- GM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

General Motors (GM) DEF 14ADefinitive proxy

Filed: 18 Apr 19, 3:02pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

☑ Filed by the Registrant ☐ Filed by a Party other than the Registrant

Check the appropriate box: | ||

☐ | Preliminary Proxy Statement | |

☐ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) | |

☑ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material Pursuant to ss.240.14a-12 | |

GENERAL MOTORS COMPANY

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box): | ||

☑ | No fee required. | |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(14) and 0-11. | |

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

| ||

☐ | Fee paid previously with preliminary materials. | |

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| |

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

| ||

We Are General Motors:

Accelerating GM’s Strategic

and Cultural Transformation

Boardroom perspectives from Mary Barra and Tim Solso

MARY T. BARRA

Chairman & Chief Executive Officer |

THEODORE M. SOLSO

Independent Lead Director |

How would you describe GM’s purpose and vision?

MARY:Our vision is to create a world with zero crashes, zero emissions, and zero congestion. Today’s technologies give us a unique opportunity to make personal mobility better, safer, and more sustainable. Each year, more than one million people are killed in crashes around the world – 40,000 in the U.S. alone. When you consider that human error is behind more than 90% of these crashes, we believe autonomous vehicles (“AVs”) will save lives.

We are fully committed to anall-electric future, and we are already building on the momentum of the groundbreaking Chevrolet Bolt EV. In January, we announced that our Cadillac brand will lead the way on our next-generation electric vehicle (“EV”) technology. At the same time, we are improving the efficiency of today’s vehicles with lightweighting and sophisticated new transmissions and engines. To redefine the future of transportation, we must execute with speed and discipline, and I am confident we have the team and the technology to lead.

How do you think about culture at GM?

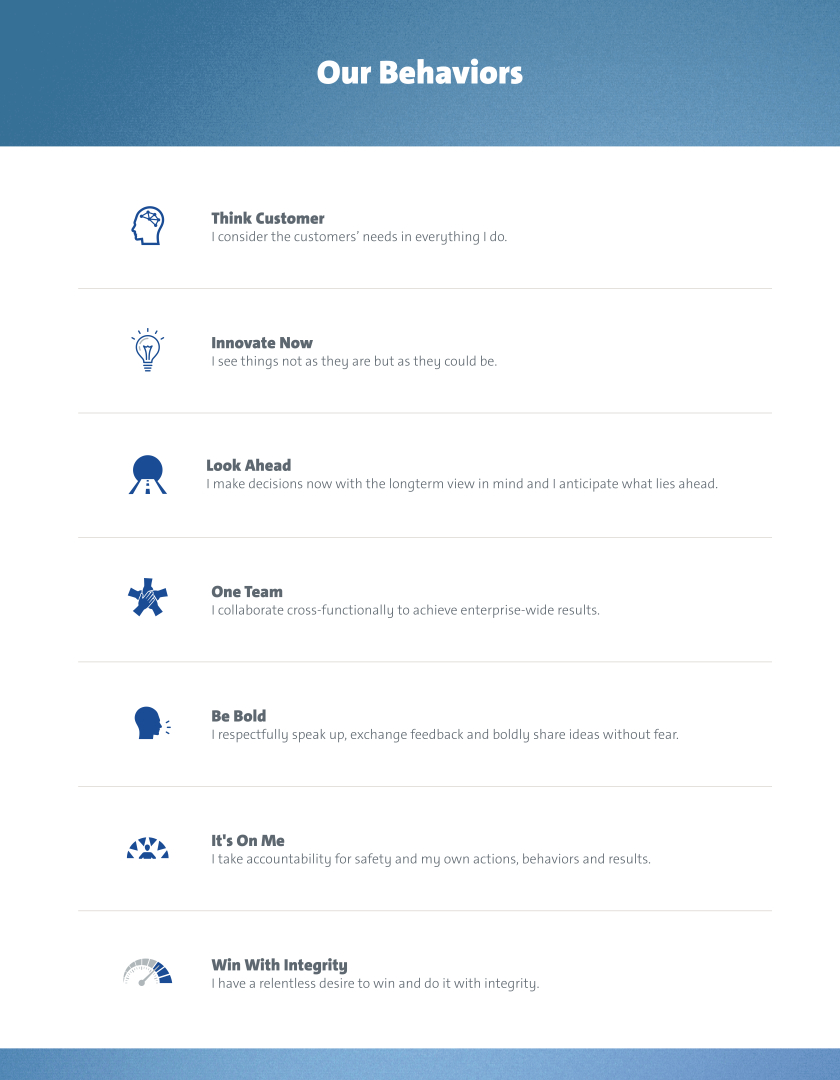

MARY: Our culture will determine the long-term success of the Company. I’ve heard from many employees who feel that they are part of something bigger and who are excited about making a positive impact on the world.

We have been on a cultural journey since 2014, when the ignition switch recall threatened our recovery from bankruptcy. At our senior leadership team meeting that year, we realized that to

transform our culture, we needed to address the underlying issues that were holding us back. So as a team we aligned ourselves around a shared set of behaviors built on our core values that continue to guide our actions today. Since that time, we have introduced various initiatives to create a workplace and culture in which our team members can thrive, yet be accountable for their performance.

TIM:Your Board of Directors (the “Board”) believes that culture is key to realizing GM’s vision of zero crashes, zero emissions, and zero congestion. By sharing our outside perspectives, your Board has helped GM reshape its behaviors and ultimately, its culture, as it continues its transformation.

In November 2018, GM announced a comprehensive plan to accelerate its strategic transformation. Can you discuss why you took these actions?

TIM:We have been navigating the dramatic changes facing our industry and taking decisive actions to stay in front of this change. Over the years we have strengthened our core business by deploying resources in regions and franchises where we see higher-return opportunities over the long term.

MARY: Our focus all along has been to reposition the Company from one of trying to be all things to all people in all markets to one that is strategic, agile, and profitable. By accelerating GM’s transformation, we can more rapidly invest in the future of personal mobility. Our transformation plan involves tough but necessary actions. We took these actions following significant feedback and input from the Board – input that began during our annual strategic review in 2017 and continued throughout 2018. This is a dynamic transformation process, and we will continue to look around corners and over the horizon to make strategic decisions that strengthen our business today and position it for long-term success.

What is GM doing to create a more sustainable future?

TIM:Your Board understands that for GM to remain acompelling investment opportunity, the Company must contribute to a safer, more sustainable future, particularly through continued efforts to reduce emissions from vehicles and facilities. GM is committed to anall-electric future as well as maintaining a sustainable supply chain. For example, in 2018, GM sourced 20% of its total power from renewable sources – leading the automotive sector and progressing towards our commitment to source 100% of our power from renewable sources by 2050.

MARY:We believe in the science of climate change, and we recognize that the transportation sector is a contributor to global greenhouse gas emissions. We have called on lawmakers to establish a National Zero Emission Vehicle program – a comprehensive approach to drive the scale and infrastructure investments needed to enable the U.S. to lead the way to azero-emissions future – as well as enact complementary policies to spur market acceptance and commercialization of EVs.

| i |

|

Notice of 2019 Annual Meeting of Shareholders

April 18, 2019

Dear Fellow Shareholder:

The Board of Directors of General Motors Company (“General Motors,” “GM,” “the Company,” “we,” and “our”) cordially invites you to attend the 2019 Annual Meeting of Shareholders (“Annual Meeting”) on June 4, 2019, at 8:00 a.m. Eastern Time.

The Annual Meeting will be conducted online only, via live video webcast. You will be able to attend the meeting exclusively online and submit questions before and during the meeting by visiting gm.onlineshareholdermeeting.com. You will also be able to vote your shares electronically during the meeting.

Details about how to attend the Annual Meeting online and how to submit questions and cast your votes are provided under “Important Information About GM’s Online Annual Meeting” on the next page and “General Information About the Annual Meeting” on page 78.

|

At the Annual Meeting, you will be asked to:

| u | Elect the 11 Board-recommended director nominees named in this Proxy Statement; |

| u | Approve, on an advisory basis, named executive officer (“NEO”) compensation; |

| u | Ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2019; |

| u | Vote on two Rule 14a-8 shareholder proposals, if properly presented at the meeting; and |

| u | Transact any other business that is properly presented at the meeting. |

Record Date:

If you were a holder of record of GM common stock at the close of business on April 8, 2019, you are entitled to vote at the Annual Meeting. This Proxy Statement is provided in conjunction with GM’s solicitation of proxies to be used at the Annual Meeting. In addition to this Proxy Statement and proxy card or voting instruction form, the GM 2018 Annual Report on Form 10-K is provided in this package or is available on the internet.

Thank you for your interest in General Motors Company.

By Order of the Board of Directors,

Rick E. Hansen

Corporate Secretary

|

Meeting Information:

| |||||

Date: June 4, 2019

Time: 8:00 a.m. Eastern Time

Place: Online via live webcast atgm.onlineshareholdermeeting.com

|

| |||||

Your vote is important.

| ||||||

Please promptly submit your vote by internet, by telephone, or by signing, dating, and returning the enclosed proxy card or voting instruction form in the postage-paid envelope provided so that your shares will be represented and voted at the meeting.

We are first mailing these proxy materials to our shareholders on or about April 18, 2019.

| ||||||

How You Can Access the Proxy Materials Online:

| ||||||

Important Notice Regarding the Availability of Proxy Materials for the 2019 Annual Meeting of Shareholders to Be Held on June 4, 2019.

Our Proxy Statement and 2018 Annual Report on Form 10-K are available atinvestor.gm.com/shareholder. You may scan the QR code above with your smartphone or other mobile device to view our Proxy Statement and Annual Report on Form 10-K.

|

| ii |

Important Information About GM’s Online Annual Meeting

GM’s 2019 Annual Meeting will be conducted online only, via live video webcast. If you were a holder of record of GM common stock at the close of business on April 8, 2019, you are entitled to participate in the annual meeting on June 4, 2019. Below are some frequently asked questions regarding the new online format for our Annual Meeting.

Patricia F. Russo Governance and Corporate Responsibility Committee Chair |

Why did the Board decide to adopt an online format for the 2019 Annual Meeting?

“Your Board believes the online format will enhance attendance by providing convenient meeting access to all of our shareholders, regardless of where they live – not just those shareholders who have the time and means to travel to anin-person meeting. Over the past five years, attendance at our Annual Meeting has averaged less then 35 shareholders. This year, even shareholders without an internet connection or a computer will be able to listen to the meeting by calling a toll-free telephone number. In addition, we believe the online format will provide a better opportunity for shareholders to communicate with your Board by submitting questions before and during the meeting through the online portal and by calling in live via telephone during the meeting. Finally, the online meeting format will also eliminate many of the costs associated with holding a physical meeting, which is a smart choice for GM and its shareholders. We look forward to increasing participation this year while lowering operating costs for the Company.”

|

u How can I view and participate in the Annual Meeting? To participate, visitgm.onlineshareholdermeeting.com and login with your16-digit control number included in your proxy materials.

u When can I join the Annual Meeting online? You may begin to log into the meeting platform beginning at 7:45 a.m. Eastern Time on June 4, 2019. The meeting will begin promptly at 8:00 a.m. Eastern Time on June 4, 2019.

u How can I ask questions and vote? We encourage you to submit your questions and vote in advance by visitingproxyvote.com. Shareholders will also be permitted to ask questions by telephone during the meeting (subject to time restrictions). Shareholders may also vote and submit questions online in advance of and during the meeting. To participate in the meeting webcast visitgm.onlineshareholdermeeting.com.

|

COMMITMENT TO TRANSPARENCY

If there are questions pertinent to meeting matters that cannot be answered during the Annual Meeting due to time constraints, management will post answers to a representative set of such questions atinvestor.gm.com/shareholder. The questions and answers will be available as soon as practicable after the meeting and will remain available until GM’s 2020 Proxy Statement is filed.

| ||||||

u What if I lost my 16-digit control number? You will be able to login as a guest. To view the meeting webcast visitgm.onlineshareholdermeeting.com and register as a guest. You will not be able to vote your shares or submit questions during the meeting.

u What if I don’t have internet access? Please call (877) 328-2502 (toll free) or (412) 317-5419 (international) to listen to the meeting proceedings. You will not be able to vote your shares during the meeting.

u What if I experience technical difficulties? Please call (800) 586-1548 (U.S.) or (303) 562-9288 (International) for assistance.

u Where can I find additional information? For additional information about how to attend the Annual Meeting, please see “General Information About the Annual Meeting” on page 78.

u What if I have additional questions? You may contact GM Shareholder Relations atshareholder.relations@gm.com or (313) 667-1432 for assistance.

|

| iii |

|

Cautionary Note on Forward-Looking Statements: This Proxy Statement contains “forward-looking” statements regarding GM’s current expectations within the meaning of the applicable securities laws and regulations. These statements are subject to a variety of risks and uncertainties that could cause actual results to differ materially from expectations. These risks and uncertainties include, but are not limited to, the risks detailed in GM’s filings with the Securities and Exchange Commission, including the “Risk Factors” section of GM’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018. We assume no obligation to update any of these forward-looking statements.

|

| iv |

This summary highlights information contained elsewhere in this Proxy Statement. It does not contain all the information that you should consider. Please read the entire Proxy Statement carefully before voting.

Agenda and Voting Recommendations

Proposal | Board Vote Recommendation | Page Reference | ||||

BOARD PROPOSALS:

| ||||||

Item No. 1– Election of Directors

|

FOR

|

|

8

|

| ||

Item No. 2– Approval of, on an Advisory Basis,

| FOR | 69 | ||||

Item No. 3– Ratification of the Selection of

| FOR | 70 | ||||

SHAREHOLDER PROPOSALS:

| ||||||

Item No. 4– Independent Board Chairman

|

AGAINST

|

|

73

|

| ||

Item No. 5– Report on Lobbying Communications and Activities

|

AGAINST

|

|

76

|

| ||

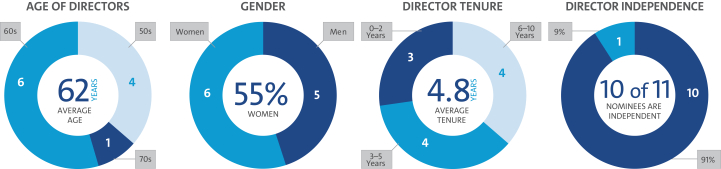

GM HAS THE RIGHT BOARD AT THE RIGHT TIMEThe Board and management are overseeing a period of strategic and cultural transformation at GM amidst a period of unprecedented change in the automotive and mobility industries. Ensuring the Board is composed of directors who bring diverse viewpoints and perspectives, possess a variety of skills, professional experience, and backgrounds, and effectively represent the long-term interests of shareholders is a top priority of your Board and the Governance and Corporate Responsibility Committee (the Governance Committee). Our membership criteria and director recruitment procedures align the Boards capabilities with the execution of the Companys business strategy. As part of our comprehensive refreshment and recruitment process, keeping in mind our commitment to diversity, we added six new directors in the past four years, including since our last annual meeting Ms. Miscik, Vice Chairman and Chief Executive Officer ("CEO") of Kissinger Associates, Inc., and Mr. Bush, Chairman of Northrop Grumman Corporation. These new directors complement our current directors mix of skills by bringing to the Board key leadership, technology, and manufacturing expertise as well as experience navigating geopolitical and macroeconomic risks. For a detailed discussion of why GM has the right Board at the right time, please see Item No. 1Election of Directors on page ["].

Composition of Board Nominees

AGE OF DIRECTORS GENDER DIRECTOR TENURE DIRECTOR INDEPENDENCE

| 1 |

PROXY STATEMENT SUMMARY

The following table provides summary information about each director nominee. For more detailed information about our directors, please see “Item No. 1—Election of Directors—Your Board’s Nominees for Director” on page 11.

| Name | Age | Director Since | Principal Occupation | Independent | Committee Memberships | |||||

Mary T. Barra | 57 | 2014 |

Chairman & | Executive – Chair | ||||||

Theodore M. Solso | 72 | 2012 |

Independent Lead Director, |  | Executive | |||||

Wesley G. Bush | 58 | 2019 |

Chairman, Northrop Grumman |  | Executive Compensation Finance | |||||

Linda R. Gooden | 66 | 2015 |

Retired Executive Vice President, |  | Audit Cybersecurity – Chair Executive Risk | |||||

Joseph Jimenez | 59 | 2015 |

Retired Chief Executive Officer, |  | Executive Compensation Governance | |||||

Jane L. Mendillo | 60 | 2016 |

Retired President & |  | Finance Audit | |||||

Judith A. Miscik | 60 | 2018 |

Chief Executive Officer & |  | Risk Audit | |||||

Patricia F. Russo | 66 | 2009 | Chairman, Hewlett Packard Enterprise Company |  |

Executive Executive Compensation Finance Governance – Chair | |||||

Thomas M. Schoewe | 66 | 2011 | Retired Executive Vice President & Chief Financial Officer, Wal-Mart Stores, Inc. |  |

Audit – Chair Cybersecurity Executive Finance Risk | |||||

Carol M. Stephenson | 68 | 2009 |

Retired Dean, Ivey Business |  | Executive Executive Compensation – Chair Governance | |||||

Devin N. Wenig | 52 | 2018 |

President & Chief Executive Officer, eBay Inc. |  |

Risk

| |||||

| 2 |

|

PROXY STATEMENT SUMMARY

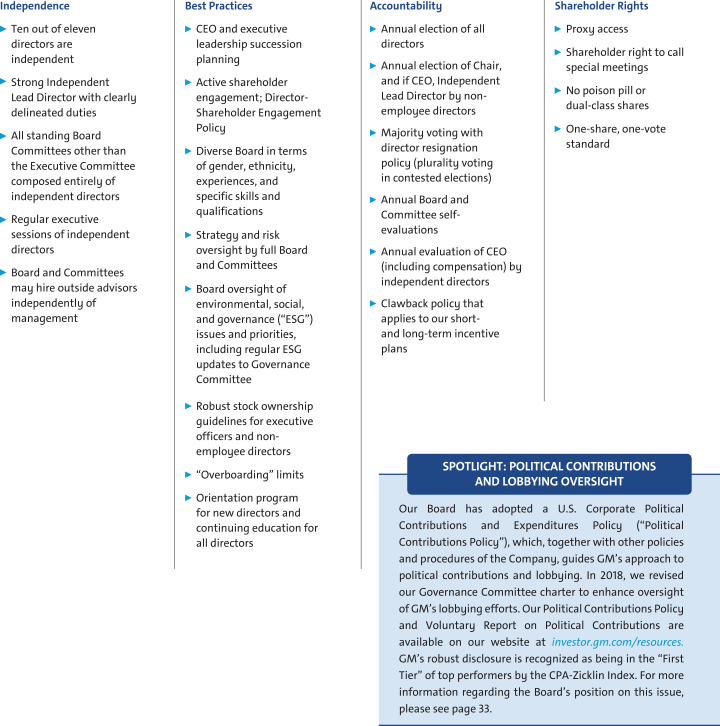

We recognize that strong corporate governance contributes to long-term shareholder value. We are committed to sound governance practices, including those described below.

Independence Ten out of eleven directors are independent Strong Independent Lead Director with clearly delineated duties All standing Board Committees other than the Executive Committee composed entirely of independent directors Regular executive sessions of independent directors Board and Committees may hire outside advisors independently of management Best Practices CEO and executive leadership succession planning Active shareholder engagement; Director-Shareholder Engagement Policy Diverse Board in terms of gender, ethnicity, and specific skills and qualifications Strategy and risk oversight by full Board and Committees (see page ["] for the Risk Committees 2019 risk areas of focus) Board oversight of ESG issues and priorities, including regular ESG updates to Governance Committee Robust stock ownership guidelines for executive officers and non-employee directors Overboarding limits Orientation program for new directors and continuing education for all directors Accountability Annual election of all directors Annual election of Chair, and if CEO, Independent Lead Director by non-employee directors Majority voting with director resignation policy (plurality voting in contested elections) Annual Board and Committee self-evaluations Annual evaluation of CEO (including compensation) by independent directors Clawback policy that applies to our short-and long-term incentive plans Shareholder Rights Proxy access Shareholder right to call special meetings No poison pill or dual-class shares One-share, one-vote standard SPOTLIGHT: POLITICAL CONTRIBUTIONS AND LOBBYING OVERSIGHT Our Board has adopted a U.S. Corporate Political Contributions and Expenditures Policy (Political Contributions Policy), which, together with other policies and procedures of the Company, guides GMs approach to political contributions and lobbying. In 2018, we revised our Governance Committee charter to enhance oversight of GMs lobbying efforts. Our Political Contributions Policy and Voluntary Report on Political Contributions are available on our website investor.gm.com/resources. GMs robust disclosure is recognized as being in the First Tier of top performers by the CPA-Zicklin Index. For more information regarding the Boards position on this issue, see page ["]. environmental, social, and governance ("ESG") please

| 3 |

PROXY STATEMENT SUMMARY

Full-Year 2018 Results Overview

GAAP vs. 2017 Non-GAAP vs. 2017 Net Revenue $147.0 B + 1.0 % EBIT-adj. Margin 8.0% (0.8) pts Income $8.1 B + 2,347 % EBIT-adj. $11.8 B (8.3) % EPS-Diluted $5.58 + 2,436% EPS-Diluted-adj. $6.54 (1.2) % Auto Operating Cash Flow $11.7 B $(2.6) B

Note: The financial information above and included in this Proxy Statement relates to our continuing operations and not our discontinued operations, which consist of the Opel and Vauxhall businesses and certain other assets in Europe and the European financing subsidiaries and branches that were sold in 2017. EBIT-adjusted, EBIT-adjusted margin and EPS-diluted-adjusted are non-GAAP financial measures. Appendix A includes a reconciliation of these non-GAAP financial measures to their most directly comparable measures reported under generally accepted accounting principles in the United States. |

Transformation Takes Shape in 2018

u GM reported strong full-year 2018 earnings driven by strong pricing, surging crossover sales, successful execution of the Company’s light-duty full-size truck launch, growth of GM Financial earnings, and disciplined cost control.

u In November 2018, the Company announced steps to align its product portfolio and capacity in North America with changed consumer preferences and transform its workforce to position the Company for long-term success.

u GM introduced the first production-ready autonomous vehicle built to operate safely with no driver or manual controls. GM Cruise has secured commitments of more than $5 billion from external investors who are attracted to Cruise’s integrated approach to software and hardware development.

u GM Financial had record full-year earnings and revenue performance in 2018.

u In the U.S., GM delivered nearly 3 million vehicles, helped by crossover sales that topped 1 million for the year. Average transaction prices (“ATPs”) were a record of nearly $36,000, while incentives as a percent of ATPs fell 0.3% year over year.

|

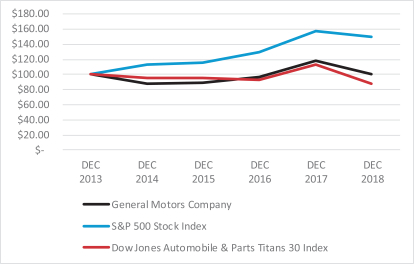

COMPARISON OF CUMULATIVE TOTAL RETURN

Cumulative Value of $100 Investment Through December 31, 2018

| “GM delivered another strong year of earnings in a highly volatile environment in 2018. We will continue to make bold decisions to lead the transformation of this industry and drive significant shareholder value.”

– Mary Barra, Chairman & CEO |

| 4 |

|

PROXY STATEMENT SUMMARY

Our Capital Allocation Framework

Your Board takes its role as the steward of your capital seriously. As a result, your Board has worked closely with management to establish a disciplined and transparent Capital Allocation Framework designed to drive long-term shareholder value. The Framework consists of the following three pillars:

Reinvest to Drive Growth Maintain Investment Grade Balance Sheet Return Available Cash to Shareholders (Target Opportunities with 20%+ ROIC-adj.) ($18 billion average target cash balance) (Through dividends and share repurchases)

Capital Allocation Oversight: Strategic Transformation

Your Board, together with its Finance and Audit Committees, oversees GM’s critical capital allocation decisions, including establishing and maintaining the dividend rate, pursuing strategic investments, approving medium- and long-term capital plans, and maintaining GM’s overall liquidity. In November 2018, GM announced proactive steps to improve its overall business performance by driving cost efficiencies, lowering capital expenditures, and realigning manufacturing capacity with changed consumer preferences. These actions not only are expected to result in significantly improved adjusted automotive free cash flow by the end of 2020, but also will enable GM to allocate more resources to the future of mobility over the next two years. Your Board worked with management to ensure that this strategic transformation was undertaken in accordance with our Capital Allocation Framework, including by securing a $3 billion revolving credit facility to maintain liquidity and financial flexibility while funding immediate transformation costs. Your Board believes that over the long term, these bold decisions will enable GM to generate additional cash to fund reinvestment in higher-return growth opportunities, maintain a healthy balance sheet, and return additional cash to shareholders.

Reinvesting to Drive Growth and Returning Available Cash to Shareholders

Since 2011, GM has returned more than $25 billion to shareholders through dividends and share repurchases, while continuing to make investments in higher-return opportunities that have enhanced our ability to lead in the future of mobility and strengthened our core business. Key investments include GM’s 2016 decisions to invest in the ride-sharing company Lyft, Inc., (“Lyft”) and acquire Cruise Automation, Inc. The latter is now our subsidiary tasked with the development and commercialization of our AV technology. These strategic investments have been validated as our investment in Lyft has appreciated and Cruise has attracted $5 billion in external capital commitments.

| 5 |

PROXY STATEMENT SUMMARY

Executive Compensation Highlights

We provide highlights of our compensation program below. Please review our Compensation Discussion and Analysis beginning on page 38 and the accompanying compensation tables beginning on page 58 of this Proxy Statement for a complete discussion of our compensation program.

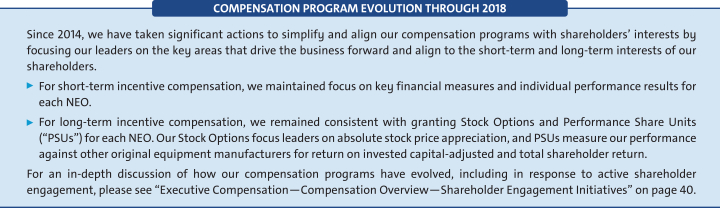

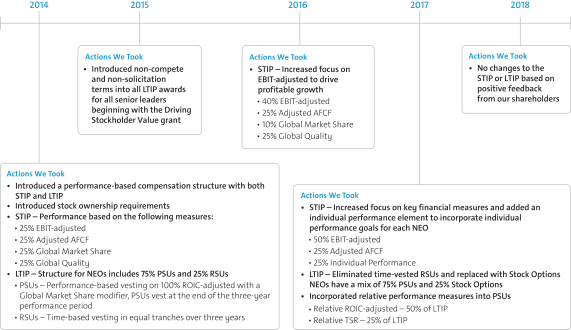

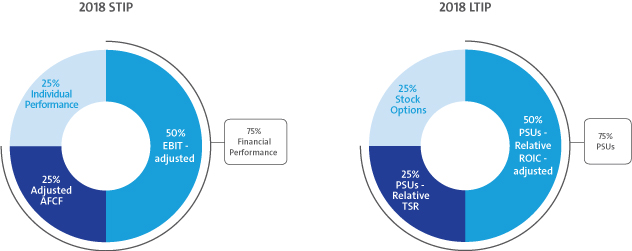

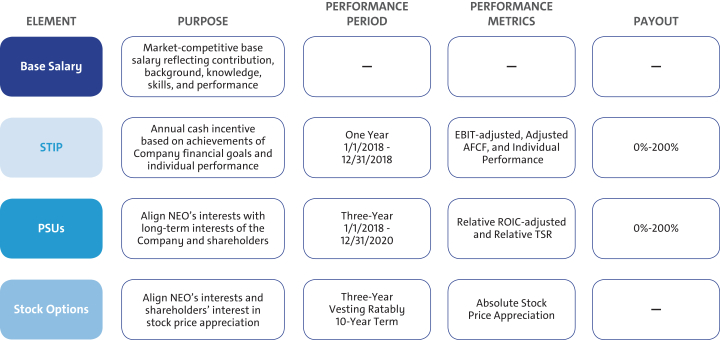

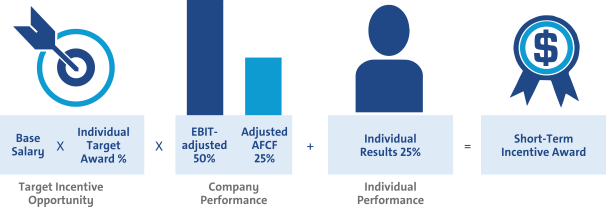

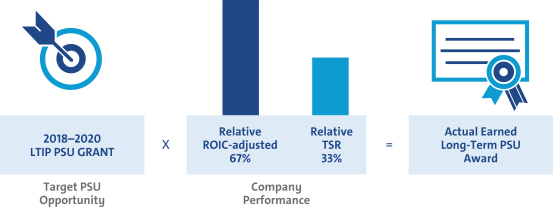

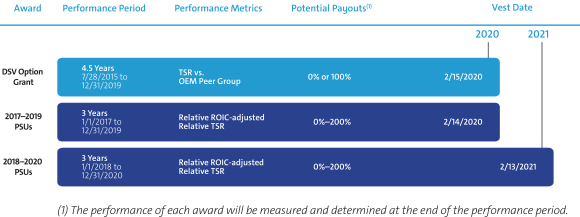

COMPENSATION PROGRAM EVOLUTION THROUGH 2018Since 2014, we have taken significant action to simplify and align our compensation programs with shareholders interests by focusing our leaders on the key areas that both drive the business forward and align to the short-term and long-term interests of our shareholders.For short-term incentive compensation, we maintained focus on key financial measures and individual performance results for each NEO.For the long-term incentive compensation, we remained consistent with granting Stock Options and Performance Share Units for each NEO. Our Stock Options focus leaders on absolute stock price appreciation and PSUs measure our performance against other OEMs for ROIC-adjusted and TSR.For an in-depth discussion of how our compensation programs have evolved, including in response to active shareholder engagement, see Executive CompensationCompensation OverviewShareholder Engagement Initiatives on page ["] (PSUs) original equipment manufacturers Return on Invested Capital-adjusted Total Shareholders Return

Performance-Based Compensation Structure

|  |

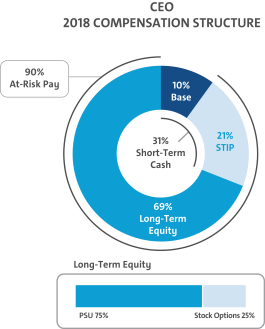

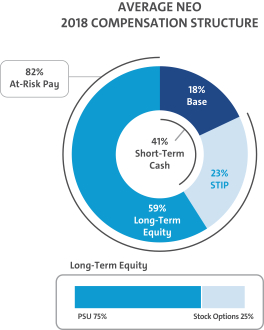

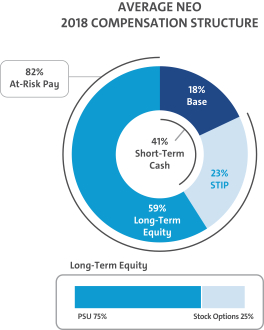

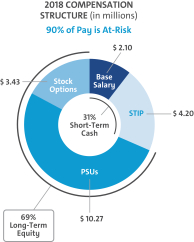

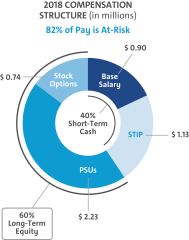

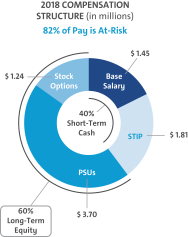

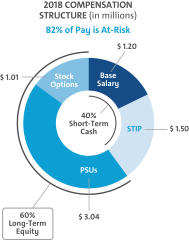

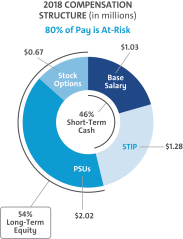

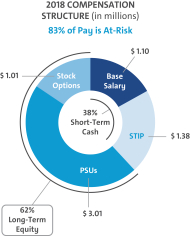

CEO 2018 COMPENSATION STRUCTURE90% At-Risk Pay 10% Base 31% Short-Term Cash 21% STIP 69% Long-Term Equity Long-Term Equity PSU 75% Stock Options 25%AVERAGE NEO 2018 COMPENSATION STRUCTURE82% At-risk Pay 18% Base 41% Short-Term Cash 23% STIP 59% Long-Term Equity Long-Term Equity PSU 75% Stock Options 25%

2018 Summary Compensation Snapshot

| Name | Salary ($) | Bonus ($) | Stock Awards ($) | Option Awards ($) | Nonequity Incentive Plan Compensation ($) | Change in Pension Value and NQ Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | ||||||||||||||||||||||||

Mary T. Barra |

|

2,100,000 |

|

|

— |

|

|

11,081,760 |

|

|

3,425,006 |

|

|

4,452,000 |

|

|

— |

|

|

811,684 |

|

|

21,870,450 |

| ||||||||

Dhivya Suryadevara |

|

668,100 |

|

|

— |

|

|

2,446,635 |

|

|

796,263 |

|

|

1,192,500 |

|

|

— |

|

|

402,592 |

|

|

5,506,090 |

| ||||||||

Daniel Ammann |

|

1,450,000 |

|

|

— |

|

|

3,993,891 |

|

|

1,234,383 |

|

|

1,921,300 |

|

|

— |

|

|

372,307 |

|

|

8,971,881 |

| ||||||||

Mark L. Reuss |

|

1,200,000 |

|

|

— |

|

|

3,276,007 |

|

|

1,012,504 |

|

|

1,590,000 |

|

|

— |

|

|

277,579 |

|

|

7,356,090 |

| ||||||||

Alan S. Batey |

|

1,025,000 |

|

|

— |

|

|

2,178,894 |

|

|

673,429 |

|

|

1,230,000 |

|

|

— |

|

|

233,197 |

|

|

5,340,520 |

| ||||||||

Charles K. Stevens, III |

|

1,100,000 |

|

|

— |

|

|

3,255,775 |

|

|

1,006,252 |

|

|

1,320,000 |

|

|

— |

|

|

257,153 |

|

|

6,939,180 |

| ||||||||

Note: For additional information on the table above, please see the Summary Compensation Table in “Executive Compensation” on page 58.

| 6 |

|

PROXY STATEMENT SUMMARY

Environmental and Sustainability Performance

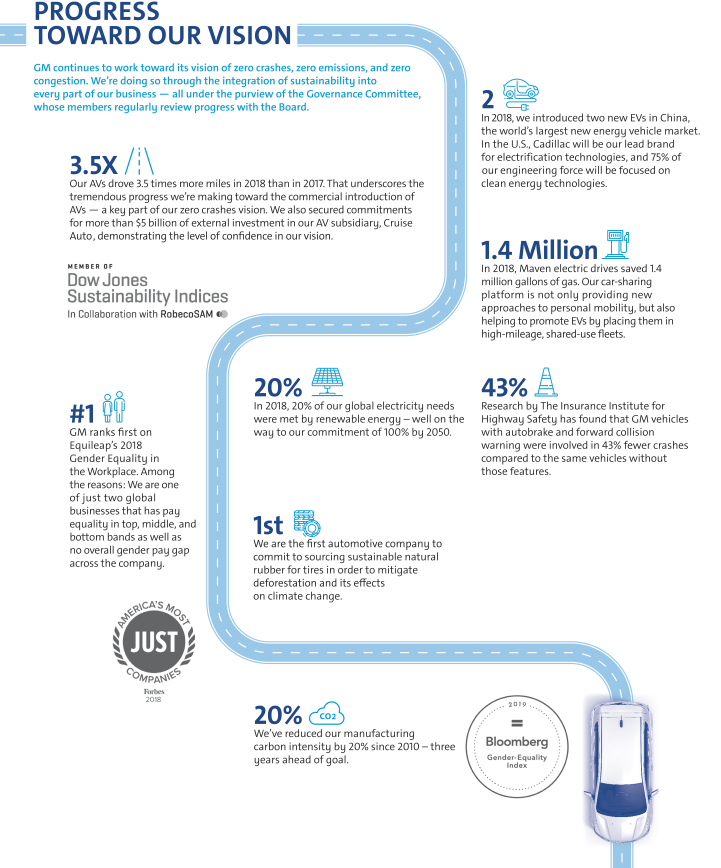

PROGRESS TOWARD OUR VISIONGM continues to work toward its vision of Zero Crashes. Zero Emissions. Zero Congestion. Were doing so through the integration of sustainability into every part of our business all under the purview of our Board of Directors Governance and Corporate Responsibility Committee whose members review progress at every Board meeting. 3.5XOur AVs drove 3.5 times more miles in 2018 than in 2017. That underscores the tremendous progress were making toward the commercial introduction of AVs a key part of our Zero Crashes vision. We also secured commitments for more than $5 billion of external investment in our AV subsidiary, Cruise Automation, demonstrating the level of confidence in our vision.MEMBER OF Dow Jones Sustainability Indices In Collaboration with RobecoSAM#1 GM ranks first on Equileaps 2018 Gender Equality in the Workplace. Among the reasons: We are one of just two global businesses that has pay equality in top, middle and bottom bands as well as no overall gender pay gap across the company.2 We introduced two new EVs in China, the worlds largest new energy vehicle market, this year; were committed to 20 new EVs by 2023. In the U.S., Cadillac will be our lead brand for electrification technologies, and 75% of our engineering force will be focused on clean energy technologies.1.4 MillionIn 2018, Maven electric drives saved 1.4 million gallons of gas. Our car-sharing platform is not only providing new approaches to personal mobility, but also helping to promote EVs by placing them in high-mileage, shared-use fleets.20%In 2018, 20% of our global electricity needs were met by renewable energy well on the way to our commitment of 100% by 2050.XX,000We continued to hire more than XX STEM positions in 2018 that equates to approximately one every 26 minutes, emphasizing our focus on attracting and retaining the top talent in the fields of connectivity, autonomous and artificial intelligence technologies. 43%Research by the The Insurance Institute for Highway Safety has found that GM vehicles with autobrake and forward collision warning were involved in 43% fewer crashes compared to the same vehicles without those features.1stWe are the first automotive company to commit to sourcing sustainable natural rubber for tires in order to mitigate deforestation and its effects on climate change. 20% Weve reduced our manufacturing carbon intensity since 2010 three years ahead of goal. the by 20%

| 7 |

ITEM NO. 1 – ELECTION OF DIRECTORS

SUMMARYAt the 2019 Annual Meeting, 11 directors will be elected. The Governance Committee evaluated the nominees in accordance with the Committees charter and our Corporate Governance Guidelines and submitted the nominees to the full Board for approval. Other than Judith A. Miscik and Wesley G. Bush, all of the nominees were elected to the Board at the 2018 Annual Meeting. Ms. Miscik was elected to the Board effective October 8, 2018, and Mr. Bushs was elected to the Board effective February 11, 2019.

Overview of Your Board Nominees

Mary T. Barra Age: 57 Direct Since: 2014Theodore M. Solso Age: 72 Independent Director Since: 2012 Wesley G. Bush Age: 58 Independent Director Since: 2019 Joseph Jimenez Age: 59 Independent Director since: 2015 Thomas M. Schoewe Age: 66 Independent Director Since: 2011 Devin N. Wenig Age: 52 Independent Director Since: 2018Carol M. Stephenson Age: 68 Independent Director Since: 2009 Patricia F. Russo Age: 66 Independent Director Since: 2009 Judith A. Miscik Age: 61 Independent Director Since: 2018 Jane L Mendillo Age: 60 Independent Director Since: 2016Linda R. Gooden Age : 66 Independent Director Since: 2015 11 NOMINEES

| 8 |

|

ITEM NO. 1 – ELECTION OF DIRECTORS

GM HAS THE RIGHT BOARD AT THE RIGHT TIMEGM's long-term strategy is to strengthen its core business by deploying capital to higher-return opportunities and developing new technologies like EVs and AVs that will unlock our vision of Zero Crashes, Zero Emissions, and Zero Congestion while also driving cost efficiencies. Your Board believes that its nominees collectively possess the right mix of skills, qualifications, and experiences to protect shareholder interests and independently oversee management as it accelerates GMs strategic and cultural transformation, capitalizes on key opportunities, and addresses critical risks.Transforming Our Core Business: In November 2018, we announced plans to accelerate GM's transformation for the future, building on the comprehensive strategy the Company laid out in 2015 to strengthen its core business, capitalize on the future of personal mobility, and drive significant cost efficiencies. Management remains focused on strengthening GM's core business by delivering winning vehicles, building profitable adjacent businesses, making tough, strategic decisions, and continuing to target 10% core margins. Your Board has directors with established track records for strategic planning and successful business restructurings as CEOs and senior leaders of large, global public companies.Leading in the Future of Personal Mobility: With our vision of Zero Crashes, Zero Emissions, and Zero Congestion, GM is transforming the future of personal mobility through investments in electrification, AV, connectivity, and ridesharing. GM's recent transformation actions are designed to provide the Company with the financial flexibility to invest in the future. Your Board has directors with extensive technology expertise gained from leading and serving in senior leadership roles at large technology companies.Overseeing a Complex, Global Manufacturing Company: As a large, complex manufacturing company with operations around the globe, GM faces a variety of critical challenges from managing our global supply chain, addressing international trade issues, and controlling raw material costs to maintaining strong relationships with our international workforce. To help management tackle these challenges, your Board has directors with extensive experience leading large, global organizations as CEOs and senior leaders. In 2018 and 2019, your Board added new directors with extensive manufacturing, geopolitical, and risk management expertise.Performance Throughout the Business Cycle: The automotive industry is cyclical. As our recent transformation actions demonstrate, we are serious about ensuring that GM is well-prepared to perform throughout the automotive business cycle. GM has taken decisive actions to maintain a strong balance sheet and consistently deploy its capital to the highest-return opportunities. Your Board has directors with deep finance and capital markets expertise to oversee management's capital allocation strategy and effectively balance long-term investment with return of value to shareholders in the near term.Navigating a Heavily Regulated Industry: As an automotive manufacturing company, GM must navigate a complex regulatory landscape with overlapping and sometimes conflicting federal, state, and international emissions, environmental, and safety regulations. In addition, as a leader in AV development, GM is working with regulators to develop new rules for AVs, a technology that did not exist just a few years ago. Your Board has directors with experience leading companies in highly regulated industries, as well as directors with public policy expertise.Fostering Deep Customer Relationships: In addition to being a global manufacturing company, GM is at its core a consumer products company. One of our key priorities is to put the customer at the center of everything we do. To support this priority, your Board has directors with marketing expertise and experience leading consumer products companies to help management grow GM brands and drive customer loyalty.Your Board is a strategic asset for GM and is driving effective oversight and execution of GM 's strategic plan and holding management accountable.

| 9 |

ITEM NO. 1 – ELECTION OF DIRECTORS

Diversity of Skills, Qualifications, and Experience

Your Board nominees offer a diverse range of skills and experience in relevant areas.

SKILL/ QUALIFICATION

| BARRA

| SOLSO

| BUSH

| GOODEN

| JIMENEZ

| MENDILLO

| MISCIK

| RUSSO

| SCHOEWE

| STEPHENSON

| WENIG

| |||||||||||

| ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||

| ● | ● | ||||||||||||||||||||

| ● | ● | ● | ● | ● | ● | ● | |||||||||||||||

| ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||

| ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||

| ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||

| ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||

| ● | ● | ● | |||||||||||||||||||

| ● | ● | ● | ● | ● | |||||||||||||||||

| ● | ● | ● | ● | ● | ● | ● | |||||||||||||||

Board Membership Criteria, Refreshment, and Succession Planning

The selection of qualified directors is fundamental to the Board’s successful oversight of GM’s strategy and enterprise risks. Ensuring your Board is composed of directors who bring diverse viewpoints and perspectives, possess a variety of skills, professional experiences, and backgrounds, and effectively represent the long-term interests of shareholders is critical to your Board and the Governance Committee. The priorities for recruiting new directors are continually evolving based on the Company’s strategic needs and the skills composition of your Board at any particular time. These dynamic priorities ensure the Board remains a strategic asset capable of overseeing and helping management address the risks, trends, and opportunities that GM will face in the future.

In evaluating potential director candidates, the Governance Committee considers, among other factors, the criteria shown above in the skills and qualifications matrix for current directors and any additional characteristics that it believes one or more directors should possess based on an assessment of the needs of the Board at that time. In every case, director candidates must be able to contribute significantly to your Board’s discussion and decision-making on the broad array of complex issues facing GM. The Governance Committee also engages a reputable, qualified search firm that uses our skills matrix to inform the search and help identify and evaluate potential candidates.

SPOTLIGHT: RECENT BOARD SUCCESSION PLANNINGOver the past several years, your Board has worked hard to develop a succession plan that will serve the Company and its shareholders in preparation for the departures of Admiral Mullen and Mr. Mulva, who will not be standing for reelection at the Annual Meeting. Your Board consciously endeavored to replace departing directors with directors having comparable or additional skill sets. In addition, your Board also has decided to waive the retirement age for Tim Solso for one-year because we believe the new members of the Board and our shareholders will benefit from his continued leadership during this period of transformation. We also plan to refresh your Boards committee assignments in May 2019. For additional information, please see pages 25 to 27.

| 10 |

|

ITEM NO. 1 – ELECTION OF DIRECTORS

| u | Board Diversity |

The Governance Committee seeks individuals with a broad range of business experience and varied backgrounds. Although GM does not have a formal policy governing diversity among directors, your Board strives to identify candidates with diverse backgrounds. We recognize the value of overall diversity and consider members’ and candidates’ opinions, perspectives, personal and professional experiences, and backgrounds, including gender, race, ethnicity, and country of origin. We believe that the judgment and perspectives offered by a diverse board of directors improves the quality of decision making and enhances the Company’s business performance. We also believe such diversity can help the Board respond more effectively to the needs of customers, shareholders, employees, suppliers, and other stakeholders.

| u | Candidate Recommendations |

The Governance Committee will consider persons recommended by shareholders for election to the Board. The Governance Committee will review the qualifications and experience of each recommended candidate using the same criteria for candidates proposed by Board members and communicate its decision to the candidate or the person who made the recommendation.

TO RECOMMEND AN INDIVIDUAL FOR BOARD MEMBERSHIP, WRITE TO:GMs Corporate Secretary, at General Motors Company, Mail Code 482-C24-A68, 300 Renaissance Center, Detroit, Michigan 48265, or by e-mail to shareholder.relations@gm.com.

| u | Director Recruitment Process |

1 Candidate Recommendations From search firms, directors, management, and shareholders 2 Governance Committee Considers detailed skills matrix and the current and future needs of the Board Screens qualifications and considers diversity Reviews independence and potential conflicts Interviews potential directors Recommends nominees to the Board 3 Board of Directors Evaluates candidates, analyzes independence and other issues, and selects nominees 4 Shareholders Vote on nominees at Annual Meeting NEW DIRECTORS 6 added in the past four years, bringing fresh perspectives to the Board Joseph Jimenez, Retired CEO, Novartis AG Linda Gooden, Retired Executive VP, Lockheed Martin Jane Mendillo, Retired President & CEO, Harvard Management Devin Wenig, President & CEO, eBay Jami Miscik, Vice Chairman & CEO, Kissinger Associates Wes Bush, Chairman, Northrop Grumman

Your Board’s Nominees for Director

Set forth below is important information about our director nominees. We believe each of your Board’s nominees is highly qualified with unique experiences that are particularly beneficial to GM.

The Board of Directors recommends a voteFOR each of the nominees below.

| 11 |

ITEM NO. 1 – ELECTION OF DIRECTORS

|  | |

| Mary T. Barra | Theodore M. Solso | |

Chairman & Chief Executive Officer, General Motors Company | Independent Lead Director, General Motors Company, and Retired Chairman & Chief Executive Officer, | |

| 57 years old | 72 years old | |

| Director since: 2014 | Director since: 2012 | |

Committees

Executive (Chair)

Current Public Company Directorships

The Walt Disney Company

Prior Public Company Directorships

General Dynamics Corporation (2011 to 2017)

Prior Experience Ms. Barra has served as Chairman of GM’s Board of Directors since January 2016 and Chief Executive Officer of GM since January 2014. Prior to that time, she served as Executive Vice President, Global Product Development, Purchasing and Supply Chain from 2013 to 2014; Senior Vice President, Global Product Development from 2011 to 2013; Vice President, Global Human Resources from 2009 to 2011; and Vice President, Global Manufacturing Engineering from 2008 to 2009. Ms. Barra began her career at GM in 1980.

Reasons for Nomination u Extensive senior leadership experience as the CEO of GM and in other key leadership positions at the Company, including experience in operational excellence, strategic planning, purchasing and supply chain, human resources, and manufacturing and engineering. u In-depth knowledge of the global automotive industry. u Deep understanding of GM’s strengths, weaknesses, opportunities, challenges, risks, and corporate culture. u Ability to drive the efficient execution of GM’s strategic plan and vision for the future. u Strong leadership and management skills coupled with extensive engineering and global product development experience. u Valuable knowledge of key governance matters gained as a director of GM and other large global public companies. | Committees

Executive

Current Public Company Directorships

Ad-Astra Rocket Company

Prior Public Company Directorships

Ashland Inc. (1999 to 2012) (Lead Director 2003 to 2010) and Ball Corporation (2003 to 2019) (Lead Director 2013 to 2019)

Prior Experience Mr. Solso served as Non-Executive Chairman of the GM Board of Directors from 2014 to 2016. He was Chairman and Chief Executive Officer of Cummins, Inc., from 2000 until his retirement in 2011 and President and Chief Operating Officer of Cummins from 1995 to 2000.

Reasons for Nomination u Extensive senior leadership experience gained as the CEO of Cummins, including automotive-related experience and experience in finance, accounting, and vehicle and workplace safety. u Background leading a company through strong financial performance and shareholder returns, international growth, and business restructurings. u Valuable knowledge of key governance matters, including environmental issues, corporate responsibility, diversity, and human rights issues, gained as the CEO of Cummins and the Independent Lead Director of GM and other large global public companies. u Extensive experience in automotive manufacturing and engineering, including with respect to emissions reduction technology, development of diesel engines, and compliance with challenging emissions laws and regulations. u Valuable insight into advancing the business priorities of GM’s international operations gained as the U.S. Chairman of the U.S.-Brazil CEO Forum. | |

| 12 |

|

ITEM NO. 1 – ELECTION OF DIRECTORS

|  | |

| Wesley G. Bush | Linda R. Gooden | |

| Chairman, Northrop Grumman Corporation | Retired Executive Vice President, Information Systems & Global Solutions, Lockheed Martin Corporation | |

| 58 years old | 66 years old | |

| Director since: 2019 | Director since: 2015 | |

Committees

Executive Compensation, Finance

Current Public Company Directorships

Northrop Grumman Corporation (“Northrop Grumman”) and Dow Inc.

Prior Public Company Directorships

Norfolk Southern Corporation

Prior Experience In 2011, Mr. Bush was appointed Chairman of the Board of Directors of Northrop Grumman. He also served as the Chief Executive Officer of Northrop Grumman from 2010 to 2018. Prior to that, Mr. Bush served in numerous leadership roles at Northrop Grumman, including President and Chief Operating Officer, Chief Financial Officer, and President of the company’s Space Technology sector. He also served in a variety of leadership positions at TRW, Inc., before it was acquired by Northrop Grumman in 2002. He is a member of the National Academy of Engineering.

Reasons for Nomination u Strong track record of creating shareholder value in a complex manufacturing enterprise known for its advanced engineering and technology. u Strong financial acumen, excellent strategic instincts, and an ability to think broadly about complex business issues. u Valuable knowledge of key governance matters, including compensation, finance, risk management, and environment, health, and safety, gained as a director of Northrop Grumman and other large global public companies. u Valuable knowledge of key governance matters gained as a director of GM and other large global public companies. | Committees

Audit, Cybersecurity (Chair), Executive, Risk

Current Public Company Directorships

Automatic Data Processing, Inc., and The Home Depot, Inc.

Prior Public Company Directorships

WGL Holdings, Inc., and Washington Gas & Light Company, a subsidiary of WGL Holdings, Inc.

Prior Experience Ms. Gooden served as Executive Vice President, Information Systems & Global Solutions of Lockheed Martin Corporation (“Lockheed Martin”) from 2007 to 2013. She also served as Deputy Executive Vice President, Information and Technology Services of Lockheed Martin from October to December 2006; and President, Information Technology of Lockheed Martin from 1997 to December 2006.

Reasons for Nomination u Significant senior leadership experience gained through various leadership positions at Lockheed Martin, including experience in technology, innovation, acquisitions, divestitures, business restructuring, and finance. u Strong track record of identifying and mitigating enterprise risks in various senior leadership roles. u Valuable insight into GM’s information technology (“IT”) function, technology systems and processes, and cybersecurity framework, including those related to mobility and autonomous vehicles, gained through various leadership roles at Lockheed Martin. u Extensive expertise in cybersecurity and IT, as well as significant operational, strategic planning, and government relations experience. u Valuable knowledge of key governance matters gained as a director of GM and other large global public companies. | |

| 13 |

ITEM NO. 1 – ELECTION OF DIRECTORS

|  | |

| Joseph Jimenez | Jane L. Mendillo | |

| Retired Chief Executive Officer, Novartis AG | Retired President & Chief Executive Officer, Harvard Management Company | |

| 59 years old | 60 years old | |

| Director since: 2015 | Director since: 2016 | |

Committees

Executive Compensation, Governance and Corporate Responsibility

Current Public Company Directorships

The Procter & Gamble Co.

Prior Public Company Directorships

Colgate-Palmolive Company (2010 to 2015)

Prior Experience Mr. Jimenez served as Chief Executive Officer of Novartis AG (“Novartis”) from 2010 until his retirement in 2018. He was Head of Novartis’ Pharmaceuticals Division from October 2007 to 2010 and Head of Novartis’ Consumer Health Division from April to October 2007. Prior to joining Novartis, Mr. Jimenez served as Advisor to the Blackstone Group L.P., a private equity firm, from 2006 to 2007. He was President and Chief Executive Officer of H.J. Heinz Company (“Heinz”) North America from 2002 to 2006 and Executive Vice President, President and Chief Executive Officer of Heinz Europe from 1999 to 2002. Prior to joining Heinz, Mr. Jimenez held various leadership positions at ConAgra Foods Inc. (“ConAgra”), including President and Senior Vice President of two operating divisions from 1993 to 1998.

Reasons for Nomination u Extensive senior leadership experience gained as the CEO of Novartis and in other senior leadership positions in the consumer products industry, including experience in international operations, strategic planning, and finance. u Valuable insight into GM’s strategy to enhance the customer experience and earn customers for life gained through various senior leadership positions at Heinz and ConAgra and as a director of Procter & Gamble. u Experience executing business restructurings and significant business transformations at both Heinz and Novartis. u Valuable knowledge of key governance matters gained as the CEO of Novartis and a director of GM and other large global public companies. | Committees

Audit, Finance

Current Public Company Directorships

Lazard Ltd.

Prior Public Company Directorships

None

Prior Experience Ms. Mendillo served as President and Chief Executive Officer of the Harvard Management Company (“HMC”) from 2008 to 2014, managing Harvard University’s approximately $37 billion global endowment and related assets. Prior to joining HMC, she was Chief Investment Officer of Wellesley College from 2002 to 2008; and prior to that, she spent 15 years at HMC in investment management positions, including in public and private equity markets and alternative asset investments. She also serves as a Trustee to the Old Mountain Private Trust Company and a member of the board and executive committee of the Berklee College of Music. She has also previously served as Chair of the investment committee of the Partners Healthcare System; a member of the investment committees at Yale University and the Rockefeller Foundation; and a member of the board of directors and investment committees of the Mellon Foundation and the Boston Foundation.

Reasons for Nomination u Extensive senior leadership experience gained as the CEO of HMC, including experience in risk and crisis management. u Deep capital markets expertise gained from her more than 30 years managing globally diverse endowments and investment portfolios. u Valuable insight into GM’s disciplined capital allocation framework and its financial policies and strategies. u Valuable knowledge of key governance matters gained as a director of GM and another large global public company. | |

| 14 |

|

ITEM NO. 1 – ELECTION OF DIRECTORS

|  | |

| Judith A. Miscik | Patricia F. Russo | |

| Chief Executive Officer & Vice Chairman, Kissinger Associates, Inc. | Chairman, Hewlett Packard Enterprise Company | |

| 60 years old | 66 years old | |

| Director since: 2018 | Director since: 2009 | |

Committees

Audit, Risk

Current Public Company Directorships

Morgan Stanley

Prior Public Company Directorship

EMC Corporation (2012 to 2016) and Pivotal Software, Inc. (2014 to 2016)

Prior Experience In July 2017, Ms. Miscik was appointed as Chief Executive Officer and Vice Chairman of Kissinger Associates, Inc. (“Kissinger Associates”). Prior to that time, she served as Co-Chief Executive Officer and Vice Chairman of Kissinger Associates from 2015 to 2017 and as President and Vice Chairman of Kissinger Associates from 2009 to 2015. Prior to joining Kissinger Associates, Ms. Miscik was the Global Head of Sovereign Risk at Lehman Brothers from 2005 to 2008 and served at the Central Intelligence Agency (“CIA”) from 1983 to 2005, where she was the Deputy Director for Intelligence from 2002 to 2005.

Reasons for Nomination u Extensive leadership experience gained as CEO of Kissinger Associates and as Deputy Director for Intelligence at the CIA. u Valuable experience in assessing and mitigating geopolitical and macroeconomic risks in both public and private sector roles, which will provide significant insight into GM’s overall strategy, particularly as GM navigates critical international issues such as trade and global economic conditions. u Unique and extensive background in intelligence, security, risk analysis, and mitigation, which will provide significant insight into the Board’s oversight of GM’s enterprise risk identification and mitigation processes. u Valuable knowledge of key governance matters gained as a director of GM and another large global company. | Committees

Executive, Executive Compensation, Finance, Governance and Corporate Responsibility (Chair)

Current Public Company Directorships

Hewlett Packard Enterprise Company (Chairman), KKR Management LLC, and Merck & Co. Inc.

Prior Public Company Directorships

Hewlett-Packard Company (2011 to 2015) (Lead Director 2014 to 2015) and Alcoa, Inc. (2016)

Prior Experience Ms. Russo served as Lead Director of the Hewlett-Packard Company Board of Directors from 2014 to 2015. She was Independent Lead Director of the GM Board of Directors from March 2010 to January 2014. She also served as Chief Executive Officer of Alcatel-Lucent S.A. (“Alcatel-Lucent”) from 2006 to 2008; Chairman and Chief Executive Officer of Lucent Technologies, Inc., (“Lucent”) from 2003 to 2006; and President and Chief Executive Officer of Lucent from 2002 to 2006.

Reasons for Nomination u Extensive senior leadership gained as the CEO of Alcatel-Lucent and Lucent, including experience in corporate strategy, finance, sales and marketing, technology, and leadership development. u Significant strategic business experience gained through managing critical technology disruptions and successfully leading Lucent through a severe industry downturn. u Valuable insight into GM’s evaluation and execution of strategic transactions gained through experience overseeing Hewlett-Packard Company’s split into two companies, the Alcoa-Arconic split, and managing the Alcatel-Lucent merger. u Valuable knowledge of key governance matters, including executive compensation, gained as the CEO of Alcatel-Lucent and Lucent and as a director of GM and other large global public companies. | |

| 15 |

ITEM NO. 1 – ELECTION OF DIRECTORS

|  | |

| Thomas M. Schoewe | Carol M. Stephenson, O.C. | |

| Retired Executive Vice President & Chief Financial Officer, Wal-Mart Stores, Inc. | Retired Dean, Ivey Business School, University of Western Ontario | |

| 66 years old | 68 years old | |

| Director since: 2011 | Director since: 2009 | |

Committees

Audit (Chair), Cybersecurity, Executive, Finance, Risk

Current Public Company Directorships

KKR Management LLC and Northrop Grumman Corporation

Prior Public Company Directorship

PulteGroup, Inc. (2009 to 2012)

Prior Experience Mr. Schoewe served as Executive Vice President and Chief Financial Officer of Wal-Mart Stores, Inc. (“Wal-Mart”) from 2000 to 2011. Prior to joining Wal-Mart, he was Senior Vice President and Chief Financial Officer of Black & Decker Corporation (“Black & Decker”) from 1996 to 1999; Vice President and Chief Financial Officer of Black & Decker from 1993 to 1996; Vice President of Finance of Black & Decker from 1989 to 1993; and Vice President of Business Planning and Analysis of Black & Decker from 1986 to 1989.

Reasons for Nomination: u Extensive financial expertise as the CFO of Wal-Mart and Black & Decker. u Significant senior leadership experience gained in various leadership positions, including experience in financial reporting, accounting and controls, business planning and analysis, and risk management. u Valuable insight into GM’s IT function, technology systems and processes, and cybersecurity framework gained through experience leading large-scale, transformational IT implementations at Wal-Mart and Black & Decker. u Valuable knowledge of key governance matters gained as a director of GM and other large global public companies. | Committees

Executive, Executive Compensation (Chair), Governance and Corporate Responsibility

Current Public Company Directorships

Intact Financial Corporation (formerly ING Canada) and Maple Leaf Foods Inc.

Prior Public Company Directorships

Ballard Power Systems, Inc. (2012 to 2017) and Manitoba Telecom Services (2008 to 2016)

Prior Experience Ms. Stephenson served as Dean of the Ivey Business School at the University of Western Ontario from 2003 until her retirement in 2013. Prior to joining the Ivey Business School, she was President and Chief Executive Officer of Lucent Technologies Canada from 1999 to 2003. She was also a member of the Advisory Board of General Motors of Canada, Limited, a GM subsidiary, from 2005 to 2009 and was appointed an officer of the Order of Canada in 2009.

Reasons for Nomination u Significant senior leadership experience gained as Dean of the Ivey Business School and in leadership positions in the telecommunications industry. u Valuable insight into GM’s strategy to strengthen our core business and transform the future of personal mobility gained through expertise in marketing, operations, strategic planning, technology development, and financial management. u Extensive expertise in North American trade issues and the Canadian business environment gained as a director at several leading Canadian companies. u Valuable knowledge of key governance matters, including executive compensation, gained as a director of GM and other large global public companies. | |

| 16 |

|

ITEM NO. 1 – ELECTION OF DIRECTORS

| ||

| Devin N. Wenig | ||

| President & Chief Executive Officer, eBay Inc. | ||

| 52 years old | ||

| Director since: 2018 | ||

Committees

Risk

Current Public Company Directorships

eBay Inc.

Prior Public Company Directorships

None

Prior Experience In July 2015, Mr. Wenig was appointed as President and Chief Executive Officer of eBay Inc. (“eBay”). Prior to that time, he served as President of eBay’s Marketplaces business from 2011 to July 2015. Prior to joining eBay, Mr. Wenig was Chief Executive Officer of Thomson Reuters Corporation’s (“Thomson Reuters”) largest division, Thomson Reuters Markets, from 2008 to 2011; Chief Operating Officer of Reuters Group plc (“Reuters”) from 2006 to 2008; and President of Reuters Business divisions from 2003 to 2006.

Reasons for Nomination u Extensive senior leadership experience gained as the CEO of eBay, including experience in technology, global operations, and strategic planning. u Critical technology insight into GM’s strategies related to the future of mobility, autonomous vehicles, vehicle connectivity, and data monetization gained through various roles at eBay. u Valuable insight into GM’s strategy to enhance the customer experience and earn customers for life gained through various consumer-facing leadership roles at eBay, Thomson Reuters, and Reuters. u Valuable knowledge of key governance matters gained as the CEO and as a director of eBay. | ||

| 17 |

ITEM NO. 1 – ELECTION OF DIRECTORS

Non-Employee Director Compensation

Our non-employee directors receive cash compensation as well as equity compensation in the form of GM Deferred Share Units (“DSUs”) for their Board service. Compensation for our non-employee directors is set by the Board at the recommendation of the Governance Committee.

| u | Guiding Principles |

| u | Fairly compensate directors for their responsibilities and time commitments. |

| u | Attract and retain highly qualified directors by offering a compensation program consistent with those at companies of similar size, scope, and complexity. |

| u | Align the interests of directors with our shareholders by providing a significant portion of compensation in equity and requiring directors to continue to own our common stock (or common stock equivalents). |

| u | Provide compensation that is simple and transparent to shareholders. |

| u | Annual Review Process |

The Governance Committee, which consists solely of independent directors, annually assesses the form and amount of non-employee director compensation and recommends changes, if appropriate, to the Board based upon competitive market practices. GM’s Legal Staff also supports the Committee in determining director compensation and designing the related benefit programs. In addition, if the Governance Committee determines it is necessary, it has the authority to engage the services of outside consultants, experts, and others to assist in designing and setting director compensation. As part of its annual review, the Committee conducts extensive benchmarking by reviewing director compensation data for the executive compensation peer group described in “Executive Compensation—Compensation Overview—Peer Group for Compensation Comparisons” on page 42. Following its annual review of GM’s director compensation in December 2018, the Governance Committee recommended that the Board maintain the same structure and level of compensation and stock ownership requirements for 2019 as were in place in 2018.

| u | Director Stock Ownership and Holding Requirements |

| u | Each non-employee director is required to own our common stock or DSUs with a market value of at least $500,000. |

| u | Each director has up to five years from the date he or she is first elected to the Board to meet this ownership requirement. |

| u | Non-employee directors are prohibited from selling any GM securities or derivatives of GM securities, such as DSUs, while they are members of the Board. |

| u | Ownership guidelines are reviewed each year to confirm they continue to be effective in aligning the interests of the Board and our shareholders. |

| u | All of our directors are in compliance with our stock retention requirements. Ms. Miscik and Messrs. Bush and Wenig are within their five-year compliance period and are expected to meet the ownership requirement by the end of such period. All other directors have met or exceeded the ownership requirement. |

| u | Annual Compensation |

During 2018, compensation for non-employee directors consisted of the elements described in the table below. We do not pay any other retainers or meeting fees. The Independent Lead Director and Committee Chairs receive additional compensation due to the increased workload and additional responsibilities associated with these positions. In particular, Mr. Solso’s compensation as Independent Lead Director reflects the additional time commitment for this role, which includes, among other responsibilities, attending all Board Committee meetings, meeting with the Company’s investors, and attending additional meetings with the Company’s senior management, including the CEO. For additional information about the roles and responsibilities of our Independent Lead Director, see “Corporate Governance—Board Leadership Structure” on page 22.

Compensation Element | 2018 | |||

Board Retainer | $ | 285,000 |

| |

Independent Lead Director Fee | $ | 100,000 |

| |

Audit Committee Chair Fee |

| $30,000 |

| |

All Other Committee Chair Fees (excluding the Executive Committee) |

| $20,000 |

| |

| 18 |

|

ITEM NO. 1 – ELECTION OF DIRECTORS

Non-employee directors are required to defer at least 50% of their annual Board retainer ($142,500) into DSUs under the General Motors Company Deferred Compensation Plan for Non-Employee Directors (the “Director Compensation Plan”). Directors may elect to defer all or half of their remaining Board retainer or amounts payable (if any) for serving as Committee Chair or Independent Lead Director into additional DSUs. The fees for a director who joins or leaves the Board or assumes additional responsibilities during the year are prorated for his or her period of service.

| u | How Deferred Share Units Work |

Each DSU is equal in value to a share of GM common stock and is fully vested upon grant, but does not have voting rights. DSUs will not be available for disposition until after the director leaves the Board. After leaving the Board, the director will receive a cash payment or payments based on the number of DSUs in the director’s account valued at the average daily closing market price for the quarter immediately preceding payment. Directors will be paid in a lump sum or in annual installments for up to five years, based on their deferral elections. All DSUs granted are rounded up to the nearest whole unit. Any portion of the retainer that is deferred into DSUs may also earn dividend equivalents, which are credited at the end of each calendar year to each director’s account in the form of additional DSUs. DSUs granted are determined as follows:

Amount of compensation required or elected to be deferred each calendar year under the Director Compensation Plan / Average daily closing market price of our common stock for that calendar year = DSUs Granted

| u | Other Compensation |

As outlined below, we provide certain additional benefits to non-employee directors.

Type | Purpose | |

u Company Vehicles |

We provide directors with the use of Company vehicles to provide feedback on our products as well as enhance the public image of our vehicles. Retired directors also receive the use of a Company vehicle for a period of time. Participants are charged with imputed income based on the lease value of the vehicles and are responsible for associated taxes.

| |

u Personal Accident Insurance

|

We provide PAI coverage in the event of accidental death or dismemberment. Directors are responsible for associated taxes on the imputed income from the coverage.

|

| (1) | Ms. Barra, our sole employee director, does not receive additional compensation for her Board service other than the PAI benefit described above, the value of which is reported for Ms. Barra in the Summary Compensation Table on page 58. |

Non-employee directors are not eligible to participate in any of the savings or retirement programs for our employees. Other than as described in this section, there are no separate benefit plans for directors.

| 19 |

ITEM NO. 1 – ELECTION OF DIRECTORS

| u | 2018 Non-Employee Director Compensation Table |

This table shows the compensation that each non-employee director received for his or her 2018 Board and Committee service.

Director |

Fees Earned or Paid in Cash(1) ($) | Stock Awards(2) ($) | All Other Compensation(3) ($) | Total ($) | ||||||||||||

Linda R. Gooden |

| 162,500 |

|

| 126,073 |

|

| 18,782 |

|

| 307,355 |

| ||||

Joseph Jimenez |

| 142,500 |

|

| 126,073 |

|

| 23,803 |

|

| 292,376 |

| ||||

Jane L. Mendillo |

| 142,500 |

|

| 126,073 |

|

| 9,573 |

|

| 278,146 |

| ||||

Judith A. Miscik(4) |

| 35,625 |

|

| 34,487 |

|

| 1,394 |

|

| 71,506 |

| ||||

Michael G. Mullen |

| 162,500 |

|

| 126,073 |

|

| 31,719 |

|

| 320,292 |

| ||||

James J. Mulva |

| 162,500 |

|

| 126,073 |

|

| 29,115 |

|

| 317,688 |

| ||||

Patricia F. Russo |

| 162,500 |

|

| 126,073 |

|

| 19,261 |

|

| 307,834 |

| ||||

Thomas M. Schoewe |

| 172,500 |

|

| 126,073 |

|

| 37,282 |

|

| 335,855 |

| ||||

Theodore M. Solso |

| 242,500 |

|

| 126,073 |

|

| 18,990 |

|

| 387,563 |

| ||||

Carol M. Stephenson |

| 162,500 |

|

| 126,073 |

|

| 16,823 |

|

| 305,396 |

| ||||

Devin N. Wenig(5) |

| 106,875 |

|

| 97,072 |

|

| 10,889 |

|

| 214,836 |

| ||||

| (1) | This column reflects director compensation eligible to be paid in cash, which consists of 50% of the annual Board retainer ($142,500) and any applicable Committee Chair or Independent Lead Director fees. Each of the following directors elected to receive DSUs in lieu of such amounts eligible to be paid in cash in the following amounts: Ms. Gooden—$20,000; Mr. Jimenez—$142,500; Ms. Mendillo—$142,500; Admiral Mullen—$20,000; Mr. Mulva—$162,500; Ms. Russo—$20,000; Mr. Solso—$242,500; Ms. Stephenson—$81,250; and Mr. Wenig—$106,875. |

| (2) | Reflects aggregate grant date fair value of DSUs granted in 2018, which does not include any cash fees that directors voluntarily elected to receive as DSUs. Grant date fair value is calculated by multiplying the number of DSUs granted by the closing price of GM common stock on December 31, 2018, which was $33.45. The holders of DSUs also receive dividend equivalents, which are reinvested in additional DSUs based on the market price of the common stock on the date the dividends are paid. |

| (3) | The following table provides more information on the type and amount of benefits included in the All Other Compensation column. |

Director | Company Vehicle Program (a) | Other (b) | Total | Director | Company Vehicle Program (a) | Other (b) | Total | |||||||||||||||||||||||

Ms. Gooden |

| $18,542 |

|

| $240 |

|

| $18,782 |

| Ms. Russo |

| $19,021 |

|

| $240 |

|

| $19,261 |

| |||||||||||

Mr. Jimenez |

| $23,563 |

|

| $240 |

|

| $23,803 |

| Mr. Schoewe |

| $37,042 |

|

| $240 |

|

| $37,282 |

| |||||||||||

Ms. Mendillo |

| $ 9,333 |

|

| $240 |

|

| $ 9,573 |

| Mr. Solso |

| $18,750 |

|

| $240 |

|

| $18,990 |

| |||||||||||

Ms. Miscik |

| $ 1,354 |

|

| $ 40 |

|

| $ 1,394 |

| Ms. Stephenson |

| $16,583 |

|

| $240 |

|

| $16,823 |

| |||||||||||

Admiral Mullen |

| $31,479 |

|

| $240 |

|

| $31,719 |

| Mr. Wenig |

| $10,729 |

|

| $160 |

|

| $10,889 |

| |||||||||||

Mr. Mulva |

| $28,875 |

|

| $240 |

|

| $29,115 |

| |||||||||||||||||||||

| (a) | The Company vehicle program includes the estimated annual lease value of the Company vehicles driven by directors. We include the annual lease value because it is more reflective of the value of the Company vehicle perquisite than the Company’s incremental costs, which are generally significantly lower because the Company manufactures and ordinarily disposes of Company vehicles for a profit, resulting in minimal incremental costs, if any. Taxes related to imputed income are the responsibility of each director. |

| (b) | Reflects the cost of premiums for providing personal accident insurance (annual premium cost of $240 is prorated, as applicable, for the period of service). In addition, Mr. Solso received tickets to attend a special event; the tickets had no incremental cost to the Company. |

| (4) | Ms. Miscik joined the Board on October 8, 2018. |

| (5) | Mr. Wenig joined the Board on April 18, 2018. |

| 20 |

|

Role of the Board of Directors

GM is governed by a Board of Directors and Committees of the Board that meet throughout the year. The Board is elected by shareholders to oversee and provide guidance on the Company’s business and affairs. It is the ultimate decision-making body of the Company except for those matters reserved for shareholders by law or pursuant to the Company’s governance instruments. The Board is actively engaged in the process of strategic development and oversight of ongoing execution of the Company’s strategic plan. It oversees management’s activities

in connection with proper safeguarding of the assets of the Company, maintenance of appropriate financial and other internal controls, compliance with applicable laws and regulations, and proper governance. The Board is committed to sound corporate governance policies and practices that are designed and routinely assessed to enable the Company to operate its business responsibly, with integrity, and to position GM to compete more effectively, sustain its success, and build long-term shareholder value.

The Board is Actively Engaged in Shaping the Company’s Purpose and Overseeing Strategy

Every year, the Board holds a multi-day session devoted to discussing, debating, challenging, and validating management’s strategic objectives, initiatives, and execution. During these discussions, directors engage in an active dialogue and shape various aspects of management’s strategy and execution. This annual strategy session is supplemented by frequent updates and discussions of GM’s strategy throughout the year – at every Board meeting and between regularly scheduled sessions as may be necessary from time to time. Since the last annual meeting, these strategy discussions included review of the Company’s recent transformation actions; Cadillac’s future growth plans; performance and strategic opportunities in China; regulatory issues related to vehicle efficiency standards; the Company’s electric vehicle execution strategy; and other issues critical to the future viability of the Company. Your Board also solicits independent views on GM’s business and key industry trends from outside experts – including investment bankers and buy- and sell-side analysts – as well as investors through its robust Director-Shareholder Engagement Policy. For additional information on shareholder engagement, please see pages 31 and 32.

|