UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22338

Legg Mason Global Asset Management Trust

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 47th Floor,

New York, NY 10018

(Address of principal executive offices) (Zip code)

Marc A. De Oliveira,

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-721-1926

Date of fiscal year end: September 30

Date of reporting period: September 30, 2020

| ITEM 1. | REPORT TO STOCKHOLDERS |

The Annual Report to Stockholders is filed herewith.

| | |

| Annual Report | | September 30, 2020 |

BrandywineGLOBAL —

DYNAMIC US LARGE CAP VALUE FUND

Beginning in or after March 2021, as permitted by regulations adopted by the Securities and Exchange Commission, the Fund intends to no longer mail paper copies of the Fund’s shareholder reports like this one, unless you specifically request paper copies of the reports from the Fund or from your Service Agent or financial intermediary (such as a broker-dealer or bank). Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically (“e-delivery”), you will not be affected by this change and you need not take any action. If you have not already elected e-delivery, you may elect to receive shareholder reports and other communications from the Fund electronically by contacting your Service Agent or, if you are a direct shareholder with the Fund, by calling 1-877-721-1926.

You may elect to receive all future reports in paper free of charge. If you invest through a Service Agent, you can contact your Service Agent to request that you continue to receive paper copies of your shareholder reports. That election will apply to all Legg Mason Funds held in your account at that Service Agent. If you are a direct shareholder with the Fund, you can call the Fund at 1-877-721-1926, or write to the Fund by regular mail at Legg Mason Funds, P.O. Box 9699, Providence, RI 02940-9699 or by express, certified or registered mail to Legg Mason Funds, 4400 Computer Drive, Westborough, MA 01581 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. That election will apply to all Legg Mason Funds held in your account held directly with the fund complex.

|

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objective

The Fund seeks to provide long-term capital appreciation by quantitatively investing in U.S. equities.

Letter from the president

Dear Shareholder,

We are pleased to provide the annual report of BrandywineGLOBAL — Dynamic US Large Cap Value Fund for the twelve-month reporting period ended September 30, 2020. Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

Special shareholder notice

On July 31, 2020, Franklin Resources, Inc. (“Franklin Resources”) acquired Legg Mason, Inc. (“Legg Mason”) in an all-cash transaction. As a result of the transaction, Legg Mason Partners Fund Advisor, LLC (“LMPFA”) and the subadviser(s) became indirect, wholly-owned subsidiaries of Franklin Resources. Under the Investment Company Act of 1940, as amended, consummation of the transaction automatically terminated the management and subadvisory agreements that were in place for the Fund prior to the transaction. The Fund’s manager and subadviser(s) continue to provide uninterrupted services with respect to the Fund pursuant to new management and subadvisory agreements that were approved by Fund shareholders.

Franklin Resources, whose principal executive offices are at One Franklin Parkway, San Mateo, California 94403, is a global investment management organization operating, together with its subsidiaries, as Franklin Templeton. As of September 30, 2020, after giving effect to the transaction described above, Franklin Templeton’s asset management operations had aggregate assets under management of approximately $1.4 trillion.

| | |

II | | BrandywineGLOBAL — Dynamic US Large Cap Value Fund |

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.leggmason.com. Here you can gain immediate access to market and investment information, including:

| • | | Fund prices and performance, |

| • | | Market insights and commentaries from our portfolio managers, and |

| • | | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

October 30, 2020

| | |

| BrandywineGLOBAL — Dynamic US Large Cap Value Fund | | III |

Fund overview

Q. What is the Fund’s investment strategy?

A. The Fund seeks to provide long-term capital appreciation by quantitatively investing in U.S. equities. The Fund will only invest in U.S. traded companies, which may include companies incorporated outside the U.S. which conduct a significant portion of their activities in the U.S. and are considered U.S. companies in the Russell U.S. indices. The Fund normally invests at least 80% of its net assets, plus the amount of borrowings for investment purposes, if any, in issuers domiciled, or having their principal activity in the United States, at the time of investment or other instruments with similar economic characteristics. In addition, the Fund normally invests at least 80% of its net assets in equity securities of large capitalization companies. Large capitalization companies are those companies with market capitalizations similar to companies in the Russell 1000 Indexi. The Fund may have significant positions in particular sectors from time to time. In addition, the Fund may engage in active and frequent trading to achieve its investment objective.

We, at Brandywine Global Investment Management, LLC, the Fund’s subadviser, use a proprietary quantitative model to identify investments for the Fund. To identify investments, the model evaluates multiple quantitative characteristics for each potential stock investment and applies specific rules to select stocks for investment based on these characteristics. The Fund will typically invest in a stock when the large capitalization threshold and its price-to-earnings (“P/E”)ii or price-to-book (“P/B”)iii ratios indicate a potentially attractive valuation and the quantitative model ranks it with a high multifactor score.

Our quantitative model seeks to identify stocks that appear to have upside potential and relatively low downside risk to the Russell 1000 Value Indexiv. The quantitative model analyzes factors regarding a stock’s valuation and quality, as well as market sentiment toward a stock, to select stocks that may have the potential to outperform the benchmark, the Russell 1000 Value Index. The Fund expects to hold approximately 75-175 stocks under normal market conditions.

Q. What were the overall market conditions during the Fund’s reporting period?

A. The twelve-month reporting period ended September 30, 2020 began on a positive note, with strong U.S. equity returns and positive performance for value investing in the fourth quarter 2019. The U.S. stock market peaked in late February 2020 prior to the full impact of the Covid-19 pandemic unfolding. As much of the U.S. went into economic lockdown, the market plunged with the S&P 500 Indexv falling over 30% in just over a month. The market bottomed on March 23, 2020 and perhaps surprisingly, the S&P 500 Index closed this period near all-time highs. In addition to this stock market turmoil, oil prices were highly volatile with lowered demand on the economic slowdown, coupled with a brief supply war sending price for a barrel of crude from the mid-$50 range down to the teens, before recovering and stabilizing near $40. Through most of this period, growth stocks outperformed the broad market while value stocks trailed by a wide margin. For the last twelve months, the Russell 1000 Growth Indexvi rose 37.53% while the Russell 1000 Value Index fell 5.03%.

| | |

| BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report | | 1 |

Fund overview (cont’d)

The Federal Reserve Board (the “Fed”)vii moved quickly as the pandemic unfolded to bolster the economy and financial markets. The rapid response included bringing the short-term Fed Funds rateviii down to near zero and committing to purchase a large quantity and wide array of fixed income securities. Longer term rates followed short term rates lower, with the U.S. ten-year Treasury yield falling from 1.6% on September 30, 2019 to under 1.0%, where it has stayed since March 2020. Congress and the President initially also moved quickly, approving a nearly $2 trillion dollar stimulus and unemployment benefits package. More recently, the political parties have been unable to reach consensus on additional COVID-19 related spending. Whether due to the Fed’s moves, the original fiscal stimulus, or the general resiliency of the American economy and people, unemployment has bounced back faster than expected, falling to 7.9% recently after leaping from 3.5% to 14.7% as the economy rapidly moved to lockdown in March 2020.

Q. How did we respond to these changing market conditions?

A. Our strategy utilizes a dynamic shifting tool which is a timing model that quantitatively evaluates market conditions to shift the Fund between investment models appropriate for broad value and for deep value environments. The dynamic shifting tool triggers changes at relatively infrequent intervals historically ranging from two to seven years. The shifts result from quantitative signals that we believe indicate whether market valuations are compressed and likely to expand or valuations are wide and likely to contract. Our investment models for the different environments are all value based, sharing many of the same factors with differing exposures. By shifting investment models based on the expected market environment, we improve the odds that we capture the appropriate factor exposures to enhance excess return and minimize underperformance against the Russell 1000 Index. During the period we shifted the model on August 6, 2020 from the broad value to the deep value model. Typically, we expect the model to shift every two to seven years.

Our investment strategy is based on the consistent application of our investment philosophy which relies on long term equity factors and market relationships while avoiding emotional reactions to near term events. We respond to volatile environments by the consistent, disciplined execution of our investment strategy. This process has been back tested over forty years of varied conditions, and while we recognize it will not excel in every situation, we believe it has the potential to outperform over most three to five years periods. We are aware of the macro implications of events for specific securities, but do not alter our primary focus on value, quality, and favorable sentiment factors.

| | |

2 | | BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report |

Performance review

For the twelve months ended September 30, 2020, Class IS shares of BrandywineGLOBAL — Dynamic US Large Cap Value Fund returned 1.66%. The Fund’s unmanaged benchmarks, the Russell 1000 Value Index and the S&P 500 Index, returned -5.03% and 15.15%, respectively, for the same period. The Lipper Large-Cap Value Funds Category Averageix returned -3.46% over the same time frame.

| | | | | | | | |

Performance Snapshot as of September 30, 2020 (unaudited) | |

| (excluding sales charges) | | 6 months | | | 12 months | |

| BrandywineGLOBAL — Dynamic US Large Cap Value Fund: | | | | | | | | |

Class A | | | 24.67 | % | | | 1.22 | % |

Class C | | | 24.12 | % | | | 0.35 | % |

Class R | | | 24.51 | % | | | 0.96 | % |

Class I | | | 24.81 | % | | | 1.49 | % |

Class IS | | | 25.03 | % | | | 1.66 | % |

| Russell 1000 Value Index | | | 20.68 | % | | | -5.03 | % |

| S&P 500 Index | | | 31.31 | % | | | 15.15 | % |

| Lipper Large-Cap Value Funds Category Average | | | 21.78 | % | | | -3.46 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.leggmason.com/mutualfunds.

All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all Fund expenses. Returns have not been adjusted to include sales charges that may apply or the deduction of taxes that a shareholder would pay on Fund distributions. If sales charges were reflected, the performance quoted would be lower. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Fund performance figures reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

The Fund is the successor to a private fund (the “Predecessor”). On October 31, 2014, the Predecessor transferred its assets to the Fund in exchange for the Fund’s Class IS shares.

| | |

| Total Annual Operating Expenses (unaudited) |

As of the Fund’s current prospectus dated February 1, 2020, the gross total annual fund operating expense ratios for Class A, Class C, Class R, Class I and Class IS shares were 1.13%, 1.79%, 1.52%, 0.77% and 0.72%, respectively.

Actual expenses may be higher. For example, expenses may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile.

As a result of expense limitation arrangements, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, dividend expense on short sales, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets will not exceed 1.10% for Class A shares, 1.85% for Class C shares, 1.35% for Class R shares, 0.75% for Class I shares and 0.65% for Class IS shares. In addition, the ratio of total annual fund operating expenses of Class IS shares will not exceed the ratio of total annual fund operating expenses of Class I shares. These expense limitation arrangements cannot be terminated prior to December 31, 2021 without the Board of Trustees’ consent.

| | |

| BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report | | 3 |

Fund overview (cont’d)

The manager is permitted to recapture amounts waived and/or reimbursed to a class within three years after the fiscal year in which the manager earned the fee or incurred the expense if the class’ total annual fund operating expenses have fallen to a level below the expense limitation (“expense cap”) in effect at the time the fees were earned or the expenses incurred. In no case will the manager recapture any amount that would result, on any particular business day of the Fund, in the class’ total annual fund operating expenses exceeding the expense cap or any other lower limit then in effect.

Q. What were the leading contributors to performance?

A. Positive stock selection and an overweight position in technology hardware storage & peripherals within Technology was our largest contributor to performance on a sector basis. Also beneficial was our positive stock selection in Consumer Discretionary from names in specialty retail and being overweight the outperforming sector while our favorable sector allocation from being underweight the beleaguered Energy sector generated positive excess return. From a factor perspective, our overweight stocks with high price to book ratios and companies with high return on equity ratios significantly contributed to excess return.

Q. What were the leading detractors from performance?

A. Our largest detractor to performance was attributed to poor stock selection in Financials from purchases in banks and consumer finance. Our underweight in Health Care and poor stock selection primarily in healthcare equipment and supplies was a negative to performance. Within Communication Services both our underweight in the sector and poor stock selection from names in media detracted from excess return. From a factor perspective by our overweight of stocks with low price-to-earnings ratios detracted from returns as value stocks continued their underperformance while our significant underweight of companies issuing shares was a negative for performance.

Q. Were there any significant changes to the Fund during the reporting period?

A. The Fund shifted from the Broad Value model to the Deep Value model on August 6, 2020. The most notable change in the portfolio was the significant increase in the portfolio’s exposure to the low price-to-book (“P/B”) factor. In addition, the exposure to the return-on-equity (“ROE”) ratio decreased significantly, although it remains above the Russell 1000 Value Index.

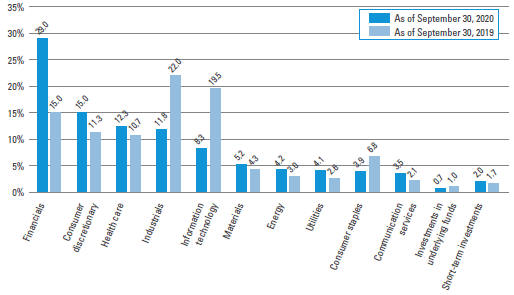

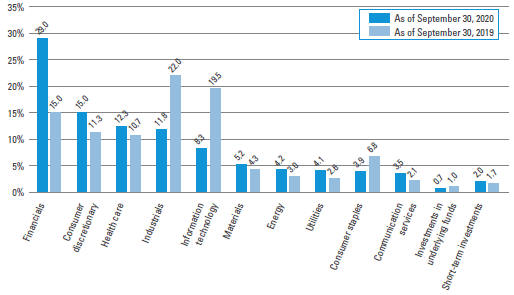

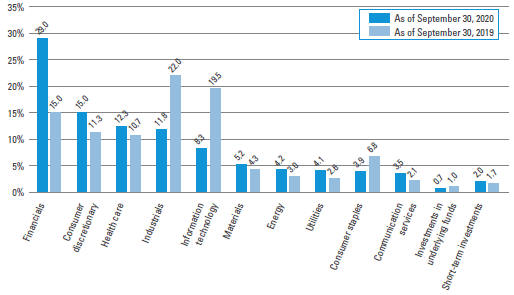

Due to the higher exposure in value (P/B) and decrease in quality (ROE), the portfolio went from being underweight in Financials before the shift in August, to 11% overweight compared to the Russell 1000 Value index at the end of September. The purchases of names in household durables increased our weight in Consumer Discretionary and purchases in biotechnology increased our weight in Health Care. Our largest sector decline was in Information Technology, as we sold names in tech hardware storage & peripherals, communications equipment & semiconductors and semiconductor equipment. Closely trailing Information Technology was our significant decrease in the Industrials sector, as we sold names in road & rail, industrial conglomerates and machinery. Selling names in tobacco decreased our weight in Consumer Staples.

| | |

4 | | BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report |

Thank you for your investment in BrandywineGLOBAL — Dynamic US Large Cap Value Fund. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

Henry F. Otto

Portfolio Manager

Brandywine Global Investment Management, LLC

Steven M. Tonkovich

Portfolio Manager

Brandywine Global Investment Management, LLC

Michael Fleisher

Portfolio Manager

Brandywine Global Investment Management, LLC

October 30, 2020

RISKS: Equity securities are subject to market and price fluctuations. Large-capitalization value stocks may underperform the overall equity market for long periods. The manager’s selection process may prove incorrect, which may have a negative impact on the Fund’s performance. The subadviser’s quantitative investment model may not adequately take into account certain factors and may result in the Fund having a lower return than if the Fund were managed using another model or investment strategy. In addition, the investment model used by the subadviser to evaluate securities or securities markets are based on certain assumptions concerning the interplay of market factors. The markets or the prices of individual securities may be affected by factors not foreseen in developing the model. The value of the Fund’s investments held for cash management or defensive investing purposes may be affected by changing interest rates and changes in the underlying investments’ credit ratings. Please see the Fund’s prospectus for a more complete discussion of these and other risks and the Fund’s investment strategies.

| | |

| BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report | | 5 |

Fund overview (cont’d)

Portfolio holdings and breakdowns are as of September 30, 2020 and are subject to change and may not be representative of the portfolio managers’ current or future investments. The Fund’s top ten holdings (as a percentage of net assets) as of September 30, 2020 were: Intel Corp. (5.1%), Emerson Electric Co. (3.7%), Biogen Inc. (3.5%), eBay Inc. (3.4%), Bank of America Corp. (3.2%), Goldman Sachs Group Inc. (3.1%), Morgan Stanley (3.0%), Cummins Inc. (3.0%), ConocoPhillips (2.7%) and Citigroup Inc. (2.5%). Please refer to pages 14 through 18 for a list and percentage breakdown of the Fund’s holdings.

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. The Fund’s top five sector holdings (as a percentage of net assets) as of September 30, 2020 were: Financials (28.9%), Consumer Discretionary (15.0%), Health Care (12.2%), Industrials (11.8%) and Information Technology (8.3%). The Fund’s portfolio composition is subject to change at any time.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| i | The Russell 1000 Index measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000 Index and includes approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000 represents approximately 90% of the U.S. market. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the U.S. equity market. |

| ii | The price-to-earnings (“P/E”) ratio is a stock’s price divided by its earnings per share. |

| iii | The price-to-book (“P/B”) ratio is a stock’s price divided by the stock’s per share book value. |

| iv | The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 Index companies with lower price-to-book ratios and lower expected growth values. (A price-to-book ratio is the price of a stock compared to the difference between a company’s assets and liabilities.) |

| v | The S&P 500 Index is an unmanaged index of the stocks of 500 leading companies, and is generally representative of the performance of larger companies in the U.S. |

| vi | The Russell 1000 Growth Index measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. (A price-to-book ratio is the price of a stock compared to the difference between a company’s assets and liabilities.) |

| vii | The Federal Reserve Board (the “Fed”) is responsible for the formulation of U.S. policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| viii | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| ix | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the period ended September 30, 2020, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 386 funds for the six-month period and among the 381 funds for the twelve-month period in the Fund’s Lipper category, and excluding sales charges, if any. |

| | |

6 | | BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report |

Fund at a glance† (unaudited)

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of September 30, 2020 and September 30, 2019. The Fund is actively managed. As a result, the composition of the Fund’s investments is subject to change at any time. |

| | |

| BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report | | 7 |

Fund expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end and back-end sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; service and/or distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on April 1, 2020 and held for the six months ended September 30, 2020.

Actual expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or back-end sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| Based on actual total return1 | | | | | | | | | Based on hypothetical total return1 | | | | |

| | | Actual

Total Return

Without

Sales

Charge2 | | | Beginning

Account

Value | | | Ending

Account

Value | | | Annualized

Expense

Ratio | | | Expenses

Paid

During

the

Period3 | | | | | | | | Hypothetical

Annualized

Total Return | | | Beginning Account Value | | | Ending

Account

Value | | | Annualized

Expense

Ratio | | | Expenses

Paid

During the

Period3 | |

| Class A | | | 24.67 | % | | $ | 1,000.00 | | | $ | 1,246.70 | | | | 1.10 | % | | $ | 6.18 | | | | | | | Class A | | | 5.00 | % | | $ | 1,000.00 | | | $ | 1,019.50 | | | | 1.10 | % | | $ | 5.55 | |

| Class C | | | 24.12 | | | | 1,000.00 | | | | 1,241.20 | | | | 1.85 | | | | 10.37 | | | | | | | Class C | | | 5.00 | | | | 1,000.00 | | | | 1,015.75 | | | | 1.85 | | | | 9.32 | |

| Class R | | | 24.51 | | | | 1,000.00 | | | | 1,245.10 | | | | 1.35 | | | | 7.58 | | | | | | | Class R | | | 5.00 | | | | 1,000.00 | | | | 1,018.25 | | | | 1.35 | | | | 6.81 | |

| Class I | | | 24.81 | | | | 1,000.00 | | | | 1,248.10 | | | | 0.75 | | | | 4.22 | | | | | | | Class I | | | 5.00 | | | | 1,000.00 | | | | 1,021.25 | | | | 0.75 | | | | 3.79 | |

| Class IS | | | 25.03 | | | | 1,000.00 | | | | 1,250.30 | | | | 0.65 | | | | 3.66 | | | | | | | Class IS | | | 5.00 | | | | 1,000.00 | | | | 1,021.75 | | | | 0.65 | | | | 3.29 | |

| | |

8 | | BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report |

| 1 | For the six months ended September 30, 2020. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charge with respect to Class A shares or the applicable contingent deferred sales charge (“CDSC”) with respect to Class C shares. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Expenses (net of compensating balance arrangements, fee waivers and/or expense reimbursements) are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), then divided by 366. |

| | |

| BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report | | 9 |

Fund performance (unaudited)

BrandywineGLOBAL — Dynamic US Large Cap Value Fund (the “Fund”) is the successor to a private fund (the “Predecessor”). The performance in the accompanying table and line graph for Class IS shares includes performance of the Predecessor. The Predecessor’s inception date was December 27, 2006. On October 31, 2014, the Predecessor transferred its assets to the Fund in exchange for the Fund’s Class IS shares. The investment policies, objectives, guidelines and restrictions of the Fund are in all material respects equivalent to those of the Predecessor. In addition, the Predecessor’s portfolio managers are the current portfolio managers of the Fund. As a mutual fund registered under the Investment Company Act of 1940, the Fund is subject to certain restrictions under the 1940 Act and the Internal Revenue Code to which the Predecessor was not subject. Had the Predecessor been registered under the 1940 Act and been subject to the provisions of the 1940 Act and the Code, its investment performance could have been adversely affected, but these restrictions are not expected to have a material effect on the Fund’s investment program. The performance information reflects the gross expenses of the Predecessor adjusted to reflect the higher fees and expenses of Class IS of the Fund. The performance is shown net of an annual management fee of 0.55% and other expenses of 0.10% which reflects the application of the Class IS expense limitation agreement. If the expense limitation agreement were not applicable, expenses would be higher and performance lower.

The Predecessor did not have distribution policies. The Predecessor was an unregistered private fund, did not qualify as a regulated investment company for federal income tax purposes and did not pay dividends or distributions.

| | | | | | | | | | | | | | | | | | | | |

| Average annual total returns | | | | | | | | | | | | | | | |

| Without sales charges1 | | Class A | | | Class C | | | Class R | | | Class I | | | Class IS | |

| Twelve Months Ended 9/30/20 | | | 1.22 | % | | | 0.35 | % | | | 0.96 | % | | | 1.49 | % | | | 1.66 | % |

| Five Years Ended 9/30/20 | | | 8.03 | | | | 7.21 | | | | 7.75 | | | | 8.37 | | | | 8.49 | |

| Ten Years Ended 9/30/20 | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 12.00 | |

| Inception* through 9/30/20 | | | 5.89 | | | | 5.08 | | | | 5.60 | | | | 6.20 | | | | — | |

| | | | | |

| With sales charges2 | | Class A | | | Class C | | | Class R | | | Class I | | | Class IS | |

| Twelve Months Ended 9/30/20 | | | -4.60 | % | | | -0.63 | % | | | 0.96 | % | | | 1.49 | % | | | 1.66 | % |

| Five Years Ended 9/30/20 | | | 6.75 | | | | 7.21 | | | | 7.75 | | | | 8.37 | | | | 8.49 | |

| Ten Years Ended 9/30/20 | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 12.00 | |

| Inception through 9/30/20 | | | 4.84 | | | | 5.08 | | | | 5.60 | | | | 6.20 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

| Cumulative total returns1 | | | | | | | | | | | | | | | |

| Without sales charges | | | | | | | | | | | | | | | |

| Class A (Inception date of 11/3/14 through 9/30/20) | | | | | | | | 40.24 | % | | | | | | | | |

| Class C (Inception date of 11/3/14 through 9/30/20) | | | | | | | | 34.02 | | | | | | | | | |

| Class R (Inception date of 11/3/14 through 9/30/20) | | | | | | | | 37.94 | | | | | | | | | |

| Class I (Inception date of 11/3/14 through 9/30/20) | | | | | | | | 42.66 | | | | | | | | | |

| Class IS (9/30/10 through 9/30/20) | | | | | | | | | | | 210.49 | | | | | | | | | |

| | |

10 | | BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report |

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower.

| 1 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charge with respect to Class A shares or the applicable contingent deferred sales charge (“CDSC”) with respect to Class C shares. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. In addition, Class A shares reflect the deduction of the maximum initial sales charge of 5.75%. Class C shares reflect the deduction of a 1.00% CDSC, which applies if shares are redeemed within one year from purchase payment. |

| * | Inception dates for Class A, C, R, I and IS shares are November 3, 2014, November 3, 2014, November 3, 2014, November 3, 2014 and December 27, 2006, respectively. |

| | |

| BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report | | 11 |

Fund performance (unaudited) (cont’d)

Historical performance

Value of $1,000,000 invested in

Class IS Shares of BrandywineGLOBAL — Dynamic US Large Cap Value Fund vs. Russell 1000 Value Index and S&P 500 Index† — September 2010 - September 2020

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower.

| † | Hypothetical illustration of $1,000,000 invested in Class IS shares of BrandywineGLOBAL — Dynamic US Large Cap Value Fund on September 30, 2010 assuming the reinvestment of all distributions, including returns of capital, if any, at net asset value through September 30, 2020 (Performance prior to October 31, 2014 on this chart is that of the Fund’s Predecessor). The hypothetical illustration also assumes a $1,000,000 investment in the Russell 1000 Value Index and the S&P 500 Index. The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 Index companies with lower price-to-book ratios and lower expected growth values. (A price-to-book ratio is the price of a stock compared to the difference between a company’s assets and liabilities). The S&P 500 Index is an unmanaged index of 500 stocks and is generally representative of the performance of larger companies in the U.S. The indices are unmanaged and are not subject to the same management and trading expenses as a mutual fund. Please note that an investor cannot invest directly in an index. The performance of the Fund’s other classes may be greater or less than the Class IS shares’ performance indicated on this chart, depending on whether greater or lesser sales charges and fees were incurred by shareholders investing in the other classes. |

| | |

12 | | BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report |

Schedule of investments

September 30, 2020

BrandywineGLOBAL — Dynamic US Large Cap Value Fund

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

| Common Stocks — 97.0% | | | | | | | | | | | | | | | | |

| Communication Services — 3.5% | | | | | | | | | | | | | | | | |

Diversified Telecommunication Services — 1.9% | | | | | | | | | | | | | | | | |

AT&T Inc. | | | | | | | | | | | 40,338 | | | $ | 1,150,036 | |

Verizon Communications Inc. | | | | | | | | | | | 38,305 | | | | 2,278,765 | |

Total Diversified Telecommunication Services | | | | | | | | | | | | | | | 3,428,801 | |

Entertainment — 0.6% | | | | | | | | | | | | | | | | |

Walt Disney Co. | | | | | | | | | | | 8,842 | | | | 1,097,115 | |

Media — 1.0% | | | | | | | | | | | | | | | | |

Comcast Corp., Class A Shares | | | | | | | | | | | 24,020 | | | | 1,111,165 | |

Discovery Inc., Class A Shares | | | | | | | | | | | 27,510 | | | | 598,893 | * |

Total Media | | | | | | | | | | | | | | | 1,710,058 | |

Total Communication Services | | | | | | | | | | | | | | | 6,235,974 | |

| Consumer Discretionary — 15.0% | | | | | | | | | | | | | | | | |

Auto Components — 0.6% | | | | | | | | | | | | | | | | |

Lear Corp. | | | | | | | | | | | 9,576 | | | | 1,044,263 | |

Distributors — 0.8% | | | | | | | | | | | | | | | | |

LKQ Corp. | | | | | | | | | | | 52,172 | | | | 1,446,730 | * |

Hotels, Restaurants & Leisure — 1.0% | | | | | | | | | | | | | | | | |

MGM Resorts International | | | | | | | | | | | 83,378 | | | | 1,813,471 | |

Household Durables — 7.8% | | | | | | | | | | | | | | | | |

DR Horton Inc. | | | | | | | | | | | 55,486 | | | | 4,196,406 | |

Lennar Corp., Class A Shares | | | | | | | | | | | 39,293 | | | | 3,209,452 | |

Meritage Homes Corp. | | | | | | | | | | | 4,756 | | | | 525,015 | * |

Mohawk Industries Inc. | | | | | | | | | | | 11,484 | | | | 1,120,724 | * |

PulteGroup Inc. | | | | | | | | | | | 42,498 | | | | 1,967,232 | |

Tempur Sealy International Inc. | | | | | | | | | | | 8,751 | | | | 780,502 | * |

Toll Brothers Inc. | | | | | | | | | | | 21,667 | | | | 1,054,316 | |

TopBuild Corp. | | | | | | | | | | | 5,664 | | | | 966,788 | * |

Total Household Durables | | | | | | | | | | | | | | | 13,820,435 | |

Internet & Direct Marketing Retail — 3.4% | | | | | | | | | | | | | | | | |

eBay Inc. | | | | | | | | | | | 114,650 | | | | 5,973,265 | |

Specialty Retail — 0.8% | | | | | | | | | | | | | | | | |

Advance Auto Parts Inc. | | | | | | | | | | | 1,400 | | | | 214,900 | |

Dick’s Sporting Goods Inc. | | | | | | | | | | | 1,320 | | | | 76,401 | |

Murphy USA Inc. | | | | | | | | | | | 4,956 | | | | 635,706 | * |

Penske Automotive Group Inc. | | | | | | | | | | | 10,742 | | | | 511,964 | |

Total Specialty Retail | | | | | | | | | | | | | | | 1,438,971 | |

Textiles, Apparel & Luxury Goods — 0.6% | | | | | | | | | | | | | | | | |

Hanesbrands Inc. | | | | | | | | | | | 59,774 | | | | 941,441 | |

Total Consumer Discretionary | | | | | | | | | | | | | | | 26,478,576 | |

See Notes to Financial Statements.

| | |

| BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report | | 13 |

Schedule of investments (cont’d)

September 30, 2020

BrandywineGLOBAL — Dynamic US Large Cap Value Fund

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

| Consumer Staples — 3.9% | | | | | | | | | | | | | | | | |

Food & Staples Retailing — 1.8% | | | | | | | | | | | | | | | | |

Kroger Co. | | | | | | | | | | | 8,842 | | | $ | 299,832 | |

Sysco Corp. | | | | | | | | | | | 19,169 | | | | 1,192,695 | |

Walmart Inc. | | | | | | | | | | | 11,818 | | | | 1,653,457 | |

Total Food & Staples Retailing | | | | | | | | | | | | | | | 3,145,984 | |

Food Products — 0.6% | | | | | | | | | | | | | | | | |

Darling Ingredients Inc. | | | | | | | | | | | 27,788 | | | | 1,001,202 | * |

Household Products — 1.5% | | | | | | | | | | | | | | | | |

Procter & Gamble Co. | | | | | | | | | | | 19,586 | | | | 2,722,258 | |

Total Consumer Staples | | | | | | | | | | | | | | | 6,869,444 | |

| Energy — 4.2% | | | | | | | | | | | | | | | | |

Oil, Gas & Consumable Fuels — 4.2% | | | | | | | | | | | | | | | | |

Cabot Oil & Gas Corp. | | | | | | | | | | | 66,437 | | | | 1,153,346 | |

ConocoPhillips | | | | | | | | | | | 146,696 | | | | 4,817,497 | |

Continental Resources Inc. | | | | | | | | | | | 61,491 | | | | 755,110 | |

Valero Energy Corp. | | | | | | | | | | | 17,210 | | | | 745,537 | |

Total Energy | | | | | | | | | | | | | | | 7,471,490 | |

| Financials — 28.9% | | | | | | | | | | | | | | | | |

Banks — 8.7% | | | | | | | | | | | | | | | | |

Bank of America Corp. | | | | | | | | | | | 235,632 | | | | 5,676,375 | |

Citigroup Inc. | | | | | | | | | | | 103,463 | | | | 4,460,290 | |

Citizens Financial Group Inc. | | | | | | | | | | | 51,238 | | | | 1,295,297 | |

East-West Bancorp Inc. | | | | | | | | | | | 16,276 | | | | 532,876 | |

Signature Bank | | | | | | | | | | | 6,501 | | | | 539,518 | |

US Bancorp | | | | | | | | | | | 65,160 | | | | 2,335,986 | |

Zions Bancorp NA | | | | | | | | | | | 19,168 | | | | 560,089 | |

Total Banks | | | | | | | | | | | | | | | 15,400,431 | |

Capital Markets — 13.7% | | | | | | | | | | | | | | | | |

Ameriprise Financial Inc. | | | | | | | | | | | 13,739 | | | | 2,117,317 | |

Bank of New York Mellon Corp. | | | | | | | | | | | 90,703 | | | | 3,114,741 | |

E*TRADE Financial Corp. | | | | | | | | | | | 22,277 | | | | 1,114,964 | |

Goldman Sachs Group Inc. | | | | | | | | | | | 27,012 | | | | 5,428,602 | |

Invesco Ltd. | | | | | | | | | | | 53,927 | | | | 615,307 | |

Lazard Ltd., Class A Shares | | | | | | | | | | | 2,280 | | | | 75,354 | |

Morgan Stanley | | | | | | | | | | | 110,589 | | | | 5,346,978 | |

State Street Corp. | | | | | | | | | | | 38,028 | | | | 2,256,201 | |

T. Rowe Price Group Inc. | | | | | | | | | | | 32,124 | | | | 4,118,939 | |

Total Capital Markets | | | | | | | | | | | | | | | 24,188,403 | |

Consumer Finance — 3.5% | | | | | | | | | | | | | | | | |

Ally Financial Inc. | | | | | | | | | | | 42,625 | | | | 1,068,608 | |

See Notes to Financial Statements.

| | |

14 | | BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report |

BrandywineGLOBAL — Dynamic US Large Cap Value Fund

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Consumer Finance — continued | | | | | | | | | | | | | | | | |

Credit Acceptance Corp. | | | | | | | | | | | 700 | | | $ | 237,048 | * |

Discover Financial Services | | | | | | | | | | | 34,796 | | | | 2,010,513 | |

OneMain Holdings Inc. | | | | | | | | | | | 15,607 | | | | 487,719 | |

Santander Consumer USA Holdings Inc. | | | | | | | | | | | 36,425 | | | | 662,571 | |

Synchrony Financial | | | | | | | | | | | 63,489 | | | | 1,661,507 | |

Total Consumer Finance | | | | | | | | | | | | | | | 6,127,966 | |

Diversified Financial Services — 0.4% | | | | | | | | | | | | | | | | |

Jefferies Financial Group Inc. | | | | | | | | | | | 30,992 | | | | 557,856 | |

Voya Financial Inc. | | | | | | | | | | | 2,360 | | | | 113,115 | |

Total Diversified Financial Services | | | | | | | | | | | | | | | 670,971 | |

Insurance — 2.6% | | | | | | | | | | | | | | | | |

Allstate Corp. | | | | | | | | | | | 31,629 | | | | 2,977,554 | |

Primerica Inc. | | | | | | | | | | | 4,670 | | | | 528,364 | |

Progressive Corp. | | | | | | | | | | | 11,527 | | | | 1,091,261 | |

Total Insurance | | | | | | | | | | | | | | | 4,597,179 | |

Thrifts & Mortgage Finance — 0.0%†† | | | | | | | | | | | | | | | | |

PennyMac Financial Services Inc. | | | | | | | | | | | 1,460 | | | | 84,855 | |

Total Financials | | | | | | | | | | | | | | | 51,069,805 | |

| Health Care — 12.2% | | | | | | | | | | | | | | | | |

Biotechnology — 5.8% | | | | | | | | | | | | | | | | |

Amgen Inc. | | | | | | | | | | | 7,093 | | | | 1,802,757 | |

Biogen Inc. | | | | | | | | | | | 21,835 | | | | 6,194,153 | * |

Regeneron Pharmaceuticals Inc. | | | | | | | | | | | 3,970 | | | | 2,222,326 | * |

Total Biotechnology | | | | | | | | | | | | | | | 10,219,236 | |

Health Care Providers & Services — 3.0% | | | | | | | | | | | | | | | | |

DaVita Inc. | | | | | | | | | | | 25,947 | | | | 2,222,361 | * |

Henry Schein Inc. | | | | | | | | | | | 24,641 | | | | 1,448,398 | * |

Molina Healthcare Inc. | | | | | | | | | | | 9,259 | | | | 1,694,767 | * |

Total Health Care Providers & Services | | | | | | | | | | | | | | | 5,365,526 | |

Pharmaceuticals — 3.4% | | | | | | | | | | | | | | | | |

Johnson & Johnson | | | | | | | | | | | 17,618 | | | | 2,622,968 | |

Merck & Co. Inc. | | | | | | | | | | | 21,169 | | | | 1,755,968 | |

Pfizer Inc. | | | | | | | | | | | 45,047 | | | | 1,653,225 | |

Total Pharmaceuticals | | | | | | | | | | | | | | | 6,032,161 | |

Total Health Care | | | | | | | | | | | | | | | 21,616,923 | |

| Industrials — 11.8% | | | | | | | | | | | | | | | | |

Aerospace & Defense — 0.7% | | | | | | | | | | | | | | | | |

Howmet Aerospace Inc. | | | | | | | | | | | 75,294 | | | | 1,258,916 | |

Building Products — 0.8% | | | | | | | | | | | | | | | | |

Johnson Controls International PLC | | | | | | | | | | | 32,010 | | | | 1,307,609 | |

See Notes to Financial Statements.

| | |

| BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report | | 15 |

Schedule of investments (cont’d)

September 30, 2020

BrandywineGLOBAL — Dynamic US Large Cap Value Fund

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Construction & Engineering — 0.1% | | | | | | | | | | | | | | | | |

Quanta Services Inc. | | | | | | | | | | | 2,790 | | | $ | 147,479 | |

Electrical Equipment — 4.0% | | | | | | | | | | | | | | | | |

Emerson Electric Co. | | | | | | | | | | | 98,981 | | | | 6,490,184 | |

Regal Beloit Corp. | | | | | | | | | | | 6,845 | | | | 642,540 | |

Total Electrical Equipment | | | | | | | | | | | | | | | 7,132,724 | |

Machinery — 4.6% | | | | | | | | | | | | | | | | |

Caterpillar Inc. | | | | | | | | | | | 14,986 | | | | 2,235,162 | |

Cummins Inc. | | | | | | | | | | | 25,090 | | | | 5,298,004 | |

Timken Co. | | | | | | | | | | | 11,160 | | | | 605,095 | |

Total Machinery | | | | | | | | | | | | | | | 8,138,261 | |

Professional Services — 0.4% | | | | | | | | | | | | | | | | |

ManpowerGroup Inc. | | | | | | | | | | | 10,044 | | | | 736,527 | |

Trading Companies & Distributors — 1.2% | | | | | | | | | | | | | | | | |

United Rentals Inc. | | | | | | | | | | | 12,132 | | | | 2,117,034 | * |

Total Industrials | | | | | | | | | | | | | | | 20,838,550 | |

| Information Technology — 8.3% | | | | | | | | | | | | | | | | |

Electronic Equipment, Instruments & Components — 0.7% | | | | | | | | | | | | | | | | |

Arrow Electronics Inc. | | | | | | | | | | | 14,877 | | | | 1,170,225 | * |

Semiconductors & Semiconductor Equipment — 5.1% | | | | | | | | | | | | | | | | |

Intel Corp. | | | | | | | | | | | 175,638 | | | | 9,094,536 | |

Software — 1.6% | | | | | | | | | | | | | | | | |

Oracle Corp. | | | | | | | | | | | 46,314 | | | | 2,764,946 | |

Technology Hardware, Storage & Peripherals — 0.9% | | | | | | | | | | | | | | | | |

NetApp Inc. | | | | | | | | | | | 36,797 | | | | 1,613,180 | |

Total Information Technology | | | | | | | | | | | | | | | 14,642,887 | |

| Materials — 5.2% | | | | | | | | | | | | | | | | |

Chemicals — 5.1% | | | | | | | | | | | | | | | | |

Celanese Corp. | | | | | | | | | | | 20,502 | | | | 2,202,940 | |

CF Industries Holdings Inc. | | | | | | | | | | | 33,646 | | | | 1,033,269 | |

Eastman Chemical Co. | | | | | | | | | | | 24,590 | | | | 1,920,971 | |

LyondellBasell Industries NV, Class A Shares | | | | | | | | | | | 56,219 | | | | 3,962,877 | |

Total Chemicals | | | | | | | | | | | | | | | 9,120,057 | |

Metals & Mining — 0.1% | | | | | | | | | | | | | | | | |

Steel Dynamics Inc. | | | | | | | | | | | 4,300 | | | | 123,109 | |

Total Materials | | | | | | | | | | | | | | | 9,243,166 | |

| Utilities — 4.0% | | | | | | | | | | | | | | | | |

Electric Utilities — 4.0% | | | | | | | | | | | | | | | | |

American Electric Power Co. Inc. | | | | | | | | | | | 6,676 | | | | 545,629 | |

Duke Energy Corp. | | | | | | | | | | | 6,676 | | | | 591,227 | |

Evergy Inc. | | | | | | | | | | | 45,303 | | | | 2,302,298 | |

See Notes to Financial Statements.

| | |

16 | | BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report |

BrandywineGLOBAL — Dynamic US Large Cap Value Fund

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Electric Utilities — continued | | | | | | | | | | | | | | | | |

Exelon Corp. | | | | | | | | | | | 16,352 | | | $ | 584,748 | |

NextEra Energy Inc. | | | | | | | | | | | 5,043 | | | | 1,399,735 | |

Southern Co. | | | | | | | | | | | 32,396 | | | | 1,756,511 | |

Total Utilities | | | | | | | | | | | | | | | 7,180,148 | |

Total Common Stocks (Cost — $168,057,822) | | | | | | | | | | | | | | | 171,646,963 | |

| Investments in Underlying Funds — 0.7% | | | | | | | | | | | | | | | | |

iShares Trust, iShares Russell 1000 Value ETF (Cost — $1,227,979) | | | | | | | | 10,500 | | | | 1,240,365 | |

Total Investments before Short-Term Investments (Cost — $169,285,801) | | | | | | | | | | | | | | | 172,887,328 | |

| | | | | | Rate | | | | | | | |

| Short-Term Investments — 2.0% | | | | | | | | | | | | | | | | |

JPMorgan U.S. Government Money Market Fund, Institutional Class

(Cost — $3,497,123) | | | | | | | 0.010% | | | | 3,497,123 | | | | 3,497,123 | |

Total Investments — 99.7% (Cost — $172,782,924) | | | | | | | | | | | | | | | 176,384,451 | |

Other Assets in Excess of Liabilities — 0.3% | | | | | | | | | | | | | | | 556,214 | |

Total Net Assets — 100.0% | | | | | | | | | | | | | | $ | 176,940,665 | |

| †† | Represents less than 0.1%. |

| * | Non-income producing security. |

| | |

Abbreviation used in this schedule: |

| |

| | ETF — Exchange-Traded Fund |

See Notes to Financial Statements.

| | |

| BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report | | 17 |

Statement of assets and liabilities

September 30, 2020

| | | | |

| |

| Assets: | | | | |

Investments, at value (Cost — $172,782,924) | | $ | 176,384,451 | |

Receivable for securities sold | | | 521,282 | |

Dividends and interest receivable | | | 109,812 | |

Receivable for Fund shares sold | | | 21,358 | |

Prepaid expenses | | | 48,156 | |

Total Assets | | | 177,085,059 | |

| |

| Liabilities: | | | | |

Investment management fee payable | | | 76,081 | |

Audit and tax fees payable | | | 38,246 | |

Fund accounting fees payable | | | 11,483 | |

Trustees’ fees payable | | | 3,855 | |

Payable for Fund shares repurchased | | | 1,651 | |

Service and/or distribution fees payable | | | 1,529 | |

Accrued expenses | | | 11,549 | |

Total Liabilities | | | 144,394 | |

| Total Net Assets | | $ | 176,940,665 | |

| |

| Net Assets: | | | | |

Par value (Note 7) | | $ | 154 | |

Paid-in capital in excess of par value | | | 164,736,055 | |

Total distributable earnings (loss) | | | 12,204,456 | |

| Total Net Assets | | $ | 176,940,665 | |

See Notes to Financial Statements.

| | |

18 | | BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report |

| | | | |

| |

| Net Assets: | | | | |

Class A | | $ | 5,922,768 | |

Class C | | $ | 337,758 | |

Class R | | $ | 73,352 | |

Class I | | $ | 1,062,782 | |

Class IS | | $ | 169,544,005 | |

| |

| Shares Outstanding: | | | | |

Class A | | | 518,772 | |

Class C | | | 29,962 | |

Class R | | | 6,419 | |

Class I | | | 92,629 | |

Class IS | | | 14,760,533 | |

| |

| Net Asset Value: | | | | |

Class A (and redemption price) | | $ | 11.42 | |

Class C* | | $ | 11.27 | |

Class R (and redemption price) | | $ | 11.43 | |

Class I (and redemption price) | | $ | 11.47 | |

Class IS (and redemption price) | | $ | 11.49 | |

Maximum Public Offering Price Per Share: | | | | |

Class A (based on maximum initial sales charge of 5.75%) | | $ | 12.12 | |

| * | Redemption price per share is NAV of Class C shares reduced by a 1.00% CDSC if shares are redeemed within one year from purchase payment (Note 2). |

See Notes to Financial Statements.

| | |

| BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report | | 19 |

Statement of operations

For the Year Ended September 30, 2020

| | | | |

| |

| Investment Income: | | | | |

Dividends | | $ | 3,922,152 | |

Interest | | | 22,465 | |

Total Investment Income | | | 3,944,617 | |

| |

| Expenses: | | | | |

Investment management fee (Note 2) | | | 905,387 | |

Registration fees | | | 81,499 | |

Fund accounting fees | | | 69,053 | |

Audit and tax fees | | | 38,246 | |

Trustees’ fees | | | 28,667 | |

Legal fees | | | 26,730 | |

Service and/or distribution fees (Notes 2 and 5) | | | 22,784 | |

Transfer agent fees (Note 5) | | | 14,615 | |

Fees recaptured by investment manager (Note 2) | | | 6,441 | |

Custody fees | | | 5,796 | |

Shareholder reports | | | 5,483 | |

Insurance | | | 3,080 | |

Interest expense | | | 2 | |

Miscellaneous expenses | | | 5,526 | |

Total Expenses | | | 1,213,309 | |

Less: Fee waivers and/or expense reimbursements (Notes 2 and 5) | | | (105,988) | |

Net Expenses | | | 1,107,321 | |

| Net Investment Income | | | 2,837,296 | |

| |

| Realized and Unrealized Gain (Loss) on Investments (Notes 1 and 3): | | | | |

Net Realized Gain From Investment Transactions | | | 7,216,119 | |

Change in Net Unrealized Appreciation (Depreciation) From Investments | | | (6,989,136) | |

| Net Gain on Investments | | | 226,983 | |

| Increase in Net Assets From Operations | | $ | 3,064,279 | |

See Notes to Financial Statements.

| | |

20 | | BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report |

Statements of changes in net assets

| | | | | | | | |

| For the Years Ended September 30, | | 2020 | | | 2019 | |

| | |

| Operations: | | | | | | | | |

Net investment income | | $ | 2,837,296 | | | $ | 2,948,525 | |

Net realized gain | | | 7,216,119 | | | | 5,831,411 | |

Change in net unrealized appreciation (depreciation) | | | (6,989,136) | | | | (8,708,212) | |

Increase in Net Assets From Operations | | | 3,064,279 | | | | 71,724 | |

| | |

| Distributions to Shareholders From (Notes 1 and 6): | | | | | | | | |

Total distributable earnings | | | (7,006,270) | | | | (14,272,010) | |

Decrease in Net Assets From Distributions to Shareholders | | | (7,006,270) | | | | (14,272,010) | |

| | |

| Fund Share Transactions (Note 7): | | | | | | | | |

Net proceeds from sale of shares | | | 33,664,850 | | | | 34,426,687 | |

Reinvestment of distributions | | | 7,002,253 | | | | 14,256,271 | |

Cost of shares repurchased | | | (37,930,251) | | | | (23,275,512) | |

Increase in Net Assets From Fund Share Transactions | | | 2,736,852 | | | | 25,407,446 | |

Increase (Decrease) in Net Assets | | | (1,205,139) | | | | 11,207,160 | |

| | |

| Net Assets: | | | | | | | | |

Beginning of year | | | 178,145,804 | | | | 166,938,644 | |

End of year | | $ | 176,940,665 | | | $ | 178,145,804 | |

See Notes to Financial Statements.

| | |

| BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report | | 21 |

Financial highlights

| | | | | | | | | | | | | | | | | | | | |

| For a share of each class of beneficial interest outstanding throughout each year ended September 30: | |

| Class A Shares1 | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| | | | | |

| Net asset value, beginning of year | | | $11.70 | | | | $12.97 | | | | $11.68 | | | | $10.04 | | | | $9.50 | |

| | | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.15 | | | | 0.16 | | | | 0.12 | | | | 0.11 | | | | 0.14 | |

Net realized and unrealized gain (loss) | | | 0.02 | | | | (0.30) | | | | 1.49 | | | | 1.65 | | | | 0.69 | |

Total income (loss) from operations | | | 0.17 | | | | (0.14) | | | | 1.61 | | | | 1.76 | | | | 0.83 | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.13) | | | | (0.15) | | | | (0.07) | | | | (0.12) | | | | (0.10) | |

Net realized gains | | | (0.32) | | | | (0.98) | | | | (0.25) | | | | — | | | | (0.19) | |

Total distributions | | | (0.45) | | | | (1.13) | | | | (0.32) | | | | (0.12) | | | | (0.29) | |

| | | | | |

| Net asset value, end of year | | | $11.42 | | | | $11.70 | | | | $12.97 | | | | $11.68 | | | | $10.04 | |

Total return2 | | | 1.22 | % | | | (0.47) | % | | | 13.95 | % | | | 17.70 | % | | | 8.87 | % |

| | | | | |

| Net assets, end of year (000s) | | | $5,923 | | | | $8,124 | | | | $7,870 | | | | $5,306 | | | | $4,424 | |

| | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.17 | %3 | | | 1.17 | %3 | | | 1.14 | %3 | | | 1.35 | %3 | | | 1.44 | % |

Net expenses4,5 | | | 1.10 | 3 | | | 1.10 | 3 | | | 1.10 | 3 | | | 1.07 | 3 | | | 1.00 | |

Net investment income | | | 1.30 | | | | 1.42 | | | | 0.94 | | | | 1.04 | | | | 1.40 | |

| | | | | |

| Portfolio turnover rate | | | 141 | % | | | 126 | % | | | 91 | % | | | 83 | % | | | 112 | % |

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | Performance figures, exclusive of sales charges, may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Reflects recapture of expenses waived/reimbursed from prior fiscal years. |

| 4 | Reflects fee waivers and/or expense reimbursements. |

| 5 | As a result of an expense limitation arrangement, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, dividend expense on short sales, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Class A shares did not exceed 1.10%. This expense limitation arrangement cannot be terminated prior to December 31, 2021 without the Board of Trustees’ consent. |

See Notes to Financial Statements.

| | |

22 | | BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report |

| | | | | | | | | | | | | | | | | | | | |

| For a share of each class of beneficial interest outstanding throughout each year ended September 30: | |

| Class C Shares1 | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| | | | | |

| Net asset value, beginning of year | | | $11.54 | | | | $12.80 | | | | $11.55 | | | | $9.92 | | | | $9.44 | |

| | | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.06 | | | | 0.08 | | | | 0.02 | | | | 0.03 | | | | 0.07 | |

Net realized and unrealized gain (loss) | | | 0.01 | | | | (0.31) | | | | 1.48 | | | | 1.63 | | | | 0.69 | |

Total income (loss) from operations | | | 0.07 | | | | (0.23) | | | | 1.50 | | | | 1.66 | | | | 0.76 | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.02) | | | | (0.05) | | | | — | | | | (0.03) | | | | (0.09) | |

Net realized gains | | | (0.32) | | | | (0.98) | | | | (0.25) | | | | — | | | | (0.19) | |

Total distributions | | | (0.34) | | | | (1.03) | | | | (0.25) | | | | (0.03) | | | | (0.28) | |

| | | | | |

| Net asset value, end of year | | | $11.27 | | | | $11.54 | | | | $12.80 | | | | $11.55 | | | | $9.92 | |

Total return2 | | | 0.35 | % | | | (1.15) | % | | | 13.11 | % | | | 16.76 | % | | | 8.12 | % |

| | | | | |

| Net assets, end of year (000s) | | | $338 | | | | $732 | | | | $808 | | | | $726 | | | | $784 | |

| | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.91 | %3 | | | 1.92 | %3 | | | 1.89 | %3 | | | 2.01 | %3 | | | 2.22 | % |

Net expenses4,5 | | | 1.85 | 3 | | | 1.85 | 3 | | | 1.85 | 3 | | | 1.79 | 3 | | | 1.78 | |

Net investment income | | | 0.52 | | | | 0.67 | | | | 0.18 | | | | 0.32 | | | | 0.70 | |

| | | | | |

| Portfolio turnover rate | | | 141 | % | | | 126 | % | | | 91 | % | | | 83 | % | | | 112 | % |

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | Performance figures, exclusive of CDSC, may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Reflects recapture of expenses waived/reimbursed from prior fiscal years. |

| 4 | Reflects fee waivers and/or expense reimbursements. |

| 5 | As a result of an expense limitation arrangement, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, dividend expense on short sales, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Class C shares did not exceed 1.85%. This expense limitation arrangement cannot be terminated prior to December 31, 2021 without the Board of Trustees’ consent. |

See Notes to Financial Statements.

| | |

| BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report | | 23 |

Financial highlights (cont’d)

| | | | | | | | | | | | | | | | | | | | |

| For a share of each class of beneficial interest outstanding throughout each year ended September 30: | |

| Class R Shares1 | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| | | | | |

| Net asset value, beginning of year | | | $11.72 | | | | $12.96 | | | | $11.68 | | | | $10.03 | | | | $9.47 | |

| | | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.12 | | | | 0.13 | | | | 0.08 | | | | 0.06 | | | | 0.11 | |

Net realized and unrealized gain (loss) | | | 0.01 | | | | (0.30) | | | | 1.51 | | | | 1.66 | | | | 0.70 | |

Total income (loss) from operations | | | 0.13 | | | | (0.17) | | | | 1.59 | | | | 1.72 | | | | 0.81 | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.10) | | | | (0.09) | | | | (0.06) | | | | (0.07) | | | | (0.06) | |

Net realized gains | | | (0.32) | | | | (0.98) | | | | (0.25) | | | | — | | | | (0.19) | |

Total distributions | | | (0.42) | | | | (1.07) | | | | (0.31) | | | | (0.07) | | | | (0.25) | |

| | | | | |

| Net asset value, end of year | | | $11.43 | | | | $11.72 | | | | $12.96 | | | | $11.68 | | | | $10.03 | |

Total return2 | | | 0.96 | % | | | (0.71) | % | | | 13.76 | % | | | 17.25 | % | | | 8.60 | % |

| | | | | |

| Net assets, end of year (000s) | | | $73 | | | | $170 | | | | $210 | | | | $264 | | | | $10 | |

| | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.56 | %3 | | | 1.53 | %3 | | | 1.47 | %3 | | | 1.65 | % | | | 1.89 | % |

Net expenses4,5 | | | 1.35 | 3 | | | 1.35 | 3 | | | 1.35 | 3 | | | 1.33 | | | | 1.35 | |

Net investment income | | | 1.01 | | | | 1.15 | | | | 0.67 | | | | 0.54 | | | | 1.11 | |

| | | | | |

| Portfolio turnover rate | | | 141 | % | | | 126 | % | | | 91 | % | | | 83 | % | | | 112 | % |

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Reflects recapture of expenses waived/reimbursed from prior fiscal years. |

| 4 | Reflects fee waivers and/or expense reimbursements. |

| 5 | As a result of an expense limitation arrangement, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, dividend expense on short sales, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Class R shares did not exceed 1.35%. This expense limitation arrangement cannot be terminated prior to December 31, 2021 without the Board of Trustees’ consent. |

See Notes to Financial Statements.

| | |

24 | | BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report |

| | | | | | | | | | | | | | | | | | | | |

| For a share of each class of beneficial interest outstanding throughout each year ended September 30: | |

| Class I Shares1 | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| | | | | |

| Net asset value, beginning of year | | | $11.76 | | | | $13.03 | | | | $11.72 | | | | $10.05 | | | | $9.51 | |

| | | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.19 | | | | 0.20 | | | | 0.16 | | | | 0.15 | | | | 0.17 | |

Net realized and unrealized gain (loss) | | | 0.01 | | | | (0.30) | | | | 1.50 | | | | 1.66 | | | | 0.68 | |

Total income (loss) from operations | | | 0.20 | | | | (0.10) | | | | 1.66 | | | | 1.81 | | | | 0.85 | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.17) | | | | (0.19) | | | | (0.10) | | | | (0.14) | | | | (0.12) | |

Net realized gains | | | (0.32) | | | | (0.98) | | | | (0.25) | | | | — | | | | (0.19) | |

Total distributions | | | (0.49) | | | | (1.17) | | | | (0.35) | | | | (0.14) | | | | (0.31) | |

| | | | | |

| Net asset value, end of year | | | $11.47 | | | | $11.76 | | | | $13.03 | | | | $11.72 | | | | $10.05 | |

Total return2 | | | 1.49 | % | | | (0.09) | % | | | 14.38 | % | | | 18.10 | % | | | 9.10 | % |

| | | | | |

| Net assets, end of year (000s) | | | $1,063 | | | | $1,432 | | | | $1,690 | | | | $1,418 | | | | $1,187 | |

| | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 0.81 | %3 | | | 0.82 | %3 | | | 0.80 | %3 | | | 1.00 | %3 | | | 1.19 | % |

Net expenses4,5 | | | 0.75 | 3 | | | 0.75 | 3 | | | 0.75 | 3 | | | 0.74 | 3 | | | 0.73 | |

Net investment income | | | 1.68 | | | | 1.76 | | | | 1.29 | | | | 1.39 | | | | 1.73 | |

| | | | | |

| Portfolio turnover rate | | | 141 | % | | | 126 | % | | | 91 | % | | | 83 | % | | | 112 | % |

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Reflects recapture of expenses waived/reimbursed from prior fiscal years. |

| 4 | Reflects fee waivers and/or expense reimbursements. |

| 5 | As a result of an expense limitation arrangement, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, dividend expense on short sales, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Class I shares did not exceed 0.75%. This expense limitation arrangement cannot be terminated prior to December 31, 2021 without the Board of Trustees’ consent. |

See Notes to Financial Statements.

| | |

| BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report | | 25 |

Financial highlights (cont’d)

| | | | | | | | | | | | | | | | | | | | |

| For a share of each class of beneficial interest outstanding throughout each year ended September 30: | |

| Class IS Shares1 | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| | | | | |

| Net asset value, beginning of year | | $ | 11.77 | | | $ | 13.04 | | | $ | 11.72 | | | $ | 10.06 | | | $ | 9.50 | |

| | | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.20 | | | | 0.22 | | | | 0.17 | | | | 0.15 | | | | 0.17 | |

Net realized and unrealized gain (loss) | | | 0.02 | | | | (0.31) | | | | 1.51 | | | | 1.65 | | | | 0.70 | |

Total income (loss) from operations | | | 0.22 | | | | (0.09) | | | | 1.68 | | | | 1.80 | | | | 0.87 | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.18) | | | | (0.20) | | | | (0.11) | | | | (0.14) | | | | (0.12) | |

Net realized gains | | | (0.32) | | | | (0.98) | | | | (0.25) | | | | — | | | | (0.19) | |

Total distributions | | | (0.50) | | | | (1.18) | | | | (0.36) | | | | (0.14) | | | | (0.31) | |

| | | | | |

| Net asset value, end of year | | $ | 11.49 | | | $ | 11.77 | | | $ | 13.04 | | | $ | 11.72 | | | $ | 10.06 | |

Total return2 | | | 1.66 | % | | | 0.01 | % | | | 14.51 | % | | | 18.07 | % | | | 9.34 | % |

| | | | | |

| Net assets, end of year (000s) | | $ | 169,544 | | | $ | 167,688 | | | $ | 156,361 | | | $ | 146,197 | | | $ | 28,712 | |

| | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 0.71 | %3 | | | 0.72 | %3 | | | 0.72 | %3 | | | 0.86 | %3 | | | 1.10 | % |

Net expenses4,5 | | | 0.65 | 3 | | | 0.65 | 3 | | | 0.65 | 3 | | | 0.65 | 3 | | | 0.65 | |

Net investment income | | | 1.75 | | | | 1.88 | | | | 1.37 | | | | 1.42 | | | | 1.80 | |

| | | | | |

| Portfolio turnover rate | | | 141 | % | | | 126 | % | | | 91 | % | | | 83 | % | | | 112 | % |

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Reflects recapture of expenses waived/reimbursed from prior fiscal years. |

| 4 | Reflects fee waivers and/or expense reimbursements. |

| 5 | As a result of an expense limitation arrangement, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, dividend expense on short sales, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Class IS shares did not exceed 0.65%. In addition, the ratio of total annual fund operating expenses for Class IS shares did not exceed the ratio of total annual fund operating expenses for Class I shares. These expense limitation arrangements cannot be terminated prior to December 31, 2021 without the Board of Trustees’ consent. |

See Notes to Financial Statements.

| | |

26 | | BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report |

Notes to financial statements

1. Organization and significant accounting policies

BrandywineGLOBAL — Dynamic US Large Cap Value Fund (the “Fund”) is a separate diversified investment series of Legg Mason Global Asset Management Trust (the “Trust”). The Trust, a Maryland statutory trust, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ. Subsequent events have been evaluated through the date the financial statements were issued.

(a) Investment valuation. Equity securities for which market quotations are available are valued at the last reported sales price or official closing price on the primary market or exchange on which they trade. The valuations for fixed income securities (which may include, but are not limited to, corporate, government, municipal, mortgage-backed, collateralized mortgage obligations and asset-backed securities) and certain derivative instruments are typically the prices supplied by independent third party pricing services, which may use market prices or broker/dealer quotations or a variety of valuation techniques and methodologies. The independent third party pricing services use inputs that are observable such as issuer details, interest rates, yield curves, prepayment speeds, credit risks/spreads, default rates and quoted prices for similar securities. Investments in open-end funds are valued at the closing net asset value per share of each fund on the day of valuation. When the Fund holds securities or other assets that are denominated in a foreign currency, the Fund will normally use the currency exchange rates as of 4:00 p.m. (Eastern Time). If independent third party pricing services are unable to supply prices for a portfolio investment, or if the prices supplied are deemed by the manager to be unreliable, the market price may be determined by the manager using quotations from one or more broker/dealers or at the transaction price if the security has recently been purchased and no value has yet been obtained from a pricing service or pricing broker. When reliable prices are not readily available, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund values these securities as determined in accordance with procedures approved by the Fund’s Board of Trustees.

The Board of Trustees is responsible for the valuation process and has delegated the supervision of the daily valuation process to the Legg Mason North Atlantic Fund Valuation Committee (the “Valuation Committee”). The Valuation Committee, pursuant to the policies adopted by the Board of Trustees, is responsible for making fair value determinations, evaluating the effectiveness of the Fund’s pricing policies, and reporting to the Board of

| | |

| BrandywineGLOBAL — Dynamic US Large Cap Value Fund 2020 Annual Report | | 27 |

Notes to financial statements (cont’d)