- ADUS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K/A Filing

Addus HomeCare (ADUS) 8-K/AFinancial Statements and Exhibits

Filed: 14 Feb 25, 5:00pm

Exhibit 99.1

KAH Hospice Company-Personal Care

(A carve-out business of KAH Hospice Company, Inc.)

Combined Financial Statements for the Year Ended December 31, 2023

KAH Hospice company-PERSONAL CARE

Index

Page

Report of Independent Auditors

To the Management of KAH Hospice Company Inc.:

Opinion

We have audited the accompanying combined financial statements of KAH Hospice Company-Personal Care (a carve- out business of KAH Hospice Company, Inc.) (the "Company"), which comprise the combined balance sheet as of December 31, 2023, and the related combined statement of operations, of net parent investment and of cash flows for the year then ended, including the related notes (collectively referred to as the "combined financial statements").

In our opinion, the accompanying combined financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2023, and the results of its operations and its cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audit in accordance with auditing standards generally accepted in the United States of America (US GAAS). Our responsibilities under those standards are further described in the Auditors' Responsibilities for the Audit of the Combined Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of Management for the Combined Financial Statements

Management is responsible for the preparation and fair presentation of the combined financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of combined financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the combined financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company's ability to continue as a going concern for one year after the date the combined financial statements are available to be issued.

Auditors' Responsibilities for the Audit of the Combined Financial Statements

Our objectives are to obtain reasonable assurance about whether the combined financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors' report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with US GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the combined financial statements.

In performing an audit in accordance with US GAAS, we:

1

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit.

/s/PricewaterhouseCoopers LLP

Nashville, Tennessee

February 14, 2025

2

kAh hospice company-Personal CARE

COMBINED STATEMENT OF OPERATIONS

(In thousands)

See Accompanying Notes to Combined Financial Statements.

3

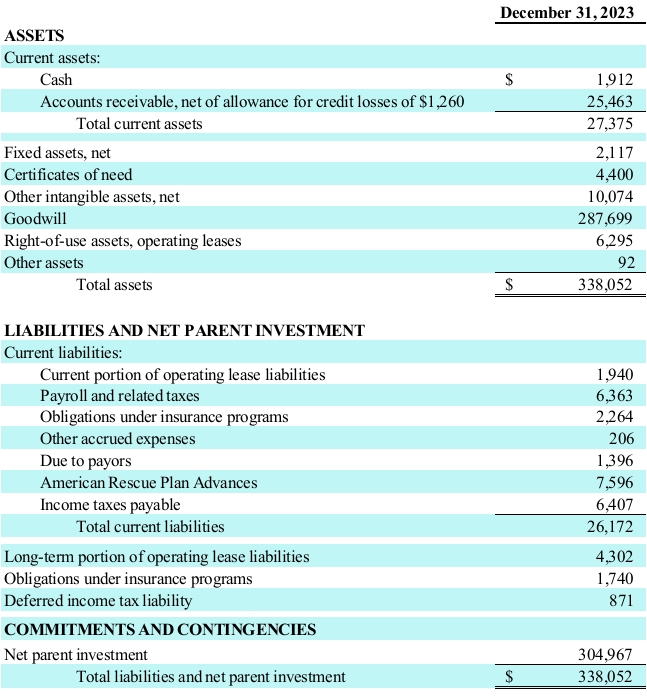

kAh hospice company-Personal CARE

COMBINED BALANCE SHEET

(In thousands)

See Accompanying Notes to Combined Financial Statements.

4

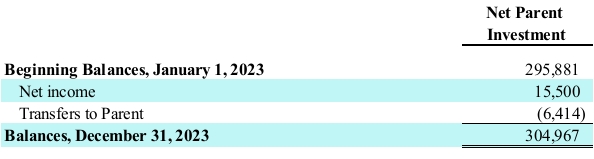

kAh hospice company-Personal CARE

COMBINED STATEMENT OF NET PARENT INVESTMENT

(In thousands)

See Accompanying Notes to Combined Financial Statements.

5

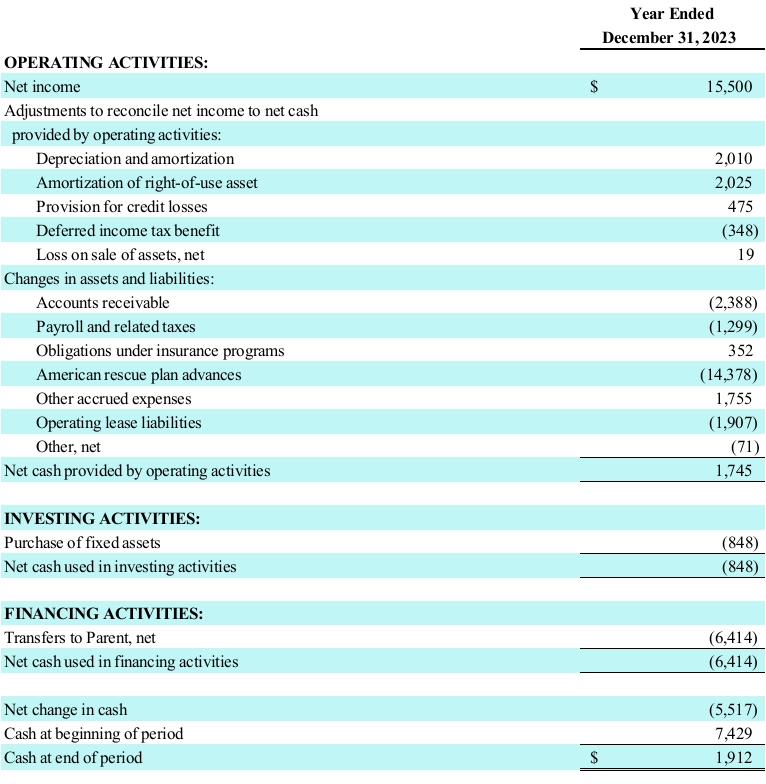

kAh hospice company-Personal CARE

COMBINED STATEMENT OF CASH FLOWS

(In thousands)

See Accompanying Notes to Combined Financial Statements.

6

kah hospice company-Personal care

Notes to COMBINED financial statements

Note 1. Basis of Presentation

Reporting Entity

KAH Hospice Company-Personal Care (“the Company”) is an operating division of KAH Hospice Company, Inc. (“KAH”) The division provides personal care services for patients in a variety of settings, including their homes, nursing centers, and other residential settings. The Company provides services in 49 locations in 7 states as of December 31, 2023.

On August 11, 2022, Clayton, Dubilier & Rice (“CD&R”) purchased 60% of the Equity interests of KAH from Humana, Inc. Previously, Humana owned 100% of the equity interests of KAH.

On June 8, 2024, Curo Health Services, LLC (“Curo”), a subsidiary of KAH, entered into a Stock and Asset Purchase agreement with Addus Healthcare, Inc. Under the terms of the agreement, Curo sold the Company as defined as all of the outstanding equity interests in wholly owned subsidiaries of IntegraCare of Abilene, LLC, NP Plus, LLC, Girling Health Care Services of Knoxville, Inc. and Girling Health Care, Inc. as well as, certain assets relating to the personal care business from its wholly owned subsidiaries Central Arizona Home Health Care, Inc., Community Home Care & Hospice, LLC, TNMO Healthcare, LLC and Odyssey HealthCare Operating A, LP. Together, the outstanding equity interests and assets of the Company were purchased for $350 million. The transaction was finalized on December 2, 2024.

Principles of combination

The accompanying combined financial statements of the Company and its subsidiaries have been derived from the combined financial statements and accounting records of KAH as if the Company had operated on a stand-alone basis during the periods presented and were prepared utilizing the management approach, in accordance with generally accepted accounting principles in the United States of America (“GAAP”).

The income tax amounts in these combined financial statements have been calculated based on a separate return

methodology and are presented as if the Company’s income gave rise to separate federal and state consolidated income tax return filing obligations in the respective jurisdictions in which it operates. In addition to various separate state and local income tax filings, the Company joins with KAH in various U.S. federal, state and local consolidated income tax filings.

The combined financial statements include an allocation of expenses related to certain KAH corporate functions as discussed in Note 9. The combined financial statements also include revenues and expenses directly attributable to the Company and assets and liabilities specifically attributable to the Company. KAH’s third-party debt and related interest expense have not been attributed to the Company, because the Company is not the primary legal obligor of the debt and the borrowings are not specifically identifiable to the Company. The entities combined in these financial statements were part of KAH’s Collateral and Guarantee Requirement agreement pursuant to which the Company agreed, jointly and severally, fully and unconditionally to guarantee all of KAH’s obligations under the credit agreement. Additionally, the Company is part of KAH’s security agreement, pursuant to which a first-priority security interest was granted in substantially all present and future real, personal and intangible assets, including the pledge of 100 percent of all outstanding capital stock of the Company’s subsidiaries to secure full payment of the obligations for the ratable benefit of the lenders. Net parent investment represents the Company’s cumulative earnings as adjusted for cash distributions and cash contributions from its parent.

The Company eliminates all intercompany transactions within the Company from its financial results. Transactions between the Company and KAH have been included in these combined financial statements. The transfers with KAH that are not expected to be settled are reflected in net parent investment on the combined balance sheet and combined statement of net parent investment. Within the combined statement of cash flow, these transfers are treated as an operating, financing or noncash activity determined by the nature of the transactions. Transactions between the Company and KAH or between the Company and Humana are considered related party transactions. Refer to Note 9 for more information regarding related party transactions.

7

kah hospice company-Personal care

Notes to COMBINED financial statements (Continued)

Recently issued accounting requirements

In June 2016, the FASB issued ASU 2016-13, ‘‘Financial Instruments-Credit Losses’’ (“ASU 2016- 13”). ASU 2016-13 requires entities to report ‘‘expected’’ credit losses on financial instruments and other commitments to extend credit rather than the current ‘‘incurred loss’’ model. These expected credit losses for financial assets held at the reporting date are to be based on historical experience, current conditions, and reasonable and supportable forecasts. This ASU requires enhanced disclosures relating to significant estimates and judgments used in estimating credit losses, as well as the credit quality. ASU 2016-13 is effective for the Company for annual reporting periods beginning after December 15, 2022. The Company adopted ASU 2016-13 effective January 1, 2023 using the modified retrospective approach and revised its accounting policies and processes to facilitate this approach. The adoption of ASU 2016-13 did not have an impact on the Company’s financial statements.

In December 2023, the FASB issued ASU 2023-09, Improvement to Income Tax Disclosures, which requires disclosure of disaggregated income taxes paid, prescribes standard categories for the components of the effective tax rate reconciliation, and modifies other income tax-related disclosures. ASU 2023-09 is effective for fiscal years beginning after December 15, 2024, may be applied prospectively or retrospectively, and allows for early adoption. These requirements are not expected to have an impact on the Company’s financial statements and will expand income tax disclosures.

In November 2024, the FASB issued ASU No. 2024-03 ("ASU 2024-03"), Income Statement - Reporting Comprehensive Income - Expense Disaggregation Disclosures (Subtopic 220-40): Disaggregation of Income Statement Expenses, which is intended to improve disclosures about a public business entity's expenses, primarily through additional disaggregation of income statement expenses. ASU 2024-03 is effective for annual periods beginning after December 15, 2026, and interim periods beginning after December 15, 2027, with early adoption permitted. The amendments in ASU 2024-03 should be applied either prospectively to financial statements issued for reporting periods after the effective date or retrospectively to any or all prior periods presented in the financial statements. The Company is currently evaluating the ASU to determine the impact on the Company's disclosures.

Summary of significant accounting policies

Use of estimates

The preparation of the financial statements in conformity with GAAP requires the use of estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting periods. Significant estimates and assumptions are used for, but not limited to: (1) revenue reserves for contractual adjustments and uncollectible amounts; (2) fair value of acquired assets and assumed liabilities in business combinations; (3) asset impairments, including goodwill; and (4) corporate allocations. Future events and their effects cannot be predicted with certainty; accordingly, the Company’s accounting estimates require the exercise of judgment. The accounting estimates used in the preparation of the financial statements will change as new events occur, as more experience is acquired, as additional information is obtained, and as the operating environment changes. The Company evaluates and updates its assumptions and estimates on an ongoing basis and may employ outside experts to assist in its evaluation, as considered necessary. Actual results could differ from those estimates.

Revenues

Net revenue from contracts with customers is recognized in the period in which the performance obligations are satisfied under the Company’s contracts by transferring the requested services to patients in amounts that reflect the consideration which is expected to be received in exchange for providing patient care, which is the transaction price allocated to the services provided in accordance with Accounting Standards Codification (“ASC”) 606, Revenue from Contracts with Customers, and all of the related amendments. Net revenue is recognized as performance obligations are satisfied, which can vary depending on the type of services provided. The performance obligation is the delivery of patient care in accordance with the requested services outlined in physicians’ orders or state program referrals, which are based on the specific needs of each patient.

8

kah hospice company-Personal care

Notes to COMBINED financial statements (Continued)

The performance obligations are associated with contracts in duration of less than one year; therefore, the optional exemption provided by ASC 606 was elected resulting in the Company not being required to disclose the aggregate amount of the transaction price allocated to the performance obligations that are unsatisfied or partially unsatisfied as of the end of the reporting period.

The Company determines the transaction price based on gross charges for services provided, reduced by estimates for explicit and implicit price concessions. The Company’s estimates of contractual adjustments and uncollectible amounts require the exercise of judgment. Explicit price concessions include contractual adjustments provided to various payers. They are recorded for the difference between the Company’s standard rates and the contracted rates to be realized from patients and third-party payers. Implicit price concessions include discounts provided to self-pay, uninsured patients or other payers, adjustments resulting from regulatory reviews, audits, billing reviews and other matters and are estimated by the Company based on historical collection experience and success rates in the claim appeals and adjudication process. The Company assesses the ability to collect for the services provided at the time of patient admission based on the verification of the patient’s insurance coverage under Medicaid, commercial insurance and other payers. Subsequent changes to the estimate of the transaction price are recorded as adjustments to net revenue in the period of change. Subsequent changes that are determined to be the result of an adverse change in the patient’s ability to pay (i.e. change in credit risk) based on a review of account aging and direct contract with payors are recorded as a provision for doubtful accounts within selling, general and administrative expenses.

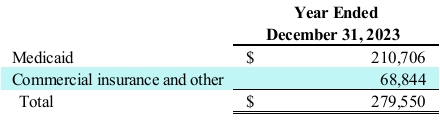

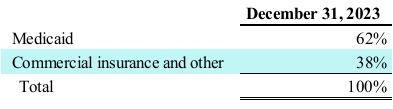

A summary of revenue by payer type follows (in thousands):

Sources of net revenue fall into Medicaid, commercial insurance, and other payers. Reimbursement is based on each payer’s predetermined fee schedule applied to each service provided. Revenue is therefore recognized as services are provided based on these various fee schedules.

Deferred Revenue

The American Rescue Plan Act of 2021 (“ARPA”) is a relief package with numerous provisions that affect healthcare providers and was signed into law in March 2021. ARPA provides for relief funding for eligible state, local, territorial, and Tribal governments to mitigate the fiscal effects of the COVID-19 public health emergency. Additionally, the law provides for a 10-percentage point increase in federal matching funds for Medicaid home and community-based services (“HCBS”) from April 1, 2021, through March 31, 2022, provided the state satisfied certain conditions. States are permitted to use the state funds equivalent to the additional federal funds through March 31, 2025. States must use the monies attributable to this matching fund increase to supplement, not supplant, their level of state spending for the implementation of activities enhanced under the Medicaid HCBS in effect as of April 1, 2021.

HCBS spending plans for the additional matching funds vary by state, but common initiatives in which the Company is participating include those aimed at strengthening the provider workforce (e.g. efforts to recruit and retain direct service providers). The Company is required to properly and fully document the use of such funds in reports to the state in which the funds originated. Funds may be subject to recoupment if not expended or if they are expended on non-approved uses. In total, the Company received state funding provided by ARPA in aggregate amount of $25.1 million, of which, $0.5 million was received during the year ended December 31, 2023. During the year ended December 31, 2023, the Company recorded revenue of $14.9 million and related costs of services sold of approximately $13.7 million. As of December 31, 2023, the deferred portion of ARPA funding was $7.6 million and is reflected on the combined balance sheet.

Cash

Cash includes amounts on deposit with several major financial institutions in excess of the maximum amount insured by the Federal Deposit Insurance Corporation. The Company participates in a centralized cash management arrangement whereby excess cash balances are swept into a master account that is legally owned by KAH. The amount

9

kah hospice company-Personal care

Notes to COMBINED financial statements (Continued)

of cash on the combined balance sheet represents the balances not swept to the master account owned by KAH as of December 31, 2023.

Accounts receivable

Accounts receivable consist primarily of amounts due from the Medicaid program, other government programs, managed care health plans, commercial insurance companies and individual patients. Accounts receivable from services rendered are reported at their estimated transaction price which takes into account price concessions from the various payers. The concentration of accounts receivable by payer class as a percentage of total net accounts receivable is as follows:

While revenues and accounts receivable from the Medicaid program are significant to its operations, the Company does not believe there are significant credit risks associated with this government agency. The Company does not believe there are any other significant concentrations of revenues from any particular payer that would subject us to any significant credit risks in the collection of accounts receivable.

Accounts requiring collection efforts are reviewed by patient account representatives, who employ various collection efforts, including contacting the applicable parties, providing financial or clinical information to allow for payment or to overturn payer decisions to deny payment, and arranging payment plans, among other techniques. When in-house efforts are exhausted or it is a more prudent use of resources, commercial insurance and other accounts may be turned over to a collection agency.

The collection of outstanding receivables from Medicaid is the Company’s primary source of cash and is critical to its operating performance. While it is the Company’s policy to verify eligibility for these programs prior to a patient being admitted, there are some circumstances in which that verification by the payer may take some period of time.

If actual results are not consistent with the Company’s assumptions and judgments, the Company may be exposed to gains or losses that could be material. Changes in general economic conditions, federal or state governmental programs, payer mix or business office operations could affect the Company’s collection of accounts receivable, financial position, results of operation and cash flows.

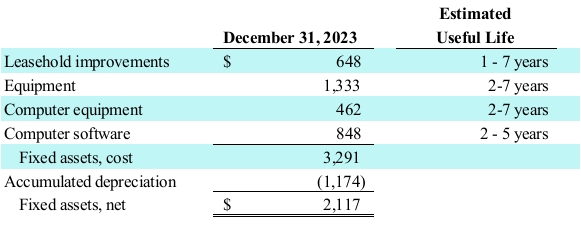

Property and equipment

Property and equipment is carried at cost less accumulated depreciation. Depreciation expense, computed by the straight-line method, was $0.8 million for the year ended December 31, 2023. The depreciable lives for the Company’s property and equipment, other than leasehold improvements, generally range from 1 to 7 years. See Note 2 for additional information about useful lives. Leasehold improvements are depreciated over their estimated useful lives or the remaining lease term, whichever is shorter. Repairs and maintenance are expensed as incurred.

Long-lived assets

The Company reviews the carrying value of certain long-lived assets and finite-lived intangible assets with respect to any events or circumstances that indicate an impairment or an adjustment to the amortization period is necessary. If circumstances suggest that the recorded amounts cannot be recovered based upon estimated future undiscounted cash flows, the carrying values of such assets are reduced to fair value.

In assessing the carrying values of long-lived assets, the Company estimates future cash flows at the lowest level for which there are independent, identifiable cash flows. Generally, sites of service at a geographical location level within the Company are considered the lowest level for which there are independent, identifiable cash flows.

10

kah hospice company-Personal care

Notes to COMBINED financial statements (Continued)

Goodwill and Indefinite-lived Intangible Assets

The Company is required to test goodwill and other indefinite-lived intangible assets for impairment on an annual basis and between annual tests if current events or circumstances require an interim impairment assessment. The Company has recognized goodwill upon the acquisition of the assets or stock of another third-party business operation. The Company has determined that its personal care program constitutes a reporting unit. Accounting guidance allows the Company to perform a qualitative assessment about the likelihood of the carrying value of a reporting unit or an indefinite-lived intangible asset exceeding its fair value, referred to as the step zero assessment. The step zero assessment requires the evaluation of certain qualitative factors, including macroeconomic conditions, industry and market considerations, cost factors and overall financial performance, as well an assessment indicates that it is more likely than not that the fair value of a reporting unit or indefinite-lived intangible asset is less than the carrying value amount, then the Company would perform a quantitative impairment test. If, after assessing these events and circumstances, it is determined that there may be an impairment, then a quantitative analysis is performed. With the quantitative analysis, the Company compares the fair value of its reporting units to the carrying amount of the units’ net assets to determine if there is a potential impairment of goodwill. If the estimated fair value of the reporting unit exceeds the carrying value, the goodwill is not impaired, and no further review is required. The Company would recognize an impairment charge for the amount by which the carrying amount exceeds the reporting unit’s fair value. To determine the fair value of the reporting units, the Company uses the combination of a present value (discounted cash flow) technique and a market-based approach or other valuation methodologies and reasonableness tests, as appropriate.

Determining the fair value of a reporting unit is judgmental in nature and requires the use of significant estimates and assumptions, including long-term growth rates, operating margins, and discount rates, as well as relevant comparable company revenue and earnings multiples for the market-based approach. The future occurrence of a potential indicator of impairment, such as, but not limited to, a significant adverse change in legal factors or business climate, reductions of projected patient census, an adverse action or assessment by a regulator, as well as other unforeseen factors, would require an interim assessment for some or all of the reporting units and could have a material impact on the Company’s combined financial statements. See Note 3 for information on the Company’s impairment testing.

The Company is required to annually compare the fair values of other indefinite-lived intangible assets, which includes certificates of need (“CONs”), to their carrying amounts. If the carrying amount of an indefinite-lived intangible asset exceeds its fair value, an impairment loss is recognized. Fair values of other indefinite-lived intangible assets are determined based on an income approach.

The Company performed its annual impairment assessment for goodwill of its personal care reporting unit as well as its indefinite-lived CONs at October 1, 2023. The Company performed a quantitative analysis using a combination of the income approach, utilizing a discounted cash flow analysis, and the market approach, utilizing the guideline public company method. Based on the results of the annual quantitative assessment conducted as of October 1, 2023, the fair value of the Company’s reporting unit exceeded their carrying values, and management concluded that no impairment charge was warranted. Based on the impairment assessment performed over the Company’s indefinite-lived CONs, the fair value exceeded the carrying value of the assets, and management concluded that no impairment charge was warranted.

Leases

The Company evaluates whether a contract is or contains a lease at the inception of the contract. Upon lease commencement, the date on which a lessor makes the underlying asset available to the Company for use, the Company classifies the lease as either an operating or finance lease. The Company’s facility leases are classified as operating leases.

The Company recognizes a right-of-use (“ROU”) asset and lease liability at lease commencement. A ROU asset represents the Company’s right to use an underlying asset for the lease term, while the lease liability represents an obligation to make lease payments arising from a lease which are measured on a discounted basis. The Company elected the short-term exemption for leases with an initial term of 12 months or less and therefore those leases are not recorded on the combined balance sheet.

11

kah hospice company-Personal care

Notes to COMBINED financial statements (Continued)

Lease liabilities are measured at the present value of the remaining fixed lease payments at commencement. The Company’s leases may also specify extension or termination clauses, which are factored into the measurement of the lease liability when it is reasonably certain that the Company will exercise these options. The Company has also elected to account for its lease and non-lease components, such as common area maintenance, as a single lease component for its leases, when the non-lease component is fixed or included in the base rent. When the Company makes payments which are not fixed at lease commencement, they will be expensed as incurred.

Allocated expense

Amounts were allocated from KAH for costs attributable to the operations of the Company. The expenses incurred by KAH include costs from certain support center and shared service functions provided by KAH to the Company.

All support center costs that were specifically identifiable to the Company have been allocated to the Company and are included in the accompanying combined statement of operations. The results of operations for the Company include allocations for certain support functions that were previously provided on a centralized basis by KAH to all or part of the Company, including cash management, information technology services, accounts receivable oversight, property and equipment record keeping, accounts payable processing, payroll and general bookkeeping. Additionally, KAH manages general business functions on behalf of the Company, including human resources, financial reporting and legal services. KAH refers to these expenses as support center allocations and, where specific identification of charges attributable to the Company was not practicable, such costs have been allocated based on a percentage of net revenues.

In the opinion of management, the cost allocations have been determined on a reasonable basis and include all the costs of doing business. The amounts that would have been or will be incurred on a stand-alone basis could differ from the amounts allocated due to economies of scale, management judgment, or other factors. See Note 9 for additional information regarding related party transactions.

Income Taxes

The Company has adopted the separate return approach for the purpose of the combined financial statements, including the income tax provisions and the related deferred tax assets and liabilities. The historic operations of the Company business reflect a separate return approach for each jurisdiction in which the Company had a presence and KAH filed a tax return.

The Company provides for income taxes using the asset and liability method. This approach recognizes the amount of income taxes payable or refundable for the current year, as well as deferred tax assets and liabilities for the future tax consequence of events recognized in the combined financial statements and income tax returns. Deferred income tax assets and liabilities are adjusted to recognize the effects of changes in tax laws or enacted tax rates.

A valuation allowance is required when it is more likely than not some portion of the deferred tax assets will not be realized. Realization is dependent on generating sufficient future taxable income in the applicable tax jurisdiction. On a quarterly basis, the Company assesses the likelihood of realization of the deferred tax assets considering all available evidence, both positive and negative. The Company’s most recent operating performance, the scheduled reversal of temporary differences, the forecast of taxable income in future periods by jurisdiction, the ability to sustain a core level of earnings, and the availability of prudent tax planning strategies are important considerations in this assessment.

The Company evaluates its tax positions and establishes assets and liabilities in accordance with the applicable accounting guidance on uncertainty in income taxes. The Company reviews these tax uncertainties in light of changing facts and circumstances, such as the progress of tax audits, and adjusts them accordingly.

12

kah hospice company-Personal care

Notes to COMBINED financial statements (Continued)

Note 2. Fixed Assets, Net

Fixed assets, net at December 31, 2023 were as follows (in thousands):

Depreciation expense was $0.8 million in the year ended December 31, 2023.

Note 3. Goodwill and Identifiable Intangible Assets

Goodwill and indefinite-lived intangible assets primarily originated from business combinations accounted for as purchase transactions. Under business combination accounting, assets and liabilities are generally recognized at their fair values and the difference between the consideration transferred, excluding transaction costs, and the fair values of the assets and liabilities is recognized as goodwill. The Company’s indefinite-lived intangible assets consist of CONs.

Goodwill

The amount of goodwill at December 31, 2023 was approximately $287.7 million. There were no changes to goodwill during the year ended December 31, 2023.

In accordance with the authoritative guidance for goodwill and other intangible assets, the Company is required to perform an impairment test for goodwill and indefinite-lived intangible assets at least annually or more frequently if adverse events or changes in circumstances indicate that the asset may be impaired. The Company performs its annual goodwill impairment test on October 1 each fiscal year.

A reporting unit is either an operating segment or one level below the operating segment, referred to as a component. The Company has determined that its personal care program constitutes a reporting unit. The measurement of goodwill impairment is the amount by which the carrying amount exceeds the reporting unit’s fair value, not to exceed the carrying amount of goodwill.

Based upon the results of the annual impairment test for goodwill at October 1, 2023, no impairment charges were recorded.

Since quoted market prices for the Company’s reporting unit are not available, the Company applies judgment in determining the fair value of the reporting unit for purposes of performing the goodwill impairment test. The Company relies on widely accepted valuation techniques, including a discounted cash flow approach and a market-based approach, which capture both the future income potential of the reporting unit and the market behaviours and actions of market participants in the industry that includes the reporting unit. These types of analyses require the Company to make assumptions and estimates regarding future cash flows, industry-specific economic factors and the profitability of future business strategies. The discounted cash flow approach uses a projection of estimated operating results and cash flows that are discounted using a discount rate that corresponds to a market-based weighted-average cost of capital. Under the discounted cash flow approach, the projection uses management’s best estimates of economic and market conditions over the projected period for each reporting unit including long-term growth rates for future revenue and operating margins. Other significant estimates and assumptions include terminal value growth rates and discount rates. The market-based approach estimates fair value by applying revenue and earnings multiples to the reporting unit’s operating results. The multiples are derived from comparable publicly traded companies with similar operating and investment characteristics to the reporting units.

13

kah hospice company-Personal care

Notes to COMBINED financial statements (Continued)

Adverse changes in the operating environment and changes in key assumptions used to determine the fair value of the Company’s reporting unit and indefinite-lived intangible assets may result in future impairment charges for a portion or all of these assets. Specifically, if the rate of growth of government and commercial revenues earned by the Company were to be less than projected, if healthcare reforms were to negatively impact the Company’s business, or if recent increases in labor costs materially exceed the Company’s projections in its reporting units, an impairment charge of a portion or all of these assets may be required. An impairment charge could have a material adverse effect on the Company’s financial position and results of operations, but it would not be expected to have an impact on the Company’s business or liquidity.

Identifiable Intangible Assets

The Company’s indefinite-lived intangible assets consist of CONs. The fair values of the Company’s indefinite-lived intangible assets are derived from current market data, including comparable sales or royalty rates, and projections at a geographical location level or reporting unit, which include management’s best estimates of economic and market conditions over the projected period. Significant assumptions include growth rates in the number of admissions, patient days, reimbursement rates, operating costs, terminal value growth rates, changes in working capital requirements, weighted-average cost of capital and opportunity costs.

The Company performs its annual indefinite-lived intangible asset impairment tests on October 1 each fiscal year. Based upon the results of the impairment test for indefinite-lived intangible assets discussed above, no impairment charges were recorded. The fair value of the CONs was measured using an income approach based on the consideration of Level 3 inputs, such as last twelve months’ revenue and EBITDA.

A summary of identifiable intangible assets at December 31, 2023 follows (in thousands):

Amortization expense was $1.2 million in the year ended December 31, 2023.

Amortization expense for future periods is as follows:

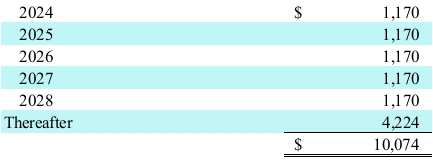

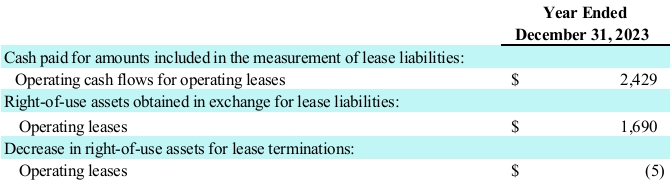

Note 4. Leases

Operating Leases

The Company leases real estate under operating lease arrangements. Real estate is leased primarily for office space. The leases generally have initial terms of three to five years, and many include multi-year renewal options. The Company’s lease arrangements may contain both lease and non-lease components. The Company has elected to combine and account for lease and non-lease components as a single lease component for its real estate leases.

Payments under the Company’s operating lease arrangements are fixed as per the lease arrangements. Lease costs associated with the Company’s operating leases were as follows:

14

kah hospice company-Personal care

Notes to COMBINED financial statements (Continued)

The following table shows right-of-use assets and lease liabilities under operating leases at December 31, 2023 (in thousands):

Supplemental cash flow information related to operating leases was as follows (in thousands):

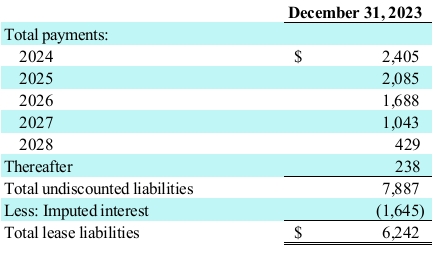

Operating lease liability maturities at December 31, 2023 are as follows (in thousands):

The weighted-average remaining lease term and discount rate related to the Company’s operating lease liabilities as of December 31, 2023 were 3.6 years and 8.26%. As the Company’s leases do not provide an implicit interest rate, the Company used KAH’s incremental borrowing rate based on the information available at commencement date in determining the present value of lease payments.

At December 31, 2023, the Company has $0.3 million of future payments under leases that had not yet commenced. These leases will commence in 2024 with lease terms ranging from 3 to 5 years.

15

kah hospice company-Personal care

Notes to COMBINED financial statements (Continued)

Note 5. Income Taxes

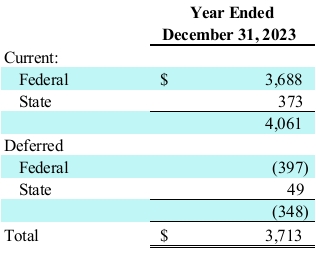

The significant components of the provision for income tax expense are as follows (in thousands):

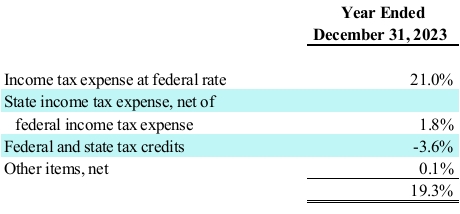

A reconciliation of differences between the federal income tax at statutory rates and the actual income tax expense from operations, which includes federal, state and other income taxes, is presented below:

Federal and state tax credits consist of credits earned from the Work Opportunity Tax Credit (WOTC) program that is earned from hiring and employing individuals from certain targeted groups who face barriers to employment.

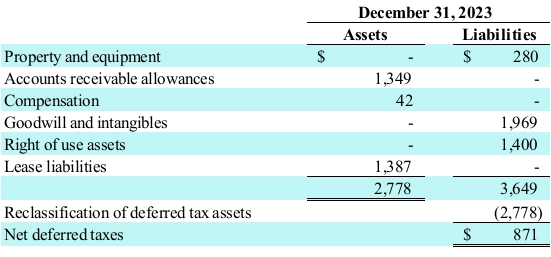

Deferred income taxes are determined based on the difference between financial statement and tax basis of assets and liabilities using enacted tax laws and rates. Deferred income taxes as of December 31, 2023, reflect the effect of temporary differences between the amounts of assets and liabilities for financial accounting and income tax purposes.

16

kah hospice company-Personal care

Notes to COMBINED financial statements (Continued)

As of December 31, 2023, the principal components of deferred tax items were as follows (in thousands):

Net deferred income tax liabilities totalling $0.9 million at December 31, 2023, are classified as noncurrent liabilities in the accompanying combined balance sheet. At each balance sheet date, management assesses all available positive and negative evidence to determine whether a valuation allowance is needed against its deferred tax assets. The Company determined that the deferred tax assets are likely to be realized, and therefore do not require a valuation allowance. The amount of deferred tax assets considered realizable, however, could be adjusted if the weighting of the positive and negative evidence changes.

The Company follows the provisions of the authoritative guidance for accounting for uncertainty in income taxes which clarifies the accounting for uncertain income tax issues recognized in an entity’s financial statements. The guidance prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in an income tax return. The Company has not identified any tax issues that qualify under the authoritative guidance for uncertainty in income taxes.

The Company is not currently under examination by the Internal Revenue Service. State jurisdictions generally have statutes of limitations for tax returns ranging from three to five years. The state impact of federal income tax changes remains subject to examination by various states for a period of up to one year after formal notification to the states. Currently, the Company has various state income tax returns under examination.

Note 6. Commitments and Contingencies

Management continually evaluates contingencies based upon the best available information. In addition, allowances for losses are provided currently for disputed items that have continuing significance, such as certain third-party reimbursements and tax returns.

Management believes that allowances for losses have been provided to the extent necessary and that its assessment of contingencies is reasonable. Principal contingencies are described below:

Revenues

Certain third-party payments are subject to examination by agencies administering the various reimbursement programs. The Company is contesting the denial of certain payments by third parties to the Company’s customers.

Legal and regulatory proceedings

From time to time, the Company is subject to legal and/or administrative proceedings incidental to its business. It is the opinion of management that the outcome of pending legal and/or administrative proceedings will not have a material effect on the Company’s combined balance sheet and combined statement of operations.

17

kah hospice company-Personal care

Notes to COMBINED financial statements (Continued)

Obligations Under Insurance Programs

The Company is obligated for certain costs under various insurance programs maintained by KAH, including workers’ compensation, professional liability, property and general liability, and employee health and welfare.

The Company may be subject to workers’ compensation claims and lawsuits alleging negligence or other similar legal claims. KAH and Humana maintain various insurance programs to cover this risk with insurance policies subject to substantial deductibles and retention amounts. The Company recognizes its obligations associated with these programs in the period the claim is incurred. The cost of both reported claims and claims incurred but not reported, up to specified deductible limits, have generally been estimated based on historical data, industry statistics, the Company’s specific historical claims experience, current enrollment statistics and other information. The Company’s estimates of its obligations and the resulting reserves are reviewed and updated from time to time, but at least quarterly. The elements which impact this critical estimate include the number, type and severity of claims and the policy deductible limits; therefore, the estimate is sensitive and changes in the estimate could have a material impact on the Company’s combined financial statements.

The Company’s workers’ compensation and professional and general liability costs under these programs were $1.9 million in the year ended December 31, 2023. Workers’ compensation and professional liability claims, including any changes in estimate relating thereto, are recorded primarily in cost of services sold in the Company’s combined statement of operations.

KAH maintains insurance coverage on individual claims under these programs and are responsible for the cost of individual workers’ compensation claims and individual professional liability claims up to policy deductibles occurrence. KAH also maintain excess liability coverage relating to professional liability and casualty claims. Payments under KAH’s workers’ compensation program are guaranteed by letters of credit. The Company records its share of costs under these programs. The Company believes that its present insurance coverage and reserves are sufficient to cover currently estimated exposures, but there can be no assurance that the Company will not incur liabilities in excess of recorded reserves or in excess of its insurance limits.

The Company provides employee health and welfare benefits under a self-insured program maintained by KAH. Employee health and welfare benefit costs were $2.2 million for the year ended December 31, 2023. Changes in estimates of the Company’s employee health and welfare claims are recorded in cost of services sold for clinical associates and in selling, general and administrative costs for administrative associates in the Company’s statement of operations.

Note 7. Related Party Transactions

Support center allocations

The results of operations for the Company include allocations for certain support functions that were provided all or in part on a centralized basis by KAH, including cash management, information services support, accounts receivable processing, property and equipment record keeping, accounts payable processing, payroll and general bookkeeping. Additionally, KAH manages general business functions on behalf of the Company, including human resources, financial reporting and legal services. KAH refers to these expenses as support center allocations and they have been allocated based on a percentage of net revenues. The total allocated selling, general and administrative charges for the year ended December 31, 2023 was $18.0 million.

Debt and intercompany interest

The carve-out combined balance sheet does not include any third-party debt held by KAH and the combined statement of operations does not include any interest expense associated with the third-party debt held by KAH.

Employee benefits

The Company participates in defined contribution retirement plans sponsored by KAH covering employees who meet certain minimum eligibility requirements. Benefits are determined as a percentage of a participant’s contributions and generally are vested based upon length of service. Retirement plan expense for the Company was $0.4 million for the year ended December 31, 2023. Amounts equal to retirement plan expense are funded annually.

18

kah hospice company-Personal care

Notes to COMBINED financial statements (Continued)

Other intercompany balances

Transactions between the Company and KAH have been included in these combined financial statements. The transfers with KAH that are not expected to be settled, are reflected in net parent investment in the combined balance sheet and combined statement of net parent investment. The net parent investment was $305.0 million at December 31, 2023. Within the combined statement of cash flows, these transfers are treated as financing activities. Transactions between the Company and KAH or between the Company and Humana are considered related party transactions.

Note 8. Subsequent Events

These combined financial statements were derived from the financial statements of KAH, which issued its annual consolidated financial statements for the year ended December 31, 2023 on March 22, 2024. Accordingly, the Company has evaluated subsequent events for consideration as recognized subsequent events in these combined financial statements through the date of March 22, 2024. Additionally, the Company has evaluated subsequent events that occurred through February 14, 2025, the date these combined financial statements were available for issuance, for the purposes of unrecognized subsequent events. On December 2, 2024 Addus Homecare Corporation completed the acquisition of the Company for $350 million which was funded through a combination of cash on hand and its existing revolving credit facility.

19