EXPLANATORY NOTE: The proxy solicitation materials included herein with respect to the annual meeting of security holders of First Community Financial Partners, Inc. (the “Proxy Solicitation Materials”) are being furnished to the Securities and Exchange Commission (the “Commission”) pursuant to the requirements of Form 10-K under “Supplemental Information Furnished with Reports Filed Pursuant to Section 15(d) of the Act by Registrants Which Have Not Registered Securities Pursuant to Section 12 of the Act” and shall not be deemed to be “filed” with the Commission or otherwise subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, nor be deemed incorporated by reference to any filing of the registrant with the Commission unless otherwise expressly provided. These Proxy Solicitation Materials are being submitted to the Commission in electronic (rather than paper) format on Form DEF 14A pursuant to Release Nos. 33-7427 and 34-38798 (dated July 1, 1997) and Rule 101(a)(iii) of Regulation S-T.

FIRST COMMUNITY FINANCIAL PARTNERS, INC.

2801 Black Road

Joliet, Illinois 60435

April 2, 2015

Dear Shareholder:

The board of directors cordially invites you to attend the annual meeting of shareholders of First Community Financial Partners, Inc., to be held at the Ruffled Feathers Golf Club, 1 Pete Dye Drive, Lemont, Illinois, on Thursday, May 21, 2015, at 10:00 a.m. At the meeting, we will review our progress and prospects for 2015. Members of our management team will be available at the meeting to respond to any questions you may have.

Our board of directors has nominated five persons to serve as Class III directors on the board of directors. All of the nominees are incumbent directors. Additionally, our audit committee has selected and we recommend that you ratify the selection of CliftonLarsonAllen LLP to serve as our independent public accountants for the year ended December 31, 2015. We recommend that you vote your shares for the nominees and in favor of the ratification of our independent public accountants.

Our annual report on Form 10-K for the fiscal year 2014 is available on our website at www.fcbankgroup.com and then clicking on Investor Relations in the upper right hand corner. Our Form 10-K can then be found under the “SEC Filings” link. Shareholders may request a paper copy of the annual report by contacting us at 2801 Black Road, Joliet, Illinois 60435, Attention: Glen Stiteley, (815) 725-1885 or gstiteley@fcbankgroup.com.

We encourage you to attend the meeting in person. Regardless of whether you plan to attend the meeting, please complete, date, sign and return the enclosed proxy card in the enclosed envelope or vote by telephone or internet by following the preprinted instructions on the enclosed proxy card. This will assure that your shares are represented at the meeting. We look forward with pleasure to seeing you at the meeting.

Sincerely,

/s/ George Barr

George Barr

Chairman of the Board

FIRST COMMUNITY FINANCIAL PARTNERS, INC.

2801 Black Road

Joliet, Illinois 60435

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS TO BE HELD MAY 21, 2015

TO THE HOLDERS OF COMMON STOCK:

The annual meeting of shareholders of First Community Financial Partners, Inc. will be held at the Ruffled Feathers Golf Club, 1 Pete Dye Drive, Lemont, Illinois, on Thursday, May 21, 2015, at 10:00 a.m., for the purpose of considering and voting upon the following matters:

| |

| 1. | to elect five Class III directors; |

| |

| 2. | to ratify the appointment of CliftonLarsonAllen LLP as the independent public accountants for the fiscal year ended December 31, 2015; and |

| |

| 3. | to transact such other business as may properly be brought before the annual meeting or any adjournments or postponements of the meeting. |

Only those shareholders of record at the close of business on March 23, 2015, are entitled to notice of the meeting and to vote at the meeting. If there are not sufficient votes for a quorum or to approve or ratify any of the foregoing proposals at the time of the annual meeting, the meeting may be adjourned or postponed to permit our further solicitation of proxies.

By Order of the Board of Directors

/s/ Glen L. Stiteley

Glen L. Stiteley Secretary

Joliet, Illinois

April 2, 2015

PLEASE SIGN AND DATE THE ENCLOSED PROXY AND RETURN IT IN THE ENCLOSED ENVELOPE OR VOTE BY TELEPHONE OR INTERNET AS PROMPTLY AS POSSIBLE, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON. IT IS HOPED THAT YOU WILL BE ABLE TO ATTEND THE MEETING, AND IF YOU DO, YOU CAN VOTE YOUR STOCK IN PERSON IF YOU WISH. YOU CAN REVOKE YOUR PROXY AT ANY TIME PRIOR TO ITS EXERCISE.

FIRST COMMUNITY FINANCIAL PARTNERS, INC.

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS MAY 21, 2015

This proxy statement is furnished in connection with the solicitation by the board of directors of First Community Financial Partners, Inc. (the “Company”) of proxies to be voted at the annual meeting of shareholders to be held at the Ruffled Feathers Golf Club, 1 Pete Dye Drive, Lemont, Illinois, on Thursday, May 21, 2015, at 10:00 a.m. local time, or at any adjournments or postponements of the meeting.

The Company, an Illinois corporation, was formed as a bank holding company in 2006 to focus on organizing de novo banks. On March 12, 2013, the Company completed a series of merger transactions to consolidate its four banking subsidiaries (the “Consolidation”). As a result of the Consolidation, the Company currently has one wholly owned banking subsidiary, First Community Financial Bank, with locations in Joliet, Plainfield, Homer Glen, Channahon, Naperville and Burr Ridge, Illinois. With assets of approximately $924 million as of December 31, 2014, First Community Financial Bank offers a broad range of products, services and resources while maintaining its commitment to and active involvement in the communities it serves.

The Company is required to file annual, quarterly and current reports and other information with the Securities and Exchange Commission (the “SEC”). You may read and copy this information at the SEC’s Public Reference Room located at 100 F Street N.E., Room 1580, Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet website that contains periodic and current reports and other information about issuers, like the Company, that file electronically with the SEC. The address of that site is www.sec.gov. For more information about the Consolidation, we urge you to review our SEC filings.

The following is information regarding the annual meeting and the voting process, presented in a question and answer format.

Why am I receiving this proxy statement and proxy form?

You are receiving a proxy statement and proxy form from us because on March 23, 2015, the record date for the annual meeting, you owned shares of the Company’s common stock. This proxy statement describes the matters that will be presented for consideration by the shareholders at the annual meeting. It also gives you information concerning these matters to assist you in making an informed decision.

When you sign the enclosed proxy form, you appoint the proxy holder as your

representative at the meeting. The proxy holder will vote your shares as you have instructed in the proxy form, which ensures that your shares will be voted whether or not you attend the meeting. Even if you plan to attend the meeting, you should complete, sign and return your proxy form, or vote by internet or telephone, in advance of the meeting just in case your plans change.

If you have signed and returned the proxy form, or voted by internet or telephone, and an issue

comes up for a vote at the meeting that is not identified on the form, the proxy holder will vote your shares, pursuant to your proxy, in accordance with his judgment.

What matters will be voted on at the meeting?

You are being asked to vote on the election of five Class III directors of the Company for a term expiring in 2018 and to approve the ratification of CliftonLarsonAllen LLP as our independent public accountants for the 2015 fiscal year. Any matters that will be voted on at the meeting are fully described in this proxy statement.

If I am the record holder of my shares, how do I vote?

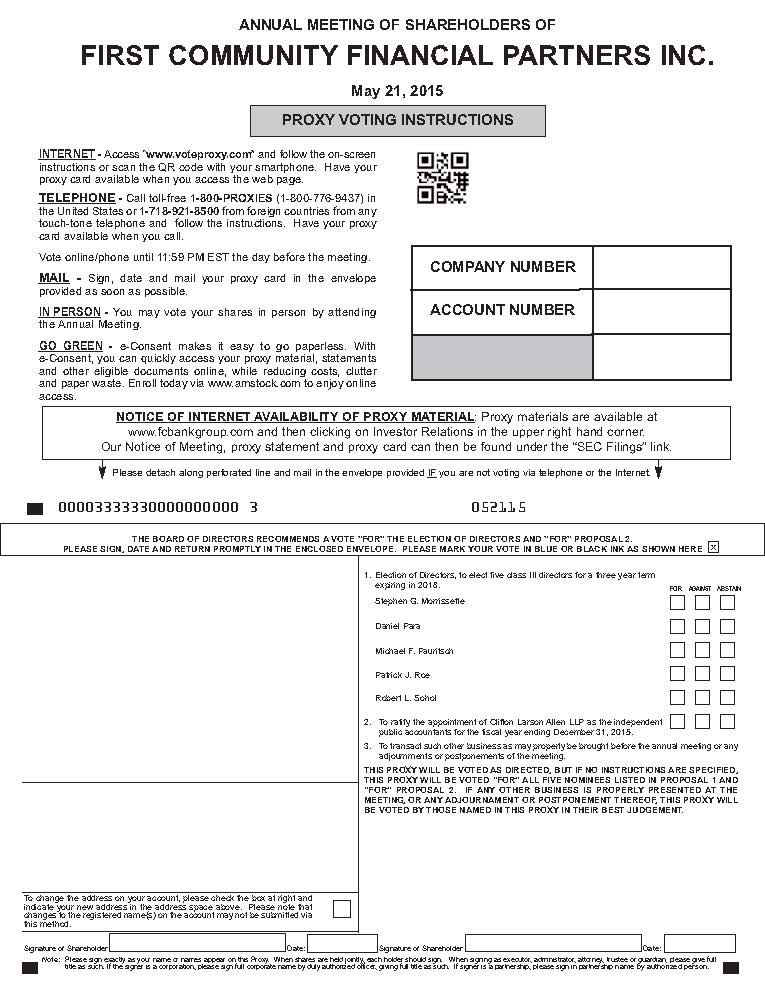

You may vote by mail, by telephone, by internet or in person at the meeting. To vote by mail, complete and sign the enclosed proxy card and mail it in the enclosed pre-addressed envelope. No postage is required if mailed in the United States. If you mark your proxy card to indicate how you want your shares voted, your shares will be voted as you instruct.

If you sign and return your proxy card but do not mark the card to provide voting instructions, the shares represented by your proxy card will be voted “for” all nominees named in this proxy statement and “for” the approval of the ratification of CliftonLarsonAllen LLP as our independent public accountants for the 2015 fiscal year.

Although you may vote by mail, we ask that you vote instead by internet or telephone, which saves us postage and processing costs. You may vote by telephone by calling the toll- free number specified on your proxy card or by accessing the internet website specified on your proxy card and by following the preprinted instructions on the proxy card. If you submit your vote by internet, you may incur costs, such as cable, telephone and internet access charges. Votes submitted by telephone or internet must be received by midnight CDT on Wednesday, May 20, 2015. The giving of a proxy by either

of these means will not affect your right to vote in person if you decide to attend the meeting.

If you want to vote in person, please come to the meeting. We will distribute written ballots to anyone who wants to vote at the meeting. Please note,

however, that if your shares are held in the name of a broker or other fiduciary (or in what is usually referred to as “street name”), you will need to arrange to obtain a legal proxy from that person or entity in order to vote in person at the meeting. Even if you plan to attend the meeting, you should complete, sign and return your proxy card, or vote by telephone or internet, in advance of the meeting just in case your plans change.

If I hold shares in the name of a broker or fiduciary, who votes my shares?

If you received this proxy statement from your broker or other fiduciary, your broker or fiduciary should have given you instructions for directing how that person or entity should vote your shares. It will then be your broker or fiduciary’s responsibility to vote your shares for you in the manner you direct. Please complete, execute and return the proxy card in the envelope provided by your broker.

Under the rules of various national and regional securities exchanges, brokers generally may vote on routine matters, such as the ratification of a company’s independent registered public accounting firm, but may not vote on non-routine matters unless they have received voting instructions from the person for whom they are holding shares. The election of directors is considered a non-routine matter, and consequently, your broker will not have discretionary authority to vote your shares on this matter. If your broker or fiduciary does not receive instructions from you on how to vote on this matter, your broker or fiduciary will return the proxy card to us, indicating that he or she does not have the authority to vote. This is generally referred to as a “broker non-vote” and may affect the outcome of the voting on this matter.

We therefore encourage you to provide directions to your broker as to how you want your shares voted on all matters to be brought before the 2015 annual meeting, including the election of directors. You should do this by carefully following the instructions your broker gives you concerning its procedures. This ensures that your shares will be voted at the meeting.

A number of banks and brokerage firms participate in a program that also permits shareholders to direct their vote by telephone or internet. If your shares are held in an account at such a bank or brokerage firm, you may vote your shares by telephone

or internet by following the instructions on their enclosed voting form. If you submit your vote by internet, you may incur costs, such as cable, telephone and internet access charges. Voting your shares in this manner will not affect your right to vote in person if you decide to attend the meeting, however, you must first request a legal proxy either on the internet or the enclosed proxy card. Requesting a legal proxy prior to the deadline stated above will automatically cancel any voting directions you have previously given by internet or by telephone with respect to your shares.

What if I change my mind after I return my proxy?

If you hold your shares in your own name, you may revoke your proxy and change your vote at any time before the polls close at the meeting. You may do this by:

| |

| • | signing another proxy with a later date and returning that proxy to First Community Financial Partners, Inc., 2801 Black Road, Joliet, Illinois 60435, Attention: Glen Stiteley; |

| |

| • | sending notice to us at the same address above that you are revoking your proxy; |

| |

| • | timely submitting another proxy via the telephone or internet; or |

| |

| • | voting in person at the meeting. |

If you hold your shares in the name of your broker and desire to revoke your proxy, you will need to contact your broker to revoke your proxy.

How many votes do we need to hold the annual meeting?

A majority of the shares that are outstanding and entitled to vote as of the record date must be present in person or by proxy at the meeting for us to hold the meeting and conduct business.

Shares are counted as present at the meeting if the shareholder either:

| |

| • | is present and votes in person at the meeting; or |

| |

| • | has properly submitted a signed proxy form or other proxy. |

On March 23, 2015, the record date for this meeting, there were 16,970,721 shares of common stock issued and outstanding. Therefore, at least 8,485,361 shares need to be present in person or by proxy at the annual meeting in order to hold the meeting and conduct business.

What happens if a nominee is unable to stand for re-election?

The board may, by resolution, provide for a lesser number of directors or designate a substitute nominee. In the latter case, shares represented by proxies may be voted for a substitute nominee. You cannot vote for more than five nominees. The board has no reason to believe the nominees will be unable to stand for re-election.

How many votes may I cast?

Generally, you are entitled to cast one vote for each share of stock you owned on the record date. The proxy form included with this

above will automatically cancel any voting directions you have previously given by internet or by telephone with respect to your shares.

What if I change my mind after I return my proxy?

If you hold your shares in your own name, you may revoke your proxy and change your vote at any time before the polls close at the meeting. You may do this by:

| |

| • | signing another proxy with a later date and returning that proxy to First Community Financial Partners, Inc., 2801 Black Road, Joliet, Illinois 60435, Attention: Richard Slehofer; |

| |

| • | sending notice to us at the same address above that you are revoking your proxy; |

| |

| • | timely submitting another proxy via the telephone or internet; or |

| |

| • | voting in person at the meeting. |

If you hold your shares in the name of your broker and desire to revoke your proxy, you will need to contact your broker to revoke your proxy.

How many votes do we need to hold the annual meeting?

A majority of the shares that are outstanding and entitled to vote as of the record date must be present in person or by proxy at the meeting for us to hold the meeting and conduct business.

Shares are counted as present at the meeting if the shareholder either:

| |

| • | is present and votes in person at the meeting; or |

| |

| • | has properly submitted a signed proxy form or other proxy. |

On April 21, 2014, the record date for this meeting, there were 16,548,653 shares of common stock issued and outstanding. Therefore, at least 8,274,327 shares need to be present in person or by proxy at the annual meeting in order to hold the meeting and conduct business.

What happens if a nominee is unable to stand for re-election?

The board may, by resolution, provide for a lesser number of directors or designate a substitute nominee. In the latter case, shares represented by proxies may be voted for a substitute nominee. You cannot vote for more than six nominees. The board has no reason to believe the nominees will be unable to stand for re-election.

How many votes may I cast?

Generally, you are entitled to cast one vote for each share of stock you owned on the record date. The proxy form included with this proxy statement indicates the number of shares owned by an account attributable to you.

How many votes are needed for each proposal?

To be elected as a director of the Company, each of the five director nominees must receive the affirmative vote of a majority of the shares present in person or by proxy at the meeting and entitled to vote. The proposal to approve the ratification of CliftonLarsonAllen LLP as our independent public accountants for the 2015 fiscal year and, in general, any other matters must also receive the affirmative

vote of a majority of the shares present in person or by proxy at the meeting and entitled to vote. On all matters, broker non-votes will not be counted as entitled to vote, but will count for purposes of determining whether or not a quorum is present. If available, we will announce voting results at the meeting. The voting results will also be disclosed on a Form 8-K that we will file with the SEC within four business days after the annual meeting.

Who bears the cost of soliciting proxies?

We will bear the cost of soliciting proxies. In addition to solicitations by mail, officers, directors or employees of the Company or one of its subsidiaries may solicit proxies in person or by telephone. These persons will not receive any special or additional compensation for soliciting proxies. We may reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to shareholders.

PROPOSAL 1: ELECTION OF DIRECTORS

The Company has a staggered board of directors divided into three classes. One class is elected annually to serve for three years. At the annual meeting of shareholders on May 21, 2015, five Class III directors will be elected for a term of three years or until their respective successors are elected and qualified.

Currently, the Company has 16 directors serving on its board, with one vacancy, for a total of 17 director seats. The board is currently assessing whether it will consider candidates to fill the vacancy or eliminate such vacancy by resolving to reduce the size of the board.

The proxy provides instructions for voting for or against the director nominees. Unless instructed to the contrary, the persons acting under your proxy will vote for all of the nominees listed below. If, however, any nominee becomes unable to serve, which is not now contemplated, the proxy holders reserve the right to vote at the meeting for a substitute nominee.

Information About Directors and Nominees

The following table contains certain information with respect to the nominees for election and for each of the Company’s other directors, whose terms of office will continue after the meeting, including the age, year first elected as a director and the positions held by the person with the Company. The nominees, if elected at the annual meeting of shareholders, will serve as directors for a three-year term expiring in 2018. The board of directors recommends that you vote your shares “FOR” all six nominees.

|

| | |

Nominees:

| | |

| Name | Served as Company Director Since | Title |

Class III Term Will Expire 2018 | | |

Stephen G. Morrissette (Age 53) | 2006 | Director |

Daniel Para (Age 62) | 2013 | Director |

Michael F. Pauritsch (Age 69) | 2008 | Director |

Patrick J. Roe (Age 57) | 2011 | President, Chief Operating Officer and Director |

Robert L. Sohol (Age 63) | 2006 | Director |

| Continuing Directors: | | |

| Name | Served as Company Director Since | Title |

Class I Term Expires 2016 | | |

George Barr (Age 60) | 2006 | Director and Chariman of the Board |

Terrence O. D'Arcy (Age 59) | 2006 | Director |

William L. Pommerening (Age 62) | 2008 | Director |

Dennis G. Tonelli (Age 68) | 2008 | Director |

|

| | |

Name |

Served as Company Director Since | Title |

Class II New Term Will Expire 2017 | | |

| Peter Coules, Jr. (Age 53) | 2013 | Director |

| Rex D. Easton (Age 63) | 2006 | Director |

| Vincent E. Jackson (Age 52) | 2013 | Director |

| Patricia L. Lambrecht (Age 64) | 2006 | Director |

| Roy C. Thygesen (Age 57) | 2013 | Chief Executive Officer and Director |

| Scott A. Wehrli (Age 46) | 2008 | Director |

The business experience of each of the nominees for the past five years, as well as their qualifications to serve on the board, are as follows:

Stephen G. Morrissette. Mr. Morrissette has served on the board of directors of First Community since 2006. From 2004 to 2013, he served as a director of FCB Joliet, a wholly owned subsidiary of First Community prior to the Consolidation. He also served on the boards of directors of three banks of which

First Community was a majority stockholder prior to the Consolidation: FCB Homer Glen (serving from 2008 to 2013), FCB Plainfield, now known as First Community Financial Bank (serving from 2008 to 2013) and Burr Ridge (serving from 2009 to 2013). From 2004 to 2009, Mr. Morrissette was the chief executive officer of each of First Community and FCB Joliet. Prior to that, he was a professor of finance at the University of St. Francis, located in Joliet, Illinois, from 1994 to 2004. In 2010, he returned to his professor of finance position at the University of St. Francis and became an adjunct professor of strategy at the University of Chicago’s Booth School of Business. He continues to serve in those capacities today. Additionally, in 2011, Mr. Morrissette became a managing director of Providence Advisors, a strategic planning and bank consulting business. We believe that Mr. Morrissette’s years of banking experience, which includes executive leadership positions and extensive consulting experience with local community banks, is a tremendous asset to the board. Moreover, Mr. Morrissette’s educational background, including a Ph.D. and MBA in finance and strategy, and his teaching experience, contribute to the board a deep knowledge of corporate finance.

Daniel Para. Mr. Para has been a director of First Community since 2013. From 2009 to 2013, he also served as a director of Burr Ridge, of which First Community was a stockholder prior to the Consolidation. Until 2009, Mr. Para served as the chief executive officer of Concert Group Logistics, a company he founded in 2001 and sold to XPO Logistics, Inc. (NYSE: XPO, formerly Express-1 Expedited Solutions) in 2008. He served on the board of directors of this public company until 2012 where he also headed the mergers and acquisitions committee of the board. We believe that Mr. Para’s experience with public company acquisitions and his past board service contribute valuable skills to the First Community board. The board also benefits from his experience with growing existing companies and overseeing matters related to that growth.

Michael F. Pauritsch. Mr. Pauritsch has been on the board of directors of First Community since 2008. The board of directors has determined he is an “audit committee financial expert” within the meaning of SEC regulations. From 2009 to 2013, he also served as the chairman of the board of directors of Burr Ridge, of which First Community was a stockholder prior to the Consolidation. Since 1976, Mr. Pauritsch has been a partner at Mulcahy, Pauritsch, Salvador & Co., Ltd, an accounting firm. Since 1999, Mr. Pauritsch has served on the business development committees of each of MPS Loria Financial Partners LLC, an investment firm, and Loria

Financial Group, LLC, a broker/dealer. We believe that Mr. Pauritsch’s extensive accounting background, including many years of experience as a Certified Public Accountant for small and medium-sized businesses, provides the board of directors with valuable accounting and financial expertise. Moreover, Mr. Paurtisch provides the board with years of experience in the securities industry. Finally, Mr. Pauritsch’s prior service on the boards of First Community and Burr Ridge provides the board with significant historical knowledge.

Patrick J. Roe. Mr. Roe has served as a director of First Community since 2011. From 2011 to 2013, Mr. Roe served as First Community’s president and chief executive officer and, since 2013, has served as First Community’s president and chief operating officer. He has also served as the president and a director of First Community Financial bank since 2013. From 2010 to 2013, he has served as served as the president and chief executive officer, and as a director, of FCB Homer Glen, of which First Community was a stockholder prior to the Consolidation, and from 2011 to 2013, served as a director of FCB Joliet, a wholly owned subsidiary of First Community prior to the Consolidation. From February 2008 through March 2009, Mr. Roe served as senior vice president of Old Second National Bank, a community banking institution. From 1984 through 2008, he was employed by Heritage Bank, also a community banking institution. He served as president, chief operating officer and director of Heritage Bank from 1996 through 2008. Mr. Roe also served as the president, chief operating officer and a director of HeritageBanc, Inc., a bank holding company and parent of Heritage Bank. We believe that Mr. Roe’s extensive community banking experience, including prior to his work with First Community,

where his responsibilities are substantially similar to the work performed for his prior employers, provides First Community and its board of directors with a wide array of expertise and vast experience in community banking. Mr. Roe’s significant qualifications in many facets of commercial banking, including with respect to lending, deposits, lending operations and accounting, also benefit First Community and the board of directors.

Robert L. Sohol. Mr. Sohol has served on the board of directors of First Community since 2006. From 2004 to 2013, he served as a director of FCB Joliet, a wholly owned subsidiary of First Community prior to the Consolidation. From 2008 to 2013, Mr. Sohol also served on the board of director of FCB Plainfield, now known as First Community Financial Bank. Since 1983, Mr. Sohol has served as chief executive officer of two construction companies, RL Sohol Carpenter Contractor Inc. and RL Sohol General Contractor Inc. Since 1987, he has been a partner in Phase III, a real estate and development company, and since 1997, he has been the chief executive officer of American Built Systems Inc., a manufacturing company. We believe that Mr. Sohol’s extensive executive experience, including experience with being primarily responsible for the creation of financial statements and responding to tax audits, benefits the board. Additionally, Mr. Sohol’s longstanding service on the boards of directors of First Community and its banking affiliates provide the board with valuable institutional knowledge.

PROPOSAL 2: RATIFICATION OF THE APPOINTMENT OF THE INDEPENDENT PUBLIC ACCOUNTANTS

Shareholders are also being asked to ratify the appointment of CliftonLarsonAllen LLP as our independent public accountants for the year ending December 31, 2015. If the appointment of CliftonLarsonAllen is not ratified by shareholders, the matter of the appointment of independent public accountants will be considered by the audit committee and board of directors. A representative of CliftonLarsonAllen is not expected to be present at the annual meeting. The board of directors recommends that you vote your shares “FOR” the ratification of CliftonLarsonAllen to serve as our independent public accountants.

CORPORATE GOVERNANCE AND THE BOARD OF DIRECTORS

General

Generally, the board oversees our business and monitors the performance of our management and does not involve itself in our day-to-day operations, which are monitored by our executive officers and management. Our directors fulfill their duties and responsibilities by attending regular meetings of the board, which are held on a monthly basis, and through committee membership.

Director Independence

The board of directors has concluded that except for Messrs. Roe and Thygesen, the members of the board of directors satisfy the independence requirements of the NASDAQ Stock Market. Although the Company does not currently have any stock listed on NASDAQ, the Company has elected to use its independence standards when determining the independence of the members of its board of directors.

Our board of directors has undertaken a review of its composition, the composition of its committees, and the independence of each director. Based upon information requested from and provided by each director concerning his or her background, employment, and affiliations, including family relationships, our board of directors has determined that Messrs. Barr, Coules, D’Arcy, Dollinger, Easton, Jackson, Morrissette, Para, Pauritsch, Pommerening, Sohol, Tonelli and Wehrli and Ms. Lambrecht, do not have a relationship that would interfere with the exercise of independent judgment in

carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the applicable rules and regulations of the SEC and the listing requirements and rules of NASDAQ. Mr. Morrissette was employed by the Company prior to March 31, 2011, and as a result, he was considered independent starting on April 1, 2014. Accordingly, a majority of our directors are independent, as required under applicable NASDAQ rules. In making this determination, our board of directors considered the current and prior relationships that each non-employee director has with our Company and all other facts and circumstances our board of directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director.

We keep the positions of Chairman of the Board and Chief Executive Officer separate at the Company. Currently, Mr. Barr, who is an “independent” director, holds the position of Chairman of the Board, and Mr. Thygesen holds the position of Chief Executive Officer. We believe that this structure provides for an appropriate balance of authority between management and the board of directors and demonstrates our commitment to good corporate governance.

The Company’s audit committee consists of Messrs. Pauritsch, Dollinger and Sohol, each of whom satisfies the independence requirements under the NASDAQ listing standards, Rule 10A-3(b)(1) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the regulations of the Federal Deposit Insurance Corporation. The chairperson of our audit committee is Mr. Pauritsch, whom our board of directors has determined is an “audit committee financial expert” within the meaning of SEC regulations. Each member of our audit committee can read and understand fundamental financial statements in accordance with audit committee requirements. In arriving at this determination, the board has examined each audit committee member’s scope of experience and the nature of their employment.

The Company’s compensation committee consists of Messrs. Barr, Easton, Para and Wehrli, each of whom the board of directors has determined to be independent under the NASDAQ listing standards. The chairperson of our compensation committee is Mr. Wehrli.

The Company’s nominating committee consists of Messrs. Jackson, Pommerening and Sohol, each of whom the board of directors has determined to be independent under the NASDAQ listing standards. The chairperson of our nominating committee is Mr. Sohol.

Code of Ethics

We have adopted a code of ethics that applies to all of our employees, officers, and directors, including those officers responsible for financial reporting. The code of ethics is available on our website at www.fcbankgroup.com. We also will furnish copies of the Code of Ethics to any person without charge, upon written request. Requests for copies should be made in writing to First Community Financial Partners, Inc., 2801 Black Road, Joliet, Illinois 60435, Attention: Glen Stiteley.

For a listing of our related party transactions and further discussion on our evaluation of director

independence, please see our Form 10-K for the fiscal year 2014, Item 13, Certain Relationships and Related Transactions, and Director Independence.

Director Nominations

In accordance with the Company’s bylaws, a shareholder’s nomination of candidates for election as directors for an annual meeting must be delivered to the Secretary of the Company not less than 90 days or more than 120 days prior to the first anniversary of the date of the previous year’s annual meeting, and in the case of a special meeting, must be delivered to the Secretary of the Company not less than 90 days or more than 120 days in advance of the date of the special meeting, regardless of any postponement or adjournments of that meeting to a later date. Any such shareholder notice must include (a) as to each person whom the shareholder proposes to nominate for election as a director: (i) the name, age, business address and residential address of such person; (ii) the principal occupation or employment of such person; (iii) the class and number of shares of the Company’s stock which are beneficially owned by such person on the date of such shareholder notice; and (iv) any other information relating to such person that would be required to be disclosed on Schedule 13D pursuant to Regulation 13D-G under the Exchange Act, in connection with the acquisition of stock, and pursuant to Regulation 14A under the Exchange Act, in connection with the solicitation of proxies with respect to nominees for election as directors, regardless of whether such person is subject to the provisions of such regulations, including, but not limited to, information required to be disclosed by Items 4(b) and 6 of Schedule 14A of Regulation 14A with the SEC; and (b) as to the shareholder giving the notice: (i) the name and address, as they appear on the Company’s books, of such shareholder and the name and principal business or residential address of any other beneficial shareholders known by such shareholder to support such nominees; and (ii) the class and number of shares of the Company stock which are beneficially owned by such shareholder on the date of such shareholder notice and the number of shares owned beneficially by any other record or beneficial shareholders known by such shareholder to be supporting such nominees on the date of such shareholder notice. The board of directors may reject any nomination by a shareholder not timely made in accordance with the foregoing requirements.

If the board of directors, or a committee designated by the board of directors, determines that the information provided in a shareholder’s notice does not satisfy the foregoing informational requirements in any material respect, the Secretary of the Company shall promptly notify such shareholder of the deficiency in the notice. The shareholder may cure the deficiency by providing additional information to the Secretary within such period of time, not less than five days from the date such deficiency notice is given to the shareholder as the board of directors or such committee shall determine. If the deficiency is not cured within such period, or if the board of directors or such committee determines that the additional information provided by the shareholder, together with information previously provided, does not satisfy the forgoing requirements in any material respect, then the board of directors may reject such shareholder’s notice and the proposed nominations shall not be accepted if presented at the shareholder meeting to which the notice relates. The Secretary of the Company shall notify a shareholder in writing whether his or her nomination has been made in accordance with the foregoing time and informational requirements. Notwithstanding the forgoing procedure, if neither the board of directors nor such committee makes a determination as to the validity of any nominations by a shareholder, the presiding officer of the shareholder’s meeting shall determine and declare at the meeting whether or not a nomination was made in accordance with the foregoing requirements. If the presiding officer determines that a nomination was not made in accordance with the foregoing terms, such officer shall so declare at the meeting and the defective nomination shall not be accepted.

While the Company has a nominating committee, the Company does not have any policies regarding diversity when identifying director nominees. However, the Company believes the diverse backgrounds and perspectives of its current directors are appropriate to the oversight of the Company’s management team and performance. The nominating committee considers and acts on all matters relating to the nomination of individuals for election as director in accordance with the Company’s articles of incorporation and bylaws.

OTHER BUSINESS

It is not anticipated that any action will be asked of the shareholders other than that set forth above, but if other matters properly are brought before the annual meeting, the persons named in the proxy will vote in accordance with their best judgment.

By order of the Board of Directors

/s/ Glen L. Stiteley

Glen L. Stiteley

Secretary

Joliet, Illinois

April 2, 2015

ALL SHAREHOLDERS ARE URGED TO VOTE THEIR PROXIES PROMPTLY