UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22338

Legg Mason Global Asset Management Trust

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 49th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-721-1926

Date of fiscal year end: May 31

Date of reporting period: May 31, 2020

| ITEM 1. | REPORT TO STOCKHOLDERS |

The Annual Report to Stockholders is filed herewith.

| | |

| Annual Report | | May 31, 2020 |

MARTIN CURRIE

INTERNATIONAL

UNCONSTRAINED

EQUITY FUND

Beginning in January 2021, as permitted by regulations adopted by the Securities and Exchange Commission, the Fund intends to no longer mail paper copies of the Fund’s shareholder reports like this one, unless you specifically request paper copies of the reports from the Fund or from your Service Agent or financial intermediary (such as a broker-dealer or bank). Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically (“e-delivery”), you will not be affected by this change and you need not take any action. If you have not already elected e-delivery, you may elect to receive shareholder reports and other communications from the Fund electronically by contacting your Service Agent or, if you are a direct shareholder with the Fund, by calling 1-877-721-1926.

You may elect to receive all future reports in paper free of charge. If you invest through a Service Agent, you can contact your Service Agent to request that you continue to receive paper copies of your shareholder reports. That election will apply to all Legg Mason Funds held in your account at that Service Agent. If you are a direct shareholder with the Fund, you can call the Fund at 1-877-721-1926, or write to the Fund by regular mail at Legg Mason Funds, P.O. Box 9699, Providence, RI 02940-9699 or by express, certified or registered mail to Legg Mason Funds, 4400 Computer Drive, Westborough, MA 01581 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. That election will apply to all Legg Mason Funds held in your account held directly with the fund complex.

|

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objective

The Fund seeks long-term capital appreciation.

Letter from the president

Dear Shareholder,

We are pleased to provide the annual report of Martin Currie International Unconstrained Equity Fund for the twelve-month reporting period ended May 31, 2020. Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.leggmason.com. Here you can gain immediate access to market and investment information, including:

| • | | Fund prices and performance, |

| • | | Market insights and commentaries from our portfolio managers, and |

| • | | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

June 30, 2020

| | |

II | | Martin Currie International Unconstrained Equity Fund |

Fund overview

Q. What is the Fund’s investment strategy?

A. The Fund seeks long-term capital appreciation. Under normal market conditions, the Fund pursues its objective by investing at least 80% of its net assets plus borrowings for investment purposes, if any, in equity and equity related securities of foreign companies and other investments with similar economic characteristics. (The Fund does not currently intend to borrow for investment purposes.) The Fund is generally unconstrained by any particular sector, geography or market capitalization.

We focus on companies that we believe have a strong history of offering high and sustainable returns on invested capital over time and seek to acquire securities of companies with reasonable valuations based on our assessment of the company’s long-term potential. When we identify an opportunity that we find attractive, we aim to make a long-term capital commitment.

The equity securities in which the Fund will invest may include common stocks, preferred stocks, securities convertible into common stock, depositary receipts, exchange traded funds (“ETFs”) and synthetic foreign equity securitiesi, including international warrants and other instruments with similar economic characteristics. The Fund may use synthetic foreign equity securities to obtain market exposure where direct access is not otherwise available. The Fund may also enter into derivatives as a substitute for buying or selling securities; to obtain market exposure; and to manage cash.

The Fund may seek investment opportunities in any foreign country and under normal market conditions will invest in or have exposure to securities of companies located in at least three foreign countries. The Fund may invest without limit in securities of companies located in any foreign country, including countries with developed or emerging markets. The Fund may invest in companies of any size and market capitalization but will typically invest in those companies with market capitalization in excess of $3 billion. The Fund’s portfolio is expected to be highly concentrated, with approximately 20-40 holdings.

While the Fund is generally unconstrained within its equity universe, we seek to be risk aware and to control company risk through due diligence.

The Fund is classified as “non-diversified,” which means it may invest a larger percentage of its assets in a smaller number of issuers than a diversified fund.

Q. What were the overall market conditions during the Fund’s reporting period?

A. The twelve-month reporting period ended May 31, 2020 has marked one of the most tumultuous periods in recent world history. From the market perspective, after fears of increased recession risks at the back end of 2018, a rapid U-turn by the US Federal Reserve Board (“the Fed”)ii and an easing of interest rates, as well as a broader synchronized easing in monetary policies globally led the market to rally sharply in 2019. Geopolitical risks, ongoing trade tensions, Brexit uncertainty, deteriorating economic momentum, and increasing climate change concerns all occupied investors’ minds during 2019, but by and large, positive market sentiment was maintained continuing a historically long bull run.

| | |

| Martin Currie International Unconstrained Equity Fund 2020 Annual Report | | 1 |

Fund overview (cont’d)

However, that all ended in mid-February 2020 when financial markets suddenly became concerned of the threat posed by COVID-19. The reversal in sentiment from bull to bear was rapid and brutal. We entered into an unprecedented period of sharp recession, given the almost globally synchronized exogenous shock to demand and supply brought up by the pandemic crisis, and the forced lockdown policies that were implemented to contain the spread of the virus. Equities fell dramatically in March 2020, in what was the fastest bear market in history. There was a flight to safety in government bonds with long-term yields falling to historic lows, as the market was anticipating major earnings and dividend downgrades in the market. Policy responses, both monetary and fiscal, were very rapid, sizeable in terms of magnitude, and almost globally synchronized in their announcements. That has contributed to markets recovering very rapidly, with the fastest bull market since 1974 happening in April 2020, and continuing into the following month. The market effectively shifted from the focus on the sharp and deep recession risk we have been facing in first and second quarters of 2020, towards anticipating a recovery in activity as economies exit the lockdown status. The shape of the recovery remains highly uncertain in our view, given the lack of clarity on (i) speed at which lockdowns end; (ii) shape of the supply and demand post lockdowns; (iii) speed of channeling the sizeable fiscal stimuli announced into the real economy; (iv) the risk of a negative feedback loop on economic activity from the underlying deterioration in the labor market; and (v) pandemic relapse risk once economies reopen. Our core assumption is of a gradual recovery in economic activity from the lows, with a return to normal activity levels only by 2022. This assumption carries a high degree of forecast error, given the unprecedented nature of this recession, and therefore will need to be reassessed as we get more evidence around shape of the post-lockdown world.

Q. How did we respond to these changing market conditions?

A. As long-term investors in companies that typically have operations all over the world, we do not usually react to market noise that affects specific markets in the short term. We are much more focused on individual stocks and how they create value for shareholders over the long term. This was conclusively evidenced during the sharp sell-off in first quarter of 2020. Indeed, we made no material change to the Fund’s portfolio exposures at that time, viewing the period instead as an opportunity to reinforce positions on stocks where we have strong conviction over the long term, and where we see an attractive upside potential. We have spent a lot of time assessing our holdings, testing our convictions, updating our financial projections and stress-testing balance sheets of the companies that we are invested in, and finally updating our fair value assumptions. Generally, given the uncertain environment, we continue to favor companies with high management quality, strong balance sheets and cash flows, operating in industries with high barriers to entry and with strong market share, which gives them pricing power, and therefore an ability to generate high returns and attractive growth profiles. In an uncertain environment, our research remains focused on finding attractive quality growth sustainable opportunities around our three long-term mega-trends, which are: Demographic Change; Future of Technology; and Resource Scarcity.

| | |

2 | | Martin Currie International Unconstrained Equity Fund 2020 Annual Report |

Performance review

For the twelve months ended May 31, 2020, Class A shares of Martin Currie International Unconstrained Equity Fund, excluding sales charges, returned 9.82%. The Fund’s unmanaged benchmark, the MSCI All-Country World Index ex-U.S.iii, returned -3.43% for the same period. The Lipper International Large-Cap Growth Funds Category Averageiv returned 4.55% over the same time frame.

| | | | | | | | |

| Performance Snapshot as of May 31, 2020 (unaudited) | |

| (excluding sales charges) | | 6 months | | | 12 months | |

| Martin Currie International Unconstrained Equity Fund: | |

Class A | | | -2.45 | % | | | 9.82 | % |

Class I | | | -2.32 | % | | | 10.07 | % |

Class IS | | | -2.23 | % | | | 10.26 | % |

| MSCI All-Country World Index ex-U.S. | | | -11.16 | % | | | -3.43 | % |

| Lipper International Large-Cap Growth Funds Category Average | | | -5.42 | % | | | 4.55 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.leggmason.com/mutualfunds.

All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all Fund expenses. Returns have not been adjusted to include sales charges that may apply or the deduction of taxes that a shareholder would pay on Fund distributions. If sales charges were reflected, the performance quoted would be lower. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Fund performance figures reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

|

| Total Annual Operating Expenses (unaudited) |

As of the Fund’s current prospectus dated September 30, 2019, the gross total annual fund operating expense ratios for Class A, Class I and Class IS shares were 5.95%, 5.28% and 5.21%, respectively.

Actual expenses may be higher. For example, expenses may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile.

As a result of expense limitation arrangements, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, dividend expense on short sales, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets will not exceed 1.20% for Class A shares, 0.85% for Class I shares and 0.75% for Class IS shares. In addition, the ratio of total

| | |

| Martin Currie International Unconstrained Equity Fund 2020 Annual Report | | 3 |

Fund overview (cont’d)

annual fund operating expenses for Class IS shares will not exceed the ratio of total annual fund operating expenses for Class I shares. These expense limitation arrangements cannot be terminated prior to December 31, 2021 without the Board of Trustees’ consent.

The manager is permitted to recapture amounts waived and/or reimbursed to a class within three years after the fiscal year in which the manager earned the fee or incurred the expense if the class’ total annual operating expenses have fallen to a level below the expense limitation (“expense cap”) in effect at the time the fees were earned or the expenses incurred. In no case will the manager recapture any amount that would result, on any particular business day of the Fund, in the class’ total annual operating expenses exceeding the expense cap or any other lower limit then in effect.

Q. What were the leading contributors to performance?

A. Swedish industrial-tool manufacturer Atlas Copco was the largest contributor to absolute returns over the twelve-month reporting period. A notable turning point came in the latter part of 2019 when the company reported very strong third-quarter results, especially impressive given the softening macroeconomic backdrop. Results exceeded market expectations across all four of the company’s reported segments, but the standout positive was in Vacuum Technique which mostly serves the semiconductor market. At this point, after four quarters of declines, orders turned dramatically positive. Elsewhere, Dutch company ASML, a strong leader in leading-edge semiconductor equipment, was another positive contributor to Fund performance during the period. The company’s share price has been supported by relatively more predictable earnings momentum, the relative defensiveness of its order book and the attraction of its long-term structural growth and high returns profile. Coloplast, the Danish chronic-care medtech company, was another large contributor to results. A number of factors including its longer-term innovation opportunities and a continued leading market share in its two key markets of Ostomy and Continence have boosted investor sentiment towards the company. In March of this year, Coloplast also updated the market with guidance incorporating a slowdown in elective procedures (which particularly impacts its U.S. urology business), while reiterating the durability of its chronic care business. The net impact is a 5–7% earnings downgrade for the year, which the market took as a positive indicator of the defensiveness of the business model during COVID-19 disruption.

Q. What were the leading detractors from performance?

A. The UK insurer Beazley was the biggest drag on Fund performance during the reporting period. Despite offering up reassurance on the company’s exposure to troubled U.S. casualty lines, and the company’s initial take on losses related to COVID-19 (around 1% of premia, related to event cancellation cover), Beazley’s share performance has been weak. In particular, the stock has been penalized by the growing uncertainty on secondary claims arising from the coronavirus pandemic and the steep reduction in U.S. interest rates. Pan-Asian insurer AIA has also struggled over the course of the year, although the majority of this poor performance came in the latter part of the reporting period. In line with other stocks with a significant domestic presence in Hong Kong, AIA’s performance was

| | |

4 | | Martin Currie International Unconstrained Equity Fund 2020 Annual Report |

negatively impacted by the social unrest there, and most recently by the news flow relating to China’s proposed security law for the region and the United States’ initial reaction to this move. Insurance provider Prudential was another of the poor performers during the reporting period. We had previously taken a positive view on the company’s ambitions to segment its conglomerate structure into separate business units. However, the market’s lingering concerns about the resilience and prospects on the U.S. business unit, led the stock to de-rate and underperform.

Q. Were there any significant changes to the Fund during the period?

A. There were a number of new purchases during the reporting period. We initiated a position in leading Chinese e-commerce player Alibaba, based on its highly profitable core China commerce business and its attractive growth profile, in particular, its ability to leverage an expansive digital ecosystem. We also bought Cyberark. The company is the leader (in revenue and technology terms) in the privileged access management (PAM) solutions market and provides a cyber security application, which is growing fast and believed to have staying power as a core cyber security defense. Dassault Systemes, a design and engineering software company with an attractive growth profile, and Linde, the Irish-domiciled multinational chemical company, were also added to the Fund’s portfolio. Sales during the period included: the insurer Beazley, as the risk/reward profile of company in our view shifted to the high end of the spectrum; Prudential, because the conglomerate nature of the business proved to be a drag rather than a benefit; multinational software provider Check Point, as increased competition and the impact on growth from the transition from license to subscription lowered our conviction; likewise, we sold out of the Fund’s position in Unilever as our conviction in the key categories and market shares of the business had started to wane. Elsewhere we also exited positions in British specialty chemicals company Croda and UK engineering firm Spirax-Sarco.

| | |

| Martin Currie International Unconstrained Equity Fund 2020 Annual Report | | 5 |

Fund overview (cont’d)

Thank you for your investment in Martin Currie International Unconstrained Equity Fund. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

Zehrid Osmani

Portfolio Manager

Martin Currie Inc.

Ken Hughes

Portfolio Manager

Martin Currie Inc.

June 30, 2020

RISKS: Equity securities are subject to market and price fluctuations. Small- and mid-cap stocks involve greater risks and volatility than large-cap stocks. The Fund may be significantly overweight or underweight in certain companies, industries or market sectors, which may cause the Fund’s performance to be more sensitive to developments affecting those companies, industries or sectors. International investments are subject to special risks, including currency fluctuations as well as social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Emerging market countries tend to have economic, political and legal systems that are less developed and are less stable than those of more developed countries. To the extent the Fund focuses its investments in a single country or only a few countries in a geographic region, economic, political, regulatory or other conditions affecting such country or region may have a greater impact on Fund performance relative to a more geographically diversified fund. Derivatives, such as warrants and other synthetic instruments, can be illiquid, may disproportionately increase losses and have a potentially large impact on Fund performance. In addition to the Fund’s operating expenses, the Fund will indirectly bear the operating expenses of any underlying funds. The Fund is classified as “non-diversified,” which means it may invest a larger percentage of its assets in a smaller number of issuers than a diversified fund. To the extent the Fund invests its assets in a smaller number of issuers, the Fund will be more susceptible to negative events affecting those issuers than a diversified fund. Please see the Fund’s prospectus for a more complete discussion of these and other risks and the Fund’s investment strategies.

Portfolio holdings and breakdowns are as of May 31, 2020 and are subject to change and may not be representative of the portfolio managers’ current or future investments. Please refer to pages 14 through 16 for a list and percentage breakdown of the Fund’s holdings.

| | |

6 | | Martin Currie International Unconstrained Equity Fund 2020 Annual Report |

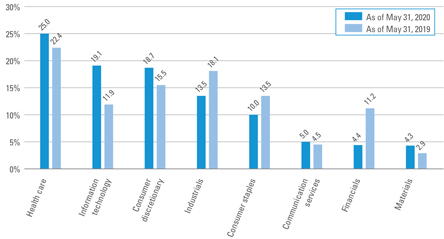

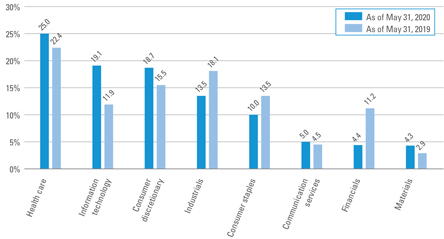

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. Portfolio holdings are subject to change at any time and may not be representative of the portfolio managers’ current or future investments. The Fund’s top five sector holdings (as a percentage of net assets) as of May 31, 2020 were: Health Care (24.4%), Information Technology (18.6%) and Consumer Discretionary (18.3%), Industrials (13.2%), Consumer Staples (9.8%). The Fund’s portfolio composition is subject to change at any time.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses, or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| i | Synthetic foreign equity securities are a type of derivative, typically issued by a bank or other financial institution, designed to replicate the economic exposure of buying an equity security directly in a particular foreign market. |

| ii | The Federal Reserve Board (the “Fed”) is responsible for the formulation of U.S. policies designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| iii | The MSCI All-Country World Index ex-U.S. (“MSCI ACWI ex-U.S.”) is a market capitalization weighted index designed to measure the equity market performance of developed and emerging markets. |

| iv | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the period ended May 31, 2020, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 248 funds for the six-month period and among the 227 funds for the twelve-month period in the Fund’s Lipper category, and excluding sales charges, if any. |

| | |

| Martin Currie International Unconstrained Equity Fund 2020 Annual Report | | 7 |

Fund at a glance† (unaudited)

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of May 31, 2020 and May 31, 2019. The fund is actively managed. As a result, the composition of the Fund’s investments is subject to change at any time. |

| | |

8 | | Martin Currie International Unconstrained Equity Fund 2020 Annual Report |

Fund expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end and back-end sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; service and/or distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on December 1, 2019 and held for the six months ended May 31, 2020.

Actual expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or back-end sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| Based on actual total return1 | | | | | | | | | Based on hypothetical total return1 | |

| | | Actual

Total Return

Without

Sales

Charge2 | | | Beginning

Account

Value | | | Ending

Account Value | | | Annualized

Expense Ratio | | | Expenses

Paid

During

the

Period3 | | | | | | | | Hypothetical

Annualized

Total Return | | | Beginning

Account

Value | | | Ending

Account

Value | | | Annualized

Expense

Ratio | | | Expenses

Paid

During

the

Period3 | |

| Class A | | | -2.45 | % | | $ | 1,000.00 | | | $ | 975.50 | | | | 1.20 | % | | | $5.93 | | | | | | | Class A | | | 5.00 | % | | $ | 1,000.00 | | | $ | 1,019.00 | | | | 1.20 | % | | | $6.06 | |

| Class I | | | -2.32 | | | | 1,000.00 | | | | 976.80 | | | | 0.85 | | | | 4.20 | | | | | | | Class I | | | 5.00 | | | | 1,000.00 | | | | 1,020.75 | | | | 0.85 | | | | 4.29 | |

| Class IS | | | -2.23 | | | | 1,000.00 | | | | 977.70 | | | | 0.75 | | | | 3.71 | | | | | | | Class IS | | | 5.00 | | | | 1,000.00 | | | | 1,021.25 | | | | 0.75 | | | | 3.79 | |

| | |

| Martin Currie International Unconstrained Equity Fund 2020 Annual Report | | 9 |

Fund expenses (unaudited) (con’d)

| 1 | For the six months ended May 31, 2020. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charge with respect to Class A shares. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Expenses (net of compensating balance arrangements, fee waivers and/or expense reimbursements) are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), then divided by 366. |

| | |

10 | | Martin Currie International Unconstrained Equity Fund 2020 Annual Report |

Fund performance (unaudited)

| | | | | | | | | | | | |

| Average annual total returns | | | | | | | | | |

| Without sales charges1 | | Class A | | | Class I | | | Class IS | |

| Twelve Months Ended 5/31/20 | | | 9.82 | % | | | 10.07 | % | | | 10.26 | % |

| Inception* through 5/31/20 | | | 7.02 | | | | 7.33 | | | | 7.40 | |

| | | |

| With sales charges2 | | Class A | | | Class I | | | Class IS | |

| Twelve Months Ended 5/31/20 | | | 3.53 | % | | | 10.07 | % | | | 10.26 | % |

| Inception* through 5/31/20 | | | 5.63 | | | | 7.33 | | | | 7.40 | |

| | | | |

| Cumulative total returns | |

| Without sales charges1 | | | |

| Class A (Inception date of 11/30/15 through 5/31/20) | | | 35.74 | % |

| Class I (Inception date of 11/30/15 through 5/31/20) | | | 37.51 | |

| Class IS (Inception date of 11/30/15 through 5/31/20) | | | 37.91 | |

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower.

| 1 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charge with respect to Class A shares. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. In addition, Class A shares reflect the deduction of the maximum initial sales charge of 5.75%. |

| * | Inception date for Class A, I and IS shares is November 30, 2015. |

| | |

| Martin Currie International Unconstrained Equity Fund 2020 Annual Report | | 11 |

Fund performance (unaudited) (cont’d)

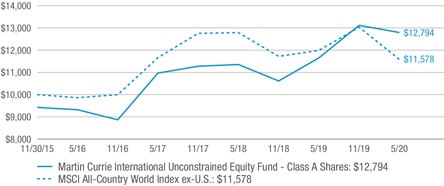

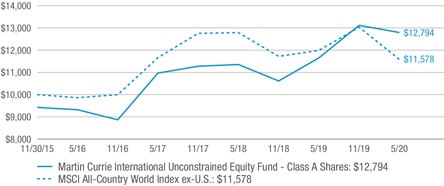

Historical performance

Value of $10,000 invested in

Class A Shares of Martin Currie International Unconstrained Equity Fund vs. MSCI All-Country World Index ex-U.S.† — November 30, 2015 - May 31, 2020

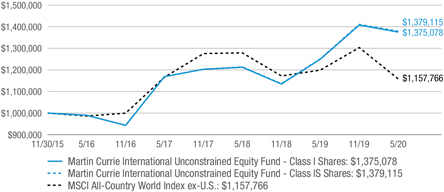

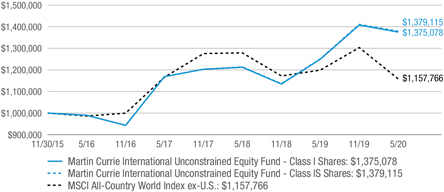

Value of $1,000,000 invested in

Class I and Class IS Shares of Martin Currie International Unconstrained Equity Fund vs. MSCI All-Country World Index ex-U.S.† — November 30, 2015 - May 31, 2020

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower.

| † | Hypothetical illustration of $10,000 invested in Class A shares and $1,000,000 invested in Class I and Class IS shares of Martin Currie International Unconstrained Equity Fund on November 30, 2015 (inception date), assuming the deduction of the maximum initial sales charge of 5.75% at the time of investment for Class A |

| | |

12 | | Martin Currie International Unconstrained Equity Fund 2020 Annual Report |

shares and the reinvestment of all distributions, including returns of capital, if any, at net asset value through May 31, 2020. The hypothetical illustration also assumes a $10,000 or $1,000,000 investment, as applicable, in the MSCI All-Country World Index ex-U.S. The MSCI All-Country World Index ex-U.S. is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global developed and emerging markets. The index is calculated assuming the minimum possible dividend reinvestment. The index is unmanaged and not subject to the same management and trading expenses as a mutual fund. Please note that an investor cannot invest directly in an index.

| | |

| Martin Currie International Unconstrained Equity Fund 2020 Annual Report | | 13 |

Schedule of investments

May 31, 2020

Martin Currie International Unconstrained Equity Fund

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

| Common Stocks — 97.7% | | | | | | | | | | | | | | | | |

| Communication Services — 4.9% | | | | | | | | | | | | | | | | |

Interactive Media & Services — 4.9% | | | | | | | | | | | | | | | | |

Tencent Holdings Ltd. | | | | | | | | | | | 5,423 | | | $ | 289,054 | (a) |

| Consumer Discretionary — 18.3% | | | | | | | | | | | | | | | | |

Automobiles — 3.4% | | | | | | | | | | | | | | | | |

Ferrari NV | | | | | | | | | | | 1,174 | | | | 198,849 | (a) |

Internet & Direct Marketing Retail — 2.9% | | | | | | | | | | | | | | | | |

Alibaba Group Holding Ltd., ADR | | | | | | | | | | | 815 | | | | 169,023 | * |

Textiles, Apparel & Luxury Goods — 12.0% | | | | | | | | | | | | | | | | |

adidas AG | | | | | | | | | | | 749 | | | | 196,412 | *(a) |

Kering SA | | | | | | | | | | | 438 | | | | 229,610 | (a) |

Moncler SpA | | | | | | | | | | | 7,423 | | | | 277,215 | *(a) |

Total Textiles, Apparel & Luxury Goods | | | | | | | | | | | | | | | 703,237 | |

Total Consumer Discretionary | | | | | | | | | | | | | | | 1,071,109 | |

| Consumer Staples — 9.8% | | | | | | | | | | | | | | | | |

Food Products — 5.3% | | | | | | | | | | | | | | | | |

Kerry Group PLC, Class A Shares | | | | | | | | | | | 2,522 | | | | 313,318 | (a) |

Personal Products — 4.5% | | | | | | | | | | | | | | | | |

L’Oreal SA | | | | | | | | | | | 900 | | | | 262,790 | (a) |

Total Consumer Staples | | | | | | | | | | | | | | | 576,108 | |

| Financials — 4.3% | | | | | | | | | | | | | | | | |

Insurance — 4.3% | | | | | | | | | | | | | | | | |

AIA Group Ltd. | | | | | | | | | | | 30,600 | | | | 249,475 | (a) |

| Health Care — 24.4% | | | | | | | | | | | | | | | | |

Biotechnology — 4.6% | | | | | | | | | | | | | | | | |

CSL Ltd. | | | | | | | | | | | 1,480 | | | | 269,997 | (a) |

Health Care Equipment & Supplies — 15.2% | | | | | | | | | | | | | | | | |

Coloplast A/S, Class B Shares | | | | | | | | | | | 1,573 | | | | 263,864 | (a) |

ResMed Inc. | | | | | | | | | | | 20,309 | | | | 319,817 | (a) |

Straumann Holding AG, Registered Shares | | | | | | | | | | | 379 | | | | 308,415 | (a) |

Total Health Care Equipment & Supplies | | | | | | | | | | | | | | | 892,096 | |

Life Sciences Tools & Services — 4.6% | | | | | | | | | | | | | | | | |

Mettler-Toledo International Inc. | | | | | | | | | | | 338 | | | | 268,710 | * |

Total Health Care | | | | | | | | | | | | | | | 1,430,803 | |

| Industrials — 13.2% | | | | | | | | | | | | | | | | |

Building Products — 4.5% | | | | | | | | | | | | | | | | |

Assa Abloy AB, Class B Shares | | | | | | | | | | | 13,013 | | | | 264,535 | (a) |

Machinery — 5.6% | | | | | | | | | | | | | | | | |

Atlas Copco AB, Class A Shares | | | | | | | | | | | 8,263 | | | | 325,360 | (a) |

See Notes to Financial Statements.

| | |

14 | | Martin Currie International Unconstrained Equity Fund 2020 Annual Report |

Martin Currie International Unconstrained Equity Fund

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Road & Rail — 3.1% | | | | | | | | | | | | | | | | |

Canadian National Railway Co. | | | | | | | | | | | 2,135 | | | $ | 183,906 | |

Total Industrials | | | | | | | | | | | | | | | 773,801 | |

| Information Technology — 18.6% | | | | | | | | | | | | | | | | |

Electronic Equipment, Instruments & Components — 4.8% | | | | | | | | | | | | | | | | |

Hexagon AB, Class B Shares | | | | | | | | | | | 5,173 | | | | 285,525 | *(a) |

Semiconductors & Semiconductor Equipment — 7.0% | | | | | | | | | | | | | | | | |

ASML Holding NV | | | | | | | | | | | 708 | | | | 231,765 | (a) |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | | | | | | | | | 18,437 | | | | 179,562 | (a) |

Total Semiconductors & Semiconductor Equipment | | | | | | | | | | | | | | | 411,327 | |

Software — 6.8% | | | | | | | | | | | | | | | | |

CyberArk Software Ltd. | | | | | | | | | | | 1,373 | | | | 142,490 | * |

Dassault Systemes SE | | | | | | | | | | | 1,500 | | | | 254,638 | (a) |

Total Software | | | | | | | | | | | | | | | 397,128 | |

Total Information Technology | | | | | | | | | | | | | | | 1,093,980 | |

| Materials — 4.2% | | | | | | | | | | | | | | | | |

Chemicals — 4.2% | | | | | | | | | | | | | | | | |

Linde PLC | | | | | | | | | | | 1,239 | | | | 248,122 | (a) |

Total Investments — 97.7% (Cost — $4,529,350) | | | | | | | | | | | | | | | 5,732,452 | |

Other Assets in Excess of Liabilities — 2.3% | | | | | | | | | | | | | | | 133,823 | |

Total Net Assets — 100.0% | | | | | | | | | | | | | | $ | 5,866,275 | |

| * | Non-income producing security. |

| (a) | Security is valued in good faith in accordance with procedures approved by the Board of Trustees (Note 1). |

| | |

Abbreviation(s) used in this schedule: |

| |

| ADR | | — American Depositary Receipts |

See Notes to Financial Statements.

| | |

| Martin Currie International Unconstrained Equity Fund 2020 Annual Report | | 15 |

Schedule of investments (cont’d)

May 31, 2020

Martin Currie International Unconstrained Equity Fund

| | | | |

| Summary of Investments by Country** (unaudited) | | | |

| Sweden | | | 15.3 | % |

| France | | | 13.0 | |

| United States | | | 12.8 | |

| Italy | | | 8.3 | |

| China | | | 8.0 | |

| Ireland | | | 5.5 | |

| Switzerland | | | 5.4 | |

| Australia | | | 4.7 | |

| Denmark | | | 4.6 | |

| Hong Kong | | | 4.4 | |

| United Kingdom | | | 4.3 | |

| Netherlands | | | 4.0 | |

| Germany | | | 3.4 | |

| Canada | | | 3.2 | |

| Taiwan | | | 3.1 | |

| | | | 100.0 | % |

| ** | As a percentage of total investments. Please note that the Fund holdings are as of May 31, 2020 and are subject to change. |

See Notes to Financial Statements.

| | |

16 | | Martin Currie International Unconstrained Equity Fund 2020 Annual Report |

Statement of assets and liabilities

May 31, 2020

| | | | |

| |

| Assets: | | | | |

Investments, at value (Cost — $4,529,350) | | $ | 5,732,452 | |

Foreign currency, at value (Cost — $8,619) | | | 8,639 | |

Cash | | | 327,598 | |

Receivable for Fund shares sold | | | 19,996 | |

Receivable from investment manager | | | 9,053 | |

Dividends receivable | | | 4,930 | |

Prepaid expenses | | | 15,301 | |

Total Assets | | | 6,117,969 | |

| |

| Liabilities: | | | | |

Payable to investment manager (Note 2) | | | 104,423 | |

Payable for securities purchased | | | 61,134 | |

Audit fees payable | | | 40,706 | |

Fund accounting fees payable | | | 37,300 | |

Trustees’ fees payable | | | 80 | |

Service and/or distribution fees payable | | | 49 | |

Accrued expenses | | | 8,002 | |

Total Liabilities | | | 251,694 | |

| Total Net Assets | | $ | 5,866,275 | |

| |

| Net Assets: | | | | |

Par value (Note 7) | | $ | 5 | |

Paid-in capital in excess of par value | | | 4,649,457 | |

Total distributable earnings (loss) | | | 1,216,813 | |

| Total Net Assets | | $ | 5,866,275 | |

| |

| Net Assets: | | | | |

Class A | | | $241,439 | |

Class I | | | $841,374 | |

Class IS | | | $4,783,462 | |

| |

| Shares Outstanding: | | | | |

Class A | | | 19,106 | |

Class I | | | 66,177 | |

Class IS | | | 376,090 | |

| |

| Net Asset Value: | | | | |

Class A (and redemption price) | | | $12.64 | |

Class I (and redemption price) | | | $12.71 | |

Class IS (and redemption price) | | | $12.72 | |

| Maximum Public Offering Price Per Share: | | | | |

Class A (based on maximum initial sales charge of 5.75%) | | | $13.41 | |

See Notes to Financial Statements.

| | |

| Martin Currie International Unconstrained Equity Fund 2020 Annual Report | | 17 |

Statement of operations

For the Year Ended May 31, 2020

| | | | |

| |

| Investment Income: | | | | |

Dividends | | $ | 55,564 | |

Less: Foreign taxes withheld | | | (6,847) | |

Total Investment Income | | | 48,717 | |

| |

| Expenses: | | | | |

Fund accounting fees | | | 76,716 | |

Registration fees | | | 57,643 | |

Audit and tax fees | | | 50,646 | |

Investment management fee (Note 2) | | | 40,788 | |

Legal fees | | | 10,181 | |

Custody fees | | | 3,315 | |

Transfer agent fees (Note 5) | | | 1,512 | |

Trustees’ fees | | | 920 | |

Shareholder reports | | | 915 | |

Fees recaptured by investment manager (Note 2) | | | 884 | |

Service and/or distribution fees (Notes 2 and 5) | | | 580 | |

Insurance | | | 392 | |

Interest expense | | | 57 | |

Miscellaneous expenses | | | 8,007 | |

Total Expenses | | | 252,556 | |

Less: Fee waivers and/or expense reimbursements (Notes 2 and 5) | | | (210,267) | |

Net Expenses | | | 42,289 | |

| Net Investment Income | | | 6,428 | |

| |

| Realized and Unrealized Gain (Loss) on Investments and Foreign Currency Transactions (Notes 1 and 3): | | | | |

Net Realized Gain (Loss) From: | | | | |

Investment transactions | | | 137,846 | |

Foreign currency transactions | | | (2,155) | |

Net Realized Gain | | | 135,691 | |

Change in Net Unrealized Appreciation (Depreciation) From: | | | | |

Investments | | | 395,734 | |

Foreign currencies | | | (30) | |

Change in Net Unrealized Appreciation (Depreciation) | | | 395,704 | |

| Net Gain on Investments and Foreign Currency Transactions | | | 531,395 | |

| Increase in Net Assets From Operations | | $ | 537,823 | |

See Notes to Financial Statements.

| | |

18 | | Martin Currie International Unconstrained Equity Fund 2020 Annual Report |

Statements of changes in net assets

| | | | | | | | |

| For the Years Ended May 31, | | 2020 | | | 2019 | |

| | |

| Operations: | | | | | | | | |

Net investment income | | $ | 6,428 | | | $ | 43,413 | |

Net realized gain (loss) | | | 135,691 | | | | (114,916) | |

Change in net unrealized appreciation (depreciation) | | | 395,704 | | | | 227,708 | |

Increase in Net Assets From Operations | | | 537,823 | | | | 156,205 | |

| | |

| Distributions to Shareholders From (Notes 1 and 6): | | | | | | | | |

Total distributable earnings | | | (21,396) | | | | (124,463) | |

Decrease in Net Assets From Distributions to Shareholders | | | (21,396) | | | | (124,463) | |

| | |

| Fund Share Transactions (Note 7): | | | | | | | | |

Net proceeds from sale of shares | | | 742,253 | | | | 19,706 | |

Reinvestment of distributions | | | 21,250 | | | | 123,667 | |

Cost of shares repurchased | | | (650,316) | | | | (5,641) | |

Increase in Net Assets From Fund Share Transactions | | | 113,187 | | | | 137,732 | |

Increase in Net Assets | | | 629,614 | | | | 169,474 | |

| | |

| Net Assets: | | | | | | | | |

Beginning of year | | | 5,236,661 | | | | 5,067,187 | |

End of year | | $ | 5,866,275 | | | $ | 5,236,661 | |

See Notes to Financial Statements.

| | |

| Martin Currie International Unconstrained Equity Fund 2020 Annual Report | | 19 |

Financial highlights

| | | | | | | | | | | | | | | | | | | | |

For a share of each class of beneficial interest outstanding throughout each year ended May 31,

unless otherwise noted: | |

| Class A Shares1 | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 20162 | |

| | | | | |

| Net asset value, beginning of year | | | $11.53 | | | | $11.51 | | | | $11.40 | | | | $9.89 | | | | $10.00 | |

| | | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.04) | | | | 0.05 | | | | 0.14 | | | | 0.09 | | | | 0.07 | |

Net realized and unrealized gain (loss) | | | 1.17 | | | | 0.21 | | | | 0.26 | | | | 1.61 | | | | (0.18) | |

Total income (loss) from operations | | | 1.13 | | | | 0.26 | | | | 0.40 | | | | 1.70 | | | | (0.11) | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.02) | | | | (0.12) | | | | (0.14) | | | | (0.09) | | | | — | |

Net realized gains | | | — | | | | (0.12) | | | | (0.15) | | | | (0.10) | | | | — | |

Total distributions | | | (0.02) | | | | (0.24) | | | | (0.29) | | | | (0.19) | | | | — | |

| | | | | |

| Net asset value, end of year | | | $12.64 | | | | $11.53 | | | | $11.51 | | | | $11.40 | | | | $9.89 | |

Total return3 | | | 9.82 | % | | | 2.60 | % | | | 3.51 | % | | | 17.67 | % | | | (1.10) | % |

| | | | | |

| Net assets, end of year (000s) | | | $241 | | | | $208 | | | | $198 | | | | $134 | | | | $99 | |

| | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 5.16 | %4 | | | 6.03 | %4 | | | 4.71 | % | | | 6.34 | %4 | | | 9.89 | %5 |

Net expenses6,7 | | | 1.20 | 4 | | | 1.20 | 4 | | | 1.09 | | | | 1.16 | 4 | | | 1.19 | 5 |

Net investment income (loss) | | | (0.31) | | | | 0.44 | | | | 1.23 | | | | 0.93 | | | | 1.38 | 5 |

| | | | | |

| Portfolio turnover rate | | | 37 | % | | | 63 | % | | | 15 | % | | | 22 | % | | | 2 | % |

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | For the period November 30, 2015 (inception date) to May 31, 2016. |

| 3 | Performance figures, exclusive of sales charges, may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 4 | Reflects recapture of expenses waived/reimbursed from prior fiscal years. |

| 6 | As a result of an expense limitation arrangement, effective August 3, 2017, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, dividend expense on short sales, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Class A shares did not exceed 1.20%. This expense limitation arrangement cannot be terminated prior to December 31, 2021 without the Board of Trustees’ consent. Prior to August 3, 2017, as a result of an expense limitation arrangement, the ratio of total annual fund operating expenses to average net assets of Class A shares did not exceed 1.35%. |

| 7 | Reflects fee waivers and/or expense reimbursements. |

See Notes to Financial Statements.

| | |

20 | | Martin Currie International Unconstrained Equity Fund 2020 Annual Report |

| | | | | | | | | | | | | | | | | | | | |

For a share of each class of beneficial interest outstanding throughout each year ended May 31,

unless otherwise noted: | |

| Class I Shares1 | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 20162 | |

| | | | | |

| Net asset value, beginning of year | | | $11.59 | | | | $11.55 | | | | $11.44 | | | | $9.90 | | | | $10.00 | |

| | | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.02 | | | | 0.09 | | | | 0.16 | | | | 0.12 | | | | 0.08 | |

Net realized and unrealized gain (loss) | | | 1.15 | | | | 0.22 | | | | 0.26 | | | | 1.62 | | | | (0.18) | |

Total income (loss) from operations | | | 1.17 | | | | 0.31 | | | | 0.42 | | | | 1.74 | | | | (0.10) | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.05) | | | | (0.15) | | | | (0.16) | | | | (0.10) | | | | — | |

Net realized gains | | | — | | | | (0.12) | | | | (0.15) | | | | (0.10) | | | | — | |

Total distributions | | | (0.05) | | | | (0.27) | | | | (0.31) | | | | (0.20) | | | | — | |

| | | | | |

| Net asset value, end of year | | | $12.71 | | | | $11.59 | | | | $11.55 | | | | $11.44 | | | | $9.90 | |

Total return3 | | | 10.07 | % | | | 3.05 | % | | | 3.69 | % | | | 18.09 | % | | | (1.00) | % |

| | | | | |

| Net assets, end of year (000s) | | | $841 | | | | $230 | | | | $214 | | | | $194 | | | | $104 | |

| | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 4.71 | %4 | | | 5.29 | %4 | | | 4.46 | % | | | 5.98 | %4 | | | 9.61 | %5 |

Net expenses6,7 | | | 0.85 | 4 | | | 0.83 | 4 | | | 0.85 | | | | 0.90 | 4 | | | 0.91 | 5 |

Net investment income | | | 0.12 | | | | 0.80 | | | | 1.36 | | | | 1.23 | | | | 1.68 | 5 |

| | | | | |

| Portfolio turnover rate | | | 37 | % | | | 63 | % | | | 15 | % | | | 22 | % | | | 2 | % |

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | For the period November 30, 2015 (inception date) to May 31, 2016. |

| 3 | Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 4 | Reflects recapture of expenses waived/reimbursed from prior fiscal years. |

| 6 | As a result of an expense limitation arrangement, effective August 3, 2017, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, dividend expense on short sales, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Class I shares did not exceed 0.85%. This expense limitation arrangement cannot be terminated prior to December 31, 2021 without the Board of Trustees’ consent. Prior to August 3, 2017, as a result of an expense limitation arrangement, the ratio of total annual fund operating expenses to average net assets of Class I shares did not exceed 1.00%. |

| 7 | Reflects fee waivers and/or expense reimbursements. |

See Notes to Financial Statements.

| | |

| Martin Currie International Unconstrained Equity Fund 2020 Annual Report | | 21 |

Financial highlights (cont’d)

| | | | | | | | | | | | | | | | | | | | |

For a share of each class of beneficial interest outstanding throughout each year ended May 31,

unless otherwise noted: | |

| Class IS Shares1 | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 20162 | |

| | | | | |

| Net asset value, beginning of year | | | $11.58 | | | | $11.55 | | | | $11.43 | | | | $9.90 | | | | $10.00 | |

| | | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.02 | | | | 0.10 | | | | 0.17 | | | | 0.12 | | | | 0.08 | |

Net realized and unrealized gain (loss) | | | 1.17 | | | | 0.21 | | | | 0.27 | | | | 1.61 | | | | (0.18) | |

Total income (loss) from operations | | | 1.19 | | | | 0.31 | | | | 0.44 | | | | 1.73 | | | | (0.10) | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.05) | | | | (0.16) | | | | (0.17) | | | | (0.10) | | | | — | |

Net realized gains | | | — | | | | (0.12) | | | | (0.15) | | | | (0.10) | | | | — | |

Total distributions | | | (0.05) | | | | (0.28) | | | | (0.32) | | | | (0.20) | | | | — | |

| | | | | |

| Net asset value, end of year | | | $12.72 | | | | $11.58 | | | | $11.55 | | | | $11.43 | | | | $9.90 | |

Total return3 | | | 10.26 | % | | | 3.06 | % | | | 3.86 | % | | | 18.03 | % | | | (1.00) | % |

| | | | | |

| Net assets, end of year (000s) | | | $4,783 | | | | $4,800 | | | | $4,655 | | | | $4,441 | | | | $3,762 | |

| | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 4.61 | %4 | | | 5.22 | %4 | | | 4.38 | % | | | 6.08 | %4 | | | 9.61 | %5 |

Net expenses6,7 | | | 0.75 | 4 | | | 0.75 | 4 | | | 0.78 | | | | 0.90 | 4 | | | 0.90 | 5 |

Net investment income | | | 0.14 | | | | 0.88 | | | | 1.42 | | | | 1.17 | | | | 1.68 | 5 |

| | | | | |

| Portfolio turnover rate | | | 37 | % | | | 63 | % | | | 15 | % | | | 22 | % | | | 2 | % |

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | For the period November 30, 2015 (inception date) to May 31, 2016. |

| 3 | Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 4 | Reflects recapture of expenses waived/reimbursed from prior fiscal years. |

| 6 | As a result of an expense limitation arrangement, effective August 3, 2017, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, dividend expense on short sales, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Class IS shares did not exceed 0.75%. In addition, the ratio of total annual fund operating expenses for Class IS shares did not exceed the ratio of total annual fund operating expenses for Class I shares. These expense limitation arrangements cannot be terminated prior to December 31, 2021 without the Board of Trustees’ consent. Prior to August 3, 2017, as a result of an expense limitation arrangement, the ratio of total annual fund operating expenses to average net assets of Class IS shares did not exceed 0.90%. In addition, the ratio of total annual fund operating expenses for Class IS shares did not exceed the ratio of total annual fund operating expenses for Class I shares. |

| 7 | Reflects fee waivers and/or expense reimbursements. |

See Notes to Financial Statements.

| | |

22 | | Martin Currie International Unconstrained Equity Fund 2020 Annual Report |

Notes to financial statements

1. Organization and significant accounting policies

Martin Currie International Unconstrained Equity Fund (the “Fund”) is a separate non-diversified investment series of Legg Mason Global Asset Management Trust (the “Trust”). The Trust, a Maryland statutory trust, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ. Subsequent events have been evaluated through the date the financial statements were issued.

(a) Investment valuation. Equity securities for which market quotations are available are valued at the last reported sales price or official closing price on the primary market or exchange on which they trade. The valuations for fixed income securities (which may include, but are not limited to, corporate, government, municipal, mortgage-backed, collateralized mortgage obligations and asset-backed securities) and certain derivative instruments are typically the prices supplied by independent third party pricing services, which may use market prices or broker/dealer quotations or a variety of valuation techniques and methodologies. The independent third party pricing services use inputs that are observable such as issuer details, interest rates, yield curves, prepayment speeds, credit risks/spreads, default rates and quoted prices for similar securities. When the Fund holds securities or other assets that are denominated in a foreign currency, the Fund will normally use the currency exchange rates as of 4:00 p.m. (Eastern Time). If independent third party pricing services are unable to supply prices for a portfolio investment, or if the prices supplied are deemed by the manager to be unreliable, the market price may be determined by the manager using quotations from one or more broker/dealers or at the transaction price if the security has recently been purchased and no value has yet been obtained from a pricing service or pricing broker. When reliable prices are not readily available, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund values these securities as determined in accordance with procedures approved by the Fund’s Board of Trustees.

The Board of Trustees is responsible for the valuation process and has delegated the supervision of the daily valuation process to the Legg Mason North Atlantic Fund Valuation Committee (the “Valuation Committee”). The Valuation Committee, pursuant to the policies adopted by the Board of Trustees, is responsible for making fair value determinations, evaluating the effectiveness of the Fund’s pricing policies, and reporting to the Board of Trustees. When determining the reliability of third party pricing information for investments owned by the Fund, the Valuation Committee, among other things, conducts due diligence

| | |

| Martin Currie International Unconstrained Equity Fund 2020 Annual Report | | 23 |

Notes to financial statements (cont’d)

reviews of pricing vendors, monitors the daily change in prices and reviews transactions among market participants.

The Valuation Committee will consider pricing methodologies it deems relevant and appropriate when making fair value determinations. Examples of possible methodologies include, but are not limited to, multiple of earnings; discount from market of a similar freely traded security; discounted cash-flow analysis; book value or a multiple thereof; risk premium/yield analysis; yield to maturity; and/or fundamental investment analysis. The Valuation Committee will also consider factors it deems relevant and appropriate in light of the facts and circumstances. Examples of possible factors include, but are not limited to, the type of security; the issuer’s financial statements; the purchase price of the security; the discount from market value of unrestricted securities of the same class at the time of purchase; analysts’ research and observations from financial institutions; information regarding any transactions or offers with respect to the security; the existence of merger proposals or tender offers affecting the security; the price and extent of public trading in similar securities of the issuer or comparable companies; and the existence of a shelf registration for restricted securities.

For each portfolio security that has been fair valued pursuant to the policies adopted by the Board of Trustees, the fair value price is compared against the last available and next available market quotations. The Valuation Committee reviews the results of such back testing monthly and fair valuation occurrences are reported to the Board of Trustees quarterly.

The Fund uses valuation techniques to measure fair value that are consistent with the market approach and/or income approach, depending on the type of security and the particular circumstance. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable securities. The income approach uses valuation techniques to discount estimated future cash flows to present value.

GAAP establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

| • | | Level 1 — quoted prices in active markets for identical investments |

| • | | Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| • | | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

| | |

24 | | Martin Currie International Unconstrained Equity Fund 2020 Annual Report |

The following is a summary of the inputs used in valuing the Fund’s assets carried at fair value:

| | | | | | | | | | | | | | | | |

| ASSETS | |

| Description | | Quoted Prices

(Level 1) | | | Other Significant

Observable Inputs

(Level 2)* | | | Significant

Unobservable

Inputs

(Level 3) | | | Total | |

| Long-term investments†: | | | | | | | | | | | | | | | | |

Common stocks: | | | | | | | | | | | | | | | | |

Consumer discretionary | | $ | 169,023 | | | $ | 902,086 | | | | — | | | $ | 1,071,109 | |

Health care | | | 268,710 | | | | 1,162,093 | | | | — | | | | 1,430,803 | |

Industrials | | | 183,906 | | | | 589,895 | | | | — | | | | 773,801 | |

Information technology | | | 142,490 | | | | 951,490 | | | | — | | | | 1,093,980 | |

Other common stocks | | | — | | | | 1,362,759 | | | | — | | | | 1,362,759 | |

| Total investments | | $ | 764,129 | | | $ | 4,968,323 | | | | — | | | $ | 5,732,452 | |

| * | As a result of the fair value pricing procedures for international equities utilized by the Fund, which account for events occurring after the close of the principal market of the security but prior to the calculation of the Fund’s net asset value, certain securities were classified as Level 2 within the fair value hierarchy. |

| † | See Schedule of Investments for additional detailed categorizations. |

(b) Foreign currency translation. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts based upon prevailing exchange rates on the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts based upon prevailing exchange rates on the respective dates of such transactions.

The Fund does not isolate that portion of the results of operations resulting from fluctuations in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, including gains and losses on forward foreign currency contracts, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the values of assets and liabilities, other than investments in securities, on the date of valuation, resulting from changes in exchange rates.

Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of U.S. dollar denominated transactions as a result of,

| | |

| Martin Currie International Unconstrained Equity Fund 2020 Annual Report | | 25 |

Notes to financial statements (cont’d)

among other factors, the possibility of lower levels of governmental supervision and regulation of foreign securities markets and the possibility of political or economic instability.

(c) Foreign investment risks. The Fund’s investments in foreign securities may involve risks not present in domestic investments. Since securities may be denominated in foreign currencies, may require settlement in foreign currencies or pay interest or dividends in foreign currencies, changes in the relationship of these foreign currencies to the U.S. dollar can significantly affect the value of the investments and earnings of the Fund. Foreign investments may also subject the Fund to foreign government exchange restrictions, expropriation, taxation or other political, social or economic developments, all of which affect the market and/or credit risk of the investments.

(d) Security transactions and investment income. Security transactions are accounted for on a trade date basis. Interest income (including interest income from payment-in-kind securities), adjusted for amortization of premium and accretion of discount, is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date for dividends received in cash and/or securities. Foreign dividend income is recorded on the ex-dividend date or as soon as practicable after the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. The cost of investments sold is determined by use of the specific identification method. To the extent any issuer defaults or a credit event occurs that impacts the issuer, the Fund may halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default or credit event.

(e) Distributions to shareholders. Distributions from net investment income and distributions of net realized gains, if any, are declared at least annually. Distributions to shareholders of the Fund are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP.

(f) Share class accounting. Investment income, common expenses and realized/ unrealized gains (losses) on investments are allocated to the various classes of the Fund on the basis of daily net assets of each class. Fees relating to a specific class are charged directly to that share class.

(g) Compensating balance arrangements. The Fund has an arrangement with its custodian bank whereby a portion of the custodian’s fees is paid indirectly by credits earned on the Fund’s cash on deposit with the bank.

(h) Federal and other taxes. It is the Fund’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986 (the “Code”), as amended, applicable to regulated investment companies. Accordingly, the Fund intends to distribute its taxable income and net realized gains, if any, to shareholders in accordance with timing requirements imposed by the Code. Therefore, no federal or state income tax provision is required in the Fund’s financial statements.

| | |

26 | | Martin Currie International Unconstrained Equity Fund 2020 Annual Report |

Management has analyzed the Fund’s tax positions taken on income tax returns for all open tax years and has concluded that as of May 31, 2020, no provision for income tax is required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

Under the applicable foreign tax laws, a withholding tax may be imposed on interest, dividends and capital gains at various rates.

(i) Reclassification. GAAP requires that certain components of net assets be adjusted to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. During the current year, the Fund had no reclassifications.

2. Investment management agreement and other transactions with affiliates

Legg Mason Partners Fund Advisor, LLC (“LMPFA”) is the Fund’s investment manager and Martin Currie Inc. (“Martin Currie”) is the Fund’s subadviser. Western Asset Management Company, LLC (“Western Asset”) manages the portion of the Fund’s cash and short-term instruments allocated to it. LMPFA, Martin Currie and Western Asset are wholly-owned subsidiaries of Legg Mason, Inc. (“Legg Mason”).

Under the investment management agreement, the Fund pays an investment management fee, calculated daily and paid monthly, in accordance with the following breakpoint schedule:

| | | | |

| Average Daily Net Assets | | Annual Rate | |

| First $1 billion | | | 0.750 | % |

| Next $1 billion | | | 0.700 | |

| Next $3 billion | | | 0.650 | |

| Next $5 billion | | | 0.600 | |

| Over $10 billion | | | 0.550 | |

LMPFA provides administrative and certain oversight services to the Fund. LMPFA delegates to the subadviser the day-to-day portfolio management of the Fund, except for the management of the portion of the cash and short-term instruments allocated to Western Asset. For its services, LMPFA pays Martin Currie monthly an aggregate fee equal to 70% of the net management fee it receives from the Fund. For Western Asset’s services to the Fund, LMPFA pays Western Asset monthly 0.02% of the portion of the Fund’s average daily net assets that are allocated to Western Asset by LMPFA.

As a result of expense limitation arrangements between the Fund and LMPFA, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, dividend expense on short sales, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Class A, Class I and Class IS shares did not exceed 1.20%, 0.85% and 0.75%, respectively. In addition, the ratio of total annual fund operating

| | |

| Martin Currie International Unconstrained Equity Fund 2020 Annual Report | | 27 |

Notes to financial statements (cont’d)

expenses for Class IS shares did not exceed the ratio of total annual fund operating expenses for Class I shares. These expense limitation arrangements cannot be terminated prior to December 31, 2021 without the Board of Trustees’ consent.

During the year ended May 31, 2020, fees waived and/or expenses reimbursed amounted to $210,267.

LMPFA is permitted to recapture amounts waived and/or reimbursed to a class within three years after the fiscal year in which LMPFA earned the fee or incurred the expense if the class’ total annual operating expenses have fallen to a level below the expense limitation (“expense cap”) in effect at the time the fees were earned or the expenses incurred. In no case will LMPFA recapture any amount that would result, on any particular business day of the Fund, in the class’ total annual operating expenses exceeding the expense cap or any other lower limit then in effect.

Pursuant to these arrangements, at May 31, 2020, the Fund had remaining fee waivers and/or expense reimbursements subject to recapture by LMPFA and respective dates of expiration as follows:

| | | | | | | | | | | | |

| | | Class A | | | Class I | | | Class IS | |

| Expires May 31, 2021 | | $ | 5,941 | | | $ | 7,454 | | | $ | 165,716 | |

| Expires May 31, 2022 | | | 9,603 | | | | 9,724 | | | | 206,541 | |

| Expires May 31, 2023 | | | 9,187 | | | | 18,071 | | | | 182,931 | |

| Total fee waivers/expense reimbursements subject to recapture | | $ | 24,731 | | | $ | 35,249 | | | $ | 555,188 | |

For the year ended May 31, 2020, fee waivers and/or expense reimbursements recaptured by LMPFA, if any, were as follows:

| | | | | | | | | | | | |

| | | Class A | | | Class I | | | Class IS | |

| LMPFA recaptured | | $ | 661 | | | $ | 71 | | | $ | 152 | |

At May 31, 2020, $104,423 was payable to LMPFA by the Fund for reimbursement of fund operating expenses paid by LMPFA on behalf of the Fund.

Legg Mason Investor Services, LLC (“LMIS”), a wholly-owned broker-dealer subsidiary of Legg Mason, serves as the Fund’s sole and exclusive distributor.

There is a maximum initial sales charge of 5.75% for Class A shares. In certain cases, Class A shares have a 1.00% contingent deferred sales charge (“CDSC”), which applies if redemption occurs within 18 months from purchase payment. This CDSC only applies to those purchases of Class A shares, which, when combined with current holdings of other shares of funds sold by LMIS, equal or exceed $1,000,000 in the aggregate. These purchases do not incur an initial sales charge.

| | |

28 | | Martin Currie International Unconstrained Equity Fund 2020 Annual Report |

For the year ended May 31, 2020, sales charges retained by LMIS and its affiliates, if any, were as follows:

| | | | |

| | | Class A | |

| Sales charges | | $ | 4 | |

| CDSCs | | | — | |

Under a Deferred Compensation Plan (the “Plan”), Trustees may have elected to defer receipt of all or a specified portion of their compensation. A participating Trustee selected one or more funds managed by affiliates of Legg Mason in which his or her deferred trustee’s fees were deemed to be invested. Deferred amounts remain in the Fund until distributed in accordance with the Plan. In May 2015, the Board of Trustees approved an amendment to the Plan so that effective January 1, 2016, no compensation earned after that date may be deferred under the Plan.

All officers and one Trustee of the Trust are employees of Legg Mason or its affiliates and do not receive compensation from the Trust.

As of May 31, 2020, Legg Mason and its affiliates owned 86% of the Fund.

3. Investments

During the year ended May 31, 2020, the aggregate cost of purchases and proceeds from sales of investments (excluding short-term investments) were as follows:

| | | | |

| Purchases | | $ | 2,201,912 | |

| Sales | | | 1,931,269 | |

At May 31, 2020, the aggregate cost of investments and the aggregate gross unrealized appreciation and depreciation of investments for federal income tax purposes were as follows:

| | | | | | | | | | | | | | | | |

| | | Cost | | | Gross

Unrealized

Appreciation | | | Gross

Unrealized

Depreciation | | | Net

Unrealized

Appreciation | |

| Securities | | $ | 4,541,945 | | | $ | 1,238,112 | | | $ | (47,605) | | | $ | 1,190,507 | |

4. Derivative instruments and hedging activities

During the year ended May 31, 2020, the Fund did not invest in derivative instruments.

5. Class specific expenses, waivers and/or expense reimbursements

The Fund has adopted a Rule 12b-1 shareholder services and distribution plan and under that plan the Fund pays service and/or distribution fees with respect to its Class A shares calculated at the annual rate of 0.25% of the average daily net assets of the class. Service and/or distribution fees are accrued daily and paid monthly.

| | |

| Martin Currie International Unconstrained Equity Fund 2020 Annual Report | | 29 |

Notes to financial statements (cont’d)

For the year ended May 31, 2020, class specific expenses were as follows:

| | | | | | | | |

| | | Service and/or

Distribution Fees | | | Transfer Agent

Fees | |

| Class A | | $ | 580 | | | $ | 89 | |

| Class I | | | — | | | | 849 | |