UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22321

MAINSTAY FUNDS TRUST

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

30 Hudson Street

Jersey City, New Jersey 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 576-7000

Date of fiscal year end: October 31

Date of reporting period: April 30, 2024

Item 1. Reports to Stockholders.

MainStay Balanced Fund

Message from the President and Semiannual Report

Unaudited | April 30, 2024

Special Notice:

Beginning in July 2024, new regulations issued by the Securities and Exchange Commission (SEC) will take effect requiring open-end mutual fund companies and ETFs to (1) overhaul the content of their shareholder reports and (2) mail paper copies of the new tailored shareholder reports to shareholders who have not opted to receive these documents electronically.

If you have not yet elected to receive your shareholder reports electronically, please contact your financial intermediary or visit newyorklifeinvestments.com/accounts.

| Not FDIC/NCUA Insured | Not a Deposit | May Lose Value | No Bank Guarantee | Not Insured by Any Government Agency |

This page intentionally left blank

Message from the President

Stock and bond markets gained broad ground during the six-month period ended April 30, 2024, bolstered by better-than-expected economic growth and the prospect of monetary easing in the face of a myriad of macroeconomic and geopolitical challenges.

Throughout the reporting period, interest rates remained at their highest levels in decades in most developed countries, with the U.S. federal funds rate in the 5.25%−5.50% range, as central banks struggled to bring inflation under control. Early in the reporting period, the U.S. Federal Reserve began to forecast interest rate cuts in 2024, but delayed action as inflation remained stubbornly high, fluctuating between 3.1% and 3.5%. Nevertheless, despite the increasing cost of capital and tighter lending environment that resulted from sustained high rates, economic growth remained surprisingly robust, supported by high levels of consumer spending, low unemployment and strong corporate earnings. Investors tended to shrug off concerns related to sticky inflation and high interest rates—not to mention the ongoing war in Ukraine, intensifying hostilities in the Middle East and simmering tensions between China and the United States—focusing instead on the positives of continued economic growth and surprisingly strong corporate profits.

The S&P 500® Index, a widely regarded benchmark of U.S. market performance, produced double-digit gains, reaching record levels in March 2024. Market strength, which had been narrowly focused on mega-cap, technology-related stocks during the previous six months broadened significantly during the reporting period. All industry sectors produced positive results, with the strongest returns in communication services, information technology and industrials, and more moderate gains in the lagging energy, real estate and consumer staples areas. Growth-oriented shares slightly outperformed value-oriented

issues, while large- and mid-cap stocks modestly outperformed their small-cap counterparts. Most overseas equity markets trailed the U.S. market, as developed international economies experienced relatively low growth rates, and weak economic conditions in China undermined emerging markets.

Bonds generally gained ground as well. The yield on the 10-year Treasury note ranged between approximately 4.7% and 3.8%, while the 2-year Treasury yield remained slightly higher, between approximately 5.0% and 4.1%, in an inverted curve pattern often viewed as indicative of an impending economic slowdown. Nevertheless, the prevailing environment of stable interest rates and attractive yields provided a favorable environment for fixed-income investors. Long-term Treasury bonds and investment-grade corporate bonds produced similar gains, while high yield bonds advanced by a slightly greater margin, despite the added risks implicit in an uptick in default rates. International bond markets modestly outperformed their U.S. counterparts, led by a rebound in the performance of emerging-markets debt.

The risks and uncertainties inherent in today’s markets call for the kind of insight and expertise that New York Life Investments offers through our one-on-one philosophy, long-lasting focus, and multi-boutique approach.

Thank you for trusting us to help you meet your investment needs.

Sincerely,

Kirk C. Lehneis

President

The opinions expressed are as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Past performance is no guarantee of future results.

Not part of the Semiannual Report

Investors should refer to the Fund’s Summary Prospectus and/or Prospectus and consider the Fund’s investment objectives, strategies, risks, charges and expenses carefully before investing. The Summary Prospectus and/or Prospectus contain this and other information about the Fund. You may obtain copies of the Fund’s Summary Prospectus, Prospectus and Statement of Additional Information, which includes information about the MainStay Funds Trust's Trustees, free of charge, upon request, by calling toll-free 800-624-6782, by writing to NYLIFE Distributors LLC, Attn: MainStay Marketing Department, 30 Hudson Street, Jersey City, NJ 07302 or by sending an e-mail to MainStayShareholderServices@nylim.com. These documents are also available on dfinview.com/NYLIM. Please read the Fund’s Summary Prospectus and/or Prospectus carefully before investing.

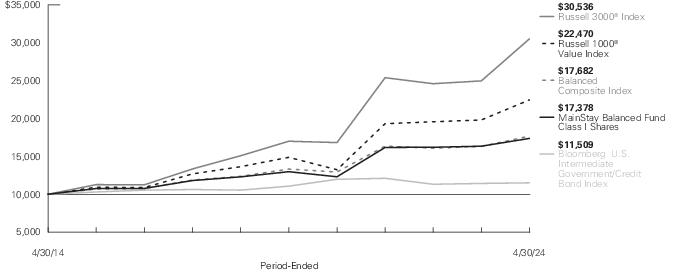

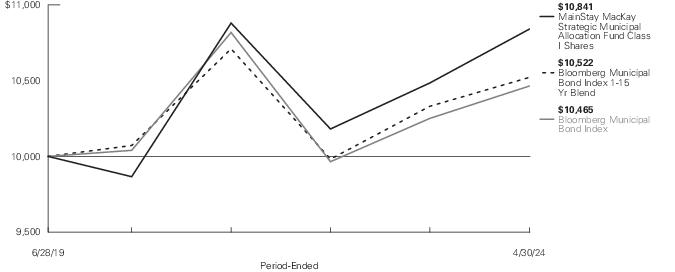

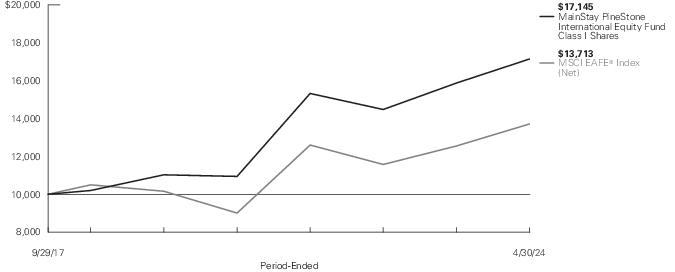

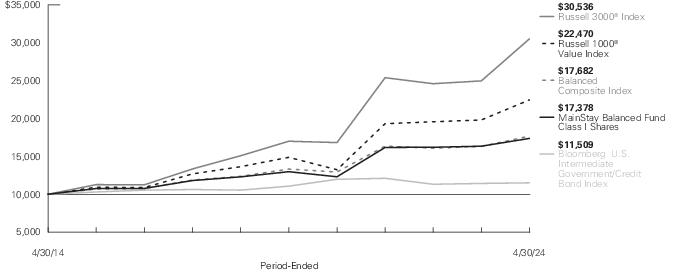

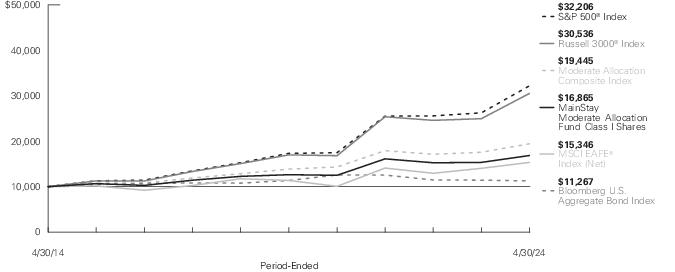

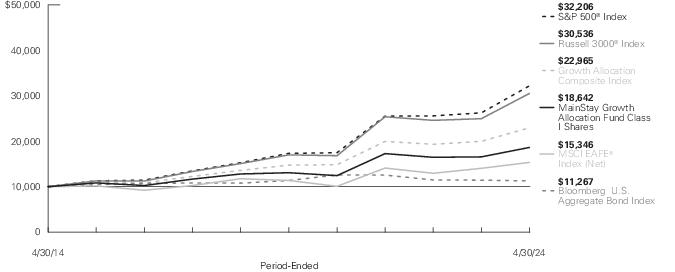

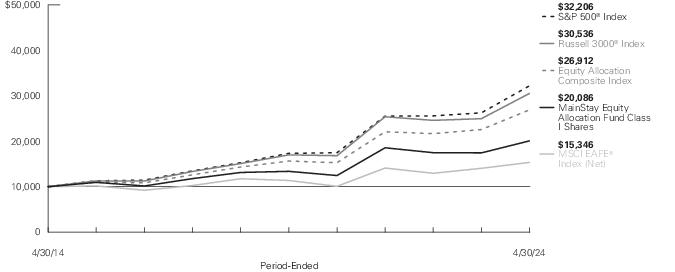

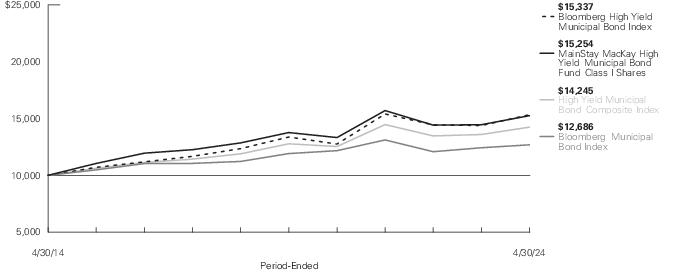

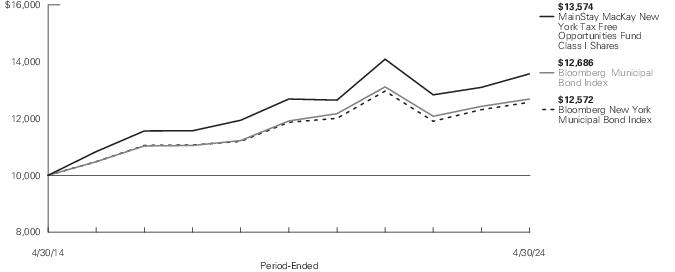

Investment and Performance Comparison (Unaudited)

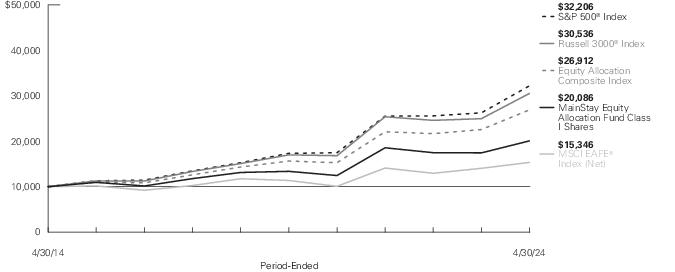

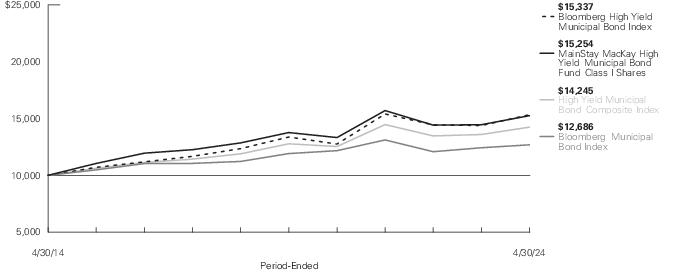

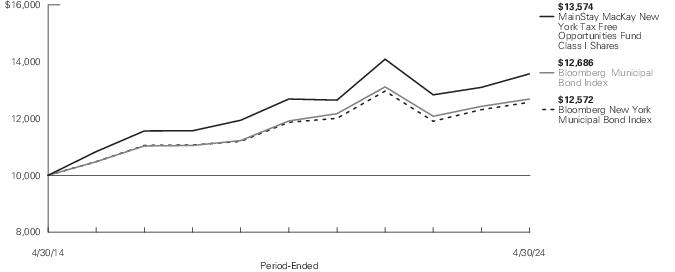

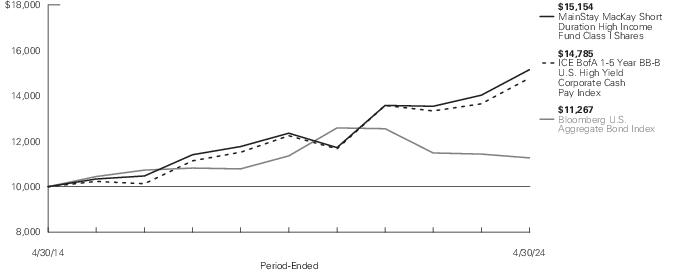

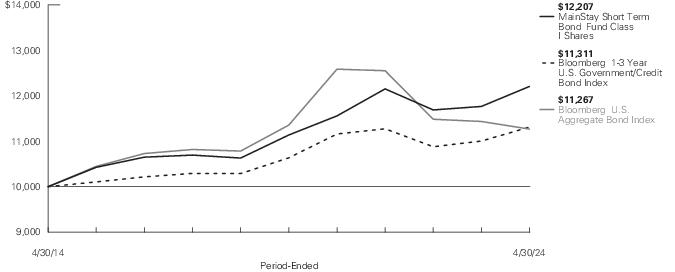

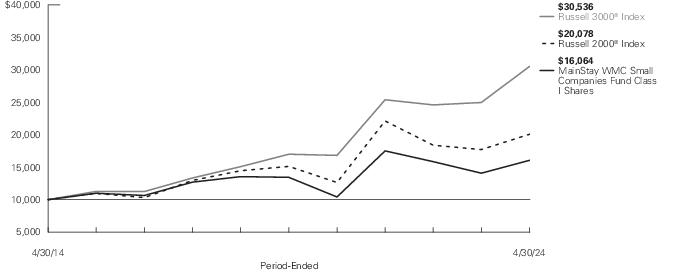

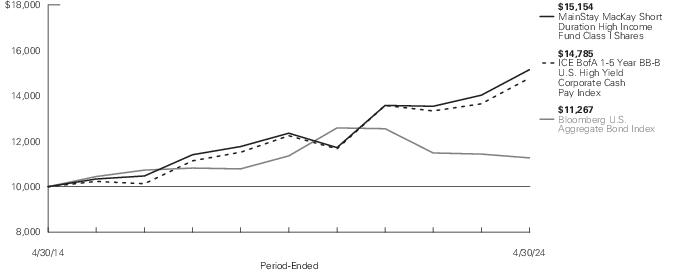

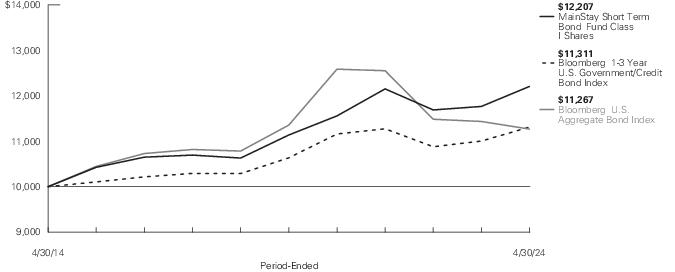

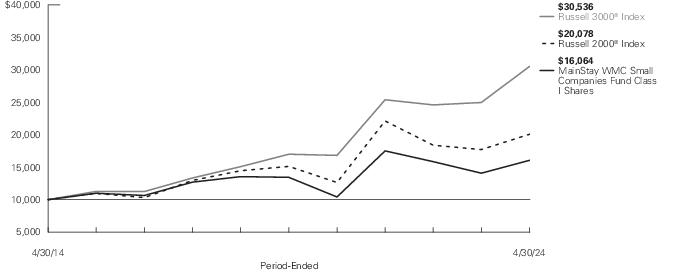

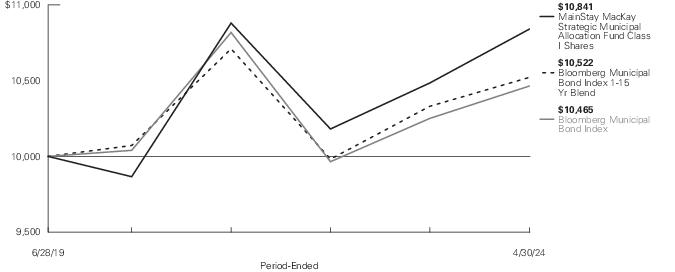

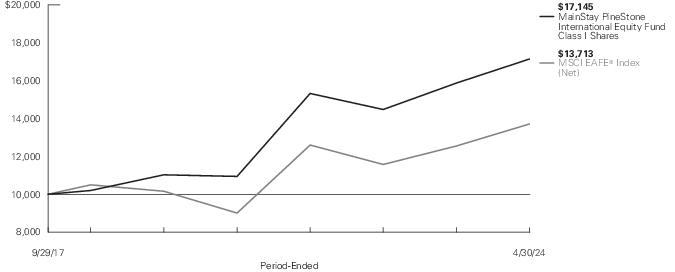

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility and other factors, current performance may be lower or higher than the figures shown. Investment return and principal value will fluctuate, and as a result, when shares are redeemed, they may be worth more or less than their original cost. The graph below depicts the historical performance of Class I shares of the Fund. Performance will vary from class to class based on differences in class-specific expenses and sales charges. For performance information current to the most recent month-end, please call 800-624-6782 or visit newyorklifeinvestments.com.

The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on distributions or Fund share redemptions. Total returns reflect maximum applicable sales charges as indicated in the table below, if any, changes in share price, and reinvestment of dividend and capital gain distributions. The graph assumes the initial investment amount shown below and reflects the deduction of all sales charges that would have applied for the period of investment. Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. For more information on share classes and current fee waivers and/or expense limitations (if any), please refer to the Notes to Financial Statements.

| Average Annual Total Returns for the Period-Ended April 30, 2024 |

| Class | Sales Charge | | Inception

Date1 | Six

Months2 | One

Year | Five

Years | Ten Years

or Since

Inception | Gross

Expense

Ratio3 |

| Class A Shares4 | Maximum 3.00% Initial Sales Charge | With sales charges | 1/2/2004 | 6.38% | 2.89% | 4.55% | 4.82% | 1.07% |

| | | Excluding sales charges | | 9.67 | 6.07 | 5.74 | 5.42 | 1.07 |

| Investor Class Shares5 | Maximum 2.50% Initial Sales Charge | With sales charges | 2/28/2008 | 6.79 | 3.15 | 4.29 | 4.60 | 1.42 |

| | | Excluding sales charges | | 9.53 | 5.80 | 5.48 | 5.20 | 1.42 |

| Class B Shares6 | Maximum 5.00% CDSC | With sales charges | 1/2/2004 | 4.13 | -0.00 | 4.37 | 4.41 | 2.17 |

| | if Redeemed Within the First Six Years of Purchase | Excluding sales charges | | 9.13 | 5.00 | 4.69 | 4.41 | 2.17 |

| Class C Shares | Maximum 1.00% CDSC | With sales charges | 12/30/2002 | 8.13 | 3.96 | 4.69 | 4.41 | 2.17 |

| | if Redeemed Within One Year of Purchase | Excluding sales charges | | 9.13 | 4.96 | 4.69 | 4.41 | 2.17 |

| Class I Shares | No Sales Charge | | 5/1/1989 | 9.80 | 6.31 | 6.01 | 5.68 | 0.82 |

| Class R6 Shares | No Sales Charge | | 12/15/2017 | 9.84 | 6.40 | 6.10 | 5.38 | 0.73 |

| 1. | Effective March 5, 2021, the Fund replaced the subadvisor to the equity portion of the Fund and modified its principal investment strategies. The past performance in the graph and table prior to that date reflects the Fund’s prior subadvisor and principal investment strategies for the equity portion of the Fund. |

| 2. | Not annualized. |

| 3. | The gross expense ratios presented reflect the Fund’s “Total Annual Fund Operating Expenses” from the most recent Prospectus, as supplemented, and may differ from other expense ratios disclosed in this report. |

| 4. | Prior to November 4, 2019, the maximum initial sales charge was 5.50%, which is reflected in the applicable average annual total return figures shown. |

| 5. | Prior to June 30, 2020, the maximum initial sales charge was 3.00%, which is reflected in the applicable average annual total return figures shown. |

| 6. | Class B shares are closed to all new purchases as well as additional investments by existing Class B shareholders. |

The footnotes on the next page are an integral part of the table and graph and should be carefully read in conjunction with them.

| Benchmark Performance* | Six

Months1 | One

Year | Five

Years | Ten

Years |

| Russell 3000® Index2 | 21.09% | 22.30% | 12.43% | 11.81% |

| Russell 1000® Value Index3 | 18.42 | 13.42 | 8.60 | 8.43 |

| Bloomberg U.S. Intermediate Government/Credit Bond Index4 | 3.47 | 0.69 | 0.78 | 1.42 |

| Balanced Composite Index5 | 12.30 | 8.37 | 5.81 | 5.86 |

| Morningstar Moderate Allocation Category Average6 | 13.00 | 10.46 | 6.28 | 6.07 |

| * | Returns for indices reflect no deductions for fees, expenses or taxes, except for foreign withholding taxes where applicable. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 1. | Not annualized. |

| 2. | In accordance with new regulatory requirements, the Fund has selected the Russell 3000® Index, which represents a broad measure of market performance, as a replacement for the Russell 1000® Value Index. The Russell 3000® Index measures the performance of the largest 3,000 U.S. companies representing approximately 98% of the investable U.S. equity market. |

| 3. | The Russell 1000® Value Index, which is generally representative of the market sectors or types of investments in which the Fund invests, measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® Index companies with lower price-to-book ratios and lower expected growth values. |

| 4. | The Bloomberg U.S. Intermediate Government/Credit Bond Index, which is generally representative of the market sectors or types of investments in which the Fund invests, measures the performance of U.S. dollar denominated U.S. treasuries, government related and investment grade U.S. corporate securities that have a remaining maturity of greater than one year and less than ten years. |

| 5. | The Balanced Composite Index, which is generally representative of the market sectors or types of investments in which the Fund invests, consists of the Russell 1000® Value Index and the Bloomberg U.S. Intermediate Government/Credit Bond Index weighted 60%/40%, respectively. |

| 6. | The Morningstar Moderate Allocation Category Average is representative of funds in allocation categories that seek to provide both income and capital appreciation by primarily investing in multiple asset classes, including stocks, bonds, and cash. These moderate strategies seek to balance preservation of capital with appreciation. They typically expect volatility similar to a strategic equity exposure between 50% and 70%. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

The footnotes on the preceding page are an integral part of the table and graph and should be carefully read in conjunction with them.

Cost in Dollars of a $1,000 Investment in MainStay Balanced Fund (Unaudited)

The example below is intended to describe the fees and expenses borne by shareholders during the six-month period from November 1, 2023 to April 30, 2024, and the impact of those costs on your investment.

Example

As a shareholder of the Fund you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from November 1, 2023 to April 30, 2024.

This example illustrates your Fund’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the six months ended April 30, 2024. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the

result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Share Class | Beginning

Account

Value

11/1/23 | Ending Account

Value (Based

on Actual

Returns and

Expenses)

4/30/24 | Expenses

Paid

During

Period1 | Ending Account

Value (Based

on Hypothetical

5% Annualized

Return and

Actual Expenses)

4/30/24 | Expenses

Paid

During

Period1 | Net Expense

Ratio

During

Period2 |

| Class A Shares | $1,000.00 | $1,096.70 | $ 5.53 | $1,019.59 | $ 5.32 | 1.06% |

| Investor Class Shares | $1,000.00 | $1,095.30 | $ 6.88 | $1,018.30 | $ 6.62 | 1.32% |

| Class B Shares | $1,000.00 | $1,091.30 | $10.76 | $1,014.57 | $10.37 | 2.07% |

| Class C Shares | $1,000.00 | $1,091.30 | $10.76 | $1,014.57 | $10.37 | 2.07% |

| Class I Shares | $1,000.00 | $1,098.00 | $ 4.23 | $1,020.84 | $ 4.07 | 0.81% |

| Class R6 Shares | $1,000.00 | $1,098.40 | $ 3.81 | $1,021.23 | $ 3.67 | 0.73% |

| 1. | Expenses are equal to the Fund’s annualized expense ratio of each class multiplied by the average account value over the period, divided by 366 and multiplied by 182 (to reflect the six-month period). The table above represents the actual expenses incurred during the six-month period. In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above-reported expense figures. |

| 2. | Expenses are equal to the Fund's annualized expense ratio to reflect the six-month period. |

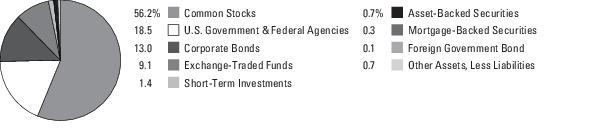

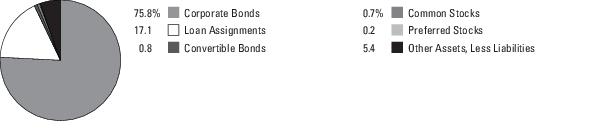

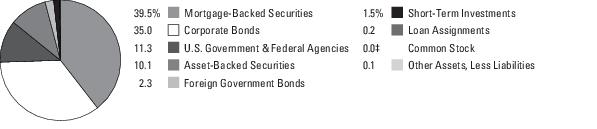

Portfolio Composition as of April 30, 2024 (Unaudited)

See Portfolio of Investments beginning on page 9 for specific holdings within these categories. The Fund's holdings are subject to change.

Top Ten Holdings and/or Issuers Held as of April 30, 2024 (excluding short-term investments) (Unaudited)

| 1. | U.S. Treasury Notes, 2.50%-4.875%, due 5/15/24–2/15/34 |

| 2. | iShares Russell 1000 Value ETF |

| 3. | JPMorgan Chase & Co. |

| 4. | Vanguard Russell 1000 Value |

| 5. | iShares Intermediate Government/Credit Bond ETF |

| 6. | Merck & Co., Inc. |

| 7. | Johnson & Johnson |

| 8. | Vanguard Intermediate-Term Treasury ETF |

| 9. | Cisco Systems, Inc. |

| 10. | Morgan Stanley |

Portfolio of Investments April 30, 2024†^(Unaudited)

| | Principal

Amount | Value |

| Long-Term Bonds 32.6% |

| Asset-Backed Securities 0.7% |

| Other Asset-Backed Securities 0.7% |

| Ballyrock CLO 23 Ltd. | | |

| Series 2023-23A, Class A1 | | |

| 7.304% (3 Month SOFR + 1.98%), due 4/25/36 (Jersey, C.I.) (a)(b) | $ 750,000 | $ 756,397 |

| Barings CLO Ltd. | | |

| Series 2024-1A, Class B | | |

| 7.369% (3 Month SOFR + 2.10%), due 1/20/37 (Cayman Islands) (a)(b) | 500,000 | 502,104 |

| Benefit Street Partners CLO XXX Ltd. | | |

| Series 2023-30A, Class A | | |

| 7.424% (3 Month SOFR + 2.10%), due 4/25/36 (Jersey, C.I.) (a)(b) | 700,000 | 705,165 |

| Carlyle Global Market Strategies CLO Ltd. | | |

| Series 2013-3A, Class A2R | | |

| 6.99% (3 Month SOFR + 1.662%), due 10/15/30 (Cayman Islands) (a)(b) | 1,100,000 | 1,100,899 |

| STORE Master Funding I-VII XIV XIX XX | | |

| Series 2021-1A, Class A1 | | |

| 2.12%, due 6/20/51 (a) | 304,376 | 259,558 |

| | | 3,324,123 |

Total Asset-Backed Securities

(Cost $3,350,412) | | 3,324,123 |

| Corporate Bonds 13.0% |

| Aerospace & Defense 0.3% |

| BAE Systems plc | | |

| 5.125%, due 3/26/29 (United Kingdom) (a) | 850,000 | 834,402 |

| Boeing Co. (The) | | |

| 5.15%, due 5/1/30 | 290,000 | 274,279 |

| 5.805%, due 5/1/50 | 120,000 | 106,191 |

| HEICO Corp. | | |

| 5.35%, due 8/1/33 | 210,000 | 206,235 |

| | | 1,421,107 |

| Auto Manufacturers 0.5% |

| Ford Motor Co. | | |

| 3.25%, due 2/12/32 | 205,000 | 165,113 |

| Ford Motor Credit Co. LLC | | |

| 4.542%, due 8/1/26 | 450,000 | 435,268 |

| General Motors Financial Co., Inc. | | |

| 6.05%, due 10/10/25 | 595,000 | 596,386 |

| | Principal

Amount | Value |

| |

| Auto Manufacturers (continued) |

| Hyundai Capital America | | |

| 5.68%, due 6/26/28 (a) | $ 580,000 | $ 577,726 |

| Volkswagen Group of America Finance LLC | | |

| 5.60%, due 3/22/34 (Germany) (a) | 295,000 | 287,952 |

| | | 2,062,445 |

| Auto Parts & Equipment 0.1% |

| Aptiv plc | | |

| 3.25%, due 3/1/32 | 320,000 | 270,436 |

| Banks 4.7% |

| ABN AMRO Bank NV | | |

| 6.339% (1 Year Treasury Constant Maturity Rate + 1.65%), due 9/18/27 (Netherlands) (a)(b) | 400,000 | 403,488 |

| Bank of America Corp. (c) | | |

| 1.734%, due 7/22/27 | 1,040,000 | 954,135 |

| 2.087%, due 6/14/29 | 865,000 | 752,557 |

| 5.202%, due 4/25/29 | 660,000 | 649,785 |

| 5.468%, due 1/23/35 | 200,000 | 194,494 |

| Bank of New York Mellon Corp. (The) | | |

| 6.474%, due 10/25/34 (c) | 175,000 | 184,733 |

| Barclays plc | | |

| 7.385% (1 Year Treasury Constant Maturity Rate + 3.30%), due 11/2/28 (United Kingdom) (b) | 405,000 | 423,009 |

| Citigroup, Inc. (c) | | |

| 2.014%, due 1/25/26 | 875,000 | 849,516 |

| 5.61%, due 9/29/26 | 1,050,000 | 1,047,691 |

| 6.174%, due 5/25/34 | 410,000 | 406,900 |

| Citizens Bank NA | | |

| 6.064%, due 10/24/25 (c) | 380,000 | 378,217 |

| Citizens Financial Group, Inc. | | |

| 6.645%, due 4/25/35 (c) | 265,000 | 265,741 |

| Credit Suisse AG | | |

| 7.95%, due 1/9/25 (Switzerland) | 1,000,000 | 1,013,460 |

| Danske Bank A/S | | |

| 6.466% (1 Year Treasury Constant Maturity Rate + 2.10%), due 1/9/26 (Denmark) (a)(b) | 850,000 | 851,097 |

| Deutsche Bank AG | | |

| 7.079%, due 2/10/34 (Germany) (c) | 270,000 | 269,242 |

| Goldman Sachs Group, Inc. (The) | | |

| 5.70%, due 11/1/24 | 650,000 | 650,136 |

| 6.484%, due 10/24/29 (c) | 345,000 | 355,985 |

| HSBC Holdings plc (United Kingdom) (c) | | |

| 6.547%, due 6/20/34 | 330,000 | 333,972 |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

9

Portfolio of Investments April 30, 2024†^(Unaudited) (continued)

| | Principal

Amount | Value |

| Corporate Bonds (continued) |

| Banks (continued) |

HSBC Holdings plc (United Kingdom) (c)

(continued) | | |

| 7.39%, due 11/3/28 | $ 470,000 | $ 492,718 |

| JPMorgan Chase & Co. (c) | | |

| 2.005%, due 3/13/26 | 190,000 | 183,800 |

| 5.012%, due 1/23/30 | 600,000 | 585,441 |

| 5.04%, due 1/23/28 | 625,000 | 616,133 |

| 5.546%, due 12/15/25 | 730,000 | 728,112 |

| 5.571%, due 4/22/28 | 295,000 | 294,767 |

| 5.581%, due 4/22/30 | 595,000 | 594,473 |

| Mitsubishi UFJ Financial Group, Inc. | | |

| 5.426% (1 Year Treasury Constant Maturity Rate + 1.00%), due 4/17/35 (Japan) (b) | 200,000 | 195,133 |

| Morgan Stanley (c) | | |

| 4.679%, due 7/17/26 | 1,314,000 | 1,296,914 |

| 5.173%, due 1/16/30 | 160,000 | 156,879 |

| 5.656%, due 4/18/30 | 310,000 | 310,066 |

| Morgan Stanley Bank NA | | |

| 4.754%, due 4/21/26 | 425,000 | 419,467 |

| 4.952%, due 1/14/28 (c) | 250,000 | 246,257 |

| National Securities Clearing Corp. | | |

| 5.00%, due 5/30/28 (a) | 375,000 | 370,519 |

| PNC Financial Services Group, Inc. (The) (c) | | |

| 5.812%, due 6/12/26 | 415,000 | 415,086 |

| 6.615%, due 10/20/27 | 545,000 | 556,907 |

| 6.875%, due 10/20/34 | 20,000 | 21,228 |

| Royal Bank of Canada | | |

| 5.66%, due 10/25/24 (Canada) | 605,000 | 605,060 |

| Truist Bank | | |

| 2.636% (5 Year Treasury Constant Maturity Rate + 1.15%), due 9/17/29 (b) | 250,000 | 240,803 |

| Truist Financial Corp. | | |

| 5.122%, due 1/26/34 (c) | 160,000 | 149,084 |

| U.S. Bancorp (c) | | |

| 4.653%, due 2/1/29 | 150,000 | 144,571 |

| 6.787%, due 10/26/27 | 385,000 | 394,856 |

| UBS Group AG (Switzerland) (a) | | |

| 5.428% (1 Year Treasury Constant Maturity Rate + 1.52%), due 2/8/30 (b) | 340,000 | 334,366 |

| 6.442%, due 8/11/28 (c) | 550,000 | 558,390 |

| | Principal

Amount | Value |

| |

| Banks (continued) |

| Wells Fargo & Co. (c) | | |

| 5.198%, due 1/23/30 | $ 845,000 | $ 828,548 |

| 5.499%, due 1/23/35 | 385,000 | 373,984 |

| | | 21,097,720 |

| Beverages 0.1% |

| Constellation Brands, Inc. | | |

| 4.90%, due 5/1/33 | 345,000 | 325,428 |

| Keurig Dr Pepper, Inc. | | |

| Series 10 | | |

| 5.20%, due 3/15/31 | 130,000 | 127,076 |

| | | 452,504 |

| Biotechnology 0.2% |

| Amgen, Inc. | | |

| 4.05%, due 8/18/29 | 590,000 | 555,004 |

| 5.15%, due 3/2/28 | 300,000 | 297,336 |

| 5.25%, due 3/2/30 | 200,000 | 198,236 |

| | | 1,050,576 |

| Chemicals 0.2% |

| Celanese US Holdings LLC | | |

| 6.33%, due 7/15/29 | 420,000 | 426,052 |

| 6.55%, due 11/15/30 | 230,000 | 235,599 |

| | | 661,651 |

| Commercial Services 0.1% |

| Global Payments, Inc. | | |

| 2.15%, due 1/15/27 | 400,000 | 366,218 |

| Computers 0.0% ‡ |

| Dell International LLC | | |

| 5.40%, due 4/15/34 | 135,000 | 130,798 |

| Diversified Financial Services 0.5% |

| American Express Co. | | |

| 6.489%, due 10/30/31 (c) | 390,000 | 408,217 |

| Ares Management Corp. | | |

| 6.375%, due 11/10/28 | 425,000 | 438,511 |

| Blackstone Holdings Finance Co. LLC | | |

| 5.90%, due 11/3/27 (a) | 605,000 | 612,226 |

| Charles Schwab Corp. (The) | | |

| 6.196%, due 11/17/29 (c) | 470,000 | 481,023 |

| Intercontinental Exchange, Inc. | | |

| 4.35%, due 6/15/29 | 110,000 | 104,999 |

| | | 2,044,976 |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

| | Principal

Amount | Value |

| Corporate Bonds (continued) |

| Electric 1.5% |

| AEP Texas, Inc. | | |

| 4.70%, due 5/15/32 | $ 40,000 | $ 37,086 |

| American Electric Power Co., Inc. | | |

| 5.625%, due 3/1/33 | 220,000 | 215,048 |

| Appalachian Power Co. | | |

| Series BB | | |

| 4.50%, due 8/1/32 | 45,000 | 40,969 |

| Arizona Public Service Co. | | |

| 5.55%, due 8/1/33 | 415,000 | 406,805 |

| Commonwealth Edison Co. | | |

| 3.10%, due 11/1/24 | 290,000 | 286,167 |

| Duke Energy Carolinas LLC | | |

| 4.95%, due 1/15/33 | 195,000 | 187,681 |

| Duke Energy Corp. | | |

| 2.45%, due 6/1/30 | 240,000 | 202,176 |

| 4.50%, due 8/15/32 | 140,000 | 128,889 |

| Duke Energy Ohio, Inc. | | |

| 5.25%, due 4/1/33 | 70,000 | 68,297 |

| Enel Finance America LLC | | |

| 7.10%, due 10/14/27 (Italy) (a) | 420,000 | 437,798 |

| Entergy Arkansas LLC | | |

| 5.15%, due 1/15/33 | 220,000 | 213,713 |

| Florida Power & Light Co. | | |

| 5.05%, due 4/1/28 | 640,000 | 636,454 |

| Georgia Power Co. | | |

| 4.65%, due 5/16/28 | 755,000 | 734,036 |

| National Rural Utilities Cooperative Finance Corp. | | |

| 5.05%, due 9/15/28 | 330,000 | 326,228 |

| NextEra Energy Capital Holdings, Inc. | | |

| 6.051%, due 3/1/25 | 280,000 | 280,554 |

| Pacific Gas and Electric Co. | | |

| 5.45%, due 6/15/27 | 400,000 | 397,452 |

| 6.10%, due 1/15/29 | 240,000 | 241,955 |

| 6.15%, due 1/15/33 | 450,000 | 450,413 |

| 6.40%, due 6/15/33 | 110,000 | 111,927 |

| PECO Energy Co. | | |

| 4.90%, due 6/15/33 | 310,000 | 298,975 |

| Southern California Edison Co. | | |

| 5.30%, due 3/1/28 | 380,000 | 377,858 |

| 5.95%, due 11/1/32 | 175,000 | 178,030 |

| Southern Co. (The) | | |

| 5.15%, due 10/6/25 | 220,000 | 218,444 |

| 5.70%, due 10/15/32 | 100,000 | 100,196 |

| Xcel Energy, Inc. | | |

| 5.50%, due 3/15/34 | 290,000 | 279,662 |

| | | 6,856,813 |

| | Principal

Amount | Value |

| |

| Entertainment 0.0% ‡ |

| Warnermedia Holdings, Inc. | | |

| 4.054%, due 3/15/29 | $ 224,000 | $ 204,329 |

| Environmental Control 0.1% |

| Waste Connections, Inc. | | |

| 2.60%, due 2/1/30 | 445,000 | 384,349 |

| Food 0.1% |

| Kraft Heinz Foods Co. | | |

| 3.75%, due 4/1/30 | 130,000 | 119,445 |

| Tyson Foods, Inc. | | |

| 5.40%, due 3/15/29 | 525,000 | 519,570 |

| | | 639,015 |

| Gas 0.2% |

| CenterPoint Energy Resources Corp. | | |

| 1.75%, due 10/1/30 | 550,000 | 439,580 |

| Southwest Gas Corp. | | |

| 5.45%, due 3/23/28 | 220,000 | 219,083 |

| | | 658,663 |

| Healthcare-Products 0.3% |

| Baxter International, Inc. | | |

| 3.95%, due 4/1/30 | 610,000 | 556,947 |

| Solventum Corp. | | |

| 5.45%, due 2/25/27 (a) | 605,000 | 599,902 |

| | | 1,156,849 |

| Healthcare-Services 0.1% |

| HCA, Inc. | | |

| 3.625%, due 3/15/32 | 620,000 | 533,290 |

| Insurance 0.4% |

| Corebridge Financial, Inc. | | |

| 3.85%, due 4/5/29 | 325,000 | 298,340 |

| Corebridge Global Funding | | |

| 5.20%, due 1/12/29 (a) | 545,000 | 534,974 |

| RGA Global Funding | | |

| 6.00%, due 11/21/28 (a) | 705,000 | 716,219 |

| | | 1,549,533 |

| Internet 0.2% |

| Amazon.com, Inc. | | |

| 2.10%, due 5/12/31 | 430,000 | 353,879 |

| Meta Platforms, Inc. | | |

| 3.85%, due 8/15/32 | 440,000 | 399,486 |

| | | 753,365 |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

11

Portfolio of Investments April 30, 2024†^(Unaudited) (continued)

| | Principal

Amount | Value |

| Corporate Bonds (continued) |

| Investment Companies 0.1% |

| Blackstone Private Credit Fund | | |

| 7.05%, due 9/29/25 | $ 420,000 | $ 423,917 |

| Media 0.1% |

| Paramount Global | | |

| 4.20%, due 5/19/32 | 605,000 | 494,070 |

| Mining 0.0% ‡ |

| Newmont Corp. | | |

| 5.35%, due 3/15/34 (a) | 195,000 | 190,211 |

| Miscellaneous—Manufacturing 0.0% ‡ |

| 3M Co. | | |

| 3.05%, due 4/15/30 | 209,000 | 183,545 |

| Oil & Gas 0.2% |

| Coterra Energy, Inc. | | |

| 5.60%, due 3/15/34 | 195,000 | 190,680 |

| Phillips 66 Co. | | |

| 3.15%, due 12/15/29 | 535,000 | 475,066 |

| | | 665,746 |

| Packaging & Containers 0.1% |

| Berry Global, Inc. | | |

| 5.65%, due 1/15/34 (a) | 305,000 | 294,567 |

| Pharmaceuticals 0.3% |

| AbbVie, Inc. | | |

| 2.95%, due 11/21/26 | 240,000 | 226,614 |

| 5.05%, due 3/15/34 | 385,000 | 375,444 |

| Cigna Group (The) | | |

| 5.25%, due 2/15/34 | 195,000 | 187,921 |

| CVS Health Corp. | | |

| 3.75%, due 4/1/30 | 170,000 | 154,209 |

| 5.30%, due 6/1/33 | 65,000 | 62,842 |

| Merck & Co., Inc. | | |

| 2.15%, due 12/10/31 | 415,000 | 336,523 |

| Pfizer Investment Enterprises Pte. Ltd. | | |

| 4.75%, due 5/19/33 | 210,000 | 200,044 |

| | | 1,543,597 |

| Pipelines 0.4% |

| Columbia Pipelines Operating Co. LLC | | |

| 5.927%, due 8/15/30 (a) | 270,000 | 270,461 |

| | Principal

Amount | Value |

| |

| Pipelines (continued) |

| Energy Transfer LP | | |

| 3.75%, due 5/15/30 | $ 185,000 | $ 166,892 |

| 5.75%, due 2/15/33 | 205,000 | 203,361 |

| Enterprise Products Operating LLC | | |

| 4.85%, due 1/31/34 | 415,000 | 395,639 |

| MPLX LP | | |

| 4.95%, due 9/1/32 | 178,000 | 167,886 |

| Targa Resources Partners LP | | |

| 5.50%, due 3/1/30 | 755,000 | 736,540 |

| | | 1,940,779 |

| Real Estate Investment Trusts 0.4% |

| American Tower Corp. | | |

| 2.10%, due 6/15/30 | 660,000 | 538,541 |

| CubeSmart LP | | |

| 2.25%, due 12/15/28 | 340,000 | 293,442 |

| Simon Property Group LP | | |

| 1.75%, due 2/1/28 | 425,000 | 372,917 |

| Sun Communities Operating LP | | |

| 2.70%, due 7/15/31 | 435,000 | 350,779 |

| | | 1,555,679 |

| Retail 0.3% |

| AutoZone, Inc. | | |

| 5.20%, due 8/1/33 | 415,000 | 402,760 |

| Home Depot, Inc. (The) | | |

| 1.875%, due 9/15/31 | 385,000 | 306,050 |

| Lowe's Cos., Inc. | | |

| 4.80%, due 4/1/26 | 310,000 | 306,456 |

| 5.00%, due 4/15/33 | 205,000 | 197,984 |

| 5.15%, due 7/1/33 | 105,000 | 102,510 |

| | | 1,315,760 |

| Semiconductors 0.4% |

| Broadcom, Inc. | | |

| 2.45%, due 2/15/31 (a) | 385,000 | 316,417 |

| Intel Corp. | | |

| 5.125%, due 2/10/30 | 290,000 | 286,989 |

| 5.20%, due 2/10/33 | 215,000 | 209,770 |

| Micron Technology, Inc. | | |

| 5.375%, due 4/15/28 | 380,000 | 378,442 |

| 5.875%, due 9/15/33 | 215,000 | 215,953 |

| QUALCOMM, Inc. | | |

| 2.15%, due 5/20/30 | 490,000 | 414,930 |

| | | 1,822,501 |

| Software 0.3% |

| Fiserv, Inc. | | |

| 5.35%, due 3/15/31 | 505,000 | 497,797 |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

| | Principal

Amount | Value |

| Corporate Bonds (continued) |

| Software (continued) |

| Microsoft Corp. | | |

| 2.525%, due 6/1/50 | $ 220,000 | $ 134,635 |

| Oracle Corp. | | |

| 4.50%, due 5/6/28 | 220,000 | 213,121 |

| 4.90%, due 2/6/33 | 280,000 | 265,074 |

| 6.15%, due 11/9/29 | 170,000 | 175,319 |

| | | 1,285,946 |

| Telecommunications 0.6% |

| AT&T, Inc. | | |

| 2.25%, due 2/1/32 | 415,000 | 327,768 |

| 4.35%, due 3/1/29 | 955,000 | 911,213 |

| T-Mobile USA, Inc. | | |

| 2.625%, due 4/15/26 | 675,000 | 637,735 |

| 2.625%, due 2/15/29 | 135,000 | 118,632 |

| 5.75%, due 1/15/34 | 405,000 | 407,879 |

| Verizon Communications, Inc. | | |

| 2.10%, due 3/22/28 | 340,000 | 301,051 |

| 3.376%, due 2/15/25 | 8,000 | 7,858 |

| | | 2,712,136 |

| Transportation 0.1% |

| Norfolk Southern Corp. | | |

| 3.00%, due 3/15/32 | 250,000 | 211,153 |

| Union Pacific Corp. | | |

| 2.80%, due 2/14/32 | 245,000 | 206,636 |

| United Parcel Service, Inc. | | |

| 4.45%, due 4/1/30 | 220,000 | 212,312 |

| | | 630,101 |

| Trucking & Leasing 0.1% |

| Penske Truck Leasing Co. LP (a) | | |

| 5.75%, due 5/24/26 | 230,000 | 230,070 |

| 6.05%, due 8/1/28 | 165,000 | 166,777 |

| | | 396,847 |

Total Corporate Bonds

(Cost $58,636,367) | | 57,750,039 |

| Foreign Government Bond 0.1% |

| France 0.1% |

| Electricite de France SA | | |

| 5.65%, due 4/22/29 (a) | 370,000 | 368,954 |

Total Foreign Government Bond

(Cost $369,477) | | 368,954 |

| | Principal

Amount | Value |

| Mortgage-Backed Securities 0.3% |

| Commercial Mortgage Loans (Collateralized Mortgage Obligation) 0.2% |

| Citigroup Commercial Mortgage Trust | | |

| Series 2020-GC46, Class A5 | | |

| 2.717%, due 2/15/53 | $ 1,000,000 | $ 852,608 |

| Whole Loan (Collateralized Mortgage Obligation) 0.1% |

| BRAVO Residential Funding Trust | | |

| Series 2023-NQM8, Class A1 | | |

| 6.394%, due 10/25/63 (a)(d) | 479,562 | 478,681 |

Total Mortgage-Backed Securities

(Cost $1,506,962) | | 1,331,289 |

| U.S. Government & Federal Agencies 18.5% |

| United States Treasury Bonds 0.0% ‡ |

| U.S. Treasury Bonds | | |

| 4.375%, due 8/15/43 | 330,000 | 308,189 |

| United States Treasury Notes 18.5% |

| U.S. Treasury Notes | | |

| 2.50%, due 5/15/24 | 7,050,000 | 7,042,004 |

| 2.875%, due 5/31/25 | 1,300,000 | 1,267,754 |

| 4.00%, due 2/15/34 | 3,960,000 | 3,749,625 |

| 4.50%, due 4/15/27 | 19,900,000 | 19,697,891 |

| 4.625%, due 4/30/29 | 9,050,000 | 9,015,355 |

| 4.625%, due 4/30/31 | 13,650,000 | 13,586,016 |

| 4.875%, due 4/30/26 | 28,000,000 | 27,915,781 |

| | | 82,274,426 |

Total U.S. Government & Federal Agencies

(Cost $82,729,874) | | 82,582,615 |

Total Long-Term Bonds

(Cost $146,593,092) | | 145,357,020 |

| |

| | Shares | |

| |

| Common Stocks 56.2% |

| Aerospace & Defense 1.8% |

| General Dynamics Corp. | 14,134 | 4,057,730 |

| L3Harris Technologies, Inc. | 18,760 | 4,015,578 |

| | | 8,073,308 |

| Air Freight & Logistics 1.1% |

| United Parcel Service, Inc., Class B | 34,087 | 5,027,151 |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

13

Portfolio of Investments April 30, 2024†^(Unaudited) (continued)

| | Shares | Value |

| Common Stocks (continued) |

| Automobile Components 0.8% |

| Gentex Corp. | 108,676 | $ 3,727,587 |

| Banks 4.3% |

| JPMorgan Chase & Co. | 53,770 | 10,309,860 |

| M&T Bank Corp. | 34,649 | 5,002,969 |

| PNC Financial Services Group, Inc. (The) | 26,082 | 3,997,327 |

| | | 19,310,156 |

| Beverages 1.5% |

| Keurig Dr Pepper, Inc. | 110,246 | 3,715,290 |

| Pernod Ricard SA, Sponsored ADR (France) | 96,829 | 2,932,951 |

| | | 6,648,241 |

| Biotechnology 0.8% |

| Gilead Sciences, Inc. | 56,871 | 3,707,989 |

| Building Products 1.5% |

| Fortune Brands Innovations, Inc. | 34,609 | 2,529,918 |

| Johnson Controls International plc | 65,345 | 4,251,999 |

| | | 6,781,917 |

| Capital Markets 5.0% |

| Ares Management Corp. | 27,856 | 3,707,355 |

| Intercontinental Exchange, Inc. | 25,605 | 3,296,900 |

| KKR & Co., Inc. | 32,827 | 3,055,209 |

| LPL Financial Holdings, Inc. | 10,375 | 2,792,224 |

| Morgan Stanley | 42,876 | 3,894,856 |

| Nasdaq, Inc. | 21,479 | 1,285,518 |

| Raymond James Financial, Inc. | 35,572 | 4,339,784 |

| | | 22,371,846 |

| Chemicals 0.6% |

| Axalta Coating Systems Ltd. (e) | 85,405 | 2,685,133 |

| Communications Equipment 2.1% |

| Cisco Systems, Inc. | 130,566 | 6,133,991 |

| F5, Inc. (e) | 20,372 | 3,367,695 |

| | | 9,501,686 |

| Distributors 0.7% |

| LKQ Corp. | 72,826 | 3,140,985 |

| Diversified Consumer Services 0.8% |

| H&R Block, Inc. | 74,024 | 3,496,154 |

| | Shares | Value |

| |

| Electrical Equipment 0.9% |

| Emerson Electric Co. | 36,764 | $ 3,962,424 |

| Electronic Equipment, Instruments & Components 0.9% |

| Corning, Inc. | 123,343 | 4,117,189 |

| Entertainment 0.8% |

| Electronic Arts, Inc. | 26,485 | 3,358,828 |

| Financial Services 0.6% |

| Global Payments, Inc. | 22,310 | 2,738,999 |

| Food Products 0.6% |

| Archer-Daniels-Midland Co. | 46,343 | 2,718,480 |

| Gas Utilities 0.8% |

| Atmos Energy Corp. | 28,967 | 3,415,209 |

| Ground Transportation 0.6% |

| Knight-Swift Transportation Holdings, Inc. | 52,083 | 2,407,797 |

| Health Care Equipment & Supplies 0.9% |

| Boston Scientific Corp. (e) | 52,783 | 3,793,514 |

| Health Care Providers & Services 3.4% |

| Centene Corp. (e) | 59,365 | 4,337,207 |

| Elevance Health, Inc. | 10,558 | 5,580,747 |

| UnitedHealth Group, Inc. | 10,644 | 5,148,503 |

| | | 15,066,457 |

| Hotel & Resort REITs 0.6% |

| Host Hotels & Resorts, Inc. | 139,524 | 2,632,818 |

| Hotels, Restaurants & Leisure 0.6% |

| Wyndham Hotels & Resorts, Inc. | 37,747 | 2,774,782 |

| Household Durables 0.7% |

| Lennar Corp., Class A | 19,375 | 2,937,638 |

| Insurance 2.8% |

| American International Group, Inc. | 65,588 | 4,939,432 |

| Everest Group Ltd. | 7,835 | 2,870,823 |

| MetLife, Inc. | 66,579 | 4,732,435 |

| | | 12,542,690 |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

| | Shares | Value |

| Common Stocks (continued) |

| Interactive Media & Services 0.6% |

| Alphabet, Inc., Class C (e) | 15,993 | $ 2,633,088 |

| IT Services 0.7% |

| Amdocs Ltd. | 38,153 | 3,204,470 |

| Machinery 0.6% |

| Middleby Corp. (The) (e) | 20,521 | 2,851,803 |

| Media 0.8% |

| Omnicom Group, Inc. | 37,846 | 3,513,623 |

| Multi-Utilities 0.9% |

| Sempra | 54,184 | 3,881,200 |

| Oil, Gas & Consumable Fuels 5.4% |

| Antero Resources Corp. (e) | 83,204 | 2,829,768 |

| ConocoPhillips | 37,025 | 4,651,080 |

| Coterra Energy, Inc. | 105,698 | 2,891,897 |

| EOG Resources, Inc. | 28,629 | 3,782,750 |

| Hess Corp. | 17,665 | 2,782,061 |

| Phillips 66 | 28,332 | 4,057,426 |

| Targa Resources Corp. | 26,301 | 2,999,892 |

| | | 23,994,874 |

| Personal Care Products 1.4% |

| Kenvue, Inc. | 156,013 | 2,936,165 |

| Unilever plc, Sponsored ADR (United Kingdom) | 63,563 | 3,295,741 |

| | | 6,231,906 |

| Pharmaceuticals 5.9% |

| AstraZeneca plc, Sponsored ADR (United Kingdom) | 48,923 | 3,712,277 |

| Johnson & Johnson | 48,437 | 7,003,506 |

| Merck & Co., Inc. | 58,586 | 7,570,483 |

| Pfizer, Inc. | 206,900 | 5,300,778 |

| Roche Holding AG | 10,672 | 2,553,162 |

| | | 26,140,206 |

| Real Estate Management & Development 0.7% |

| CBRE Group, Inc., Class A (e) | 35,061 | 3,046,450 |

| Semiconductors & Semiconductor Equipment 2.4% |

| Analog Devices, Inc. | 18,337 | 3,678,586 |

| NXP Semiconductors NV (China) | 16,286 | 4,172,310 |

| | Shares | | Value |

| |

| Semiconductors & Semiconductor Equipment (continued) |

| QUALCOMM, Inc. | 17,042 | | $ 2,826,416 |

| | | | 10,677,312 |

| Specialized REITs 1.6% |

| Crown Castle, Inc. | 38,171 | | 3,579,677 |

| Gaming and Leisure Properties, Inc. | 78,847 | | 3,369,132 |

| | | | 6,948,809 |

Total Common Stocks

(Cost $211,164,779) | | | 250,062,719 |

| Exchange-Traded Funds 9.1% |

| iShares Intermediate Government/Credit Bond ETF | 80,097 | | 8,191,520 |

| iShares Russell 1000 Value ETF | 92,544 | | 15,871,296 |

| Vanguard Intermediate-Term Treasury ETF (f) | 121,600 | | 6,954,304 |

| Vanguard Russell 1000 Value (f) | 123,521 | | 9,299,896 |

Total Exchange-Traded Funds

(Cost $38,026,503) | | | 40,317,016 |

| Short-Term Investments 1.4% |

| Affiliated Investment Company 0.7% |

| MainStay U.S. Government Liquidity Fund, 5.242% (g) | 3,033,470 | | 3,033,470 |

| Unaffiliated Investment Company 0.7% |

| Invesco Government & Agency Portfolio, 5.309% (g)(h) | 3,077,100 | | 3,077,100 |

Total Short-Term Investments

(Cost $6,110,570) | | | 6,110,570 |

Total Investments

(Cost $401,894,944) | 99.3% | | 441,847,325 |

| Other Assets, Less Liabilities | 0.7 | | 3,314,713 |

| Net Assets | 100.0% | | $ 445,162,038 |

| † | Percentages indicated are based on Fund net assets. |

| ^ | Industry classifications may be different than those used for compliance monitoring purposes. |

| ‡ | Less than one-tenth of a percent. |

| (a) | May be sold to institutional investors only under Rule 144A or securities offered pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended. |

| (b) | Floating rate—Rate shown was the rate in effect as of April 30, 2024. |

| (c) | Fixed to floating rate—Rate shown was the rate in effect as of April 30, 2024. |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

15

Portfolio of Investments April 30, 2024†^(Unaudited) (continued)

| (d) | Step coupon—Rate shown was the rate in effect as of April 30, 2024. |

| (e) | Non-income producing security. |

| (f) | All or a portion of this security was held on loan. As of April 30, 2024, the aggregate market value of securities on loan was $5,741,221; the total market value of collateral held by the Fund was $5,904,807. The market value of the collateral held included non-cash collateral in the form of U.S. Treasury securities with a value of $2,827,707. The Fund received cash collateral with a value of $3,077,100. (See Note 2(I)) |

| (g) | Current yield as of April 30, 2024. |

| (h) | Represents a security purchased with cash collateral received for securities on loan. |

Investments in Affiliates (in 000's)

Investments in issuers considered to be affiliate(s) of the Fund during the six-month period ended April 30, 2024 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

| Affiliated Investment Companies | Value,

Beginning

of Period | Purchases

at Cost | Proceeds

from

Sales | Net

Realized

Gain/(Loss)

on Sales | Change in

Unrealized

Appreciation/

(Depreciation) | Value,

End of

Period | Dividend

Income | Other

Distributions | Shares

End of

Period |

| MainStay U.S. Government Liquidity Fund | $ 2,083 | $ 29,713 | $ (28,763) | $ — | $ — | $ 3,033 | $ 52 | $ — | 3,033 |

Futures Contracts

As of April 30, 2024, the Fund held the following futures contracts1:

| Type | Number of

Contracts | Expiration

Date | Value at

Trade Date | Current

Notional

Amount | Unrealized

Appreciation

(Depreciation)2 |

| Long Contracts | | | | | |

| U.S. Treasury 5 Year Notes | 120 | June 2024 | $ 12,763,506 | $ 12,569,063 | $ (194,443) |

| U.S. Treasury 10 Year Notes | 11 | June 2024 | 1,215,020 | 1,181,812 | (33,208) |

| U.S. Treasury 10 Year Ultra Bonds | 1 | June 2024 | 114,611 | 110,219 | (4,392) |

| Total Long Contracts | | | | | (232,043) |

| Short Contracts | | | | | |

| U.S. Treasury 2 Year Notes | (13) | June 2024 | (2,641,009) | (2,634,531) | 6,478 |

| U.S. Treasury Long Bonds | (3) | June 2024 | (355,573) | (341,438) | 14,135 |

| U.S. Treasury Ultra Bonds | (2) | June 2024 | (250,477) | (239,125) | 11,352 |

| Total Short Contracts | | | | | 31,965 |

| Net Unrealized Depreciation | | | | | $ (200,078) |

| 1. | As of April 30, 2024, cash in the amount of $179,404 was on deposit with a broker or futures commission merchant for futures transactions. |

| 2. | Represents the difference between the value of the contracts at the time they were opened and the value as of April 30, 2024. |

| Abbreviation(s): |

| ADR—American Depositary Receipt |

| CLO—Collateralized Loan Obligation |

| ETF—Exchange-Traded Fund |

| REIT—Real Estate Investment Trust |

| SOFR—Secured Overnight Financing Rate |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

The following is a summary of the fair valuations according to the inputs used as of April 30, 2024, for valuing the Fund’s assets and liabilities:

| Description | Quoted

Prices in

Active

Markets for

Identical

Assets

(Level 1) | | Significant

Other

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | | Total |

| Asset Valuation Inputs | | | | | | | |

| Investments in Securities (a) | | | | | | | |

| Long-Term Bonds | | | | | | | |

| Asset-Backed Securities | $ — | | $ 3,324,123 | | $ — | | $ 3,324,123 |

| Corporate Bonds | — | | 57,750,039 | | — | | 57,750,039 |

| Foreign Government Bond | — | | 368,954 | | — | | 368,954 |

| Mortgage-Backed Securities | — | | 1,331,289 | | — | | 1,331,289 |

| U.S. Government & Federal Agencies | — | | 82,582,615 | | — | | 82,582,615 |

| Total Long-Term Bonds | — | | 145,357,020 | | — | | 145,357,020 |

| Common Stocks | | | | | | | |

| Pharmaceuticals | 23,587,044 | | 2,553,162 | | — | | 26,140,206 |

| All Other Industries | 223,922,513 | | — | | — | | 223,922,513 |

| Total Common Stocks | 247,509,557 | | 2,553,162 | | — | | 250,062,719 |

| Exchange-Traded Funds | 40,317,016 | | — | | — | | 40,317,016 |

| Short-Term Investments | | | | | | | |

| Affiliated Investment Company | 3,033,470 | | — | | — | | 3,033,470 |

| Unaffiliated Investment Company | 3,077,100 | | — | | — | | 3,077,100 |

| Total Short-Term Investments | 6,110,570 | | — | | — | | 6,110,570 |

| Total Investments in Securities | 293,937,143 | | 147,910,182 | | — | | 441,847,325 |

| Other Financial Instruments | | | | | | | |

| Futures Contracts (b) | 31,965 | | — | | — | | 31,965 |

| Total Investments in Securities and Other Financial Instruments | $ 293,969,108 | | $ 147,910,182 | | $ — | | $ 441,879,290 |

| Liability Valuation Inputs | | | | | | | |

| Other Financial Instruments | | | | | | | |

| Futures Contracts (b) | $ (232,043) | | $ — | | $ — | | $ (232,043) |

| (a) | For a complete listing of investments and their industries, see the Portfolio of Investments. |

| (b) | The value listed for these securities reflects unrealized appreciation (depreciation) as shown on the Portfolio of Investments. |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

17

Statement of Assets and Liabilities as of April 30, 2024 (Unaudited)

| Assets |

Investment in unaffiliated securities, at value

(identified cost $398,861,474) including securities on loan of $5,741,221 | $438,813,855 |

Investment in affiliated investment companies, at value

(identified cost $3,033,470) | 3,033,470 |

| Cash | 6,583,496 |

| Cash collateral on deposit at broker for futures contracts | 179,404 |

| Receivables: | |

| Investment securities sold | 3,275,803 |

| Dividends and interest | 1,054,241 |

| Fund shares sold | 107,046 |

| Securities lending | 1,758 |

| Other assets | 73,752 |

| Total assets | 453,122,825 |

| Liabilities |

| Cash collateral received for securities on loan | 3,077,100 |

| Payables: | |

| Investment securities purchased | 3,999,872 |

| Fund shares redeemed | 335,930 |

| Manager (See Note 3) | 240,412 |

| Transfer agent (See Note 3) | 101,844 |

| NYLIFE Distributors (See Note 3) | 88,610 |

| Variation margin on futures contracts | 50,061 |

| Professional fees | 35,986 |

| Custodian | 18,425 |

| Shareholder communication | 10,436 |

| Trustees | 142 |

| Accrued expenses | 1,969 |

| Total liabilities | 7,960,787 |

| Net assets | $445,162,038 |

| Composition of Net Assets |

| Shares of beneficial interest outstanding (par value of $.001 per share) unlimited number of shares authorized | $ 15,013 |

| Additional paid-in-capital | 402,600,013 |

| | 402,615,026 |

| Total distributable earnings (loss) | 42,547,012 |

| Net assets | $445,162,038 |

| Class A | |

| Net assets applicable to outstanding shares | $344,036,978 |

| Shares of beneficial interest outstanding | 11,603,661 |

| Net asset value per share outstanding | $ 29.65 |

| Maximum sales charge (3.00% of offering price) | 0.92 |

| Maximum offering price per share outstanding | $ 30.57 |

| Investor Class | |

| Net assets applicable to outstanding shares | $ 36,741,058 |

| Shares of beneficial interest outstanding | 1,239,245 |

| Net asset value per share outstanding | $ 29.65 |

| Maximum sales charge (2.50% of offering price) | 0.76 |

| Maximum offering price per share outstanding | $ 30.41 |

| Class B | |

| Net assets applicable to outstanding shares | $ 1,776,100 |

| Shares of beneficial interest outstanding | 60,728 |

| Net asset value and offering price per share outstanding | $ 29.25 |

| Class C | |

| Net assets applicable to outstanding shares | $ 9,574,414 |

| Shares of beneficial interest outstanding | 327,518 |

| Net asset value and offering price per share outstanding | $ 29.23 |

| Class I | |

| Net assets applicable to outstanding shares | $ 52,976,487 |

| Shares of beneficial interest outstanding | 1,780,214 |

| Net asset value and offering price per share outstanding | $ 29.76 |

| Class R6 | |

| Net assets applicable to outstanding shares | $ 57,001 |

| Shares of beneficial interest outstanding | 1,913 |

| Net asset value and offering price per share outstanding(a) | $ 29.79 |

| (a) | The difference between the calculated and stated NAV was caused by rounding. |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

Statement of Operations for the six months ended April 30, 2024 (Unaudited)

| Investment Income (Loss) |

| Income | |

| Dividends-unaffiliated (net of foreign tax withholding of $27,049) | $ 3,833,007 |

| Interest | 3,680,981 |

| Dividends-affiliated | 51,957 |

| Securities lending, net | 9,148 |

| Total income | 7,575,093 |

| Expenses | |

| Manager (See Note 3) | 1,466,242 |

| Distribution/Service—Class A (See Note 3) | 430,324 |

| Distribution/Service—Investor Class (See Note 3) | 47,363 |

| Distribution/Service—Class B (See Note 3) | 12,361 |

| Distribution/Service—Class C (See Note 3) | 53,562 |

| Distribution/Service—Class R2 (See Note 3)(a) | 260 |

| Distribution/Service—Class R3 (See Note 3)(a) | 2,632 |

| Transfer agent (See Note 3) | 309,269 |

| Registration | 53,575 |

| Professional fees | 49,149 |

| Custodian | 18,709 |

| Shareholder communication | 12,413 |

| Trustees | 5,700 |

| Shareholder service (See Note 3) | 656 |

| Miscellaneous | 14,946 |

| Total expenses before waiver/reimbursement | 2,477,161 |

| Expense waiver/reimbursement from Manager (See Note 3) | (28,110) |

| Net expenses | 2,449,051 |

| Net investment income (loss) | 5,126,042 |

| Realized and Unrealized Gain (Loss) |

| Net realized gain (loss) on: | |

| Unaffiliated investment transactions | 5,606,212 |

| Futures transactions | (251,889) |

| Foreign currency transactions | 1,343 |

| Net realized gain (loss) | 5,355,666 |

| Net change in unrealized appreciation (depreciation) on: | |

| Unaffiliated investments | 31,043,346 |

| Futures contracts | (34,798) |

| Translation of other assets and liabilities in foreign currencies | (1,409) |

| Net change in unrealized appreciation (depreciation) | 31,007,139 |

| Net realized and unrealized gain (loss) | 36,362,805 |

| Net increase (decrease) in net assets resulting from operations | $41,488,847 |

| (a) | Class liquidated and is no longer offered for sale as of February 23, 2024. |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

19

Statements of Changes in Net Assets

for the six months ended April 30, 2024 (Unaudited) and the year ended October 31, 2023

| | Six months

ended

April 30,

2024 | Year

ended

October 31,

2023 |

| Increase (Decrease) in Net Assets |

| Operations: | | |

| Net investment income (loss) | $ 5,126,042 | $ 9,538,218 |

| Net realized gain (loss) | 5,355,666 | (485,097) |

| Net change in unrealized appreciation (depreciation) | 31,007,139 | (12,348,597) |

| Net increase (decrease) in net assets resulting from operations | 41,488,847 | (3,295,476) |

| Distributions to shareholders: | | |

| Class A | (3,936,313) | (7,916,075) |

| Investor Class | (375,977) | (791,702) |

| Class B | (13,457) | (50,948) |

| Class C | (64,861) | (167,807) |

| Class I | (680,267) | (1,495,744) |

| Class R1(a) | (600) | (4,769) |

| Class R2(a) | (1,468) | (12,812) |

| Class R3(a) | (4,982) | (38,396) |

| Class R6 | (734) | (1,952) |

| Total distributions to shareholders | (5,078,659) | (10,480,205) |

| Capital share transactions: | | |

| Net proceeds from sales of shares | 20,062,015 | 61,966,081 |

| Net asset value of shares issued to shareholders in reinvestment of distributions | 4,995,375 | 10,314,554 |

| Cost of shares redeemed | (51,422,791) | (92,500,140) |

| Increase (decrease) in net assets derived from capital share transactions | (26,365,401) | (20,219,505) |

| Net increase (decrease) in net assets | 10,044,787 | (33,995,186) |

| Net Assets |

| Beginning of period | 435,117,251 | 469,112,437 |

| End of period | $445,162,038 | $435,117,251 |

| (a) | Class liquidated and is no longer offered for sale as of February 23, 2024. |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

Financial Highlights selected per share data and ratios

| | Six months ended

April 30,

2024* | | Year Ended October 31, |

| Class A | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

| Net asset value at beginning of period | $ 27.34 | | $ 28.21 | | $ 37.09 | | $ 29.72 | | $ 30.98 | | $ 31.49 |

| Net investment income (loss) (a) | 0.34 | | 0.59 | | 0.36 | | 0.27 | | 0.36 | | 0.44 |

| Net realized and unrealized gain (loss) | 2.31 | | (0.82) | | (2.03) | | 7.70 | | (0.54) | | 1.58 |

| Total from investment operations | 2.65 | | (0.23) | | (1.67) | | 7.97 | | (0.18) | | 2.02 |

| Less distributions: | | | | | | | | | | | |

| From net investment income | (0.34) | | (0.61) | | (0.33) | | (0.28) | | (0.41) | | (0.46) |

| From net realized gain on investments | — | | (0.03) | | (6.88) | | (0.32) | | (0.67) | | (2.07) |

| Total distributions | (0.34) | | (0.64) | | (7.21) | | (0.60) | | (1.08) | | (2.53) |

| Net asset value at end of period | $ 29.65 | | $ 27.34 | | $ 28.21 | | $ 37.09 | | $ 29.72 | | $ 30.98 |

| Total investment return (b) | 9.67% | | (0.86)% | | (5.35)% | | 27.03% | | (0.53)% | | 7.07% |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | |

| Net investment income (loss) | 2.29%†† | | 2.06% | | 1.22% | | 0.78% | | 1.21% | | 1.47% |

| Net expenses (c) | 1.06%†† | | 1.06% | | 1.06% | | 1.08% | | 1.13% | | 1.12% |

| Portfolio turnover rate | 123% | | 313% | | 290% | | 182% | | 217% | | 194% |

| Net assets at end of period (in 000’s) | $ 344,037 | | $ 328,665 | | $ 345,376 | | $ 343,224 | | $ 252,574 | | $ 279,636 |

| * | Unaudited. |

| †† | Annualized. |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. For periods of less than one year, total return is not annualized. |

| (c) | In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| | Six months ended

April 30,

2024* | | Year Ended October 31, |

| Investor Class | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

| Net asset value at beginning of period | $ 27.34 | | $ 28.20 | | $ 37.10 | | $ 29.75 | | $ 31.01 | | $ 31.51 |

| Net investment income (loss) (a) | 0.30 | | 0.51 | | 0.28 | | 0.19 | | 0.29 | | 0.38 |

| Net realized and unrealized gain (loss) | 2.31 | | (0.80) | | (2.03) | | 7.69 | | (0.55) | | 1.58 |

| Total from investment operations | 2.61 | | (0.29) | | (1.75) | | 7.88 | | (0.26) | | 1.96 |

| Less distributions: | | | | | | | | | | | |

| From net investment income | (0.30) | | (0.54) | | (0.27) | | (0.21) | | (0.33) | | (0.39) |

| From net realized gain on investments | — | | (0.03) | | (6.88) | | (0.32) | | (0.67) | | (2.07) |

| Total distributions | (0.30) | | (0.57) | | (7.15) | | (0.53) | | (1.00) | | (2.46) |

| Net asset value at end of period | $ 29.65 | | $ 27.34 | | $ 28.20 | | $ 37.10 | | $ 29.75 | | $ 31.01 |

| Total investment return (b) | 9.53% | | (1.08)% | | (5.62)% | | 26.68% | | (0.75)% | | 6.79% |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | |

| Net investment income (loss) | 2.05%†† | | 1.81% | | 0.95% | | 0.54% | | 0.97% | | 1.26% |

| Net expenses (c) | 1.32%†† | | 1.31% | | 1.32% | | 1.35% | | 1.38% | | 1.33% |

| Expenses (before waiver/reimbursement) (c) | 1.43%†† | | 1.41% | | 1.34% | | 1.37% | | 1.40% | | 1.35% |

| Portfolio turnover rate | 123% | | 313% | | 290% | | 182% | | 217% | | 194% |

| Net assets at end of period (in 000's) | $ 36,741 | | $ 36,675 | | $ 40,341 | | $ 46,706 | | $ 47,358 | | $ 53,006 |

| * | Unaudited. |

| †† | Annualized. |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. For periods of less than one year, total return is not annualized. |

| (c) | In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

21

Financial Highlights selected per share data and ratios

| | Six months ended

April 30,

2024* | | Year Ended October 31, |

| Class B | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

| Net asset value at beginning of period | $ 26.97 | | $ 27.81 | | $ 36.72 | | $ 29.56 | | $ 30.82 | | $ 31.35 |

| Net investment income (loss) (a) | 0.19 | | 0.30 | | 0.05 | | (0.07) | | 0.07 | | 0.16 |

| Net realized and unrealized gain (loss) | 2.28 | | (0.80) | | (1.99) | | 7.63 | | (0.54) | | 1.54 |

| Total from investment operations | 2.47 | | (0.50) | | (1.94) | | 7.56 | | (0.47) | | 1.70 |

| Less distributions: | | | | | | | | | | | |

| From net investment income | (0.19) | | (0.31) | | (0.09) | | (0.08) | | (0.12) | | (0.16) |

| From net realized gain on investments | — | | (0.03) | | (6.88) | | (0.32) | | (0.67) | | (2.07) |

| Total distributions | (0.19) | | (0.34) | | (6.97) | | (0.40) | | (0.79) | | (2.23) |

| Net asset value at end of period | $ 29.25 | | $ 26.97 | | $ 27.81 | | $ 36.72 | | $ 29.56 | | $ 30.82 |

| Total investment return (b) | 9.13% | | (1.83)% | | (6.30)% | | 25.74% | | (1.51)% | | 6.00% |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | |

| Net investment income (loss) | 1.34%†† | | 1.06% | | 0.18% | | (0.21)% | | 0.23% | | 0.54% |

| Net expenses (c) | 2.07%†† | | 2.07% | | 2.07% | | 2.10% | | 2.13% | | 2.08% |

| Expenses (before waiver/reimbursement) (c) | 2.17%†† | | 2.16% | | 2.09% | | 2.12% | | 2.15% | | 2.10% |

| Portfolio turnover rate | 123% | | 313% | | 290% | | 182% | | 217% | | 194% |

| Net assets at end of period (in 000’s) | $ 1,776 | | $ 2,999 | | $ 5,798 | | $ 9,645 | | $ 10,671 | | $ 15,049 |

| * | Unaudited. |

| †† | Annualized. |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. For periods of less than one year, total return is not annualized. |

| (c) | In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| | Six months ended

April 30,

2024* | | Year Ended October 31, |

| Class C | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

| Net asset value at beginning of period | $ 26.95 | | $ 27.80 | | $ 36.71 | | $ 29.55 | | $ 30.81 | | $ 31.33 |

| Net investment income (loss) (a) | 0.19 | | 0.30 | | 0.06 | | (0.07) | | 0.07 | | 0.18 |

| Net realized and unrealized gain (loss) | 2.28 | | (0.81) | | (2.00) | | 7.63 | | (0.54) | | 1.53 |

| Total from investment operations | 2.47 | | (0.51) | | (1.94) | | 7.56 | | (0.47) | | 1.71 |

| Less distributions: | | | | | | | | | | | |

| From net investment income | (0.19) | | (0.31) | | (0.09) | | (0.08) | | (0.12) | | (0.16) |

| From net realized gain on investments | — | | (0.03) | | (6.88) | | (0.32) | | (0.67) | | (2.07) |

| Total distributions | (0.19) | | (0.34) | | (6.97) | | (0.40) | | (0.79) | | (2.23) |

| Net asset value at end of period | $ 29.23 | | $ 26.95 | | $ 27.80 | | $ 36.71 | | $ 29.55 | | $ 30.81 |

| Total investment return (b) | 9.13% | | (1.87)% | | (6.30)% | | 25.75% | | (1.51)% | | 6.03% |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | |

| Net investment income (loss) | 1.31%†† | | 1.06% | | 0.19% | | (0.20)% | | 0.23% | | 0.59% |

| Net expenses (c) | 2.07%†† | | 2.07% | | 2.07% | | 2.10% | | 2.13% | | 2.08% |

| Expenses (before waiver/reimbursement) (c) | 2.18%†† | | 2.16% | | 2.09% | | 2.12% | | 2.15% | | 2.10% |

| Portfolio turnover rate | 123% | | 313% | | 290% | | 182% | | 217% | | 194% |

| Net assets at end of period (in 000’s) | $ 9,574 | | $ 11,121 | | $ 17,020 | | $ 26,050 | | $ 30,769 | | $ 45,437 |

| * | Unaudited. |

| †† | Annualized. |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. For periods of less than one year, total return is not annualized. |

| (c) | In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

Financial Highlights selected per share data and ratios

| | Six months ended

April 30,

2024* | | Year Ended October 31, |

| Class I | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

| Net asset value at beginning of period | $ 27.44 | | $ 28.31 | | $ 37.19 | | $ 29.80 | | $ 31.06 | | $ 31.56 |

| Net investment income (loss) (a) | 0.38 | | 0.66 | | 0.44 | | 0.37 | | 0.44 | | 0.53 |

| Net realized and unrealized gain (loss) | 2.31 | | (0.81) | | (2.03) | | 7.70 | | (0.55) | | 1.57 |

| Total from investment operations | 2.69 | | (0.15) | | (1.59) | | 8.07 | | (0.11) | | 2.10 |

| Less distributions: | | | | | | | | | | | |

| From net investment income | (0.37) | | (0.69) | | (0.41) | | (0.36) | | (0.48) | | (0.53) |

| From net realized gain on investments | — | | (0.03) | | (6.88) | | (0.32) | | (0.67) | | (2.07) |

| Total distributions | (0.37) | | (0.72) | | (7.29) | | (0.68) | | (1.15) | | (2.60) |

| Net asset value at end of period | $ 29.76 | | $ 27.44 | | $ 28.31 | | $ 37.19 | | $ 29.80 | | $ 31.06 |

| Total investment return (b) | 9.80% | | (0.61)% | | (5.09)% | | 27.32% | | (0.27)% | | 7.32% |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | |

| Net investment income (loss) | 2.55%†† | | 2.30% | | 1.47% | | 1.08% | | 1.47% | | 1.75% |

| Net expenses (c) | 0.81%†† | | 0.81% | | 0.81% | | 0.84% | | 0.88% | | 0.87% |

| Portfolio turnover rate | 123% | | 313% | | 290% | | 182% | | 217% | | 194% |

| Net assets at end of period (in 000’s) | $ 52,976 | | $ 53,113 | | $ 57,772 | | $ 72,481 | | $ 152,036 | | $ 177,076 |

| * | Unaudited. |

| †† | Annualized. |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. Class I shares are not subject to sales charges. For periods of less than one year, total return is not annualized. |

| (c) | In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| | Six months ended

April 30,

2024* | | Year Ended October 31, |

| Class R6 | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

| Net asset value at beginning of period | $ 27.47 | | $ 28.35 | | $ 37.23 | | $ 29.83 | | $ 31.06 | | $ 31.57 |

| Net investment income (loss) (a) | 0.39 | | 0.69 | | 0.46 | | 0.39 | | 0.61 | | 0.53 |

| Net realized and unrealized gain (loss) | 2.32 | | (0.83) | | (2.03) | | 7.73 | | (0.69) | | 1.59 |

| Total from investment operations | 2.71 | | (0.14) | | (1.57) | | 8.12 | | (0.08) | | 2.12 |

| Less distributions: | | | | | | | | | | | |

| From net investment income | (0.39) | | (0.71) | | (0.43) | | (0.40) | | (0.48) | | (0.56) |

| From net realized gain on investments | — | | (0.03) | | (6.88) | | (0.32) | | (0.67) | | (2.07) |

| Total distributions | (0.39) | | (0.74) | | (7.31) | | (0.72) | | (1.15) | | (2.63) |

| Net asset value at end of period | $ 29.79 | | $ 27.47 | | $ 28.35 | | $ 37.23 | | $ 29.83 | | $ 31.06 |

| Total investment return (b) | 9.84% | | (0.51)% | | (5.04)% | | 27.45% | | (0.17)% | | 7.40% |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | |

| Net investment income (loss) | 2.63%†† | | 2.40% | | 1.55% | | 1.12% | | 1.94% | | 1.75% |

| Net expenses (c) | 0.73%†† | | 0.72% | | 0.73% | | 0.74% | | 0.78% | | 0.77% |

| Portfolio turnover rate | 123% | | 313% | | 290% | | 182% | | 217% | | 194% |

| Net assets at end of period (in 000’s) | $ 57 | | $ 52 | | $ 53 | | $ 61 | | $ 49 | | $ 14,697 |

| * | Unaudited. |

| †† | Annualized. |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. Class R6 shares are not subject to sales charges. For periods of less than one year, total return is not annualized. |

| (c) | In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

23

Notes to Financial Statements (Unaudited)

Note 1-Organization and Business

MainStay Funds Trust (the “Trust”) was organized as a Delaware statutory trust on April 28, 2009. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company, and is comprised of thirty-nine funds (collectively referred to as the “Funds”). These financial statements and notes relate to the MainStay Balanced Fund (the "Fund"), a “diversified” fund, as that term is defined in the 1940 Act, as interpreted or modified by regulatory authorities having jurisdiction, from time to time.

The following table lists the Fund's share classes that have been registered and commenced operations:

| Class | Commenced Operations |

| Class A | January 2, 2004 |

| Investor Class | February 28, 2008 |

| Class B | January 2, 2004 |

| Class C | December 30, 2002 |

| Class I | May 1, 1989 |

| Class R6 | December 15, 2017 |

Effective at the close of business on February 23, 2024, Class R1, R2 and R3 shares were liquidated.

Class B shares of the MainStay Group of Funds are closed to all new purchases as well as additional investments by existing Class B shareholders. Existing Class B shareholders may continue to reinvest dividends and capital gains distributions, as well as exchange their Class B shares for Class B shares of other funds in the MainStay Group of Funds as permitted by the current exchange privileges. Class B shareholders continue to be subject to any applicable contingent deferred sales charge ("CDSC") at the time of redemption. All other features of the Class B shares, including but not limited to the fees and expenses applicable to Class B shares, remain unchanged. Unless redeemed, Class B shareholders will remain in Class B shares of their respective fund until the Class B shares are converted to Class A or Investor Class shares pursuant to the applicable conversion schedule.

Class A and Investor Class shares are offered at net asset value (“NAV”) per share plus an initial sales charge. No initial sales charge applies to investments of $250,000 or more (and certain other qualified purchases) in Class A and Investor Class shares. However, a CDSC of 1.00% may be imposed on certain redemptions made within 18 months of the date of purchase on shares that were purchased without an initial sales charge. Class C shares are offered at NAV without an initial sales charge, although a 1.00% CDSC may be imposed on certain redemptions of such shares made within one year of the date of purchase of Class C shares. When Class B shares were offered, they were offered at NAV without an initial sales charge, although a CDSC that declines depending on the number of years a shareholder held its Class B shares may be imposed on certain redemptions of such shares made within six years of the date of purchase of such shares. Class I and Class R6 shares are offered at NAV without a sales charge. Depending upon eligibility, Class B shares convert to either Class A or Investor Class shares at the end of the

calendar quarter eight years after the date they were purchased. In addition, depending upon eligibility, Class C shares convert to either Class A or Investor Class shares at the end of the calendar quarter ten years after the date they were purchased. Additionally, Investor Class shares may convert automatically to Class A shares. Under certain circumstances and as may be permitted by the Trust’s multiple class plan pursuant to Rule 18f-3 under the 1940 Act, specified share classes of the Fund may be converted to one or more other share classes of the Fund as disclosed in the capital share transactions within these Notes. The classes of shares have the same voting (except for issues that relate solely to one class), dividend, liquidation and other rights, and the same terms and conditions, except that under distribution plans pursuant to Rule 12b-1 under the 1940 Act, Class B and Class C shares are subject to higher distribution and/or service fees than Class A, Investor Class shares. Class I and Class R6 shares are not subject to a distribution and/or service fees.

The Fund's investment objective is to seek total return.

Note 2–Significant Accounting Policies

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services—Investment Companies. The Fund prepares its financial statements in accordance with generally accepted accounting principles (“GAAP”) in the United States of America and follows the significant accounting policies described below.

(A) Securities Valuation. Investments are usually valued as of the close of regular trading on the New York Stock Exchange (the "Exchange") (usually 4:00 p.m. Eastern time) on each day the Fund is open for business ("valuation date").

Pursuant to Rule 2a-5 under the 1940 Act, the Board of Trustees of the Trust (the "Board") has designated New York Life Investment Management LLC ("New York Life Investments" or the "Manager") as its Valuation Designee (the "Valuation Designee"). The Valuation Designee is responsible for performing fair valuations relating to all investments in the Fund’s portfolio for which market quotations are not readily available; periodically assessing and managing material valuation risks; establishing and applying fair value methodologies; testing fair valuation methodologies; evaluating and overseeing pricing services; ensuring appropriate segregation of valuation and portfolio management functions; providing quarterly, annual and prompt reporting to the Board, as appropriate; identifying potential conflicts of interest; and maintaining appropriate records. The Valuation Designee has established a valuation committee ("Valuation Committee") to assist in carrying out the Valuation Designee’s responsibilities and establish prices of securities for which market quotations are not readily available. The Fund's and the Valuation Designee's policies and procedures ("Valuation Procedures") govern the Valuation Designee’s selection and application of methodologies for determining and calculating the fair value of Fund investments. The Valuation Designee may value the Fund's portfolio securities for which

market quotations are not readily available and other Fund assets utilizing inputs from pricing services and other third-party sources. The Valuation Committee meets (in person, via electronic mail or via teleconference) on an ad-hoc basis to determine fair valuations and on a quarterly basis to review fair value events with respect to certain securities for which market quotations are not readily available, including valuation risks and back-testing results, and to preview reports to the Board.