name registrar, China Internet Network Information Center, or CNNIC and which came into effect on December 1, 2002, and were amended by CNNIC on June 5, 2009. Domain name service organizations accept applications for network domain names; successful applicants become holders of the registered domain names after registration. A holder needs to pay operation fees on time to keep the registered domain names, otherwise the domain name registrar may revoke the domain names. In case there is any changes to the registration information of a domain name, the holder shall file the changes with the domain name registrar within 30 days after such changes. The CNNIC is responsible for the administration of .cn domain names and domain names in Chinese language. Disputes in respect of domain names are regulated by the Measures on Resolution of Disputes regarding Domain Names which were issued by CNNIC and revised on February 14, 2006, and shall be settled by organizations approved by the CNNIC. We have obtained an Internet Registration Certification from the Shenzhen Municipal Public Security Bureau, No. 3303101901203.

20

Content of Internet Information

Provision of Internet information services in the PRC is regulated by the Administrative Measures on Internet Information Services adopted by the State Council on September 20, 2000. According to these measures, provision of Internet information services regarding news, publication, education, medical and health care, pharmacy and medical appliances are subject to examination, approval and regulation by relevant authorities responsible for regulating these sectors. Internet content providers are not allowed to provide services beyond the scope of an applicable license or registration. The measures also provide a list of prohibited content on the Internet. Internet information service providers are required to monitor and censor the information on their websites, and when prohibited content is found, they shall terminate the transmission immediately, keep the relevant record and report immediately to relevant authorities.

According to these measures, commercial Internet information service providers must obtain a License for Internet Content Providers, or ICP license, in order to engage in such business. Moreover, provision of ICP services in multiple provinces, autonomous regions and centrally administered municipalities may require a trans-regional ICP license. We have obtained an ICP license (ICP No. 07047476).

On November 6, 2000, the MII issued the Regulations for the Administration of Internet Electronic Notice Services to regulate the provision of information via Internet in the form of, among others, electronic bulletin boards, electronic whiteboards, electronic forums, Internet chat-rooms and message boards. The Internet electronic bulletin service providers are required to record the content and time of information released, the website or domain name in the electronic bulletin system, keep such records for at least 60 days, and to provide such information to the relevant authorities upon request.

Regulations on Technology Export

The Technology Import and Export Administrative Regulations of the PRC promulgated by the State Council on December 10, 2001 and the Regulations of Protection of Computer Software which came into effect on January 1, 2002, requires approval of imports and exports of restricted technology, and registration of contracts to import or export unrestricted technology. Software is part of the technology governed by this regime. To implement this requirement, the Administrative Measures for Registration of Technology Import and Export Contracts, or the Registration Measures, was promulgated by the Ministry of Commerce, or the MOFCOM and become effective on March 1, 2009; the Administrative Measures on Prohibited and Restricted Technology Exports, or the Technology Export Measures was jointly promulgated by the MOFCOM and the Ministry for Science and Technology and become effective on May 20, 2009, and the Administrative Measures on Prohibited and Restricted Technology Imports, or the Technology Import Measures was promulgated by the MOFCOM and become effective on March 1, 2009. Pursuant to these regulations, the technology within the prohibited list for import and/or export shall not be imported and/or exported, and a permit for import and/or export shall be obtained by the importer and/or exporter if the technology to be imported and/or exported are listed within the restricted list for import and/or export. For any import or export technology, the relevant department of commerce is responsible for the registration of contracts for such technology import or export.

Regulations on Intellectual Property Rights

The PRC’s intellectual property protection regime is consistent with those of other modern industrialized countries. The PRC has domestic laws for the protection of rights in copyrights, patents, trademarks and trade secrets. The PRC is also signatory to most of the world’s major intellectual property conventions, including:

- Convention establishing the World Intellectual Property Organization (WIPO Convention) (June 3, 1980);

21

- Paris Convention for the Protection of Industrial Property (March 19, 1985);

- Patent Cooperation Treaty (January 1, 1994); and

- The Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPs) (December 11, 2001).

Trademarks

Registered trademarks in the PRC are protected by the Trademark Law of the PRC which came into effect in 1982 and was revised in 1993 and 2001 and the Regulations for the Implementation of Trademark Law of PRC which came into effect in 2002. A trademark can be registered in the PRC with the Trademark Office under the State Administration for Industry and Commerce, or the SAIC. The protection period for a registered trademark in the PRC is ten years starting from the date of registration and may be renewed if an application for renewal is filed within six months prior to expiration.

Copyright

Copyright in the PRC is protected by the Copyright Law of the PRC which was promulgated in 1990 and revised in 2001 and February 2010 and the Regulation for the Implementation of the Copyright Law of the PRC which came into effect in September 2002 and revised in January 2011. Under the revised Copyright Law, copyright protections have been extended to information network and products transmitted on information network. Copyrights are reserved by the author, unless specified otherwise by the laws. According to Article 16 of the Copyright Law, if a work constitutes “work for hire”, the employer, instead of the employee, is considered the legal author of the work and will enjoy the copyrights of such “work for hire” other than rights of authorship. “Works for hire” include, (1) drawings of engineering designs and product designs, maps, computer software and other works for hire, which are created mainly with the materials and technical resources of the legal entity or organization with responsibilities being assumed by such legal entity or organization; (2) those works the copyrights of which are, in accordance with the laws or administrative regulations or under contractual arrangements, enjoyed by a legal entity or organization. The actual creator may enjoy the rights of authorship of such “work for hire.”

A copyright owner may transfer its copyrights to others or permit others to use its copyrighted works. Use of copyrighted works of others generally requires a licensing contract with the copyright owner. The protection period for copyrights in the PRC varies, with 50 years as the minimum. The protection period for a “work for hire” where a legal entity or organization owns the copyright (except for the right of authorship) is 50 years, expiring on December 31 of the fiftieth year after the first publication of such work.

Patent protection in China

Patents in the PRC are governed by the China Patent Law and its Implementing Regulations, each of which went into effect in 1985. Amended versions of the China Patent Law and its Implementing Regulations came into effect in 2009 and 2010, respectively.

The PRC is signatory to the Paris Convention for the Protection of Industrial Property, in accordance with which any person who has duly filed an application for a patent in one signatory country shall enjoy, for the purposes of filing in the other countries, a right of priority during the period fixed in the convention (12 months for inventions and utility models, and 6 months for industrial designs).

The Patent Law covers three kinds of patents—patents for inventions, utility models and designs. The Chinese patent system adopts the principle of first to file; therefore, where more than one person files a patent application for the same invention, a patent can only be granted to the person who first filed the application. Consistent with international practice, the PRC only allows the patenting of inventions or utility models that possess the characteristics of novelty, inventiveness and practical applicability. For a design to be patentable, it cannot be identical with or similar to any design which, before the date of filing, has been publicly disclosed in publications in the country or abroad or has been publicly used in the country, and should not be in conflict with any prior right of another.

22

PRC law provides that anyone wishing to exploit the patent of another must conclude a written licensing contract with the patent holder and pay the patent holder a fee. One broad exception to this rule, however, is that, where the patent holder has not exploited the patent or has not exploited the patent adequately without any reasonable reason in the statutory period of time, or the patent holder’s act of exploiting the patent is held to be monopolistic, the PRC State Intellectual Property Office, or SIPO, is authorized to grant a compulsory license. A compulsory license can also be granted where a national emergency or any extraordinary state of affairs occurs or where the public interest so requires. SIPO, however, has not granted any compulsory license to date. The patent holder may appeal such decision within three months from receiving notification by filing a suit in a people’s court.

PRC law defines patent infringement as the exploitation of a patent without the authorization of the patent holder. Patent holders who believe their patent is being infringed may file a civil suit or file a complaint with a PRC local Intellectual Property Administrative Authority, which may order the infringer to stop the infringing acts. A preliminary injunction may be issued by the People’s Court upon the patentee’s or the interested parties’ request before instituting any legal proceedings or during the proceedings. Damages in the case of patent infringement is calculated as either the loss suffered by the patent holder arising from the infringement or the benefit gained by the infringer from the infringement. If it is difficult to ascertain damages in this manner, damages may be reasonably determined in an amount ranging from one or more times the license fee under a contractual license. The infringing party may be also fined by the Administration of Patent Management in an amount of up to four times the unlawful income earned by such infringing party. If there is no unlawful income so earned, the infringing party may be fined in an amount of up to RMB200,000, or approximately USD $31,250.

Measures for the Registration of Computer Software Copyright

In China, holders of computer software copyrights enjoy protections under the Copyright Law. China’s State Council and the State Copyright Administration have promulgated various regulations relating to the protection of software copyrights in China. Under these regulations, computer software that is independently developed and exists in a physical form is protected, and software copyright owners may license or transfer their software copyrights to others. Registration of software copyrights, exclusive licensing and transfer contracts with the Copyright Protection Center of China (previously, the State Copyright Administration) or its local branches is encouraged. Such registration is not mandatory under Chinese law, but can enhance the protections available to the registered copyrights holders. For example, the registration certificate is proof of protection.

Foreign Exchange Regulation

Pursuant to the Foreign Currency Administration Rules promulgated in 1996 and amended in 2008 and various regulations issued by the State Administration of Foreign Exchange (“SAFE”), and other relevant PRC government authorities, the Renminbi is freely convertible only to the extent of current account items, such as trade-related receipts and payments, interest and dividends. Capital account items, such as direct equity investments, loans and repatriation of investments, require the prior approval from the SAFE or its local counterpart for conversion of Renminbi into a foreign currency, such as U.S. dollars, and remittance of the foreign currency outside the PRC.

Payments for transactions that take place within the PRC must be made in Renminbi. Unless otherwise approved, PRC companies must repatriate foreign currency payments received from abroad. Foreign-invested enterprises may retain foreign exchange in accounts with designated foreign exchange banks subject to a cap set by the SAFE or its local counterpart. Unless otherwise approved, domestic enterprises must convert all of their foreign currency receipts into Renminbi.

Under the Implementing Rules of Measures for the Administration of Individual Foreign Exchange, or the Implementation Rules, issued by the SAFE on January 5, 2007, PRC citizens who are granted shares or share options by an overseas listed company according to its share incentive plan are required, through a qualified PRC agent or the PRC subsidiary of such overseas listed company, to register with the SAFE and complete certain other procedures related to the share incentive plan. Foreign exchange income received from the sale of shares or dividends distributed by the overseas listed company must be remitted into a foreign currency account of such PRC citizen or be exchanged into Renminbi.

23

In addition, domestic wages and salaries of foreign employees outside of the PRC, as well as other rightful earnings, such as dividends, bonuses and profits, of shareholders outside of the PRC may be remitted freely out of the PRC after taxes have been paid in accordance with the provisions of the Chinese tax law with a tax certificate. Since we do not have any debt that is generated outside the PRC and do not have any employees located outside PRC, management is not aware of any material risk of paying in foreign currency in respect of those employee-related and debt-settlement amounts due to any other party located outside PRC.

Liquidation

According to the bankruptcy law of the PRC, CC Investment, as a WFOE, needs to have its debt to creditors settled in the priority as set forth in the relevant Bankruptcy law in China and its immediate equity holder, CC Mobility, located in Hong Kong, would be the last party to be entitled to any residual interest of the entity. Such priority of payment and distribution in the case of the liquidation of CC Investment does not have any different priority in respect of PRC nationals or foreigners. The priority is based on the status of being a creditor and other requirements as set forth in the bankruptcy law in China, which does not have any discrimination or preference in respect of whether the party is a PRC national or foreigner.

Taxation