OMB APPROVAL

OMB Number:

3235-0570

Expires: January

31, 2017

Estimated average

burden hours per

response: 20.6

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22320

Russell Exchange Traded Funds Trust

(Exact name of registrant as specified in charter)

1301 2nd Avenue, 18th Floor, Seattle Washington 98101

(Address of principal executive offices) (Zip code)

Mary Beth R. Albaneze, Secretary and Chief Legal Officer

Russell Exchange Traded Funds Trust

1301 2nd Avenue

18th Floor

Seattle, Washington 98101

206-505-4846

_________________________________________________________

(Name and address of agent for service)

Registrant's telephone number, including area code: 206-505-7877

| |

| Date of fiscal year end: | March 31 |

| Date of reporting period: | April 1, 2013 – March 31, 2014 |

Item 1. Reports to Stockholders

Russell Exchange

Traded Funds Trust

Russell OneFund ETFs™

MARCH 31, 2014

FUND

Russell Equity ETF

|

| Russell Exchange Traded |

| Funds Trust |

| |

| Russell Exchange Traded Funds |

| Trust is a series investment |

| company with a single investment |

| portfolio referred to as a Fund. |

Russell Exchange Traded Funds Trust

Russell OneFund ETFsTM

Annual Report

March 31, 2014

Table of Contents

Page

To Our Shareholders .......................................................................... 3

Market Summary .............................................................................. 4

Portfolio Management Discussion and Analysis ........................................... 6

Shareholder Expense Example ............................................................... 9

Schedule of Investments ..................................................................... 10

Statement of Assets and Liabilities ......................................................... 12

Statement of Operations ..................................................................... 13

Statements of Changes in Net Assets ...................................................... 14

Financial Highlights ........................................................................... 16

Notes to Financial Statements ............................................................... 18

Report of Independent Registered Public Accounting Firm .............................. 23

Frequency Distribution of Discounts and Premiums ...................................... 24

Tax Information ............................................................................... 25

Shareholder Requests for Additional Information ......................................... 26

Disclosure of Information about Fund Trustees and Officers ........................... 27

Adviser and Service Providers .............................................................. 32

Russell Exchange Traded Funds Trust.

Copyright © Russell Investments 2014. All rights reserved.

Russell Investments is a Washington, USA corporation, which operates through subsidiaries worldwide and is a

subsidiary of The Northwestern Mutual Life Insurance Company.

Fund objectives, risks, charges and expenses should be carefully considered before

investing. A prospectus containing this and other important information must precede

or accompany this material. Please read the prospectus carefully before investing.

Securities distributed through ALPS Distributors, Inc., member FINRA, not affiliated with Russell

Investments.

Indices and benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance,

and are not a guarantee of future performance, and are not indicative of any specific investment. Index return

information is provided by vendors and although deemed reliable, is not guaranteed by Russell Investments or its

affiliates.

Russell Investments is the owner of the trademarks, service marks, and copyrights related to its respective indexes.

To Our Shareholders

Dear Shareholder,

During 2013, investors endured their fair share of short-term political uncertainty here in the United States, but the equity

markets continued to look beyond these events. In fact, the U.S. and world economies have generally shown consistent,

stable growth that’s been in line with Russell’s expectations.

Looking further into 2014, we maintain modest growth expectations for the U.S. and global economies. Although we remain

optimistic, we don’t think it’s reasonable to expect double-digit gains like we saw in 2013.

However, as global markets and economies continue to evolve, we will continue to invest where we believe the world is

going – not where it’s been – to seek to improve the overall return potential of our portfolios. This means being proactive

and agile in the way we allocate assets on your behalf. It also means balancing the risk and return potential of the multi-

asset solutions we build and manage for investors like you.

On the following pages you can gain additional insights by reviewing the Russell Exchange Traded Funds Trust’s March

31, 2014 Annual Report for the Russell Equity ETF, including a portfolio management discussion and more detailed fund

performance information.

Thank you for the trust you have placed in our firm. All of us at Russell Investments appreciate the opportunity to help you

achieve financial security.

CEO, U.S. Private Client Services

Performance quoted represents past performance and does not guarantee future results.

To Our Shareholders 3

Russell Exchange Traded Funds Trust

Market Summary as of March 31, 2014 (Unaudited)

Global equity markets finished the fiscal year ended March 31, 2014, with strong year-over-year gains. For the fiscal year,

global equities gained 17.41% as measured by the Russell Global Index. Gains were largely led by the U.S., as the Russell

1000® Index posted a gain of 22.41% and the Russell 2000® finished up 24.90%. This is compared to the 17.58% gain

for the Russell Developed ex-U.S. Large Cap Index. Emerging market equities underperformed developed equities, as the

Russell Emerging Markets Index was up 0.50%.

Global equity markets opened the first quarter of the fiscal year modestly negative after financial markets sharply reacted

to U.S. Federal Reserve (“Fed”) Chairman Ben Bernanke’s first indication of tapering the Fed’s stimulus program in May.

Equities, fixed income, and commodities sold off globally as investors attempted to gauge the timing and extent of the

tapering. The yield on the ten-year U.S. Treasury jumped more than 100 basis points from its May low and investors feared

the rise in rates would derail the fragile U.S. housing recovery. Despite iterative assurances from Fed officials on the data

dependency of tapering, global equity markets finished the quarter well lower than their intra-quarter high. The Russell

Global Index finished the quarter down 0.47%, weighed down by non-U.S. markets. Emerging markets continue to lag

developed markets, as a quick liquidity crisis in China and geo-political issues in Turkey and Brazil weighed on returns.

Emerging markets posted a loss of 7.38% for the quarter, as measured by the Russell Emerging Markets Index.

Global markets experienced three comparatively distinct periods of performance in what was a relatively strong quarter

from July through September. A positive start, spurred on by encouraging macroeconomic data and Fed Chairman

Bernanke’s assurance that there would be “no immediate end to quantitative easing” saw markets gain in July. However,

speculation surrounding the timeline for the end of the “quantitative easing era” triggered a sell-off in August, particularly

in emerging markets and emerging markets currencies, as investors grew anxious that stimulus reduction would commence

in September. The prospect of military action in Syria exacerbated losses before diplomatic efforts between the U.S. and

Russia appeared to reach a resolution. This was a positive catalyst for markets which then rallied higher on the back of a

weak non-farm payrolls report that was interpreted as an indication the Fed would be unlikely to unwind stimulus at too

rapid a rate. Investors then awaited September’s Federal Open Market Committee meeting with anticipation, the majority

expecting a taper of $10-15 billion. The committee’s decision not to reduce asset purchases surprised markets and drove

the rally higher, with emerging markets enjoying an immediate bounce. The quarter ended with markets reversing some of

their gains as uncertainty surrounding upcoming U.S. budget and debt ceiling negotiations ticked up. The Russell Global

Index finished up 8.39%, led by non-U.S. markets. The Russell Developed ex-U.S. Large Cap Index finished the quarter up

11.51%, outperforming the Russell 1000® Index and Russell Emerging Markets Index, which were up 6.02% and 6.24%,

respectively.

The fourth quarter of 2013 saw equity markets finish 2013 on a positive note. The Russell Global Index gained 7.30%,

largely driven by strong U.S. performance as the Russell 1000® Index finished the quarter up 10.23%, while the Russell

Developed ex-U.S. Large Cap Index gained 5.81% and emerging markets lagged once again as the Russell Emerging

Markets Index finished up 2.36%. The political conundrum of the U.S. government shutdown during October had limited

overspill in the markets, despite its potential to affect the deadline in Fed’s debt limit increase. Several important U.S. macro

indicators came in on the upside during November and December, fueling the positive momentum in the U.S. economy

and spurring market anticipation of a near-term deceleration in the pace of quantitative easing. U.S. GDP grew 2.8% year-

over-year during the quarter, while the ISM Manufacturing Index and non-farm payrolls both beat consensus forecasts.

The beginning of quantitative easing’s wind down was officially announced towards mid-December in the amount of $10

billion tapering to start in January 2014. The relatively low amount of tapering and Janet Yellen’s dovish commentary on

the overall monetary policy stance were positively acknowledged by the markets. Macroeconomic data remained positive in

Europe as well, with the composite Purchasing Managers Index (“PMI”) generally stable. The Russell Developed Europe

ex-UK Index gained 8.5%, while the Russell UK Index returned 8%. Manufacturing PMIs continued to expand in the first

part of the quarter, providing support to the markets, but then remained flat towards year end.

In the first quarter of 2014, volatility returned to financial markets. Despite geopolitics and policymaker rhetoric dominating

headlines, global equities registered positive returns, after recovering strongly from a sharp decline at the end of January.

4 Market Summary

Russell Exchange Traded Funds Trust

Market Summary as of March 31, 2014, continued — (Unaudited)

The quarter began with concerns over the outlook for growth in emerging markets, amid ongoing speculation regarding

the Fed’s plans for the reversal of quantitative easing. Political upheaval in a number of emerging markets countries also

caused concern, most notably in Ukraine and Venezuela, as the currencies of a series of emerging markets countries sold-

off. However, comments from new Fed Chair Yellen soothed investor concerns as she stated that “a highly accommodative

policy will remain appropriate for a considerable time after asset purchases end.” European Central Bank (“ECB”)

Chairman Draghi added to the positive mood as he re-iterated the ECB was “ready and willing” to act. However, an uptick

in political risk weighed on markets at the beginning of March as fallout from Crimea’s independence referendum and its

resulting decision to join with Russia stoked wider international tensions. Despite tit-for-tat sanctions between Russia and

its Western critics, a feared escalation of tensions did not materialise and markets rebounded. Although macro data out of

China worsened towards the second half of March, comments from the country’s Premier Li served to boost equity markets

and spark a reversal in sentiment as he reassured investors that the government would support the economy. Overall, the

Russell Global Index finished up 1.43%, with continued relative strength of the U.S. over non-U.S markets. The Russell

1000® Index gained 2.05% for the quarter, while the Russell Developed ex-U.S. Large Cap Index gained 1.19% and the

Russell Emerging Markets Index lost 0.23%.

Market Summary 5

Russell Exchange Traded Funds Trust

Russell Equity ETF

Portfolio Management Discussion and Analysis — March 31, 2014 (Unaudited)

| | | | | | | | |

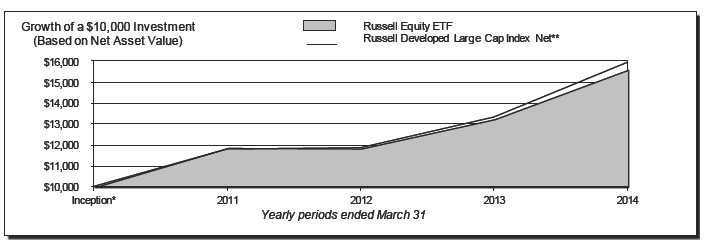

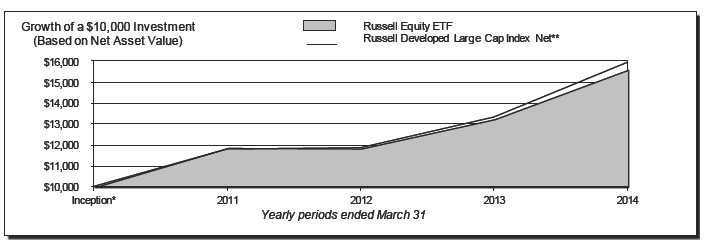

| Average Annual Total Return | | | | Cumulative Total Return | | |

| | | | Russell | | | | | Russell |

| | | | Developed | | | | | Developed |

| | | | Large Cap | | | | | Large Cap |

| | Net Asset Value Market Value‡ | Index Net** | | | Net Asset Value Market Value‡ | Index Net** |

| 1 Year | 17.75% | 17.92% | 19.85% | | 1 Year | 17.75% | 17.92% | 19.85% |

| Inception*§ | 12.08% | 12.12% | 12.78% | | Inception* | 55.85% | 56.07% | 59.66% |

Performance quoted represents past performance and does not guarantee future results. The investment return and

principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their

original cost. Current performance may be lower or higher than the performance data quoted. Current to the most recent

month-end performance may be obtained by visiting www.russelletfs.com/Products/ONEF_Performance.

6 Portfolio Management Discussion and Analysis

Russell Exchange Traded Funds Trust

Russell Equity ETF

Portfolio Management Discussion and Analysis, continued — March 31, 2014

(Unaudited)

| |

| The Russell Equity ETF (the “Fund”) is a “fund of funds”, which | term, and allocated towards Underlying ETFs with exposure to |

| means that the Fund seeks to achieve its investment objective | Canada and the Asia-Pacific region, while maintaining a tilt away |

| by investing primarily in shares of other exchange-traded funds | from European equities. The Fund held these positions through |

| (“Underlying ETFs”). Under normal circumstances, the Fund | most of 3rd quarter 2013, which detracted from performance. The |

| will invest at least 80% of the value of its net assets in shares of | Fund’s positioning was detrimental given strong European equity |

| equity Underlying ETFs. | performance relative to broader equities, and underperformance |

| |

| What is the Fund’s investment objective? | of consumer staples, utilities, and mega cap equities relative to |

| | broad U.S. equities. |

| The Fund seeks to provide long-term capital appreciation. | |

| | In mid-September, the Fund implemented a new strategic and |

| How did the Fund perform relative to its benchmark for the | tactical asset allocation. The new strategic allocation added |

| fiscal year ended March 31, 2014? | exposure across a broader suite of U.S. sector Underlying |

| For the fiscal year-ended March 31, 2014, the Fund gained | ETFs, more concentrated regional Underlying ETFs, micro cap |

| 17.75%. This is compared to the Fund’s benchmark, the Russell | Underlying ETFs and infrastructure Underlying ETFs in order to |

| Developed Large Cap Index Net, which gained 19.85% during | have a broader opportunity set with which to implement RIMCo’s |

| the same period. The Fund’s performance includes operating | strategic views. From a tactical standpoint, the Fund tilted further |

| expenses, whereas the index returns are unmanaged and do not | away from U.S equities and emerging markets, while continuing |

| include expenses of any kind. | to tilt towards non-U.S. developed equities. These positions |

| | were held through the remainder of the year, but detracted from |

| How did the market conditions described in the Market | performance as the U.S. continued to outperform the rest of the |

| Summary report affect the Fund’s performance? | world. |

| The Fund is a fund of funds and its performance is based on the | |

| performance of the Underlying ETFs in which the Fund invests | The Fund adjusted tactical positioning at the end of 2013 to pare |

| and the active management strategy of Russell Investment | back its U.S. small and micro cap exposure and add to large and |

| Management Company (“RIMCo”), the Fund’s adviser. | mega cap exposure, while also adjusting its sector exposure. The |

| | Fund added exposure to energy and information technology, while |

| Global equity markets performed strongly over the fiscal year | pulling back its weight in industrials, financials, and consumer |

| ended March 31, 2014, largely led by the U.S. equity market. | discretionary sector Underlying ETFs. Overall, strong headwinds |

| The Russell 1000® Index gained 22.41% over the period, | from exposure to emerging markets and a large underweight to |

| outperforming the Russell Developed ex-U.S. Large Cap Index, | the U.S. after the reallocation were primary drivers of negative |

| which gained 17.58%. The U.S. outperformance served as a | returns relative to the Russell Developed Large Cap Index Net. |

| headwind to the Fund’s benchmark relative performance, as | |

| the Fund moved to a notable underweight position to the U.S. | Describe any changes to the Fund’s structure or allocation |

| as part of a strategic reallocation in September of 2013 in favor | to the Underlying Funds. |

| of non-U.S. developed equity markets. Performance of emerging | As stated above, the Fund implemented new strategic and |

| markets was also a headwind to the Fund’s benchmark relative | tactical allocations in mid-September, which included changes to |

| performance, due to the Fund’s out-of-benchmark exposure to | RIMCo’s desired Underlying ETF exposures. |

| emerging markets. The Russell Emerging Markets Index finished | |

| the fiscal year with a gain of 0.50%, compared to the Fund’s | The views expressed in this report reflect those of the portfolio |

| index, which finished up 19.85%. | managers only through the end of the period covered by |

| | the report. These views do not necessarily represent the |

| How did the investment strategies and techniques employed | views of RIMCo, or any other person in RIMCo or any other |

| by the Fund and the Underlying ETFs affect the Fund’s | affiliated organization. These views are subject to change |

| performance? | at any time based upon market conditions or other events, |

| In early April 2013, the Fund took a defensive position within | and RIMCo disclaims any responsibility to update the views |

| the U.S., by tactically tilting away from U.S. large cap and | contained herein. These views should not be relied on as |

| small cap Underlying ETFs, while adding exposure to consumer | investment advice and, because investment decisions for |

| staples, utilities and mega cap. From a regional perspective, the | a Russell Exchange Traded Funds Trust (“RET”) Fund are |

| Fund also took a larger tilt away from emerging markets, given | based on numerous factors, should not be relied on as an |

| a growing concern over emerging market equities in the near | indication of investment decisions of this RET Fund. |

Portfolio Management Discussion and Analysis 7

Russell Exchange Traded Funds Trust

Russell Equity ETF

Portfolio Management Discussion and Analysis, continued — March 31, 2014

(Unaudited)

| * | The Fund first issued shares on May 11, 2010. |

| ** | The Russell Developed Large Cap Index Net is an index which offers investors access to the large-cap segment of the developed equity universe. It is constructed to provide a comprehensive and unbiased barometer for the large-cap segment of this market and is completely reconstituted annually to accurately reflect the changes in the market over time. |

| ‡ | Market return is based on market price per share of the Fund. |

| § | Annualized. |

Performance is historical and assumes reinvestment of all dividends and capital gains. Investment return and principal value will fluctuate so that an investor’s

shares, when redeemed, may be worth more or less than when purchased. Past performance is not indicative of future results. The returns shown do not reflect the

deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

8 Portfolio Management Discussion and Analysis

Russell Exchange Traded Funds Trust

Russell Equity ETF

Shareholder Expense Example — March 31, 2014 (Unaudited)

| | | | | |

| Fund Expenses | Please note that the expenses shown in the table are meant |

| The following disclosure provides important information | to highlight your ongoing costs only and do not reflect any |

| regarding the Fund’s Shareholder Expense Example | transactional costs. Therefore, the information under the heading |

| (‘Example”). | “Hypothetical Performance (5% return before expenses)” is |

| | useful in comparing ongoing costs only, and will not help you |

| Example | determine the relative total costs of owning different funds. In |

| As a shareholder of the Fund, you incur two types of costs: (1) | addition, if these transactional costs were included, your costs |

| transaction costs, and (2) ongoing costs, including management | would have been higher. | | | | |

| fees and other Fund expenses. The Example is intended to help | | | | | Hypothetical |

| you understand your ongoing costs (in dollars) of investing in | | | Actual | Performance (5% |

| the Fund and to compare these costs with the ongoing costs of | | | Performance | | return before expenses) |

| investing in other funds. The Example is based on an investment | | | | | |

| | Beginning Account Value | | | | |

| of $1,000 invested at the beginning of the period and held for the | October 1, 2013 | $ | 1,000.00 | $ | 1,000.00 |

| entire period indicated, which for this Fund is from October 1, | Ending Account Value | | | | |

| 2013 to March 31, 2014. | March 31, 2014 | $ | 1,090.10 | $ | 1,023.49 |

| | Expenses Paid During Period* | $ | 1.51 | $ | 1.46 |

| Actual Expenses | | | | | |

| The information in the table under the heading “Actual | * Expenses are equal to the Fund's annualized expense ratio of 0.29% |

| | (representing the six month period annualized), multiplied by the average |

| Performance” provides information about actual account values | account value over the period, multiplied by 182/365 (to reflect the one-half |

| and actual expenses. You may use the information in this column, | year period). May reflect amounts waived and/or reimbursed. Without any |

| together with the amount you invested, to estimate the expenses | waivers and/or reimbursements, expenses would have been higher. |

| that you paid over the period. Simply divide your account value by | | | | | |

| $1,000 (for example, an $8,600 account value divided by $1,000 | | | | | |

| = 8.6), then multiply the result by the number in the first column | | | | | |

| in the row entitled “Expenses Paid During Period” to estimate | | | | | |

| the expenses you paid on your account during this period. | | | | | |

| |

| Hypothetical Example for Comparison Purposes | | | | | |

| The information in the table under the heading “Hypothetical | | | | | |

| Performance (5% return before expenses)” provides information | | | | | |

| about hypothetical account values and hypothetical expenses | | | | | |

| based on the Fund’s actual expense ratio and an assumed rate of | | | | | |

| return of 5% per year before expenses, which is not the Fund’s | | | | | |

| actual return. The hypothetical account values and expenses | | | | | |

| may not be used to estimate the actual ending account balance or | | | | | |

| expenses you paid for the period. You may use this information | | | | | |

| to compare the ongoing costs of investing in the Fund and other | | | | | |

| funds. To do so, compare this 5% hypothetical example with the | | | | | |

| 5% hypothetical examples that appear in the shareholder reports | | | | | |

| of other funds. | | | | | |

Shareholder Expense Example 9

Russell Exchange Traded Funds Trust

Russell Equity ETF

Schedule of Investments — March 31, 2014

| | | |

| Amounts in thousands (except share amounts) | | |

| |

| | | | Fair |

| | | | Value |

| | | Shares | $ |

| |

| Investments in Other ETFs - 99.9% | | | |

| Consumer Discretionary Select Sector SPDR Fund | | 3,981 | 258 |

| Consumer Staples Select Sector SPDR Fund | | 6,186 | 266 |

| Energy Select Sector SPDR Fund | | 5,525 | 492 |

| Financial Select Sector SPDR Fund | | 30,410 | 679 |

| Health Care Select Sector SPDR Fund | | 6,377 | 373 |

| Industrial Select Sector SPDR Fund | | 6,789 | 355 |

| iShares Global Infrastructure ETF | | 6,840 | 285 |

| iShares Micro-Cap ETF | | 585 | 45 |

| iShares MSCI Canada ETF | | 6,052 | 179 |

| iShares MSCI EAFE ETF | | 14,672 | 986 |

| iShares MSCI EAFE Small-Cap ETF | | 7,039 | 367 |

| iShares Russell 1000 Growth ETF | | 3,090 | 267 |

| iShares Russell 2000 ETF | | 382 | 44 |

| iShares Russell Mid-Cap ETF | | 1,776 | 275 |

| Technology Select Sector SPDR Fund | | 23,564 | 857 |

| Vanguard FTSE All-World ex-US ETF | | 17,655 | 888 |

| Vanguard FTSE Developed Markets ETF | | 4,273 | 176 |

| Vanguard FTSE Europe ETF | | 20,551 | 1,212 |

| Vanguard FTSE Pacific ETF | | 8,776 | 519 |

| Vanguard Mega Cap ETF | | 7,011 | 448 |

| Total Investments in Other ETFs | | | |

| (identified cost $8,386) | | | 8,971 |

| |

| Short-Term Investments - 0.1% | | | |

| Russell U.S. Cash Management Fund | | 6,810 (∞) | 7 |

| Total Short-Term Investments | | | |

| (identified cost $7) | | | 7 |

| |

| |

| Total Investments 100.0% | | | |

| (identified cost $8,393) | | | 8,978 |

| |

| Other Assets and Liabilities, | | | |

| Net - (0.0%) | | | (2) |

| |

| Net Assets - 100.0% | | | 8,976 |

| |

| (∞) Unrounded units. | | | |

See accompanying notes which are an integral part of the financial statements.

10 Schedule of Investments

Russell Exchange Traded Funds Trust

Russell Equity ETF

Schedule of Investments, continued — March 31, 2014

| | | | | | | | |

| Presentation of Portfolio Holdings | | | | | | | | |

| Amounts in thousands | | | | | | | | |

| | | | Fair Value | | | | |

| | | | | | | | | % of Net |

| Portfolio Summary | Level 1 | | Level 2 | | Level 3 | | Total | Assets |

| Investments in Other ETFs | $ 8,971 | $ | — | $ | | — | $ 8,971 | 99.9 |

| Short-Term Investments | — | | 7 | | | — | 7 | 0.1 |

| Total Investments | 8,971 | | 7 | | | — | 8,978 | 100.0 |

| Other Assets and Liabilities, Net | | | | | | | | (—)* |

| | | | | | | | | 100.0 |

| * Less than .05% of net assets. | | | | | | | | |

| For a description of the Levels see note 2 in the Notes to Financial Statements. | | | | | | |

| There were no significant transfers in and out of levels 1, 2, and 3 during the period ended March 31, 2014. | | | | |

See accompanying notes which are an integral part of the financial statements.

Schedule of Investments 11

Russell Exchange Traded Funds Trust

Russell Equity ETF

Statement of Assets and Liabilities — March 31, 2014

| | |

| Amounts in thousands | | |

| Assets | | |

| Investments, at identified cost | $ | 8,393 |

| Investments, at fair value* | | 8,978 |

| Total assets | | 8,978 |

| Liabilities | | |

| Payables: | | |

| Accrued fees to affiliates | | 2 |

| Total liabilities | | 2 |

| Net Assets | $ | 8,976 |

| Net Assets Consist of: | | |

| Undistributed (overdistributed) net investment income | $ | 2 |

| Accumulated net realized gain (loss) | | (22) |

| Unrealized appreciation (depreciation) on investments | | 585 |

| Additional paid-in capital | | 8,411 |

| Net Assets | $ | 8,976 |

| Net Asset Value, offering and redemption price per share: | | |

| Net asset value per share: (#) | $ | 35.90 |

| Net assets | $ | 8,975,647 |

| Shares outstanding ($.001 par value) | | 250,000 |

| Amounts in thousands | | |

| * Investments in affiliates, Russell U.S. Cash Management Fund | $ | 7 |

| (#) Net asset value per share equals net assets divided by shares outstanding. | | |

See accompanying notes which are an integral part of the financial statements.

12 Statement of Assets and Liabilities

Russell Exchange Traded Funds Trust

Russell Equity ETF

Statement of Operations — For the Period Ended March 31, 2014

| | |

| Amounts in thousands | | |

| Investment Income | | |

| Income Distributions from Underlying ETFs | $ | 208 |

| Total investment income | | 208 |

| |

| Expenses | | |

| Management fees | | 31 |

| Expenses before reductions | | 31 |

| Expense reductions | | (2) |

| Net expenses | | 29 |

| Net investment income (loss) | | 179 |

| |

| Net Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investments | | 57 |

| In-kind redemptions | | 1,315 |

| Net realized gain (loss) | | 1,372 |

| Net change in unrealized appreciation (depreciation) on investments | | 42 |

| Net realized and unrealized gain (loss) | | 1,414 |

| Net Increase (Decrease) in Net Assets from Operations | $ | 1,593 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations 13

Russell Exchange Traded Funds Trust

Russell Equity ETF

Statements of Changes in Net Assets

| | | | | |

| | | For the Periods Ended March 31, | |

| Amounts in thousands | | 2014 | | 2013 | |

| Increase (Decrease) in Net Assets | | | | | |

| Operations | | | | | |

| Net investment income (loss) | $ | 179 | $ | 97 | |

| Net realized gain (loss) | | 1,372 | | (6) | |

| Net change in unrealized appreciation (depreciation) | | 42 | | 422 | |

| Net increase (decrease) in net assets from operations | | 1,593 | | 513 | |

| Distributions | | | | | |

| From net investment income | | (177) | | (98) | |

| Net decrease in net assets from distributions | | (177) | (98) |

| |

| Share Transactions* | | | | | |

| Net increase (decrease) in net assets from share transactions | | (1,774) | | 3,211 | |

| |

| Total Net Increase (Decrease) in Net Assets | | (358) | | 3,626 | |

| |

| Net Assets | | | | | |

| Beginning of period | | 9,334 | | 5,708 | |

| End of period | $ | 8,976 | $ | 9,334 | |

| Undistributed (overdistributed) net investment income included in net assets | $ | 2 | $ | — | |

* Share transaction amounts (in thousands) for the periods ended March 31, 2014 and March 31, 2013 were as follows:

| | | | | | | | |

| | | 2014 | | | 2013 | |

| | | Shares | | Dollars | | Shares | | Dollars |

| |

| Shares created | | 250 | $ | 8,395 | | 200 | $ | 5,993 |

| Shares redeemed | | (300) | | (10,169) | | (100) | | (2,782) |

| Total increase (decrease) | | (50) | $ | (1,774) | | 100 | $ | 3,211 |

| | | | | | | | | |

See accompanying notes which are an integral part of the financial statements.

14 Statements of Changes in Net Assets

(This page intentionally left blank)

Russell Exchange Traded Funds Trust

Russell Equity ETF

Financial Highlights — For the Periods Ended

| | | | | | | | | |

| For a Share Outstanding Throughout Each Period. | | | | | |

| |

| |

| | | $ | | $ | | $ | $ | $ | |

| | Net Asset Value, | | Net | | Net Realized | Total from | Distributions | $ |

| | Beginning of | Investment | | and Unrealized | Investment | from Net | Return of |

| | | Period | Income (Loss)(b) | | Gain (Loss) | Operations | Investment Income | Capital |

| March 31, 2014 | | 31.11 | | .67(a)(d) | | 4.79 | 5.46 | (.67) | — |

| March 31, 2013 | | 28.54 | | .54(a)(d) | | 2.76 | 3.30 | (.73) | — |

| March 31, 2012(1) | | 25.45 | | .03(a)(d) | | 3.10 | 3.13 | (.04) | — |

| December 31, 2011 | | 27.80 | | .36(a)(d) | | (2.13) | (1.77) | (.53) | (.05) |

| December 31, 2010(2) | | 25.00 | | .35 | | 2.81 | 3.16 | (.36) | — |

| (1) | For the period January 1, 2012 through the fiscal year ended March 31, 2012. |

| (2) | For the period May 11, 2010 (commencement of operations) to December 31, 2010. |

| (a) | Average daily shares outstanding were used for this calculation. |

| (b) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the Underlying Funds in which the Fund invests. |

| (c) | Periods less than one year are not annualized. |

| (d) | May reflect amounts waived and/or reimbursed by Russell Investment Management Company (“RIMCo”). |

| (e) | The ratios for periods less than one year are annualized. |

| (f) | The calculation includes only those expense charged directly to the Fund and does not include expense charged to the Underlying Funds in which the Fund invests. |

| (g) | Portfolio turnover rate excludes securities received or delivered from in-kind creation or redemption units. |

| (h) | Less than 0.5%. |

See accompanying notes which are an integral part of the financial statements.

16 Financial Highlights

| | | | | | | | | | | | | |

| | | | | | | | | | | | | % | |

| | | | | | | | | % | | % | Ratio of Net | |

| | | | $ | | | $ | Ratio of Expenses | Ratio of Expenses | Investment Income | |

| | | Net Asset Value, | % | Net Assets, | to Average | to Average | to Average | % |

| | $ | | End of | Total | End of Period | Net Assets, | Net Assets, | Net Assets | Portfolio |

| Total Distributions | | Period | Return(c) | | (000) | Gross(e)(f) | Net(e)(f) | | (b)(e) | Turnover Rate(c)(g) |

| | (.67) | | 35.90 | 17.75 | | 8,976 | | .35 | | .32(d) | | 2.01(d) | 30 |

| | (.73) | | 31.11 | 11.82 | | 9,334 | | .35 | | .35(d) | | 1.87(d) | 11 |

| | (.04) | | 28.54 | 12.21 | | 5,708 | | .58 | | .35(d) | | .48(d) | —(h) |

| | (.58) | | 25.45 | (6.32) | | 5,090 | | .65 | | .35(d) | | 1.29(d) | 6 |

| | (.36) | | 27.80 | 12.62 | | 9,839 | | .57 | | .53 | | 3.57 | — |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights 17

Russell Exchange Traded Funds Trust

Russell Equity ETF

Notes to Financial Statements — March 31, 2014

1. Organization

Russell Exchange Traded Funds Trust (the “Investment Company” or “RET” or “Trust”) is a series investment company with a

single investment portfolio, the Russell Equity ETF (the “Fund”). The Investment Company is registered under the Investment

Company Act of 1940, as amended, as an open-end management investment company. It is organized and operates as a Delaware

statutory trust. Prior to April 15, 2011, the name of the Trust was U.S. One Trust and the Fund name was One Fund ETF.

The Fund is an exchange-traded fund (“ETF”). ETFs are funds that trade like other publicly-traded securities and may be designed

to track an index or to be actively managed. The Fund is a “fund of funds,” which means that the Fund seeks to achieve its investment

objective by investing primarily in shares of other exchange-traded funds (“Underlying ETFs”). Russell Investment Management

Company (“Adviser” or “RIMCo”) employs an asset allocation strategy that seeks to provide exposure to multiple asset classes in

a variety of domestic and foreign markets. The Adviser’s asset allocation strategy establishes a target asset allocation for the Fund

and the Adviser then implements the strategy by selecting Underlying ETFs that represent each of the desired asset classes, sectors

and strategies. The Adviser employs an active management strategy, meaning that it buys and holds Underlying ETFs based on its

asset allocation views, not based on time period dependent rebalancing policies.

Unlike shares of a mutual fund, which can be bought from and redeemed by the issuing fund by all shareholders at a price based

on net asset value (“NAV”), shares of the Fund may be directly purchased from and redeemed by the Fund at NAV solely by certain

large institutional investors. Also unlike shares of a mutual fund, shares of the Fund are listed on a national securities exchange and

trade in the secondary market at market prices that change throughout the day. The date the shares began trading on the secondary

market is the “commencement of operations” date.

The Fund issues and redeems shares at their respective NAV only in blocks of a specified number of shares or multiples thereof

(“Creation Units”). Only certain large institutional investors may purchase or redeem Creation Units directly with the Fund at NAV

(“Authorized Participants”). These transactions are in exchange for certain securities similar to the Fund’s portfolio and/or cash.

Except when aggregated in Creation Units, shares of the Fund are not redeemable securities. Shareholders who are not Authorized

Participants may not redeem shares directly from the Fund

2. Significant Accounting Policies

The Fund’s financial statements are prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”)

which require the use of management estimates and assumptions at the date of the financial statements. Actual results could differ

from those estimates. The following is a summary of the significant accounting policies consistently followed by the Fund in the

preparation of its financial statements.

Security Valuation

The Fund values its portfolio securities, the shares of the Underlying ETFs, at the last reported sale or settlement price.

Fair value of securities is defined as the price that the Fund would receive upon selling an investment in a timely transaction to

an independent buyer in the principal or most advantageous market for the investment. To increase consistency and comparability

in fair value measurement, the fair value hierarchy was established to maximize the use of observable market data and minimize

the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Inputs refer

broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk

(e.g., the risk inherent in a particular valuation technique, such as a pricing model or the risks inherent in the inputs to a particular

valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market

participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the

reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market

participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

The fair value hierarchy of inputs is summarized in the three broad levels listed below.

• Level 1 — Quoted prices (unadjusted) in active markets or exchanges for identical assets and liabilities.

• Level 2 — Inputs other than quoted prices included within Level 1 that are observable, which may include, but are not

limited to quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets

or liabilities in markets that are not active, inputs such as interest rates, yield curves, implied volatilities, credit spreads, or

other market corroborated inputs.

18 Notes to Financial Statements

Russell Exchange Traded Funds Trust

Russell Equity ETF

Notes to Financial Statements, continued — March 31, 2014

• Level 3 — Significant unobservable inputs based on the best information available in the circumstances, to the extent

observable inputs are not available, which may include assumptions made by Russell Fund Services Company (“RFSC”),

acting at the discretion of the Board of Trustees (the “Board”), that are used in determining the fair value of investments.

Investment Transactions

Investment transactions are reflected as of the trade date for financial reporting purposes. This may cause the NAV stated in the

financial statements to be different from the NAV at which shareholders may transact. Realized gains and losses from securities

transactions, if any, are recorded on the basis of specific identified cost.

Investment Income

Distributions of income and capital gains from the Underlying ETFs are recorded on the ex-dividend date.

Federal Income Taxes

For each year, the Fund intends to qualify as a regulated investment company under sub-chapter M of the Internal Revenue Code

(the “Code”) and intends to distribute all of its taxable income and capital gains. Therefore, no federal income tax provision is

required for the Fund.

The Fund complies with the authoritative guidance for uncertainty in income taxes which requires management to determine

whether a tax position of the Fund is more likely than not to be sustained upon examination, including resolution of any related

appeals or litigation processes, based on the technical merits of the position. For tax positions meeting the more likely than not

threshold, the tax amount recognized in the financial statements is reduced by the largest benefit that has a greater than 50%

likelihood of being realized upon ultimate settlement with the relevant taxing authority. Management determined that no accruals

need to be made in the financial statements due to uncertain tax positions. Management continually reviews and adjusts its liability

for income taxes based on analyses of tax laws and regulations, as well as their interpretations, and other relevant factors.

The Fund files a U.S. tax return. At March 31, 2014, the Fund had recorded no liabilities for net unrecognized tax benefits relating

to uncertain income tax positions it has taken or expects to take in future tax returns. While the statute of limitations remains open

to examine the Fund’s U.S. tax return filed for tax years ended December 31, 2011 through December 31, 2013, no examinations

are in progress or anticipated at this time. The Fund is not aware of any tax positions for which it is reasonably possible that the

total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Dividends and Distributions to Shareholders

Income dividends, capital gain distributions and return of capital, if any, are recorded on the ex-dividend date. Income dividends

are generally declared and paid quarterly. Capital gain distributions, if any, are generally declared and paid annually. An additional

distribution may be paid by the Fund to avoid imposition of federal income and excise tax on any remaining undistributed capital

gains and net investment income. Dividends and distributions cannot be automatically reinvested in additional shares of the Fund.

The timing and characterization of certain income and capital gain distributions are determined in accordance with federal tax

regulations which may differ from U.S. GAAP. As a result, net investment income and net realized gain (or loss) from investment

transactions for a reporting period may differ significantly from distributions during such period. The differences between tax

regulations and U.S. GAAP relate primarily to investments in the Underlying ETFs sold at a loss, wash sale deferrals and in-kind

transactions. Accordingly, the Fund may periodically make reclassifications among certain of its capital accounts without impacting

its net asset value.

Expenses

Expenses included in the accompanying financial statements reflect the expenses of the Fund and do not include those expenses

incurred by the Underlying ETFs. Because the Underlying ETFs have varied expense and fee levels and the Fund may own different

proportions of the Underlying ETFs at different times, the amount of the fees and expenses incurred indirectly by the Fund will vary.

Notes to Financial Statements 19

Russell Exchange Traded Funds Trust

Russell Equity ETF

Notes to Financial Statements, continued — March 31, 2014

Guarantees

In the normal course of business, the Fund enters into contracts that contain a variety of representations which provide general

indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that

may be made against the Fund that have not yet occurred. However, the Fund expects the risk of loss to be remote.

Market, Credit and Counterparty Risk

In the normal course of business, the Underlying ETFs trade financial instruments and enter into financial transactions where risk

of potential loss exists due to changes in the market (market risk) or failure of the other party to a transaction to perform (credit

risk). Similar to credit risk, the Underlying ETFs may also be exposed to counterparty risk or the risk that an institution or other

entity with which the Underlying ETFs have unsettled or open transactions will default. The potential loss could exceed the value

of the relevant assets recorded in the Underlying ETFs’ financial statements (the “Assets”). The Assets consist principally of cash

due from counterparties and investments. The extent of the Underlying ETFs’ exposure to market, credit and counterparty risks with

respect to the Assets approximates their carrying value as recorded in the Underlying ETFs’ Statement of Assets and Liabilities.

Global economies and financial markets are becoming increasingly interconnected and political and economic conditions (including

recent instability and volatility) and events (including natural disasters) in one country, region or financial market may adversely

impact issuers in a different country, region or financial market. As a result, issuers of securities held by the Fund may experience

significant declines in the value of their assets and even cease operations. Such conditions and/or events may not have the same

impact on all types of securities and may expose the Fund to greater market and liquidity risk and potential difficulty in valuing

portfolio instruments held by the Fund. This could cause the Fund to underperform other types of investments.

3. Investment Transactions

Securities

During the period ended March 31, 2014, purchases and sales of the Underlying ETFs (excluding investments held for short-term

purposes and in-kind transactions) were as follows:

| | | | |

| | | Purchases | | Sales |

| Russell Equity ETF | $ | 2,597,941 | $ | 3,059,018 |

In-kind transactions during the period ended March 31, 2014, were as follows:

| | | | |

| | | Purchases | | Sales |

| Russell Equity ETF | $ | 8,310,054 | $ | 9,589,438 |

4. Related Party Transactions, Fees and Expenses

Adviser and Administrator

RIMCo advises the Fund and RFSC is the Fund’s administrator. RFSC is a wholly-owned subsidiary of RIMCo. RIMCo is a wholly-

owned subsidiary of Frank Russell Company (a subsidiary of The Northwestern Mutual Life Insurance Company).

The Fund may also invest its cash reserves in the Russell U.S. Cash Management Fund, an unregistered fund advised by RIMCo

and administered by RFSC. As of March 31, 2014, the Fund had invested $6,810 in the Russell U.S. Cash Management Fund.

The Fund’s management fee of 0.35% is based upon the average daily net assets of the Fund and is payable monthly. Management

fees paid by the Fund for the period ended March 31, 2014, were $31,159.

Waivers

RIMCo has contractually agreed, until July 31, 2014, to waive up to the full amount of its 0.35% management fee to the extent that

total annual fund operating expenses, excluding extraordinary expenses, exceed 0.51% of the average daily net assets of the Fund

on an annual basis. This waiver may not be terminated during the relevant period except with Board approval.

For the period ended March 31, 2014, RIMCo waived $2,561.

RIMCo does not have the ability to recover amounts waived from previous periods.

20 Notes to Financial Statements

Russell Exchange Traded Funds Trust

Russell Equity ETF

Notes to Financial Statements, continued — March 31, 2014

Accrued Fees Payable to Affiliates

Accrued fees payable to affiliates for the period ended March 31, 2014, were $2,586.

Board of Trustees

The Russell Fund Complex consists of Russell Investment Company (“RIC”), which has 37 Funds, Russell Investment Funds

(“RIF”), which has 9 Funds, and RET, which has 1 Fund. Each of the Trustees is a Trustee of RIC, RIF and RET. During the

period, the Russell Fund Complex paid each of its independent Trustees a retainer of $87,000 per year (effective January 1, 2014,

$96,000); each of its interested Trustees a retainer of $75,000 per year; and each Trustee $7,000 for each regularly scheduled

meeting attended in person and $3,500 for each special meeting and the Annual 38a-1 meeting attended in person, and for each

Audit Committee meeting, Nominating and Governance Committee meeting, Investment Committee meeting or any other committee

meeting established and approved by the Board that is attended in person. Each Trustee receives a $1,000 fee for attending

regularly scheduled and special meetings by phone instead of receiving the full fee had the member attended in person (except

for telephonic meetings called pursuant to the Funds’ valuation and pricing procedures) and a $500 fee for attending committee

meetings by phone instead of receiving the full fee had the member attended in person. Trustees’ out-of-pocket expenses are also

paid by the Russell Fund Complex. The Audit Committee Chair and Investment Committee Chair are each paid a fee of $15,000 per

year and the Nominating and Governance Committee Chair is paid a fee of $12,000 per year. The chairman of the Board receives

additional annual compensation of $75,000 (effective January 1, 2014, $85,000). Ms. Cavanaugh is not compensated by the Russell

Fund Complex for service as a Trustee.

5. Federal Income Taxes

At March 31, 2014, the Fund had net tax basis capital loss carryforwards which may be applied against any net realized taxable

gains for an unlimited period. Under the Regulated Investment Company Modernization Act of 2010, the Fund is permitted to

carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. Post enactment

capital losses that are carried forward will retain their character as either short-term or long-term capital losses. Available capital

loss carryforwards are as follows:

| | |

| | No Expiration |

| | Long-term | Totals |

| Russell Equity ETF | $ 21,640 | $ 21,640 |

At March 31, 2014, the cost of investments and net unrealized appreciation (depreciation), undistributed ordinary income and

undistributed long-term capital gains for income tax purposes were as follows:

| | |

| | | Russell Equity ETF |

| Cost of Investments | $ | 8,393,527 |

| Unrealized Appreciation | $ | 587,090 |

| Unrealized Depreciation | | (2,383) |

| Net Unrealized Appreciation (Depreciation) | $ | 584,707 |

| Undistributed Ordinary Income | $ | 2,076 |

| Undistributed Long-Term Capital Gains | | |

| (Capital Loss Carryforward) | $ | (21,640) |

| Tax Composition of Distributions | | |

| Ordinary Income | $ | 177,158 |

6. Fund Share Transactions

As of March 31, 2014, there were an unlimited number of $0.001 par shares of beneficial interest authorized by the Trust. Shares

are created and redeemed by the Fund at their NAV only in Creation Units or multiples thereof. Except when aggregated in Creation

Units, shares of the Fund are not redeemable. The Shares are listed on the New York Stock Exchange Arca (the “Exchange”),

subject to notice of issuance. The Shares trade on the Exchange at market prices. These prices may differ from the Shares’ NAV. The

Shares are also redeemable only in Creation Unit aggregations, and generally in exchange for portfolio securities and a specified

cash payment. Investors purchasing and redeeming Creation Units pay a purchase transaction fee and a redemption transaction

fee directly to State Street Bank and Trust Company, the Fund’s custodian. A Creation Unit of the Fund consists of 50,000 Shares.

Transactions in shares for the Fund for the periods ended March 31, 2014 and March 31, 2013 can be found following the Statements

of Changes in Net Assets.

Notes to Financial Statements 21

Russell Exchange Traded Funds Trust

Russell Equity ETF

Notes to Financial Statements, continued — March 31, 2014

7. Pending Legal Proceedings

On October 17, 2013, Fred McClure filed a derivative lawsuit against RIMCo on behalf of ten RIC funds: the Russell Commodity

Strategies Fund, Russell Emerging Markets Fund, Russell Global Equity Fund, Russell Global Infrastructure Fund, Russell Global

Opportunistic Credit Fund, Russell International Developed Markets Fund, Russell Multi-Strategy Alternative Fund, Russell

Strategic Bond Fund, Russell U.S. Small Cap Equity Fund and Russell Global Real Estate Securities Fund. The lawsuit, which

was filed in the United States District Court for the District of Massachusetts, seeks recovery under Section 36(b) of the Investment

Company Act of 1940, as amended, for the alleged payment of excessive investment management fees to RIMCo. Although this

action was purportedly filed on behalf of these ten funds, none of these ten Funds are themselves parties to the suit. The plaintiffs

seek recovery of the amount of compensation or payments received from these ten Funds and earnings that would have accrued to

plaintiff had that compensation not been paid or, alternatively, rescission of the contracts and restitution of all excessive fees paid.

RIMCo intends to vigorously defend the action.

8. Subsequent Events

Management has evaluated events and/or transactions that have occurred through the date the financial statements were available

to be issued and noted no items requiring adjustments of the financial statements or additional disclosures.

22 Notes to Financial Statements

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders

of Russell Equity ETF

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements

of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position

of Russell Equity ETF (the “Fund”) at March 31, 2014, the results of its operations for the year then ended, and the changes in its

net assets and the financial highlights for each period indicated, in conformity with accounting principles generally accepted in the

United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are

the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our

audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting

Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about

whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting

the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by

management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of

securities at March 31, 2014 by correspondence with the custodian and transfer agent, provide a reasonable basis for our opinion.

Report of Independent Registered Public Accounting Firm 23

Russell Exchange Traded Funds Trust

Russell Equity ETF

Frequency Distribution of Discounts and Premiums — March 31, 2014 (Unaudited)

The chart below presents information about differences between the per share NAV of the Fund and the market trading price of

shares of the Fund. For these purposes, the “market price” is the mid-point of the highest bid and lowest offer for Fund shares as

of the close of trading on the exchange where Fund shares are listed. The term “premium” is sometimes used to describe a market

price in excess of NAV and the term “discount” is sometimes used to describe a market price below NAV. The chart presents

information about the size and frequency of premiums or discounts. As with other exchange traded funds, the market price of Fund

shares is typically slightly higher or lower than the Fund’s per share NAV. Factors that contribute to the differences between market

price and NAV include the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s

portfolio securities.

| | |

| | Number of | Percentage of |

| Premium/Discount Range | Days* | Total Days |

| Greater than 0.20% and less than or equal to 1.00% | 26 | 1.83% |

| Greater than 0.05% and less than or equal to 0.20% | 279 | 19.62% |

| Greater than -0.05% and less than or equal to 0.05% | 595 | 41.84% |

| Greater than -0.20% and less than or equal to -0.05% | 396 | 27.85% |

| Greater than -1.00% and less than or equal to -0.20% | 126 | 8.86% |

| | 1,422 | 100.00% |

* Number of days are based on inception date which is one day prior to commencement of operations.

24 Frequency Distribution of Discounts and Premiums

Russell Exchange Traded Funds Trust

Russell Equity ETF

Tax Information — March 31, 2014 (Unaudited)

For the tax year ended March 31, 2014, the Fund hereby designates 100% or the maximum amount allowable, of its net taxable

income as qualified dividends taxed at individual net capital gain rates.

For the tax year ended March 31, 2014, the Fund hereby designates under Section 871(k)(2)(c) of the Code, the maximum amount

allowable as a short term capital gain dividend for purposes of the tax imposed under Section 871(a)(1)(A) of the Code. This applies

to nonresident alien shareholders only.

The Form 1099 you receive in January 2015 will show the tax status of all distributions paid to your account in calendar year 2014.

The Fund designates dividends distributed during the fiscal year as qualifying for the dividends received deduction for corporate

shareholders as follows:

Please consult a tax adviser for any questions about federal or state income tax laws.

Tax Information 25

Russell Exchange Traded Funds Trust

Russell Equity ETF

Shareholder Requests for Additional Information — March 31, 2014 (Unaudited)

A complete unaudited schedule of investments is made available generally no later than 60 days after the end of the first and third

quarters of each fiscal year. These reports are available (i) free of charge, upon request, by calling the Fund at (888) 775-3837, (ii)

on the Securities and Exchange Commission’s website at www.sec.gov, and (iii) at the Securities and Exchange Commission’s public

reference room.

The Board has delegated to RIMCo, as RET’s investment adviser, the primary responsibility for monitoring, evaluating and voting

proxies solicited by or with respect to issuers of securities in which assets of the Fund may be invested. RIMCo has established a proxy

voting committee (“Committee”) and has adopted written proxy voting policies and procedures (“P&P”) and proxy voting guidelines

(“Guidelines”). The Fund maintains a Portfolio Holdings Disclosure Policy that governs the timing and circumstances of disclosure

to shareholders and third parties of information regarding the portfolio investments held by the Fund. A description of the P&P,

Guidelines, Portfolio Holdings Disclosure Policy and additional information about Fund Trustees are contained in the Fund’s Statement

of Additional Information (“SAI”). The SAI and information regarding how the Fund voted proxies relating to portfolio securities during

the most recent 12 month period ended June 30, 2013 is available (i) free of charge, upon request, by calling the Fund at (888) 775-

3837 and (ii) on the Securities and Exchange Commission’s website at www.sec.gov.

To reduce expenses, we may mail only one copy of the Fund’s prospectus and each annual and semi-annual report to those addresses

shared by two or more accounts. If you wish to receive individual copies of these documents, please contact your financial institution.

Some Financial Intermediaries may offer electronic delivery of the Fund’s prospectus and annual and semi-annual reports. Please

contact your Financial Intermediary for further details.

26 Shareholder Requests for Additional Information

Russell Exchange Traded Funds Trust

Russell Equity ETF

Disclosure of Information about Fund Trustees and Officers — March 31, 2014

(Unaudited)

The following tables provide information for each officer and trustee of the Russell Fund Complex. The Russell Fund Complex consists

of Russell Investment Company (“RIC”), which has 37 funds, Russell Investment Funds (“RIF”), which has 9 funds, and Russell

Exchange Traded Funds Trust (“RET”), which has 1 fund. Each of the trustees is a trustee of RIC, RIF and RET. The first table provides

information for the interested trustees. The second table provides information for the independent trustees. The third table provides

information for the officers. Furthermore, each Trustee possesses the following specific attributes: Mr. Alston has business, financial and

investment experience as a senior executive of an international real estate firm and is trained as a lawyer; Ms. Blake has had experience

as a certified public accountant and has had experience as a member of boards of directors/trustees of other investment companies; Ms.

Burgermeister has had experience as a certified public accountant and as a member of boards of directors/trustees of other investment

companies; Mr. Connealy has had experience with other investment companies and their investment advisers first as a partner in the

investment management practice of PricewaterhouseCoopers LLP and, subsequently, as the senior financial executive of two other

investment organizations sponsoring and managing investment companies; Ms. Krysty has had business, financial and investment

experience as the founder and senior executive of a registered investment adviser focusing on high net worth individuals as well as a

certified public accountant and a member of the boards of other corporations and non-profit organizations. Mr. Tennison has had business,

financial and investment experience as a senior executive of a corporation with international activities and was trained as an accountant;

and Mr. Thompson has had experience in business, governance, investment and financial reporting matters as a senior executive of an

organization sponsoring and managing other investment companies, and, subsequently, has served as a board member of other investment

companies, and has been determined by the Board to be an audit committee financial expert. Ms. Cavanaugh has had experience with other

financial services companies, including companies engaged in the sponsorship, management and distribution of investment companies.

As a senior officer and/or director of the Funds, the Adviser and various affiliates of the Adviser providing services to the Funds, Ms.

Cavanaugh is in a position to provide the Board with such parties’ perspectives on the management, operations and distribution of the Fund.

| | | | | | | |

| | | | | | | No. of | |

| | | | | | | Portfolios | |

| | | | | | | in Russell | Other |

| | | Position(s) Held | | | | Fund | Directorships |

| | Name, | With Fund and | Term | | Principal Occupation(s) | Complex | Held by Trustee |

| | Age, | Length of | of | | During the | Overseen | During the |

| | Address | Time Served | Office* | | Past 5 Years | by Trustee | Past 5 Years |

| |

| | INTERESTED TRUSTEES | | | | | | |

| # Sandra Cavanaugh, | President and Chief | Until successor | • | President and CEO RIC, RIF and | 47 | None |

| Born May 10, 1954 | Executive Officer since | is chosen and | | RET | | |

| | | 2012 | qualified by | • | Chairman of the Board, Co- | | |

| 1301 Second Avenue, | | Trustees | | President and CEO, Russell | | |

| 18th Floor | Trustee since 2012 | | | Financial Services, Inc. (“RFS”) | | |

| Seattle, WA 98101 | | Appointed until | • | Chairman of the Board, President | | |

| | | | successor is | | and CEO, Russell Fund Services | | |

| | | | duly elected and | | Company (“RFSC”) | | |

| | | | qualified | • | Director, RIMCo | | |

| | | | | • | Chairman of the Board, President | | |

| | | | | | and CEO, Russell Insurance | | |

| | | | | | Agency, Inc. (“RIA”) (insurance | | |

| | | | | | agency) | | |

| | | | | • | May 2009 to December 2009, | | |

| | | | | | Executive Vice President, Retail | | |

| | | | | | Channel, SunTrust Bank | | |

| | | | | • | 2007 to January 2009, Senior Vice | | |

| | | | | | President, National Sales — Retail | | |

| | | | | | Distribution, JPMorgan Chase/ | | |

| | | | | | Washington Mutual, Inc. | | |

| | | | | | (investment company) | | |

| * | Each Trustee is subject to mandatory retirement at age 72. | | | | |

| # | Ms. Cavanaugh is also an officer and/or director of one or more affiliates of RIC, RIF and RET and is therefore classified as an Interested Trustee. |

Disclosure of Information about Fund Trustees and Officers 27

Russell Exchange Traded Funds Trust

Russell Equity ETF

Disclosure of Information about Fund Trustees and Officers, continued —

March 31, 2014 (Unaudited)

| | | | | | |

| | | | | | No. of | |

| | | | | | Portfolios | |

| | | | | | in Russell | Other |

| | Position(s) Held | | | | Fund | Directorships |

| Name, | With Fund and | Term | | Principal Occupation(s) | Complex | Held by Trustee |

| Age, | Length of | of | | During the | Overseen | During the |

| Address | Time Served | Office* | | Past 5 Years | by Trustee | Past 5 Years |

| |

| INTERESTED TRUSTEES (continued) | | | | | |

| ## Daniel P. Connealy, | Trustee since 2012 | Appointed until | • | June 2004 to present, Senior Vice | 47 | None |

| Born June 6, 1946 | | successor is | | President and Chief Financial | | |

| | | duly elected and | | Officer, Waddell & Reed Financial, | | |

| 1301 Second Avenue, | | qualified | | Inc. (investment company) | | |

| 18th Floor | | | | | | |

| Seattle, WA 98101 | | | | | | |

| |

| |

| ## Mr. Connealy is an officer of a broker-dealer that distributes shares of the RIC Funds and is therefore classified as an Interested Trustee. Due to the fact that |

| board meetings of RIC and RET are expected to be held concurrently for administrative purposes, he will be treated as an interested person of RET. |

| | | | | | |

| | | | | | No. of | |

| | | | | | Portfolios | |

| | | | | | in Russell | Other |

| | Positions(s) Held | | | | Fund | Directorships |

| Name, | With Fund and | Term | | Principal Occupation(s) | Complex | Held by Trustee |

| Age, | Length of | of | | During the | Overseen | During the |

| Address | Time Served | Office* | | Past 5 Years | by Trustee | Past 5 Years |

| |

| INDEPENDENT TRUSTEES | | | | | | |

| Thaddas L. Alston, | Trustee since 2012 | Appointed until | • | Senior Vice President, Larco | 47 | None |

| Born April 7, 1945 | | successor is | | Investments, Ltd. (real estate firm) | | |

| | Chairman of the | duly elected and | | | | |

| 1301 Second Avenue, | Investment Committee | qualified | | | | |

| 18th Floor | since 2012 | | | | | |

| Seattle, WA 98101 | | Appointed until | | | | |

| | | successor is | | | | |

| | | duly elected and | | | | |

| | | qualified | | | | |

| |

| |

| |

| Kristianne Blake, | Trustee since 2012 | Appointed until | • | Director and Chairman of the | 47 | •Director, |

| Born January 22, 1954 | | successor is | | Audit Committee, Avista Corp | | Avista Corp |

| | Chairman since 2012 | duly elected and | | (electric utilities) | | (electric |

| 1301 Second Avenue, | | qualified | • | Regent, University of Washington | | utilities); |

| 18th Floor | | | • | President, Kristianne Gates Blake, | | •Director, |

| Seattle, WA 98101 | | Annual | | P.S. (accounting services) | | Ecova (total |

| | | | • | Director, Ecova (total energy and | | energy and |

| | | | | sustainability management) | | sustainability |

| | | | | | | management); |

| |

| * Each Trustee is subject to mandatory retirement at age 72. | | | | |

28 Disclosure of Information about Fund Trustees and Officers

Russell Exchange Traded Funds Trust

Russell Equity ETF

Disclosure of Information about Fund Trustees and Officers, continued —

March 31, 2014 (Unaudited)

| | | | | | |

| | | | | | No. of | |

| | | | | | Portfolios | |

| | | | | | in Russell | Other |

| | Positions(s) Held | | | | Fund | Directorships |

| Name, | With Fund and | Term | | Principal Occupation(s) | Complex | Held by Trustee |

| Age, | Length of | of | | During the | Overseen | During the |

| Address | Time Served | Office* | | Past 5 Years | by Trustee | Past 5 Years |

| |

| INDEPENDENT TRUSTEES (continued) | | | | | |

| | | | • | Until December 31, 2013, Trustee | 47 | •Until |

| | | | | and Chairman of the Operations | | December 31, |

| | | | | Committee, Principal Investors | | 2013, Trustee, |

| | | | | Funds and Principal Variable | | Principal |

| | | | | Contracts Funds (investment | | Investors Funds |

| | | | | company) | | (investment |

| | | | • | From April 2004 through December | | company); |

| | | | | 31, 2012, Director, Laird Norton | | •Until |

| | | | | Wealth Management | | December 31, |

| | | | | and Laird Norton Tyee Trust | | 2013, Trustee |

| | | | | (investment company) | | Principal |

| | | | | | | Variable |

| | | | | | | Contracts |

| | | | | | | Funds |

| | | | | | | (investment |

| | | | | | | company) |

| | | | | | | •From April |

| | | | | | | 2004 through |

| | | | | | | December |

| | | | | | | 31, 2012, |

| | | | | | | Director, Laird |

| | | | | | | Norton Wealth |

| | | | | | | Management |

| | | | | | | and Laird |

| | | | | | | Norton |

| | | | | | | Tyee Trust |

| | | | | | | (investment |

| | | | | | | company) |

| |

| |

| |

| Cheryl Burgermeister, | Trustee since 2012 | Appointed until | • | Retired | 47 | •Trustee and |

| Born June 26, 1951 | | successor is | • | Trustee and Chairperson of Audit | | Chairperson |

| | | duly elected and | | Committee, Select Sector SPDR | | of Audit |

| 1301 Second Avenue, | | qualified | | Funds (investment company) | | Committee, |

| 18th Floor | | | | | | Select Sector |

| Seattle, WA 98101 | | | | | | SPDR Funds |

| | | | | | | (investment |

| | | | | | | company) |

| | | | | | | •Trustee, ALPS |

| | | | | | | Series Trust |

| | | | | | | (investment |

| | | | | | | company) |

| * Each Trustee is subject to mandatory retirement at age 72. | | | | |

Disclosure of Information about Fund Trustees and Officers 29

Russell Exchange Traded Funds Trust

Russell Equity ETF

Disclosure of Information about Fund Trustees and Officers, continued —

March 31, 2014 (Unaudited)

| | | | | | |

| | | | | | No. of | |

| | | | | | Portfolios | |

| | | | | | in Russell | Other |

| | Position(s) Held | | | | Fund | Directorships |

| Name, | With Fund and | Term | | Principal Occupation(s) | Complex | Held by Trustee |

| Age, | Length of | of | | During the | Overseen | During the |

| Address | Time Served | Office* | | Past 5 Years | by Trustee | Past 5 Years |

| |

| INDEPENDENT TRUSTEES (continued) | | | | | |

| Katherine W. Krysty, | Trustee since 2014 | Appointed until | • | Retired | 47 | None |

| Born December 3, 1951 | | successor is | • | January 2011 through March 2013, | | |

| | | duly elected and | | President Emerita, Laird Norton | | |

| 1301 Second Avenue, | | qualified | | Wealth Management (investment | | |

| 18th Floor | | | | company) | | |

| Seattle, WA 98101 | | | • | April 2003 through December 2010, | | |

| | | | | Chief Executive Officer of | | |

| | | | | Laird Norton Wealth | | |

| | | | | Management (investment | | |

| | | | | company) | | |

| |

| |

| Raymond P. Tennison, Jr., | Trustee since 2012 | Appointed until | • | Retired | 47 | None |

| Born December 21, 1955 | | successor is | • | From January 2008 until | | |

| | Chairman of | duly elected and | | December 2011, Vice Chairman of | | |

| 1301 Second Avenue, | the Nominating | qualified | | the Board, Simpson Investment | | |

| 18th Floor | and Governance | | | Company (paper and forest | | |

| Seattle, WA 98101 | Committee since | Appointed until | | products) | | |

| | 2012 | successor is | • | Until November 2010, President, | | |

| | | duly elected and | | Simpson Investment Company | | |

| | | qualified | | and several additional subsidiary | | |

| | | | | companies, including Simpson | | |

| | | | | Timber Company, Simpson Paper | | |

| | | | | Company and Simpson Tacoma | | |

| | | | | Kraft Company | | |

| |

| |

| Jack R. Thompson, | Trustee since 2012 | Appointed until | • | September 2007 to September | 47 | •Director, |

| Born March 21, 1949 | | successor is | | 2010, Director, Board Chairman | | Board Chairman |

| | Chairman of the | duly elected and | | and Chairman of the Audit | | and Chairman |

| 1301 Second Avenue, | Audit Committee | qualified | | Committee, LifeVantage | | of the Audit |

| 18th Floor | since 2012 | | | Corporation (health products | | Committee, |

| Seattle, WA 98101 | | Appointed until | | company) | | LifeVantage |

| | | successor is | • | September 2003 to September | | Corporation |

| | | duly elected and | | 2009, Independent Board Chair | | until September |

| | | qualified | | and Chairman of the Audit | | 2010 (health |

| | | | | Committee, Sparx Asia Funds | | products |

| | | | | (investment company) | | company); |

| | | | | | | •Director, Sparx |

| | | | | | | Asia Funds |

| | | | | | | until 2009 |

| | | | | | | (investment |

| | | | | | | company) |

| |

| * Each Trustee is subject to mandatory retirement at age 72. | | | | |

30 Disclosure of Information about Fund Trustees and Officers

Russell Exchange Traded Funds Trust

Russell Equity ETF

Disclosure of Information about Fund Trustees and Officers, continued —

March 31, 2014 (Unaudited)

| | | | |

| | Positions(s) Held | | | |

| Name, | With Fund and | Term | | Principal Occupation(s) |

| Age, | Length of | of | | During the |

| Address | Time Served | Office | | Past 5 Years |

| |

| OFFICERS | | | | |

| Cheryl Wichers, | Chief Compliance | Until removed | • | Chief Compliance Officer, RIC, RIF and RET |

| Born December 16, 1966 | Officer since 2011 | by Independent | • | Chief Compliance Officer, RFSC and U.S. One Inc. |