Exhibit 99.8

General Conditions of the

Plan to Receive Remuneration through the delivery

of Ferrovial, SE Shares (the “Plan”)

ARTICLE ONE.- Purpose and administration of the Plan

| 1.1 | The Board of Directors of Ferrovial, SE (the "Company" or "FERROVIAL"), has approved, within the framework of its General Remuneration Policy, to offer the Employees and Managers of the Company and its subsidiaries (the "Participants") the possibility of participating in a Plan for the delivery of shares of the Company (the "Shares"). |

| 1.2 | The purpose of the Plan is to increase the shareholding of the Employees and Managers of its business group and to provide them with the possibility of linking part of their remuneration to the evolution of the value of the Shares, allowing them to receive part of their annual remuneration for the years 2025 to 2029 in Shares. |

| 1.3 | The Plan shall be governed by the General Conditions set forth herein. |

| 1.4 | The Human Resources General Direction will be responsible for: |

(i) the development of the basic conditions of the Plan.

| (ii) | the administration of the Plan, being able to carry out and subscribe the acts and documents required for its execution, in particular the General Conditions of the Plan. |

ARTICLE TWO.- Actions on which the Plan is put into practice

| 2.1 | Under this Plan, the Participants shall receive common shares of the Company. The Plan will be put into practice with the number of Shares authorised by the Board of Directors, which will depend on the final number of Participants adhering to the Plan and the closing price of the Share on the Transfer Date (as defined below). At the date of the Plan's approval, this represents a maximum number of 500,000 Shares (representing 0.07% approximately of the total number of Shares comprising the share capital) for each year. |

| 2.2 | The Shares acquired by means of this Plan shall be free of any charge or encumbrance and shall not be subject to any limitations or restrictions that are not applicable to the majority of the Company's shareholders, whether by contractual, statutory or legal provision, without prejudice to the commitment assumed by the Participants in Article 4 below. |

ARTICLE THREE.- Main characteristics of the Plan

Participants

| 3.1. | The Plan is aimed at Employees and Managers of the Ferrovial Group companies – excluding the Company’s Executive Directors - who are tax residents in Spain and therefore subject to Personal Income Tax in Spain. |

Application for participation in the Plan

| 3.2. | This Plan is voluntary, and the Participants may or may not adhere to it. Participants who wish to participate in the Plan must communicate, prior to 24:00 on the date indicated in the "Application for Adherence to the Plan to Receive Part of the Remuneration through the Delivery of Ferrovial Shares" (the “Application for Adherence”), the amount of the annual fixed or variable remuneration that they would like to receive in kind by means of the delivery of Shares. This communication must be made through the Workday platform, in the route: Workday - Menu - Apps - Benefits and Pay. Those who do not have this access to this platform, may communicate their application by downloading the documentation from the corporate website (www.ferrovial.com) in the “Newsroom” section, sub-sections “Latest - News” and send the signed Application for Adherence toto the Human Resources Department of their respective business. The Application for Adherence to this Plan entails a reduction of the Participant's salary payments by an equivalent amount of the value of the Shares calculated as established in clauses 3.9 and 3.10 below, with this reduction being able to be assigned to the following salary items: |

| · | Variable Remuneration. In the event that the annual variable remuneration finally assigned to each Participant is less than the amount in Shares requested by the Participant, FERROVIAL will reduce the amount initially requested in Shares by the Participant up to that amount. |

| · | Fixed Remuneration The amount requested will be reduced from the fixed remuneration corresponding to the months of February, March, April, May, June, July, August and September, prior to the delivery of the Shares, by an amount equivalent each month to one eighth of the amount requested in Shares. |

If the Participant, once the Application for Adherence to the Plan has been completed, decides to renounce the Plan, he/she must expressly inform the Human Resources Department of the respective business about the decision before the Shares have been delivered, in accordance with the provisions of art. 3.7 of these Regulations.

The relevant Human Resources Department shall at all times ensure compliance with the legal and contractual obligations of the Participant arising from agreements, pacts or regulations (social security, personal income tax, etc.). To ensure such compliance, the relevant Human Resources Department may adjust the amount in Shares requested by the employee.

If the Participant leaves the Company for any reason, the part of the remuneration that has not yet been paid in Shares will be paid in cash together with the payment of the salary corresponding to the date of leaving the Company.

| 3.3. | The maximum limit of remuneration that each Participant may receive in Shares will be the lesser of (i) 12,000 euros, or (ii) the result of deducting the remaining remuneration in kind from 30% of their total annual remuneration. |

| 3.4. | The Company may agree, with a view to better management and administration of the Plan, to engage a company specializing in the management of employee incentive plans in shares (the “Collaborating Entity”) so as to instrument the delivery of the Shares to the Participants in the Plan. Participants, through their acceptance of the Terms and Conditions of the Collaborating Entity, and of these General Conditions, undertake to comply with all the obligations and conditions necessary or required, by the Collaborating Entity or by the Company, for their inclusion in the computer tool or platform of the Collaborating Entity managing the Plan, where applicable. The non-acceptance of the Terms and Conditions of the Collaborating Entity by the Participant shall imply the resignation of the Application for Adherence to the Plan. |

In the event that the Plan is managed by the Collaborating Entity, the Participants express their consent to the application, among others, of the following conditions:

| (i) | The delivery of the Shares shall be effected by transferring the ownership of the Shares to the Participants in the relevant book-entry register in the securities account held by the Participants with the Collaborating Entity. |

| (ii) | The Participant may transfer free of charge the Shares deposited in the securities account held with the Collaborating Entity to a securities account held by the Participant with an entity other than the Collaborating Entity within a maximum period of 90 calendar days from their delivery; if after this period the Participant has not transferred the Shares, all costs, as well as any liability associated with such Shares, shall be borne by the Participant. |

| (iii) | Regarding the dividends corresponding to the Shares deposited in the Participant's securities account opened with the Collaborating Entity, if the Collaborating Entity does not offer the Participant the possibility of receiving the dividend, at his/her choice, in cash or in Shares, the Participant who wishes the unavailable option, must transfer the Shares to the securities account opened with his/her financial Entity in advance of the dates established for the payment of the dividend. |

| 3.5. | In the event that the service is not outsourced, the Participants must indicate the securities account, if any, that they have opened solely and exclusively in their name with a financial institution, in which they wish to receive the Shares corresponding to them. This account must be kept open until the Shares are received. The Company reserves the right to require the Participants, as a necessary condition to adhere to this Plan, to open a securities account in a specific financial institution proposed by the Company itself, provided that this decision results in a simplification or acceleration of the process of delivery of the Shares to the Participants. This decision shall in no case entail a higher cost for the Participants than that which would result from the delivery of the Shares in the securities accounts of which they are currently holders. The Participant may deposit them in any other entity once the Shares have been received. |

| 3.6. | In the event that the Participant does not return the Application for Adherence duly completed within the term mentioned in section 3.2 above, it will be understood that they waive their participation in the Plan. |

Delivery of the Shares and appraisal of the Shares

| 3.7. | The Company will make its best efforts to deliver the Shares to the Participants of the Plan on the last trading day of March of each year (hereinafter, "Transfer Date"), for that part of the remuneration in kind that corresponds to variable remuneration, and on the last trading day of September of each year for that part of the remuneration in kind that corresponds to fixed remuneration. If this is not possible, it will do so on the closest business date to the Transfer Date permitted by the rules for settlement and clearing of securities transactions in the stock market established by Sociedad de Gestión de los Sistemas de Registro, Compensación y Liquidación de Valores S.A. (Iberclear) or the relevant central securities depository. Any delay that may occur in the delivery of the Shares shall not generate any liability for the Company. If the participant requests that a portion be delivered against variable remuneration and another against fixed remuneration, the Shares corresponding to each portion will be delivered separately on the dates indicated above. The Company may accelerate or delay the date of delivery of the Shares according to the business calendar and its coincidence with holidays or non-working days. |

| 3.8. | The Company's share price at the close of trading on the Madrid Stock Exchange (the “Stock Exchange”) on the Transfer Date will be taken into account for the valuation of the Shares. |

Number of Shares to be received

| 3.9. | The number of Shares to be received by Participants will depend on the Company's share price at the close of trading on the Stock Exchange on the Transfer Date. Therefore, at the date of the Application for Adherence, it will not be possible to determine exactly the number of Shares that each Participant will finally receive. |

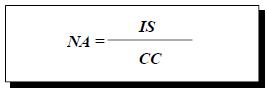

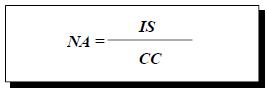

| 3.10. | The number of Shares to which each Participant shall be entitled shall be determined in accordance with the following formula: |

Where:

NA: Number of shares of the Company, rounded down, to be received by the Participant.

IS: Amount requested to be received in shares of the Company (maximum limit/participant: the lesser of (i) 12,000 euros, or (ii) the result of deducting the remaining remuneration in kind from 30% of their total annual remuneration.)

CC: Closing price of the Company's shares corresponding to the Date of Transfer.

This formula shall be applicable to the delivery of Shares charged to the Fixed Remuneration as well as to the Variable Remuneration and, each of them, with reference to the closing price of the Share corresponding to each Transfer Date.

| 3.11. | In no case may the number of Shares to be received by Plan Participants exceed the maximum number authorised by the Board of Directors. For this reason, the Company reserves the right to deliver a lower number of Shares than the result of the application of the above formula, making the corresponding proration according to the amount requested by each Participant. |

ARTICLE FOUR. Tax implications

General Considerations

| 4.1. | In accordance with the tax regulations in force in the Common Territory, for Personal Income Tax (hereinafter, IRPF) purposes, the delivery of Shares made by a company to its employees is exempt from taxation if the following requirements are met: |

| · | That the offer is made within the general remuneration policy of the company or group of companies, and that it contributes to employee participation in the company. |

| · | That each of the employees, together with their spouses or relatives up to the second degree, do not have a direct or indirect shareholding in the company in which they render their services or in any other company in the group of more than 5%. |

| · | The Shares must be held for at least three years. |

| 4.2. | This Plan has been designed to meet the first two requirements mentioned above, so the benefit of the tax advantage mentioned above will depend on the Participant holding the Shares for three years. |

| 4.3. | For this reason, by adhering to the Plan, the Participant knows, accepts and is responsible for the obligation to maintain the Shares in order to be able to take advantage of the tax benefit established in the current regulations, as mentioned above. |

| 4.4. | In the event that the Participant fails to comply with this requirement, the tax regulations establish that the Participant will be obliged to file a supplementary personal income tax return, with the corresponding late payment interest, within the period between the date on which the requirement is not complied with and the end of the regulatory period for filing the tax return corresponding to the tax period in which such non-compliance occurs. |

| 4.5. | In any case, both the Personal Income Tax (IRPF) and the withholdings and payments on account of this tax which, in accordance with the legislation in force at any given time, are or could be levied on the remuneration in kind obtained by the Participant or their successors, as a consequence of the implementation of this Plan, shall be borne by the Participant or their successors. |

| 4.6. | Likewise, the taxes arising from the sale of the Shares acquired as a result of this Plan shall also be borne by the Participant or their successors. |

Foral Specialities

| 4.7. | The regulations in force in the Territories of Vizcaya, Guipúzcoa and Álava do not provide for the tax exemption of remuneration consisting of the delivery of Company Shares to Employees free of charge; in Navarra, on the other hand, the same tax treatment applies as in the Common Territory. In any case, the provisions of the regulations in force at any given time shall apply. |

ARTICLE FIVE: Implications in the event of termination of the employment relationship of the plan's Participant

| 5.1. | The Participant's Adherence to the Plan shall not affect the basis to be taken into account for calculating the possible compensation, if any, as a consequence of the termination of the employment relationship, the compensation of which shall be determined considering as part of the annual remuneration, the economic value of the Shares received, valued in accordance with the provisions of section 3.10 above. |

| 5.2. | In the event of (i) the termination of the employment relationship of the Participant with a company that is part of the Group of companies of FERROVIAL or that (ii) the subsidiary with which the Participant maintains the contract at that time ceases to be under the direct or indirect control of Ferrovial, the following rules shall apply: |

| · | If the termination of the employment relationship or the change of control of the subsidiary occurs prior to the Share Transfer Date, the Participant will not be entitled to receive the Shares. However, they will be entitled to receive an amount equivalent to the amount by which their annual compensation would have been reduced as a result of adhering to the Plan. For any Participant who is subject to United States federal income tax, such amount shall be payable no later than March 15 following the year in which the termination of employment relationship or the change of control of the subsidiary occurs. |

| · | If the termination of the employment relationship or the change of control of the subsidiary were to occur after the Transfer Date, there would be no implication, since the Shares would be owned on that date by the Participant. |

ARTICLE SIX: Limit of rights, declaration of limitation of liability and privacy of data with respect to the plan

| 6.1. | By accepting the contents of these General Conditions, the Participant acknowledges: |

| · | That neither FERROVIAL nor the group company for which the Participant renders their services shall be liable and, consequently, the Participant shall not be entitled to claim any compensation for fluctuations in the price of the Shares. |

| · | That the company of the FERROVIAL group of companies for which the Participant renders their services shall be responsible for the expenses of the execution of this Plan until the effective placement of the Shares in the securities account that the Participant has opened with the Collaborating Entity, in accordance with clause 3.4 above or, if the service is not outsourced, in his / her private securities account referred to in clause 3.5 above. Any other expenses derived from the maintenance of the Shares in the corresponding securities account shall be borne by the Participant under the terms agreed, if any, with the Collaborating Entity or the financial institution with which the securities account is open. |

| 6.2. | When formalizing his adhesion to the Plan, the Participant: |

| a) | Is aware and consents that his personal data will be processed automatically or manually for the sole purpose of enabling the proper management and administration of the Plan. The personal data requested are essential to be able to assign and, if necessary, allow the subsequent delivery of the Shares. The legitimate basis for the treatment is the development and execution of the employment relationship established. Likewise, is aware that his/her data may be communicated to the Ferrovial Group companies for the fulfillment of the same purpose mentioned above; as well as, if applicable, to the public administrations such as fiscal and tax authorities, for the fulfillment of legal obligations; and to financial entities for the management of collections and payments. |

| | Once the purpose for which the data was collected is fulfilled, it will be blocked for the period of limitation of the legal actions that may correspond. Once this instance has been exhausted, the data will be definitively deleted. |

| | | In accordance with the provisions of Regulation (EU) 2016/679, General Data Protection Regulation (GDPR), FERROVIAL, in its capacity as data controller, guarantees the rights of access, cancellation, rectification, deletition, portability, limitation and opposition that may be exercised by sending a communication to the address of FERROVIAL, in c/ Príncipe de Vergara, 135, 28002, Madrid, including its name, surname, an address for notification purposes and the right you wish to exercise or by writing to dpd@ferrovial.com. The Participant may also contact the Data Protection Officer by writing to dpd@ferrovial.com. He/she can also complain to the Dutch Data Protection Supervisory Authority (Autoriteit Persoonsgegegevens www.autoriteitpersoonsgegevens.nl), especially when no satisfaction has been obtained in the exercise of rights. |

| b) | Authorises FERROVIAL to amend the conditions of the Plan in the event of an amendment in the tax regulations related to this type of incentive schemes. |

| c) | Accepts that adhesion to the Plan constitutes in itself a partial amendment of the salary remuneration system in its form of remuneration, agreed with the company from the time of application for adhering to the Share Plan, whereby the fixed remuneration and/or gross annual variable remuneration that to date they have been receiving or could receive, will be partially amended in its form of remuneration for the amount requested, for the right to receive Ferrovial Shares with the aforementioned limits: the lesser of (i) 12,000 euros, or (ii) the result of deducting the remaining remuneration in kind from 30% of their total annual remuneration. |

ARTICLE SEVEN: Amendments and Term of Validity

| 7.1. | Any amendment of the General Conditions of this Plan is the responsibility of the Human Resources General Direction. |

| 7.2. | This Plan will be applicable to the annual variable remuneration, corresponding to the financial years 2024 to 2028, to be received in the years 2025 to 2029, as well as to the fixed remuneration for the years 2025, 2026, 2027, 2028 and 2029. The foregoing shall be without prejudice to those actions that, in accordance with these General Conditions, are carried out after said date. |

ARTICLE EIGHT.- Communications and Information on the Plan

| 8.1. | All communications made by the Participant to the Company in connection with the Plan, except for the Application for Adherence, which shall be made in accordance with the provisions of Section 3.2, shall be addressed to the Human Resources General Direction. |

| 8.2. | The Company’s Human Resources General Direction will provide all the information required on this Plan to the Participants and will keep them informed of any amendment that the Plan may undergo in the future. |

ARTICLE NINE.- Applicable law and interpretation of the Plan

| 9.1. | This Plan shall be governed by Spanish law. |

| 9.2. | In the event of discrepancies regarding the interpretation or effects of the provisions of the Plan, the parties undertake to submit the matter to the Company's Human Resources General Direction prior to the exercise of any legal action, stating their intention to take into account what the latter may rule. |