VEON Average and closing rates of functional currencies to USD Index sheet Average rates Closing rates Consolidated VEON 4Q19 4Q18 YoY 4Q19 4Q18 YoY Consolidated VEON Russian Ruble RUB 63.72 66.48 -4.2% 64.74 69.47 -6.8% Customers Euro EUR 0.90 0.88 3.0% 0.89 0.87 2.4% Russia Algerian Dinar DZD 119.84 118.63 1.0% 119.41 118.21 1.0% Pakistan Pakistan Rupee PKR 155.66 134.20 16.0% 150.36 139.80 7.6% Algeria Bangladeshi Taka BDT 84.81 84.06 0.9% 84.33 83.60 0.9% Bangladesh Ukrainian Hryvnia UAH 24.26 27.95 -13.2% 25.84 27.69 -6.7% Ukraine Kazakh Tenge KZT 386.90 370.13 4.5% 382.87 384.20 -0.3% Uzbekistan Uzbekistan Som UZS 9,484.72 8,260.17 14.8% 8,839.03 8,339.55 6.0% Kazakhstan Armenian Dram AMD 477.24 485.30 -1.7% 480.36 483.75 -0.7% Kyrgyz Som KGS 69.82 69.65 0.2% 69.79 69.85 -0.1% Georgian Lari GEL 2.95 2.68 10.1% 2.82 2.68 5.3%

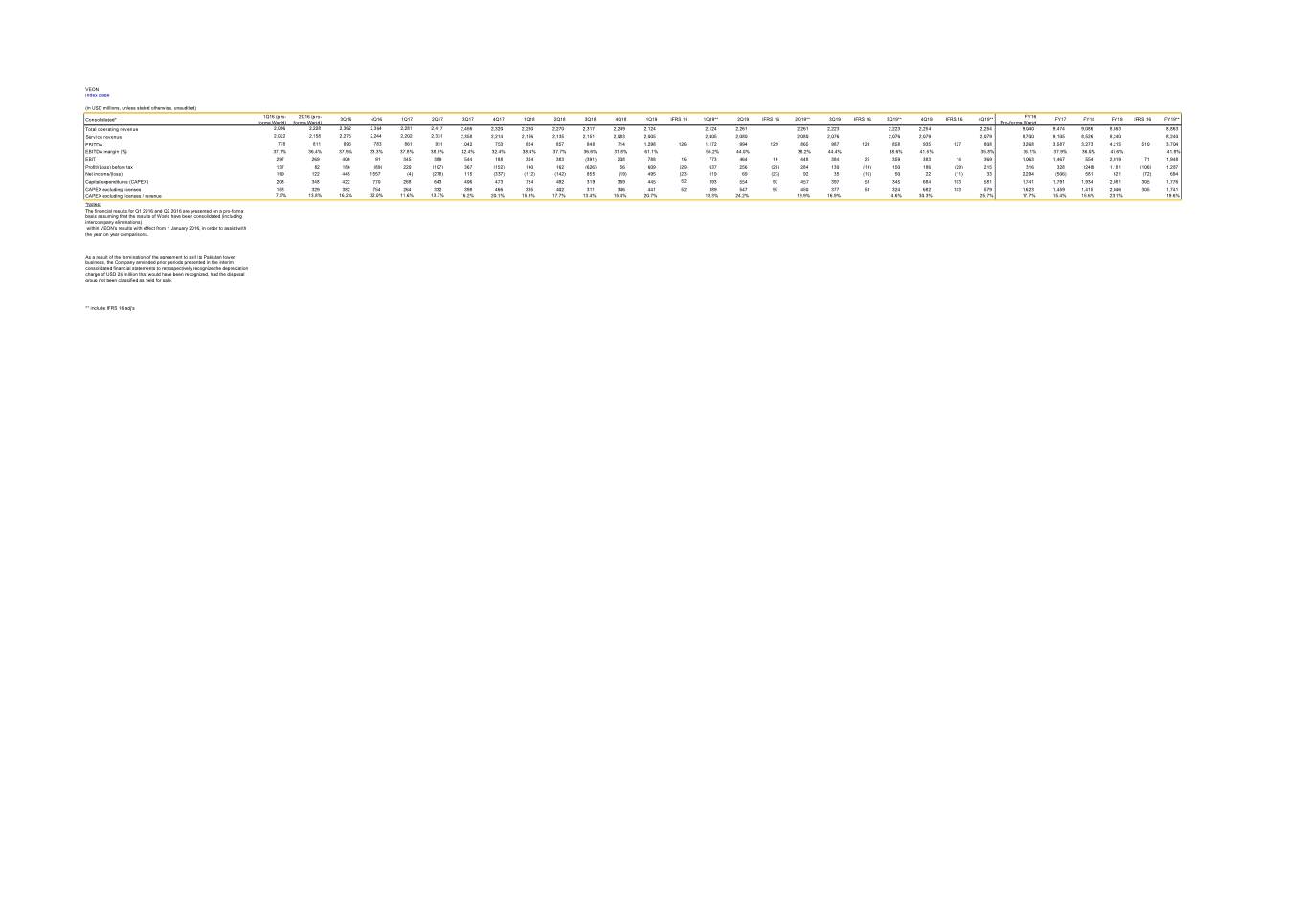

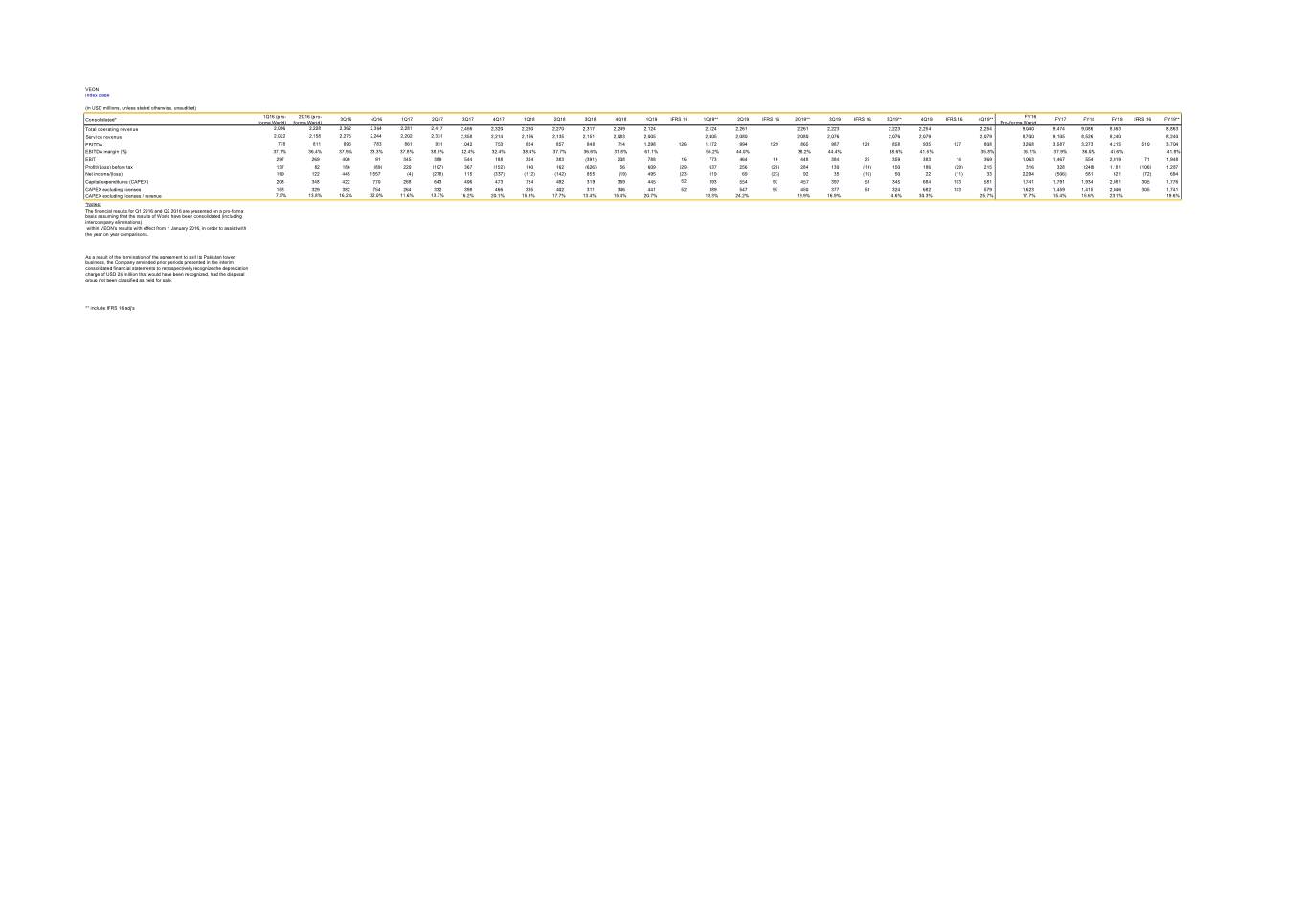

VEON index page (in USD millions, unless stated otherwise, unaudited) 1Q16 (pro- 2Q16 (pro- FY16 Consolidated* 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19** 2Q19 IFRS 16 2Q19** 3Q19 IFRS 16 3Q19** 4Q19 IFRS 16 4Q19** FY17 FY18 FY19 IFRS 16 FY19** forma Warid) forma Warid) Pro-forma Warid Total operating revenue 2,096 2,228 2,362 2,354 2,281 2,417 2,456 2,320 2,250 2,270 2,317 2,249 2,124 2,124 2,261 2,261 2,223 2,223 2,254 2,254 9,040 9,474 9,086 8,863 8,863 Service revenue 2,022 2,158 2,276 2,244 2,202 2,331 2,358 2,214 2,156 2,135 2,151 2,083 2,005 2,005 2,080 2,080 2,076 2,076 2,079 2,079 8,700 9,105 8,526 8,240 8,240 EBITDA 778 811 896 783 861 931 1,042 753 854 857 848 714 1,298 126 1,172 994 129 865 987 129 858 935 127 808 3,268 3,587 3,273 4,215 510 3,704 EBITDA margin (%) 37.1% 36.4% 37.9% 33.3% 37.8% 38.5% 42.4% 32.4% 38.0% 37.7% 36.6% 31.8% 61.1% 55.2% 44.0% 38.2% 44.4% 38.6% 41.5% 35.8% 36.1% 37.9% 36.0% 47.6% 41.8% EBIT 297 269 406 91 345 389 544 188 354 383 (391) 208 788 16 773 464 16 448 384 25 359 383 14 369 1,063 1,467 554 2,019 71 1,948 Profit/(Loss) before tax 137 82 186 (89) 220 (107) 367 (152) 160 162 (626) 56 609 (29) 637 256 (28) 284 130 (19) 150 186 (29) 215 316 328 (248) 1,181 (106) 1,287 Net income/(loss) 169 122 445 1,557 (4) (278) 115 (337) (112) (142) 855 (19) 495 (23) 519 69 (23) 92 35 (16) 50 22 (11) 33 2,294 (506) 581 621 (72) 694 Capital expenditures (CAPEX) 203 348 422 770 268 643 406 473 754 492 319 369 445 52 393 554 97 457 397 53 345 684 103 581 1,741 1,791 1,934 2,081 305 1,776 CAPEX excluding licenses 158 329 382 754 264 332 398 466 355 402 311 346 441 52 389 547 97 450 377 53 324 682 103 579 1,623 1,459 1,415 2,046 305 1,741 CAPEX excluding licenses / revenue 7.5% 13.8% 16.2% 32.0% 11.6% 13.7% 16.2% 20.1% 15.8% 17.7% 13.4% 15.4% 20.7% 18.3% 24.2% 19.9% 16.9% 14.6% 30.3% 25.7% 17.7% 15.4% 15.6% 23.1% 19.6% *Notes: The financial results for Q1 2016 and Q2 2016 are presented on a pro-forma basis assuming that the results of Warid have been consolidated (including intercompany eliminations) within VEON’s results with effect from 1 January 2016, in order to assist with the year on year comparisons. As a result of the termination of the agreement to sell its Pakistan tower business, the Company amended prior periods presented in the interim consolidated financial statements to retrospectively recognize the depreciation charge of USD 25 million that would have been recognized, had the disposal group not been classified as held for sale. ** include IFRS 16 adj's

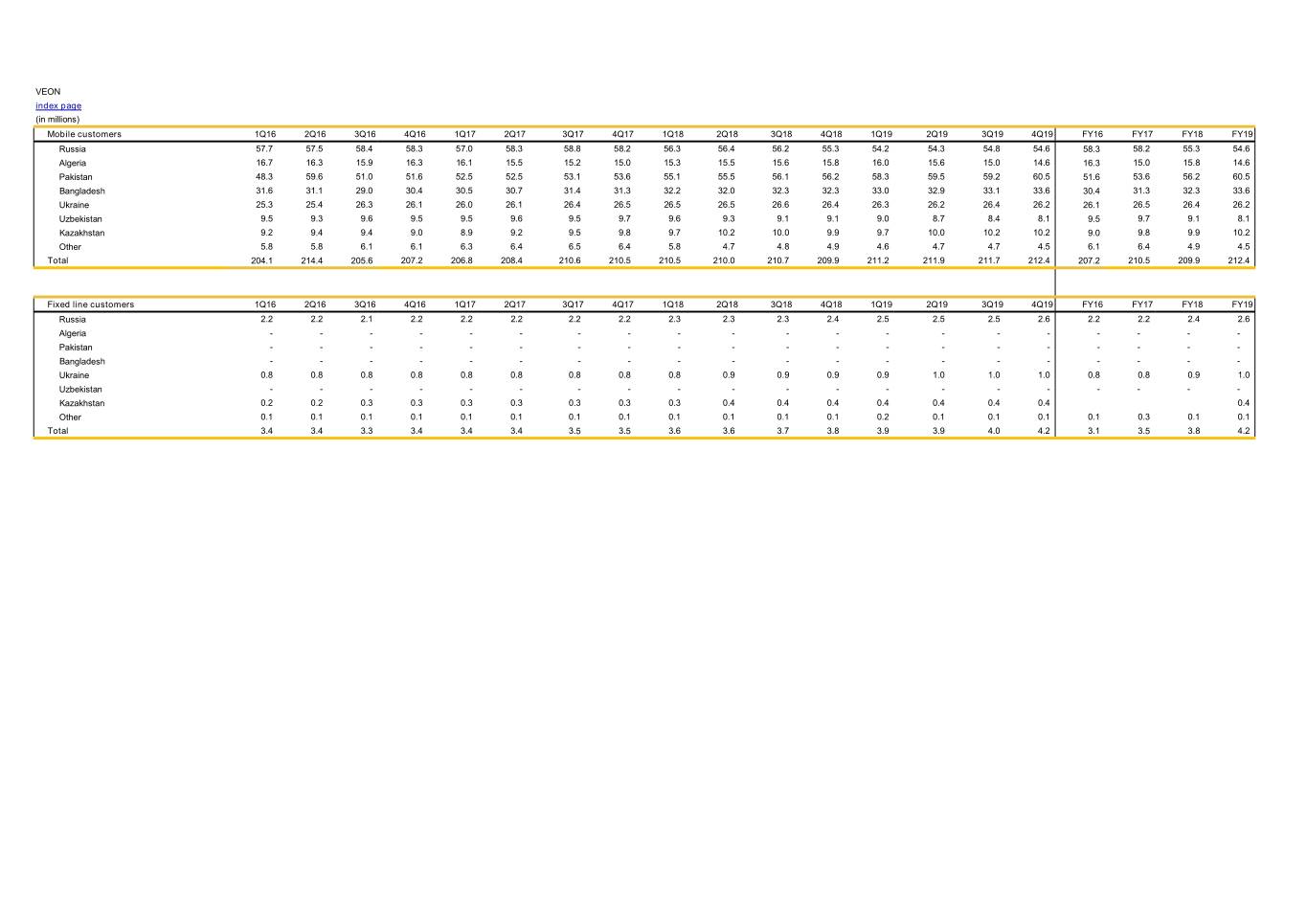

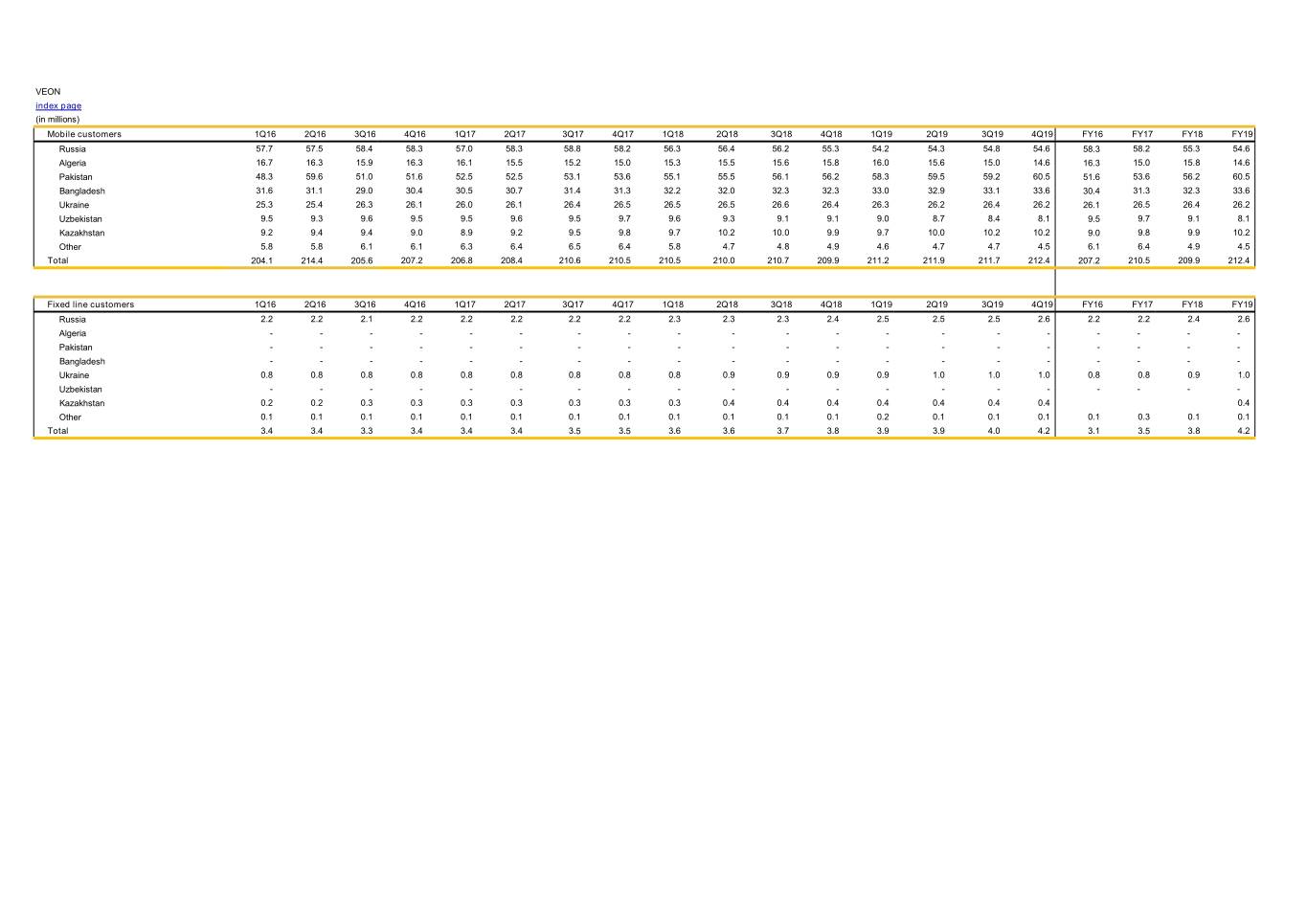

VEON index page (in millions) Mobile customers 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 FY16 FY17 FY18 FY19 Russia 57.7 57.5 58.4 58.3 57.0 58.3 58.8 58.2 56.3 56.4 56.2 55.3 54.2 54.3 54.8 54.6 58.3 58.2 55.3 54.6 Algeria 16.7 16.3 15.9 16.3 16.1 15.5 15.2 15.0 15.3 15.5 15.6 15.8 16.0 15.6 15.0 14.6 16.3 15.0 15.8 14.6 Pakistan 48.3 59.6 51.0 51.6 52.5 52.5 53.1 53.6 55.1 55.5 56.1 56.2 58.3 59.5 59.2 60.5 51.6 53.6 56.2 60.5 Bangladesh 31.6 31.1 29.0 30.4 30.5 30.7 31.4 31.3 32.2 32.0 32.3 32.3 33.0 32.9 33.1 33.6 30.4 31.3 32.3 33.6 Ukraine 25.3 25.4 26.3 26.1 26.0 26.1 26.4 26.5 26.5 26.5 26.6 26.4 26.3 26.2 26.4 26.2 26.1 26.5 26.4 26.2 Uzbekistan 9.5 9.3 9.6 9.5 9.5 9.6 9.5 9.7 9.6 9.3 9.1 9.1 9.0 8.7 8.4 8.1 9.5 9.7 9.1 8.1 Kazakhstan 9.2 9.4 9.4 9.0 8.9 9.2 9.5 9.8 9.7 10.2 10.0 9.9 9.7 10.0 10.2 10.2 9.0 9.8 9.9 10.2 Other 5.8 5.8 6.1 6.1 6.3 6.4 6.5 6.4 5.8 4.7 4.8 4.9 4.6 4.7 4.7 4.5 6.1 6.4 4.9 4.5 Total 204.1 214.4 205.6 207.2 206.8 208.4 210.6 210.5 210.5 210.0 210.7 209.9 211.2 211.9 211.7 212.4 207.2 210.5 209.9 212.4 Fixed line customers 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 FY16 FY17 FY18 FY19 Russia 2.2 2.2 2.1 2.2 2.2 2.2 2.2 2.2 2.3 2.3 2.3 2.4 2.5 2.5 2.5 2.6 2.2 2.2 2.4 2.6 Algeria - - - - - - - - - - - - - - - - - - - - Pakistan - - - - - - - - - - - - - - - - - - - - Bangladesh - - - - - - - - - - - - - - - - - - - - Ukraine 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.9 0.9 0.9 0.9 1.0 1.0 1.0 0.8 0.8 0.9 1.0 Uzbekistan - - - - - - - - - - - - - - - - - - - - Kazakhstan 0.2 0.2 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 Other 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.2 0.1 0.1 0.1 0.1 0.3 0.1 0.1 Total 3.4 3.4 3.3 3.4 3.4 3.4 3.5 3.5 3.6 3.6 3.7 3.8 3.9 3.9 4.0 4.2 3.1 3.5 3.8 4.2

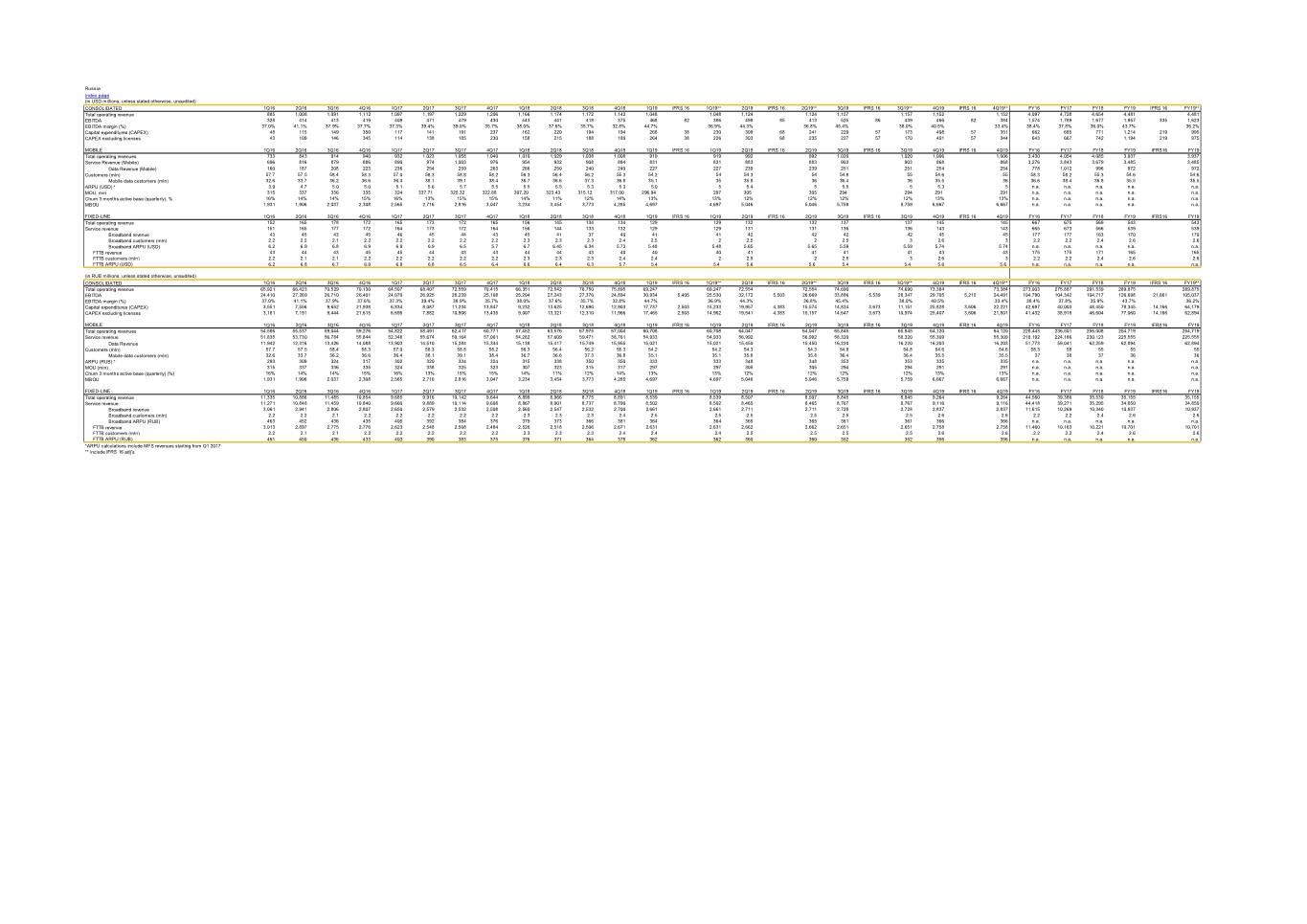

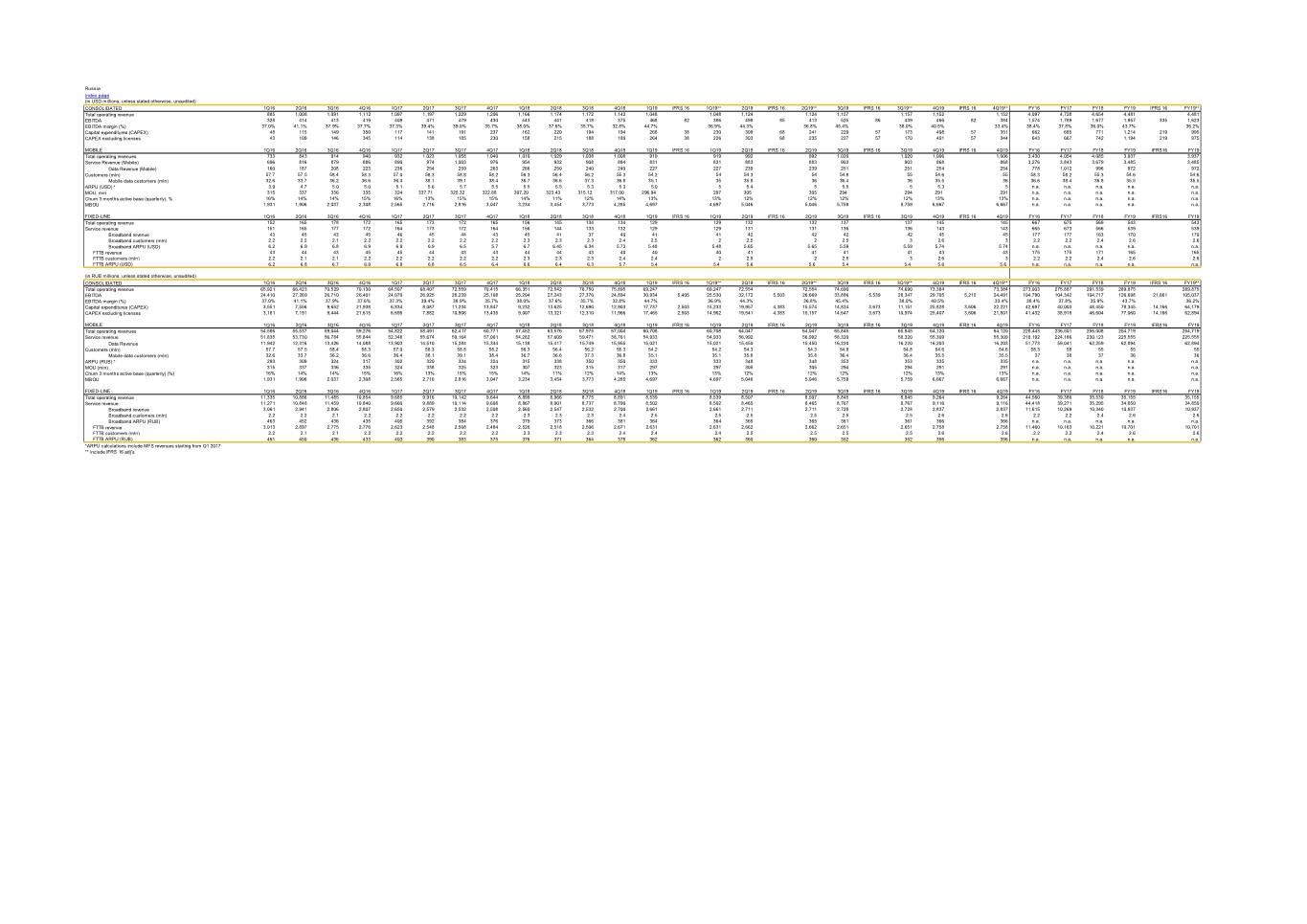

Russia index page (in USD millions, unless stated otherwise, unaudited) CONSOLIDATED 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19** 2Q19 IFRS 16 2Q19** 3Q19 IFRS 16 3Q19** 4Q19 IFRS 16 4Q19** FY16 FY17 FY18 FY19 IFRS 16 FY19** Total operating revenue 885 1,008 1,091 1,112 1,097 1,197 1,229 1,206 1,166 1,174 1,172 1,142 1,048 1,048 1,124 1,124 1,157 1,157 1,152 1,152 4,097 4,728 4,654 4,481 4,481 EBITDA 328 414 413 419 409 471 479 430 443 441 418 375 468 82 386 498 85 413 525 86 439 466 82 384 1,574 1,789 1,677 1,957 335 1,623 EBITDA margin (%) 37.0% 41.1% 37.9% 37.7% 37.3% 39.4% 39.0% 35.7% 38.0% 37.6% 35.7% 32.8% 44.7% 36.9% 44.3% 36.8% 45.4% 38.0% 40.5% 33.4% 38.4% 37.8% 36.0% 43.7% 36.2% Capital expenditures (CAPEX) 48 115 149 350 117 141 191 237 162 220 194 194 268 38 230 309 68 241 229 57 173 408 57 351 662 685 771 1,214 219 995 CAPEX excluding licenses 43 109 146 345 114 138 185 230 158 215 188 180 264 38 226 303 68 235 227 57 170 401 57 344 643 667 742 1,194 219 975 MOBILE 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19 2Q19 IFRS 16 2Q19 3Q19 IFRS 16 3Q19 4Q19 IFRS 16 4Q19 FY16 FY17 FY18 FY19 IFRS16 FY19 Total operating revenues 733 843 914 940 932 1,023 1,058 1,040 1,010 1,029 1,038 1,008 919 919 992 992 1,020 1,020 1,006 1,006 3,430 4,054 4,085 3,937 3,937 Service Revenue (Mobile) 696 816 879 886 890 974 1,003 976 954 932 908 884 831 831 883 883 903 903 868 868 3,276 3,843 3,679 3,485 3,485 Data Revenue (Mobile) 160 187 208 223 236 254 259 263 266 250 240 240 227 227 239 239 251 251 254 254 778 1,012 996 972 972 Customers (mln) 57.7 57.5 58.4 58.3 57.0 58.3 58.8 58.2 56.3 56.4 56.2 55.3 54.2 54 54.3 54 54.8 55 54.6 55 58.3 58.2 55.3 54.6 54.6 Mobile data customers (mln) 32.6 33.7 36.2 36.6 36.4 38.1 39.1 38.4 36.7 36.6 37.3 36.8 35.1 35 35.8 36 36.4 36 35.5 36 36.6 38.4 36.8 35.5 35.5 ARPU (USD) * 3.9 4.7 5.0 5.0 5.1 5.6 5.7 5.5 5.5 5.5 5.3 5.3 5.0 5 5.4 5 5.5 5 5.3 5 n.a. n.a. n.a. n.a. n.a. MOU, min 315 337 336 335 324 337.71 325.32 322.88 307.20 323.43 315.12 317.00 296.94 297 305 305 294 294 291 291 n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly), % 16% 14% 14% 15% 16% 13% 15% 15% 14% 11% 12% 14% 13% 13% 12% 12% 12% 12% 13% 13% n.a. n.a. n.a. n.a. n.a. MBOU 1,931 1,906 2,037 2,308 2,565 2,716 2,816 3,047 3,234 3,454 3,773 4,285 4,697 4,697 5,046 5,046 5,759 5,759 6,667 6,667 n.a. n.a. n.a. n.a. n.a. FIXED-LINE 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19 2Q19 IFRS 16 2Q19 3Q19 IFRS 16 3Q19 4Q19 IFRS 16 4Q19 FY16 FY17 FY18 FY19 IFRS16 FY19 Total operating revenue 152 165 178 172 165 173 172 165 156 145 134 134 129 129 132 132 137 137 145 145 667 675 569 543 543 Service revenue 151 165 177 172 164 173 172 164 156 144 133 132 129 129 131 131 136 136 143 143 665 673 566 539 539 Broadband revenue 43 45 43 45 46 45 44 43 45 41 37 40 41 41 42 42 42 42 45 45 177 177 163 170 170 Broadband customers (mln) 2.2 2.2 2.1 2.2 2.2 2.2 2.2 2.2 2.3 2.3 2.3 2.4 2.5 2 2.5 2 2.5 3 2.6 3 2.2 2.2 2.4 2.6 2.6 Broadband ARPU (USD) 6.2 6.9 6.8 6.9 6.9 6.9 6.5 5.7 6.7 6.45 6.34 5.73 5.48 5.48 5.65 5.65 5.59 5.59 5.74 5.74 n.a. n.a. n.a. n.a. n.a. FTTB revenue 43 44 43 45 45 44 43 43 44 44 43 40 40 40 41 41 41 41 43 43 175 175 171 165 165 FTTB customers (mln) 2.2 2.1 2.1 2.2 2.2 2.2 2.2 2.2 2.3 2.3 2.3 2.4 2.4 2 2.5 2 2.5 3 2.6 3 2.2 2.2 2.4 2.6 2.6 FTTB ARPU (USD) 6.2 6.8 6.7 6.9 6.9 6.8 6.5 6.4 6.6 6.4 6.3 5.7 5.4 5.4 5.6 5.6 5.4 5.4 5.6 5.6 n.a. n.a. n.a. n.a. n.a. (in RUB millions, unless stated otherwise, unaudited) CONSOLIDATED 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19** 2Q19 IFRS 16 2Q19** 3Q19 IFRS 16 3Q19** 4Q19 IFRS 16 4Q19** FY16 FY17 FY18 FY19 IFRS 16 FY19** Total operating revenue 65,921 66,423 70,529 70,130 64,507 68,407 72,559 70,415 66,351 72,542 76,750 75,895 69,247 69,247 72,554 72,554 74,690 74,690 73,384 73,384 273,003 275,887 291,539 289,875 289,875 EBITDA 24,410 27,269 26,710 26,401 24,070 26,925 28,239 25,108 25,204 27,243 27,376 24,894 30,934 5,405 25,530 32,172 5,503 26,669 33,886 5,539 28,347 29,705 5,215 24,491 104,790 104,342 104,717 126,698 21,661 105,037 EBITDA margin (%) 37.0% 41.1% 37.9% 37.6% 37.3% 39.4% 38.9% 35.7% 38.0% 37.6% 35.7% 32.8% 44.7% 36.9% 44.3% 36.8% 45.4% 38.0% 40.5% 33.4% 38.4% 37.8% 35.9% 43.7% 36.2% Capital expenditures (CAPEX) 3,551 7,556 9,652 21,938 6,834 8,087 11,234 13,847 9,232 13,625 12,690 12,903 17,737 2,503 15,233 19,957 4,383 15,574 14,824 3,673 11,151 25,828 3,606 22,221 42,697 40,003 48,450 78,345 14,166 64,179 CAPEX excluding licenses 3,181 7,191 9,444 21,615 6,695 7,882 10,906 13,435 9,007 13,321 12,310 11,966 17,465 2,503 14,962 19,541 4,383 15,157 14,647 3,673 10,974 25,407 3,606 21,801 41,432 38,918 46,604 77,060 14,166 62,894 MOBILE 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19 2Q19 IFRS 16 2Q19 3Q19 IFRS 16 3Q19 4Q19 IFRS 16 4Q19 FY16 FY17 FY18 FY19 IFRS16 FY19 Total operating revenues 54,586 55,537 59,044 59,276 54,822 58,491 62,417 60,771 57,452 63,576 67,975 67,004 60,708 60,708 64,047 64,047 65,845 65,845 64,120 64,120 228,443 236,501 256,008 254,719 254,719 Service revenue 51,835 53,730 56,784 55,844 52,348 55,674 59,164 57,001 54,282 57,609 59,471 58,761 54,933 54,933 56,992 56,992 58,320 58,320 55,309 55,309 218,192 224,186 230,123 225,555 225,555 Data Revenue 11,942 12,316 13,426 14,088 13,903 14,510 15,284 15,344 15,138 15,417 15,749 15,955 15,021 15,021 15,450 15,450 16,220 16,220 16,203 16,203 51,773 59,041 62,259 62,894 62,894 Customers (mln) 57.7 57.5 58.4 58.3 57.0 58.3 58.8 58.2 56.3 56.4 56.2 55.3 54.2 54.2 54.3 54.3 54.8 54.8 54.6 54.6 58.3 58 55 55 55 Mobile data customers (mln) 32.6 33.7 36.2 36.6 36.4 38.1 39.1 38.4 36.7 36.6 37.3 36.8 35.1 35.1 35.8 35.8 36.4 36.4 35.5 35.5 37 38 37 36 36 ARPU (RUB) * 293 309 324 317 302 320 334 324 315 338 350 350 333 333 348 348 353 353 335 335 n.a. n.a. n.a. n.a. n.a. MOU (min) 315 337 336 335 324 338 325 323 307 323 315 317 297 297 305 305 294 294 291 291 n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 16% 14% 14% 15% 16% 13% 15% 15% 14% 11% 12% 14% 13% 13% 12% 12% 12% 12% 13% 13% n.a. n.a. n.a. n.a. n.a. MBOU 1,931 1,906 2,037 2,308 2,565 2,716 2,816 3,047 3,234 3,454 3,773 4,285 4,697 4,697 5,046 5,046 5,759 5,759 6,667 6,667 n.a. n.a. n.a. n.a. n.a. FIXED-LINE 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19 2Q19 IFRS 16 2Q19 3Q19 IFRS 16 3Q19 4Q19 IFRS 16 4Q19 FY16 FY17 FY18 FY19 IFRS16 FY19 Total operating revenue 11,335 10,886 11,485 10,854 9,685 9,916 10,142 9,644 8,899 8,966 8,775 8,891 8,539 8,539 8,507 8,507 8,845 8,845 9,264 9,264 44,560 39,386 35,530 35,155 35,155 Service revenue 11,271 10,848 11,459 10,840 9,660 9,889 10,114 9,608 8,867 8,901 8,737 8,790 8,502 8,502 8,465 8,465 8,767 8,767 9,116 9,116 44,418 39,271 35,295 34,850 34,850 Broadband revenue 3,061 2,941 2,806 2,807 2,650 2,579 2,532 2,508 2,560 2,547 2,532 2,700 2,661 2,661 2,711 2,711 2,728 2,728 2,837 2,837 11,615 10,269 10,340 10,937 10,937 Broadband customers (mln) 2.2 2.2 2.1 2.2 2.2 2.2 2.2 2.2 2.3 2.3 2.3 2.4 2.5 2.5 2.5 2.5 2.5 2.5 2.6 2.6 2.2 2.2 2.4 2.6 2.6 Broadband ARPU (RUB) 463 452 436 435 405 392 384 376 379 373 366 381 364 364 365 365 361 361 366 366 n.a. n.a. n.a. n.a. n.a. FTTB revenue 3,013 2,897 2,775 2,776 2,623 2,548 2,508 2,484 2,526 2,518 2,506 2,671 2,631 2,631 2,662 2,662 2,651 2,651 2,758 2,758 11,460 10,163 10,221 10,701 10,701 FTTB customers (mln) 2.2 2.1 2.1 2.2 2.2 2.2 2.2 2.2 2.3 2.3 2.3 2.4 2.4 2.4 2.5 2.5 2.5 2.5 2.6 2.6 2.2 2.2 2.4 2.6 2.6 FTTB ARPU (RUB) 461 450 436 433 403 390 383 375 376 371 364 378 362 362 360 360 352 352 356 356 n.a. n.a. n.a. n.a. n.a. *ARPU calculations include MFS revenues starting from Q1 2017 ** include IFRS 16 adj's

Pakistan index page (in USD millions, unless stated otherwise, unaudited) MOBILE 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19** 2Q19 IFRS 16 2Q19** 3Q19 IFRS 16 3Q19** 4Q19 IFRS 16 4Q19** FY16 FY17 FY18 FY19 IFRS 16 FY19** Total operating revenue 351 361 368 369 370 386 391 379 368 363 395 368 362 362 347 347 286 286 324 324 1,450 1,525 1,494 1,320 1,320 Service revenue 332 341 345 346 345 359 363 350 341 337 369 344 337 337 324 324 265 265 302 302 1,364 1,418 1,391 1,228 1,228 EBITDA 136 130 147 129 154 167 208 173 175 174 192 173 183 13 170 185 11 175 140 11 130 160 12 148 542 703 713 669 47 622 EBITDA margin (%) 38.7% 36.0% 40.0% 34.9% 41.8% 43.3% 53.3% 45.8% 47.5% 47.9% 48.5% 47.0% 50.7% 47.1% 53.4% 50.3% 48.9% 45.2% 49.4% 45.6% 37.4% 46.1% 47.7% 50.7% 47.2% Capital expenditures (CAPEX) 20 57 73 96 35 360 78 63 66 57 33 43 53 1 52 66 1 65 31 1 29 70 -6 76 246 535 199 219 -3 222 CAPEX excluding licenses 20 57 73 96 35 65 78 63 66 57 33 43 53 1 52 66 1 65 31 1 29 70 -6 76 246 240 199 219 -3 222 Data Revenue 38.8 37.6 43.8 47.7 49.9 54.9 60.5 60.0 62.9 67.5 92.3 88.6 97.3 97.3 85.2 85.2 90.3 90.3 97.0 97.0 167.9 225 311 370 370 Customers (mln) 48.3 49.3 51.0 51.6 52.5 52.5 53.1 53.6 55.1 55.5 56.1 56.2 58.3 58.3 59.5 59.5 59.2 59.2 60.5 60.5 51.6 53.6 56.2 60.5 60.5 ARPU (USD) 2.4 2.3 2.3 2.3 2.2 2.3 2.3 2.2 2.1 2.0 2.2 2.0 2.0 2.0 1.8 1.8 1.5 1.5 1.7 1.7 n.a. n.a. n.a. n.a. n.a. MOU (min) * 580 566 522 540 515 520 512 515 538 543 531 539 548 548 520 520 489 489 498 498 n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 5.5% 4.3% 5.4% 6.0% 4.1% 6.1% 6.1% 6.8% 4.3% 5.3% 5.9% 5.4% 2.7% 2.7% 4.2% 4.2% 6.6% 6.6% 5.1% 5.1% n.a. n.a. n.a. n.a. n.a. MBOU 304 292 421 464 465 509 573 672 821 950 1,227 1,373 1,669 1,669 1,831 1,831 2,119 2,119 2,527 2,527 n.a. n.a. n.a. n.a. n.a. (in PKR billions, unless stated otherwise, unaudited) MOBILE 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19** 2Q19 IFRS 16 2Q19** 3Q19 IFRS 16 3Q19** 4Q19 IFRS 16 4Q19** FY16 FY17 FY18 FY19 IFRS 16 FY19** Total operating revenue 36.8 37.8 38.5 38.7 38.7 40.4 41.2 40.3 40.9 42.4 48.9 49.5 50.5 50.5 51.0 51.0 45.4 45.4 50.5 50.5 151.8 161 182 197 197 Service revenue 34.7 35.7 36.1 36.2 36.2 37.7 38.2 37.3 37.9 39.4 45.7 46.2 47.1 47.1 47.7 47.7 42.0 42.0 46.9 46.9 142.8 149 169 184 184 EBITDA 14.2 13.6 15.4 13.5 16.2 17.5 22.0 18.4 19.4 20.4 24 23 25.6 1.8 23.8 27.3 1.6 25.7 22.3 1.7 20.6 24.9 1.9 23.0 56.8 74 87 100 7 93 EBITDA margin (%) 38.7% 36.0% 40.0% 34.9% 41.8% 43.3% 53.3% 45.7% 47.5% 48.2% 48.5% 47.0% 50.7% 47.1% 53.5% 50.4% 49.0% 45.3% 49.4% 45.6% 37.4% 46.1% 47.8% 50.7% 47.1% Capital expenditures (CAPEX) 2.1 5.9 7.6 10.1 3.6 37.7 8.2 6.6 7.3 6.7 4.0 5.9 7.4 0.2 7.2 9.7 -0.1 9.8 4.8 -0.2 5.0 10.9 1.0 9.9 25.7 56 24 33 1 32 CAPEX excluding licenses 2.1 5.9 7.6 10.1 3.6 6.8 8.2 6.6 7.3 6.7 4.0 5.9 7.4 0.2 7.2 9.7 -0.1 9.8 4.8 -0.2 5.0 10.9 1.0 9.9 25.7 25 24 33 1 32 Data Revenue 4.1 3.9 4.6 5.0 5.2 5.8 6.4 6.4 7.0 7.9 11.4 11.9 13.6 13.6 12.5 12.5 14.3 14.3 15.1 15.1 17.6 24 38 56 56 Customers (mln) 48.3 49.3 51.0 51.6 52.5 52.5 53.1 53.6 55.1 55.5 56.1 56.2 58.3 58.3 59.5 59.5 59.2 59.2 60.5 60.5 51.6 53.6 56.2 60.5 60.5 ARPU (PKR) 247 245 241 244 231 238 240.9 232.4 232.2 236.9 272.3 264.8 272.4 272.4 268.2 268.2 234.1 234.1 259.7 259.7 n.a. n.a. n.a. n.a. n.a. MOU (min) * 580 566 522 540 515 520 512 515 538 543 531 539 548 548 520 520 489 489 498 498 n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 5.5% 4.3% 5.4% 6.0% 4.1% 6.1% 6.1% 6.8% 4.3% 5.3% 5.9% 5.4% 2.7% 2.7% 4.2% 4.2% 6.6% 6.6% 5.1% 5.1% n.a. n.a. n.a. n.a. n.a. MBOU 304 292 421 464 465 509 573 672 821 950 1,227 1,373 1,669 1,669 1,831 1,831 2,119 2,119 2,527 2,527 n.a. n.a. n.a. n.a. n.a. * MOU calculation is aligned with group accounting policy ** include IFRS 16 adj's

Algeria index page (in USD millions, unless stated otherwise, unaudited) MOBILE 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19** 2Q19 IFRS 16 2Q19** 3Q19 IFRS 16 3Q19** 4Q19 IFRS 16 4Q19** FY16 FY17 FY18 FY19 IFRS 16 FY19** Total operating revenue 279 251 264 246 232 232 238 214 203 200 207 203 192 192 187 187 197 197 198 198 1,040 915 813 775 775 Service revenue 276 248 263 244 228 228 233 210 201 198 206 195 192 192 187 187 197 197 194 194 1,031 898 801 769 769 EBITDA 158 128 135 125 114 104 115 92 91 87 93 93 89 8 81 84 9 75 89 8 81 92 9 83 547 426 363 354 34 320 EBITDA margin (%) 56.8% 51.1% 51.3% 50.9% 49.2% 45.1% 48.5% 42.9% 44.9% 43.4% 44.9% 45.7% 46.3% 42.1% 44.6% 39.8% 45.2% 41.1% 46.6% 42.0% 52.6% 46.5% 44.7% 45.7% 41.3% Capital expenditures (CAPEX) 27 43 76 56 26 29 42 35 14 28 16 49 21 2 20 29 0.4 29 22 0.9 21 39 0.6 39 202 132 107 112 4 108 CAPEX excluding licenses 27 43 39 56 26 29 42 35 14 28 16 49 21 2 20 29 0.4 29 22 0.9 21 39 0.6 39 165 132 107 112 4 108 Data Revenue 16.2 15.7 19.3 21.9 25.1 29.8 29.9 28.7 43.5 50.6 47.9 46.4 52.8 52.8 53.7 53.7 60.3 60.3 64.9 64.9 73.1 113 188 232 232 Customers (mln) 16.7 16.3 15.9 16.3 16.1 15.5 15.2 15.0 15.3 15.5 15.6 15.8 16.0 16.0 15.6 15.6 15.0 15.0 14.6 14.6 16.3 15.0 15.8 14.6 14.6 ARPU (USD)* 5.4 5.0 5.4 5.0 4.7 4.8 5.0 4.6 4.4 4.3 4.4 4.1 4.0 4.0 3.9 3.9 4.3 4.3 4.4 4.4 n.a. n.a. n.a. n.a. n.a. MOU (min) 351 339 335 323 365 379 415 430 437 447 448 437 420 420 413 413 421 421 430 430 n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 9.0% 9.8% 9.4% 9.9% 9.9% 10.6% 10.4% 11.0% 10.4% 10.0% 9.9% 11.7% 12.2% 12.2% 15.7% 15.7% 15.5% 15.5% 14.2% 14.2% n.a. n.a. n.a. n.a. n.a. MBOU 295 304 345 447 573 478 515 561 1,065 1,643 1,823 2,191 2,244 2,244 2,703 2,703 3,444 3,444 3,986 3,986 n.a. n.a. n.a. n.a. n.a. (in DZD billions, unless stated otherwise, unaudited) MOBILE 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19** 2Q19 IFRS 16 2Q19** 3Q19 IFRS 16 3Q19** 4Q19 IFRS 16 4Q19** FY16 FY17 FY18 FY19 IFRS 16 FY19** Total operating revenue 30.0 27.4 29.0 27.2 25.5 25.3 26.2 24.5 23.1 23.1 24.4 24.1 22.8 22.8 22.3 22.3 23.6 23.6 23.7 23.7 114 101 95 93 93 Service revenue 29.7 27.2 28.9 26.9 25.0 24.9 25.6 24.1 23.0 22.9 24.3 23.2 22.7 22.7 22.3 22.3 23.6 23.6 23.3 23.3 113 100 93 92 92 EBITDA 17.1 14.0 14.9 13.9 12.5 11.4 12.7 10.5 10.4 10.0 11.0 11.0 10.6 0.9 9.6 10.0 1.1 8.9 10.7 1.0 9.7 11.1 1.1 10.0 60 47 42 42 4 38 EBITDA margin (%) 56.8% 51.1% 51.3% 50.9% 49.2% 45.1% 48.5% 42.9% 44.9% 43.4% 44.9% 45.7% 46.3% 42.1% 44.6% 39.8% 45.2% 41.1% 46.6% 42.0% 52.6% 46.5% 44.7% 45.7% 41.3% Capital expenditures (CAPEX) 2.9 4.7 8.3 6.2 2.9 3.1 4.6 4.0 1.6 3.3 1.9 5.8 2.5 0.2 2.3 3.5 0.1 3.4 2.6 0.1 2.5 4.7 0.1 4.6 22 15 13 13 0 13 CAPEX excluding licenses 2.9 4.7 4.3 6.2 2.9 3.1 4.6 4.0 1.6 3.3 1.9 5.8 2.5 0.2 2.3 3.5 0.1 3.4 2.6 0.1 2.5 4.7 0.1 4.6 18 15 13 13 0 13 Data Revenue 1.7 1.7 2.1 2.4 2.8 3.2 3.3 3.3 5.0 5.9 5.7 5.5 6.3 6.3 6.4 6.4 7.2 7.2 7.8 7.8 8.0 13 22 28 28 Customers (mln) 16.7 16.3 15.9 16.3 16.1 15.5 15.2 15.0 15.3 15.5 15.6 15.8 16.0 16.0 15.6 15.6 15.0 15.0 14.6 14.6 16.3 15.0 15.8 14.6 14.6 ARPU (DZD)* 586 546 593 555 513 522 553.4 528.3 503.7 495.5 518.1 489.0 474.3 474.3 468.6 468.6 511.6 511.6 523.7 523.7 n.a. n.a. n.a. n.a. n.a. MOU (min) 351 339 335 323 365 379 414.9 430 437 447 448 437 420 420 413 413 421 421 430 430 n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 9% 10% 9% 10% 10% 11% 10.4% 11.0% 10.4% 10.0% 9.9% 11.7% 12.2% 12.2% 15.7% 15.7% 15.5% 15.5% 14.2% 14.2% n.a. n.a. n.a. n.a. n.a. MBOU 295 304 345 447 573 478 514.7 561 1,065 1,643 1,823 2,191 2,244 2,244 2,703 2,703 3,444 3,444 3,986 3,986 n.a. n.a. n.a. n.a. n.a. *ARPU calculations include MFS revenues starting from Q1 2017 ** include IFRS 16 adj's

Bangladesh index page (in USD millions, unless stated otherwise, unaudited) MOBILE 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19** 2Q19 IFRS 16 2Q19** 3Q19 IFRS 16 3Q19** 4Q19 IFRS 16 4Q19** FY16 FY17 FY18 FY19 IFRS 16 FY19** Total operating revenue 155 157 157 152 151 148 144 131 129 131 131 130 134 134 137 137 135 135 131 131 621 574 521 537 537 Service revenue 153 152 153 147 147 144 140 127 125 125 127 127 131 131 134 134 133 133 128 128 606 557 504 525 525 EBITDA 70 69 73 55 69 61 56 47 47 45 47 45 60 10 50 55 10 45 55 10 45 53 10 43 267 233 183 222 40 182 EBITDA margin (%) 45.3% 43.7% 46.7% 36.4% 45.9% 41.1% 38.6% 36.1% 36.1% 34.4% 35.9% 34.3% 44.8% 37.4% 39.8% 32.7% 40.9% 33.2% 40.3% 32.7% 43.1% 40.6% 35.2% 41.4% 34.0% Capital expenditures (CAPEX) 17 33 22 65 10 18 28 46 385 21 9 8 16 2 14 22 0.4 21 27 2.2 25 32 11.2 20 137 101 423 96 16 80 CAPEX excluding licenses 17 33 22 65 10 18 28 46 55 21 9 8 16 2 14 22 0.4 21 27 2.2 25 32 11.2 20 137 101 93 96 16 80 Data Revenue 13.6 14.9 16.6 17.5 19.2 19.0 20.5 19.2 19.8 21.0 22.2 23.6 26.7 26.7 26.7 26.7 27.8 27.8 27.7 27.7 63 78 87 109 109 Customers (mln) 31.6 31.1 29.0 30.4 30.5 30.7 31.4 31.3 32.2 32.0 32.3 32.3 33.0 33.0 32.9 32.9 33.1 33.1 33.6 33.6 30.4 31.3 32.3 33.6 33.6 ARPU (USD) 1.6 1.6 1.7 1.6 1.6 1.6 1.5 1.3 1.3 1.3 1.3 1.3 1.3 1.3 1.4 1.4 1.3 1.3 1.3 1.3 n.a. n.a. n.a. n.a. n.a. MOU (min) * 311.4 315.7 321.9 321.7 305.4 285.4 280.1 274.3 271.6 270.0 254.7 231.7 231.6 231.6 235.7 235.7 232.2 232.2 226.2 226.2 n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 4.5% 4.7% 13.9% 4.6% 5.5% 5.4% 5.9% 6.9% 6.0% 6.7% 5.9% 7.5% 6.2% 6.2% 7.9% 7.9% 7.7% 7.7% 6.3% 6.3% n.a. n.a. n.a. n.a. n.a. MBOU 157 167 254 391 304 364 523 580 600 684 734 1,024 1,200 1,200 1,250 1,250 1,344 1,344 1,370 1,370 n.a. n.a. n.a. n.a. n.a. (in BDT billions, unless stated otherwise, unaudited) MOBILE 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19** 2Q19 IFRS 16 2Q19** 3Q19 IFRS 16 3Q19** 4Q19 IFRS 16 4Q19** FY16 FY17 FY18 FY19 IFRS 16 FY19** Total operating revenue 12.2 12.3 12.3 12.0 12.0 12.0 11.7 10.8 10.7 10.9 11.0 11.0 11.2 11.2 11.5 11.5 11.4 11.4 11.1 11.1 48.7 46 44 45 45 Service revenue 12.0 11.9 12.0 11.6 11.7 11.6 11.3 10.4 10.4 10.5 10.7 10.7 11.0 11.0 11.3 11.3 11.2 11.2 10.9 10.9 47.5 45 42 44 44 EBITDA 5.5 5.4 5.7 4.4 5.5 4.9 4.5 3.9 3.9 3.8 4.0 3.8 5.0 0.8 4.2 4.6 0.8 3.8 4.7 0.9 3.8 4.5 0.8 3.6 21.0 19 15 19 3 15 EBITDA margin (%) 45.3% 43.7% 46.7% 36.4% 46.0% 41.1% 38.6% 36.1% 36.1% 34.4% 35.9% 34.3% 44.8% 37.4% 39.8% 32.7% 40.9% 33.2% 40.3% 32.7% 43.1% 40.5% 35.2% 41.4% 34.0% Capital expenditures (CAPEX) 1.3 2.6 1.7 5.1 0.8 1.4 2.3 3.7 32.1 1.7 0.8 0.7 1.3 0.2 1.2 1.8 0.0 1.8 2.3 0.2 2.1 2.7 1.0 1.7 10.7 8 35 8 1 7 CAPEX excluding licenses 1.3 2.6 1.7 5.1 0.8 1.4 2.3 3.7 4.6 1.7 0.8 0.7 1.3 0.2 1.2 1.8 0.0 1.8 2.3 0.2 2.1 2.7 1.0 1.7 10.7 8 8 8 1 7 Data Revenue 1.1 1.2 1.3 1.4 1.5 1.5 1.7 1.6 1.6 1.8 1.9 2.0 2.2 2.2 2.3 2.3 2.3 2.3 2.3 2.3 4.9 6 7 9 9 Customers (mln) 31.6 31.1 29.0 30.4 30.5 30.7 31.4 31.3 32.2 32.0 32.3 32.3 33.0 33.0 32.9 32.9 33.1 33.1 33.6 33.6 30.4 31.3 32.3 33.6 33.6 ARPU (BDT) 125 126 133 130 128 127 121 111 109 109 110 110 112 112 114 114 113 113 109 109 n.a. n.a. n.a. n.a. n.a. MOU (min) * 311 316 322 322 305 285 280 274 272 270 255 232 232 232 236 236 232 232 226 226 n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 4.5% 4.7% 13.9% 4.6% 5.5% 5.4% 5.9% 6.9% 6.0% 6.7% 5.9% 7.5% 6.2% 6.2% 7.9% 7.9% 7.7% 7.7% 6.3% 6.3% n.a. n.a. n.a. n.a. n.a. MBOU 157 167 254 391 304 364 523 580 600 684 734 1,024 1,200 1,200 1,250 1,250 1,344 1,344 1,370 1,370 n.a. n.a. n.a. n.a. n.a. * Starting from 1Q15 MOU is reported (not MOU billed) due to alingment with the Group policies. ** include IFRS 16 adj's

Ukraine index page (in USD millions, unless stated otherwise, unaudited) CONSOLIDATED 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19** 2Q19 IFRS 16 2Q19** 3Q19 IFRS 16 3Q19** 4Q19 IFRS 16 4Q19** FY16 FY17 FY18 FY19 IFRS 16 FY19** Total operating revenue 135 146 155 150 143 153 167 159 156 173 180 179 188 188 212 212 231 231 240 240 586 622 688 870 870 EBITDA 71 80 86 69 77 87 91 92 89 95 104 100 118 5 113 138 6 132 149 6 143 167 7 160 306 347 387 572 24 548 EBITDA margin (%) 52.5% 55.0% 55.4% 46.3% 53.6% 56.8% 54.4% 58.0% 56.7% 55.1% 57.5% 55.8% 62.9% 60.2% 65.0% 62.4% 64.8% 62.1% 69.5% 66.6% 52.3% 55.7% 56.3% 65.7% 63.0% Capital expenditures (CAPEX) 10 30 34 33 29 38 27 20 91 120 28 35 36 7 29 44 6 38 55 7 48 67 26 41 106 114 275 202 45 156 CAPEX excluding licenses 9 29 33 32 27 27 25 20 26 35 27 27 36 7 29 43 6 37 55 7 48 67 26 41 104 98 115 201 45 156 MOBILE 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19 2Q19 IFRS 16 2Q19 3Q19 IFRS 16 3Q19 4Q19 IFRS 16 4Q19 FY16 FY17 FY18 FY19 IFRS16 FY19 Total operating revenue 125 136 144 139 132 143 156 149 145 161 169 168 175 175 198 198 216 216 223 223 545 580 644 812 812 Service revenue 125 135 144 139 132 142 155 148 145 160 168 167 175 175 198 198 216 216 223 223 542 577 641 812 812 Data Revenue 19.3 21.5 25.9 28.2 31.2 35.3 43.4 44.6 49.2 60.1 74.7 79.3 90.0 90.0 104.8 104.8 110.8 110.8 115.9 115.9 95 154 263 421 421 Customers (mln) 25.3 25.4 26.3 26.1 26.0 26.1 26.4 26.5 26.5 26.5 26.6 26.4 26.3 26.3 26.2 26.2 26.4 26.4 26.2 26.2 26.1 26.5 26.4 26.2 26.2 ARPU (USD) 1.6 1.7 1.8 1.7 1.7 1.8 1.9 1.8 1.8 2.0 2.1 2.1 2.2 2.2 2.5 2.5 2.7 2.7 2.8 2.8 n.a. n.a. n.a. n.a. n.a. MOU (min) 572 559 544 565 574 573 570 589 586 580 565 584 585 585 571 571 566 566 577 577 n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 5.0% 4.5% 2.6% 6.2% 5.3% 4.4% 4.4% 5.0% 4.8% 4.8% 5.2% 5.6% 4.4% 4.4% 4.7% 4.7% 4.3% 4.3% 4.7% 4.7% n.a. n.a. n.a. n.a. n.a. FIXED-LINE 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19 2Q19 IFRS 16 2Q19 3Q19 IFRS 16 3Q19 4Q19 IFRS 16 4Q19 FY16 FY17 FY18 FY19 IFRS16 FY19 Total operating revenue 10 10 10 10 11 10 11 11 11 11 11 11 12 12 13 13 13 13 15 15 41 43 44 52 52 Service revenue 10 10 10 10 11 10 11 11 11 11 11 11 12 12 13 13 13 13 15 15 41 43 44 52 52 Broadband revenue 6 6 6 6 6 6 6 6 7 7 7 7 8 8 8 8 9 9 9 9 24 26 27 34 34 Broadband customers (mln) 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.9 0.9 0.9 0.9 0.9 1.0 1.0 1.0 1.0 1.0 1.0 0.8 0.8 0.9 1.0 0.9 Broadband ARPU (USD) 2.3 2.5 2.5 2.5 2.6 2.6 2.7 2.6 2.6 2.8 2.6 2.5 2.8 2.8 2.9 2.9 2.9 2.9 3.1 3.1 n.a n.a n.a n.a n.a (in UAH millions, unless stated otherwise, unaudited) CONSOLIDATED 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19** 2Q19 IFRS 16 2Q19** 3Q19 IFRS 16 3Q19** 4Q19 IFRS 16 4Q19** FY16 FY17 FY18 FY19 IFRS 16 FY19** Total operating revenue 3,468 3,689 3,922 3,881 3,871 4,058 4,316 4,297 4,263 4,521 4,925 5,009 5,125 5,125 5,624 5,624 5,828 5,828 5,815 5,815 14,960 16,542 18,719 22,392 22,392 EBITDA 1,822 2,027 2,170 1,793 2,073 2,305 2,349 2,494 2,412 2,490 2,833 2,793 3,223 140 3,083 3,656 148 3,508 3,772 154 3,619 4,031 165 3,866 7,811 9,221 10,529 14,683 607 14,076 EBITDA margin (%) 52.5% 54.9% 55.3% 46.2% 53.6% 56.8% 54.4% 58.0% 56.6% 55.1% 57.5% 55.8% 62.9% 60.2% 65.0% 62.4% 64.7% 62.1% 69.3% 66.5% 52.2% 55.7% 56.2% 65.6% 62.9% Capital expenditures (CAPEX) 264 745 868 847 782 1,009 697 535 2,416 3,152 772 982 983 188 795 1,159 160 998 1,385 177 1,208 1,606 612 994 2,723 3,023 7,322 5,134 1,138 3,996 CAPEX excluding licenses 249 727 860 836 737 705 643 534 687 927 737 749 983 188 795 1,152 160 991 1,370 177 1,193 1,606 612 994 2,672 2,618 3,100 5,111 1,138 3,972 MOBILE 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19 2Q19 IFRS 16 2Q19 3Q19 IFRS 16 3Q19 4Q19 IFRS 16 4Q19 FY16 FY17 FY18 FY19 IFRS16 FY19 Total operating revenue 3,209 3,427 3,661 3,611 3,576 3,781 4,042 4,012 3,968 4,224 4,624 4,698 4,772 4,772 5,248 5,248 5,466 5,466 5,417 5,417 13,908 15,411 17,513 20,903 20,903 Service revenue 3,199 3,399 3,652 3,601 3,560 3,768 4,024 3,986 3,949 4,200 4,602 4,671 4,763 4,763 5,257 5,257 5,466 5,466 5,417 5,417 13,851 15,338 17,421 20,903 20,903 Data Revenue 496 544 659 731 845 933 1,123.1 1,201.7 1,340.9 1,574.1 2,044.8 2,217.1 2,453.7 2,453.7 2,784.4 2,784.4 2,798.7 2,798.7 2,809.8 2,809.8 2,429 4,103 7,177 10,847 10,847 Customers (mln)* 25.3 25.4 26.3 26.1 26.0 26.1 26.4 26.5 26.5 26.5 26.6 26.4 26.3 26.3 26.2 26.2 26.4 26.4 26.2 26.2 26.1 26.5 26.4 26.2 26.2 ARPU (UAH) 41.6 43.8 46.2 45.2 44.9 47.5 50.0 49.3 48.7 52.1 57.2 58.2 59.8 59.8 66.2 66.2 68.6 68.6 68.3 68.3 n.a. n.a. n.a. n.a. n.a. MOU (min) 572 559 544 565 574 573 570 589 586 580 565 584 585 585 571 571 566 566 577 577 n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 5.0% 4.5% 2.6% 6.2% 5.3% 4.4% 4.4% 5.0% 4.8% 4.8% 5.2% 5.6% 4.4% 4.4% 4.7% 4.7% 4.3% 4.3% 4.7% 4.7% n.a. n.a. n.a. n.a. n.a. FIXED-LINE 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19 2Q19 IFRS 16 2Q19 3Q19 IFRS 16 3Q19 4Q19 IFRS 16 4Q19 FY16 FY17 FY18 FY19 IFRS16 FY19 Total operating revenue 259 262 261 270 295 277 275 285 295 297 302 311 329 329 333 333 333 333 355 355 1,052 1,132 1,206 1,350 1,350 Service revenue 259 262 261 270 295 277 275 285 295 297 302 311 329 329 333 333 333 333 355 355 1,052 1,132 1,206 1,350 1,350 Broadband revenue 148 150.7 150.0 156 170 169 167 170 181 185 186 190 209 209 215 215 216 216 224 224 604 678 741 864 864 Broadband customers (mln) 0.8 0.81 0.80 0.8 0.8 0.8 0.80 0.86 0.84 0.86 0.88 0.91 0.94 0.94 0.96 0.96 0.98 0.98 1.01 1.01 0.8 0.8 0.9 1.0 1.0 Broadband ARPU (UAH) 61 61.9 62.18 64 69 70 69.2 68.3 71.0 72.6 71.1 70.5 75.2 75.2 75.8 75.8 74.2 74.2 74.9 74.9 n.a n.a n.a n.a n.a *ARPU calculations include MFS revenues starting from Q1 2017 ** include IFRS 16 adj's

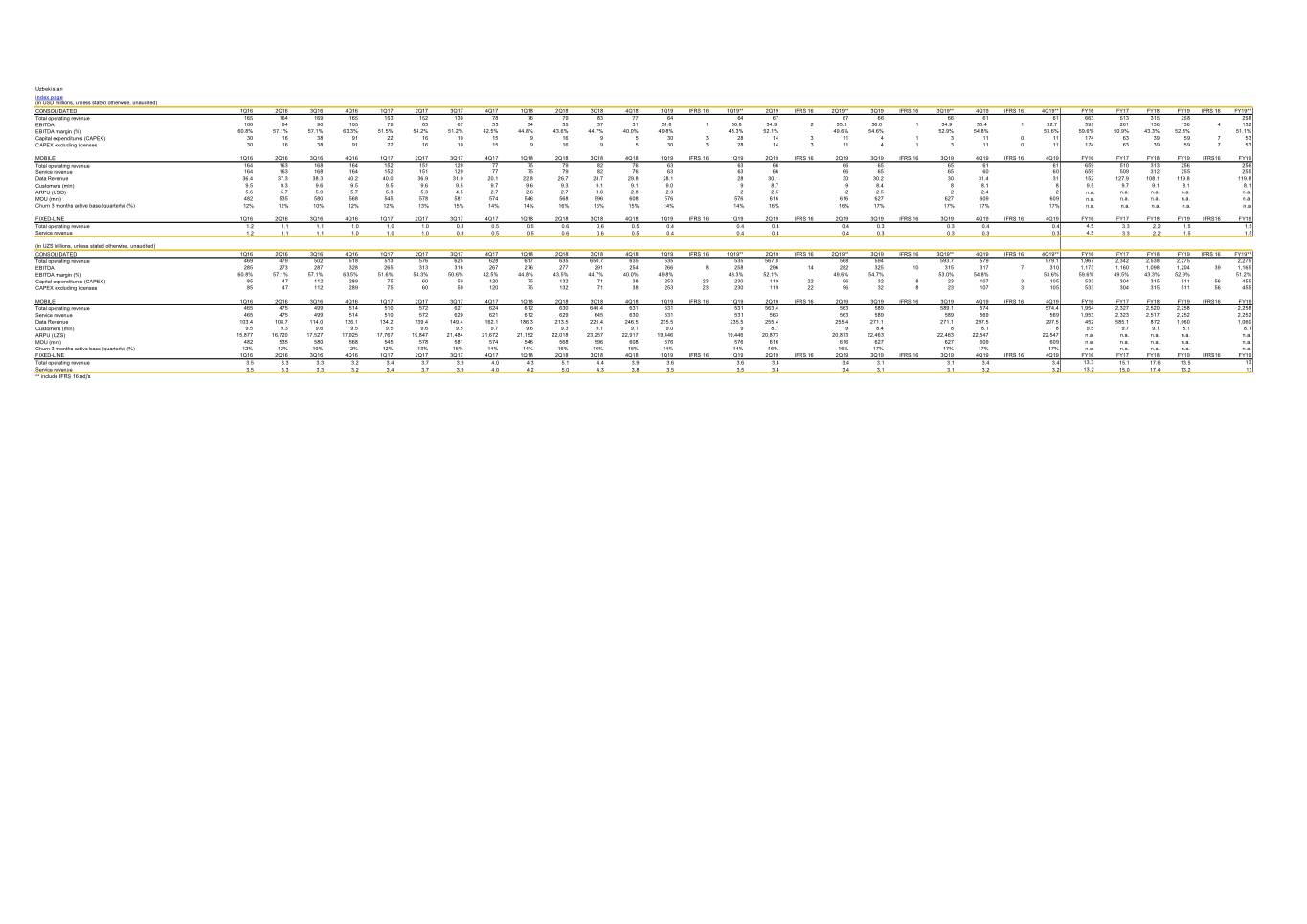

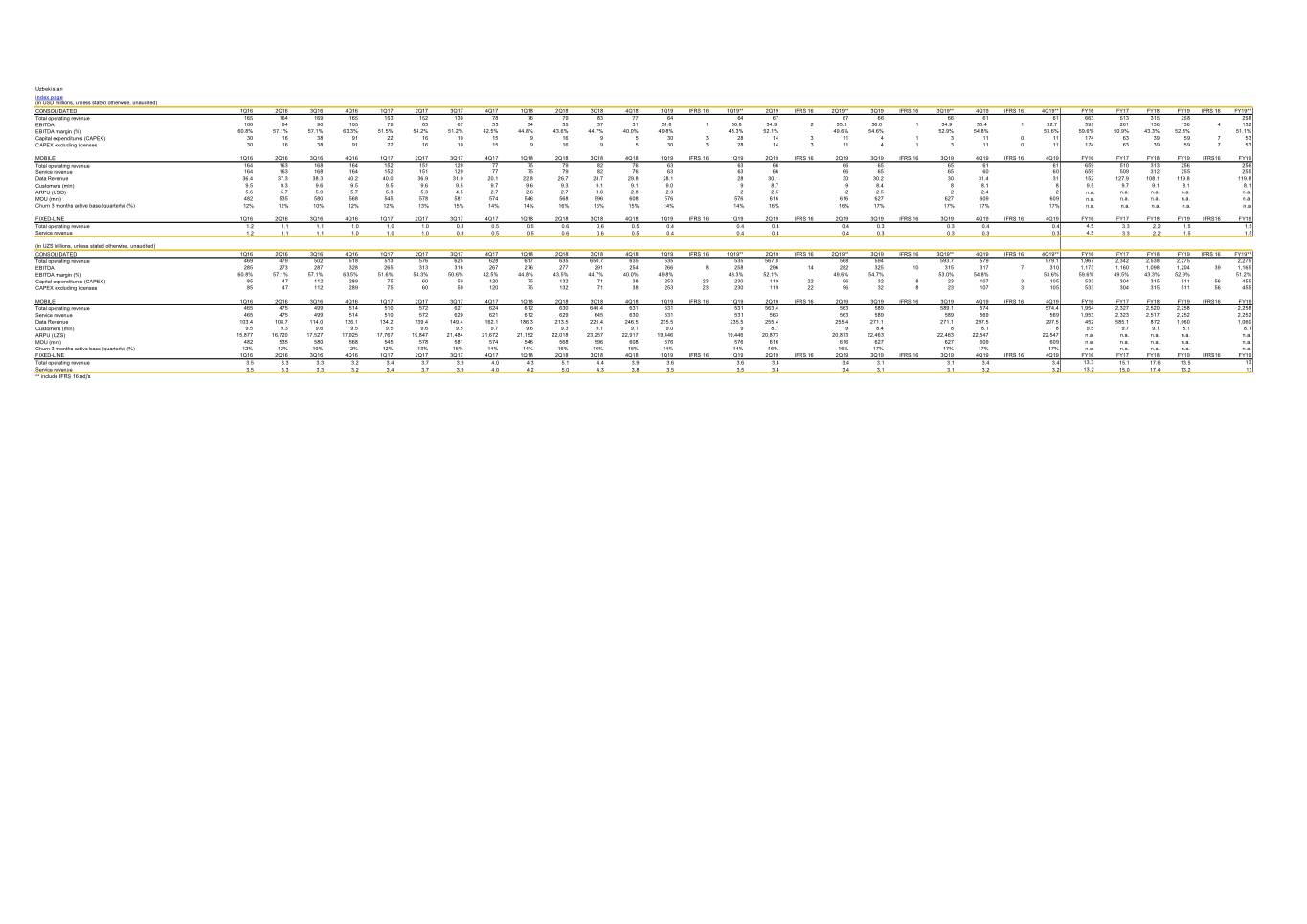

Uzbekistan index page (in USD millions, unless stated otherwise, unaudited) CONSOLIDATED 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19** 2Q19 IFRS 16 2Q19** 3Q19 IFRS 16 3Q19** 4Q19 IFRS 16 4Q19** FY16 FY17 FY18 FY19 IFRS 16 FY19** Total operating revenue 165 164 169 165 153 152 130 78 76 79 83 77 64 64 67 67 66 66 61 61 663 513 315 258 258 EBITDA 100 94 96 105 79 83 67 33 34 35 37 31 31.8 1 30.8 34.9 2 33.3 36.0 1 34.9 33.4 1 32.7 395 261 136 136 4 132 EBITDA margin (%) 60.8% 57.1% 57.1% 63.3% 51.5% 54.2% 51.2% 42.5% 44.8% 43.6% 44.7% 40.0% 49.8% 48.3% 52.1% 49.6% 54.6% 52.9% 54.8% 53.6% 59.6% 50.9% 43.3% 52.8% 51.1% Capital expenditures (CAPEX) 30 16 38 91 22 16 10 15 9 16 9 5 30 3 28 14 3 11 4 1 3 11 0 11 174 63 39 59 7 53 CAPEX excluding licenses 30 16 38 91 22 16 10 15 9 16 9 5 30 3 28 14 3 11 4 1 3 11 0 11 174 63 39 59 7 53 MOBILE 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19 2Q19 IFRS 16 2Q19 3Q19 IFRS 16 3Q19 4Q19 IFRS 16 4Q19 FY16 FY17 FY18 FY19 IFRS16 FY19 Total operating revenue 164 163 168 164 152 151 129 77 75 79 82 76 63 63 66 66 65 65 61 61 659 510 313 256 256 Service revenue 164 163 168 164 152 151 129 77 75 79 82 76 63 63 66 66 65 65 60 60 659 509 312 255 255 Data Revenue 36.4 37.3 38.3 40.2 40.0 36.9 31.0 20.1 22.8 26.7 28.7 29.8 28.1 28 30.1 30 30.2 30 31.4 31 152 127.9 108.1 119.8 119.8 Customers (mln) 9.5 9.3 9.6 9.5 9.5 9.6 9.5 9.7 9.6 9.3 9.1 9.1 9.0 9 8.7 9 8.4 8 8.1 8 9.5 9.7 9.1 8.1 8.1 ARPU (USD) 5.6 5.7 5.9 5.7 5.3 5.3 4.5 2.7 2.6 2.7 3.0 2.8 2.3 2 2.5 2 2.5 2 2.4 2 n.a. n.a. n.a. n.a. n.a. MOU (min) 482 535 580 568 545 578 581 574 546 568 596 608 576 576 616 616 627 627 609 609 n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 12% 12% 10% 12% 12% 13% 15% 14% 14% 16% 16% 15% 14% 14% 16% 16% 17% 17% 17% 17% n.a. n.a. n.a. n.a. n.a. FIXED-LINE 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19 2Q19 IFRS 16 2Q19 3Q19 IFRS 16 3Q19 4Q19 IFRS 16 4Q19 FY16 FY17 FY18 FY19 IFRS16 FY19 Total operating revenue 1.2 1.1 1.1 1.0 1.0 1.0 0.8 0.5 0.5 0.6 0.6 0.5 0.4 0.4 0.4 0.4 0.3 0.3 0.4 0.4 4.5 3.3 2.2 1.5 1.5 Service revenue 1.2 1.1 1.1 1.0 1.0 1.0 0.8 0.5 0.5 0.6 0.6 0.5 0.4 0.4 0.4 0.4 0.3 0.3 0.3 0.3 4.5 3.3 2.2 1.5 1.5 (in UZS billions, unless stated otherwise, unaudited) CONSOLIDATED 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19** 2Q19 IFRS 16 2Q19** 3Q19 IFRS 16 3Q19** 4Q19 IFRS 16 4Q19** FY16 FY17 FY18 FY19 IFRS 16 FY19** Total operating revenue 469 479 502 518 513 576 625 628 617 635 650.7 635 535 535 567.8 568 594 593.7 579 579.1 1,967 2,342 2,538 2,275 2,275 EBITDA 285 273 287 328 265 313 316 267 276 277 291 254 266 8 258 296 14 282 325 10 315 317 7 310 1,173 1,160 1,098 1,204 39 1,165 EBITDA margin (%) 60.8% 57.1% 57.1% 63.5% 51.6% 54.3% 50.6% 42.5% 44.8% 43.5% 44.7% 40.0% 49.8% 48.3% 52.1% 49.6% 54.7% 53.0% 54.8% 53.6% 59.6% 49.5% 43.3% 52.9% 51.2% Capital expenditures (CAPEX) 85 47 112 289 75 60 50 120 75 132 71 38 253 23 230 119 22 96 32 8 23 107 3 105 533 304 315 511 56 455 CAPEX excluding licenses 85 47 112 289 75 60 50 120 75 132 71 38 253 23 230 119 22 96 32 8 23 107 3 105 533 304 315 511 56 455 MOBILE 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19 2Q19 IFRS 16 2Q19 3Q19 IFRS 16 3Q19 4Q19 IFRS 16 4Q19 FY16 FY17 FY18 FY19 IFRS16 FY19 Total operating revenue 465 475 499 514 510 572 621 624 612 630 646.4 631 531 531 563.4 563 589 589.1 574 574.4 1,954 2,327 2,520 2,258 2,258 Service revenue 465 475 499 514 510 572 620 621 612 629 645 630 531 531 563 563 589 589 569 569 1,953 2,323 2,517 2,252 2,252 Data Revenue 103.4 108.7 114.0 126.1 134.2 139.4 149.4 162.1 186.3 213.5 225.4 246.5 235.5 235.5 255.4 255.4 271.1 271.1 297.5 297.5 452 585.1 872 1,060 1,060 Customers (mln) 9.5 9.3 9.6 9.5 9.5 9.6 9.5 9.7 9.6 9.3 9.1 9.1 9.0 9 8.7 9 8.4 8 8.1 8 9.5 9.7 9.1 8.1 8.1 ARPU (UZS) 15,877 16,720 17,527 17,925 17,767 19,847 21,484 21,672 21,152 22,018 23,257 22,917 19,446 19,446 20,873 20,873 22,463 22,463 22,547 22,547 n.a. n.a. n.a. n.a. n.a. MOU (min) 482 535 580 568 545 578 581 574 546 568 596 608 576 576 616 616 627 627 609 609 n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 12% 12% 10% 12% 12% 13% 15% 14% 14% 16% 16% 15% 14% 14% 16% 16% 17% 17% 17% 17% n.a. n.a. n.a. n.a. n.a. FIXED-LINE 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19 2Q19 IFRS 16 2Q19 3Q19 IFRS 16 3Q19 4Q19 IFRS 16 4Q19 FY16 FY17 FY18 FY19 IFRS16 FY19 Total operating revenue 3.5 3.3 3.3 3.2 3.4 3.7 3.9 4.0 4.3 5.1 4.4 3.9 3.6 3.6 3.4 3.4 3.1 3.1 3.4 3.4 13.3 15.1 17.6 13.5 13 Service revenue 3.5 3.3 3.3 3.2 3.4 3.7 3.9 4.0 4.2 5.0 4.3 3.8 3.5 3.5 3.4 3.4 3.1 3.1 3.2 3.2 13.2 15.0 17.4 13.2 13 ** include IFRS 16 adj's

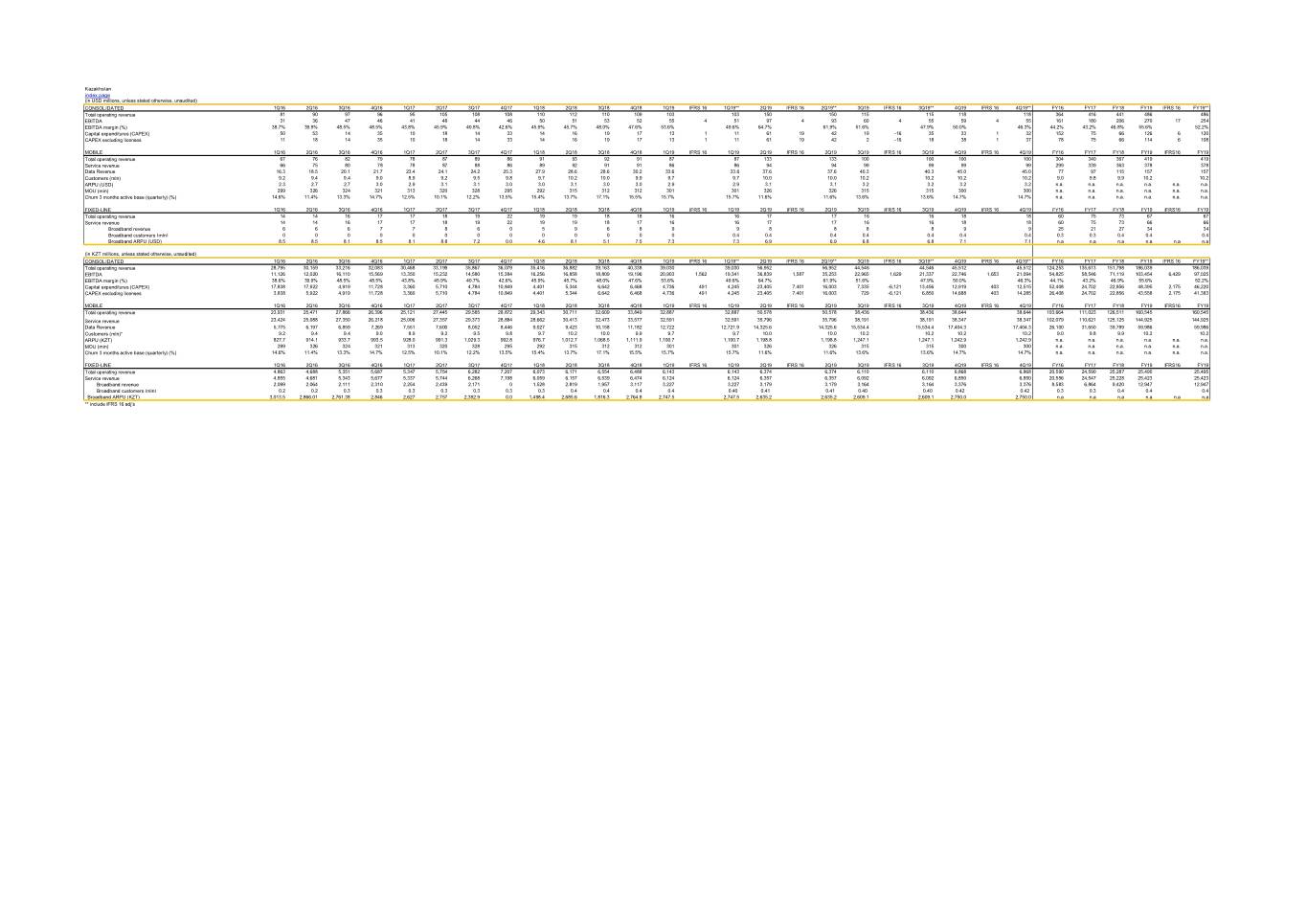

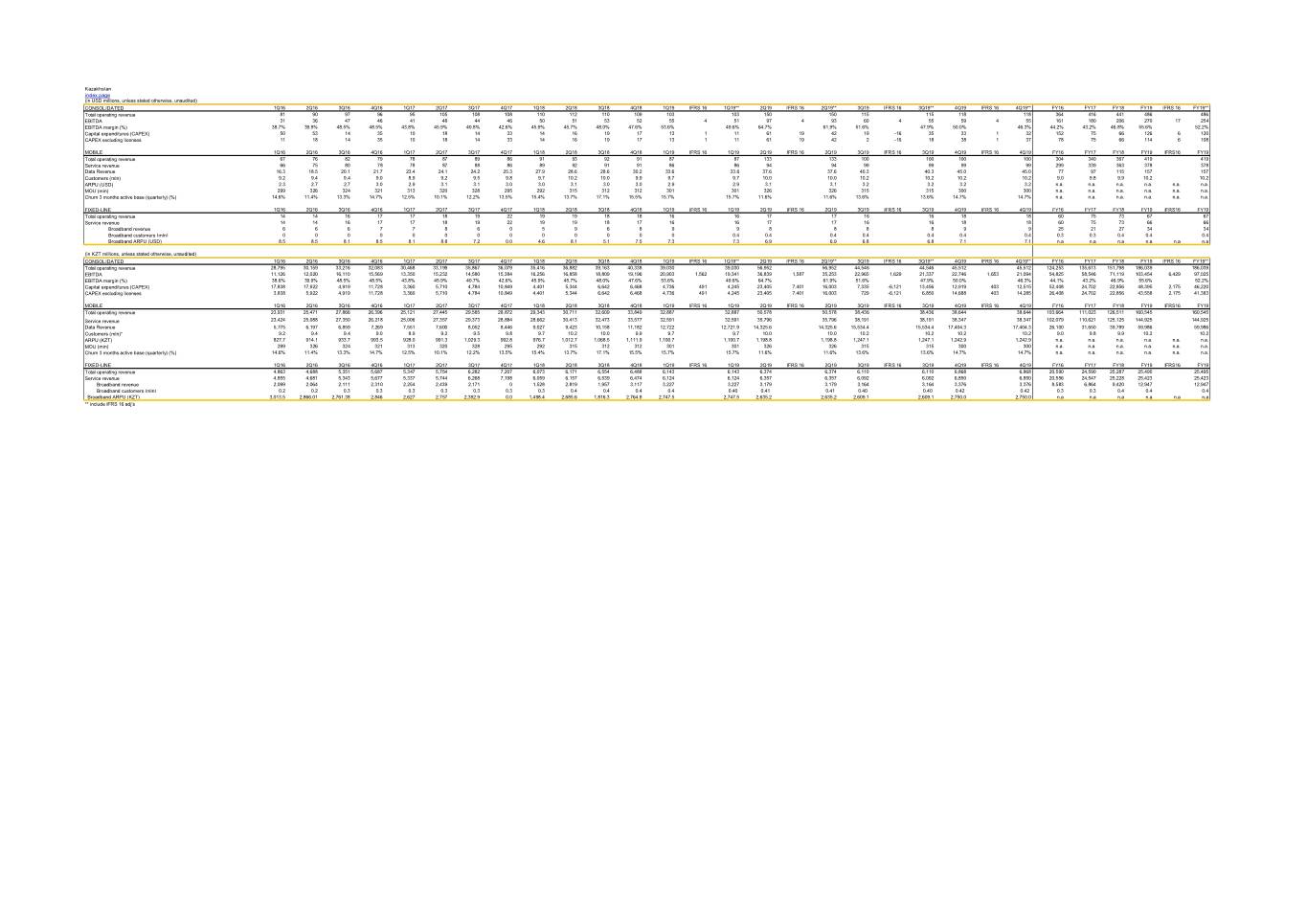

Kazakhstan index page (in USD millions, unless stated otherwise, unaudited) CONSOLIDATED 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19** 2Q19 IFRS 16 2Q19** 3Q19 IFRS 16 3Q19** 4Q19 IFRS 16 4Q19** FY16 FY17 FY18 FY19 IFRS 16 FY19** Total operating revenue 81 90 97 96 95 105 108 108 110 112 110 109 103 103 150 150 115 115 118 118 364 416 441 486 486 EBITDA 31 36 47 46 41 48 44 46 50 51 53 52 55 4 51 97 4 93 60 4 55 59 4 55 161 180 206 270 17 254 EBITDA margin (%) 38.7% 39.9% 48.5% 48.5% 43.8% 45.9% 40.8% 42.6% 45.9% 45.7% 48.0% 47.6% 53.6% 49.6% 64.7% 61.9% 51.6% 47.9% 50.0% 46.3% 44.2% 43.2% 46.8% 55.6% 52.2% Capital expenditures (CAPEX) 50 53 14 35 10 18 14 33 14 16 19 17 13 1 11 61 19 42 19 -16 35 33 1 32 152 75 66 126 6 120 CAPEX excluding licenses 11 18 14 35 10 18 14 33 14 16 19 17 13 1 11 61 19 42 2 -16 18 38 1 37 78 75 66 114 6 108 MOBILE 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19 2Q19 IFRS 16 2Q19 3Q19 IFRS 16 3Q19 4Q19 IFRS 16 4Q19 FY16 FY17 FY18 FY19 IFRS16 FY19 Total operating revenue 67 76 82 79 78 87 89 86 91 93 92 91 87 87 133 133 100 100 100 100 304 340 367 419 419 Service revenue 66 75 80 78 78 87 88 86 89 92 91 91 86 86 94 94 99 99 99 99 299 339 363 378 378 Data Revenue 16.3 18.5 20.1 21.7 23.4 24.1 24.2 25.3 27.9 28.6 28.6 30.2 33.6 33.6 37.6 37.6 40.3 40.3 45.0 45.0 77 97 115 157 157 Customers (mln) 9.2 9.4 9.4 9.0 8.9 9.2 9.5 9.8 9.7 10.2 10.0 9.9 9.7 9.7 10.0 10.0 10.2 10.2 10.2 10.2 9.0 9.8 9.9 10.2 10.2 ARPU (USD) 2.3 2.7 2.7 3.0 2.9 3.1 3.1 3.0 3.0 3.1 3.0 3.0 2.9 2.9 3.1 3.1 3.2 3.2 3.2 3.2 n.a. n.a. n.a. n.a. n.a. n.a. MOU (min) 299 326 324 321 313 320 328 295 292 315 312 312 301 301 326 326 315 315 300 300 n.a. n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 14.6% 11.4% 13.3% 14.7% 12.5% 10.1% 12.2% 13.5% 15.4% 13.7% 17.1% 15.5% 15.7% 15.7% 11.6% 11.6% 13.6% 13.6% 14.7% 14.7% n.a. n.a. n.a. n.a. n.a. n.a. FIXED-LINE 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19 2Q19 IFRS 16 2Q19 3Q19 IFRS 16 3Q19 4Q19 IFRS 16 4Q19 FY16 FY17 FY18 FY19 IFRS16 FY19 Total operating revenue 14 14 16 17 17 18 19 22 19 19 18 18 16 16 17 17 16 16 18 18 60 75 73 67 67 Service revenue 14 14 16 17 17 18 19 22 19 19 18 17 16 16 17 17 16 16 18 18 60 75 73 66 66 Broadband revenue 6 6 6 7 7 8 6 0 5 9 6 8 9 9 8 8 8 8 9 9 25 21 27 34 34 Broadband customers (mln) 0 0 0 0 0 0 0 0 0 0 0 0 0 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.3 0.3 0.4 0.4 0.4 Broadband ARPU (USD) 8.5 8.5 8.1 8.5 8.1 8.8 7.2 0.0 4.6 8.1 5.1 7.5 7.3 7.3 6.9 6.9 6.8 6.8 7.1 7.1 n.a n.a n.a n.a n.a n.a (in KZT millions, unless stated otherwise, unaudited) CONSOLIDATED 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19** 2Q19 IFRS 16 2Q19** 3Q19 IFRS 16 3Q19** 4Q19 IFRS 16 4Q19** FY16 FY17 FY18 FY19 IFRS 16 FY19** Total operating revenue 28,795 30,159 33,216 32,083 30,468 33,199 35,867 36,079 35,416 36,882 39,163 40,338 39,030 39,030 56,952 56,952 44,546 44,546 45,512 45,512 124,253 135,613 151,798 186,039 186,039 EBITDA 11,126 12,020 16,110 15,569 13,350 15,232 14,580 15,384 16,256 16,858 18,809 19,196 20,903 1,562 19,341 36,839 1,587 35,253 22,965 1,629 21,337 22,746 1,653 21,094 54,825 58,546 71,119 103,454 6,429 97,025 EBITDA margin (%) 38.6% 39.9% 48.5% 48.5% 43.8% 45.9% 40.7% 42.6% 45.9% 45.7% 48.0% 47.6% 53.6% 49.6% 64.7% 61.9% 51.6% 47.9% 50.0% 46.3% 44.1% 43.2% 46.9% 55.6% 52.2% Capital expenditures (CAPEX) 17,838 17,922 4,919 11,728 3,360 5,710 4,784 10,849 4,401 5,344 6,642 6,468 4,736 491 4,245 23,405 7,401 16,003 7,335 -6,121 13,456 12,919 403 12,515 52,408 24,702 22,856 48,395 2,175 46,220 CAPEX excluding licenses 3,838 5,922 4,919 11,728 3,360 5,710 4,784 10,849 4,401 5,344 6,642 6,468 4,736 491 4,245 23,405 7,401 16,003 729 -6,121 6,850 14,688 403 14,285 26,408 24,702 22,856 43,558 2,175 41,383 MOBILE 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19 2Q19 IFRS 16 2Q19 3Q19 IFRS 16 3Q19 4Q19 IFRS 16 4Q19 FY16 FY17 FY18 FY19 IFRS16 FY19 Total operating revenue 23,931 25,471 27,866 26,396 25,121 27,445 29,585 28,872 29,343 30,711 32,609 33,849 32,887 32,887 50,578 50,578 38,436 38,436 38,644 38,644 103,664 111,023 126,511 160,545 160,545 Service revenue 23,424 25,088 27,350 26,218 25,006 27,357 29,373 28,884 28,662 30,413 32,473 33,577 32,591 32,591 35,796 35,796 38,191 38,191 38,347 38,347 102,079 110,621 125,125 144,925 144,925 Data Revenue 5,775 6,197 6,859 7,269 7,551 7,600 8,052 8,446 9,027 9,423 10,158 11,182 12,722 12,721.9 14,325.6 14,325.6 15,534.4 15,534.4 17,404.3 17,404.3 26,100 31,650 39,789 59,986 59,986 Customers (mln)* 9.2 9.4 9.4 9.0 8.9 9.2 9.5 9.8 9.7 10.2 10.0 9.9 9.7 9.7 10.0 10.0 10.2 10.2 10.2 10.2 9.0 9.8 9.9 10.2 10.2 ARPU (KZT) 827.7 914.1 933.7 993.5 928.0 991.3 1,029.3 992.8 976.7 1,012.7 1,068.5 1,111.9 1,100.7 1,100.7 1,198.8 1,198.8 1,247.1 1,247.1 1,242.9 1,242.9 n.a. n.a. n.a. n.a. n.a. n.a. MOU (min) 299 326 324 321 313 320 328 295 292 315 312 312 301 301 326 326 315 315 300 300 n.a. n.a. n.a. n.a. n.a. n.a. Churn 3 months active base (quarterly) (%) 14.6% 11.4% 13.3% 14.7% 12.5% 10.1% 12.2% 13.5% 15.4% 13.7% 17.1% 15.5% 15.7% 15.7% 11.6% 11.6% 13.6% 13.6% 14.7% 14.7% n.a. n.a. n.a. n.a. n.a. n.a. FIXED-LINE 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 IFRS 16 1Q19 2Q19 IFRS 16 2Q19 3Q19 IFRS 16 3Q19 4Q19 IFRS 16 4Q19 FY16 FY17 FY18 FY19 IFRS16 FY19 Total operating revenue 4,863 4,688 5,351 5,687 5,347 5,754 6,282 7,207 6,073 6,171 6,554 6,488 6,143 6,143 6,374 6,374 6,110 6,110 6,868 6,868 20,590 24,590 25,287 25,495 25,495 Service revenue 4,855 4,681 5,343 5,677 5,337 5,744 6,268 7,198 6,059 6,157 6,539 6,474 6,124 6,124 6,357 6,357 6,092 6,092 6,850 6,850 20,556 24,547 25,228 25,423 25,423 Broadband revenue 2,099 2,064 2,111 2,310 2,254 2,439 2,171 0 1,528 2,819 1,957 3,117 3,227 3,227 3,179 3,179 3,164 3,164 3,376 3,376 8,583 6,864 9,420 12,947 12,947 Broadband customers (mln) 0.2 0.2 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.4 0.4 0.4 0.4 0.40 0.41 0.41 0.40 0.40 0.42 0.42 0.3 0.3 0.4 0.4 0.4 Broadband ARPU (KZT) 3,013.5 2,866.01 2,761.38 2,846 2,627 2,757 2,392.9 0.0 1,498.4 2,685.6 1,816.3 2,764.8 2,747.5 2,747.5 2,635.2 2,635.2 2,609.1 2,609.1 2,750.0 2,750.0 n.a n.a n.a n.a n.a n.a ** include IFRS 16 adj's