UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-22335)

Evermore Funds Trust

(Exact name of registrant as specified in charter)

89 Summit Avenue

Summit, New Jersey 07901

(Address of principal executive offices) (Zip code)

Eric LeGoff

89 Summit Ave, 3rd Floor

Summit, New Jersey 07901

(Name and address of agent for service)

(866) 383-7667

Registrant's telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: December 31, 2010

Item 1. Reports to Stockholders.

EVERMORE FUNDS Annual Report December 31, 2010 | |||||

Evermore Global Value Fund | Evermore European Value Fund |

Evermore Funds

Elements of Our Active Value Investment Approach

At Evermore Global Advisors, LLC, we employ an active value approach to investing. We seek to leverage our deep operating and investing experience and extensive global relationships to identify and invest in great companies around the world that have compelling valuations and are undergoing strategic changes which we believe will unlock value.

Seeking to Generate Value . . .

| • | Catalyst-Driven Investing. We do more than pick cheap stocks and hope for their prices to rise. We invest in companies where a series of catalysts exist to unlock value. The catalysts we look for reflect strategic changes in the company’s management, operations or financial structure that are already underway. They are not broadly recognized, but we feel they are likely to have a significant impact on a stock’s performance over time. |

Supporting Our Active Value Orientation . . .

| • | Original Fact-Based Research. We do not rely on brokerage reports to research companies. We conduct our own, original fact-based research to validate management’s stated objectives and the existence of catalysts to unlock value. We also perform detailed business segment analysis on each company we research. |

| • | Business Operating Experience. Our senior team has hands-on business operating experience; including starting and managing businesses, sitting on company boards, and assisting the management of multi-national corporations restructure their businesses. We rely on this experience to better evaluate investment opportunities. |

| • | A Global Network of Strategic Relationships. Over the past 20 years, our investment team has developed an extensive global network of strategic relationships, including individuals and families that control businesses, corporate board members, corporate management, regional brokerage firms, press contacts, etc. We leverage these relationships to help generate and better evaluate investment opportunities. |

| • | Taking a Private Equity Approach to Public Equity Investing. When we are interested in an investment opportunity, we get to know the management team of the company, study the company’s business model, evaluate the competitive and regulatory environment, and test and crosscheck everything the management team tells us against our own experience. |

| • | Always Active, Sometimes Activist. We are always engaged with the companies in which we invest to ensure management teams follow through on their |

1

Evermore Funds

| commitments to change. On limited occasions, when we are not satisfied with the efforts of management, we may play an activist role working with other shareholders to facilitate change. |

Executing Our Approach . . .

| • | Targeting Complex Investment Opportunities. We love looking at holding companies and conglomerates that are often under-researched and/or misunderstood. |

| • | Investing Across the Capital Structure. We evaluate all parts of a company’s capital structure to determine where the best risk-adjusted return potential exists. At times, we may invest in multiple parts of a company’s capital structure (e.g., investing in both a company’s debt and equity). |

| • | Investing in Merger Arbitrage and Distressed Situations. We look to take advantage of announced merger and acquisition deals where an attractive spread exists between the market price and the announced deal price for the target company. We also look for opportunities in distressed companies that have filed or may file for bankruptcy, or are involved in reorganizations or financial restructurings. |

| • | Exploiting Short Selling Opportunities. We seek to take advantage of short selling opportunities to address currency, security, sector and market risk. |

| • | Tactically Managing Cash Levels. We are not afraid to hold significant cash positions when it makes sense for the portfolios. |

2

Evermore Funds

A Letter from the CEO

Eric LeGoff

CEO, Evermore Funds Trust

To Our Shareholders:

As we look back at our first full year in business, we are extremely appreciative of the efforts of the Evermore team, our Board of Trustees, our advisors, and our partners, and are grateful for the commitment of our investors. Our investment team spent the year constructing our Funds’ portfolios to position them for long-term success. Our operations team focused on putting a technology and operational infrastructure in place to manage the continued growth of our business while ensuring compliance and mitigating risk. Our sales team did a great job in getting our story out to the investing public and in making sure that the Funds were available on the right platforms so investors could easily invest. We ended 2010 with our Funds available on 30 distribution platforms.

Our Funds’ Board of Trustees consists of an incredibly talented group of individuals, all of whom have deep roots in the financial services industry. William L. Richter, our chairman, is co-founder and a senior managing director of Cerberus Capital Management, L.P., a large private equity fund. Stephen Apkon is the founder and executive director of The Jacob Burns Film Center, a nonprofit, membership film organization that opened in 2001. Mr. Apkon formerly was an investment banker at Goldman Sachs & Co. and a principal at Odyssey Partners, L.P., a buyout firm. Eugene Bebout is CFO of Herbert L. Jamison & Co., LLC, a large insurance agency and was formerly a partner at BDO Seidman LLP, a national public accounting firm. This group of experienced and talented independent trustees keeps us ever-focused on our mission of providing our shareholders with superior, risk-adjusted returns over time.

In addition to assembling a great team of employees and Board of Trustees, we were very fortunate to have asset management industry veterans, A. Michael Lipper and Michael F. Price, join and participate on our advisory board. Their perspective and advice before, during and after the launch of our mutual funds have been invaluable. We look forward to continuing to tap into their incredible knowledge and experience in the coming years.

Picking the right partners is critical to the success of any business. We approach selection of our business partners with the same focus on vetting and value that we bring to investing. Our partners have helped us tremendously during our first year of operations, and it is important to acknowledge their contributions. We thank U.S. Bancorp Fund Services, Howard & Majewski, Alaric Compliance Services,

3

Tiller, LLC, Wechsler Ross, Hewes Communications, Eze Castle Software, Advent Software, Morningstar, our brokers who execute our trades, and the many others who have provided us with great support and guidance over the last year.

And finally, we would also like to thank you, our shareholders, for the support and confidence you have shown us in our early days. We look forward to a long and rewarding relationship.

Sincerely,

Eric LeGoff

CEO, Evermore Funds Trust

4

Evermore Global Investor Letter for the Year Ended

December 31, 2010

|  |

| David Marcus | Jae Chung |

| Lead Portfolio Manager | Co-Portfolio Manager |

To Our Shareholders:

On January 1, 2010, the Evermore Global Value and Evermore European Value Funds went live. This was the culmination of the many months of effort by the exceptionally talented, dedicated and hard-working team of individuals that we have assembled at Evermore Global Advisors, LLC, the adviser to the Funds.

We believe that investing is a long term endeavor. As such, we felt it was important to take our time investing our shareholders’ capital, with a relentless focus on the long-term. In the short-run, this approach produced modest investment returns in 2010 relative to their respective benchmarks. But, we believe that by sticking to our principles and taking the time to find and invest in only those companies that meet our standards and approach, we have constructed a portfolio of deep value-oriented investments with significant catalysts for value creation.

Evermore builds its portfolios bottom-up, one company at a time. In our experience, a macro crisis like we experienced in the middle of last year, will usually create an exceptional environment for bottom-up stock pickers.

As 2010 drew to a close and market observers turned their attention to 2011, many were projecting an ongoing – though not particularly robust – recovery for the global economy. As was true of 2010, 2011 seems to promise an environment in which investors cannot count on a vibrant global economy to provide a boost across all markets. In this kind of market, the most careful targeting of investment opportunity on a global basis will remain paramount.

For Evermore, this past year was a time for “planting seeds.” We ended the year with 38 investments in the Global Value Fund and 24 investments in the European Value Fund. Our approach of focusing on situations where catalysts exist for strategic change brought us a whole host of investment opportunities across the globe. These range from media companies like Grupo Prisa in Spain and Schibsted in Norway to industrial conglomerates like Siemens in Germany, Fiat in Italy and Motorola here in the U.S. The portfolios include old line holding companies with vast holdings in a cross section of businesses and regions like Orkla in Norway, Bollore in France and AP Moller - Maersk in Denmark. In addition, we found interesting companies at various stages of liquidation—Retail Holdings in the Netherlands and SeaCo Ltd. in the U.K.

5

We’d like to take this opportunity to discuss several of these holdings.

Grupo Prisa (www.prisa.com). Grupo Prisa (Prisa) is amongst the largest, diversified entertainment and education groups in Europe, with a significant market presence in Spain and Portugal and among the fastest growing Hispanic community in the U.S. At year-end, Prisa was the largest position in each of the Funds with our ownership of the Prisa ADR and the Prisa Class B ADR. This investment is extremely attractive to us as it is deeply undervalued and embodies so many of the catalysts we look for in an investment – namely management changes, operational and financial restructurings, asset sales, and employee reductions. This investment is also attractive we feel, because it offered us a two-stage investment opportunity—the first in a special purpose acquisition company (“SPAC”) called Liberty Acquisition Holdings Corp. (Liberty), which ultimately merged with Prisa in late November of last year; and the second in post-merger securities of Prisa.

In the first stage, the Funds purchased a combination of Liberty common stock and warrants. There was an especially large arbitrage in the Liberty warrants, which we purchased at an average price of $1.30 and $1.23 in the Global Value Fund and European Value Fund, respectively, in 2010. On the day the deal closed, we exchanged the warrants for a package of cash and Prisa securities worth approximately $1.80 at year-end. In addition, we exchanged our Liberty common stock, which we acquired at an average cost of $10.29 and $10.35 in the Global Value Fund and European Value Fund, respectively, for a package of cash and securities worth approximately $10.67 at year-end.

As a practice, we are not SPAC investors. However, three key factors attracted us to Liberty. First, there was an interesting arbitrage opportunity. Second, Liberty was started and controlled by two well-known value creators—Martin Franklin, Chairman and CEO of Jarden Corp. and international financier, Nicolas Berggruen. Third, Liberty was a cheaper way of becoming Prisa shareholders. We believe Prisa is dramatically undervalued based on its low price to earnings and price to cash flow multiples at the bottom of the cycle for media companies. We believe in the restructuring opportunities and that we will continue to see significant value creation at Prisa over the coming years.

Schibsted ASA (www.schibsted.com). Schibsted is a large Norway-based media conglomerate with businesses in 26 countries. Since 2008, the company has undergone a major restructuring of its operations. The company continues to resize and refocus its operations for the new realities of media businesses globally. In addition, Schibsted is seeing a modest pickup in revenues, which will likely bring a renewed focus on the company from investors. With the continuing restructuring and improvement in operating results, we expect further significant value creation over time. In 2010, the company’s stock was up 32.2%.

Siemens AG (www.siemens.com). Like Schibsted, Siemens has been involved in a massive restructuring over the past couple of years. One benefit of the 2008 global financial crisis was that huge, complacent companies like Siemens began to take a

6

different perspective on their business. Quite suddenly, a company that had never considered rationalizing its businesses by reducing headcount started looking to cut costs by laying off employees and moving operations to less expensive markets. Siemens also named its first non-German CEO in the company’s history. As a result of cost-cutting measures over the past couple of years, Siemens is extremely well-positioned to benefit from the continuing global economic recovery. In 2010, the company’s stock was up 44.3%.

FIAT SpA (www.fiat.com). At the end of December each Fund made an investment in Fiat SpA, which is controlled by Italy’s Agnelli family. The company’s shareholders had approved a plan in September to split the company into two – Fiat SpA (the auto company) and Fiat Industrial SpA (the industrial company) – a split that occurred on January 1, 2011. Sergio Marchionne, the CEO of both the former and current Fiat SpA, has publicly announced his intentions to initiate a public offering of the Chrysler unit in the second half of 2011. We believe that this split will unlock tremendous value for shareholders in the next 12 to 18 months.

Motorola, Inc. (www.motorola.com). Motorola, Inc. is another break-up situation in which the Evermore Global Value Fund invested in 2010. The company split into two on January 4, 2011—Motorola Mobility, Inc., which consists of mobile device and home businesses, and Motorola Solutions, Inc., which consists of enterprise mobility solutions and wireless networks businesses. When we originally purchased Motorola, we saw an opportunity to tap the approximately $7 billion revenue mobile phone business essentially for “free.” Although this business was not profitable at the time of our investment, we believed that it would reach near-term profitability based on its Droid family of smartphones which are based on the Android operating platform. We remain bullish on the Motorola Mobility, Inc. business and believe it should earn a strong operating margin over time, as smartphones come to represent a more significant part of overall mobile phone revenues.

Orkla ASA (www.orkla.com). Orkla ASA is another position that has also started reaping rewards from emergent catalysts. Orkla, a large Norwegian conglomerate and one of Evermore Global Value Fund’s top 10 holdings as of year-end, recently signed a definitive agreement to sell its Elkem unit for $2 billion as part of its corporate restructuring. We expect this $9.4 billion market cap company to continue its dramatic transformation over the next 18 months.

Bollore SA (www.bollore.com). Bollore is a great example of a family-controlled conglomerate in which the individual that controls the business is not merely a steward of capital, but a creator of value. Bollore SA was founded in 1822 and is currently managed by Vincent Bollore and his nephew, Cedric de Bailliencourt. The company owns a myriad of successful businesses, mainly across Europe and Africa, including freight forwarding and international logistics, transportation and logistics in Africa, fuel distribution, plastic films, media, etc. Bollore also offers a good example of Evermore’s approach of “sneaking into” emerging markets, such as Africa. The company’s stock was up 38.2% in 2010.

7

A.P. Moller – Maersk A/S (www.maersk.com). Historically, investors have viewed Maersk’s stock as a proxy for global trade; as global trade slowed during 2007-2010, Maersk shares sold off. Our view is that the company is much more than an owner and operator of container ships – in reality, they are a global conglomerate with significant oil reserves, ports around the world, logistics businesses, and of course, container and product shipping assets. Additionally, they are slowly divesting non-industrial assets, a move that will slowly reveal Maersk’s value to the market.

Retail Holdings NV (www.retailholdings.com). Formerly known as Singer, N.V., Retail Holdings engages in the retail distribution of a wide variety of home appliances, primarily in Asia. The company is in the process of liquidation, which we estimate might take another 18 to 24 months to complete. We originally began buying our position in Retail Holdings in the Evermore Global Value Fund in September at $10.28. We believe that the company has a liquidation value of between $25 and $30 per share. The stock closed at $16.10 on December 31, 2010.

SeaCo Ltd. (www.seacoltd.com). SeaCo is another interesting liquidation scenario in which the Evermore Global Value Fund has invested. SeaCo is a shipping container investment and leasing company, newly formed in February 2009 to hold the existing container leasing investments of Sea Containers Group following its U.S. Chapter 11 re-organization in 2008. SeaCo’s main assets include a 50% joint venture interest in GE SeaCo (one of the world’s largest container leasing companies) as well as an investment in its own container fleet, which is managed on behalf of SeaCo by GE SeaCo. The time frame for this liquidation is much shorter than for Retail Holdings and we believe should be completed within the next six months.

We believe our fundamental investing approach continues to be well aligned with these times. At Evermore Global Advisors, we seek to identify companies trading at what we believe are significant discounts to their intrinsic values – and within which catalysts exist with high potential to unlock this value.

The Evermore strategy demands focus, deliberation and patience, as these catalysts can often take months or years to unfold, earn the recognition of investors, and translate into investment value. Our portfolios in 2010 provided several strong examples of such catalysts in action, demonstrating the power as well as the potential of our strategy. We believe our Funds are extremely well positioned to realize the substantial value inherent in our portfolio companies over the near and longer term.

We thank you for the trust you have placed in Evermore Global Advisors, LLC.

Sincerely,

|  |

| David Marcus | Jae Chung |

| Lead Portfolio Manager | Co-Portfolio Manager |

8

Management’s Discussion of Fund Performance

2010 was a year full of opportunities, challenges and crisis situations around the world—in other words, a typical year. Global economies continued their modest recoveries from the pandemic that spread as a result of the financial crisis in the U.S. from late 2007 through early 2009. In 2010, we saw a new crisis in Europe, starting in Greece. As the new Greek government of Prime Minister Papandreou came into power, it discovered that most of the economic data that the predecessor government had been disseminating to the markets had been misleading. The public realized that Greece could not come close to hitting the 3% budget deficit goal required as part of European Union (“EU”) membership, setting off a firestorm of panic selling across Europe that eventually affected markets globally. As is typical with these situations, the selling was without regard to valuation. Investors wanted out at any price. This, in our experience, creates terrific buying opportunities. History has proven that investors who were willing to step forward and buy while others were in panic mode have fared extremely well in subsequent periods.

As the crisis in Europe deepened, fears of defaults in other markets began to take hold. Investors worried that Spain and Portugal could be the next markets to turn and, soon after, focus shifted to the financial problems in Italy and Ireland. Ultimately, Ireland was the next market to undergo intense scrutiny and feverish selling. The EU, led by Germany and France, created a massive bailout fund to help protect the Euro and all EU members. The Euro, which only one year earlier was viewed as the new reserve currency for the world, quickly collapsed along with the European equity and bond markets and the dollar retained its stature as the currency of choice in crisis times. All of this happened before the third quarter ended. During 2010’s final four months, the Euro rallied to close down 7% compared with being down approximately 17% at the depths of the crisis. Investors started to understand one of the most fundamental realities of the Continent – namely, that Europe is not a country, but rather a series of countries, each with its own distinctive economy, culture, companies and opportunities. As an illustration, in 2010 the Greek market (Athex Composite Share Price Index) was down 35.6%, but the Swedish market (OMX Stockholm 30 Index) was up 21.4%.

Markets across the globe were generally up for 2010 with solid corporate earnings reassuring investors that economies were recovering, albeit slowly.

Evermore Global Value Fund

The Evermore Global Value Fund Class A shares (at net asset value), returned 5.00% for the year ended December 31, 2010. The MSCI All-Country World Index returned 12.67% during the same period.

As a result of the volatility in the markets in the spring of 2010, we added to our positions in VIX call options, which, in addition to our cash position, we use as a

9

market hedge. Unfortunately, when markets rally as they did in the 3rd and 4th quarters of 2010, these market hedges can hurt performance. We view these market hedges as disability insurance that can pay off not when there are small down moves in the markets, but when there are crisis down moves (5% to 10%) in the markets.

The biggest contributors to Fund performance last year were General Growth Properties, Inc. (U.S.), CIT Group, Inc. (U.S.), Schibsted ASA (Norway), Swedish Match AB (Sweden), PPR SA (France) and Bollore SA (France).

Besides our market hedges, our largest detractors from performance in 2010 were Cable & Wireless Communications plc (U.K.), Cable & Wireless Worldwide plc (U.K.), CIR spa (Italy), Promotora de Informaciones SA (Spain) and VimpelCom Ltd. (Russia).

As of December 31, 2010, our largest five positions were Grupo Prisa – Class B – ADR , American International Group, 5/22/2038, 8.625% Bond, SeaCo Ltd., Grupo Prisa – ADR, and Airgas, Inc. The Fund’s cash and equivalents position stood at 4.1%, which is lower than the Fund’s typical cash position of 10% to 20% of net assets.

Evermore European Value Fund

The Evermore European Value Fund Class A shares (at net asset value), returned 0.20% for the year ended December 31, 2010. The MSCI Daily Total Return Net Europe Local Index returned 6.83% during the same period.

As a result of the volatility in the markets in the spring of 2010, we added to our positions in VIX call options, which, in addition to our cash position, we use as a market hedge. Unfortunately, when markets rally as they did in the 3rd and 4th quarters of 2010, these market hedges can hurt performance. We view these market hedges as disability insurance that can pay off not when there are small down moves in the markets, but when there are crisis down moves (5% to 10%) in the markets.

The biggest contributors to Fund performance last year were Siemens AG (Germany), Swedish Match AB (Sweden), Schibsted ASA (Norway), PPR SA (France) and Bollore SA (France).

Besides our market hedges, our largest detractors from performance in 2010 were Cable & Wireless Communications plc (U.K.), Cable & Wireless Worldwide plc (U.K.), Promotora de Informaciones SA (Spain), CIR spa (Italy) and VimpelCom Ltd. (Russia).

As of December 31, 2010, our largest five positions were Grupo Prisa – Class B – ADR, Bollore SA, LBG Capital No. 2 PLC, 12/21/2019, 15.000% Bond, Siemens AG, and Schibsted ASA. The Fund’s cash and equivalents position stood at 13.3%, which is within the range of the Fund’s typical cash position of 10% to 20% of net assets.

10

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Past performance does not guarantee future results. Short-term performance, in particular, is not a good indication of the Funds’ future performance, and an investment should not be made based solely on returns. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

Mutual fund investing involves risk. Principal loss is possible. The Funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. Investing in smaller companies involves additional risks such as limited liquidity and greater volatility. The Funds may make short sales of securities, which involves the risk that losses may exceed the original amount invested. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment in lower-rated, non-rated and distressed securities presents a greater risk of loss to principal and interest than higher-rated securities. Additional special risks relevant to our Funds involve derivatives and hedging. Please refer to the prospectus for further details.

The Evermore European Value Fund concentrates its investments in a single region, which may subject it to greater risk and volatility than a broadly diversified fund.

Please refer to the Schedules of Investments for complete holdings information. Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security.

The price to earnings ratio is the measure of price paid for a share of stock relative to the annual profit per share that is earned by the company. The price to cash flow multiple is used by investors to evaluate the investment attractiveness, from a value standpoint, of a company’s stock. This metric compares the stock’s market price to the amount of cash flow the company generates on a per-share basis.

References to other funds should not be interpreted as an offer of these securities.

The MSCI All-Country World Index is an unmanaged index comprised of 48 country indices, including 23 developed and 25 emerging market country indices, and is calculated with dividends reinvested after deduction of holding tax. The index is a trademark of Morgan Stanley Capital International and is not available for direct investment. The MSCI Daily Total Return Net Europe Local Index is a free float-adjusted market capitalization weighted index comprised of 16 European developed market indices and reinvests dividends after deduction of withholding tax on the days securities are quoted ex-dividend. The index is a trademark of Morgan Stanley Capital International and is not available for direct investment.

The Athex Composite Share Price Index is a cap weighted index of Greek stocks listed on the Athens Stock Exchange. The OMX Stockholm 30 Index is a cap weighted index of the 30 stocks that have the largest volume of trading on the Stockholm Stock Exchange. The indices are not available for direct investment.

Must be preceded or accompanied by a prospectus.

The Evermore Funds are distributed by Quasar Distributors, LLC.

11

(This Page Intentionally Left Blank.)

12

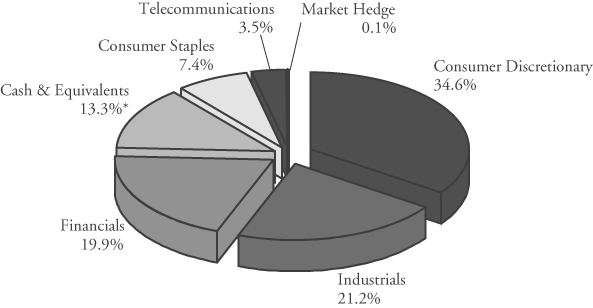

SECTOR ALLOCATION as a Percentage of Net Assets at December 31, 2010 (Unaudited) |

Evermore Global Value Fund

Evermore European Value Fund

*Cash equivalents and liabilities in excess of other assets.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC, the Fund’s Administrator.

13

Evermore Funds

EXPENSE EXAMPLE for the Six Months Ended December 31, 2010 (Unaudited) |

As a shareholder of the Evermore Global Value Fund or the Evermore European Value Fund (each a “Fund” and collectively the “Funds”), you incur two types of costs: (1) transaction costs, including sales charges or loads; and (2) ongoing costs, including investment advisory fees, distribution fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (7/1/10 – 12/31/10).

Actual Expenses

The first line of the table below provides information about actual account values based on actual returns and actual expenses. You will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. You will be charged a redemption fee equal to 2% of the net amount of the redemption if you redeem shares less than 30 calendar days after you purchase them. An Individual Retirement Account (“IRA”) will be charged a $15.00 annual maintenance fee. To the extent the Funds invest in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Funds invest in addition to the expenses of the Funds. Actual expenses of the underlying funds may vary. These expenses are not included in the example below. The example below includes, but is not limited to, investment advisory fees, shareholder servicing fees, fund accounting fees, custody fees and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

14

Evermore Funds

EXPENSE EXAMPLE for the Six Months Ended December 31, 2010 (Unaudited), Continued |

Evermore Global Value Fund

| Beginning | Ending | Expenses Paid | |

| Account Value | Account Value | During the Period | |

| 7/01/10 | 12/31/10 | 7/01/10–12/31/10* | |

Class A Actual^ | $1,000 | $1,160 | $ 8.82 |

| Class A Hypothetical (5% annual | |||

return before expenses)+ | $1,000 | $1,017 | $ 8.24 |

Class C Actual^ | $1,000 | $1,154 | $12.87 |

| Class C Hypothetical (5% annual | |||

return before expenses)+ | $1,000 | $1,013 | $12.03 |

Class I Actual^ | $1,000 | $1,162 | $ 7.47 |

| Class I Hypothetical (5% annual | |||

return before expenses)+ | $1,000 | $1,018 | $ 6.97 |

| ^ | Excluding interest expense, your actual cost of investments in the Fund would be $8.71 for Class A shares, $12.76 for Class C shares and $7.36 for Class I shares. |

| + | Excluding interest expense, your hypothetical cost of investment in a fund would be $8.13 for Class A shares, $11.93 for Class C shares and $6.87 for Class I shares. |

| * | Expenses are equal to the Fund’s expense ratios for the most recent six-month period, including interest expense of 1.62% for Class A shares, 2.37% for Class C shares and 1.37% for Class I shares multiplied by the average account value over the period multiplied by 184/365 (to reflect the one-half year period). If interest expense was excluded, the annualized ratio would have been 1.60% for Class A shares, 2.35% for Class C shares and 1.35% for Class I shares. Expense ratios reflect expense reimbursements currently in effect. |

Evermore European Value Fund

| Beginning | Ending | Expenses Paid | |

| Account Value | Account Value | During the Period | |

| 7/01/10 | 12/31/10 | 7/01/10–12/31/10* | |

Class A Actual^ | $1,000 | $1,083 | $ 8.56 |

| Class A Hypothetical (5% annual | |||

return before expenses)+ | $1,000 | $1,017 | $ 8.29 |

Class C Actual^ | $1,000 | $1,080 | $12.48 |

| Class C Hypothetical (5% annual | |||

return before expenses)+ | $1,000 | $1,013 | $12.08 |

Class I Actual^ | $1,000 | $1,085 | $ 7.26 |

| Class I Hypothetical (5% annual | |||

return before expenses)+ | $1,000 | $1,018 | $ 7.02 |

| ^ | Excluding interest expense, your actual cost of investments in the Fund would be $8.40 for Class A shares, $12.32 for Class C shares and $7.10 for Class I shares. |

| + | Excluding interest expense, your hypothetical cost of investment in a fund would be $8.13 for Class A shares, $11.93 for Class C shares and $6.87 for Class I shares. |

| * | Expenses are equal to the Fund’s expense ratios for the most recent six-month period, including interest expense of 1.63% for Class A shares, 2.38% for Class C shares and 1.38% for Class I shares multiplied by the average account value over the period multiplied by 184/365 (to reflect the one-half year period). If interest expense was excluded, the annualized ratio would have been 1.60% for Class A shares, 2.35% for Class C shares and 1.35% for Class I shares. Expense ratios reflect expense reimbursements currently in effect. |

15

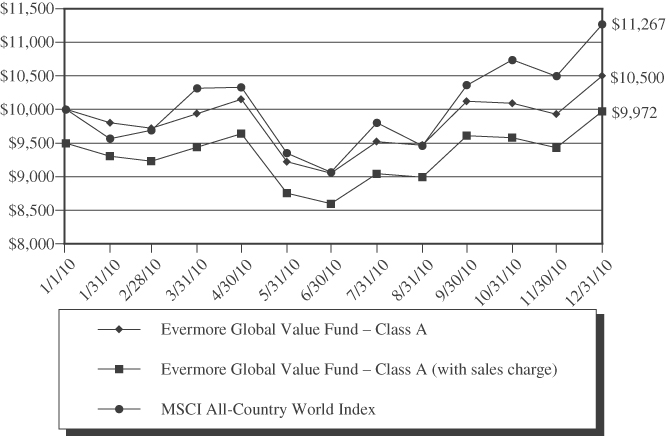

Evermore Global Value Fund – Class A

Value of $10,000 vs. MSCI All-Country World Index

| Total Returns | Since Inception | |||

| Year Ended December 31, 2010 | (1/1/2010) | |||

| Class A | 5.00 | % | ||

| Class A (with sales charge) | (0.28 | )% | ||

| MSCI All-Country World Index | 12.67 | % | ||

This chart illustrates the performance of a hypothetical $10,000 investment made on January 1, 2010, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains and dividends for the Fund and index.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 866-EVERMORE or (866) 383-7667.

The Fund imposes a 2.00% redemption fee on shares redeemed within 30 days. Performance does not reflect the redemption fee. If reflected, total returns would be reduced.

16

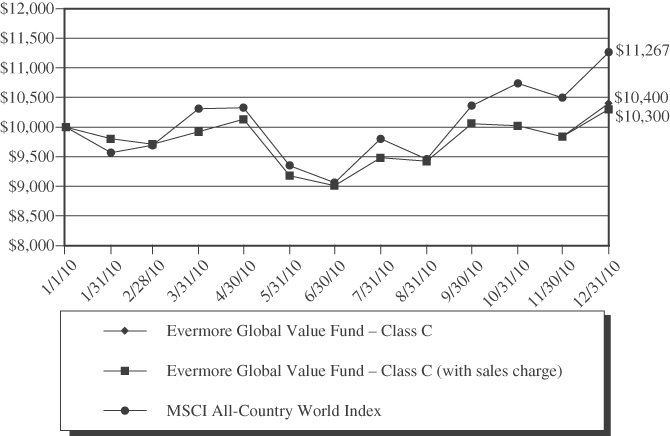

Evermore Global Value Fund – Class C

Value of $10,000 vs. MSCI All-Country World Index

| Total Returns | Since Inception | |||

| Year Ended December 31, 2010 | (1/1/2010) | |||

| Class C | 4.00 | % | ||

| Class C (with sales charge) | 3.00 | % | ||

| MSCI All-Country World Index | 12.67 | % | ||

This chart illustrates the performance of a hypothetical $10,000 investment made on January 1, 2010, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains and dividends for the Fund and index.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 866-EVERMORE or (866) 383-7667.

The Fund imposes a 2.00% redemption fee on shares redeemed within 30 days. Performance does not reflect the redemption fee. If reflected, total returns would be reduced.

17

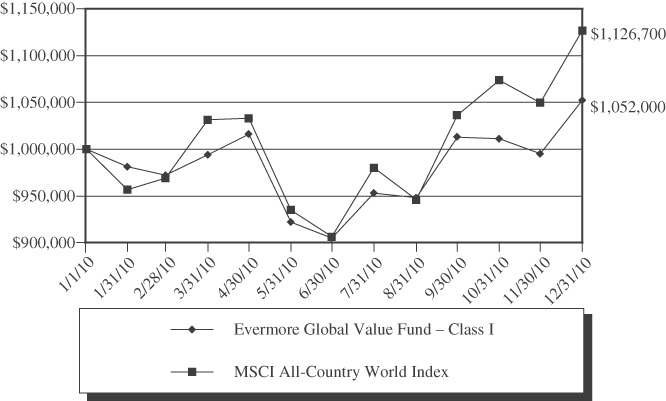

Evermore Global Value Fund – Class I

Value of $1,000,000 vs. MSCI All-Country World Index

| Total Returns | Since Inception | |||

| Year Ended December 31, 2010 | (1/1/2010) | |||

| Class I | 5.20 | % | ||

| MSCI All-Country World Index | 12.67 | % | ||

This chart illustrates the performance of a hypothetical $1,000,000 investment made on January 1, 2010, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains and dividends for the Fund and index.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 866-EVERMORE or (866) 383-7667.

The Fund imposes a 2.00% redemption fee on shares redeemed within 30 days. Performance does not reflect the redemption fee. If reflected, total returns would be reduced.

18

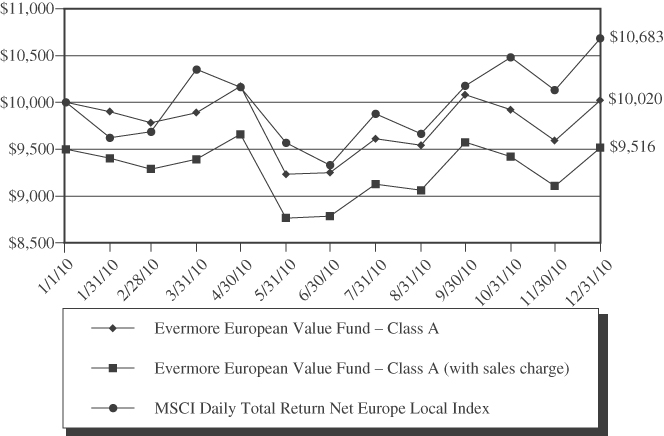

Evermore European Value Fund – Class A

Value of $10,000 vs. MSCI Daily Total Return Net Europe Local Index

| Total Returns | Since Inception | |||

| Year Ended December 31, 2010 | (1/1/2010) | |||

| Class A | 0.20 | % | ||

| Class A (with sales charge) | (4.84 | )% | ||

| MSCI Daily Total Return Net Europe Local Index | 6.83 | % | ||

This chart illustrates the performance of a hypothetical $10,000 investment made on January 1, 2010, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains and dividends for the Fund and index.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 866-EVERMORE or (866) 383-7667.

The Fund imposes a 2.00% redemption fee on shares redeemed within 30 days. Performance does not reflect the redemption fee. If reflected, total returns would be reduced.

19

Evermore European Value Fund – Class C

Value of $10,000 vs. MSCI Daily Total Return Net Europe Local Index

| Total Returns | Since Inception | |||

| Year Ended December 31, 2010 | (1/1/2010) | |||

| Class C | (0.60 | )% | ||

| Class C (with sales charge) | (1.59 | )% | ||

| MSCI Daily Total Return Net Europe Local Index | 6.83 | % | ||

This chart illustrates the performance of a hypothetical $10,000 investment made on January 1, 2010, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains and dividends for the Fund and index.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 866-EVERMORE or (866) 383-7667.

The Fund imposes a 2.00% redemption fee on shares redeemed within 30 days. Performance does not reflect the redemption fee. If reflected, total returns would be reduced.

20

Evermore European Value Fund – Class I

Value of $1,000,000 vs. MSCI Daily Total Return Net Europe Local Index

| Total Returns | Since Inception | |||

| Year Ended December 31, 2010 | (1/1/2010) | |||

| Class I | 0.70 | % | ||

| MSCI Daily Total Return Net Europe Local Index | 6.83 | % | ||

This chart illustrates the performance of a hypothetical $1,000,000 investment made on January 1, 2010, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains and dividends for the Fund and index.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 866-EVERMORE or (866) 383-7667.

The Fund imposes a 2.00% redemption fee on shares redeemed within 30 days. Performance does not reflect the redemption fee. If reflected, total returns would be reduced.

21

Evermore Global Value Fund

SCHEDULE OF INVESTMENTS at December 31, 2010 |

| Shares | Value | ||||||

| COMMON STOCKS – 75.8% | |||||||

Air Freight & Logistics – 1.5% | |||||||

| 20,612 | TNT NV | ||||||

| (Netherlands) | $ | 543,994 | |||||

Apparel & Luxury Goods – 2.2% | |||||||

| 4,916 | PPR SA (France) | 781,746 | |||||

Automobiles – 2.1% | |||||||

| 37,000 | Fiat SPA (Italy) | 762,912 | |||||

Beverages – 2.6% | |||||||

| 11,210 | Coca-Cola FEMSA – | ||||||

ADR (Mexico)1 | 924,040 | ||||||

Capital Markets – 1.1% | |||||||

| 104,100 | LaBranche & Co., Inc. | ||||||

| (United States)* | 374,760 | ||||||

Chemicals – 5.0% | |||||||

| 21,038 | Airgas, Inc. | ||||||

(United States)1 | 1,314,033 | ||||||

| 523,100 | Yingde Gases Group Co. | ||||||

| Ltd. (Hong Kong)* | 465,035 | ||||||

| 1,779,068 | |||||||

| Commercial Banks – 0.9% | |||||||

| 320,000 | Lloyds Banking | ||||||

| Group PLC | |||||||

| (United Kingdom)* | 327,783 | ||||||

Communications Equipment – 2.3% | |||||||

| 50,000 | Motorola, Inc. | ||||||

(United States)*1 | 453,500 | ||||||

| 13,200 | Motorola Mobility | ||||||

| Holdings, Inc. | |||||||

| (United States)* | 384,120 | ||||||

| 837,620 | |||||||

| Diversified Financial Services – 6.2% | |||||||

| 31,080 | Bank of America Corp. | ||||||

(United States)1 | 414,607 | ||||||

| 13,060 | CIT Group, Inc. | ||||||

(United States)*1 | 615,126 | ||||||

| 10,500 | EXOR SPA (Italy) | 346,291 | |||||

| 103,109 | RHJ International SA | ||||||

| (Belgium)* | 854,270 | ||||||

| 2,230,294 | |||||||

| Diversified Telecommunication | |||||||

| Services – 1.5% | |||||||

| 36,850 | VimpelCom Ltd. – | ||||||

ADR (Russia)1 | 554,224 | ||||||

Hotels, Restaurants & Leisure – 1.5% | |||||||

| 462,751 | Punch Taverns PLC | ||||||

| (United Kingdom)* | 541,103 | ||||||

Household Durables – 3.3% | |||||||

| 72,200 | Retail Holdings NV | ||||||

(Netherlands)2 | 1,162,420 | ||||||

Industrial Conglomerates – 6.8% | |||||||

| 3,802 | Bollore SA (France) | 807,569 | |||||

| 95,710 | Orkla ASA (Norway) | 930,027 | |||||

| 5,534 | Siemens AG (Germany) | 685,529 | |||||

| 2,423,125 | |||||||

| Insurance – 2.0% | |||||||

| 363,484 | Old Mutual PLC | ||||||

| (United Kingdom) | 697,613 | ||||||

Internet Software & Services – 1.2% | |||||||

| 65,474 | ModusLink Global | ||||||

| Solutions, Inc. | |||||||

| (United States)* | 438,676 | ||||||

Machinery – 2.3% | |||||||

| 2,300 | MAN SE (Germany) | 273,511 | |||||

| 23,900 | Scania AB (Sweden) | 549,736 | |||||

| 823,247 | |||||||

| Marine – 5.4% | |||||||

| 55 | A.P. Moller-Maersk | ||||||

| A/S – Class B | |||||||

| (Denmark) | 498,032 | ||||||

| 3,050,995 | SeaCo Ltd. | ||||||

(United Kingdom)*2 | 1,433,968 | ||||||

| 1,932,000 | |||||||

| Media – 21.0% | |||||||

| 28,110 | British Sky Broadcasting | ||||||

| Group PLC | |||||||

| (United Kingdom) | 322,559 | ||||||

| 19,100 | DIRECTV – Class A | ||||||

(United States)*1 | 762,663 | ||||||

The accompanying notes are an integral part of these financial statements.

22

Evermore Global Value Fund

SCHEDULE OF INVESTMENTS at December 31, 2010, Continued |

| Shares | Value | ||||||

| Media – 21.0% (Continued) | |||||||

| 151,454 | Havas SA (France) | $ | 787,295 | ||||

| 175,793 | Promotora de | ||||||

| Informaciones SA – | |||||||

| ADR (Spain)* | 1,409,860 | ||||||

| 293,759 | Promotora de | ||||||

| Informaciones SA – | |||||||

| Class B – ADR | |||||||

| (Spain)* | 2,802,461 | ||||||

| 19,000 | ProSiebenSat.1 Media | ||||||

| AG (Germany) | 571,272 | ||||||

| 28,800 | Schibsted ASA | ||||||

| (Norway) | 848,939 | ||||||

| 7,505,049 | |||||||

| Oil, Gas & Consumable Fuels – 1.9% | |||||||

| 18,000 | Petroleo Brasileiro | ||||||

| SA – Petrobras – | |||||||

| ADR (Brazil) | 681,120 | ||||||

Real Estate Management & | |||||||

| Development – 1.2% | |||||||

| 8,053 | The Howard Hughes | ||||||

| Corp. (United States)* | 438,244 | ||||||

Tobacco – 3.8% | |||||||

| 7,730 | Philip Morris | ||||||

| International, Inc. | |||||||

(United States)1 | 452,437 | ||||||

| 30,804 | Swedish Match AB | ||||||

| (Sweden) | 891,741 | ||||||

| 1,344,178 | |||||||

| TOTAL COMMON STOCKS | |||||||

| (Cost $25,093,538) | 27,103,216 | ||||||

| PREFERRED STOCK – 0.9% | |||||||

Real Estate Investment Trust – 0.9% | |||||||

| 18,100 | iStar Financial, Inc. | ||||||

| (United States) | 316,750 | ||||||

| TOTAL PREFERRED STOCK | |||||||

| (Cost $278,516) | 316,750 | ||||||

PARTNERSHIPS & TRUSTS – 7.1% | |||||||

Real Estate Investment Trust – 7.1% | |||||||

| 81,890 | General Growth | ||||||

| Properties, Inc. | |||||||

| (United States) | 1,267,657 | ||||||

| 163,200 | iStar Financial, Inc. | ||||||

| (United States)* | 1,276,224 | ||||||

| TOTAL PARTNERSHIPS | |||||||

| & TRUSTS | |||||||

| (Cost $1,958,589) | 2,543,881 | ||||||

| WARRANTS – 1.6% | |||||||

Diversified Financial Services – 0.9% | |||||||

| Bank of America Corp., | |||||||

| Expiration: | |||||||

| January, 2019, | |||||||

| Exercise Price: $13.30 | |||||||

| 18,300 | (United States)* | 130,662 | |||||

| JPMorgan Chase & Co., | |||||||

| Expiration: | |||||||

| October, 2018, | |||||||

| Exercise Price: $42.42 | |||||||

| 13,050 | (United States)* | 188,573 | |||||

| 319,235 | |||||||

| Media – 0.7% | |||||||

| Promotora de | |||||||

| Informaciones SA – | |||||||

| Class A, | |||||||

| Expiration: June, 2014, | |||||||

| Exercise Price: $2.00 | |||||||

| 589,226 | (Spain)* | 236,216 | |||||

| TOTAL WARRANTS | |||||||

| (Cost $457,906) | 555,451 | ||||||

The accompanying notes are an integral part of these financial statements.

23

Evermore Global Value Fund

SCHEDULE OF INVESTMENTS at December 31, 2010, Continued |

| Principal | |||||||

| Amount | Value | ||||||

| CORPORATE BONDS – 10.4% | |||||||

Commercial Banks – 2.9% | |||||||

| LBG Capital No. 2 | |||||||

| PLC, 15.000%, | |||||||

| 12/21/2019 | |||||||

| $ | 600,000 | (United Kingdom) | $ | 1,046,330 | |||

Hotels, Restaurants & Leisure – 1.0% | |||||||

| Punch Taverns Finance | |||||||

| B, 6.962%, 06/30/2028 | |||||||

| 83,000 | (United Kingdom) | 58,851 | |||||

| Punch Taverns | |||||||

| Finance Notes, | |||||||

| 8.374%, 07/15/2029 | |||||||

| 353,000 | (United Kingdom) | 282,406 | |||||

| 341,257 | |||||||

| Insurance – 6.5% | |||||||

| American International | |||||||

| Group, Inc., | |||||||

| 8.625%, 05/22/2038 | |||||||

| 1,500,000 | (United States)3 | 2,315,248 | |||||

| TOTAL CORPORATE BONDS | |||||||

| (Cost $3,477,315) | 3,702,835 | ||||||

| Contracts | |||||||

| (100 shares per contract) | |||||||

| CALL OPTIONS PURCHASED – 0.1% | |||||||

Investment Company – 0.1% | |||||||

| CBOE Volatility Index, | |||||||

| Expiration: | |||||||

| February, 2011, | |||||||

| Exercise Price: $25.00 | |||||||

| 311 | (United States) | 46,650 | |||||

Media – 0.0% | |||||||

| Promotora de | |||||||

| Informaciones SA, | |||||||

| Expiration: | |||||||

| March, 2011, | |||||||

| Exercise Price: $2.30 | |||||||

| 800 | (Spain)2 | 5,185 | |||||

| TOTAL CALL OPTIONS | |||||||

| PURCHASED | |||||||

| (Cost $178,316) | 51,835 | ||||||

| Shares | |||||||

| SHORT-TERM INVESTMENT – 9.4% | |||||||

Money Market Fund – 9.4% | |||||||

| 3,361,302 | Invesco Liquid | ||||||

| Assets Portfolio – | |||||||

| Institutional | |||||||

Class, 0.195%4 | 3,361,302 | ||||||

| TOTAL SHORT-TERM | |||||||

| INVESTMENT | |||||||

| (Cost $3,361,302) | 3,361,302 | ||||||

| TOTAL INVESTMENTS IN | |||||||

| SECURITIES – 105.3% | |||||||

| (Cost $34,805,482) | 37,635,270 | ||||||

| Liabilities in Excess of | |||||||

| Other Assets – (5.3)% | (1,896,495 | ) | |||||

| TOTAL NET | |||||||

| ASSETS – 100.0% | $ | 35,738,775 | |||||

| ADR | American Depository Receipt |

| * | Non-income producing security. |

| 1 | All or a portion of this security was segregated as collateral for forward currency contracts. |

| 2 | Illiquid securities represent 7.3% of total net assets as of December 31, 2010 (Note 2). |

| 3 | Restricted security represents 6.5% of total net assets as of December 31, 2010 (Note 2). |

| 4 | 7-day yield as of December 31, 2010. |

The accompanying notes are an integral part of these financial statements.

24

Evermore Global Value Fund

SCHEDULE OF INVESTMENTS at December 31, 2010, Continued |

| Country | Percent of Net Assets | |||

| United States | 31.3% | |||

| United Kingdom | 13.2% | |||

| Spain | 12.5% | |||

| France | 6.6% | |||

| Norway | 5.0% | |||

| Netherlands | 4.8% | |||

| Germany | 4.3% | |||

| Sweden | 4.0% | |||

| Italy | 3.1% | |||

| Mexico | 2.6% | |||

| Belgium | 2.4% | |||

| Brazil | 1.9% | |||

| Russia | 1.5% | |||

| Denmark | 1.4% | |||

| Hong Kong | 1.3% | |||

| Cash & Equivalents^ | 4.1% | |||

| Total | 100.0% | |||

| ^ | Includes money market fund and liabilities in excess of other assets. |

The accompanying notes are an integral part of these financial statements.

25

Evermore European Value Fund

SCHEDULE OF INVESTMENTS at December 31, 2010 |

| Shares | Value | ||||||

| COMMON STOCKS – 77.0% | |||||||

Air Freight & Logistics – 3.0% | |||||||

| 8,950 | TNT NV | ||||||

| (Netherlands) | $ | 236,209 | |||||

Apparel & Luxury Goods – 3.9% | |||||||

| 1,964 | PPR SA (France) | 312,317 | |||||

Automobiles – 2.1% | |||||||

| 8,000 | Fiat SPA (Italy) | 164,954 | |||||

Commercial Banks – 3.2% | |||||||

| 247,400 | Lloyds Banking | ||||||

| Group PLC | |||||||

(United Kingdom)*1 | 253,417 | ||||||

Diversified Financial Services – 4.8% | |||||||

| 2,200 | EXOR SPA (Italy) | 72,556 | |||||

| 37,122 | RHJ International SA | ||||||

| (Belgium)* | 307,560 | ||||||

| 380,116 | |||||||

| Diversified Telecommunication | |||||||

| Services – 3.4% | |||||||

| 18,321 | VimpelCom Ltd. – | ||||||

ADR (Russia)1 | 275,548 | ||||||

Hotels, Restaurants & Leisure – 2.5% | |||||||

| 167,649 | Punch Taverns PLC | ||||||

| (United Kingdom)* | 196,035 | ||||||

Industrial Conglomerates – 12.9% | |||||||

| 1,849 | Bollore SA (France)1 | 392,740 | |||||

| 30,400 | Orkla ASA (Norway)1 | 295,401 | |||||

| 2,761 | Siemens AG (Germany) | 342,021 | |||||

| 1,030,162 | |||||||

| Insurance – 3.7% | |||||||

| 155,308 | Old Mutual PLC | ||||||

(United Kingdom)1 | 298,073 | ||||||

Machinery – 2.8% | |||||||

| 500 | MAN SE (Germany) | 59,459 | |||||

| 7,250 | Scania AB (Sweden) | 166,761 | |||||

| 226,220 | |||||||

| Marine – 2.5% | |||||||

| 22 | A.P. Moller-Maersk | ||||||

| A/S – Class B | |||||||

| (Denmark) | 199,213 | ||||||

Media – 24.8% | |||||||

| 18,110 | British Sky Broadcasting | ||||||

| Group PLC | |||||||

| (United Kingdom) | 207,810 | ||||||

| 52,916 | Havas SA (France) | 275,070 | |||||

| 32,300 | Promotora de | ||||||

| Informaciones SA – | |||||||

ADR (Spain)*1 | 259,046 | ||||||

| 77,349 | Promotora de | ||||||

| Informaciones SA – | |||||||

| Class B – ADR | |||||||

(Spain)*1 | 737,910 | ||||||

| 5,100 | ProSiebenSat.1 | ||||||

| Media AG (Germany) | 153,341 | ||||||

| 11,550 | Schibsted ASA | ||||||

(Norway)1 | 340,460 | ||||||

| 1,973,637 | |||||||

| Tobacco – 7.4% | |||||||

| 4,968 | Philip Morris | ||||||

| International, Inc. | |||||||

(United States)1 | 290,777 | ||||||

| 10,396 | Swedish Match AB | ||||||

(Sweden)1 | 300,953 | ||||||

| 591,730 | |||||||

| TOTAL COMMON STOCKS | |||||||

| (Cost $5,644,062) | 6,137,631 | ||||||

| WARRANT – 0.6% | |||||||

Media – 0.6% | |||||||

| Promotora de | |||||||

| Informaciones SA – | |||||||

| Class A, Expiration: | |||||||

| June, 2014, | |||||||

| Exercise Price: $2.00 | |||||||

| 125,200 | (Spain)* | 50,192 | |||||

| TOTAL WARRANT | |||||||

| (Cost $32,143) | 50,192 | ||||||

The accompanying notes are an integral part of these financial statements.

26

Evermore European Value Fund

SCHEDULE OF INVESTMENTS at December 31, 2010, Continued |

| Principal | |||||||

| Amount | Value | ||||||

| CORPORATE BONDS – 9.0% | |||||||

Commercial Banks – 4.4% | |||||||

| LBG Capital No. 2 PLC, | |||||||

| 15.000%, 12/21/2019 | |||||||

| $ | 200,000 | (United Kingdom) | $ | 348,777 | |||

Hotels, Restaurants & Leisure – 0.7% | |||||||

| Punch Taverns Finance B, | |||||||

| 6.962%, 06/30/2028 | |||||||

| 29,000 | (United Kingdom) | 20,563 | |||||

| Punch Taverns Finance | |||||||

| Notes, 8.374%, | |||||||

| 07/15/2029 | |||||||

| 45,000 | (United Kingdom) | 36,001 | |||||

| 56,564 | |||||||

| Insurance – 3.9% | |||||||

| American International | |||||||

| Group, Inc., | |||||||

| 8.625%, 05/22/2038 | |||||||

| 200,000 | (United States)2 | 308,699 | |||||

| TOTAL CORPORATE BONDS | |||||||

| (Cost $697,281) | 714,040 | ||||||

| Contracts | |||||||

| (100 shares per contract) | |||||||

| CALL OPTIONS PURCHASED – 0.1% | |||||||

Investment Company – 0.1% | |||||||

| CBOE Volatility Index, | |||||||

| Expiration: | |||||||

| February, 2011, | |||||||

| Exercise Price: $25.00 | |||||||

| 61 | (United States) | 9,150 | |||||

Media – 0.0% | |||||||

| Promotora de | |||||||

| Informaciones SA, | |||||||

| Expiration: | |||||||

| March, 2011, | |||||||

| Exercise Price: $2.30 | |||||||

| 150 | (Spain)3 | 972 | |||||

| TOTAL CALL OPTIONS | |||||||

| PURCHASED | |||||||

| (Cost $34,512) | 10,122 | ||||||

| Shares | |||||||

| SHORT-TERM INVESTMENT – 19.6% | |||||||

Money Market Fund – 19.6% | |||||||

| 1,563,246 | Invesco Liquid | ||||||

| Assets Portfolio – | |||||||

| Institutional | |||||||

Class, 0.195%4 | 1,563,246 | ||||||

| TOTAL SHORT-TERM | |||||||

| INVESTMENT | |||||||

| (Cost $1,563,246) | 1,563,246 | ||||||

| TOTAL INVESTMENTS IN | |||||||

| SECURITIES – 106.3% | |||||||

| (Cost $7,971,244) | 8,475,231 | ||||||

| Liabilities in Excess of | |||||||

| Other Assets ��� (6.3)% | (499,853 | ) | |||||

| TOTAL NET | |||||||

| ASSETS – 100.0% | $ | 7,975,378 | |||||

| ADR | American Depository Receipt |

| * | Non-income producing security. |

| 1 | All or a portion of this security was segregated as collateral for forward currency contracts. |

| 2 | Restricted security represents 3.9% of total net assets as of December 31, 2010 (Note 2). |

| 3 | Illiquid security represents less than 0.0% of total net assets as of December 31, 2010 (Note 2). |

| 4 | 7-day yield as of December 31, 2010. |

The accompanying notes are an integral part of these financial statements.

27

Evermore European Value Fund

SCHEDULE OF INVESTMENTS at December 31, 2010, Continued |

| Percent of | ||||

| Country | Net Assets | |||

| United Kingdom | 17.1% | |||

| Spain | 13.1% | |||

| France | 12.3% | |||

| Norway | 8.0% | |||

| United States | 7.6% | |||

| Germany | 6.9% | |||

| Sweden | 5.9% | |||

| Belgium | 3.9% | |||

| Russia | 3.4% | |||

| Italy | 3.0% | |||

| Netherlands | 3.0% | |||

| Denmark | 2.5% | |||

| Cash & Equivalents^ | 13.3% | |||

| Total | 100.0% | |||

| ^ | Includes money market fund and liabilities in excess of other assets. |

The accompanying notes are an integral part of these financial statements.

28

(This Page Intentionally Left Blank.)

29

Evermore Funds

STATEMENTS OF ASSETS AND LIABILITIES at December 31, 2010 |

| Evermore | Evermore | |||||||

| Global | European | |||||||

| Value Fund | Value Fund | |||||||

| ASSETS | ||||||||

| Investments in securities, at value^ (Note 2) | $ | 37,635,270 | $ | 8,475,231 | ||||

| Unrealized gain on forward currency contracts | 56,047 | 11,372 | ||||||

| Cash | — | 1,843 | ||||||

| Foreign cash (cost of $2,842 and | ||||||||

| $32,043, respectively) | 2,267 | 32,444 | ||||||

| Receivables: | ||||||||

| Investment securities sold | 292,464 | — | ||||||

| Fund shares sold | 88,485 | 230,790 | ||||||

| Currency receivable | 3,114 | 1,886 | ||||||

| Dividends and interest, net | 126,067 | 25,018 | ||||||

| Due from adviser, net | 4,201 | 21,778 | ||||||

| Prepaid expenses | 36,090 | 33,542 | ||||||

| Total assets | 38,244,005 | 8,833,904 | ||||||

| LIABILITIES | ||||||||

| Unrealized loss on forward currency contracts | 106,676 | 39,226 | ||||||

| Due to broker | 898,419 | 197,347 | ||||||

| Payables: | ||||||||

| Investment securities purchased | 1,140,437 | 566,414 | ||||||

| Fund shares redeemed | 296,767 | — | ||||||

| Administration fees | 4,689 | 4,689 | ||||||

| Custody fees | 13,447 | 9,173 | ||||||

| Distribution fees | — | 6 | ||||||

| Fund accounting fees | 6,494 | 6,250 | ||||||

| Transfer agent fees | 8,188 | 6,664 | ||||||

| Other accrued expenses | 30,113 | 28,757 | ||||||

| Total liabilities | 2,505,230 | 858,526 | ||||||

| NET ASSETS | $ | 35,738,775 | $ | 7,975,378 | ||||

| COMPONENTS OF NET ASSETS | ||||||||

| Paid-in capital | $ | 33,523,638 | $ | 7,612,656 | ||||

| Accumulated net investment income | 47,447 | 27,033 | ||||||

| Accumulated net realized loss on investments, foreign | ||||||||

| currency transactions & forward currency contracts | (609,934 | ) | (139,414 | ) | ||||

| Net unrealized appreciation on investments | 2,829,788 | 503,987 | ||||||

| Net unrealized depreciation on foreign currency | ||||||||

| transactions & forward currency contracts | (52,164 | ) | (28,884 | ) | ||||

| Net assets | $ | 35,738,775 | $ | 7,975,378 | ||||

| ^ Cost of Investments | $ | 34,805,482 | $ | 7,971,244 | ||||

The accompanying notes are an integral part of these financial statements.

30

Evermore Funds

STATEMENTS OF ASSETS AND LIABILITIES at December 31, 2010, Continued |

| Evermore | Evermore | |||||||||||

| Global | European | |||||||||||

| Value Fund | Value Fund | |||||||||||

| Class A: | ||||||||||||

| Net assets | $ | 3,651,271 | $ | 856,857 | ||||||||

| Shares issued and outstanding (unlimited number | ||||||||||||

| of shares authorized without par value) | 347,722 | 85,479 | ||||||||||

| Net asset value, and redemption price per share | $ | 10.50 | $ | 10.02 | ||||||||

| Maximum offering price per share* | ||||||||||||

| (net asset value per share/front-end sales charge) | ||||||||||||

| ($10.50/95.00%) | $ | 11.05 | ||||||||||

| ($10.02/95.00%) | $ | 10.55 | ||||||||||

| Class C: | ||||||||||||

| Net assets | $ | 29,916 | $ | 16,569 | ||||||||

| Shares issued and outstanding (unlimited number | ||||||||||||

| of shares authorized without par value) | 2,877 | 1,667 | ||||||||||

| Net asset value, offering price, and | ||||||||||||

| redemption price per share** | $ | 10.40 | $ | 9.94 | ||||||||

| Class I: | ||||||||||||

| Net assets | $ | 32,057,588 | $ | 7,101,952 | ||||||||

| Shares issued and outstanding (unlimited number | ||||||||||||

| of shares authorized without par value) | 3,046,885 | 705,588 | ||||||||||

| Net asset value, offering price, and | ||||||||||||

| redemption price per share | $ | 10.52 | $ | 10.07 | ||||||||

| * | Class A share investments of $1 million or more, which are purchased at Net Asset Value, are subject to a 0.75% contingent deferred sales charge (“CDSC”) if redeemed within 12 months. |

| ** | A 1.00% CDSC applies to the lesser of the amount invested or the redemption value of Class C shares redeemed within 12 months after purchase. |

The accompanying notes are an integral part of these financial statements.

31

Evermore Funds

STATEMENTS OF OPERATIONS for the Year Ended December 31, 2010* |

| Evermore | Evermore | |||||||

| Global | European | |||||||

| Value Fund | Value Fund | |||||||

| INVESTMENT INCOME | ||||||||

| Income | ||||||||

| Dividends (net of $14,995 and $3,378 foreign | ||||||||

| withholding tax, respectively) | $ | 177,772 | $ | 27,355 | ||||

| Interest | 175,664 | 30,296 | ||||||

| Other income | 6,145 | 719 | ||||||

| Total investment income | 359,581 | 58,370 | ||||||

| EXPENSES (Note 3) | ||||||||

| Investment advisory fees | 183,180 | 35,355 | ||||||

| Custody fees | 61,633 | 45,420 | ||||||

| Transfer agent fees | 58,745 | 52,018 | ||||||

| Registration fees | 54,691 | 53,425 | ||||||

| Professional fees | 51,082 | 50,923 | ||||||

| Administration fees | 48,030 | 48,030 | ||||||

| Fund accounting fees | 43,464 | 42,407 | ||||||

| Chief Compliance Officer fees | 40,864 | 40,751 | ||||||

| Trustee fees | 25,631 | 25,562 | ||||||

| Insurance expense | 14,245 | 13,972 | ||||||

| Miscellaneous expenses | 10,178 | 7,037 | ||||||

| Reports to shareholders | 6,502 | 5,299 | ||||||

| Distribution fees – Class A | 4,688 | 1,224 | ||||||

| Interest expense | 3,833 | 938 | ||||||

| Distribution fees – Class C | 1,208 | 162 | ||||||

| Total expenses | 607,974 | 422,523 | ||||||

| Less expense reimbursement | (347,718 | ) | (371,722 | ) | ||||

| Net expenses | 260,256 | 50,801 | ||||||

| Net investment income | 99,325 | 7,569 | ||||||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS, OPTIONS & | ||||||||

| FOREIGN CURRENCY TRANSACTIONS | ||||||||

| Net realized loss on investments, options | ||||||||

| and foreign currency transactions | (1,067,585 | ) | (237,236 | ) | ||||

| Change in unrealized appreciation on investments | 2,829,788 | 503,987 | ||||||

| Change in unrealized depreciation on foreign currency | ||||||||

| translations & forward currency contracts | (52,164 | ) | (28,884 | ) | ||||

| Net realized and unrealized gain on investments & | ||||||||

| foreign currency transactions | 1,710,039 | 237,867 | ||||||

| Net increase in net assets | ||||||||

| resulting from operations | $ | 1,809,364 | $ | 245,436 | ||||

* Funds commenced operations on January 1, 2010.

The accompanying notes are an integral part of these financial statements.

32

(This Page Intentionally Left Blank.)

33

Evermore Global Value Fund

| STATEMENT OF CHANGES IN NET ASSETS |

| Year Ended | ||||

| December 31, | ||||

| 2010* | ||||

| INCREASE (DECREASE) IN NET ASSETS FROM: | ||||

| OPERATIONS | ||||

| Net investment income | $ | 99,325 | ||

| Net realized loss on investments, options & foreign currency | ||||

| transactions | (1,067,585 | ) | ||

| Change in unrealized appreciation on investments | 2,829,788 | |||

| Change in unrealized depreciation on foreign currency | ||||

| translations & forward currency contracts | (52,164 | ) | ||

| Net increase in net assets resulting from operations | 1,809,364 | |||

| CAPITAL SHARE TRANSACTIONS (Note 3) | ||||

| Net increase in net assets derived from net change in | ||||

| outstanding shares – Class A (a)(b) | 3,540,677 | |||

| Net increase in net assets derived from net change in | ||||

| outstanding shares – Class C (a) | 25,540 | |||

| Net increase in net assets derived from net change in | ||||

| outstanding shares – Class I (a) | 30,363,194 | |||

| Total increase in net assets from capital share transactions | 33,929,411 | |||

| Total increase in net assets | 35,738,775 | |||

| NET ASSETS | ||||

| Beginning of year | — | |||

| End of year | $ | 35,738,775 | ||

| Undistributed net investment income | $ | 47,447 | ||

The accompanying notes are an integral part of these financial statements.

34

Evermore Global Value Fund

STATEMENT OF CHANGES IN NET ASSETS, Continued |

| (a) | Summary of capital share transactions is as follows: |

| Year Ended | ||||||||

| December 31, | ||||||||

| 2010* | ||||||||

| Class A | Shares | Value | ||||||

| Shares sold | 444,299 | $ | 4,443,211 | |||||

| Shares redeemed (b) | (96,577 | ) | (902,534 | ) | ||||

| Net increase | 347,722 | $ | 3,540,677 | |||||

| (b) | Net of redemption fees of $1,250. |

| Year Ended | ||||||||

| December 31, | ||||||||

| 2010* | ||||||||

| Class C | Shares | Value | ||||||

| Shares sold | 23,054 | $ | 228,667 | |||||

| Shares redeemed | (20,177 | ) | (203,127 | ) | ||||

| Net increase | 2,877 | $ | 25,540 | |||||

| Year Ended | ||||||||

| December 31, | ||||||||

| 2010* | ||||||||

| Class I | Shares | Value | ||||||

| Shares sold | 3,314,806 | $ | 33,082,689 | |||||

| Shares redeemed | (267,921 | ) | (2,719,495 | ) | ||||

| Net increase | 3,046,885 | $ | 30,363,194 | |||||

| * | Fund commenced operations on January 1, 2010. |

The accompanying notes are an integral part of these financial statements.

35

Evermore European Value Fund

| STATEMENT OF CHANGES IN NET ASSETS |

| Year Ended | ||||

| December 31, | ||||

| 2010* | ||||

| INCREASE (DECREASE) IN NET ASSETS FROM: | ||||

| OPERATIONS | ||||

| Net investment income | $ | 7,569 | ||

| Net realized loss on investments, options & foreign | ||||

| currency transactions | (237,236 | ) | ||

| Change in unrealized appreciation on investments | 503,987 | |||

| Change in unrealized depreciation on foreign | ||||

| currency translations & forward currency contracts | (28,884 | ) | ||

| Net increase in net assets resulting from operations | 245,436 | |||

| CAPITAL SHARE TRANSACTIONS (Note 3) | ||||

| Net increase in net assets derived from net change in | ||||

| outstanding shares – Class A (a)(b) | 847,017 | |||

| Net increase in net assets derived from net change in | ||||

| outstanding shares – Class C (a) | 16,667 | |||

| Net increase in net assets derived from net change in | ||||

| outstanding shares – Class I (a)(c) | 6,866,258 | |||

| Total increase in net assets from capital share transactions | 7,729,942 | |||

| Total increase in net assets | 7,975,378 | |||

| NET ASSETS | ||||

| Beginning of year | — | |||

| End of year | $ | 7,975,378 | ||

| Undistributed net investment income | $ | 27,033 | ||

The accompanying notes are an integral part of these financial statements.

36

Evermore European Value Fund

STATEMENT OF CHANGES IN NET ASSETS, Continued |

| (a) | Summary of capital share transactions is as follows: |

| Year Ended | ||||||||

| December 31, | ||||||||

| 2010* | ||||||||

| Class A | Shares | Value | ||||||

| Shares sold | 160,213 | $ | 1,574,634 | |||||

| Shares redeemed (b) | (74,734 | ) | (727,617 | ) | ||||

| Net increase | 85,479 | $ | 847,017 | |||||

| (b) | Net of redemption fees of $194. |

| Year Ended | ||||||||

| December 31, | ||||||||

| 2010* | ||||||||

| Class C | Shares | Value | ||||||

| Shares sold | 1,667 | $ | 16,667 | |||||

| Shares redeemed | — | — | ||||||

| Net increase | 1,667 | $ | 16,667 | |||||

| Year Ended | ||||||||

| December 31, | ||||||||

| 2010* | ||||||||

| Class I | Shares | Value | ||||||

| Shares sold | 720,711 | $ | 7,014,504 | |||||

| Shares redeemed (c) | (15,123 | ) | (148,246 | ) | ||||

| Net increase | 705,588 | $ | 6,866,258 | |||||

| (c) | Net of redemption fees of $2,139. |

| * | Fund commenced operations on January 1, 2010. |

The accompanying notes are an integral part of these financial statements.

37

Evermore Global Value Fund

FINANCIAL HIGHLIGHTS For a capital share outstanding throughout the year |

CLASS A

| Year Ended | ||||

| December 31, | ||||

| 2010* | ||||

| Net asset value, beginning of year | $ | 10.00 | ||

| INCOME FROM INVESTMENT OPERATIONS | ||||

| Net investment income | 0.02 | |||

| Net realized and unrealized gain on investments | 0.48 | |||

| Total from investment operations | 0.50 | |||

| Paid-in capital from redemption fees (Note 2) | 0.00 | 1 | ||

| Net asset value, end of year | $ | 10.50 | ||

| Total return without sales load. | 5.00 | % | ||

| Total return with sales load. | (0.28 | )% | ||

| RATIOS/SUPPLEMENTAL DATA | ||||

| Net assets, end of year (thousands) | $ | 3,651 | ||

| RATIO OF EXPENSES TO AVERAGE NET ASSETS | ||||

Before expenses absorbed2,6 | 3.60 | % | ||

After expenses absorbed3,6 | 1.62 | % | ||

| RATIO OF NET INVESTMENT INCOME (LOSS) TO AVERAGE NET ASSETS | ||||

Before expenses absorbed4,6 | (1.59 | )% | ||

After expenses absorbed5,6 | 0.39 | % | ||

| Portfolio turnover rate | 77 | % | ||

| * | Fund commenced operations on January 1, 2010. |

| 1 | Amount less than $0.01. |

| 2 | The ratio of expenses to average net assets before expenses absorbed includes interest expense. The ratio excluding interest expense for the year ended December 31, 2010 was 3.58%. |

| 3 | The ratio of expenses to average net assets after expenses absorbed includes interest expense. The ratio excluding interest expense for the year ended December 31, 2010 was 1.60%. |

| 4 | The ratio of net investment income (loss) to average net assets before expenses absorbed includes interest expense. The ratio excluding interest expense for the year ended December 31, 2010 was (1.57)%. |

| 5 | The ratio of net investment income (loss) to average net assets after expenses absorbed includes interest expense. The ratio excluding interest expense for the year ended December 31, 2010 was 0.41%. |

| 6 | Does not include expenses of the investment companies in which the Fund invests. |

The accompanying notes are an integral part of these financial statements.

38

Evermore Global Value Fund

FINANCIAL HIGHLIGHTS For a capital share outstanding throughout the year, Continued |

CLASS C

| Year Ended | ||||

| December 31, | ||||

| 2010* | ||||

| Net asset value, beginning of year | $ | 10.00 | ||

| INCOME FROM INVESTMENT OPERATIONS | ||||

| Net investment loss | (0.21 | ) | ||

| Net realized and unrealized gain on investments | 0.61 | |||

| Total from investment operations | 0.40 | |||

| Paid-in capital from redemption fees (Note 2) | — | |||

| Net asset value, end of year | $ | 10.40 | ||

| Total return without sales load. | 4.00 | % | ||

| Total return with sales load. | 3.00 | % | ||

| RATIOS/SUPPLEMENTAL DATA | ||||

| Net assets, end of year (thousands) | $ | 30 | ||

| RATIO OF EXPENSES TO AVERAGE NET ASSETS | ||||

Before expenses absorbed1,5 | 5.86 | % | ||

After expenses absorbed2,5 | 2.37 | % | ||

| RATIO OF NET INVESTMENT LOSS TO AVERAGE NET ASSETS | ||||

Before expenses absorbed3,5 | (4.02 | )% | ||

After expenses absorbed4,5 | (0.53 | )% | ||

| Portfolio turnover rate | 77 | % | ||

| * | Fund commenced operations on January 1, 2010. |

| 1 | The ratio of expenses to average net assets before expenses absorbed includes interest expense. The ratio excluding interest expense for the year ended December 31, 2010 was 5.84%. |

| 2 | The ratio of expenses to average net assets after expenses absorbed includes interest expense. The ratio excluding interest expense for the year ended December 31, 2010 was 2.35%. |