Fourth Quarter 2021 Investor Presentation March 2, 2022

We make forward-looking statements in this presentation that are subject to risks and uncertainties, many of which are difficult to predict and are generally beyond the Company's control. In particular, it is difficult to fully assess the impact of COVID-19 at this time due to, among other factors, uncertainty regarding the severity and duration of the outbreak domestically and internationally and the effectiveness of federal, state and local governments’ efforts to contain the spread of COVID-19 and respond to its direct and indirect impact on the U.S. economy and economic activity. These forward-looking statements include information about possible or assumed future results of our business, financial condition, liquidity, results of operations, plans and objectives. When we use the words "believe," "expect," "anticipate," "estimate," "plan," "continue," "intend," "should," "may" or similar expressions, we intend to identify forward-looking statements. Statements regarding the following subjects, among others, may be forward-looking: our business and investment strategy; our projected operating results; our ability to obtain financing arrangements; financing and advance rates for mortgage loans, MBS and our potential target assets; our expected leverage; general volatility of the securities markets in which we invest and the market price of our common stock; our expected investments; interest rate mismatches between mortgage loans, MBS and our potential target assets and our borrowings used to fund such investments; changes in interest rates and the market value of MBS and our potential target assets; changes in prepayment rates on mortgage loans, Agency MBS and Non-Agency MBS; effects of hedging instruments on MBS and our potential target assets; rates of default or decreased recovery rates on our potential target assets; the degree to which any hedging strategies may or may not protect us from interest rate volatility; impact of and changes in governmental regulations, tax law and rates, accounting guidance and similar matters; our ability to maintain our qualification as a REIT; our ability to maintain our exemption from registration under the Investment Company Act of 1940, as amended; availability of investment opportunities in mortgage-related, real estate-related and other securities; availability of qualified personnel; estimates relating to our ability to make distributions to our stockholders in the future; our understanding of our competition; and the uncertainty and economic impact of pandemics, epidemics or other public health emergencies, such as the recent outbreak of COVID-19 pandemic. The forward-looking statements in this presentation are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. You should not place undue reliance on these forward-looking statements. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us. Some of these factors are described in our filings with the SEC under the headings "Summary," "Risk factors," "Management's discussion and analysis of financial condition and results of operations" and "Business." If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Except as required by law, we are not obligated to, and do not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. This presentation is not an offer to sell securities nor a solicitation of an offer to buy securities in any jurisdiction where the offer and sale is not permitted. 1 Safe Harbor Statement

Lisa Meyer President, Chief Financial Officer & Treasurer Bonnie M. Wongtrakool Chief Executive Officer Greg Handler Chief Investment Officer 2 Sean Johnson Deputy Chief Investment Officer Fourth Quarter 2021 WMC Earnings Call Presenters

3 Western Asset Mortgage Capital Corporation (“WMC”) is a public REIT that benefits from the leading fixed income management capabilities of Western Asset Management Company, LLC ("Western Asset") • One of the world’s leading global fixed income managers, known for team management, proprietary research, robust risk management and a long-term fundamental value approach. • AUM of $492.4 billion(1) ◦ AUM of the Mortgage and Consumer Credit Group is $61.3 billion(1) ◦ Extensive mortgage and consumer credit investing track record • Publicly traded mortgage REIT positioned to capture attractive current and long-term investment opportunities in the residential and commercial mortgage markets • Completed Initial Public Offering in May 2012 Please refer to page 26 for footnote disclosures. Overview of Western Asset Mortgage Capital Corporation

Our Manager's 2022 Outlook • Russia-Ukraine conflict poses massive geopolitical uncertainty. • Inflation remains challenging but should ease substantially during 2022. • Fixed-Income Outlook ◦ Covid-19 pandemic continues to bedevil global populations. ◦ U.S. and global growth are decelerating from high levels. ◦ Monetary accommodation will be withdrawn but the bar for Federal Reserve tightening remains high. ◦ Global fiscal stimulus will be sharply reduced. • Investment Implications ◦ Global growth has recently downshifted but should remain firm, which continues to support the overweight of a spread product. ◦ The recovery of "reopening" sectors has been delayed, not derailed. ◦ With the Federal Reserve committed to tapering, risk asset volatility should increase. ◦ Longer term rates should remain range-bound. 4

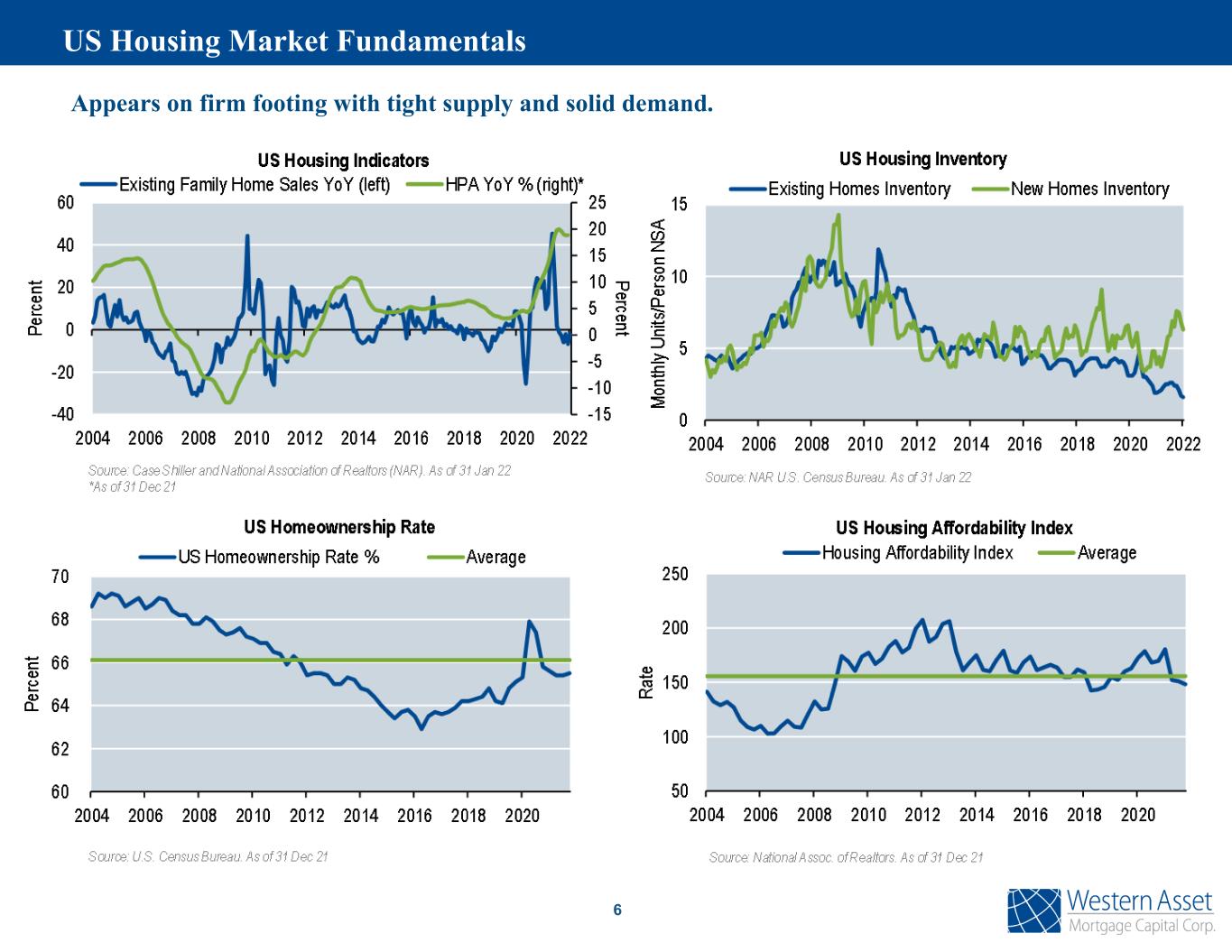

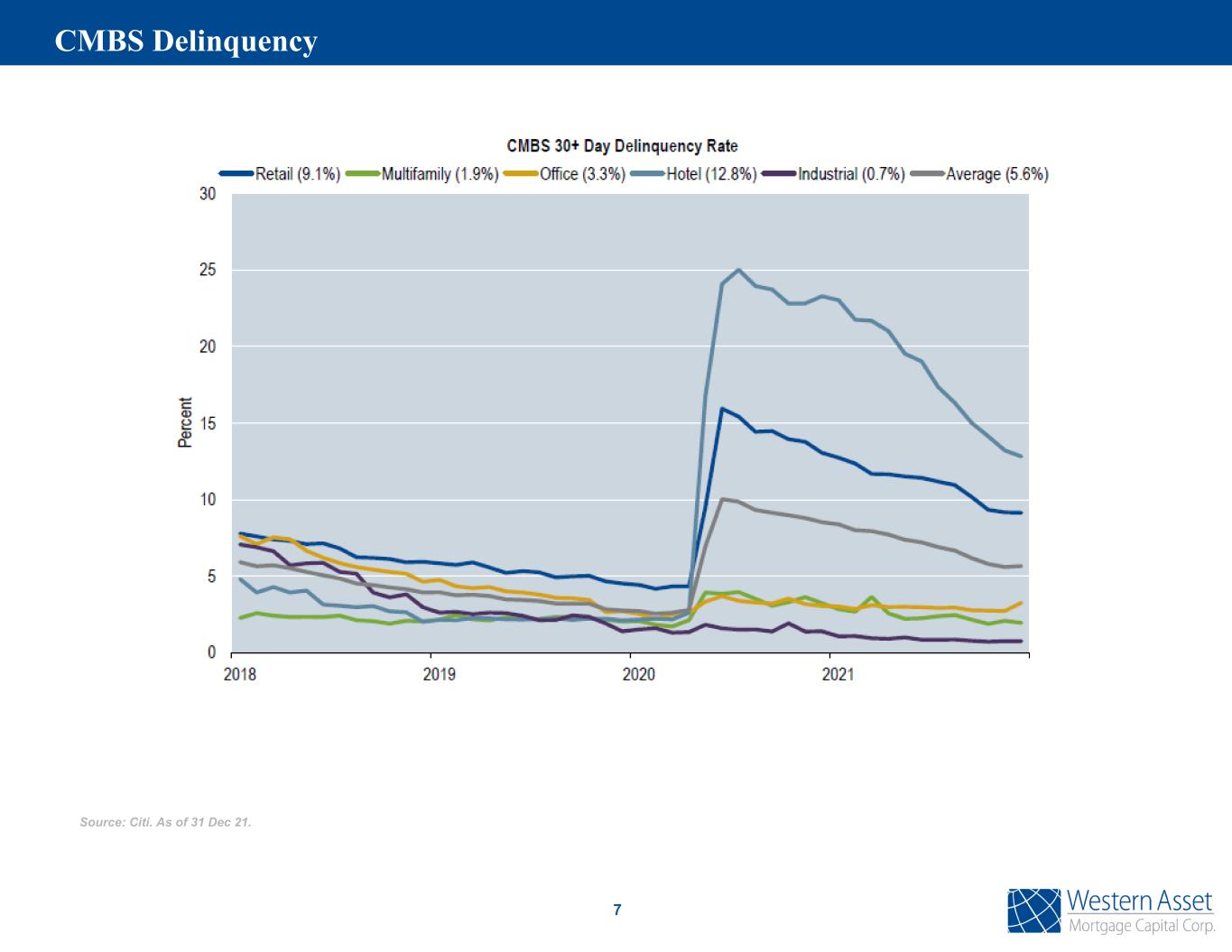

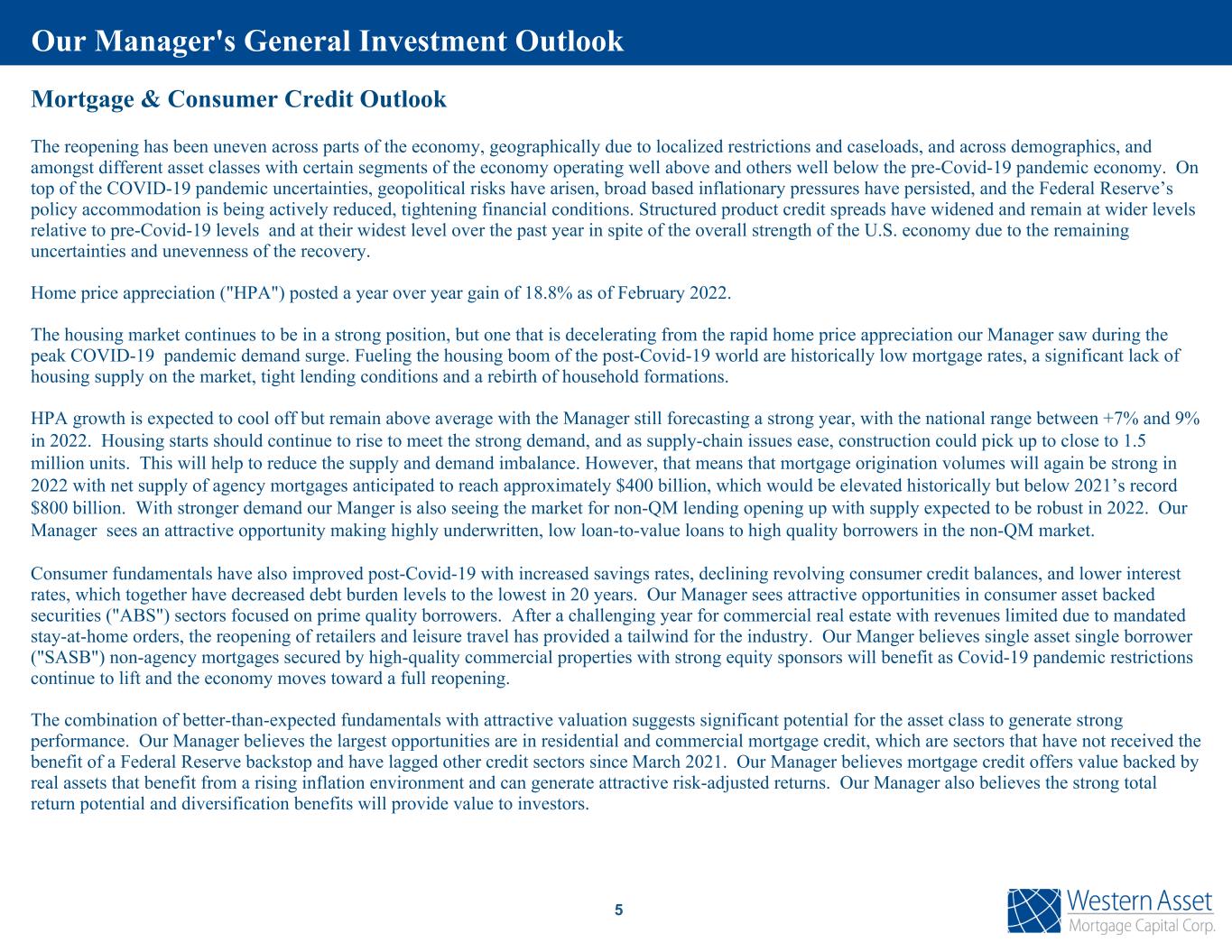

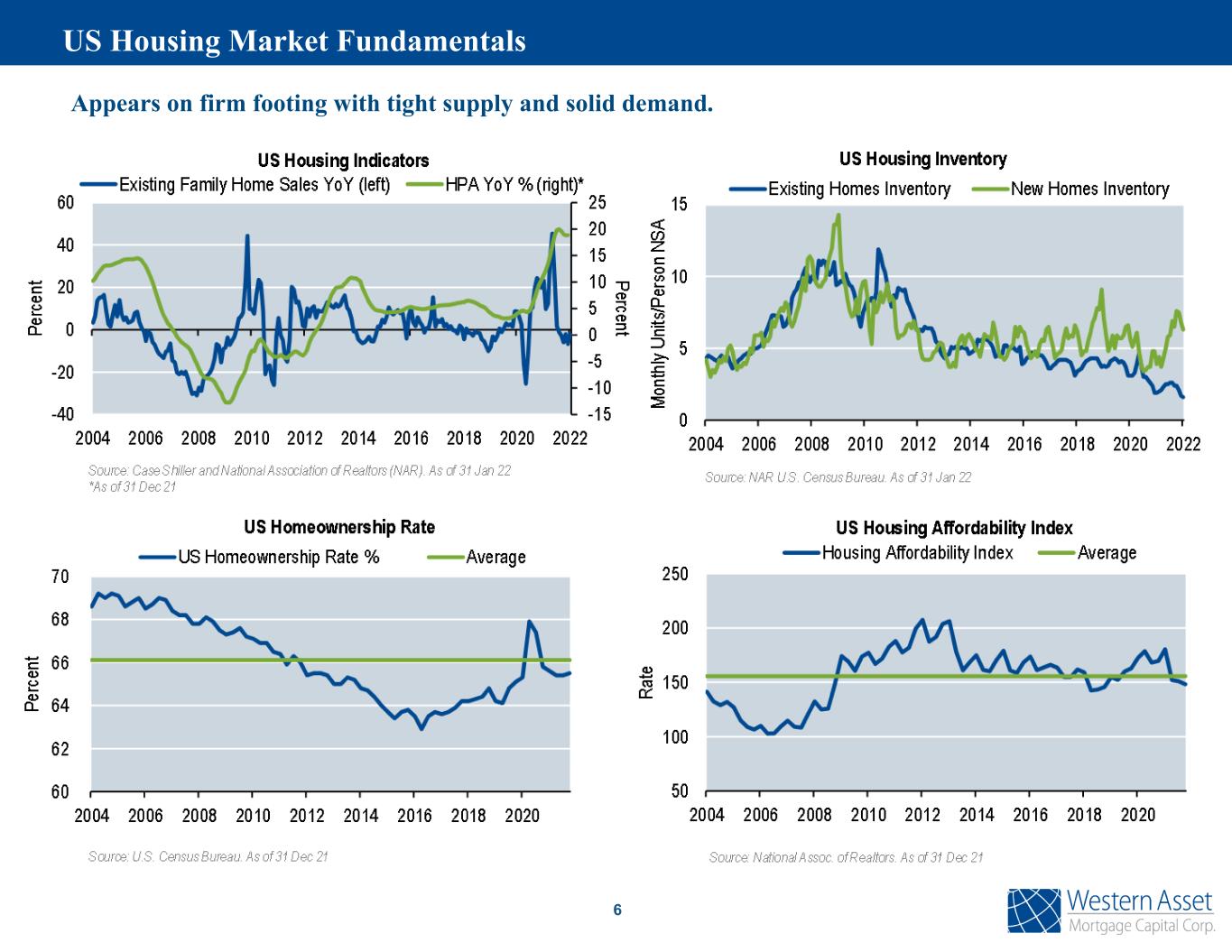

Mortgage & Consumer Credit Outlook The reopening has been uneven across parts of the economy, geographically due to localized restrictions and caseloads, and across demographics, and amongst different asset classes with certain segments of the economy operating well above and others well below the pre-Covid-19 pandemic economy. On top of the COVID-19 pandemic uncertainties, geopolitical risks have arisen, broad based inflationary pressures have persisted, and the Federal Reserve’s policy accommodation is being actively reduced, tightening financial conditions. Structured product credit spreads have widened and remain at wider levels relative to pre-Covid-19 levels and at their widest level over the past year in spite of the overall strength of the U.S. economy due to the remaining uncertainties and unevenness of the recovery. Home price appreciation ("HPA") posted a year over year gain of 18.8% as of February 2022. The housing market continues to be in a strong position, but one that is decelerating from the rapid home price appreciation our Manager saw during the peak COVID-19 pandemic demand surge. Fueling the housing boom of the post-Covid-19 world are historically low mortgage rates, a significant lack of housing supply on the market, tight lending conditions and a rebirth of household formations. HPA growth is expected to cool off but remain above average with the Manager still forecasting a strong year, with the national range between +7% and 9% in 2022. Housing starts should continue to rise to meet the strong demand, and as supply-chain issues ease, construction could pick up to close to 1.5 million units. This will help to reduce the supply and demand imbalance. However, that means that mortgage origination volumes will again be strong in 2022 with net supply of agency mortgages anticipated to reach approximately $400 billion, which would be elevated historically but below 2021’s record $800 billion. With stronger demand our Manger is also seeing the market for non-QM lending opening up with supply expected to be robust in 2022. Our Manager sees an attractive opportunity making highly underwritten, low loan-to-value loans to high quality borrowers in the non-QM market. Consumer fundamentals have also improved post-Covid-19 with increased savings rates, declining revolving consumer credit balances, and lower interest rates, which together have decreased debt burden levels to the lowest in 20 years. Our Manager sees attractive opportunities in consumer asset backed securities ("ABS") sectors focused on prime quality borrowers. After a challenging year for commercial real estate with revenues limited due to mandated stay-at-home orders, the reopening of retailers and leisure travel has provided a tailwind for the industry. Our Manger believes single asset single borrower ("SASB") non-agency mortgages secured by high-quality commercial properties with strong equity sponsors will benefit as Covid-19 pandemic restrictions continue to lift and the economy moves toward a full reopening. The combination of better-than-expected fundamentals with attractive valuation suggests significant potential for the asset class to generate strong performance. Our Manager believes the largest opportunities are in residential and commercial mortgage credit, which are sectors that have not received the benefit of a Federal Reserve backstop and have lagged other credit sectors since March 2021. Our Manager believes mortgage credit offers value backed by real assets that benefit from a rising inflation environment and can generate attractive risk-adjusted returns. Our Manager also believes the strong total return potential and diversification benefits will provide value to investors. Our Manager's General Investment Outlook 5

6 Appears on firm footing with tight supply and solid demand. US Housing Market Fundamentals

7 CMBS Delinquency Source: Citi. As of 31 Dec 21.

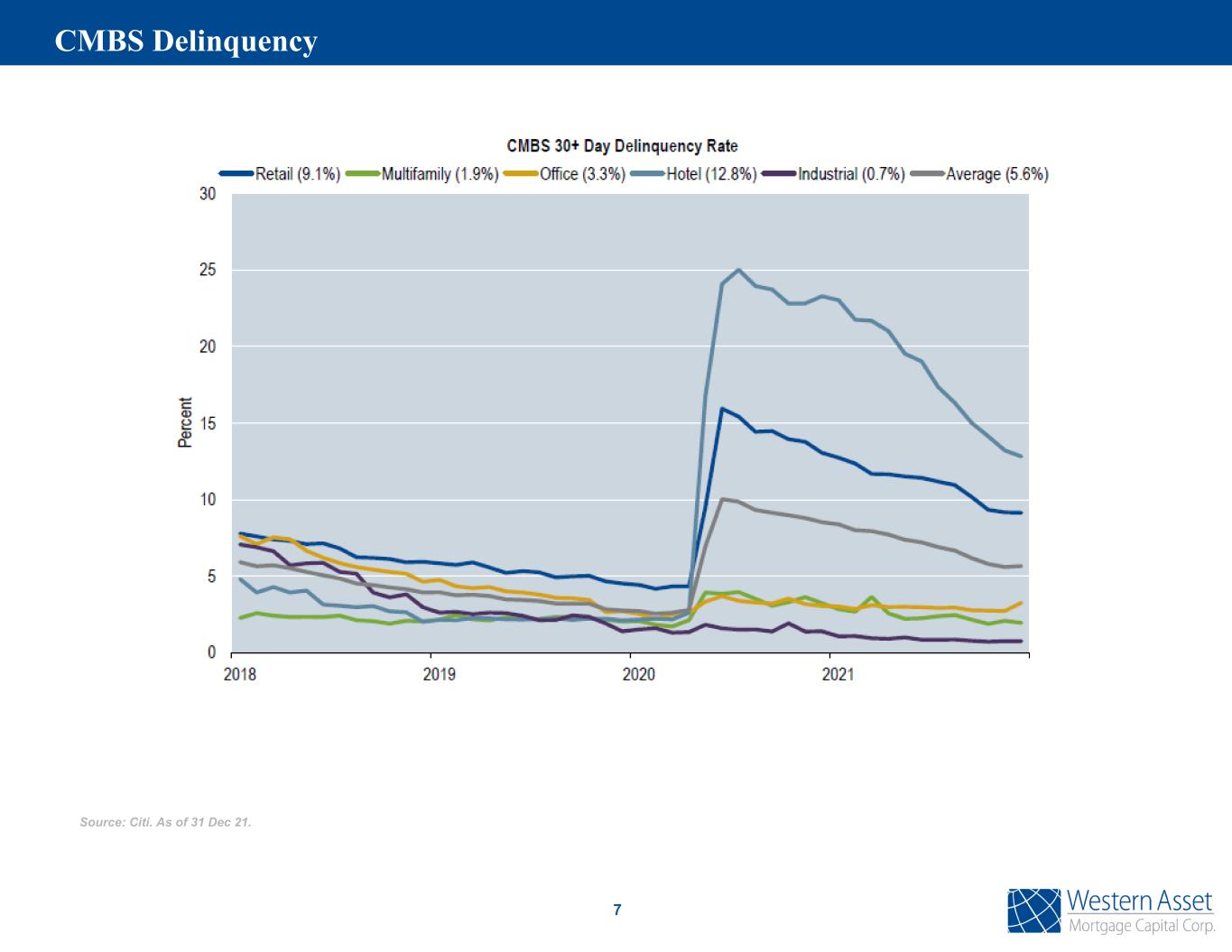

8 Investment Strategy Our investment strategy's primary goal is to generate attractive returns while preserving book value. We continue to find value in credit sensitive mortgages. Under current market conditions we expect to continue to focus investments in non-qualified residential mortgages and other mortgage credit that are accretive to portfolio earnings. Target Investments Residential Non-Qualified Mortgages ◦ Program initiated in 2014 ◦ No cumulative losses ◦ Strategic partnerships with seasoned originators ◦ Average coupon in the low 4% range ◦ Average loan to value mid to high 60% at origination ◦ Non-recourse debt through securitization Other Mortgage Credit ◦ Assets with low leverage and strongly underwritten ◦ Residential securities ◦ Commercial loans and securities ◦ Yields between 4%-10% ◦ Favoring long-term financing utilizing structural leverage and low recourse leverage

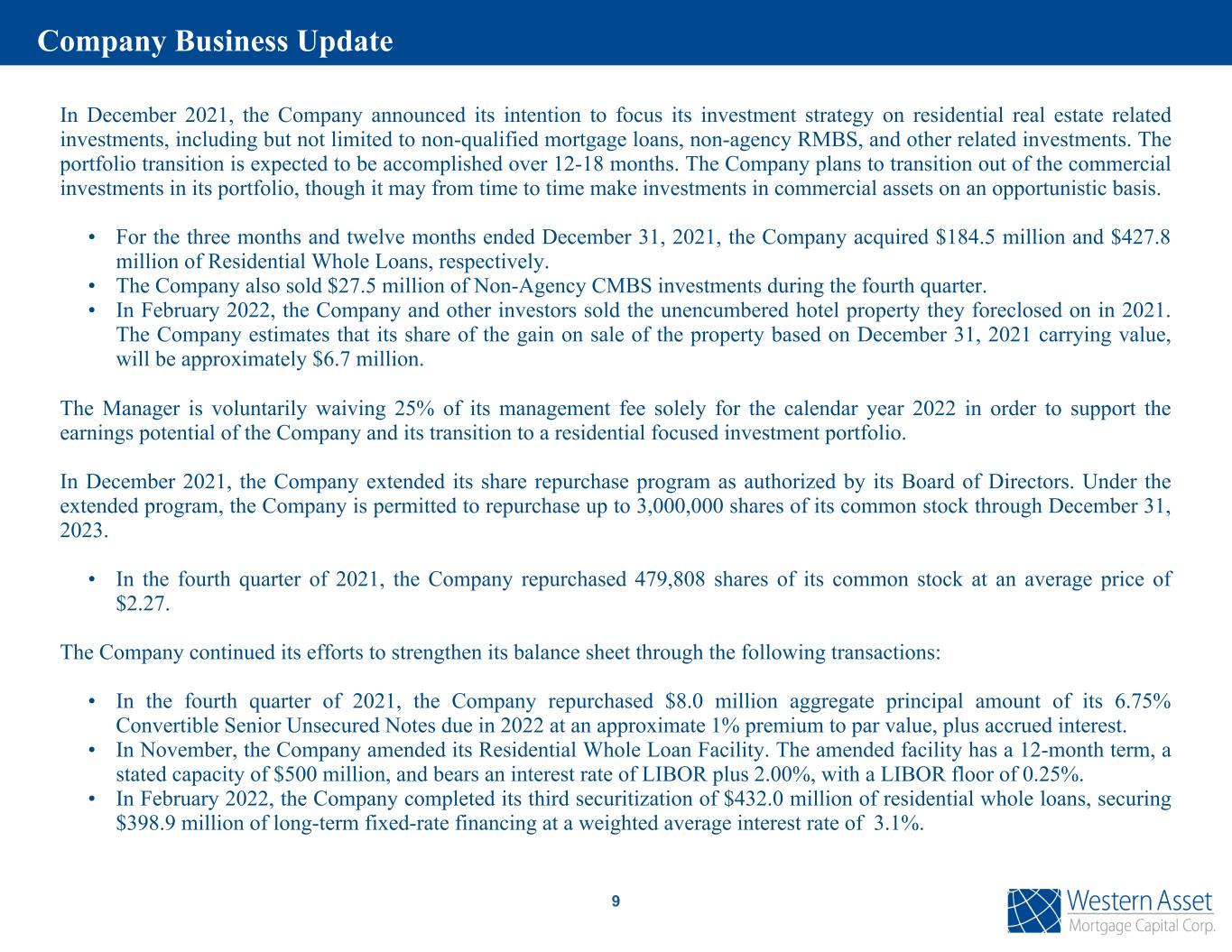

Company Business Update In December 2021, the Company announced its intention to focus its investment strategy on residential real estate related investments, including but not limited to non-qualified mortgage loans, non-agency RMBS, and other related investments. The portfolio transition is expected to be accomplished over 12-18 months. The Company plans to transition out of the commercial investments in its portfolio, though it may from time to time make investments in commercial assets on an opportunistic basis. • For the three months and twelve months ended December 31, 2021, the Company acquired $184.5 million and $427.8 million of Residential Whole Loans, respectively. • The Company also sold $27.5 million of Non-Agency CMBS investments during the fourth quarter. • In February 2022, the Company and other investors sold the unencumbered hotel property they foreclosed on in 2021. The Company estimates that its share of the gain on sale of the property based on December 31, 2021 carrying value, will be approximately $6.7 million. The Manager is voluntarily waiving 25% of its management fee solely for the calendar year 2022 in order to support the earnings potential of the Company and its transition to a residential focused investment portfolio. In December 2021, the Company extended its share repurchase program as authorized by its Board of Directors. Under the extended program, the Company is permitted to repurchase up to 3,000,000 shares of its common stock through December 31, 2023. • In the fourth quarter of 2021, the Company repurchased 479,808 shares of its common stock at an average price of $2.27. The Company continued its efforts to strengthen its balance sheet through the following transactions: • In the fourth quarter of 2021, the Company repurchased $8.0 million aggregate principal amount of its 6.75% Convertible Senior Unsecured Notes due in 2022 at an approximate 1% premium to par value, plus accrued interest. • In November, the Company amended its Residential Whole Loan Facility. The amended facility has a 12-month term, a stated capacity of $500 million, and bears an interest rate of LIBOR plus 2.00%, with a LIBOR floor of 0.25%. • In February 2022, the Company completed its third securitization of $432.0 million of residential whole loans, securing $398.9 million of long-term fixed-rate financing at a weighted average interest rate of 3.1%. 9

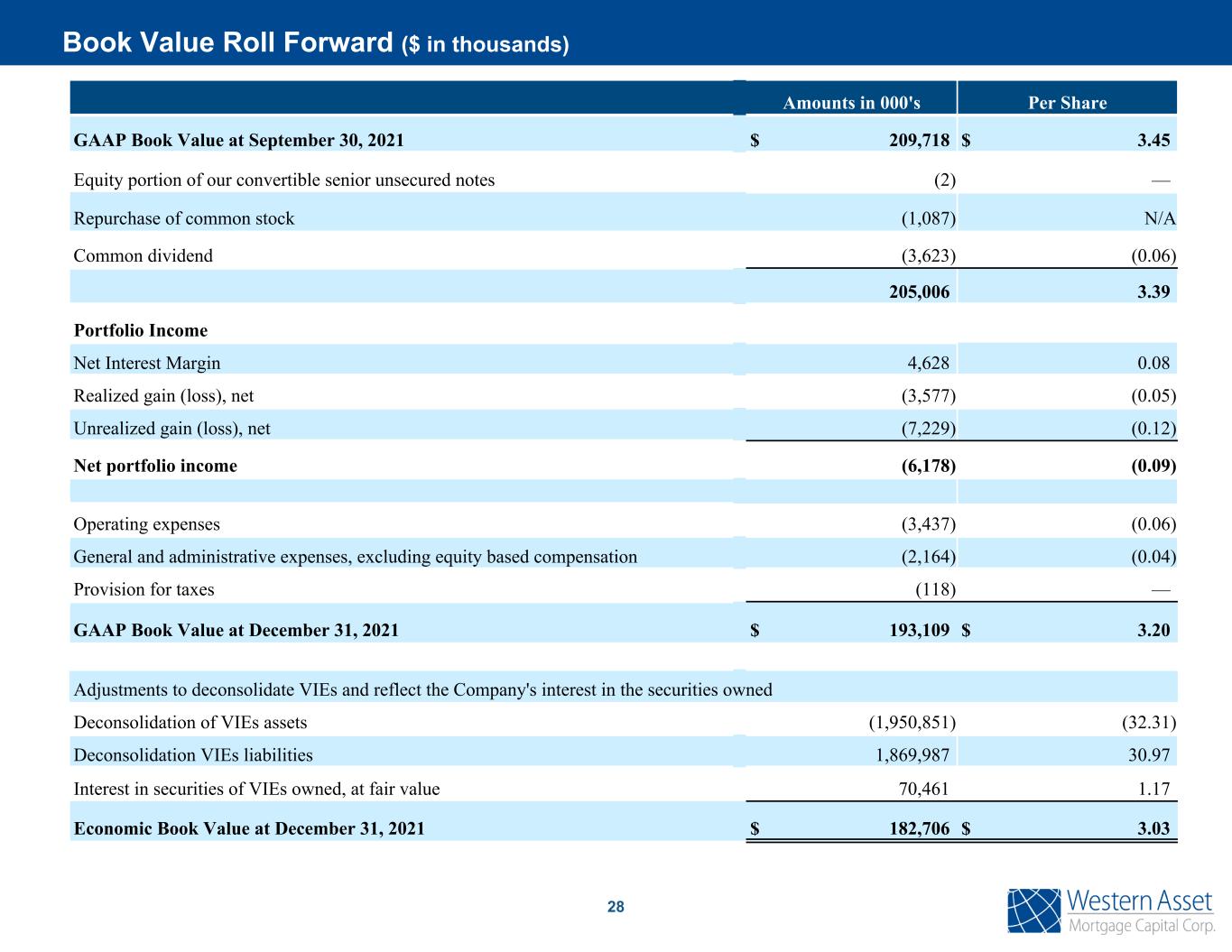

10 Please refer to page 26 for footnote disclosures. • GAAP book value per share of $3.20. • Economic book value(5) per share of $3.03. • GAAP Net loss attributable to common shareholders and participating securities of $12.1 million, or $0.20 per basic and diluted share. • Distributable earnings(2) of $908 thousand, or $0.01 per basic and diluted share. • Economic return on book value was a negative 5.5%(3) for the quarter. • 0.96%(4) annualized net interest margin on our investment portfolio. • 3.8x recourse leverage as of December 31, 2021. • On December 21, 2021 we declared a fourth quarter common dividend of $0.06 per share. Fourth Quarter Financial Results

11 The following are the Company's key metrics as of December 31, 2021; Share Price Market Cap (in MMs) Q4 Dividend Q4 Dividend Yield Recourse Leverage Net Interest Margin(4) $2.11 $127.4 $0.06 11.4% 3.8x 0.96% Economic Book Value(5) December 31, 2021 Economic Book Value(5) September 30, 2021 Economic Book Value(5) Change Q4 Economic Return(3) $3.03 $3.20 $(0.17) (5.5)% Please refer to page 26 for footnote disclosures. WMC Key Metrics GAAP Book Value December 31, 2021 GAAP Book Value September 30, 2021 GAAP Book Value Change GAAP Book Value Change Price to GAAP Book Value $3.20 $3.45 $(0.25) (7.2)% 65.9%

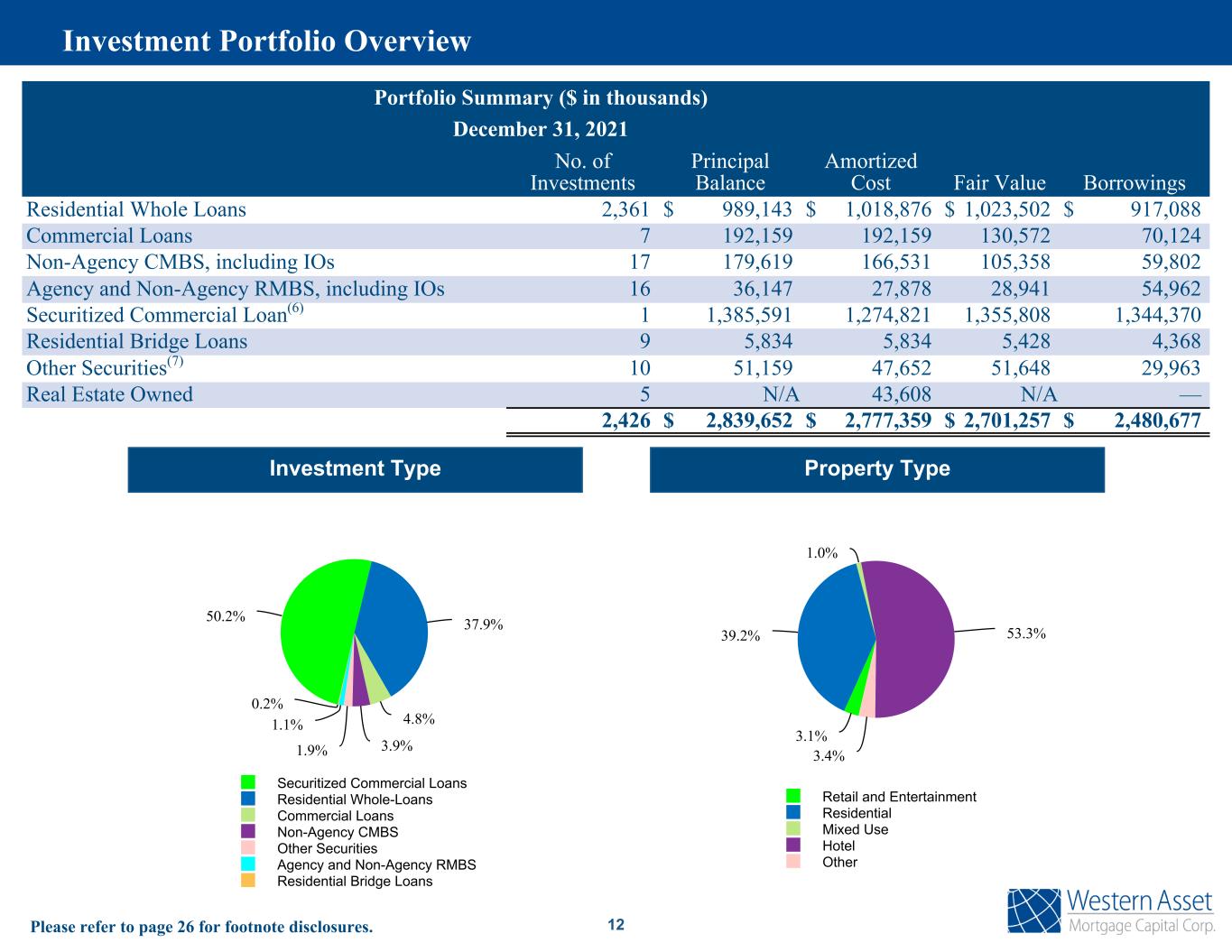

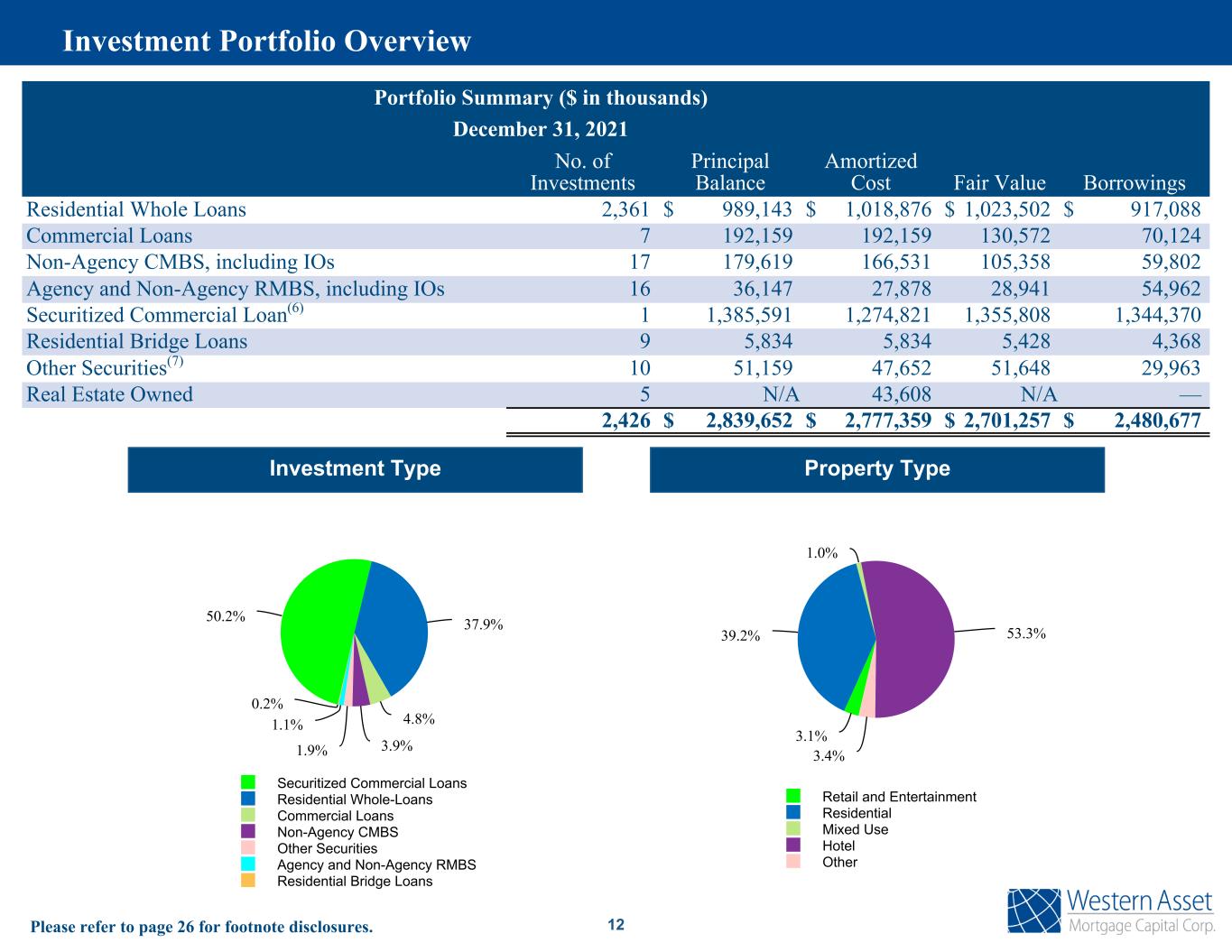

Investment Type Portfolio Summary ($ in thousands) December 31, 2021 No. of Investments Principal Balance Amortized Cost Fair Value Borrowings Residential Whole Loans 2,361 $ 989,143 $ 1,018,876 $ 1,023,502 $ 917,088 Commercial Loans 7 192,159 192,159 130,572 70,124 Non-Agency CMBS, including IOs 17 179,619 166,531 105,358 59,802 Agency and Non-Agency RMBS, including IOs 16 36,147 27,878 28,941 54,962 Securitized Commercial Loan(6) 1 1,385,591 1,274,821 1,355,808 1,344,370 Residential Bridge Loans 9 5,834 5,834 5,428 4,368 Other Securities(7) 10 51,159 47,652 51,648 29,963 Real Estate Owned 5 N/A 43,608 N/A — 2,426 $ 2,839,652 $ 2,777,359 $ 2,701,257 $ 2,480,677 Property Type 3.1% 39.2% 1.0% 53.3% 3.4% Retail and Entertainment Residential Mixed Use Hotel Other 12 50.2% 37.9% 4.8% 3.9%1.9% 1.1% 0.2% Securitized Commercial Loans Residential Whole-Loans Commercial Loans Non-Agency CMBS Other Securities Agency and Non-Agency RMBS Residential Bridge Loans Please refer to page 26 for footnote disclosures. Investment Portfolio Overview

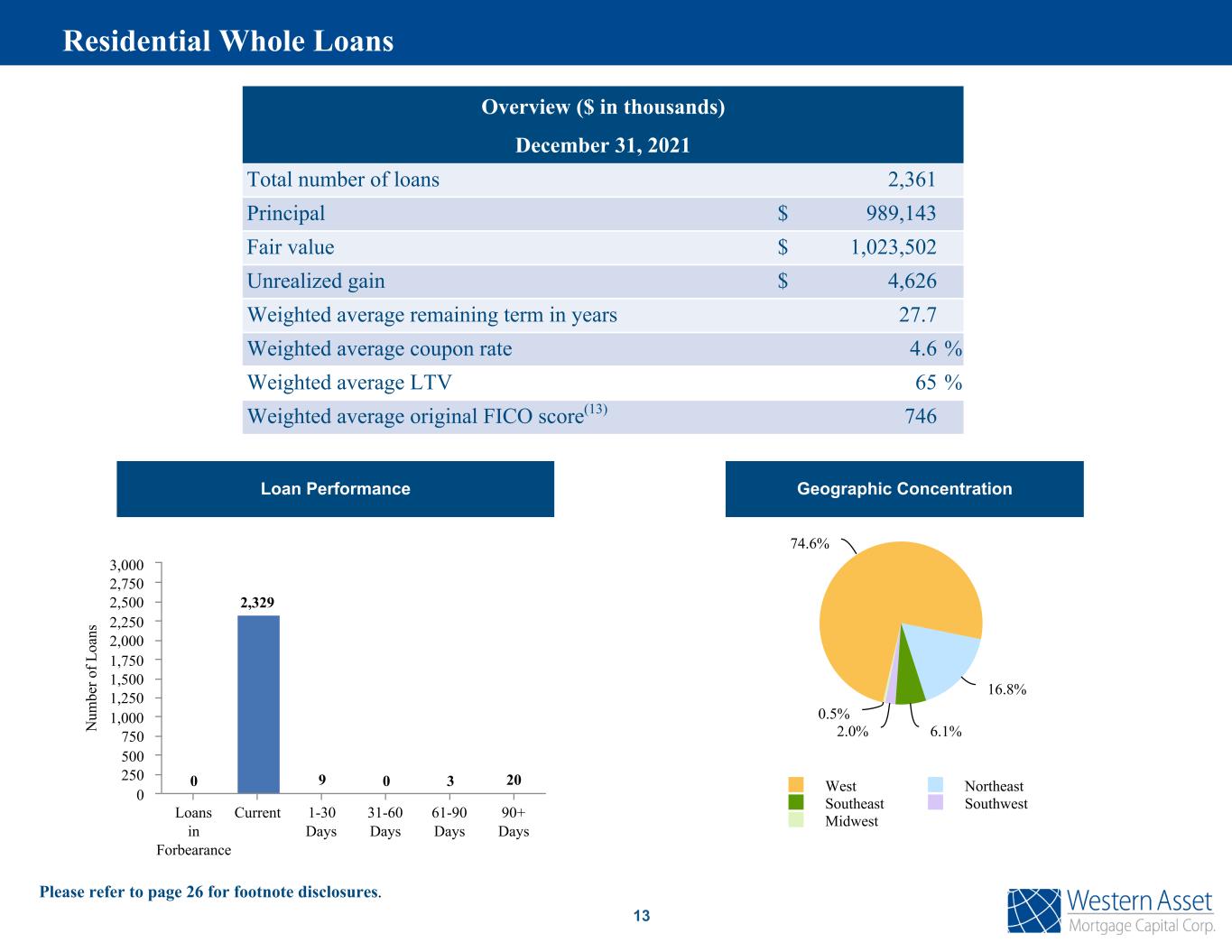

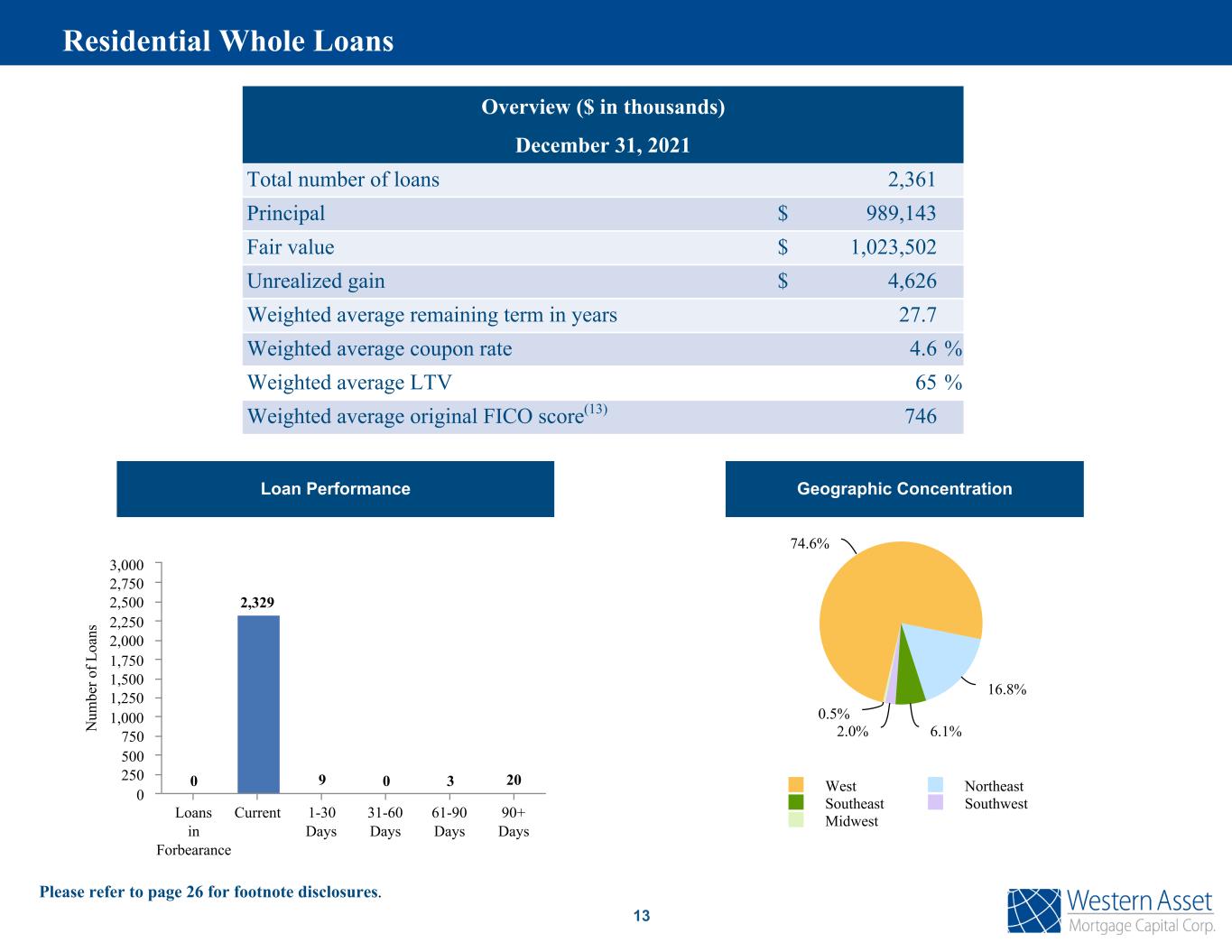

13 Overview ($ in thousands) December 31, 2021 Total number of loans 2,361 Principal $ 989,143 Fair value $ 1,023,502 Unrealized gain $ 4,626 Weighted average remaining term in years 27.7 Weighted average coupon rate 4.6 % Weighted average LTV 65 % Weighted average original FICO score(13) 746 Loan Performance Geographic Concentration 74.6% 16.8% 6.1%2.0% 0.5% West Northeast Southeast Southwest Midwest N um be r o f L oa ns 0 2,329 9 0 3 20 Loans in Forbearance Current 1-30 Days 31-60 Days 61-90 Days 90+ Days 0 250 500 750 1,000 1,250 1,500 1,750 2,000 2,250 2,500 2,750 3,000 Residential Whole Loans Please refer to page 26 for footnote disclosures.

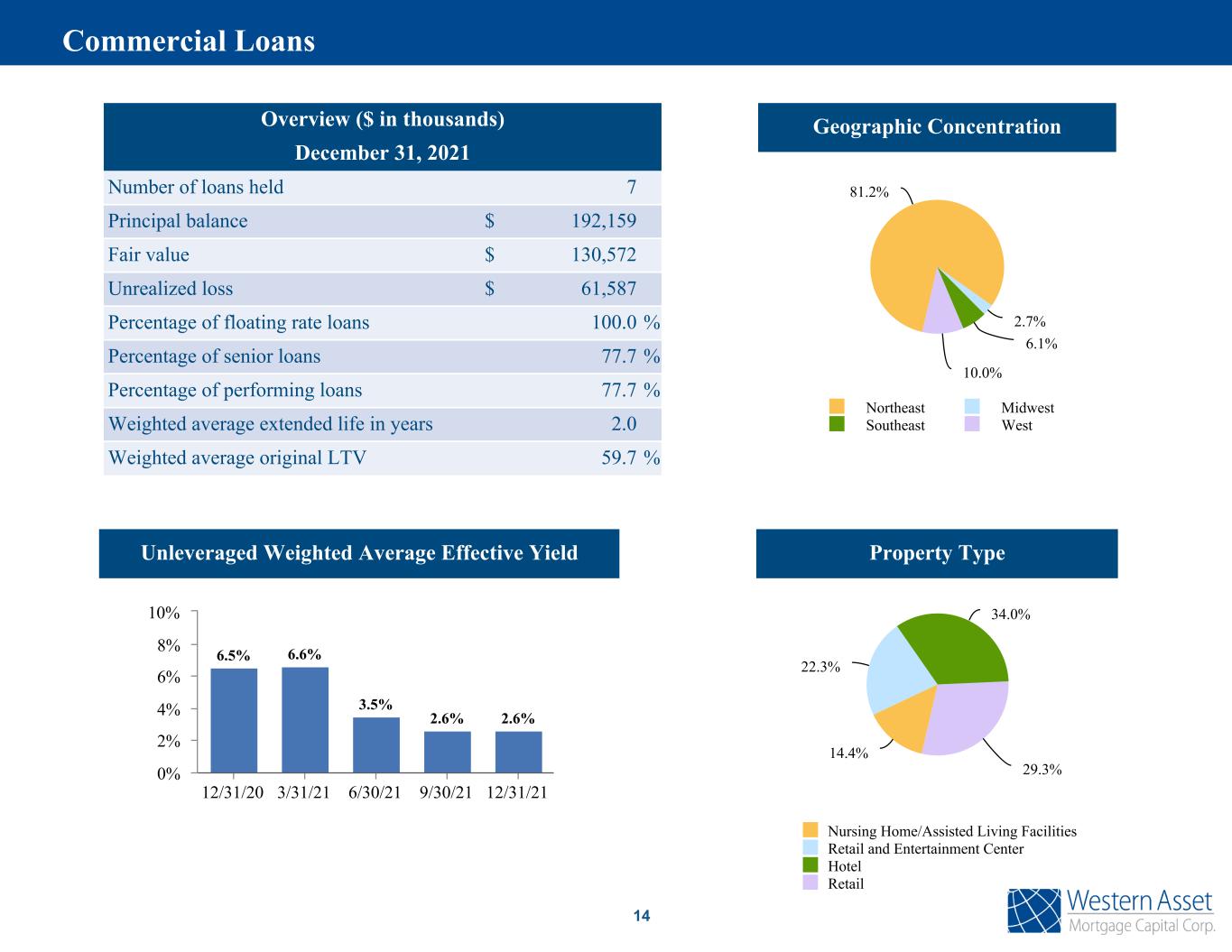

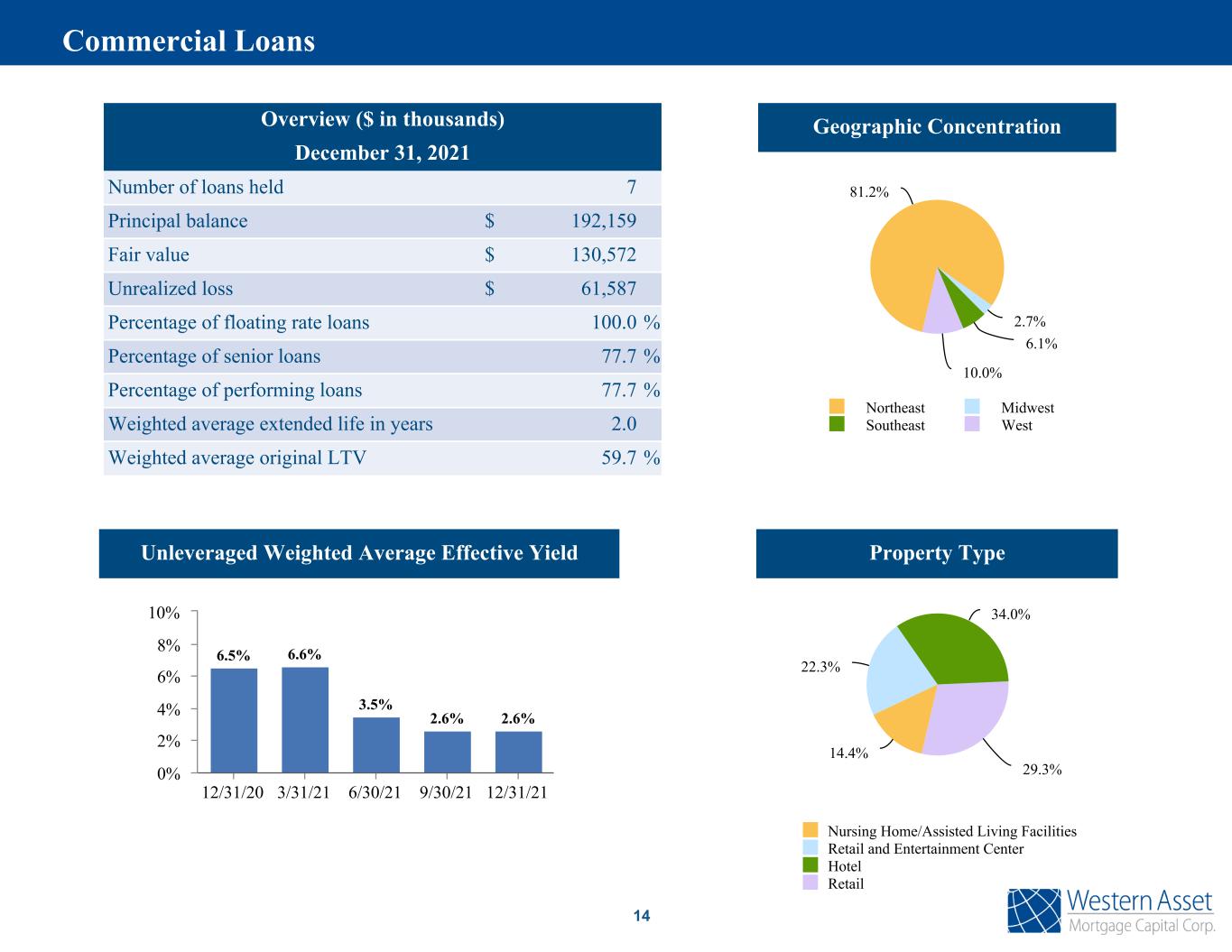

14 Overview ($ in thousands) December 31, 2021 Number of loans held 7 Principal balance $ 192,159 Fair value $ 130,572 Unrealized loss $ 61,587 Percentage of floating rate loans 100.0 % Percentage of senior loans 77.7 % Percentage of performing loans 77.7 % Weighted average extended life in years 2.0 Weighted average original LTV 59.7 % 14.4% 22.3% 34.0% 29.3% Nursing Home/Assisted Living Facilities Retail and Entertainment Center Hotel Retail Property Type Geographic Concentration 81.2% 2.7% 6.1% 10.0% Northeast Midwest Southeast West Unleveraged Weighted Average Effective Yield 6.5% 6.6% 3.5% 2.6% 2.6% 12/31/20 3/31/21 6/30/21 9/30/21 12/31/21 0% 2% 4% 6% 8% 10% Commercial Loans

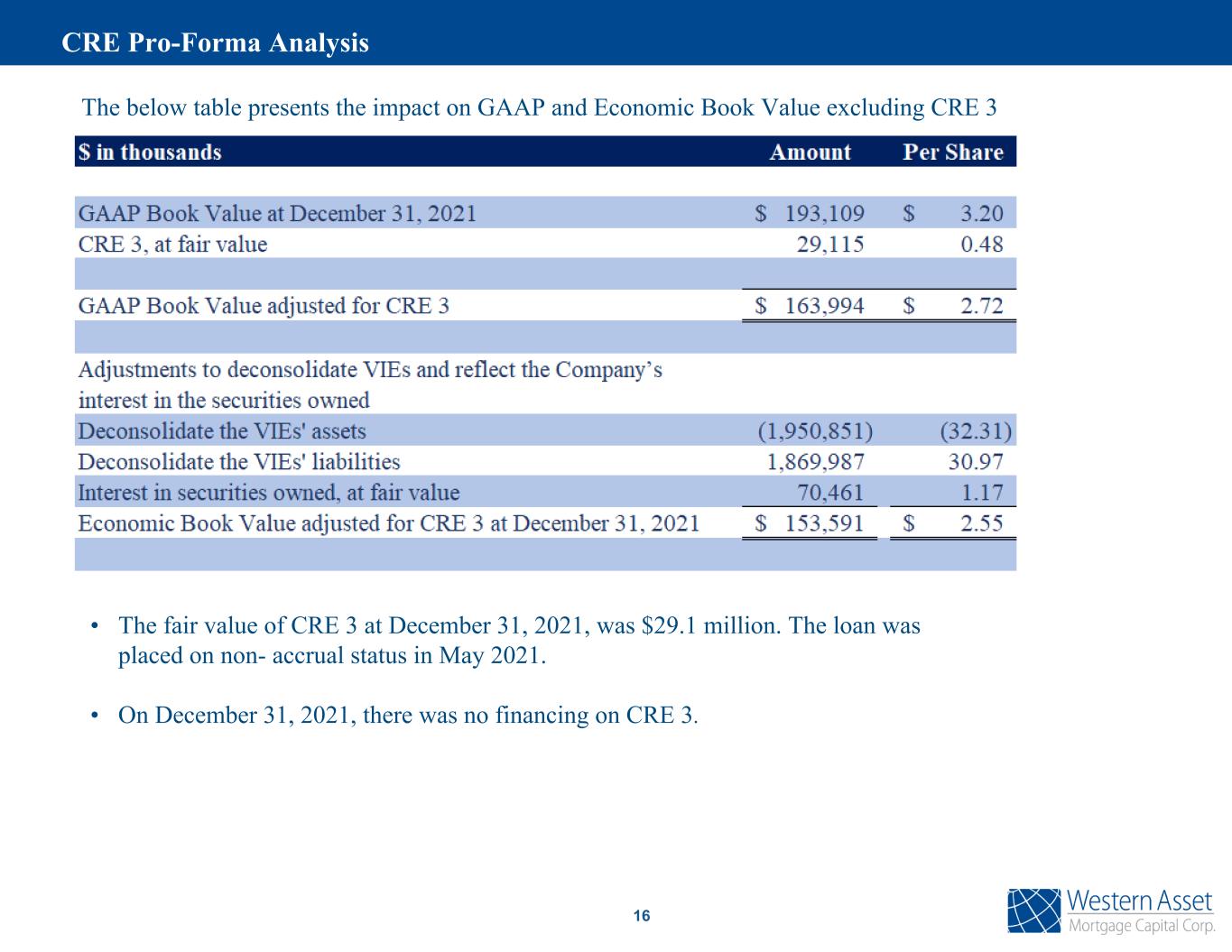

15 Loan Acquisition Date Loan Type Principal Balance Fair Value Origina l LTV Interest Rate Maturity Date Extension Option Collateral Geographical Location CRE 3(1) August 2019 Interest-Only Mezzanine loan $ 90,000 $ 29,113 57.9% 1-Month LIBOR plus 9.25% 6/29/2021 None Entertainment and Retail Northeast CRE 4 September 2019 Interest-Only First Mortgage 38,367 38,267 63.0% 1-Month LIBOR plus 3.02% 8/6/2022 One-Year Extension Retail Northeast CRE 5 December 2019 Interest-Only First Mortgage 24,535 24,212 61.8% 1-Month LIBOR plus 3.75% 11/6/2022 Two One-Year Extensions Hotel Northeast CRE 6 December 2019 Interest-Only First Mortgage 13,207 13,033 61.8% 1-Month LIBOR plus 3.75% 11/6/2022 Two One-Year Extensions Hotel West CRE 7 December 2019 Interest-Only First Mortgage 7,259 7,163 61.8% 1-Month LIBOR plus 3.75% 11/6/2022 Two One-Year Extensions Hotel Midwest and Southeast CRE 8 December 2019 Interest-Only First Mortgage 4,429 4,422 79.0% 1-Month LIBOR plus 4.85% 12/6/2022 None Assisted Living Southeast SBC 3 January 2019 Interest-Only First Mortgage 14,362 14,362 49.0% One-Month LIBOR plus 4.10% 7/6/2022 None Nursing Facilities Northeast $ 192,159 $ 130,572 (1) As of December 31, 2021, the CRE 3 junior mezzanine loan with an outstanding principal balance of $90.0 million secured by a retail facility was non-performing and past its maturity date of June 29, 2021. We were receiving interest payments on this loan from a reserve that was exhausted in May 2021. During the second quarter of 2021, the fair value of the loan declined significantly. We are currently in discussions with the borrower and certain other lenders regarding alternatives to address the situation, which might include modifications of loan terms, deferral of payments, and the funding of new advances. There can be no assurance that these discussions will result in an outcome in which we would be repaid any principal amount of the loan, and we may suffer further declines in fair value for this mezzanine investment. For the twelve months ended December 31, 2021, we suffered a decline of $51.2 million in the fair value of this investment.The Company could experience a total loss of its investment under various scenarios, which at current levels would result in a $29.1 million reduction in the Company’s book value. Commercial Loans as of December 31, 2021 ($ in thousands)

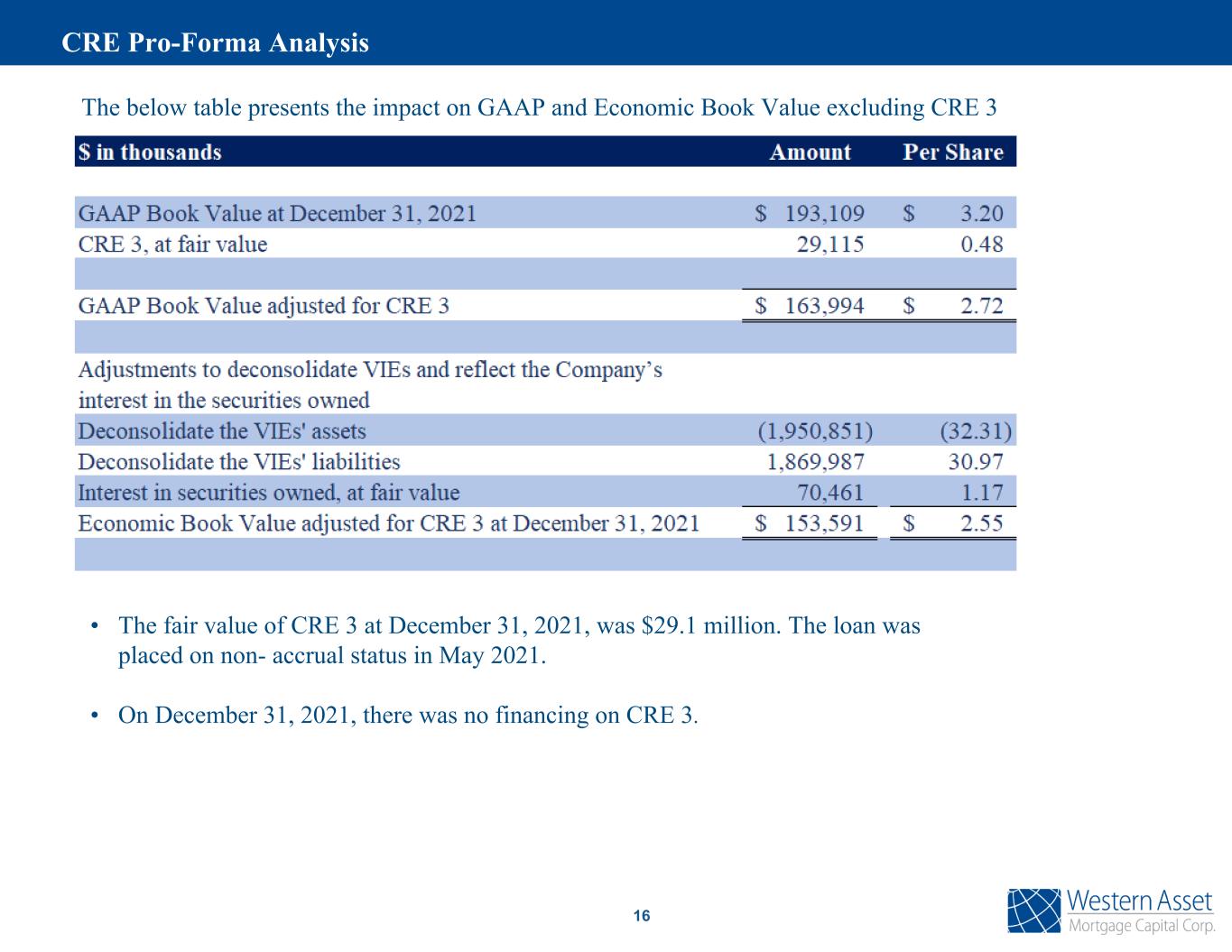

16 CRE Pro-Forma Analysis The below table presents the impact on GAAP and Economic Book Value excluding CRE 3 • The fair value of CRE 3 at December 31, 2021, was $29.1 million. The loan was placed on non- accrual status in May 2021. • On December 31, 2021, there was no financing on CRE 3.

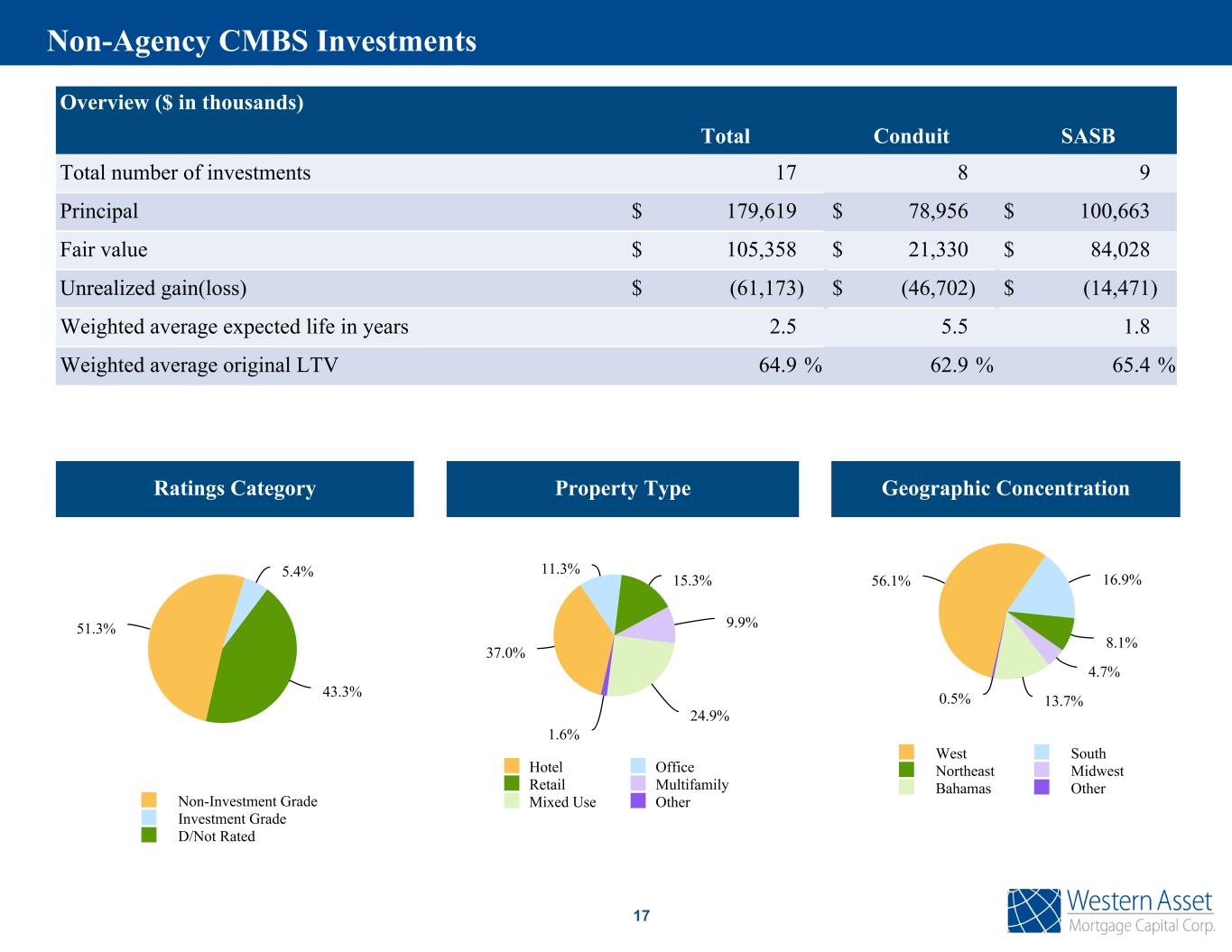

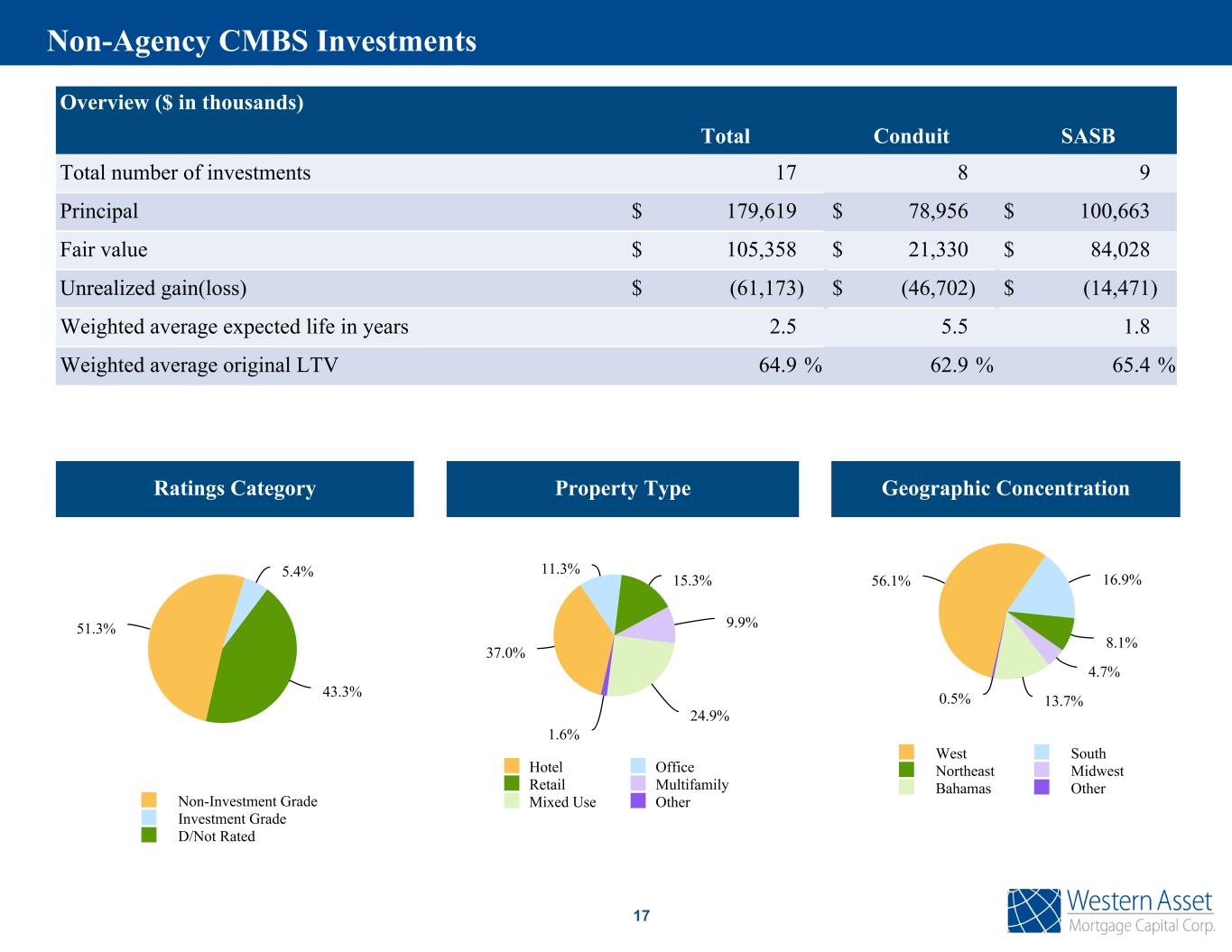

17 Overview ($ in thousands) Total Conduit SASB Total number of investments 17 8 9 Principal $ 179,619 $ 78,956 $ 100,663 Fair value $ 105,358 $ 21,330 $ 84,028 Unrealized gain(loss) $ (61,173) $ (46,702) $ (14,471) Weighted average expected life in years 2.5 5.5 1.8 Weighted average original LTV 64.9 % 62.9 % 65.4 % 51.3% 5.4% 43.3% Non-Investment Grade Investment Grade D/Not Rated Ratings Category 37.0% 11.3% 15.3% 9.9% 24.9% 1.6% Hotel Office Retail Multifamily Mixed Use Other Property Type Geographic Concentration 56.1% 16.9% 8.1% 4.7% 13.7%0.5% West South Northeast Midwest Bahamas Other Non-Agency CMBS Investments

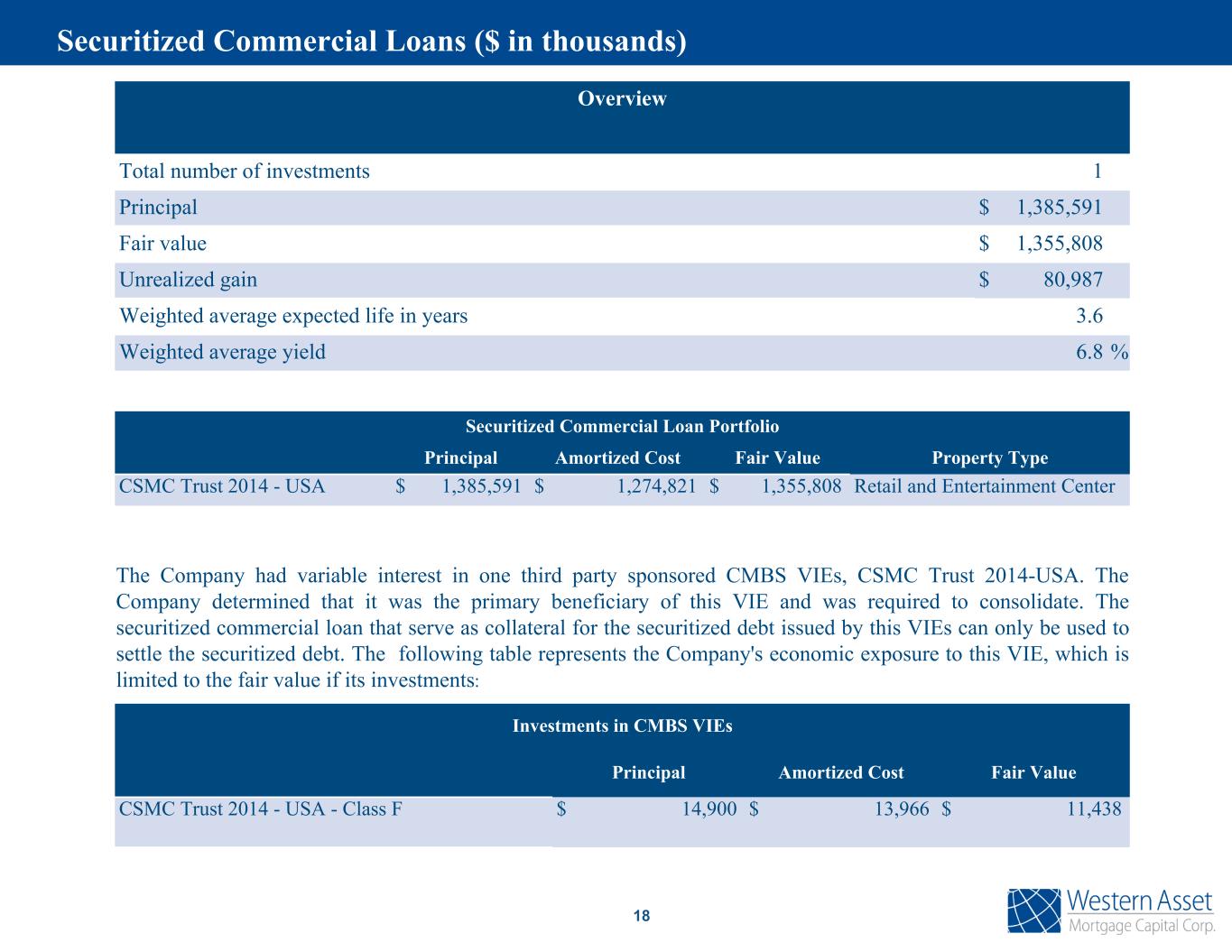

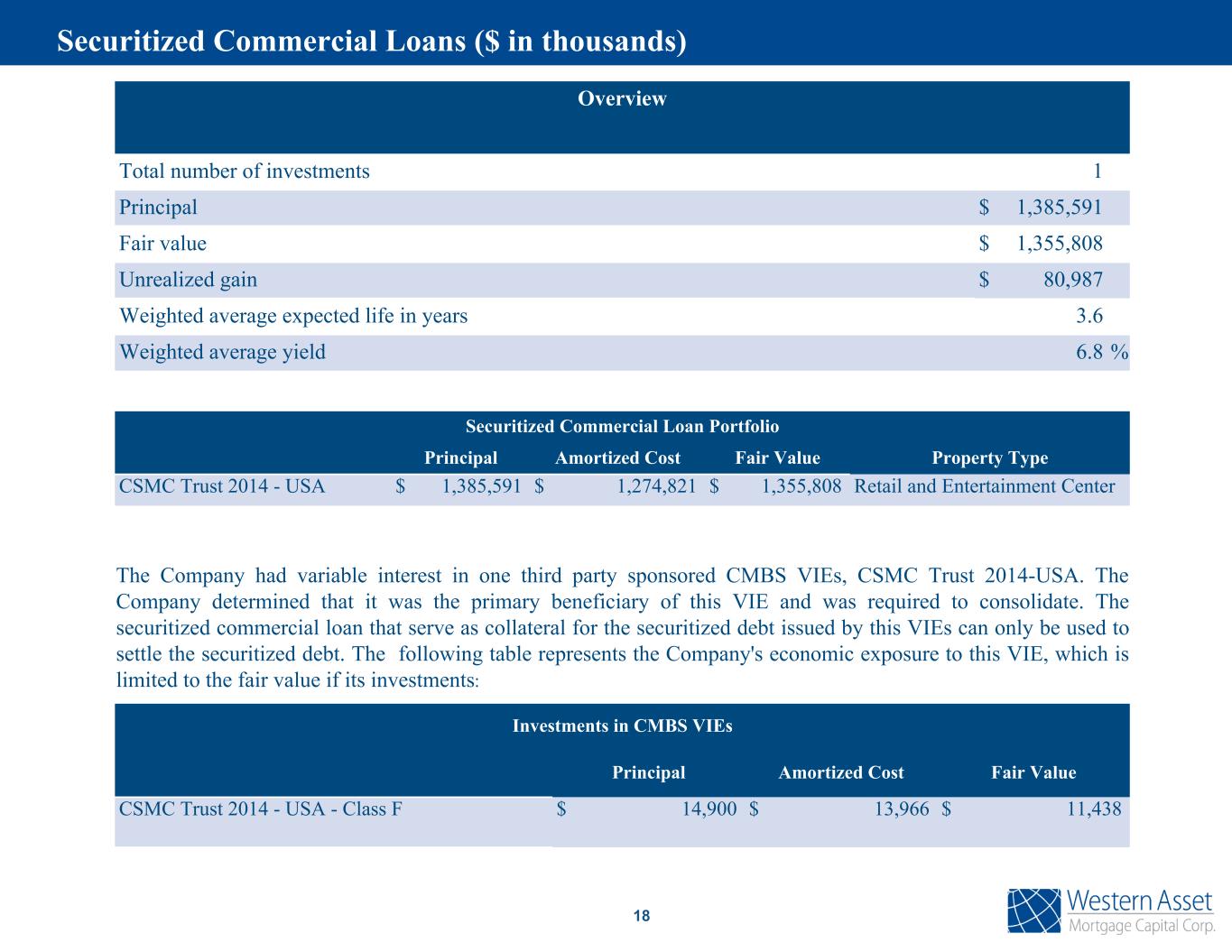

18 Overview Total number of investments 1 Principal $ 1,385,591 Fair value $ 1,355,808 Unrealized gain $ 80,987 Weighted average expected life in years 3.6 Weighted average yield 6.8 % Securitized Commercial Loan Portfolio Principal Amortized Cost Fair Value Property Type CSMC Trust 2014 - USA $ 1,385,591 $ 1,274,821 $ 1,355,808 Retail and Entertainment Center The Company had variable interest in one third party sponsored CMBS VIEs, CSMC Trust 2014-USA. The Company determined that it was the primary beneficiary of this VIE and was required to consolidate. The securitized commercial loan that serve as collateral for the securitized debt issued by this VIEs can only be used to settle the securitized debt. The following table represents the Company's economic exposure to this VIE, which is limited to the fair value if its investments: Investments in CMBS VIEs Principal Amortized Cost Fair Value CSMC Trust 2014 - USA - Class F $ 14,900 $ 13,966 $ 11,438 Securitized Commercial Loans ($ in thousands)

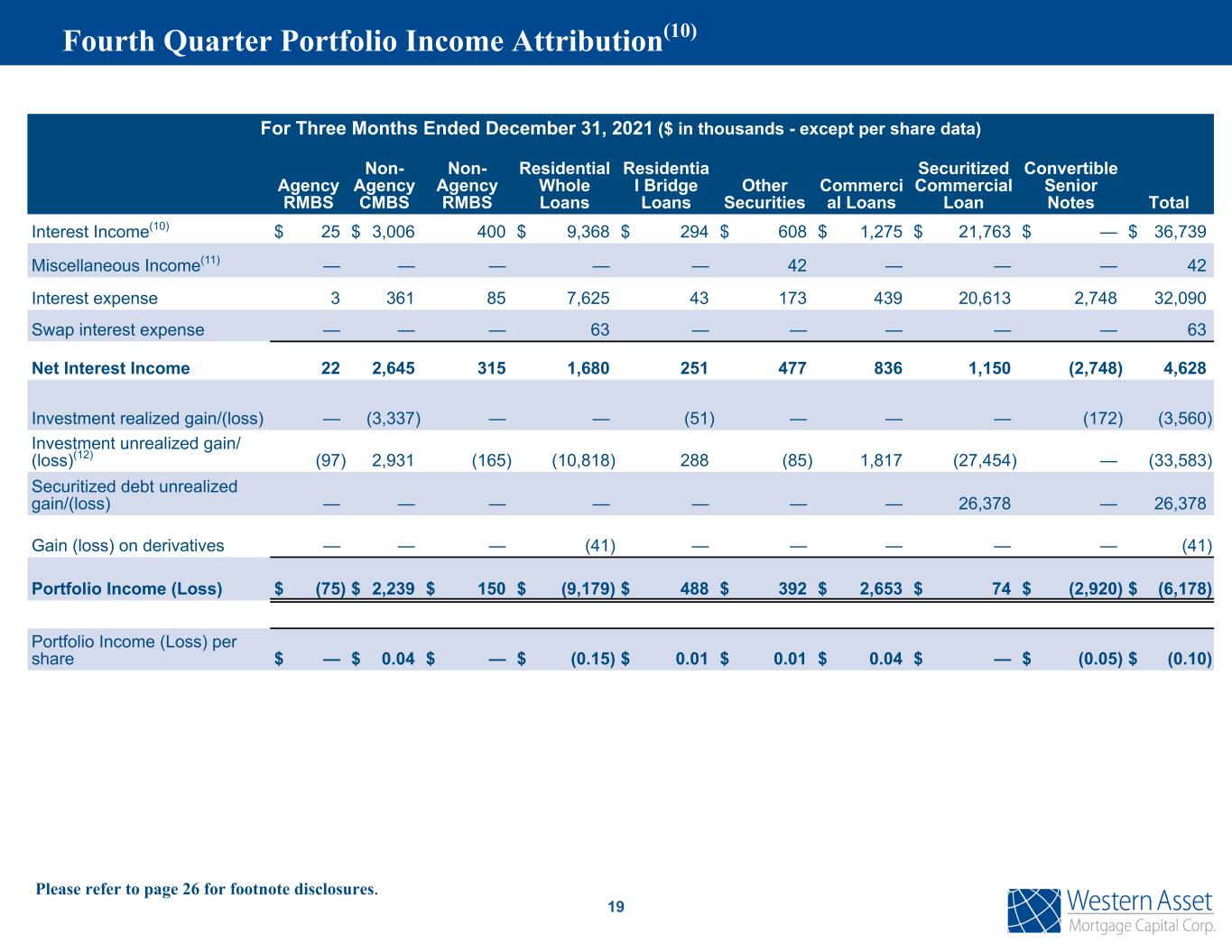

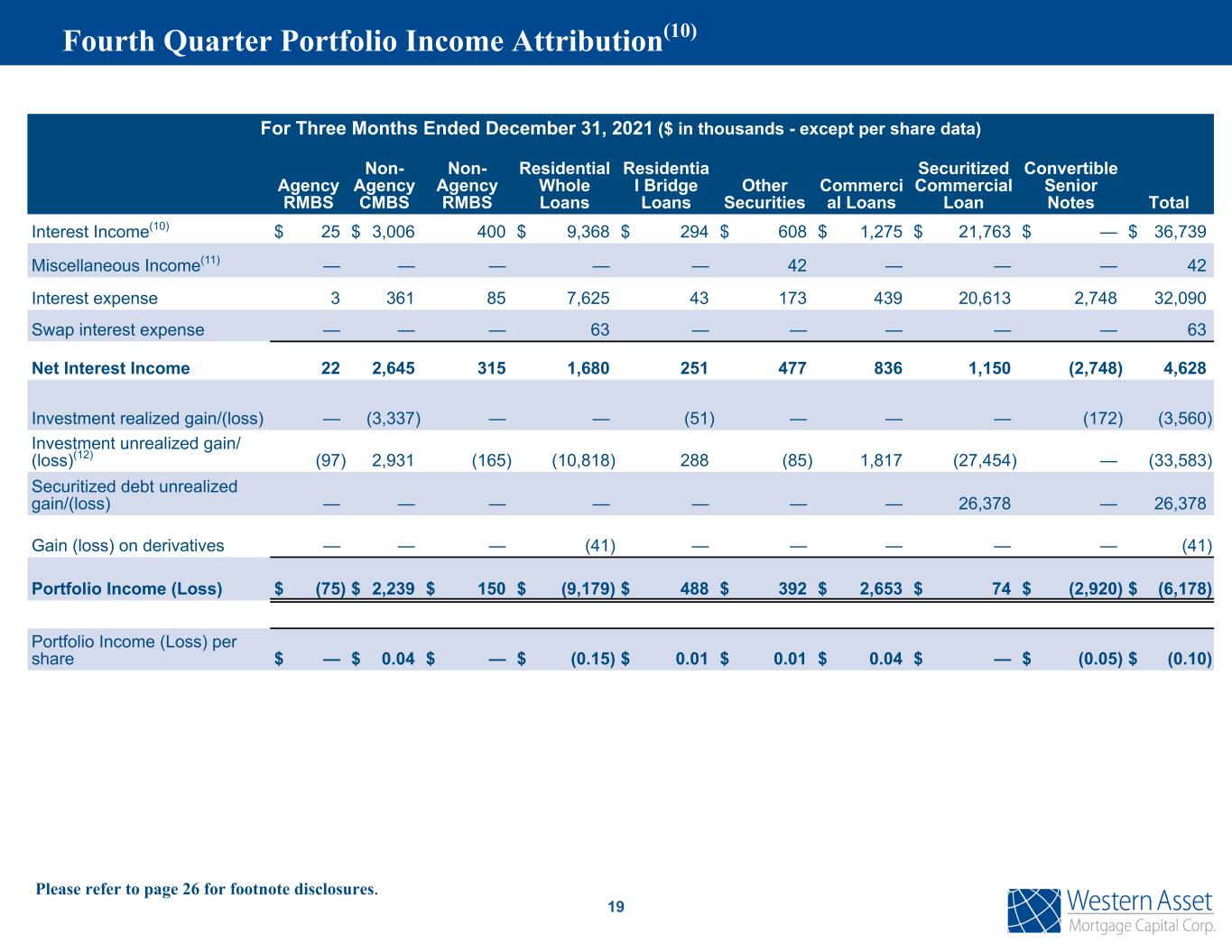

19 Please refer to page 26 for footnote disclosures. For Three Months Ended December 31, 2021 ($ in thousands - except per share data) Agency RMBS Non- Agency CMBS Non- Agency RMBS Residential Whole Loans Residentia l Bridge Loans Other Securities Commerci al Loans Securitized Commercial Loan Convertible Senior Notes Total Interest Income(10) $ 25 $ 3,006 400 $ 9,368 $ 294 $ 608 $ 1,275 $ 21,763 $ — $ 36,739 Miscellaneous Income(11) — — — — — 42 — — — 42 Interest expense 3 361 85 7,625 43 173 439 20,613 2,748 32,090 Swap interest expense — — — 63 — — — — — 63 Net Interest Income 22 2,645 315 1,680 251 477 836 1,150 (2,748) 4,628 Investment realized gain/(loss) — (3,337) — — (51) — — — (172) (3,560) Investment unrealized gain/ (loss)(12) (97) 2,931 (165) (10,818) 288 (85) 1,817 (27,454) — (33,583) Securitized debt unrealized gain/(loss) — — — — — — — 26,378 — 26,378 Gain (loss) on derivatives — — — (41) — — — — — (41) Portfolio Income (Loss) $ (75) $ 2,239 $ 150 $ (9,179) $ 488 $ 392 $ 2,653 $ 74 $ (2,920) $ (6,178) Portfolio Income (Loss) per share $ — $ 0.04 $ — $ (0.15) $ 0.01 $ 0.01 $ 0.04 $ — $ (0.05) $ (0.10) Fourth Quarter Portfolio Income Attribution(10)

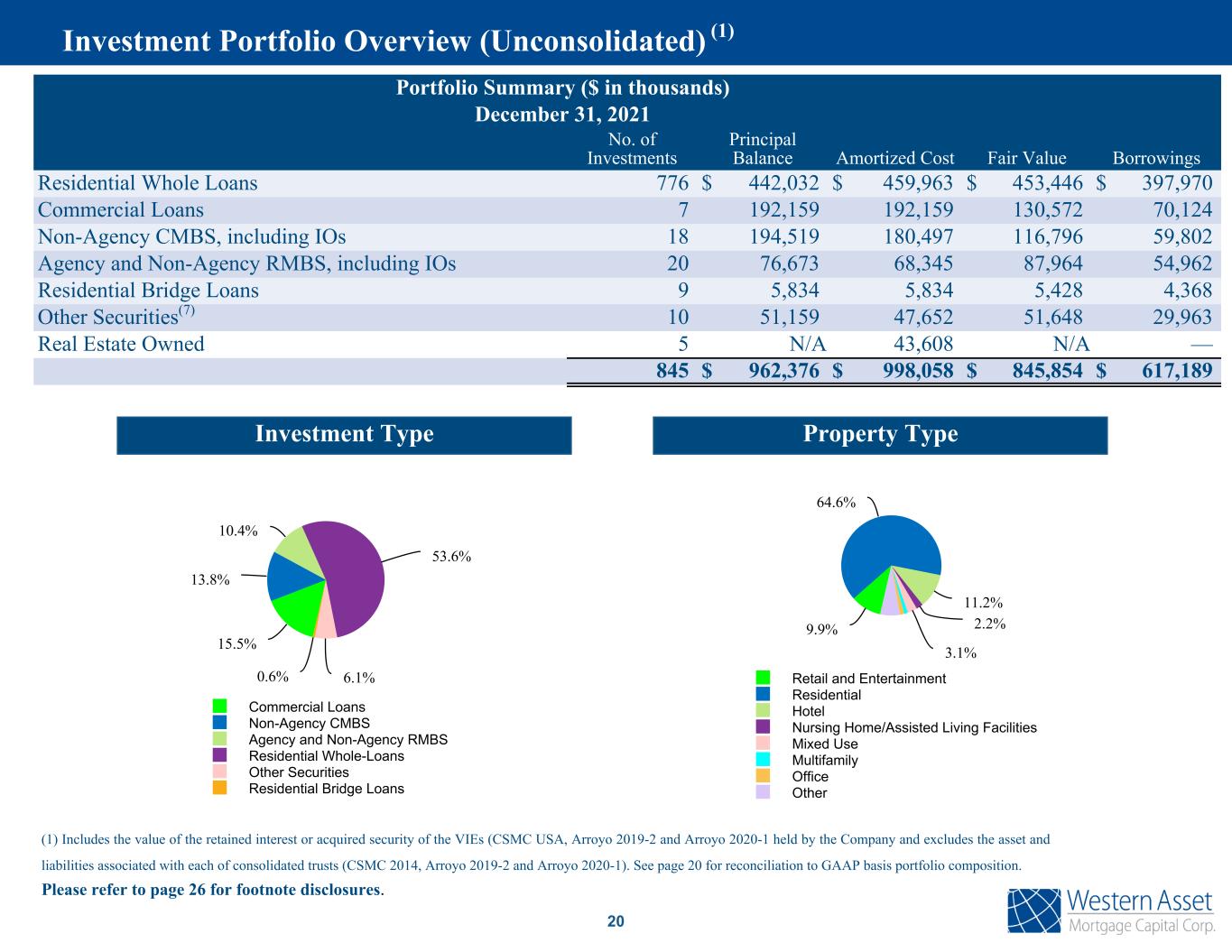

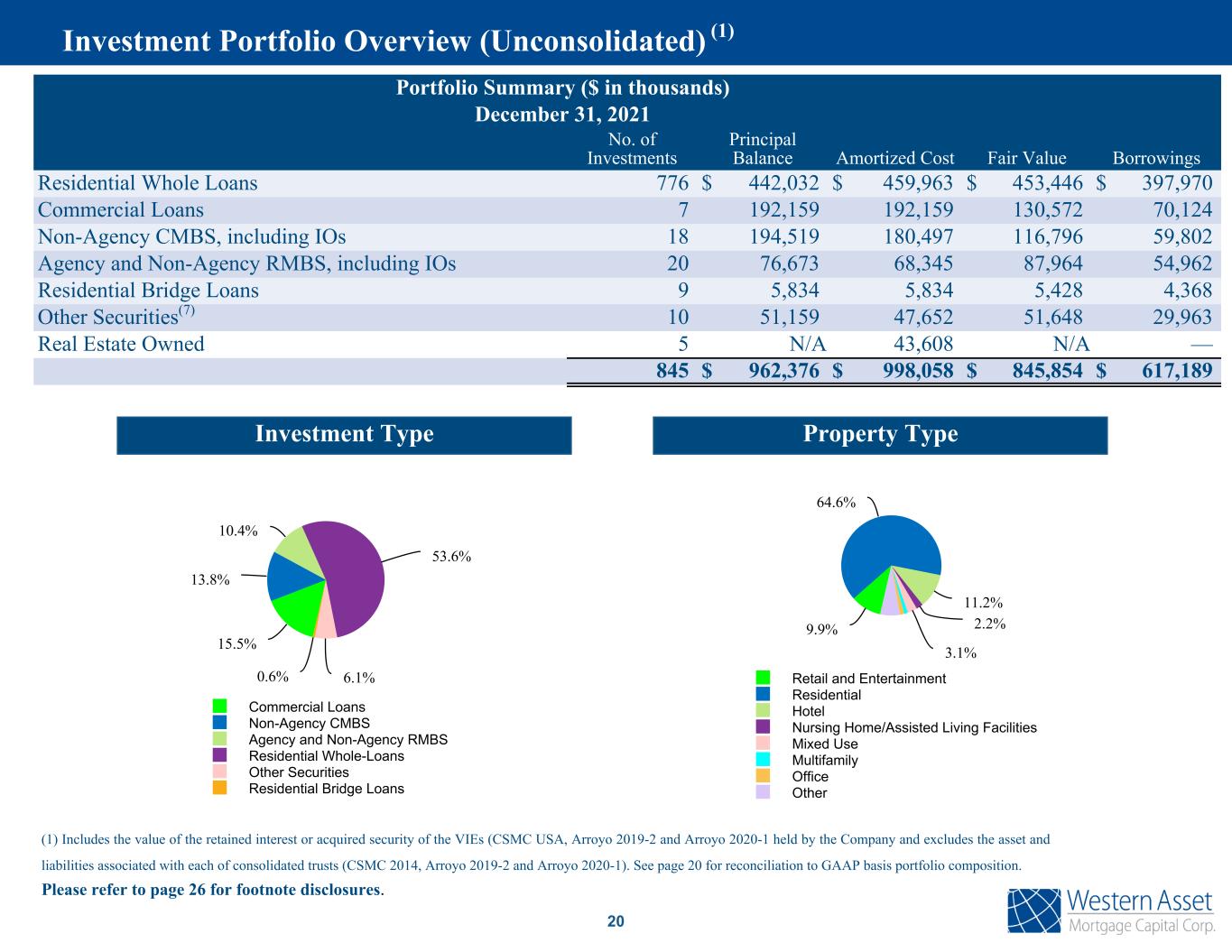

Investment Type 15.5% 13.8% 10.4% 53.6% 6.1%0.6% Commercial Loans Non-Agency CMBS Agency and Non-Agency RMBS Residential Whole-Loans Other Securities Residential Bridge Loans Portfolio Summary ($ in thousands) December 31, 2021 No. of Investments Principal Balance Amortized Cost Fair Value Borrowings Residential Whole Loans 776 $ 442,032 $ 459,963 $ 453,446 $ 397,970 Commercial Loans 7 192,159 192,159 130,572 70,124 Non-Agency CMBS, including IOs 18 194,519 180,497 116,796 59,802 Agency and Non-Agency RMBS, including IOs 20 76,673 68,345 87,964 54,962 Residential Bridge Loans 9 5,834 5,834 5,428 4,368 Other Securities(7) 10 51,159 47,652 51,648 29,963 Real Estate Owned 5 N/A 43,608 N/A — 845 $ 962,376 $ 998,058 $ 845,854 $ 617,189 Property Type 9.9% 64.6% 11.2% 2.2% 3.1% Retail and Entertainment Residential Hotel Nursing Home/Assisted Living Facilities Mixed Use Multifamily Office Other (1) Includes the value of the retained interest or acquired security of the VIEs (CSMC USA, Arroyo 2019-2 and Arroyo 2020-1 held by the Company and excludes the asset and liabilities associated with each of consolidated trusts (CSMC 2014, Arroyo 2019-2 and Arroyo 2020-1). See page 20 for reconciliation to GAAP basis portfolio composition. 20 Investment Portfolio Overview (Unconsolidated) (1) Please refer to page 26 for footnote disclosures.

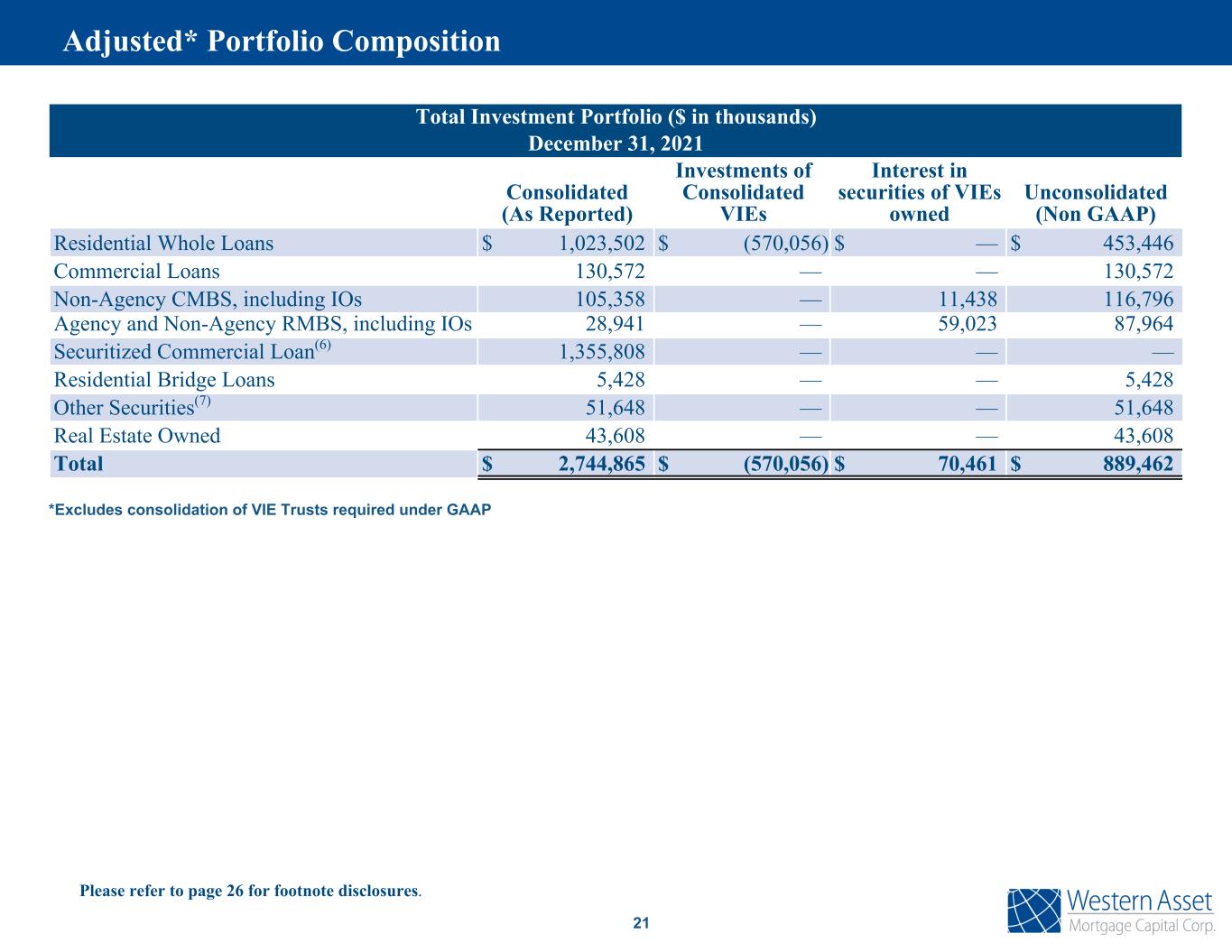

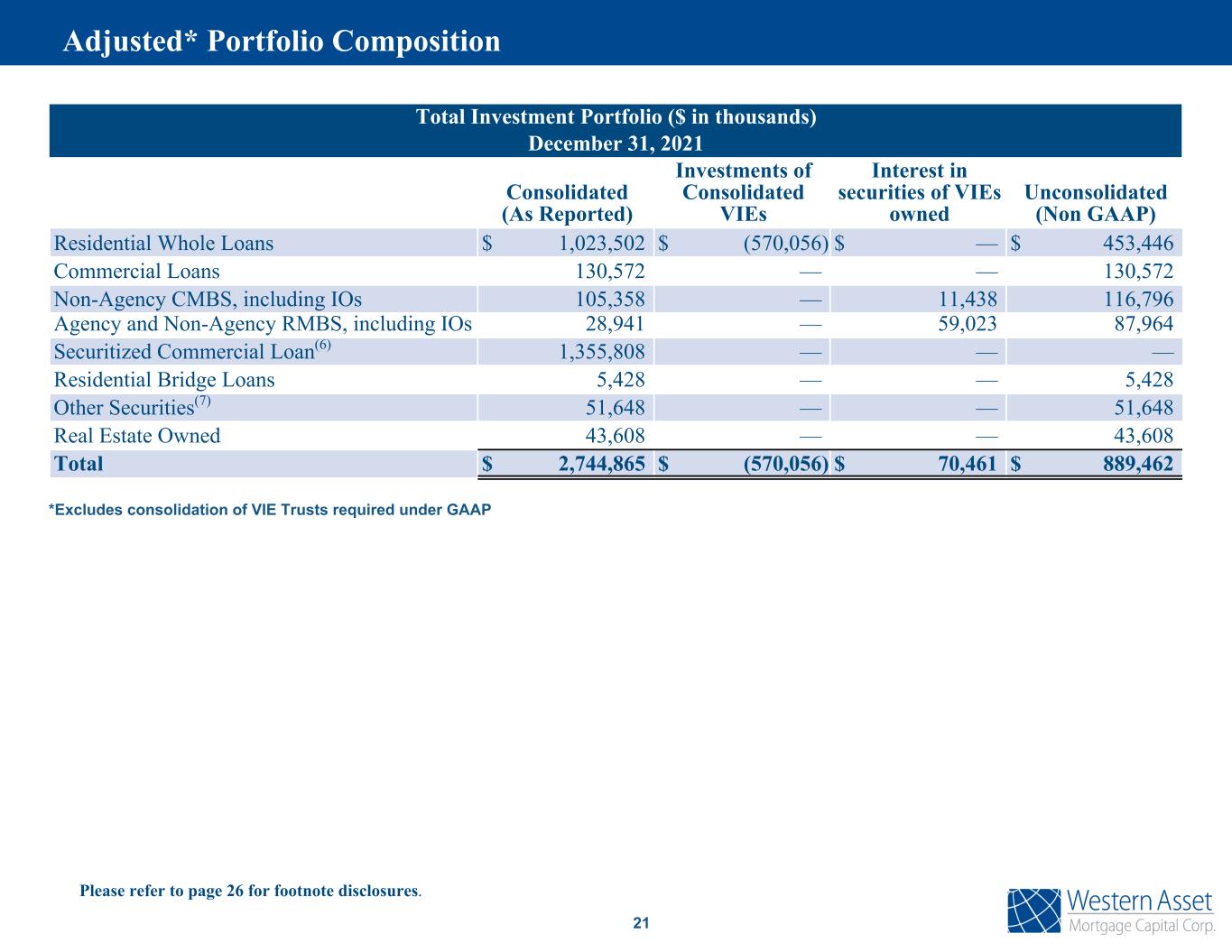

21 *Excludes consolidation of VIE Trusts required under GAAP Please refer to page 26 for footnote disclosures. Total Investment Portfolio ($ in thousands) December 31, 2021 Consolidated (As Reported) Investments of Consolidated VIEs Interest in securities of VIEs owned Unconsolidated (Non GAAP) Residential Whole Loans $ 1,023,502 $ (570,056) $ — $ 453,446 Commercial Loans 130,572 — — 130,572 Non-Agency CMBS, including IOs 105,358 — 11,438 116,796 Agency and Non-Agency RMBS, including IOs 28,941 — 59,023 87,964 Securitized Commercial Loan(6) 1,355,808 — — — Residential Bridge Loans 5,428 — — 5,428 Other Securities(7) 51,648 — — 51,648 Real Estate Owned 43,608 — — 43,608 Total $ 2,744,865 $ (570,056) $ 70,461 $ 889,462 Adjusted* Portfolio Composition

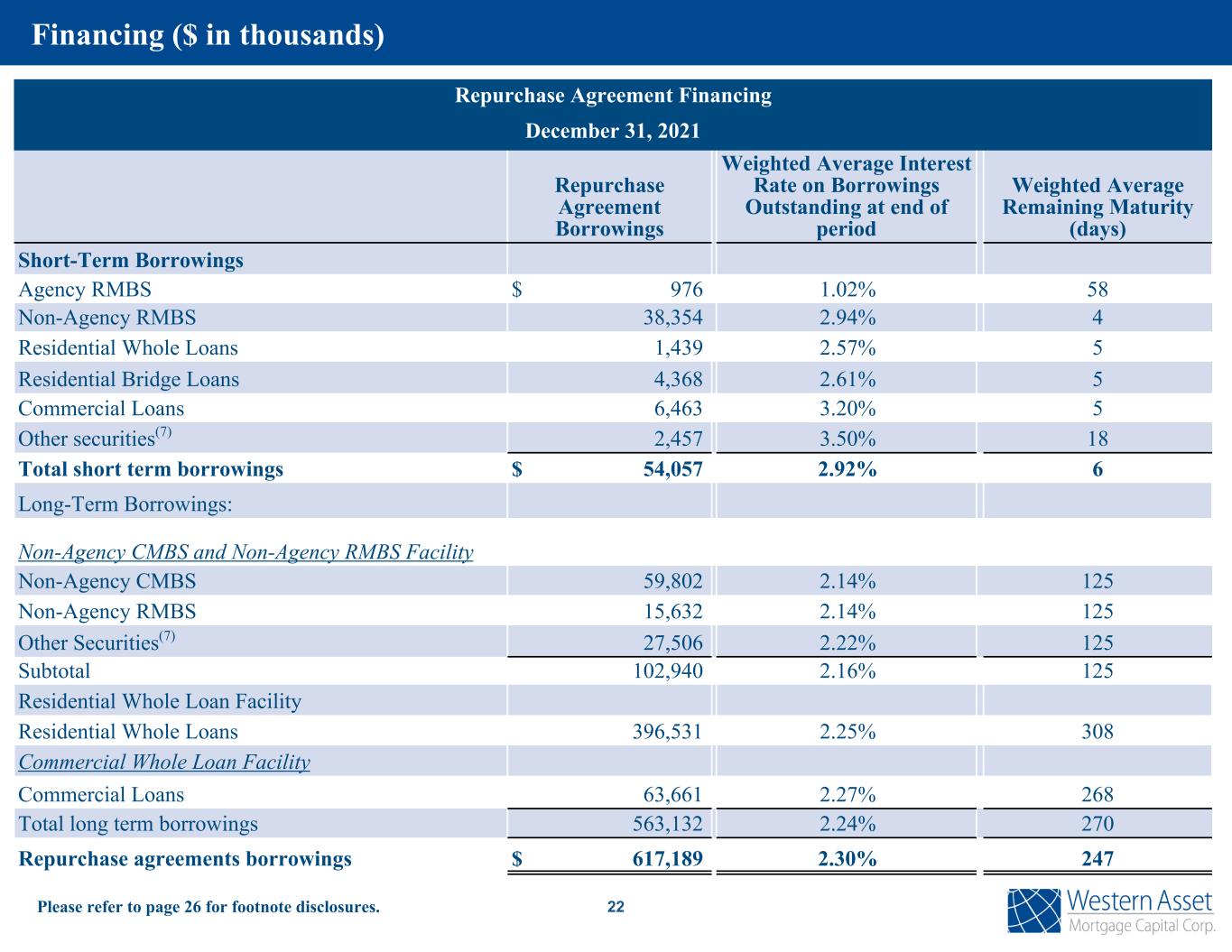

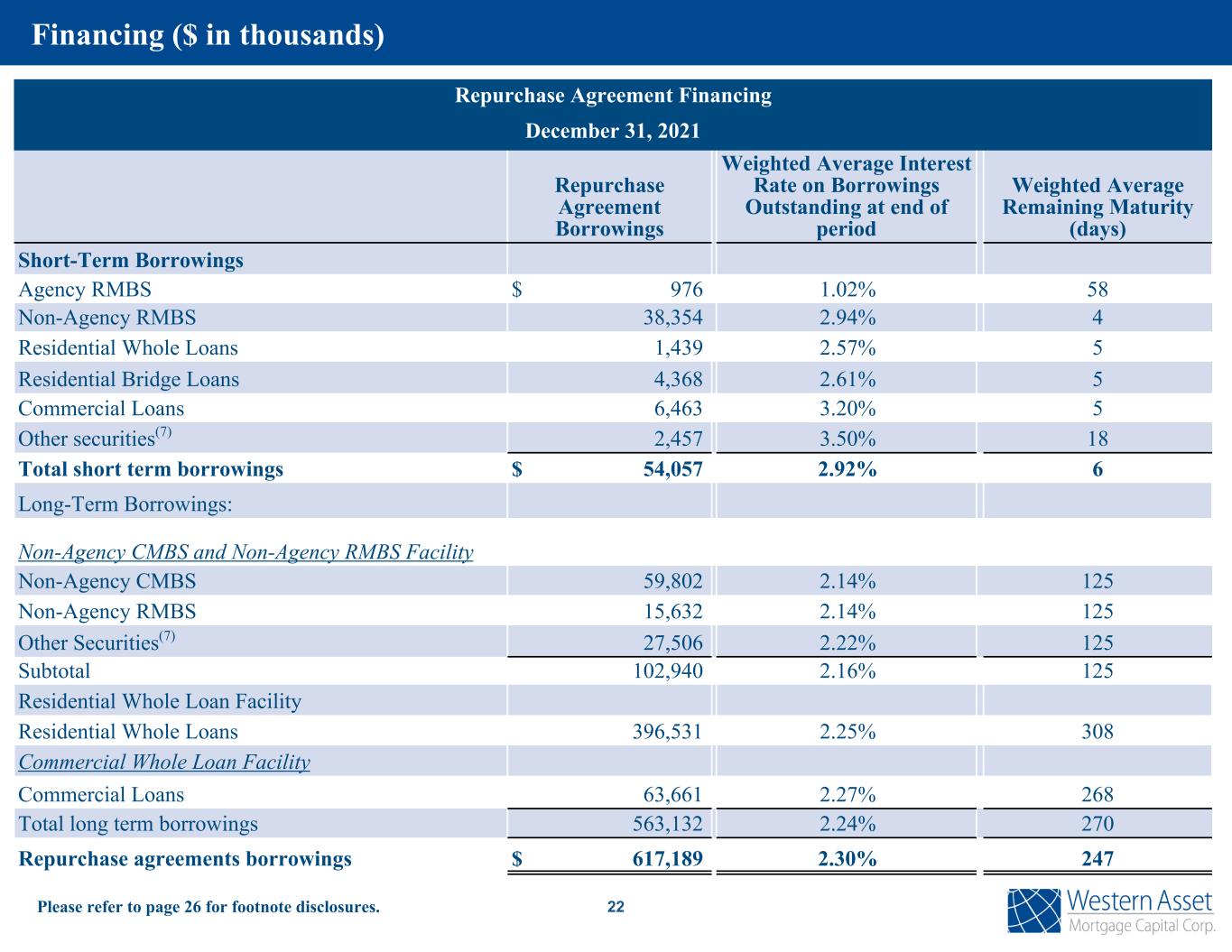

Repurchase Agreement Financing December 31, 2021 Repurchase Agreement Borrowings Weighted Average Interest Rate on Borrowings Outstanding at end of period Weighted Average Remaining Maturity (days) Short-Term Borrowings Agency RMBS $ 976 1.02% 58 Non-Agency RMBS 38,354 2.94% 4 Residential Whole Loans 1,439 2.57% 5 Residential Bridge Loans 4,368 2.61% 5 Commercial Loans 6,463 3.20% 5 Other securities(7) 2,457 3.50% 18 Total short term borrowings $ 54,057 2.92% 6 Long-Term Borrowings: Non-Agency CMBS and Non-Agency RMBS Facility Non-Agency CMBS 59,802 2.14% 125 Non-Agency RMBS 15,632 2.14% 125 Other Securities(7) 27,506 2.22% 125 Subtotal 102,940 2.16% 125 Residential Whole Loan Facility Residential Whole Loans 396,531 2.25% 308 Commercial Whole Loan Facility Commercial Loans 63,661 2.27% 268 Total long term borrowings 563,132 2.24% 270 Repurchase agreements borrowings $ 617,189 2.30% 247 22Please refer to page 26 for footnote disclosures. Financing ($ in thousands)

Long-Term Financing Facilities Residential Whole Loan Financing Facility • On November 5, 2021, the Company entered into an amendment of its Residential Whole Loan Facility. The amended facility has a stated capacity of $500 million and bears an interest rate of one-month LIBOR plus 2.00%, with a LIBOR floor of 0.25%. The facility is available to finance five types of residential mortgages: Non-Agency mortgage loans, Non-QM loans, investor loans, re-performing, and non- performing loans. The advance rates differ by type of loan, but for performing Non-QM loans, the advance rate is 90% of the outstanding principal amount. The facility matures on November 4, 2022. The facility is a mark-to- market margin facility; however, the margin requirement is only triggered if the fair value of the collateral declines to the outstanding principal amount. • As of December 31, 2021, approximately $451.7 million in non QM loans remained in the facility. The outstanding borrowing under this facility was $396.5 million as of December 31, 2021. Commercial Whole Loan Facility • As of December 31, 2021, the company had approximately $63.7 million in borrowings, with a weighted average interest rate of 2.27% under its commercial whole loan facility. The borrowing is secured by loans with an estimated fair market value of $87.1 million. The facility has a term of 12-months and matures in May 2022 and has a 12-month extension option, subject to the lender's consent. Non-Agency CMBS and Non-Agency RMBS Facility • As of December 31, 2021, the outstanding balance under this facility was $102.9 million. The borrowing is secured by investments with a fair market value of $181.0 million as of December 31, 2021. Convertible Senior Unsecured Notes • During fourth quarter of 2021, the Company repurchased $8.0 million aggregate principal amount of its 2022 Notes at a 1% premium to par value. • As of December 31, 2021, the Company had $86.3 million aggregate principal amount outstanding of 6.75% convertible senior unsecured note due in 2024. • As of December 31, 2021, the the Company had $37.7 million aggregate principal amount outstanding of 6.75% convertible senior unsecured notes due in 2022. 23 Financing (Continued)

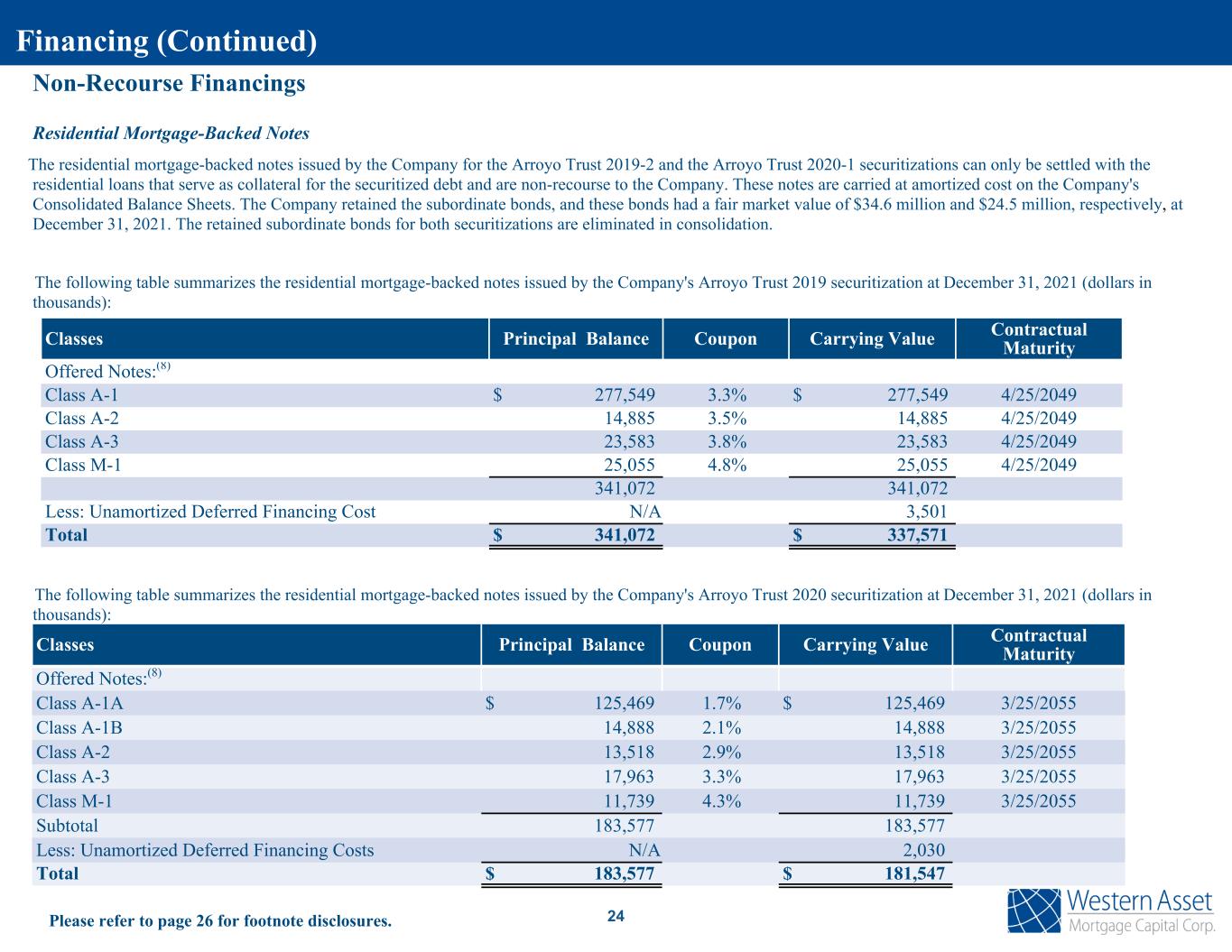

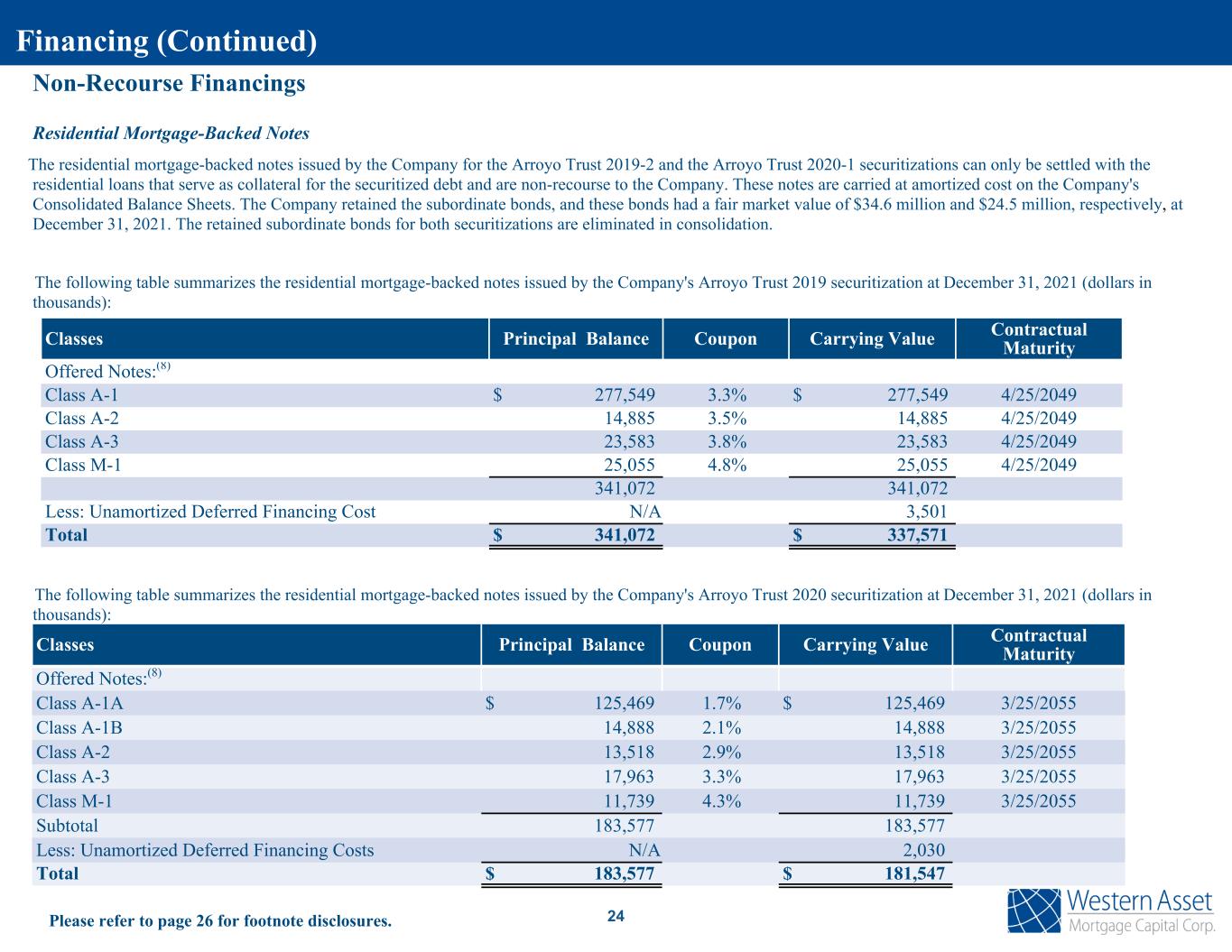

Non-Recourse Financings Residential Mortgage-Backed Notes The residential mortgage-backed notes issued by the Company for the Arroyo Trust 2019-2 and the Arroyo Trust 2020-1 securitizations can only be settled with the residential loans that serve as collateral for the securitized debt and are non-recourse to the Company. These notes are carried at amortized cost on the Company's Consolidated Balance Sheets. The Company retained the subordinate bonds, and these bonds had a fair market value of $34.6 million and $24.5 million, respectively, at December 31, 2021. The retained subordinate bonds for both securitizations are eliminated in consolidation. The following table summarizes the residential mortgage-backed notes issued by the Company's Arroyo Trust 2019 securitization at December 31, 2021 (dollars in thousands): The following table summarizes the residential mortgage-backed notes issued by the Company's Arroyo Trust 2020 securitization at December 31, 2021 (dollars in thousands): 24Please refer to page 26 for footnote disclosures. Classes Principal Balance Coupon Carrying Value Contractual Maturity Offered Notes:(8) Class A-1 $ 277,549 3.3% $ 277,549 4/25/2049 Class A-2 14,885 3.5% 14,885 4/25/2049 Class A-3 23,583 3.8% 23,583 4/25/2049 Class M-1 25,055 4.8% 25,055 4/25/2049 341,072 341,072 Less: Unamortized Deferred Financing Cost N/A 3,501 Total $ 341,072 $ 337,571 Classes Principal Balance Coupon Carrying Value Contractual Maturity Offered Notes:(8) Class A-1A $ 125,469 1.7% $ 125,469 3/25/2055 Class A-1B 14,888 2.1% 14,888 3/25/2055 Class A-2 13,518 2.9% 13,518 3/25/2055 Class A-3 17,963 3.3% 17,963 3/25/2055 Class M-1 11,739 4.3% 11,739 3/25/2055 Subtotal 183,577 183,577 Less: Unamortized Deferred Financing Costs N/A 2,030 Total $ 183,577 $ 181,547 Financing (Continued)

25 Commercial Mortgage backed Notes As of December 31, 2021, the Company had one consolidated commercial mortgage-backed variable interest entities that had an aggregate securitized debt balance of $1.3 billion. The securitized debt of the trust can only be settled with the collateral held by the trust and is non-recourse to the Company. The Company holds an interest in a subordinate bond in CMSC 2014 USA securitzation and this bond had a fair market $11.4 million at December 31, 2021. The retained subordinate bond is not reflected in the below tables because is is eliminated in consolidation. The following table summarizes CSMC 2014 USA's commercial mortgage pass-through certificates at December 31, 2021 (dollars in thousands): Classes Principal Balance Coupon Carrying Value Contractual Maturity Class A-1 $ 120,391 3.3% $ 124,143 9/11/2025 Class A-2 531,700 4.0% 559,447 9/11/2025 Class B 136,400 4.2% 133,776 9/11/2025 Class C 94,500 4.3% 91,460 9/11/2025 Class D 153,950 4.4% 142,388 9/11/2025 Class E 180,150 4.4% 160,325 9/11/2025 Class F 153,600 4.4% 117,912 9/11/2025 Class X-1 (Interest Only) n/a 0.7% 12,347 9/11/2025 Class X-2 (Interest Only) n/a 0.2% 2,572 9/11/2025 $ 1,370,691 $ 1,344,370 Financing (Continued)

26 (1) As of December 31, 2021. (2) Distributable Earnings is a non-GAAP financial measure that is used by us to approximate cash yield or income associated with our portfolio and is defined as GAAP net income (loss) as adjusted, excluding, net realized gain (loss) on investments and termination of derivative contracts, net unrealized gain (loss) on investments and debt, net unrealized gain (loss) resulting from mark-to-market adjustments on derivative contracts, provision for income taxes, non-cash stock- based compensation expense, non-cash amortization of the convertible senior unsecured notes discount, one-time charges such as acquisition costs and impairment on loans and one-time events pursuant to changes in GAAP and certain other non-cash charges after discussions between us, our Manager and our Independent Directors and after approval by a majority of our independent directors. (3) Economic return, for any period, is calculated by taking the sum of (i) the total dividends declared and (ii) the change in net book value during the period and dividing by the beginning book value. (4) Non-GAAP measures which include interest income, interest expense, the cost of interest rate swaps and interest income on IOs and IIOs classified as derivatives, and are weighted averages for the period. Excludes the net income from the consolidation of VIE Trusts required under GAAP. (5) Economic book value is a non-GAAP financial measure of our financial position on an unconsolidated basis. The Company owns certain securities that represent a controlling variable interest, which under GAAP requires consolidation; however, the Company's economic exposure to these variable interests is limited to the fair value of the individual investments. Economic book value is calculated by taking the GAAP book value and 1) adding the fair value of the retained interest or acquired security of the VIEs held by the Company and 2) the removing the asset and liabilities associated with each of consolidated trusts ( CSMC 2014 USA, Arroyo 2019-2 and Arroyo 2020-1). Management considers that Economic book value provides investors with a useful supplemental measure to evaluate our financial position as it reflects the actual financial interest of these investments irrespective of the variable interest consolidation model applied for GAAP reporting purposes. Economic book value does not represent and should not be considered as a substitute for Stockholders' Equity, as determined in accordance with GAAP, and our calculation of this measure may not be comparable to similarly titled measures reported by other companies. (6) At December 31, 2021, the Company held a $11.4 million Non-Agency CMBS security which resulted in the consolidation of a variable interest entity. The Securitized Commercial loan value represents the estimate fair market value of collateral within the variable interest entity. (7) At December 31, 2021 Other Securities include GSE Credit Risk Transfer securities with an estimated fair value of $45.6 million and student loans ABS with a fair value of $6.1 million. (8) The subordinate notes were retained by the Company. (9) Non-GAAP measure which includes net interest margin (as defined in footnote 4) and realized and unrealized gains or losses in the portfolio. (10) Non-GAAP measure which includes interest income on IO's and IIO's accounted for as derivatives and other income. (11) Includes miscellaneous fees and interest on cash investments. (12) Non-GAAP measure which includes net unrealized losses on IO's and IIO's accounted for as derivatives. (13) The original FICO score is not available for 230 loans with a principal balance of approximately $74.3 million at December 31, 2021. The Company has excluded these loans from the weighted average computations. Footnotes

27 Supplemental Information

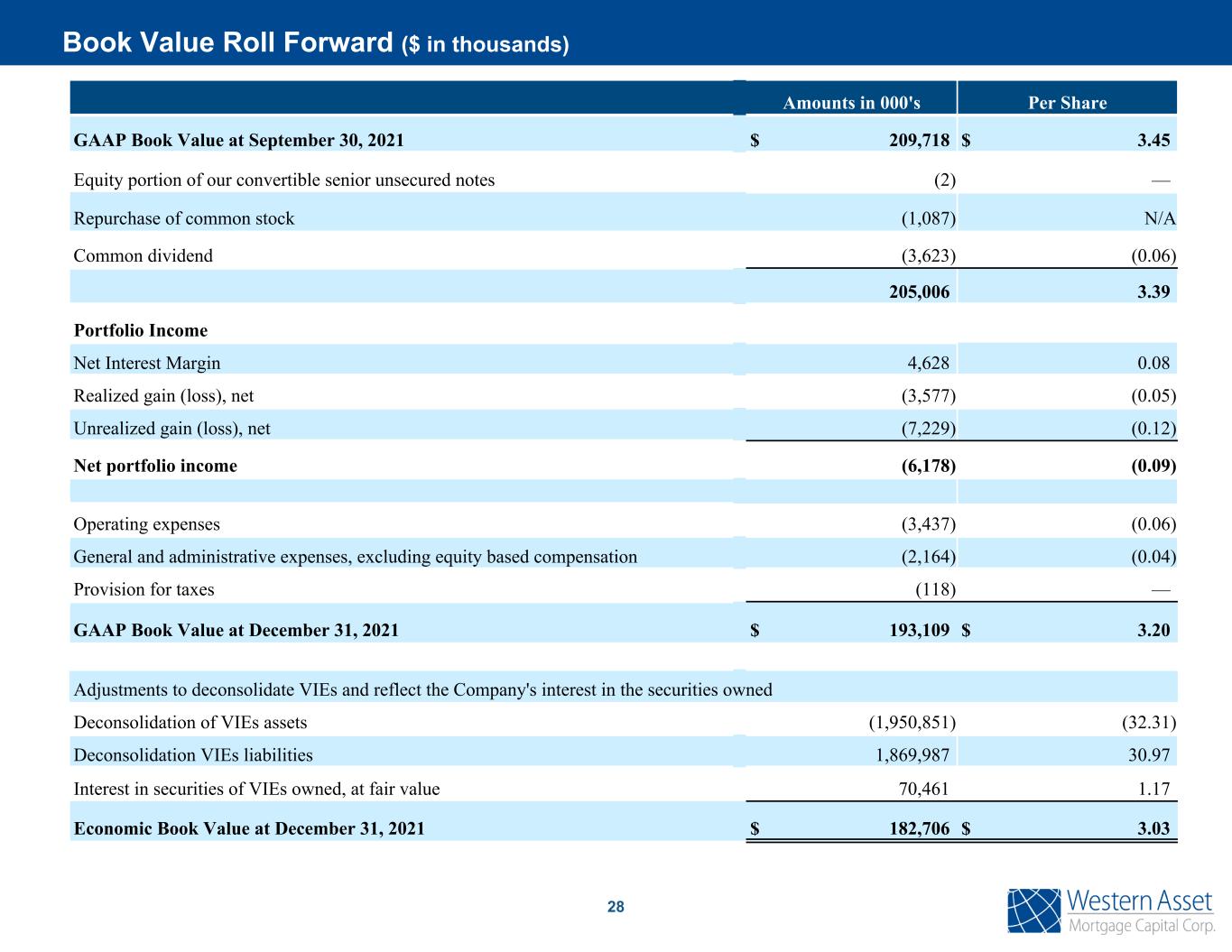

28 Book Value Roll Forward ($ in thousands) Amounts in 000's Per Share GAAP Book Value at September 30, 2021 $ 209,718 $ 3.45 Equity portion of our convertible senior unsecured notes (2) — Repurchase of common stock (1,087) N/A Common dividend (3,623) (0.06) 205,006 3.39 Portfolio Income Net Interest Margin 4,628 0.08 Realized gain (loss), net (3,577) (0.05) Unrealized gain (loss), net (7,229) (0.12) Net portfolio income (6,178) (0.09) Operating expenses (3,437) (0.06) General and administrative expenses, excluding equity based compensation (2,164) (0.04) Provision for taxes (118) — GAAP Book Value at December 31, 2021 $ 193,109 $ 3.20 Adjustments to deconsolidate VIEs and reflect the Company's interest in the securities owned Deconsolidation of VIEs assets (1,950,851) (32.31) Deconsolidation VIEs liabilities 1,869,987 30.97 Interest in securities of VIEs owned, at fair value 70,461 1.17 Economic Book Value at December 31, 2021 $ 182,706 $ 3.03

Western Asset Mortgage Capital Corporation c/o Financial Profiles, Inc. 11601 Wilshire Blvd., Suite 1920 Los Angeles, CA 90025 www.westernassetmcc.com Investor Relations Contact: Larry Clark Tel: (310) 622-8223 lclark@finprofiles.com Contact Information