U.S. Bank Global Fund Services, LLC

Semi-Annual Report

March 31, 2020

ETFMG Prime Junior Silver Miners ETF

ETFMG Prime Cyber Security ETF

ETFMG Prime Mobile Payments ETF

ETFMG Sit Ultra Short ETF

ETFMG Travel Tech ETF

Beginning on January 1, 2021, as permitted by regulations adopted by the SEC, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the Fund’s reports from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. Please contact your financial intermediary to elect to receive shareholder reports and other Fund communications electronically.

You may elect to receive all future Fund reports in paper free of charge. Please contact your financial intermediary to inform them that you wish to continue receiving paper copies of Fund shareholder reports and for details about whether your election to receive reports in paper will apply to all funds held with your financial intermediary.

The funds are a series of ETF Managers Trust.

Page Intentionally Left Blank

ETFMG™ ETFs

TABLE OF CONTENTS

March 31, 2020 (Unaudited)

ETFMG™ ETFs

Dear Shareholder,

On behalf of the entire team, we want to express our appreciation for the confidence you have placed in these ETFs. The following information pertains to the fiscal period from October 1, 2019 to March 31, 2020.

Performance Overview

During the 6-month period ended March 31, 2020, the S&P 500 Information Technology Sector Index, a broad measure of US listed technology companies, returned 0.07%. During the same period, the S&P Global 1200 Information Technology Sector Index, a broad measure of global technology companies, returned -0.74%. Below is a performance overview for each Fund for the same 6-month period, except as noted otherwise.

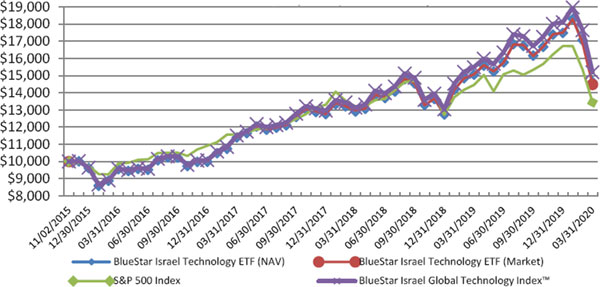

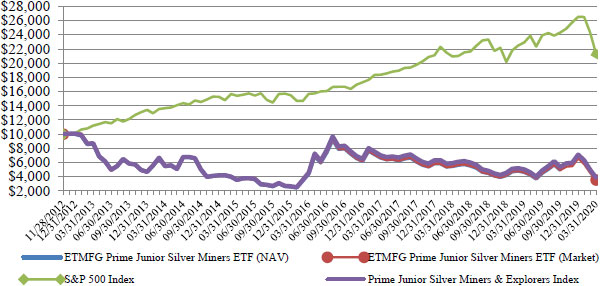

ETFMG Prime Junior Silver Miners ETF (SILJ)

The ETFMG Prime Junior Silver Miners ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Prime Junior Silver Miners & Explorers Index (the “Index”).

Over the period, the total return for the Fund was -27.66%, while the total return for the Index was -28.04%. The worst performers in the Fund on the basis of contribution to return were Hochschild Mining, First Majestic Silver, and Hecla Mining.

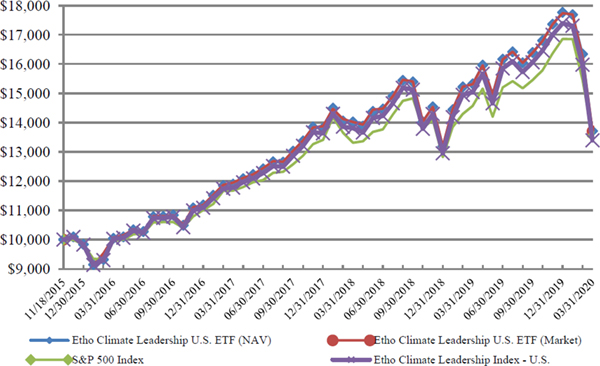

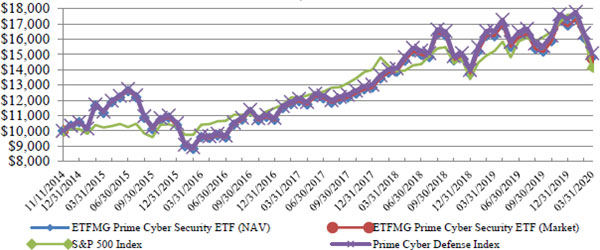

ETFMG Prime Cyber Security ETF (HACK)

The ETFMG Prime Cyber Security ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Prime Cyber Defense Index (the “Index”).

Over the period, the total return for the Fund was -2.44%, while the total return for the Index was -2.98%. The best performers in the Fund on the basis of contribution to return were Sophos Group, Carbonite, and Fortinet, while the worst performers were Tufin Software Technologies, Cisco Systems, and Fingerprint Cards.

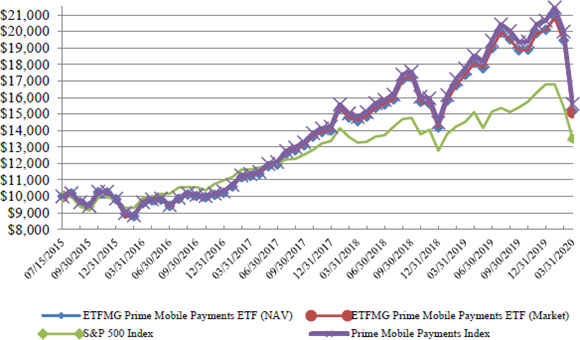

ETFMG Prime Mobile Payments ETF (IPAY)

The ETFMG Prime Mobile Payments ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Prime Mobile Payments Index (the “Index”).

Over the period, the total return for the Fund was -19.65%, while the total return for the Index was -19.33%. The best performers in the Fund on the basis of contribution to return were Adyen, Nexi Spa, and GMO Payment Gateway, while the worst performers were PagSeguro Digital, Discover Financial Services, and American Express.

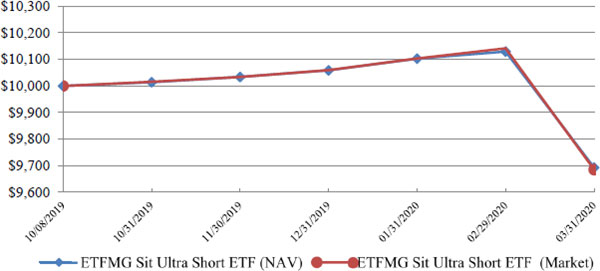

ETFMG Sit Ultra Short ETF (VALT)

The following information pertains to the fiscal period from the Fund’s inception, October 8, 2019 to March 31, 2020.

The ETFMG Sit Ultra Short ETF (the “Fund”) is an actively managed exchange-traded fund (“ETF”) that seeks maximum current income, consistent with preservation of capital and daily liquidity.

Over the fiscal period, the total return for the Fund was -3.07%, while the total return for its benchmark, the Bloomberg Barclays U.S. Treasury Bills Index: 1-3 month Index, was 0.91%.

The Fund seeks to achieve its investment objective by investing in a diversified portfolio of high-quality, short-term U.S. dollar-denominated domestic and foreign debt securities and other instruments. The Fund uses the Bloomberg Barclays U.S. Treasury Bills Index: 1-3-month Index as its benchmark index. The Fund seeks to maintain an average effective duration within a range of 2 months to 1 year.

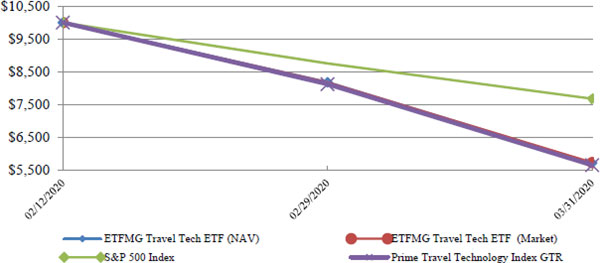

ETFMG Travel Tech ETF (AWAY)

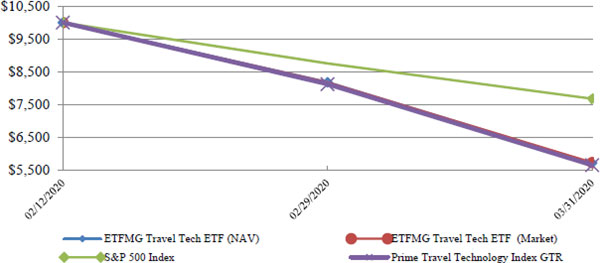

The following information pertains to the fiscal period from the Fund’s inception, February 12, 2020 to March 31, 2020.

The ETFMG Travel Tech ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Prime Travel Technology Index NTR (the “Index”).

Over the fiscal period, the total return for the Fund was -42.91%, while the total return the Index, was -43.59%. The best performers in the Fund on the basis of contribution to return were Lotte Tour Development and Hana Tour Service, while the worst performers were Webjet, Expedia Group, and Despegar.com.

In late February, as COVID-19, the disease caused by the coronavirus, spread into regions beyond China, global stock markets began to experience significant declines and turbulence. As we write this letter in late April, the course of the coronavirus outbreak remains uncertain, and markets are likely to remain volatile in response to any news or government action concerning the virus. While markets continue working to assess the economic impact of the virus and the public health measures taken in response, it is still unclear what the costs will be and how long the effects will last, but history has shown that markets recover from downturns. For investors, we believe the most important course of action is to remain focused on your long-term goals, and to consult with your financial advisor.

You can find further details about SILJ, HACK, IPAY, VALT and AWAY by visiting www.etfmgfunds.com, or by calling 1-844-383-6477.

Sincerely,

Samuel Masucci III

Chairman of the Board

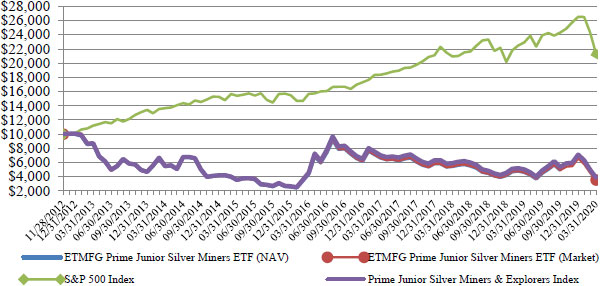

ETFMG Prime Junior Silver Miners ETF

Growth of $10,000 (Unaudited)

Average Annual Returns

Period Ended March 31, 2020 | | 1 Year

Return | | 5 Year

Return | | Since Inception

(11/28/12) | | Value of $10,000

(3/31/20) |

| ETFMG Prime Junior Silver Miners ETF (NAV) | | -23.01% | | 0.30% | | -13.05% | | $3,583 |

| ETFMG Prime Junior Silver Miners ETF (Market) | | -23.58% | | -0.08% | | -13.22% | | $3,534 |

| S&P 500 Index | | -6.98% | | 6.73% | | 10.88% | | $21,329 |

| Prime Junior Silver Miners & Explorers Index | | -23.25% | | 1.66% | | -12.18% | | $3,856 |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. All performance is historical and includes reinvestment of dividends and capital gains. Performance data current to the most recent month end may be obtained by calling 1-844-ETF-MGRS (1-844-383-6477).

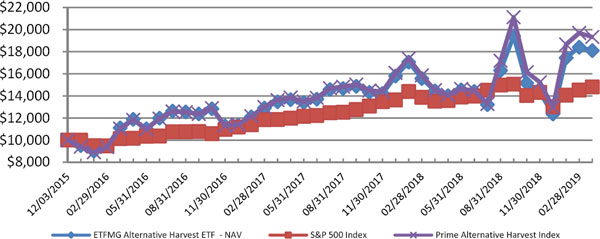

The chart illustrates the performance of a hypothetical $10,000 investment made on November 28, 2012, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions from the sale of Fund shares. The chart assumes reinvestment of capital gains and dividends, if any. The index returns do not reflect fees or expenses and are not available for direct investment.

ETFMG Prime Junior Silver Miners ETF

Top Ten Holdings as of March 31, 2020* (Unaudited)

| | | | Security | | | % of Total Investments |

| 1 | | Pan American Silver Corp. | | 13.41% |

| 2 | | Hecla Mining Co. | | 11.15% |

| 3 | | First Majestic Silver Corp. | | 11.07% |

| 4 | | Coeur Mining, Inc. | | 8.86% |

| 5 | | SilverCrest Metals, Inc. | | 4.70% |

| 6 | | Hochschild Mining PLC | | 4.56% |

| 7 | | MAG Silver Corp. | | 4.28% |

| 8 | | Silvercorp Metals, Inc. | | 4.10% |

| 9 | | SSR Mining, Inc. | | 4.10% |

| 10 | | Yamana Gold, Inc. | | 3.83% |

Top Ten Holdings = 70.06% of Total Investments

* Current portfolio holdings may not be indicative of future fund holdings.

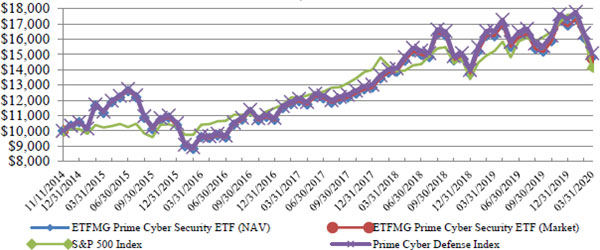

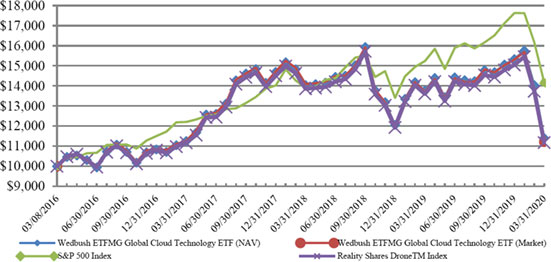

ETFMG Prime Cyber Security ETF

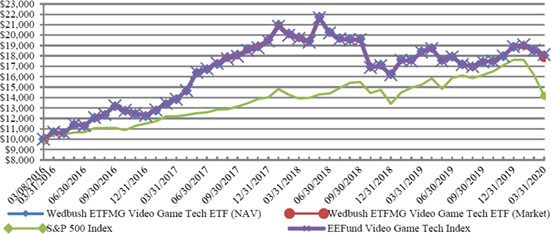

Growth of $10,000 (Unaudited)

Average Annual Returns

Period Ended March 31, 2020 | | 1 Year

Return | | 5 Year

Return | | Since

Inception

(11/11/14) | | Value of

$10,000

(3/31/20) |

| ETFMG Prime Cyber Security ETF (NAV) | | -8.52% | | 5.81% | | 7.59% | | $14,824 |

| ETFMG Prime Cyber Security ETF (Market) | | -9.04% | | 5.69% | | 7.49% | | $14,752 |

| S&P 500 Index | | -6.98% | | 6.73% | | 6.67% | | $14,154 |

| Prime Cyber Defense Index | | -8.78% | | 6.01% | | 7.93% | | $15,077 |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. All performance is historical and includes reinvestment of dividends and capital gains. Performance data current to the most recent month end may be obtained by calling 1-844-ETF-MGRS (1-844-383-6477).

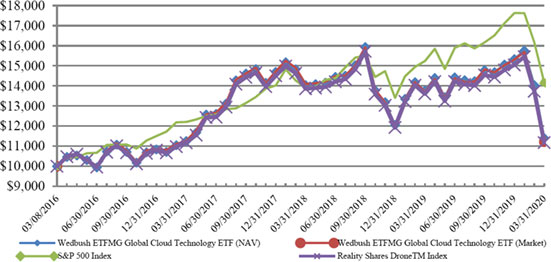

The chart illustrates the performance of a hypothetical $10,000 investment made on November 11, 2014, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions from the sales of Fund shares. The chart assumes reinvestment of capital gains and dividends. The chart assumes reinvestment of capital gains and dividends, if any. The Index Returns do not reflect fees or expenses and are not available for direct investment.

ETFMG Prime Cyber Security ETF

Top Ten Holdings as of March 31, 2020* (Unaudited)

| | | | Security | | | % of Total Investments |

| 1 | | CloudFlare, Inc. | | 3.35% |

| 2 | | ETFMG Sit Ultra Short ETF | | 3.31% |

| 3 | | Cisco Systems, Inc. | | 3.17% |

| 4 | | Akamai Technologies, Inc. | | 2.87% |

| 5 | | Qualys, Inc. | | 2.62% |

| 6 | | Splunk, Inc. | | 2.60% |

| 7 | | Fortinet, Inc. | | 2.56% |

| 8 | | Trend Micro, Inc. | | 2.41% |

| 9 | | Ping Identity Holding Corp. | | 2.37% |

| 10 | | Proofpoint, Inc. | | 2.35% |

Top Ten Holdings = 27.61% of Total Investments

* Current portfolio holdings may not be indicative of future Fund holdings.

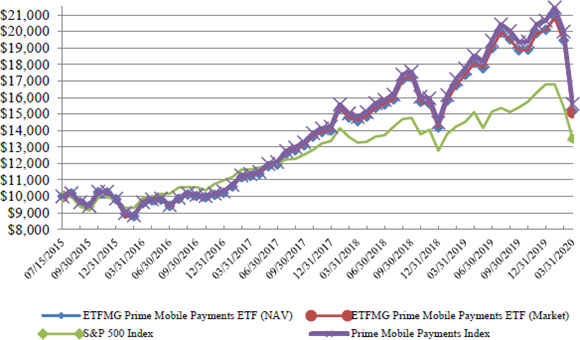

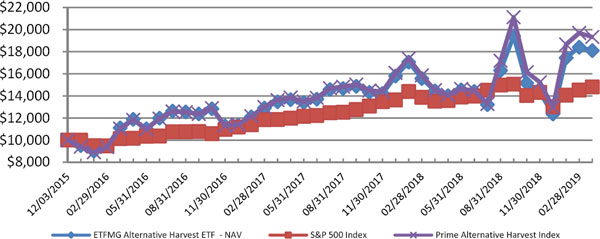

ETFMG Prime Mobile Payments ETF

Growth of $10,000 (Unaudited)

Average Annual Returns

Period Ended March 31, 2020 | | 1 Year

Return | | Since

Inception

(7/15/15) | | Value of

$10,000

(3/31/20) |

| ETFMG Prime Mobile Payments ETF (NAV) | | -12.73% | | 9.23% | | $15,161 |

| ETFMG Prime Mobile Payments ETF (Market) | | -13.22% | | 9.13% | | $15,092 |

| S&P 500 Index | | -6.98% | | 6.59% | | $13,509 |

| Prime Mobile Payments Index | | -12.08% | | 9.91% | | $15,611 |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. All performance is historical and includes reinvestment of dividends and capital gains. Performance data current to the most recent month end may be obtained by calling 1-844-ETF-MGRS (1-844-383-6477).

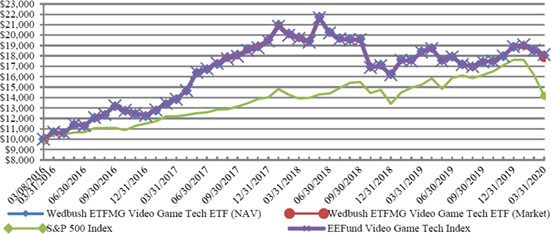

The chart illustrates the performance of a hypothetical $10,000 investment made on July 15, 2015, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions from the sales of Fund shares. The chart assumes reinvestment of capital gains and dividends. The chart assumes reinvestment of capital gains and dividends, if any. The Index Returns do not reflect fees or expenses and are not available for direct investment.

ETFMG Prime Mobile Payments ETF

Top Ten Holdings as of March 31, 2020* (Unaudited)

| | | | Security | | | % of Total Investments |

| 1 | | PayPal Holdings, Inc. | | 5.73% |

| 2 | | Fidelity National Information Services, Inc. | | 5.67% |

| 3 | | Visa, Inc. | | 5.60% |

| 4 | | MasterCard, Inc. | | 5.25% |

| 5 | | Fiserv, Inc. | | 5.24% |

| 6 | | Global Payments, Inc. | | 4.95% |

| 7 | | ETFMG Sit Ultra Short ETF | | 4.94% |

| 8 | | American Express Co. | | 4.42% |

| 9 | | Adyen N.V. | | 4.10% |

| 10 | | Square, Inc. | | 3.32% |

| | | | | |

Top Ten Holdings= 49.22% of Total Investments

* Current Fund holdings may not be indicative of future Fund holdings.

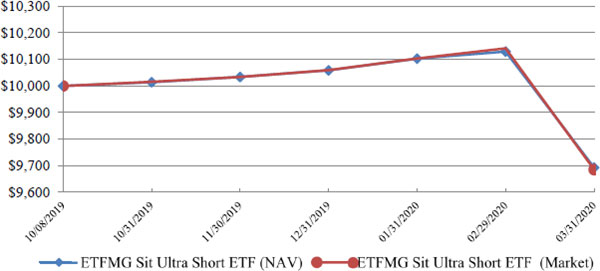

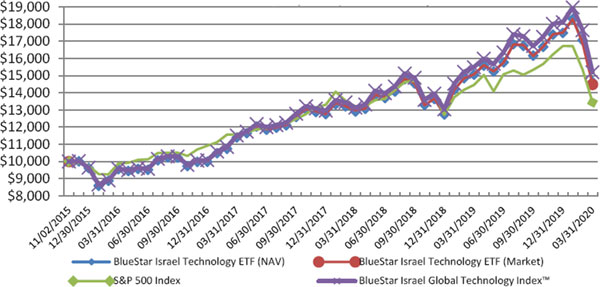

ETFMG Sit Ultra Short ETF

Growth of $10,000 (Unaudited)

Average Annual Returns

Period Ended March 31, 2020 | | Since Inception

(10/8/2019) | | Value of $10,000

(3/31/20) |

| ETFMG Sit Ultra Short ETF (NAV) | | -3.07% | | $9,693 |

| ETFMG Sit Ultra Short ETF (Market) | | -3.15% | | $9,685 |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. All performance is historical and includes reinvestment of dividends and capital gains. Performance data current to the most recent month end may be obtained by calling 1-844-ETF-MGRS (1-844-383-6477).

The chart illustrates the performance of a hypothetical $10,000 investment made on October 8, 2019, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions from the sales of Fund shares. The chart assumes reinvestment of capital gains and dividends. The chart assumes reinvestment of capital gains and dividends, if any.

ETFMG Sit Ultra Short ETF

Top Ten Holdings as of March 31, 2020* (Unaudited)

| | | | Security | | | % of Total Investments |

| 1 | | Carvana Auto Receivables Trust | | 3.47% |

| 2 | | Albemarle Corp. | | 2.99% |

| 3 | | Hyundai Capital America | | 2.99% |

| 4 | | Westlake Automobile Receivables Trust | | 2.91% |

| 5 | | AbbVie, Inc. | | 2.86% |

| 6 | | HSBC Holdings PLC | | 2.64% |

| 7 | | Arrow Electronics, Inc. | | 2.53% |

| 8 | | Commonwealth Bank of Australia | | 2.49% |

| 9 | | Westpac Banking Corp. | | 2.47% |

| 10 | | Daimler Finance North America LLC | | 2.33% |

Top Ten Holdings =27.68% of Total Investments

* Current Fund holdings may not be indicative of future Fund holdings.

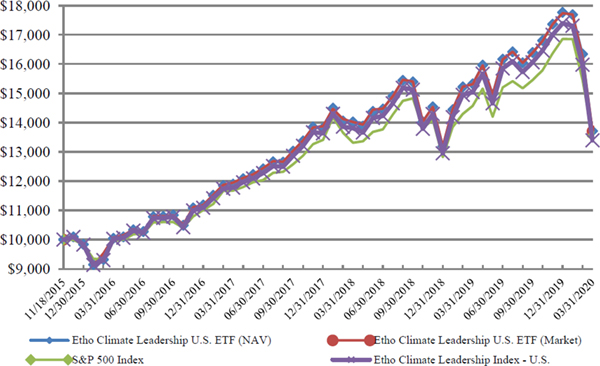

ETFMG Travel Tech ETF

Growth of $10,000 (Unaudited)

| | | | | |

Average Annual Returns

Period Ended March 31, 2020 | | Since Inception

(2/12/2020) | | Value of $10,000

(3/31/20) |

| ETFMG Travel Tech ETF (NAV) | | -42.91% | | $5,709 |

| ETFMG Travel Tech ETF (Market) | | -42.80% | | $5,720 |

| S&P 500 Index | | -23.28% | | $7,672 |

| Prime Travel Technology Index GTR | | -43.59% | | $5,641 |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. All performance is historical and includes reinvestment of dividends and capital gains. Performance data current to the most recent month end may be obtained by calling 1-844-ETF-MGRS (1-844-383-6477).

The chart illustrates the performance of a hypothetical $10,000 investment made on February 12, 2020, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions from the sales of Fund shares. The chart assumes reinvestment of capital gains and dividends. The chart assumes reinvestment of capital gains and dividends, if any. The Index Returns do not reflect fees or expenses and are not available for direct investment.

ETFMG Travel Tech ETF

Top Ten Holdings as of March 31, 2020* (Unaudited)

| | | | Security | | | % of Total Investments |

| 1 | | Uber Technologies, Inc. | | 13.25% |

| 2 | | Booking holdings, Inc. | | 9.40% |

| 3 | | Lyft, Inc. | | 7.84% |

| 4 | | Trip.com Group, Ltd. | | 7.21% |

| 5 | | Amadeus IT Group S.A. | | 6.28% |

| 6 | | Trainline PLC | | 5.05% |

| 7 | | Hongcheng-Elong Holdings, Ltd. | | 4.74% |

| 8 | | TravelSky, Ltd. | | 4.51% |

| 9 | | Expedia Group, Inc. | | 4.18% |

| 10 | | TripAdvisor, Inc. | | 4.02% |

Top Ten Holdings = 66.48% of Total Investments

* Current Fund holdings may not be indicative of future Fund holdings.

ETFMG™ ETFs

Important Disclosures and Key Risk Factors

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Narrowly focused investments typically exhibit higher volatility.

Past performance is not indicative of future return. A fund’s performance for very short time periods may not be indicative of future performance.

SILJ

The ETFMG Prime Junior Silver Miners ETF (the “Fund” or the “Junior Silver ETF”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Prime Junior Silver Miners & Explorers Index (the “Index”).

Investments in foreign securities involve political, economic and currency risks, greater volatility and differences in accounting methods. These risks are greater for investments in emerging markets. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual issuer volatility than a diversified fund. Funds that are less diversified across countries or geographic regions are generally riskier than more geographically diversified funds and risks associated with such countries or geographic regions may negatively affect a Fund. Investments in small capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. The ETFMG Prime Junior Silver Miners ETF is subject to risks associated with the worldwide price of silver and the costs of extraction and production. Worldwide silver prices may fluctuate substantially over short periods of time, so the Fund’s share price may be more volatile than other types of economic conditions, tax treatment, government regulation and intervention, and world events in the regions in which the companies operation. Several foreign countries have begun a process of privatizing certain entities and industries. Privatized entities may lose money or be renationalized. The Fund invests in some economies that are heavily dependent upon trading with key partners. Any reduction in this trading may cause an adverse impact on the economy in which the Fund invests. The Fund’s return may not match or achieve a high degree of correlation with the return of the Prime Junior Silver Miners & Explorers Index. To the extent the Fund utilizes a sampling approach, it may experience tracking error to a greater extent than if the Fund had sought to replicate the Prime Junior Silver Miners & Explorers Index. IOPV or indicative optimized portfolio value is an estimated intraday fair value of one share of an ETF determined by the last trade price of the fund’s underlying securities.

The Prime Junior Silver Miners & Explorers Index is designed to provide a benchmark for investors interested in tracking public, small-cap companies that are active in silver mining exploration and production industry. The stocks are screened for liquidity and weighted according to modified freefloat market capitalization. The Index generally is comprised of 25-35 securities. An investment cannot be made directly in an index.

Unlike with an actively managed fund, the Fund’s adviser does not use techniques or defensive strategies designed to lessen the effects of market volatility or to reduce the impact of periods of market decline. This means that, based on market and economic conditions, the Fund’s performance could be lower than other types of funds that may actively shift their portfolio assets to take advantage of market opportunities or to lessen the impact of a market decline.

Natural or environmental disasters, such as earthquakes, fires, floods, hurricanes, tsunamis and other severe weather-related phenomena generally, and widespread disease, including pandemics and epidemics, have been and may be highly disruptive to economies and markets, adversely impacting individual companies, sectors, industries, markets, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of the Fund’s investments. Given the increasing interdependence among global economies and markets, conditions in one country, market, or region are increasingly likely to adversely affect markets, issuers, and/or foreign exchange rates in other countries, including the U.S. Any such events could have a significant adverse impact on the value of the Fund’s investments.

ETFMG™ ETFs

Additionally, natural or environmental disasters, widespread disease or other public health issues, war, acts of terrorism or other events could result in increased premiums or discounts to the Fund’s NAV.

HACK

The Fund seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Prime Cyber Defense Index (the “Index”).

The fund is concentrated in technology-related companies face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. Such companies may have limited product lines, markets, financial resources or personnel. The products of such companies may face obsolescence due to rapid technological developments, frequent new product introduction, unpredictable changes in growth rates, competition for the services of qualified personnel, and competition from foreign competitors with lower production costs. Technology companies are heavily dependent on patent and intellectual property rights. The loss or impairment of these rights may adversely affect the profitability of these companies. Investments in foreign securities involve political, economic and currency risks, greater volatility and differences in accounting methods. The Funds are non-diversified, meaning they may concentrate its assets in fewer individual holdings than a diversified fund. Investments in smaller companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Diversification does not assure a profit or protect against a loss in a declining market. The Fund’s return may not match or achieve a high degree of correlation with the return of the Prime Cyber Defense Index . To the extent the Fund utilizes a sampling approach, it may experience tracking error to a greater extent than if the Fund had sought to replicate the Prime Cyber Defense Index.

The Prime Cyber Defense Index provides a benchmark for investors interested in tracking companies actively involved in providing cyber security technology and services. The Index uses a market capitalization weighted allocation across the infrastructure provider and service provider categorizations as well as an equal weighted allocation methodology for all components within each sector allocation. Index components are reviewed semi-annually for eligibility, and the weights are reset accordingly. An investment cannot be made directly in an index.

Unlike with an actively managed fund, the Fund’s adviser does not use techniques or defensive strategies designed to lessen the effects of market volatility or to reduce the impact of periods of market decline. This means that, based on market and economic conditions, the Fund’s performance could be lower than other types of funds that may actively shift their portfolio assets to take advantage of market opportunities or to lessen the impact of a market decline.

Natural or environmental disasters, such as earthquakes, fires, floods, hurricanes, tsunamis and other severe weather-related phenomena generally, and widespread disease, including pandemics and epidemics, have been and may be highly disruptive to economies and markets, adversely impacting individual companies, sectors, industries, markets, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of the Fund’s investments. Given the increasing interdependence among global economies and markets, conditions in one country, market, or region are increasingly likely to adversely affect markets, issuers, and/or foreign exchange rates in other countries, including the U.S. Any such events could have a significant adverse impact on the value of the Fund’s investments.

Additionally, natural or environmental disasters, widespread disease or other public health issues, war, acts of terrorism or other events could result in increased premiums or discounts to the Fund’s NAV.

ETFMG™ ETFs

IPAY

The ETFMG Prime Mobile Payments ETF (the “Fund” or the “Mobile Payments ETF”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Prime Mobile Payments Index (the “Index”).

Mobile Payment Companies face intense competition, both domestically and internationally, and are subject to increasing regulatory constraints, particularly with respect to fees, competition and antitrust matters, cybersecurity and privacy. Mobile Payment Companies may be highly dependent on their ability to enter into agreements with merchants and other third parties to utilize a particular payment method, system, software or service, and such agreements may be subject to increased regulatory scrutiny. Additionally, certain Mobile Payment Companies have recently faced increased costs related to class-action litigation challenging such agreements. Such factors may adversely affect the profitability and value of such companies. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Investments in smaller companies tend to have limited liquidity and greater price volatility than large-capitalization companies. The Fund’s return may not match or achieve a high degree of correlation with the return of the Prime Mobile Payments Index. To the extent the Fund utilizes a sampling approach, it may experience tracking error to a greater extent than if the Fund had sought to replicate the Index. Diversification does not guarantee a profit, nor does it protect against a loss in a declining market.

The Prime Mobile Payments Index is designed to provide a benchmark for investors interested in tracking the mobile and electronic payments industry. The stocks are screened for liquidity and weighted according to a modified linear-based capitalization-weighted methodology. The Index generally is comprised of 25-40 securities. An investment cannot be made directly in an index.

Unlike with an actively managed fund, the Fund’s adviser does not use techniques or defensive strategies designed to lessen the effects of market volatility or to reduce the impact of periods of market decline. This means that, based on market and economic conditions, the Fund’s performance could be lower than other types of funds that may actively shift their portfolio assets to take advantage of market opportunities or to lessen the impact of a market decline.

Natural or environmental disasters, such as earthquakes, fires, floods, hurricanes, tsunamis and other severe weather-related phenomena generally, and widespread disease, including pandemics and epidemics, have been and may be highly disruptive to economies and markets, adversely impacting individual companies, sectors, industries, markets, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of the Fund’s investments. Given the increasing interdependence among global economies and markets, conditions in one country, market, or region are increasingly likely to adversely affect markets, issuers, and/or foreign exchange rates in other countries, including the U.S. Any such events could have a significant adverse impact on the value of the Fund’s investments.

Additionally, natural or environmental disasters, widespread disease or other public health issues, war, acts of terrorism or other events could result in increased premiums or discounts to the Fund’s NAV.

VALT

The ETFMG Sit Ultra Short ETF (the “Fund” or the “Ultra Short ETF”) seeks maximum current income, consistent with preservation of capital and daily liquidity.

The market price of the Fund’s fixed-income instruments may change, sometimes rapidly or unpredictably, in response to changes in interest rates, factors affecting securities markets generally, and other factors. Generally, when interest rates rise, the values of fixed-income instruments fall, and vice versa. The Fund may invest in floating rate securities, which are generally less sensitive to interest rate changes than securities with fixed interest rates but may decline in value if their interest rates do not rise as much, or as quickly, as comparable market interest rates. The Fund may invest in U.S. dollar-denominated debt obligations of foreign issuers. Mortgage- and asset-backed securities are subject to interest rate risk. Modest movements in interest rates (both increases and decreases) may quickly and significantly reduce the value of certain types of these securities. From time to time the Fund may invest a substantial amount of its assets in taxable or tax-exempt municipal securities whose interest is paid solely from revenues of similar projects.

ETFMG™ ETFs

Natural or environmental disasters, such as earthquakes, fires, floods, hurricanes, tsunamis and other severe weather-related phenomena generally, and widespread disease, including pandemics and epidemics, have been and may be highly disruptive to economies and markets, adversely impacting individual companies, sectors, industries, markets, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of the Fund’s investments. Given the increasing interdependence among global economies and markets, conditions in one country, market, or region are increasingly likely to adversely affect markets, issuers, and/or foreign exchange rates in other countries, including the U.S. Any such events could have a significant adverse impact on the value of the Fund’s investments.

The Fund is recently organized with a limited operating history. The Fund may not meet its investment objective based on the success or failure to implement investment strategies for the Fund.

The Fund’s investment strategy may require it to redeem shares for cash or to otherwise include cash as part of its redemption proceeds. In the event of large shareholder redemptions, the Fund may have to sell portfolio securities at times when it would not otherwise do so, which may negatively impact the Fund’s performance.

AWAY

The ETFMG Travel Tech ETF (the “Fund” or the “Travel Tech ETF”) seeks investment results that correspond generally to the price and yield, before fund fees and expenses, of the Prime Travel Technology Index (the “Index”).

Investing involves risk, including loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Narrowly focused investments typically exhibit higher volatility. Companies in the technology field, including companies in the computers, telecommunications and electronics industries, face intense competition, which may have an adverse effect on profit margins. Technology companies may have limited product lines, markets, financial resources or personnel. The products of technology companies may face obsolescence due to rapid technological developments and frequent new product introduction, and such companies may face unpredictable changes in growth rates, competition for the services of qualified personnel and competition from foreign competitors with lower production costs. Companies in the technology sector are heavily dependent on patent and intellectual property rights. The loss or impairment of these rights may adversely affect the profitability of these companies.

Unlike with an actively managed fund, the Fund’s adviser does not use techniques or defensive strategies designed to lessen the effects of market volatility or to reduce the impact of periods of market decline. This means that, based on market and economic conditions, the Fund’s performance could be lower than other types of funds that may actively shift their portfolio assets to take advantage of market opportunities or to lessen the impact of a market decline.

ETFMG™ ETFs

Natural or environmental disasters, such as earthquakes, fires, floods, hurricanes, tsunamis and other severe weather-related phenomena generally, and widespread disease, including pandemics and epidemics, have been and may be highly disruptive to economies and markets, adversely impacting individual companies, sectors, industries, markets, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of the Fund’s investments. Given the increasing interdependence among global economies and markets, conditions in one country, market, or region are increasingly likely to adversely affect markets, issuers, and/or foreign exchange rates in other countries, including the U.S. Any such events could have a significant adverse impact on the value of the Fund’s investments.

Additionally, natural or environmental disasters, widespread disease or other public health issues, war, acts of terrorism or other events could result in increased premiums or discounts to the Fund’s NAV.

The Fund is a recently organized, diversified management investment company with limited operating history.

ETFMG™ ETFs

As of March 31, 2020 (Unaudited)

| | | ETFMG

Prime

Junior

Silver

Miners

ETF | | | ETFMG

Prime

Cyber

Security

ETF | | | ETFMG

Prime

Mobile

Payments

ETF | | | ETFMG

Sit

Ultra ETF | | | ETFMG

Travel

Tech

ETF | |

| As a percent of Net Assets: | | | | | | | | | | | | | | | |

| Australia | | | — | % | | | — | % | | | 0.4 | % | | | — | % | | | 1.8 | % |

| Brazil | | | — | | | | — | | | | 1.2 | | | | — | | | | 1.4 | |

| Canada | | | 66.4 | | | | — | | | | — | | | | — | | | | — | |

| China | | | — | | | | — | | | | — | | | | — | | | | 4.4 | |

| Cyprus | | | — | | | | — | | | | 1.2 | | | | — | | | | 0.1 | |

| Finland | | | — | | | | 0.1 | | | | — | | | | — | | | | — | |

| France | | | — | | | | — | | | | 6.2 | | | | — | | | | — | |

| Germany | | | — | | | | — | | | | 3.7 | | | | — | | | | — | |

| Hong Kong | | | — | | | | — | | | | 0.8 | | | | — | | | | — | |

| Israel | | | — | | | | 7.2 | | | | — | | | | — | | | | — | |

| Italy | | | — | | | | — | | | | 3.2 | | | | — | | | | — | |

| Japan | | | — | | | | 4.4 | | | | 3.7 | | | | — | | | | 11.2 | |

| Mauritus | | | — | | | | — | | | | — | | | | — | | | | 3.2 | |

| Netherlands | | | — | | | | 5.0 | | | | — | | | | 0.8 | | | | | |

| Peru | | | 4.5 | | | | — | | | | — | | | | — | | | | — | |

| Republic of Korea | | | — | | | | 0.7 | | | | — | | | | — | | | | 5.1 | |

| Spain | | | — | | | | — | | | | — | | | | — | | | | 6.2 | |

| Sweden | | | — | | | | 1.6 | | | | — | | | | — | | | | — | |

| United Kingdom | | | — | | | | 6.9 | | | | 0.4 | | | | — | | | | 7.4 | |

| United States | | | 22.6 | | | | 76.3 | | | | 74.0 | | | | — | | | | 54.4 | |

| Asset Backed Securities | | | — | | | | — | | | | — | | | | 12.4 | | | | — | |

| Coporate Obligations | | | — | | | | — | | | | — | | | | 86.6 | | | | — | |

| Exchange Traded Funds | | | — | | | | 4.1 | | | | 6.0 | | | | — | | | | — | |

| Municipal Debt Obligations | | | — | | | | — | | | | — | | | | 1.1 | | | | — | |

| Short-Term and other Net Assets | | | | | | | | | | | | | | | | | | | | |

| (Liabilities) | | | 6.5 | | | | (1.3 | ) | | | (5.8 | ) | | | (0.1 | ) | | | 4.0 | |

| | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

ETFMG™ ETFs

ETFMG Prime Junior Silver Miners ETF

March 31, 2020 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 93.5% | | | | | | |

| Canada - 66.4% | | | | | | |

| Commercial Services & Supplies - 2.1% | | | | | | |

| Alexco Resource Corp. (a) | | | 1,578,031 | | | $ | 1,925,198 | |

| Metals & Mining - 64.3% (c) | | | | | | | | |

| Americas Gold & Silver Corp. (a) | | | 1,072,154 | | | | 1,630,363 | |

| Bear Creek Mining Corp. (a) | | | 1,434,762 | | | | 1,203,026 | |

| Canada Cobalt Works, Inc. (a) | | | 1,277,161 | | | | 290,408 | |

| Endeavour Silver Corp. (a) | | | 1,705,255 | | | | 2,285,042 | |

| Excellon Resources, Inc. (a) | | | 2,596,733 | | | | 1,014,853 | |

| First Majestic Silver Corp. (a) | | | 1,647,051 | | | | 10,195,246 | |

| Fortuna Silver Mines, Inc. (a) | | | 768,164 | | | | 1,768,529 | |

| Great Panther Mining, Ltd. (a) | | | 3,379,410 | | | | 1,041,534 | |

| Hudbay Minerals, Inc. | | | 1,034,782 | | | | 1,955,887 | |

| Kootenay Silver, Inc. (a)(e) | | | 6,570,289 | | | | 770,339 | |

| MAG Silver Corp. (a) | | | 511,153 | | | | 3,944,519 | |

| Mandalay Resources Corp. (a)(d) | | | 1,612,061 | | | | 824,759 | |

| Maya Gold & Silver, Inc. (a)(d) | | | 1,512,882 | | | | 1,042,774 | |

| Minaurum Gold, Inc. (a)(d) | | | 4,773,140 | | | | 1,017,510 | |

| Minco Silver Corp. (a)(d) | | | 1,088,483 | | | | 344,187 | |

| Mirasol Resources, Ltd. (a) | | | 1,002,891 | | | | 224,480 | |

| Pan American Silver Corp. | | | 858,551 | | | | 12,353,910 | |

| Sabina Gold & Silver Corp. (a) | | | 1,619,094 | | | | 1,346,081 | |

| Sierra Metals, Inc. (a)(d) | | | 1,266,951 | | | | 963,290 | |

| Silvercorp Metals, Inc. (a) | | | 1,152,850 | | | | 3,776,479 | |

| SilverCrest Metals, Inc. (a) | | | 827,326 | | | | 4,332,689 | |

| SSR Mining, Inc. (a) | | | 331,084 | | | | 3,775,953 | |

| Trevali Mining Corp. (a) | | | 9,444,252 | | | | 570,427 | |

| Yamana Gold, Inc. | | | 1,283,721 | | | | 3,530,233 | |

| Total Metals & Mining | | | | | | | 60,202,518 | |

| Total Canada | | | | | | | 62,127,716 | |

| | | | | | | | | |

| Peru - 4.5% | | | | | | | | |

| Metals & Mining - 4.5% (c) | | | | | | | | |

| Hochschild Mining PLC | | | 3,175,899 | | | | 4,197,241 | |

| | | | | | | | | |

| United States - 22.6% | | | | | | | | |

| Metals & Mining - 22.6% (c) | | | | | | | | |

| Coeur Mining, Inc. (a) | | | 2,544,256 | | | | 8,167,062 | |

| Gold Resource Corp. | | | 398,261 | | | | 1,095,218 | |

| Golden Minerals Co. (a) | | | 1,524,317 | | | | 320,259 | |

| Hecla Mining Co. | | | 5,641,832 | | | | 10,268,134 | |

| McEwen Mining, Inc. | | | 2,056,696 | | | | 1,359,064 | |

| Total Metals & Mining | | |

| | | | 21,209,737 | |

| Total United States | | |

| | | | 21,209,737 | |

| TOTAL COMMON STOCKS (Cost $138,760,933) | | | | | | | 87,534,694 | |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Prime Junior Silver Miners ETF

Schedule of Investments

March 31, 2020 (Unaudited) (Continued)

| | | Shares | | | Value | |

| SHORT-TERM INVESTMENTS - 4.9% | | | | | | |

| MONEY MARKET FUNDS - 4.9% | | | | | | |

| Invesco Advisers, Inc. STIT-Treasury Portfolio - Institutional Class, 0.30% (b) | | | 4,596,605 | | | $ | 4,596,605 | |

| TOTAL MONEY MARKET FUNDS (Cost $4,596,605) | | | | | | | 4,596,605 | |

| | | | | | | | | |

| Total Investments (Cost $143,357,538) - 98.4% | | | | | | | 92,131,299 | |

| Liabilities in Excess of Other Assets - 1.6% | | | | | | | 1,543,389 | |

| TOTAL NET ASSETS - 100.0% | | | | | | $ | 93,674,688 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | The rate quoted is the annualized seven-day yield at March 31, 2020. |

| (c) | As of March 31, 2020, the Fund had a significant portion of its assets invested in the Metals & Mining Industry. |

| (d) | These securities have been deemed illiquid according to the Fund’s liquidity guidelines. The value of these securities total $4,192,520, which represents 4.48% of total net assets. |

| (e) | Affiliated security. Please refer to Note 9 of the Notes to Financial Statements. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC., doing business as U.S. Bank Global Fund Services (“Fund Services”).

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Prime Cyber Security ETF

Schedule of Investments

March 31, 2020 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 97.2% | | | | | | |

| Finland - 0.1% | | | | | | |

| Software - 0.1% | | | | | | |

| F-Secure Oyj | | | 574,485 | | | $ | 1,504,800 | |

| | | | | | | | | |

| Israel - 7.2% | | | | | | | | |

| Communications Equipment - 0.9% | | | | | | | | |

| Radware, Ltd. (a) | | | 524,590 | | | | 11,053,111 | |

| Software - 6.3% | | | | | | | | |

| Check Point Software Technologies, Ltd. (a)(b) | | | 336,574 | | | | 33,839,150 | |

| CyberArk Software, Ltd. (a)(b) | | | 300,454 | | | | 25,706,844 | |

| Tufin Software Technologies Ltd. (a)(b) | | | 1,543,242 | | | | 13,549,665 | |

| Total Software | | | | | | | 73,095,659 | |

| Total Israel | | | | | | | 84,148,770 | |

| | | | | | | | | |

| Japan - 4.4% | | | | | | | | |

| Software - 4.4% | | | | | | | | |

| Digital Arts, Inc. | | | 262,454 | | | | 11,398,839 | |

| FFRI, Inc. (a)(b) | | | 247,124 | | | | 4,332,283 | |

| Trend Micro, Inc. | | | 704,187 | | | | 34,971,947 | |

| Total Software | | | | | | | 50,703,069 | |

| | | | | | | | | |

| Republic of Korea - 0.7% | | | | | | | | |

| Software - 0.7% | | | | | | | | |

| Ahnlab, Inc. | | | 174,174 | | | | 8,141,045 | |

| | | | | | | | | |

| Sweden - 1.6% | | | | | | | | |

| Electronic Equipment, Instruments & Components - 1.6% | | | | | | | | |

| Fingerprint Cards AB - Class B (b) | | | 13,980,838 | | | | 18,598,625 | |

| | | | | | | | | |

| United Kingdom - 6.9% | | | | | | | | |

| Aerospace & Defense - 2.9% | | | | | | | | |

| BAE Systems PLC | | | 1,727,848 | | | | 11,198,637 | |

| QinetiQ Group PLC | | | 2,713,148 | | | | 10,851,379 | |

| Ultra Electronics Holdings PLC | | | 455,628 | | | | 11,363,960 | |

| Total Aerospace & Defense | | | | | | | 33,413,976 | |

| IT Services - 0.4% | | | | | | | | |

| NCC Group PLC | | | 2,362,776 | | | | 4,871,763 | |

| Software - 3.6% | | | | | | | | |

| Avast Plc | | | 6,468,133 | | | | 31,605,951 | |

| Mimecast, Ltd. (a) | | | 294,017 | | | | 10,378,800 | |

| Total Software | | | | | | | 41,984,751 | |

| Total United Kingdom | | | | | | | 80,270,490 | |

| | | | | | | | | |

| United States - 76.3% | | | | | | | | |

| Aerospace & Defense - 2.5% | | | | | | | | |

| Parsons Corp. (a) | | | 895,115 | | | | 28,607,875 | |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Prime Cyber Security ETF

Schedule of Investments

March 31, 2020 (Unaudited) (Continued)

| | | Shares | | | Value | |

| Communications Equipment - 8.6% | | | | | | |

| Cisco Systems, Inc. | | | 1,172,172 | | | $ | 46,078,081 | |

| F5 Networks, Inc. (a)(b) | | | 102,189 | | | | 10,896,413 | |

| Juniper Networks, Inc. | | | 1,595,766 | | | | 30,542,961 | |

| NetScout Systems, Inc. (a)(b) | | | 539,188 | | | | 12,762,580 | |

| Total Communications Equipment | | | | | | | 100,280,035 | |

| Internet Software & Services - 0.5% | | | | | | | | |

| Zix Corp. (a)(b) | | | 1,241,005 | | | | 5,348,732 | |

| IT Services - 15.3% | | | | | | | | |

| Akamai Technologies, Inc. (a) | | | 455,318 | | | | 41,657,044 | |

| Booz Allen Hamilton Holding Corp. (b) | | | 205,250 | | | | 14,088,360 | |

| CACI International, Inc. - Class A (a) | | | 155,503 | | | | 32,834,459 | |

| Leidos Holdings, Inc. | | | 150,679 | | | | 13,809,730 | |

| ManTech International Corp. - Class A | | | 164,059 | | | | 11,922,168 | |

| Okta, Inc. (a)(b) | | | 137,944 | | | | 16,865,034 | |

| Science Applications International Corp. | | | 441,935 | | | | 32,981,609 | |

| VeriSign, Inc. (a) | | | 76,196 | | | | 13,722,138 | |

| Total IT Services | | | | | | | 177,880,542 | |

| Software - 49.4% (e) | | | | | | | | |

| A10 Networks, Inc. (a) | | | 996,736 | | | | 6,189,731 | |

| Cloudflare, Inc. - Class A (a)(b) | | | 2,068,926 | | | | 48,578,383 | |

| CommVault Systems, Inc. (a)(b) | | | 816,050 | | | | 33,033,704 | |

| Crowdstrike Holdings, Inc. - Class A (a)(b) | | | 318,327 | | | | 17,724,447 | |

| Everbridge, Inc. (a)(b) | | | 164,373 | | | | 17,482,712 | |

| FireEye, Inc. (a) | | | 2,319,805 | | | | 24,543,537 | |

| ForeScout Technologies, Inc. (a) | | | 374,114 | | | | 11,818,261 | |

| Fortinet, Inc. (a) | | | 367,930 | | | | 37,223,478 | |

| MobileIron, Inc. (a) | | | 1,899,444 | | | | 7,217,887 | |

| NortonLifeLock, Inc. | | | 1,530,622 | | | | 28,637,938 | |

| OneSpan, Inc. (a) | | | 751,017 | | | | 13,630,959 | |

| Palo Alto Networks, Inc. (a) | | | 189,069 | | | | 30,999,753 | |

| Ping Identity Holding Corp. (a)(b) | | | 1,715,868 | | | | 34,351,677 | |

| Proofpoint, Inc. (a)(b) | | | 332,499 | | | | 34,111,073 | |

| Qualys, Inc. (a)(b) | | | 437,810 | | | | 38,085,092 | |

| Rapid7, Inc. (a) | | | 230,249 | | | | 9,976,689 | |

| SailPoint Technologies Holding, Inc. (a)(b) | | | 1,572,855 | | | | 23,938,853 | |

| SecureWorks Corp. - Class A (a)(b)(d) | | | 909,155 | | | | 10,464,374 | |

| SolarWinds Corp. (a)(b) | | | 2,076,684 | | | | 32,541,638 | |

| Splunk, Inc. (a) | | | 298,680 | | | | 37,702,376 | |

| Tenable Holdings, Inc. (a) | | | 1,494,784 | | | | 32,675,978 | |

| Varonis Systems, Inc. (a)(b) | | | 171,105 | | | | 10,894,255 | |

| Verint Systems, Inc. (a)(b) | | | 254,123 | | | | 10,927,289 | |

| Zscaler, Inc. (a)(b) | | | 322,584 | | | | 19,632,462 | |

| Total Software | | | | | | | 572,382,546 | |

| Total United States | | | | | | | 884,499,730 | |

| TOTAL COMMON STOCKS (Cost $1,217,436,977) | | | | | | | 1,127,866,529 | |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Prime Cyber Security ETF

Schedule of Investments

March 31, 2020 (Unaudited) (Continued)

| | | Shares | | | Value | |

| INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING COLLATERAL – 25.1% | | | | | | |

| ETFMG Sit Ultra Short ETF (d) | | | 1,000,000 | | | $ | 48,080,000 | |

| Mount Vernon Liquid Assets Portfolio, LLC, 0.91% (c) | | | 243,676,366 | | | | 243,676,366 | |

| TOTAL INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING COLLATERAL (Cost $293,785,243) | | | | | | | 291,756,366 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS - 2.9% | | | | | | | | |

| Money Market Funds - 2.9% | | | | | | | | |

| Invesco Advisers, Inc. STIT-Treasury Portfolio - Institutional Class 0.30% (c) | | | 32,213,192 | | | | 32,213,192 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $32,213,192) | | | | | | | 32,213,192 | |

| | | | | | | | | |

| Total Investments (Cost $1,543,435,412) - 125.2% | | | | | | | 1,451,836,087 | |

| Liabilities in Excess of Other Assets - (25.2)% | | | | | | | (291,965,062 | ) |

| TOTAL NET ASSETS - 100.0% | | | | | | $ | 1,159,871,025 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | All or a portion of this security is out on loan as of March 31, 2020. |

| (c) | The rate quoted is the annualized seven-day yield at March 31, 2020. |

| (d) | Affiliated security. Please refer to Note 9 of the Notes to Financial Statements. |

| (e) | As of March 31, 2020 the Fund had a significant portion of its assets in the Software Industry. |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Prime Mobile Payments ETF

Schedule of Investments

March 31, 2020 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 99.8% | | | | | | |

| Australia - 0.4% | | | | | | |

| IT Services - 0.4% (d) | | | | | | |

| EML Payments, Ltd. (a) | | | 1,357,165 | | | $ | 1,920,024 | |

| | | | | | | | | |

| Brazil - 1.2% | | | | | | | | |

| IT Services - 1.2% (d) | | | | | | | | |

| Cielo SA | | | 6,526,129 | | | | 5,639,291 | |

| | | | | | | | | |

| Cyprus - 1.2% | | | | | | | | |

| IT Services - 1.2% (d) | | | | | | | | |

| QIWI PLC - ADR | | | 551,683 | | | | 5,908,525 | |

| | | | | | | | | |

| France - 6.2% | | | | | | | | |

| Electronic Equipment, Instruments & Components - 3.1% | | | | | | | | |

| Ingenico Group SA | | | 136,554 | | | | 14,599,697 | |

| IT Services - 3.1% (d) | | | | | | | | |

| Worldline SA (a) | | | 250,646 | | | | 14,844,701 | |

| Total France | | | | | | | 29,444,398 | |

| | | | | | | | | |

| Germany - 3.7% | | | | | | | | |

| IT Services - 3.7% (d) | | | | | | | | |

| Wirecard AG (b) | | | 153,344 | | | | 17,698,742 | |

| | | | | | | | | |

| Hong Kong - 0.8% | | | | | | | | |

| Electronic Equipment, Instruments & Components - 0.4% | | | | | | | | |

| PAX Global Technology, Ltd. (a) | | | 5,157,894 | | | | 1,942,672 | |

| IT Services - 0.4% (d) | | | | | | | | |

| Huifu Payment, Ltd. (a) | | | 5,972,171 | | | | 1,764,054 | |

| Total Hong Kong | | | | | | | 3,706,726 | |

| | | | | | | | | |

| Italy - 3.2% | | | | | | | | |

| IT Services - 3.2% (d) | | | | | | | | |

| Nexi SpA (a) | | | 1,188,016 | | | | 15,537,106 | |

| | | | | | | | | |

| Japan - 3.7% | | | | | | | | |

| Consumer Finance - 0.6% | | | | | | | | |

| Jaccs Co, Ltd. | | | 157,917 | | | | 2,693,511 | |

| IT Services - 2.9% (d) | | | | | | | | |

| GMO Payment Gateway, Inc. | | | 199,794 | | | | 14,084,525 | |

| Software - 0.2% | | | | | | | | |

| Intelligent Wave, Inc. | | | 191,977 | | | | 885,567 | |

| Total Japan | | | | | | | 17,663,603 | |

| | | | | | | | | |

| Netherlands - 5.0% | | | | | | | | |

| IT Services - 5.0% (d) | | | | | | | | |

| Adyen NV (a) | | | 28,160 | | | | 23,933,050 | |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Prime Mobile Payments ETF

Schedule of Investments

March 31, 2020 (Unaudited) (Continued)

| | | Shares | | | Value | |

| United Kingdom - 0.4% | | | | | | |

| Commercial Services & Supplies - 0.4% | | | | | | |

| PayPoint PLC | | | 304,455 | | | $ | 2,026,952 | |

| | | | | | | | | |

| United States - 74.0% | | | | | | | | |

| Consumer Finance - 9.8% | | | | | | | | |

| American Express Co. (b) | | | 301,605 | | | | 25,820,403 | |

| Discover Financial Services | | | 272,977 | | | | 9,737,090 | |

| Green Dot Corp. - Class A (a) | | | 449,427 | | | | 11,410,952 | |

| Total Consumer Finance | | | | | | | 46,968,445 | |

| IT Services - 61.0% (d) | | | | | | | | |

| Euronet Worldwide, Inc. (a) | | | 97,351 | | | | 8,344,928 | |

| EVERTEC, Inc. | | | 386,511 | | | | 8,785,395 | |

| Evo Payments, Inc. - Class A (a) | | | 458,754 | | | | 7,018,936 | |

| Fidelity National Information Services, Inc. | | | 272,210 | | | | 33,111,624 | |

| Fiserv, Inc. (a) | | | 322,206 | | | | 30,606,348 | |

| FleetCor Technologies, Inc. (a) | | | 76,557 | | | | 14,280,943 | |

| Global Payments, Inc. (b) | | | 200,343 | | | | 28,895,471 | |

| I3 Verticals, Inc. - Class A (a) | | | 139,779 | | | | 2,668,381 | |

| International Money Express, Inc. (a) | | | 169,694 | | | | 1,549,306 | |

| MasterCard, Inc. - Class A | | | 127,049 | | | | 30,689,956 | |

| Net 1 UEPS Technologies, Inc. (a)(b) | | | 594,512 | | | | 1,730,030 | |

| Pagseguro Digital, Ltd. - Class A (a)(b) | | | 519,483 | | | | 10,041,606 | |

| PayPal Holdings, Inc. (a) | | | 349,442 | | | | 33,455,577 | |

| Paysign, Inc. (a)(b) | | | 210,597 | | | | 1,086,681 | |

| Square, Inc. - Class A (a) | | | 369,907 | | | | 19,375,729 | |

| StoneCo, Ltd. - Class A (a)(b) | | | 410,848 | | | | 8,944,161 | |

| Visa, Inc. - Class A (b) | | | 203,191 | | | | 32,738,134 | |

| Western Union Co. (b) | | | 603,960 | | | | 10,949,795 | |

| WEX, Inc. (a) | | | 75,004 | | | | 7,841,668 | |

| Total IT Services | | | | | | | 292,114,669 | |

| Software - 1.8% | | | | | | | | |

| ACI Worldwide, Inc. (a) | | | 359,902 | | | | 8,691,633 | |

| Technology Hardware, Storage & Peripherals - 1.4% | | | | | | | | |

| NCR Corp. (a) | | | 386,919 | | | | 6,848,466 | |

| Total United States | | | | | | | 354,623,213 | |

| TOTAL COMMON STOCKS (Cost $627,584,432) | | | | | | | 478,101,630 | |

| | | | | | | | | |

| INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING COLLATERAL - 22.0% | | | | | | | | |

| ETFMG Sit Ultra Short ETF (e) | | | 600,000 | | | | 28,848,000 | |

| Mount Vernon Liquid Assets Portfolio, LLC, 0.91% (c) | | | 76,435,279 | | | | 76,435,279 | |

| TOTAL INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING COLLATERAL (Cost $106,517,546) | | | | | | | 105,283,279 | |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Prime Mobile Payments ETF

Schedule of Investments

March 31, 2020 (Unaudited) (Continued)

| | | Shares | | | Value | |

| SHORT-TERM INVESTMENTS - 0.2% | | | | | | |

| Money Market Funds - 0.2% | | | | | | |

| Invesco Advisers, Inc. STIT-Treasury Portfolio - Institutional Class, 0.30% (c) | | | 882,104 | | | $ | 882,104 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $882,104) | | | | | | | 882,104 | |

| | | | | | | | | |

| Total Investments (Cost $734,984,082) - 122.0% | | | | | | | 584,267,013 | |

| Liabilities in Excess of Other Assets - (22.0)% | | | | | | | (105,209,208 | ) |

| TOTAL NET ASSETS - 100.0% | | | | | | $ | 479,057,805 | |

Percentages are stated as a percent of net assets.

ADR American Depositary Receipt

| (a) | Non-income producing security. |

| (b) | All or a portion of this security is out on loan as of March 31, 2020. |

| (c) | The rate quoted is the annualized seven-day yield at March 31, 2020. |

| (d) | As of March 31, 2020 the Fund had a significant portion of its assets in the IT Services Industry. |

| (e) | Affiliated security. Please refer to Note 9 of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Sit Ultra Short ETF

Schedule of Investments

March 31, 2020 (Unaudited)

| | | Principal

Amount | | | Value | |

| ASSET BACKED SECURITIES - 12.4% | | | | | | |

| Air Canada Class B Pass Through Trust | | | | | | |

| Series 2013-1, 5.375%, 11/15/2022 (a) | | $ | 1,078,096 | | | $ | 1,093,617 | |

| Carvana Auto Receivables Trust | | | | | | | | |

| Series 2019-2, 2.580%, 03/15/2023 (a) | | | 3,480,000 | | | | 3,406,551 | |

| Continental Airlines Class A Pass Through Trust | | | | | | | | |

| Series 2010-1, 4.750%, 01/12/2021 | | | 499,350 | | | | 503,794 | |

| DT Auto Owner Trust | | | | | | | | |

| Series 2019-4, 2.360%, 01/16/2024 (a) | | | 1,105,000 | | | | 1,084,922 | |

| Hertz Vehicle Financing II LP | | | | | | | | |

| Series 2017-2, 3.290%, 10/25/2023 (a) | | | 1,950,000 | | | | 1,886,054 | |

| United Auto Credit Securitization Trust | | | | | | | | |

| Series 2018-2, 4.260%, 05/10/2023 (a) | | | 1,000,000 | | | | 990,663 | |

| Westlake Automobile Receivables Trust | | | | | | | | |

| Serires 2019-2, 2.570%, 02/15/2023 (a) | | | 2,862,948 | | | | 2,853,948 | |

| TOTAL ASSET BACKED SECURITIES (Cost $12,096,804) | | | | | | | 11,819,549 | |

| | | | | | | | | |

| CORPORATE OBLIGATIONS - 86.6% | | | | | | | | |

| Aerospace & Defense - 2.9% | | | | | | | | |

| General Dynamics Corp. | | | | | | | | |

| 2.875%, 05/11/2020 | | | 430,000 | | | | 430,306 | |

| 2.021% (3 Month LIBOR + 0.290%) 05/11/2020 (b) | | | 643,000 | | | | 643,121 | |

| 3.000%, 05/11/2021 | | | 340,000 | | | | 342,728 | |

| Lockheed Martin Corp. | | | | | | | | |

| 2.500%, 11/23/2020 | | | 599,000 | | | | 601,973 | |

| Textron, Inc. | | | | | | | | |

| 2.284% (3 Month LIBOR + 0.550%) 11/10/2020 (b) | | | 700,000 | | | | 700,036 | |

| | | | | | | | 2,718,164 | |

| Airlines - 0.6% | | | | | | | | |

| United Airlines 2014-2 Class B Pass Through Trust | | | | | | | | |

| 4.625%, 03/03/2024 | | | 580,877 | | | | 544,119 | |

| | | | | | | | | |

| Automotive - 4.2% | | | | | | | | |

| American Honda Finance Corp. | | | | | | | | |

| 2.043% (3 Month LIBOR + 0.280%) 11/02/2020 (b) | | | 1,000,000 | | | | 987,535 | |

| Hyundai Capital America | | | | | | | | |

| 2.850%, 11/01/2022 (a) | | | 3,000,000 | | | | 2,933,546 | |

| | | | | | | | 3,921,081 | |

| | | | | | | | | |

| Automotive Equipment Rental and Leasing - 1.6% | | | | | | | | |

| General Motors Financial Co. Inc. | | | | | | | | |

| 3.150%, 06/30/2022 | | | 1,688,000 | | | | 1,522,370 | |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Sit Ultra Short ETF

Schedule of Investments

March 31, 2020 (Unaudited) (Continued)

| | | Principal

Amount | | | Value | |

| Banks - 18.6% | | | | | | |

| Bank of America Corp. | | | | | | |

| 2.250%, 04/21/2020 | | $ | 123,000 | | | $ | 122,982 | |

| 2.369%, 07/21/2021 | | | 1,000,000 | | | | 999,506 | |

| Bank of Nova Scotia | | | | | | | | |

| 1.639% (3 Month LIBOR + 0.640%) 03/07/2022 (b) | | | 150,000 | | | | 144,592 | |

| Barclays PLC | | | | | | | | |

| 3.844% (3 Month LIBOR + 2.110%) 08/10/2021 (b) | | | 450,000 | | | | 434,729 | |

| 3.459% (3 Month LIBOR + 1.625%) 01/10/2023 (b) | | | 1,300,000 | | | | 1,250,524 | |

| Commonwealth Bank of Australia | | | | | | | | |

| 1.569% (3 Month LIBOR + 0.680%) 09/18/2022 (a)(b) | | | 2,539,000 | | | | 2,442,961 | |

| Fulton Financial Corp. | | | | | | | | |

| 3.600%, 03/16/2022 | | | 600,000 | | | | 605,045 | |

| HSBC Holdings PLC | | | | | | | | |

| 3.400% (3 Month LIBOR + 1.500%) 01/05/2022 (b) | | | 2,700,000 | | | | 2,589,419 | |

| JPMorgan Chase & Co. | | | | | | | | |

| 4.250%, 10/15/2020 (c) | | | 65,000 | | | | 65,747 | |

| JPMorgan Chase Bank NA | | | | | | | | |

| 3.086%, 04/26/2021 | | | 1,000,000 | | | | 999,611 | |

| PNC Bank NA | | | | | | | | |

| 2.053% (3 Month LIBOR + 0.360%) 05/19/2020 (b) | | | 340,000 | | | | 339,502 | |

| Swedbank AB | | | | | | | | |

| 1.441% (3 Month LIBOR + 0.700%) 03/14/2022 (a)(b) | | | 200,000 | | | | 193,879 | |

| Truist Bank | | | | | | | | |

| 2.250% (3 Month LIBOR + 0.590%) 06/01/2020 (b) | | | 1,175,000 | | | | 1,172,860 | |

| 2.353%, 08/02/2022 | | | 1,655,000 | | | | 1,562,536 | |

| US Bank NA | | | | | | | | |

| 2.051% (3 Month LIBOR + 0.250%) 07/24/2020 (b) | | | 2,000,000 | | | | 1,995,377 | |

| Wells Fargo & Co. | | | | | | | | |

| 2.600%, 07/22/2020 | | | 298,000 | | | | 298,074 | |

| Westpac Banking Corp. | | | | | | | | |

| 2.418% (3 Month LIBOR + 0.570%) 01/11/2023 (b) | | | 2,500,000 | | | | 2,421,343 | |

| | | | | | | | 17,638,687 | |

| Beverages - 1.1% | | | | | | | | |

| Constellation Brands, Inc. | | | | | | | | |

| 2.392% (3 Month LIBOR + 0.700%) 11/15/2021 (b) | | | 1,175,000 | | | | 1,107,897 | |

| Biotechnology - 3.5% | | | | | | | | |

| AbbVie, Inc. | | | | | | | | |

| 2.346% (3 Month LIBOR + 0.650%) 11/21/2022 (a)(b) | | | 3,000,000 | | | | 2,807,840 | |

| GlaxoSmithKline Capital PLC | | | | | | | | |

| 3.125%, 05/14/2021 | | | 495,000 | | | | 501,952 | |

| 2.054% (3 Month LIBOR + 0.350%) 05/14/2021 (b) | | | 120,000 | | | | 115,312 | |

| | | | | | | | 3,425,104 | |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Sit Ultra Short ETF

Schedule of Investments

March 31, 2020 (Unaudited) (Continued)

| | | Principal

Amount | | | Value | |

| Business Support Services - 2.3% | | | | | | | | |

| Glencore Finance Canada, Ltd. | | | | | | | | |

| 4.950%, 11/15/2021 (a) | | $ | 1,200,000 | | | $ | 1,189,332 | |

| 4.250%, 10/25/2022 (a) | | | 1,000,000 | | | | 959,777 | |

| Pentair Finance Sarl | | | | | | | | |

| 3.625%, 09/15/2020 | | | 50,000 | | | | 49,746 | |

| | | | | | | | 2,198,855 | |

| Capital Markets - 6.3% | | | | | | | | |

| Ares Capital Corp. | | | | | | | | |

| 3.625%, 01/19/2022 | | | 1,500,000 | | | | 1,406,765 | |

| Bank of New York Mellon Corp. | | | | | | | | |

| 2.562% (3 Month LIBOR + 0.870%) 08/17/2020 (b) | | | 175,000 | | | | 175,037 | |

| 2.450%, 11/27/2020 | | | 1,565,000 | | | | 1,559,058 | |

| Charles Schwab Corp. | | | | | | | | |

| 2.016% (3 Month LIBOR + 0.320%) 05/21/2021 (b) | | | 500,000 | | | | 490,584 | |

| Morgan Stanley | | | | | | | | |

| 2.800%, 06/16/2020 | | | 1,000,000 | | | | 999,897 | |

| 3.219% (3 Month LIBOR + 1.400%) 04/21/2021 (b) | | | 150,000 | | | | 148,970 | |

| State Street Corp. | | | | | | | | |

| 2.592% (3 Month LIBOR + 0.900%) 08/18/2020 (b) | | | 1,200,000 | | | | 1,193,365 | |

| | | | | | | | 5,973,676 | |

| Chemicals - 3.1% | | | | | | | | |

| Albemarle Corp. | | | | | | | | |

| 2.742% (3 Month LIBOR + 1.050%) 11/15/2022 (a)(b) | | | 3,085,000 | | | | 2,938,985 | |

| Consumer Finance - 0.4% | | | | | | | | |

| American Express Credit Corp. | | | | | | | | |

| 1.791% (3 Month LIBOR + 1.050%) 09/14/2020 (b) | | | 350,000 | | | | 348,133 | |

| Converted Paper Product Manufacturing - 0.3% | | | | | | | | |

| Georgia-Pacific LLC | | | | | | | | |

| 5.400%, 11/01/2020 | | | 325,000 | | | | 328,136 | |

| Cosmetics & Toiletries - 0.7% | | | | | | | | |

| Unilever Capital Corp. | | | | | | | | |

| 1.800%, 05/05/2020 | | | 675,000 | | | | 674,551 | |

| Depository Credit Intermediation - 3.5% | | | | | | | | |

| BBVA USA | | | | | | | | |

| 1.498% (3 Month LIBOR + 0.730%) 06/11/2021 (b) | | | 500,000 | | | | 485,273 | |

| Citibank NA | | | | | | | | |

| 2.295% (3 Month LIBOR + 0.600%) 05/20/2022 (b) | | | 200,000 | | | | 193,313 | |

| Fifth Third Bank | | | | | | | | |

| 2.200%, 10/30/2020 | | | 1,700,000 | | | | 1,694,698 | |

| Manufacturers & Traders Trust Co. | | | | | | | | |

| 2.064% (3 Month LIBOR + 0.270%) 01/25/2021 (b) | | | 400,000 | | | | 394,447 | |

| 2.220% (3 Month LIBOR + 0.640%) 12/01/2021 (c) | | | 340,000 | | | | 330,401 | |

| Wells Fargo Bank NA | | | | | | | | |

| 2.082%, 09/09/2022 | | | 200,000 | | | | 199,216 | |

| | | | | | | | 3,297,348 | |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Sit Ultra Short ETF

Schedule of Investments

March 31, 2020 (Unaudited) (Continued)

| | | Principal

Amount | | | Value | |

| Diversed Financial Services - 1.1% | | | | | | | | |

| Century Housing Corp. | | | | | | | | |

| 3.824%, 11/01/2020 | | $ | 1,000,000 | | | $ | 1,015,435 | |

| Diversified Telecommunication Services - 1.1% | | | | | | | | |

| Verizon Communications, Inc. | | | | | | | | |

| 2.233% (3 Month LIBOR + 0.550%) 05/22/2020 (b) | | | 1,100,000 | | | | 1,099,869 | |

| Electric Power Generation, Transmission and Distribution - 1.6% | | | | | | | | |

| Duke Energy Indiana LLC | | | | | | | | |

| 3.750%, 07/15/2020 | | | 1,500,000 | | | | 1,505,515 | |

| Electronic Equipment, Instruments & Components - 2.6% | | | | | | | | |

| Arrow Electronics, Inc. | | | | | | | | |

| 3.500%, 04/01/2022 | | | 2,500,000 | | | | 2,487,492 | �� |

| Equity Real Estate Investment Trusts (REITs) - 2.7% | | | | | | | | |

| AvalonBay Communities, Inc. | | | | | | | | |

| 2.261% (3 Month LIBOR + 0.430%) 01/15/2021 (b) | | | 1,565,000 | | | | 1,540,406 | |

| Weyerhaeuser Co. | | | | | | | | |

| 4.700%, 03/15/2021 | | | 1,000,000 | | | | 1,009,400 | |

| | | | | | | | 2,549,806 | |

| Finance - 1.6% | | | | | | | | |

| Avolon Holdings Funding, Ltd. | | | | | | | | |

| 3.625%, 05/01/2022 (a) | | | 1,750,000 | | | | 1,553,550 | |

| Food Products - 0.6% | | | | | | | | |

| Conagra Brands, Inc. | | | | | | | | |

| 2.552% (3 Month LIBOR + 0.750%) 10/22/2020 (b) | | | 533,000 | | | | 527,407 | |

| Grain and Oilseed Milling - 0.7% | | | | | | | | |

| Bunge Ltd Finance Corp. | | | | | | | | |

| 3.000%, 09/25/2022 | | | 706,000 | | | | 695,936 | |

| Health Care Providers & Services - 1.4% | | | | | | | | |

| Cigna Corp. | | | | | | | | |

| 1.493%, (3 Month LIBOR + 0.650%) 09/17/2021 (b) | | | 1,350,000 | | | | 1,296,351 | |

| Hotels, Restaurants & Leisure - 0.2% | | | | | | | | |

| Choice Hotels International, Inc. | | | | | | | | |

| 5.750%, 07/01/2022 | | | 200,000 | | | | 184,500 | |

| Industrials - 0.6% | | | | | | | | |

| Perrigo Finance Unlimited Co. | | | | | | | | |

| 3.500%, 12/15/2021 | | | 200,000 | | | | 206,690 | |

| 3.500%, 03/15/2021 | | | 500,000 | | | | 499,878 | |

| | | | | | | | 706,568 | |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Sit Ultra Short ETF

Schedule of Investments

March 31, 2020 (Unaudited) (Continued)

| | | Principal

Amount | | | Value | |

| Insurance - 6.1% | | | | | | |

| Infinity Property & Casualty Corp. | | | | | | | | |

| 5.000%, 09/19/2022 | | $ | 1,050,000 | | | $ | 1,023,322 | |

| Jackson National Life Global Funding | | | | | | | | |

| 2.154% (3 Month LIBOR + 0.600%) 01/06/2023 (a)(b) | | | 2,000,000 | | | | 1,933,801 | |

| Metropolitan Life Global Funding I | | | | | | | | |

| 2.145% (3 Month SOFR + 0.570%) 01/13/2023 (a)(b) | | | 2,000,000 | | | | 1,748,834 | |

| Progressive Corp. | | | | | | | | |

| 3.750%, 08/23/2021 | | | 1,000,000 | | | | 1,022,225 | |

| | | | | | | | 5,728,182 | |

| Insurance and Employee Benefit Funds - 0.2% | | | | | | | | |

| Athene Global Funding | | | | | | | | |

| 3.138% (3 Month LIBOR + 1.230%) 07/01/2022 (a)(b) | | | 200,000 | | | | 201,341 | |

| Media - 1.2% | | | | | | | | |

| Comcast Corp. | | | | | | | | |

| 2.239% (3 Month LIBOR + 0.330%) 10/01/2020 (b) | | | 1,100,000 | | | | 1,093,025 | |

| Motor Vehicle Manufacturing - 3.5% | | | | | | | | |

| BMW US Capital LLC | | | | | | | | |

| 2.540% (3 Month LIBOR + 0.640%) 04/06/2022 (a)(b) | | | 990,000 | | | | 945,094 | |

| Daimler Finance North America LLC | | | | | | | | |

| 2.563% (3 Month LIBOR + 0.880%) 02/22/2022 (a)(b) | | | 2,422,000 | | | | 2,284,927 | |

| | | | | | | | 3,230,021 | |

| Multiline Retail - 1.1% | | | | | | | | |

| Dollar Tree, Inc. | | | | | | | | |

| 2.536%, (3 Month LIBOR + 0.700%) 04/17/2020 (b) | | | 1,097,000 | | | | 1,096,771 | |

| Multi-Utilities - 3.9% | | | | | | | | |

| Ameren Corp. | | | | | | | | |

| 2.700%, 11/15/2020 | | | 1,000,000 | | | | 997,163 | |

| CenterPoint Energy Houston Electric LLC | | | | | | | | |

| 1.850%, 06/01/2021 | | | 350,000 | | | | 344,353 | |

| Duke Energy Florida LLC | | | | | | | | |

| 4.550%, 04/01/2020 | | | 2,000,000 | | | | 2,000,000 | |

| NextEra Energy Capital Holdings, Inc. | | | | | | | | |

| 4.500%, 06/01/2021 | | | 150,000 | | | | 153,074 | |

| WEC Energy Group, Inc. | | | | | | | | |

| 2.450%, 06/15/2020 | | | 225,000 | | | | 224,822 | |

| | | | | | | | 3,719,412 | |

| Oil, Gas & Consumable Fuels - 2.2% | | | | | | | | |

| BP Capital Markets PLC | | | | | | | | |

| 1.702% (3 Month LIBOR + 0.650%) 09/19/2022 (b) | | | 130,000 | | | | 129,826 | |

| Marathon Petroleum Corp. | | | | | | | | |

| 5.125%, 03/01/2021 | | | 100,000 | | | | 96,985 | |

| MPLX LP | | | | | | | | |

| 2.099%, (3 Month LIBOR + 1.100%) 09/09/2022 (b) | | | 1,859,000 | | | | 1,730,341 | |

| Phillips 66 | | | | | | | | |

| 2.247% (3 Month LIBOR + 0.600%) 02/26/2021 (b) | | | 224,000 | | | | 209,559 | |

| | | | | | | | 2,166,711 | |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Sit Ultra Short ETF

Schedule of Investments

March 31, 2020 (Unaudited) (Continued)

| | | Principal

Amount | | | Value | |

| Other Financial Investment Activities - 1.1% | | | | | | | | |

| Diageo Capital PLC | | | | | | | | |

| 4.828%, 07/15/2020 | | $ | 1,000,000 | | | $ | 1,007,584 | |

| Professional Services - 1.8% | | | | | | | | |

| Equifax, Inc. (b) | | | | | | | | |

| 2.562%, (3 Month LIBOR + 0.870%) 08/15/2021 | | | 1,747,000 | | | | 1,705,299 | |

| Semiconductors & Semiconductor Equipment - 0.5% | | | | | | | | |

| Intel Corp. | | | | | | | | |

| 1.850%, 05/11/2020 | | | 200,000 | | | | 199,864 | |

| 1.811% (3 Month LIBOR + 0.080%) 05/11/2020 (b) | | | 300,000 | | | | 299,813 | |

| | | | | | | | 499,677 | |

| Specialty Retail - 1.2% | | | | | | | | |

| AutoZone, Inc. | | | | | | | | |

| 2.500%, 04/15/2021 | | | 100,000 | | | | 99,604 | |

| Home Depot, Inc. | | | | | | | | |

| 1.464% (3 Month LIBOR + 0.150%) 06/05/2020 (b) | | | 1,000,000 | | | | 995,894 | |

| | | | | | | | 1,095,498 | |

| Trading Companies & Distributors - 0.5% | | | | | | | | |

| GATX Corp. | | | | | | | | |

| 2.461% (3 Month LIBOR + 0.720%) 11/05/2021 (b) | | | 500,000 | | | | 490,260 | |

| TOTAL CORPORATE OBLIGATIONS (Cost $85,179,119) | | | | | | | 82,293,316 | |

| | | | | | | | | |

| MUNICIPAL DEBT OBLIGATIONS - 1.1% | | | | | | | | |

| California Housing Finance | | | | | | | | |

| 4.950%, 08/01/2020 | | | 1,000,000 | | | | 1,011,110 | |

| TOTAL MUNICIPAL DEBT OBLIGATIONS (Cost $1,004,125) | | | | | | | 1,011,110 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS - 3.2% | | | | | | | | |

| Money Market Funds - 3.2% | | | | | | | | |

| First American Government Obligations Fund - Class X, 0.45% (d) | | | 3,084,894 | | | | 3,084,894 | |

| TOTAL SHORT TERM INVESTMENTS (Cost $3,084,894) | | | | | | | 3,084,894 | |

| | | | | | | | | |

| Total Investments (Cost $101,364,942) - 103.3% | | | | | | | 98,208,869 | |

| Liabilities in Excess of Other Assets - (3.3)% | | | | | | | (3,170,610 | ) |

| TOTAL NET ASSETS - 100.0% | | | | | | $ | 95,038,259 | |

Percentages are stated as a percent of net assets.

ADR American Depositary Receipt

| (a) | Restricted security as defined in Rule 144(a) under the Securities Act of 1933. Resale to the public may require registration or may extend only to qualified institutional buyers. At March 31, 2020, the market value of these securities total $33,449,622, which represents 35.20% of total net assets. |

| (b) | Variable rate security based on a reference index and spread. The rate reported is the rate in effect as of March 31, 2020. |

| (c) | Variable rate security. The coupon is based on an underlying pool of assets. The rate reported is the rate in effect as of March 31, 2020. |

| (d) | The rate quoted is the annualized seven-day yield at March 31, 2020. |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Travel Tech ETF

Schedule of Investments

March 31, 2020 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS - 96.0% | | | | | | | | |

| Australia - 1.8% | | | | | | | | |

| Internet & Direct Marketing Retail - 1.8% | | | | | | | | |

| Webjet, Ltd. | | | 11,422 | | | $ | 25,784 | |

| | | | | | | | | |

| Brazil - 1.4% | | | | | | | | |

| Hotels, Restaurants & Leisure - 1.4% | | | | | | | | |

| CVC Brasil Operadora e Agencia de Viagens SA | | | 9,272 | | | | 20,128 | |

| | | | | | | | | |

| China - 4.4% | | | | | | | | |

| IT Services - 4.4% | | | | | | | | |

| TravelSky Technology, Ltd. (a) | | | 35,812 | | | | 63,192 | |

| | | | | | | | | |

| Cyprus - 0.1% | | | | | | | | |

| Internet & Direct Marketing Retail - 0.1% | | | | | | | | |

| Yatra Online, Inc. (a) | | | 2,066 | | | | 2,128 | |

| | | | | | | | | |

| Japan - 11.2% | | | | | | | | |

| Hotels, Restaurants & Leisure - 1.9% | | | | | | | | |

| Adventure, Inc. | | | 1,600 | | | | 26,784 | |

| Internet & Direct Marketing Retail - 9.3% | | | | | | | | |

| Airtrip Corp. | | | 3,800 | | | | 25,375 | |

| Open Door, Inc. (a) | | | 5,200 | | | | 35,690 | |

| Temairazu, Inc. | | | 1,600 | | | | 56,247 | |

| Veltra Corp. (a) | | | 4,200 | | | | 15,702 | |

| Total Internet & Direct Marketing Retail | | | | | | | 133,014 | |

| Total Japan | | | | | | | 159,798 | |

| | | | | | | | | |

| Mauritius - 3.2% | | | | | | | | |

| Internet & Direct Marketing Retail - 3.2% | | | | | | | | |

| MakeMyTrip, Ltd. (a) | | | 3,856 | | | | 46,098 | |

| | | | | | | | | |

| Netherlands - 0.8% | | | | | | | | |

| Interactive Media & Services - 0.8% | | | | | | | | |

| Trivago NV - ADR (a) | | | 7,378 | | | | 10,772 | |

| | | | | | | | | |

| Republic of Korea - 5.1% | | | | | | | | |

| Hotels, Restaurants & Leisure - 5.1% | | | | | | | | |

| Hana Tour Service, Inc. | | | 1,518 | | | | 46,263 | |

| Lotte Tour Development Co., Ltd. (a) | | | 3,777 | | | | 26,559 | |

| Total Hotels, Restaurants & Leisure | | | | | | | 72,822 | |

| | | | | | | | | |

| Spain - 6.2% | | | | | | | | |

| IT Services - 6.2% | | | | | | | | |

| Amadeus IT Group SA (a) | | | 1,850 | | | | 88,143 | |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Travel Tech ETF

Schedule of Investments

March 31, 2020 (Unaudited) (Continued)

| | | Shares | | | Value | |

| United Kingdom - 7.4% | | | | | | | | |

| Electronic Equipment, Instruments & Components - 0.3% | | | | | | | | |

| Accesso Technology Group PLC (a) | | | 1,978 | | | $ | 4,545 | |

| Internet & Direct Marketing Retail - 7.1% | | | | | | | | |

| Hostelworld Group PLC | | | 18,390 | | | | 12,175 | |

| On the Beach Group PLC | | | 6,068 | | | | 16,582 | |

| Trainline PLC (a) | | | 16,770 | | | | 70,822 | |

| Total Internet & Direct Marketing Retail | | | | | | | 99,579 | |

| Total United Kingdom | | | | | | | 104,124 | |

| | | | | | | | | |

| United States - 54.4% | | | | | | | | |

| Interactive Media & Services - 3.9% | | | | | | | | |

| TripAdvisor, Inc. | | | 3,241 | | | | 56,361 | |

| Internet & Direct Marketing Retail - 28.0% | | | | | | | | |

| Booking Holdings, Inc. (a) | | | 98 | | | | 131,842 | |

| Despegar.com Corp. (a) | | | 7,399 | | | | 41,952 | |

| Expedia Group, Inc. (a) | | | 1,041 | | | | 58,577 | |

| Tongcheng-Elong Holdings, Ltd. (a) | | | 47,268 | | | | 66,457 | |