UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedDecember 31, 2014

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to _____________

Commission file number:000-54333

XCELMOBILITY INC.

(Exact name of registrant as specified in its charter)

| Nevada | 98-0561888 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| 303 Twin Dolphins Drive | |

| Suite 600, Redwood City | |

| California | 94065 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code:(650) 632-4210

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yesx No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer¨ | Accelerated filer¨ |

| | |

Non-accelerated filer¨

(Do not check if a smaller reporting company) | Smaller reporting companyx |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes¨ Nox

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2014 was $5,889,659 based upon the closing price of $0.06 per share reported for such date on the OTCQB. Shares of common stock held by each officer and director and by each person who is known to own 10% of more of the outstanding Common Stock have been excluded in that such persons may be deemed to be affiliates of the Company. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| Common Stock | Outstanding at April 6, 2015 |

| Common Stock, $.001 par value per share | 234,682,756 shares |

DOCUMENTS INCORPORATED BY REFERENCE:None.

XCELMOBILITY INC.

TABLE OF CONTENTS

PART I

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some discussions in this Annual Report on Form 10-K contain forward-looking statements that have been made pursuant to the provisions of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties and relate to future events or future financial performance. A number of important factors could cause our actual results to differ materially from those expressed in any forward-looking statements made by us in this Form 10-K. Forward-looking statements are often identified by words such as “believe,” “expect,” “estimate,” “anticipate,” “intend,” “project,” “plans,” “seek” and similar expressions or words which, by their nature, refer to future events. In some cases, you can also identify forward-looking statements by terminology such as “may,” “will,” “should,” “plans,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology.

These forward-looking statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” below that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. In addition, you are directed to factors discussed in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section as well as those discussed elsewhere in this Form 10-K.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results. However, readers should carefully review the risk factors set forth in other reports or documents the Company files from time to time with the Securities and Exchange Commission (the “SEC”), particularly the Company’s Quarterly Reports on Form 10-Q and any Current Reports on Form 8-K. All written and oral forward-looking statements made subsequent to the date of this report and attributable to us or persons acting on our behalf are expressly qualified in their entirety by this section.

As used in this Annual Report on Form 10-K, references to “dollars” and “$” are to United States dollars and, unless otherwise indicated, references to “we,” “our,” “us,” “Xcel,” “XCLL,” the “Company” or the “Registrant” refer to XcelMobility Inc., a Nevada corporation and its wholly owned subsidiaries, CC Mobility Limited (“CC Mobility”), a company organized under the laws of Hong Kong, Shenzhen CC Power Investment Consulting Co. Ltd. (“CC Investment”), a company organized under the laws of the People’s Republic of China, and a wholly-owned subsidiary of CC Mobility, and Shenzhen CC Power Corporation (“CC Power”), a company organized under the laws of the People’s Republic of China.

ITEM 1.BUSINESS.

Background and Overview

We were incorporated in the state of Nevada on December 27, 2007 under the name “Advanced Messaging Solutions, Inc.” On March 29, 2011, we amended our Articles of Incorporation to change our name from “Advanced Messaging Solutions, Inc.” to “XcelMobility Inc.” and we effected a 35-for-1 forward stock split of all of our issued and outstanding shares of common stock.

On July 5, 2011, we entered into a voluntary share exchange agreement (the “Exchange Agreement”) with Shenzhen CC Power Corporation, a company organized under the laws of the People’s Republic of China (PRC) (“CC Power”), CC Mobility Limited, a company organized under the laws of Hong Kong (“CC Mobility”) and the shareholders of CC Mobility. Pursuant to the closing of the transactions contemplated under the Exchange Agreement, on August 30, 2011, we issued 30,300,000 shares of our common stock to the shareholders of CC Mobility representing 50.5% of our issued and outstanding common stock in exchange for 100% of the issued and outstanding capital stock of CC Mobility (the “Exchange Transaction”). As a result of the Exchange Transaction, CC Mobility became our wholly-owned subsidiary and we control the business and operations of CC Power.

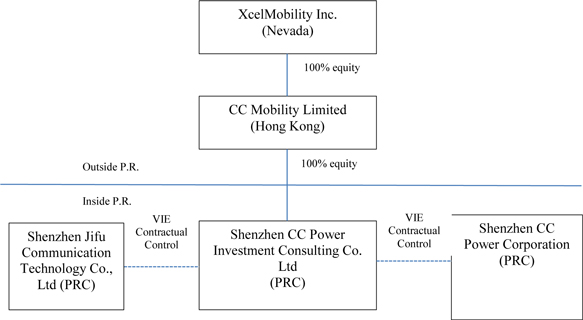

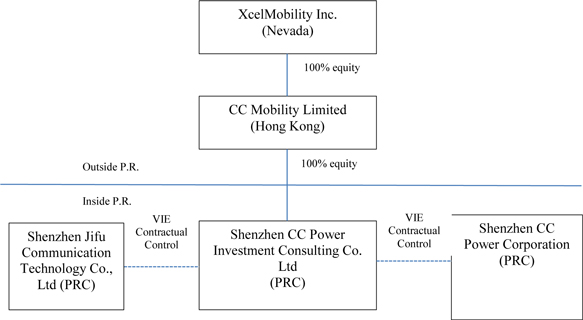

On May 7, 2013, we entered into and consummated a stock purchase agreement (the “Purchase Agreement”) with CC Investment, Jifu and certain of its shareholders (the “Jifu Shareholders”). Pursuant to the terms of the Purchase Agreement, we issued an aggregate of 27,000,000 shares of our common stock to the Jifu Shareholders as consideration for Jifu entering into certain controlling agreements with CC Investment (the “Jifu Acquisition”). Through these controlling agreements, CC Investment will effectively own Jifu through a variable interest entity or VIE structure.

On October 1, 2014, we entered into a Settlement Agreement, Waiver and Mutual Release (the “Release”) with the Jifu Shareholders. Pursuant to the Release, the parties cancelled the Purchase Agreement and we returned control of Jifu to the Jifu Shareholders. In exchange, we have agreed to issue 1,000,000 shares of our common stock to the Jifu Shareholders.

On September 22, 2014, we entered into an asset purchase agreement with Xinjiang Silvercreek Digital Technology Co., Ltd. (“Silvercreek”) pursuant to which we acquired certain assets of Silvercreek (the “Assets”) relating to an online sports lottery business in exchange for the issuance of up to 80,000,000 shares (“Shares”) of common stock of the Company.

Previously, our business was focused on wearable computing. Our new lottery business aggregates and processes lottery purchase orders, deriving revenue from service fees paid by local sports lottery administration centers for the purchase orders of sports lottery products directed to such centers. We offer a comprehensive and integrated suite of online lottery services in China. We believe that the merging of our lottery business with our existing mobile technologies, partners, and customers, will provide a platform for growth in this industry.

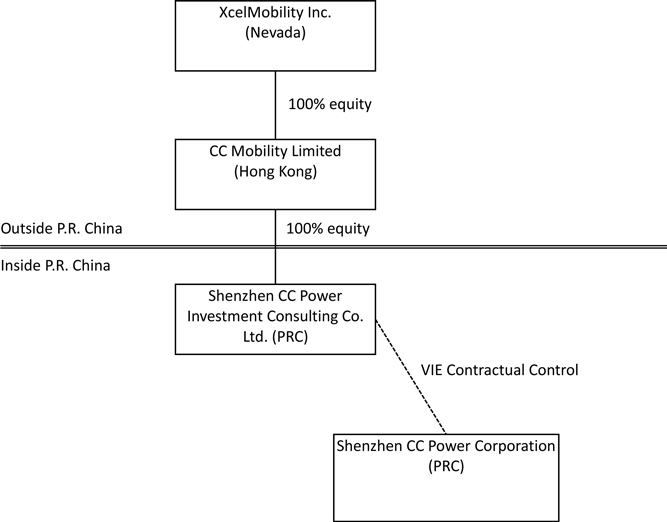

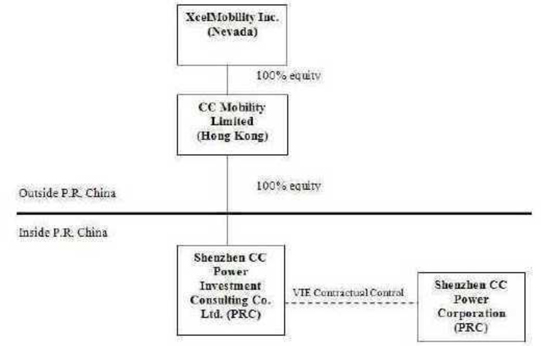

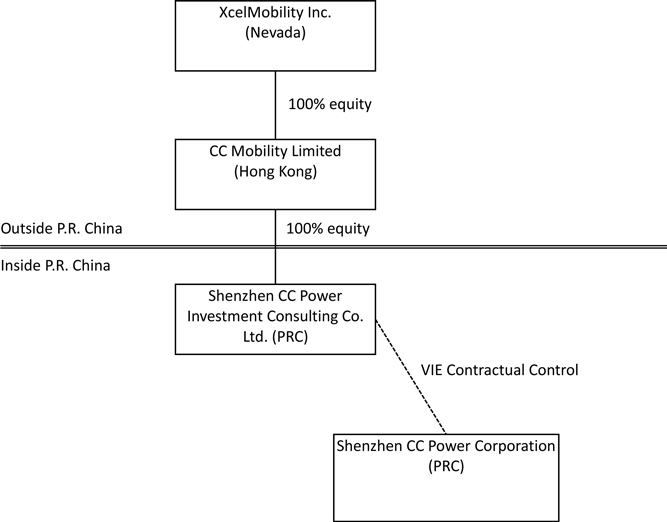

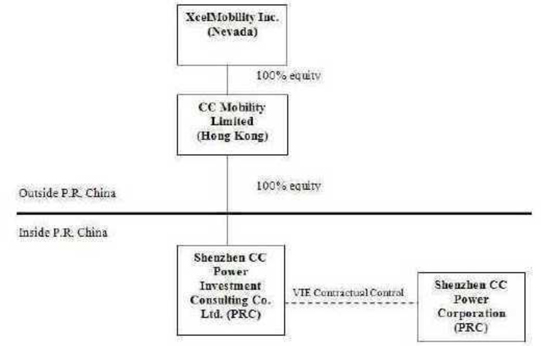

Corporate Structure

The organizational structure of the Registrant is as follows:

CC Mobility Limited (“CC Mobility”) was incorporated on May 3, 2011 under the laws of Hong Kong as a limited liability company.

Shenzhen CC Power Investment Consulting Co. Ltd., (“CC Investment”) a wholly-owned subsidiary of CC Mobility, was incorporated on July 27, 2011 under the laws of the People’s Republic of China as a wholly foreign owned limited liability company.

Shenzhen CC Power Corporation (“CC Power”) is a Chinese enterprise incorporated on March 13, 2003 under the laws of the PRC. CC Power is owned entirely by Xili Wang (the “CC Power Shareholder”), who is also our Chief Financial Officer and Secretary. CC Power maintains all the licenses and approvals necessary to operate its business in the PRC.

PRC law places certain restrictions on roundtrip investments through the acquisition of a PRC entity by PRC residents. To comply with these restrictions, in conjunction with the Exchange Transaction, we (via our wholly-owned subsidiary, CC Investment), entered into and consummated certain contractual arrangements with CC Power and/or the CC Power Shareholder pursuant to which we provide CC Power with exclusive technology consulting and management services. Through these contractual arrangements, we have the ability to substantially influence CC Power’s daily operations and financial affairs, appoint its directors and senior executives, and approve all matters requiring board and/or shareholder approval. These contractual arrangements enable us to control CC Power and operate our business in the PRC through CC Power and we are considered the primary beneficiary of CC Power. Accordingly, our consolidated financial statements reflect the results of operations, assets and liabilities of CC Power.

On August 22, 2011, our subsidiary, CC Investment, entered into the following contractual arrangements with CC Power and/or the CC Power Shareholder, each of which is enforceable and valid in accordance with the laws of the PRC:

Entrusted Management Agreement. Pursuant to the Entrusted Management Agreement among CC Power, CC Investment, and the CC Power Shareholder, CC Investment agrees to provide, and CC Power agrees to accept, exclusive management services provided by CC Investment. Such management services include but are not limited to financial management, business management, marketing management, human resource management and internal control of CC Power. The Entrusted Management Agreement will remain in effect until the acquisition of all assets or equity of CC Power by CC Investment is complete (as more fully described in the Exclusive Purchase Option Agreement below).

Technical Services Agreement. Pursuant to the Technical Services Agreement among CC Power, CC Investment, and the CC Power Shareholder, CC Investment agrees to provide, and CC Power agrees to accept, exclusive technical services provided by CC Investment. Such technical services include but are not limited to software, computer system, data analysis, training and other technical services. CC Investment shall be entitled to charge CC Power service fees equivalent to CC Power’s total net income. The Technical Service Agreement will remain in effect until the acquisition of all assets or equity of CC Power by CC Investment is complete (as more fully described in the Exclusive Purchase Option Agreement below).

Exclusive Purchase Option Agreement. Under the Exclusive Purchase Option Agreement among CC Power, CC Investment, and the CC Power Shareholder, the CC Power Shareholder granted CC Investment an irrevocable and exclusive purchase option to acquire CC Power’s equity and/or assets at a nominal consideration. CC Investment may exercise the purchase option at any time.

Loan Agreement. Under the Loan Agreement between CC Investment and the CC Power Shareholder, CC Investment agreed to lend RMB 10,000,000 to the CC Power Shareholder, to be used solely for the operations of CC Power.

Equity Pledge Agreement. Under the Equity Pledge Agreement among CC Investment and the CC Power Shareholder, the CC Power Shareholder pledged all of its equity interests in CC Power, including the proceeds thereof, to guarantee all of CC Investment’s rights and benefits under the Entrusted Management Agreement, the Technical Service Agreement, the Exclusive Purchase Option Agreement and the Loan Agreement. Prior to termination of this Equity Pledge Agreement, the pledged equity interests cannot be transferred without CC Investment’s prior consent. The CC Power Shareholder covenants to CC Investment that among other things, it will only appoint/elect the candidates for the directors of CC Power nominated by CC Investment.

Subsidiaries

As a result of the Exchange Transaction, CC Investment and (via a contractual relationship) CC Power are wholly-owned subsidiaries of our subsidiary CC Mobility. CC Power does not have any subsidiaries.

Strategy

We provide specialized lottery services to our users, which we believe solidify our reputation as a professional service provider dedicated to online lottery services. Our commitment to investment on research and development has enabled us to provide our users with innovative and proprietary tools with increasing utility and variety. Such tools are designed to address various aspects of users’ needs in the lottery purchase process, such as availability of information on a real-time basis, professional analysis on odds and trends, and the capability to combine purchases to increase payout amounts. As a result, we believe the combination of such tools enables our users to make informed and planned lottery purchases and enhance their purchase experience.

We strive to provide our users with the most comprehensive and up-to-date lottery related information, which is important to decision-making for most sports lottery products. We have a dedicated and direct data interface with China Sports Lottery Administration Center, which enables us to publish real-time sports match scores and odds for a sports match.

Customers

The majority of online lottery purchasers in China are young adults with relatively high individual disposable incomes. The average age of online lottery purchasers is approximately 30 years old.

Technology

We have developed an integrated fulfilment platform that enables us to service and support multi- provincial contracts for the fulfilment of welfare and sports lottery tickets through a single interface. Our mobile platform enables us to deliver white-label mobile application solutions to interested companies seeking to leverage their large client bases. The mobile platform allows users to seamlessly connect through our mobile cloud network throughout China. The network is connected to our application and processing servers to fulfill lottery orders.

Intellectual Property

CC Power has developed or acquired unique intellectual property for its lottery business. Our intellectual property consists of application related software and solutions for our lottery business, including cloud computing software and other application specific software. CC Power is the owner of intellectual property that we believe provides a competitive advantage over competitors and new entrants to the market.

We will continue to evaluate the business benefits in pursuing patents and copyrights in the future. We currently protect all of our development work with confidentiality and trade secret agreements with our engineers, employees and any outside contractors. However, third parties may, in an unauthorized manner, attempt to use, copy or otherwise obtain and market or distribute our intellectual property or technology or otherwise develop a product with the same functionality as our service. Policing unauthorized use of intellectual property rights is difficult, and nearly impossible on a worldwide basis. Therefore, we cannot be certain that the steps we have taken or will take in the future will prevent misappropriation of our technology or intellectual property, particularly in foreign countries where we do business or where our service is sold or used, where the laws may not protect proprietary rights as fully as do the laws of the United States or where the enforcement of such laws is not common or effective.

Services

Individual Lottery Purchase

We provide online purchase services for both sports lottery products and welfare lottery products. Users place purchase orders for lottery products through our websites after registering, opening and funding an online account.

Lottery Pool Purchase

Lottery pools enable individual users to purchase a share in a pooled lottery outcome or group of outcomes with other users. Lottery pool purchase is a service developed and first offered by us in China utilizing the unique advantages of the Internet, and it has become a standard feature on all websites that offer online lottery services.

Through our lottery pool service, an initiator starts a lottery pool by specifying a range of parameters, such as the lottery portfolio, total purchase amount and payout scheme. The initiator is required to commit a minimum of 5.0% of the total purchase amount when he initiates a pool. Other players may then join the pool by agreeing to the conditions set by the initiator and putting down commitment amounts of their choices. When the total purchase amount as specified by the initiator is reached, the system will close the pool and deliver the purchase order for the lottery portfolio in the manner as specified by the initiator.

A user familiar with a particular sport or experienced with sports lotteries in general may develop a reputation for having a more educated anticipation of the results of particular matches, or for picking a lottery portfolio with a combined winning probability that is higher than that of randomly selected combinations, thereby attracting other players to participate in pools he initiates. Our lottery pool service offers less experienced users a chance to join a more experienced user or a user with a track record of winning results. It also enables users who lack the time or resources to study the odds to join another user who has done relevant research, potentially enhancing their chances of winning. For number based lotteries, users can pool their commitment amounts together and purchase multiple numbers. This enables users to spread their commitments over a wide range of lottery numbers and thereby increase the pool’s probability of winning. Pooling small purchase orders provides us with a stable revenue flow as it generates purchase momentum among users.

Automatic Tag-along Purchase

Automatic tag-along purchase is another service we provide that distinguishes us from traditional offline lottery agents. Through this service, a user can choose to automatically and periodically join a lottery pool initiated by another user. A user can customize the automatic tag-along feature by specifying the pools he wishes to automatically join, the commitment to be put down for each automatic pool and other specifications. Users may also use the “following” feature to be notified of the pooling activities initiated by certain users without automatically tagging-along. We place the option to automatically join or follow a user’s pool on such user’s profile page. A profile page also contains a user’s basic information, such as winning record, number of pools initiated and consummated, number of followers and date of registration, to allow other users to judge whether to follow or join pools initiated by this particular user.

Recurring Purchase

Users may select our recurring purchase service to repeatedly purchase a particular number or a combination of numbers. The user sets the combination once, and specifies the type and number of rounds or dates of lotteries he wants to purchase with the selected combination. We process the purchase orders automatically. Users may cancel a recurring purchase prior to the date of any particular lottery. We also offer a filtering tool that helps users set certain parameters in choosing the combination of numbers.

Distribution

The Company will expand distribution in China by continuously strengthening its collaboration with telecom operators, financial institutions and other partners.

Industry

Chinese Lottery Market

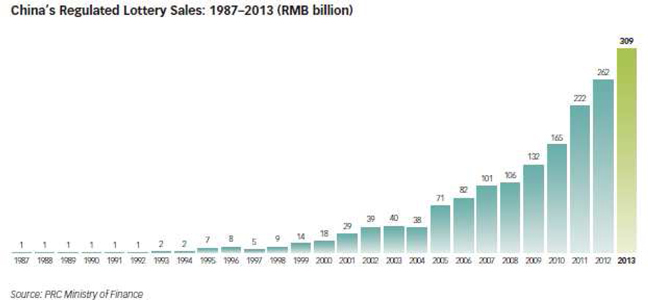

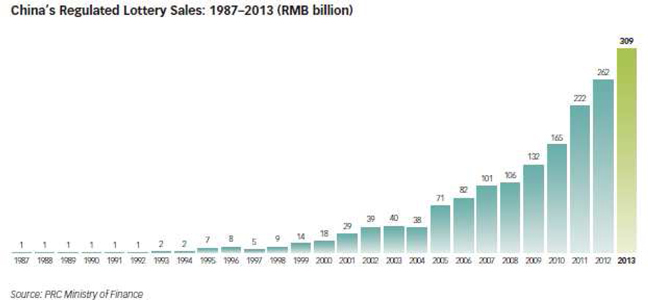

The Chinese lottery market has experienced strong growth in recent years as a result of positive macro trends in China, such as robust economic growth, increases in disposable income and a more positive shift in public perception towards the lottery business. Total lottery sales in China amounted to RMB166.3 billion, RMB221.6 billion and RMB261.5 billion (US$42.6 billion), in 2010, 2011 and 2012, respectively, representing a 33.3% and 18.0% increases in 2011 and 2012 as compared to 2010 and 2011, respectively, according to a report by the Ministry of Finance (“MOF”). According to the iResearch Report, although no accurate projection of the future growth of the Chinese lottery market can be guaranteed, the Chinese lottery market is expected to continue to grow at a comparable rate in the near future due to the continued growth of China’s GDP and individual disposable income and the increasingly favorable regulatory environment for the development of the lottery market in China. Total lottery sales in China is projected to be RMB450.3 billion in 2015 respectively, representing a 46.2% increase from 2013 to 2015 according to the iResearch Report.

The following charts show the total online lottery sales amount and online sales amount for sports lottery products from 2005 to 2014(3 Quarters only) in China:

Source: the Ministry of finance

Drivers for the Growth of the Online Lottery Market

Online lottery sales are affected by many factors, including general economic conditions, individual disposable income, and lottery purchaser demography. We believe the growth of the online lottery market will be driven by:

Growth of GDP and individual disposable income. Growth of GDP and individual disposable income are among the main growth drivers of the online lottery market in China.

In recent years, growth of online lottery market sales in China has been much faster than the growth of GDP and individual disposable income. According to the National Bureau of Statistics of China, from 2010 to 2012, China’s GDP grew from RMB40.1 trillion to RMB51.9 trillion (US$8.5 trillion), representing a 29.4% increase, and the individual disposable income for urban population grew from RMB19,109 to RMB24,565 (US$4,003), representing a 28.5% increase. Total online lottery sales grew from RMB5.5 billion to RMB14.7 billion (US$2.4 billion) from 2010 to 2012 representing a 167% increase. Although there is no guarantee that the growth rate of the online lottery market in China will continue to be faster than that of China’s GDP and individual disposable income, online lottery sales are expected to continue to grow as China’s GDP and individual disposable income grow.

Government regulations and evolving public acceptance of the lottery industry. The Chinese government has shown increasing support for the lottery market in general and the online lottery market in particular through a series of legislation. According to an announcement by the MOF, the MOF applied RMB8.5 billion of lottery income to a wide range of social welfare endeavors, including earthquake relief, medical care in rural and urban areas, education subsidy, handicapped assistance, and red-cross activities, in 2011. The MOF regards the development of the Chinese lottery market as healthy and beneficial. According to the “Twelfth Five-Year Plan” approved by the PRC National People’s Congress in March 2011, the central government will expand social security fund source by increasing lottery issuance. At the same time, the recent implementation of the Urgent Notice and the subsequent investigations and penalties on certain online lottery sales service provider who does not have the relevant approvals could have a significant impact on the competitive landscape of the online lottery market. The Urgent Notice and the subsequent government actions have brought significant risks and uncertainties to online lottery sales service providers who do not have the relevant approvals, and as a result may reduce competition for online lottery sales service providers that possess relevant approvals in the near future.

Increase in the number of lottery purchasers. The increase in the number of lottery purchasers in general and the increase in the number of online purchasers in particular are important factors in online lottery market growth. The number of general and online lottery purchasers are expected to continue to grow in the next few years. According to iResearch, the number of lottery purchasers grew from 250 million in 2010 to 338 million in 2012 and the number of purchasers is projected to grow to 531 million by the end of 2015. Similarly, according to the estimate in the iResearch Report, the number of active online lottery purchasers grew from 5.0 million in 2010 to 16.5 million in 2012, representing a 230% increase, and is expected to grow to 58.9 million by 2015.

Increasing Internet penetration in lottery distribution. The Internet and Internet applications have experienced significant growth in China in recent years. As a result, both the number of Internet users and the percentage of online lottery purchasers to the number of Internet users have grown. According to the iResearch Report, there were 250 million, 290 million and 338 million lottery purchasers in China in 2010, 2011 and 2012, respectively, among which 2.0%, 3.2% and 4.9% were online lottery purchasers, respectively. The increase in the number of online lottery purchasers was attributable to a variety of factors, including, among other things, the ease of online payment, the ease of access, the reliability of the prize collection process, the availability of information, and the popularity of lottery pool purchases.

Lottery Products

The government authority in charge of the Chinese lottery market is the MOF, which is responsible for drafting and enacting laws, rules and regulations on Chinese lottery sales and administration, as well as monitoring the sales and promotion of lottery products.

Lottery Products by Issuing Entities

Two categories of lottery products are currently approved by the MOF, namely sports lottery products and welfare lottery products, which are issued by China Sports Lottery Administration Center and China Welfare Lottery Issuance and Administration Center, respectively. National lottery products are sold through provincial lottery administration centers that are authorized to license the sales of national lottery products directly to lottery sales agents. Provincial lottery administration centers are also authorized to issue provincial-level sports or welfare lottery products upon the approval of the corresponding state lottery administration center.

Welfare lottery products. In China, welfare lottery products are defined as lottery products issued by China Welfare Lottery Issuance and Administration Center and provincial welfare lottery administration centers.

Welfare lottery products were first issued in China in 1987. Most welfare lottery products are number-based lottery products, the outcomes of which depend on combinations of numbers.

Sports lottery products. In China, sports lottery products are defined as lottery products issued by China Sports Lottery Administration Center and provincial sports lottery administration centers. There are generally two types of sports lottery products: those based on outcomes of sports matches and those that are number-based.

Lottery Products by Type

There are three types of lottery products depending on the rules or outcomes: Lotto, sports match lottery, and instant lottery.

Lotto. Lotto is a type of lottery product whose outcome depends on combinations of numbers. A purchaser of a lotto ticket will select a combination of numbers at the time of purchase, and the result and payout depend on how well the selected number combination matches the prize winning number combination, which is randomly drawn at a set time. The grand prize of each lotto ticket in China is usually RMB10 million, although the issuing lottery administration centers have the discretion to add extra prize money amounts as incentives. High-frequency lottery is a new type of lotto product which is characterized by a high frequency of lottery draws, usually every few minutes. It has experienced rapid development since 2009. Given their nature, high frequency lottery products are currently only sold through online and mobile sales channels. According to a report by the MOF, sales of Lotto products accounted for 66.9%, 64.4% and 66.5% of total lottery sales in China in 2010, 2011 and 2012, respectively.

Sports Match Lottery. Sports match lottery is a type of lottery product whose outcome depends on the outcome of sports matches. The majority of sports match lottery products in China relate to soccer lottery products, where a lottery purchaser predicts one or more results of a soccer match or a combination of soccer matches, such as the winners and final scores, and the lottery result and payout amount depends on the outcome of the match or matches and the odds published by lottery administration centers. Sports match lottery products have greater information and knowledge requirements than other types of lotteries, and a purchaser needs to make a rational decision based on certain information, such as player status and official odds, which needs to be real-time or constantly updated to be meaningful references. As such, sports match lottery products are mostly suitable to be purchased online, where such information is readily available and updated. Benefiting from the introduction of popular sports match lottery products following a series of international sports matches, sales of sports match lottery products have grown significantly in recent years. According to the iResearch Report, sales amount of sports match lottery products accounted for 8.9%, 9.9% and 10.3% of total lottery sales amounts in China in 2010, 2011 and 2012, respectively, and is expected to continue to grow in the next few years.

Instant Lottery. Instant lottery is a type of lottery product for which the winning tickets and prize amounts are predetermined. The tickets are pre-printed and a ticket purchaser will know instantly if he or she has won a prize once the ticket is opened. Given their nature, instant lottery products are currently only sold through traditional sales channels.

Instant lottery products accounted for 24.2%, 25.7% and 14.6% of total lottery sales amount in China in 2010, 2011 and 2012, respectively, according to a report by the MOF.

Traditional Sales Channels

The majority of lottery products are sold through authorized lottery stations throughout China, in the form of physical lottery tickets.

Online Sales Channels

Internet users can also place purchase orders on online lottery service platforms, which in turn direct the purchase orders to the relevant provincial level lottery administration centers. The iResearch Report estimated that total lottery sales through online channels were approximately RMB5.5 billion, RMB11.0 billion and RMB14.7 billion (US$2.4 billion) in 2010, 2011 and 2012, respectively. Mobile devices are new lottery distribution channels that have been developing in recent years. Mobile phone users can place purchase orders on their handsets through services such as mobile Internet. According to the iResearch Report, lottery sales through mobile channels have increased significantly in recent years. The iResearch Report estimated total lottery sales through mobile devices to be approximately RMB530 million, RMB1.07 billion and RMB2.03 billion (US$331.7 million) in 2010, 2011 and 2012, respectively. Compared to traditional sales channels, online sales channels have the following advantages:

Easy access. Online users can submit purchase orders at lottery service websites at any time and from anywhere with an Internet connection. In comparison, traditional lottery stations can only sell lottery tickets to purchasers who physically come to the station during business hours. In addition, online lottery service websites have near-unlimited capacity to take multiple purchase orders at the same time, while lottery stations can only serve a certain number of purchasers at a given time. Purchasers at traditional lottery stations often have to wait in line to purchase new or popular lottery products for which transaction volumes are high.

Services and supports. Besides sales service, online sales channels provide a variety of services to users. Information services are valuable to online users at the time of purchase, especially for certain types of lottery products such as sports match lottery products. Online forum services provide venues for users to discuss lottery-related topics and socialize. Data services provide users valuable information to study and research lottery products. In comparison, only a limited number of larger and well equipped lottery stations in China have the capacity to provide information services such as news feeds and real-time information updates.

Lottery pool purchase is a purchase mode favored by many lottery purchasers. Online sales channels greatly facilitate the pool purchase process. Purchasers can initiate purchase pools or join existing pools online conveniently. In comparison, purchase pools formed offline usually involve participants having to meet in person. An online community is an ideal venue for pool initiators to advertise their pools and find pool participants. In addition, the transfer of individual purchase amounts and the allocation of prize money among participants can be handled electronically, which is fast and automated, reducing chances of error or misappropriation.

Convenient prize collection. Traditionally, winners of lottery draws needed to go to the lottery station from which they purchased the winning tickets and present the winning tickets as proof for prize collection. If the winning tickets were lost or severely damaged, the prize could not be collected. Users who purchase lottery products online are able to have the prize money wire-transferred to their online accounts, which reduces the chance of error and protects the anonymity of the winners. Purchase records are stored in the online service providers’ database and no physical lottery ticket is required to be presented by the purchaser in the process.

Among the different types of lottery products, Lotto, sports match lottery products and high frequency lottery products are more suited to online purchase. According to the iResearch Report, in 2011, sales of Lotto, sports match lottery products and high frequency lottery products accounted for approximately 25%, 50% and 25% of total online lottery sales amount, respectively.

Government Regulation

Overview

The PRC government has imposed extensive and stringent measures to regulate the telecommunications and software development industries. The State Council of the PRC, or the State Council, the Ministry of Industry and Information Technology, or the MIIT (formerly the Ministry of Information Industry, or the MII), and other relevant authorities in the PRC have issued various regulations with respect to the telecommunications and software development industries. This section summarizes the principal PRC laws and regulations relevant to our business and operations.

Business license

Any company that conducts business in the PRC must have a business license that covers a particular type of work. Our business license covers our present business to design, develop, and produce mobile Internet software. Prior to expanding our business beyond that of our business license, we are required to apply and receive approval from the PRC government.

Employment laws

We are subject to laws and regulations governing our relationship with our employees, including: wage and hour requirements, working and safety conditions, citizenship requirements, work permits and travel restrictions. These include local labor laws and regulations, which may require substantial resources for compliance. China’s National Labor Law, which became effective on January 1, 1995, and China’s National Labor Contract Law, which became effective on January 1, 2008, permit workers in both state and private enterprises in China to bargain collectively. The National Labor Law and the National Labor Contract Law provide for collective contracts to be developed through collaboration between the labor union (or worker representatives in the absence of a union) and management that specify such matters as working conditions, wage scales, and hours of work. The laws also permit workers and employers in all types of enterprises to sign individual contracts, which are to be drawn up in accordance with the collective contract.

Regulations on Lottery Services Industry and Online Lottery Sales

Since 1991, the Chinese government has promulgated a series of rules and regulations to regulate the lottery industry in China. The major rules and regulations currently in effect and applicable to our online lottery services include Regulation on Administration of Lottery, promulgated by the State Council on May 4, 2009 and effective as of July 1, 2009, or the Lottery Regulation, and the Interim Measures for the Administration of Online Sales of Lottery, promulgated by the MOF on September 26, 2010, or the Lottery Measures, and effective upon the promulgation. On January 18, 2012, the MOF, the Ministry of Civil Affairs and the General Administration of Sports of China jointly promulgated the Implementing Rules, which became effective on March 1, 2012. On February 28, 2012, General Administration of Sports of China promulgated the Urgent Notice with regard to the Implementation of the Implementing Rules of Regulation on Administration of Lottery promulgated by the General Administration of Sports of China on February 28, 2012, or the Urgent Notice. Under currently effective rules and regulations, only qualified service providers approved by the MOF may engage in online lottery sales. Such qualified service providers will act as agencies for the relevant lottery administration centers and must obtain a Lottery Agency License from and enter into lottery agency agreements with the competent lottery administration centers before engaging in lottery sales on their behalf.

Certain rules and regulations previously promulgated by the MOF and other regulatory authorities had previously prohibited the sales of lotteries through the Internet, but after the promulgation of the Lottery Measures those rules and regulations have ceased to have legal effect.

Online Lottery Sales

The Lottery Measures set forth detailed requirements for the administration of online lottery sales as well as the requirements for qualified online lottery service providers. According to the Lottery Measures, the MOF is the supervisory and regulatory body of online lottery sales in the PRC, and China Welfare Lottery Issuance and Administration Center and China Sports Lottery Administration Center (collectively, “Lottery Issuance Agencies”) are responsible for the overall planning and management of online lottery sales for welfare lottery and sports lottery, respectively. The Lottery Issuance Agencies may collaborate with other entities or authorize relevant lottery sales agencies to conduct online lottery sales, or appoint qualified entities as their online lottery sales agents. The Lottery Measures require qualified online lottery service providers to meet certain criteria, including, among others, that (i) they have a minimum registered capital of RMB50 million, (ii) they maintain adequate organizational, internal control and risk management systems, (iii) they and their senior management have a clean criminal and credit history for the past five years, and (iv) they have obtained an Internet content provider license. The Lottery Issuance Agencies are required to selectively submit to the MOF information on the online lottery service providers that apply to become qualified to engage in online lottery business under the Lottery Measures.

Lottery Regulatory Authorities

Under the current regulations and provisions, the State Council is vested with the power to authorize the issuance of welfare lottery and sports lottery, and is also the highest authority for granting the right to issue lotteries. The MOF is responsible for administering, regulating and supervising the national lottery industry. The Ministry of Civil Affairs and the General Administration of Sport of China are responsible for administering and regulating welfare lottery and sports lottery, respectively, and have established China Welfare Lottery Issuance and Administration Center and China Sports Lottery Administration Center, respectively, pursuant to regulations for the issuance and sales of welfare lottery and sports lottery. The civil affairs departments and sports administration departments of provincial governments are responsible for the administration of welfare lotteries and sports lotteries within their respective administrative regions.

Regulations on Lottery Administration

On May 4, 2009, the State Council promulgated the Lottery Regulations, which set forth general provisions for the issuance, sales and administration of lottery products. According to the Lottery Regulations, the welfare and sports lotteries sold in China must be issued by the lottery issuance authorities, established by the civil affairs’ department and sports administration department of the PRC State Council, or the Lottery Issuance Agencies, and must be sold through Lottery Issuance Agencies or lottery sales offices established by the civil affairs’ departments and sports administration departments of the people’s government at the provincial level (“Lottery Sales Agencies”). Lottery Issuance Agencies and Lottery Sales Agencies may, by entering into agency agreements, appoint other entities or individuals as their agents in distributing lotteries. The Lottery Regulation also listed circumstances where the Lottery Issuance Agencies and Lottery Sales Agencies may terminate such agency agreements, including situations where the agent subcontracts the sales of the lottery products to any other persons or entities or sells lottery products to underage buyers.

The Lottery Regulations prohibits the Lottery Issuance Agencies, the Lottery Sales Agencies and their sales agents from (i) advertising false or misleading information, (ii) competing unfairly by discrediting others in the same industry, (iii) selling lottery or paying lottery prizes to underage purchasers and (iv) selling lottery on credit. If the Lottery Issuance Agencies or the Lottery Sales Agencies fail to comply with these requirements, the MOF or its relevant branches will have the power to (i) require the Lottery Issuance Agencies or the Lottery Sales Agencies to correct or cease their operations; (ii) confiscate the illegal income received by the Lottery Issuance Agencies or the Lottery Sales Agencies and impose fines; and/or (iii) impose administrative sanctions against persons that are responsible. If any lottery sales agent sells lotteries to the underage buyers, its relevant income may be confiscated and it may be subject to administrative fines up to RMB10,000, and the Lottery Issuance Agencies or the Lottery Sales Agencies may have the right to terminate the agency agreement with the lottery sales agent. In addition, the Lottery Measures prohibits the opening of online lottery accounts for or the granting of lottery prizes to underage buyers.

Prior to the promulgation of the Lottery Regulation, the issuance and sales of the lottery products were governed by the Interim Provisions for the Administration of the Lottery Issuance and Sales, or the Interim Provisions, promulgated by the MOF on March 1, 2002. The Interim Provisions were replaced by the Administrative Measures for Lottery Issuance and Sales promulgated by the MOF on December 28, 2012. The Administrative Measures for Lottery Issuance and Sales provided that any Lottery Issuance Agency, which wishes to apply to create, change or abolish a specific type of welfare or sports lottery, is required to apply to the Ministry of Civil Affairs or the General Administration of Sport of China for creating, changing or abolishing a specific type of welfare or sports lottery. If the application has been approved by the Ministry of Civil Affairs or the General Administration of Sport of China, such application will be further submitted to the MOF for the MOF’s examination and approval before the implementation. After the creation or change of specific type of welfare or sports lottery has been approved by the MOF, the Lottery Issuance Agency receiving MOF approval or its related Lottery Sales Agencies shall submit sales implementation plans to the MOF or its provincial counterparts for approval prior to the sales of the specific type of lottery. The sales implementation plan shall include, among other things, the proposed sales commencement date, promotion plans and risk control measures. In order to sell the specific type of welfare or sports lottery so created or changed, the Lottery Issuance Agencies or the Lottery Sales Agencies may engage specific sales agents by entering into lottery sales agency agreements with such sales agents.

The Company currently has a sport lottery license from the Fujian Administration of Sport and Gaming.

Regulations Concerning the Software Development Industry

Software Products

On March 1, 2009, the MIIT issued the Administrative Measures for Software Products, or the Measures for Software Products, to regulate the development, production, sale, and import and export of software products, including computer software, software embedded in information systems and equipments, and computer software provided in conjunction with other information or technology services. Any entity or individual shall not develop, produce, sell and import or export any software product which infringes upon the intellectual property rights of third parties, contains computer viruses, endangers computer system security, is not in compliance with the software standard specification of the PRC, or contains contents prohibited under PRC laws and regulations. To that end, for any software products, the Measures for Software Products require registration and filing with the provincial level software registration institutions authorized to accept and review software products registration applications. Once accepted for review, the software product registration application shall be filed with and publicly announced by the MIIT, and if no objection is received within a seven-working-day publication period, a software registration number and a software product registration certificate will be granted. A software registration certificate is valid for five years and may be renewed upon expiration. We have obtained a Software Company Certification, as issued by the Technology and Information Bureau of Shenzhen City (R2007-0033).

Software Enterprises

A PRC enterprise that develops one or more software products and meets the Certifying Standards and Administrative Measures for Software Enterprises (Proposed), promulgated by the MII, Ministry of Education, Ministry of Science and Technology and the State Administration of Taxation, or the SAT on October 16, 2000, can be certified as a “software enterprise.” The certification standards for software enterprises include the following:

| · | the applicant shall be an enterprise established in PRC which engages in the business of computer software development and production, system integration, application service, etc., and whose operating revenue is primarily derived from the above referenced business activities; |

| · | the enterprise develops one or more software products or possesses one or more intellectual property rights of software products, or provides technical services such as computer information system integration that has passed qualification and grade certification; |

| · | the proportion of technical staff in the work of software development and technical service shall be no less than 50% of the total staff in the enterprise; |

| · | the applicant shall possess relevant technical equipments and premises necessary for developing software and providing relevant services; |

| · | the applicant shall possess methods and ability to safeguard the qualify of the software products and the technical services; |

| · | the development fund for software technique and products shall be above 8% of the enterprise’s annual software income; and |

| · | the annual sale income of software shall be more than 35% of the total annual income of the enterprise, with the income of self-developed software more than 50% of the software sales income; |

| · | the enterprise has clearly-established ownership, standardized management and complies with disciplines and laws. |

Enterprises that qualified as “software enterprises” are entitled to certain preferential treatments in the PRC. According to the Circular on Relevant Taxation Policies for Encouraging the Development of the Software and Integrate Circuit Industries (Circular No. 25) (2000) by the Ministry of Finance, the General Administration of Customs and the State Administration of Taxation, or the SAT, newly-established software manufacturing enterprises (i.e. those established after July 1, 2000) may be exempt from income tax in the first two years of profitability and enjoy 50% income taxes reduction for the next three years, such policy is known as the “Two Free, Three Half” preferential policy. On February 22, 2008, the Ministry of Finance and SAT promulgated the Notice on Several Preferential Policies in Respect of Enterprise Income Tax, or the Notice 2008 No. 1, which reiterated that a software production enterprise newly established within China may, upon certification, enjoy the Two Free, Three Half preferential treatment. On April 24, 2009, the Ministry of Finance and SAT promulgated the Notice on Several Issues Relevant to the Implementation of the Preferential Policies on Enterprise Income Tax, which states that, the software production enterprises and the integrated circuit production enterprises established prior to the end of 2007 may, upon certification, enjoy the preferential policies on the enterprise income tax reductions and exemptions within specified periods as provided in the Notice 2008 No. 1. An enterprise which became profitable in or before 2007 and started enjoying the enterprise income tax reductions and exemptions within specified periods may continue to enjoy the relevant preferential treatment from 2008 until the expiration of the specified periods. According to the Circular on Relevant Policies for Further Encouraging the Development of the Software and Integrate Circuit Industries (Circular No. 4) (2011) issued by the State Council on January 28, 2011, the software production enterprises and the integrated circuit production enterprises may, upon certification, enjoy the “Two Free, Three Half” preferential policy from the year of profitability prior to December 31, 2017, until the expiration of the specified periods.

Foreign Investments in Software Development Industry

According to the Catalogue of Industries for Guiding Foreign Investment amended in December 2011, foreign investment is encouraged in the software development and production sector. As such, there are no restrictions on foreign investment in the software development industry in the PRC aside from business licenses and other permits that every software development entity in the PRC must obtain.

Regulations on Internet Domain Name and Content

Internet Domain Name

Internet domain names in the PRC are regulated by the Administrative Measures on the PRC Internet Domain Name, which were promulgated by the MII and which came into effect on December 20, 2004, and the Implementation Rules of Registration of Domain Name, which were promulgated by PRC’s domain name registrar, China Internet Network Information Center, or CNNIC and which came into effect on December 1, 2002, and were amended by CNNIC on June 5, 2009. Domain name service organizations accept applications for network domain names; successful applicants become holders of the registered domain names after registration. A holder needs to pay operation fees on time to keep the registered domain names, otherwise the domain name registrar may revoke the domain names. In case there is any changes to the registration information of a domain name, the holder shall file the changes with the domain name registrar within 30 days after such changes. The CNNIC is responsible for the administration of .cn domain names and domain names in Chinese language. Disputes in respect of domain names are regulated by the Measures on Resolution of Disputes regarding Domain Names which were issued by CNNIC and revised on February 14, 2006, and shall be settled by organizations approved by the CNNIC. We have obtained an Internet Registration Certification from the Shenzhen Municipal Public Security Bureau, No. 3303101901203.

Content of Internet Information

Provision of Internet information services in the PRC is regulated by the Administrative Measures on Internet Information Services adopted by the State Council on September 20, 2000. According to these measures, provision of Internet information services regarding news, publication, education, medical and health care, pharmacy and medical appliances are subject to examination, approval and regulation by relevant authorities responsible for regulating these sectors. Internet content providers are not allowed to provide services beyond the scope of an applicable license or registration. The measures also provide a list of prohibited content on the Internet. Internet information service providers are required to monitor and censor the information on their websites, and when prohibited content is found, they shall terminate the transmission immediately, keep the relevant record and report immediately to relevant authorities.

According to these measures, commercial Internet information service providers must obtain a License for Internet Content Providers, or ICP license, in order to engage in such business. Moreover, provision of ICP services in multiple provinces, autonomous regions and centrally administered municipalities may require a trans-regional ICP license. We have obtained an ICP license (ICP No. 07047476).

On November 6, 2000, the MII issued the Regulations for the Administration of Internet Electronic Notice Services to regulate the provision of information via Internet in the form of, among others, electronic bulletin boards, electronic whiteboards, electronic forums, Internet chat-rooms and message boards. The Internet electronic bulletin service providers are required to record the content and time of information released, the website or domain name in the electronic bulletin system, keep such records for at least 60 days, and to provide such information to the relevant authorities upon request.

Regulations on Technology Export

The Technology Import and Export Administrative Regulations of the PRC promulgated by the State Council on December 10, 2001 and the Regulations of Protection of Computer Software which came into effect on January 1, 2002, requires approval of imports and exports of restricted technology, and registration of contracts to import or export unrestricted technology. Software is part of the technology governed by this regime. To implement this requirement, the Administrative Measures for Registration of Technology Import and Export Contracts, or the Registration Measures, was promulgated by the Ministry of Commerce, or the MOFCOM and become effective on March 1, 2009; the Administrative Measures on Prohibited and Restricted Technology Exports, or the Technology Export Measures was jointly promulgated by the MOFCOM and the Ministry for Science and Technology and become effective on May 20, 2009, and the Administrative Measures on Prohibited and Restricted Technology Imports, or the Technology Import Measures was promulgated by the MOFCOM and become effective on March 1, 2009. Pursuant to these regulations, the technology within the prohibited list for import and/or export shall not be imported and/or exported, and a permit for import and/or export shall be obtained by the importer and/or exporter if the technology to be imported and/or exported are listed within the restricted list for import and/or export. For any import or export technology, the relevant department of commerce is responsible for the registration of contracts for such technology import or export.

Regulations on Intellectual Property Rights

The PRC’s intellectual property protection regime is consistent with those of other modern industrialized countries. The PRC has domestic laws for the protection of rights in copyrights, patents, trademarks and trade secrets. The PRC is also signatory to most of the world’s major intellectual property conventions, including:

| · | Convention establishing the World Intellectual Property Organization (WIPO Convention) (June 3, 1980); |

| · | Paris Convention for the Protection of Industrial Property (March 19, 1985); |

| · | Patent Cooperation Treaty (January 1, 1994); and |

| · | The Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPs) (December 11, 2001). |

Trademarks

Registered trademarks in the PRC are protected by the Trademark Law of the PRC which came into effect in 1982 and was revised in 1993 and 2001 and the Regulations for the Implementation of Trademark Law of PRC which came into effect in 2002. A trademark can be registered in the PRC with the Trademark Office under the State Administration for Industry and Commerce, or the SAIC. The protection period for a registered trademark in the PRC is ten years starting from the date of registration and may be renewed if an application for renewal is filed within six months prior to expiration.

Copyright

Copyright in the PRC is protected by the Copyright Law of the PRC which was promulgated in 1990 and revised in 2001 and February 2010 and the Regulation for the Implementation of the Copyright Law of the PRC which came into effect in September 2002 and revised in January 2011. Under the revised Copyright Law, copyright protections have been extended to information network and products transmitted on information network. Copyrights are reserved by the author, unless specified otherwise by the laws. According to Article 16 of the Copyright Law, if a work constitutes “work for hire”, the employer, instead of the employee, is considered the legal author of the work and will enjoy the copyrights of such “work for hire” other than rights of authorship. “Works for hire” include, (1) drawings of engineering designs and product designs, maps, computer software and other works for hire, which are created mainly with the materials and technical resources of the legal entity or organization with responsibilities being assumed by such legal entity or organization; (2) those works the copyrights of which are, in accordance with the laws or administrative regulations or under contractual arrangements, enjoyed by a legal entity or organization. The actual creator may enjoy the rights of authorship of such “work for hire.”

A copyright owner may transfer its copyrights to others or permit others to use its copyrighted works. Use of copyrighted works of others generally requires a licensing contract with the copyright owner. The protection period for copyrights in the PRC varies, with 50 years as the minimum. The protection period for a “work for hire” where a legal entity or organization owns the copyright (except for the right of authorship) is 50 years, expiring on December 31 of the fiftieth year after the first publication of such work.

Patent protection in China

Patents in the PRC are governed by the China Patent Law and its Implementing Regulations, each of which went into effect in 1985. Amended versions of the China Patent Law and its Implementing Regulations came into effect in 2009 and 2010, respectively.

The PRC is signatory to the Paris Convention for the Protection of Industrial Property, in accordance with which any person who has duly filed an application for a patent in one signatory country shall enjoy, for the purposes of filing in the other countries, a right of priority during the period fixed in the convention (12 months for inventions and utility models, and 6 months for industrial designs).

The Patent Law covers three kinds of patents—patents for inventions, utility models and designs. The Chinese patent system adopts the principle of first to file; therefore, where more than one person files a patent application for the same invention, a patent can only be granted to the person who first filed the application. Consistent with international practice, the PRC only allows the patenting of inventions or utility models that possess the characteristics of novelty, inventiveness and practical applicability. For a design to be patentable, it cannot be identical with or similar to any design which, before the date of filing, has been publicly disclosed in publications in the country or abroad or has been publicly used in the country, and should not be in conflict with any prior right of another.

PRC law provides that anyone wishing to exploit the patent of another must conclude a written licensing contract with the patent holder and pay the patent holder a fee. One broad exception to this rule, however, is that, where the patent holder has not exploited the patent or has not exploited the patent adequately without any reasonable reason in the statutory period of time, or the patent holder’s act of exploiting the patent is held to be monopolistic, the PRC State Intellectual Property Office, or SIPO, is authorized to grant a compulsory license. A compulsory license can also be granted where a national emergency or any extraordinary state of affairs occurs or where the public interest so requires. SIPO, however, has not granted any compulsory license to date. The patent holder may appeal such decision within three months from receiving notification by filing a suit in a people’s court.

PRC law defines patent infringement as the exploitation of a patent without the authorization of the patent holder. Patent holders who believe their patent is being infringed may file a civil suit or file a complaint with a PRC local Intellectual Property Administrative Authority, which may order the infringer to stop the infringing acts. A preliminary injunction may be issued by the People’s Court upon the patentee’s or the interested parties’ request before instituting any legal proceedings or during the proceedings. Damages in the case of patent infringement is calculated as either the loss suffered by the patent holder arising from the infringement or the benefit gained by the infringer from the infringement. If it is difficult to ascertain damages in this manner, damages may be reasonably determined in an amount ranging from one or more times the license fee under a contractual license. The infringing party may be also fined by the Administration of Patent Management in an amount of up to four times the unlawful income earned by such infringing party. If there is no unlawful income so earned, the infringing party may be fined in an amount of up to RMB200,000, or approximately USD $31,250.

Measures for the Registration of Computer Software Copyright

In China, holders of computer software copyrights enjoy protections under the Copyright Law. China’s State Council and the State Copyright Administration have promulgated various regulations relating to the protection of software copyrights in China. Under these regulations, computer software that is independently developed and exists in a physical form is protected, and software copyright owners may license or transfer their software copyrights to others. Registration of software copyrights, exclusive licensing and transfer contracts with the Copyright Protection Center of China (previously, the State Copyright Administration) or its local branches is encouraged. Such registration is not mandatory under Chinese law, but can enhance the protections available to the registered copyrights holders. For example, the registration certificate is proof of protection.

Foreign Exchange Regulation

Pursuant to the Foreign Currency Administration Rules promulgated in 1996 and amended in 2008 and various regulations issued by the State Administration of Foreign Exchange (“SAFE”), and other relevant PRC government authorities, the Renminbi is freely convertible only to the extent of current account items, such as trade-related receipts and payments, interest and dividends. Capital account items, such as direct equity investments, loans and repatriation of investments, require the prior approval from the SAFE or its local counterpart for conversion of Renminbi into a foreign currency, such as U.S. dollars, and remittance of the foreign currency outside the PRC.

Payments for transactions that take place within the PRC must be made in Renminbi. Unless otherwise approved, PRC companies must repatriate foreign currency payments received from abroad. Foreign-invested enterprises may retain foreign exchange in accounts with designated foreign exchange banks subject to a cap set by the SAFE or its local counterpart. Unless otherwise approved, domestic enterprises must convert all of their foreign currency receipts into Renminbi.

Under the Implementing Rules of Measures for the Administration of Individual Foreign Exchange, or the Implementation Rules, issued by the SAFE on January 5, 2007, PRC citizens who are granted shares or share options by an overseas listed company according to its share incentive plan are required, through a qualified PRC agent or the PRC subsidiary of such overseas listed company, to register with the SAFE and complete certain other procedures related to the share incentive plan. Foreign exchange income received from the sale of shares or dividends distributed by the overseas listed company must be remitted into a foreign currency account of such PRC citizen or be exchanged into Renminbi.

In addition, domestic wages and salaries of foreign employees outside of the PRC, as well as other rightful earnings, such as dividends, bonuses and profits, of shareholders outside of the PRC may be remitted freely out of the PRC after taxes have been paid in accordance with the provisions of the Chinese tax law with a tax certificate. Since we do not have any debt that is generated outside the PRC and do not have any employees located outside PRC, management is not aware of any material risk of paying in foreign currency in respect of those employee-related and debt-settlement amounts due to any other party located outside PRC.

Liquidation

According to the bankruptcy law of the PRC, CC Investment, as a WFOE, needs to have its debt to creditors settled in the priority as set forth in the relevant Bankruptcy law in China and its immediate equity holder, CC Mobility, located in Hong Kong, would be the last party to be entitled to any residual interest of the entity. Such priority of payment and distribution in the case of the liquidation of CC Investment does not have any different priority in respect of PRC nationals or foreigners. The priority is based on the status of being a creditor and other requirements as set forth in the bankruptcy law in China, which does not have any discrimination or preference in respect of whether the party is a PRC national or foreigner.

Taxation

Under the Enterprise Income Tax Law (“EIT”), effective January 1, 2008, China adopted a uniform tax rate of 25.0% for all enterprises (including foreign-invested enterprises) and revoke the current tax exemption, reduction and preferential treatments applicable to foreign-invested enterprises. However, there will be a transition period for enterprises, whether foreign-invested or domestic, that are currently receiving preferential tax treatment granted by relevant tax authorities. Enterprises that are subject to an enterprise income tax rate lower than 25.0% may continue to enjoy the lower rate and gradually transition to the new tax rate within five years after the effective date of the EIT Law. Enterprises that are currently entitled to exemptions or reductions from the standard income tax rate for a fixed term may continue to enjoy such treatment until the fixed term expires. However, the two-year exemption from enterprise income tax for foreign-invested enterprise will begin from January 1, 2008 instead of from when such enterprise first becomes profitable. Preferential tax treatments will continue to be granted to industries and projects that are strongly supported and encouraged by the state, and enterprises otherwise classified as “new and high technology enterprises strongly supported by the state” will be entitled to a 15.0% enterprise income tax rate even though the EIT Law does not currently define this term.

Provisions Regarding Mergers and Acquisitions of Domestic Enterprises by Foreign Investors

On August 8, 2006, six PRC regulatory agencies, including the Chinese Securities Regulatory Commission (“CSRC”), promulgated a rule entitled Provisions Regarding Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (the “new M&A rule”) to regulate foreign investment in PRC domestic enterprises. The new M&A rule provides that the Ministry of Commerce must be notified in advance of any change-of-control transaction in which a foreign investor takes control of a PRC domestic enterprise and any of the following situations exists:

| (i) | the transaction involves an important industry in China; |

| (ii) | the transaction may affect national “economic security;” or |

| (iii) | the PRC domestic enterprise has a well-known trademark or historical Chinese trade name in China. |

On September 21, 2006, the CSRC issued a clarification that sets forth the criteria and process for obtaining any required approval from the CSRC. To date, the application of this new M&A rule is unclear.

Employees

We currently employ 98 individuals amongst our various offices. All employees enter into confidentiality agreements.

Corporate Information

The principal executive offices for the Registrant are located at: 303 Twin Dolphins Drive, Suite 600, Redwood City, CA 94065. The Registrant’s main telephone number is: 650-632-4210 and its fax number is 650-551-9901. The Registrant’s website is located at: www.xcelmobility.com

CC Power’s offices are located at: Room 706, Cyber Times Tower B, Tairan Road, Futian District, Shenzhen, PRC.

ITEM 1A.RISK FACTORS.

You should carefully consider the risks described below together with all of the other information included in our public filings before making an investment decision with regard to our securities. The statements contained in or incorporated into this document that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following events described in these risk factors actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Business and Industry

Our operating results are difficult to predict, and we may experience significant fluctuations in our operating results.

Our operating results may fluctuate significantly. As a result, you may not be able to rely on period to period comparisons of our operating results as an indication of our future performance. Factors causing these fluctuations include, among others:

| · | our ability to maintain and increase sales to existing customers, attract new customers and satisfy our customers’ demands; |

| · | the price we charge for our services or changes in our pricing strategies or the pricing strategies of our competitors; |

| · | timing and costs of marketing and promotional programs organized by us and/or our partners, including the extent to which we or our partners offer promotional discounts to their customers; |

| · | technical difficulties, system downtime or interruptions of our computer system, which we use to support our services; |

| · | the introduction by our competitors of new products and services; |

| · | the effects of strategic alliances, potential acquisitions and other business combinations, and our ability to successfully and timely integrate them into our business; |

| · | changes in government regulations with respect to the online lottery industry; and |

| · | economic and geopolitical conditions in China and elsewhere. |

In addition, a significant percentage of our operating expenses are fixed in the short term. As a result, a delay in generating or recognizing revenue for any reason could result in substantial operating losses.

The rules and regulations on online lottery sales service market in China are relatively new and subject to interpretation, and their implementation involves uncertainty.

As the relevant rules and regulations relating to online lottery sales are relatively new, we face uncertainties in the implementation of such rules and regulations by the competent authorities. The competent authorities may establish certain management systems to supervise and monitor the online lottery sales, which systems may comprise a sales monitoring system, a back-office management system and an application service platform. The competent authorities may also ask the approved entities to adopt certain measures to meet specific regulatory requirements that may be adopted from time to time. For example, the competent authorities may monitor or adjust the categories of lottery products being sold online, and supervise the sales procedures and key data of our online lottery sales on a real-time basis, such as those relating to our customer account opening procedures, capital management, database information and risk controls. Any unfavorable new regulatory requirements could have a material adverse effect on our business, financial condition, results of operations and prospects.

Our product portfolio depends on the offerings of the lottery administration centers and could change unfavorably for us as a result of decisions made by them.

The lottery products we service are issued and sold by lottery administration centers. We do not have the right to issue lottery products and cannot prevent the discontinuation of lottery products currently being offered. If the national lottery administration centers decide to discontinue one or more lottery products or to replace them with other products, this could lead to a decline in our purchase orders and thus have an adverse effect on our financial position and results of operations. In addition, if we want to provide services on newly issued lottery products, we have to enter into service agreements with the lottery administration centers that issue or sell such new lottery products. We cannot assure you that such service agreements can be entered into on terms favorable to us, or at all. If our competitors are able to enter into service agreements to service popular newly issued lottery products while we cannot, it could have an adverse effect on our revenue and brand name.