Exhibit 99.6

CERTAIN PORTIONS OF INFORMATION HAVE BEEN OMITTED FROM THIS EXHIBIT BECAUSE SUCH INFORMATION IS BOTH (I) NOT MATERIAL AND (II) THE TYPE OF INFORMATION THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL. OMITTED INFORMATION IS MARKED AS [***] BELOW.

General Conditions of the

Performance-Based Share Plan of

“Ferrovial, S.E.” for Executives 2023-2025

Madrid, 15 December 2022

ARTICLE ONE. – Purpose and Administration of the Plan

| 1.1 | The Board of Directors of Ferrovial, S.E., a company domiciled in Gustav Mahlerplein 61-63, 14th floor, 1082 MS, Amsterdam, Netherlands, registered in the commercial register of Amsterdam under number 73422134 with Dutch tax identification number 859532161, (hereinafter the “Company”), agreed, at its meeting held on 15 December 2022, to offer executives and other employees of the Company and its subsidiaries who, as determined by the Company, have that status on the corresponding Unit Allocation Date, as defined in section 3.2 of these General Conditions (hereinafter, the “Participants”), the opportunity to participate in a plan linked to the Company shares (hereinafter, either the “Ferrovial Performance-Based Share Plan 2023-2025” or the “Plan”), which will allow them to receive, after a certain period of time and provided that certain requirements are met, shares of the Company (hereinafter the “Shares”). |

| 1.2 | The Plan is intended to align the Participants’ interests with those of the Company and its shareholders, and to provide the Company and its Group with an instrument to attract and keep the best executives. |

For the purposes of this document, the Group formed by the Company and its subsidiary companies shall mean those companies under direct or indirect control according to the terms of article 42.1 of the Spanish Commercial Code.

| 1.3 | The Plan shall be governed by the General Conditions established in this document and by the Specific Conditions agreed upon with each Participant, following the model attached hereto as Annex 1 to these General Conditions. Participants must expressly accept those General Conditions so that their participation in the Plan is understood as formally concluded. |

| 1.4 | The Company Nominations and Remunerations Committee shall be in charge of the following duties, along with any other matters expressly attributed to it under this document: |

| (i) | Determining the number of Participants. |

| (ii) | Changing the companies that make up the group of comparison entities for the purposes of this Plan, in case of winding-up, dissolution, division, insolvency proceedings or equivalent legal situations, delisting (with or without prior takeover bid), transformation or takeover of any of those companies as a result of any corporate operations or company restructuring, thus modifying in accordance the relevant positions table of the various entities on the companies ranking and their corresponding coefficients. |

| (iii) | The appropriate adjustments to the ratios, targets and coefficients established in the General Conditions and the Specific Conditions of the Plan, should some situation, company operation or significant event arise which suggests altering the essential elements of the Plan. |

| (iv) | Interpreting the application of the situations of change of control over subsidiaries and investees by the Company referred to in section 3.11.2.iv of these General Conditions. |

| (v) | In general, interpreting the basic rules and conditions of this Plan, and any other matter that, due to its relevance, is considered appropriate. |

| 1.5 | The General Human Resources Management Department will normally be in charge of: |

| (i) | Determining the basic conditions of the Plan. |

| (ii) | Managing the Plan, being authorised to execute and subscribe all necessary acts and documents, particularly the General and Specific Conditions of the Plan. |

ARTICLE TWO. – Shares Involved in the Plan

| 2.1 | The Company shall allocate to each Participant a specific number of units (hereinafter, the “Units”), which shall be the basis to determine the final number of Shares to be received by each Participant as a result of this Plan. Each Unit may become, initially, a Share. The Plan shall include the number of Units that the Chief Executive Officer of the Company authorises for each Participant annually. The total cost of Shares for the Plan for each allocation of units shall in no event exceed the maximum number approved by the Board of Directors. |

| 2.2 | If, prior to Units becoming Shares, there occurred any capital increases against reserves or at a lower issue rate than market prices, any falls in the face value without the amount of the number of shares being altered, capital decreases with return of the capital put in or other company operations with a dilutive effect, including operations related to company mergers, divisions or restructuring, non-recurring dividends or other similar circumstances that affect the value of the Company’s shares or those of any other company in the group of comparison entities indicated in section 3.4 below, the number of Units allocated to each Participant may be modified, to the extent necessary for keeping the scope of the right granted. |

| 2.3 | In the event of merger by take-over by another company, or of split, the Shares that the holder of a specific number of Units would have received from the exchange shall be calculated for the purpose of establishing the number of Shares that can be delivered at the time of translation of said Units. |

| 2.4 | The Shares received under this Plan, once the relevant Units are turned into Shares, if applicable, shall be free of any liens or encumbrances and they shall not be subject to any limitations or restrictions which are not generally applicable to the Company shareholders, or to shares of the same type, class or series, whether because of contractual, statutory or legal provisions. |

| 2.5 | Notwithstanding the above, the Company may choose (i) for those Participants who provide services in subsidiary companies abroad, (ii) for those Participants who are involved in any of the particular situations described in section 3.11.2 below (i.e. unfair dismissal, retirement, etc.), and (iii) in other situations in which the interest of the Company renders it advisable, to pay an amount in cash equivalent to the weighted average price of the Company’s shares on the Vesting Date provided by the Finance Department, as defined in section 3.8. below, except for the special situations described in section 3.11.2, in which case the amount in cash will be calculated in accordance with the provisions of that section. |

ARTICLE THREE. – Main Characteristics of the Plan

Participants

| 3.1. | The Plan is intended, in principle, for executives and other employees of the companies included in the Group, which, as determined by the Company, hold said status on the corresponding Unit Allocation Date established in section 3.2 below, under the terms determined by the Company. Participation in the Plan shall not confer any right upon Participants to participate in other share or cash incentive plans that the Company may implement in the future. |

Allocation of Units

| 3.2. | The Units shall be allocated annually by the Company three times in the years 2023, 2024 and 2025, on a specific date that shall be communicated to each Participant each year through the Specific Conditions of the Plan (“Unit Allocation Date”), and each Participant shall formally accept the allocated Units. The number of Units shall appear in the relevant individual certificate to be issued by the Company’s General Human Resources Management Department for each Participant in the Plan. Said certificate is attached hereto as Annex 2 to these General Conditions (“Certificate of Units Allocated”). |

| 3.3. | The number of Allocated Units, and therefore, the number of Shares the Participant may enjoy the right to receive should the requirements set out in the Plan be met, shall be determined by the Chief Executive Officer of the Company annually. The allocation of units on a Unit Allocation Date will not be entitled to receive Units in the subsequent years. |

Condition to Receive the Shares

| 3.4. | In addition to the condition of continued employment as set out in section 3.8 below, in order for any Participant to be entitled to turn the allocated Units into Shares and therefore to receive Shares by virtue of taking part in this Plan, the following conditions will have to be met: |

| 1. | The Ratio A (hereinafter, the “Ratio A”), understood as [***]. |

The Specific Conditions related to the corresponding allocation of Units shall establish the specific Ratio A amount to be met (target), as well as the minimum target to be achieved in order to receive Shares and for the special situations described in section 3.11.2, the adjustment to be made on the objectives set for the Ratio A will be detailed.

| 2. | Ratio B (hereinafter, the “Ratio B”) understood as the evolution of the “Total Shareholder Return” index (hereinafter “TSR” or “RTA”, according to the Spanish acronym) of the Company [***]. |

| 3. | That Ratio C (hereinafter, "Ratio C") is the Company's environmental, social and governance ("ESG") target, [***]. |

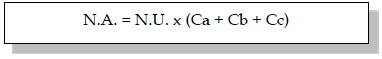

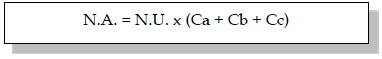

The number of Shares to be received, if applicable, by the Participants in the Plan shall be determined by applying the following formula:

Where:

N.A. = Number of Shares to be received by the Participant, rounded off by default.

N.U. = Number of Units allocated on the corresponding Unit Allocation Date.

Ca = Coefficient referred to Ratio A as defined in the relevant Specific Conditions on each Unit Allocation Date, expressed as a percentage.

Cb = Coefficient referred to Ratio B as defined in the relevant Specific Conditions on each Unit Allocation Date, expressed as a percentage.

Cc = Coefficient referred to Ratio C as defined in the relevant Specific Conditions on each Unit Allocation Date, expressed as a percentage.

| 3.5. | In no event shall the number of Shares to be delivered exceed the number of Units allocated on the corresponding Unit Allocation Date. |

| 3.6. | The Board of Directors, at the proposal of the Nominations and Remunerations Committee, may change the aforementioned ratios in the event that there was a change in the applicable accounting standards that affected the amount or manner of determining those ratios. |

| 3.7. | The Plan is subject in all cases to the interest of Ferrovial and the objectives pursued. The allocation of Units only confers a right expectation pending compliance with the indicated conditions. Further, the Board of Directors, at the proposal of the Nominations and Remunerations Committee, may change the ratios should some event or company operation occur before the Vesting Date defined in section 3.8 below (such as a material change in the structure of the business of a Company, a merger operation, or any other situation that in its judgment justifies it). |

Date of Delivery of Shares

| 3.8. | Without prejudice to what is established in section 3.11 below in these General Conditions, in order for Participants to receive any Shares under this Plan, it shall be a prerequisite that the relevant Participant has an employment relationship with the Company or with any of its subsidiaries up to the Third Anniversary of the Allocation of Units. The Shares resulting from application of what is set out in section 3.4 above, shall be delivered to Participants within forty-five days following the date of preparation of the consolidated annual financial statements for the financial year previous to the financial year in which the Third Anniversary of the Allocation of Units occurs (hereinafter “Vesting Date”). Up to that date, the Participant shall only hold a right expectation regarding the possibility of receiving Shares by virtue of his/her participation in this Plan. For the cases provided for in section 2.5 above, the cash equivalent will be delivered to Participants within fifteen business days following the Vesting Date. |

Delivery of Shares

| 3.9. | The Company's General Human Resources Management Department shall communicate the delivery of Shares to each Participant. The delivered Shares shall be deposited in the securities account that each Participant shall hold in a financial institution or investment service firm and that each Participant shall have notified to the Company before the Vesting Date as a prerequisite for the Shares to be delivered on the aforesaid date. The only and exclusive holder of such securities account shall be the relevant Participant. |

Alternatively, the Company may agree, with a view to better management and administration of the Plan, to engage a company specializing in the management of employee incentive plans in shares (the “Collaborating Entity”) so as to instrument the delivery of the Shares to the Participants in the Plan. Participants, through their acceptance of these General Conditions, undertake to comply with all the obligations and conditions necessary or required, by the Collaborating Entity or by the Company, for their inclusion in the computer tool or platform of the Collaborating Entity managing the Plan, where applicable.

In the event that the Plan is managed by the Collaborating Entity, the Participants express their consent to the application, among others, of the following conditions:

| (i) | The delivery of the Shares shall be effected by transferring the ownership of the Shares to the Participants in the relevant book-entry register in the securities account held by the Participants with the Collaborating Entity. |

| (ii) | The Participant may transfer free of charge the Shares deposited in the securities account held with the Collaborating Entity to a securities account held by the Participant with an entity other than the Collaborating Entity within a maximum period of 90 calendar days from their delivery; if after this period the Participant has not transferred the Shares, all costs, as well as any liability associated with such Shares, shall be borne by the Participant. |

| (iii) | In the event that the Company decides to carry out a capital increase through monetary contribution without excluding pre-emptive subscription rights, the pre-emptive subscription rights corresponding to the Shares delivered and remaining in the Collaborating Entity shall be sold on the market in the name and on behalf of the Participant, as soon as possible after the start of the trading period. The amount obtained from the sale, subject to compliance with the relevant tax obligations, shall be automatically reinvested in the acquisition of new Shares, unless the Participant expressly indicates otherwise, at least ten (10) days prior to the end of the trading period of the pre-emptive subscription rights. |

| 3.10. | As a general rule, from the number of Shares to be delivered to each Participant as a result of applying what is set out in section 3.4 above, the Company shall deduct a number of Shares with a market value, on the Vesting Date, equivalent to the appropriate advance payment of personal income tax (hereinafter, “PIT”), or any other tax as applicable, for the value of the Shares to be delivered to the Participant. |

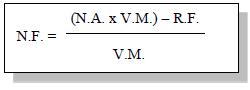

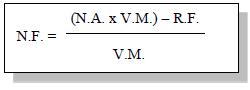

The final number of Shares to be delivered by the Company to each Participant shall be determined according to the following formula:

Where:

N.F. = Final Number of Shares to be delivered to each Participant, rounded off by default.

N.A. = Number of Shares to be received by each Participant in accordance with what is set out in section 3.4 above.

V.M. = Market Value of the Company’s shares on the Vesting Date of the Shares. The market value shall correspond to the weighted average price of the Company’s shares on the Vesting Date provided by the Finance Department.

R.F. = Tax Withholding. Amount to be deducted as advance payment of PIT, or any other tax, which shall be applied to the Market Value of the Company’s shares on the Vesting Date, determined according to the following formula:

Where:

t.r. = Withholding Rate. Estimate of percentage of withholding or advance payment of PIT or any other tax applicable on the total Shares resulting from conversion of Units. Any differences which, as the case might be, could appear as a result of calculating said withholding percentage, and the withholding rate as finally applicable, shall be adjusted on the payslip for the month following the month in which the Shares are delivered.

In those situations where the Company opts, pursuant to the foregoing section 2.5, to settle the Plan in cash, prior to payment, the Company shall deduct the amount corresponding to the withholding of PIT or any other tax applicable, and which shall in all cases be borne by the Participant.

Special Situations

| 3.11. | Delivery of the relevant Shares under this Plan in the special situations contained in this section shall take place in accordance with the following rules: |

| - | Unless expressly established to the contrary for a specific situation, what is set out in section 3.4 regarding ratios shall apply. The Specific Conditions related to the corresponding allocation of Units shall detail the adjustment to be made on the objectives set for the Ratio A and the Ratio C, in the event that a special situation occurs described in section 3.11.2. |

| - | For the purposes of these General Conditions, the financial year is deemed to have closed at 23:59 on 31 December of the relevant financial year. |

| - | With regards to the Vesting Date established in section 3.8 above, in these special situations of section 3.11.2 the effective delivery date of the Shares or the payment of the corresponding cash settlement, shall be expressly governed by each special situation. |

| 3.11.2. | Special situations: |

| i) | Retirement. Subject to the last sentence of this section 3.11.2, if the Participant retires before the Third Anniversary of the Allocation of Units, and provided that the levels required in the relevant Specific Conditions for each of the ratios set out in paragraph 3.4 above have been achieved for the financial years ending after each Unit Allocation Date, the Participant shall be entitled to receive within fifteen working days following the date on which retirement is effective, except where the consolidated financial statements for the last completed financial year prior to retirement have not yet been authorised for issue on the latter date, in which case it will be the number of Shares resulting from the application of the following. formula: |

Where:

N.F.SE = Final Number of Shares to be delivered to each Participant, rounded off by default, in the special situation of this section 3.11.2.i).

N.A. = Number of Shares to be received by each Participant in accordance with what is set out in section 3.4 above, in respect of the financial years closed subsequently to the corresponding Unit Allocation Date.

n = Number of days elapsed between the corresponding Unit Allocation Date and the date on which the Participant retires, but in no case may "n" be greater than "N".

N= Total number of days between the corresponding Unit Allocation Date and the Third Anniversary of the Unit Allocation, 1,095 days being taken for these purposes.

In such a case, for the purpose of compliance with the ratios established in section 3.4, on which the final number of Shares to be received is based, the closed financial years elapsed since each Unit Allocation Date shall be taken into account.

In the case of Ratio B, a financial year means each calendar year ending on or after each Unit Allocation Date.

In the event that on the date of retirement, no financial year has closed since the corresponding Unit Allocation Date (i.e. that the retirement is effective before 1 January of the year following the relevant Unit Allocation Date), the Participant shall not be entitled to receive Shares by virtue of this Plan. For any Participant who is subject to United States federal income tax, at the time of the Participant’s termination of employment, the Company, in its sole discretion, shall determine whether such termination qualifies as a “retirement” for purposes of this section 3.11.2.

| ii) | Voluntary leave. In the event that the Participant leaves voluntarily (termination of contract between Participant and the Group company, by the Participant’s unilateral decision, without the Participant continuing to be employed by any other Group company), the right to receive Shares under this Plan shall expire automatically on the date when the Participant’s voluntary leave is effective. |

| iii) | Dismissal by the Group company. |

a) If the Participant is dismissed following a decision by the Group company (termination of contract by the Group company’s unilateral decision, without the Participant continuing to be employed with any other Group company) and provided that the levels required in the corresponding Specific Conditions have been achieved for each ratio established in section 3.4 above in respect of the financial years closed subsequently to each Unit Allocation Date, the Participant shall be entitled to receive either, (i) within fifteen working days following the date on which the Participant’s dismissal is effective, unless the consolidated financial statements for the last financial year closed prior to termination have not yet been prepared by the latter date, in which case they shall be delivered within fifteen working days following the date on which they are prepared, or (ii) should the Company so decide, on the delivery date envisaged initially on each Unit Allocation Date, the number of Shares resulting from the following formula: [***].

For the purposes of determining the level of compliance with the ratios foreseen in section 3.4 above, only closed financial years elapsed following the Unit Allocation Date shall be considered.

In case of Ratio B, financial year shall mean each of the calendar years ended following each Unit Allocation Date.

In the event that on the date of dismissal, no financial year has closed since the corresponding Unit Allocation Date (i.e. that the dismissal is effective before 1 January of the year following the relevant Unit Allocation Date), the Participant shall not be entitled to receive Shares by virtue of this Plan.

b) If the Group Company adduced as the cause for dismissal the Participant's breach of legal or contractual duties, the right to receive Shares shall lapse. The above shall not be applicable in the event that, pursuant to Labour Law, dismissal was declared or ruled wrongful on a firm basis or in the event that the reason adduced for dismissal is not appropriate, in which case the Shares that the Participant might be entitled to receive may only be delivered within fifteen working days following the date of that declaration or ruling, unless the consolidated financial statements for the last financial year closed prior to the termination have not yet been prepared by the latter date, in which case they shall be delivered within fifteen working days following the date on which they are prepared, and the formula established in paragraph a) above shall apply, as well as the conditions related to the ratios established in section 3.4 above.

| iv) | Change of control situations. In the event of a change of control of the Company [***]. |

| v) | Removal by mutual agreement and leave situations due to special services. In the case of the Participant’s removal by mutual agreement and of the Participant’s leave due to special services, what is agreed in each case between the Participant and the Company shall apply. |

| vi) | Death, severe disability or permanent disability. In these circumstances, or when contingencies relate to severe disability or permanent disability occur that are equivalent in each jurisdiction, the Participant, the Participant’s heirs or the Participant’s legal representatives may receive, within fifteen working days following the time where any of the aforesaid situations occurs, the number of Shares resulting from applying the following formula to the number of Units as initially allocated to the Participant, and the conditions related to the ratios established in section 3.4 above shall not apply. |

Where:

N.FSE = Final Number of Shares to be delivered to each Participant, rounded off by default, in the special situations set out in the present section 3.11.2.vi).

N.U. = Number of Units allocated on the corresponding Unit Allocation Date.

n = Number of days elapsed between the corresponding Unit Allocation Date and the date on which death, severe disability or permanent incapacity actually occurs, but in no case may "n" be greater than "N".

N= Total number of days between the corresponding Allocation Date of Units and the Third Anniversary of the Allocation, 1,095 days being taken for these purposes.

In all the above situations that result in the delivery of a certain number of Shares, the final number of Shares to be delivered by the Company shall take into account the amount to be deducted, in accordance with the settlement mechanism set out in section 3.10 above.

Without prejudice to the above, in all the special cases foreseen in section 3.11.2 above that could result in the delivery of a certain number of Shares, the Company may choose to pay in cash an equivalent amount to the weighted average of the closing market value on the day before the vesting date of the markets on which we are listed and provided by the Economic and Financial Department, of the Shares that, as the case may be, the Participant or, when appropriate, his/her heirs or legal representatives were entitled to receive, as regulated by each special case except for the cases provided:

| - | In section 3.11.2.iii).a), in which by decision of the Company, the actual vesting date of the Shares regulated for that special case coincides with the Vesting Date initially foreseen for each Unit Allocation Date, in accordance with the provisions of paragraph 3.8, the amount in cash will be equivalent to the market value for the Shares the Participant may be entitled to receive by virtue of the Plan, will be calculated using the weighted average price of the Company’s shares on the Vesting Date provided by the Finance Department, and |

| - | in section 3.11.2.iv), if the change of control arises [***]. |

The provisions in the last paragraph of the foregoing section 3.10 shall also be applicable to that cash amount, relative to the application of the corresponding withholdings on account of PTI or any other tax that may be applicable.

Transfer of Units

| 3.12. | The Units as initially allocated to each Participant shall not in any event confer any political or economic rights regarding the Shares of the Company, since they are simply a right expectation. Therefore, the Units cannot be encumbered or pledged or be transferred under any title. Only upon settlement of the Plan, if the conditions established for this event occur, the Company’s Shares shall be delivered to the Participants in the Plan, or, in the event of death, to the Participant’s legal heirs, who shall then become shareholders of the Company, except in the case that the Plan has been settled in cash, in which circumstance neither the Participants, nor their legal heirs, shall receive Shares in the Company. |

Extinction of Units

| 3.13. | The Units shall lapse for the following reasons: |

| 3.13.1. | Due to delivery of the Shares or its corresponding amount in cash in accordance with the procedure established in the Plan. |

| 3.13.2. | On the Third Anniversary of the Allocation of Units being reached without fulfilment of the conditions related to the ratios set out in section 3.4 above. |

| 3.13.3. | Upon termination of the relationship between the Participant and the Company, or its subsidiaries, before the Third Anniversary of the Allocation of Units, with the exception of the special situations which, as per section 3.11.2 above, may give rise to delivery of Shares. |

Authorisation of the General Shareholders' Meeting of the Company

| 3.14. | In accordance with Article 146.1a) of Spanish Companies Act, the Company shall submit the necessary authorisation for acquisition of own shares, with the purpose of delivering them to the Participants, to the General Shareholders' Meeting, for approval. |

| 3.15. | In the event that on the Vesting Date there was no authorisation by the General Shareholders' Meeting as mentioned in the paragraph above, the Participant shall be entitled to receive, from the Company and in cash, an amount equivalent to the number of Units allocated to each Participant as might have been turned into Shares, in accordance with the requirements referred to in section 3.4 above, by the weighted average price of the Company’s share on the Vesting Date provided by the Finance Department. Such cash amount shall be delivered to Participants within fifteen working days following the Vesting Date. The provisions in the last paragraph of the foregoing section 3.10 shall also be applicable to that cash amount. |

| 3.16. | What is set out in the paragraph above shall also apply in the event that, if any of the special situations established in section 3.11.2 above occurred, a specific number of Shares should be delivered, without there being any authorisation by the General Shareholders' Meeting. |

Modifications and Term of Validity

| 3.17. | Without prejudice to the powers of the Nominations and Remunerations Committee and to the legal or conventional obligation, if any, of reaching an agreement with the Participants in the Plan, any modification to the General Conditions of this Plan shall require the previous agreement of the Board of Directors of the Company. |

| 3.18. | This Plan shall be valid until the Vesting Date of the Shares, corresponding to the third Unit Allocation Date as established in section 3.2 above. The foregoing shall be understood without prejudice to any actions that, in accordance with these General Conditions, are developed subsequently to the aforesaid date. |

Plan Information

| 3.19. | The General Human Resources Management Department of the Company shall provide the Participants with any information concerning this Plan as required and shall keep the Participants informed about any modification to the Plan as might occur in the future. |

ARTICLE FOUR.- Execution

| 4.1. | The General Conditions, the Specific Conditions (Annex 1) and the Certificate of Allocated Units (Annex 2) shall be issued to all employees electronically, through the HR Management system tool. |

On each of the Unit Allocation Dates, the Specific Conditions shall be accepted electronically, through the HR management systems tool, as established for the allocation of Units corresponding to each Participant, according to Annex 1, and said conditions shall include the parameters to be fulfilled in order to receive the Shares. Notwithstanding the foregoing, in cases where access to such system is not available, acceptance of the Specific Conditions shall be made by e-mail.

| 4.2. | Likewise, the Certificate of Allocated Units issued electronically to each Participant on each Unit Allocation Date, following the model in Annex 2, shall be accepted by the Participant in accordance with the procedure set out in this section for the Specific Conditions. |

ARTICLE FIVE. – Lack of Legal Effect within the Employment Area

| 5.1. | No provision or guarantee under this Plan shall be understood or interpreted as a right of the Participants to keep their employment relationship, employment contract or any other contract in force, or as any other similar rights; and no provision or guarantee under the Plan shall limit the rights held by the Company to modify or discharge said relationship or contracts in accordance with the legislation in force or with the terms of said contract or relationship. |

| 5.2. | The Participant acknowledges that neither the Units nor the Shares as the Participant may receive under this Plan are working incentives, and that said Units and Shares cannot be regarded as a consideration for the Participant’s work in the Company or its subsidiaries; and that said Units and Shares shall not count to any effect in any compensation, to or by the Participant, as might apply on the existence or cessation of the employment relationship; and the Participant and the Company expressly agree that the Units or the Shares that, as the case may be, the Participant may receive under this Plan are excluded from calculation for compensation purposes as might be contractually established. No executive has the right or expectation to participate in the Plan; nor does the executive’s participation in this Plan bind the executive for the purpose of the executive’s possible participation in any other plan of a similar or identical nature to that of this Plan. The allocation of Units under this Plan is voluntary, discretionary and cannot be consolidated and it does not entail any right to receive new Units or Shares in the future. |

ARTICLE SIX. - Notices

| 6.1 | Any communication from the Participant to the Company or, where appropriate, to the Collaborating Entity in relation to the Plan, shall be addressed, respectively, to The General Human Resources Management Department or, to the professional or department indicated by the Collaborating Entity. |

ARTICLE SEVEN. Expenses, Taxes and Social Security

| 7.1. | Any expenses as derived from delivery of Shares to the Participant by virtue of what is contained in this Plan, shall be fully paid by the Company. |

However, the Participant shall bear any expenses arising from possible subsequent disposal of the Shares.

| 7.2. | Taxes derived from implementation of this Plan shall be paid by the individuals or entities that turn out to be tax payers in accordance with the applicable tax legislation. In particular, withholdings or advance tax payments as may be required under the regulations on PIT, or any other tax, direct or indirect, as applicable by virtue of the tax regulations in force from time to time, including, where applicable, the Financial Transfers Tax ("FTT"), shall be borne by the Participant. |

| 7.3. | Likewise, contributions to Social Security or to systems of a similar nature in other jurisdictions that, where appropriate, are legally attributable to the Participant, will also be borne by the Participant. |

ARTICLE EIGHT. – Interpretation of the Plan

| 8.1. | In the event of any dispute about the interpretation of or the effects of what is established in the Plan, the parties undertake to submit any question as might arise to the Nominations and Remunerations Committee before initiating any legal action, and they hereby state that they intend to take into consideration what the Committee may decide. |

Annex 1

Specific Conditions applicable to [NAME] regarding the Performance-Based Share Plan of “Ferrovial, S.E.” for Executives 2023-2025

ARTICLE ONE.- Definitions

The capitalized terms used in these SPECIFIC CONDITIONS and not defined in it shall have the meaning granted by the General Conditions of the PERFORMANCE-BASED SHARE PLAN OF “FERROVIAL, S.E.” for Executives 2023-2025, dated 15 December 2022, to which Annex 1 is attached as an integral part of these.

ARTICLE TWO.- Allocation of Units

The Company allocates to [NAME] the Units listed in Article Three below, following what is set out in the General Conditions of the PLAN.

ARTICLE THREE.- Terms of Units

The characteristics of the Units allocated are the following:

Number of Units:

[NUMBER OF UNITS]

UNIT ALLOCATION DATE for the purposes of calculating the Conditions set out in the general conditions of the plan: 15 February 2024.

ARTICLE FOUR.- Ratios Applicable to Allocated Units

In accordance with what is set out in the General Conditions, upon allocation of Units, the target to be met for RATIO A, RATIO B, and the RATIO C metrics, as well as the minimum target as regards RATIOS A, B and RATIO C metrics shall be determined in the Specific Conditions. The eventual delivery of shares by virtue of this PLAN shall depend on the fulfilment of such percentage and minimum target.

The ratios to be achieved for the PARTICIPANTS to receive COMPANY SHARES under this Plan, as defined in the General Conditions of the PLAN, are:

| - | RATIO B: Relative position of the evolution of the “Total Shareholder Return” index of Ferrovial, S.E. [***]. |

| - | RATIO C: Environmental, social and governance ("ESG") [***]. |

ARTICLE FIVE. – Acceptance of General Conditions

By accepting via electronic means, through the HR Management Systems tool, or via email in cases where they do not have access to this tool, the PARTICIPANT declares to be aware of and to expressly accept all of the terms and conditions of the General Conditions of the PLAN.