UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

___________________

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box |

| | |

| ¨ | | Preliminary Proxy Statement |

| | | |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | |

| x | | Definitive Proxy Statement |

| | | |

| ¨ | | Definitive Additional Materials |

| | | |

| ¨ | | Soliciting Material Pursuant to Rule 14a-12 |

First Community Financial Partners, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1)

| |

| (1) | Title of each Class of securities to which transaction applies: |

_______________________________________________________________________________________________

| |

| (2) | Aggregate numbers of securities to which transaction applies: |

______________________________________________________________________________________________

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

_______________________________________________________________________________________________

| |

| (4) | Proposed maximum aggregate value of transaction: |

_______________________________________________________________________________________________

_______________________________________________________________________________________________

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

______________________________________________________________________________________________

(2) Form, Schedule or Registration Statement No.:

_______________________________________________________________________________________________

(3) Filing Party:

_______________________________________________________________________________________________

(4) Date Filed:

_______________________________________________________________________________________________

____________________________________________________________________________________________________________________________________________________________________________________________________________

FIRST COMMUNITY FINANCIAL PARTNERS, INC.

2801 Black Road

Joliet, Illinois 60435

April 8, 2016

Dear Shareholder:

The board of directors cordially invites you to attend the annual meeting of shareholders of First Community Financial Partners, Inc., to be held at Mistwood Golf Club, 1700 W. Renwick Road, Romeoville, Illinois, on Thursday, May 19, 2016, at 4:00 p.m local time. At the meeting, we will review our progress and prospects for 2016. Members of our management team will be available at the meeting to respond to any questions you may have.

There are a number of proposals to be considered at this meeting. Our shareholders will be asked to; (i) elect five persons to serve as Class I directors on the board of directors; (ii) ratify the appointment of CliftonLarsonAllen LLP as our independent registered public accounting firm for the fiscal year ended December 31, 2016; and (iii) approve the First Community Financial Partners, Inc. 2016 Equity Incentive Plan.

Our annual report on Form 10-K for the fiscal year ended December 31, 2015 is available on our website at investors.fcfp.com. Our Form 10-K can then be found under “SEC Filings”. Shareholders may request a paper copy of the annual report by contacting us at 2801 Black Road, Joliet, Illinois 60435, Attention: Glen Stiteley, (815) 725-1885 or gstiteley@fcbankgroup.com.

We encourage you to attend the meeting in person. Regardless of whether you plan to attend the meeting, please complete, date, sign and return the enclosed proxy card in the enclosed envelope or vote by telephone or internet by following the preprinted instructions on the enclosed proxy card. This will assure that your shares are represented at the meeting. We look forward with pleasure to seeing you at the meeting.

Sincerely,

/s/ George Barr

George Barr

Chairman of the Board

FIRST COMMUNITY FINANCIAL PARTNERS, INC.

2801 Black Road

Joliet, Illinois 60435

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS TO BE HELD MAY 19, 2016

TO THE SHAREHOLDERS OF FIRST COMMUNITY FINANCIAL PARTNERS, INC.:

The annual meeting of shareholders of First Community Financial Partners, Inc. will be held at Mistwood Golf Club, 1700 W. Renwick Road, Romeoville, Illinois, on Thursday, May 19, 2016, at 4:00 p.m. local time, for the purpose of considering and voting upon the following matters:

| |

| 1. | to elect five Class I directors; |

| |

| 2. | to ratify the appointment of CliftonLarsonAllen LLP as the independent public accountants for the fiscal year ended December 31, 2016; |

| |

| 3. | to approve the First Community Financial Partners, Inc. 2016 Equity Incentive Plan: and |

| |

| 4. | to transact such other business as may properly be brought before the annual meeting or any adjournments or postponements of the meeting. |

Only those shareholders of record at the close of business on March 22, 2016, are entitled to notice of the meeting and to vote at the meeting. If there are not sufficient votes for a quorum or to approve or ratify any of the foregoing proposals at the time of the annual meeting, the meeting may be adjourned or postponed to permit our further solicitation of proxies.

By Order of the Board of Directors

/s/ Glen L. Stiteley

Glen L. Stiteley Secretary

Joliet, Illinois

April 8, 2016

PLEASE SIGN AND DATE THE ENCLOSED PROXY AND RETURN IT IN THE ENCLOSED ENVELOPE OR VOTE BY TELEPHONE OR INTERNET AS PROMPTLY AS POSSIBLE, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON. IT IS HOPED THAT YOU WILL BE ABLE TO ATTEND THE MEETING, AND IF YOU DO, YOU CAN VOTE YOUR STOCK IN PERSON IF YOU WISH. YOU CAN REVOKE YOUR PROXY AT ANY TIME PRIOR TO ITS EXERCISE.

FIRST COMMUNITY FINANCIAL PARTNERS, INC.

PROXY STATEMENT - TABLE OF CONTENTS

FIRST COMMUNITY FINANCIAL PARTNERS, INC.

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS MAY 19, 2016

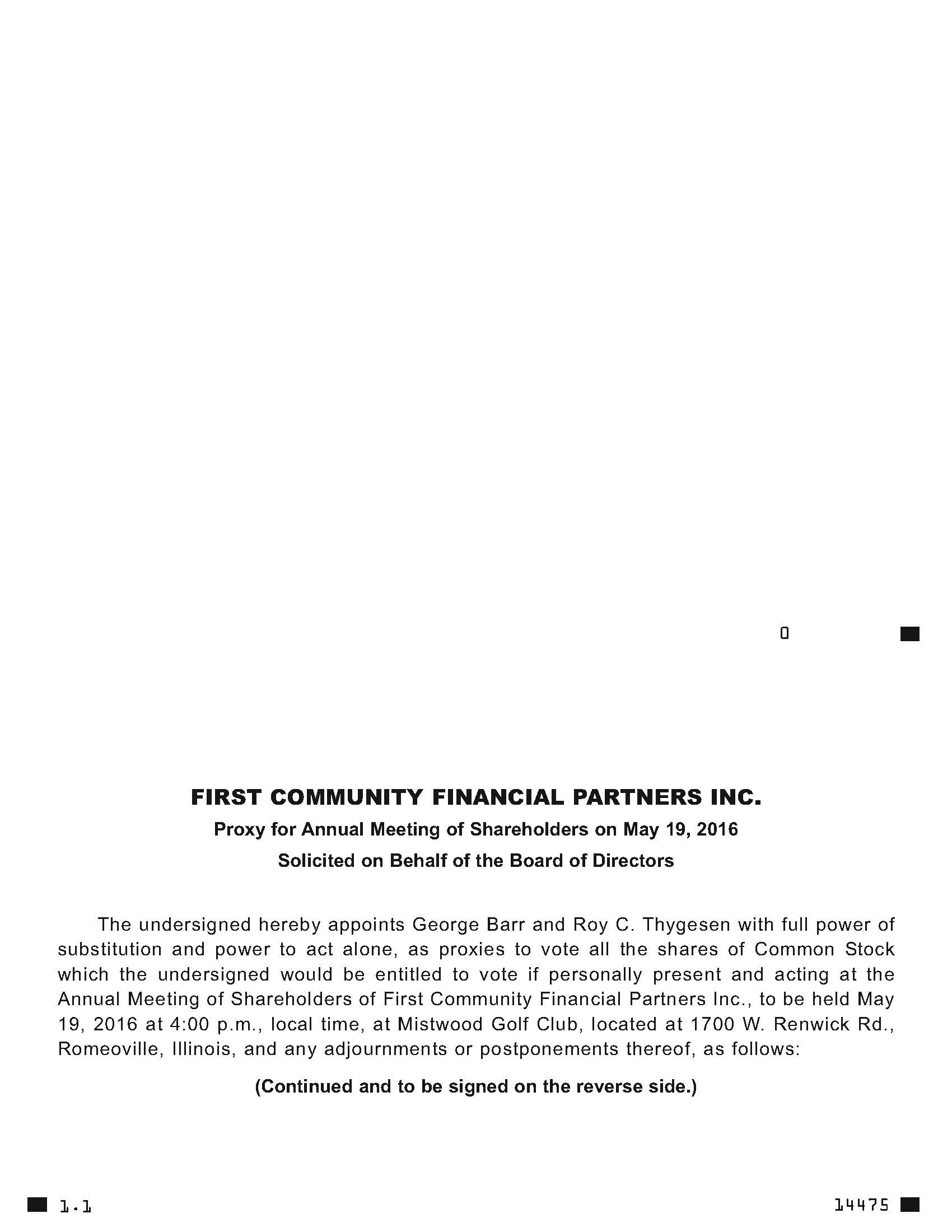

This proxy statement is furnished in connection with the solicitation by the board of directors of First Community Financial Partners, Inc. (the “Company” or “First Community”) of proxies to be voted at the annual meeting of shareholders to be held at Mistwood Golf Club, 1700 W. Renwick Road, Romeoville, Illinois, on Thursday, May 19, 2016, at 4:00 p.m. local time, or at any adjournments or postponements of the meeting. This proxy statement and the accompanying form of proxy are first being transmitted or delivered to shareholders of the Company on or about April 8, 2016.

The Company, an Illinois corporation, was formed as a bank holding company in 2006 to focus on organizing de novo banks. On March 12, 2013, the Company completed a series of merger transactions to consolidate its four banking subsidiaries (the “Consolidation”). As a result of the Consolidation, the Company currently has one wholly owned banking subsidiary, First Community Financial Bank (the “Bank”), with locations in Joliet, Plainfield, Homer Glen, Channahon, Naperville and Burr Ridge, Illinois. With assets of $1.0 billion as of December 31, 2015, the Bank offers a broad range of products, services and resources while maintaining its commitment to and active involvement in the communities it serves.

The Company is required to file annual, quarterly and current reports and other information with the Securities and Exchange Commission (the “SEC”). You may read and copy this information at the SEC’s Public Reference Room located at 100 F Street N.E., Room 1580, Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet website that contains periodic and current reports and other information about issuers, like the Company, that file electronically with the SEC. The address of that site is www.sec.gov.

QUESTIONS AND ANSWERS

The following is information regarding the annual meeting and the voting process, presented in a question and answer format.

Why am I receiving this proxy statement and proxy form?

You are receiving a proxy statement and proxy form from us because on March 22, 2016, the record date for the annual meeting, you owned shares of the Company’s common stock. This proxy statement describes the matters that will be presented for consideration by the shareholders at the annual meeting. It also gives you information concerning these matters to assist you in making an informed decision.

When you sign and return the enclosed proxy form or vote by internet or telephone, you appoint the proxy holder as your representative at the meeting. The proxy holder will vote your shares as you have instructed, which ensures that your shares will be voted whether or not you attend the meeting. Even if you plan to attend the meeting, you should complete, sign and return your proxy form, or vote by internet or telephone, in advance of the meeting just in case your plans change.

If you have signed and returned the proxy form,or voted by internet or telephone, and an issue comes up for a vote at the meeting that is not identified on the form, the proxy holder will vote your shares, pursuant to your proxy, in accordance with his judgment.

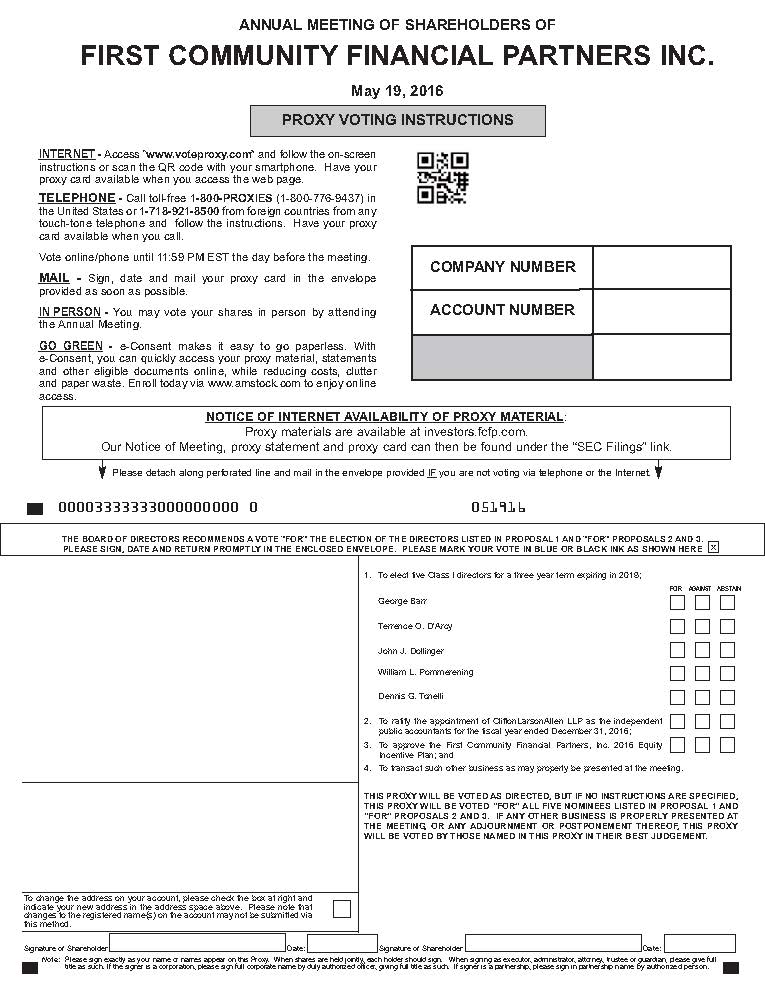

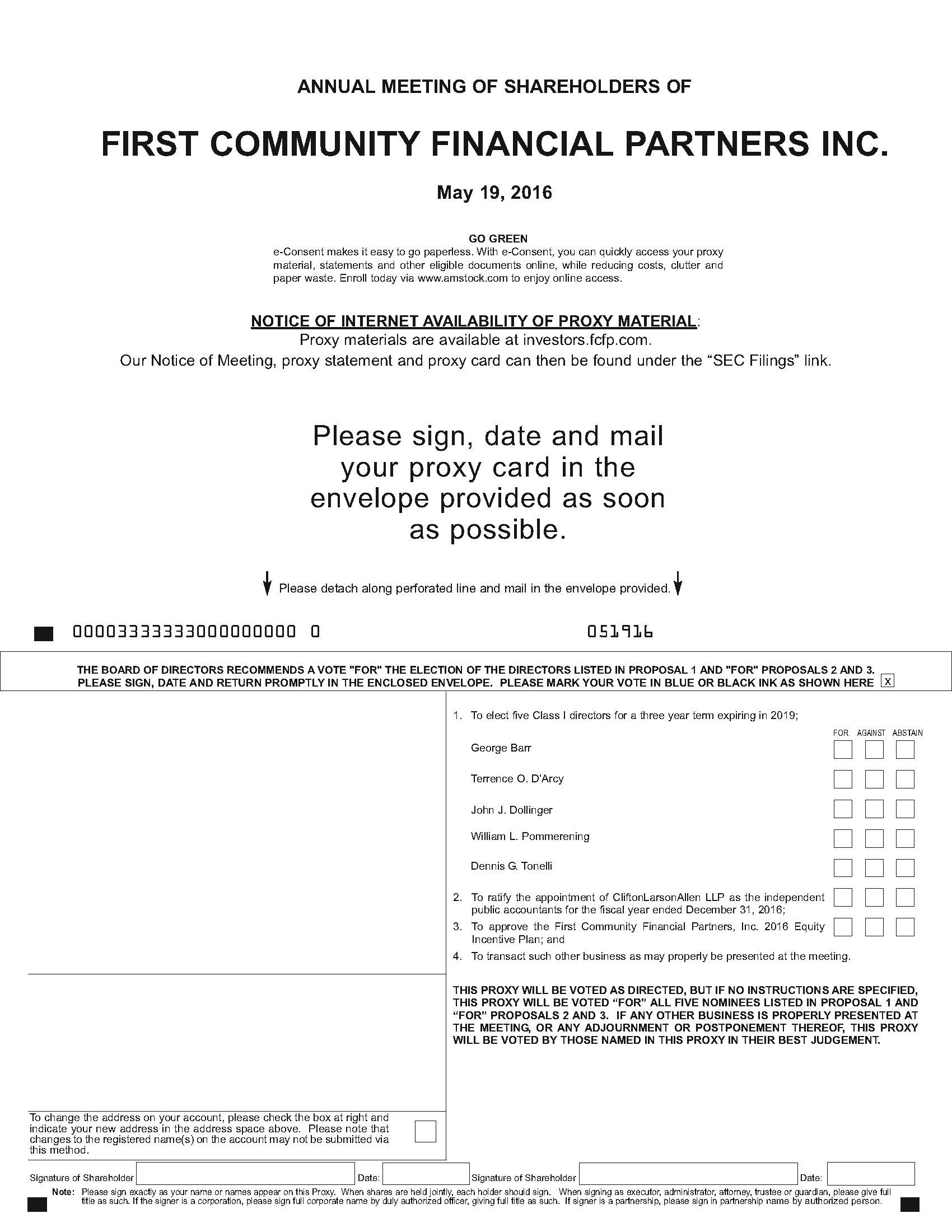

What matters will be voted on at the meeting?

You are being asked to vote on the election of five Class I directors of the Company for a term expiring in 2019, to ratify the appointment of CliftonLarsonAllen LLP as our independent public accountants for the 2016 fiscal year, and to approve the First Community Financial Partners, Inc. 2016 Equity Incentive Plan (the “2016 Equity Incentive Plan”). Any matters that will be voted on at the meeting are fully described in this proxy statement.

If I am the record holder of my shares, how do I vote?

You may vote by mail, by telephone, by internet or in person at the meeting. To vote by mail, complete and sign the enclosed proxy card and mail it in the enclosed pre-addressed envelope. No postage is required if mailed in the United States. If you mark your proxy card to indicate how you want your shares voted, your shares will be voted as you instruct.

If you sign and return your proxy card but do not mark the card to provide voting instructions, the shares represented by your proxy card will be voted “for” all

nominees named in this proxy statement, “for” the ratification of the appointment of CliftonLarsonAllen LLP as our independent public accountants for the 2016 fiscal year, and “for” the 2016 Equity Incentive Plan.

Although you may vote by mail, we ask that you vote instead by internet or telephone, which saves us postage and processing costs. You may vote by telephone by calling the toll-free number specified on your proxy card or by accessing the internet website specified on your proxy card and by following the preprinted instructions on the proxy card. If you submit your vote by internet, you may incur costs, such as cable, telephone and internet access charges. Votes submitted by telephone or internet must be received by 11:59 EST on Wednesday, May 18, 2016. The giving of a proxy by either of these means will not affect your right to vote in person if you decide to attend the meeting.

If you want to vote in person, please come to the meeting. We will distribute written ballots to anyone who wants to vote at the meeting. Please note, however, that if your shares are held in the name of a broker or other fiduciary (or in what is usually referred to as “street name”), you will need to arrange to obtain a legal proxy from that person or entity in order to vote in person at the meeting. Even if you plan to attend the meeting, you should complete, sign and return your proxy card, or vote by telephone or internet, in advance of the meeting just in case your plans change.

If I hold shares in the name of a broker or fiduciary, who votes my shares?

If you received this proxy statement from your broker or other fiduciary, your broker or fiduciary should have given you instructions for directing how that person or entity should vote your shares. It will then be your broker or fiduciary’s responsibility to vote your shares for you in the manner you direct. Please complete, execute and return the proxy card in the envelope provided by your broker.

Under the rules of various national and regional securities exchanges, brokers generally may vote on routine matters, such as the ratification of a company’s independent registered public accounting firm, but may not vote on non-routine matters unless they have received voting instructions from the person for whom they are holding shares. The election of directors and the approval of the 2016 Equity Incentive Plan are considered non-routine matters, and consequently, your broker will not have discretionary authority to vote your shares on those matters. If your broker or fiduciary does not receive instructions from you on how to vote on those matters, your broker or fiduciary will return the proxy card to us, indicating that he or she does not have the authority to vote. This is generally referred to as a “broker non-vote” and may affect the outcome of the voting on those matters.

We therefore encourage you to provide directions

to your broker as to how you want your shares voted on all matters to be brought before the annual meeting, including the election of directors and the approval of the 2016 Equity Incentive Plan. You should do this by carefully following the instructions your broker gives you concerning its procedures. This ensures that your shares will be voted at the meeting.

A number of banks and brokerage firms participate in a program that also permits shareholders to direct their vote by telephone or internet. If your shares are held in an account at such a bank or brokerage firm, you may vote your shares by telephone or internet by following the instructions on their enclosed voting form. If you submit your vote by internet, you may incur costs, such as cable, telephone and internet access charges. Voting your shares in this manner will not affect your right to vote in person if you decide to attend the meeting, however, you must first request a legal proxy from your broker or other fiduciary. Requesting a legal proxy prior to the deadline stated above will automatically cancel any voting directions you have previously given by internet or by telephone with respect to your shares.

What does it mean if I receive more than one proxy card?

It means that you have multiple holdings reflected in our stock transfer records or in accounts with brokers. To vote all of your shares by proxy, please follow the separate voting instructions you received for the shares of common stock held in each of your different accounts.

What if I change my mind after I return my proxy?

If you hold your shares in your own name, you may revoke your proxy and change your vote at any time before the polls close at the meeting. You may do this by:

| |

| • | signing another proxy with a later date and returning that proxy to First Community Financial Partners, Inc., 2801 Black Road, Joliet, Illinois 60435, Attention: Glen Stiteley; |

| |

| • | sending notice to us at the same address and attention above that you are revoking your proxy; |

| |

| • | timely submitting another proxy via the telephone or internet; or |

| |

| • | voting in person at the meeting. |

If you hold your shares in the name of your broker and desire to revoke your proxy, you will need to contact your broker to revoke your proxy.

How many votes do we need to hold the annual meeting?

A majority of the shares that are outstanding and entitled to vote as of the record date must be present in person or by proxy at the meeting for us to hold the meeting and conduct business.

Shares are counted as present at the meeting if the shareholder either:

| |

| • | is present and votes in person at the meeting; or |

| |

| • | has properly submitted a signed proxy form or other proxy. |

On March 22, 2016, the record date for this meeting, there were 17,165,864 shares of common stock issued and outstanding. Therefore, at least 8,582,933 shares need to be present in person or by proxy at the annual meeting in order to hold the meeting and conduct business.

What happens if a nominee is unable to stand for re-election?

The board may, by resolution, provide for a lesser number of directors or designate a substitute nominee. In the latter case, shares represented by proxies may be voted for a substitute nominee. You cannot vote for more than five nominees. The board has no reason to believe the nominees will be unable to stand for re-election.

How many votes may I cast?

Generally, you are entitled to cast one vote for each share of stock you owned on the record date.

How many votes are needed for each proposal?

To be elected as a director of the Company, each of the five director nominees must receive the affirmative vote of a majority of the shares present in person or by proxy at the meeting and entitled to vote. The ratification of the appointment of CliftonLarsonAllen LLP as our independent public accountants for the 2016 fiscal year, the approval of the 2016 Equity Incentive Plan and, in general, any other proposals, must also receive the affirmative vote of a majority of the shares present in person or by proxy at the meeting and entitled to vote.

Where do I find the voting results of the meeting?

On all matters, broker non-votes will not be counted as entitled to vote, but will count for purposes of determining whether or not a quorum is present. If available, we will announce voting results at the meeting. The voting results will also be disclosed on a Form 8-K that we will file with the SEC within four business days after the annual meeting.

Who bears the cost of soliciting proxies?

We will bear the cost of soliciting proxies. In addition to solicitations by mail, officers, directors or employees of the Company or one of its subsidiaries may solicit proxies in person or by telephone. These persons will not receive any special or additional compensation for soliciting proxies. We may reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to shareholders.

PROPOSAL 1: ELECTION OF DIRECTORS

The Company has a staggered board of directors divided into three classes. One class is elected annually to serve for three years. At the annual meeting of shareholders on May 19, 2016, five Class I directors will be elected for a term of three years or until their respective successors are elected and qualified. Currently, the Company has 16 directors serving on its board, with one vacancy, for a total of 17 director seats. The board is currently assessing whether it will consider candidates to fill the vacancy or eliminate such vacancy by resolving to reduce the size of the board.

The proxy provides instructions for voting on the director nominees. Unless instructed to the contrary, the persons acting under your proxy will vote for all of the nominees listed below. If, however, any nominee becomes unable to serve, which is not now contemplated, the proxy holders reserve the right to vote at the meeting for a substitute nominee.

Information About Directors and Nominees

The following table contains certain information with respect to the nominees for election and for each of the Company’s continuing directors, including the age, year first elected as a director and the positions held by the person with the Company. The nominees, if elected at the annual meeting, will serve as directors for a three-year term expiring in 2019. The board of directors recommends that you vote your shares “FOR” all five nominees.

|

| | |

Nominees:

| | |

| Name | Served as Company Director Since | Title |

| Class I Term Expires in 2019 | |

George Barr (Age 61) | 2006 | Director and Chairman of the Board |

Terrence O. D’Arcy (Age 60) | 2006 | Director |

| John Dollinger (Age 59) | 2006 | Director |

William L. Pommerening (Age 63) | 2008 | Director |

Dennis G. Tonelli (Age 69) | 2008 | Director |

| | | |

| Continuing Directors: | | |

| Name | Served as Company Director Since | Title |

| Class II New Term Will Expire in 2017 | |

| Peter Coules, Jr. (Age 54) | 2013 | Director |

| Rex D. Easton (Age 64) | 2006 | Director |

| Vincent E. Jackson (Age 53) | 2013 | Director |

| Patricia L. Lambrecht (Age 65) | 2006 | Director |

| Roy C. Thygesen (Age 58) | 2013 | Chief Executive Officer and Director |

| Scott A. Wehrli (Age 47) | 2008 | Director |

|

| | |

| Name | Served as Company Director Since | Title |

| Class III Term Will Expire in 2018 | |

Stephen G. Morrissette

(Age 54) | 2006 | Director |

Daniel Para

(Age 65) | 2013 | Director |

Michael F. Pauritsch

(Age 70) | 2008 | Director |

Patrick J. Roe

(Age 58) | 2011 | President, Chief Operating Officer and Director |

Robert L. Sohol

(Age 63) | 2006 | Director |

Board of Directors

The business experience of each of the nominees and continuing directors for the past five years, as well as their qualifications to serve on the board, are as follows:

George Barr. Mr. Barr has been a director and the chairman of the board of directors of First Community since 2006. He has also served as a director of the Bank since 2013. From 2004 to 2013, he served as a director and the chairman of the board of directors of First Community Bank of Joliet (“FCB Joliet”), a wholly owned subsidiary of First Community prior to the Consolidation. Mr. Barr also was a director of Burr Ridge Bank and Trust (“Burr Ridge”), of which First Community was a shareholder prior to the Consolidation, from 2009 to 2013. Since 1987, Mr. Barr has been an attorney at the law firm of George Barr & Associates, located in Joliet, Illinois. Since 1990, Mr. Barr has been the president and owner of The Barr Group, P.C., also located in Joliet, Illinois, a real estate management and development company. We believe that Mr. Barr’s significant legal and business experience provides much insight to the board of directors. Mr. Barr’s involvement with numerous local commercial, industrial, apartment, residential and entertainment real estate development projects provide him and the board of directors with a detailed knowledge of the real estate markets in the areas in which First Community and the First Community Financial Bank operate and provide loans. His in depth knowledge of First Community and First Community Financial Bank also provides the board of directors of First Community with source of historical knowledge of our business.

Peter Coules, Jr. Mr. Coules has been a director of First Community since 2013. From 2008 to 2013, Mr. Coules served as a director and the vice-chairman of the board of directors of First Community Bank of Homer Glen & Lockport (“FCB Homer Glen”), of which First Community was a shareholder prior to the Consolidation. Since December 1994, Mr. Coules has been an attorney, officer and shareholder of Donatelli & Coules, Ltd., a law firm located in Hinsdale, Illinois. We believe that Mr. Coules’ experience with FCB Homer Glen while serving on its board of directors provides the board of directors of First Community with additional insight into our business’ banking market and operations. Additionally, we believe that the board of directors benefits from Mr. Coules’ legal experience in the areas of borrowing and bonding. Mr. Coules also has extensive ties to the local community, including serving as a trustee for the Village of Lemont, Illinois from 2002 through 2010.

Terrence O. D’Arcy. Mr. D’Arcy has been on the board of directors of First Community since 2006. From 2004 to 2013, he was on the board of directors of FCB Joliet, a wholly owned subsidiary of First Community prior to the Consolidation, and from 2008 to 2013, he was on the board of directors of First Community Bank of Plainfield (“FCB Plainfield”), which is now known as First Community Financial Bank. Since 1991, Mr. D’Arcy has been the owner and operator of automobile dealerships located in Joliet, Illinois. He currently operates three dealerships which sell Buick, Cadillac, Chevy, GMC, and Hyundai vehicles and provide parts and services for customers. From 2000 through 2009, Mr. D’Arcy was a director of the Chicago Automobile Trade Association. We believe that Mr. D’Arcy’s involvement in the local community provides the board of directors with insights into the business markets in which First Community and the Bank operate, and that his business and leadership experience provides the board with keen judgment on issues relating to our local business community. The board also benefits from Mr. D’Arcy’s extensive historical knowledge of First Community and our banking market.

John J. Dollinger. Mr. Dollinger has been on the board of directors of First Community since 2006. From 2004 to 2013, he was on the board of directors of FCB Joliet, a wholly owned subsidiary of First Community prior to the Consolidation. Since 1977, Mr. Dollinger has been a self-employed farmer in Channahon, Illinois. Mr. Dollinger also manages

his family businesses. We believe that Mr. Dollinger’s knowledge of the local farming community and farm real estate matters, and his performance as a local businessman, provide the board of directors with insights into the local community and a knowledge base on local farming related matters.

Rex D. Easton. Mr. Easton has been on the board of directors of First Community since 2006. From 2004 to 2013, he served as a director of FCB Joliet, a wholly owned subsidiary of First Community prior to the Consolidation. Mr. Easton also was a director of Burr Ridge, of which First Community was a shareholder prior to the Consolidation, from 2009 to 2013. Since 1994 Mr. Easton has been the majority owner Packard Transport, Inc. and Packard Transport Management, Inc., located in Channahon, Illinois, which provide equipment to transport machinery, building materials and other products nationwide. Mr. Easton also has experience serving on the board of directors of a community bank located in Channahon, Illinois during the 1980s to early 1990s, and working as a teller, auditor and installment loan officer in a community bank located in Joliet, Illinois during the late 1960s and 1970s. We believe that Mr. Easton’s experience as a businessman in our local communities and his extensive background in local community banking provide the board of directors with an important source of banking expertise.

Vincent E. Jackson. Mr. Jackson has been a director of First Community since 2013. Mr. Jackson also served as a director of Burr Ridge, of which First Community was a shareholder prior to the Consolidation, from 2009 to 2013. Since 1991, Mr. Jackson has been the president of Bo Jackson Enterprises, a celebrity endorsement and promotion company. Additionally, since 2007, Mr. Jackson has served as chief executive officer of Bo Jackson Elite Sports, which provides sports training facilities in the Chicago area. From 2001 to 2008, he was an officer of N’Genuity Enterprise, a food broker and supplier of protein products to commissaries worldwide. We believe that Mr. Jackson’s experience with Burr Ridge, gained while serving on its board of directors, provides the board of directors of First Community with additional insight into the Bank’s Burr Ridge banking market and operations. Additionally, we believe that the board of directors benefits from Mr. Jackson’s extensive business experience as an entrepreneur invested in the local community.

Patricia L. Lambrecht. Ms. Lambrecht has served on the board of directors of First Community since 2006. From 2004 to 2013, she served as a director of FCB Joliet, a wholly owned subsidiary of First Community prior to the Consolidation. From 2008 to 2013, she also served as a director of FCB Homer Glen, of which First Community was a shareholder prior to the Consolidation. Since 2003, Ms. Lambrecht has been on the board of directors of T. J. Lambrecht Construction, Inc., a heavy civil contractor headquartered in Joliet, Illinois with a special expertise in earthmoving, underground and project management. We believe Ms. Lambrecht’s position as a local business leader and her long time involvement with First Community provide First Community with insights into our local economy and businesses coupled with a deep understanding of our business.

Stephen G. Morrissette. Mr. Morrissette has served on the board of directors of First Community since 2006. From 2004 to 2013, he served as a director of FCB Joliet, a wholly owned subsidiary of First Community prior to the Consolidation. He also served on the boards of directors of three banks of which First Community was a majority shareholder prior to the Consolidation: FCB Homer Glen (serving from 2008 to 2013), FCB Plainfield, now known as First Community Financial Bank (serving from 2008 to 2013) and Burr Ridge (serving from 2009 to 2013). From 2004 to 2009, Mr. Morrissette was the chief executive officer of each of First Community and FCB Joliet. Prior to that, he was a professor of finance at the University of St. Francis, located in Joliet, Illinois, from 1994 to 2004. In 2010, he returned to his professor of finance position at the University of St. Francis and became an adjunct professor of strategy at the University of Chicago’s Booth School of Business. He continues to serve in those capacities today. Additionally, in 2011, Mr. Morrissette became a managing director of Providence Advisors, a strategic planning and bank consulting business. We believe that Mr. Morrissette’s years of banking experience, which includes executive leadership positions and extensive consulting experience with local community banks, is a tremendous asset to the board. Moreover, Mr. Morrissette’s educational background, including a Ph.D. and MBA in finance and strategy, and his teaching experience, contribute to the board a deep knowledge of corporate finance.

Daniel Para. Mr. Para has been a director of First Community since 2013. From 2009 to 2013, he also served as a director of Burr Ridge, of which First Community was a shareholder prior to the Consolidation. Until 2009, Mr. Para served as the chief executive officer of Concert Group Logistics, a company he founded in 2001 and sold to XPO Logistics, Inc. (NYSE: XPO, formerly Express-1 Expedited Solutions) in 2008. He served on the board of directors of this public company until 2012 where he also headed the mergers and acquisitions committee of the board. We believe that Mr. Para’s experience with public company acquisitions and his past board service contribute valuable skills to the First Community board. The board also benefits from his experience with growing existing companies and overseeing matters related to that growth.

Michael F. Pauritsch. Mr. Pauritsch has been on the board of directors of First Community since 2008. The board of directors has determined he is an “audit committee financial expert” within the meaning of SEC regulations. From 2009 to 2013, he also served as the chairman of the board of directors of Burr Ridge, of which First Community was a shareholder prior to the Consolidation. Since 1976, Mr. Pauritsch has been a partner at Mulcahy, Pauritsch, Salvador & Co., Ltd, an accounting

firm. Since 1999, Mr. Pauritsch has served on the business development committees of each of MPS Loria Financial Partners LLC, an investment firm, and Loria Financial Group, LLC, a broker/dealer. We believe that Mr. Pauritsch’s extensive accounting background, including many years of experience as a Certified Public Accountant for small and medium-sized businesses, provides the board of directors with valuable accounting and financial expertise. Moreover, Mr. Paurtisch provides the board with years of experience in the securities industry. Finally, Mr. Pauritsch’s prior service on the boards of First Community and Burr Ridge provides the board with significant historical knowledge.

William L. Pommerening. Mr. Pommerening has served on the board of directors of First Community since 2008. From 2008 to 2013, he was also on the board of directors of FCB Plainfield, which is now known as First Community Financial Bank, including serving as its chairman. For 26 years, Mr. Pommerening served as President of Valley Concrete, Inc., a concrete production company. We believe that Mr. Pommerening’s experience as a business owner in our local communities offers the board valuable insight and his service on the boards of directors of First Community and FCB Plainfield provides the board with significant historical knowledge.

Patrick J. Roe. Mr. Roe has served as a director of First Community since 2011. From 2011 to 2013, Mr. Roe served as First Community’s president and chief executive officer and, since 2013, has served as First Community’s president and chief operating officer. He has also served as the president and a director of the Bank since 2013. From 2010 to 2013, he has served as served as the president and chief executive officer, and as a director, of FCB Homer Glen, of which First Community was a shareholder prior to the Consolidation, and from 2011 to 2013, served as a director of FCB Joliet, a wholly owned subsidiary of First Community prior to the Consolidation. From February 2008 through March 2009, Mr. Roe served as senior vice president of Old Second National Bank, a community banking institution. From 1984 through 2008, he was employed by Heritage Bank, also a community banking institution. He served as president, chief operating officer and director of Heritage Bank from 1996 through 2008. Mr. Roe also served as the president, chief operating officer and a director of HeritageBanc, Inc., a bank holding company and parent of Heritage Bank. We believe that Mr. Roe’s extensive community banking experience, including prior to his work with First Community, where his responsibilities are substantially similar to the work performed for his prior employers, provides First Community and its board of directors with a wide array of expertise and vast experience in community banking. Mr. Roe’s significant qualifications in many facets of commercial banking, including with respect to lending, deposits, lending operations and accounting, also benefit First Community and the board of directors.

Robert L. Sohol. Mr. Sohol has served on the board of directors of First Community since 2006. From 2004 to 2013, he served as a director of FCB Joliet, a wholly owned subsidiary of First Community prior to the Consolidation. From 2008 to 2013, Mr. Sohol also served on the board of director of FCB Plainfield, now known as First Community Financial Bank. Since 1983, Mr. Sohol has served as chief executive officer of two construction companies, RL Sohol Carpenter Contractor Inc. and RL Sohol General Contractor Inc. Since 1987, he has been a partner in Phase III, a real estate and development company, and since 1997, he has been the chief executive officer of American Built Systems Inc., a manufacturing company. We believe that Mr. Sohol’s extensive executive experience, including experience with being primarily responsible for the creation of financial statements and responding to tax audits, benefits the board. Additionally, Mr. Sohol’s longstanding service on the boards of directors of First Community and its banking affiliates provide the board with valuable institutional knowledge.

Roy C. Thygesen. Mr. Thygesen has been a director of First Community since 2013. Since 2013, he has also served as the chief executive officer of First Community, and the chief executive officer and a director of the Bank. From 2009 to 2013, Mr. Thygesen was the president and chief executive officer, and a director, of Burr Ridge, of which First Community was a shareholder prior to the Consolidation. From 1993 to 2007, Mr. Thygesen served as regional president of a predecessor to BMO Harris Bank, a banking institution, as well as chief executive officer, president, and a director of several of that organization’s wholly owned community bank subsidiaries. Mr. Thygesen possesses a material amount of experience and knowledge in the community banking market in which First Community operates, and his responsibilities at his job prior to commencing work at Burr Ridge, and prior to his appointment to officer positions at First Community and the Bank, provide Mr. Thygesen with a substantial level expertise in the banking markets of First Community in the areas of banking business development, commercial lending, cash management and relationship management. We believe that Mr. Thygesen’s continuing expertise in community banking within our local markets, including his knowledge of and experience with Burr Ridge, benefits the board of directors of First Community.

Dennis G. Tonelli. Mr. Tonelli has served on the board of directors of First Community since 2008. From 2008 to 2013, he was a director and chairman of the board of FCB Homer Glen, of which First Community was a shareholder prior to the Consolidation. From 1981 to 2011, Mr. Tonelli was a director and vice president of Ruettiger Tonelli & Assoc., a land survey and civil engineering firm that he co-founded. His experience also includes being a director of Three Rivers Manufacturers Association from 1985 to 1988, and a director of the Joliet Chamber of Commerce from 1995 to 2000. From 1997 to 2009, and from 2010 to 2015, Mr. Tonelli served as a trustee of Lewis University, located in Romeoville, Illinois. We believe that Mr. Tonelli’s experience being a local business owner, his deep knowledge of the local community and his service

as a director of several diverse organizations, including First Community and FCB Homer Glen, provides the board with a unique viewpoint and skillset.

Scott A. Wehrli. Mr. Wehrli has been on the board of directors of First Community since 2008. From 2008 to 2013, he was a director of FCB Plainfield, now known as First Community Financial Bank. Since 1997, Mr. Wehrli has served as secretary and treasurer of DuKane Precast, Inc., a Naperville, Illinois producer of pre-stressed, pre-cast concrete wall panels, columns, beams and parking deck components. Mr. Wehrli became a partner of DuKane Precast in 2005, and he also serves as vice president of Naperville Excavating, an excavating company, overseeing its administrative and legal matters. Mr. Wehrli is also active in the communities of Naperville, Illinois and its surrounding areas, including serving presently, and in the past, on numerous city commissions and community groups. We believe that Mr. Wehrli’s service on the board of directors of First Community, and his prior service on the board of directors of FCB Plainfield, has provided him with valuable knowledge of the banking industry. Additionally, Mr. Wehrli’s service with local companies and community focused groups has given him an understanding of corporate governance matters and local issues that are relevant to the board.

Executive Officers

In addition to Mr. Thygesen, our chief executive officer, and Mr. Roe, our president and chief operating officer, the following individual is an executive officer of First Community:

Glen L. Stiteley. Mr. Stiteley, age 45, is the executive vice president and chief financial officer of First Community and the Bank. From 2005 to 2013, he served as the senior vice president and chief financial officer of First Community and FCB Joliet. Mr. Stiteley’s skills have assisted First Community as it has grown in size and operations since 2005. Prior to 2005, Mr. Stiteley was a practice leader for the Chicago-based community bank practice of McGladrey & Pullen, LLP (now known as RSM US LLP) and was with the firm from 1995 to 2005. His community bank clients ranged in size from de novo institutions to institutions with $5 billion in assets, including a number of SEC registrants.

CORPORATE GOVERNANCE AND THE BOARD OF DIRECTORS

General

Generally, the board oversees our business and monitors the performance of our management and does not involve itself in our day-to-day operations, which are monitored by our executive officers and management. Our directors fulfill their duties and responsibilities by attending regular meetings of the board, which are held on a monthly basis, and through committee membership.

In 2015, a total of 12 regularly scheduled meetings were held by the board of directors of the Company. All incumbent directors attended at least 75 percent of the meetings of the board and the committees on which they served in 2015 except for Patricia Lambrecht and Vincent Jackson. Although we do not have a formal policy regarding director attendance at the annual meeting, we encourage our directors to attend. Last year, all of our directors were present at the annual meeting.

Director Independence

The board of directors has concluded that except for Messrs. Roe and Thygesen, who also serve as our executive officers, the members of the board of directors satisfy the independence requirements under the NASDAQ listing standards. Our board of directors has undertaken a review of its composition, the composition of its committees, and the independence of each director. Based upon information requested from and provided by each director concerning his or her background, employment, and affiliations, including family relationships, our board of directors has determined that Messrs. Barr, Coules, D’Arcy, Dollinger, Easton, Jackson, Morrissette, Para, Pauritsch, Pommerening, Sohol, Tonelli and Wehrli and Ms. Lambrecht, do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the applicable rules and regulations of the SEC and the NASDAQ listing standards. Accordingly, a majority of our directors are independent, as required under applicable NASDAQ listing standards.

Board Leadership Structure

We keep the positions of Chairman of the Board and Chief Executive Officer separate at the Company. Currently, Mr. Barr, who is an independent director under the NASDAQ listing standards, holds the position of Chairman of the Board, and Mr. Thygesen holds the position of Chief Executive Officer. We believe that this structure provides for an appropriate balance of authority between management and the board of directors and demonstrates our commitment to good corporate governance.

Audit Committee

In 2015, the Company’s audit committee consisted of directors Pauritsch, Dollinger and Sohol, each of whom satisfies the independence requirements under the NASDAQ listing standards, Rule 10A-3(b)(1) of Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the regulations of the Federal Deposit Insurance Corporation. The chairperson of the Audit Committee is Mr. Pauritsch, whom our board of directors has determined is an “audit committee financial expert” within the meaning of SEC regulations. The board based this decision on Mr. Pauritsch’s educational and professional experience. Each member of our audit committee can read and understand fundamental financial statements in accordance with audit committee requirements. In arriving at this determination, the board has examined each audit committee member’s scope of experience and the nature of their employment.

The functions performed by the Audit Committee include but are not limited to:

| |

| • | selecting the Company’s independent auditors and pre-approving engagements and fee arrangements; |

| |

| • | reviewing the independence of the independent auditors; |

| |

| • | overseeing the work of the Company’s independent auditors; |

| |

| • | reviewing the integrity of the Company’s financial reporting processes, both internal and external; and |

| |

| • | meeting with management, the internal auditors and the independent auditors to review the effectiveness of internal controls and internal audit procedures. |

To promote independence of the audit function, the Audit Committee consults separately and jointly with the independent auditors, the internal auditors and management. The Audit Committee has adopted a written charter, which sets forth the duties and responsibilities. The current charter of the Audit Committee is available on the Company’s website at http://investors.fcfp.com/govdocs. The Audit Committee met seven times during 2015.

Compensation Committee

In 2015, the Company’s Compensation Committee consisted of directors Barr, Easton, Para and Wehrli, each of whom the board of directors has determined to be independent under the NASDAQ listing standards, “outside” as defined in Section 162(m) of the Internal Revenue Code of 1986 (the “Code”), and a “non-employee” as defined in Section 16 of the Exchange Act. The chairperson of our Compensation Committee is Mr. Wehrli. The purpose of the Compensation Committee is to determine the compensation to be paid to the Company’s executive officers.

The Compensation Committee reviews the executive officers’ performance in light of the Company’s goals and objectives relevant to executive compensation. The Compensation Committee relies on Mr. Thygesen to provide it with evaluations as to employee performance, guidance on establishing performance targets and objectives, and recommendations with respect to other compensation programs. The Compensation Committee also reviews and recommends to the board for approval other incentive compensation and equity compensation plans for the Company. The responsibilities and functions are further described in its charter, which is available on our website at investors.fcfp.com/govdocs. The Compensation Committee met six times during 2015.

Nominations Committee

In 2015, the Company’s Nominations Committee consisted of directors Jackson, Pommerening and Sohol, each of whom the board of directors has determined to be independent under the NASDAQ listing standards. The chairperson of our Nominations Committee is Mr. Sohol. The primary purposes of the Nominations Committee are to identify and recommend individuals to be presented to our shareholders for election or re-election to the board of directors and to review and monitor our policies and procedures as they relate to corporate governance. The responsibilities and functions are further described in the Nominations Committee’s charter, which is available on our website at investors.fcfp.com/govdocs. The Nominations Committee met one time during 2015.

Director Nominations and Qualifications

The Nominations Committee identifies nominees by first evaluating the current members of the board who are willing to continue in service. Current members of the board with skills and experience that are relevant to our business and who are willing to continue in service are considered for re-nomination. If any member of the board does not wish to continue in service or if the committee or the board decides not to re-nominate a member for re-election, the committee would identify the desired skills and experience of a new nominee in light of the criteria below.

The Nominations Committee reviews qualified candidates for directors and focuses on those who present varied, complementary backgrounds that emphasize both business experience and community standing. While we do not have a separate diversity policy, the committee does consider the diversity of our directors and nominees in terms of knowledge, experience, skills, expertise, and other demographics which may contribute to the board. The Nominations Committee also believes that directors should possess the highest personal and professional ethics.

The Nominations Committee has established the following minimum criteria, which it considers necessary for service on the board:

| |

| • | integrity and high ethical standards in the nominee’s professional life; |

| |

| • | sufficient educational and professional experience, business experience or comparable service on other boards of directors to qualify the nominee for service to the board; |

| |

| • | evidence of leadership and sound judgment in the nominee’s professional life; |

| |

| • | whether the nominee is well recognized in the community and has a demonstrated record of service to the community; |

| |

| • | a willingness to abide by any published Code of Ethics for the Company; and |

| |

| • | a willingness and ability to devote sufficient time to carrying out the duties and responsibilities required of a board member. |

For the annual meeting, the Nominations Committee nominated for re‑election to the board five incumbent directors whose term would otherwise expire in 2016. The Company did not receive any shareholder nominations for directorships for the annual meeting.

Board's Role in Risk Oversight

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. We face a number of risks, including general economic risks, credit risks, regulatory risks, audit risks, reputational risks and others, such as the impact of competition or risk-related behavior that may be affected by our compensation plans. Management is responsible for the day-to-day management of risks the Company faces, while the board, as a whole and through its committees, has responsibility for the oversight of risk management.

While the full board of directors is charged with ultimate oversight responsibility for risk management, various committees of the board and members of management also have responsibilities with respect to our risk oversight. In particular, the Audit Committee plays a large role in monitoring and assessing our financial, legal and organizational risks, and receives regular reports from the management team’s senior risk officers regarding comprehensive organizational risk as well as particular areas of concern. The board’s Compensation Committee monitors and assesses the various risks associated with compensation policies, and oversees incentive plans to ensure a reasonable and manageable level of risk-taking consistent with our overall strategy.

Code of Ethics

We have adopted a code of ethics that applies to all of our employees, officers, and directors, including those officers responsible for financial reporting. The code of ethics is available on our website at investors.fcfp.com/govdocs. We also will furnish copies of the code of ethics to any person without charge, upon written request. Requests for copies should be made in writing to First Community Financial Partners, Inc., 2801 Black Road, Joliet, Illinois 60435, Attention: Glen Stiteley.

Shareholder Communications with Directors

Shareholders of the Company may contact any member of the board of directors, or the board as a whole, through the Corporate Secretary either in person, in writing by mail or by e‑mail at 2801 Black Road, Joliet, Illinois, 60435, gstiteley@fcbankgroup.com. Any such communication should indicate whether the sender is a shareholder of the Company. Any communication will be forwarded promptly to the board as a group or to the attention of a specified director as requested, except for communications that are primarily commercial in nature or related to an improper or irrelevant topic.

Process for Shareholder Nominations of Directors

In order for a shareholder nominee to be considered by the Nominations Committee to be its nominee and included in our proxy statement, the nominating shareholder must file a written notice of the proposed director nomination with our Secretary, at the above address, at least 90 days, but no more than 120 days, prior to the anniversary of the previous year’s annual meeting. Any such shareholder notice of nomination must include (a) as to each person whom the shareholder proposes to nominate for election as a director: (i) the name, age, business address and residential address of such person; (ii) the principal occupation or employment of such person; (iii) the class and number of shares of the Company’s stock which are beneficially owned by such person on the date of such shareholder notice; and (iv) any other information relating to such person that would be required to be disclosed on Schedule 13D pursuant to Regulation 13D-G under the Exchange Act, in connection with the acquisition of stock, and pursuant to Regulation 14A under the Exchange Act, in connection with the solicitation of proxies with respect to nominees for election as directors, regardless of whether such person is subject to the provisions of such regulations, including, but not limited to, information required to be disclosed by Items 4(b) and 6 of Schedule 14A of Regulation 14A with the SEC; and (b) as to the shareholder giving the notice: (i) the name and address, as they appear on the Company’s books, of such shareholder and the name and principal business or residential address of any other beneficial shareholders known by such shareholder to support such nominees; and (ii) the class and number of shares of the Company stock which are beneficially owned by such shareholder on the date of such shareholder notice and the number of shares owned beneficially by any other record or beneficial shareholders known by such shareholder to be supporting such nominees on the date of such shareholder notice. The board of directors may reject any nomination by a shareholder not timely made in accordance with the foregoing requirements.

If the board of directors, or a committee designated by the board of directors, determines that the information provided in a shareholder’s notice does not satisfy the foregoing informational requirements in any material respect, the Secretary of the Company shall promptly notify such shareholder of the deficiency in the notice. The shareholder may cure the deficiency by providing additional information to the Secretary within such period of time, not less than 5 days from the date such deficiency notice is given to the shareholder. If the deficiency is not cured within such period, or if the board of directors or such committee determines that the additional information provided by the shareholder, together with information previously provided, does not satisfy the forgoing requirements in any material respect, then the board of directors may reject such

shareholder’s notice and the proposed nominations shall not be accepted if presented at the shareholder meeting to which the notice relates. The Secretary of the Company shall notify a shareholder in writing whether his or her nomination has been made in compliance with the foregoing time and informational requirements. Notwithstanding the forgoing, if neither the board of directors nor a committee designated by the board makes a determination as to the validity of any nominations by a shareholder, the presiding officer of the shareholder’s meeting shall determine and declare at the meeting whether or not a nomination was made in accordance with the foregoing requirements. If the presiding officer determines that a nomination was not made in accordance with the foregoing terms, such officer shall so declare at the meeting and the defective nomination shall not be accepted.

Other Shareholder Proposals

To be considered for inclusion in our proxy statement and form of proxy relating to our 2017 annual meeting of shareholders, the proposing shareholder must file a written notice of the proposal with our Corporate Secretary, at the above address, by December 10, 2016, and must otherwise comply with the rules and regulations set forth by the SEC.

PROPOSAL 2:

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

CliftonLarsonAllen LLP has served as our independent registered public accounting firm since July 2014, and our Audit Committee has selected CliftonLarsonAllen LLP to be our independent registered public accounting firm for the fiscal year ending December 31, 2016.

Although we are not required to do so, our board of directors recommends that the shareholders ratify the appointment. A representative of CliftonLarsonAllen LLP is not expected to attend the meeting. If the appointment of our independent registered public accounting firm is not ratified, the Audit Committee of the board of directors will reconsider the matter of the appointment. Our board of directors unanimously recommends that you vote to approve the ratification of this appointment by voting “FOR” this proposal.

Following is a summary of fees for professional services paid to CliftonLarsonAllen LLP.

Accountant Fees

During the period covering the fiscal years ended December 31, 2015 and 2014, CliftonLarsonAllen LLP performed the following professional services:

|

| | |

| | 2015 | 2014 |

Audit Fees (1) | $162,500 | $159,500 |

Audit-Related Fees | $0 | $0 |

Tax Fees(2) | $15,750 | $33,092 |

All Other Fees (3) | $0 | $8,414 |

| |

(1) | Audit fees consist of fees for professional services rendered for the audit of the Company’s financial statements, review of financial statements included in the Company’s quarterly reports on Form 10-Q, and review and assistance with other SEC filings. |

| |

(2) | Tax Fees consist of fees for the preparation of federal and state tax returns, tax planning and tax advice. |

| |

(3) | All other fees include fees incurred related to development of the Bank’s Business Continuity Plan. |

Audit Committee Approval Policy

Among other things, the Audit Committee is responsible for appointing, setting compensation for and overseeing the work of the independent auditor. The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by any audit, tax consulting or general business consulting firm with the exception of minor non-audit services. All of the fees earned by CliftonLarsonAllen LLP described above were attributable to services pre-approved by the Audit Committee.

EXECUTIVE COMPENSATION

The Compensation Committee has overall responsibility for evaluating the compensation plans, policies and programs relating to the executive officers of the Company. The Compensation Committee relies on the input of management, particularly Mr. Thygesen, when carrying out its responsibilities in establishing executive compensation. Management provides the committee with evaluations as to employee performance, guidance on establishing performance targets and objectives and recommends salary levels and equity awards. The committee also consults with management on matters that are related to executive compensation and benefit plans where board or shareholder action is expected, including the adoption of new plans or the amendment of existing plans. No executive officer participates in any recommendation or decision regarding his or her own compensation.

The Company maintains a comprehensive compensation program. The compensation program is designed to attract and retain key employees, motivate the key employees to achieve superior performance and reward them for doing so. The overall design of the compensation program strives to balance short- and long-term performance goals, with the ultimate goal being the increase of stockholder value over the long term. With respect to the individuals named in the Summary Compensation Table, the compensation program includes the following: salary, annual cash incentive bonus, long-term incentive compensation (which is delivered primarily through equity awards) and other benefits and perquisites. The executive compensation program is administered by the Compensation Committee.

Our executive compensation program consists of several elements, each with an objective that fits into our overall compensation program. The following overview explains the structure and rationale of the elements of compensation used for 2015.

Base Salary

Cash salaries are intended to be competitive with the market, and take into account the individual’s experience, performance, responsibilities, and past and potential contribution to the Company. The salaries are intended to offer each executive security and to allow the Company to maintain a stable management team and environment. The Compensation Committee reviews the salaries of the named executive officers on an annual basis with any adjustments made effective January 1st. The Compensation Committee uses its own judgment when determining the positioning of each executive’s salary compared to the competitive marketplace. Examples of the determining factors include the executive’s level of responsibility, prior experience, length of time with the Company, breadth of knowledge and internal performance. There is no specific weighting of the above-mentioned items.

Annual Cash Incentive Bonus

Annual cash incentive bonuses are an important piece of total compensation for our named executive officers as they support and encourage the achievement of our business goals and strategies by tying a meaningful portion of compensation to financial results for the year as compared to internal and external standards. The Compensation Committee believes the named executive officers should have a significant portion of their total compensation package at risk and available through an annual cash incentive program. However, maximum bonus opportunities are capped to avoid encouraging excessive risk-taking and to avoid any focus on maximizing short-term results at the expense of long-term soundness. Each executive has measurable goals that were established by the Compensation Committee at the beginning of 2015, and focus primarily on net income and other financial performance. Annual bonuses for named executive officers for 2015 were determined at the discretion of the Compensation Committee based on quantitative and qualitative analysis performed at the beginning of 2016. The quantitative metrics established by the Compensation Committee for 2015 and 2016 included core deposit growth, return on average assets, efficiency ratio, ratio of nonperforming assets to total assets, and net loan growth.

Long-Term Stock Incentives

Equity compensation is the other key element of compensation for our named executive officers. We use our current equity incentive plans, which authorizes various types of long-term incentive awards, to drive the creation of long-term value for our shareholders, attract and retain executives capable of effectively executing our business strategies and structure compensation to account for the time horizons of risks. Equity compensation supports the achievement of many of our key compensation objectives:

| |

| • | Tie pay to performance by linking compensation to shareholder value creation; |

| |

| • | Align executives’ interests with those of our shareholders; |

| |

| • | Attract executives, particularly those interested in building long-term value for our shareholders; and |

| |

| • | Retain executives and reward continued service by providing for the forfeiture of rewards prior to satisfaction of multi-year vesting periods. |

The quantitative metrics established by the Compensation Committee for long term incentives include growth in common book value per share, asset growth, return on average assets and the ratio of noninterest income to average assets.

Summary Compensation Table

The following table sets forth information regarding compensation in 2015 and 2014 for each of our named executive officers.

|

| | | | | | |

Name and Principal Position | Year | Salary ($)(1) | Bonus ($)(2) | Stock Awards ($) (3) | All Other Compensation ($)(4) | Total ($) |

Roy C. Thygesen, Chief Executive Officer | 2015 | $322,950 | $145,650 | $51,658 | $55,734 | $575,992 |

| | 2014 | 291,700 | 100,000 | — | 58,620 | 450,320 |

Patrick J. Roe, President and Chief Operating Officer | 2015 | 280,000 | 126,280 | 33,591 | 25,466 | 465,337 |

| | 2014 | 280,000 | 94,000 | — | 21,195 | 395,195 |

Glen L. Stiteley, Chief Financial Officer | 2015 | 194,000 | 95,448 | 78,275 | 23,397 | 391,120 |

| | 2014 | 183,188 | 52,000 | — | 17,741 | 252,929 |

|

| |

| (1) | Amounts reflect base salary earned in the year, before any deferrals at the officer’s election and including salary increases effective during the year, if any. For 2016, salaries for Messrs. Thygesen, Roe and Stiteley will be $355,000, $290,000 and $225,000, respectively. |

| (2) | Amounts reflect discretionary annual bonuses earned by the officers. The 2015 bonus amounts for all of our named executive officers, as well as Mr. Stiteley’s 2014 bonus, were paid in cash. Messrs. Thygesen and Roe received approximately 50% of their 2014 bonus amounts in restricted stock units which vested on February 19, 2015, with the remainder paid in cash. |

| (3) | Reflects the grant date fair value of restricted stock unit awards computed in accordance with FASB ASC Topic 718. The above amounts include performance based restricted stock units based on the probable outcome of the performance conditions on the date of grant of $51,658, $33,591 and $23,275 for Messrs. Thygesen, Roe and Stiteley, respectively. At maximum outcome, the value of these awards would equal $92,538, $60,173 and $41,691 for Messrs. Thygesen, Roe and Stiteley, respectively. The performance based restricted stock units vest based on the attainment of performance criteria on each of December 31, 2015, 2016 and 2017. In addition, Mr. Stiteley was granted time based restricted stock units with a grant date fair value of $55,000 which vest in equal increments on April 16, 2016, 2017 and 2018. For a discussion of valuation assumptions, please see Note 10 to the Consolidated Financial Statements in the Form 10-K for the year ended December 31, 2015. |

| (4) | All other compensation includes the following: |

|

| | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | Year | 401(k) Match | Automobile Allowance | Personal Use Company-Owned Automobile | Supplemental Life Insurance | Split Dollar Life Insurance Policy | Personal Expense Allowance | Total ($) |

Roy C. Thygesen, Chief Executive Officer | 2015 | $ | 15,900 |

| $ | 6,000 |

| $ | 2,068 |

| $ | 10,800 |

| $ | 566 |

| $ | 20,400 |

| $55,734 |

Patrick J. Roe, President and Chief Operating Officer | 2015 | 15,900 |

| 9,000 |

| — |

| — |

| 566 |

| — |

| 25,466 |

Glen L. Stiteley, Chief Financial Officer | 2015 | 14,282 |

| 9,000 |

| — |

| — |

| 115 |

| — |

| 23,397 |

Employment Agreements

Terms of Mr. Thygesen’s Employment Agreement

Mr. Thygesen is subject to an employment agreement with the Company and the Bank, which became effective March 12, 2013 and was subsequently amended. Mr. Thygesen serves as the chief executive officer of the Company and the Bank under the employment agreement. The agreement had an initial term of one year, with automatic one-year renewal terms unless either party gives notice of non-renewal no later than 90 days prior to the expiration of the then current term. Mr. Thygesen is entitled to a minimum annual salary pursuant to the agreement (which is subject to annual review for increase, but not decrease), as well as annual performance bonuses, a monthly automobile allowance of $500, a monthly general expense allowance of $1,700, a monthly life insurance allowance of $900, and participation in the Bank’s benefit plans. In April 2016, Mr. Thygesen’s employment agreement was amended to no longer provide his monthly general expense and life insurance allowances effective January 1, 2016.

Under the agreement, upon a termination of Mr. Thygesen’s employment by the employer without cause or by Mr. Thygesen for good reason, Mr. Thygesen will be entitled to severance payments equal to the sum of i) 100% of his base salary, plus ii) the average annual bonus for the last 3 completed fiscal years, payable in 24 equal semi-monthly installments following the date of termination (or in a lump sum if the termination occurs within six months before or two years following a change in control), as well as one year of continued medical coverage at the same rates offered to current employees. Further under the agreement, in the event of a termination of his employment due to his disability, Mr. Thygesen will be entitled to a lump sum payment equal to 100% of his annual base salary, as well as one year of continued medical coverage and disability and life insurance coverage at the same rates offered to current employees. In the event of his death, Mr. Thygesen’s beneficiaries will be entitled to a lump sum payment equal to 50% of his annual base salary, as well as one year of employer-paid medical coverage. All of the aforementioned severance benefits are contingent upon Mr. Thygesen’s (or his beneficiaries’, if applicable) execution of a general release of claims. Mr. Thygesen’s agreement also provides that if any payments or benefits would be subject to an excise tax under Section 280G of the Internal Revenue Code, the payments or benefits may be reduced to the largest portion payable that would result in no such excise tax if that amount would result in a better net after-tax result to Mr. Thygesen than if there were no such reduction of payments or benefits. Under the agreement, Mr. Thygesen will be subject to one-year non-solicit restrictive covenants of employees and customers following the termination of his employment.

Terms of Mr. Roe’s Employment Agreement

Mr. Roe is subject to an employment agreement with the Company and the Bank, which became effective March 12, 2013 and was subsequently amended. Mr. Roe serves as the president and chief operating officer of the Company and the Bank under the employment agreement. The agreement had an initial term of one year, with automatic one-year renewal terms unless either party gives notice of non-renewal no later than 90 days prior to the expiration of the then current term. Mr. Roe is entitled to a minimum annual salary pursuant to the agreement (which is subject to annual review for increase, but not decrease), as well as annual performance bonuses, a monthly automobile allowance of $750, and participation in First Community Financial Bank’s benefit plans.

Under the agreement, upon a termination of Mr. Roe’s employment by the employer without cause or by Mr. Roe for good reason, Mr. Roe will be entitled to severance payments equal to the sum of i)100% of his base salary, plus ii) the average annual bonus for the last 3 completed fiscal years, payable in 24 equal semi-monthly installments following the date of termination (or in a lump sum if the termination occurs within six months before or two years following a change in control), as well as one year of continued medical coverage at the same rates offered to current employees. Further under the agreement, in the event of a termination of his employment due to his disability, Mr. Roe will be entitled to a lump sum payment equal to 100% of his annual base salary, as well as one year of continued medical coverage and disability and life insurance coverage at the same rates offered to current employees. In the event of his death, Mr. Roe’s beneficiaries will be entitled to a lump sum payment equal to 50% of his annual base salary, as well as one year of employer-paid medical coverage. All of the aforementioned severance benefits are contingent upon Mr. Roe’s (or his beneficiaries’, if applicable) execution of a general release of claims. Mr. Roe’s agreement also provides that if any payments or benefits would be subject to an excise tax under Section 280G of the Internal Revenue Code, the payments or benefits may be reduced to the largest portion payable that would result in no such excise tax if that amount would result in a better net after-tax result to Mr. Roe than if there were no such reduction of payments or benefits. Under the agreement, Mr. Roe will be subject to one-year non-solicit restrictive covenants of employees and customers following the termination of his employment.

Terms of Mr. Stiteley’s Employment Agreement

Mr. Stiteley is subject to an employment agreement with the Company and the Bank, which became effective on March 12, 2013. Mr. Stiteley serves as chief financial officer of the Company and the Bank under the employment agreement. The agreement had an initial term of one year, with automatic one-year renewal terms unless either party gives notice of non-renewal no later than 90 days prior to the expiration of the then current term. Mr. Stiteley is entitled to a minimum annual salary pursuant to the agreement (which is subject to annual review for increase, but not decrease), as well as annual performance bonuses, and participation in the Bank’s benefit plans.

Under the agreement, upon a termination of Mr. Stiteley’s employment by the employer without cause or by Mr. Stiteley for good reason, Mr. Stiteley will be entitled to severance payments equal to the sum of i) 100% of his base salary, plus ii) the average annual bonus for the last 3 completed fiscal years, payable in 24 equal semi-monthly installments following the date of termination (or in a lump sum if the termination occurs within six months before or two years following a change in control), as well as one year of continued medical coverage at the same rates offered to current employees. Further under the agreement, in the event of a termination of his employment due to his disability, Mr. Stiteley will be entitled to a lump sum payment equal to 100% of his annual base salary, as well as one year of continued medical coverage and disability and life insurance coverage at the same rates offered to current employees. In the event of his death, Mr. Stiteley’s beneficiaries will be entitled to a lump sum payment equal to 50% of his annual base salary, as well as one year of employer-paid medical coverage. All of the aforementioned severance benefits are contingent upon Mr. Stiteley’s (or his beneficiaries’, if applicable) execution of a general release of claims. Mr. Stiteley’s agreement also provides that if any payments or benefits would be subject to an excise tax under Section 280G of the Internal Revenue Code, the payments or benefits may be reduced to the largest portion payable that would result in no such excise tax if that amount would result in a better net after-tax result to Mr. Stiteley than if there were no such reduction of payments or benefits. Under the agreement, Mr. Stiteley will be subject to one-year non-solicit restrictive covenants of employees and customers following the termination of his employment.

Split Dollar Life Insurance Plans

Effective October 1, 2015, we entered into split dollar life insurance agreements with our named executive officers. Under the terms of the agreements Messrs. Thygesen, Roe and Stiteley are entitled to a death benefit equal to the lower of the net at risk value of the policy, or $400,000, $400,000, and $300,000, respectively. The death benefit is payable upon the executive’s death on or prior to attainment of age 70 provided that at the time of death the executive was employed by the Bank, or had been previously terminated from the Bank due to disability, or had been previously terminated from the Bank for any reason subsequent to a change in control.

Retirement Plans

All eligible employees, including our named executive officers, may participate in the First Community 401(k) Plan and are permitted to contribute up to the maximum percentage allowable not to exceed the limits of the Internal Revenue Code. First Community makes a matching contribution to the plan equal to 100% of each participant’s first 6% of compensation deferred.

Equity Compensation Plans

2008 Equity Incentive Plan.

The Company maintains the First Community Financial Partners, Inc. Amended and Restated 2008 Equity Incentive Plan (the “2008 Equity Incentive Plan”), which assumed and incorporated all outstanding awards under previously adopted Company equity incentive plans. Our 2008 Equity Incentive Plan was amended and restated effective May 20, 2009, which amendment and restatement was approved by our shareholders. The 2008 Equity Incentive Plan allows for the granting of awards including stock options, restricted stock, restricted stock units, stock appreciation rights, stock awards and cash incentive awards. This plan was amended in December 2011 to increase the number of shares authorized for delivery by 1,000,000 shares. As a result, under the 2008 Equity Incentive Plan, 2,430,000 shares of Company common stock have been reserved for the granting of awards.

Under the 2008 Equity Incentive Plan, options are to be granted at the fair value of the stock at the date of the grant and generally vest at 33-1/3% as of the first anniversary of the grant date and an additional 33-1/3% as of each successive anniversary of the grant date. Options must be exercised within 10 years after the date of grant, unless otherwise provided by the board of directors.

2013 Equity Incentive Plan.