UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22338

Legg Mason Global Asset Management Trust

(Exact name of registrant as specified in charter)

100 International Drive, Baltimore, MD, 21202

(Address of principal executive offices) (Zip code)

Marc A. De Oliveira

Franklin Templeton

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 877-6LM-FUND/656-3863

Date of fiscal year end: December 31

Date of reporting period: December 31, 2022

| ITEM 1. | REPORT TO STOCKHOLDERS |

The Annual Report to Stockholders is filed herewith.

| | |

| Annual Report | | December 31, 2022 |

FRANKLIN

U.S. SMALL CAP

EQUITY FUND

|

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objective

The Fund seeks long-term capital appreciation.

Letter from the president

Dear Shareholder,

We are pleased to provide the annual report of Franklin U.S. Small Cap Equity Fund for the twelve-month reporting period ended December 31, 2022. Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.franklintempleton.com. Here you can gain immediate access to market and investment information, including:

| • | | Fund prices and performance, |

| • | | Market insights and commentaries from our portfolio managers, and |

| • | | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

January 31, 2023

| | |

II | | Franklin U.S. Small Cap Equity Fund |

Fund overview

Q. What is the Fund’s investment strategy?

A. The Fund’s investment objective is long-term capital appreciation. Under normal market conditions, the Fund will invest at least 80% of net assets, plus any borrowings for investment purposes, in equity securities of companies with small market capitalizations domiciled, or having their principal activities, in the U.S., at the time of investment or other investments with similar economic characteristics. The Fund normally intends to hold a portfolio that is generally comparable to, but not the same as, the Russell 2000 Indexi (the “Index”) in terms of economic sector weightings and market capitalization but may depart from this if we believe it to be in the best interests of the Fund. The Fund may also invest in securities of foreign companies in the form of American Depositary Receipts (“ADRs”).

At Franklin Advisers, Inc., the Fund’s subadviser, all portfolios are managed on a collaborative basis using a systematic, rules-based approach. We use a bottom-up, quantitative stock selection process. The cornerstone of this process is a proprietary stock selection model that ranks the stocks in the Fund’s investable universe on a daily basis according to a variety of fundamental measures of their relative attractiveness.

Q. What were the overall market conditions during the Fund’s reporting period?

A. U.S. equities, as measured by the Index, were volatile and negative, returning -20.44% for the twelve-month reporting period ended December 31, 2022. The communication services, information technology (“IT”) and consumer discretionary sectors were especially hard hit, each with a negative return significantly worse than the Index overall. The energy sector posted an exceptionally strong return of approximately 52% on limited supply and rising demand and was the only sector with a positive return. The utilities and consumer staples sectors had negative returns, but significantly outperformed the Index.

Even before Russia’s invasion of Ukraine in February, the U.S. equity market experienced a bumpy start to 2022 on the highest inflation rates since 1982 and a spike in COVID-19 Omicron variant infections. Expansions in the U.S. manufacturing and services sectors lost some momentum amid price pressures and supply-chain snags, while consumer spending softened as inflation continued to outpace wage gains. The perceived pivot to a more hawkish stance by the Federal Reserve Board (the “Fed”) led to a sell-off in risk markets. Russia’s invasion of Ukraine during the last few days of February led to significant market declines, as sanctions aimed at Russia’s banks and prominent individuals, potential additional future sanctions and the war itself raised the possibility of trade disruptions in commodity markets. Against this backdrop, the Fed raised interest rates for the first time since 2018 to help address high inflation just a few weeks after Russia’s invasion and forecast four more rate increases in 2023.

U.S. equities suffered broad-based losses during the second quarter of 2022. Investors unloaded riskier assets amid persistently elevated inflation and interest-rate hikes by the Fed that grew in size with each meeting. The market reflected a growing fear that the Fed might push the country into a recession before price stability is restored. A comparatively minor stock market rally in late June occurred despite the release of worsening economic

| | | | |

| Franklin U.S. Small Cap Equity Fund 2022 Annual Report | | | | 1 |

Fund overview (cont’d)

data. The quarter capped a volatile first half of the year that saw U.S. and non-U.S. stocks, bonds and currencies jolted by surging inflation, central bank moves and the Russia-Ukraine war. Consumer expectations sank amid the worst inflation shock since the early 1970’s and drew market attention toward the possibility that corporate profit margins may come under pressure in the coming quarters.

The U.S. equity market rose during the first half of the 2022’s third quarter but ended down as investors feared that the Fed’s aggressive rate hikes to combat persistently high inflation could lead to a recession. Standard & Poor’s 500 Indexii stocks fell for a third consecutive quarter to a twenty-two month low, capped by the worst September (-9.21%) in two decades. To cool stubbornly high inflation, the Fed lifted the federal funds target rate range by 75 basis points in both July and September and the Fed indicated the latest increase will not be the last. Stocks sold off further in September as Fed Chair Jerome Powell reiterated the main points he made in his hawkish speech at Jackson Hole in late August. He stressed that monetary policy may have to be restrictive for a while to bring inflation down and that the process may be painful. He also warned of a housing market correction and said a soft landing for the economy may be less likely.

Following a solid rebound in October and November as inflation data improved, and despite a broad pull-back in December, major indexes had their strongest quarter of 2022 but their worst calendar-year performance since 2008. Even as the U.S. economy returned to growth in the third quarter and supply chains continued improving through December, investor sentiment oscillated between expectations of a soft and a hard economic landing, driven by what has been the fastest pace of interest-rate hikes since the early 1980’s. And although markets initially cheered as China began rapidly phasing out pandemic lockdowns tied to its zero-COVID policies, by mid-December U.S. investors grew at least equally worried about the global implications of a dramatic surge in COVID-19 cases across China.

Q. How did we respond to these changing market conditions?

A. We believe that fundamentals, the very basis of our investment process, will continue to be the primary driver of long-term returns. As a result, we continue to adhere to our investment philosophy while continuing to enhance our process to address sustainable market shifts. We also believe that integrated risk management is an important element of portfolio construction and our investment process will continue to reflect these long-held views. We strongly believe, particularly during times of extreme market volatility, in the value of a broadly diversified, rules-based, risk-controlled process.

Much of our research continues to be focused on developing tools to enhance performance regardless of market environment. This includes both individual factor research as well as factor allocation strategies.

Performance review

For the twelve months ended December 31, 2022, Class I shares of Franklin U.S. Small Cap Equity Fund returned -15.10%. The Fund’s unmanaged benchmark, the Russell 2000 Index,

| | | | |

2 | | | | Franklin U.S. Small Cap Equity Fund 2022 Annual Report |

returned -20.44% for the same period. The Lipper Small-Cap Core Funds Category Averageiii returned -14.41% over the same time frame.

| | | | | | | | |

Performance Snapshot as of December 31, 2022 (unaudited) | | | | | | |

| (excluding sales charges) | | 6 months | | | 12 months | |

| Franklin U.S. Small Cap Equity Fund: | | | | | | | | |

Class A | | | 6.92 | % | | | -15.42 | % |

Class C | | | 6.53 | % | | | -16.08 | % |

Class FI | | | 7.00 | % | | | -15.37 | % |

Class I | | | 7.18 | % | | | -15.10 | % |

Class IS | | | 7.24 | % | | | -14.92 | % |

| Russell 2000 Index | | | 3.91 | % | | | -20.44 | % |

| Lipper Small-Cap Core Funds Category Average | | | 5.09 | % | | | -14.41 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.franklintempleton.com.

All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all Fund expenses. Returns have not been adjusted to include sales charges that may apply or the deduction of taxes that a shareholder would pay on Fund distributions. If sales charges were reflected, the performance quoted would be lower. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Fund performance figures reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

|

| Total Annual Operating Expenses (unaudited) |

As of the Fund’s current prospectus dated May 1, 2022, the gross total annual fund operating expense ratios for Class A, Class C, Class FI, Class I and Class IS shares were 1.32%, 2.04%, 1.77%, 1.03% and 0.84%, respectively.

Actual expenses may be higher. For example, expenses may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile.

As a result of expense limitation arrangements, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, dividend expense on short sales, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets will not exceed 1.30% for Class A shares, 2.05% for Class C shares, 1.30% for Class FI shares, 1.00% for Class I shares and 0.75% for Class IS shares. In addition, the ratio of total annual fund operating expenses for Class IS shares will not exceed the ratio of total annual fund operating expenses for Class I shares. These expense limitation arrangements cannot be terminated prior to December 31, 2024 without the Board of Trustees’ consent.

| | | | |

| Franklin U.S. Small Cap Equity Fund 2022 Annual Report | | | | 3 |

Fund overview (cont’d)

The manager has also agreed to voluntarily waive fees and/or reimburse operating expenses, other than interest, brokerage commissions, dividend expense on short sales, taxes, extraordinary expenses and acquired fund fees and expenses, so that annual fund operating expenses will not exceed 1.20% for Class A shares, 1.95% for Class C shares, 1.20% for Class FI shares and 0.90% for Class I shares. These arrangements are expected to continue until December 31, 2024 but may be terminated at any time by the manager.

The manager is permitted to recapture amounts waived and/or reimbursed to a class within three years after the fiscal year in which the manager earned the fee or incurred the expense if the class’ total annual fund operating expenses have fallen to a level below the expense limitation (“expense cap”) in effect at the time the fees were earned or the expenses incurred. In no case will the manager recapture any amount that would result, on any particular business day of the Fund, in the class’ total annual operating expenses exceeding the expense cap or any other lower limit then in effect.

Q. What were the leading contributors to performance?

A. Stock selection was the leading contributor to performance for the year, adding value in all but three sectors. Selection in the IT, industrials and consumer discretionary sectors was especially strong. Sector allocation results also added value, led by an overweight to consumer staples.

At the security level, the leading contributor was SandRidge Energy, which engages in the acquisition, development, and production of oil and natural gas primarily in the United States Mid-Continent and which significantly outperformed along with other energy stocks. Titan International, a holding company engaged in the manufacture of wheels and tires, also outperformed returning almost 40% for the year; its agriculture and earthmoving construction segments have been witnessing strong sales volume growth over the past few quarters, and momentum continues with growing investor interest. Pharmaceutical firm Ardelyx was also a major contributor. At the end of 2022, the U.S. Food and Drug Administration granted Ardelyx appeal for the agency to review its experimental kidney disease drug again, a year after declining to approve it.

Q. What were the leading detractors from performance?

A. Stock selection in the health care, energy and consumer staples sectors was the leading detractor from relative return for the reporting period. An overweight to the IT sector, which was one of the worst performing in the Index, also detracted.

The Joint Corp, which develops, owns, operates, supports, and manages chiropractic clinics and had a return of -78.7%, was the leading detractor at the security level. The company’s aggressive growth plans took a hit during the COVID-19 lockdowns and more recently have been held back by economic uncertainty as recent earnings releases and guidance have disappointed investors. Technology consulting firm Grid Dynamics Holdings was also a major detractor, falling -70.5% on fears of business disruption as the company has 30-40% of its employees located in Ukraine and Russia. Beazer Homes USA fell -45.1% as home sales and price momentum waned as mortgage rates began to rise.

| | | | |

4 | | | | Franklin U.S. Small Cap Equity Fund 2022 Annual Report |

Thank you for your investment in Franklin U.S. Small Cap Equity Fund. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

Franklin Advisers, Inc.

January 11, 2023

RISKS: Equity securities are subject to market and price fluctuations. Investments in small-cap companies may involve greater risks and volatility than investments in larger, more established companies. Small-cap companies may have limited product lines, operating histories, markets or financial resources. The Fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and may have a potentially large impact on Fund performance. Please see the Fund’s prospectus for a more complete discussion of these and other risks and the Fund’s investment strategies.

Portfolio holdings and breakdowns are as of December 31, 2022 and are subject to change and may not be representative of the portfolio managers’ current or future investments. The Fund’s top ten holdings (as a percentage of net assets) as of December 31, 2022 were: Ensign Group Inc. (1.0%), Murphy Oil Corp. (0.9%), ExlService Holdings Inc. (0.8%), NOW Inc. (0.8%), Titan International Inc. (0.8%), Portland General Electric Co. (0.8%), Insperity Inc. (0.8%), SM Energy Co. (0.8%), SunCoke Energy Inc. (0.8%) and Enova International Inc. (0.8%). Please refer to pages 12 through 24 for a list and percentage breakdown of the Fund’s holdings.

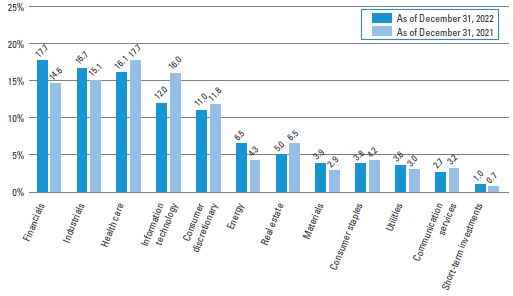

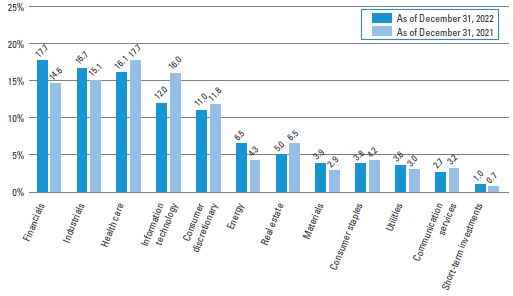

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. The Fund’s top five sector holdings (as a percentage of net assets) as of December 31, 2022 were: financials (17.7%), industrials (16.7%), health care (16.2%), information technology (12.0%) and consumer discretionary (10.9%). The Fund’s portfolio composition is subject to change at any time.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| | | | |

| Franklin U.S. Small Cap Equity Fund 2022 Annual Report | | | | 5 |

Fund overview (cont’d)

| i | The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 is a subset of the Russell 3000 Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the U.S. equity market. |

| ii | The Standard & Poor’s 500 Index is an unmanaged index of the stocks of 500 leading companies, and is generally representative of the performance of larger companies in the U.S. |

| iii | Lipper, Inc., a wholly-owned subsidiary of Refinitiv, provides independent insight on global collective investments. Returns are based on the period ended December 31, 2022, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 913 funds for the six-month period and among the 909 funds for the twelve-month period in the Fund’s Lipper category, and excluding sales charges, if any. |

| | | | |

6 | | | | Franklin U.S. Small Cap Equity Fund 2022 Annual Report |

Fund at a glance† (unaudited)

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of December 31, 2022 and December 31, 2021. The Fund is actively managed. As a result, the composition of the Fund’s investments is subject to change at any time. |

| | | | |

| Franklin U.S. Small Cap Equity Fund 2022 Annual Report | | | | 7 |

Fund expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end and back-end sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; service and/or distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on July 1, 2022 and held for the six months ended December 31, 2022.

Actual expenses

The table below titled “Based on actual total return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on hypothetical total return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or back-end sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| Based on actual total return1 | | | | | | | | | Based on hypothetical total return1 | |

| | | | | | | | | | | | |

| | | Actual

Total Return

Without

Sales

Charge2 | | | Beginning

Account

Value | | | Ending

Account

Value | | | Annualized

Expense

Ratio | | | Expenses

Paid During

the

Period3 | | | | | | | | Hypothetical

Annualized

Total Return | | | Beginning Account

Value | | | Ending

Account

Value | | | Annualized

Expense

Ratio | | | Expenses

Paid During the

Period3 | |

| Class A | | | 6.92 | % | | $ | 1,000.00 | | | $ | 1,069.20 | | | | 1.20 | % | | $ | 6.26 | | | | | | | Class A | | | 5.00 | % | | $ | 1,000.00 | | | $ | 1,019.16 | | | | 1.20 | % | | $ | 6.11 | |

| Class C | | | 6.53 | | | | 1,000.00 | | | | 1,065.30 | | | | 1.95 | | | | 10.15 | | | | | | | Class C | | | 5.00 | | | | 1,000.00 | | | | 1,015.38 | | | | 1.95 | | | | 9.91 | |

| Class FI | | | 7.00 | | | | 1,000.00 | | | | 1,070.00 | | | | 1.20 | | | | 6.26 | | | | | | | Class FI | | | 5.00 | | | | 1,000.00 | | | | 1,019.16 | | | | 1.20 | | | | 6.11 | |

| Class I | | | 7.18 | | | | 1,000.00 | | | | 1,071.80 | | | | 0.90 | | | | 4.70 | | | | | | | Class I | | | 5.00 | | | | 1,000.00 | | | | 1,020.67 | | | | 0.90 | | | | 4.58 | |

| Class IS | | | 7.24 | | | | 1,000.00 | | | | 1,072.40 | | | | 0.75 | | | | 3.92 | | | | | | | Class IS | | | 5.00 | | | | 1,000.00 | | | | 1,021.42 | | | | 0.75 | | | | 3.82 | |

| | | | |

8 | | | | Franklin U.S. Small Cap Equity Fund 2022 Annual Report |

| 1 | For the six months ended December 31, 2022. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charge with respect to Class A shares or the applicable contingent deferred sales charge (“CDSC”) with respect to Class C shares. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Expenses (net of compensating balance arrangements, fee waivers and/or expense reimbursements) are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

| | | | |

| Franklin U.S. Small Cap Equity Fund 2022 Annual Report | | | | 9 |

Fund performance (unaudited)

| | | | | | | | | | | | | | | | | | | | |

| Average annual total returns | |

| Without sales charges1 | | Class A | | | Class C | | | Class FI | | | Class I | | | Class IS | |

| Twelve Months Ended 12/31/22 | | | -15.42 | % | | | -16.08 | % | | | -15.37 | % | | | -15.10 | % | | | -14.92 | % |

| Five Years Ended 12/31/22 | | | 4.41 | | | | 3.61 | | | | 4.35 | | | | 4.67 | | | | 4.83 | |

| Ten Years Ended 12/31/22 | | | 8.68 | | | | 7.85 | | | | 8.65 | | | | 9.03 | | | | 9.15 | |

| | | | | |

| With sales charges2 | | Class A | | | Class C | | | Class FI | | | Class I | | | Class IS | |

| Twelve Months Ended 12/31/22 | | | -20.30 | % | | | -16.88 | % | | | -15.37 | % | | | -15.10 | % | | | -14.92 | % |

| Five Years Ended 12/31/22 | | | 3.18 | | | | 3.61 | | | | 4.35 | | | | 4.67 | | | | 4.83 | |

| Ten Years Ended 12/31/22 | | | 8.04 | | | | 7.85 | | | | 8.65 | | | | 9.03 | | | | 9.15 | |

| | | | |

| Cumulative total returns | | | |

| Without sales charges1 | | | |

| Class A (12/31/12 through 12/31/22) | | | 129.93 | % |

| Class C (12/31/12 through 12/31/22) | | | 113.00 | |

| Class FI (12/31/12 through 12/31/22) | | | 129.18 | |

| Class I (12/31/12 through 12/31/22) | | | 137.29 | |

| Class IS (12/31/12 through 12/31/22) | | | 139.98 | |

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower.

| 1 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charge with respect to Class A shares or the applicable contingent deferred sales charge (“CDSC”) with respect to Class C shares. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. In addition, Class A shares reflect the deduction of the maximum initial sales charge of 5.50% (5.75% prior to August 15, 2022). Class C shares reflect the deduction of a 1.00% CDSC, which applies if shares are redeemed within one year from purchase payment. |

| | | | |

10 | | | | Franklin U.S. Small Cap Equity Fund 2022 Annual Report |

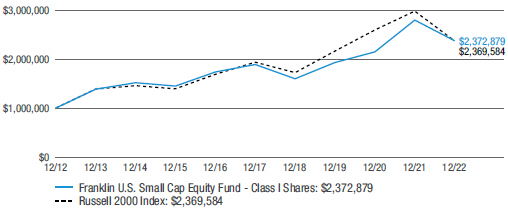

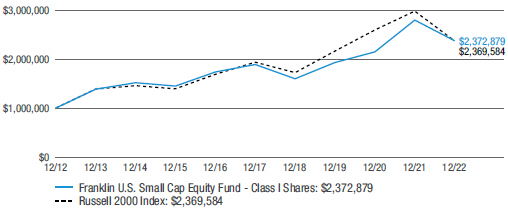

Historical performance

Value of $1,000,000 invested in

Class I Shares of Franklin U.S. Small Cap Equity Fund vs. Russell 2000 Index† — December 2012 - December 2022

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower.

| † | Hypothetical illustration of $1,000,000 invested in Class I shares of Franklin U.S. Small Cap Equity Fund on December 31, 2012, assuming the reinvestment of all distributions, including returns of capital, if any, at net asset value through December 31, 2022. The hypothetical illustration also assumes a $1,000,000 investment in the Russell 2000 Index. The Russell 2000 Index (the “Index”) measures the performance of the small-cap segment of the U.S. equity universe. The Index is a subset of the Russell 3000 Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the U.S. equity market. The Index is unmanaged and is not subject to the same management and trading expenses as a mutual fund. Please note that an investor cannot invest directly in an index. The performance of the Fund’s other classes may be greater or less than the Class I shares’ performance indicated on this chart, depending on whether greater or lesser sales charges and fees were incurred by shareholders investing in the other classes. |

| | | | |

| Franklin U.S. Small Cap Equity Fund 2022 Annual Report | | | | 11 |

Schedule of investments

December 31, 2022

Franklin U.S. Small Cap Equity Fund

(Percentages shown based on Fund net assets)

| | | | | | | | |

| Security | | Shares | | | Value | |

| Common Stocks — 99.0% | | | | | | | | |

| Communication Services — 2.7% | | | | | | | | |

Diversified Telecommunication Services — 0.9% | | | | | | | | |

EchoStar Corp., Class A Shares | | | 14,030 | | | | $ 234,021 | * |

Iridium Communications Inc. | | | 12,878 | | | | 661,929 | * |

Total Diversified Telecommunication Services | | | | | | | 895,950 | |

Entertainment — 0.1% | | | | | | | | |

Marcus Corp. | | | 8,418 | | | | 121,135 | |

Interactive Media & Services — 1.0% | | | | | | | | |

Angi Inc. | | | 51,513 | | | | 121,056 | * |

Cargurus Inc. | | | 12,025 | | | | 168,470 | * |

EverQuote Inc., Class A Shares | | | 3,073 | | | | 45,296 | * |

TrueCar Inc. | | | 73,491 | | | | 184,462 | * |

Yelp Inc. | | | 17,370 | | | | 474,896 | * |

Total Interactive Media & Services | | | | | | | 994,180 | |

Media — 0.5% | | | | | | | | |

Gannett Co. Inc. | | | 53,448 | | | | 108,499 | * |

Perion Network Ltd. | | | 16,702 | | | | 422,561 | * |

Total Media | | | | | | | 531,060 | |

Wireless Telecommunication Services — 0.2% | | | | | | | | |

Telephone & Data Systems Inc. | | | 7,883 | | | | 82,693 | |

United States Cellular Corp. | | | 7,044 | | | | 146,867 | * |

Total Wireless Telecommunication Services | | | | | | | 229,560 | |

Total Communication Services | | | | | | | 2,771,885 | |

| Consumer Discretionary — 10.9% | | | | | | | | |

Auto Components — 1.4% | | | | | | | | |

Goodyear Tire & Rubber Co. | | | 38,000 | | | | 385,700 | * |

Modine Manufacturing Co. | | | 30,000 | | | | 595,800 | * |

Patrick Industries Inc. | | | 4,009 | | | | 242,946 | |

Standard Motor Products Inc. | | | 6,213 | | | | 216,212 | |

Total Auto Components | | | | | | | 1,440,658 | |

Automobiles — 0.2% | | | | | | | | |

Winnebago Industries Inc. | | | 4,076 | | | | 214,805 | |

Diversified Consumer Services — 1.1% | | | | | | | | |

2U Inc. | | | 35,700 | | | | 223,839 | * |

American Public Education Inc. | | | 17,000 | | | | 208,930 | * |

Chegg Inc. | | | 16,000 | | | | 404,320 | * |

Perdoceo Education Corp. | | | 18,707 | | | | 260,027 | * |

Total Diversified Consumer Services | | | | | | | 1,097,116 | |

Hotels, Restaurants & Leisure — 2.1% | | | | | | | | |

Bloomin’ Brands Inc. | | | 26,056 | | | | 524,247 | |

See Notes to Financial Statements.

| | | | |

12 | | | | Franklin U.S. Small Cap Equity Fund 2022 Annual Report |

Franklin U.S. Small Cap Equity Fund

(Percentages shown based on Fund net assets)

| | | | | | | | |

| Security | | Shares | | | Value | |

Hotels, Restaurants & Leisure — continued | | | | | | | | |

Bluegreen Vacations Holding Corp. | | | 8,284 | | | | $ 206,769 | |

Cracker Barrel Old Country Store Inc. | | | 802 | | | | 75,981 | |

Fiesta Restaurant Group Inc. | | | 10,622 | | | | 78,072 | * |

International Game Technology PLC | | | 20,000 | | | | 453,600 | |

Penn Entertainment Inc. | | | 4,008 | | | | 119,037 | * |

Playa Hotels & Resorts NV | | | 44,000 | | | | 287,320 | * |

Red Robin Gourmet Burgers Inc. | | | 3,741 | | | | 20,875 | * |

SeaWorld Entertainment Inc. | | | 6,000 | | | | 321,060 | * |

Total Hotels, Restaurants & Leisure | | | | | | | 2,086,961 | |

Household Durables — 2.4% | | | | | | | | |

Beazer Homes USA Inc. | | | 44,094 | | | | 562,639 | * |

Ethan Allen Interiors Inc. | | | 12,693 | | | | 335,349 | |

GoPro Inc., Class A Shares | | | 28,060 | | | | 139,739 | * |

M/I Homes Inc. | | | 6,948 | | | | 320,859 | * |

MDC Holdings Inc. | | | 4,676 | | | | 147,761 | |

Meritage Homes Corp. | | | 6,014 | | | | 554,491 | * |

Tri Pointe Homes Inc. | | | 18,774 | | | | 349,009 | * |

Total Household Durables | | | | | | | 2,409,847 | |

Multiline Retail — 0.3% | | | | | | | | |

Macy’s Inc. | | | 13,361 | | | | 275,905 | |

Specialty Retail — 3.0% | | | | | | | | |

Academy Sports & Outdoors Inc. | | | 12,693 | | | | 666,890 | |

Dick’s Sporting Goods Inc. | | | 4,009 | | | | 482,243 | |

Genesco Inc. | | | 4,143 | | | | 190,661 | * |

Hibbett Inc. | | | 6,681 | | | | 455,778 | |

MarineMax Inc. | | | 9,687 | | | | 302,428 | * |

Signet Jewelers Ltd. | | | 8,686 | | | | 590,648 | |

TravelCenters of America Inc. | | | 8,552 | | | | 382,958 | * |

Total Specialty Retail | | | | | | | 3,071,606 | |

Textiles, Apparel & Luxury Goods — 0.4% | | | | | | | | |

Lakeland Industries Inc. | | | 11,357 | | | | 151,048 | * |

Movado Group Inc. | | | 9,353 | | | | 301,635 | |

Total Textiles, Apparel & Luxury Goods | | | | | | | 452,683 | |

Total Consumer Discretionary | | | | | | | 11,049,581 | |

| Consumer Staples — 3.8% | | | | | | | | |

Beverages — 0.6% | | | | | | | | |

Coca-Cola Consolidated Inc. | | | 1,203 | | | | 616,369 | |

See Notes to Financial Statements.

| | | | |

| Franklin U.S. Small Cap Equity Fund 2022 Annual Report | | | | 13 |

Schedule of investments (cont’d)

December 31, 2022

Franklin U.S. Small Cap Equity Fund

(Percentages shown based on Fund net assets)

| | | | | | | | |

| Security | | Shares | | | Value | |

Food & Staples Retailing — 0.9% | | | | | | | | |

Sprouts Farmers Market Inc. | | | 13,000 | | | | $ 420,810 | * |

United Natural Foods Inc. | | | 12,500 | | | | 483,875 | * |

Total Food & Staples Retailing | | | | | | | 904,685 | |

Food Products — 1.3% | | | | | | | | |

Cal-Maine Foods Inc. | | | 1,900 | | | | 103,455 | |

Darling Ingredients Inc. | | | 7,900 | | | | 494,461 | * |

John B Sanfilippo & Son Inc. | | | 4,009 | | | | 326,012 | |

Simply Good Foods Co. | | | 11,357 | | | | 431,906 | * |

Total Food Products | | | | | | | 1,355,834 | |

Personal Products — 0.3% | | | | | | | | |

Nature’s Sunshine Products Inc. | | | 11,491 | | | | 95,605 | * |

USANA Health Sciences Inc. | | | 3,274 | | | | 174,177 | * |

Total Personal Products | | | | | | | 269,782 | |

Tobacco — 0.7% | | | | | | | | |

Turning Point Brands Inc. | | | 7,349 | | | | 158,959 | |

Vector Group Ltd. | | | 44,094 | | | | 522,955 | |

Total Tobacco | | | | | | | 681,914 | |

Total Consumer Staples | | | | | | | 3,828,584 | |

| Energy — 6.5% | | | | | | | | |

Energy Equipment & Services — 0.5% | | | | | | | | |

Helmerich & Payne Inc. | | | 10,300 | | | | 510,571 | |

Oil, Gas & Consumable Fuels — 6.0% | | | | | | | | |

Chord Energy Corp. | | | 3,675 | | | | 502,777 | |

DHT Holdings Inc. | | | 40,000 | | | | 355,200 | |

Diamondback Energy Inc. | | | 5,011 | | | | 685,405 | |

Golar LNG Ltd. | | | 19,375 | | | | 441,556 | * |

Murphy Oil Corp. | | | 20,043 | | | | 862,049 | |

Ovintiv Inc. | | | 14,779 | | | | 749,443 | |

PDC Energy Inc. | | | 4,343 | | | | 275,694 | |

Ranger Oil Corp., Class A Shares | | | 10,000 | | | | 404,300 | |

SandRidge Energy Inc. | | | 41,948 | | | | 714,374 | * |

SM Energy Co. | | | 23,383 | | | | 814,430 | |

Teekay Tankers Ltd., Class A Shares | | | 9,000 | | | | 277,290 | * |

Total Oil, Gas & Consumable Fuels | | | | | | | 6,082,518 | |

Total Energy | | | | | | | 6,593,089 | |

| Financials — 17.7% | | | | | | | | |

Banks — 9.5% | | | | | | | | |

Amerant Bancorp Inc. | | | 10,151 | | | | 272,453 | |

Associated Banc-Corp. | | | 19,000 | | | | 438,710 | |

Berkshire Hills Bancorp Inc. | | | 18,707 | | | | 559,339 | |

See Notes to Financial Statements.

| | | | |

14 | | | | Franklin U.S. Small Cap Equity Fund 2022 Annual Report |

Franklin U.S. Small Cap Equity Fund

(Percentages shown based on Fund net assets)

| | | | | | | | |

| Security | | Shares | | | Value | |

Banks — continued | | | | | | | | |

Carter Bankshares Inc. | | | 30,022 | | | | $ 498,065 | * |

Central Pacific Financial Corp. | | | 11,491 | | | | 233,037 | |

Community Trust Bancorp Inc. | | | 2,404 | | | | 110,416 | |

CrossFirst Bankshares Inc. | | | 20,000 | | | | 248,200 | * |

Equity Bancshares Inc., Class A Shares | | | 9,554 | | | | 312,129 | |

Financial Institutions Inc. | | | 10,021 | | | | 244,112 | |

First BanCorp | | | 54,757 | | | | 696,509 | |

First Commonwealth Financial Corp. | | | 21,810 | | | | 304,686 | |

First Financial Corp. | | | 6,614 | | | | 304,773 | |

First Horizon Corp. | | | 26,724 | | | | 654,738 | |

First Internet Bancorp | | | 6,013 | | | | 145,996 | |

Flushing Financial Corp. | | | 20,043 | | | | 388,433 | |

Hancock Whitney Corp. | | | 7,518 | | | | 363,796 | |

Hanmi Financial Corp. | | | 30,545 | | | | 755,989 | |

Heartland Financial USA Inc. | | | 3,674 | | | | 171,282 | |

Heritage Financial Corp. | | | 8,685 | | | | 266,108 | |

HomeStreet Inc. | | | 7,349 | | | | 202,685 | |

HomeTrust Bancshares Inc. | | | 8,017 | | | | 193,771 | |

Hope Bancorp Inc. | | | 32,269 | | | | 413,366 | |

Midland States Bancorp Inc. | | | 14,221 | | | | 378,563 | |

OFG Bancorp | | | 18,467 | | | | 508,950 | |

Peoples Bancorp Inc. | | | 10,355 | | | | 292,529 | |

Umpqua Holdings Corp. | | | 16,034 | | | | 286,207 | |

Washington Federal Inc. | | | 10,000 | | | | 335,500 | |

Total Banks | | | | | | | 9,580,342 | |

Capital Markets — 0.7% | | | | | | | | |

BGC Partners Inc., Class A Shares | | | 87,455 | | | | 329,705 | |

CION Investment Corp. | | | 22,300 | | | | 217,425 | |

Evercore Inc., Class A Shares | | | 1,336 | | | | 145,731 | |

Total Capital Markets | | | | | | | 692,861 | |

Consumer Finance — 1.4% | | | | | | | | |

Bread Financial Holdings Inc. | | | 3,674 | | | | 138,363 | |

Enova International Inc. | | | 20,043 | | | | 769,050 | * |

LendingClub Corp. | | | 26,615 | | | | 234,212 | * |

Navient Corp. | | | 16,000 | | | | 263,200 | |

Total Consumer Finance | | | | | | | 1,404,825 | |

Diversified Financial Services — 1.0% | | | | | | | | |

Acacia Research Corp. | | | 47,700 | | | | 200,817 | * |

See Notes to Financial Statements.

| | | | |

| Franklin U.S. Small Cap Equity Fund 2022 Annual Report | | | | 15 |

Schedule of investments (cont’d)

December 31, 2022

Franklin U.S. Small Cap Equity Fund

(Percentages shown based on Fund net assets)

| | | | | | | | |

| Security | | Shares | | | Value | |

Diversified Financial Services — continued | | | | | | | | |

Cannae Holdings Inc. | | | 15,000 | | | | $ 309,750 | * |

Jackson Financial Inc., Class A Shares | | | 15,000 | | | | 521,850 | |

Total Diversified Financial Services | | | | | | | 1,032,417 | |

Insurance — 2.5% | | | | | | | | |

Ambac Financial Group Inc. | | | 24,000 | | | | 418,560 | * |

Genworth Financial Inc., Class A Shares | | | 100,216 | | | | 530,143 | * |

ProAssurance Corp. | | | 12,025 | | | | 210,077 | |

RLI Corp. | | | 2,500 | | | | 328,175 | |

Safety Insurance Group Inc. | | | 5,212 | | | | 439,163 | |

Stewart Information Services Corp. | | | 8,017 | | | | 342,566 | |

United Fire Group Inc. | | | 9,487 | | | | 259,564 | |

Total Insurance | | | | | | | 2,528,248 | |

Mortgage Real Estate Investment Trusts (REITs) — 0.2% | | | | | | | | |

Redwood Trust Inc. | | | 36,918 | | | | 249,566 | |

Thrifts & Mortgage Finance — 2.4% | | | | | | | | |

Essent Group Ltd. | | | 5,151 | | | | 200,271 | |

MGIC Investment Corp. | | | 44,763 | | | | 581,919 | |

Mr. Cooper Group Inc. | | | 8,685 | | | | 348,529 | * |

New York Community Bancorp Inc. | | | 40,235 | | | | 346,021 | |

NMI Holdings Inc., Class A Shares | | | 13,361 | | | | 279,245 | * |

Radian Group Inc. | | | 35,087 | | | | 669,109 | |

Total Thrifts & Mortgage Finance | | | | | | | 2,425,094 | |

Total Financials | | | | | | | 17,913,353 | |

| Health Care — 16.2% | | | | | | | | |

Biotechnology — 7.8% | | | | | | | | |

Abeona Therapeutics Inc. | | | 8,551 | | | | 26,337 | * |

ACADIA Pharmaceuticals Inc. | | | 18,200 | | | | 289,744 | * |

Achillion Pharmaceuticals Inc., CVR | | | 89,796 | | | | 0 | *(a)(b)(c) |

Aeglea BioTherapeutics Inc. | | | 30,064 | | | | 13,526 | * |

Agios Pharmaceuticals Inc. | | | 7,727 | | | | 216,974 | * |

Akebia Therapeutics Inc. | | | 80,173 | | | | 46,260 | * |

Alaunos Therapeutics Inc. | | | 128,783 | | | | 83,593 | * |

Alector Inc. | | | 14,297 | | | | 131,961 | * |

Alkermes PLC | | | 13,562 | | | | 354,375 | * |

AnaptysBio Inc. | | | 5,000 | | | | 154,950 | * |

Anika Therapeutics Inc. | | | 5,010 | | | | 148,296 | * |

Aptevo Therapeutics Inc. | | | 10,288 | | | | 23,868 | * |

Aravive Inc. | | | 24,853 | | | | 32,806 | * |

Arbutus Biopharma Corp. | | | 30,064 | | | | 70,049 | * |

Ardelyx Inc. | | | 200,432 | | | | 571,231 | * |

See Notes to Financial Statements.

| | | | |

16 | | | | Franklin U.S. Small Cap Equity Fund 2022 Annual Report |

Franklin U.S. Small Cap Equity Fund

(Percentages shown based on Fund net assets)

| | | | | | | | |

| Security | | Shares | | | Value | |

Biotechnology — continued | | | | | | | | |

Arrowhead Pharmaceuticals Inc. | | | 1,669 | | | $ | 67,695 | * |

Assembly Biosciences Inc. | | | 79,545 | | | | 103,408 | * |

Atara Biotherapeutics Inc. | | | 20,043 | | | | 65,741 | * |

Beyondspring Inc. | | | 12,092 | | | | 22,733 | * |

Bluebird Bio Inc. | | | 23,000 | | | | 159,160 | * |

Calithera Biosciences Inc. | | | 4,342 | | | | 14,155 | * |

Caribou Biosciences Inc. | | | 14,030 | | | | 88,108 | * |

CASI Pharmaceuticals Inc. | | | 23,723 | | | | 41,515 | * |

Cellectar Biosciences Inc. | | | 10,124 | | | | 17,312 | * |

Chimerix Inc. | | | 26,992 | | | | 50,205 | * |

Cyclerion Therapeutics Inc. | | | 75,786 | | | | 49,731 | * |

CytomX Therapeutics Inc. | | | 33,405 | | | | 53,448 | * |

Deciphera Pharmaceuticals Inc. | | | 8,685 | | | | 142,347 | * |

Eagle Pharmaceuticals Inc. | | | 5,475 | | | | 160,034 | * |

Editas Medicine Inc. | | | 8,000 | | | | 70,960 | * |

Enanta Pharmaceuticals Inc. | | | 2,900 | | | | 134,908 | * |

GlycoMimetics Inc. | | | 116,129 | | | | 351,871 | * |

Gritstone bio Inc. | | | 26,724 | | | | 92,198 | * |

Heron Therapeutics Inc. | | | 28,000 | | | | 70,000 | * |

Homology Medicines Inc. | | | 50,000 | | | | 63,000 | * |

Icosavax Inc. | | | 15,000 | | | | 119,100 | * |

Infinity Pharmaceuticals Inc. | | | 120,000 | | | | 66,600 | * |

Inovio Pharmaceuticals Inc. | | | 60,000 | | | | 93,600 | * |

Intercept Pharmaceuticals Inc. | | | 7,349 | | | | 90,907 | * |

Ironwood Pharmaceuticals Inc. | | | 15,000 | | | | 185,850 | * |

iTeos Therapeutics Inc. | | | 4,342 | | | | 84,799 | * |

Jounce Therapeutics Inc. | | | 23,383 | | | | 25,955 | * |

Karyopharm Therapeutics Inc. | | | 19,800 | | | | 67,320 | * |

MacroGenics Inc. | | | 32,000 | | | | 214,720 | * |

NextCure Inc. | | | 23,383 | | | | 32,970 | * |

PDL BioPharma Inc. | | | 152,500 | | | | 192,150 | *(a)(b) |

Pieris Pharmaceuticals Inc. | | | 29,063 | | | | 30,226 | * |

Precigen Inc. | | | 33,405 | | | | 50,776 | * |

Precision BioSciences Inc. | | | 68,684 | | | | 81,734 | * |

Protagonist Therapeutics Inc. | | | 14,000 | | | | 152,740 | * |

Prothena Corp. PLC | | | 4,000 | | | | 241,000 | * |

Puma Biotechnology Inc. | | | 23,383 | | | | 98,910 | * |

RAPT Therapeutics Inc. | | | 8,351 | | | | 165,350 | * |

REGENXBIO Inc. | | | 5,478 | | | | 124,241 | * |

Rigel Pharmaceuticals Inc. | | | 53,448 | | | | 80,172 | * |

See Notes to Financial Statements.

| | | | |

| Franklin U.S. Small Cap Equity Fund 2022 Annual Report | | | | 17 |

Schedule of investments (cont’d)

December 31, 2022

Franklin U.S. Small Cap Equity Fund

(Percentages shown based on Fund net assets)

| | | | | | | | |

| Security | | Shares | | | Value | |

Biotechnology — continued | | | | | | | | |

Sangamo Therapeutics Inc. | | | 26,000 | | | $ | 81,640 | * |

Savara Inc. | | | 177,634 | | | | 275,333 | * |

Selecta Biosciences Inc. | | | 59,395 | | | | 67,116 | * |

Sio Gene Therapies Inc. | | | 53,448 | | | | 23,250 | * |

Solid Biosciences Inc. | | | 9,333 | | | | 50,212 | * |

Spectrum Pharmaceuticals Inc. | | | 80,173 | | | | 29,544 | * |

Surface Oncology Inc. | | | 54,947 | | | | 45,057 | * |

Sutro Biopharma Inc. | | | 21,463 | | | | 173,421 | * |

Synlogic Inc. | | | 75,017 | | | | 57,013 | * |

Syros Pharmaceuticals Inc. | | | 4,209 | | | | 15,110 | * |

T2 Biosystems Inc. | | | 5,010 | | | | 7,114 | * |

Tempest Therapeutics Inc. | | | 10,173 | | | | 11,801 | * |

uniQure NV | | | 4,500 | | | | 102,015 | * |

UNITY Biotechnology Inc. | | | 10,000 | | | | 27,400 | * |

Vanda Pharmaceuticals Inc. | | | 18,707 | | | | 138,245 | * |

Vaxcyte Inc. | | | 2,500 | | | | 119,875 | * |

Verastem Inc. | | | 104,558 | | | | 42,085 | * |

Vir Biotechnology Inc. | | | 7,349 | | | | 186,003 | * |

Voyager Therapeutics Inc. | | | 17,171 | | | | 104,743 | * |

Xencor Inc. | | | 4,409 | | | | 114,810 | * |

Total Biotechnology | | | | | | | 7,853,406 | |

Health Care Equipment & Supplies — 3.1% | | | | | | | | |

Avanos Medical Inc. | | | 5,946 | | | | 160,899 | * |

Co-Diagnostics Inc. | | | 23,383 | | | | 58,925 | * |

Electromed Inc. | | | 23,196 | | | | 243,326 | * |

iRadimed Corp. | | | 4,208 | | | | 119,044 | |

Lantheus Holdings Inc. | | | 3,000 | | | | 152,880 | * |

Masimo Corp. | | | 1,905 | | | | 281,845 | * |

Meridian Bioscience Inc. | | | 10,939 | | | | 363,284 | * |

QuidelOrtho Corp. | | | 3,007 | | | | 257,610 | * |

Semler Scientific Inc. | | | 4,000 | | | | 132,000 | * |

Shockwave Medical Inc. | | | 3,207 | | | | 659,391 | * |

STAAR Surgical Co. | | | 4,009 | | | | 194,597 | * |

Varex Imaging Corp. | | | 12,025 | | | | 244,107 | * |

Zynex Inc. | | | 17,638 | | | | 245,345 | |

Total Health Care Equipment & Supplies | | | | | | | 3,113,253 | |

Health Care Providers & Services — 3.6% | | | | | | | | |

Addus HomeCare Corp. | | | 3,675 | | | | 365,626 | * |

Alignment Healthcare Inc. | | | 18,800 | | | | 221,088 | * |

AMN Healthcare Services Inc. | | | 4,677 | | | | 480,889 | * |

See Notes to Financial Statements.

| | | | |

18 | | | | Franklin U.S. Small Cap Equity Fund 2022 Annual Report |

Franklin U.S. Small Cap Equity Fund

(Percentages shown based on Fund net assets)

| | | | | | | | |

| Security | | Shares | | | Value | |

Health Care Providers & Services — continued | | | | | | | | |

Cross Country Healthcare Inc. | | | 13,000 | | | $ | 345,410 | * |

Ensign Group Inc. | | | 10,726 | | | | 1,014,787 | |

Fulgent Genetics Inc. | | | 4,276 | | | | 127,339 | * |

InfuSystem Holdings Inc. | | | 12,025 | | | | 104,377 | * |

Joint Corp. | | | 10,021 | | | | 140,094 | * |

ModivCare Inc. | | | 3,300 | | | | 296,109 | * |

Owens & Minor Inc. | | | 8,017 | | | | 156,572 | * |

Tenet Healthcare Corp. | | | 8,018 | | | | 391,198 | * |

Total Health Care Providers & Services | | | | | | | 3,643,489 | |

Health Care Technology — 0.4% | | | | | | | | |

NextGen Healthcare Inc. | | | 18,888 | | | | 354,717 | * |

Life Sciences Tools & Services — 0.2% | | | | | | | | |

Adaptive Biotechnologies Corp. | | | 18,000 | | | | 137,520 | * |

Berkeley Lights Inc. | | | 36,000 | | | | 96,480 | * |

Total Life Sciences Tools & Services | | | | | | | 234,000 | |

Pharmaceuticals — 1.1% | | | | | | | | |

Amphastar Pharmaceuticals Inc. | | | 8,685 | | | | 243,354 | * |

Assertio Holdings Inc. | | | 50,108 | | | | 215,464 | * |

Cara Therapeutics Inc. | | | 13,361 | | | | 143,497 | * |

Clearside Biomedical Inc. | | | 74,428 | | | | 83,359 | * |

Iterum Therapeutics PLC | | | 16,831 | | | | 14,138 | * |

Nektar Therapeutics | | | 30,000 | | | | 67,800 | * |

SIGA Technologies Inc. | | | 12,600 | | | | 92,736 | |

Theravance Biopharma Inc. | | | 10,021 | | | | 112,436 | * |

VYNE Therapeutics Inc. | | | 93,534 | | | | 14,030 | * |

WaVe Life Sciences Ltd. | | | 22,000 | | | | 154,000 | * |

Total Pharmaceuticals | | | | | | | 1,140,814 | |

Total Health Care | | | | | | | 16,339,679 | |

| Industrials — 16.7% | | | | | | | | |

Aerospace & Defense — 0.4% | | | | | | | | |

AAR Corp. | | | 10,021 | | | | 449,943 | * |

Building Products — 0.9% | | | | | | | | |

Alpha Pro Tech Ltd. | | | 17,705 | | | | 71,174 | * |

Caesarstone Ltd. | | | 12,827 | | | | 73,242 | |

Masonite International Corp. | | | 8,820 | | | | 710,981 | * |

Total Building Products | | | | | | | 855,397 | |

Commercial Services & Supplies — 0.7% | | | | | | | | |

CoreCivic Inc. | | | 34,474 | | | | 398,519 | * |

GEO Group Inc. | | | 23,383 | | | | 256,044 | * |

Total Commercial Services & Supplies | | | | | | | 654,563 | |

See Notes to Financial Statements.

| | | | |

| Franklin U.S. Small Cap Equity Fund 2022 Annual Report | | | | 19 |

Schedule of investments (cont’d)

December 31, 2022

Franklin U.S. Small Cap Equity Fund

(Percentages shown based on Fund net assets)

| | | | | | | | |

| Security | | Shares | | | Value | |

Construction & Engineering — 1.3% | | | | | | | | |

Argan Inc. | | | 8,479 | | | $ | 312,706 | |

Dycom Industries Inc. | | | 5,345 | | | | 500,292 | * |

MYR Group Inc. | | | 3,007 | | | | 276,854 | * |

Orion Group Holdings Inc. | | | 112,926 | | | | 268,764 | * |

Total Construction & Engineering | | | | | | | 1,358,616 | |

Electrical Equipment — 1.0% | | | | | | | | |

Atkore Inc. | | | 2,500 | | | | 283,550 | * |

Encore Wire Corp. | | | 2,000 | | | | 275,120 | |

GrafTech International Ltd. | | | 25,788 | | | | 122,751 | |

SunPower Corp. | | | 16,034 | | | | 289,093 | * |

Total Electrical Equipment | | | | | | | 970,514 | |

Machinery — 1.9% | | | | | | | | |

Briggs & Stratton Corp. | | | 158,200 | | | | 0 | *(a)(b)(c) |

Greenbrier Cos. Inc. | | | 11,156 | | | | 374,061 | |

Manitowoc Co. Inc. | | | 23,383 | | | | 214,188 | * |

Terex Corp. | | | 12,025 | | | | 513,708 | |

Titan International Inc. | | | 55,260 | | | | 846,583 | * |

Total Machinery | | | | | | | 1,948,540 | |

Professional Services — 3.3% | | | | | | | | |

Barrett Business Services Inc. | | | 1,604 | | | | 149,621 | |

CRA International Inc. | | | 4,677 | | | | 572,605 | |

Exponent Inc. | | | 3,675 | | | | 364,156 | |

Heidrick & Struggles International Inc. | | | 7,349 | | | | 205,551 | |

Insperity Inc. | | | 7,216 | | | | 819,738 | |

Kforce Inc. | | | 12,026 | | | | 659,386 | |

TriNet Group Inc. | | | 5,000 | | | | 339,000 | * |

TrueBlue Inc. | | | 13,328 | | | | 260,962 | * |

Total Professional Services | | | | | | | 3,371,019 | |

Road & Rail — 1.5% | | | | | | | | |

ArcBest Corp. | | | 5,345 | | | | 374,364 | |

Covenant Logistics Group Inc. | | | 15,366 | | | | 531,202 | |

Werner Enterprises Inc. | | | 16,034 | | | | 645,529 | |

Total Road & Rail | | | | | | | 1,551,095 | |

Trading Companies & Distributors — 5.7% | | | | | | | | |

BlueLinx Holdings Inc. | | | 10,022 | | | | 712,664 | * |

Boise Cascade Co. | | | 5,345 | | | | 367,041 | |

Herc Holdings Inc. | | | 5,345 | | | | 703,242 | |

MRC Global Inc. | | | 46,767 | | | | 541,562 | * |

NOW Inc. | | | 66,810 | | | | 848,487 | * |

Rush Enterprises Inc., Class A Shares | | | 11,357 | | | | 593,744 | |

See Notes to Financial Statements.

| | | | |

20 | | | | Franklin U.S. Small Cap Equity Fund 2022 Annual Report |

Franklin U.S. Small Cap Equity Fund

(Percentages shown based on Fund net assets)

| | | | | | | | |

| Security | | Shares | | | Value | |

Trading Companies & Distributors — continued | | | | | | | | |

Titan Machinery Inc. | | | 15,000 | | | $ | 595,950 | * |

Triton International Ltd. | | | 9,354 | | | | 643,368 | |

Veritiv Corp. | | | 5,948 | | | | 723,931 | |

Total Trading Companies & Distributors | | | | | | | 5,729,989 | |

Total Industrials | | | | | | | 16,889,676 | |

| Information Technology — 12.0% | | | | | | | | |

Communications Equipment — 1.5% | | | | | | | | |

ADTRAN Holdings Inc. | | | 19,375 | | | | 364,056 | |

Applied Optoelectronics Inc. | | | 34,741 | | | | 65,661 | * |

EMCORE Corp. | | | 45,230 | | | | 43,534 | * |

Extreme Networks Inc. | | | 30,064 | | | | 550,472 | * |

Inseego Corp. | | | 82,800 | | | | 69,759 | * |

NETGEAR Inc. | | | 8,710 | | | | 157,738 | * |

NetScout Systems Inc. | | | 9,687 | | | | 314,924 | * |

Total Communications Equipment | | | | | | | 1,566,144 | |

Electronic Equipment, Instruments & Components — 1.3% | | | | | | | | |

Arlo Technologies Inc. | | | 44,963 | | | | 157,820 | * |

Avnet Inc. | | | 4,008 | | | | 166,653 | |

Sanmina Corp. | | | 8,017 | | | | 459,294 | * |

TTM Technologies Inc. | | | 21,379 | | | | 322,395 | * |

Vishay Intertechnology Inc. | | | 8,017 | | | | 172,927 | |

Total Electronic Equipment, Instruments & Components | | | | | | | 1,279,089 | |

IT Services — 1.6% | | | | | | | | |

AvidXchange Holdings Inc. | | | 30,000 | | | | 298,200 | * |

ExlService Holdings Inc. | | | 5,011 | | | | 849,014 | * |

Grid Dynamics Holdings Inc. | | | 19,709 | | | | 221,135 | * |

International Money Express Inc. | | | 9,800 | | | | 238,826 | * |

Total IT Services | | | | | | | 1,607,175 | |

Semiconductors & Semiconductor Equipment — 2.2% | | | | | | | | |

Alpha & Omega Semiconductor Ltd. | | | 9,000 | | | | 257,130 | * |

Amkor Technology Inc. | | | 26,000 | | | | 623,480 | |

Axcelis Technologies Inc. | | | 5,000 | | | | 396,800 | * |

Everspin Technologies Inc. | | | 23,383 | | | | 130,010 | * |

Kulicke & Soffa Industries Inc. | | | 8,017 | | | | 354,832 | |

Photronics Inc. | | | 26,724 | | | | 449,765 | * |

Total Semiconductors & Semiconductor Equipment | | | | | | | 2,212,017 | |

Software — 5.3% | | | | | | | | |

A10 Networks Inc. | | | 34,340 | | | | 571,074 | |

Alarm.com Holdings Inc. | | | 5,011 | | | | 247,944 | * |

Box Inc., Class A Shares | | | 16,000 | | | | 498,080 | * |

See Notes to Financial Statements.

| | | | |

| Franklin U.S. Small Cap Equity Fund 2022 Annual Report | | | | 21 |

Schedule of investments (cont’d)

December 31, 2022

Franklin U.S. Small Cap Equity Fund

(Percentages shown based on Fund net assets)

| | | | | | | | |

| Security | | Shares | | | Value | |

Software — continued | | | | | | | | |

CommVault Systems Inc. | | | 8,441 | | | $ | 530,432 | * |

Couchbase Inc. | | | 25,000 | | | | 331,500 | * |

Domo Inc., Class B Shares | | | 4,008 | | | | 57,074 | * |

Duck Creek Technologies Inc. | | | 20,700 | | | | 249,435 | * |

eGain Corp. | | | 20,644 | | | | 186,415 | * |

HubSpot Inc. | | | 668 | | | | 193,139 | * |

LiveRamp Holdings Inc. | | | 12,617 | | | | 295,743 | * |

Manhattan Associates Inc. | | | 4,677 | | | | 567,788 | * |

Qualys Inc. | | | 5,078 | | | | 569,904 | * |

Sprout Social Inc., Class A Shares | | | 4,677 | | | | 264,063 | * |

Tenable Holdings Inc. | | | 11,357 | | | | 433,270 | * |

Varonis Systems Inc. | | | 7,883 | | | | 188,719 | * |

Zuora Inc., Class A Shares | | | 24,051 | | | | 152,964 | * |

Total Software | | | | | | | 5,337,544 | |

Technology Hardware, Storage & Peripherals — 0.1% | | | | | | | | |

Stratasys Ltd. | | | 12,025 | | | | 142,616 | * |

Total Information Technology | | | | | | | 12,144,585 | |

| Materials — 3.9% | | | | | | | | |

Chemicals — 1.5% | | | | | | | | |

AdvanSix Inc. | | | 12,025 | | | | 457,191 | |

American Vanguard Corp. | | | 12,827 | | | | 278,474 | |

Rayonier Advanced Materials Inc. | | | 42,532 | | | | 408,307 | * |

Tronox Holdings PLC, Class A Shares | | | 25,756 | | | | 353,115 | |

Total Chemicals | | | | | | | 1,497,087 | |

Containers & Packaging — 0.3% | | | | | | | | |

O-I Glass Inc. | | | 18,000 | | | | 298,260 | * |

Metals & Mining — 1.4% | | | | | | | | |

Alcoa Corp. | | | 6,000 | | | | 272,820 | |

Compass Minerals International Inc. | | | 8,200 | | | | 336,200 | |

SunCoke Energy Inc. | | | 90,862 | | | | 784,139 | |

Total Metals & Mining | | | | | | | 1,393,159 | |

Paper & Forest Products — 0.7% | | | | | | | | |

Clearwater Paper Corp. | | | 10,989 | | | | 415,494 | * |

Sylvamo Corp. | | | 7,500 | | | | 364,425 | |

Total Paper & Forest Products | | | | | | | 779,919 | |

Total Materials | | | | | | | 3,968,425 | |

| Real Estate — 5.0% | | | | | | | | |

Equity Real Estate Investment Trusts (REITs) — 4.1% | | | | | | | | |

Apple Hospitality REIT Inc. | | | 33,405 | | | | 527,131 | |

Braemar Hotels & Resorts Inc. | | | 33,405 | | | | 137,294 | |

See Notes to Financial Statements.

| | | | |

22 | | | | Franklin U.S. Small Cap Equity Fund 2022 Annual Report |

Franklin U.S. Small Cap Equity Fund

(Percentages shown based on Fund net assets)

| | | | | | | | |

| Security | | Shares | | | Value | |

Equity Real Estate Investment Trusts (REITs) — continued | | | | | | | | |

CareTrust REIT Inc. | | | 21,463 | | | $ | 398,782 | |

Chatham Lodging Trust | | | 24,854 | | | | 304,959 | |

DiamondRock Hospitality Co. | | | 65,682 | | | | 537,935 | |

Hersha Hospitality Trust, Class A Shares | | | 66,810 | | | | 569,221 | |

Innovative Industrial Properties Inc. | | | 2,662 | | | | 269,794 | |

National Health Investors Inc. | | | 7,400 | | | | 386,428 | |

Outfront Media Inc. | | | 18,039 | | | | 299,087 | |

Pebblebrook Hotel Trust | | | 17,370 | | | | 232,584 | |

Piedmont Office Realty Trust Inc., Class A Shares | | | 23,717 | | | | 217,485 | |

RLJ Lodging Trust | | | 28,125 | | | | 297,844 | |

Total Equity Real Estate Investment Trusts (REITs) | | | | | | | 4,178,544 | |

Real Estate Management & Development — 0.9% | | | | | | | | |

Forestar Group Inc. | | | 22,047 | | | | 339,744 | * |

Marcus & Millichap Inc. | | | 9,379 | | | | 323,107 | |

RE/MAX Holdings Inc., Class A Shares | | | 13,000 | | | | 242,320 | |

Total Real Estate Management & Development | | | | | | | 905,171 | |

Total Real Estate | | | | | | | 5,083,715 | |

| Utilities — 3.6% | | | | | | | | |

Electric Utilities — 2.6% | | | | | | | | |

ALLETE Inc. | | | 7,350 | | | | 474,149 | |

IDACORP Inc. | | | 5,145 | | | | 554,888 | |

Otter Tail Corp. | | | 4,009 | | | | 235,369 | |

PNM Resources Inc. | | | 10,689 | | | | 521,516 | |

Portland General Electric Co. | | | 17,036 | | | | 834,764 | |

Total Electric Utilities | | | | | | | 2,620,686 | |

Gas Utilities — 0.6% | | | | | | | | |

National Fuel Gas Co. | | | 4,878 | | | | 308,777 | |

Northwest Natural Holding Co. | | | 6,949 | | | | 330,703 | |

Total Gas Utilities | | | | | | | 639,480 | |

Water Utilities — 0.4% | | | | | | | | |

Consolidated Water Co. Ltd. | | | 23,498 | | | | 347,770 | |

Total Utilities | | | | | | | 3,607,936 | |

Total Investments before Short-Term Investments (Cost — $99,857,447) | | | | | | | 100,190,508 | |

See Notes to Financial Statements.

| | | | |

| Franklin U.S. Small Cap Equity Fund 2022 Annual Report | | | | 23 |

Schedule of investments (cont’d)

December 31, 2022

Franklin U.S. Small Cap Equity Fund

(Percentages shown based on Fund net assets)

| | | | | | | | | | | | |

| Security | | Rate | | | Shares | | | Value | |

| Short-Term Investments — 1.0% | | | | | | | | | | | | |

Invesco Treasury Portfolio, Institutional Class (Cost — $1,002,583) | | | 4.235 | % | | | 1,002,583 | | | $ | 1,002,583 | (d) |

Total Investments — 100.0% (Cost — $100,860,030) | | | | | | | | | | | 101,193,091 | |

Other Assets in Excess of Liabilities — 0.0%†† | | | | | | | | | | | 9,086 | |

Total Net Assets — 100.0% | | | | | | | | | | $ | 101,202,177 | |

| †† | Represents less than 0.1%. |

| * | Non-income producing security. |

| (a) | Security is valued in good faith in accordance with procedures approved by the Board of Trustees (Note 1). |

| (b) | Security is valued using significant unobservable inputs (Note 1). |

| (c) | Value is less than $1. |

| (d) | Rate shown is one-day yield as of the end of the reporting period. |

| | |

Abbreviation(s) used in this schedule: |

| |

| CVR | | — Contingent Value Rights |

| |

| REIT | | — Real Estate Investment Trust |

See Notes to Financial Statements.

| | | | |

24 | | | | Franklin U.S. Small Cap Equity Fund 2022 Annual Report |

Statement of assets and liabilities

December 31, 2022

| | | | |

| |

| Assets: | | | | |

Investments, at value (Cost — $100,860,030) | | $ | 101,193,091 | |

Dividends receivable | | | 120,383 | |

Receivable for Fund shares sold | | | 16,497 | |

Other assets | | | 131,505 | |

Prepaid expenses | | | 4,186 | |

Total Assets | | | 101,465,662 | |

| |

| Liabilities: | | | | |

Trustees’ fees payable | | | 133,821 | |

Investment management fee payable | | | 43,685 | |

Fund accounting fees payable | | | 22,315 | |

Transfer agent fees payable | | | 20,511 | |

Payable for Fund shares repurchased | | | 18,634 | |

Service and/or distribution fees payable | | | 12,324 | |

Accrued expenses | | | 12,195 | |

Total Liabilities | | | 263,485 | |

| Total Net Assets | | $ | 101,202,177 | |

| |

| Net Assets: | | | | |

Par value (Note 7) | | $ | 92 | |

Paid-in capital in excess of par value | | | 99,905,682 | |

Total distributable earnings (loss) | | | 1,296,403 | |

| Total Net Assets | | $ | 101,202,177 | |

| |

| Net Assets: | | | | |

Class A | | | $56,112,887 | |

Class C | | | $366,179 | |

Class FI | | | $17,933 | |

Class I | | | $1,554,825 | |

Class IS | | | $43,150,353 | |

| |

| Shares Outstanding: | | | | |

Class A | | | 5,090,209 | |

Class C | | | 38,047 | |

Class FI | | | 1,738 | |

Class I | | | 136,045 | |

Class IS | | | 3,920,516 | |

| |

| Net Asset Value: | | | | |

Class A (and redemption price) | | | $11.02 | |

Class C* | | | $9.62 | |

Class FI (and redemption price) | | | $10.32 | |

Class I (and redemption price) | | | $11.43 | |

Class IS (and redemption price) | | | $11.01 | |

| Maximum Public Offering Price Per Share: | | | | |

Class A (based on maximum initial sales charge of 5.50%; 5.75% prior to August 15, 2022) | | | $11.66 | |

| * | Redemption price per share is NAV of Class C shares reduced by a 1.00% CDSC if shares are redeemed within one year from purchase payment (Note 2). |

See Notes to Financial Statements.

| | | | |

| Franklin U.S. Small Cap Equity Fund 2022 Annual Report | | | | 25 |

Statement of operations

For the Year Ended December 31, 2022

| | | | |

| |

| Investment Income: | | | | |

Dividends | | $ | 1,586,762 | |

Less: Foreign taxes withheld | | | (5,478) | |

Total Investment Income | | | 1,581,284 | |

| |

| Expenses: | | | | |

Investment management fee (Note 2) | | | 917,623 | |

Service and/or distribution fees (Notes 2 and 5) | | | 150,992 | |

Transfer agent fees (Note 5) | | | 127,872 | |

Registration fees | | | 73,228 | |

Fund accounting fees | | | 67,777 | |

Audit and tax fees | | | 39,911 | |

Legal fees | | | 34,343 | |

Shareholder reports | | | 15,468 | |

Trustees’ fees | | | 11,540 | |

Custody fees | | | 860 | |

Commitment fees (Note 8) | | | 771 | |

Insurance | | | 631 | |

Miscellaneous expenses | | | 8,013 | |

Total Expenses | | | 1,449,029 | |

Less: Fee waivers and/or expense reimbursements (Notes 2 and 5) | | | (193,204) | |

Net Expenses | | | 1,255,825 | |

| Net Investment Income | | | 325,459 | |

| |

| Realized and Unrealized Gain (Loss)on Investments (Notes 1, 3 and 9): | | | | |

Net Realized Gain From Investment Transactions | | | 10,445,934 | |

Change in Net Unrealized Appreciation (Depreciation) From Investments | | | (37,624,863) | |

| Net Loss on Investments | | | (27,178,929) | |

| Decrease in Net Assets From Operations | | $ | (26,853,470) | |

See Notes to Financial Statements.

| | | | |

26 | | | | Franklin U.S. Small Cap Equity Fund 2022 Annual Report |

Statements of changes in net assets

| | | | | | | | |

| For the Years Ended December 31, | | 2022 | | | 2021 | |

| | |

| Operations: | | | | | | | | |

Net investment income | | $ | 325,459 | | | $ | 594,356 | |

Net realized gain | | | 10,445,934 | | | | 36,266,908 | |

Change in net unrealized appreciation (depreciation) | | | (37,624,863) | | | | 14,428,905 | |

Increase (Decrease) in Net Assets From Operations | | | (26,853,470) | | | | 51,290,169 | |

| | |

| Distributions to Shareholders From (Notes 1 and 6): | | | | | | | | |

Total distributable earnings | | | (5,718,112) | | | | (37,064,492) | |

Decrease in Net Assets From Distributions to Shareholders | | | (5,718,112) | | | | (37,064,492) | |

| | |

| Fund Share Transactions (Note 7): | | | | | | | | |

Net proceeds from sale of shares | | | 10,186,124 | | | | 63,327,830 | |

Reinvestment of distributions | | | 5,705,292 | | | | 36,966,915 | |

Cost of shares repurchased | | | (34,407,097) | | | | (106,431,692) | |

Shares redeemed in-kind (Note 9) | | | (37,396,485) | | | | — | |

Decrease in Net Assets From Fund Share Transactions | | | (55,912,166) | | | | (6,136,947) | |

Increase (Decrease) in Net Assets | | | (88,483,748) | | | | 8,088,730 | |

| | |

| Net Assets: | | | | | | | | |

Beginning of year | | | 189,685,925 | | | | 181,597,195 | |

End of year | | $ | 101,202,177 | | | $ | 189,685,925 | |

See Notes to Financial Statements.

| | | | |

| Franklin U.S. Small Cap Equity Fund 2022 Annual Report | | | | 27 |

Financial highlights

| | | | | | | | | | | | | | | | | | | | |

| For a share of each class of beneficial interest outstanding throughout each year ended December 31: | |

| | | | | |

| Class A Shares1 | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| | | | | |

| Net asset value, beginning of year | | | $13.71 | | | | $13.09 | | | | $12.22 | | | | $10.29 | | | | $13.55 | |

| | | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.01 | | | | 0.04 | | | | 0.04 | | | | 0.04 | | | | 0.02 | |

Net realized and unrealized gain (loss) | | | (2.14) | | | | 3.84 | | | | 1.29 | | | | 2.05 | | | | (2.13) | |

Total income (loss) from operations | | | (2.13) | | | | 3.88 | | | | 1.33 | | | | 2.09 | | | | (2.11) | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.04) | | | | (0.00) | 2 | | | (0.10) | | | | (0.02) | | | | (0.01) | |

Net realized gains | | | (0.52) | | | | (3.26) | | | | (0.36) | | | | (0.14) | | | | (1.14) | |

Total distributions | | | (0.56) | | | | (3.26) | | | | (0.46) | | | | (0.16) | | | | (1.15) | |

| | | | | |

| Net asset value, end of year | | | $11.02 | | | | $13.71 | | | | $13.09 | | | | $12.22 | | | | $10.29 | |

Total return3 | | | (15.42) | % | | | 30.03 | % | | | 10.99 | % | | | 20.43 | % | | | (15.58) | % |

| | | | | |

| Net assets, end of year (000s) | | | $56,113 | | | | $68,716 | | | | $12,128 | | | | $13,223 | | | | $11,916 | |

| | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.36 | % | | | 1.32 | % | | | 1.27 | % | | | 1.24 | % | | | 1.22 | % |

Net expenses4,5 | | | 1.20 | | | | 1.19 | | | | 1.14 | | | | 1.12 | | | | 1.13 | |

Net investment income | | | 0.08 | | | | 0.23 | | | | 0.37 | | | | 0.38 | | | | 0.11 | |

| | | | | |

| Portfolio turnover rate | | | 31 | %6 | | | 39 | % | | | 37 | % | | | 51 | % | | | 26 | % |

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | Amount represents less than $0.005 per share. |

| 3 | Performance figures, exclusive of sales charges, may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 4 | As a result of an expense limitation arrangement, the ratio of total annual fund operating expenses to average net assets of Class A shares did not exceed 1.30%. This expense limitation arrangement cannot be terminated prior to December 31, 2024 without the Board of Trustees’ consent. The manager currently intends to voluntarily waive fees and/or reimburse expenses so that total annual fund operating expenses do not exceed 1.20%. This arrangement is expected to continue until December 31, 2024, but may be terminated at any time by the manager. These expense limitation arrangements do not include interest, brokerage commissions, dividend expense on short sales, taxes, extraordinary expenses and acquired fund fees and expenses. |

| 5 | Reflects fee waivers and/or expense reimbursements. |

| 6 | Excludes securities delivered as a result of a redemption in-kind. |

See Notes to Financial Statements.

| | | | |

28 | | | | Franklin U.S. Small Cap Equity Fund 2022 Annual Report |

| | | | | | | | | | | | | | | | | | | | |

| For a share of each class of beneficial interest outstanding throughout each year ended December 31: | |

| | | | | |

| Class C Shares1 | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| | | | | |

| Net asset value, beginning of year | | | $12.10 | | | | $11.95 | | | | $11.17 | | | | $9.47 | | | | $12.66 | |

| | | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.07) | | | | (0.12) | | | | (0.04) | | | | (0.05) | | | | (0.08) | |

Net realized and unrealized gain (loss) | | | (1.89) | | | | 3.53 | | | | 1.18 | | | | 1.89 | | | | (1.97) | |

Total income (loss) from operations | | | (1.96) | | | | 3.41 | | | | 1.14 | | | | 1.84 | | | | (2.05) | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net realized gains | | | (0.52) | | | | (3.26) | | | | (0.36) | | | | (0.14) | | | | (1.14) | |

Total distributions | | | (0.52) | | | | (3.26) | | | | (0.36) | | | | (0.14) | | | | (1.14) | |

| | | | | |

| Net asset value, end of year | | | $9.62 | | | | $12.10 | | | | $11.95 | | | | $11.17 | | | | $9.47 | |

Total return2 | | | (16.08) | % | | | 28.92 | % | | | 10.16 | % | | | 19.52 | % | | | (16.18) | % |

| | | | | |

| Net assets, end of year (000s) | | | $366 | | | | $326 | | | | $640 | | | | $1,125 | | | | $3,579 | |

| | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 2.11 | % | | | 2.04 | % | | | 2.05 | % | | | 2.04 | %3 | | | 1.93 | %3 |

Net expenses4,5 | | | 1.95 | | | | 1.95 | | | | 1.91 | | | | 1.93 | 3 | | | 1.83 | 3 |

Net investment loss | | | (0.64) | | | | (0.84) | | | | (0.42) | | | | (0.42) | | | | (0.58) | |

| | | | | |

| Portfolio turnover rate | | | 31 | %6 | | | 39 | % | | | 37 | % | | | 51 | % | | | 26 | % |

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | Performance figures, exclusive of CDSC, may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Reflects recapture of expenses waived/reimbursed from prior fiscal years. |

| 4 | As a result of an expense limitation arrangement, the ratio of total annual fund operating expenses to average net assets of Class C shares did not exceed 2.05%. This expense limitation arrangement cannot be terminated prior to December 31, 2024 without the Board of Trustees’ consent. The manager currently intends to voluntarily waive fees and/or reimburse expenses so that total annual fund operating expenses do not exceed 1.95%. This arrangement is expected to continue until December 31, 2024, but may be terminated at any time by the manager. These expense limitation arrangements do not include interest, brokerage commissions, dividend expense on short sales, taxes, extraordinary expenses and acquired fund fees and expenses. |

| 5 | Reflects fee waivers and/or expense reimbursements. |

| 6 | Excludes securities delivered as a result of a redemption in-kind. |

See Notes to Financial Statements.

| | | | |

| Franklin U.S. Small Cap Equity Fund 2022 Annual Report | | | | 29 |

Financial highlights (cont’d)

| | | | | | | | | | | | | | | | | | | | |

| For a share of each class of beneficial interest outstanding throughout each year ended December 31: | |

| | | | | |

| Class FI Shares1 | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| | | | | |

| Net asset value, beginning of year | | | $12.86 | | | | $12.45 | | | | $11.61 | | | | $9.78 | | | | $12.96 | |

| | | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.01 | | | | 0.00 | 2 | | | 0.02 | | | | 0.04 | | | | 0.00 | 2 |

Net realized and unrealized gain (loss) | | | (2.00) | | | | 3.67 | | | | 1.24 | | | | 1.95 | | | | (2.04) | |

Total income (loss) from operations | | | (1.99) | | | | 3.67 | | | | 1.26 | | | | 1.99 | | | | (2.04) | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.03) | | | | — | | | | (0.06) | | | | (0.02) | | | | — | |

Net realized gains | | | (0.52) | | | | (3.26) | | | | (0.36) | | | | (0.14) | | | | (1.14) | |

Total distributions | | | (0.55) | | | | (3.26) | | | | (0.42) | | | | (0.16) | | | | (1.14) | |

| | | | | |

| Net asset value, end of year | | | $10.32 | | | | $12.86 | | | | $12.45 | | | | $11.61 | | | | $9.78 | |

Total return3 | | | (15.37) | % | | | 29.85 | % | | | 10.94 | % | | | 20.42 | % | | | (15.73) | % |

| | | | | |

| Net assets, end of year (000s) | | | $18 | | | | $23 | | | | $18 | | | | $150 | | | | $107 | |

| | | | | |