0001468522fer:SundryReceivablesMemberMemberfer:OtherReceivablesMember2024-12-310001468522ifrs-full:LaterThanTwoYearsAndNotLaterThanThreeYearsMemberfer:ExinfrastructureProjectMemberfer:CorporateDebtMember2027-12-310001468522country:ESfer:ConstructionDivisionMemberfer:IIDepusaAragonSAAMember2024-01-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

☐REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF

1934

OR

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 001-41912

Ferrovial SE

(Exact name of Registrant as specified in its charter)

The Netherlands

(Jurisdiction of incorporation or organization)

Gustav Mahlerplein 61-63 Symphony Towers, 14th Floor

1082 MS Amsterdam

The Netherlands

(Address of principal executive offices)

I

Ignacio Madridejos

Chief Executive Officer

Gustav Mahlerplein 61-63 Symphony Towers, 14th Floor

1082 MS Amsterdam

The Netherlands

Telephone: +31 20 798 3700

Investor Relations

ir@ferrovial.com

Príncipe de Vergara, 135

28002 Madrid

Spain

Telephone: +34 91 586 2736

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered, pursuant to Section 12(b) of the Act.

| | | | |

| | | | Name of each exchange on which registered |

Ordinary shares, par value EUR 0.01 per share | | | | Nasdaq Global Select Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital stock or common stock as of the close of the period covered by the annual report: As of December 31, 2024,

the registrant had 721,806,552 ordinary shares outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for

such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated

filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☒ Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5,

2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under

Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to

previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive

officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

☐ U.S. GAAP☒ International Financial Reporting Standards as issued by the International Accounting Standards Board☐ Other

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

| |

|

| |

| |

INTRODUCTION AND USE OF CERTAIN TERMS | |

PRESENTATION OF FINANCIAL AND OTHER INFORMATION | |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | |

| |

| |

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT, AND ADVISERS | |

A. Directors and Senior Management | |

| |

| |

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE | |

| |

| |

B. Capitalization and Indebtedness | |

C. Reasons for the Offer and Use of Proceeds | |

| |

ITEM 4. INFORMATION ON THE COMPANY | |

A. History and Development of the Company | |

| |

C. Organizational Structure | |

D. Property, Plants, and Equipment | |

ITEM 4A. UNRESOLVED STAFF COMMENTS | |

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS | |

| |

B. Liquidity and Capital Resources | |

C. Research and Development, Patents and Licenses, etc | |

| |

E. Critical Accounting Estimates | |

ITEM 6. DIRECTORS, SENIOR MANAGEMENT, AND EMPLOYEES | |

A. Directors and Senior Management | |

| |

| |

| |

| |

F. Disclosure of a Registrant’s Action to Recover Erroneously Awarded Compensation. | |

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | |

| |

B. Related Party Transactions | |

C. Interests of Experts and Counsel | |

ITEM8. FINANCIAL INFORMATION | |

A. Consolidated Statements and Other Financial Information | |

| |

ITEM 9. THE OFFER AND LISTING | |

| |

| |

| |

| |

| |

F. Expenses of the Issuer | |

ITEM 10. ADDITIONAL INFORMATION | |

| |

| |

B. Memorandum and Articles of Association | |

| |

| |

| |

F. Dividends and Paying Agents | |

| |

| |

I. Subsidiary Information | |

J. Annual Report to Security Holders | |

ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |

ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | |

| |

| |

| |

D. American Depositary Shares | |

| |

ITEM 13. DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | |

ITEM 14. MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | |

ITEM 15. CONTROLS AND PROCEDURES | |

A. Disclosure Controls and Procedures | |

B. Management’s Annual Report on Internal Control Over Financial Reporting | |

C. Attestation Report of the Registered Public Accounting Firm | |

D. Changes in Internal Control Over Financial Reporting | |

| |

ITEM 16A. AUDIT COMMITTEE FINANCIAL EXPERT | |

| |

ITEM 16C. PRINCIPAL ACCOUNTANT FEES AND SERVICES | |

ITEM 16D. EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | |

ITEM 16E. PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | |

ITEM 16F. CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT | |

ITEM 16G. CORPORATE GOVERNANCE | |

ITEM 16H. MINE SAFETY DISCLOSURE | |

ITEM 16I. DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS | |

ITEM 16J. INSIDER TRADING POLICIES | |

| |

| |

ITEM 17. FINANCIAL STATEMENTS | |

ITEM 18. FINANCIAL STATEMENTS | |

| |

| |

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | |

INTRODUCTION AND USE OF CERTAIN TERMS

The Group started its operations in 1952 as a Spanish railway infrastructure company under the commercial name

“Ferrovial”. In May 1999, our predecessor, Grupo Ferrovial, S.A., completed an initial public offering of its ordinary

shares and the listing of its ordinary shares on the Madrid, Barcelona, Bilbao and Valencia Stock Exchanges, regulated

markets of Bolsas y Mercados Españoles, Sociedad Holding de Mercados y Sistemas Financieros, S.A. (such

exchanges, together, the “Spanish Stock Exchanges”).

Since our inception, we have undergone various corporate reorganizations, the most recent taking place on June 16,

2023, when we completed: (i) our re-domiciliation from Spain to the Netherlands through a cross-border merger by

absorption between Ferrovial, S.A. (“Ferrovial, S.A.”), as the Spanish absorbed company and the pre-Merger parent of

the Group (as defined below), and Ferrovial International SE (renamed Ferrovial SE (the “Company” or “Ferrovial”)

following the Merger (as defined below)), as a wholly-owned subsidiary of Ferrovial, S.A. and the Dutch absorbing

company, with the termination, via dissolution without liquidation, of Ferrovial, S.A. and the acquisition of all of

Ferrovial, S.A.’s assets, liabilities and other legal relationships by universal succession by Ferrovial International SE

(the “Merger”) and (ii) the admission to listing and trading of all ordinary shares with a nominal value of EUR 0.01

each (“ordinary shares”) in the share capital of Ferrovial on Euronext in Amsterdam, a regulated market of Euronext

Amsterdam N.V. (“Euronext Amsterdam”) and the Spanish Stock Exchanges. Our ordinary shares began trading on

Euronext Amsterdam and the Spanish Stock Exchanges on June 16, 2023, and on the Nasdaq Global Select Market,

under the symbol “FER”, on May 9, 2024.

We have prepared this Annual Report on Form 20-F (the “Annual Report”) using a number of conventions, which you

should consider when reading the information contained herein.

In this Annual Report, unless otherwise specified, the terms “Ferrovial,” the “Company,” the “Group”, “our

company,” “we,” “us,” and “our” refer to Ferrovial SE, individually or together with its consolidated subsidiaries, as

the context may require (or Ferrovial, S.A., individually or together with its consolidated subsidiaries, if referring to

the period prior to the Merger completion); the term the “Group Companies” refers to the companies within the Group

and the term the “Companies” refers to the companies within the Group and our equity-accounted companies. In

addition, we may use the full name of the pre-Merger or post-Merger parent company, wherever such reference may

aid in the understanding of this filing.

Additionally, this Annual Report uses the following conventions:

▪“Australian dollar”, “AUD” and “AU$” are the lawful currency of Australia;

▪“Canadian dollar”, “CAD”, and “Can$” are the lawful currency of Canada;

▪“euro”, “EUR” or “€” are the single currency of the European Economic and Monetary Union;

▪“Indian rupee”, “INR” and “₹” are the lawful currency of India;

▪“IFRS-IASB” are the International Financial Reporting Standards as issued by the International Accounting

Standards Board;

▪“Nasdaq” is the Nasdaq Global Select Market;

▪“Polish zloty”, “PLN” and “gr” are the lawful currency of Poland;

▪“pound sterling”, “GBP” or “£” are the lawful currency of the United Kingdom; and

▪“US$”, “U.S. dollar” and “dollar” are the lawful currency of the United States.

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Financial Statements

The financial information contained in this Annual Report includes our audited consolidated financial statements as of

December 31, 2024 and 2023 and for each of the years ending December 31, 2024, 2023 and 2022, prepared in

accordance with IFRS-IASB, which have been audited by Ernst & Young, S.L. (collectively, the “Audited Financial

Statements”).

In the Merger, all shareholders of the former parent company of the Group were allotted shares in the new parent

company of the Group, Ferrovial SE, except for a small group of shareholders who received cash in lieu of shares in

connection with the Merger, in compliance with the applicable laws and regulations. The only changes affecting the

corporate structure of the Group pursuant to the Merger were (i) the change of the parent company from the Spanish

entity Ferrovial, S.A. to the Dutch entity Ferrovial SE and (ii) the transfer of the Spanish assets from Ferrovial, S.A. to

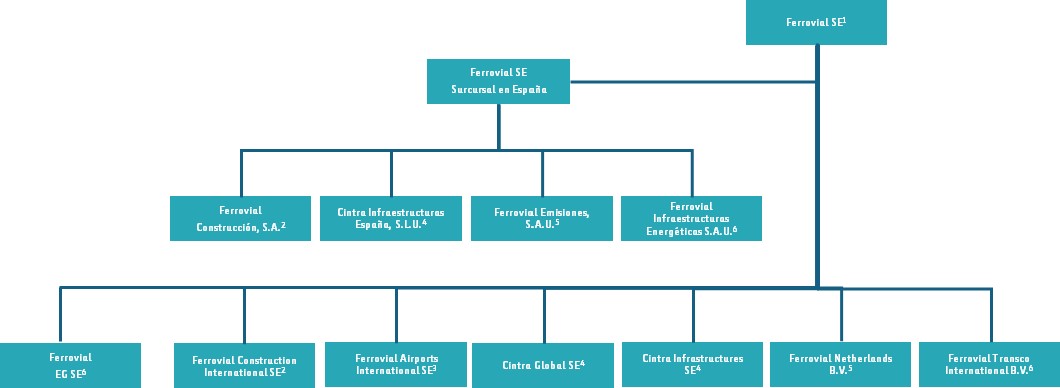

Ferrovial SE’s Spanish branch, Ferrovial SE Sucursal en España. See “Item 4. Information on the Company—C.

Organizational Structure —Group Structure.” Therefore, in preparing the Audited Financial Statements, the Company

has decided to apply a “pooling of interest” or “predecessor accounting” approach, as it considers this approach best

reflects the substance of the reorganization. Moreover, the Company believes that this approach provides useful

information about the Group and is the best way for users of our financial information to understand the performance

of the Group’s underlying business. Therefore, the Audited Financial Statements covering the period before the

completion of the Merger were prepared for the consolidated group headed by Ferrovial, S.A.

In January 2024, we conducted a partial reorganization of our Business Divisions (for further information, see “Item 4.

Information on the Company —B.Business Overview —1. Overview” and Note 1.5 (Segment Reporting) to the Audited

Financial Statements). Information presented in this Annual Report for historical periods prior to the segment change

has been revised to reflect the partial reorganization.

The financial information presented in this Annual Report reflects the operating and financial performance of the

Group, its cash flows and financial position and resources. The Group’s results as reported in accordance with IFRS-

IASB represent the Group’s overall performance. The Group also uses a number of non-IFRS measures to report the

performance of its business, as described in “Item 5. Operating and Financial Review and Prospects—A. Operating

Results—8. Non-IFRS Measures: Operating Results” and “ —B. Liquidity and Capital Resources—6. Non-IFRS

Measures: Liquidity and Capital Resources.”

Industry and Market Data

This Annual Report includes statistical data, market data and other industry data and forecasts obtained from market

research, publicly available information and independent industry publications and reports that we believe to be

reliable sources, although we have not verified the accuracy and completeness of such third-party data. Forecasts,

projections and other forward-looking information obtained or derived from these sources involve risks and

uncertainties and are subject to the same qualifications and additional uncertainties applicable to the other forward-

looking statements included in this Annual Report. You should not place undue reliance on these statements. See

“Cautionary Statement Regarding Forward-Looking Statements.”

Foreign Currency Translations

Unless stated otherwise, transactions in foreign currencies are translated into euro at the exchange rates applicable at

the transaction dates. Monetary assets and liabilities denominated in foreign currencies are translated into the

functional currency at the applicable reporting date. For further details see Note 1.4 (Exchange Rate) to the Audited

Financial Statements.

Rounding

Amounts in this Annual Report have been rounded off to the nearest million euros, or in certain cases, the nearest

thousand euros; there may be discrepancies in totals and sums of the amounts listed due to rounding. Figures shown

as totals in certain tables may not be an arithmetic aggregation of the figures preceding them.

Trademarks, Service Marks and Trade Names

Throughout this Annual Report, we refer to various trademarks, service marks and trade names that we use in our

business. The “Ferrovial” logo is the property of Ferrovial SE. We have several other trademarks and service marks.

Solely for convenience, some of the trademarks, service marks and trade names referred to in this Annual Report are

listed without the “®” or “™” trademark designations. All rights to such trademarks are nevertheless reserved, and

other trademarks and service marks appearing in this Annual Report are the property of their respective owners.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements within the meaning of the safe harbor provisions of the U.S.

Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the

safe harbor provisions for forward-looking statements contained in Section 27A of the U.S. Securities Act of 1933, as

amended (the “Securities Act”), and Section 21E of the U.S. Securities Exchange Act of 1934, as amended (the

“Exchange Act”). All statements other than statements of historical facts contained in this Annual Report, including

statements regarding our future results of operations, financial condition, the sufficiency of our sources of liquidity and

available working capital, business strategy and plans and objectives of management for future operations, plans,

expectations and estimations related to expenditures and divestitures, expectations surrounding future shareholder

distributions, our anticipated appointment of a new independent registered public accounting firm, are forward-looking

statements.

In some cases, you can identify forward-looking statements because they contain words such as “anticipate,”

“believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “objective,”

“outlook,” “plan,” “potential,” “predict,” “probability,” “project,” “risk,” “should,” “target,” “trends,” “will,” or

“would,” or the negative of these words or other similar terms or expressions.

We have based these forward-looking statements largely on our current expectations and projections about future

events and trends that we believe may affect our financial condition, results of operations, business strategy and

financial needs. These forward-looking statements are neither promises nor guarantees, but are subject to a number of

known and unknown risks, uncertainties, other factors and assumptions that could cause our actual results,

performance or achievements to be materially different from any future results, performance, achievements

expectations or projections expressed or implied by the forward-looking statements, including the risks described in

“Item 3. Key Information—D. Risk Factors” and elsewhere in this Annual Report. Furthermore, new risks may

emerge from time to time and it is not possible for our management to predict all risks, nor can we assess the impact of

all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to

differ materially from those contained in, or implied by, any forward-looking statements.

You should not rely on forward-looking statements as predictions of future events. We undertake no obligation to

update any forward-looking statements made in this Annual Report to reflect events or circumstances after the date of

this Annual Report or to reflect new information or the occurrence of unanticipated events, except as required by law.

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and

you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect

the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject.

These statements are based on information available to us as of the date of this Annual Report. While we believe that

information provides a reasonable basis for these statements, that information may be limited or incomplete. Our

statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant

information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these

statements.

Additionally, we may provide information herein or on our website, or documents accessible thereby, that is not

necessarily “material” under the federal securities laws for Securities and Exchange Commission (“SEC”) reporting

purposes, but that is informed by various environmental, social, and governance (“ESG”) standards and frameworks

(including standards for the measurement of underlying data), and the interests of various stakeholders, among other

things. Much of this information is subject to assumptions, estimates or third-party information that are still evolving

and subject to change. For example, our disclosures based on any standards may change due to revisions in framework

requirements, availability or quality of information, changes in our business or applicable government policies, or

other factors, some of which may be beyond our control.

You should read this Annual Report and the documents that we reference in this Annual Report and have filed as

exhibits to the Annual Report of which this Annual Report is a part with the understanding that our actual future

results, levels of activity, performance and achievements may be different from what we expect. We qualify all of our

forward-looking statements by these cautionary statements.

SUMMARY OF RISK FACTORS

Our business is subject to numerous risks and uncertainties, including those described in “Item 3. Key Information—D.

Risk Factors.” You should carefully consider these risks and uncertainties when investing in our ordinary shares.

Principal risks and uncertainties affecting our business include the following:

◦risks related to our diversified geographical operations and Business Divisions, including without limitation

vehicle and passenger use levels for toll roads and airports we operate, unanticipated construction and

planning issues, including budget overruns and delays, and their impact on major project capital investment

programs, the availability of private sector projects and reductions in project procurement and delays in the

completion of projects by the private sector, energy price volatility and difficulties in securing long-term off-

take agreements, and changes in the regulation of any of the energy markets where we operate, and the

triggering of performance guarantees or other similar contractual obligations in connection with any of the

foregoing risks;

◦risks related to our acquisitions, divestments and other strategic transactions that we may undertake and

considering that our business is derived from a small number of projects;

◦the impact of competitive pressures in our industry and pricing, including the costs of and lack of certainty in

winning competitive tender processes, and the lack of funds allocated to public sector projects in the

countries in which we operate, and competition for skilled talent;

◦general economic and political conditions and events and the impact they may have on us, including, but not

limited to, increases in inflation rates and rates of interest, exchange rate fluctuations, increased costs for

materials, and the impact of cybersecurity attacks, terrorist attacks and other acts of violence, and impacts

resulting from the ongoing Russia/Ukraine and the Middle East conflicts;

◦our ability to obtain adequate financing in the future as needed;

◦our ability to maintain compliance with the continued listing requirements of Nasdaq Global Select Market,

Euronext Amsterdam and the Spanish Stock Exchanges;

◦lawsuits and other claims by third parties or investigations by various regulatory agencies that we may be

subject to;

◦impact of any changes in existing or future tax regimes or regulations; and other risks and uncertainties;

◦risks specific to our securities, including the payment of future dividends, which will depend on our financial

condition and results of operations, and the liquidity of our shares as a consequence of the multiple listings in

different jurisdictions;

◦risks related to increased digitalization and to cybersecurity threats, including risks relating to related

evolving legal and regulatory regimes;

◦risks related to the concentration of individual projects upon which our business is dependent;

◦the impacts of accidents or other incidents at our project sites and facilities, including possible disruptions

and delays, harm to our employees or customers and reputational damage;

◦physical and transitional risks in connection with the impacts of climate change, including the impact of

extreme weather conditions, and risks in connection with natural disasters or similar catastrophic events,

including extreme weather conditions, health emergencies and government and societal responses thereto;

◦risk related to increased scrutiny and changing expectations in connection with sustainability and ESG

matters;

◦risks related to the adequacy or existence of our insurance coverage and any non-recoverable losses;

◦risk associated with the international nature of our business and operations, including compliance with the

U.S. Foreign Corrupt Practices Act, EU anti-corruption legislation, the U.K. Bribery Act, import and export

controls and economic sanctions laws imposed by the U.S. government, and similar laws in other

jurisdictions;

◦our reliance on and ability to locate, select, monitor, and manage subcontractors and service providers;

◦our legal and regulatory risks given that we operate in highly regulated environments and may be subject to

changes in regulations, including that we contract with government authorities and face risks and

uncertainties in obtaining permits and rights-of-way and in securing land rights; and

◦risks related to our holding company structure and from our joint venture and partnership operations,

including impacts from our reliance on our partners’ financial condition, performance, and decisions

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT, AND ADVISERS

1.A.Directors and Senior Management

Not applicable.

1.B.Advisers

Not applicable.

1.C.Auditors

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

3.A.[Reserved]

3.B.Capitalization and Indebtedness

Not applicable.

3.C.Reasons for the Offer and Use of Proceeds

Not applicable.

3.D.Risk Factors

You should carefully consider the risks described below, together with all of the other information in this Annual

Report, including the Audited Financial Statements and related notes. Our business, financial condition, and results of

operations could be materially and adversely affected if any of the risks described below occur. As a result, the market

price of our ordinary shares could decline, and you could lose all or part of your investment. This Annual Report also

contains forward-looking statements that involve risks and uncertainties. See “Cautionary Statement Regarding

Forward-Looking Statements.” Our actual results could differ materially and adversely from those anticipated in

these forward-looking statements due to certain important factors, including the risks facing our Group. Additional

risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business

operations.

3.D.1Risks Related to Our Business and Structure

3.D.1.1Global economic and political conditions have had and in the future could have a material adverse effect

on our business, financial condition, results of operations, and prospects and may magnify certain risks that affect

our business.

Our business performance is closely linked to the economic cycle and political conditions in the countries, regions,

and cities in which we operate. As a result of our diverse geographical operations, in 2024 we generated the majority

of our revenues across several core jurisdictions, including the United States (35.8%), Poland (23.2%), Spain (17.3%),

the United Kingdom (8.8%) and Canada (2.7%).

Typically, robust economic growth in the areas where we operate results in greater demand for our services, while

slow economic growth or economic contraction adversely affects such demand. For example, the toll roads and

aviation businesses are cyclical by nature and are closely linked to general economic conditions.

All revenues, dividends, and investments from our Companies are exposed to risks inherent to economic conditions in

the countries in which they operate. Operations in the countries where we do business are exposed to factors such as:

(i) fluctuations in local economic growth; (ii) changes in inflation rates; (iii) devaluation, depreciation or excessive

appreciation of local currencies; (iv) foreign exchange controls or restrictions on profit repatriation; (v) changing

interest rate environments; (vi) changes in financial, economic and tax policies; (vii) instances of fraud, non-

compliance, bribery or corruption; (viii) social conflicts; (ix) political and macroeconomic instability; and (x) changes

in applicable law.

Geopolitical conflict, political uncertainty and instability risks have been on the rise across many economies, resulting,

in some cases, in inward-looking policies and protectionism, which could in turn lead to increased pressures for policy

reversals or failure to implement needed reforms. The conflicts in Ukraine and the Middle East have contributed to

greater global political uncertainty and instability, as further discussed under “—7. The conflicts in Ukraine and in the

Middle East may adversely impact our global activities and could have a material adverse effect on our business,

financial condition, results of operations, and prospects”.”

Economic growth, globally and in the EU, has been subject to constraints on private sector lending and increases in the

cost of financing. Recent examples of downside risks to the global economy that have also affected our results include:

(i) rising geopolitical tensions , most notably the ongoing conflicts in Ukraine and in the Middle East, (ii) the sharp

rise in inflation, and (iii) volatile global financial conditions. In addition, many developed economies where we

operate, such as the United States, Spain, the United Kingdom, and Canada, have experienced high inflation rates and

a corresponding tightening of monetary policy as a result of the strong and persistent upturn in prices.

Continued weakness in many emerging economies where we operate has also contributed to the risk of deterioration of

global economic and political conditions. For example, we believe that in Latin America, political systems and

institutions may be subject to increased stress as a consequence of the global macroeconomic events, including (i) the

conflicts in Ukraine and the Middle East, and (ii) high food and energy costs as a result of inflationary pressures, and

(iii) the slowdown in the Chinese economy and its contribution to global uncertainty, all of which contribute to

increased risks of sovereign defaults and social unrest. Although a number of measures have been implemented by the

public sector to mitigate these risks (such as the United States’ Infrastructure Investment and Jobs Act, the European

Union’s Next Generation EU (NGEU) fund, and the UK Build Back Better plan, among others), these measures may

prove to be ineffective or insufficient to prevent the deterioration of the economies of the countries in which we

operate.

Also, in the U.S., our assets are affected by economic growth and regulations. Regulations such as international trade

relations, energy and infrastructure, and new legislation and regulations, including those related to taxation and

importation; economic and monetary policies, and foreign policy and diplomacy; heightened diplomatic tensions and

political and civil unrest, which could adversely impact the global economy and our operating results. The nature,

timing, and economic and political effects of these potential changes to the current policy, legal and regulatory

framework affecting our activities remain highly uncertain. For example, potential stricter conditions for the import of

equipment from certain countries, which might impact the growth and profitability of our businesses in the US. In

addition, although the Federal Reserve recently decreased interest rates, inflation remains at moderately high levels.

In Canada, 2025 is a year of elections both at the federal and provincial levels in Ontario. The nature, timing, and

economic impact of potential changes on current policy, legal, and regulatory framework affecting our activities

remain highly uncertain.

In Spain, a number of concerns continue to exist in respect to the Spanish economy (where, in 2024, we generated

17.3% of our revenue) (for a detailed overview of the countries in which we operate, see “Item 5. Operating and

Financial Review and Prospects”). While in recent years, there has been some progress, the Spanish economy

continues to be susceptible to various geopolitical and macroeconomic factors, such as the uncertainty originated by,

among other circumstances, (a) international trade tensions between the United States and China, or (b) volatility in

commodity prices. These events could cause an increase in Spain’s political and economic uncertainty, which could, in

turn, have a material adverse effect on our business, financial condition, results of operations, and prospects.

We also have operations in a number of Latin American countries, which tend to be more vulnerable to the effects of

macroeconomic events and political instability. In those countries, we are exposed to, among others, macroeconomic

factors such as inflation, geopolitical tensions, environmental factors, and other socioeconomic and political factors.

For example, we have significant operations in Chile, where in the year ended December 31, 2024, we generated EUR

371 million in revenue.

In addition, other factors or events may affect global and national economic conditions, such as heightened

geopolitical tensions, war, acts of terrorism, natural disasters, pandemics, or other similar events outside our control.

Even in the absence of an economic downturn, we are exposed to substantial risk stemming from volatility in areas

such as consumer spending, business investment, financial conditions, government spending, capital markets

conditions, and price inflation, which affect our business and our economic environment and, consequently, our size

and profitability. Increases in national public debt may lead countries to increase taxes and to reduce investment in

infrastructure. Unfavorable economic conditions could also lead to decreased use of, and related income from, toll

roads projects, reduced air travel, and reduced investment in the construction sector and energy sector. Furthermore,

any financial difficulties suffered by our sub-contractors or suppliers could increase our costs or adversely affect our

project schedules.

Any deterioration of the economies or political conditions of the countries in which we operate could have a material

adverse effect on our business, financial condition, results of operations, and prospects.

3.D.1.2We operate in highly competitive industries and where customer risk transfer dynamics may not be

balanced; our profitability could be affected by our failure to manage competitive dynamics and address risk

transfer imbalances, including a failure to accurately estimate revenue, project risks, the availability and cost of

resources and time, when bidding on projects, any of which could have a material adverse effect on our business,

financial condition, and results of operations.

The market for infrastructure development and operation projects is highly competitive and is exposed to political and

social factors that are difficult to predict and manage. Most of our competitors are multinational companies bidding on

projects worldwide, which places the competitive focus on the attractiveness of each individual project as opposed to

its geographical location. These circumstances may have an impact on the achievement of our growth objectives.

We compete against various groups and companies that may have more local experience, resources, or awareness than

we do. Furthermore, the economic slowdown in Europe and the financial difficulties faced by emerging countries are

negatively affecting public clients’ investment capacity and, by extension, could affect to some of our business

opportunities in those geographies. This lack of investment opportunities in Europe has pushed capital flows towards

markets with greater availability of resources in which we also operate, increasing the competitive tension within those

markets and resulting in pressures on prices and profit margins in projects in which the customer risk transfer dynamic

is not balanced.

Technological developments in terms of digitalization of processes may also pose a risk to our business if our

competitors develop an advantage over us in this area. Specifically, if we fail to develop differential competitive

capabilities at the same or a higher pace than our competitors due to the rapid deployment of generative artificial

intelligence by said competitors, this may pose a significant risk to our business, financial condition, and results of

operations, as the engineering and construction industry is highly dependent on technology. Failure to adequately keep

up with technological advances could result in our decreased profitability and loss of market share.

In recent years, the construction sector at an international level has been experiencing low profitability margins, which

we believe to be partly driven by aggressive commercial strategies, imbalances in customer risk transfer, and cost

inflation. These financial considerations may be further accentuated by the political and economic environment created

as a result of the conflicts in Ukraine and the Middle East. In addition, the increase in infrastructure-focused

investment funds requiring lower rates of return in their investments, coupled with these funds’ readiness to take on

more segments of a project’s value chain, may increase competition in our target markets.

If we are unable to obtain contracts for new projects to sustain our current order book (the “Order Book”) volume, or if

these projects are only awarded under less favorable terms as a result of macroeconomic and competitive pressures,

our business, financial condition, and results of operations may be adversely affected.

Furthermore, particularly when operating under fixed fee contracts in the Construction Business Division, we realize a

profit only if we can successfully estimate our costs and prevent any cost overruns on contracts. Cost overruns can

result in lower profits or operating losses on projects, which could have an adverse effect on our business, financial

condition, and results of operations. Our estimates and predictions can be difficult to make, particularly in a highly

competitive and uncertain environment (for additional information on the worsening of the global economic and

political conditions and their impact on our business, see “—1. Global economic and political conditions have had and

in the future could have a material adverse effect on our business, financial condition, results of operations, and

prospects and may magnify certain risks that affect our business” and “—7. The conflicts in Ukraine and in the Middle

East may adversely impact our global activities and could have a material adverse effect on our business, financial

condition, results of operations, and prospects”), and may turn out to be inaccurate. If we fail to identify key risks or

effectively estimate costs for projects where we are exposed to the risk of cost overruns, this could have an adverse

effect on our business, financial condition, and results of operations.

For example, most of our customers in the public infrastructure sector are public entities. These or other customers

may, from time to time, request amendments or alterations to agreed projects plans, even after the project has

commenced, or ask to renegotiate terms. Any of this could lead to project delays, increased project development costs

for us, or even termination of contracts. We may not always be able to recoup the increased costs in such cases. Any

potential project amendments or renegotiations with our customers could therefore significantly reduce the revenue

and profit we are able to realize. If we are unsuccessful in our claims against customers in this context, there may be a

reduction in the expected revenues and profit of such projects, which could have an adverse effect on our business,

financial conditions, and results of operations.

If we fail to identify key risks or effectively estimate costs for projects where we are exposed to the risk of cost

overruns, or if client renegotiations cause a project to incur additional, unexpected costs, this could have an adverse

effect on our business, financial condition, and results of operations.

3.D.1.3We depend on funds allocated to public sector projects in the countries in which we operate, and any

decrease in allocation of such funds may adversely impact our project volume, which could adversely affect our

business, financial condition, and results of operations.

We currently indirectly benefit from funds granted by the European Union to its member states (the “Member States”)

and allocated to those Member States’ public entities. However, due to political, economic, or other considerations,

these funds may no longer be available to us in the future, or there may be delays in receipt of such funds. A

cancellation or delay in the receipt of such funds may adversely affect our business, financial condition, results of

operations, and prospects.

In particular, our Construction Business Division depends on public sector projects. For example, in 2024 clients from

the public sector accounted for 86% of the total Order Book of our Construction Business Division, which amounted

to EUR 14,411 million as of December 31, 2024 (for further information on the Construction Business Division’s

clients, see “Item 4. Information on the Company—B. Business Overview—3. Group Overview—3. Our Business

Divisions—3. Construction Business Division”).

The toll roads industry, generally, and our Toll Roads Business Division, specifically, depend mainly on the continued

availability of attractive levels of government funds and incentives to attract private investments, in particular as it

pertains to public-private risk sharing in connection with private toll roads development. Such government funds are

generally granted in connection with the construction and operation of toll roads for the benefit of the general public.

For instance, in the United States, we currently benefit from the Transportation Infrastructure Finance and Innovation

Act (“TIFIA”)’s credit assistance program as granted by the United States Department of Transportation to leverage

limited federal resources and stimulate capital market investment in transportation infrastructure by providing credit

assistance in the form of direct loans, loan guarantees, and standby lines of credit (rather than grants) to projects of

national or regional significance, such as our development of additional highway lanes within existing highways that

incorporate dynamic tolls that change in real-time based on traffic conditions (the “Managed Lanes”). Our projects in

the United States have been granted funds through different financial instruments under the TIFIA credit assistance

program (for a description of the credit assistance received, see “Item 5. Operating and Financial Review and

Prospects—B. Liquidity and Capital Resources—8. Financing”). As of December 31, 2024 the balance of these TIFIA

loans was USD 2,620 million.

If, due to political, economic, or other considerations, funds like those received through TIFIA are no longer available

or the TIFIA credit assistance program is cancelled, this could have a material adverse effect on our ability to develop

new projects. Furthermore, decreases in the funds allocated to public sector projects may force private sector

construction companies, such as us, to halt projects that are already underway. For these reasons, a continued and

further decrease in the spending on the development and execution of public sector projects by governments and local

authorities in the markets in which we already operate or in those in which we could operate in the future could

adversely affect our business, financial condition, and results of operations.

3.D.1.4The increase in digitalization and consequently, the increased risk of cyber threats and misuse of quantum

technology, may affect our normal operation of assets and our ability to generate expected value, which could have

a material adverse effect on our business, financial condition, and results of operations.

In a highly digitalized and interconnected economic environment, the risk of cyber security events or system failures

potentially harming us has exponentially increased in recent years. Our digital products and services, industrial

systems and Internet connected assets, which include hardware, software, technology infrastructure and online sites

and networks for both internal and external operations (collectively, “digital and technological environments” or “DT

environments”), are critical to our business operations. We own and manage some of these DT environments but also

rely on third-party providers for a range of services, including cloud computing. We and certain of our third-party

providers use these DT environments to collect, maintain and process data about customers, employees, business

partners and others, including information about individuals, as well as proprietary information belonging to our

business such as trade secrets (collectively, “Confidential Information”).

Our DT environments and Confidential Information are exposed to threats in the cyber space from diverse threat

actors by, among others, hostile government agencies, hacktivists, insiders, criminals as well as through diverse attack

vectors, such as social engineering/phishing, malware (including ransomware), human or technological error, and as a

result of malicious code embedded in open-source software, or misconfigurations, bugs or other vulnerabilities in

commercial software that is integrated into our (or our suppliers’ or service providers’) DT environments.

These threats can impact the normal operation of our DT environments, impact our ability to generate expected value

of the assets, result in the disclosure of our Confidential Information, or potentially undermine our reputation. For

example, there may be an increase in cyber threats in connection with the conflict in Ukraine, as discussed under “—7.

The conflicts in Ukraine and in the Middle East may adversely impact our global activities and could have a material

adverse effect on our business, financial condition, results of operations, and prospects.”

The extent to which a cyber threat can impact our DT environment, Confidential Information, or an asset depends on

the nature of the DT environment, Confidential Information or asset, the cyber threat agent’s origin, the scope of the

security breach, and the extent to which we are prepared to respond to such a cyber threat. Critical infrastructures

(such as airports, highways, and energy infrastructure), which are the main assets of our business, are a common target

for such threats. Additionally, if a cyber threat is not successfully managed, it could impact our ability to generate

expected value. For instance, a ransomware attack affecting one of our airports could cause flight cancellations, which

in turn could materially affect our operating revenues and financial results. Additionally, the rapid development of the

quantum computing industry is also relevant as it is shortening the time in which quantum computers can break current

encryption systems and compromise sensitive data security. Furthermore, remote and hybrid working arrangements

increase cybersecurity risks due to challenges in managing remote computing assets and vulnerabilities in non-

corporate networks.

During 2024, we experienced various security events, some of which were associated with malicious, harmful, or

potentially malicious and/or harmful activities (which we consider “security incidents”). None of these security

incidents had a significant impact on our DT environments, Confidential Information or assets, and they were

managed using our protection, detection, response, and recovery procedures, as appropriate. While to date no security

incidents have had a material impact on our operations or financial results, we cannot guarantee that material incidents

will not occur in the future. Additionally, cyber threats are expected to accelerate globally in frequency and magnitude,

with threat actors using sophisticated techniques, including artificial intelligence, to circumvent security controls,

evade detection and remove forensic evidence. As a result, we may be unable to detect, investigate, remediate or

recover from future attacks or security incidents, or to avoid a material adverse impact to our DT environments,

Confidential Information or assets.

There can also be no assurance that our cybersecurity risk management program and processes, including our policies,

controls or procedures, will be fully implemented, complied with or effective in protecting our DT environments,

Confidential Information, and assets. Furthermore, we regularly identify and track security vulnerabilities across our

DT environments, which may persist even after patches are issued or other remedial measures taken.

Any adverse impact on our DT environments, Confidential Information, or assets can result in legal claims, regulatory

actions, fines, reputational damage, and significant incident response costs. For example, there is a potential risk that

cyberattacks may render our DT environments or assets, or those of our service providers, temporarily inoperative.

Furthermore, the increased risk of cyber threats may impact our business plan due to a consequent reduction in the

value of the asset, may lead to loss or theft of Confidential Information, know-how and intellectual and industrial

property, as well as lead to economic loss tied to resuming operations, and may damage our reputation and related

competitive advantage, compromising potential business opportunities. In addition, we may face sanctions as a

consequence of potential regulatory and contractual non-compliance resulting from an asset’s lack of operations

following a cyber-attack or incur expenses in an effort to comply with obligations, including notification obligations,

under applicable laws.

Finally, we cannot guarantee that costs and liabilities from an attack will be covered by our existing insurance policies

or that future insurance will be available on reasonable terms or at all. These factors could have an adverse effect on

our business, financial condition, and results of operations.

3.D.1.5Any actual or perceived failure to comply with new or existing laws, regulations and other requirements

relating to the privacy, security and processing of Personal Information could adversely affect our business, results

of operations, or financial condition.

In conducting our business, we receive, store, use and otherwise process information that relates to individuals and/or

constitutes “personal data,” “personal information,” “personally identifiable information,” or similar terms under

applicable data privacy laws (collectively, “Personal Information”). We are therefore subject to a variety of federal,

state and foreign laws, regulations and other requirements relating to the privacy, security and handling of Personal

Information. For example, in Europe and the UK, we are subject to the European Union General Data Protection

Regulation (the “EU GDPR”) and to the United Kingdom General Data Protection Regulation and Data Protection Act

2018 (collectively, the “UK GDPR”) (the EU GDPR and UK GDPR together referred to as the “GDPR”), while in the

U.S., we are subject to various state and federal laws like the California Consumer Privacy Act and others. In addition,

the GDPR regulates cross-border transfers from the EEA and the UK and we anticipate ongoing legal complexity and

scrutiny regarding international data transfers. We have invested significant resources in complying with these

requirements, which can be both time-consuming and costly.

The application and interpretation of such requirements are constantly evolving and are subject to change, creating a

complex compliance environment. In some cases, these requirements may be either unclear in their interpretation and

application or they may have inconsistent or conflicting requirements with each other. Further, there has been a

substantial increase in legislative activity and regulatory focus on data privacy and security around the globe, including

in relation to cybersecurity incidents. In addition, some such requirements place restrictions on our ability to process

Personal Information across our business or across country borders.

It is possible that new laws, regulations and other requirements, or amendments to or changes in interpretations of

existing laws, regulations and other requirements, may require us to incur significant costs, implement new processes,

or change our handling of information and business operations, which could ultimately hinder our ability to grow our

business. In addition, any failure or perceived failure by us to comply with laws, regulations and other requirements

relating to the privacy, security and handling of information could result in legal claims or proceedings (including

class actions), regulatory investigations or enforcement actions. We could incur significant costs in investigating and

defending such claims and, if found liable, pay significant damages or fines or be required to make changes to our

business. These proceedings and any subsequent adverse outcomes may subject us to significant negative publicity and

an erosion of trust. If any of these events were to occur, our business, results of operations, and financial condition

could be materially adversely affected.

3.D.1.6Our business is derived from a small number of major projects, which, if terminated or otherwise

materially affected, may have a material adverse effect on our business, financial condition, and results of

operations.

Our main projects in terms of valuation and equity invested are (i) in the Toll Roads Business Division, the 407

Express Toll Road (the “407 ETR”) and several Managed Lanes projects such as the North Tarrant Express toll road

(“NTE”), the North Tarrant Express 35W toll road (“NTE 35W”), the I-66 toll road (“I-66”), the I-77 Express lane

(“I-77”), and the Lyndon B. Johnson Expressway (“LBJ”) and (ii) in the Airports Business Division, the New

Terminal One at John F. Kennedy International Airport (“NTO at JFK” or “NTO”). According to market analysts’

reports, Toll Roads and Airports amounted to approximately 91% of our valuation as of December 2024. This figure

still includes valuation from Heathrow, that should be reclassified to cash in 2025 after completion of the divestment

of the 19.75% on December 12, 2024. For further details on this divestment, see “Item 4. Information on the Company

—A. History and development of the Company —1. Summary of Historical Investments and Divestments —2. Sale of

Heathrow Stake.”

Aside from the Heathrow divestment, we cannot guarantee that any of the aforementioned projects, or our

performance thereunder, will not be terminated or otherwise materially affected by developments outside of our

control, such as regulatory developments, other factors related to our operations in highly regulated environments, or

the public and/or governmental nature of our clients in all of the above-mentioned projects, as well as inflationary

pressures, foreign exchange rate fluctuations, factors affecting traffic and infrastructure use, adverse weather,

availability of financing in favorable terms, or other conditions. For example, our concessions contracts typically

include termination rights that may be exercised by the concession grantor or lessor (see —2. Risks Related to Legal,

Regulatory, and Industry Matters —1. We operate in highly regulated environments that are subject to changes in

regulations and are subject to risks related to contracts with government authorities, which could have a material

adverse effect on our business, financial condition, and results of operations.”). The termination of any of these

projects or any material impact to our performance as a result of these factors could potentially have a material adverse

effect on our business, financial condition, and results of operations.

Furthermore, our reliance on a relatively small number of projects may adversely affect the development of our

business. As such, the loss of, or a material adverse effect to, any of our main projects may in turn have a material

adverse effect on our business, financial condition, and results of operations.

3.D.1.7The conflicts in Ukraine and in the Middle East may adversely impact our global activities and could have

a material adverse effect on our business, financial condition, results of operations, and prospects.

On February 24, 2022, Russia began its invasion of Ukraine. As of the date of this Annual Report, the conflict has not

come to an end. Although our direct exposure to the conflict is limited and mostly concentrated on our operations in

Poland and our operations at the Dalaman International Airport (“Dalaman”) in Turkey, which has experienced lower

demand from Russian and Ukrainian passengers in part due to inflation and currency devaluation related to the

Ukrainian conflict, the macroeconomic scenario triggered by this conflict includes broad-based price rises essentially

affecting energy and commodities, supply issues, and difficulties in the distribution chain for certain materials,

particularly in the construction industry. Additionally, and as a result of these financial pressures, interest rates have

been rising, impacting the banking and financing markets.

As a result of the invasion, the EU, together with the United States and most NATO countries, condemned the attack

and put in place coordinated sanctions and export-control measure packages against Russia, Belarus, and some other

territories related to the conflict in Ukraine. The uncertain nature, magnitude, and duration of Russia’s war in Ukraine

and the potential effects of the war, actions taken by Western and other states and multinational organizations in

response thereto (including, among other things, sanctions, export- control measures, travel bans, and asset seizures),

as well as of any Russian retaliatory actions (including, among other things, restrictions on oil and gas exports and

cyber-attacks) on the world economy and markets have contributed to increased market volatility and uncertainty.

Our activities in Poland (through Budimex’s construction business), as a neighboring country to Ukraine, are at an

increased risk of being disrupted by the conflict. Although as of the date of this Annual Report, our revenue generated

in Poland, which, in 2024, amounted to 23.2% of our revenues was not materially affected as a result of the conflict,

the risk that such impact may materialize in the future cannot be excluded. This potential risk has been evidenced by

the unattributed missile strike on an area close to Poland’s south-eastern border with Ukraine on December 15, 2022

that killed two people as well as by the disruption in the infrastructures of Poland and Ukraine as a consequence of

refugees from Ukraine entering Poland to flee the war and by the transportation of western military equipment to

support the Ukrainian front. Another country in which we operate that is close to Ukraine’s borders, and which could

be at risk of disruption in operations, is Slovakia, where we hold a concession for the D4R7 Bratislava ring road

(although, as of the date of this Annual Report, the impact of the Ukraine conflict in Slovakia has not significantly

impacted our Slovak business, other than through an increase of our labor costs due to the decreased access to

employees from Ukraine, which constituted a significant market for employees carrying out our projects in Slovakia).

Moreover, the situation that began in the Middle East on October 7, 2023, its escalation and any resulting conflicts in

the region (such as the attacks on commercial shipping vessels travelling through the Red Sea) could lead to further

disruptions in supply chains, higher oil and gas prices, the imposition of sanctions, travel and import/export

restrictions, increased inflationary pressures and market volatility, among other potential consequences.

Additionally, as a result of the Ukrainian and Middle East conflicts, there is also an increased risk of cyber-attacks,

and we are particularly exposed to these attacks as a holder of so-called “critical assets,” due to our position as a

provider of critical infrastructure services and solutions. Infrastructures are exposed to a variety of existing threats in

cyberspace (such as hostile government agencies, hacktivists, insiders, and mafias), which may impact or impede (i)

the normal operation of assets, (ii) our ability to generate the expected economic value from our assets, and (iii) our

reputation. Any adverse impact on our digital and technological environments or assets as a result of a cyber-attack

can result in legal claims, regulatory actions, fines, reputational damage, and significant incident response costs. For

more information on our increased risk of cyber-attacks, see “—4. The increase in digitalization and consequently, the

increased risk of cyber threats and misuse of quantum technology, may affect our normal operation of assets and our

ability to generate expected value, which could have a material adverse effect on our business, financial condition,

and results of operations.”

Although we do not foresee material effects to our results of operations as a direct result of the Ukrainian and Middle

East conflicts, the Construction Business Division is the most vulnerable to such effects due to the potential impact the

conflict could have on raw materials within the surrounding area, including cost increases of certain materials and

decreasing availability.

In contrast, our Toll Roads Business Division has been positively impacted by rising toll rates in those assets with

pricing models directly linked to inflation, although it is adversely exposed to possible negative impacts of significant

rises of fuel prices on traffic. Finally, unless there is a significant future escalation, no relevant impact is expected in

the Airports Business Division other than the aforementioned impact to the Dalaman airport in Turkey due to the scant

exposure to passenger traffic (the total number of incoming and outcoming passengers at the airport in a particular

period) from these regions in the airports managed by us, although the effects of inflation on ticket prices as a result,

among others, of the aforementioned fuel cost increases could have a certain consumer dissuasive effect that could

affect our results of operations. For additional information on the worsening of the global economic conditions and

their impact on our business, see “—1. Global economic and political conditions have had and in the future could have

a material adverse effect on our business, financial condition, results of operations, and prospects and may magnify

certain risks that affect our business”.

In addition, the increase in political tensions worldwide because of the conflict in Ukraine increases the risk of a large-

scale armed conflict. In this context, countries tend to boost regional economies at the expense of global integration by

applying competition and trade restrictions, sanctions, investment controls, expropriations, or other restrictions, which

could lead to a global recession with serious effects on global economy.

All of the above factors, as well as any further escalation of the conflict in Ukraine, could have a material adverse

effect on our business, financial condition, results of operations, and prospects.

3.D.1.8The increase in demand for skilled labor in the geographic areas in which we are active makes it more

difficult for us to attract and retain talent, which could impact our competitiveness and have an adverse effect on

our business, financial condition, and results of operations.

The increase in demand for skilled labor (i.e., STEM positions requiring higher education degrees, and more

specifically civil, industrial, or computer engineers, which are normally the main positions required for delivering our

projects and managing our assets) in our main markets and particularly in those markets in which the operations of toll

roads and other transportation-related construction are concentrated, such as in the United States, Spain, and the

United Kingdom, as well as several other western countries, makes it more difficult for us to attract and retain talent,

which could impact our competitiveness.

We may lose certain business opportunities and may not be able to fulfill certain commitments to clients, such as

commitments regarding contractual deadlines or the pre-established quality of work, due to hiring difficulties and/or

understaffing in the event of a potential lack or scarcity of qualified staff. This inability to acquire and retain skilled

labor and the resulting inability to fulfill contractual requirements could have an adverse effect on our business,

financial condition, and results of operations, and may impact our competitiveness. Furthermore, we may experience

lower profit margins due to increased labor costs resulting from a higher demand of skilled labor. This could have an

adverse effect on our business, financial condition, and results of operations.

3.D.1.9Regulators and other stakeholders may demand that our business objectives become more sustainable and

may be willing to penalize us if we do not meet them, and we could be affected by degradation of ecosystems, which

could have a material adverse effect on our business, financial condition, and results of operations.

Both regulators and other stakeholders may demand that our business objectives become more sustainable, both from

an environmental and social point of view, and may be willing to penalize us if we do not meet their expectations and

demands, for example if our activities do not qualify as environmentally sustainable in accordance with the EU

Taxonomy for sustainable activities in accordance with Regulation (EU) 2020/852 on the establishment of a

framework to facilitate sustainable investment , or in accordance with our own commitments in relation to reduction of

CO2 emissions. A misalignment between our strategy and the expectations and demands of regulators and other

stakeholders with regards to sustainability would compromise the fulfillment of our growth and investment objectives.

Furthermore, increasing demands in connection with sustainability by our stakeholders may result in increase in our

compliance costs in this regard.

We also run the risk that our subsidiaries may perform work on projects for governments and public institutions that

do not meet our environmental standards, potentially impacting protected areas or endangered fauna or flora.

In particular, if we are not able to adhere to a call for increased sustainability by certain regulators or stakeholders, we

may face penalties by said regulators and stakeholders, including shareholders, suffer damage to our corporate

reputation, lose our positioning in sustainability indexes, experience an increase in our financing costs, and experience

a negative impact in analysts’ ratings. Furthermore, as a consequence of the financial demands derived from our need

to become more sustainable or of our potential failure to become more sustainable, project financing and our access to

sources of financing may worsen.

Furthermore, if we or our counterparties fail to comply with environmental requirements in the relevant jurisdictions,

we may be subject to investigation or litigation and our reputation and business could be adversely affected. For

example, see “Item 8. Financial Information—A. Consolidated Statements and Other Financial Information—2. Legal

Proceedings —4. Legal Proceedings Related to D4R7 project (Slovakia).”

In addition, biodiversity plays a key role in the provision of ecosystem services that support the economy and social

well-being. The degradation of ecosystems and natural capital entails operational, economic, and reputational risks for

the development of business activities. Particularly, we could be affected by the loss of quality of certain ecosystem

services, such as the lack of water or the reduced availability of certain raw materials. Any of the above factors could

have an adverse effect on our business, financial condition, and results of operations.

3.D.1.10 Accidents may occur at our project sites and facilities and at our infrastructure assets, which may severely

disrupt our operations and cause harm to our employees or customers, which could in turn have a material adverse

effect on our business, financial condition, results of operations, and reputation.

Notwithstanding our implementation of health and safety strategies and systems, and the commitment of our top

management to invest resources in employee health and safety, the occurrence of low-probability high-impact events,

such as accidents, is a material risk to us and these events have taken place in the past and may occur in future.

The frequency rate of serious injuries and fatal accidents, calculated by reference to the total number of serious injuries

and fatal accidents against the total number of hours worked, has decreased by 26% as of December 31, 2024,

compared to December 31, 2022. Nevertheless, this risk remains relevant to us due to, among others, the fact that the

risk of an accident is inherent to the nature of our activities, the variability of the subcontractor’s safety cultures, or

uncontrolled risks caused by third parties in this respect (e.g. driving behaviors of the general public).

Our project sites and facilities, such as toll roads, airports, and construction project sites, may be exposed to incidents

such as fires, explosions, toxic product leaks, and other environmental incidents. In addition, these sites and facilities’

respective employees may be exposed to accidents (for example, falling from a significant height, being hit by vehicles

and machinery, overturning of heavy equipment, and coming in contact with electricity). Any such accidents may

cause death and injury to employees, contractors, and also residents in surrounding areas, and may cause damage to

the assets and property owned by us and third parties, as well as damage to the environment. We are also exposed to a

risk of negative impacts to our business, financial conditions, and results of operations resulting from various types of

damage, including temporary interruption of services as a result of accidents during the course of operations, as well as

impacts connected to accidents involving land and air transport, substances, goods, and equipment.

If an accident occurs at one of our facilities or project sites, in addition to the internal investigation to be carried out in

accordance with our internal policies and protocols, legal proceedings could be initiated by the relevant authorities to

identify the causes of the accident and assess any potential civil, labor, or criminal liability. Such legal proceedings

could result in the relevant facility or project site being closed while the investigation is conducted, disrupting our

operations during the time of such closure. In addition, sanctions may be imposed on us or victims of such accidents

may claim compensation from us and hence may expose us to civil liability.

Furthermore, accidents may occur on our infrastructure assets to the users of the infrastructures, such as incidents on

the toll roads we currently operate, which are more likely when the area is affected by heavy and severe weather

events. For instance, there was a multiple vehicle accident on February 11, 2021 on the NTE 35W in Dallas, Texas.

The accident involved 133 vehicles and resulted in six deaths and other injuries. As a result of this incident, the

concession company NTE Mobility Partners Segment 3 LLC, of which we indirectly own 53.7%, together with several

of our U.S. Companies, have been named parties to 29 claims filed. Of these, three cases have been fully resolved and

one additional case has been partially resolved by the parties. Discovery in the other cases is on-going and the court

has announced that one of the trials will start on July 20, 2025. Following consultation with external legal advisors, the

concession company expects no material impact even in the event of an unfavorable ruling due to the insurance

policies in place. Therefore, no provision has been recorded in relation to this event (see “Item 8. Financial

Information—A. Consolidated Statements and Other Financial Information—2. Legal Proceedings—1. Litigation and

other contingent liabilities relating to the Toll Roads Business Division”).

Any accidents, incidents, and consequential claims for damages, including any reputational damage, and disruptions at

our project sites or facilities, or related to our infrastructure assets, could have a material adverse effect on our

business, financial condition, results of operations, and reputation.

3.D.1.11 Beneficiaries of guarantees provided by our Group Companies could request their execution, which could

have a material adverse effect on our business, financial condition, and results of operations.

Some of our Group Companies provide guarantees to cover liability to customers for improper performance of

obligations under construction contracts. Such guarantees are subject to potential enforcement by customers if a

project were not carried out or failed to meet contractual specifications and requirements. In order to protect ourselves