- GM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

General Motors (GM) DEF 14ADefinitive proxy

Filed: 27 Apr 20, 3:03pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

☑ Filed by the Registrant ☐ Filed by a Party other than the Registrant

Check the appropriate box: | ||

☐ | Preliminary Proxy Statement | |

☐ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) | |

☑ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material Pursuant to ss.240.14a-12 | |

GENERAL MOTORS COMPANY

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box): | ||

☑ | No fee required. | |

��☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(14) and 0-11. | |

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

| ||

☐ | Fee paid previously with preliminary materials. | |

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| |

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

| ||

Proxy Statement and Notice

2020 Annual Meeting of Shareholders

June 16, 2020 | 8:00 a.m. ET

April 27, 2020

To Our Fellow Shareholders:

As I write this letter, the world is in the midst of responding to the COVID-19 pandemic and its significant impact on public health, the global economy, and our industry. Your Board of Directors and the GM team have been taking swift and necessary actions to protect our Company and its employees, customers, communities, shareholders, and other stakeholders. I’d like to share what we are doing right now as we look ahead to the 2020 Annual Meeting and beyond to position the Company for long-term strength.

Commitment to Our Employees

Ever since COVID-19 emerged, GM has proactively addressed everything within our control, with the health and safety of our employees as our top priority. To help prevent the spread of COVID-19 in our workforce and communities, we asked our employees to work from home if their work permits it. This included a systematic and orderly suspension of a majority of our vehicle manufacturing operations around the world, including in North America. We are working closely with governments, health and public safety officials, and employee representatives as we monitor our production status on a week-to-week basis. Where our facilities continue to operate, we have adopted stringent and comprehensive safety measures to ensure a safe working environment. These measures include physical distancing, monitoring employee health daily, requiring employees to wear masks inside our facilities, and regularly sterilizing high-traffic public areas.

Commitment to Our Customers

Vehicles are an integral part of our lives and livelihood and, in trying times like these, we want to be a resource for our customers. We have taken a variety of actions to help them— including providing complimentary OnStar Crisis Assist services and in-vehicle data to owners of compatible vehicles. OnStar advisors can help with special routing assistance, including to a hospital or clinic, and contact family members, emergency medical dispatch, and first responders. GM Financial’s Customer Experience team is also standing by to help customers affected by COVID-19 discuss personalized options in these uncertain times. Lastly, our digital Shop Click Drive dealer digital tool allows customers to arrange for the purchase and delivery of vehicles from home where available.

Commitment to Our Communities

We are also constantly exploring ways to help our communities in this time of crisis. Last month, we were proud to announce a collaboration with Ventec Life Systems to expand production of Ventec’sV-Pro and VCSN critical-care ventilators to GM’s Kokomo, Indiana, plant. GM leveraged its IT, purchasing and logistics, supply chain, product development, manufacturing, talent acquisition,

and legal expertise to support this work, which resulted in an initial contract with the U.S. Department of Health and Human services for 30,000 ventilators. GM is also making face masks in its plant in Warren, Michigan, and we continue to investigate other ways we can use our expertise and resources to lend a hand in combatting the COVID-19 pandemic.

Commitment to Our Shareholders

GM is aggressively pursuing austerity measures to preserve cash and is taking necessary steps to manage our liquidity, ensure the ongoing viability of our operations, and protect shareholder value. We recently drew down approximately $16 billion from our revolving credit facilities – a proactive measure to fortify our balance sheet, increase our cash position, and preserve financial flexibility in light of current uncertainty in global markets. We also implemented pay deferments for all salaried employees. Over the past several years, we have made strategic decisions and structural changes that have transformed the Company. These actions have better positioned us to face this challenge.

Advancing Toward Our Vision

In this Proxy Statement, we share important details about your Board’s role in shaping GM’s purpose, strategy, governance, and culture. We have faced significant challenges in the last year, including a six-week labor stoppage in North America, difficult industry conditions in China and, now, COVID-19. Despite these challenges, we have improved and continue to improve our business through ongoing cost savings actions, operational excellence, and strong product launches, while advancing toward our vision of a world with zero crashes, zero emissions, and zero congestion.

Right Board at the Right Time

In recent years, your Board has worked to strategically refresh its membership to ensure it has the breadth of experience to guide the Company during times just like these – when companies are facing new and unexpected challenges. Even in the face of this current environment of uncertainty, I continue to believe GM has an unprecedented opportunity to do more for our stakeholders and, ultimately, the planet. We have the right Board, at the right time, to ensure we emerge from this even stronger.

Sincerely,

Mary T. Barra

Chairman and Chief Executive Officer

300 Renaissance Center | Detroit, Michigan 48265

Notice of 2020 Annual Meeting of Shareholders

April 27, 2020

Dear Fellow Shareholder:

The Board of Directors of General Motors Company cordially invites you to attend the 2020 Annual Meeting of Shareholders.

At the Annual Meeting, you will be asked to:

| u | Elect the 11 Board-recommended director nominees named in this Proxy Statement; |

| u | Approve, on an advisory basis, Named Executive Officer compensation; |

| u | Approve, on an advisory basis, the frequency of future advisory votes on Named Executive Officer compensation; |

| u | Approve the General Motors Company 2020 Long-Term Incentive Plan; |

| u | Ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2020; |

| u | Vote on four Rule 14a-8 shareholder proposals, if properly presented at the meeting; and |

| u | Transact any other business that is properly presented at the meeting. |

Record Date: April 17, 2020.

A list of registered shareholders will be available for examination for any purpose that is germane to the meeting for 10 business days before the Annual Meeting. Shareholders may request to review the list by emailingshareholder.relations@gm.com.

This Proxy Statement is provided in conjunction with GM’s solicitation of proxies to be used at the Annual Meeting. Thank you for your interest in General Motors Company.

By Order of the Board of Directors,

Rick E. Hansen

Corporate Secretary

|

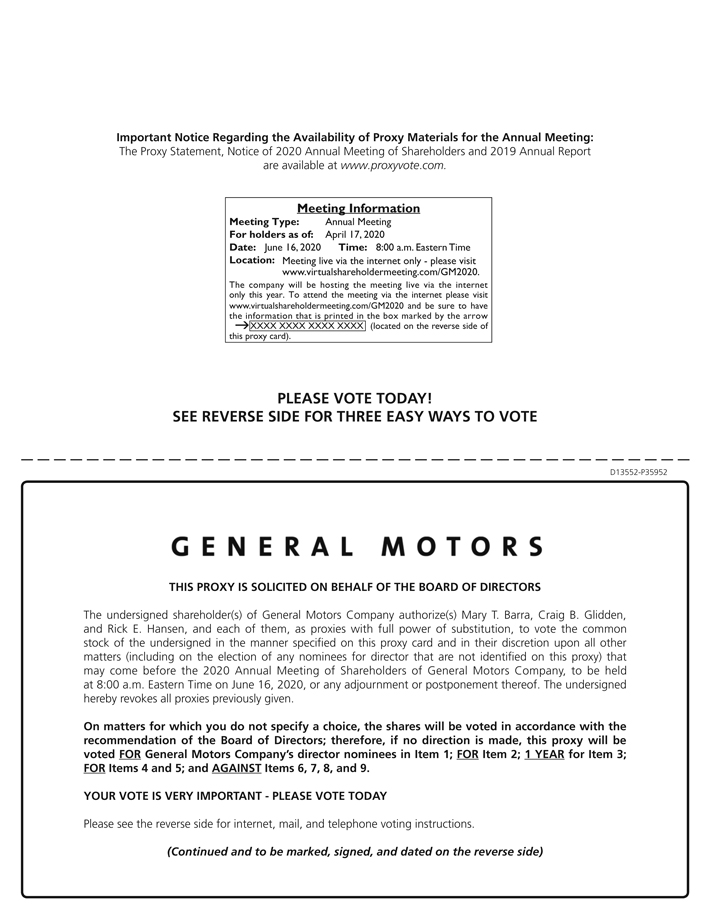

Meeting Information:

| |||||

Date: June 16, 2020

Time: 8:00 a.m. Eastern Time

Place: Online via live webcast atvirtualshareholdermeeting.com/GM2020

|

| |||||

Your vote is important.

| ||||||

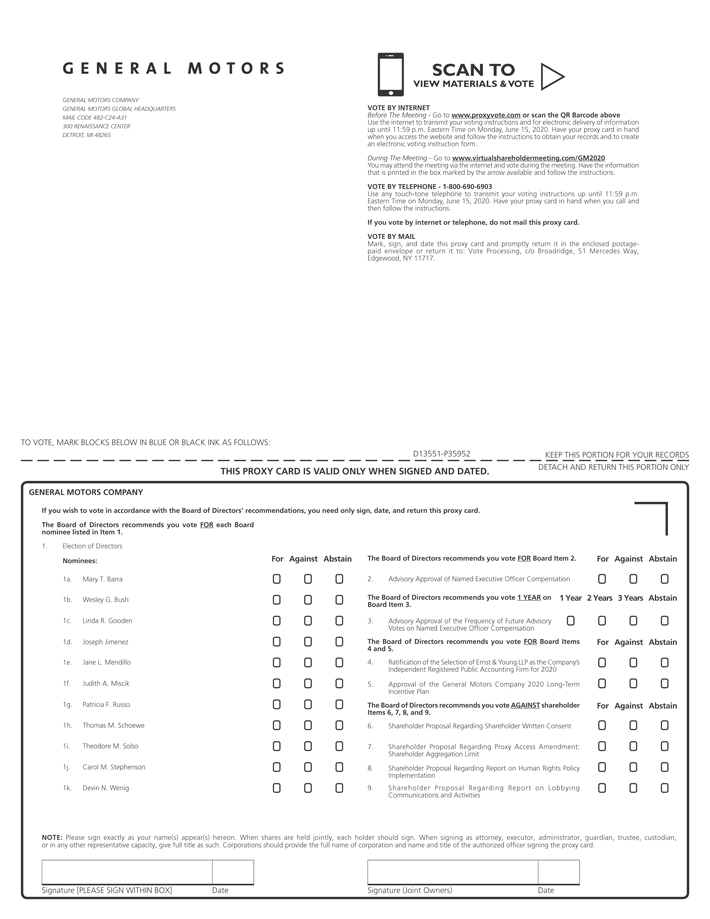

Please promptly submit your vote by internet, by telephone, or by signing, dating, and returning the enclosed proxy card or voting instruction form in the postage-paid envelope provided so that your shares will be represented and voted at the meeting.

We are first mailing these proxy materials to our shareholders on or about April 27, 2020.

| ||||||

How You Can Access the Proxy Materials Online:

| ||||||

Important Notice Regarding the Availability of Proxy Materials for the 2020 Annual Meeting of Shareholders to Be Held on June 16, 2020.

Our Proxy Statement and 2019 Annual Report are available atinvestor.gm.com/shareholder. You may scan the QR code above with your smartphone or other mobile device to view our Proxy Statement and Annual Report.

|

| ii |

Helpful Resources

Annual Meeting:investor.gm.com/shareholder |

Proxy Statement |

Annual Report |

| Governance Documents:investor.gm.com/resources |

Board Committee Charters |

Bylaws and Certificate of Incorporation |

Corporate Governance Guidelines |

Key Compliance Policies:investor.gm.com/resources |

Winning with Integrity: Our Values and Guidelines |

Policy on Recoupment of Incentive Compensation |

Related Party Transactions Policy |

Insider Trading Policy |

ESG Policies: investor.gm.com/resources |

Voluntary Report of 2019 Political Contributions |

Company Policy on Corporate Political Contributions |

Conflict Minerals Policy |

Environmental Policy |

Global Human Rights Policy |

Global Integrity Policy |

Supplier Code of Conduct |

Sustainability Report:gmsustainability.com |

Investors Relations:investor.gm.com/investor-relations |

| Defined Terms and Commonly Used Acronyms | ||

Annual Meeting | GM’s Annual Meeting of Shareholder to be held on June 16, 2020 | |

AV | Autonomous Vehicle | |

CEO | Chief Executive Officer | |

CFO | Chief Financial Officer | |

Code of Conduct | Winning with Integrity: Our Values and Guidelines for Employee Conduct | |

Committees | Audit Committee Executive Committee Executive Compensation Committee Governance and Corporate Responsibility Committee Finance Committee Risk and Cybersecurity Committee | |

DSU | Deferred Share Unit | |

ESG | Environmental, Social, and Governance | |

EV | Electric Vehicle | |

EY | Ernst & Young LLP | |

GM or the Company | General Motors Company | |

Governance Committee | Governance and Corporate Responsibility Committee | |

LTIP | Long-Term Incentive Plan | |

NEO | Named Executive Officer | |

NYSE | New York Stock Exchange | |

SEC | U.S. Securities and Exchange Commission | |

| iii |

|

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 10 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 18 | ||||

| 22 | ||||

| 25 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 33 | ||||

| 35 | ||||

| 37 | ||||

| 38 | ||||

| 45 | ||||

| 45 | ||||

| 47 | ||||

| 50 | ||||

| 58 | ||||

| 61 | ||||

| 62 | ||||

| 73 | ||||

| 74 | ||||

| 75 | ||||

| 75 | ||||

Item No. 2 – Advisory Approval of Named Executive Officer Compensation | 76 | |||

| 77 | ||||

| 78 | ||||

Item No. 5– Approval of the General Motors Company 2020 Long-Term Incentive Plan | 80 | |||

| 90 | ||||

| 90 | ||||

Item No. 7 – Proxy Access Amendment: Shareholder Aggregation Limit | 92 | |||

| 94 | ||||

Item No. 9 – Report on Lobbying Communications and Activities | 96 | |||

| 98 | ||||

| A-1 | ||||

APPENDIX B – General Motors Company 2020 Long-Term Incentive Plan | B-1 | |||

INDEX OF FREQUENTLY ACCESSED INFORMATION

Auditor Fees | 79 | |||

Beneficial Ownership Table | 33 | |||

Board and Committee Evaluations | 25 | |||

Burn Rate | 83 | |||

CEO Pay Ratio | 73 | |||

CEO Succession Planning | 25 | |||

Clawback Policies | 59 | |||

Climate Change Risk Oversight | 24 | |||

Code of Business Conduct and Ethics | 25 | |||

Compensation Decisions for our NEOs | 50 | |||

Corporate Governance Guidelines | 25 | |||

Cybersecurity and Privacy Risk Oversight | 24 | |||

Director Biographies | 4 | |||

Director Compensation | 12 | |||

Director Independence | 14 | |||

Director Skills Matrix | 3 | |||

Environmental & Sustainability Highlights | 30 | |||

Executive Perquisites | 63 | |||

Financial Performance | 38 | |||

Human Capital Management | 31 | |||

Independent Lead Director Duties | 15 | |||

Lobbying Disclosure | 28 | |||

Pay-for-Performance | 50 | |||

Peer Group | 43 | |||

Related Party Transactions | 29 | |||

Risk Oversight | 22 | |||

Shareholder Engagement | 27 | |||

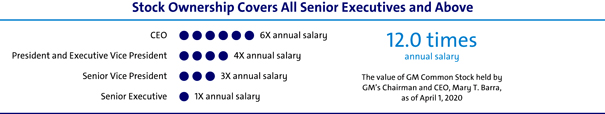

Stock Ownership Requirements | 10 | |||

Supply Chain Governance and Compliance | 32 |

| iv |

BOARD PROPOSALS | BOARD RECOMMENDATION |

PAGE | ||||||||||||

| ||||||||||||||

Item 1 – Election of Directors | FOR | 75 | ||||||||||||

| ||||||||||||||

Item 2 – Advisory Approval of Named Executive Officer Compensation |

FOR |

76 | ||||||||||||

| ||||||||||||||

Item 3 – Advisory Approval of the Frequency of Future Advisory Votes on Named Executive Officer Compensation |

1 YEAR |

77 | ||||||||||||

| ||||||||||||||

Item 4 – Ratification of the Selection of the Independent Registered Public Accounting Firm for 2020 |

FOR |

78 | ||||||||||||

| ||||||||||||||

Item 5 – Approval of the General Motors Company 2020 Long-Term Incentive Plan |

FOR |

80 | ||||||||||||

SHAREHOLDER PROPOSALS | BOARD RECOMMENDATION |

PAGE | ||||||||||||

| ||||||||||||||

Item 6 – Shareholder Written Consent | AGAINST | 89 | ||||||||||||

| ||||||||||||||

Item 7 – Proxy Access Amendment: Shareholder Aggregation Limit | AGAINST | 91 | ||||||||||||

| ||||||||||||||

Item 8 – Report on Human Rights Policy Implementation | AGAINST | 93 | ||||||||||||

| ||||||||||||||

Item 9 – Report on Lobbying Communications and Activities | AGAINST | 95 | ||||||||||||

| 1 |

Snapshot of Your Board Nominees

Name & Principal Occupation |

Age | Director Since |

Independent | Committee Memberships | ||||||

| Mary T. Barra Chairman & Chief Executive Officer, General Motors Company | 58 | 2014 | Executive – Chair | ||||||

| Theodore M. Solso Independent Lead Director, General Motors Company, and Retired Chairman & Chief Executive Officer, Cummins, Inc. | 73 | 2012 |  | Executive Governance | |||||

| Wesley G. Bush Retired Chairman & Chief Executive Officer, Northrop Grumman Corporation | 59 | 2019 |  | Audit Executive Compensation Finance | |||||

| Linda R. Gooden Retired Executive Vice President, Information Systems | 67 | 2015 |  | Audit Executive Risk and Cybersecurity – Chair | |||||

| Joseph Jimenez Retired Chief Executive Officer, Novartis AG | 60 | 2015 |  | Executive Executive Compensation Finance –Chair Risk and Cybersecurity | |||||

| Jane L. Mendillo Retired President & Chief Executive Officer, Harvard Management Company | 61 | 2016 |  | Audit Finance Governance | |||||

| Judith A. Miscik Chief Executive Officer & Vice Chairman, Kissinger Associates, Inc. | 61 | 2018 |  | Audit Risk and Cybersecurity | |||||

| Patricia F. Russo Chairman, Hewlett Packard Enterprise Company | 67 | 2009 |  | Executive Executive Compensation Finance Governance – Chair | |||||

| Thomas M. Schoewe Retired Executive Vice President & Chief Financial Officer, Wal-Mart Stores, Inc. | 67 | 2011 |  | Audit – Chair Executive Finance Risk and Cybersecurity | |||||

| Carol M. Stephenson Retired Dean, Ivey Business School, The University of Western Ontario | 69 | 2009 |  | Executive Executive Compensation –Chair Governance | |||||

| Devin N. Wenig Retired President & Chief Executive Officer, eBay Inc. | 53 | 2018 |  | Risk and Cybersecurity | |||||

|  |  |

| 2 |

|

BOARD OF DIRECTORS

Diversity of Skills, Qualifications, and Experience

Your Board nominees offer a diverse range of skills and experience in relevant areas.

SKILL/ QUALIFICATION | M. BARRA | T. SOLSO | W. BUSH | L. GOODEN | J. JIMENEZ | J. MENDILLO | J. MISCIK | P. RUSSO | T. SCHOEWE | C. STEPHENSON | D. WENIG | |||||||||||

| ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

| ✓ | ✓ | ||||||||||||||||||||

| ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||

| ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||

| ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

| ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

| ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

| ✓ | ✓ | ✓ | |||||||||||||||||||

| ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||

| ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||

| ✓ | ✓ | ||||||||||||||||||||

| 3 |

BOARD OF DIRECTORS

Set forth below is a short biography of each director nominee.

|  | |||

| Mary T. Barra, Age 58 | Theodore M. Solso, Age 73 | |||

Chairman & Chief Executive Officer, General Motors Company | Independent Lead Director, General Motors Company, and Retired Chairman & Chief Executive Officer, Cummins, Inc. | |||

Committees: Executive (Chair)

Current Public Company Directorships: The Walt Disney Company

Prior Public Company Directorships: General Dynamics Corporation (2011 to 2017)

Prior Experience:Ms. Barra has served as Chairman of GM’s Board of Directors since January 2016 and CEO of GM since January 2014. Prior to that time, she served as Executive Vice President, Global Product Development, Purchasing and Supply Chain from 2013 to 2014; Senior Vice President, Global Product Development from 2011 to 2013; Vice President, Global Human Resources from 2009 to 2011; and Vice President, Global Manufacturing Engineering from 2008 to 2009. Ms. Barra began her career at GM in 1980.

Reasons for Nomination: Ms. Barra has in-depth knowledge of the Company and the global automotive industry; extensive senior leadership, strategic planning, operational and business experience; and a strong engineering background with experience in global product development. |

Committees:Executive, Governance

Current Public Company Directorships: Ad-Astra Rocket Company

Prior Public Company Directorships:Ashland Inc. (1999 to 2012) (Lead Director 2003 to 2010) and Ball Corporation (2003 to 2019) (Lead Director 2013 to 2019)

Prior Experience: Mr. Solso served as Non-Executive Chairman of the GM Board of Directors from 2014 to 2016. He was Chairman and CEO of Cummins, Inc., from 2000 until his retirement in 2011, and President and Chief Operating Officer of Cummins from 1995 to 2000.

Reasons for Nomination: Mr. Solso has extensive experience in automotive manufacturing and engineering, emissions reduction technology, and compliance with emissions laws and regulations. He also has extensive senior leadership experience in finance, accounting, corporate governance, and vehicle and workplace safety. | |||

| 4 |

|

BOARD OF DIRECTORS

|

|  | ||

| Wesley G. Bush, Age 59 | Linda R. Gooden, Age 67 | |||

Retired Chairman and Chief Executive Officer, | Retired Executive Vice President, Information Systems & Global Solutions, Lockheed Martin Corporation | |||

Committees:Audit, Executive Compensation, Finance

Current Public Company Directorships: Dow Inc. and Cisco Systems Inc.

Prior Public Company Directorships:Norfolk Southern Corporation and Northrop Grumman Corporation

Prior Experience:Mr. Bush served as Chairman of the Board of Directors of Northrop Grumman Corporation (“Northrop Grumman”) from 2011 to 2019. He also served as the CEO of Northrop Grumman from 2010 to 2018. Prior to that, Mr. Bush served in numerous leadership roles at Northrop Grumman, including President and Chief Operating Officer, Chief Financial Officer, and President of the company’s Space Technology sector. He also served in a variety of leadership positions at TRW, Inc., before it was acquired by Northrop Grumman in 2002.

Reasons for Nomination:Mr. Bush has valuable experience in a manufacturing enterprise known for its advanced engineering and technology; strong financial acumen; and knowledge of key governance issues, including risk management. |

Committees:Audit, Executive, Risk and Cybersecurity (Chair)

Current Public Company Directorships: The Home Depot, Inc.

Prior Public Company Directorships:WGL Holdings, Inc., and Washington Gas & Light Company, a subsidiary of WGL Holdings, Inc.

Prior Experience:Ms. Gooden served as Executive Vice President, Information Systems and Global Solutions of Lockheed Martin Corporation (“Lockheed Martin”) from 2007 to 2013. She served as Deputy Executive Vice President, Information and Technology Services of Lockheed Martin from October to December 2006; and President, Information Technology of Lockheed Martin from 1997 to December 2006.

Reasons for Nomination: Ms. Gooden has extensive expertise in cybersecurity and information technology, operational and strategic planning, and government relations, as well as valuable insight into GM’s cybersecurity framework related to mobility and autonomous vehicles. | |||

| 5 |

BOARD OF DIRECTORS

|

|  | ||

| Joseph Jimenez, Age 60 | Jane L. Mendillo, Age 61 | |||

Retired Chief Executive Officer, Novartis AG | Retired President & Chief Executive Officer, Harvard Management Company | |||

Committees:Executive, Executive Compensation, Finance (Chair), Risk and Cybersecurity

Current Public Company Directorships: The Procter & Gamble Co.

Prior Public Company Directorships: Colgate-Palmolive Company (2010 to 2015)

Prior Experience: Mr. Jimenez served as CEO of Novartis AG (“Novartis”) from 2010 until his retirement in 2018. He led Novartis’ Pharmaceuticals Division from October 2007 to 2010 and its Consumer Health Division in 2007. From 2006 to 2007, Mr. Jimenez served as Advisor to the Blackstone Group L.P. He was Executive Vice President, President and CEO of Heinz Europe from 2002 to 2006, and President and CEO of H.J. Heinz Company North America from 1999 to 2002.

Reasons for Nomination: Mr. Jimenez has extensive senior leadership experience in the consumer products industry, international operations, strategic planning, and finance. |

Committees: Audit, Finance, Governance

Current Public Company Directorships: Lazard Ltd.

Prior Public Company Directorships: None

Prior Experience: Ms. Mendillo was President and CEO of the Harvard Management Company (“HMC”) from 2008 to 2014. From 2002 to 2008, she was Chief Investment Officer of Wellesley College. Before that, she spent 15 years at HMC in investment management positions. She previously chaired the Partners Healthcare System’s investment committee, served as a member of Yale University’s and the Rockefeller Foundation’s investment committees and as a director and investment committee member of the Mellon Foundation and the Boston Foundation.

Reasons for Nomination: Ms. Mendillo has experience in risk and crisis management, as well as valuable insight into GM’s capital allocation framework, financial policies, and business strategies. | |||

| 6 |

|

BOARD OF DIRECTORS

|

|  | ||

| Judith A. Miscik, Age 61 | Patricia F. Russo, Age 67 | |||

| Chief Executive Officer & Vice Chairman, Kissinger Associates, Inc. |

Chairman, Hewlett Packard Enterprise Company | |||

Committees:Audit, Risk and Cybersecurity

Current Public Company Directorships: Morgan Stanley

Prior Public Company Directorships: EMC Corporation (2012 to 2016) and Pivotal Software, Inc. (2014 to 2016)

Prior Experience:In 2017, Ms. Miscik was appointed as CEO and Vice Chairman of Kissinger Associates, Inc. (“Kissinger Associates”). Prior to that time, she served as Co-Chief Executive Officer and Vice Chairman of Kissinger Associates from 2015 to 2017 and as President and Vice Chairman of Kissinger Associates from 2009 to 2015. Prior to joining Kissinger Associates, Ms. Miscik was the Global Head of Sovereign Risk at Lehman Brothers from 2005 to 2008; and from 2002 to 2005, Deputy Director for Intelligence at the U.S. Central Intelligence Agency from 1983 to 2005, which she jointed in 1983.

Reasons for Nomination: Ms. Miscik has a unique and extensive background in intelligence, security, and risk analysis, bringing valuable experience in assessing and mitigating geopolitical and macroeconomic risks in both the public and private sectors. |

Committees: Executive, Executive Compensation, Finance, Governance

Current Public Company Directorships: Hewlett Packard Enterprise Company (Chairman), KKR Management LLC, and Merck & Co. Inc.

Prior Public Company Directorships: Hewlett-Packard Company (2011 to 2015) (Lead Director 2014 to 2015) and Alcoa, Inc. (2016)

Prior Experience: Ms. Russo served as Lead Director of the Hewlett-Packard Company Board of Directors from 2014 to 2015. She was Independent Lead Director of the GM Board of Directors from March 2010 to January 2014. She also served as CEO of Alcatel-Lucent S.A. from 2006 to 2008; Chairman and CEO of Lucent Technologies, Inc., (“Lucent”) from 2003 to 2006; and President and CEO of Lucent from 2002 to 2006.

Reasons for Nomination:Ms. Russo has extensive senior leadership experience in corporate strategy, finance, sales and marketing, technology, and leadership development, as well as experience managing business-critical technology disruptions. | |||

| 7 |

BOARD OF DIRECTORS

|

|  | ||

| Thomas M. Schoewe, Age 67 | Carol M. Stephenson, O.C., Age 69 | |||

| Retired Executive Vice President & Chief Financial Officer, Wal-Mart Stores, Inc. | Retired Dean, Ivey Business School, University of Western Ontario | |||

Committees:Audit (Chair), Executive, Finance, Risk and Cybersecurity

Current Public Company Directorships:KKR Management LLC and Northrop Grumman Corporation

Prior Public Company Directorship: PulteGroup, Inc. (2009 to 2012)

Prior Experience:Mr. Schoewe served as Executive Vice President and Chief Financial Officer of Wal-Mart Stores, Inc. (“Wal-Mart”) from 2000 to 2011. Prior to joining Wal-Mart, he was Senior Vice President and Chief Financial Officer of Black & Decker Corporation (“Black & Decker”) from 1996 to 1999. Prior to that, he served in numerous leadership roles at Black & Decker, including Vice President and Chief Financial Officer, Vice President of Finance, and Vice President of Business Planning and Analysis.

Reasons for Nomination:Mr. Schoewe has senior leadership experience in financial reporting, accounting and controls, business planning and analysis, and risk management. He also has valuable insight into GM’s technology systems and processes and cybersecurity framework. |

Committees: Executive, Executive Compensation (Chair), Governance and Corporate Responsibility

Current Public Company Directorships: Intact Financial Corporation (formerly ING Canada) and Maple Leaf Foods Inc.

Prior Public Company Directorships:Ballard Power Systems, Inc. (2012 to 2017) and Manitoba Telecom Services (2008 to 2016)

Prior Experience: Ms. Stephenson served as Dean of the Ivey Business School at the University of Western Ontario from 2003 until her retirement in 2013. Prior to joining the Ivey Business School, she was President and CEO of Lucent Technologies Canada from 1999 to 2003 and a member of the Advisory Board of General Motors of Canada, Limited, a GM subsidiary, from 2005 to 2009. Ms. Stephenson is an officer of the Order of Canada.

Reasons for Nomination: Ms. Stephenson has expertise in marketing, operations, strategic planning, technology development, financial management, and executive compensation. She also has extensive expertise in North American trade issues. | |||

| 8 |

|

BOARD OF DIRECTORS

|

| |||

| Devin N. Wenig, Age 53 | ||||

| Retired President & Chief Executive Officer, eBay Inc. | ||||

Committees: Risk and Cybersecurity

Current Public Company Directorships: None

Prior Public Company Directorships: eBay Inc. (2015 to 2019)

Prior Experience: Mr. Wenig served as President and CEO of eBay Inc. (“eBay”), as well as a member of its Board of Directors, from July 2015 to August 2019. Prior to that time, he served as President of eBay’s Marketplaces business from 2011 to July 2015. Prior to joining eBay, Mr. Wenig was CEO of Thomson Reuters Corporation’s largest division, Thomson Reuters Markets, from 2008 to 2011; Chief Operating Officer of Reuters Group plc (“Reuters”) from 2006 to 2008; and President of Reuters Business divisions from 2003 to 2006.

Reasons for Nomination:Mr. Wenig has extensive senior leadership experience in technology, global operations, and strategic planning. His experience leading technology companies provides key insights into GM’s cybersecurity framework and strategy related to the future of mobility, autonomous vehicles, vehicle connectivity, and data monetization. | ||||

| 9 |

NON-EMPLOYEE DIRECTOR COMPENSATION

Our non-employee directors receive cash compensation as well as equity compensation in the form of GM DSUs for their Board service. Compensation for our non-employee directors is set

by the Board at the recommendation of the Governance Committee.

Guiding Principles

| • | Fairly compensate directors for their responsibilities and time commitments. |

| • | Attract and retain highly qualified directors by offering a compensation program consistent with those at companies of similar size, scope, and complexity. |

| • | Align the interests of directors with our shareholders by providing a significant portion of compensation in equity and requiring directors to continue to own our common stock (or common stock equivalents) until retirement. |

| • | Provide compensation that is simple and transparent to shareholders. |

| u | Annual Review Process |

The Governance Committee annually assesses the form and amount of non-employee director compensation and recommends changes, if appropriate, to the Board. As part of its annual review, the Committee conducts extensive benchmarking by reviewing director compensation data for the executive compensation peer group described in “Executive Compensation—Compensation Overview—Peer Group for Compensation Comparisons” on page 43 of this Proxy Statement.

In December 2019, following its annual review of GM’s director compensation, the Board and the Governance Committee approved an increase in non-employee director compensation. In March 2020, the Board and the Governance Committee, in response to the COVID-19 pandemic, approved a 20% temporary reduction in base annual compensation, effective April 1, 2020, and continuing until at least October 2020, but no later than March 15, 2021. Beginning in 2020, director compensation will be as set forth on page 11 of this Proxy Statement.

Director Stock Ownership and Holding Requirements

| • | Each non-employee director is required to own our common stock or DSUs with a market value of at least $500,000. |

| • | Each director has up to five years from the date he or she is first elected to the Board to meet this ownership requirement. |

| • | Non-employee directors are prohibited from selling any GM securities or derivatives of GM securities, such as DSUs, while they are members of the Board. |

| • | Ownership guidelines are reviewed each year to confirm they continue to be effective in aligning the interests of the Board and our shareholders. |

| • | All of our directors are in compliance with our stock retention requirements. |

| 10 |

|

NON-EMPLOYEE DIRECTOR COMPENSATION

Annual Compensation

The 2019 and 2020 compensation for non-employee directors are described in the table below. We do not pay any other retainers or meeting fees. The Independent Lead Director and Committee Chairs receive additional compensation due to the increased workload and additional responsibilities associated with these positions. In particular, Mr. Solso’s compensation as Independent Lead Director reflects the additional time commitment for this role, which

includes, among other responsibilities, attending all Board Committee meetings, meeting with the Company’s investors, and attending additional meetings with the Company’s senior management, including the CEO. For additional information about the roles and responsibilities of our Independent Lead Director, see “Corporate Governance—Board Leadership Structure and Composition” on page 15 of this Proxy Statement.

| Compensation Element | 2019 | 2020 (Pre-COVID-19) | 2020 (Post-COVID-19) | |||||||||

Board Retainer | $ | 285,000 | $ | 305,000 | $ | 244,000 | ||||||

Independent Lead Director Fee | $ | 100,000 | $ | 100,000 | $ | 100,000 | ||||||

Audit Committee Chair Fee | $ | 30,000 | $ | 30,000 | $ | 30,000 | ||||||

All Other Committee Chair Fees (excluding the Executive Committee) | $ | 20,000 | $ | 20,000 | $ | 20,000 | ||||||

Non-employee directors are required to defer at least 50% of their annual Board retainer into DSUs under the General Motors Company Deferred Compensation Plan for Non-Employee Directors (the “Director Compensation Plan”). Directors may elect to defer all or half of their remaining Board retainer or

amounts payable (if any) for serving as a Committee Chair or Independent Lead Director into additional DSUs. The fees for a director who joins or leaves the Board, or assumes additional responsibilities during the year, are prorated for his or her period of service.

How Deferred Share Units Work

Each DSU is equal in value to one share of GM common stock and is fully vested upon grant, but does not have voting rights. DSUs will not be available for disposition until after the director leaves the Board. After leaving the Board, the director will receive a cash payment or payments based on the number of DSUs in the director’s account valued at the average daily closing market price for the quarter immediately preceding payment. Directors will be

paid in a lump sum or in annual installments for up to five years, based on their deferral elections. All DSUs granted are rounded up to the nearest whole unit. Any portion of the retainer that is deferred into DSUs may also earn dividend equivalents, which are credited at the end of each calendar year to each director’s account in the form of additional DSUs. DSUs granted are determined as follows:

| 11 |

NON-EMPLOYEE DIRECTOR COMPENSATION

Other Compensation

We provide certain additional benefits to non-employee directors.

| Type | Purpose | |

u Company Vehicles | We provide directors with the use of Company vehicles to provide feedback on our products as well as enhance the public image of our vehicles. Retired directors also receive the use of a Company vehicle for a period of time. Participants are charged with imputed income based on the lease value of the vehicles and are responsible for associated taxes. | |

u Personal Accident Insurance (“PAI”)(1) | We provide PAI coverage in the event of accidental death or dismemberment. Directors are responsible for associated taxes on the imputed income from the coverage. | |

| (1) | Ms. Barra, our sole employee director, does not receive additional compensation for her Board service other than the PAI benefit described above, the value of which is reported for Ms. Barra in the Summary Compensation Table on page 62 of this Proxy Statement. |

Non-employee directors are not eligible to participate in any of the savings or retirement programs for our employees. Other than as described in this section, there are no separate benefit plans for directors.

2019 Non-Employee Director Compensation Table

This table shows the compensation that each non-employee director received for his or her 2019 Board and Committee service.

| Director | Fees Earned or Paid in Cash(1) ($) | Stock Awards(2) ($) | All Other Compensation(3) ($) | Total ($) | ||||||||||||

Wesley G. Bush (4) | $130,625 | $127,185 | $ 7,825 | $ | 265,635 | |||||||||||

Linda R. Gooden | $162,500 | $138,860 | $16,344 | $ | 317,704 | |||||||||||

Joseph Jimenez(5) | $157,500 | $138,860 | $36,740 | $ | 333,100 | |||||||||||

Jane L. Mendillo | $142,500 | $138,860 | $11,323 | $ | 292,683 | |||||||||||

Judith A. Miscik | $142,500 | $138,860 | $25,469 | $ | 306,829 | |||||||||||

Michael G. Mullen(6) | $ 76,250 | $ 69,430 | $39,370 | $ | 185,050 | |||||||||||

James J. Mulva(7) | $ 76,250 | $ 69,430 | $30,787 | $ | 176,467 | |||||||||||

Patricia F. Russo | $162,500 | $138,860 | $15,740 | $ | 317,100 | |||||||||||

Thomas M. Schoewe | $172,500 | $138,860 | $45,948 | $ | 357,308 | |||||||||||

Theodore M. Solso | $242,500 | $138,860 | $21,990 | $ | 403,350 | |||||||||||

Carol M. Stephenson | $162,500 | $138,860 | $15,384 | $ | 316,744 | |||||||||||

Devin N. Wenig | $142,500 | $138,860 | $35,948 | $ | 317,308 | |||||||||||

| (1) | This column reflects director compensation eligible to be paid in cash, which consists of 50% of the annual Board retainer ($142,500) and any applicable Committee Chair or Independent Lead Director fees. Each of the following directors elected to receive DSUs in lieu of such amounts eligible to be paid in cash in the following amounts: Mr. Bush—$130,625; Mr. Jimenez —$157,500; Ms. Mendillo— $142,500; Admiral Mullen—$76,250; Mr. Mulva—$76,250; Ms. Russo—$91,250; Mr. Solso—$242,500; Ms. Stephenson—$81,250; and Mr. Wenig—$142,500. |

| 12 |

|

NON-EMPLOYEE DIRECTOR COMPENSATION

| (2) | Reflects aggregate grant date fair value of DSUs granted in 2019, which does not include any cash fees that directors voluntarily elected to receive as DSUs. Grant date fair value is calculated by multiplying the number of DSUs granted by the closing price of GM common stock on December 31, 2019, which was $36.60. The holders of DSUs also receive dividend equivalents, which are reinvested in additional DSUs based on the market price of the common stock on the date the dividends are paid. |

| (3) | The following table provides more information on the type and amount of benefits included in the All Other Compensation column. |

| Director | Company Vehicle Program (a) | Other (b) | Total | Director | Company Vehicle Program (a) | Other (b) | Total | |||||||||||||||||||||||

Mr. Bush | $ 7,625 | $ | 200 | $ | 7,825 | Mr. Mulva | $30,667 | $ | 120 | $ | 30,787 | |||||||||||||||||||

Ms. Gooden | $16,104 | $ | 240 | $ | 16,344 | Ms. Russo | $15,500 | $ | 240 | $ | 15,740 | |||||||||||||||||||

Mr. Jimenez | $36,500 | $ | 240 | $ | 36,740 | Mr. Schoewe | $45,708 | $ | 240 | $ | 45,948 | |||||||||||||||||||

Ms. Mendillo | $11,083 | $ | 240 | $ | 11,323 | Mr. Solso | $21,750 | $ | 240 | $ | 21,990 | |||||||||||||||||||

Ms. Miscik | $25,229 | $ | 240 | $ | 25,469 | Ms. Stephenson | $15,144 | $ | 240 | $ | 15,384 | |||||||||||||||||||

Adm. Mullen | $39,250 | $ | 120 | $ | 39,370 | Mr. Wenig | $35,708 | $ | 240 | $ | 35,948 | |||||||||||||||||||

| (a) | The Company vehicle program includes the estimated annual lease value of the Company vehicles driven by directors. We include the annual lease value because it is more reflective of the value of the Company vehicle perquisite than the Company’s incremental costs, which are generally significantly lower because the Company manufactures and ordinarily disposes of Company vehicles for a profit, resulting in minimal incremental costs, if any. Taxes related to imputed income are the responsibility of each director. |

| (b) | Reflects the cost of premiums for providing personal accident insurance (annual premium cost of $240 is prorated, as applicable, for the period of service). |

| (4) | Mr. Bush joined the Board on February 11, 2019. |

| (5) | Mr. Jimenez was appointed Chair of the Finance Committee on April 16, 2019. |

| (6) | Adm. Mullen retired from the Board effective June 4, 2019. |

| (7) | Mr. Mulva retired from the Board effective June 4, 2019. |

| 13 |

GM is governed by a Board of Directors and Committees of the Board that meet throughout the year. The Board is elected by shareholders to oversee and provide guidance on the Company’s business and affairs. It is the ultimate decision-making body of the Company except for those matters reserved for shareholders by law or pursuant to the Company’s governance instruments. Among other things, the Board oversees company strategy and execution of the strategic plan. In addition, it oversees management’s proper safeguarding of the assets of

the Company, maintenance of appropriate financial and other internal controls, compliance with applicable laws and regulations, and proper governance. The Board is committed to sound corporate governance policies and practices that are designed and routinely assessed to enable the Company to operate its business responsibly, with integrity, and to position GM to compete more effectively, sustain its success, and build long-term shareholder value.

| u | Board Size |

The Board sets the number of directors from time to time by a resolution adopted by a majority of the directors. The Governance Committee reassesses the suitability of the Board’s size at least annually. The Board has the flexibility to increase or decrease the size of the Board as circumstances warrant, although the Company’s Certificate of Incorporation limits the total number of directors to 17. There are currently 11

members of the Board. If all of the Board’s nominees are elected, the Board will be composed of 11 members immediately following the Annual Meeting. If any nominee is unable to serve as a director or if any director leaves the Board between annual meetings, the Board, by resolution, may reduce the number of directors or elect an individual to fill the resulting vacancy.

| u | Director Independence |

GM’s Bylaws and Corporate Governance Guidelines define our standards for director independence and reflect applicable NYSE and SEC requirements. At least two-thirds of our directors are and must be independent under these standards. In addition, all members of the Audit Committee and the Executive Compensation Committee (the “Compensation Committee”) must meet heightened independence standards under applicable NYSE and SEC rules.

The Governance Committee annually assesses the independence of each director and makes recommendations to the Board. For a director to be “independent,” the Board must determine that the director has no material relationship with the Company other than his or her service as a director.

In recommending to the Board that it determine each director is independent, the Governance Committee considered whether there were any other facts or circumstances that might impair a director’s independence. The Governance Committee also considered that GM, in the ordinary course of

business, during the last three years, has sold fleet vehicles to and purchased products and services from companies at which some of our directors serve as non-employee directors or executives. The Board determined that these transactions were not material to GM or the other companies involved and that none of our directors had a material interest in the transactions with these companies. In each case, these transactions were in the ordinary course of business for GM and the other companies involved, and were on terms and conditions available to similarly situated customers and suppliers. Therefore, the Board determined they did not impair such directors’ independence.

Consistent with these standards, the Board has reviewed all relationships between the Company and each director and considered all relevant quantitative and qualitative criteria. The Board has affirmatively determined that all directors were independent during 2019, and that all current members are independent, except Ms. Barra, who serves as CEO.

| 14 |

|

CORPORATE GOVERNANCE

Board Leadership Structure and Composition

Your Board has the flexibility to decide when the positions of Chairman and CEO should be combined or separated, and whether an executive or an independent director should be Chairman. This allows the Board to choose the leadership structure that it believes will best serve the interests of our shareholders at any particular time. In January 2016, the Board recombined the positions of Chairman and CEO under the leadership of Ms. Barra and designated Mr. Solso as Independent Lead Director. Prior to that time, Mr. Solso served as the Board’s non-executive chairman.

Since then, each year your Board has voted to elect Ms. Barra as Chairman of the Board, and the independent directors have voted to appoint Mr. Solso as the Independent Lead Director. Your Board believes that, right now, combining the role of Chairman and CEO and electing a strong Independent Lead Director is the optimal Board leadership structure for GM.

| DUTIES OF THE INDEPENDENT LEAD DIRECTOR | ||

u Presiding over all Board meetings when the Chairman is not present, including executive sessions of non-management directors, and advising the Chairman of any actions taken;

u Providing Board leadership if circumstances arise in which the Chairman is actually, potentially, or perceived to have a conflict of interest;

u Calling executive sessions for non-management directors, relaying feedback from these sessions to the Chairman, and implementing decisions made by the non-management directors;

u Leading non-management directors in the annual evaluation of the CEO’s performance, communicating the results of that evaluation to the CEO, and overseeing CEO succession planning;

u Approving Board meeting agendas to ensure sufficient time for discussion of all items; | u Advising on the scope, quality, quantity, and timeliness of the flow of information between management and the Board;

u Serving as a liaison between non-management directors and the Chairman when requested to do so (although all non-management directors have direct and complete access to the Chairman at any time that they deem necessary or appropriate);

u Interviewing, along with the Chair of the Governance Committee, all director candidates and making recommendations to the Governance Committee and the Board;

u Being available to advise the Board Committee Chairs in fulfilling their designated roles and responsibilities to the Board; and

u Engaging, when requested to do so, with shareholders. | |

| 15 |

CORPORATE GOVERNANCE

A Message from the Independent Lead Director

As the Independent Lead Director it is my responsibility to help my fellow independent directors oversee and shape the partnership between management and the Board. Let me briefly highlight a few areas of focus that I believe demonstrate our oversight and help forge an effective partnership that drives strong Company performance and enables GM to effectively mitigate risk in these challenging times.

Focused Board Leadership: Why Your Board Believes that the Roles of Chairman and CEO Should Be Combined Right Now

Your Board carefully considers the appropriate leadership structure for GM and its shareholders on an annual basis and determines whether to combine or separate the roles of Chairman and CEO. Your Board believes that Ms. Barra’s service as both Chairman and CEO continues to provide a clear and unified strategic vision for GM – particularly in times like this as the Board supports management’s efforts to mitigate the impact of the COVID-19 pandemic on our business and the communities where we operate. As the individual with primary responsibility for managing the Company, Ms. Barra’s in-depth knowledge of our business and understanding of GM’s day-to-day operations has provided focused leadership that has enabled GM to respond decisively to this uncertain environment. Ms. Barra has been a significant asset to the Board throughout her tenure as GM has taken bold, strategic actions to strengthen its core business, invest in technologies that will redefine the future of personal transportation, and be prepared to weather storms like the one we are facing today in COVID-19.

My Role as the Independent Lead Director

My job is to complement Ms. Barra’s role by providing strong, independent leadership. My key duties and responsibilities are described on page 15 of this Proxy Statement. In my role, I provide independent oversight of GM’s management team for our shareholders, including a specific focus on strategic risk management, compliance, governance, and CEO succession planning.

Your Board is Shaping the Company’s Strategy and Overseeing Risk

Your Board plays an important role in shaping management’s development and execution of GM’s strategy and overseeing its risk management processes. In recent weeks, the Board has been actively engaged with management as it has taken actions to safeguard our employees and our business in response to COVID-19. For more on our recent efforts, see “Responding to the COVID-19 Pandemic” on page 22 of this Proxy Statement. From a strategy perspective, the Board dedicates a portion of each meeting to strategic reviews that span the Company’s regions, vehicle franchises, adjacent businesses, and other key initiatives. In addition, the Board holds an annual multi-day session devoted to discussing, debating, challenging, and validating management’s overall strategy. Since the last annual meeting, these strategic reviews and discussions included labor and workforce issues, EV and AV execution, Cadillac rebranding, fuel economy regulation, capital allocation, workplace and vehicle safety, international reorganization, and various alternative future business scenarios. Your Board also regularly solicits independent views on GM’s business and key industry trends from outside experts, including investment bankers and buy- and sell-side analysts— as well as from shareholders through our routine engagements.

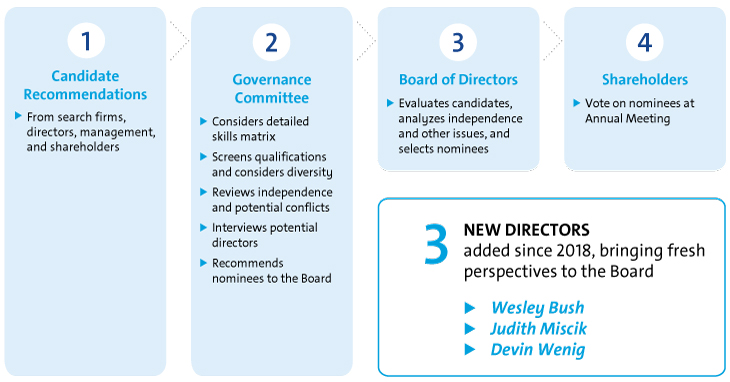

GM has the Right Board at the Right Time

Your Board has significantly refreshed its membership in recent years to ensure it remains a strategic asset. Since 2018, we have added three new directors, each of whom has helped bolster the Board’s expertise in technology and managing operational, strategic, geopolitical, and economic risks. As a result, I believe that the director nominees listed on page 2 of this Proxy Statement individually and collectively possess the right mix of skills, qualifications, and experience for GM as we continue to execute our vision of a world with zero crashes, zero emissions, and zero congestion.

I am proud to work closely with our Chairman and CEO and my fellow directors as we drive long-term shareholder value. On behalf of the entire Board, thank you for your continued support.

| Theodore M. Solso Independent Lead Director

|

| 16 |

|

CORPORATE GOVERNANCE

| u | Board Membership Criteria, Refreshment, and Succession Planning |

The selection of qualified directors is fundamental to the Board’s successful oversight of GM’s strategy and enterprise risks. We seek directors who bring diverse viewpoints and perspectives, possess a variety of skills, professional experiences, and backgrounds, and effectively represent the long-term interests of shareholders. The priorities for recruiting new directors are continually evolving based on the Company’s strategic needs. It is important that the Board remains a strategic asset capable of overseeing and helping management address the risks, trends, and opportunities that GM will face in the future. In evaluating potential director candidates, the

Governance Committee considers, among other factors, the criteria on page 3 of this Proxy Statement in the skills and qualifications matrix for current directors and any additional characteristics that it believes one or more directors should possess based on an assessment of the needs of the Board at that time. In every case, director candidates must be able to contribute significantly to your Board’s discussion and decision making on the broad array of complex issues facing GM. The Governance Committee also engages a reputable, qualified search firm that uses our skills matrix to inform the search and help identify and evaluate potential candidates.

Director Recruitment Process

Board Diversity

The Governance Committee seeks individuals with a broad range of business experience and varied backgrounds. Although GM does not have a formal policy governing diversity among directors, your Board strives to identify candidates with diverse backgrounds. Your Board recognizes the value of overall diversity and considers members’ and candidates’ opinions, perspectives, personal and

professional experiences, and backgrounds, including gender, race, ethnicity, and country of origin. The judgment and perspectives offered by a diverse board of directors improves the quality of decision making and enhances the Company’s business performance. Such diversity can help the Board respond more effectively to the needs of customers, shareholders, employees, suppliers, and other stakeholders.

| 17 |

CORPORATE GOVERNANCE

Candidate Recommendations

The Governance Committee will consider director candidates recommended by shareholders. The Governance Committee will review the qualifications and experience of each recommended candidate using the same criteria for candidates proposed by

Board members, and communicate its decision to the candidate or the person who made the recommendation. Shareholder nominations must be submitted to the Company by the deadlines found on page 101 of this Proxy Statement.

Your Board of Directors has six standing Committees: Audit, Compensation, Executive, Finance, Governance, and Risk and Cybersecurity. The key responsibilities, recent activities, and focus areas of each Committee, together with their current membership and the number of meetings held in 2019, are set forth on pages 19 to 21 of this Proxy Statement. Each Committee Chair meets regularly with management during the year to discuss

Committee business, shape agendas, and facilitate efficient meetings. The Chairman, Ms. Barra, attends all Committee meetings to serve as a resource and identify topics requiring the full Board’s attention. The Board has determined that each member of the Audit, Compensation, Finance, Governance, and Risk and Cybersecurity Committees is independent according to NYSE listing standards and our Corporate Governance Guidelines.

| u | Board and Committee Meetings and Attendance |

In 2019, your Board held eight meetings, and average director attendance at Board and Committee meetings was 97%. Each director standing for re-election attended at least 81% of the total meetings of the Board and Committees on which he or she

served in 2019. Directors are encouraged to attend our Annual Meeting of Shareholders, which is held in conjunction with a regularly scheduled Board meeting. All directors then in office attended the 2019 Annual Meeting.

| u | Executive Sessions |

Independent directors have an opportunity to meet in executive session without management present as part of each regularly scheduled Board and Committee meeting. Executive sessions are chaired by our Independent Lead Director, Mr. Solso, or the respective Committee Chair.

During executive sessions of the Board, the independent directors may review CEO performance, compensation, and succession planning; strategy;

key enterprise risks; future Board agendas and the flow of information to directors; corporate governance matters; and any other matters of importance to the Company raised during a meeting or otherwise presented by the independent directors.

The non-management directors of the Board, all of whom are independent, met in executive session six times in 2019.

| u | Access to Outside Advisors |

The Board and each Board Committee can select and retain the service of outside advisors at the Company’s expense.

| 18 |

|

CORPORATE GOVERNANCE

| AUDIT | EXECUTIVE COMPENSATION | |||||||

Thomas M. Schoewe, Chair | Members: Thomas M. Schoewe (Chair), Wesley G. Bush, Linda R. Gooden, Jane L. Mendillo, and Judith A. Miscik

Meetings held in 2019: 6 |

Carol M. Stephenson, Chair | Members: Carol M. Stephenson (Chair), Wesley G. Bush, Joseph Jimenez, and Patricia F. Russo

Meetings held in 2019: 5 | |||||

Key Responsibilities u Monitors the effectiveness of GM’s financial reporting processes and systems and disclosure and internal controls; u Selects and engages GM’s external auditors and reviews and evaluates the audit process; u Reviews and evaluates the scope and performance of the internal audit function; u Facilitates ongoing communications about GM’s financial position and affairs between the Board and the external auditors, GM’s financial and senior management, and GM’s internal audit staff; u Reviews GM’s policies and procedures regarding ethics and compliance; and u Oversees the preparation of the Audit Committee Report and related disclosures for the annual Proxy Statement.

The Board has determined that all members of the Audit Committee meet heightened independence and qualification criteria and are financially literate in accordance with the NYSE Corporate Governance Standards and SEC rules, and that Mr. Bush, Ms. Gooden, Ms. Mendillo, and Mr. Schoewe are each qualified as an “audit committee financial expert” as defined by the SEC.

Recent Activities and Key Focus Areas u Oversaw the implementation of a suite of new systems and system architectures designed to enhance the Company’s close, consolidation, planning, and reporting processes u Reviewed the financial impacts and disclosures relating to the 2019 labor disruption and GM’s continued transformational cost savings actions u Reviewed the expected impact on GM Financial of the adoption of a new accounting standard relating to the recognition of expected credit losses |

Key Responsibilities u Reviews the Company’s executive compensation policies, practices, and programs; u Reviews and approves corporate goals and objectives for compensation, evaluates performance (along with the full Board), and determines compensation levels for the Chairman and CEO; u Reviews and approves compensation of NEOs, executive officers, and other senior leaders under its purview; u Reviews compensation policies and practices so that the plans do not encourage unnecessary or excessive risks; and u Reviews the Company’s compensation policies and practices that promote diversity and inclusion.

The Board has determined that all members of the Compensation Committee meet heightened independence and qualification criteria in accordance with NYSE listing standards and SEC rules. The Compensation Committee’s charter permits the Committee to delegate its authority to members of management and also form and delegate authority to subcommittees consisting of one or more members when it deems it appropriate.

Recent Activities and Key Focus Areas u Conducted a competitive process for the selection of the Company’s new compensation consultant, Frederic W. Cook & Co. u Performed an in-depth review and analysis of GM’s incentive compensation plans, adding performance caps to GM’s LTIP in order to further align interests with those of our shareholders | |||||||

| 19 |

CORPORATE GOVERNANCE

FINANCE

| GOVERNANCE AND CORPORATE RESPONSIBILITY | |||||||

Joseph Jimenez, Chair | Members: Joseph Jimenez (Chair), Wesley G. Bush, Jane L. Mendillo, Patricia F. Russo, and Thomas M. Schoewe

Meetings held in 2019: 4 |

Patricia F. Russo, Chair | Members: Patricia F. Russo (Chair), Jane L. Mendillo, Theodore Solso, and Carol M. Stephenson

Meetings held in 2019: 4 | |||||

Key Responsibilities u Reviews financial policies, strategies, and capital structure; u Reviews the Company’s cash management policies and proposed capital plans, capital expenditures, dividend actions, stock repurchase programs, issuances of debt or equity securities, and credit facility and other borrowings; u Reviews any significant financial exposures and risks, including foreign exchange, interest rate, and commodities exposures, and the use of derivatives to hedge those exposures; and u Reviews the regulatory compliance, administration, financing, investment performance, risk and liability profile, and funding of the Company’s pension obligations.

Recent Activities and Key Focus Areas u Oversaw $1.2 billion fundraising effort by Cruise, including a $0.7 billion investment by GM u Monitored efforts to create structural cost savings and increased focus on cash flow u Monitored GM’s disciplined Capital Allocation Strategy, particularly in response to the 2019 labor disruption |

Key Responsibilities u Reviews the Company’s corporate governance framework, including all significant governance policies and procedures; u Monitors Company policies and strategies related to corporate responsibility, sustainability, and political contributions and lobbying activities; u Reviews the appropriate composition of the Board and recommends director nominees; u Monitors the self-evaluation process of the Board and Committees; u Recommends compensation of non-employee directors to the Board; and u Reviews and approves related party transactions and any potential Board conflicts of interest, as applicable.

Recent Activities and Key Focus Areas u Guided management through the adoption of the Company’s first virtual annual meeting u Reviewed the Company’s ESG strategy, with a broader focus on corporate purpose and culture and how those attributes align with the Company’s corporate strategy u Approved amendments to the General Motors Deferred Compensation Plan for Non-Employee Directors to align with changed practices and changes in tax law u Revised process for Board and Committee evaluations to improve the quality of feedback and enhance transparency to shareholders | |||||||

| 20 |

|

CORPORATE GOVERNANCE

| RISK AND CYBERSECURITY | EXECUTIVE | |||||||

Linda R. Gooden, Chair | Members: Linda R. Gooden (Chair), Joseph Jimenez, Judith A. Miscik, Thomas M. Schoewe, and Devin Wenig

Meetings held in 2019: 4 |

Mary T. Barra, Chair | Members: Mary T. Barra (Chair), Theodore Solso, Linda R. Gooden, Joseph Jimenez, Patricia F. Russo, Thomas M. Schoewe, and Carol M. Stephenson

Meetings held in 2019: 0 | |||||

Key Responsibilities u Reviews the Company’s key strategic, enterprise, and cybersecurity risks; u Reviews privacy risk, including potential impact to the Company’s employees, customers, and stakeholders; u Reviews the Company’s risk management framework and management’s implementation of risk policies, procedures, and governance to assess their effectiveness; u Reviews management’s evaluation of strategic and operating risks, including risk concentrations, mitigating measures, and the types and levels of risk that are acceptable in the pursuit and protection of shareholder value; and u Reviews the Company’s risk culture, including the integration of risk management into the Company’s behaviors, decision making, and processes.

Recent Activities and Key Focus Areas u Reviewed the results of the annual enterprise risk assessment, including the relationships between the 2020 enterprise risks and those risks that were more likely to influence or trigger others u Monitored compliance with California Consumer Privacy Act u Reviewed GM’s information security program, which seeks to secure a complex, global IT ecosystem that collectively support’s GM’s global environment |

Your Board has an Executive Committee composed of the Chairman and CEO, the Independent Lead Director, and the Chairs of all other standing Committees. The Executive Committee is chaired by Ms. Barra, and it can act on certain limited matters for the full Board in intervals between meetings of the Board. The Executive Committee meets as necessary, and all actions by the Executive Committee are reported and ratified at the next succeeding Board meeting. | |||||||

| 21 |

CORPORATE GOVERNANCE

Board and Committee Oversight of Risk

| u | Role of the Board of Directors |

The Board of Directors has overall responsibility for risk oversight and focuses on the most significant risks facing the Company. The Board discharges its risk oversight responsibilities, in part, through delegation to its Committees. The Company’s risk governance is facilitated through a top-down and bottom-up communication structure, with the tone established at the top by Ms. Barra, our Chairman and CEO, who is also our Chief Risk Officer, and other

members of management, specifically the Senior Leadership Team. The Senior Leadership Team also utilizes our Risk Advisory Council, an executive-level body with delegates from each business unit and function, to discuss and monitor the most significant enterprise risks in a cross-functional setting. They are tasked with championing risk management practices and integrating them into their functional or regional business units.

Top-Down and Bottom-Up Risk Oversight Communication Structure

| 22 |

|

CORPORATE GOVERNANCE

| u | Role of the Board Committees |

Each of the Board’s Committees has a critical role to play in the overall execution of the Board’s risk oversight duties. The Board delegates oversight for certain risks to each Committee based on the risk categories relevant to the subject matter of the Committee. The Chair of the Risk and Cybersecurity Committee coordinates with the Chairs of the other Committees to support them in managing the relationship between risk management

policies and practices and their respective oversight responsibilities. The Risk and Cybersecurity Committee also assists the Board by monitoring the overall effectiveness of the Company’s risk management framework and processes. Below is a summary of the key risk oversight responsibilities that the Board has delegated to the Committees.

| RISK AND CYBERSECURITY | AUDIT

| FINANCE

| ||||||

u Oversees risks related to the Company’s key strategic, enterprise, and cybersecurity risks, including workplace and product safety and privacy | u Oversees risks related to financial reporting, internal controls, or auditing matters

u Oversees risk related to legal, regulatory, and compliance programs | u Oversees significant financial exposures and contingent liabilities of the Company

u Oversees regulatory compliance of employee defined benefits plans | ||||||

GOVERNANCE AND CORPORATE RESPONSIBILITY | EXECUTIVE COMPENSATION

| |||

u Oversees risks related to public policy and political activities

u Oversees risks related to director independence and related party transactions

u Oversees risks related to the sustainability of our operations and products | u Oversees risks related to executive and employee compensation plans, including by designing compensation plans that promote prudent risk management | |||

| u | Annual Risk Assessment |

The Company’s Strategic Risk Management team conducts an annual risk assessment designed to prioritize GM’s most significant enterprise risks. The Risk and Cybersecurity Committee reviews this assessment and helps management focus on and select the key

risks that should be brought to the Board and the other Committees. Below are certain of the key enterprise risks that the Board and management have identified for 2020.

Talent |

Customer |

Supply Chain Disruptions |

Privacy |

Manufacturing Disruptions | ||||||||||||

| ||||||||||||||||

| Workplace Safety and Health |

Vehicle Safety | Shifting Trade and Government Policies |

Economic Fluctuations |

Cybersecurity | ||||||||||||

| 23 |

CORPORATE GOVERNANCE

| SPOTLIGHT: | ||||

| ||||

CYBERSECURITY AND PRIVACY RISK OVERSIGHT |

| CLIMATE CHANGE RISK OVERSIGHT | ||

The Risk and Cybersecurity Committee works closely with management and the other Committees to manage GM’s cybersecurity and data privacy risks.

Cybersecurity

At each meeting, the Risk and Cybersecurity Committee reviews management’s Cybersecurity Risk Scorecard, which measures the maturity of GM’s domain security programs, and discusses various cybersecurity topics. The Risk and Cybersecurity Committee also receives intelligence briefings on notable cyber events impacting the industry. The briefings summarize the vulnerabilities that led to the event, provide insight into what happened, and highlight learnings that GM can leverage in the future.

GM’s Global Cybersecurity organization is a virtual alignment of cybersecurity domains across functions and business units that enables the Company to leverage both business and technical experts to accelerate the development and execution of security solutions. In recent years, GM has invested heavily in cybersecurity, including through the hiring of nearly 500 employees. These employees have diverse skillsets and include pen-testers, cryptologists, mathematicians, data analysts, program managers, and “true hackers.”

Privacy

In recent years, GM’s Strategic Risk Management team determined that privacy risks were increasing in significance due to the enactment of new and more stringent U.S. and global regulations on the use and protection of personal information. Accordingly, the Risk and Cybersecurity Committee has taken steps to continue to enhance its oversight on GM’s data privacy policies and practices. The Committee’s charter makes it clear that the Committee is responsible for overseeing GM’s privacy risks relating to the Company’s employees, customers, and stakeholders. The Committee also devotes portions of its meetings to discuss critical privacy issues with management, including GM’s processes and policies designed to ensure compliance with the California Consumer Privacy Act. | GM takes the challenge of climate change seriously and recognizes the role of the transportation sector in contributing to global greenhouse gas emissions.

Governance

The Board is committed to overseeing the Company’s integration of ESG principles throughout the enterprise. GM is fortunate that several of its Board members have extensive business experience in managing ESG- and climate-related issues, such as transitioning from high- to low-carbon-emitting technologies and managing environmental impacts within the supply chain.

The Board has been actively involved in shaping GM’s EV strategy, which has led to the development of our third-generation global EV platform powered by our proprietary Ultium battery system. This highly flexible platform will support vehicles ranging from affordable cars and crossovers to luxury SUVs and pickup trucks, effectively competing for nearly every customer in the market.

Risk Management and Scenario Planning

Climate change has been incorporated into GM’s enterprise risk management process. This designation ensures that these issues are at the forefront of daily decision making and that we manage them at the highest levels of the organization. As an example, a cross-functional climate change workshop helped us assess the risks, challenges, and opportunities associated with various two-degree warming scenarios. The workshop consisted of a three-step process including exploring uncertainties and defining success in the future world; answering questions to shape each scenario; and performing an analysis to determine what GM should be doing now to influence its future. This exercise helped clarify risks but also highlighted opportunities. Above all, it underscored the reality that the need to limit global warming is influencing consumer choices and brand perception today. | |||

| 24 |

|

CORPORATE GOVERNANCE

Your Board’s Governance Policies and Practices

| u | Code of Business Conduct and Ethics: “Winning with Integrity” |

The Board is committed to the highest legal and ethical standards in fulfilling its responsibilities. We have adopted a code of business conduct and ethics, “Winning with Integrity,” that applies to our directors, officers, and employees. This Code of Conduct forms the foundation for compliance with corporate policies and procedures and creates a Company-wide focus on uncompromising integrity in every aspect of our operations. It embodies our expectations for a number of topics, including

workplace and vehicle safety, conflicts of interest, protection of confidential information, insider trading, competition and fair dealing, human rights, community involvement and corporate citizenship, political activities and lobbying, preservation and use of Company assets, and compliance with all laws and regulations applicable to the conduct of our business. Employees are expected to report any conduct that they believe in good faith to be an actual or apparent violation of our Code of Conduct.

| u | Corporate Governance Guidelines |

Our Corporate Governance Guidelines form a transparent framework for the effective governance of the Company. The Corporate Governance Guidelines address matters such as the respective roles and responsibilities of the Board and management, the Board’s leadership structure, the responsibilities of the Independent Lead Director, director independence, the Board membership criteria, Board Committees, and Board and CEO

evaluation. The Governance Committee regularly reviews the Corporate Governance Guidelines and periodically recommends to your Board the adoption of amendments in response to changing regulations, evolving best practices, and shareholder concerns. For a summary of our corporate governance best practices, please see “Shareholder Protections and Governance Best Practices” on page 28 of this Proxy Statement.

| u | CEO Succession Planning |

Our Independent Lead Director oversees the CEO succession planning process and leads, at least annually, the Board’s discussion of CEO succession planning. Our CEO provides the Board with recommendations for and evaluations of potential CEO successors and reviews with the Board development plans for these successors. Directors

engage with potential CEO and senior management talent at Board and Committee meetings and in less formal settings to enable directors to personally assess candidates. The Board reviews management succession in the ordinary course of business as well as contingency planning in the event of an emergency or unanticipated event.

| u | Board and Committee Evaluations |

The Governance Committee periodically reviews the form and process for Board and Committee self-evaluations. In 2019, following extensive benchmarking, engagement with shareholders, interviewing third-party facilitators, and internal

discussion, the Board approved, based on the recommendation of the Governance Committee, changes to its self-evaluation process. Beginning in 2020, the Board and its Committees will observe the following self-evaluation process:

Throughout the process, directors have ample opportunity to provide feedback on individual director performance.

| 25 |

CORPORATE GOVERNANCE

The Board is committed to incorporating feedback from its self-evaluations. Recent examples of changes to practice, include:

| • | Conducting bi-annual “Next Generation Lunches” with emerging leaders of the Company to assess talent and cultural change. |

| • | Meeting with dealers to understand concerns and strategize about opportunities to create a better customer experience. |

| • | Combining the Risk and Cybersecurity Committees to create more efficient meeting cycles and allow for broader discussions about risk management. |

| • | Enhancing pre-read and meeting presentation materials to allow for more discussion during meetings. |

| • | Changing the Board’s Self-Evaluation Process to make it more efficient and collaborative. |

| u | Annual Evaluation of CEO |

Each year, the Board reviews the CEO’s performance against her annual strategic goals. The non-management directors, meeting separately in executive session, annually conduct a formal evaluation of the CEO, which is communicated to the CEO by the Independent Lead Director. The evaluation is based on both objective and subjective criteria, including, but not limited to: the Company’s financial performance; accomplishment of ongoing

initiatives in furtherance of the Company’s long-term strategic objectives; and development of the Company’s top management team. The results of the evaluation are considered by the Compensation Committee in its deliberations when determining the compensation of the CEO as further described in “Executive Compensation” on page 52 of this Proxy Statement.

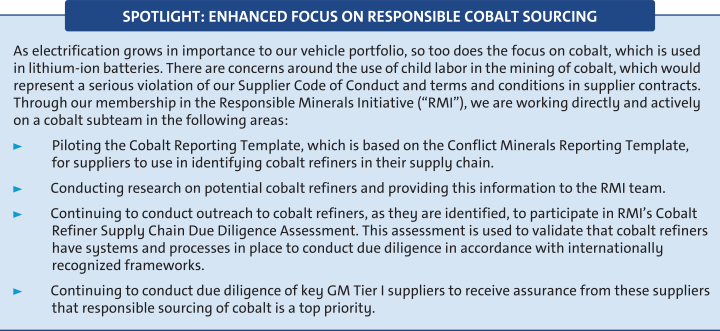

| u | Director Orientation and Continuing Education |