Semi-Annual Report

March 31, 2021

(Unaudited)

ETFMG Prime Cyber Security ETF

ETFMG Prime Junior Silver Miners ETF

ETFMG Prime Mobile Payments ETF

ETFMG Sit Ultra Short ETF

ETFMG Travel Tech ETF

ETFMG Treatments, Testing and Advancements ETF

The Funds are a series of ETF Managers Trust.

ETFMG™ ETFs

TABLE OF CONTENTS |

March 31, 2021 (Unaudited) |

ETFMG™ ETFs

Dear Shareholder,

On behalf of the entire team, we want to express our appreciation for the confidence you have placed in these ETFs. The following information pertains to the fiscal period from October 1, 2020 to March 31, 2021.

Performance Overview

During the 6-month period ended March 31, 2021, the S&P 500 Information Technology Sector Index, a broad measure of US listed technology companies, returned 13.85%. During the same period, the S&P Global 1200 Information Technology Sector Index, a broad measure of global technology companies, returned 16.97%. Below is a performance overview for each Fund for the same 6-month period.

ETFMG Prime Cyber Security ETF (HACK)

The ETFMG Prime Cyber Security ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the Prime Cyber Defense Index (the “Index”).

Over the period, the total return for the Fund was 17.60%, while the total return for the Index was 18.06%. The best performers in the Fund on the basis of contribution to return were Cloudflare Inc - Class A, Blackberry Ltd, Fireeye Inc, Fortinet Inc, and Commvault Systems Inc, while the worst performers were Sumo Logic Inc, Ping Identity Holding Corp, Splunk Inc, Trend Micro Inc, and Solarwinds Corp.

At the end of the reporting period, the Fund saw an average approximate allocation of 64.0% to Software, 10.1% to Communications Equipment and 8.5% to IT Services. The Fund was exposed predominately to the United States 72.5%, followed by Israel 9.7% and the United Kingdom 6.8%.

ETFMG Prime Junior Silver Miners ETF (SILJ)

The ETFMG Prime Junior Silver ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the Prime Junior Silver Miners & Explorers Index (the “Index”).

Over the period, the total return for the Fund was 5.43%, while the total return for the Index, which does not incur Fund expenses, was 5.80%. The best performers in the Fund on the basis of contribution to return were First Majestic Silver Corp, Turquoise Hill Resources Ltd, Hecla Mining Co, Capstone Mining Corp, and Hudbay Minerals Inc, while the worst performers in the Fund on the basis of contribution to return were Yamana Gold Inc, Silvercorp Metals Inc, Pan American Silver Corp, Ssr Mining Inc, and Harmony Gold Mng-Spon Adr.

At the end of the reporting period, the Fund saw an average approximate allocation of 98.3% to Metals and Mining and 1.2% to Commercial Services & Supplies. The Fund was exposed predominately to Canada 75.1%, followed by the United States 12.4% and the United Kingdom 4.7%.

ETFMG Prime Mobile Payments ETF (IPAY)

The ETFMG Prime Mobile Payments ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the Prime Mobile Payments Index (the “Index”).

Over the period, the total return for the Fund was 22.55%, while the total return for the Index was 22.91%. The best performers in the Fund on the basis of contribution to return were Square Inc - A, American Express Co, Discover Financial Services, Paypal Holdings Inc, and Ncr Corporation, while the worst performers were Affirm Holdings Inc, Nexi Spa, Fidelity National Info Serv, Qiwi Plc-Sponsored Adr, and Green Dot Corp-Class A.

At the end of the reporting period, the Fund saw an average approximate allocation of 83.7% to IT Services, 10.9% to Consumer Finance and 1.7% to Software. The Fund was exposed predominately to the United States 70.1%, followed by the Cayman Islands 5.0%, Netherlands 4.9% and Australia 3.6%.

ETFMG Sit Ultra Short ETF (VALT)

The ETFMG Sit Ultra Short ETF (the “Fund”) is an actively managed exchange-traded fund (“ETF”) that seeks maximum current income, consistent with preservation of capital and daily liquidity.

Over the fiscal period, the total return for the Fund was 0.33%, while the total return for its benchmark, the Bloomberg Barclays U.S. Treasury Bills Index: 1-3 month Index, was 0.04%.

The Fund seeks to achieve its investment objective by investing in a diversified portfolio of high-quality, short-term U.S. dollar-denominated domestic and foreign debt securities and other instruments. The Fund uses the Bloomberg Barclays U.S. Treasury Bills Index: 1-3-month Index as its benchmark index. The Fund seeks to maintain an average effective duration within a range of 2 months to 1 year.

ETFMG Travel Tech ETF (AWAY)

The ETFMG Travel Tech ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the Prime Travel Technology Index NTR (the “Index”).

Over the fiscal period, the total return for the Fund was 64.05%, while the total return the for the Index was 64.19%. The best performers in the Fund on the basis of contribution to return were Tripadvisor Inc, Trivago Nv, Facedrive Inc, Lyft Inc-A, and Sabre Corp, while the worst performers were Tuniu Corp-Spon, Veltra Corp, Temairazu Inc, Adventure Inc, and Cvc Brasil Operadora.

At the end of the reporting period, the Fund saw an average approximate allocation of 46.4% to Internet & Direct Marketing Retail, 18.4% to Hotels, Restaurants & Leisure, and 11.9% to Road & Rail. The Fund was exposed predominately to the United States 31.2%, followed by the United Kingdom 12.8%, the Cayman Islands 11.1% and the Japan 8.0%.

ETFMG Treatments, Testing and Advancements ETF (GERM)

The ETFMG Treatments, Testing and Advancements ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the Prime Treatments, Testing and Advancements Index (the “Index”).

Over the fiscal period, the total return for the Fund was 28.90%, while the total return the for the Index was 28.30%. The best performers in the Fund on the basis of contribution to return were Moderna Inc, Biontech Se-Adr, Curevac Nv, Zai Lab Ltd-Adr, and Novavax Inc, while the worst performers were Quidel Corp, Vaxcyte Inc, Adaptive Biotechnologies, Assembly Biosciences Inc, and Emergent Biosolutions Inc.

At the end of the reporting period, the Fund saw an average approximate allocation of 57.5% to Biotechnology, 14.0% to Life Sciences Tools & Services and 10.5% to Health Care Providers & Services. The Fund was exposed predominately to the United States 71.0%, followed by Germany 6.5% and Canada 5.9%.

You can find further details about HACK, SILJ, IPAY, VALT, AWAY and GERM by visiting www.etfmg.com, or by calling 1-844-383-6477.

Sincerely,

Samuel Masucci III

Chairman of the Board

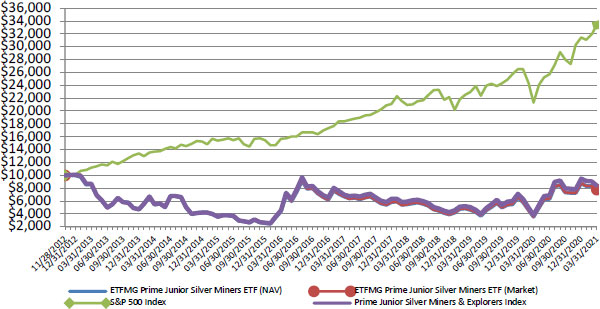

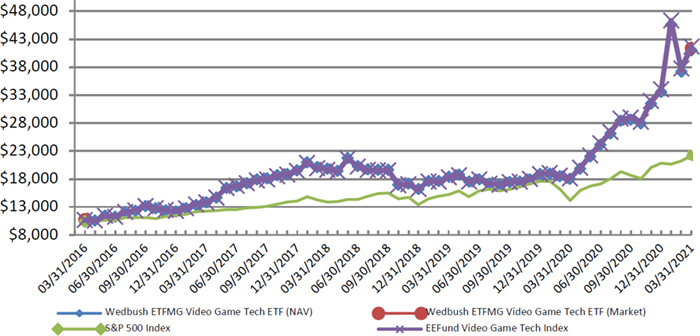

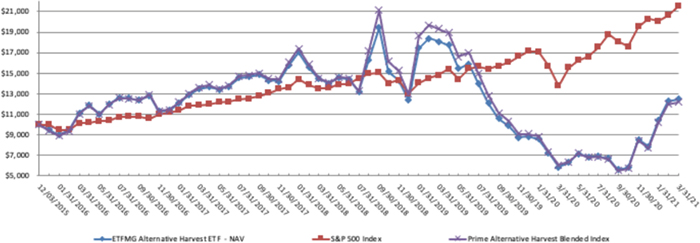

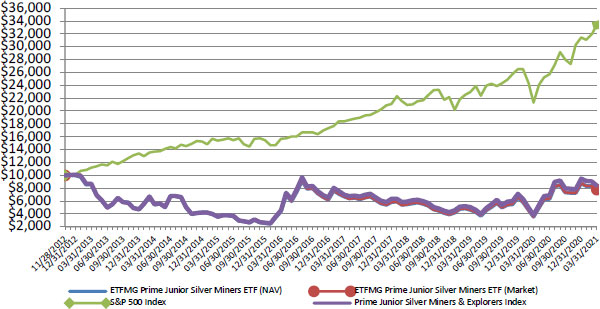

ETFMG Prime Junior Silver Miners ETF

Growth of $10,000 (Unaudited)

Average Annual Returns | 1 Year | 5 Year | Since Inception | Value of $10,000 |

Period Ended March 31, 2021 | Return | Return | (11/28/12) | (3/31/21) |

ETFMG Prime Junior Silver Miners ETF (NAV) | 115.80% | 11.86% | -3.04% | $7,733 |

ETFMG Prime Junior Silver Miners ETF (Market) | 119.88% | 11.74% | -2.98% | $7,770 |

S&P 500 Index | 56.35% | 16.29% | 15.54% | $33,348 |

Prime Junior Silver Miners & Explorers Index | 118.34% | 12.94% | -2.04% | $8,418 |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. All performance is historical and includes reinvestment of dividends and capital gains. Performance data current to the most recent month end may be obtained by calling 1-844-ETF-MGRS (1-844-383-6477).

The chart illustrates the performance of a hypothetical $10,000 investment made on November 28, 2012, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions from the sale of Fund shares. The chart assumes reinvestment of capital gains and dividends, if any. The index returns do not reflect fees or expenses and are not available for direct investment.

ETFMG Prime Junior Silver Miners ETF

Top Ten Holdings as of March 31, 2021* (Unaudited)

Security | | % of Total Investments |

1 Pan American Silver Corp. | | 12.62% |

2 First Majestic Silver Corp. | | 10.67% |

3 Hecla Mining Co. | | 8.96% |

4 MAG Silver Corp.** | | 6.21% |

5 Hochschild Mining PLC | | 4.68% |

6 Yamana Gold, Inc. | | 4.58% |

7 Turquoise Hill Resources, Ltd. | | 3.80% |

8 SilverCrest Metals, Inc. | | 3.69% |

9 SSR Mining, Inc. | | 3.68% |

10 Harmony Gold Mining Co., Ltd. | | 3.07% |

Top Ten Holdings = 61.96% of Total Investments

* Current Fund holdings may not be indicative of future Fund holdings.

** Affiliated security. Please refer to Note 9 of the Notes to Financial Statements.

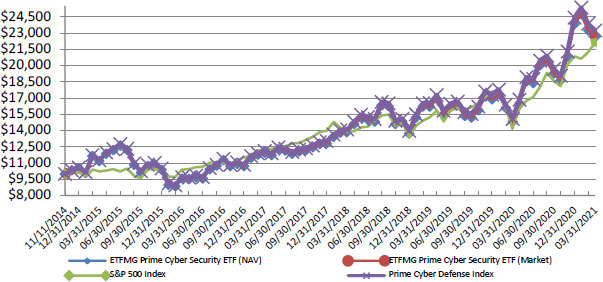

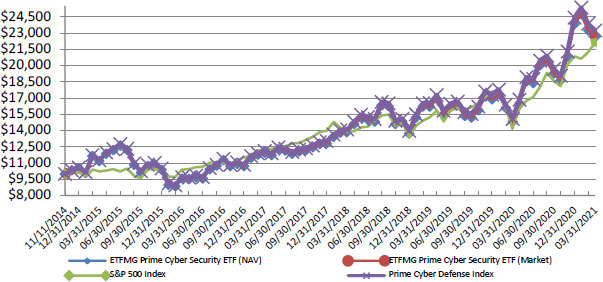

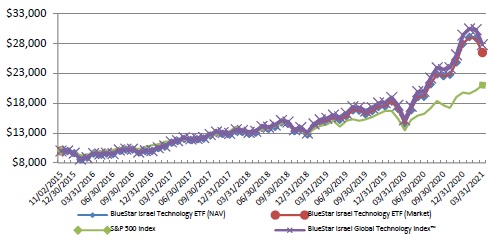

ETFMG Prime Cyber Security ETF

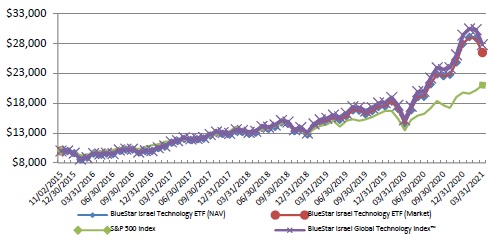

Growth of $10,000 (Unaudited)

Average Annual Returns

Period Ended March 31, 2021 | 1 Year

Return | 5 Year

Return | Since

Inception

(11/11/14) | Value of

$10,000

(3/31/21) |

ETFMG Prime Cyber Security ETF (NAV) | 52.78% | 18.75% | 13.66% | $22,647 |

ETFMG Prime Cyber Security ETF (Market) | 54.09% | 18.85% | 13.73% | $22,732 |

S&P 500 Index | 56.35% | 16.29% | 13.25% | $22,130 |

Prime Cyber Defense Index | 54.11% | 19.09% | 14.12% | $23,235 |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. All performance is historical and includes reinvestment of dividends and capital gains. Performance data current to the most recent month end may be obtained by calling 1-844-ETF-MGRS (1-844-383-6477).

The chart illustrates the performance of a hypothetical $10,000 investment made on November 11, 2014, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions from the sales of Fund shares. The chart assumes reinvestment of capital gains and dividends, if any. The Index Returns do not reflect fees or expenses and are not available for direct investment.

ETFMG Prime Cyber Security ETF |

Top Ten Holdings as of March 31, 2021* (Unaudited)

| | Security | % of Total Investments |

1 | | Cisco Systems, Inc. | 3.81% |

2 | | Fortinet, Inc. | 2.70% |

3 | | Akamai Technologies, Inc. | 2.60% |

4 | | CloudFlare, Inc. - Class A | 2.59% |

5 | | Qualys, Inc. | 2.59% |

6 | | CACI International, Inc. - Class A | 2.58% |

7 | | Parsons Corp. | 2.52% |

8 | | Proofpoint, Inc. | 2.51% |

9 | | ETFMG Sit Ultra Short ETF** | 2.48% |

10 | | Juniper Networks, Inc. | 2.47% |

Top Ten Holdings = 26.85% of Total Investments

* | Current Fund holdings may not be indicative of future Fund holdings. |

** | Affiliated security. Please refer to Note 9 of the Notes to Financial Statements. |

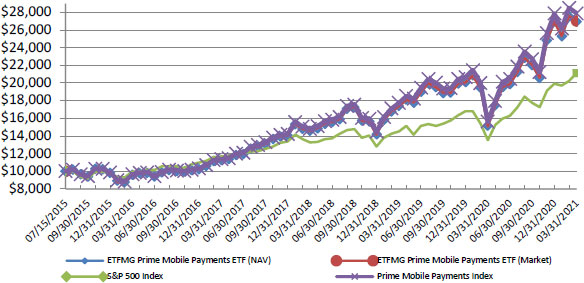

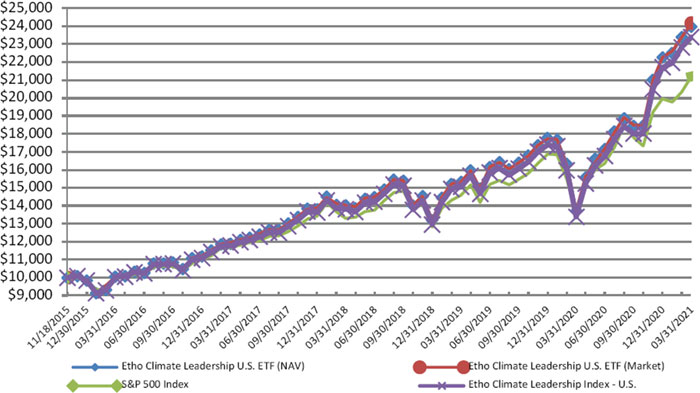

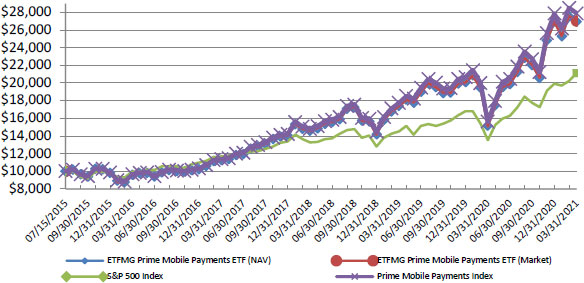

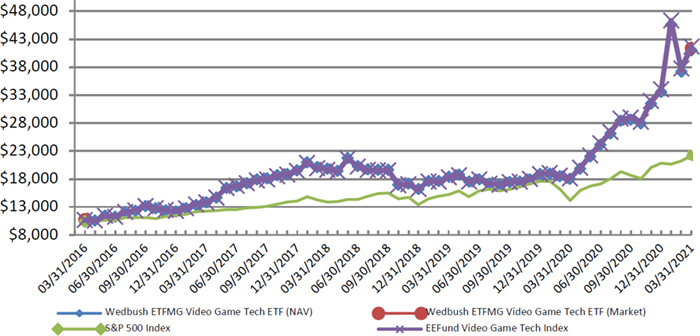

ETFMG Prime Mobile Payments ETF

Growth of $10,000 (Unaudited)

Average Annual Returns

Period Ended March 31, 2021 | 1 Year

Return | 5 Year

Return | Since

Inception

(7/15/15) | Value of

$10,000

(3/31/21) |

ETFMG Prime Mobile Payments ETF (NAV) | 77.79% | 22.96% | 18.96% | $26,955 |

ETFMG Prime Mobile Payments ETF (Market) | 79.21% | 23.01% | 19.03% | $27,046 |

S&P 500 Index | 56.35% | 16.29% | 13.98% | $21,122 |

Prime Mobile Payments Index | 78.73% | 23.67% | 19.68% | $27,902 |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. All performance is historical and includes reinvestment of dividends and capital gains. Performance data current to the most recent month end may be obtained by calling 1-844-ETF-MGRS (1-844-383-6477).

The chart illustrates the performance of a hypothetical $10,000 investment made on July 15, 2015, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions from the sales of Fund shares. The chart assumes reinvestment of capital gains and dividends, if any. The Index Returns do not reflect fees or expenses and are not available for direct investment.

ETFMG Prime Mobile Payments ETF

Top Ten Holdings as of March 31, 2021* (Unaudited)

| | Security | % of Total Investments |

1 | | Square, Inc. - Class A | 6.23% |

2 | | MasterCard, Inc. - Class A | 6.10% |

3 | | PayPal Holdings, Inc. | 6.09% |

4 | | Fidelity National Information Services, Inc. | 6.03% |

5 | | Visa, Inc. - Class A | 6.00% |

6 | | American Express Co. | 5.94% |

7 | | Fiserv, Inc. | 5.62% |

8 | | Adyen NV | 4.93% |

9 | | Global Payments, Inc. | 4.54% |

10 | | Discover Financial Services | 2.84% |

Top Ten Holdings = 54.32% of Total Investments

* | Current Fund holdings may not be indicative of future Fund holdings. |

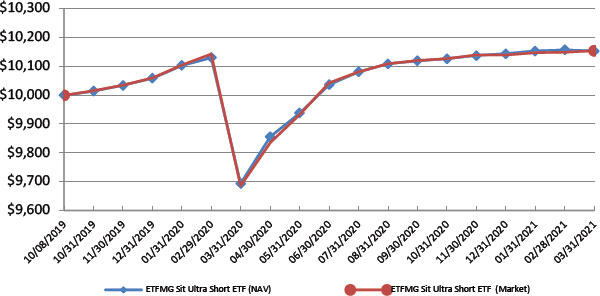

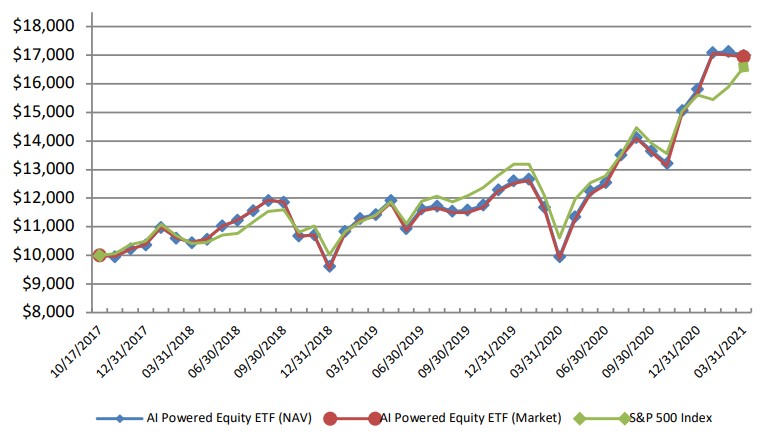

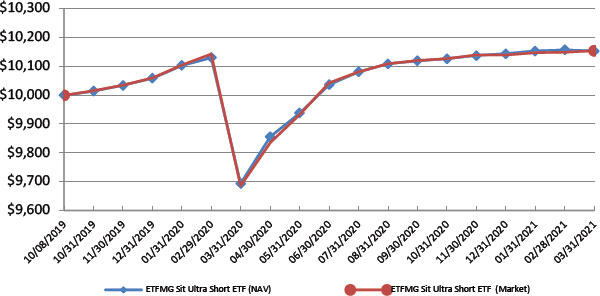

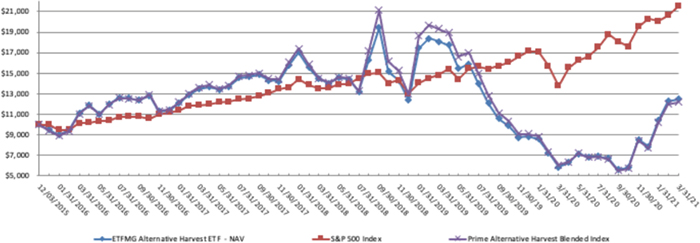

ETFMG Sit Ultra Short ETF

Growth of $10,000 (Unaudited)

Average Annual Returns

Period Ended March 31, 2021 | 1 Year

Return | Since Inception

(10/8/2019) | Value of $10,000

(3/31/2021) |

ETFMG Sit Ultra Short ETF (NAV) | 4.75% | 1.03% | $10,153 |

ETFMG Sit Ultra Short ETF (Market) | 4.85% | 1.04% | $10,154 |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. All performance is historical and includes reinvestment of dividends and capital gains. Performance data current to the most recent month end may be obtained by calling 1-844-ETF-MGRS (1-844-383-6477).

The chart illustrates the performance of a hypothetical $10,000 investment made on October 8, 2019, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions from the sales of Fund shares. The chart assumes reinvestment of capital gains and dividends, if any. The Index Returns do not reflect fees or expenses and are not available for direct investment.

ETFMG Sit Ultra Short ETF |

Top Ten Holdings as of March 31, 2021* (Unaudited)

| | Security | % of Total Investments |

1 | | Florida Power & Light Co. | 2.47% |

2 | | Hewlett Packard Enterprise Co. | 2.38% |

3 | | Commonwealth Bank of Australia | 2.29% |

4 | | Verizon Communications, Inc. | 2.24% |

5 | | Daimler Finance North America LLC | 2.18% |

6 | | Equifax, Inc. | 2.16% |

7 | | Otis Worldwide Corp. | 2.14% |

8 | | Capital One Financial Corp. | 2.06% |

9 | | Honeywell International, Inc. | 2.03% |

10 | | AstraZeneca PLC | 1.98% |

Top Ten Holdings = 21.93% of Total Investments

* | Current Fund holdings may not be indicative of future Fund holdings. |

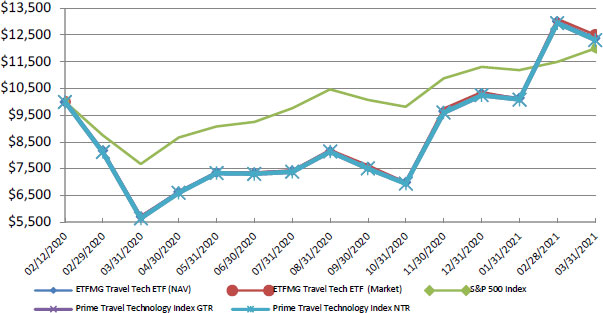

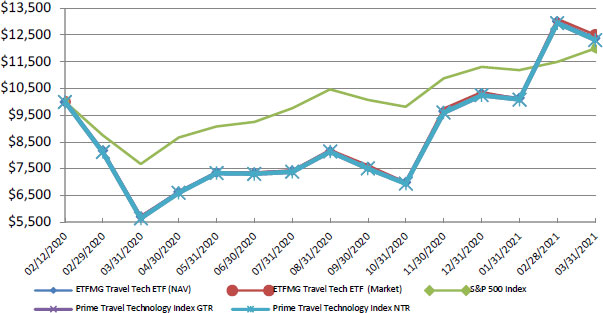

ETFMG Travel Tech ETF

Growth of $10,000 (Unaudited)

Average Annual Returns

Period Ended March 31, 2021 | 1 Year

Return | | Since Inception

(2/12/2020) | | Value of $10,000

(3/31/2021) |

ETFMG Travel Tech ETF (NAV) | 116.96% | | 20.81% | | $12,386 |

ETFMG Travel Tech ETF (Market) | 118.69% | | 21.88% | | $12,509 |

S&P 500 Index | 56.35% | | 17.45% | | $11,996 |

Prime Travel Technology Index GTR | 118.31% | | 20.21% | | $12,315 |

Prime Travel Technology Index NTR | 118.29% | | 20.17% | | $12,311 |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. All performance is historical and includes reinvestment of dividends and capital gains. Performance data current to the most recent month end may be obtained by calling 1-844-ETF-MGRS (1-844-383-6477).

The chart illustrates the performance of a hypothetical $10,000 investment made on February 12, 2020, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions from the sales of Fund shares. The chart assumes reinvestment of capital gains and dividends, if any. The Index Returns do not reflect fees or expenses and are not available for direct investment.

ETFMG Travel Tech ETF

Top Ten Holdings as of March 31, 2021* (Unaudited)

| Security | % of Total Investments |

1 | Expedia Group, Inc. | 4.88% |

2 | Booking Holdings, Inc. | 4.72% |

3 | Airbnb, Inc. | 4.69% |

4 | Trivago NV** | 4.62% |

5 | Uber Technologies, Inc. | 4.62% |

6 | Despegar.com Corp. | 4.25% |

7 | TripAdvisor, Inc. | 4.16% |

8 | Tongcheng-Elong Holdings, Ltd. | 4.16% |

9 | Lyft, Inc. | 4.08% |

10 | Trip.com Group, Ltd. | 4.05% |

Top Ten Holdings = 44.23% of Total Investments

* Current Fund holdings may not be indicative of future Fund holdings.

** Affiliated security. Please refer to Note 9 of the Notes to Financial Statements.

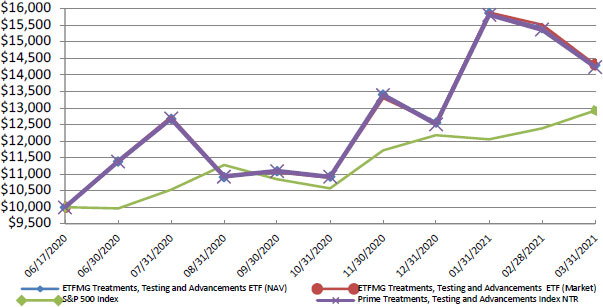

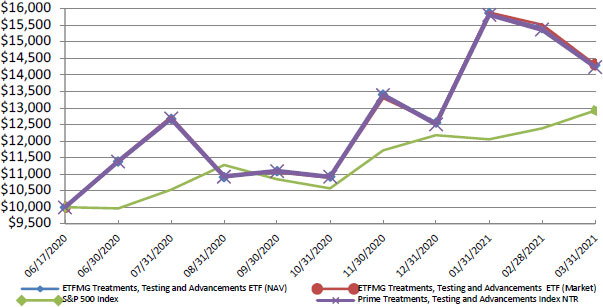

ETFMG Treatments, Testing and Advancements ETF

Growth of $10,000 (Unaudited)

Average Cumulative Returns | Since Inception | | Value of $10,000 |

Period Ended March 31, 2021 | (6/17/2020) | | (3/31/2021) |

ETFMG Treatments, Testing and Advancements ETF (NAV) | 42.85% | | $14,285 |

ETFMG Treatments, Testing and Advancements ETF (Market) | 43.14% | | $14,314 |

S&P 500 Index | 29.22% | | $12,922 |

Prime Treatments, Testing and Advancements Index NTR | 42.26% | | $14,235 |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. All performance is historical and includes reinvestment of dividends and capital gains. Performance data current to the most recent month end may be obtained by calling 1-844-ETF-MGRS (1-844-383-6477).

The chart illustrates the performance of a hypothetical $10,000 investment made on June 17, 2020, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions from the sales of Fund shares. The chart assumes reinvestment of capital gains and dividends, if any. The Index Returns do not reflect fees or expenses and are not available for direct investment.

ETFMG Treatments, Testing and Advancements ETF

Top Ten Holdings as of March 31, 2021* (Unaudited)

| Security | % of Total Investments |

1 | BioNTech SE | 6.61% |

2 | Laboratory Corp. of America Holdings | 6.24% |

3 | Alnylam Pharmaceuticals, Inc. | 5.92% |

4 | Bio-Rad Laboratories, Inc. - Class A | 5.85% |

5 | Moderna, Inc. | 5.70% |

6 | Novavax, Inc. | 4.39% |

7 | AbCellera Biologics, Inc. | 4.35% |

8 | CureVac NV | 4.32% |

9 | Quest Diagnostics, Inc. | 4.19% |

10 | Zai Lab, Ltd. | 3.84% |

Top Ten Holdings = 51.41% of Total Investments

* Current Fund holdings may not be indicative of future Fund holdings.

ETFMG™ ETFs

Important Disclosures and Key Risk Factors

Past performance is not indicative of future return. A fund’s performance for very short time periods may not be indicative of future performance.

SILJ

The ETFMG Prime Junior Silver Miners ETF (the “Fund” or the “Junior Silver ETF”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Prime Junior Silver Miners & Explorers Index (the “Index”).

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Narrowly focused investments typically exhibit higher volatility. Investments in foreign securities involve political, economic and currency risks, greater volatility and differences in accounting methods. These risks are greater for investments in emerging markets. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual issuer volatility than a diversified fund. Funds that are less diversified across countries or geographic regions are generally riskier than more geographically diversified funds and risks associated with such countries or geographic regions may negatively affect a Fund. Investments in small capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. The ETFMG Prime Junior Silver Miners ETF is subject to risks associated with the worldwide price of silver and the costs of extraction and production. Worldwide silver prices may fluctuate substantially over short periods of time, so the Fund’s share price may be more volatile. Several foreign countries have begun a process of privatizing certain entities and industries. Privatized entities may lose money or be renationalized. The Fund invests in some economies that are heavily dependent upon trading with key partners. Any reduction in this trading may cause an adverse impact on the economy in which the Fund invests. The Fund’s return may not match or achieve a high degree of correlation with the return of the Prime Junior Silver Miners & Explorers Index. To the extent the Fund utilizes a sampling approach, it may experience tracking error to a greater extent than if the Fund had sought to replicate the Prime Junior Silver Miners & Explorers Index. IOPV or indicative optimized portfolio value is an estimated intraday fair value of one share of an ETF determined by the last trade price of the fund’s underlying securities.

Unlike with an actively managed fund, the Fund’s adviser does not use techniques or defensive strategies designed to lessen the effects of market volatility or to reduce the impact of periods of market decline. This means that, based on market and economic conditions, the Fund’s performance could be lower than other types of funds that may actively shift their portfolio assets to take advantage of market opportunities or to lessen the impact of a market decline.

Natural or environmental disasters, such as earthquakes, fires, floods, hurricanes, tsunamis and other severe weather-related phenomena generally, and widespread disease, including pandemics and epidemics, have been and may be highly disruptive to economies and markets, adversely impacting individual companies, sectors, industries, markets, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of the Fund’s investments. Given the increasing interdependence among global economies and markets, conditions in one country, market, or region are increasingly likely to adversely affect markets, issuers, and/or foreign exchange rates in other countries, including the U.S. Any such events could have a significant adverse impact on the value of the Fund’s investments.

ETF Managers Group LLC is the investment adviser to the Fund.

The Fund is distributed by ETFMG Financial LLC, ETF Managers Group LLC and ETFMG Financial LLC are wholly owned subsidiaries of Exchange Traded Managers Group LLC (collectively, “ETFMG”). ETFMG is not affiliated with Prime Indexes.

ETFMG™ ETFs

HACK

The ETFMG Prime Cyber Security ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Prime Cyber Defense Index (the “Index”).

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Narrowly focused investments typically exhibit higher volatility. The fund is concentrated in technology-related companies that face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. Such companies may have limited product lines, markets, financial resources or personnel. The products of such companies may face obsolescence due to rapid technological developments, frequent new product introduction, unpredictable changes in growth rates, competition for the services of qualified personnel, and competition from foreign competitors with lower production costs. Technology companies are heavily dependent on patent and intellectual property rights. The loss or impairment of these rights may adversely affect the profitability of these companies. Investments in foreign securities involve political, economic and currency risks, greater volatility and differences in accounting methods. Investments in smaller companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Diversification does not assure a profit or protect against a loss in a declining market. The Fund’s return may not match or achieve a high degree of correlation with the return of the Prime Cyber Defense Index. To the extent the Fund utilizes a sampling approach, it may experience tracking error to a greater extent than if the Fund had sought to replicate the Prime Cyber Defense Index.

Unlike with an actively managed fund, the Fund’s adviser does not use techniques or defensive strategies designed to lessen the effects of market volatility or to reduce the impact of periods of market decline. This means that, based on market and economic conditions, the Fund’s performance could be lower than other types of funds that may actively shift their portfolio assets to take advantage of market opportunities or to lessen the impact of a market decline.

Natural or environmental disasters, such as earthquakes, fires, floods, hurricanes, tsunamis and other severe weather-related phenomena generally, and widespread disease, including pandemics and epidemics, have been and may be highly disruptive to economies and markets, adversely impacting individual companies, sectors, industries, markets, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of the Fund’s investments. Given the increasing interdependence among global economies and markets, conditions in one country, market, or region are increasingly likely to adversely affect markets, issuers, and/or foreign exchange rates in other countries, including the U.S. Any such events could have a significant adverse impact on the value of the Fund’s investments.

ETF Managers Group LLC is the investment adviser to the Fund.

The Fund is distributed by ETFMG Financial LLC, ETF Managers Group LLC and ETFMG Financial LLC are wholly owned subsidiaries of Exchange Traded Managers Group LLC (collectively, “ETFMG”). ETFMG is not affiliated with Prime Indexes.

IPAY

The ETFMG Prime Mobile Payments ETF (the “Fund” or the “Mobile Payments ETF”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Prime Mobile Payments Index (the “Index”).

ETFMG™ ETFs

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Narrowly focused investments typically exhibit higher volatility. Mobile Payment Companies face intense competition, both domestically and internationally, and are subject to increasing regulatory constraints, particularly with respect to fees, competition and anti-trust matters, cybersecurity and privacy. Mobile Payment Companies may be highly dependent on their ability to enter into agreements with merchants and other third parties to utilize a particular payment method, system, software or service, and such agreements may be subject to increased regulatory scrutiny. Additionally, certain Mobile Payment Companies have recently faced increased costs related to class-action litigation challenging such agreements. Such factors may adversely affect the profitability and value of such companies. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Investments in smaller companies tend to have limited liquidity and greater price volatility than large-capitalization companies. The Fund’s return may not match or achieve a high degree of correlation with the return of the Prime Mobile Payments Index. To the extent the Fund utilizes a sampling approach, it may experience tracking error to a greater extent than if the Fund had sought to replicate the Index. Diversification does not guarantee a profit, nor does it protect against a loss in a declining market.

Unlike with an actively managed fund, the Fund’s adviser does not use techniques or defensive strategies designed to lessen the effects of market volatility or to reduce the impact of periods of market decline. This means that, based on market and economic conditions, the Fund’s performance could be lower than other types of funds that may actively shift their portfolio assets to take advantage of market opportunities or to lessen the impact of a market decline.

Natural or environmental disasters, such as earthquakes, fires, floods, hurricanes, tsunamis and other severe weather-related phenomena generally, and widespread disease, including pandemics and epidemics, have been and may be highly disruptive to economies and markets, adversely impacting individual companies, sectors, industries, markets, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of the Fund’s investments. Given the increasing interdependence among global economies and markets, conditions in one country, market, or region are increasingly likely to adversely affect markets, issuers, and/or foreign exchange rates in other countries, including the U.S. Any such events could have a significant adverse impact on the value of the Fund’s investments.

ETF Managers Group LLC is the investment adviser to the Fund.

The Fund is distributed by ETFMG Financial LLC, ETF Managers Group LLC and ETFMG Financial LLC are wholly owned subsidiaries of Exchange Traded Managers Group LLC (collectively, “ETFMG”). ETFMG is not affiliated with Prime Indexes.

VALT

The ETFMG Sit Ultra Short ETF (the “Fund” or the “Ultra Short ETF”) seeks maximum current income, consistent with preservation of capital and daily liquidity.

Investing involves risk. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Although the Fund’s shares are approved for listing on the Exchange, there can be no assurance that an active trading market will be maintained for Fund shares.

The market price of the Fund’s fixed-income instruments may change, sometimes rapidly or unpredictably, in response to changes in interest rates, factors affecting securities markets generally, and other factors. Generally, when interest rates rise, the values of fixed-income instruments fall, and vice versa. The Fund may invest in floating rate securities, which are generally less sensitive to interest rate changes than securities with fixed interest rates but may decline in value if their interest rates do not rise as much, or as quickly, as comparable market interest rates. The Fund may invest in U.S. dollar-denominated debt obligations of foreign issuers. Mortgage- and asset-backed securities are subject to interest rate risk. Modest movements in interest rates (both increases and decreases) may quickly and significantly reduce the value of certain types of these securities. From time to time the Fund may invest a substantial amount of its assets in taxable or tax-exempt municipal securities whose interest is paid solely from revenues of similar projects.

ETFMG™ ETFs

The Fund is recently organized with a limited operating history. The Fund may not meet its investment objective based on the success or failure to implement investment strategies for the Fund.

The Fund’s investment strategy may require it to redeem shares for cash or to otherwise include cash as part of its redemption proceeds. In the event of large shareholder redemptions, the Fund may have to sell portfolio securities at times when it would not otherwise do so, which may negatively impact the Fund’s performance.

ETF Managers Group LLC is the investment advisor to the Fund. Sit Fixed Income Advisors II LLC (“Sit Advisors”) is the sub-advisor to the Fund. Sit Advisors is a subsidiary of Sit Investment Associates Inc. (“Sit”). Sit is a full product global asset manager offering management expertise in domestic equities, international equities and fixed income instruments.

ETFMG Financial LLC is the distributor of the Fund. ETF Managers Group LLC and ETFMG Financial LLC are wholly owned subsidiaries of Exchange Traded Managers Group LLC (collectively, “ETFMG”). ETFMG is not affiliated with Sit.

AWAY

The ETFMG Travel Tech ETF (the “Fund” or the “Travel Tech ETF”) seeks investment results that correspond generally to the price and yield, before fund fees and expenses, of the Prime Travel Technology Index (the “Index”).

Investing involves risk, including loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Narrowly focused investments typically exhibit higher volatility. Companies in the technology field, including companies in the computers, telecommunications and electronics industries, face intense competition, which may have an adverse effect on profit margins. Technology companies may have limited product lines, markets, financial resources or personnel. The products of technology companies may face obsolescence due to rapid technological developments and frequent new product introduction, and such companies may face unpredictable changes in growth rates, competition for the services of qualified personnel and competition from foreign competitors with lower production costs. Companies in the technology sector are heavily dependent on patent and intellectual property rights. The loss or impairment of these rights may adversely affect the profitability of these companies.

Unlike with an actively managed fund, the Fund’s adviser does not use techniques or defensive strategies designed to lessen the effects of market volatility or to reduce the impact of periods of market decline. This means that, based on market and economic conditions, the Fund’s performance could be lower than other types of funds that may actively shift their portfolio assets to take advantage of market opportunities or to lessen the impact of a market decline.

Natural or environmental disasters, such as earthquakes, fires, floods, hurricanes, tsunamis and other severe weather-related phenomena generally, and widespread disease, including pandemics and epidemics, have been and may be highly disruptive to economies and markets, adversely impacting individual companies, sectors, industries, markets, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of the Fund’s investments. Given the increasing interdependence among global economies and markets, conditions in one country, market, or region are increasingly likely to adversely affect markets, issuers, and/or foreign exchange rates in other countries, including the U.S. Any such events could have a significant adverse impact on the value of the Fund’s investments.

ETFMG™ ETFs

The Fund is a recently organized, diversified management investment company with limited operating history.

ETF Managers Group LLC is the investment advisor to the Fund.

The Fund is distributed by ETFMG Financial LLC, ETF Managers Group LLC and ETFMG Financial LLC are wholly owned subsidiaries of Exchange Traded Managers Group LLC (collectively, “ETFMG”). ETFMG is not affiliated with Prime Indexes.

GERM

The ETFMG Treatments, Testing and Advancements ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the Prime Treatments, Testing and Advancements Index (the “Index”).

Investing involves risk, including loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Narrowly focused investments typically exhibit higher volatility. Treatment Companies and Testing Companies are involved in discovering, developing and commercializing novel drugs or tests with significant market potential. These companies face challenges including pre-clinical testing and clinical trial stages of development. Clinical trials may be delayed and certain programs may never advance in the clinic or may be more costly to conduct than anticipated. Such companies may be dependent on their ability to secure significant funding for research, development, and commercialization of therapeutics, vaccines, tests, and other health care products or services. If there are delays in obtaining required regulatory and marketing approvals for products, the ability of such companies to generate revenue may be materially impaired. If regulatory approval is obtained, products will still remain subject to regulatory scrutiny with regulatory authorities having the ability to impose significant restrictions on the indicated uses or marketing. Lastly, even if a licensed product is achieved, such companies may encounter difficulties in manufacturing, product release, shelf life, testing, storage, supply chain management, or shipping. The Fund is a recently organized, non-diversified management investment company with limited operating history.

Natural or environmental disasters, such as earthquakes, fires, floods, hurricanes, tsunamis and other severe weather-related phenomena generally, and widespread disease, including pandemics and epidemics, have been and may be highly disruptive to economies and markets, adversely impacting individual companies, sectors, industries, markets, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of the Fund’s investments. Given the increasing interdependence among global economies and markets, conditions in one country, market, or region are increasingly likely to adversely affect markets, issuers, and/or foreign exchange rates in other countries, including the U.S. Any such events could have a significant adverse impact on the value of the Fund’s investments.

Additionally, natural or environmental disasters, widespread disease or other public health issues, war, acts of terrorism or other events could result in increased premiums or discounts to the Fund’s NAV.

ETF Managers Group LLC is the investment adviser to the Fund.

The Fund is distributed by ETFMG Financial LLC, ETF Managers Group LLC and ETFMG Financial LLC are wholly owned subsidiaries of Exchange Traded Managers Group LLC (collectively, “ETFMG”). ETFMG is not affiliated with Prime Indexes.

ETFMG™ ETFs

PORTFOLIO ALLOCATIONS

As of March 31, 2021 (Unaudited)

| | ETFMG Prime Junior Silver Miners ETF | | | ETFMG Prime Cyber Security ETF | | | ETFMG Prime Mobile Payments ETF | | | ETFMG Sit Ultra Short ETF | | | ETFMG Travel Tech ETF | | | ETFMG

Treatments,

Testing and Advancements

ETF | |

As a percent of Net Assets: Australia | | | — | % | | | — | % | | | 3.6 | % | | | — | % | | | 3.9 | % | | | — | % |

Bermuda | | | — | | | | — | | | | 1.5 | | | | — | | | | — | | | | — | |

Brazil | | | — | | | | — | | | | 1.5 | | | | — | | | | 3.1 | | | | — | |

Canada | | | 75.1 | | | | 3.3 | | | | 2.0 | | | | — | | | | 3.2 | | | | 5.9 | |

Cayman Islands | | | — | | | | — | | | | 5.0 | | | | — | | | | 11.1 | | | | 5.7 | |

China | | | — | | | | — | | | | — | | | | — | | | | 3.8 | | | | — | |

Cyprus | | | — | | | | — | | | | 0.4 | | | | — | | | | — | | | | — | |

Denmark | | | — | | | | — | | | | — | | | | — | | | | — | | | | 0.1 | |

Finland | | | — | | | | 0.2 | | | | — | | | | — | | | | — | | | | — | |

France | | | — | | | | — | | | | 2.5 | | | | — | | | | — | | | | 0.6 | |

Germany | | | — | | | | — | | | | — | | | | — | | | | — | | | | 6.5 | |

Israel | | | — | | | | 9.7 | | | | — | | | | — | | | | — | | | | — | |

Italy | | | — | | | | — | | | | 1.8 | | | | — | | | | — | | | | — | |

Japan | | | — | | | | 3.8 | | | | 3.0 | | | | — | | | | 8.0 | | | | 0.7 | |

Jersey | | | — | | | | 1.2 | | | | — | | | | — | | | | — | | | | — | |

Luxembourg | | | 1.6 | | | | — | | | | — | | | | — | | | | 2.9 | | | | — | |

Mauritius | | | — | | | | — | | | | — | | | | — | | | | 3.9 | | | | — | |

Netherlands | | | — | | | | — | | | | 4.9 | | | | — | | | | 4.6 | | | | 4.4 | |

Peru | | | 2.6 | | | | — | | | | — | | | | — | | | | — | | | | — | |

Puerto Rico | | | — | | | | — | | | | 1.4 | | | | — | | | | — | | | | — | |

Republic of Korea | | | — | | | | 0.8 | | | | — | | | | — | | | | 7.3 | | | | — | |

South Africa | | | 3.1 | | | | — | | | | — | | | | — | | | | — | | | | — | |

Spain | | | — | | | | — | | | | — | | | | — | | | | 3.8 | | | | — | |

Sweden | | | — | | | | 1.1 | | | | — | | | | — | | | | — | | | | — | |

United Kingdom | | | 4.7 | | | | 6.8 | | | | 1.8 | | | | — | | | | 12.8 | | | | 4.7 | |

United States | | | 12.4 | | | | 72.5 | | | | 70.1 | | | | — | | | | 31.2 | | | | 71.0 | |

Asset Backed Securities | | | — | | | | — | | | | — | | | | 0.6 | | | | — | | | | — | |

Coporate Obligations | | | — | | | | — | | | | — | | | | 97.4 | | | | — | | | | — | |

Municipal Debt Obligations | | | — | | | | — | | | | — | | | | 0.9 | | | | — | | | | — | |

Short-Term and other Net Assets

(Liabilities) | | | 0.5 | | | | 0.6 | | | | 0.5 | | | | 1.1 | | | | 0.4 | | | | 0.4 | |

| | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

ETFMG™ ETFs

ETFMG Prime Junior Silver Miners ETF

Schedule of Investments

March 31, 2021 (Unaudited)

| | Shares | | | Value | |

COMMON STOCKS - 99.5% Canada - 75.1% Commercial Services & Supplies - 1.2% Alexco Resource Corp. (a) | | | 3,603,264 | | | $ | 9,044,193 | |

Metals & Mining - 73.9% (c) Americas Gold & Silver Corp. (a) | | | 3,367,073 | | | | 7,635,998 | |

Aya Gold & Silver, Inc. (a) | | | 2,475,432 | | | | 9,711,053 | |

Bear Creek Mining Corp. (a) | | | 2,949,712 | | | | 5,093,400 | |

Canada Silver Cobalt Works, Inc. (a) | | | 1,057,376 | | | | 349,177 | |

Capstone Mining Corp. (a) | | | 3,575,534 | | | | 11,779,033 | |

Discovery Metals Corp. (a) | | | 8,431,314 | | | | 14,759,999 | |

Dundee Precious Metals, Inc. | | | 1,586,317 | | | | 9,681,747 | |

Eldorado Gold Corp. (a) | | | 1,528,548 | | | | 16,517,611 | |

Endeavour Silver Corp. (a) | | | 4,135,941 | | | | 20,514,267 | |

Excellon Resources, Inc. (a) | | | 849,245 | | | | 2,426,028 | |

First Majestic Silver Corp. (a) | | | 5,098,215 | | | | 79,430,190 | |

Fortuna Silver Mines, Inc. (a) | | | 1,610,722 | | | | 10,445,917 | |

Gran Colombia Gold Corp. | | | 540,819 | | | | 2,319,579 | |

Great Panther Mining, Ltd. (a) | | | 3,075,195 | | | | 2,367,900 | |

GT Gold Corp. (a) | | | 1,117,140 | | | | 2,862,410 | |

Hudbay Minerals, Inc. | | | 2,284,722 | | | | 15,635,083 | |

Kootenay Silver, Inc. (a)(f) | | | 8,355,076 | | | | 2,160,738 | |

Liberty Gold Corp. (a) | | | 2,285,629 | | | | 2,637,194 | |

MAG Silver Corp. (a)(f) | | | 3,069,556 | | | | 46,213,097 | |

Mandalay Resources Corp. (a)(e) | | | 797,743 | | | | 1,237,844 | |

Metalla Royalty & Streaming, Ltd. | | | 353,331 | | | | 3,157,402 | |

Minaurum Gold, Inc. (a)(e) | | | 2,978,640 | | | | 1,042,891 | |

Minco Silver Corp. (a)(e) | | | 1,600,920 | | | | 605,106 | |

Mirasol Resources, Ltd. (a) | | | 473,225 | | | | 199,578 | |

New Gold, Inc. (a)(f) | | | 5,911,571 | | | | 9,125,844 | |

New Pacific Metals Corp. (a) | | | 1,342,731 | | | | 5,545,296 | |

Orla Mining, Ltd. (a) | | | 2,010,218 | | | | 7,486,131 | |

Pan American Silver Corp. | | | 3,131,909 | | | | 93,954,778 | |

Premier Gold Mines, Ltd. (a) | | | 2,089,929 | | | | 4,623,222 | |

Sabina Gold & Silver Corp. (a) | | | 2,855,683 | | | | 4,112,983 | |

Seabridge Gold, Inc. (a) | | | 648,591 | | | | 10,482,122 | |

Sierra Metals, Inc. (a) | | | 1,422,367 | | | | 4,470,717 | |

Silvercorp Metals, Inc. | | | 4,600,316 | | | | 22,659,311 | |

SilverCrest Metals, Inc. (a) | | | 3,393,360 | | | | 27,488,187 | |

Sombrero Resources, Inc. (a)(b) | | | 585,867 | | | | 130,064 | |

SSR Mining, Inc. | | | 1,916,087 | | | | 27,398,809 | |

Tier One Silver, Inc. (a)(b) | | | 585,867 | | | | 153,713 | |

Trevali Mining Corp. (a) | | | 8,649,224 | | | | 1,342,085 | |

Turquoise Hill Resources, Ltd. (a) | | | 1,758,022 | | | | 28,314,129 | |

Yamana Gold, Inc. | | | 7,849,211 | | | | 34,065,576 | |

Total Metals & Mining | | | | | | | 550,136,209 | |

Total Canada | | | | | | | 559,180,402 | |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Prime Junior Silver Miners ETF

Schedule of Investments

March 31, 2021 (Unaudited) (Continued)

| | Shares | | | Value | |

Luxembourg - 1.6% Metals & Mining - 1.6% (c) Nexa Resources SA | | | 1,156,565 | | | $ | 11,854,791 | |

| | | | | | | | |

Peru - 2.6% Metals & Mining - 2.6% (c) Cia de Minas Buenaventura SAA - ADR (a) | | | 1,965,086 | | | | 19,709,813 | |

| | | | | | | | |

South Africa - 3.1% Metals & Mining - 3.1% (c) Harmony Gold Mining Co., Ltd. - ADR | | | 5,242,292 | | | | 22,856,393 | |

| | | | | | | | |

United Kingdom - 4.7% Metals & Mining - 4.7% (c) Hochschild Mining PLC | | | 12,924,703 | | | | 34,869,989 | |

| | | | | | | | |

United States - 12.4% | | | | | | | | |

Metals & Mining - 12.4% (c) Coeur Mining, Inc. (a) | | | 2,127,108 | | | | 19,207,785 | |

Gold Resource Corp. | | | 650,068 | | | | 1,716,180 | |

Golden Minerals Co. (a) | | | 1,418,821 | | | | 935,429 | |

Hecla Mining Co. | | | 11,718,928 | | | | 66,680,700 | |

McEwen Mining, Inc. (a) | | | 4,009,249 | | | | 4,169,619 | |

Total Metals & Mining | | | | | | | 92,709,713 | |

Total United States | | | | | | | 92,709,713 | |

TOTAL COMMON STOCKS (Cost $728,848,593) | | | | | | | 741,181,101 | |

| | | | | | | | | |

SHORT-TERM INVESTMENTS - 0.5% Money Market Funds - 0.5% Invesco Advisers, Inc. STIT - Treasury Portfolio – Institutional Class, 0.01% (d) | | | 3,587,114 | | | | 3,587,114 | |

TOTAL SHORT-TERM INVESTMENTS (Cost $3,587,114) | | | | | | | 3,587,114 | |

| | | | | | | | | |

Total Investments (Cost $732,435,707) - 100.0% | | | | | | | 744,768,215 | |

Liabilities in Excess of Other Assets - (0.0)% (g) | | | | | | | (234,691 | ) |

TOTAL NET ASSETS - 100.0% | | | | | | $ | 744,533,524 | |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Prime Junior Silver Miners ETF

Schedule of Investments

March 31, 2021 (Unaudited) (Continued)

Percentages are stated as a percent of net assets.

ADR American Depositary Receipt

PLC Public Limited Company

(a) | Non-income producing security. |

(b) | Value determined based on estimated fair value. The value of these securities total $283,777, which represents 0.04% of total net assets. Classified as Level 3 in the fair value hierarchy. Please refer to Note 2 of the Notes to Financial Statements. |

(c) | As of March 31, 2021, the Fund had a significant portion of its assets invested in the Metals & Mining Industry. |

(d) | The rate quoted is the annualized seven-day yield at March 31, 2021. |

(e) | These securities have been deemed illiquid according to the Fund’s liquidity guidelines. The value of these securities total $2,885,841, which represents 0.4% of total net assets. |

(f) | Affiliated security. Please refer to Note 9 of the Notes to Financial Statements. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services”).

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Prime Cyber Security ETF

Schedule of Investments

March 31, 2021 (Unaudited)

| | Shares | | | Value | |

COMMON STOCKS - 99.4% | | | | | | | | |

Canada - 3.3% | | | | | | | | |

Software - 3.3% (d) | | | | | | | | |

Absolute Software Corp. | | | 1,565,742 | | | $ | 21,741,225 | |

BlackBerry, Ltd. (a) | | | 5,279,788 | | | | 44,281,822 | |

Total Canada | | | | | | | 66,023,047 | |

| | | | | | | | | |

Finland - 0.2% | | | | | | | | |

Software - 0.2% (d) | | | | | | | | |

F-Secure Oyj | | | 785,704 | | | | 3,722,449 | |

| | | | | | | | | |

Israel - 9.7% | | | | | | | �� | |

Communications Equipment - 1.2% | | | | | | | | |

Radware, Ltd. (a) | | | 934,192 | | | | 24,363,727 | |

Software - 8.5% (d) | | | | | | | | |

Allot Communications, Ltd. (a) | | | 1,059,627 | | | | 16,922,243 | |

Check Point Software Technologies, Ltd. (a) | | | 429,197 | | | | 48,057,188 | |

Cognyte Software, Ltd. (a) | | | 1,654,398 | | | | 46,008,809 | |

CyberArk Software, Ltd. (a) | | | 328,909 | | | | 42,541,090 | |

Tufin Software Technologies Ltd. (a) | | | 1,523,446 | | | | 15,996,183 | |

Total Software | | | | | | | 169,525,513 | |

Total Israel | | | | | | | 193,889,240 | |

| | | | | | | | | |

Japan - 3.8% | | | | | | | | |

Software - 3.8% (d) | | | | | | | | |

Digital Arts, Inc. | | | 262,243 | | | | 22,949,963 | |

FFRI Security, Inc. (a) | | | 319,876 | | | | 6,349,853 | |

Trend Micro, Inc. | | | 960,808 | | | | 48,072,940 | |

Total Japan | | | | | | | 77,372,756 | |

| | | | | | | | | |

Jersey - 1.2% | | | | | | | | |

Software - 1.2% (d) | | | | | | | | |

Mimecast, Ltd. (a) | | | 587,678 | | | | 23,630,533 | |

| | | | | | | | | |

Republic of Korea - 0.8% | | | | | | | | |

Software - 0.8% (d) | | | | | | | | |

Ahnlab, Inc. | | | 274,035 | | | | 15,859,768 | |

| | | | | | | | | |

Sweden - 1.1% | | | | | | | | |

Electronic Equipment, Instruments & | | | | | | | | |

Components - 1.1% | | | | | | | | |

Fingerprint Cards AB - Class B (b) | | | 6,672,657 | | | | 22,271,605 | |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Prime Cyber Security ETF

Schedule of Investments

March 31, 2021 (Unaudited) (Continued)

| | Shares | | | Value | |

United Kingdom - 6.8% | | | | | | | | |

Aerospace & Defense - 3.6% | | | | | | | | |

BAE Systems PLC | | | 3,659,706 | | | $ | 25,478,743 | |

QinetiQ Group PLC | | | 5,299,506 | | | | 23,086,754 | |

Ultra Electronics Holdings PLC | | | 856,484 | | | | 23,945,704 | |

Total Aerospace & Defense | | | | | | | 72,511,201 | |

IT Services - 1.0% | | | | | | | | |

NCC Group PLC | | | 5,447,380 | | | | 19,375,271 | |

Software - 2.2% (d) | | | | | | | | |

Avast PLC (f) | | | 7,185,134 | | | | 45,168,964 | |

Total United Kingdom | | | | | | | 137,055,436 | |

| | | | | | | | | |

United States - 72.5% | | | | | | | | |

Aerospace & Defense - 2.5% | | | | | | | | |

Parsons Corp. (a)(b) | | | 1,251,208 | | | | 50,598,852 | |

Communications Equipment - 8.9% | | | | | | | | |

Cisco Systems, Inc. | | | 1,477,938 | | | | 76,424,174 | |

F5 Networks, Inc. (a) | | | 136,998 | | | | 28,580,523 | |

Juniper Networks, Inc. | | | 1,958,236 | | | | 49,602,118 | |

NetScout Systems, Inc. (a) | | | 872,325 | | | | 24,564,672 | |

Total Communications Equipment | | | | | | | 179,171,487 | |

Internet Software & Services - 0.8% | | | | | | | | |

Zix Corp. (a) | | | 2,129,728 | | | | 16,079,446 | |

IT Services - 7.5% | | | | | | | | |

Akamai Technologies, Inc. (a) | | | 511,957 | | | | 52,168,418 | |

LiveRamp Holdings, Inc. (a) | | | 826,754 | | | | 42,891,998 | |

Okta, Inc. (a)(b) | | | 129,311 | | | | 28,504,024 | |

VeriSign, Inc. (a) | | | 136,751 | | | | 27,180,629 | |

Total IT Services | | | | | | | 150,745,069 | |

Professional Services - 8.8% | | | | | | | | |

Booz Allen Hamilton Holding Corp. | | | 326,679 | | | | 26,307,460 | |

CACI International, Inc. - Class A (a) | | | 210,153 | | | | 51,836,339 | |

Leidos Holdings, Inc. | | | 282,187 | | | | 27,168,964 | |

ManTech International Corp. - Class A | | | 305,786 | | | | 26,588,093 | |

Science Applications International Corp. | | | 527,208 | | | | 44,069,317 | |

Total Professional Services | | | | | | | 175,970,173 | |

Software - 44.0% (d) | | | | | | | | |

A10 Networks, Inc. (a) | | | 2,583,826 | | | | 24,830,568 | |

Cloudflare, Inc. - Class A (a) | | | 741,252 | | | | 52,080,365 | |

CommVault Systems, Inc. (a) | | | 748,243 | | | | 48,261,673 | |

Crowdstrike Holdings, Inc. - Class A (a) | | | 181,179 | | | | 33,066,979 | |

Everbridge, Inc. (a)(b) | | | 172,331 | | | | 20,883,071 | |

FireEye, Inc. (a) | | | 2,490,549 | | | | 48,740,044 | |

Fortinet, Inc. (a) | | | 293,629 | | | | 54,151,060 | |

McAfee Corp. - Class A (b) | | | 1,135,106 | | | | 25,812,310 | |

NortonLifeLock, Inc. (b) | | | 2,320,240 | | | | 49,328,302 | |

OneSpan, Inc. (a) | | | 950,692 | | | | 23,291,954 | |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Prime Cyber Security ETF

Schedule of Investments

March 31, 2021 (Unaudited) (Continued)

| | Shares | | | Value | |

Palo Alto Networks, Inc. (a) | | | 152,353 | | | $ | 49,066,807 | |

Ping Identity Holding Corp. (a)(b) | | | 1,933,640 | | | | 42,404,725 | |

Proofpoint, Inc. (a) | | | 401,104 | | | | 50,454,872 | |

Qualys, Inc. (a)(b) | | | 495,977 | | | | 51,968,470 | |

Rapid7, Inc. (a)(b) | | | 306,201 | | | | 22,845,657 | |

Sailpoint Technologies Holdings, Inc. (a)(b) | | | 846,233 | | | | 42,853,239 | |

SecureWorks Corp. - Class A (a)(b)(e) | | | 1,388,102 | | | | 18,572,805 | |

SolarWinds Corp. (a)(b) | | | 2,840,964 | | | | 49,546,412 | |

Splunk, Inc. (a) | | | 358,926 | | | | 48,627,294 | |

Sumo Logic, Inc. (a)(b) | | | 1,662,115 | | | | 31,347,489 | |

Tenable Holdings, Inc. (a) | | | 1,191,767 | | | | 43,124,089 | |

Varonis Systems, Inc. (a) | | | 457,220 | | | | 23,473,675 | |

Zscaler, Inc. (a) | | | 161,634 | | | | 27,747,709 | |

Total Software | | | | | | | 882,479,569 | |

Total United States | | | | | | | 1,455,044,596 | |

TOTAL COMMON STOCKS (Cost $1,655,085,573) | | | | | | | 1,994,869,430 | |

| | | | | | | | | |

INVESTMENTS PURCHASED WITH PROCEEDS FROM | | | | | | | | |

SECURITIES LENDING COLLATERAL - 8.1% | | | | | | | | |

ETFMG Sit Ultra Short ETF (e) | | | 1,000,000 | | | | 49,745,500 | |

Mount Vernon Liquid Assets Portfolio, LLC, 0.11% (c) | | | 112,946,580 | | | | 112,946,580 | |

TOTAL INVESTMENTS PURCHASED WITH PROCEEDS | | | | | | | | |

FROM SECURITIES LENDING COLLATERAL (Cost $163,055,457) | | | | | | | 162,692,080 | |

| | | | | | | | | |

SHORT-TERM INVESTMENTS - 0.5% | | | | | | | | |

Money Market Funds - 0.5% | | | | | | | | |

Invesco Advisers, Inc. STIT-Treasury Portfolio - Institutional Class, 0.01% (c) | | | 10,720,628 | | | | 10,720,628 | |

TOTAL SHORT-TERM INVESTMENTS (Cost $10,720,628) | | | | | | | 10,720,628 | |

Total Investments (Cost $1,828,861,658) - 108.0% | | | | | | | 2,168,282,138 | |

Liabilities in Excess of Other Assets - (8.0)% | | | | | | | (160,443,257 | ) |

TOTAL NET ASSETS - 100.0% | | | | | | $ | 2,007,838,881 | |

Percentages are stated as a percent of net assets.

PLC Public Limited Company

(a) | Non-income producing security. |

(b) | All or a portion of this security is out on loan as of March 31, 2021. |

(c) | The rate quoted is the annualized seven-day yield at March 31, 2021. |

(d) | As of March 31, 2021 the Fund had a significant portion of its assets in the Software Industry. |

(e) | Affiliated security. Please refer to Note 9 of the Notes to Financial Statements. |

(f) | Acquired in a transaction exempt from registration under Rule 144A or Section 4(a)(2) of the Securities Act of 1933. May be resold in the U.S. in transactions exempt from registration, normally to qualified institutional buyers. The total value of all such securities was $45,168,964, which represented 2.25% of the net assets of the Fund. |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Prime Mobile Payments ETF

Schedule of Investments

March 31, 2021 (Unaudited)

| | Shares | | | Value | |

COMMON STOCKS - 99.5% | | | | | | | | |

Australia - 3.6% | | | | | | | | |

IT Services - 3.6% (d) | | | | | | | | |

Afterpay, Ltd. (a) | | | 354,228 | | | $ | 27,308,948 | |

EML Payments, Ltd. (a) | | | 4,155,044 | | | | 15,464,210 | |

Total IT Services | | | | | | | 42,773,158 | |

Bermuda - 1.5% | | | | | | | | |

Electronic Equipment, Instruments & Components - 1.5% | | | | | | | | |

PAX Global Technology, Ltd. | | | 17,073,078 | | | | 18,337,840 | |

Brazil - 1.5% | | | | | | | | |

IT Services - 1.5% (d) | | | | | | | | |

Cielo SA | | | 26,841,617 | | | | 17,787,432 | |

Canada - 2.0% | | | | | | | | |

IT Services - 2.0% (d) | | | | | | | | |

Nuvei Corp. (a)(f) | | | 396,668 | | | | 23,894,141 | |

Cayman Islands - 5.0% | | | | | | | | |

IT Services - 5.0% (d) | | | | | | | | |

Pagseguro Digital, Ltd. - Class A (a)(b) | | | 506,097 | | | | 23,432,291 | |

StoneCo., Ltd. - Class A (a) | | | 400,151 | | | | 24,497,244 | |

Yeahka, Ltd. (a) | | | 1,773,249 | | | | 12,203,190 | |

Total IT Services | | | | | | | 60,132,725 | |

Cyprus - 0.4% | | | | | | | | |

IT Services - 0.4% (d) | | | | | | | | |

QIWI PLC - ADR (b) | | | 405,093 | | | | 4,314,240 | |

France - 2.5% | | | | | | | | |

IT Services - 2.5% (d) | | | | | | | | |

Worldline SA (a)(f) | | | 364,271 | | | | 30,517,890 | |

Italy - 1.8% | | | | | | | | |

IT Services - 1.8% (d) | | | | | | | | |

Nexi SpA (a)(f) | | | 1,276,537 | | | | 22,275,363 | |

Japan - 3.0% | | | | | | | | |

Consumer Finance - 0.4% | | | | | | | | |

Jaccs Co., Ltd. | | | 220,199 | | | | 4,512,364 | |

IT Services - 2.4% (d) | | | | | | | | |

GMO Financial Gate, Inc. | | | 29,276 | | | | 6,052,180 | |

GMO Payment Gateway, Inc. | | | 169,743 | | | | 22,504,649 | |

Total IT Services | | | | | | | 28,556,829 | |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Prime Mobile Payments ETF

Schedule of Investments

March 31, 2021 (Unaudited) (Continued)

Software - 0.2% | | Shares | | | Value | |

| | | | | | | |

Intelligent Wave, Inc. | | | 287,926 | | | $ | 1,817,659 | |

Total Japan | | | | | | | 34,886,852 | |

Netherlands - 4.9% | | | | | | | | |

IT Services - 4.9% (d) | | | | | | | | |

Adyen NV (a)(f) | | | 26,669 | | | | 59,531,671 | |

Puerto Rico - 1.4% | | | | | | | | |

IT Services - 1.4% (d) | | | | | | | | |

EVERTEC, Inc. | | | 466,456 | | | | 17,361,492 | |

United Kingdom - 1.8% | | | | | | | | |

Commercial Services & Supplies - 0.3% | | | | | | | | |

PayPoint PLC | | | 371,823 | | | | 3,024,326 | |

IT Services - 1.5% (d) | | | | | | | | |

Network International Holdings PLC (a)(f) | | | 3,245,138 | | | | 18,503,510 | |

Total United Kingdom | | | | | | | 21,527,836 | |

United States - 70.1% | | | | | | | | |

Consumer Finance - 10.2% | | | | | | | | |

American Express Co. | | | 507,145 | | | | 71,730,589 | |

Discover Financial Services (b) | | | 361,129 | | | | 34,303,644 | |

Green Dot Corp. - Class A (a) | | | 369,276 | | | | 16,909,148 | |

Total Consumer Finance | | | | | | | 122,943,381 | |

IT Services - 56.7% (d) | | | | | | | | |

Affirm Holdings, Inc. (a)(b) | | | 349,653 | | | | 24,727,460 | |

Boku, Inc. (a)(f) | | | 1,942,415 | | | | 4,739,753 | |

Euronet Worldwide, Inc. (a) | | | 134,681 | | | | 18,626,382 | |

Evo Payments, Inc. - Class A (a)(b) | | | 652,824 | | | | 17,965,716 | |

Fidelity National Information Services, Inc. | | | 518,266 | | | | 72,873,382 | |

Fiserv, Inc. (a) | | | 570,574 | | | | 67,921,129 | |

FleetCor Technologies, Inc. (a) | | | 109,598 | | | | 29,441,311 | |

Global Payments, Inc. | | | 271,889 | | | | 54,807,385 | |

I3 Verticals, Inc. - Class A (a)(b) | | | 496,865 | | | | 15,464,923 | |

International Money Express, Inc. (a) | | | 214,928 | | | | 3,226,069 | |

MasterCard, Inc. - Class A | | | 207,035 | | | | 73,714,812 | |

Net 1 UEPS Technologies, Inc. (a) | | | 584,276 | | | | 3,271,946 | |

PayPal Holdings, Inc. (a) | | | 302,671 | | | | 73,500,626 | |

Paysign, Inc. (a)(b) | | | 645,132 | | | | 2,819,227 | |

Sezzle, Inc. (a) | | | 796,083 | | | | 4,450,330 | |

Shift4 Payments, Inc. - Class A (a) | | | 249,485 | | | | 20,460,265 | |

Square, Inc. - Class A (a) | | | 331,298 | | | | 75,221,212 | |

USA Technologies, Inc. (a) | | | 448,687 | | | | 5,258,612 | |

Visa, Inc. - Class A (b) | | | 342,126 | | | | 72,438,338 | |

Western Union Co. (b) | | | 920,965 | | | | 22,710,997 | |

WEX, Inc. (a) | | | 101,973 | | | | 21,334,791 | |

Total IT Services | | | | | | | 684,974,666 | |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Prime Mobile Payments ETF

Schedule of Investments

March 31, 2021 (Unaudited) (Continued)

Software - 1.5% | | Shares | | | Value | |

| | | | | | | |

ACI Worldwide, Inc. (a) | | | 491,835 | | | $ | 18,714,322 | |

Technology Hardware, Storage & Peripherals - 1.7% | | | | | | | | |

NCR Corp. (a) | | | 533,262 | | | | 20,237,293 | |

Total United States | | | | | | | 846,869,662 | |

TOTAL COMMON STOCKS (Cost $1,011,463,970) | | | | | | | 1,200,210,302 | |

INVESTMENTS PURCHASED WITH PROCEEDS FROM | | | | | | | | |

SECURITIES LENDING COLLATERAL - 9.4% | | | | | | | | |

ETFMG Sit Ultra Short ETF (e) | | | 600,000 | | | | 29,847,300 | |

Mount Vernon Liquid Assets Portfolio, LLC, 0.11% (c) | | | 84,242,577 | | | | 84,242,577 | |

TOTAL INVESTMENTS PURCHASED WITH PROCEEDS | | | | | | | | |

FROM SECURITIES LENDING COLLATERAL (Cost | | | | | | | | |

$114,324,845) | | | | | | | 114,089,877 | |

SHORT-TERM INVESTMENTS - 0.1% | | | | | | | | |

Money Market Funds - 0.1% | | | | | | | | |

Invesco Advisers, Inc. STIT-Treasury Portfolio – | | | | | | | | |

Institutional Class, 0.01% (c) | | | 1,767,533 | | | | 1,767,533 | |

TOTAL SHORT-TERM INVESTMENTS (Cost $1,767,533) | | | | | | | 1,767,533 | |

Total Investments (Cost $1,127,556,348) - 109.0% | | | | | | | 1,316,067,712 | |

Liabilities in Excess of Other Assets - (9.0)% | | | | | | | (108,362,693 | ) |

TOTAL NET ASSETS - 100.0% | | | | | | $ | 1,207,705,019 | |

Percentages are stated as a percent of net assets.

ADR American Depositary Receipt

PLC Public Limited Company

(a) | Non-income producing security. |

(b) | All or a portion of this security is out on loan as of March 31, 2021. |

(c) | The rate quoted is the annualized seven-day yield at March 31, 2021. |

(d) | As of March 31, 2021 the Fund had a significant portion of its assets in the IT Services Industry. |

(e) | Affiliated security. Please refer to Note 9 of the Notes to Financial Statements. |

(f) | Acquired in a transaction exempt from registration under Rule 144A or Section 4(a)(2) of the Securities Act of 1933. May be resold in the U.S. in transactions exempt from registration, normally to qualified institutional buyers. The total value of all such securities was $159,462,328, which represented 13.20% of the net assets of the Fund. |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Sit Ultra Short ETF

Schedule of Investments

March 31, 2021 (Unaudited)

| | Principal Amount | | | Value | |

ASSET BACKED SECURITIES - 0.6% | | | | | | | | |

Carvana Auto Receivables Trust | | | | | | | | |

Series 2019-2, 2.580%, 03/15/2023 (a) | | $ | 649,074 | | | $ | 650,050 | |

TOTAL ASSET BACKED SECURITIES (Cost $650,104) | | | | | | | 650,050 | |

CORPORATE OBLIGATIONS - 97.4% | | | | | | | | |

Agriculture - 0.2% | | | | | | | | |

| Bunge, Ltd. Finance Corp. | | | | | | | | |

3.000%, 09/25/2022 | | | 206,000 | | | | 212,464 | |

Automotive - 9.9% | | | | | | | | |

| American Honda Finance Corp. | | | | | | | | |

0.545% (3 Month LIBOR + 0.350%) 11/05/2021 (b) | | | 450,000 | | | | 450,866 | |

0.503% (3 Month LIBOR + 0.280%) 01/12/2024 (b) | | | 2,000,000 | | | | 2,000,347 | |

BMW US Capital LLC | | | | | | | | |

0.634% (3 Month LIBOR + 0.410%) 04/12/2021 (a)(b) | | | 500,000 | | | | 500,054 | |

0.698% (3 Month LIBOR + 0.500%) 08/13/2021 (a)(b) | | | 160,000 | | | | 160,251 | |

0.877%(3 Month LIBOR + 0.640%) 04/06/2022 (a)(b) | | | 1,290,000 | | | | 1,295,705 | |

Daimler Finance North America LLC | | | | | | | | |

1.062% (3 Month LIBOR + 0.880%) 02/22/2022 (a)(b) | | | 2,422,000 | | | | 2,437,035 | |

| General Motors Financial Co., Inc. | | | | | | | | |

3.150%, 06/30/2022 | | | 1,488,000 | | | | 1,530,027 | |

Hyundai Capital America | | | | | | | | |

2.850%, 11/01/2022 (a) | | | 2,000,000 | | | | 2,063,512 | |

| PACCAR Financial Corp. | | | | | | | | |

0.455% (3 Month LIBOR + 0.260%) 05/10/2021 (b) | | | 190,000 | | | | 190,062 | |

| Toyota Motor Credit Corp. | | | | | | | | |

0.592% (3 Month LIBOR + 0.400%) 05/17/2022 (b) | | | 500,000 | | | | 501,561 | |

| | | | | | | 11,129,420 | |

Banks - 27.5% (e) | | | | | | | | |

Bank of America Corp. | | | | | | | | |

1.643% (3 Month LIBOR + 1.420%) 04/19/2021 (b) | | | 1,000,000 | | | | 1,000,556 | |

1.404% (3 Month LIBOR + 1.180%) 10/21/2022 (b) | | | 100,000 | | | | 100,603 | |

1.218% (3 Month LIBOR + 1.000%) 04/24/2023 (b) | | | 1,000,000 | | | | 1,008,638 | |

1.178% (3 Month LIBOR + 0.960%) 07/23/2024 (b) | | | 1,250,000 | | | | 1,268,751 | |

Bank of Montreal | | | | | | | | |

0.807% (3 Month LIBOR + 0.630%) 09/11/2022 (b) | | | 250,000 | | | | 251,904 | |

Bank of Nova Scotia | | | | | | | | |

0.816% (3 Month LIBOR + 0.640%) 03/07/2022 (b) | | | 150,000 | | | | 150,783 | |

Barclays PLC | | | | | | | | |

1.850% (3 Month LIBOR + 1.625%) 01/10/2023 (b) | | | 1,500,000 | | | | 1,513,210 | |

Citibank NA | | | | | | | | |

0.782% (3 Month LIBOR + 0.600%) 05/20/2022 (b) | | | 1,821,000 | | | | 1,822,520 | |

| Citizens Financial Group, Inc. | | | | | | | | |

4.150%, 09/28/2022 (a) | | | 672,000 | | | | 703,413 | |

Commonwealth Bank of Australia | | | | | | | | |

0.870% (3 Month LIBOR + 0.680%) 09/18/2022 (a)(b) | | | 2,539,000 | | | | 2,559,537 | |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Sit Ultra Short ETF

Schedule of Investments

March 31, 2021 (Unaudited) (Continued)

| Principal Amount | | Value | |

Cooperatieve Rabobank UA | | | | | | |

0.705% (3 Month LIBOR + 0.480%) 01/10/2023 (b) | $ | 895,000 | | $ | 900,151 | |

Credit Suisse AG | | | | | | |

0.531% (3 Month SOFR + 0.450%) 02/04/2022 (b) | | 1,490,000 | | | 1,490,952 | |

Fifth Third Bank NA | | | | | | |

0.845% (3 Month LIBOR + 0.640%) 02/01/2022 (b) | | 2,000,000 | | | 2,009,686 | |

First Niagara Financial Group, Inc. | | | | | | |

7.250%, 12/15/2021 | | 1,050,000 | | | 1,099,028 | |

Fulton Financial Corp. | | | | | | |

3.600%, 03/16/2022 | | 87,000 | | | 89,459 | |

Goldman Sachs Group, Inc. | | | | | | |

0.992% (3 Month LIBOR + 0.780%) 10/31/2022 (b) | | 698,000 | | | 700,391 | |

Huntington Bancshares, Inc. | | | | | | |

4.350%, 02/04/2023 | | 766,000 | | | 815,027 | |

JPMorgan Chase & Co. | | | | | | |

1.241% (3 Month LIBOR + 1.000%) 01/15/2023 (b) | | 1,000,000 | | | 1,007,063 | |

1.118% (3 Month LIBOR + 0.900%) 04/25/2023 (b) | | 1,155,000 | | | 1,164,033 | |

0.590% (3 Month SOFR + 0.580%) 03/16/2024 (b) | | 1,000,000 | | | 1,003,556 | |

Mitsubishi UFJ Financial Group, Inc. | | | | | | |

1.008% (3 Month LIBOR + 0.790%) 07/25/2022 (b) | | 409,000 | | | 412,147 | |

Mizuho Financial Group, Inc. | | | | | | |

1.063% (3 Month LIBOR + 0.840%) 07/16/2023 (b) | | 500,000 | | | 503,373 | |

Morgan Stanley | | | | | | |

0.725% (3 Month SOFR + 0.700%) 01/20/2023 (b) | | 1,678,000 | | | 1,683,355 | |

PNC Bank NA | | | | | | |

0.713% (3 Month LIBOR + 0.500%) 07/27/2022 (b) | | 2,160,000 | | | 2,172,218 | |

Royal Bank of Canada | | | | | | |

0.602% (3 Month LIBOR + 0.390%) 04/30/2021 (b) | | 445,000 | | | 445,154 | |

0.583% (3 Month LIBOR + 0.360%) 01/17/2023 (b) | | 1,000,000 | | | 1,003,899 | |

Swedbank AB | | | | | | |

0.884% (3 Month LIBOR + 0.700%) 03/14/2022 (a)(b) | | 200,000 | | | 201,106 | |

Truist Bank | | | | | | |

0.792% (3 Month LIBOR + 0.590%) 08/02/2022 (b) | | 590,000 | | | 591,010 | |

US Bank NA | | | | | | |

0.615% (3 Month LIBOR + 0.440%) 05/23/2022 (b) | | 805,000 | | | 808,024 | |

Wells Fargo Bank NA | | | | | | |

0.845% (3 Month LIBOR + 0.660%) 09/09/2022 (b) | | 750,000 | | | 752,527 | |

2.082%, 09/09/2022 (c) | | 200,000 | | | 201,540 | |

Westpac Banking Corp. | | | | | | |

0.795% (3 Month LIBOR + 0.570%) 01/11/2023 (b) | | 1,500,000 | | | 1,510,986 | |

Business Support Services - 2.4% | | | | | 30,944,600 | |

| | | | | |

Glencore Finance Canada, Ltd. | | | | | | |

4.950%, 11/15/2021 (a) | | 1,200,000 | | | 1,233,769 | |

4.250%, 10/25/2022 (a) | | 1,000,000 | | | 1,053,585 | |

Pentair Finance | | | | | | |

5.000%, 05/15/2021 | | 400,000 | | | 401,226 | |

| | | | | | 2,688,580 | |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Sit Ultra Short ETF

Schedule of Investments

March 31, 2021 (Unaudited) (Continued)

| Principal Amount | | Value | |

Capital Markets - 5.0% | | | | | | |

Bank of New York Mellon Corp. | | | | | | |

1.262% (3 Month LIBOR + 1.050%) 10/30/2023 (b) | $ | 400,000 | | $ | 405,611 | |

BGC Partners, Inc. | | | | | | |

5.125%, 05/27/2021 | | 1,148,000 | | | 1,154,079 | |

5.375%, 07/24/2023 | | 1,245,000 | | | 1,354,183 | |

Charles Schwab Corp. | | | | | | |

0.502% (3 Month LIBOR + 0.320%) 05/21/2021 (b) | | 649,000 | | | 649,105 | |

0.510% (3 Month SOFR + 0.500%) 03/18/2024 (b) | | 2,000,000 | | | 2,013,561 | |

Chemicals - 3.1% | | | | | 5,576,539 | |

| | | | | |

LYB International Finance III LLC | | | | | | |

1.202% (3 Month LIBOR + 1.000%) 10/01/2023 (b) | | 2,000,000 | | | 2,006,056 | |

Sherwin-Williams Co. | | | | | | |

2.750%, 06/01/2022 | | 293,000 | | | 299,632 | |

Westlake Chemical Corp. | | | | | | |

3.600%, 07/15/2022 | | 1,150,000 | | | 1,176,761 | |

Communications Equipment - 0.3% | | | | | 3,482,449 | |

| | | | | |

Motorola Solutions, Inc. | | | | | | |

3.500%, 03/01/2023 | | 361,000 | | | 379,633 | |

Consumer Finance - 3.2% | | | | | | |

AIG Global Funding | | | | | | |

0.661% (3 Month LIBOR + 0.460%) 06/25/2021 (a)(b) | | 1,132,000 | | | 1,133,246 | |

2.700%, 12/15/2021 (a) | | 75,000 | | | 76,289 | |

Capital One Financial Corp. | | | | | | |

0.932% (3 Month LIBOR + 0.720%) 01/30/2023 (b) | | 2,291,000 | | | 2,308,170 | |

Containers & Packaging - 0.5% | | | | | 3,517,705 | |

| | | | | |

WestRock RKT LLC | | | | | | |

4.000%, 03/01/2023 | | 500,000 | | | 526,771 | |

Diversified Telecommunication Services - 2.2% | | | | | | |

Verizon Communications, Inc. | | | | | | |

0.510% (3 Month SOFR + 0.500%) 03/22/2024 (b) | | 2,500,000 | | | 2,507,841 | |

Electronic Products - 0.5% | | | | | | |

Arrow Electronics, Inc. | | | | | | |

3.500%, 04/01/2022 | | 500,000 | | | 511,807 | |

Energy - 0.1% | | | | | | |

ConocoPhillips Co. | | | | | | |

1.098% (3 Month LIBOR + 0.900%) 05/15/2022 (b) | | 150,000 | | | 151,161 | |

Food Products - 1.5% | | | | | | |

General Mills, Inc. | | | | | | |

1.233% (3 Month LIBOR + 1.010%) 10/17/2023 (b) | | 1,650,000 | | | 1,674,695 | |

The accompanying notes are an integral part of these financial statements.

ETFMG™ ETFs

ETFMG Sit Ultra Short ETF

Schedule of Investments

March 31, 2021 (Unaudited) (Continued)

| | Principal

Amount | | Value | |

Health Care Providers & Services - 2.0% | | | | | | | |

Cigna Corp. | | | | | | | |

1.131% (3 Month LIBOR + 0.890%) 07/15/2023 (b) | | $ | 1,920,000 | | $ | 1,944,020 | |

UnitedHealth Group, Inc. | | | | | | | |

0.444% (3 Month LIBOR + 0.260%) 06/15/2021 (b) | | | 270,000 | | | 270,101 | |

Household Products - 0.2% | | | | | | 2,214,121 | |

| | | | | | |

Reckitt Benckiser Treasury Services PLC | | | | | | | |

0.751% (3 Month LIBOR + 0.560%) 06/24/2022 (a)(b) | | | 200,000 | | | 201,156 | |

Industrial Conglomerates - 2.0% | | | | | | | |

Honeywell International, Inc. | | | | | | | |

0.411% (3 Month LIBOR + 0.230%) 08/19/2022 (b) | | | 2,270,000 | | | 2,271,825 | |

Insurance - 7.2% | | | | | | | |

Allstate Corp. | | | | | | | |

0.823% (3 Month LIBOR + 0.630%) 03/29/2023 (b) | | | 1,683,000 | | | 1,696,989 | |

Athene Global Funding | | | | | | | |

1.468% (3 Month LIBOR + 1.230%) 07/01/2022 (a)(b) | | | 200,000 | | | 202,180 | |

Fidelity National Financial, Inc. | | | | | | | |

5.500%, 09/01/2022 | | | 500,000 | | | 534,106 | |

Infinity Property and Casualty Corp. | | | | | | | |

5.000%, 09/19/2022 | | | 295,000 | | | 311,362 | |

Jackson National Life Global Funding | | | | | | | |

0.657% (3 Month LIBOR + 0.480%) 06/11/2021 (a)(b) | | | 250,000 | | | 250,200 | |

0.692% (3 Month SOFR + 0.600%) 01/06/2023 (a)(b) | | | 2,000,000 | | | 2,010,466 | |

Metropolitan Life Global Funding I | | | | | | | |

0.662% (3 Month SOFR + 0.570%) 01/13/2023 (a)(b) | | | 2,000,000 | | | 2,012,380 | |

Progressive Corp. | | | | | | | |

3.750%, 08/23/2021 | | | 1,000,000 | | | 1,013,533 | |

Insurance Carriers - 1.2% | | | | | | 8,031,216 | |

| | | | | | |

John Hancock Life Insurance Co. | | | | | | | |

7.375%, 02/15/2024 (a) | | | 245,000 | | | 287,478 | |

Metropolitan Life Insurance Co. | | | | | | | |

7.875%, 02/15/2024 (a) | | | 825,000 | | | 985,156 | |

Internet & Direct Marketing Retail - 1.4% | | | | | | 1,272,634 | |

| | | | | | |

Expedia Group, Inc. | | | | | | | |

3.600%, 12/15/2023 (a) | | | 1,500,000 | | | 1,597,252 | |

Investment & Miscellaneous Financial Services - 1.1% | | | | | | | |

FMR LLC | | | | | | | |

5.350%, 11/15/2021 (a) | | | 200,000 | | | 205,933 | |

Intercontinental Exchange, Inc. | | | | | | | |

0.834% (3 Month LIBOR + 0.650%) 06/15/2023 (b) | | | 1,000,000 | | | 1,001,383 | |

| | | | | | 1,207,316 | |

The accompanying notes are an integral part of these financial statements.