UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22338

Legg Mason Global Asset Management Trust

(Exact name of registrant as specified in charter)

100 International Drive, Baltimore, MD, 21202

(Address of principal executive offices) (Zip code)

Marc A. De Oliveira

Franklin Templeton

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 877-6LM-FUND/656-3863

Date of fiscal year end: October 31

Date of reporting period: October 31, 2022

| ITEM 1. | REPORT TO STOCKHOLDERS |

The Annual Report to Stockholders is filed herewith.

| | |

Annual Report | | October 31, 2022 |

BrandywineGLOBAL —

ALTERNATIVE CREDIT FUND

|

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objective

The Fund’s objective is to provide positive returns independent of market cycles through a high level of income and capital appreciation.

Letter from the president

Dear Shareholder,

We are pleased to provide the annual report of BrandywineGLOBAL — Alternative Credit Fund for the twelve-month reporting period ended October 31, 2022. Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.franklintempleton.com. Here you can gain immediate access to market and investment information, including:

| • | | Fund prices and performance, |

| • | | Market insights and commentaries from our portfolio managers, and |

| • | | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

November 30, 2022

| | |

II | | BrandywineGLOBAL — Alternative Credit Fund |

Fund overview

Q. What is the Fund’s investment strategy?

A. The Fund’s objective is to provide positive returns independent of market cycles through a high level of income and capital appreciation. Under normal circumstances, the Fund seeks to achieve its investment objective by taking a flexible, long and short global credit approach. The Fund will rotate amongst the global credit opportunities (long or short) that we at Brandywine Global Investment Management, LLC (“Brandywine Global”), the Fund’s subadviser, find most attractive and navigate the credit quality spectrum throughout the different phases of the business cycle. The Fund also has the flexibility to hedge or increase exposure to certain risks based on Brandywine Global’s macroeconomic views. The Fund expects to trade actively.

The Fund may invest in securities, derivatives and other financial instruments of issuers located anywhere in the world. The Fund may focus a significant portion of its investments in a single country or currency and may change a country or currency focus at any time based on the opportunities we find most attractive. In selecting investment opportunities, we may consider whether the security is denominated in a currency that we expect to appreciate versus the U.S. dollar.

The Fund may hold debt securities of any credit quality, whether rated or unrated. As a general guideline, the Fund over the long term normally aims to average at least 50% of its total assets in high yield securities (commonly known as “junk bonds”); however, this allocation may range from 0%-100% at any time. High yield bonds are those rated below investment grade (that is, securities rated below the Baa/BBB categories by at least one Nationally Recognized Statistical Rating Organization) or, if unrated, that we determined to be of comparable credit quality. The Fund’s investments may be rated either below investment grade or investment grade and may include, but are not limited to: corporate bonds; sovereign or government debt securities, including U.S. municipal securities; debt of supranational agencies; convertible securities; agency and non-agency mortgage-backed securities (“MBS”); asset-backed securities; bank loans; common and preferred stock; and currencies.

The Fund may invest a significant portion of its investments in certain types of investments, including agency and non-agency mortgage-backed securities. The Fund may invest in stripped mortgage-backed securities and other stripped securities. The Fund may enter into dollar rolls (sometimes referred to as mortgage dollar rolls). The Fund may hold instruments of any maturity or duration, and the securities may have fixed, floating or variable rates of interest. The weighted average effective duration of the Fund’s portfolio, including derivatives, is expected to range from -10 to 10 years. The Fund may invest in the equities of issuers of any market capitalization. It will not invest more than 20% of its total assets in equity securities.

The Fund may also enter into various derivative transactions for both hedging and non-hedging purposes, including as a substitute for buying or selling securities, for purposes of enhancing returns, which transactions may be regarded as speculative. These derivative

| | | | |

| BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report | | | | 1 |

Fund overview (cont’d)

transactions include, but are not limited to, forwards, futures, options, swaps, credit default swaps and commodity-linked investments. Further, the Fund may establish short positions, mainly through, but not limited to derivatives, to a substantial degree. Derivatives will not be used in a way that would cause the Fund to violate its investment guidelines, but there are no other percentage limits on the use of derivatives. The Fund may use one or more types of these instruments without limit. The Fund will not be leveraged through borrowing. However, certain types of derivatives have a leverage-like effect on the portfolio, in that they require a relatively small premium or margin payment in relation to the size of the investment exposure the Fund acquires.

The Fund is classified as “non-diversified,” which means it may invest a larger percentage of its assets in a small number of issuers than a diversified fund.

Q. What were the overall market conditions during the Fund’s reporting period?

A. After rebounding from the COVID-19 induced recession, the global economy then weakened during the twelve-month reporting period ended October 31, 2022, with increased fears of another recession on the horizon. Looking back, substantial fiscal and monetary support helped the global economy regain its footing following lockdowns and restrictions tied to the pandemic. However, an unintended consequence was a sharp increase in inflation, which was initially characterized as being “transitory” by Federal Reserve Chair Jerome Powell. This was partially based on expectations that supply chain bottlenecks would help to ease rising prices. However, pent-up consumer demand and the repercussions from the war in Ukraine pushed inflation sharply higher and most central banks then pivoted and began tightening monetary policy.

In the U.S., the Federal Reserve Board (the “Fed”) raised interest rates 0.25% (25 basis points) in March 2022, the first increase since 2018. This pushed the federal funds rate to a range between 0.25% and 0.50%. Two months later, the Fed raised the federal funds rate 50 basis points and with inflation continuing to surprise to the upside, the Fed raised rates 75 basis points at its meeting in June, the largest such increase since 1994. This was followed by similar 75 basis points hikes in both July and September. Finally, in early November—after the reporting period ended—the Fed again raised rates 75 basis points, pushing the federal funds rate to a range between 3.75% and 4.00%. The Bank of England, the European Central Bank, and numerous central banks in developing countries also aggressively raised rates during the reporting period.

Against this backdrop, the International Monetary Fund (the “IMF”) has repeatedly downgraded its expectations for global growth. In its October 2022 World Economic Outlook Update, the IMF said, “The global economy continues to face steep challenges, shaped by the lingering effects of three powerful forces: the Russian invasion of Ukraine, a cost-of-living crisis caused by persistent and broadening inflation pressures, and the slowdown in China.” The IMF now forecasts global gross domestic product (“GDP”) will be 3.2% in 2022, versus 6.0% in 2021. From a regional perspective, the IMF projects U.S. GDP will be 1.6% in 2022, compared to 5.7% in 2021. Elsewhere, the IMF expects 2022 GDP of 3.1% in the

| | | | |

2 | | | | BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report |

eurozone (from 5.2% in 2021), 3.6% in the U.K. (from 7.4% in 2021) and 1.7% in Japan (the same as in 2021).

Turning to the fixed income market, it experienced periods of volatility and fell sharply over the reporting period. Elevated inflation and aggressive central bank tightening took its toll, pushing yields higher and bond prices lower. The yield for the two-year Treasury note began the reporting period at 0.48% and ended at 4.51%. The yield for the ten-year Treasury note began the reporting period at 1.55% and ended at 4.10%. The same dynamic also occurred in most countries across the globe.

All told, the Bloomberg Global Aggregate Indexi and the Bloomberg U.S. Aggregate Indexii returned -20.79% and -15.68%, respectively, for the twelve months ended October 31, 2022. Riskier fixed-income securities, including high yield bonds and emerging market debt, also produced weak results. Over the reporting period, the Bloomberg U.S. Corporate High Yield

— 2% Issuer Cap Indexiii and the JPMorgan Emerging Markets Bond Index Globaliv returned -11.76% and -22.21%, respectively.

Q. How did we respond to these changing market conditions?

A. Beginning of the reporting period, we held outsized exposures across the structured credit space, with allocations to residential mortgage-backed securities (“RMBS”), commercial mortgage-backed securities (“CMBS”), subprime asset-backed securities (“ABS”), and collateralized loan obligations (“CLO”). We also allocated to corporate credit, notably in shorter-term higher-quality high yield issues, as well as having significant notional exposure to credit via protection selling in both straight credit default swaps and credit default swap indexes. As inflation persisted and markets deteriorated over the reporting period, we searched for opportunities to limit downside and potentially achieve positive returns with tactical positions. Overall portfolio duration was reduced over the reporting period, while we moved up portfolio credit quality amid heightened risks across markets. In early summer 2022, when markets became increasingly volatile and the Fed remained stubbornly hawkish, we sold out of select cash bonds in favor of U.S. Treasury floaters, which reduced much of the performance pain witnessed across asset classes in summer and fall. Over the reporting period, tactical shorting of stock index futures allowed us to short volatility in equity markets, while both long and short bond futures enabled us to hedge duration or invest in yield curve trends in both the U.S. and Europe. Market volatility has created attractive valuations as of late. Toward the end of the reporting period, we selectively invested in credit risk transfer securities (“CRTs”), high-quality seasoned BBB-rated CMBS, and higher-yielding bonds at the top of their respective capital stacks.

During the reporting period, the Fund used interest rate futures and stock index futures. The use of these instruments contributed to performance. The Fund’s credit default swap positions, which were used to manage its high yield credit exposure, detracted from results. Currency forwards, which were used to manage the Fund’s currency exposures, also contributed to results.

| | | | |

| BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report | | | | 3 |

Fund overview (cont’d)

Performance review

For the twelve months ended October 31, 2022, Class IS shares of BrandywineGLOBAL — Alternative Credit Fund returned -4.73%. The Fund’s unmanaged benchmark, the FTSE 3-Month U.S. Treasury Bill Indexv, returned 0.88%, for the same period. The Lipper Alternative Credit Focus Funds Category Averagevi returned -9.85% over the same time frame.

| | | | | | | | |

Performance Snapshot as of October 31, 2022 (unaudited) | |

| (excluding sales charges) | | 6 months | | | 12 months | |

| BrandywineGLOBAL — Alternative Credit Fund: | | | | | | | | |

Class A | | | -2.20 | % | | | -5.15 | % |

Class C | | | -2.47 | % | | | -5.67 | % |

Class FI | | | -2.23 | % | | | -5.18 | % |

Class I | | | -1.93 | % | | | -4.91 | % |

Class IS | | | -1.99 | % | | | -4.73 | % |

| FTSE 3-Month U.S. Treasury Bill Index | | | 0.81 | % | | | 0.88 | % |

| Lipper Alternative Credit Focus Funds Category Average | | | -4.94 | % | | | -9.85 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value, investment returns and yields will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.franklintempleton.com.

All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all Fund expenses. Returns have not been adjusted to include sales charges that may apply or the deduction of taxes that a shareholder would pay on Fund distributions. If sales charges were reflected, the performance quoted would have been lower. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Fund performance figures reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

The 30-Day SEC Yields for the period ended October 31, 2022 for Class A, Class C, Class FI, Class I and Class IS shares were 4.27%, 3.75%, 4.41%, 4.72% and 4.82%, respectively. Absent fee waivers and/or expense reimbursements, the 30-Day SEC Yields for Class A, Class C, Class FI, Class I and Class IS shares were 4.20%, 3.65%, 4.15%, 4.55% and 4.70%, respectively. The 30-Day SEC Yield, calculated pursuant to the standard SEC formula, is based on the Fund’s investments over an annualized trailing 30-day period, and not on the distributions paid by the Fund, which may differ.

The Fund is the successor to an institutional account (the “Predecessor”). On November 29, 2013, the Predecessor transferred its assets to the Fund in exchange for the Fund’s Class IS shares.

|

| Total Annual Operating Expenses (unaudited) |

As of the Fund’s current prospectus dated March 1, 2022, the gross total annual fund operating expense ratios for Class A, Class C, Class FI, Class I and Class IS shares were 1.68%, 2.36%, 1.81%, 1.35% and 1.29%, respectively.

| | | | |

4 | | | | BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report |

Actual expenses may be higher. For example, expenses may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile.

As a result of expense limitation arrangements, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, dividend expense on short sales, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets will not exceed 1.65% for Class A shares, 2.40% for Class C shares, 1.65% for Class FI shares, 1.35% for Class I shares and 1.25% for Class IS shares. In addition, the ratio of total annual fund operating expenses for Class IS shares will not exceed the ratio of total annual fund operating expenses for Class I shares. These expense limitation arrangements cannot be terminated prior to December 31, 2024 without the Board of Trustees’ consent. In addition, the manager has agreed to waive the Fund’s management fee to an extent sufficient to offset the net management fee payable in connection with any investment in an affiliated money market fund. This management fee waiver is not subject to the recapture provision discussed below.

The manager is permitted to recapture amounts waived and/or reimbursed to a class within three years after the fiscal year in which the manager earned the fee or incurred the expense if the class’ total annual fund operating expenses have fallen to a level below the expense limitation (“expense cap”) in effect at the time the fees were earned or the expenses incurred. In no case will the manager recapture any amount that would result, on any particular business day of the Fund, in the class’ total annual fund operating expenses exceeding the expense cap or any other lower limit then in effect.

Q. What were the leading contributors to performance?

A. The largest contributor to performance for the Fund came from our tactical allocations to stock index futures and interest rate futures. Short positions on broad-based U.S. equity indices provided significant cushion during a year marked by asset-wide downturns. The portfolio saw consistent success in short NASDAQvii futures throughout the reporting period, further supported by other short futures positions in the S&P 500 Indexviii and the Dow Jones Industrial Indexix, that especially ramped up in summer 2022. Both long and short U.S. interest rate futures were accretive to the portfolio over the reporting period, as we successfully timed our tactical allocations. In particular, short-term, opportunistic plays on the U.S. five-year yield curve reaped the lion’s share of gains amidst heightened rate volatility over the past six months. More recent short positions on the U.S. ten-year yield curve and Italian yield curve have also benefited the portfolio. We have been able to close out of these positions to realize gains and reassess our options when conditions are favorable. In a reporting period marked by negative returns and unprecedented cross-asset correlations, these allocations stabilized the Fund by contributing positive absolute performance.

Q. What were the leading detractors from performance?

A. To say that it has been a challenging period for structured credit would be an understatement. In particular, the U.S. MBS market has experienced negative returns. For example, the MBS portion of the Bloomberg Global Aggregate Index was the largest

| | | | |

| BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report | | | | 5 |

Fund overview (cont’d)

detractor amongst subindices, and several broad-based MBS indices are logging their largest drawdowns ever recorded, with double-digit negative performance over the reporting period. Despite the broad-based poor performance of U.S. MBS, the portfolio managed to eke out a small positive contribution over the reporting period from U.S. RMBS. This is attributable to the strategy’s outsized exposure to floaters (roughly 85% of our U.S. RMBS positions), where coupons adjust according to market conditions, and the residential real estate market’s strength relative to corporate real estate over the reporting period. The same cannot be said for the exposure to lower quality Spanish RMBS, which saw significant negative performance due to unrelenting U.S. dollar strength and weakening credit conditions in Europe. Although these bonds represented 5% to 6% of the portfolio, they were responsible for the majority of the negative Fund performance in the reporting period. U.S. CMBS also significantly detracted over the reporting period. The majority of CMBS positions were fixed rate and concentrated in office space — a subcategory that has experienced challenges following the COVID-19 pandemic and subsequent hybrid work environment.

Thank you for your investment in BrandywineGLOBAL — Alternative Credit Fund. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

Brian L. Kloss, JD, CPA

Portfolio Manager

Brandywine Global Investment Management, LLC

Tracy Chen, CFA, CAIA

Portfolio Manager

Brandywine Global Investment Management, LLC

November 12, 2022

RISKS: Fixed income securities involve interest rate, credit, inflation and reinvestment risks. As interest rates rise, the value of fixed income securities falls. High-yield bonds, known as “junk bonds”, possess greater price volatility, illiquidity and possibility of default than higher-grade bonds. Asset-backed, mortgage-backed or mortgage related securities are subject to prepayment and extension risks. International investments are subject to special risks, including currency fluctuations, as well as social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Emerging markets countries tend to

| | | | |

6 | | | | BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report |

have economic, political and legal systems that are less developed and are less stable than those of more developed countries. To the extent the Fund focuses its investments in a single country or only a few countries in a particular geographic region, economic, political, regulatory or other conditions affecting such country or region may have a greater impact on Fund performance relative to a more geographically diversified fund. Equity securities are subject to market and price fluctuations. The Fund may use derivatives to a significant extent, which could result in substantial losses and greater volatility in the Fund’s net assets. Derivatives, such as options and futures, can be illiquid, may disproportionately increase losses and have a potentially large impact on Fund performance. Potential active and frequent trading may result in higher transaction costs and increased investor liability. The use of leverage may increase volatility and possibility of loss. The Fund is non-diversified and may invest its assets in a smaller number of issuers than a diversified fund, which may magnify the Fund’s losses from events affecting a particular issuer. The managers’ investment style may become out of favor and/or the managers’ selection process may prove incorrect, which may have a negative impact on the Fund’s performance. Please see the Fund’s prospectus for a more complete discussion of these and other risks and the Fund’s investment strategies.

Portfolio holdings and breakdowns are as of October 31, 2022 and are subject to change and may not be representative of the portfolio managers’ current or future investments. Please refer to pages 15 through 21 for a list and percentage breakdown of the Fund’s holdings.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| | | | |

| BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report | | | | 7 |

Fund overview (cont’d)

| i | The Bloomberg Global Aggregate Index is a market-weighted index of global government, government-related agencies, corporate and securitized fixed-income investments. |

| ii | The Bloomberg U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage-and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

| iii | The Bloomberg U.S. Corporate High Yield — 2% Issuer Cap Index is an index of the 2% Issuer Cap component of the Bloomberg U.S. Corporate High Yield Index, which covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market. |

| iv | The JPMorgan Emerging Markets Bond Index Global tracks total returns for U.S. dollar-denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans, Eurobonds and local market instruments. |

| v | The FTSE 3-Month U.S. Treasury Bill Index is an unmanaged index generally representative of the average yield of 3-month U.S. Treasury bills. |

| vi | Lipper, Inc., a wholly-owned subsidiary of Refinitiv, provides independent insight on global collective investments. Returns are based on the period ended October 31, 2022, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 100 funds for the six-month period and among the 98 funds for the twelve-month period in the Fund’s Lipper category, and excluding sales charges, if any. |

| vii | The NASDAQ Composite Index is a market capitalization-weighted index of the approximate 2,500 equities listed on the NASDAQ stock exchange. The index contains companies in the information technology sector. |

| viii | The S&P 500 Index is an unmanaged index of the stocks of 500 leading companies, and is generally representative of the performance of larger companies in the U.S. |

| ix | The Dow Jones Industrial Average is a price-weighted index that tracks 30 large, publicly-owned companies trading on the New York Stock Exchange and the NASDAQ. |

| | | | |

8 | | | | BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report |

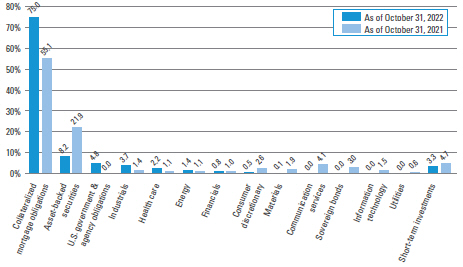

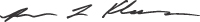

Fund at a glance† (unaudited)

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of October 31, 2022 and October 31, 2021 and does not include derivatives, such as futures contracts, forward foreign currency contracts and swap contracts. The Fund is actively managed. As a result, the composition of the Fund’s investments is subject to change at any time. |

| | | | |

| BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report | | | | 9 |

Fund expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end and back-end sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; service and/or distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on May 1, 2022 and held for the six months ended October 31, 2022.

Actual expenses

The table below titled “Based on actual total return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on hypothetical total return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or back-end sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| Based on actual total return1 | | | | | | Based on hypothetical total return1 | |

| | | Actual Total Return Without Sales Charge2 | | | Beginning Account Value | | | Ending Account Value | | | Annualized Expense Ratio | | | Expenses Paid During the Period3 | | | | | | | | Hypothetical Annualized Total Return | | | Beginning Account Value | | | Ending Account Value | | | Annualized Expense Ratio | | | Expenses Paid During the Period3 | |

| Class A | | | -2.20 | % | | $ | 1,000.00 | | | $ | 978.00 | | | | 1.65 | % | | $ | 8.23 | | | | | | | Class A | | | 5.00 | % | | $ | 1,000.00 | | | $ | 1,016.89 | | | | 1.65 | % | | $ | 8.39 | |

| Class C | | | -2.47 | | | | 1,000.00 | | | | 975.30 | | | | 2.33 | | | | 11.60 | | | | | | | Class C | | | 5.00 | | | | 1,000.00 | | | | 1,013.46 | | | | 2.33 | | | | 11.82 | |

| Class FI | | | -2.23 | | | | 1,000.00 | | | | 977.70 | | | | 1.65 | | | | 8.23 | | | | | | | Class FI | | | 5.00 | | | | 1,000.00 | | | | 1,016.89 | | | | 1.65 | | | | 8.39 | |

| Class I | | | -1.93 | | | | 1,000.00 | | | | 980.70 | | | | 1.35 | | | | 6.74 | | | | | | | Class I | | | 5.00 | | | | 1,000.00 | | | | 1,018.40 | | | | 1.35 | | | | 6.87 | |

| Class IS | | | -1.99 | | | | 1,000.00 | | | | 980.10 | | | | 1.25 | | | | 6.24 | | | | | | | Class IS | | | 5.00 | | | | 1,000.00 | | | | 1,018.90 | | | | 1.25 | | | | 6.36 | |

| | | | |

10 | | | | BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report |

| 1 | For the six months ended October 31, 2022. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charge with respect to Class A shares or the applicable contingent deferred sales charge (“CDSC”) with respect to Class C shares. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Expenses (net of compensating balance arrangements, fee waivers and/or expense reimbursements) are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

| | | | |

| BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report | | | | 11 |

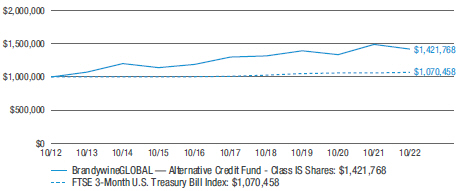

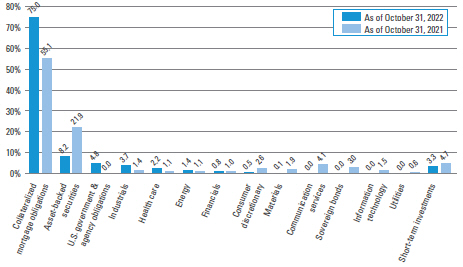

Fund performance (unaudited)

BrandywineGLOBAL — Alternative Credit Fund (the “Fund”) is the successor to an institutional account (the “Predecessor”). The performance in the accompanying table and line graph includes performance of the Predecessor. The Predecessor’s inception date was August 31, 2010. On November 29, 2013, the Predecessor transferred its assets to the Fund in exchange for the Fund’s Class IS shares. The investment policies, objectives, guidelines and restrictions of the Fund are in all material respects equivalent to those of the Predecessor. In addition, the Predecessor’s portfolio managers are the current portfolio managers of the Fund. As a mutual fund registered under the Investment Company Act of 1940, the Fund is subject to certain restrictions under the 1940 Act and the Internal Revenue Code to which the Predecessor was not subject. Had the Predecessor been registered under the 1940 Act and been subject to the provisions of the 1940 Act and the Code, its investment performance may have been adversely affected. The performance was achieved by the Predecessor when fund assets were relatively small; the same strategies may not be available, and similar performance may not be achieved, when the fund’s assets are larger. The performance information reflects the expenses of the Predecessor adjusted to reflect the highest management fees paid by an investor of the Predecessor which fees were separately paid by such investors. The performance shown includes an annual management fee of 1.75% and does not include any expenses paid by the Predecessor’s adviser.

The Predecessor did not have distribution policies. The Predecessor was an unregistered separately managed account, did not qualify as a regulated investment company for federal income tax purposes and did not pay dividends or distributions.

| | | | | | | | | | | | | | | | | | | | |

| Average annual total returns | | | | | | | | | | | | | | | |

| Without sales charges1 | | Class A | | | Class C | | | Class FI | | | Class I | | | Class IS | |

| Twelve Months Ended 10/31/22 | | | -5.15 | % | | | -5.67 | % | | | -5.18 | % | | | -4.91 | % | | | -4.73 | % |

| Five Years Ended 10/31/22 | | | 1.38 | | | | 0.63 | | | | 1.35 | | | | 1.70 | | | | 1.78 | |

| Ten Years Ended 10/31/22 | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 3.58 | |

| Inception* through 10/31/22 | | | 2.74 | | | | 2.01 | | | | 2.71 | | | | 3.04 | | | | — | |

| | | | | |

| With sales charges2 | | Class A | | | Class C | | | Class FI | | | Class I | | | Class IS | |

| Twelve Months Ended 10/31/22 | | | -9.18 | % | | | -6.59 | % | | | -5.18 | % | | | -4.91 | % | | | -4.73 | % |

| Five Years Ended 10/31/22 | | | 0.51 | | | | 0.63 | | | | 1.35 | | | | 1.70 | | | | 1.78 | |

| Ten Years Ended 10/31/22 | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 3.58 | |

| Inception* through 10/31/22 | | | 2.24 | | | | 2.01 | | | | 2.71 | | | | 3.04 | | | | — | |

| | | | |

| Cumulative total returns | |

| Without sales charges1 | | | |

| Class A (Inception date of 12/2/13 through 10/31/22) | | | 27.20 | % |

| Class C (Inception date of 12/2/13 through 10/31/22) | | | 19.38 | |

| Class FI (Inception date of 12/2/13 through 10/31/22) | | | 26.90 | |

| Class I (Inception date of 12/2/13 through 10/31/22) | | | 30.64 | |

| Class IS (10/31/12 through 10/31/22) | | | 42.18 | |

| | | | |

12 | | | | BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report |

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower.

| 1 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charge with respect to Class A shares or the applicable contingent deferred sales charge (“CDSC”) with respect to Class C shares. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. In addition, Class A shares reflect the deduction of the maximum initial sales charge of 3.75% (4.25% prior to August 15, 2022). Class C shares reflect the deduction of a 1.00% CDSC, which applies if shares are redeemed within one year from purchase payment. |

| * | Inception dates for Class A, C, FI, I and IS shares are December 2, 2013, December 2, 2013, December 2, 2013, December 2, 2013 and August 31, 2010, respectively. |

| | | | |

| BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report | | | | 13 |

Fund performance (unaudited) (cont’d)

Historical performance

Value of $1,000,000 invested in

Class IS Shares of BrandywineGLOBAL — Alternative Credit Fund vs. FTSE 3-Month U.S. Treasury Bill Index† — October 2012 - October 2022

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower.

| † | Hypothetical illustration of $1,000,000 invested in Class IS shares of BrandywineGLOBAL — Alternative Credit Fund on October 31, 2012, assuming the reinvestment of all distributions, including returns of capital, if any, at net asset value through October 31, 2022. The hypothetical illustration also assumes a $1,000,000 investment in the FTSE 3-Month U.S. Treasury Bill Index. The FTSE 3-Month U.S. Treasury Bill Index (the “Index”) is comprised of a single issue purchased at the beginning of the month and held for a full month. Each month the Index is rebalanced and the issue selected is the outstanding U.S. Treasury Bill that matures closest to, but not beyond 3 months from the rebalancing date. The Index is unmanaged and is not subject to the same management and trading expenses as a mutual fund. Please note that an investor cannot invest directly in an index. The performance of the Fund’s other classes may be greater or less than the Class IS shares’ performance indicated on this chart, depending on whether greater or lesser sales charges and fees were incurred by shareholders investing in the other classes. |

| | | | |

14 | | | | BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report |

Schedule of investments

October 31, 2022

BrandywineGLOBAL — Alternative Credit Fund

(Percentages shown based on Fund net assets)

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

| Collateralized Mortgage Obligations (a) — 71.9% | | | | | | | | | | | | | | | | |

Citigroup Commercial Mortgage Trust, 2013-GC17 C | | | 5.101 | % | | | 11/10/46 | | | | 5,320,000 | | | $ | 5,033,501 | (b) |

Citigroup Commercial Mortgage Trust, 2014-GC23 D | | | 4.481 | % | | | 7/10/47 | | | | 1,840,000 | | | | 1,662,942 | (b)(c) |

COLT Mortgage Loan Trust, 2022-7 A2 | | | 6.027 | % | | | 4/25/67 | | | | 3,853,390 | | | | 3,682,291 | (b)(c) |

Federal Home Loan Mortgage Corp. (FHLMC) REMIC, Structured Agency Credit Risk Debt Notes, 2020-DNA4 B1 (1 mo. USD LIBOR + 6.000%) | | | 9.586 | % | | | 8/25/50 | | | | 3,800,000 | | | | 3,977,062 | (b)(c) |

Federal Home Loan Mortgage Corp. (FHLMC) Structured Agency Credit Risk Debt Notes, 2018- HRP2 B1 (1 mo. USD LIBOR + 4.200%) | | | 7.786 | % | | | 2/25/47 | | | | 3,542,000 | | | | 3,449,903 | (b)(c) |

Federal Home Loan Mortgage Corp. (FHLMC) Structured Agency Credit Risk Debt Notes, 2019- HRP1 M3 (1 mo. USD LIBOR + 2.250%) | | | 5.836 | % | | | 2/25/49 | | | | 5,660,000 | | | | 5,211,588 | (b)(c) |

Federal National Mortgage Association (FNMA) — CAS, 2015-C04 1M2 (1 mo. USD LIBOR + 5.700%) | | | 9.286 | % | | | 4/25/28 | | | | 1,987,841 | | | | 2,095,828 | (b) |

Federal National Mortgage Association (FNMA) — CAS, 2017-C01 1B1 (1 mo. USD LIBOR + 5.750%) | | | 9.336 | % | | | 7/25/29 | | | | 2,410,000 | | | | 2,573,243 | (b) |

Federal National Mortgage Association (FNMA) — CAS, 2017-C06 1B1 (1 mo. USD LIBOR + 4.150%) | | | 7.736 | % | | | 2/25/30 | | | | 1,752,404 | | | | 1,779,426 | (b) |

Federal National Mortgage Association (FNMA) — CAS, 2018-C01 1B1 (1 mo. USD LIBOR + 3.550%) | | | 7.136 | % | | | 7/25/30 | | | | 4,700,000 | | | | 4,695,142 | (b) |

Federal National Mortgage Association (FNMA) — CAS, 2018-R07 1B1 (1 mo. USD LIBOR + 4.350%) | �� | | 7.936 | % | | | 4/25/31 | | | | 3,600,000 | | | | 3,553,826 | (b)(c) |

Federal National Mortgage Association (FNMA) — CAS, 2019-R02 1B1 (1 mo. USD LIBOR + 4.150%) | | | 7.736 | % | | | 8/25/31 | | | | 3,800,000 | | | | 3,732,970 | (b)(c) |

Federal National Mortgage Association (FNMA) — CAS, 2019-R03 1B1 (1 mo. USD LIBOR + 4.100%) | | | 7.686 | % | | | 9/25/31 | | | | 2,000,000 | | | | 1,992,018 | (b)(c) |

Federal National Mortgage Association (FNMA) — CAS, 2019-R04 2B1 (1 mo. USD LIBOR + 5.250%) | | | 8.836 | % | | | 6/25/39 | | | | 2,907,496 | | | | 2,880,580 | (b)(c) |

Federal National Mortgage Association (FNMA) — CAS, 2019-R05 1B1 (1 mo. USD LIBOR + 4.100%) | | | 7.686 | % | | | 7/25/39 | | | | 8,850,415 | | | | 8,657,325 | (b)(c) |

Federal National Mortgage Association (FNMA) — CAS, 2019-R06 2B1 (1 mo. USD LIBOR + 3.750%) | | | 7.336 | % | | | 9/25/39 | | | | 4,820,000 | | | | 4,529,678 | (b)(c) |

Federal National Mortgage Association (FNMA) — CAS, 2019-R07 1B1 (1 mo. USD LIBOR + 3.400%) | | | 6.986 | % | | | 10/25/39 | | | | 4,015,000 | | | | 3,815,799 | (b)(c) |

Federal National Mortgage Association (FNMA) — CAS, 2021-R01 1M1 (30 Day Average SOFR + 0.750%) | | | 3.747 | % | | | 10/25/41 | | | | 4,808,623 | | | | 4,734,848 | (b)(c) |

GC Pastor Hipotecario FTA, 5 A2 (3 mo. EURIBOR + 0.170%, 0.000% floor) | | | 1.236 | % | | | 6/21/46 | | | | 1,586,282 | EUR | | | 1,407,857 | (b)(d) |

See Notes to Financial Statements.

| | | | |

| BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report | | | | 15 |

Schedule of investments (cont’d)

October 31, 2022

BrandywineGLOBAL — Alternative Credit Fund

(Percentages shown based on Fund net assets)

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

| Collateralized Mortgage Obligations (a) — continued | | | | | | | | | | | | | |

IM Pastor FTH, 3 B (3 mo. EURIBOR + 0.290%) | | | 1.390 | % | | | 3/22/43 | | | | 8,800,000 | EUR | | $ | 5,411,972 | (b)(d) |

JPMBB Commercial Mortgage Securities Trust, 2015-C28 C | | | 4.182 | % | | | 10/15/48 | | | | 4,080,000 | | | | 3,703,786 | (b) |

Wells Fargo Commercial Mortgage Trust, 2015-C28 D | | | 4.083 | % | | | 5/15/48 | | | | 2,605,000 | | | | 2,225,699 | (b) |

Wells Fargo Commercial Mortgage Trust, 2019-C51 D | | | 3.000 | % | | | 6/15/52 | | | | 3,689,000 | | | | 2,553,695 | (c) |

Wells Fargo Commercial Mortgage Trust, 2020-C57 D | | | 2.500 | % | | | 8/15/53 | | | | 2,738,000 | | | | 1,742,590 | (c) |

Total Collateralized Mortgage Obligations (Cost — $89,488,726) | | | | | | | | 85,103,569 | |

| Corporate Bonds & Notes — 8.2% | | | | | | | | | | | | | | | | |

| Consumer Discretionary — 0.5% | | | | | | | | | | | | | | | | |

Hotels, Restaurants & Leisure — 0.5% | | | | | | | | | | | | | | | | |

Viking Cruises Ltd., Senior Secured Notes | | | 13.000 | % | | | 5/15/25 | | | | 500,000 | | | | 538,812 | (c) |

| Energy — 1.3% | | | | | | | | | | | | | | | | |

Oil, Gas & Consumable Fuels — 1.3% | | | | | | | | | | | | | | | | |

Magnolia Oil & Gas Operating LLC/Magnolia Oil & Gas Finance Corp., Senior Notes | | | 6.000 | % | | | 8/1/26 | | | | 1,605,000 | | | | 1,561,381 | (c) |

| Financials — 0.8% | | | | | | | | | | | | | | | | |

Thrifts & Mortgage Finance — 0.8% | | | | | | | | | | | | | | | | |

Freedom Mortgage Corp., Senior Notes | | | 8.250 | % | | | 4/15/25 | | | | 1,120,000 | | | | 959,110 | (c) |

| Health Care — 2.1% | | | | | | | | | | | | | | | | |

Pharmaceuticals — 2.1% | | | | | | | | | | | | | | | | |

Horizon Therapeutics USA Inc., Senior Notes | | | 5.500 | % | | | 8/1/27 | | | | 1,480,000 | | | | 1,428,104 | (c) |

Teva Pharmaceutical Finance Netherlands III BV, Senior Notes | | | 2.800 | % | | | 7/21/23 | | | | 1,060,000 | | | | 1,032,032 | |

Total Health Care | | | | | | | | | | | | | | | 2,460,136 | |

| Industrials — 3.5% | | | | | | | | | | | | | | | | |

Aerospace & Defense — 1.0% | | | | | | | | | | | | | | | | |

TransDigm Inc., Senior Secured Notes | | | 6.250 | % | | | 3/15/26 | | | | 1,230,000 | | | | 1,215,406 | (c) |

Airlines — 1.8% | | | | | | | | | | | | | | | | |

Allegiant Travel Co., Senior Secured Notes | | | 7.250 | % | | | 8/15/27 | | | | 2,280,000 | | | | 2,146,867 | (c) |

Machinery — 0.7% | | | | | | | | | | | | | | | | |

HTA Group Ltd., Senior Notes | | | 7.000 | % | | | 12/18/25 | | | | 935,000 | | | | 825,138 | (d) |

Total Industrials | | | | | | | | | | | | | | | 4,187,411 | |

Total Corporate Bonds & Notes (Cost — $10,129,549) | | | | | | | | | | | | 9,706,850 | |

| Asset-Backed Securities — 7.9% | | | | | | | | | | | | | | | | |

American Credit Acceptance Receivables Trust, 2020-4 F | | | 5.220 | % | | | 8/13/27 | | | | 1,300,000 | | | | 1,231,786 | (c) |

See Notes to Financial Statements.

| | | | |

16 | | | | BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report |

BrandywineGLOBAL — Alternative Credit Fund

(Percentages shown based on Fund net assets)

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

| Asset-Backed Securities — continued | | | | | | | | | | | | | | | | |

Neuberger Berman Loan Advisers CLO Ltd., 2017-26A D (3 mo. USD LIBOR + 2.650%) | | | 6.844 | % | | | 10/18/30 | | | | 1,055,000 | | | $ | 932,770 | (b)(c) |

Santander Drive Auto Receivables Trust, 2020-3 D | | | 1.640 | % | | | 11/16/26 | | | | 4,587,000 | | | | 4,385,118 | |

Westlake Automobile Receivables Trust, 2020-3A D | | | 1.650 | % | | | 2/17/26 | | | | 3,000,000 | | | | 2,792,280 | (c) |

Total Asset-Backed Securities (Cost — $9,759,043) | | | | | | | | | | | | 9,341,954 | |

| U.S. Government & Agency Obligations — 4.6% | | | | | | | | | | | | | | | | |

U.S. Government Obligations — 4.6% | | | | | | | | | | | | | | | | |

U.S. Treasury Notes (3 mo. U.S. Treasury Money Market Yield—0.075%)

(Cost — $5,496,032) | | | 4.037 | % | | | 4/30/24 | | | | 5,500,000 | | | | 5,492,013 | (b) |

| | | | |

| | | | | | | | | Shares | | | | |

| Common Stocks — 0.1% | | | | | | | | | | | | | | | | |

| Materials — 0.1% | | | | | | | | | | | | | | | | |

Chemicals — 0.1% | | | | | | | | | | | | | | | | |

Danimer Scientific Inc. (Cost — $2,409,899) | | | | | | | | | | | 37,903 | | | | 99,306 | * |

Total Investments before Short-Term Investments (Cost — $117,283,249) | | | | 109,743,692 | |

| | | | |

| | | Rate | | | | | | | | | | |

| Short-Term Investments — 3.2% | | | | | | | | | | | | | | | | |

Western Asset Premier Institutional U.S. Treasury Reserves, Premium Shares (Cost — $3,761,831) | | | 3.147 | % | | | | | | | 3,761,831 | | | | 3,761,831 | (e)(f) |

Total Investments — 95.9% (Cost — $121,045,080) | | | | | | | | | | | | | | | 113,505,523 | |

Other Assets in Excess of Liabilities — 4.1% | | | | | | | | | | | | | | | 4,874,821 | |

Total Net Assets — 100.0% | | | | | | | | | | | | | | $ | 118,380,344 | |

See Notes to Financial Statements.

| | | | |

| BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report | | | | 17 |

Schedule of investments (cont’d)

October 31, 2022

BrandywineGLOBAL — Alternative Credit Fund

| † | Face amount denominated in U.S. dollars, unless otherwise noted. |

| * | Non-income producing security. |

| (a) | Collateralized mortgage obligations are secured by an underlying pool of mortgages or mortgage pass-through certificates that are structured to direct payments on underlying collateral to different series or classes of the obligations. The interest rate may change positively or inversely in relation to one or more interest rates, financial indices or other financial indicators and may be subject to an upper and/or lower limit. |

| (b) | Variable rate security. Interest rate disclosed is as of the most recent information available. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description above. |

| (c) | Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to guidelines approved by the Board of Trustees. |

| (d) | Security is exempt from registration under Regulation S of the Securities Act of 1933. Regulation S applies to securities offerings that are made outside of the United States and do not involve direct selling efforts in the United States. This security has been deemed liquid pursuant to guidelines approved by the Board of Trustees. |

| (e) | Rate shown is one-day yield as of the end of the reporting period. |

| (f) | In this instance, as defined in the Investment Company Act of 1940, an “Affiliated Company” represents Fund ownership of at least 5% of the outstanding voting securities of an issuer, or a company which is under common ownership or control with the Fund. At October 31, 2022, the total market value of investments in Affiliated Companies was $3,761,831 and the cost was $3,761,831 (Note 8). |

| | |

Abbreviation(s) used in this schedule: |

| |

| CAS | | — Connecticut Avenue Securities |

| |

| CLO | | — Collateralized Loan Obligation |

| |

| EUR | | — Euro |

| |

| EURIBOR | | — Euro Interbank Offered Rate |

| |

| LIBOR | | — London Interbank Offered Rate |

| |

| REMIC | | — Real Estate Mortgage Investment Conduit |

| |

| SOFR | | — Secured Overnight Financing Rate |

| |

| USD | | — United States Dollar |

At October 31, 2022, the Fund had the following open futures contracts:

| | | | | | | | | | | | | | | | | | | | |

| | | Number of Contracts | | | Expiration

Date | | | Notional

Amount | | | Market Value | | | Unrealized

Depreciation | |

| Contracts to Buy: | | | | | | | | | | | | | | | | | | | | |

| U.S. Treasury 10-Year Notes | | | 88 | | | | 12/22 | | | $ | 9,827,094 | | | $ | 9,732,250 | | | $ | (94,844) | |

| U.S. Treasury Ultra Long-Term Bonds | | | 80 | | | | 12/22 | | | | 10,315,414 | | | | 10,212,500 | | | | (102,914) | |

| | | | | | | | | | | | | | | | | | | | (197,758) | |

| Contracts to Sell: | | | | | | | | | | | | | | | | | | | | |

| E-mini Nasdaq 100 Index | | | 55 | | | | 12/22 | | | | 12,261,430 | | | | 12,591,975 | | | | (330,545) | |

| E-mini S&P 500 Index | | | 32 | | | | 12/22 | | | | 5,927,734 | | | | 6,212,800 | | | | (285,066) | |

| Euro-Bobl | | | 112 | | | | 12/22 | | | | 13,117,039 | | | | 13,245,554 | | | | (128,515) | |

| Euro-OAT | | | 55 | | | | 12/22 | | | | 7,061,717 | | | | 7,222,527 | | | | (160,810) | |

See Notes to Financial Statements.

| | | | |

18 | | | | BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report |

BrandywineGLOBAL — Alternative Credit Fund

| | | | | | | | | | | | | | | | | | | | |

| | | Number of Contracts | | | Expiration

Date | | | Notional

Amount | | | Market Value | | | Unrealized

Depreciation | |

| Contracts to Sell continued | | | | | | | | | | | | | | | | | | | | |

| United Kingdom Long Gilt Bonds | | | 50 | | | | 12/22 | | | $ | 5,284,075 | | | $ | 5,856,134 | | | $ | (572,059) | |

| | | | | | | | | | | | | | | | | | | | (1,476,995) | |

| Net unrealized depreciation on open futures contracts | | | | | | | | | | | $ | (1,674,753) | |

| | |

Abbreviation(s) used in this table: |

| |

| Bobl | | — Bundesobligation |

| |

| OAT | | — Obligations Assimilables du Trésor (French Treasury Bonds) |

At October 31, 2022, the Fund had the following open forward foreign currency contracts:

| | | | | | | | | | | | | | | | | | | | |

Currency Purchased | | | Currency Sold | | | Counterparty | | Settlement

Date | | | Unrealized

Appreciation

(Depreciation) | |

| EUR | | | 740,000 | | | USD | | | 739,855 | | | Barclays Bank PLC | | | 11/2/22 | | | $ | (8,450) | |

| EUR | | | 7,320,000 | | | USD | | | 7,293,941 | | | Barclays Bank PLC | | | 11/2/22 | | | | (58,965) | |

| USD | | | 10,799,042 | | | EUR | | | 10,540,000 | | | Barclays Bank PLC | | | 11/2/22 | | | | 381,466 | |

| USD | | | 2,676,775 | | | EUR | | | 2,710,000 | | | Goldman Sachs Group Inc. | | | 11/2/22 | | | | (1,748) | |

| USD | | | 3,616,836 | | | EUR | | | 3,680,000 | | | Goldman Sachs Group Inc. | | | 11/2/22 | | | | (20,420) | |

| EUR | | | 2,580,000 | | | USD | | | 2,576,267 | | | HSBC Securities Inc. | | | 11/2/22 | | | | (26,234) | |

| EUR | | | 4,130,000 | | | USD | | | 4,243,408 | | | HSBC Securities Inc. | | | 11/2/22 | | | | (161,378) | |

| EUR | | | 3,040,000 | | | USD | | | 2,950,369 | | | UBS Securities LLC | | | 11/2/22 | | | | 54,321 | |

| EUR | | | 4,230,000 | | | USD | | | 4,165,272 | | | UBS Securities LLC | | | 11/2/22 | | | | 15,595 | |

| USD | | | 1,504,892 | | | EUR | | | 1,460,000 | | | UBS Securities LLC | | | 11/2/22 | | | | 61,850 | |

| USD | | | 3,627,910 | | | EUR | | | 3,650,000 | | | UBS Securities LLC | | | 11/2/22 | | | | 20,306 | |

| CNH | | | 32,950,000 | | | USD | | | 4,914,272 | | | Citibank N.A. | | | 11/9/22 | | | | (420,701) | |

| USD | | | 4,325,818 | | | CNH | | | 29,540,000 | | | HSBC Securities Inc. | | | 11/9/22 | | | | 297,288 | |

| USD | | | 4,886,574 | | | CNH | | | 32,950,000 | | | HSBC Securities Inc. | | | 11/9/22 | | | | 393,002 | |

| CNH | | | 25,440,000 | | | USD | | | 3,670,911 | | | Morgan Stanley & Co. Inc. | | | 11/9/22 | | | | (201,519) | |

| CNH | | | 4,100,000 | | | USD | | | 593,121 | | | UBS Securities LLC | | | 11/9/22 | | | | (33,981) | |

| CNH | | | 34,600,000 | | | USD | | | 4,823,952 | | | HSBC Securities Inc. | | | 11/18/22 | | | | (102,892) | |

| USD | | | 4,965,146 | | | CNH | | | 34,600,000 | | | HSBC Securities Inc. | | | 11/18/22 | | | | 244,086 | |

| USD | | | 2,494,537 | | | GBP | | | 2,210,000 | | | Barclays Bank PLC | | | 12/5/22 | | | | (42,580) | |

| GBP | | | 2,210,000 | | | USD | | | 2,398,828 | | | HSBC Securities Inc. | | | 12/5/22 | | | | 138,288 | |

| USD | | | 5,009,527 | | | GBP | | | 4,630,000 | | | JPMorgan Chase & Co. | | | 12/5/22 | | | | (305,792) | |

| USD | | | 2,497,076 | | | AUD | | | 3,900,000 | | | Goldman Sachs Group Inc. | | | 12/7/22 | | | | (390) | |

| AUD | | | 3,900,000 | | | USD | | | 2,499,651 | | | HSBC Securities Inc. | | | 12/7/22 | | | | (2,185) | |

| AUD | | | 7,300,000 | | | USD | | | 4,759,605 | | | JPMorgan Chase & Co. | | | 12/7/22 | | | | (84,861) | |

| USD | | | 4,916,441 | | | AUD | | | 7,300,000 | | | National Australia Bank Ltd. | | | 12/7/22 | | | | 241,697 | |

See Notes to Financial Statements.

| | | | |

| BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report | | | | 19 |

Schedule of investments (cont’d)

October 31, 2022

BrandywineGLOBAL — Alternative Credit Fund

| | | | | | | | | | | | | | | | | | | | |

Currency

Purchased | | | Currency Sold | | | Counterparty | | Settlement

Date | | | Unrealized

Appreciation

(Depreciation) | |

| USD | | | 2,484,117 | | | TWD | | | 78,200,000 | | | JPMorgan Chase & Co. | | | 12/23/22 | | | $ | 45,901 | |

| USD | | | 7,148,872 | | | EUR | | | 7,120,000 | | | Barclays Bank PLC | | | 2/3/23 | | | | 57,313 | |

| Total | | | | | | | | | | | | | | | | | | $ | 479,017 | |

| | |

Abbreviation(s) used in this table: |

| |

| AUD | | — Australian Dollar |

| |

| CNH | | — Chinese Offshore Yuan |

| |

| EUR | | — Euro |

| |

| GBP | | — British Pound |

| |

| TWD | | — Taiwan Dollar |

| |

| USD | | — United States Dollar |

At October 31, 2022, the Fund had the following open swap contracts:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| OTC CREDIT DEFAULT SWAPS ON CORPORATE ISSUES — SELL PROTECTION1 | |

Swap Counterparty

(Reference Entity) | | Notional

Amount2 | | | Termination

Date | | | Implied

Credit

Spread at October 31,

20223 | | Periodic

Payments

Received by

the Fund† | | | Market

Value | | | Upfront

Premiums

Paid

(Received) | | | Unrealized Appreciation | |

| Morgan Stanley & Co. Inc. (Dell Inc., 7.100%, due 4/15/28) | | $ | 6,115,000 | | | | 12/20/22 | | | 0.506% | | | 1.000% quarterly | | | $ | 4,152 | | | $ | (7,073) | | | $ | 11,225 | |

| | | | | | | | | | | | | | | | | | | | | | |

| CENTRALLY CLEARED CREDIT DEFAULT SWAPS ON CREDIT INDICES — BUY PROTECTION4 | |

| Reference Entity | | Notional

Amount2 | | | Termination

Date | | | Periodic

Payments Made by the Fund† | | Market

Value5 | | | Upfront

Premiums

Paid

(Received) | | | Unrealized Depreciation | |

| Markit iTraxx Europe Index | | | 20,120,000 | EUR | | | 12/20/27 | | | 1.000% quarterly | | $ | 1,082,944 | | | $ | 1,390,286 | | | $ | (307,342) | |

See Notes to Financial Statements.

| | | | |

20 | | | | BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report |

BrandywineGLOBAL — Alternative Credit Fund

| 1 | If the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) pay to the buyer of protection an amount equal to the notional amount of the swap and take delivery of the referenced obligation or underlying securities comprising the referenced index or (ii) pay a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying securities comprising the referenced index. |

| 2 | The maximum potential amount the Fund could be required to pay as a seller of credit protection or receive as a buyer of credit protection if a credit event occurs as defined under the terms of that particular swap agreement. |

| 3 | Implied credit spreads, utilized in determining the market value of credit default swap agreements on corporate or sovereign issues as of period end, serve as an indicator of the current status of the payment/performance risk and represent the likelihood or risk of default for the credit derivative. The implied credit spread of a particular referenced entity reflects the cost of buying/selling protection and may include upfront payments required to be made to enter into the agreement. Wider credit spreads represent a deterioration of the referenced entity’s credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the agreement. A credit spread identified as “Defaulted” indicates a credit event has occurred for the referenced entity or obligation. |

| 4 | If the Fund is a buyer of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) receive from the seller of protection an amount equal to the notional amount of the swap and deliver the referenced obligation or the underlying securities comprising the referenced index or (ii) receive a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or the underlying securities comprising the referenced index. |

| 5 | The quoted market prices and resulting values for credit default swap agreements on asset-backed securities and credit indices serve as an indicator of the current status of the payment/performance risk and represent the likelihood of an expected loss (or profit) for the credit derivative had the notional amount of the swap agreement been closed/sold as of the period end. Decreasing market values (sell protection) or increasing market values (buy protection) when compared to the notional amount of the swap, represent a deterioration of the referenced entity’s credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the agreement. |

| † | Percentage shown is an annual percentage rate. |

| | |

Abbreviation(s) used in this table: |

| |

| EUR | | — Euro |

| | | | |

| Summary of Investments by Country** (unaudited) | | | |

| United States | | | 88.2 | % |

| Spain | | | 6.0 | |

| Israel | | | 0.9 | |

| Cayman Islands | | | 0.8 | |

| Tanzania | | | 0.8 | |

| Short-Term Investments | | | 3.3 | |

| | | | 100.0 | % |

| ** | As a percentage of total investments. Please note that the Fund holdings are as of October 31, 2022 and are subject to change. |

See Notes to Financial Statements.

| | | | |

| BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report | | | | 21 |

Statement of assets and liabilities

October 31, 2022

| | | | |

| |

| Assets: | | | | |

Investments in unaffiliated securities, at value (Cost — $117,283,249) | | $ | 109,743,692 | |

Investments in affiliated securities, at value (Cost — $3,761,831) | | | 3,761,831 | |

Foreign currency, at value (Cost — $4) | | | 2 | |

Deposits with brokers for open futures contracts | | | 4,297,036 | |

Unrealized appreciation on forward foreign currency contracts | | | 1,951,113 | |

Deposits with brokers for centrally cleared swap contracts | | | 697,554 | |

Interest and dividends receivable from unaffiliated investments | | | 363,369 | |

Receivable from brokers — net variation margin on open futures contracts | | | 187,062 | |

Receivable from brokers — net variation margin on centrally cleared swap contracts | | | 159,935 | |

Receivable for Fund shares sold | | | 37,731 | |

Dividends receivable from affiliated investments | | | 11,115 | |

Receivable for open OTC swap contracts | | | 7,134 | |

OTC swaps, at value (premiums received — $7,073) | | | 4,152 | |

Prepaid expenses | | | 1,943 | |

Total Assets | | | 121,223,669 | |

| |

| Liabilities: | | | | |

Unrealized depreciation on forward foreign currency contracts | | | 1,472,096 | |

Foreign currency collateral due to brokers for open futures contracts, at value (Cost — $1,024,558) | | | 1,020,099 | |

Investment management fee payable | | | 106,267 | |

Deposits from brokers for OTC derivatives | | | 70,000 | |

Payable for Fund shares repurchased | | | 58,321 | |

Service and/or distribution fees payable | | | 6,301 | |

Trustees’ fees payable | | | 3,149 | |

Accrued expenses | | | 107,092 | |

Total Liabilities | | | 2,843,325 | |

| Total Net Assets | | $ | 118,380,344 | |

| |

| Net Assets: | | | | |

Par value (Note 7) | | $ | 124 | |

Paid-in capital in excess of par value | | | 243,846,614 | |

Total distributable earnings (loss) | | | (125,466,394) | |

| Total Net Assets | | $ | 118,380,344 | |

See Notes to Financial Statements.

| | | | |

22 | | | | BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report |

| | | | |

| |

| Net Assets: | | | | |

Class A | | | $12,257,026 | |

Class C | | | $3,079,349 | |

Class FI | | | $4,086,853 | |

Class I | | | $49,984,139 | |

Class IS | | | $48,972,977 | |

| |

| Shares Outstanding: | | | | |

Class A | | | 1,284,561 | |

Class C | | | 325,109 | |

Class FI | | | 429,645 | |

Class I | | | 5,237,077 | |

Class IS | | | 5,116,242 | |

| |

| Net Asset Value: | | | | |

Class A (and redemption price) | | | $9.54 | |

Class C* | | | $9.47 | |

Class FI (and redemption price) | | | $9.51 | |

Class I (and redemption price) | | | $9.54 | |

Class IS (and redemption price) | | | $9.57 | |

| |

| Maximum Public Offering Price Per Share: | | | | |

Class A (based on maximum initial sales charge of 3.75%; 4.25% prior to August 15, 2022) | | | $9.91 | |

| * | Redemption price per share is NAV of Class C shares reduced by a 1.00% CDSC if shares are redeemed within one year from purchase payment (Note 2). |

See Notes to Financial Statements.

| | | | |

| BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report | | | | 23 |

Statement of operations

For the Year Ended October 31, 2022

| | | | |

| |

| Investment Income: | | | | |

Interest | | $ | 7,740,081 | |

Dividends from affiliated investments | | | 50,235 | |

Less: Foreign taxes withheld | | | (6,334) | |

Total Investment Income | | | 7,783,982 | |

| |

| Expenses: | | | | |

Investment management fee (Note 2) | | | 2,144,414 | |

Transfer agent fees (Note 5) | | | 100,227 | |

Registration fees | | | 83,968 | |

Fund accounting fees | | | 71,808 | |

Service and/or distribution fees (Notes 2 and 5) | | | 67,421 | |

Legal fees | | | 32,276 | |

Audit and tax fees | | | 18,757 | |

Trustees’ fees | | | 17,456 | |

Shareholder reports | | | 12,232 | |

Custody fees | | | 11,785 | |

Commitment fees (Note 9) | | | 1,374 | |

Insurance | | | 1,271 | |

Fees recaptured by investment manager (Note 2) | | | 585 | |

Interest expense | | | 416 | |

Miscellaneous expenses | | | 16,575 | |

Total Expenses | | | 2,580,565 | |

Less: Fee waivers and/or expense reimbursements (Notes 2 and 5) | | | (109,058) | |

Net Expenses | | | 2,471,507 | |

| Net Investment Income | | | 5,312,475 | |

|

Realized and Unrealized Gain (Loss) on Investments, Futures Contracts,

Swap Contracts, Forward Foreign Currency Contracts and Foreign Currency Transactions (Notes 1, 3 and 4): | |

Net Realized Gain (Loss) From: | | | | |

Investment transactions in unaffiliated securities | | | (12,022,107) | |

Futures contracts | | | 7,822,500 | |

Swap contracts | | | (10,714) | |

Forward foreign currency contracts | | | 412,099 | |

Foreign currency transactions | | | 49,224 | |

Net Realized Loss | | | (3,748,998) | |

Change in Net Unrealized Appreciation (Depreciation) From: | | | | |

Investments in unaffiliated securities | | | (8,581,122) | |

Futures contracts | | | (1,538,797) | |

Swap contracts | | | (821,211) | |

Forward foreign currency contracts | | | 606,204 | |

Foreign currencies | | | 4,772 | |

Change in Net Unrealized Appreciation (Depreciation) | | | (10,330,154) | |

| Net Loss on Investments, Futures Contracts, Swap Contracts, Forward Foreign Currency Contracts and Foreign Currency Transactions | | | (14,079,152) | |

| Decrease in Net Assets From Operations | | $ | (8,766,677) | |

See Notes to Financial Statements.

| | | | |

24 | | | | BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report |

Statements of changes in net assets

| | | | | | | | |

| For the Years Ended October 31, | | 2022 | | | 2021 | |

| | |

| Operations: | | | | | | | | |

Net investment income | | $ | 5,312,475 | | | $ | 7,153,811 | |

Net realized gain (loss) | | | (3,748,998) | | | | 4,918,444 | |

Change in net unrealized appreciation (depreciation) | | | (10,330,154) | | | | 12,456,200 | |

Increase (Decrease) in Net Assets From Operations | | | (8,766,677) | | | | 24,528,455 | |

| | |

| Distributions to Shareholders From (Notes 1 and 6): | | | | | | | | |

Total distributable earnings | | | (4,950,026) | | | | (12,500,035) | |

Decrease in Net Assets From Distributions to Shareholders | | | (4,950,026) | | | | (12,500,035) | |

| | |

| Fund Share Transactions (Note 7): | | | | | | | | |

Net proceeds from sale of shares | | | 135,228,859 | | | | 96,952,232 | |

Reinvestment of distributions | | | 4,874,664 | | | | 12,143,992 | |

Cost of shares repurchased | | | (222,256,956) | | | | (127,340,273) | |

Decrease in Net Assets From Fund Share Transactions | | | (82,153,433) | | | | (18,244,049) | |

Decrease in Net Assets | | | (95,870,136) | | | | (6,215,629) | |

| | |

| Net Assets: | | | | | | | | |

Beginning of year | | | 214,250,480 | | | | 220,466,109 | |

End of year | | $ | 118,380,344 | | | $ | 214,250,480 | |

See Notes to Financial Statements.

| | | | |

| BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report | | | | 25 |

Financial highlights

| | | | | | | | | | | | | | | | | | | | |

| For a share of each class of beneficial interest outstanding throughout each year ended October 31: | |

| Class A Shares1 | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| | | | | |

| Net asset value, beginning of year | | | $10.28 | | | | $9.75 | | | | $10.56 | | | | $10.21 | | | | $10.39 | |

| | | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.26 | | | | 0.29 | | | | 0.24 | | | | 0.19 | | | | 0.21 | |

Net realized and unrealized gain (loss) | | | (0.78) | | | | 0.78 | | | | (0.71) | | | | 0.36 | | | | (0.11) | |

Total income (loss) from operations | | | (0.52) | | | | 1.07 | | | | (0.47) | | | | 0.55 | | | | 0.10 | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.22) | | | | (0.54) | | | | (0.34) | | | | (0.20) | | | | (0.28) | |

Total distributions | | | (0.22) | | | | (0.54) | | | | (0.34) | | | | (0.20) | | | | (0.28) | |

| | | | | |

| Net asset value, end of year | | | $9.54 | | | | $10.28 | | | | $9.75 | | | | $10.56 | | | | $10.21 | |

Total return2 | | | (5.15) | % | | | 11.07 | % | | | (4.47) | % | | | 5.43 | % | | | 0.93 | % |

| | | | | |

| Net assets, end of year (000s) | | | $12,257 | | | | $11,942 | | | | $9,840 | | | | $7,644 | | | | $8,395 | |

| | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Gross expenses3 | | �� | 1.69 | % | | | 1.69 | % | | | 1.71 | % | | | 1.67 | % | | | 1.67 | % |

Net expenses3,4,5 | | | 1.65 | | | | 1.65 | | | | 1.65 | | | | 1.65 | | | | 1.65 | |

Net investment income | | | 2.61 | | | | 2.79 | | | | 2.48 | | | | 1.87 | | | | 2.05 | |

| | | | | |

| Portfolio turnover rate | | | 182 | % | | | 187 | % | | | 73 | % | | | 184 | % | | | 142 | % |

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | Performance figures, exclusive of sales charges, may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Reflects recapture of fees waived and/or expenses reimbursed from prior fiscal years. |

| 4 | As a result of an expense limitation arrangement, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, dividend expense on short sales, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Class A shares did not exceed 1.65%. This expense limitation arrangement cannot be terminated prior to December 31, 2024 without the Board of Trustees’ consent. In addition, the manager has agreed to waive the Fund’s management fee to an extent sufficient to offset the net management fee payable in connection with any investment in an affiliated money market fund. |

| 5 | Reflects fee waivers and/or expense reimbursements. |

See Notes to Financial Statements.

| | | | |

26 | | | | BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report |

| | | | | | | | | | | | | | | | | | | | |

| For a share of each class of beneficial interest outstanding throughout each year ended October 31: | |

| Class C Shares1 | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| | | | | |

| Net asset value, beginning of year | | | $10.20 | | | | $9.67 | | | | $10.49 | | | | $10.14 | | | | $10.33 | |

| | | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.19 | | | | 0.21 | | | | 0.17 | | | | 0.12 | | | | 0.13 | |

Net realized and unrealized gain (loss) | | | (0.76) | | | | 0.77 | | | | (0.72) | | | | 0.35 | | | | (0.12) | |

Total income (loss) from operations | | | (0.57) | | | | 0.98 | | | | (0.55) | | | | 0.47 | | | | 0.01 | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.16) | | | | (0.45) | | | | (0.27) | | | | (0.12) | | | | (0.20) | |

Total distributions | | | (0.16) | | | | (0.45) | | | | (0.27) | | | | (0.12) | | | | (0.20) | |

| | | | | |

| Net asset value, end of year | | | $9.47 | | | | $10.20 | | | | $9.67 | | | | $10.49 | | | | $10.14 | |

Total return2 | | | (5.67) | % | | | 10.22 | % | | | (5.26) | % | | | 4.64 | % | | | 0.12 | % |

| | | | | |

| Net assets, end of year (000s) | | | $3,079 | | | | $2,767 | | | | $4,877 | | | | $7,503 | | | | $10,418 | |

| | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 2.40 | % | | | 2.40 | %3 | | | 2.44 | %3 | | | 2.40 | %3 | | | 2.40 | %3 |

Net expenses4,5 | | | 2.36 | | | | 2.36 | 3 | | | 2.40 | 3 | | | 2.40 | 3 | | | 2.40 | 3 |

Net investment income | | | 1.96 | | | | 2.03 | | | | 1.73 | | | | 1.12 | | | | 1.29 | |

| | | | | |

| Portfolio turnover rate | | | 182 | % | | | 187 | % | | | 73 | % | | | 184 | % | | | 142 | % |

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | Performance figures, exclusive of CDSC, may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Reflects recapture of fees waived and/or expenses reimbursed from prior fiscal years. |

| 4 | As a result of an expense limitation arrangement, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, dividend expense on short sales, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Class C shares did not exceed 2.40%. This expense limitation arrangement cannot be terminated prior to December 31, 2024 without the Board of Trustees’ consent. In addition, the manager has agreed to waive the Fund’s management fee to an extent sufficient to offset the net management fee payable in connection with any investment in an affiliated money market fund. |

| 5 | Reflects fee waivers and/or expense reimbursements. |

See Notes to Financial Statements.

| | | | |

| BrandywineGLOBAL — Alternative Credit Fund 2022 Annual Report | | | | 27 |

Financial highlights (cont’d)

| | | | | | | | | | | | | | | | | | | | |

| For a share of each class of beneficial interest outstanding throughout each year ended October 31: | |

| Class FI Shares1 | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| | | | | |

| Net asset value, beginning of year | | | $10.26 | | | | $9.73 | | | | $10.53 | | | | $10.19 | | | | $10.38 | |

| | | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.31 | | | | 0.29 | | | | 0.24 | | | | 0.19 | | | | 0.21 | |

Net realized and unrealized gain (loss) | | | (0.83) | | | | 0.77 | | | | (0.72) | | | | 0.35 | | | | (0.11) | |

Total income (loss) from operations | | | (0.52) | | | | 1.06 | | | | (0.48) | | | | 0.54 | | | | 0.10 | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.23) | | | | (0.53) | | | | (0.32) | | | | (0.20) | | | | (0.29) | |

Total distributions | | | (0.23) | | | | (0.53) | | | | (0.32) | | | | (0.20) | | | | (0.29) | |

| | | | | |

| Net asset value, end of year | | | $9.51 | | | | $10.26 | | | | $9.73 | | | | $10.53 | | | | $10.19 | |

Total return2 | | | (5.18) | % | | | 11.04 | % | | | (4.51) | % | | | 5.34 | % | | | 0.96 | % |

| | | | | |

| Net assets, end of year (000s) | | | $4,087 | | | | $104 | | | | $107 | | | | $378 | | | | $464 | |

| | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.73 | % | | | 1.81 | % | | | 1.70 | %3 | | | 1.65 | %3 | | | 1.65 | %3 |