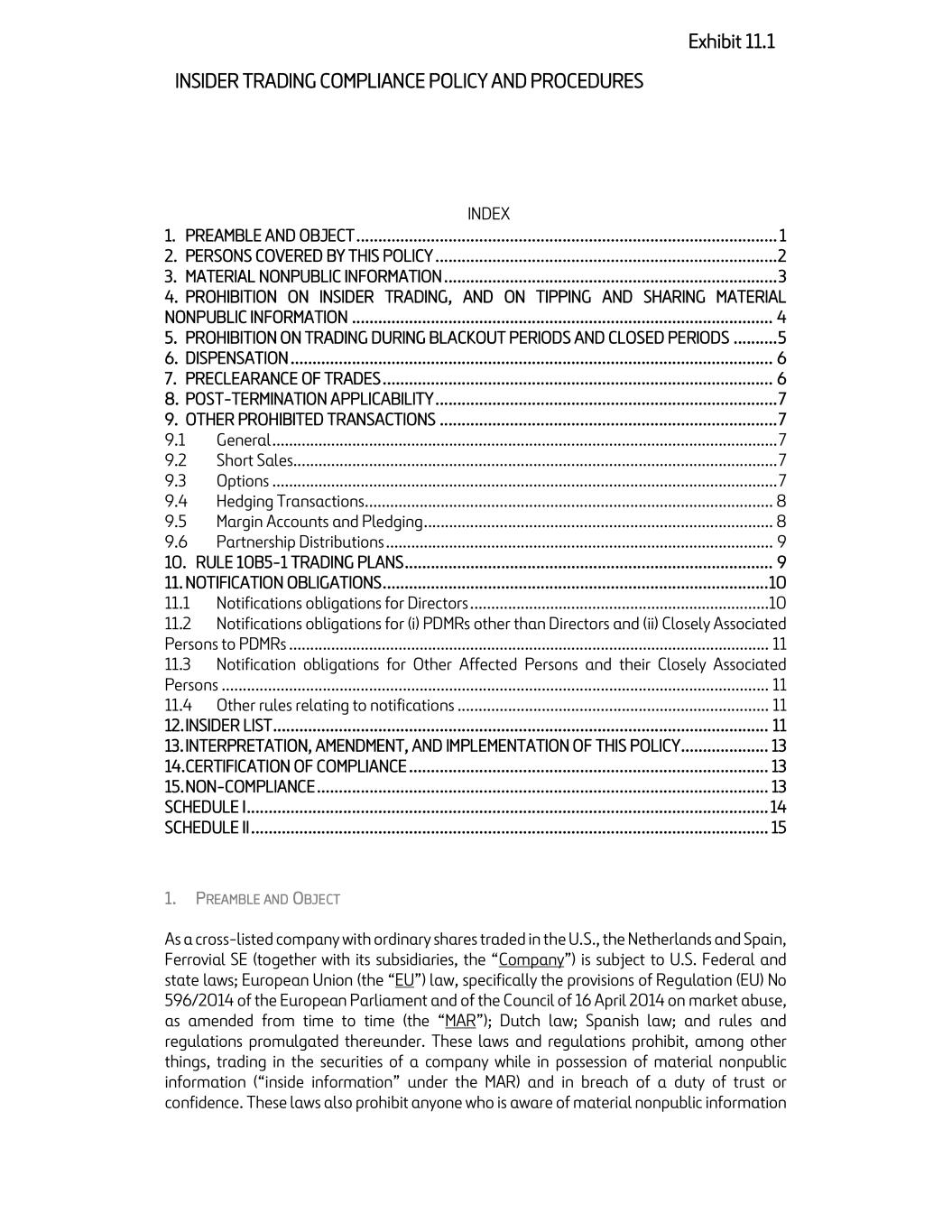

NG.FER.AJ-[*] 2023/06/16 INSIDER TRADING COMPLIANCE POLICY AND PROCEDURES Exhibit 11.1 INDEX 1. PREAMBLE AND OBJECT ................................................................................................ 1 2. PERSONS COVERED BY THIS POLICY .............................................................................. 2 3. MATERIAL NONPUBLIC INFORMATION ............................................................................ 3 4. PROHIBITION ON INSIDER TRADING, AND ON TIPPING AND SHARING MATERIAL NONPUBLIC INFORMATION ................................................................................................ 4 5. PROHIBITION ON TRADING DURING BLACKOUT PERIODS AND CLOSED PERIODS .......... 5 6. DISPENSATION .............................................................................................................. 6 7. PRECLEARANCE OF TRADES ......................................................................................... 6 8. POST-TERMINATION APPLICABILITY .............................................................................. 7 9. OTHER PROHIBITED TRANSACTIONS ............................................................................. 7 9.1 General ........................................................................................................................ 7 9.2 Short Sales................................................................................................................... 7 9.3 Options ........................................................................................................................ 7 9.4 Hedging Transactions ................................................................................................. 8 9.5 Margin Accounts and Pledging ................................................................................... 8 9.6 Partnership Distributions ............................................................................................ 9 10. RULE 10B5-1 TRADING PLANS .................................................................................... 9 11. NOTIFICATION OBLIGATIONS ........................................................................................ 10 11.1 Notifications obligations for Directors .......................................................................10 11.2 Notifications obligations for (i) PDMRs other than Directors and (ii) Closely Associated Persons to PDMRs .................................................................................................................. 11 11.3 Notification obligations for Other Affected Persons and their Closely Associated Persons .................................................................................................................................. 11 11.4 Other rules relating to notifications .......................................................................... 11 12. INSIDER LIST ................................................................................................................. 11 13. INTERPRETATION, AMENDMENT, AND IMPLEMENTATION OF THIS POLICY .................... 13 14. CERTIFICATION OF COMPLIANCE .................................................................................. 13 15. NON-COMPLIANCE ....................................................................................................... 13 SCHEDULE I ....................................................................................................................... 14 SCHEDULE II ...................................................................................................................... 15 1. PREAMBLE AND OBJECT As a cross-listed company with ordinary shares traded in the U.S., the Netherlands and Spain, Ferrovial SE (together with its subsidiaries, the “Company”) is subject to U.S. Federal and state laws; European Union (the “EU”) law, specifically the provisions of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse, as amended from time to time (the “MAR”); Dutch law; Spanish law; and rules and regulations promulgated thereunder. These laws and regulations prohibit, among other things, trading in the securities of a company while in possession of material nonpublic information (“inside information” under the MAR) and in breach of a duty of trust or confidence. These laws also prohibit anyone who is aware of material nonpublic information

NG.FER.AJ-[*] 2023/06/16 INSIDER TRADING COMPLIANCE POLICY AND PROCEDURES from providing this information to others. Violating such laws can undermine investor trust, harm the reputation and integrity of the Company, and result in dismissal from the Company or even serious criminal, administrative and civil charges against the individual and the Company. The Company reserves the right to take whatever disciplinary or other measure(s) it determines in its sole discretion to be appropriate in any particular situation, including disclosure of wrongdoing to governmental authorities. 2. PERSONS COVERED BY THIS POLICY 2.1 This Insider Trading Compliance Policy and Procedures applies to: (i) the members of the Company's board of directors (the "Board", and each member a "Director"), members of the Company's management committee and any other senior managers of the Company possessing regular access to material nonpublic information and power to take management decisions affecting the future developments and business prospects of the Company (together, "Persons Discharging Managerial Responsibilities" or "PDMRs"); (ii) the officers and the employees of the Company designated by the General Counsel’s Office (or his or her designee) due to their potential regular and recurring access to material nonpublic information (“Other Affected Persons"); (iii) the employees of the Company and their Closely Associated Persons (as defined below); (iv) family members who are members of the same household, the spouse, partner equivalent to a spouse under national law and children who are dependent in accordance with national law of a PDMR, Other Affected Person or other employee; and (v) any legal person, trust or partnership, the managerial responsibilities of which are discharged by, which is directly or indirectly controlled by, which has been created for the benefit of, or the economic interests of which are substantially equivalent to those of, a PDMR, Other Affected Person or other employee (together with the persons referred to under (iv) of this section 2.1, “Closely Associated Persons”). The persons or entities identified in this section 2.1 are collectively referred to as “Covered Persons.” 2.2 PDMRs must inform the General Counsel’s Office of all persons who qualify as their Closely Associated Persons. The Company shall prepare a confidential register of (i) PDMRs and their Closely Associated Persons; (ii) Other Affected Persons. The General Counsel's Office shall notify them of their inclusion in the register and they shall acknowledge receipt of such notification. 2.3 Each PDMR shall notify their Closely Associated Persons in writing (and keep a copy thereof) of their duty to notify the Netherlands Authority for the Financial Markets

NG.FER.AJ-[*] 2023/06/16 INSIDER TRADING COMPLIANCE POLICY AND PROCEDURES (Stichting Autoriteit Financiële Markten or "AFM"), and the General Counsel’s Office, promptly and ultimately within 3 business days, of every transaction in Company securities. 3. MATERIAL NONPUBLIC INFORMATION 3.1 The term "material nonpublic information" includes any nonpublic information that: (i) in the context of compliance with the MAR (which refers to material nonpublic information as "inside information") and for the purposes of this Policy: a) is of a precise nature; b) relates, directly or indirectly, to the Company or to one or more financial instruments (including Company securities); and c) if made public, would be likely to have a significant effect on the prices of those financial instruments or on the price of related derivative financial instruments; or (ii) a reasonable investor would consider important in a decision to buy, hold or sell a security. U.S. courts have described that as information that could be considered to significantly alter the “total mix” of information available to a reasonable investor in making its investment decision. Stated differently, information is “material” if there is a substantial likelihood that a reasonable investor would consider it important in making an investment decision, or if it would significantly alter the total mix of information available to investors. Any information that could reasonably be expected to affect the price of a security is material. 3.2 Examples of material information or events may include, but are not limited to: (i) corporate earnings or earnings forecasts; (ii) potential significant mergers, significant acquisitions or investments, tender offers, or significant divestments; (iii) important business developments, such as developments regarding strategic collaborations; (iv) changes in control of the Company; (v) changes in auditors or auditor notification that the issuer may no longer rely on an audit report; (vi) significant events concerning the Company’s physical assets; (vii) significant defaults on borrowings; (viii) bankruptcies or receiverships; (ix) significant cybersecurity or data security incidents; and (x) significant litigation or regulatory investigations. 3.3 Information is “nonpublic” if it is not available to the general public. In order for information to be considered “public,” it must be widely disseminated in a manner that

NG.FER.AJ-[*] 2023/06/16 INSIDER TRADING COMPLIANCE POLICY AND PROCEDURES makes it generally available to investors through a Regulation FD-compliant method, such as through a press release, a filing with the U.S. Securities and Exchange Commission (the “SEC”) or with any other regulatory body of securities markets to which supervision the Company is subject, or a Regulation FD-compliant conference call. 3.4 The circulation of rumors, even if accurate and reported in the media, does not constitute public dissemination. In addition, even after a public announcement, a reasonable period of time may need to lapse in order for the market to react to the information. Generally, the passage of two full trading days following release of the information to the public is a reasonable waiting period before such information is deemed to be public. 4. PROHIBITION ON INSIDER TRADING , AND ON TIPPING AND SHARING MATERIAL NONPUBLIC INFORMATION 4.1 No Covered Person shall purchase or sell, for its own account or for the account of a third party, directly or indirectly, any type of security while in possession of material nonpublic information relating to the security or the issuer of such security, whether the issuer of such security is the Company or any other company, until such information becomes public or is no longer material. 4.2 In addition, Covered Persons shall not directly or indirectly communicate material nonpublic information relating to a security or the issuer of such security to anyone outside the Company or within the Company other than on a “need-to-know” basis, and in accordance with the Company’s policies regarding confidential information. 4.3 “Securities” includes shares, bonds, notes, debentures, options, warrants, equity and other convertible securities, as well as derivative instruments or other financial instruments linked to them. 4.4 “Purchase” and “sale” are defined broadly under the U.S. federal securities law. “Purchase” includes not only the actual purchase of a security, but also any contract to purchase or otherwise acquire a security. “Sale” includes not only the actual sale of a security, but also any contract to sell or otherwise dispose of a security. These definitions extend to a broad range of transactions, including conventional cash-for-shares transactions, conversions, the exercise of share options, transfers, gifts, and acquisitions and exercises of warrants or puts, calls, pledging and margin loans, or other derivative securities, in each case whether the Covered Person doing such transaction is acting for his or her own benefit or for the benefit of another, even if such person is acting through an agent or trustee. 4.5 The prohibition on trading securities while in possession of material nonpublic information is also set forth under the MAR, which prohibits Covered Persons from buying, selling, carrying out other transactions or attempting to carry out transactions involving, directly or indirectly, for their own account or for the account of a third party, securities using material nonpublic information. The use of material nonpublic

NG.FER.AJ-[*] 2023/06/16 INSIDER TRADING COMPLIANCE POLICY AND PROCEDURES information by cancelling or amending a transaction concerning securities to which the material nonpublic information relates is also prohibited. 4.6 The MAR also prohibits Covered Persons from: giving “tips,” either by (i) disclosing material nonpublic information concerning the Company to others unless this is required in the normal exercise of their employment, profession, duties or position; or (ii) by recommending or inducing others to buy or sell securities or to cancel or amend an order concerning the securities while possessing material nonpublic information. 5. PROHIBITION ON TRADING DURING BLACKOUT PERIODS AND CLOSED PERIODS 5.1 PDMRs, Other Affected Persons and their Closely Associated Persons shall not purchase or sell, for its own account or for the account of a third party, directly or indirectly, any security of the Company during the period: (i) beginning on the 15th calendar day of the last month of any fiscal quarter (or other reporting period) for which financial information will be released, and ending after completion of the second full trading day after the public release of earnings data for such fiscal quarter (or other reporting period), or during any other trading suspension period declared by the Company, such period, a “blackout period”; and (ii) thirty (30) calendar days prior to the Company's public release of its semi-annual or annual report, such period, a “closed period”. A closed period is generally shorter and embedded in a blackout period. Questions as to whether financial information is publicly available should be directed to the Finance Department. 5.2 The prohibitions on trading during a blackout period that is not also a closed period do not apply to: (i) purchases of the Company’s securities from the Company, or sales of the Company’s securities to the Company; (ii) exercises of share options or other equity awards or the surrender of shares to the Company in payment of the exercise price or in satisfaction of any tax withholding obligations in a manner permitted by the applicable equity award agreement, or vesting of equity-based awards, in each case, that do not involve a market sale of the Company’s securities (the “cashless exercise” of a Company share option or other equity award through a broker does involve a market sale of the Company’s securities, and therefore would not qualify under this exception); or (iii) purchases or sales of the Company’s securities made pursuant to a Trading Plan (as defined below) adopted to comply with the Exchange Act Rule 10b5-1 (“Rule 10b5-1”). Any Trading Plans entered into by PDMRs must provide for no transactions in the Company’s securities to take place during a closed period.

NG.FER.AJ-[*] 2023/06/16 INSIDER TRADING COMPLIANCE POLICY AND PROCEDURES 5.3 In addition to blackout periods indicated in section 5.1, the CEO, after consultation with the General Counsel and the CFO, may prohibit Directors, officers, employees or others from purchasing or selling Company securities (as defined in section 4.4) because of developments that have not yet been disclosed to the public or in order to best comply with this Policy. The General Counsel’s Office, or the Supervising Manager (as this term is defined below), will inform relevant persons of the start and, where possible, end dates of such specific blackout periods. 6. DISPENSATION 6.1 The Company may grant dispensation from the restrictions included under the section 5 of this Policy to the extent permitted by law. Any dispensation from a prohibition granted by the Company is without prejudice to the statutory market abuse prohibitions, including the prohibition on insider trading. Section 7.2 below is applicable here. 7. PRECLEARANCE OF TRADES 7.1 All transactions in the Company’s securities by PDMRs, other Affected Persons and their respective Closely Associated Persons (each, a “Preclearance Person”) must be submitted for preclearance by the General Counsel’s Office (or by the Chief Financial Officer or his or her designee for transactions made by a member of the General Counsel’s Office). 7.2 Preclearance should not be understood to represent legal advice by the Company that a proposed transaction complies with the law. Preclearance implies solely that procedural requirements stated in this Policy are fulfilled. It does not imply an assessment by the Company, for instance, as to whether the Preclearance Person is in possession of Material Nonpublic Information, which is always the responsibility of the Preclearance Person. Nothing in this Policy should be interpreted as providing a Preclearance Person with remedies against the Company in connection with such Preclearance Person’s decision to trade in the Company’s securities. 7.3 A request for preclearance must be in writing, should be made at least two full business days in advance of the proposed transaction, and should include the identity of the Preclearance Person, a description of the proposed transaction, the proposed date of the transaction, and the number of shares or other securities involved. In addition, the Preclearance Person must execute a certification that he or she is not aware of material nonpublic information about the Company. 7.4 The General Counsel’s Office will respond not later than the second business day after the day in which a complete request for preclearance was received (meaning business days where the counsel in charge is based). 7.5 All trades that are precleared must be effected within five trading days after the day of receipt of the preclearance (meaning trading days in the market where the transaction is executed). A precleared trade (or any portion of a precleared trade) that has not been

NG.FER.AJ-[*] 2023/06/16 INSIDER TRADING COMPLIANCE POLICY AND PROCEDURES effected during that period must be submitted for preclearance determination again prior to execution. Notwithstanding receipt of preclearance, if the Preclearance Person becomes aware of material nonpublic information, or becomes subject to a blackout period before the transaction is effected, the transaction may not be completed at that time. 7.6 None of the Company or the Company’s employees or advisors will have any liability for any delay in reviewing, or refusal of, or granting, a request for preclearance. 8. POST-TERMINATION APPLICABILITY 8.1 If a PDMR or Other Affected Person is in possession of material nonpublic information when his or her service with the Company terminates, that individual shall remain subject to this Policy (other than any preclearance requirements) until the time when that information has ceased to be material or accurate or has become public. 8.2 In addition, if a PDMR’s or Other Affected Person’s service with the Company is terminated during a blackout period, the restrictions on trading applicable during the blackout period shall continue to apply until the lapse of such period. 9. OTHER PROHIBITED TRANSACTIONS 9.1 GENERAL The Company has determined that there is a heightened legal risk and the appearance of improper or inappropriate conduct if persons subject to this Policy engage in certain types of transactions. Therefore, PDMRs, Other Affected Persons, and their Closely Associated Persons shall comply with the following policies, even if they are not in possession of material nonpublic information, with respect to certain transactions in the Company’s securities. 9.2 SHORT SALES Short sales of the Company’s securities are prohibited by this Policy. Short sales of the Company’s securities, or sales of shares that the person does not own at the time of sale, or sales of shares against which the person does not deliver the shares within 20 days after the sale, evidence an expectation on the part of the seller that the securities will decline in value, and, therefore, signal to the market that the seller has no confidence in the Company or its short- term prospects. 9.3 OPTIONS Transactions in puts, calls, or other derivative securities involving the Company’s equity securities, on an exchange, on an over-the-counter market, or in any other organized market, are prohibited by this Policy. A transaction in options is, in effect, a bet on the short- term movement of the Company’s shares and, therefore, creates the appearance that a Covered Person is trading based on material nonpublic information. Transactions in options,

NG.FER.AJ-[*] 2023/06/16 INSIDER TRADING COMPLIANCE POLICY AND PROCEDURES whether traded on an exchange, on an over-the-counter market, or any other organized market, also may focus PDMRs, Other Affected Persons, and their Closely Associated Persons’ attention on short-term performance at the expense of the Company’s long-term objectives. Option positions arising from certain types of hedging transactions are governed by the Section 9.4 below. 9.4 HEDGING TRANSACTIONS Hedging transactions involving the Company’s securities, such as prepaid variable forward contracts, equity swaps, collars and exchange funds, or other transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of the Company’s equity securities, are prohibited by this Policy. Such transactions allow PDMRs, Other Affected Persons, and their Closely Associated Persons to continue to own the covered securities, but without the full risks and rewards of ownership. When that occurs, PDMRs, Other Affected Persons, and their Closely Associated Persons may no longer have the same objectives as the Company’s other shareholders. Notwithstanding the foregoing, under certain circumstances an exception may be granted to enter into certain types of hedging arrangements. Any PDMR or Other Affected Person that wishes to do so must submit a request (on behalf of themselves or their respective Closely Associated Persons) to the Company at least two weeks prior to the proposed execution of documents evidencing the proposed hedge or similar arrangement and must set forth a justification for the proposed transaction The Company shall have absolute discretion over approving or rejecting such proposed transaction. The Company shall assume no liability for the consequences of any transaction made pursuant to such request. 9.5 MARGIN ACCOUNTS AND PLEDGING PDMRs, Other Affected Persons, and their Closely Associated Persons are prohibited from pledging Company securities as collateral for a loan, purchasing Company securities on margin (i.e., borrowing money to purchase the securities), or placing Company securities in a margin account. This prohibition does not apply to cashless exercises of share options under the Company’s equity plans. Notwithstanding the foregoing, under certain circumstances an exception may be granted to pledge Company securities as collateral for a loan (not including margin debt) where the PDMR or Other Affected Person (on behalf of themselves or their respective Closely Associated Persons) clearly demonstrates the financial capacity to repay the loan without resorting to the pledged securities. Any PDMR or Other Affected Person that wishes to do so must submit a request (on behalf of themselves or their respective Closely Associated Persons) to the Company at least two weeks prior to the proposed execution of documents evidencing the proposed pledge. The Company shall have absolute discretion over approving or rejecting such proposed pledge and may impose additional requirements in connection with granting the request, including a requirement that the proposed pledgee expressly agrees to accept the terms of this Policy with respect to such pledged Company securities to the reasonable satisfaction of the Company. The Company shall assume no liability for the consequences of any transaction made pursuant to such request.

NG.FER.AJ-[*] 2023/06/16 INSIDER TRADING COMPLIANCE POLICY AND PROCEDURES 9.6 PARTNERSHIP DISTRIBUTIONS Nothing in this Policy is intended to limit the ability of an investment fund, venture capital partnership or other similar entity with which a Director is affiliated to distribute Company securities to its partners, members, or other similar persons. It is the responsibility of each affected Director and the affiliated entity, in consultation with their own counsel (as appropriate), to determine the timing of any distributions, based on all relevant facts and circumstances, and applicable securities laws. 10. RULE 10B5-1 TRADING PLANS 10.1 The trading restrictions set forth in this Policy, other than those transactions described under “Other Prohibited Transactions”, do not apply to transactions under a previously established contract, plan or instruction to trade in the Company’s securities entered into in accordance with Rule 10b5-1 (a “Trading Plan”) that: (i) has been submitted to and preapproved by the General Counsel’s Office and the Finance Department; (ii) includes a “Cooling Off Period” for a) directors and executive officers that extends to the later of 90 calendar days after adoption or modification of a Trading Plan or two business days (in the U.S.) after filing the Form 20-F or Form 6-K disclosing financial results covering the fiscal quarter in which the Trading Plan was adopted, up to a maximum of 120 days; and b) other employees of the Group and any other persons, other than the Company, that extends 30 days after adoption or modification of a Trading Plan; (iii) for directors and officers, includes a representation in the Trading Plan that the director or officer is (1) not aware of any material nonpublic information about the Company or its securities; and (2) adopting the Trading Plan in good faith and not as part of a plan or scheme to evade the prohibitions of Rule 10b-5; (iv) has been entered into in good faith at a time when the individual was not in possession of material nonpublic information about the Company and not otherwise in a blackout period, and the person who entered into the Trading Plan has acted in good faith with respect to the Trading Plan; (v) either (1) specifies the amounts, prices, and dates of all transactions under the Trading Plan; or (2) provides a written formula, algorithm, or computer program for determining the amount, price, and date of the transactions; (vi) prohibits the individual from exercising any subsequent influence over the transactions; and (vii) complies with all other applicable requirements of Rule 10b5-1 and the MAR; and (viii) where the Trading Plan is entered into by a PDMR, provides for no transactions in the Company’s securities to take place during a Closed Period.

NG.FER.AJ-[*] 2023/06/16 INSIDER TRADING COMPLIANCE POLICY AND PROCEDURES 10.2. The General Counsel’s Office and the Finance Department may impose such other conditions on the implementation and operation of the Trading Plan as they deem necessary or advisable. Individuals may not adopt more than one Trading Plan at a time except under the limited circumstances permitted by Rule 10b5-1 and subject to preapproval by those departments. 10.3. An individual may only modify a Trading Plan outside of a blackout period and, in any event, when the individual does not possess material nonpublic information. Modifications to and terminations of a Trading Plan are subject to preapproval by the General Counsel’s Office and Finance Department, and modifications of a Trading Plan that change the amount, price, or timing of the purchase or sale of the securities underlying a Trading Plan will trigger a new Cooling-Off Period. 10.4. The Company reserves the right to publicly disclose, announce, or respond to inquiries from the media regarding the adoption, modification, or termination of a Trading Plan and non-Rule 10b5-1 trading arrangements, or the execution of transactions made under a Trading Plan. The Company also reserves the right from time to time to suspend, discontinue, or otherwise prohibit transactions under a Trading Plan if the General Counsel’s Office and the Finance Department or the Board of Directors, in its discretion, determines that such suspension, discontinuation, or other prohibition is in the best interests of the Company. 10.5. Compliance of a Trading Plan with the terms of Rule 10b5-1 and the MAR and the execution of transactions pursuant to the Trading Plan are the sole responsibility of the person initiating the Trading Plan, and neither the Company nor anyone from the Company assumes any liability regarding Trading Plans, nor the legality or consequences relating to a person entering into, informing the Company of, or trading under, a Trading Plan. 11. NOTIFICATION OBLIGATIONS 11.1 NOTIFICATIONS OBLIGATIONS FOR DIRECTORS Each Director must notify the AFM and the General Counsel’s Office of the following at the time indicated: a) without delay: each change, in number and/or type, in his share and/or voting interest in the Company. In this context, "share" also includes rights to obtain shares, such as options. A change in the type of interest will, for example, occur if an option is exercised and consequently shares are obtained; b) promptly and ultimately within 3 business days: every transaction in the Company's securities conducted by him or on his account. The notifications referred to in this clause 11.1(ii) do not need to be made until all transactions within a calendar year have reached a total amount of EUR 20,000 (calculated without netting). Any subsequent transaction must be notified as set forth in this clause; and c) within two weeks of the appointment as a Director: their holding in the Company's shares or voting rights.

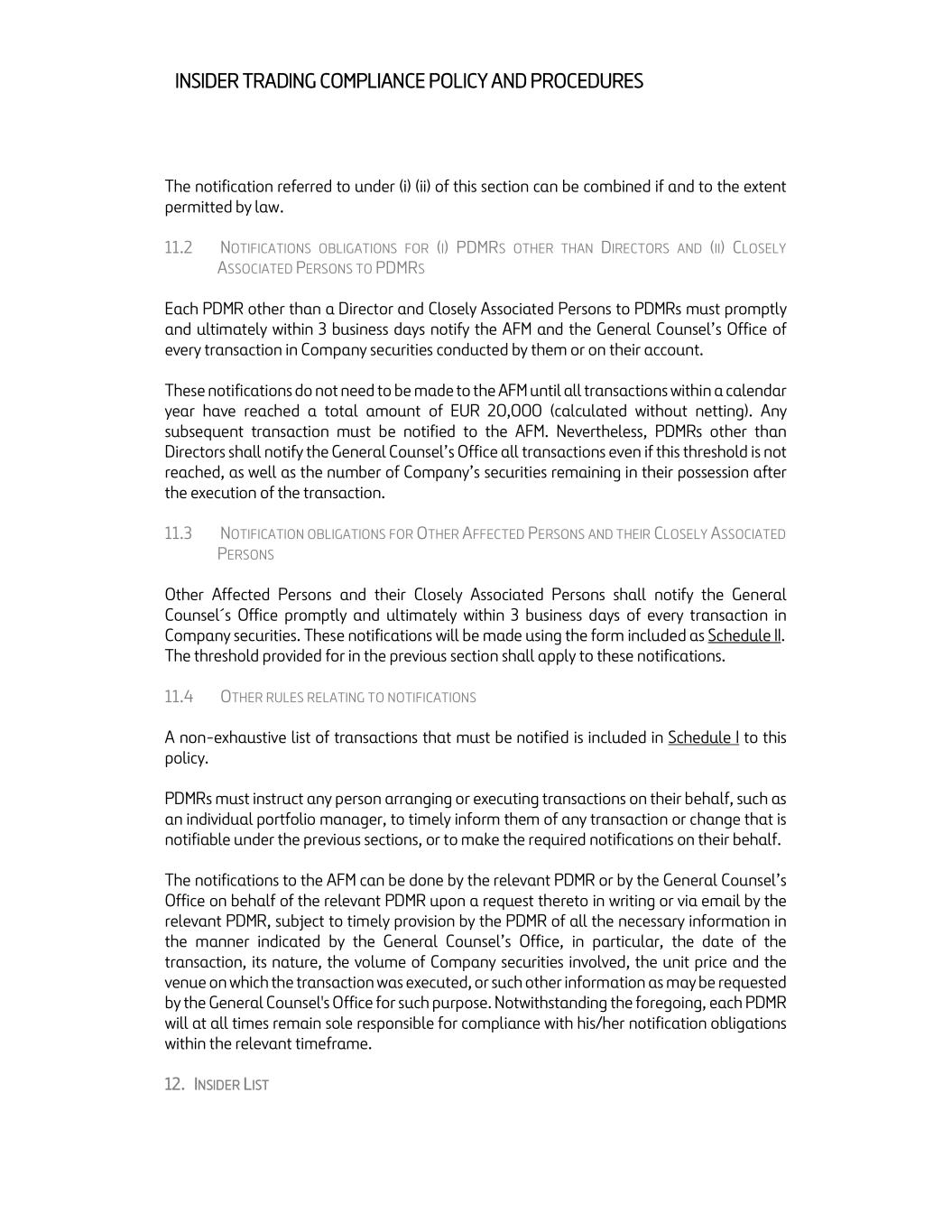

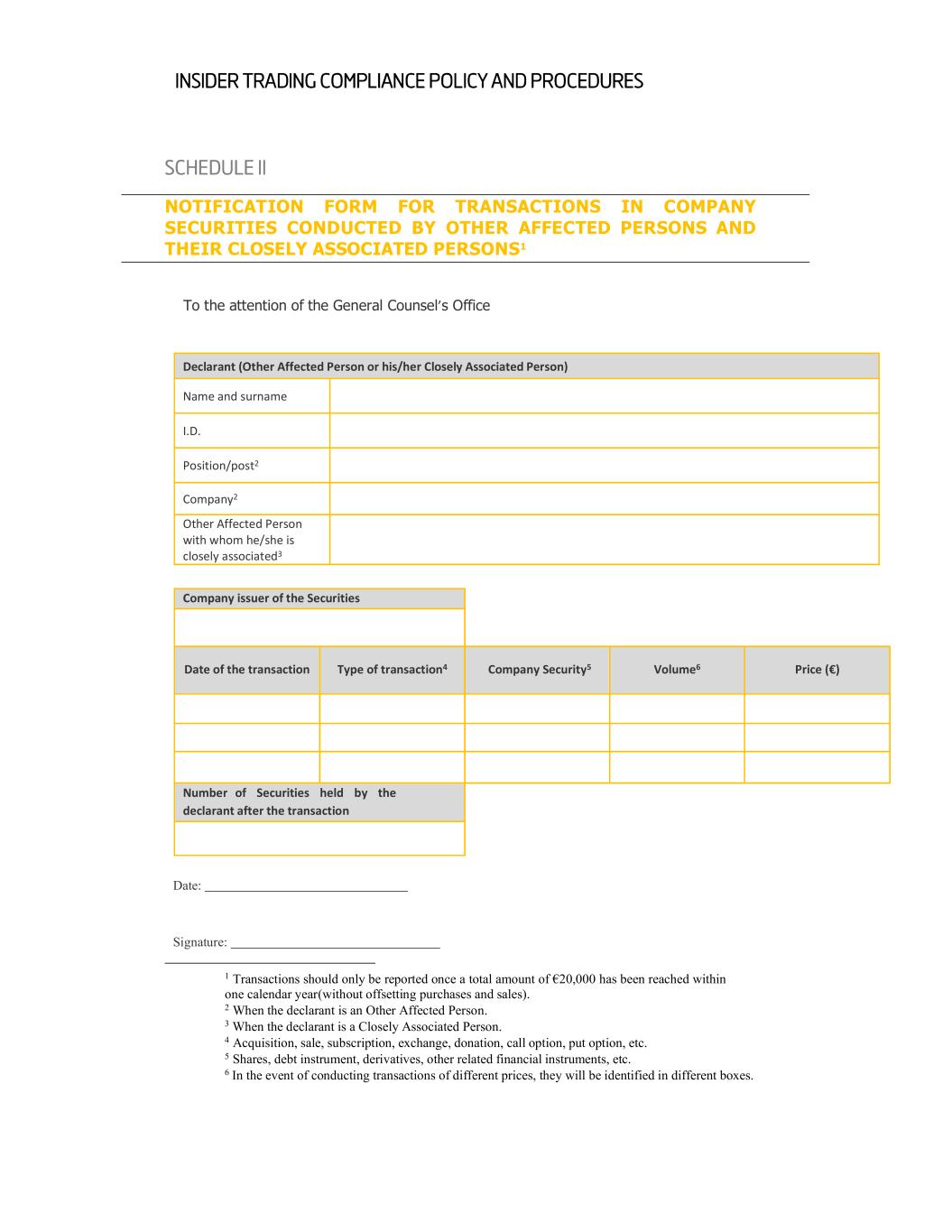

NG.FER.AJ-[*] 2023/06/16 INSIDER TRADING COMPLIANCE POLICY AND PROCEDURES The notification referred to under (i) (ii) of this section can be combined if and to the extent permitted by law. 11.2 NOTIFICATIONS OBLIGATIONS FOR (I) PDMRS OTHER THAN DIRECTORS AND (II) CLOSELY ASSOCIATED PERSONS TO PDMRS Each PDMR other than a Director and Closely Associated Persons to PDMRs must promptly and ultimately within 3 business days notify the AFM and the General Counsel’s Office of every transaction in Company securities conducted by them or on their account. These notifications do not need to be made to the AFM until all transactions within a calendar year have reached a total amount of EUR 20,000 (calculated without netting). Any subsequent transaction must be notified to the AFM. Nevertheless, PDMRs other than Directors shall notify the General Counsel’s Office all transactions even if this threshold is not reached, as well as the number of Company’s securities remaining in their possession after the execution of the transaction. 11.3 NOTIFICATION OBLIGATIONS FOR OTHER AFFECTED PERSONS AND THEIR CLOSELY ASSOCIATED PERSONS Other Affected Persons and their Closely Associated Persons shall notify the General Counsel´s Office promptly and ultimately within 3 business days of every transaction in Company securities. These notifications will be made using the form included as Schedule II. The threshold provided for in the previous section shall apply to these notifications. 11.4 OTHER RULES RELATING TO NOTIFICATIONS A non-exhaustive list of transactions that must be notified is included in Schedule I to this policy. PDMRs must instruct any person arranging or executing transactions on their behalf, such as an individual portfolio manager, to timely inform them of any transaction or change that is notifiable under the previous sections, or to make the required notifications on their behalf. The notifications to the AFM can be done by the relevant PDMR or by the General Counsel’s Office on behalf of the relevant PDMR upon a request thereto in writing or via email by the relevant PDMR, subject to timely provision by the PDMR of all the necessary information in the manner indicated by the General Counsel’s Office, in particular, the date of the transaction, its nature, the volume of Company securities involved, the unit price and the venue on which the transaction was executed, or such other information as may be requested by the General Counsel's Office for such purpose. Notwithstanding the foregoing, each PDMR will at all times remain sole responsible for compliance with his/her notification obligations within the relevant timeframe. 12. INSIDER LIST

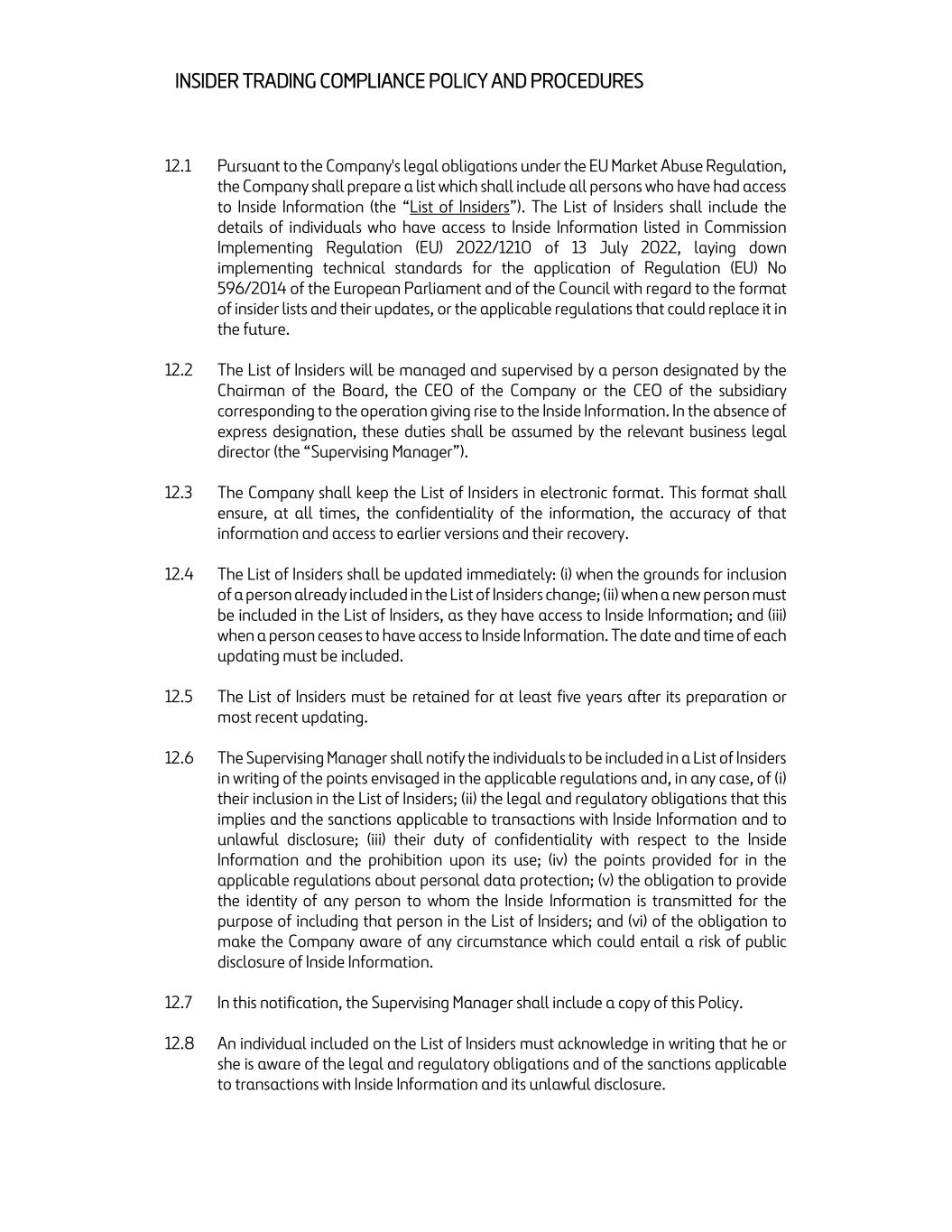

NG.FER.AJ-[*] 2023/06/16 INSIDER TRADING COMPLIANCE POLICY AND PROCEDURES 12.1 Pursuant to the Company's legal obligations under the EU Market Abuse Regulation, the Company shall prepare a list which shall include all persons who have had access to Inside Information (the “List of Insiders”). The List of Insiders shall include the details of individuals who have access to Inside Information listed in Commission Implementing Regulation (EU) 2022/1210 of 13 July 2022, laying down implementing technical standards for the application of Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to the format of insider lists and their updates, or the applicable regulations that could replace it in the future. 12.2 The List of Insiders will be managed and supervised by a person designated by the Chairman of the Board, the CEO of the Company or the CEO of the subsidiary corresponding to the operation giving rise to the Inside Information. In the absence of express designation, these duties shall be assumed by the relevant business legal director (the “Supervising Manager”). 12.3 The Company shall keep the List of Insiders in electronic format. This format shall ensure, at all times, the confidentiality of the information, the accuracy of that information and access to earlier versions and their recovery. 12.4 The List of Insiders shall be updated immediately: (i) when the grounds for inclusion of a person already included in the List of Insiders change; (ii) when a new person must be included in the List of Insiders, as they have access to Inside Information; and (iii) when a person ceases to have access to Inside Information. The date and time of each updating must be included. 12.5 The List of Insiders must be retained for at least five years after its preparation or most recent updating. 12.6 The Supervising Manager shall notify the individuals to be included in a List of Insiders in writing of the points envisaged in the applicable regulations and, in any case, of (i) their inclusion in the List of Insiders; (ii) the legal and regulatory obligations that this implies and the sanctions applicable to transactions with Inside Information and to unlawful disclosure; (iii) their duty of confidentiality with respect to the Inside Information and the prohibition upon its use; (iv) the points provided for in the applicable regulations about personal data protection; (v) the obligation to provide the identity of any person to whom the Inside Information is transmitted for the purpose of including that person in the List of Insiders; and (vi) of the obligation to make the Company aware of any circumstance which could entail a risk of public disclosure of Inside Information. 12.7 In this notification, the Supervising Manager shall include a copy of this Policy. 12.8 An individual included on the List of Insiders must acknowledge in writing that he or she is aware of the legal and regulatory obligations and of the sanctions applicable to transactions with Inside Information and its unlawful disclosure.

NG.FER.AJ-[*] 2023/06/16 INSIDER TRADING COMPLIANCE POLICY AND PROCEDURES 12.9 The List of Insiders shall be furnished to the regulatory bodies of the securities markets to which supervision the Company is subject as soon as possible, upon their request. 12.10 The Company may prepare a permanent List of Insiders that includes all those persons who have access at all times to all Inside Information. The other provisions of this article shall apply, where appropriate, to the List of Insiders provided for in this paragraph. 13. INTERPRETATION , AMENDMENT, AND IMPLEMENTATION OF THIS POLICY 13.1 The General Counsel’s Office shall have the authority to interpret this Policy and all related policies and procedures. 13.2 This Policy may be amended by the Board of Directors of the Company. Actions taken by the Company or any of its employees do not constitute legal advice, nor do they insulate you from the consequences of noncompliance with this Policy or with applicable securities laws. 14. CERTIFICATION OF COMPLIANCE 14.1 All Covered Persons and others subject to this Policy may be asked periodically to certify their compliance with the terms and provisions of this Policy. 15. NON-COMPLIANCE 15.1 Nothing in this Policy should be deemed to change or amend obligations imposed by the applicable regulations. 15.2 Non-compliance with the provisions of this Policy shall give rise to the corresponding liability, depending on the nature of the relationship between the person who has failed to comply with and the Company or any of its subsidiaries. In the event of non- compliance with the provisions of this Policy, the Company reserves the right to impose any sanctions which is entitled to impose pursuant to the law and/or the (employment) agreement with the person in question. Such possible sanctions include termination of the (employment) agreement with the person involved, by way of summary dismissal or otherwise. 15.3 The foregoing shall be understood without prejudice to the liability arising from the applicable regulations.

NG.FER.AJ-[*] 2023/06/16 INSIDER TRADING COMPLIANCE POLICY AND PROCEDURES SCHEDULE I Non-Exhaustive List of Transactions That Must Be Notified by PDMRs and Closely Associated Persons of PDMRs Transactions in the Company's securities which need to be notified to the AFM and the Company under Article 19 of the MAR, include the following: a) acquisitions or disposals; b) transactions undertaken by persons professionally arranging or executing transactions or by another person on behalf of a PDMR or a Person Closely Associated with a PDMR, including where discretion is exercised (e.g. under an individual portfolio or asset management mandate); c) gifts and donations made or received, and inheritance received; d) acceptance or exercise of a stock option, including of a stock option granted to managers or employees as part of their remuneration package, and the disposal of shares stemming from the exercise of a stock option; e) subscription to a capital increase or debt instrument issuance; f) conditional transactions upon the occurrence of the conditions and actual execution of the transactions; g) automatic or non-automatic conversion of a financial instrument into another financial instrument, including the exchange of convertible bonds to shares; h) pledging (or a similar security interest), borrowing or lending by or on behalf of a PDMR or Person Closely Associated with a PDMR; i) short sale, subscription or exchange; j) entering into or exercise of equity swaps; k) transactions in or related to derivatives, including cash-settled transactions; l) entering into a contract for difference on a financial instrument of [Company] or on emission allowances or auction products based thereon; m) acquisition, disposal or exercise of rights, including put and call options, and warrants; n) transactions in derivatives and financial instruments linked to a debt instrument of the Company, including credit default swaps; o) transactions executed in index-related products, baskets and derivatives, insofar as required by Article 19 of the MAR; p) transactions executed in shares or units of investment funds, including alternative investment funds (AIFs) referred to in Article 1 of Directive 2011/61/EU of the European Parliament and of the Council, insofar as required by Article 19 of the MAR; q) transactions executed by manager of an AIF in which the PDMR or Person Closely Associated with such PDMR have invested, insofar as required by Article 19 of the MAR; and r) transactions made under a life insurance policy, where the investment risk is borne by the PDMR or Person Closely Associated with such PDMR and they have the power or discretion to make investment decisions regarding specific instruments in that life insurance policy or to execute transactions regarding specific instruments for that life insurance policy.

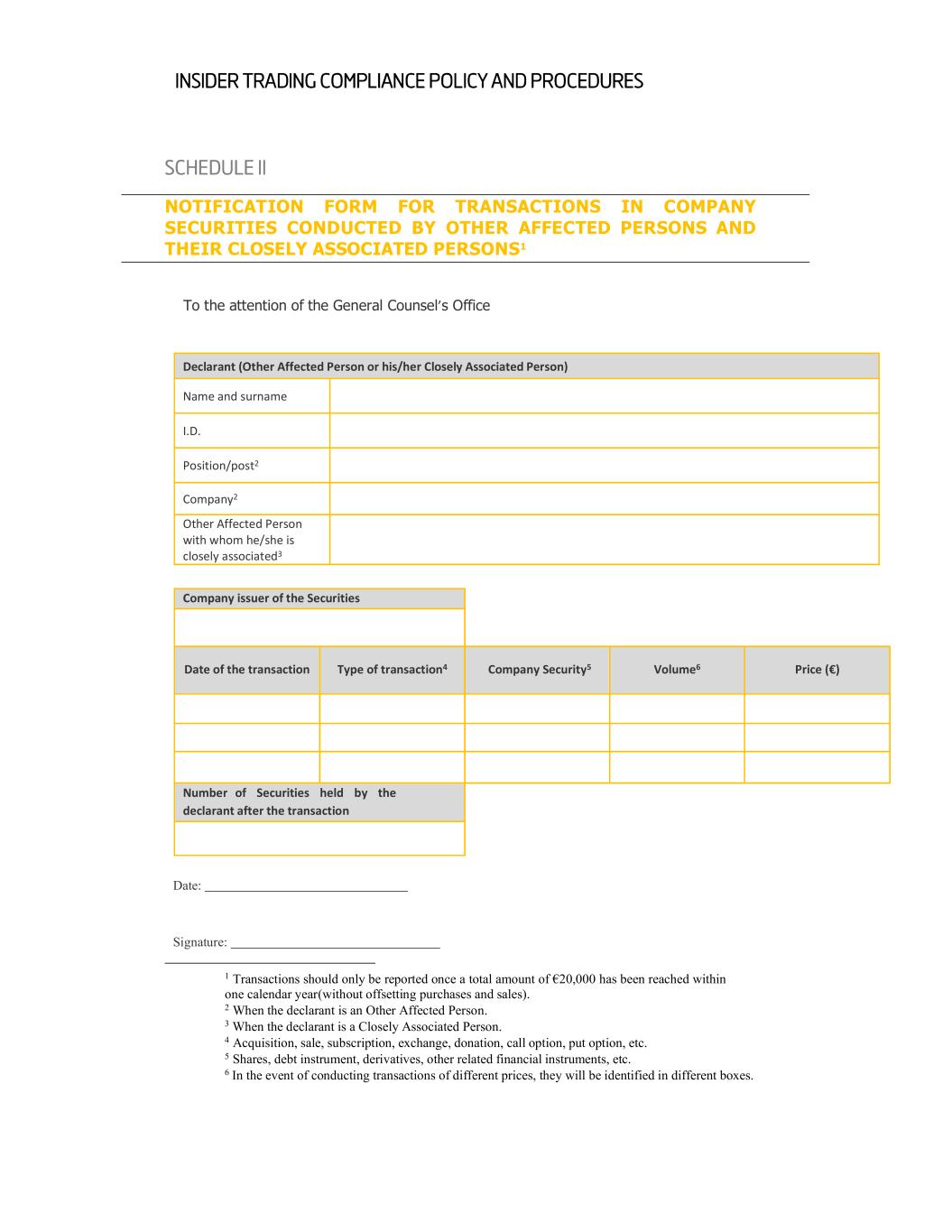

NG.FER.AJ-[*] 2023/06/16 INSIDER TRADING COMPLIANCE POLICY AND PROCEDURES SCHEDULE II NOTIFICATION FORM FOR TRANSACTIONS IN COMPANY SECURITIES CONDUCTED BY OTHER AFFECTED PERSONS AND THEIR CLOSELY ASSOCIATED PERSONS1 To the attention of the General Counsel’s Office Declarant (Other Affected Person or his/her Closely Associated Person) Name and surname I.D. Position/post2 Company2 Other Affected Person with whom he/she is closely associated3 Company issuer of the Securities Date of the transaction Type of transaction4 Company Security5 Volume6 Price (€) Number of Securities held by the declarant after the transaction Date: Signature: 1 Transactions should only be reported once a total amount of €20,000 has been reached within one calendar year (without offsetting purchases and sales). 2 When the declarant is an Other Affected Person. 3 When the declarant is a Closely Associated Person. 4 Acquisition, sale, subscription, exchange, donation, call option, put option, etc. 5 Shares, debt instrument, derivatives, other related financial instruments, etc. 6 In the event of conducting transactions of different prices, they will be identified in different boxes.

NG.FER.AJ-[*] 2023/06/16 INSIDER TRADING COMPLIANCE POLICY AND PROCEDURES In compliance with the provisions of the data protection regulations, we hereby inform you that your data will be processed by Ferrovial SE, as Data Controller, in order to establish mechanisms that prevent market abuse within the corporate framework. The applicable legal basis is the legitimate interest of Ferrovial SE to comply with the aforementioned purpose. The data may be communicated to the companies of the Ferrovial Group and will be conserved for the legal periods established in the applicable sectorial regulations. You have the right to access your data, rectify, delete or port, limit or oppose their processing in certain cases, as well as revoke the consents provided, where appropriate, by sending a written communication to dpd@ferrovial.com including your name, surnames, an address for notifications and the right to exercise. You may also claim to the Dutch supervisory authority - Autoriteit Persoonsgegevens (https://autoriteitpersoonsgegevens.nl), especially when you have not obtained satisfaction in the exercise of your rights.