UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22321

MAINSTAY FUNDS TRUST

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

30 Hudson Street

Jersey City, New Jersey 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 576-7000

Date of fiscal year end: April 30

(MainStay CBRE Global Infrastructure Fund, MainStay CBRE Real Estate Fund, MainStay Conservative ETF Allocation Fund, MainStay Defensive ETF Allocation Fund, MainStay Equity ETF Allocation Fund, MainStay Growth ETF Allocation Fund, MainStay Moderate ETF Allocation Fund, and MainStay ESG Multi-Asset Allocation Fund)

Date of reporting period: October 31, 2023

FORM N-CSR

The information presented in this Form N-CSR relates solely to the

MainStay CBRE Global Infrastructure Fund, MainStay CBRE Real Estate Fund, MainStay Conservative

ETF Allocation Fund, MainStay Defensive ETF Allocation Fund, MainStay Equity ETF Allocation Fund,

MainStay Growth ETF Allocation Fund, MainStay Moderate ETF Allocation Fund, and MainStay ESG

Multi-Asset Allocation Fund, each a

series of the Registrant.

Item 1. Reports to Stockholders.

MainStay CBRE Global Infrastructure Fund

Message from the President and Semiannual Report

Unaudited | October 31, 2023

Special Notice:

Beginning in July 2024, new regulations issued by the Securities and Exchange Commission (SEC) will take effect requiring open-end mutual fund companies and ETFs to (1) overhaul the content of their shareholder reports and (2) mail paper copies of the new tailored shareholder reports to shareholders who have not opted to receive these documents electronically.

If you have not yet elected to receive your shareholder reports electronically, please contact your financial intermediary or visit newyorklifeinvestments.com/accounts.

| Not FDIC/NCUA Insured | Not a Deposit | May Lose Value | No Bank Guarantee | Not Insured by Any Government Agency |

This page intentionally left blank

Message from the President

Interest rates and inflation were the primary forces driving market behavior during the six-month reporting period ended October 31, 2023, with equity indices delivering mixed performance while bond indices generally declined.

U.S. inflation levels, as measured by the Consumer Price Index, ranged between 3.0% and 4.0% throughout the reporting period, down from the peak of 9.1% in June 2022, although well above the 2.0% target set by the U.S. Federal Reserve (the “Fed”). At the same time, the benchmark federal funds rate climbed to over 5%, its highest level since the financial crisis of 2007, as the Fed attempted to drive inflation still lower. Comments from Fed members reinforced the central bank’s hawkish stance in response to surprisingly robust U.S. economic growth and rising wage pressures, thus increasing the likelihood that interest rates would stay higher for longer. International developed markets exhibited similar dynamics of persistently elevated inflation and rising interest rates.

Against a backdrop of high interest rates, political dysfunction in Washington D.C. and intensifying global geopolitical instability—including the ongoing war in Ukraine and the outbreak of hostilities in the Middle East—equity markets struggled to advance. The S&P 500® Index, a widely regarded benchmark of large-cap U.S. market performance, eked out a slight gain, bolstered by the strong performance of mega-cap, growth-oriented, technology-related shares as investors flocked to companies creating the infrastructure for developments in artificial intelligence. However, smaller-cap stocks and value-oriented shares trended lower. Among industry sectors, information technology posted the strongest gains, followed by consumer discretionary, which rose in response to healthy consumer spending trends, while energy shares benefited from rising petroleum prices. All other sectors lost ground. Utilities declined most sharply as rising interest rates undermined the appeal of high-yielding stocks, while real estate came under pressure from

rising mortgage rates and weak levels of office occupancy, and consumer staples declined as market sentiment turned away from defensive, value-oriented businesses. International equities broadly trailed their U.S. counterparts as economic growth in the rest of world generally lagged that of the United States, and as the U.S. dollar rose in value compared to most other global currencies.

Bond prices were driven lower by rising yields and increasing expectations of high interest rates for an extended period of time. The U.S. yield curve steepened, with the 30-year Treasury yield exceeding 5% for the first time in more than a decade. The yield curve remained inverted, with the 10-year Treasury yield ending the period at 4.88%, compared with 5.07% for the 2-year Treasury yield. Corporate bonds outperformed long-term Treasury bonds, but still trended lower under pressure from rising yields and an uptick in default rates. Among corporates, lower-credit-quality instruments performed relatively well compared to their higher-credit-quality counterparts, while floating rate securities performed better still.

In the face of today’s uncertain market environment, New York Life Investments remains dedicated to providing the guidance, resources and investment solutions you need to pursue your financial goals.

Thank you for trusting us to help meet your investment needs.

Sincerely,

Kirk C. Lehneis

President

The opinions expressed are as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Past performance is no guarantee of future results.

Not part of the Semiannual Report

Investors should refer to the Fund’s Summary Prospectus and/or Prospectus and consider the Fund’s investment objectives, strategies, risks, charges and expenses carefully before investing. The Summary Prospectus and/or Prospectus contain this and other information about the Fund. You may obtain copies of the Fund’s Summary Prospectus, Prospectus and Statement of Additional Information, which includes information about the MainStay Funds Trust's Trustees, free of charge, upon request, by calling toll-free 800-624-6782, by writing to NYLIFE Distributors LLC, Attn: MainStay Marketing Department, 30 Hudson Street, Jersey City, NJ 07302 or by sending an e-mail to MainStayShareholderServices@nylim.com. These documents are also available via the MainStay Funds’ website at newyorklifeinvestments.com. Please read the Fund’s Summary Prospectus and/or Prospectus carefully before investing.

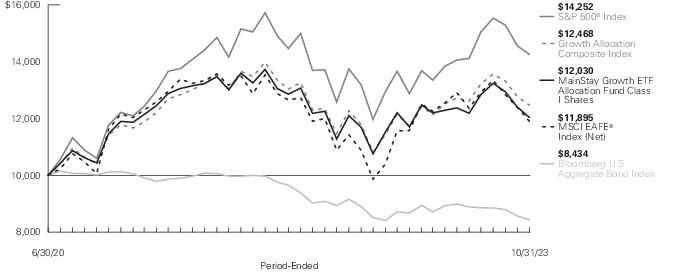

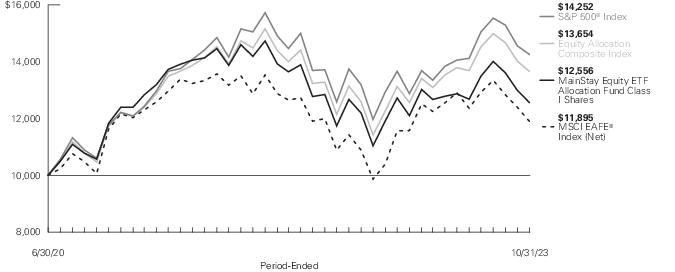

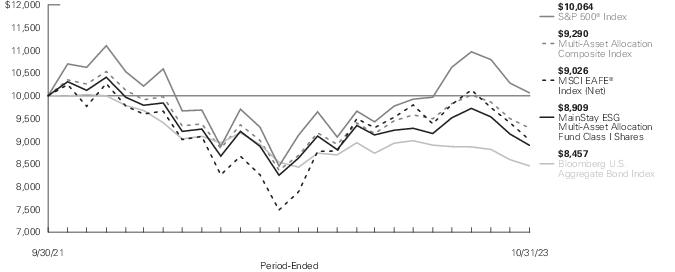

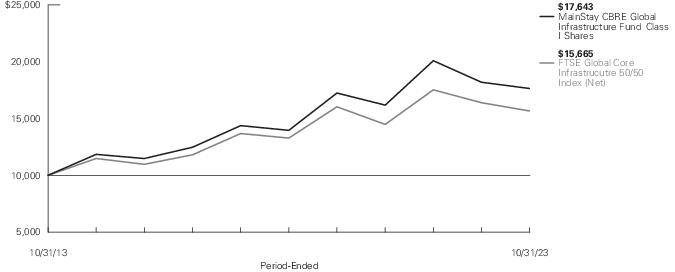

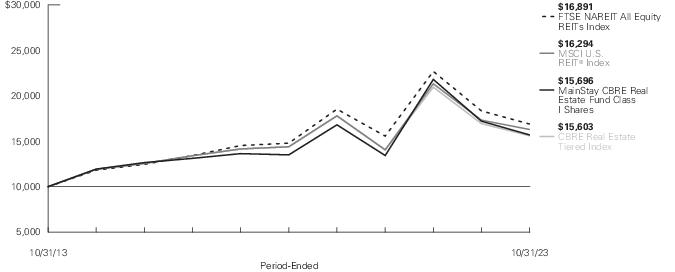

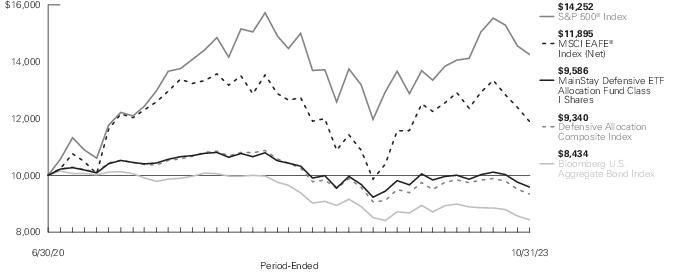

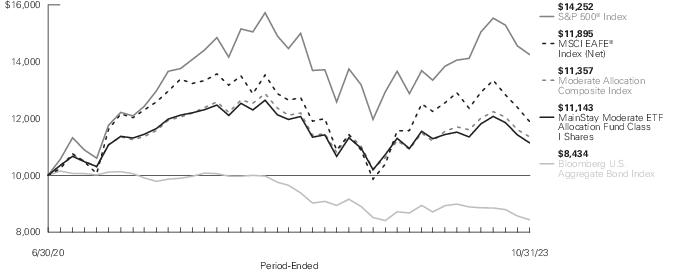

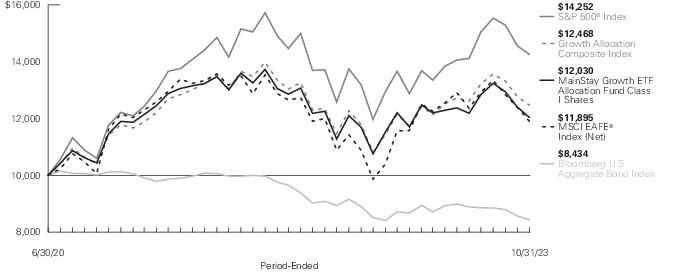

Investment and Performance Comparison (Unaudited)

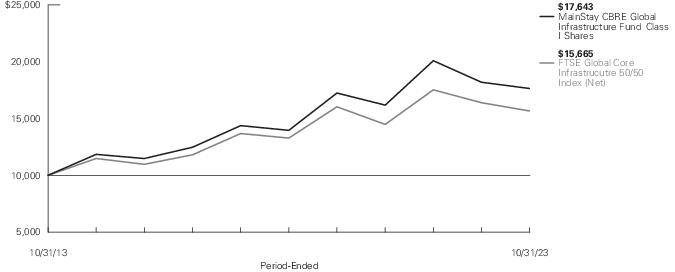

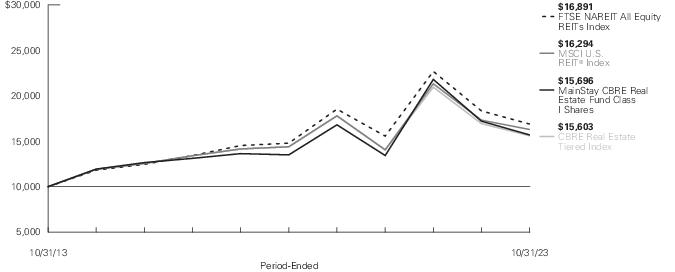

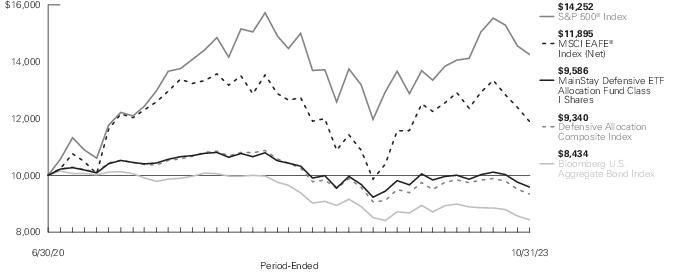

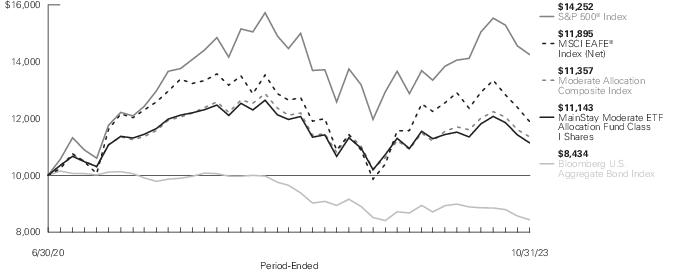

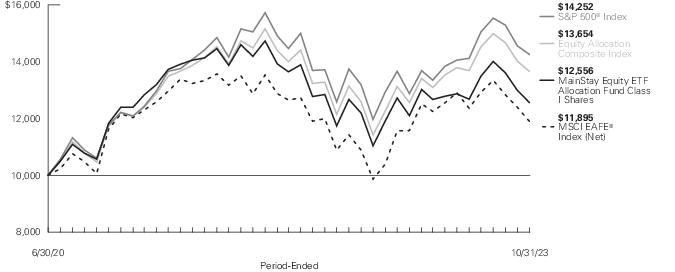

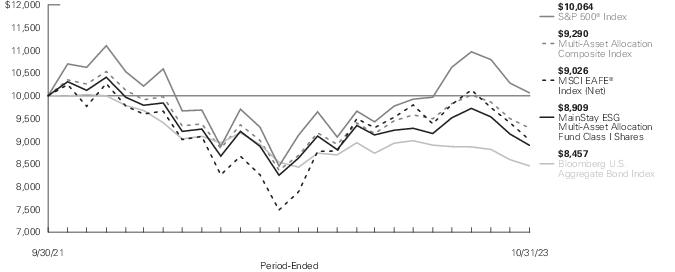

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility and other factors, current performance may be lower or higher than the figures shown. Investment return and principal value will fluctuate, and as a result, when shares are redeemed, they may be worth more or less than their original cost. The graph below depicts the historical performance of Class I shares of the Fund. Performance will vary from class to class based on differences in class-specific expenses and sales charges. For performance information current to the most recent month-end, please call 800-624-6782 or visit newyorklifeinvestments.com.

The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on distributions or Fund share redemptions. Total returns reflect maximum applicable sales charges as indicated in the table below, if any, changes in share price, and reinvestment of dividend and capital gain distributions. The graph assumes the initial investment amount shown below and reflects the deduction of all sales charges that would have applied for the period of investment. Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. For more information on share classes and current fee waivers and/or expense limitations (if any), please refer to the Notes to Financial Statements.

| Average Annual Total Returns for the Period-Ended October 31, 2023 |

| Class | Sales Charge | | Inception

Date1 | Six

Months2 | One

Year | Five

Years | Ten Years

or Since

Inception | Gross

Expense

Ratio3 |

| Class A Shares4 | Maximum 5.50% Initial Sales Charge | With sales charges | 10/16/2013 | -18.05% | -8.65% | 3.26% | 4.91% | 1.27% |

| | | Excluding sales charges | | -13.28 | -3.33 | 4.49 | 5.53 | 1.27 |

| Investor Class Shares5 | Maximum 5.00% Initial Sales Charge | With sales charges | 2/24/2020 | -17.71 | -8.19 | N/A | -3.18 | 1.29 |

| | | Excluding sales charges | | -13.37 | -3.36 | N/A | -1.68 | 1.29 |

| Class C Shares4 | Maximum 1.00% CDSC | With sales charges | 2/28/2019 | -14.49 | -4.98 | N/A | 1.95 | 2.04 |

| | if Redeemed Within One Year of Purchase | Excluding sales charges | | -13.63 | -4.04 | N/A | 1.95 | 2.04 |

| Class I Shares4 | No Sales Charge | | 6/28/2013 | -13.13 | -3.02 | 4.79 | 5.84 | 1.02 |

| Class R6 Shares | No Sales Charge | | 2/24/2020 | -13.16 | -2.95 | N/A | -1.26 | 0.89 |

| 1. | Effective at the close of business on February 21, 2020, the Fund changed its fiscal and tax year end from October 31 to April 30. |

| 2. | Not annualized. |

| 3. | The gross expense ratios presented reflect the Fund’s “Total Annual Fund Operating Expenses” from the most recent Prospectus, as supplemented, and may differ from other expense ratios disclosed in this report. |

| 4. | Performance figures for Class A shares, Class C shares and Class I shares reflect the historical performance of the then-existing Class A shares, Class C shares and Class I shares, respectively, of the Voya CBRE Global Infrastructure Fund (the predecessor to the Fund, which was subject to a different fee structure) for periods prior to February 21, 2020. The MainStay CBRE Global Infrastructure Fund commenced operations on February 24, 2020. |

| 5. | Prior to June 30, 2020, the maximum initial sales charge was 5.50%, which is reflected in the applicable average annual total return figures shown. |

The footnotes on the next page are an integral part of the table and graph and should be carefully read in conjunction with them.

| Benchmark Performance* | Six

Months1 | One

Year | Five

Years | Ten

Years |

| FTSE Global Core Infrastructure 50/50 Index (Net)2 | -11.78% | -4.44% | 3.36% | 4.59% |

| Morningstar Infrastructure Category Average3 | -12.21 | -4.30 | 4.13 | 4.32 |

| * | Returns for indices reflect no deductions for fees, expenses or taxes, except for foreign withholding taxes where applicable. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 1. | Not annualized. |

| 2. | The FTSE Global Core Infrastructure 50/50 Index (Net) is a market-capitalization-weighted index of worldwide infrastructure and infrastructure-related securities. Constituent weights are adjusted semi-annually according to three broad industry sectors: 50% utilities, 30% transportation, and a 20% mix of other sectors. |

| 3. | The Morningstar Infrastructure Category Average is representative of funds that invest more than 60% of their assets in stocks of companies engaged in infrastructure activities. Industries considered to be part of the infrastructure sector include: oil & gas midstream; waste management; airports; integrated shipping; railroads; shipping & ports; trucking; engineering & construction; infrastructure operations; and the utilities sector. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

The footnotes on the preceding page are an integral part of the table and graph and should be carefully read in conjunction with them.

| 6 | MainStay CBRE Global Infrastructure Fund |

Cost in Dollars of a $1,000 Investment in MainStay CBRE Global Infrastructure Fund (Unaudited)

The example below is intended to describe the fees and expenses borne by shareholders during the six-month period from May 1, 2023 to October 31, 2023, and the impact of those costs on your investment.

Example

As a shareholder of the Fund you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from May 1, 2023 to October 31, 2023.

This example illustrates your Fund’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the six months ended October 31, 2023. Simply divide your account value by $1,000 (for example, an

$8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Share Class | Beginning

Account

Value

5/1/23 | Ending Account

Value (Based

on Actual

Returns and

Expenses)

10/31/23 | Expenses

Paid

During

Period1 | Ending Account

Value (Based

on Hypothetical

5% Annualized

Return and

Actual Expenses)

10/31/23 | Expenses

Paid

During

Period1 | Net Expense

Ratio

During

Period2 |

| Class A Shares | $1,000.00 | $867.20 | $6.05 | $1,018.65 | $ 6.55 | 1.29% |

| Investor Class Shares | $1,000.00 | $866.30 | $6.24 | $1,018.45 | $ 6.75 | 1.33% |

| Class C Shares | $1,000.00 | $863.70 | $9.74 | $1,014.68 | $10.53 | 2.08% |

| Class I Shares | $1,000.00 | $868.70 | $4.56 | $1,020.26 | $ 4.93 | 0.97% |

| Class R6 Shares | $1,000.00 | $868.40 | $4.23 | $1,020.61 | $ 4.57 | 0.90% |

| 1. | Expenses are equal to the Fund’s annualized expense ratio of each class multiplied by the average account value over the period, divided by 366 and multiplied by 184 (to reflect the six-month period). The table above represents the actual expenses incurred during the six-month period. In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above-reported expense figures. |

| 2. | Expenses are equal to the Fund's annualized expense ratio to reflect the six-month period. |

Country Composition as of October 31, 2023 (Unaudited)

| United States | 58.0% |

| Australia | 7.1 |

| Spain | 6.6 |

| Canada | 6.4 |

| France | 6.0 |

| Japan | 5.6 |

| United Kingdom | 3.3 |

| Italy | 3.0 |

| Portugal | 2.0% |

| China | 1.6 |

| Mexico | 1.3 |

| Hong Kong | 0.6 |

| Other Assets, Less Liabilities | –1.5 |

| | 100.0% |

See Portfolio of Investments beginning on page 11 for specific holdings within these categories. The Fund's holdings are subject to change.

Top Ten Holdings and/or Issuers Held as of October 31, 2023 (excluding short-term investments) (Unaudited)

| 1. | American Tower Corp. |

| 2. | NextEra Energy, Inc. |

| 3. | WEC Energy Group, Inc. |

| 4. | Vinci SA |

| 5. | Aena SME SA |

| 6. | Transurban Group |

| 7. | Targa Resources Corp. |

| 8. | CSX Corp. |

| 9. | Sempra |

| 10. | Central Japan Railway Co. |

| 8 | MainStay CBRE Global Infrastructure Fund |

Portfolio Management Discussion and Analysis (Unaudited)

Questions answered by portfolio managers Jeremy Anagnos, CFA, Joseph P. Smith, CFA, Daniel Foley, CFA, and Hinds Howard of CBRE Investment Management Listed Real Assets LLC.

How did MainStay CBRE Global Infrastructure Fund perform relative to its benchmark and peer group during the six months ended October 31, 2023?

For the six months ended October 31, 2023, Class I shares of MainStay CBRE Global Infrastructure Fund returned −13.13%, underperforming the −11.78% return of the Fund’s primary benchmark, the FTSE Global Core Infrastructure 50/50 Index (Net) (the “Index”). Over the same period, Class I shares also underperformed the −12.21% return of the Morningstar Infrastructure Category Average.1

What factors affected the Fund’s relative performance during the reporting period?

The Fund underperformed the Index primarily due to negative stock selection, particularly in emerging markets. Underweight exposure to the outperforming emerging markets sector also detracted from relative returns, although to a lesser degree. Stock selection in Europe further undermined relative performance. Conversely, the Fund’s strongest relative performance came from stock selection in North America, where all sectors made positive contributions, and in Asia, where communications and transport holdings bolstered returns. (Contributions take weightings and total returns into account.) From a sector perspective, selection in communications added to performance, benefiting from exposure to the data center industry, which experienced strong fundamentals and growing demand related to data-intensive artificial intelligence (“AI”) applications. While underweight exposure to lagging North American utilities also enhanced returns, other allocations generally detracted across regions and sectors.

During the reporting period, which sectors and subsectors were the strongest positive contributors to the Fund’s relative performance and which sectors and subsectors were particularly weak?

The strongest positive contributions to the Fund’s performance relative to the Index came from North American utilities and communications as well as Asian communications. During the reporting period, utilities in North America generated volatile performance amid rising rates. The Fund was well positioned, with a focus on companies with strong balance sheets and relatively little rate sensitivity. Communications in Asia and North America benefited from data center exposure, which rose on solid fundamentals and increasing AI demand.

The weakest contributors to relative performance included emerging markets, European communications and Asian utilities. Emerging markets were a detractor due to both negative stock selection and underweight exposure to this outperforming region. European communications were sold off in the latter part of the

reporting period in response to a rising rate environment. In Asia, where Japanese utilities materially outperformed Hong Kong-listed names, the Fund held no exposure in Japan and modest exposure to Hong Kong–a combination that undermined relative performance.

During the reporting period, which individual stocks made the strongest positive contributions to the Fund’s absolute performance and which stocks detracted the most?

The holdings making the largest positive contributions to absolute performance during the reporting period included liquid natural gas (“LNG”) infrastructure company Cheniere Energy and U.S. midstream energy company Targa Resources. As the largest owner and operator of U.S. LNG export facilities, Cheniere was well positioned to capitalize on increasing global demand for natural gas through sales of existing assets and contracts for future development. Targa, with assets focused on natural gas liquid from the Permian Basin in Texas, likewise experienced surging domestic and global demand. Additionally, Targa’s share price benefited from the company’s disciplined use of capital, improving its balance sheet while also increasing shareholder returns through stock buybacks and increased dividends.

During the same period, positions in European telecommunication tower company Cellnex Telecom and diversified U.S. utility The AES Corporation detracted most from the Fund’s absolute performance. Cellnex shares declined alongside those of other highly leveraged global tower companies, as a rapidly rising interest rate environment raised the prospect of higher interest costs on refinancing. Negative headlines regarding renewable development—as well as poor results in the clean energy technology market driven by materials and labor cost inflation and higher financing costs—weighed on shares of The AES Corporation, which is viewed as a leader in both categories.

What were some of the Fund’s largest purchases and sales during the reporting period?

During the reporting period, we substantially increased the Fund’s positions in the U.S. midstream sector, adding a new position in Kinder Morgan as well as adding large increases to holdings in Targa Resources, Cheniere Energy and, to a lesser extent, Pembina Pipeline. We expect the recovery in commodity prices and sustained energy inflation to provide support for fundamental improvement in midstream assets. We continue to believe that natural gas midstream is well positioned to benefit from global demand, particularly given supply limits related to the war in Ukraine. Kinder Morgan owns one of the largest natural gas pipeline networks in North America, and the stock’s

| 1. | See "Investment and Performance Comparison" for other share class returns, which may be higher or lower than Class I share returns, and for more information on benchmark and peer group returns. |

underperformance relative to its peers for much of 2023 provided an attractive entry point based on valuation.

The Fund’s largest sales during the reporting period involved positions in U.K. utilities SSE and National Grid, along with tower companies Crown Castle International, based in the United States, and Cellnex Telecom, based in Spain. The sales of the Fund’s U.K. utilities holdings reflected their relatively high valuation compared with U.S. utilities, which had underperformed. We reduced the Fund’s holdings in tower companies due to their sensitivity to higher interest rates and our view that the sustained high interest rates were likely to persist.

How did the Fund’s subsector weightings change during the reporting period?

During the reporting period, we increased the Fund’s exposure to more economically sensitive sectors while decreasing exposure to more interest rate sensitive sectors. In particular, we increased exposure to the midstream and freight rail sectors in the United States. Midstream benefits from energy inflation, which increased during the reporting period. Freight rail saw weak volumes throughout 2023, but appeared to be nearing an inflection point, with improved activity likely in the next 12-to-18 months. Both sectors traded at undemanding valuations. In light of recent rate increases and U.S. Federal Reserve statements indicating that interest rates would likely remain higher for longer than previously expected, we reduced exposure to more interest rate sensitive sectors like utilities and towers on a global basis. While these sectors have offsets in the form of regulations or contractual increases to boost revenues in a higher inflation environment, market sentiment focused on the interest rate increases and the high leverage of these businesses remained headwinds.

How was the Fund positioned at the end of the reporting period?

As of October 31, 2023, the Fund remains positioned to benefit from long-term growth in renewable development, which translates into a preference for integrated utilities over regulated utilities. We believe that energy security has regained attention globally and midstream assets in North America, particularly natural gas-oriented assets, are attractively positioned to meet this need. The Fund is also positioned to benefit from exposure to long-term data growth through a preference for communications infrastructure exposure. Within transports, we favor leisure-exposed airports, toll roads, freight rail companies and passenger rail stocks in Japan. The Fund continues to hold underweight exposure to emerging markets due to ongoing

regulatory and policy challenges that can lead to excessive volatility and negative returns.

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecasts will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

| 10 | MainStay CBRE Global Infrastructure Fund |

Portfolio of Investments October 31, 2023†^(Unaudited)

| | Shares | Value |

| Common Stocks 101.3% |

| Australia 7.1% |

| Atlas Arteria Ltd. (Transportation) | 10,280,153 | $ 34,627,652 |

| NEXTDC Ltd. (Communications) (a) | 1,026,775 | 7,653,183 |

| Transurban Group (Transportation) | 5,122,344 | 38,407,422 |

| | | 80,688,257 |

| Canada 6.4% |

| Canadian National Railway Co. (Transportation) | 138,647 | 14,670,037 |

| Enbridge, Inc. (Midstream / Pipelines) | 915,251 | 29,330,272 |

| Pembina Pipeline Corp. (Midstream / Pipelines) | 934,215 | 28,752,332 |

| | | 72,752,641 |

| China 1.6% |

| China Resources Gas Group Ltd. (Utilities) | 2,998,000 | 8,869,199 |

| Guangdong Investment Ltd. (Utilities) | 13,226,253 | 9,025,679 |

| | | 17,894,878 |

| France 6.0% |

| Eiffage SA (Transportation) | 301,003 | 27,294,702 |

| Vinci SA (Transportation) | 365,924 | 40,453,004 |

| | | 67,747,706 |

| Hong Kong 0.6% |

| CK Infrastructure Holdings Ltd. (Utilities) | 1,479,360 | 6,853,046 |

| Italy 3.0% |

| Enel SpA (Utilities) | 5,261,448 | 33,336,023 |

| Japan 5.6% |

| Central Japan Railway Co. (Transportation) | 1,651,165 | 36,993,939 |

| West Japan Railway Co. (Transportation) | 705,813 | 26,756,401 |

| | | 63,750,340 |

| Mexico 1.3% |

| Grupo Aeroportuario del Pacifico SAB de CV, Class B (Transportation) | 1,230,501 | 14,353,911 |

| Portugal 2.0% |

| EDP - Energias de Portugal SA (Utilities) | 5,401,366 | 22,689,286 |

| Spain 6.6% |

| Aena SME SA (Transportation) | 271,313 | 39,257,682 |

| | Shares | Value |

| |

| Spain (continued) |

| Cellnex Telecom SA (Communications) | 1,211,434 | $ 35,532,004 |

| | | 74,789,686 |

| United Kingdom 3.3% |

| National Grid plc (Utilities) | 2,267,259 | 26,967,671 |

| Pennon Group plc (Utilities) | 1,108,398 | 9,787,425 |

| | | 36,755,096 |

| United States 57.8% |

| AES Corp. (The) (Utilities) | 1,472,284 | 21,937,031 |

| ALLETE, Inc. (Utilities) (b) | 141,834 | 7,593,792 |

| Ameren Corp. (Utilities) | 400,094 | 30,291,117 |

| American Electric Power Co., Inc. (Utilities) | 54,768 | 4,137,175 |

| American Tower Corp. (Communications) | 342,833 | 61,089,412 |

| Cheniere Energy, Inc. (Midstream / Pipelines) | 218,729 | 36,400,880 |

| CMS Energy Corp. (Utilities) | 476,504 | 25,893,227 |

| Constellation Energy Corp. (Utilities) | 95,276 | 10,758,566 |

| Crown Castle, Inc. (Communications) | 129,417 | 12,033,193 |

| CSX Corp. (Transportation) | 1,262,202 | 37,676,730 |

| Equinix, Inc. (Communications) | 30,044 | 21,921,304 |

| Kinder Morgan, Inc. (Midstream / Pipelines) | 1,671,770 | 27,082,674 |

| NextEra Energy Partners LP (Utilities) (b) | 196,340 | 5,314,924 |

| NextEra Energy, Inc. (Utilities) | 1,006,864 | 58,700,170 |

| NiSource, Inc. (Utilities) | 499,400 | 12,564,904 |

| OGE Energy Corp. (Utilities) | 486,224 | 16,628,861 |

| PG&E Corp. (Utilities) (a) | 1,224,926 | 19,966,294 |

| PPL Corp. (Utilities) | 1,365,358 | 33,546,846 |

| Revenir Energy Inc. (Midstream / Pipelines) (a)(c)(d) | 5,055 | 16,884 |

| Revenir Energy Inc. (Midstream / Pipelines) (a)(c)(d) | 27,942 | 93,326 |

| SBA Communications Corp. (Communications) | 72,254 | 15,074,352 |

| Sempra (Utilities) | 528,456 | 37,007,774 |

| Southern Co. (The) (Utilities) | 481,519 | 32,406,229 |

| Targa Resources Corp. (Midstream / Pipelines) | 457,006 | 38,210,272 |

| Union Pacific Corp. (Transportation) | 112,133 | 23,279,932 |

| WEC Energy Group, Inc. (Utilities) | 517,115 | 42,087,990 |

| Xcel Energy, Inc. (Utilities) | 346,952 | 20,563,845 |

| | | 652,277,704 |

Total Common Stocks

(Cost $1,261,199,146) | | 1,143,888,574 |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

11

Portfolio of Investments October 31, 2023†^(Unaudited) (continued)

| | Shares | | Value |

| Short-Term Investment 0.2% |

| Unaffiliated Investment Company 0.2% |

| United States 0.2% |

| Invesco Government & Agency Portfolio, 5.357% (e)(f) | 1,624,750 | | $ 1,624,750 |

Total Short-Term Investment

(Cost $1,624,750) | | | 1,624,750 |

Total Investments

(Cost $1,262,823,896) | 101.5% | | 1,145,513,324 |

| Other Assets, Less Liabilities | (1.5) | | (16,634,113) |

| Net Assets | 100.0% | | $ 1,128,879,211 |

| † | Percentages indicated are based on Fund net assets. |

| ^ | Industry and country classifications may be different than those used for compliance monitoring purposes. |

| (a) | Non-income producing security. |

| (b) | All or a portion of this security was held on loan. As of October 31, 2023, the aggregate market value of securities on loan was $1,592,344. The Fund received cash collateral with a value of $1,624,750. (See Note 2(I)) |

| (c) | Illiquid security—As of October 31, 2023, the total market value deemed illiquid under procedures approved by the Board of Trustees was $110,210, which represented less than one-tenth of a percent of the Fund’s net assets. |

| (d) | Security in which significant unobservable inputs (Level 3) were used in determining fair value. |

| (e) | Current yield as of October 31, 2023. |

| (f) | Represents a security purchased with cash collateral received for securities on loan. |

Investments in Affiliates (in 000's)

Investments in issuers considered to be affiliate(s) of the Fund during the six-month period ended October 31, 2023 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

| Affiliated Investment Companies | Value,

Beginning

of Period | Purchases

at Cost | Proceeds

from

Sales | Net

Realized

Gain/(Loss)

on Sales | Change in

Unrealized

Appreciation/

(Depreciation) | Value,

End of

Period | Dividend

Income | Other

Distributions | Shares

End of

Period |

| MainStay U.S. Government Liquidity Fund | $ 8,287 | $ 139,108 | $ (147,395) | $ — | $ — | $ — | $ 153 | $ — | — |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

| 12 | MainStay CBRE Global Infrastructure Fund |

The following is a summary of the fair valuations according to the inputs used as of October 31, 2023, for valuing the Fund’s assets:

| Description | Quoted

Prices in

Active

Markets for

Identical

Assets

(Level 1) | | Significant

Other

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | | Total |

| Asset Valuation Inputs | | | | | | | |

| Investments in Securities (a) | | | | | | | |

| Common Stocks | $ 1,143,778,364 | | $ — | | $ 110,210 | | $ 1,143,888,574 |

| Short-Term Investment | | | | | | | |

| Unaffiliated Investment Company | 1,624,750 | | — | | — | | 1,624,750 |

| Total Investments in Securities | $ 1,145,403,114 | | $ — | | $ 110,210 | | $ 1,145,513,324 |

| (a) | For a complete listing of investments and their industries, see the Portfolio of Investments. |

The table below sets forth the diversification of the Fund’s investments by sector.

Sector Diversification

| | Value | | Percent † ^ |

| Utilities | $ 496,927,074 | | 44.2% |

| Transportation | 333,771,412 | | 29.5 |

| Midstream / Pipelines | 159,886,640 | | 14.1 |

| Communications | 153,303,448 | | 13.5 |

| | 1,143,888,574 | | 101.3 |

| Short-Term Investment | 1,624,750 | | 0.2 |

| Other Assets, Less Liabilities | (16,634,113) | | (1.5) |

| Net Assets | $1,128,879,211 | | 100.0% |

| † | Percentages indicated are based on Fund net assets. |

| ^ | Industry and country classifications may be different than those used for compliance monitoring purposes. |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

13

Statement of Assets and Liabilities as of October 31, 2023 (Unaudited)

| Assets |

Investment in securities, at value

(identified cost $1,262,823,896) including securities on loan of $1,592,344 | $1,145,513,324 |

Cash denominated in foreign currencies

(identified cost $125) | 125 |

| Receivables: | |

| Investment securities sold | 19,959,080 |

| Dividends | 2,120,554 |

| Fund shares sold | 1,363,268 |

| Securities lending | 332 |

| Other assets | 57,915 |

| Total assets | 1,169,014,598 |

| Liabilities |

| Cash collateral received for securities on loan | 1,624,750 |

| Due to custodian | 16,578,501 |

| Payables: | |

| Fund shares redeemed | 18,583,248 |

| Investment securities purchased | 1,998,277 |

| Manager (See Note 3) | 729,507 |

| Transfer agent (See Note 3) | 454,919 |

| Professional fees | 60,589 |

| Custodian | 41,526 |

| NYLIFE Distributors (See Note 3) | 30,589 |

| Shareholder communication | 28,757 |

| Trustees | 4,652 |

| Accrued expenses | 72 |

| Total liabilities | 40,135,387 |

| Net assets | $1,128,879,211 |

| Composition of Net Assets |

| Shares of beneficial interest outstanding (par value of $.001 per share) unlimited number of shares authorized | $ 103,102 |

| Additional paid-in-capital | 1,558,087,170 |

| | 1,558,190,272 |

| Total distributable earnings (loss) | (429,311,061) |

| Net assets | $1,128,879,211 |

| Class A | |

| Net assets applicable to outstanding shares | $ 80,081,528 |

| Shares of beneficial interest outstanding | 7,320,561 |

| Net asset value per share outstanding | $ 10.94 |

| Maximum sales charge (5.50% of offering price) | 0.64 |

| Maximum offering price per share outstanding | $ 11.58 |

| Investor Class | |

| Net assets applicable to outstanding shares | $ 1,902,745 |

| Shares of beneficial interest outstanding | 174,013 |

| Net asset value per share outstanding | $ 10.93 |

| Maximum sales charge (5.00% of offering price) | 0.58 |

| Maximum offering price per share outstanding | $ 11.51 |

| Class C | |

| Net assets applicable to outstanding shares | $ 15,329,169 |

| Shares of beneficial interest outstanding | 1,408,129 |

| Net asset value and offering price per share outstanding | $ 10.89 |

| Class I | |

| Net assets applicable to outstanding shares | $1,030,925,863 |

| Shares of beneficial interest outstanding | 94,141,268 |

| Net asset value and offering price per share outstanding | $ 10.95 |

| Class R6 | |

| Net assets applicable to outstanding shares | $ 639,906 |

| Shares of beneficial interest outstanding | 58,429 |

| Net asset value and offering price per share outstanding | $ 10.95 |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

| 14 | MainStay CBRE Global Infrastructure Fund |

Statement of Operations for the six months ended October 31, 2023 (Unaudited)

| Investment Income (Loss) |

| Income | |

| Dividends-unaffiliated (net of foreign tax withholding of $1,621,396) | $ 32,705,809 |

| Securities lending, net | 159,789 |

| Dividends-affiliated | 153,202 |

| Total income | 33,018,800 |

| Expenses | |

| Manager (See Note 3) | 6,882,271 |

| Transfer agent (See Note 3) | 1,159,787 |

| Distribution/Service—Class A (See Note 3) | 116,839 |

| Distribution/Service—Investor Class (See Note 3) | 2,657 |

| Distribution/Service—Class C (See Note 3) | 90,631 |

| Professional fees | 83,508 |

| Custodian | 75,579 |

| Registration | 59,911 |

| Shareholder communication | 48,291 |

| Interest expense | 45,194 |

| Trustees | 25,970 |

| Miscellaneous | 53,400 |

| Total expenses before waiver/reimbursement | 8,644,038 |

| Expense waiver/reimbursement from Manager (See Note 3) | (491,548) |

| Net expenses | 8,152,490 |

| Net investment income (loss) | 24,866,310 |

| Realized and Unrealized Gain (Loss) |

| Net realized gain (loss) on: | |

| Unaffiliated investment transactions | (40,860,052) |

| Foreign currency transactions | (416,501) |

| Net realized gain (loss) | (41,276,553) |

| Net change in unrealized appreciation (depreciation) on: | |

| Unaffiliated investments | (204,734,551) |

| Translation of other assets and liabilities in foreign currencies | (39,538) |

| Net change in unrealized appreciation (depreciation) | (204,774,089) |

| Net realized and unrealized gain (loss) | (246,050,642) |

| Net increase (decrease) in net assets resulting from operations | $(221,184,332) |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

15

Statements of Changes in Net Assets

for the six months ended October 31, 2023 (Unaudited) and the year ended April 30, 2023

| | Six months

ended

October 31,

2023 | Year

ended

April 30,

2023 |

| Increase (Decrease) in Net Assets |

| Operations: | | |

| Net investment income (loss) | $ 24,866,310 | $ 33,878,395 |

| Net realized gain (loss) | (41,276,553) | (54,492,022) |

| Net change in unrealized appreciation (depreciation) | (204,774,089) | 37,646,073 |

| Net increase (decrease) in net assets resulting from operations | (221,184,332) | 17,032,446 |

| Distributions to shareholders: | | |

| Class A | (1,347,758) | (2,556,120) |

| Investor Class | (30,154) | (62,277) |

| Class C | (189,328) | (402,553) |

| Class I | (23,086,922) | (53,898,639) |

| Class R6 | (11,999) | (278,160) |

| Total distributions to shareholders | (24,666,161) | (57,197,749) |

| Capital share transactions: | | |

| Net proceeds from sales of shares | 219,378,650 | 1,009,200,139 |

| Net asset value of shares issued to shareholders in reinvestment of distributions | 18,753,369 | 39,221,114 |

| Cost of shares redeemed | (971,665,270) | (553,345,710) |

| Increase (decrease) in net assets derived from capital share transactions | (733,533,251) | 495,075,543 |

| Net increase (decrease) in net assets | (979,383,744) | 454,910,240 |

| Net Assets |

| Beginning of period | 2,108,262,955 | 1,653,352,715 |

| End of period | $1,128,879,211 | $2,108,262,955 |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

| 16 | MainStay CBRE Global Infrastructure Fund |

Financial Highlights selected per share data and ratios

| | Six months ended

October 31, | | Year Ended April 30, | | November 1,

2019 through

April 30, | | Year Ended October 31, |

| Class A | 2023 * | | 2023 | | 2022 | | 2021 | | 2020 # | | 2019 | | 2018 |

| Net asset value at beginning of period | $ 12.80 | | $ 13.11 | | $ 12.81 | | $ 10.39 | | $ 11.99 | | $ 10.04 | | $ 11.40 |

| Net investment income (loss) | 0.16(a) | | 0.19(a) | | 0.23(a) | | 0.16(a) | | 0.07(a) | | 0.16 | | 0.19 |

| Net realized and unrealized gain (loss) | (1.85) | | (0.17) | | 0.26 | | 2.42 | | (1.30) | | 2.12 | | (0.51) |

| Total from investment operations | (1.69) | | 0.02 | | 0.49 | | 2.58 | | (1.23) | | 2.28 | | (0.32) |

| Less distributions: | | | | | | | | | | | | | |

| From net investment income | (0.17) | | (0.21) | | (0.19) | | (0.16) | | (0.06) | | (0.17) | | (0.25) |

| From net realized gain on investments | — | | (0.12) | | — | | — | | (0.29) | | (0.16) | | (0.79) |

| Return of capital | — | | — | | — | | — | | (0.02) | | — | | — |

| Total distributions | (0.17) | | (0.33) | | (0.19) | | (0.16) | | (0.37) | | (0.33) | | (1.04) |

| Net asset value at end of period | $ 10.94 | | $ 12.80 | | $ 13.11 | | $ 12.81 | | $ 10.39 | | $ 11.99 | | $ 10.04 |

| Total investment return (b) | (13.28)% | | 0.33% | | 3.91% | | 25.04% | | (10.57)% | | 23.24% | | (3.16)% |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | | | |

| Net investment income (loss) | 2.64%†† | | 1.50% | | 1.75% | | 1.35% | | 1.32%†† | | 1.51% | | 1.89% |

| Net expenses | 1.29%†† (c)(d) | | 1.27%(d) | | 1.26%(d) | | 1.29%(d) | | 1.32%†† (d)(e) | | 1.35% | | 1.35% |

| Expenses (before waiver/reimbursement) | 1.29%†† (c)(d) | | 1.27%(d) | | 1.26%(d) | | 1.35%(d) | | 1.54%†† (d)(e) | | 1.56% | | 1.83% |

| Portfolio turnover rate | 18% | | 43% | | 32% | | 51% | | 49% | | 53% | | 61% |

| Net assets at end of period (in 000's) | $ 80,082 | | $ 102,258 | | $ 88,715 | | $ 45,642 | | $ 11,237 | | $ 11,700 | | $ 1,787 |

| * | Unaudited. |

| # | The Fund changed its fiscal year end from October 31 to April 30. |

| †† | Annualized. |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. For periods of less than one year, total return is not annualized. |

| (c) | Net of interest expense of 0.01%. (See Note 6) |

| (d) | In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| (e) | Net of interest expense of less than 0.01%. (See Note 6) |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

17

Financial Highlights selected per share data and ratios

| | Six months ended

October 31, | | Year Ended April 30, | | February 24,

2020^ through

April 30, |

| Investor Class | 2023 * | | 2023 | | 2022 | | 2021 | | 2020 |

| Net asset value at beginning of period | $ 12.80 | | $ 13.11 | | $ 12.80 | | $ 10.38 | | $ 12.50 |

| Net investment income (loss) (a) | 0.16 | | 0.19 | | 0.23 | | 0.13 | | (0.00)‡ |

| Net realized and unrealized gain (loss) | (1.86) | | (0.17) | | 0.26 | | 2.43 | | (2.08) |

| Total from investment operations | (1.70) | | 0.02 | | 0.49 | | 2.56 | | (2.08) |

| Less distributions: | | | | | | | | | |

| From net investment income | (0.17) | | (0.21) | | (0.18) | | (0.14) | | (0.03) |

| From net realized gain on investments | — | | (0.12) | | — | | — | | — |

| Return of capital | — | | — | | — | | — | | (0.01) |

| Total distributions | (0.17) | | (0.33) | | (0.18) | | (0.14) | | (0.04) |

| Net asset value at end of period | $ 10.93 | | $ 12.80 | | $ 13.11 | | $ 12.80 | | $ 10.38 |

| Total investment return (b) | (13.37)% | | 0.34% | | 3.85% | | 24.87% | | (16.66)% |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | |

| Net investment income (loss) | 2.60%†† | | 1.49% | | 1.77% | | 1.11% | | (0.12)%†† |

| Net expenses (c) | 1.33%††(d) | | 1.29% | | 1.31% | | 1.45% | | 1.45%†† |

| Expenses (before waiver/reimbursement) (c) | 1.33%††(d) | | 1.29% | | 1.31% | | 1.76% | | 1.67%†† |

| Portfolio turnover rate | 18% | | 43% | | 32% | | 51% | | 49% |

| Net assets at end of period (in 000's) | $ 1,903 | | $ 2,338 | | $ 2,430 | | $ 2,159 | | $ 106 |

| * | Unaudited. |

| ^ | Inception date. |

| ‡ | Less than one cent per share. |

| †† | Annualized. |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. For periods of less than one year, total return is not annualized. |

| (c) | In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| (d) | Net of interest expense of 0.01%. (See Note 6) |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

| 18 | MainStay CBRE Global Infrastructure Fund |

Financial Highlights selected per share data and ratios

| | Six months ended

October 31, | | Year Ended April 30, | | November 1,

2019 through

April 30,

2020# | | February 28,

2019^

through

October 31, |

| Class C | 2023 * | | 2023 | | 2022 | | 2021 | | 2019 |

| Net asset value at beginning of period | $ 12.74 | | $ 13.04 | | $ 12.75 | | $ 10.37 | | $ 11.96 | | $ 10.82 |

| Net investment income (loss) (a) | 0.11 | | 0.09 | | 0.12 | | 0.06 | | 0.03 | | 0.04 |

| Net realized and unrealized gain (loss) | (1.84) | | (0.16) | | 0.27 | | 2.42 | | (1.29) | | 1.22 |

| Total from investment operations | (1.73) | | (0.07) | | 0.39 | | 2.48 | | (1.26) | | 1.26 |

| Less distributions: | | | | | | | | | | | |

| From net investment income | (0.12) | | (0.11) | | (0.10) | | (0.10) | | (0.03) | | (0.12) |

| From net realized gain on investments | — | | (0.12) | | — | | — | | (0.29) | | — |

| Return of capital | — | | — | | — | | — | | (0.01) | | — |

| Total distributions | (0.12) | | (0.23) | | (0.10) | | (0.10) | | (0.33) | | (0.12) |

| Net asset value at end of period | $ 10.89 | | $ 12.74 | | $ 13.04 | | $ 12.75 | | $ 10.37 | | $ 11.96 |

| Total investment return (b) | (13.63)% | | (0.42)% | | 3.11% | | 24.04% | | (10.89)% | | 11.67% |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | |

| Net investment income (loss) | 1.86%†† | | 0.74% | | 0.89% | | 0.52% | | 0.58%†† | | 0.46%†† |

| Net expenses | 2.08%†† (c)(d) | | 2.04%(d) | | 2.06%(d) | | 2.08%(d) | | 2.09%†† (d)(e) | | 2.10%†† |

| Expenses (before waiver/reimbursement) | 2.08%†† (c)(d) | | 2.04%(d) | | 2.06%(d) | | 2.51%(d) | | 2.36%†† (d)(e) | | 2.31%†† |

| Portfolio turnover rate | 18% | | 43% | | 32% | | 51% | | 49% | | 53% |

| Net assets at end of period (in 000’s) | $ 15,329 | | $ 20,401 | | $ 24,119 | | $ 11,522 | | $ 992 | | $ 1,048 |

| * | Unaudited. |

| # | The Fund changed its fiscal year end from October 31 to April 30. |

| ^ | Inception date. |

| †† | Annualized. |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. For periods of less than one year, total return is not annualized. |

| (c) | Net of interest expense of 0.01%. (See Note 6) |

| (d) | In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| (e) | Net of interest expense of less than 0.01%. (See Note 6) |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

19

Financial Highlights selected per share data and ratios

| | Six months ended

October 31, | | Year Ended April 30, | | November 1,

2019 through

April 30,

2020# | | Year Ended October 31, |

| Class I | 2023 * | | 2023 | | 2022 | | 2021 | | 2019 | | 2018 |

| Net asset value at beginning of period | $ 12.81 | | $ 13.12 | | $ 12.82 | | $ 10.39 | | $ 11.99 | | $ 10.04 | | $ 11.40 |

| Net investment income (loss) | 0.19(a) | | 0.22(a) | | 0.27(a) | | 0.21(a) | | 0.09(a) | | 0.20 | | 0.23 |

| Net realized and unrealized gain (loss) | (1.86) | | (0.16) | | 0.26 | | 2.41 | | (1.30) | | 2.11 | | (0.52) |

| Total from investment operations | (1.67) | | 0.06 | | 0.53 | | 2.62 | | (1.21) | | 2.31 | | (0.29) |

| Less distributions: | | | | | | | | | | | | | |

| From net investment income | (0.19) | | (0.25) | | (0.23) | | (0.19) | | (0.08) | | (0.20) | | (0.28) |

| From net realized gain on investments | — | | (0.12) | | — | | — | | (0.29) | | (0.16) | | (0.79) |

| Return of capital | — | | — | | — | | — | | (0.02) | | — | | — |

| Total distributions | (0.19) | | (0.37) | | (0.23) | | (0.19) | | (0.39) | | (0.36) | | (1.07) |

| Net asset value at end of period | $ 10.95 | | $ 12.81 | | $ 13.12 | | $ 12.82 | | $ 10.39 | | $ 11.99 | | $ 10.04 |

| Total investment return (b) | (13.13)% | | 0.63% | | 4.19% | | 25.46% | | (10.46)% | | 23.52% | | (2.88)% |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | | | |

| Net investment income (loss) | 3.11%†† | | 1.79% | | 2.09% | | 1.78% | | 1.59%†† | | 1.83% | | 2.14% |

| Net expenses | 0.97%†† (c)(d) | | 0.97%(d) | | 0.97%(d) | | 0.97%(d) | | 1.05%†† (d)(e) | | 1.10% | | 1.10% |

| Expenses (before waiver/reimbursement) | 1.04%†† (c)(d) | | 1.02%(d) | | 1.01%(d) | | 1.10%(d) | | 1.18%†† (d)(e) | | 1.14% | | 1.41% |

| Portfolio turnover rate | 18% | | 43% | | 32% | | 51% | | 49% | | 53% | | 61% |

| Net assets at end of period (in 000's) | $ 1,030,926 | | $ 1,982,388 | | $ 1,527,548 | | $ 465,299 | | $ 208,291 | | $ 225,176 | | $ 71,919 |

| * | Unaudited. |

| # | The Fund changed its fiscal year end from October 31 to April 30. |

| †† | Annualized. |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. Class I shares are not subject to sales charges. For periods of less than one year, total return is not annualized. |

| (c) | Net of interest expense of 0.01%. (See Note 6) |

| (d) | In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| (e) | Net of interest expense of less than 0.01%. (See Note 6) |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

| 20 | MainStay CBRE Global Infrastructure Fund |

Financial Highlights selected per share data and ratios

| | Six months ended

October 31, | | Year Ended April 30, | | February 24,

2020^ through

April 30, |

| Class R6 | 2023 * | | 2023 | | 2022 | | 2021 | | 2020 |

| Net asset value at beginning of period | $ 12.82 | | $ 13.12 | | $ 12.82 | | $ 10.39 | | $ 12.51 |

| Net investment income (loss) (a) | 0.19 | | 0.23 | | 0.35 | | 0.17 | | 0.02 |

| Net realized and unrealized gain (loss) | (1.86) | | (0.15) | | 0.19 | | 2.45 | | (2.11) |

| Total from investment operations | (1.67) | | 0.08 | | 0.54 | | 2.62 | | (2.09) |

| Less distributions: | | | | | | | | | |

| From net investment income | (0.20) | | (0.26) | | (0.24) | | (0.19) | | (0.02) |

| From net realized gain on investments | — | | (0.12) | | — | | — | | — |

| Return of capital | — | | — | | — | | — | | (0.01) |

| Total distributions | (0.20) | | (0.38) | | (0.24) | | (0.19) | | (0.03) |

| Net asset value at end of period | $ 10.95 | | $ 12.82 | | $ 13.12 | | $ 12.82 | | $ 10.39 |

| Total investment return (b) | (13.16)% | | 0.78% | | 4.23% | | 25.50% | | (16.65)% |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | |

| Net investment income (loss) | 3.08%†† | | 1.80% | | 2.63% | | 1.47% | | 0.85%†† |

| Net expenses (c) | 0.90%††(d) | | 0.89% | | 0.91% | | 0.95% | | 0.95%†† |

| Expenses (before waiver/reimbursement) (c) | 0.90%††(d) | | 0.89% | | 0.91% | | 1.02% | | 1.13%†† |

| Portfolio turnover rate | 18% | | 43% | | 32% | | 51% | | 49% |

| Net assets at end of period (in 000's) | $ 640 | | $ 878 | | $ 10,541 | | $ 350 | | $ 21 |

| * | Unaudited. |

| ^ | Inception date. |

| †† | Annualized. |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. Class R6 shares are not subject to sales charges. For periods of less than one year, total return is not annualized. |

| (c) | In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| (d) | Net of interest expense of 0.01%. (See Note 6) |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

21

Notes to Financial Statements (Unaudited)

Note 1-Organization and Business

MainStay Funds Trust (the “Trust”) was organized as a Delaware statutory trust on April 28, 2009. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company, and is comprised of thirty-seven funds (collectively referred to as the “Funds”). These financial statements and notes relate to the MainStay CBRE Global Infrastructure Fund (the "Fund"), a “diversified” fund, as that term is defined in the 1940 Act, as interpreted or modified by regulatory authorities having jurisdiction, from time to time.

The following table lists the Fund's share classes that have been registered and commenced operations:

| Class | Commenced Operations |

| Class A | October 16, 2013 |

| Investor Class | February 24, 2020 |

| Class C | February 28, 2019 |

| Class I | June 28, 2013 |

| Class R6 | February 24, 2020 |

Class A and Investor Class shares are offered at net asset value (“NAV”) per share plus an initial sales charge. No initial sales charge applies to investments of $1 million or more (and certain other qualified purchases) in Class A and Investor Class shares. However, a contingent deferred sales charge (“CDSC”) of 1.00% may be imposed on certain redemptions made within 18 months of the date of purchase on shares that were purchased without an initial sales charge. Class C shares are offered at NAV without an initial sales charge, although a 1.00% CDSC may be imposed on certain redemptions of such shares made within one year of the date of purchase of Class C shares. Class I and Class R6 shares are offered at NAV without a sales charge. In addition, depending upon eligibility, Class C shares convert to either Class A or Investor Class shares at the end of the calendar quarter eight years after the date they were purchased. Additionally, Investor Class shares may convert automatically to Class A shares. Under certain circumstances and as may be permitted by the Trust’s multiple class plan pursuant to Rule 18f-3 under the 1940 Act, specified share classes of the Fund may be converted to one or more other share classes of the Fund as disclosed in the capital share transactions within these Notes. The classes of shares have the same voting (except for issues that relate solely to one class), dividend, liquidation and other rights, and the same terms and conditions, except that under distribution plans pursuant to Rule 12b-1 under the 1940 Act, Class C shares are subject to higher distribution and/or service fees than Class A and Investor Class shares. Class I and Class R6 shares are not subject to a distribution and/or service fee.

The Fund's investment objective is to seek total return.

Note 2–Significant Accounting Policies

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification

Topic 946 Financial Services—Investment Companies. The Fund prepares its financial statements in accordance with generally accepted accounting principles (“GAAP”) in the United States of America and follows the significant accounting policies described below.

(A) Securities Valuation. Investments are usually valued as of the close of regular trading on the New York Stock Exchange (the "Exchange") (usually 4:00 p.m. Eastern time) on each day the Fund is open for business ("valuation date").

Pursuant to Rule 2a-5 under the 1940 Act, the Board of Trustees of the Trust (the "Board") has designated New York Life Investment Management LLC (“New York Life Investments” or the "Manager") as its Valuation Designee (the "Valuation Designee"). The Valuation Designee is responsible for performing fair valuations relating to all investments in the Fund’s portfolio for which market quotations are not readily available; periodically assessing and managing material valuation risks; establishing and applying fair value methodologies; testing fair valuation methodologies; evaluating and overseeing pricing services; ensuring appropriate segregation of valuation and portfolio management functions; providing quarterly, annual and prompt reporting to the Board, as appropriate; identifying potential conflicts of interest; and maintaining appropriate records. The Valuation Designee has established a valuation committee ("Valuation Committee") to assist in carrying out the Valuation Designee’s responsibilities and establish prices of securities for which market quotations are not readily available. The Fund's and the Valuation Designee's policies and procedures ("Valuation Procedures") govern the Valuation Designee’s selection and application of methodologies for determining and calculating the fair value of Fund investments. The Valuation Designee may value the Fund's portfolio securities for which market quotations are not readily available and other Fund assets utilizing inputs from pricing services and other third-party sources. The Valuation Committee meets (in person, via electronic mail or via teleconference) on an ad-hoc basis to determine fair valuations and on a quarterly basis to review fair value events with respect to certain securities for which market quotations are not readily available, including valuation risks and back-testing results, and preview reports to the Board.

The Valuation Committee establishes prices of securities for which market quotations are not readily available based on such methodologies and measurements on a regular basis after considering information that is reasonably available and deemed relevant by the Valuation Committee. The Board shall oversee the Valuation Designee and review fair valuation materials on a prompt, quarterly and annual basis and approve proposed revisions to the Valuation Procedures.

Investments for which market quotations are not readily available are valued at fair value as determined in good faith pursuant to the Valuation Procedures. A market quotation is readily available only when that quotation is a quoted price (unadjusted) in active markets for identical investments that the Fund can access at the measurement date, provided that a quotation will not be readily available if it is not reliable. "Fair value" is defined as the price the Fund would reasonably expect to receive upon selling an asset or liability in an orderly transaction to an independent

| 22 | MainStay CBRE Global Infrastructure Fund |

buyer in the principal or most advantageous market for the asset or liability. Fair value measurements are determined within a framework that establishes a three-tier hierarchy that maximizes the use of observable market data and minimizes the use of unobservable inputs to establish a classification of fair value measurements for disclosure purposes. "Inputs" refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, such as the risk inherent in a particular valuation technique used to measure fair value using a pricing model and/or the risk inherent in the inputs for the valuation technique. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions market participants would use in pricing the asset or liability based on the information available. The inputs or methodology used for valuing assets or liabilities may not be an indication of the risks associated with investing in those assets or liabilities. The three-tier hierarchy of inputs is summarized below.

| • | Level 1—quoted prices (unadjusted) in active markets for an identical asset or liability |

| • | Level 2—other significant observable inputs (including quoted prices for a similar asset or liability in active markets, interest rates and yield curves, prepayment speeds, credit risk, etc.) |

| • | Level 3—significant unobservable inputs (including the Fund's own assumptions about the assumptions that market participants would use in measuring fair value of an asset or liability) |

The level of an asset or liability within the fair value hierarchy is based on the lowest level of an input, both individually and in the aggregate, that is significant to the fair value measurement. The aggregate value by input level of the Fund’s assets and liabilities as of October 31, 2023, is included at the end of the Portfolio of Investments.

The Fund may use third-party vendor evaluations, whose prices may be derived from one or more of the following standard inputs, among others:

| • Broker/dealer quotes | • Benchmark securities |

| • Two-sided markets | • Reference data (corporate actions or material event notices) |

| • Bids/offers | • Monthly payment information |

| • Industry and economic events | • Reported trades |

An asset or liability for which a market quotation is not readily available is valued by methods deemed reasonable in good faith by the Valuation Committee, following the Valuation Procedures to represent fair value. Under these procedures, the Valuation Designee generally uses a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values and other relevant information. The Valuation Designee may also use an income-based valuation approach in which the anticipated future cash flows of the asset or liability are discounted to calculate fair value. Discounts may also be applied due to the nature and/or duration of any

restrictions on the disposition of the asset or liability. Fair value represents a good faith approximation of the value of a security. Fair value determinations involve the consideration of a number of subjective factors, an analysis of applicable facts and circumstances and the exercise of judgment. As a result, it is possible that the fair value for a security determined in good faith in accordance with the Valuation Procedures may differ from valuations for the same security determined for other funds using their own valuation procedures. Although the Valuation Procedures are designed to value a security at the price the Fund may reasonably expect to receive upon the security's sale in an orderly transaction, there can be no assurance that any fair value determination thereunder would, in fact, approximate the amount that the Fund would actually realize upon the sale of the security or the price at which the security would trade if a reliable market price were readily available. During the six-month period ended October 31, 2023, there were no material changes to the fair value methodologies.

Securities which may be valued in this manner include, but are not limited to: (i) a security for which trading has been halted or suspended or otherwise does not have a readily available market quotation on a given day; (ii) a debt security that has recently gone into default and for which there is not a current market quotation; (iii) a security of an issuer that has entered into a restructuring; (iv) a security that has been delisted from a national exchange; (v) a security subject to trading collars for which no or limited trading takes place; and (vi) a security whose principal market has been temporarily closed at a time when, under normal conditions, it would be open. Securities valued in this manner are generally categorized as Level 2 or 3 in the hierarchy. As of October 31, 2023, securities that were fair valued in such a manner are shown in the Portfolio of Investments.

Certain securities held by the Fund may principally trade in foreign markets. Events may occur between the time the foreign markets close and the time at which the Fund's NAVs are calculated. These events may include, but are not limited to, situations relating to a single issuer in a market sector, significant fluctuations in U.S. or foreign markets, natural disasters, armed conflicts, governmental actions or other developments not tied directly to the securities markets. Should the Valuation Designee conclude that such events may have affected the accuracy of the last price of such securities reported on the local foreign market, the Valuation Designee may, pursuant to the Valuation Procedures, adjust the value of the local price to reflect the estimated impact on the price of such securities as a result of such events. In this instance, securities are generally categorized as Level 3 in the hierarchy. Additionally, certain foreign equity securities are also fair valued whenever the movement of a particular index exceeds certain thresholds. In such cases, the securities are fair valued by applying factors provided by a third-party vendor in accordance with the Valuation Procedures and are generally categorized as Level 2 in the hierarchy. No foreign equity securities held by the Fund as of October 31, 2023 were fair valued in such a manner.

If the principal market of certain foreign equity securities is closed in observance of a local foreign holiday, these securities are valued using the last closing price of regular trading on the relevant exchange and fair

Notes to Financial Statements (Unaudited) (continued)

valued by applying factors provided by a third-party vendor in accordance with the Valuation Procedures. These securities are generally categorized as Level 2 in the hierarchy. No securities held by the Fund as of October 31, 2023, were fair valued in such a manner.

Equity securities, rights and warrants, if applicable, are valued at the last quoted sales prices as of the close of regular trading on the relevant exchange on each valuation date. Securities that are not traded on the valuation date are valued at the mean of the last quoted bid and ask prices. Prices are normally taken from the principal market in which each security trades. These securities are generally categorized as Level 1 in the hierarchy.

Investments in mutual funds, including money market funds, are valued at their respective NAVs at the close of business each day on the valuation date. These securities are generally categorized as Level 1 in the hierarchy.

Temporary cash investments acquired in excess of 60 days to maturity at the time of purchase are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities and ratings), both as furnished by independent pricing services. Temporary cash investments that mature in 60 days or less at the time of purchase ("Short-Term Investments") are valued using the amortized cost method of valuation, unless the use of such method would be inappropriate. The amortized cost method involves valuing a security at its cost on the date of purchase and thereafter assuming a constant amortization to maturity of the difference between such cost and the value on maturity date. Amortized cost approximates the current fair value of a security. Securities valued using the amortized cost method are not valued using quoted prices in an active market and are generally categorized as Level 2 in the hierarchy.

The information above is not intended to reflect an exhaustive list of the methodologies that may be used to value portfolio investments. The Valuation Procedures permit the use of a variety of valuation methodologies in connection with valuing portfolio investments. The methodology used for a specific type of investment may vary based on the market data available or other considerations. The methodologies summarized above may not represent the specific means by which portfolio investments are valued on any particular business day.

A portfolio investment may be classified as an illiquid investment under the Trust's written liquidity risk management program and related procedures (“Liquidity Program”). Illiquidity of an investment might prevent the sale of such investment at a time when the Manager or the Subadvisor might wish to sell, and these investments could have the effect of decreasing the overall level of the Fund's liquidity. Further, the lack of an established secondary market may make it more difficult to value illiquid investments, requiring the Fund to rely on judgments that may be somewhat subjective in measuring value, which could vary materially from the amount that the Fund could realize upon disposition. Difficulty in selling illiquid investments may result in a loss or may be costly to the Fund. An illiquid investment is any investment that the Manager or Subadvisor reasonably expects cannot be sold or disposed of

in current market conditions in seven calendar days or less without the sale or disposition significantly changing the market value of the investment. The liquidity classification of each investment will be made using information obtained after reasonable inquiry and taking into account, among other things, relevant market, trading and investment-specific considerations in accordance with the Liquidity Program. Illiquid investments are often fair valued in accordance with the Fund's procedures described above. The liquidity of the Fund's investments was determined as of October 31, 2023, and can change at any time. Illiquid investments as of October 31, 2023, are shown in the Portfolio of Investments.

(B) Income Taxes. The Fund's policy is to comply with the requirements of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), applicable to regulated investment companies and to distribute all of its taxable income to the shareholders of the Fund within the allowable time limits.

The Manager evaluates the Fund’s tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax liabilities in the financial statements. Recognition of tax benefits of an uncertain tax position is permitted only to the extent the position is “more likely than not” to be sustained assuming examination by taxing authorities. The Manager analyzed the Fund's tax positions taken on federal, state and local income tax returns for all open tax years (for up to three tax years) and has concluded that no provisions for federal, state and local income tax are required in the Fund's financial statements. The Fund's federal, state and local income tax and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state and local departments of revenue.

(C) Foreign Taxes. The Fund may be subject to foreign taxes on income and other transaction-based taxes imposed by certain countries in which it invests. A portion of the taxes on gains on investments or currency purchases/repatriation may be reclaimable. The Fund will accrue such taxes and reclaims as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

The Fund may be subject to taxation on realized capital gains, repatriation proceeds and other transaction-based taxes imposed by certain countries in which it invests. The Fund will accrue such taxes as applicable based upon its current interpretation of tax rules and regulations that exist in the market in which it invests. Capital gains taxes relating to positions still held are reflected as a liability in the Statement of Assets and Liabilities, as well as an adjustment to the Fund's net unrealized appreciation (depreciation). Taxes related to capital gains realized, if any, are reflected as part of net realized gain (loss) in the Statement of Operations. Changes in tax liabilities related to capital gains taxes on unrealized investment gains, if any, are reflected as part of the change in net unrealized appreciation (depreciation) on investments in the Statement of

| 24 | MainStay CBRE Global Infrastructure Fund |

Operations. Transaction-based charges are generally assessed as a percentage of the transaction amount.

(D) Dividends and Distributions to Shareholders. Dividends and distributions are recorded on the ex-dividend date. The Fund intends to declare and pay dividends from net investment income, if any, at least quarterly and distributions from net realized capital and currency gains, if any, at least annually. Unless a shareholder elects otherwise, all dividends and distributions are reinvested at NAV in the same class of shares of the Fund. Dividends and distributions to shareholders are determined in accordance with federal income tax regulations and may differ from determinations using GAAP.

(E) Security Transactions and Investment Income. The Fund records security transactions on the trade date. Realized gains and losses on security transactions are determined using the identified cost method. Dividend income is recognized on the ex-dividend date, net of any foreign tax withheld at the source, and interest income is accrued as earned using the effective interest rate method. Distributions received from real estate investment trusts may be classified as dividends, capital gains and/or return of capital.

The Fund may also invest up to 25% of its net assets in master limited partnerships.

Investment income and realized and unrealized gains and losses on investments of the Fund are allocated pro rata to the separate classes of shares based upon their relative net assets on the date the income is earned or realized and unrealized gains and losses are incurred.

(F) Expenses. Expenses of the Trust are allocated to the individual Funds in proportion to the net assets of the respective Funds when the expenses are incurred, except where direct allocations of expenses can be made. Expenses (other than transfer agent expenses and fees incurred under the shareholder services plans and/or the distribution plans further discussed in Note 3(B)) are allocated to separate classes of shares pro rata based upon their relative net assets on the date the expenses are incurred. The expenses borne by the Fund, including those of related parties to the Fund, are shown in the Statement of Operations.