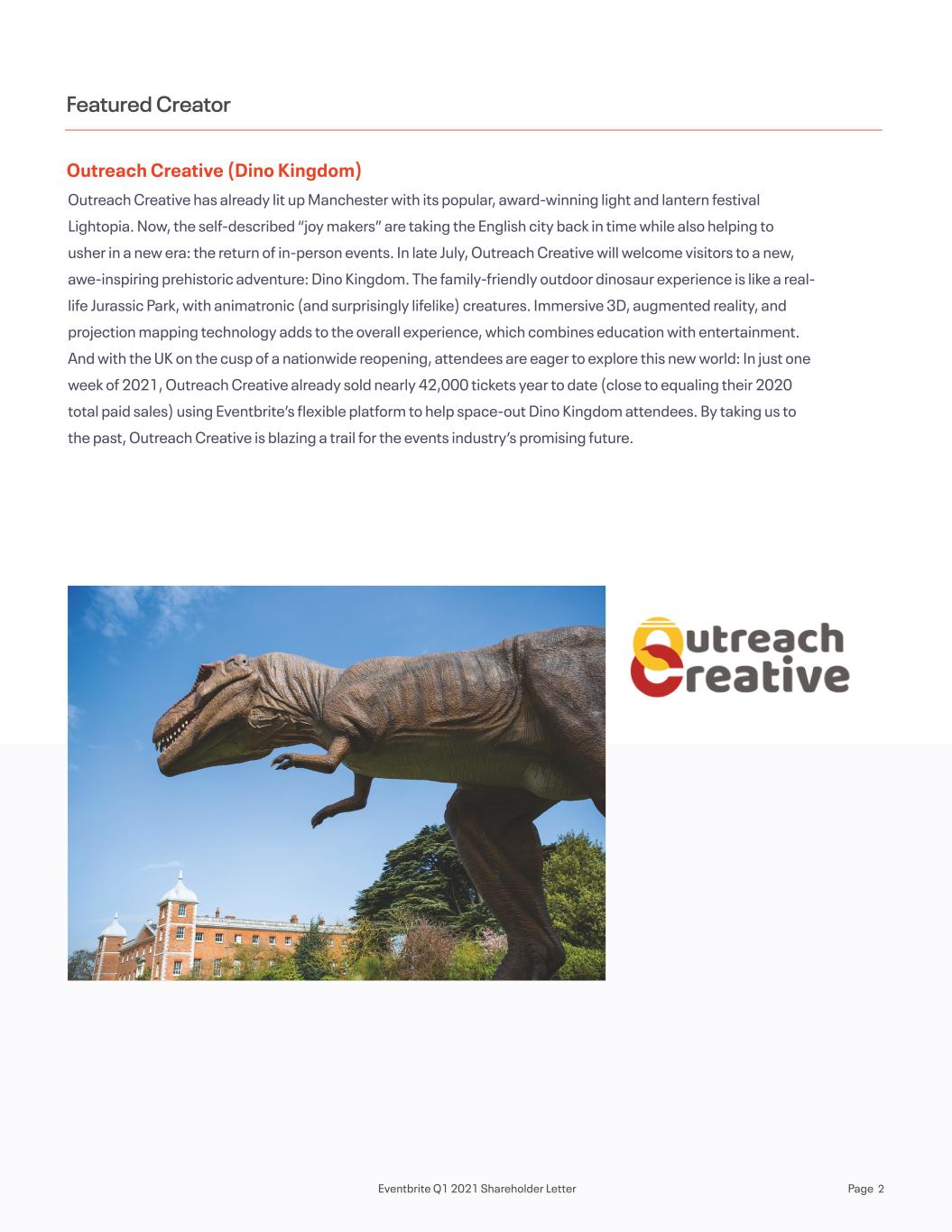

Q1 2021 Shareholder Letter May 6, 2021 investor.eventbrite.com London Dino Kingdom, Wythenshawe Park, Manchester, U.K. Exhibit 99.2

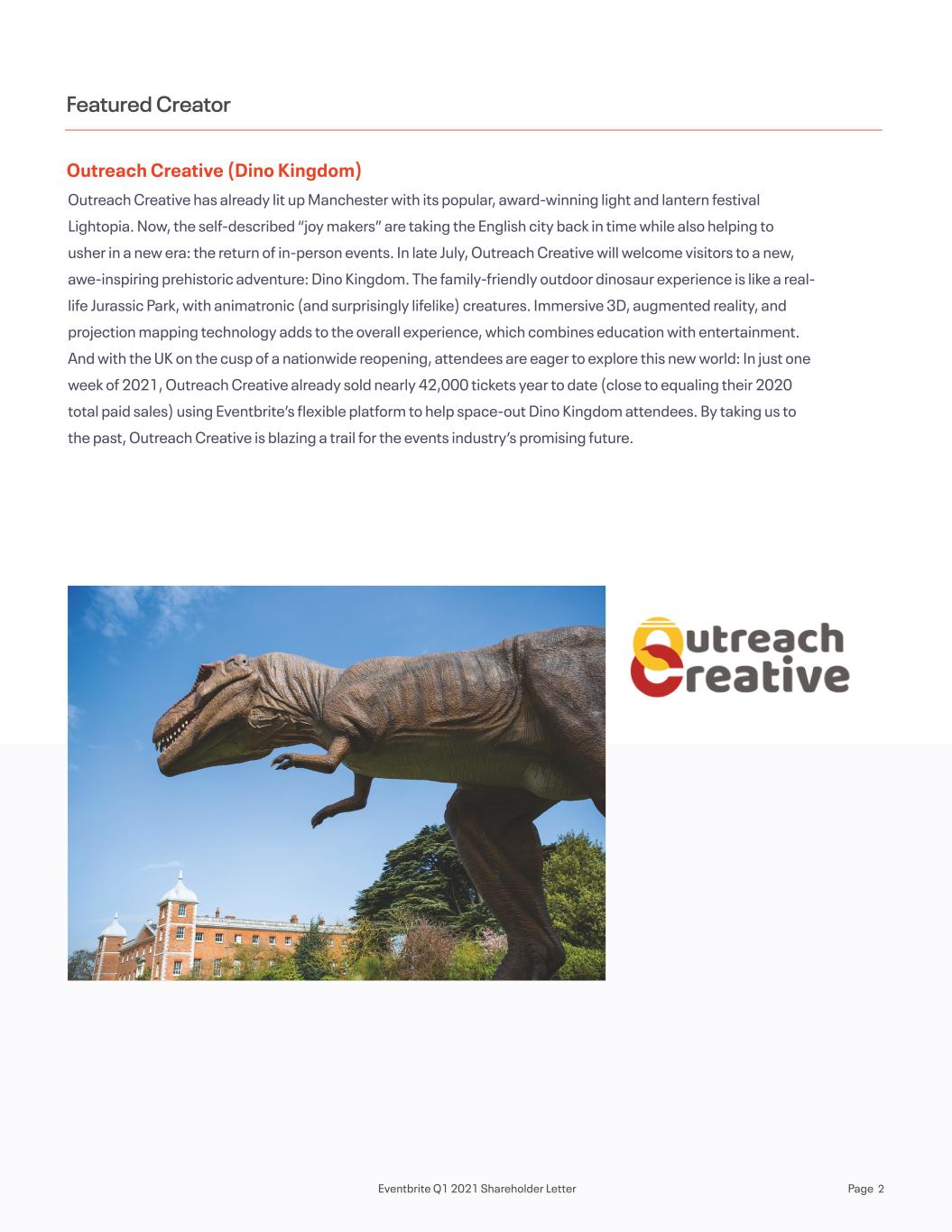

Outreach Creative (Dino Kingdom) Featured Creator Outreach Creative has already lit up Manchester with its popular, award-winning light and lantern festival Lightopia. Now, the self-described “joy makers” are taking the English city back in time while also helping to usher in a new era: the return of in-person events. In late July, Outreach Creative will welcome visitors to a new, awe-inspiring prehistoric adventure: Dino Kingdom. The family-friendly outdoor dinosaur experience is like a real- life Jurassic Park, with animatronic (and surprisingly lifelike) creatures. Immersive 3D, augmented reality, and projection mapping technology adds to the overall experience, which combines education with entertainment. And with the UK on the cusp of a nationwide reopening, attendees are eager to explore this new world: In just one week of 2021, Outreach Creative already sold nearly 42,000 tickets year to date (close to equaling their 2020 total paid sales) using Eventbrite’s flexible platform to help space-out Dino Kingdom attendees. By taking us to the past, Outreach Creative is blazing a trail for the events industry’s promising future. Eventbrite Q1 2021 Shareholder Letter Page 2

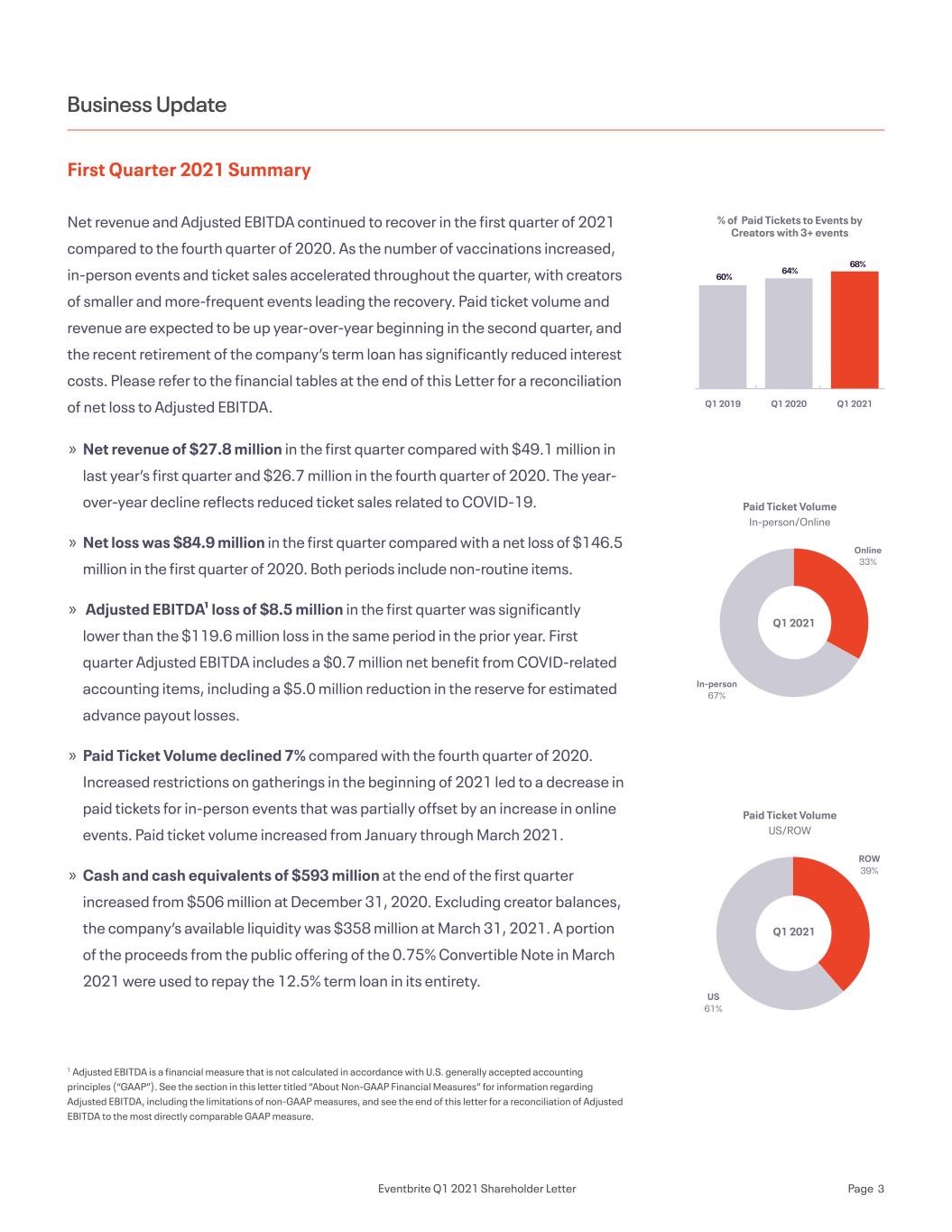

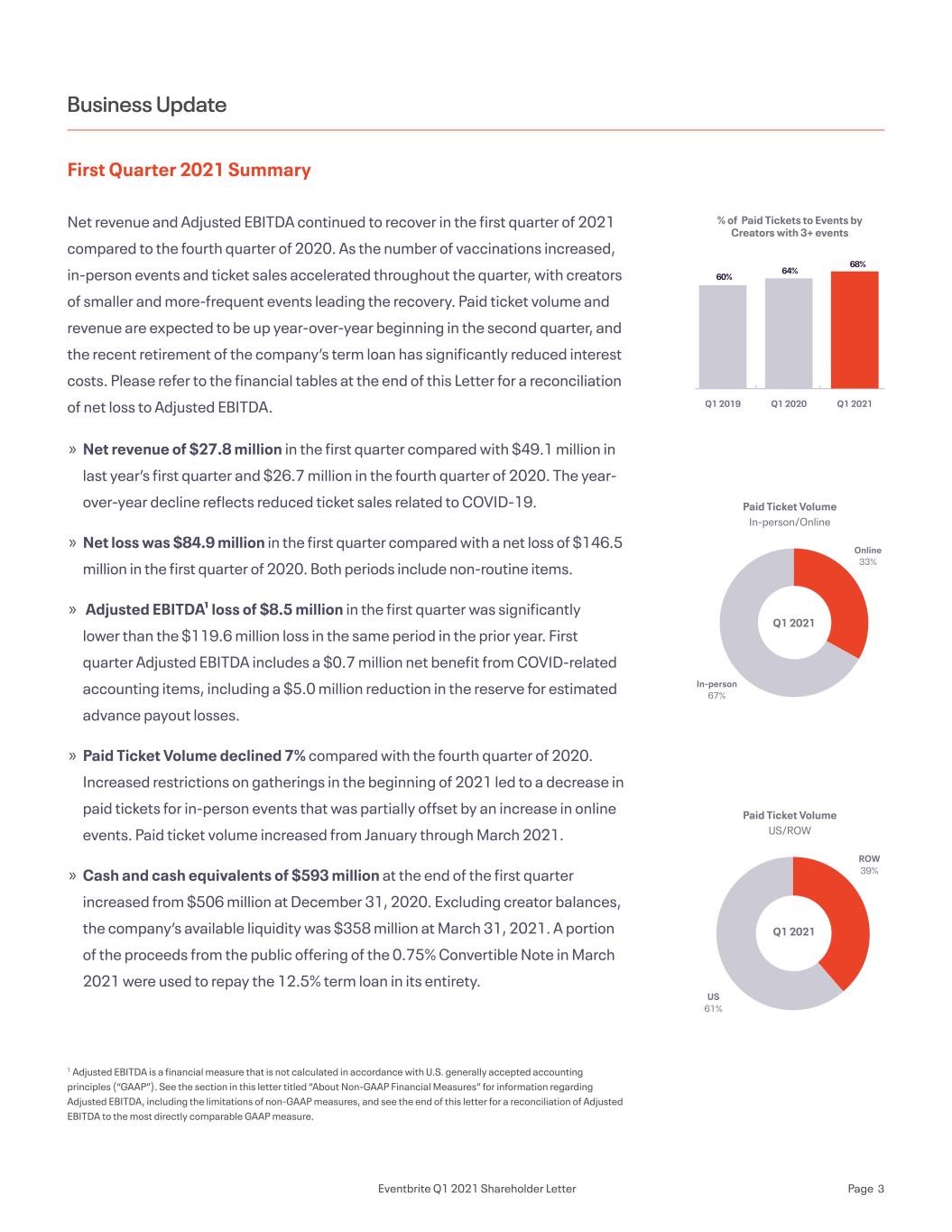

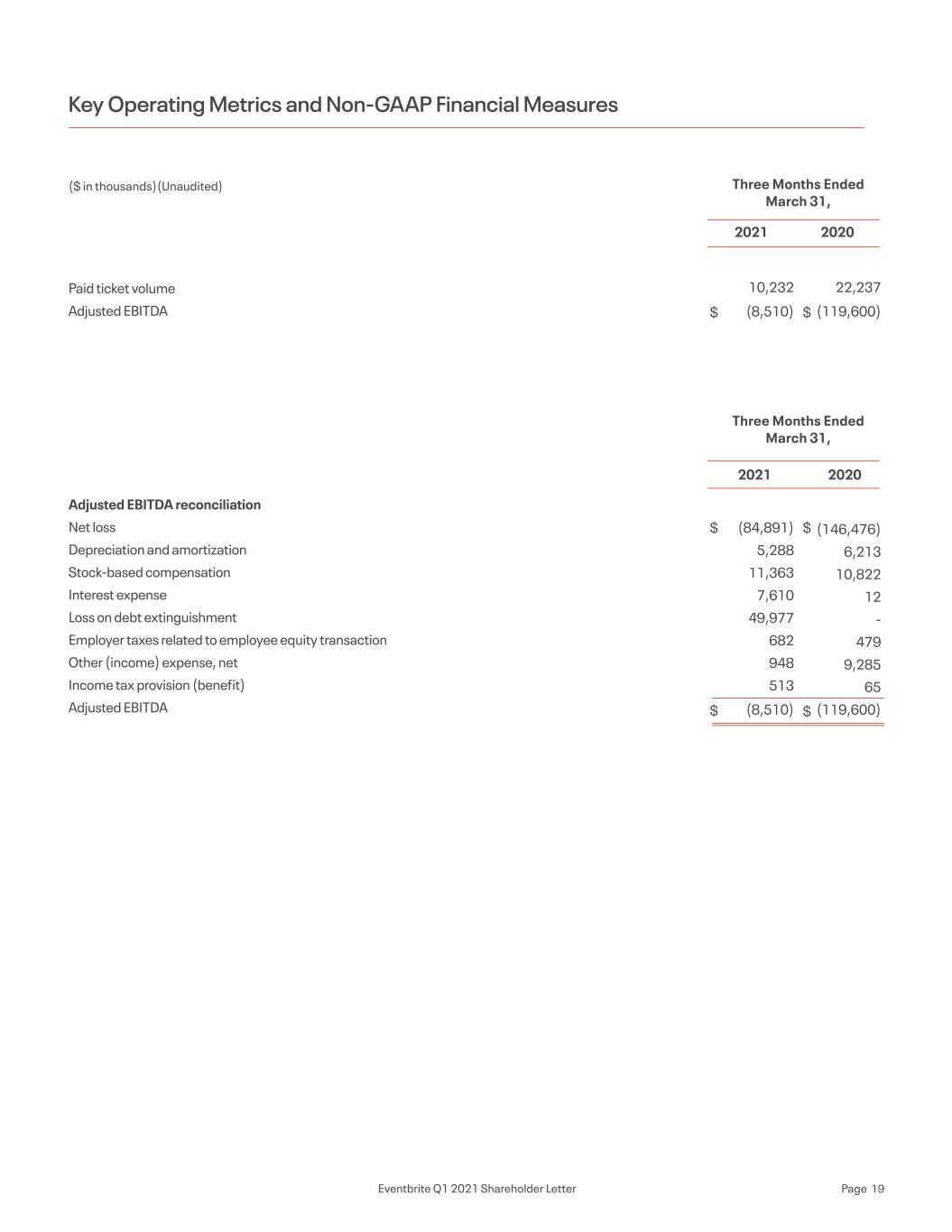

Business Update First Quarter 2021 Summary Net revenue and Adjusted EBITDA continued to recover in the first quarter of 2021 compared to the fourth quarter of 2020. As the number of vaccinations increased, in-person events and ticket sales accelerated throughout the quarter, with creators of smaller and more-frequent events leading the recovery. Paid ticket volume and revenue are expected to be up year-over-year beginning in the second quarter, and the recent retirement of the company’s term loan has significantly reduced interest costs. Please refer to the financial tables at the end of this Letter for a reconciliation of net loss to Adjusted EBITDA. 1 Adjusted EBITDA is a financial measure that is not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). See the section in this letter titled “About Non-GAAP Financial Measures” for information regarding Adjusted EBITDA, including the limitations of non-GAAP measures, and see the end of this letter for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure. » Net revenue of $27.8 million in the first quarter compared with $49.1 million in last year’s first quarter and $26.7 million in the fourth quarter of 2020. The year- over-year decline reflects reduced ticket sales related to COVID-19. » Net loss was $84.9 million in the first quarter compared with a net loss of $146.5 million in the first quarter of 2020. Both periods include non-routine items. » Adjusted EBITDA¹ loss of $8.5 million in the first quarter was significantly lower than the $119.6 million loss in the same period in the prior year. First quarter Adjusted EBITDA includes a $0.7 million net benefit from COVID-related accounting items, including a $5.0 million reduction in the reserve for estimated advance payout losses. » Paid Ticket Volume declined 7% compared with the fourth quarter of 2020. Increased restrictions on gatherings in the beginning of 2021 led to a decrease in paid tickets for in-person events that was partially offset by an increase in online events. Paid ticket volume increased from January through March 2021. » Cash and cash equivalents of $593 million at the end of the first quarter increased from $506 million at December 31, 2020. Excluding creator balances, the company’s available liquidity was $358 million at March 31, 2021. A portion of the proceeds from the public offering of the 0.75% Convertible Note in March 2021 were used to repay the 12.5% term loan in its entirety. Paid Ticket Volume US/ROW US 61% ROW 39% Paid Ticket Volume In-person/Online In-person 67% Online 33% Q1 2021Q1 2020Q1 2019 60% 64% 68% % of Paid Tickets to Events by Creators with 3+ events Q1 2021 Q1 2021 Eventbrite Q1 2021 Shareholder Letter Page 3

Dear Eventbrite Shareholder, The light shining at the end of the pandemic tunnel grew brighter during the first quarter of the new year. Effective vaccination campaigns and the gradual lifting of pandemic-related restrictions drove month-over-month increases in paid creators, events and ticket volume that strengthened as the quarter progressed. Recent product iterations have been well-received by a community of event producers that is now beginning to recover and reaccelerate. The strategic choices and decisive actions we took in 2020 look increasingly prescient and well-timed. We believe that steps to strengthen our capital structure in early 2021 set us up to lean into a recovery and well beyond. Long before and all throughout the COVID-19 pandemic, Eventbrite has been guided by our singular mission to bring the world together through live experiences. We hold creators at the center of our strategic and operating focus, delivering products and service experiences that embrace creators’ ingenuity and increase their confidence to host live events. Drawing upon our flexibility and adaptability, we move quickly with our market as it evolves, as we did to help propel the online events wave in the past year. Similarly, our intuitive platform has powered over 1.4 million vaccine registrations for health care organizations globally in 2021, a humbling opportunity to serve our communities and to play a small but important role in the pandemic recovery process. As the effects of the pandemic recede, we believe that Eventbrite is well positioned to play a leading role in helping the world reconvene. Encouraging Progress in Early 2021 Net revenue and Adjusted EBITDA both improved in the first quarter compared with the fourth quarter of 2020. Paid ticket volume continued to grow quarter to quarter in Australia, paid tickets for online events hit a new record high, and paid ticket volume improved steadily in North America as the quarter progressed. In early March, we refinanced our debt obligations, issuing $213 million in convertible notes to provide greater financial flexibility and significantly-reduced interest costs in support of our future growth plans. Exiting March 2021, all key business metrics were strongly positive year-to-year for the first time since the pandemic began. Sugar Republic (Creative Nation) Sugar Republic is Australia's first experience museum — an art-based interactive exhibition that invites visitors to relive the joy of childhood through immersive rooms and spaces. Since its launch in 2018, Sugar Republic has toured the East Coast of Australia, activating in vacant retail spaces, car parks, and warehouses and attracting a strong following for its unique blend of art gallery and themed attraction. After a forced break from exhibiting in 2020, Sugar Republic has returned in 2021 with an all new in-person installation, Museum of Love. With COVID prevention procedures in place, attendees are invited to step through the doors of a historic Sydney warehouse and explore three levels of immersive art installations and photo- worthy backdrops. In 2021, they have hosted over 160 events and nearly 4,000 Sydney-siders, using Eventbrite to drive 80% of all paid tickets. With in- person events back on the rise, Sugar Republic is here to spread the love. Eventbrite Q1 2021 Shareholder Letter Page 4

As we prepare to move beyond the pandemic and into the future, the structural improvements made to Eventbrite’s operating and financial model are becoming ingrained and increasingly evident. Self-sign-on creators accounted for two-thirds of paid tickets in the first quarter, up from one-half a year ago, as we increased emphasis on our most profitable acquisition channel. We acquired over 75,000 new creators during the first quarter without making any upfront incentive payments, and the proportion of first quarter ticket sale proceeds advanced to creators was reduced by 91% compared with a year ago, reflecting the less capital intensive, lower risk nature of self-service customers and changes to our advance payment program. The shift in strategy to focus more on further developing and differentiating our self-service capabilities and less on delivering high-touch support services positions Eventbrite well as the market recovers. Gross margins are poised to improve with increasing paid ticket volume and the discontinuation of certain lower-margined services offered previously. As intended, Sales and Marketing expenses and General and Administrative expenses eliminated in April 2020 have not returned, and we’ve continued to invest first and foremost in Product and Engineering to support creators’ needs. The significant expense reductions we implemented one year ago increase operating leverage, lower our breakeven and provide a path to profitability on an adjusted EBITDA basis as the year and the recovery progress. Nimble, Frequent Creators are Leading the Recovery We’ve often been asked about the size and shape of the live events economy in the post-pandemic environment. While the market remains fluid and the pace and timing of a full recovery is somewhat uncertain, we are increasingly confident that the growth opportunity for Eventbrite has never been larger nor our future brighter. Our core customer base of smaller, highly-entrepreneurial creators have weathered the pandemic well by being nimble. These creators seized upon the opportunity to go virtual last year and, with our help, many of them are reaching new audiences beyond their traditional, local markets. Paid tickets for online events climbed to a new record in the first quarter, up another 17% compared to the fourth quarter and 8-times higher than in the year-ago quarter. Online events accounted for one-third LA Times A household name, the Los Angeles Times is the largest American newspaper on the West Coast and has the fifth largest circulation in the US. The daily newspaper and digital news site has been offering events on Eventbrite for over a decade, selling tickets and registering attendees for their popular Festival of Books, Book Club and Ideas Exchange discussions, the Dinner Series virtual supper club, movie screenings, reporter panels, and more. A leading source for breaking news, entertainment, sports, politics, and more for Southern California and the world, the LA Times has been hosting both online and in-person events amidst the pandemic, and they show no signs of slowing down. Since 2019, the media company has hosted nearly 220 events and sold over 243,000 tickets. From the page to your computer screen or in-person, the Los Angeles Times brings the news to life with their events and Eventbrite helps make that possible. Eventbrite Q1 2021 Shareholder Letter Page 5

of paid tickets and half of free tickets in the first quarter. During the first quarter we introduced an enhanced integration with Zoom that provides an even faster and more unified experience for both event creators and their virtual event attendees. In March 2021, we surveyed a group of Eventbrite users and more than one-third of respondents said they have attended between three and five virtual events in the last two months. Our deeper integration with Zoom enables creators to continue offering interactive online experiences as a key component of a resurging live events landscape. As restrictions on gatherings ease and creators and consumers regain confidence around in-person events, we anticipate that the mix of events and tickets on our platform will shift back toward in-person. However, as we’re seeing in places that are moving further beyond the pandemic, it is likely that online events will retain a portion of their increased popularity and we expect they will normalize at a level well above the pre-pandemic benchmark of 1-2% of paid tickets. Meanwhile, as in-person gatherings begin to resume, creators who are hosting smaller, more frequent events are again leading the way. Although they represent a much smaller proportion of our customer count, creators who hosted three or more paid events accounted for 68% of paid tickets, up from 64% in the first quarter of 2020 and 60% in the same period of 2019. Within that same group of creators, events per creator were up nearly 40% year to year in the first quarter, reflecting their resourceful ability to grow even in challenging conditions. To support the needs of frequent creators we are reframing the Eventbrite product experience around the organizer rather than the event. This means simplifying the event-creation workflow, introducing enhancements to the creator dashboard, and streamlining multiple-event management and reporting, making analysis easier and more actionable. In February, improvements introduced to our Creator Calendar drove the adoption of this feature by 10 percentage points in March. Shortly after that, we released an improved navigation for our reporting feature which included new designs for key reports. With these changes, creators can now more easily discover the data they need to manage their operations and understand ticket sales performance. Neighbourhood Events Co Founded in 2016 to bring local communities and people together, Neighbourhood Events Co hosts curated walking tours of the best bars and restaurants in select cities across Australia and New Zealand. Whether you’re a self-proclaimed sommelier, craft beer enthusiast, foodie, or just love a good time, this team of hospitality experts has something for you. When venues in Australia and New Zealand were able to re-open last summer, the team turned to Eventbrite, and with the help of the platform’s ToneDen integration, were able to sell over 5,000 tickets in the second half of 2020. As more and more people step out of their quarantines and into their local communities, Neighbourhood Events Co is keeping their record pace, selling almost 2,500 tickets to just five events this year. Eventbrite Q1 2021 Shareholder Letter Page 6

We’ve also made it simpler for creators to publish and host online events with an improved integration with Zoom’s video streaming capability powered by their recently released SDK. Looking forward, we anticipate that creators of smaller, frequent events will continue to innovate and seek to grow with Eventbrite and that creators of larger, less frequent events will start to reaccelerate on our platform later this year and into 2022. Our Strategy Anticipates Creators’ Needs Over the past year, we’ve maintained a flexible approach to positioning Eventbrite for the new post-recovery environment. The strategic decisions we have made in reducing operating expenses and allocating human and financial resources have been made with a singular focus – to do right by our active and frequent customers and serve their needs. During the throes of the pandemic, we continued to focus our time and resources on maximizing the efficiencies and general ease of use for our self-service experience. Given the large opportunity before us, we will continue to invest in serving creators with the best and most innovative products and services. Our criteria for future investment in our business includes higher margin growth opportunities that are designed to drive improved financial results. We continued to make meaningful progress on the key objectives that will drive our growth strategy as we move through 2021. The new features we introduced have enhanced the value of our creators’ self-service experience and improved efficiencies. We have streamlined the event creation process and launched tools that promote multiple events and opportunities to further monetize their events. Today we launched Eventbrite Boost, the only all-in-one marketing platform designed specifically for event organizers. We are committed to helping creators drive demand and increase audience size for their events, and Eventbrite Boost helps creators make informed marketing decisions and launch optimized advertising campaigns to grow their businesses. 5x15 Getting people talking is what 5x15 does best. The UK-based spoken-word events leader specializes in bringing together high-profile figures from around the world to spark ideas and inspiration in their global audiences. Past 5x15 events have included such cultural luminaries as Gloria Steinem, Emma Watson, Werner Herzog, and Malcolm Gladwell. Founded by Rosie Boycott, Daisy Leitch, and Eleanor O’Keeffe, 5x15 distributes content broadly through a popular podcast and YouTube channel. As other live events producers pulled back during the pandemic, 5x15 increased the frequency of events — moving to a virtual-first, inclusive model that prioritizes access with a sliding scale of free and paid tickets. In 2020, 5x15 increased overall ticket volume on Eventbrite by more than 300% (moving nearly 23,000 tickets) and increased paid ticket sales by 33%. This year is already off to a strong start: With 19 events in the books, 5x15 has already moved over 15,000 tickets, proving that thought-provoking conversations with cultural figures are always in high- demand. Eventbrite Q1 2021 Shareholder Letter Page 7

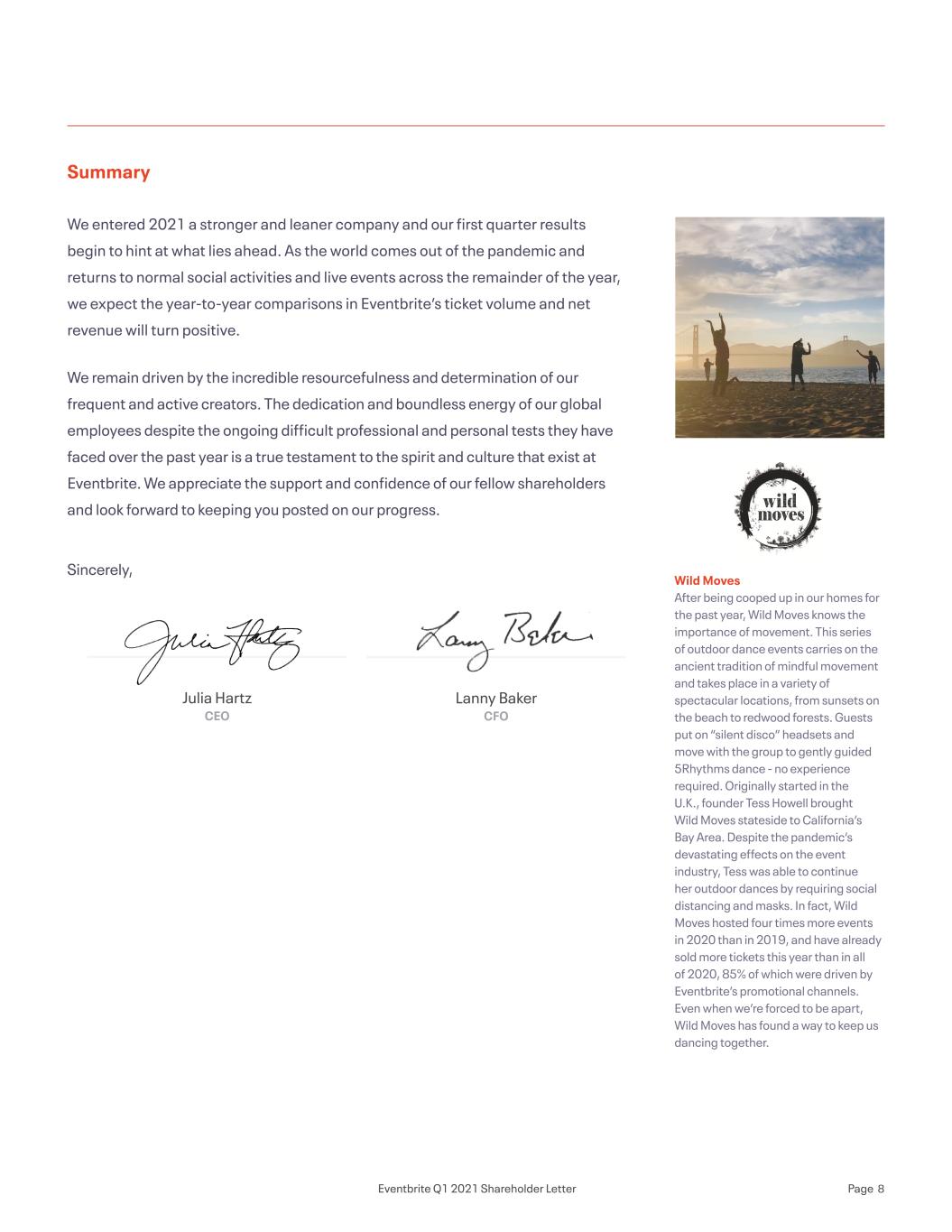

Summary We entered 2021 a stronger and leaner company and our first quarter results begin to hint at what lies ahead. As the world comes out of the pandemic and returns to normal social activities and live events across the remainder of the year, we expect the year-to-year comparisons in Eventbrite’s ticket volume and net revenue will turn positive. We remain driven by the incredible resourcefulness and determination of our frequent and active creators. The dedication and boundless energy of our global employees despite the ongoing difficult professional and personal tests they have faced over the past year is a true testament to the spirit and culture that exist at Eventbrite. We appreciate the support and confidence of our fellow shareholders and look forward to keeping you posted on our progress. Sincerely, Julia Hartz CEO Lanny Baker CFO Wild Moves After being cooped up in our homes for the past year, Wild Moves knows the importance of movement. This series of outdoor dance events carries on the ancient tradition of mindful movement and takes place in a variety of spectacular locations, from sunsets on the beach to redwood forests. Guests put on “silent disco” headsets and move with the group to gently guided 5Rhythms dance - no experience required. Originally started in the U.K., founder Tess Howell brought Wild Moves stateside to California’s Bay Area. Despite the pandemic’s devastating effects on the event industry, Tess was able to continue her outdoor dances by requiring social distancing and masks. In fact, Wild Moves hosted four times more events in 2020 than in 2019, and have already sold more tickets this year than in all of 2020, 85% of which were driven by Eventbrite’s promotional channels. Even when we’re forced to be apart, Wild Moves has found a way to keep us dancing together. Eventbrite Q1 2021 Shareholder Letter Page 8

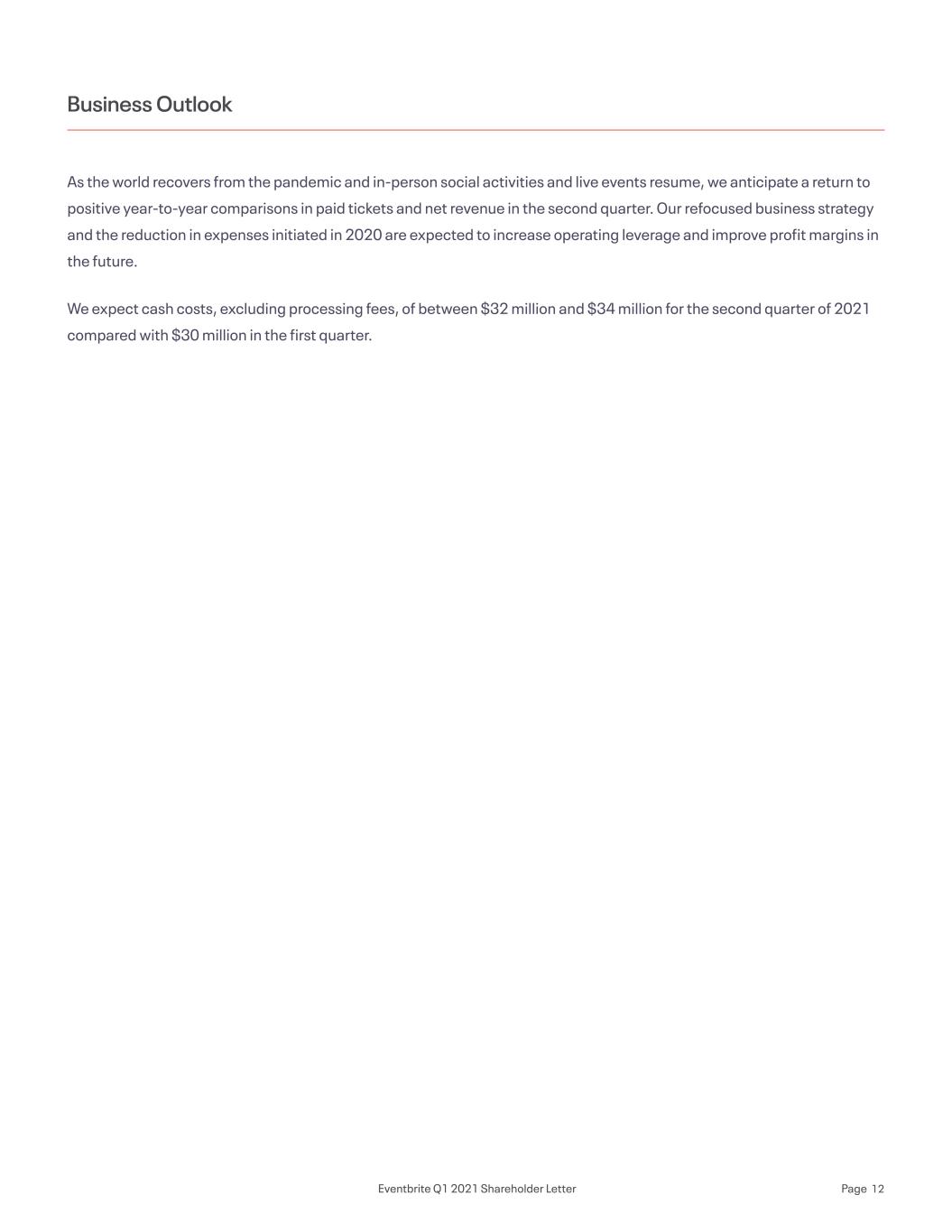

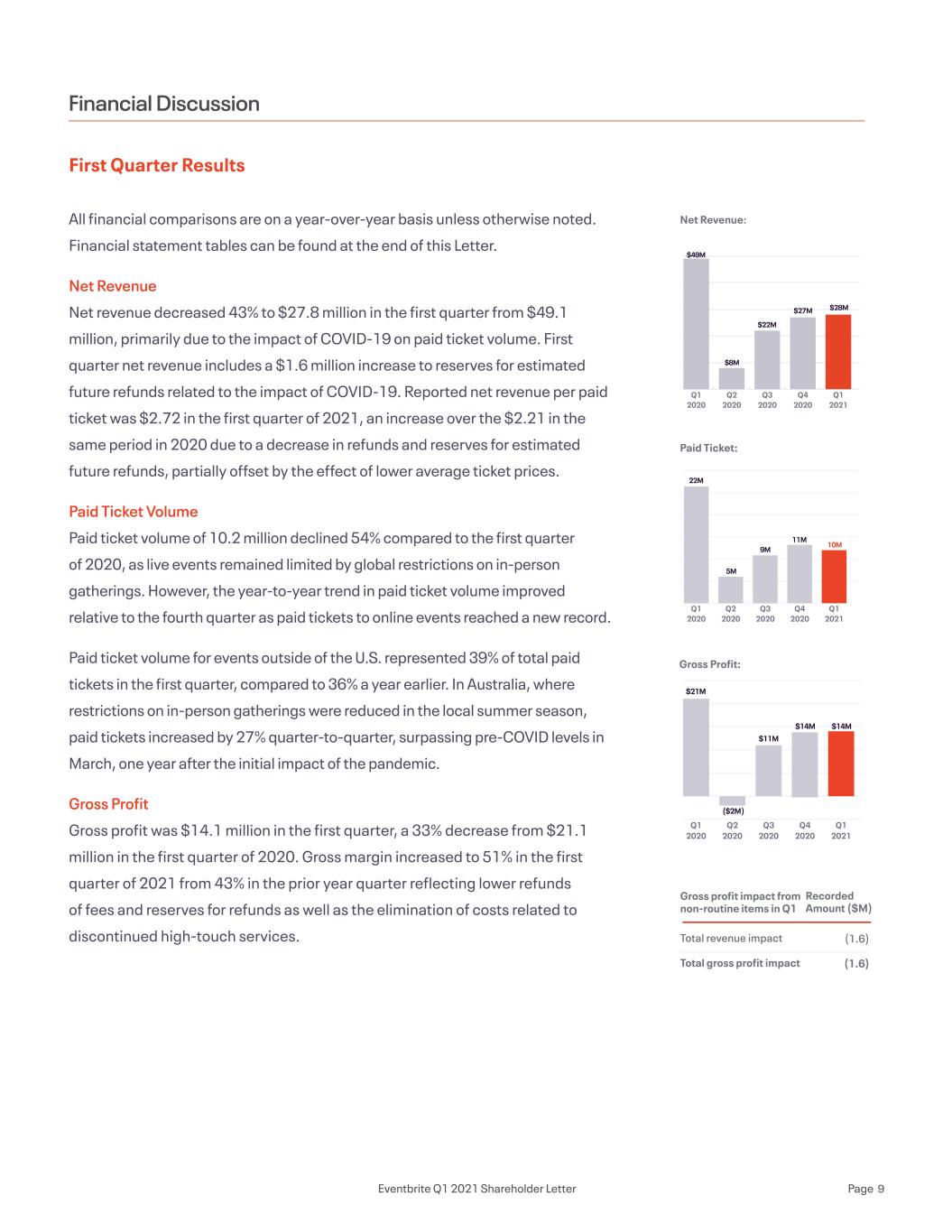

First Quarter Results All financial comparisons are on a year-over-year basis unless otherwise noted. Financial statement tables can be found at the end of this Letter. Net Revenue Net revenue decreased 43% to $27.8 million in the first quarter from $49.1 million, primarily due to the impact of COVID-19 on paid ticket volume. First quarter net revenue includes a $1.6 million increase to reserves for estimated future refunds related to the impact of COVID-19. Reported net revenue per paid ticket was $2.72 in the first quarter of 2021, an increase over the $2.21 in the same period in 2020 due to a decrease in refunds and reserves for estimated future refunds, partially offset by the effect of lower average ticket prices. Paid Ticket Volume Paid ticket volume of 10.2 million declined 54% compared to the first quarter of 2020, as live events remained limited by global restrictions on in-person gatherings. However, the year-to-year trend in paid ticket volume improved relative to the fourth quarter as paid tickets to online events reached a new record. Paid ticket volume for events outside of the U.S. represented 39% of total paid tickets in the first quarter, compared to 36% a year earlier. In Australia, where restrictions on in-person gatherings were reduced in the local summer season, paid tickets increased by 27% quarter-to-quarter, surpassing pre-COVID levels in March, one year after the initial impact of the pandemic. Gross Profit Gross profit was $14.1 million in the first quarter, a 33% decrease from $21.1 million in the first quarter of 2020. Gross margin increased to 51% in the first quarter of 2021 from 43% in the prior year quarter reflecting lower refunds of fees and reserves for refunds as well as the elimination of costs related to discontinued high-touch services. Financial Discussion Net Revenue: Paid Ticket: Gross Profit: Q1 2021 Q4 2020 Q3 2020 Q2 2020 Q1 2020 $49M $8M $22M $27M $28M $27M $21M ($2M) $11M $14M $14M $14M $11M Q1 2021 Q4 2020 Q3 2020 Q2 2020 Q1 2020 22M 5M 9M 11M 5M 9M 10M Q1 2021 Q4 2020 Q3 2020 Q2 2020 Q1 2020 Gross profit impact from non-routine items in Q1 Total revenue impact Total gross profit impact Recorded Amount ($M) (1.6) (1.6) Eventbrite Q1 2021 Shareholder Letter Page 9

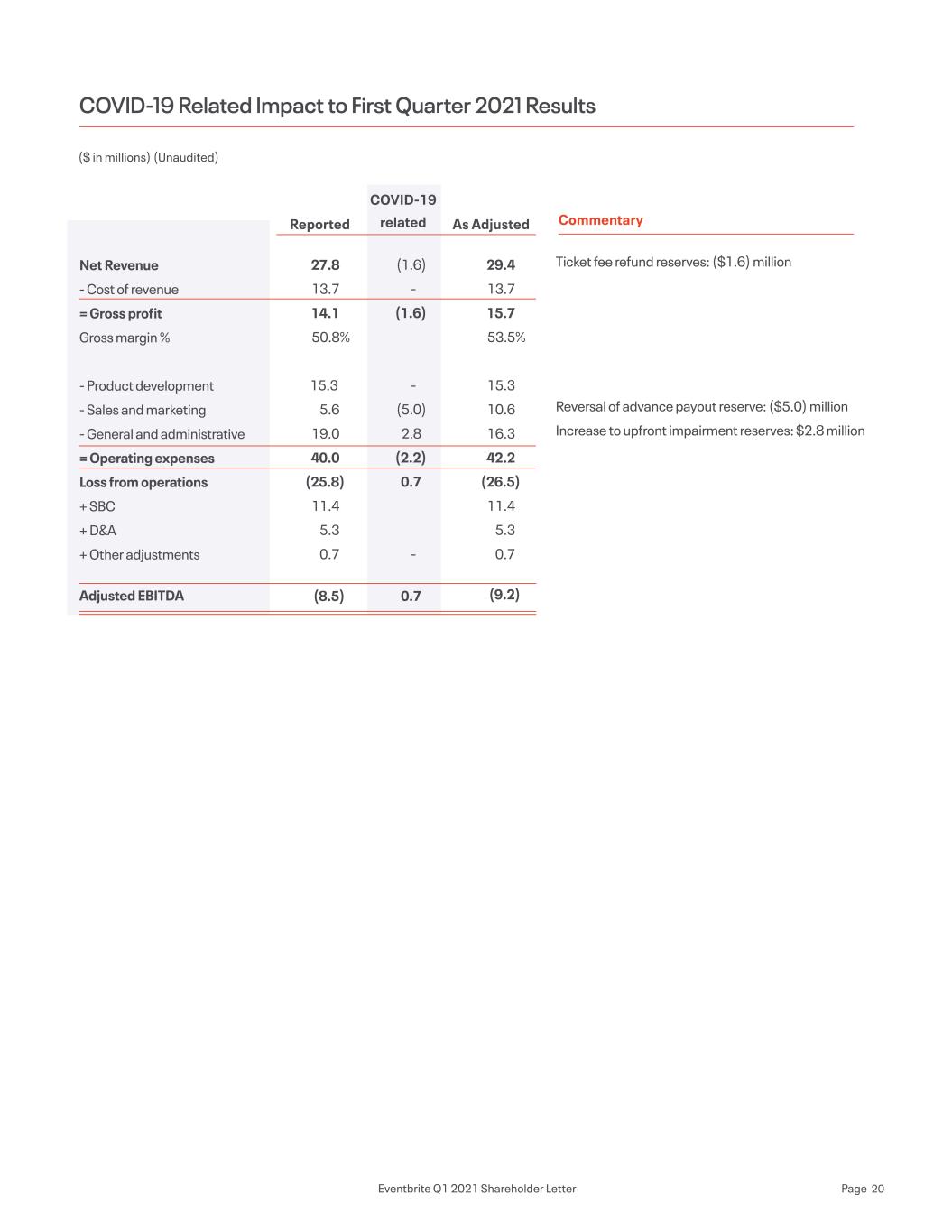

OpEx impact from non-routine items in Q1 Reversal of advance payout reserve Increase to upfront impairment reserves Total operating expense impact Recorded Amount ($M) ($5.0) 2.8 ($2.2) General & Administrative 38% Sales & Marketing 37% Product Development 26% General & Administrative 39% Sales & Marketing 25% Product Development 36% OpEx Investment Profile: OpEx Investment Profile: Q1 2020 Q1 2021 OpEx Investment Profile: Product Development Sales and Marketing General and Administrative Q1 2021Q1 2020 $23M $16M $11M $15M$23M $16M $63M $42M Operating Expenses Operating expenses were $40.0 million in the first quarter, compared to $158.2 million in the first quarter of 2020. Operating expenses in the first quarter of 2021 included a $5.0 million reversal of reserves for estimated advance payout losses, partially offset by a $2.8 million write-off for impairment of creator advances. The release of reserves related to advance payouts reflects the ongoing favorable resolution of the advance payout balance and lower than expected chargeback activity. Operating expenses in the first quarter of 2020 included a $76.5 million reserve for estimated advance payout losses and $19.1 million in reserves related to creator advances. Excluding COVID-related reserves and write-offs from both periods, operating expenses were 34% lower year-to-year in the first quarter as a result of the expense savings initiatives implemented in April 2020. Product development expenses of $15.3 million for the first quarter of 2021 decreased 5% compared to the same period in 2020, primarily due to a decrease of $1.8 million in compensation costs from lower headcount, partially offset by a decline in capitalized software costs. Sales, marketing and support expenses were $5.6 million in the first quarter of 2021 compared to $99.9 million in the first quarter of 2020. In the first quarter of 2021, Sales, marketing and support expenses included a $5.0 million reversal of reserves for estimated advance payout losses. Sales, marketing and support expenses in last year’s first quarter included reserves for estimated advance payout losses of $76.5 million. Excluding these items, Sales, marketing and support expenses decreased 55% to $10.6 million in the first quarter of 2021 compared to $23.4 million in the first quarter of 2020. General and administrative expenses were $19.0 million in the first quarter of 2021 compared to $42.1 million in the first quarter of 2020. General and administrative expenses included a $2.8 million write-off in the first quarter of 2021 and a $19.1 million reserve in the first quarter of 2020, both related to creator advances. Excluding these items, General and administrative expenses were 29% lower in the first quarter as a result of expense reductions made last April. Eventbrite Q1 2021 Shareholder Letter Page 10

($7M) Adj. EBITDA impact from non-routine items in Q1 Impact to Net revenue Impact to Cost of net revenue Impact to Operating expense Total Adjusted EBITDA impact Recorded Amount ($M) (1.6) - (2.2) $0.7 Adjusted EBITDA: ($2M) $2M ($9M) $4M ($21M) Q1 2021 Q4 2020 Q3 2020 Q2 2020 Q1 2020 ($120M) Available Liquidity Cash and cash equivalents Funds receivable Creator advances Accounts payable, creators Available liquidity $ in thousands $593.3 14.8 4.4 (254.1) $358.4 Net Loss Net loss was $84.9 million for the first quarter of 2021 compared with net loss of $146.5 million in the same period in 2020. Adjusted EBITDA Adjusted EBITDA loss was $8.5 million in the first quarter compared to $119.6 million a year ago. Adjusted EBITDA for the first quarter of 2021 included the benefit of $5.0 million in reversals of refunds and chargeback reserves partially offset by the impact of a $1.6 million increase in refund reserves and a $2.8 million increase in reserves for upfront advances to creators. The first quarter of 2020 included a net $113.7 million income statement impact which was largely related to COVID-19. Please refer to the financial tables at the end of this Letter for a reconciliation of net loss to Adjusted EBITDA. Balance Sheet and Liquidity Cash and cash equivalents totaled $593.3 million at the end of the first quarter of 2021, up from $505.8 million as of December 31, 2020. To evaluate Eventbrite’s liquidity, the company adds funds receivable from ticket sales within the last five business days of the period to creator advances and cash and cash equivalents, and then reduces that balance by funds payable and creator payables. On that basis, the company’s available liquidity as of March 31, 2021 increased to $358.4 million from $332.1 million as of December 31, 2020. As of March 31, 2021, the company had paid $3.2 million in net refunds and chargebacks related to our March 11, 2020 advance payout balance, a loss rate consistent with historic trends. The advance payout balance stood at $222.5 million on March 31, 2021 including $12.5 million of recently issued advance payouts, as the company has resumed the program on a limited basis. In March 2021, the company issued $212.8 million, in aggregate principal amount, of 0.750% convertible senior notes due March 15, 2026 in a private offering. Approximately $153.2 million of the net proceeds were used to repay in full the outstanding amount of the 12.5% term loan established in May 2020. Eventbrite Q1 2021 Shareholder Letter Page 11

As the world recovers from the pandemic and in-person social activities and live events resume, we anticipate a return to positive year-to-year comparisons in paid tickets and net revenue in the second quarter. Our refocused business strategy and the reduction in expenses initiated in 2020 are expected to increase operating leverage and improve profit margins in the future. We expect cash costs, excluding processing fees, of between $32 million and $34 million for the second quarter of 2021 compared with $30 million in the first quarter. Business Outlook Eventbrite Q1 2021 Shareholder Letter Page 12

Eventbrite will hold a conference call and live webcast today at 2:00 p.m. PST to discuss the first quarter 2021 financial results. To listen to a live audio webcast, please visit Eventbrite’s Investor Relations website at https://investor.eventbrite. com/overview/default.aspx. A replay of the webcast will be available at the same website. About Eventbrite Eventbrite is a global self-service ticketing and experience technology platform that serves a community of hundreds of thousands of event creators in nearly 180 countries. Since inception, Eventbrite has been at the center of the experience economy, transforming the way people organize and attend events. The company was founded by Julia Hartz, Kevin Hartz and Renaud Visage, with a vision to build a self-service platform that would make it possible for anyone to create and sell tickets to live experiences. The Eventbrite platform provides an intuitive, secure, and reliable service that enables creators to plan and execute their live and online events, whether it’s an annual culinary festival attracting thousands of foodies, a professional webinar, a weekly yoga workshop or a youth dance class. With over 200 million tickets distributed to more than 4 million experiences in 2020, Eventbrite is where people all over the world discover new things to do or new ways to do more of what they love. Learn more at http://www.eventbrite.com. . Earnings Webcast The neon icons can be used to convey abstract concepts and work well in presentations. They should feel active and expressive. Feel free to expand on these as you build out the experience. Eventbrite Q1 2021 Shareholder Letter Page 13

Forward-Looking Statements This letter contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve substantial risks and uncertainties. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to, statements regarding the future performance of Eventbrite, Inc. and its consolidated subsidiaries (the “Company”); the impacts of the COVID-19 global health pandemic, including its impact on the Company, its operations, or its future financial or operational results; the recovery from the COVID-19 global health pandemic, including the impact of vaccines, the removal of restrictions on in-person events, the market response to the recovery and event creator and event attendees’ behaviour in relation to the recovery; the impact of the Company re-centering its business around a self-service model; the Company’s expectations regarding the timing of recovery of paid ticket volumes; growth strategies and opportunities in the Company’s businesses and products; the Company’s expectations regarding the development of its platform and products; the Company’s expectations regarding scale, profitability, online events as a percentage of paid tickets, higher margin growth opportunities, improved financial results and market trends, and the demand for or benefits from its products, product features, and services in the U.S. and in international markets; and the Company’s expectations regarding net revenue, paid ticket volume, and cash costs described under “Business Outlook” above. In some cases, forward-looking statements can be identified by terms such as “may,” “will,” “appears,” “shall,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” or “continue,” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans, or intentions. Such statements are subject to a number of known and unknown risks, uncertainties, assumptions, and other factors that may cause the Company’s actual results, performance, or achievements to differ materially from results expressed or implied in this letter. Investors are cautioned not to place undue reliance on these statements. Actual results could differ materially from those expressed or implied, and reported results should not be considered as an indication of future performance. The forward-looking statements contained in this letter are also subject to additional risks, uncertainties and factors, including those more fully described in the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual Report on 10-Q for quarter ended March 31. Further information on potential risks that could affect actual results will be included in the subsequent periodic and current reports and other filings that the Company makes with the Securities and Exchange Commission from time to time, including the Company's Quarterly Report on Form 10-Q for the quarter ended March 31, 2021. All forward-looking statements are based on information and estimates available to the Company at the time of this letter and are not guarantees of future performance. Except as required by law, the Company assumes no obligation to update any of the statements in this letter. About Non-GAAP Financial Measures We believe that the use of Adjusted EBITDA is helpful to our investors as it is a metric used by management in assessing the health of our business and our operating performance. This measure is not prepared in accordance with GAAP and has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results of operations as reported under GAAP. In addition, other companies may not calculate non-GAAP financial measures in the same manner as we calculate them, limiting their usefulness as comparative measures. You are encouraged to evaluate the adjustments and the reasons we consider them appropriate. Adjusted EBITDA Adjusted EBITDA is a key performance measure that our management uses to assess our operating performance. Because Adjusted EBITDA facilitates internal comparisons of our historical operating performance on a more consistent basis, we use this measure for business planning purposes and in evaluating acquisition opportunities. We calculate Adjusted EBITDA as net loss adjusted to exclude depreciation and amortization, stock-based compensation expense, interest expense, direct and indirect acquisition related costs, employer taxes related to employee transactions and other income (expense), which consisted of interest income foreign exchange rate gains and losses, and income tax provision (benefit). Adjusted EBITDA should not be considered as an alternative to net loss or any other measure of financial performance calculated and presented in accordance with GAAP. Some of the limitations of Adjusted EBITDA include (i) Adjusted EBITDA does not properly reflect capital spending that occurs off of the income statement or account for future contractual commitments, (ii) although depreciation and amortization are non-cash charges, the underlying assets may need to be replaced and Adjusted EBITDA does not reflect these capital expenditures and (iii) Adjusted EBITDA does not reflect the interest and principal required to service our indebtedness. In evaluating Adjusted EBITDA, you should be aware that in the future we expect to incur expenses similar to the adjustments in this letter. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these expenses or any unusual or non-recurring items. When evaluating our performance, you should consider Adjusted EBITDA alongside other financial performance measures, including our net loss and other GAAP results. Eventbrite Q1 2021 Shareholder Letter Page 14

Net revenue Cost of net revenue Gross profit Operating expenses: Product development Sales, marketing and support General and administrative Total operating expenses Loss from operations Interest expense Loss on debt extinguishment Other income (expense), net Loss before income taxes Income tax provision (benefit) Net loss Net loss per share, basic and diluted Weighted-average shares outstanding used to compute net loss per share, basic and diluted $ $ $ $ $ $ 27,818 13,675 14,143 15,319 5,639 19,028 39,986 (25,843) (7,610) (49,977) (948) (84,378) 513 (84,891) (0.91) 92,879 49,086 28,005 21,081 16,171 99,915 42,109 158,195 (137,114) (12) - (9,285) (146,411) 65 (146,476) (1.71) 85,879 Consolidated Statements of Operations ($ in thousands, except per share data)(Unaudited) March 31, 2020 March 31, 2021 Eventbrite Q1 2021 Shareholder Letter Page 15

Assets Current assets Cash and cash equivalents Funds receivable Accounts receivable, net Creator signing fees, net Creator advances, net Prepaid expenses and other current assets Total current assets Restricted cash Creator signing fees, noncurrent Property, plant and equipment, net Operating lease right-of-use assets Goodwill Acquired intangible assets, net Other assets Total assets Liabilities and Stockholders’ Equity Current liabilities Accounts payable, creators Accounts payable, trade Chargebacks and refunds reserve Accrued compensation and benefits Accrued taxes Operating lease liabilities Other accrued liabilities Total current liabilities Accrued taxes, noncurrent Operating lease liabilities, noncurrent Long-term debt Other liabilities Total liabilities Commitments and contigencies Stockholders' equity Preferred stock, $0.00001 par value; 100,000,000 shares authorized, no shares issued or outstanding as of March 31, 2021 and December 31, 2020 Common stock, $0.00001 par value; 1,100,000,000 shares authorized; 93,495,469 shares issued and outstanding as of March 31, 2021; 92,654,785 shares issued and outstanding as of December 31, 2020 Additional paid-in capital Accumulated deficit Total stockholders’ equity Total liabilities and stockholders’ equity 593,342 14,780 444 2,626 4,355 8,697 624,244 2,790 3,795 9,271 12,186 174,388 39,555 1,821 868,050 254,082 2,085 28,022 5,863 3,709 3,334 10,861 307,956 12,880 10,693 352,060 1,169 684,758 - 1 862,673 (679,382) 183,292 868,050 505,756 10,807 458 3,657 6,651 9,804 537,133 2,674 5,838 11,574 13,886 174,388 42,333 7,859 795,685 191,134 1,903 33,225 3,980 2,992 4,940 8,362 246,536 14,234 11,517 206,630 1,196 480,113 - 1 913,115 (597,544) 315,572 795,685 Consolidated Balance Sheets ($ in thousands)(Unaudited) March 31, 2021 December 31, 2020 $ $ $ $ $ $ $ $ Eventbrite Q1 2021 Shareholder Letter Page 16

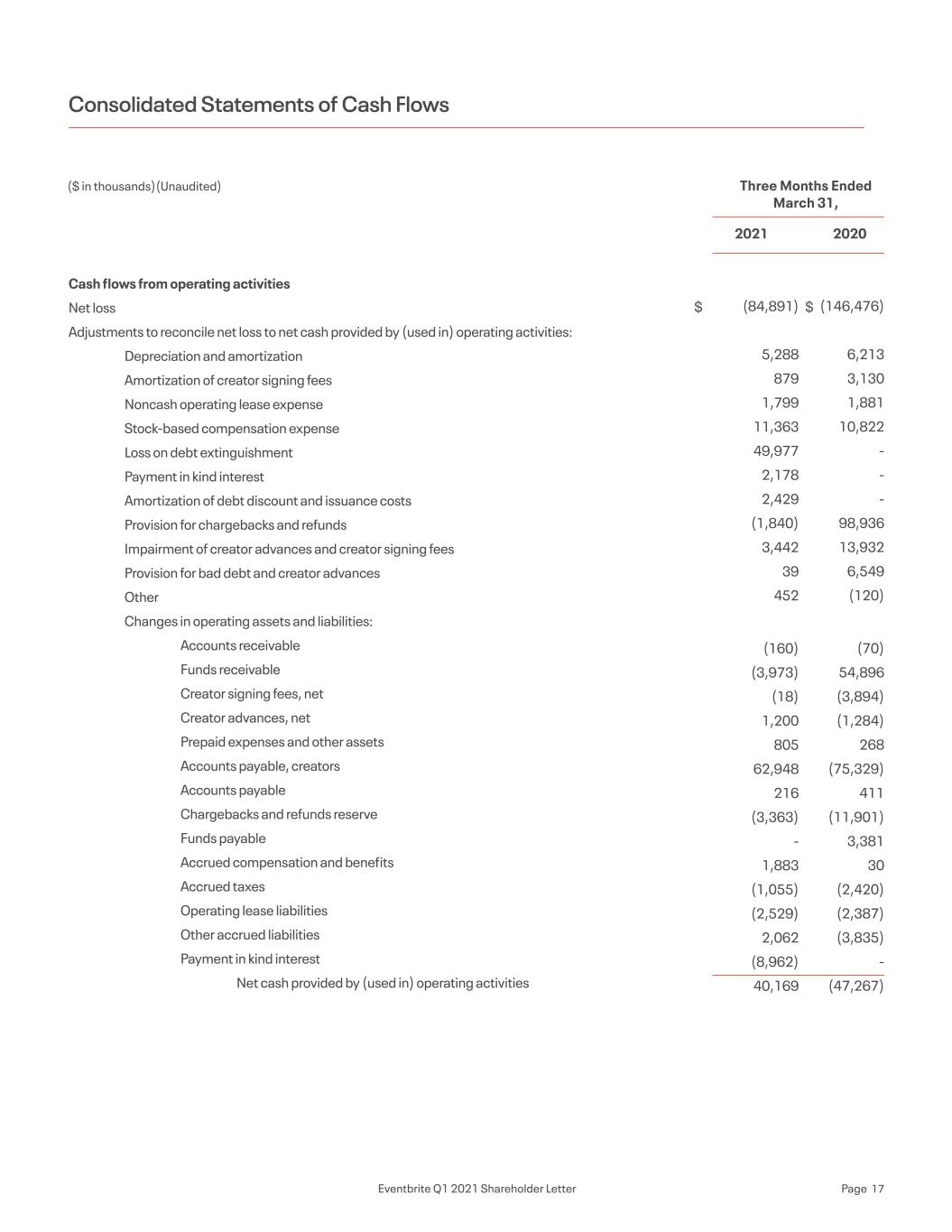

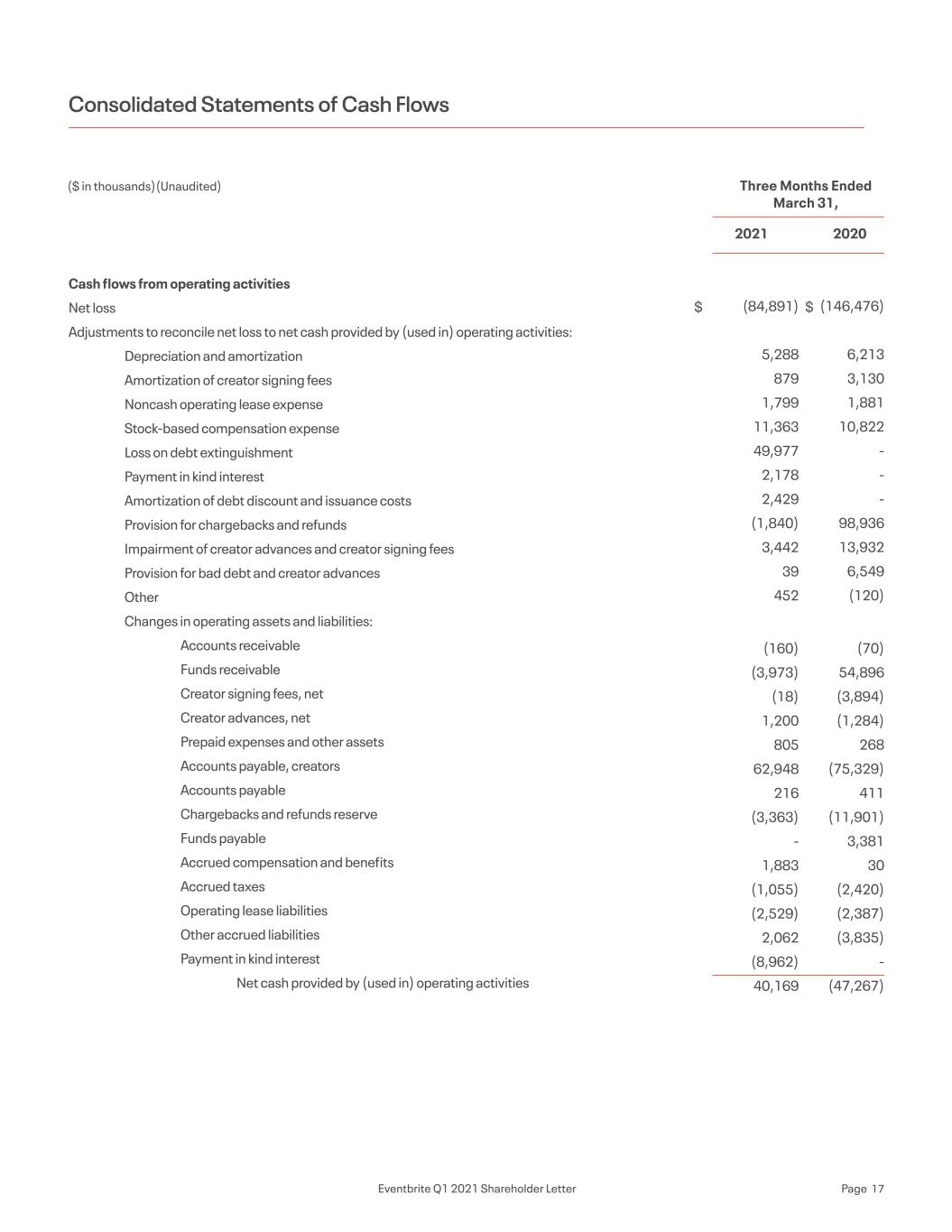

Cash flows from operating activities Net loss Adjustments to reconcile net loss to net cash provided by (used in) operating activities: Depreciation and amortization Amortization of creator signing fees Noncash operating lease expense Stock-based compensation expense Loss on debt extinguishment Payment in kind interest Amortization of debt discount and issuance costs Provision for chargebacks and refunds Impairment of creator advances and creator signing fees Provision for bad debt and creator advances Other Changes in operating assets and liabilities: Accounts receivable Funds receivable Creator signing fees, net Creator advances, net Prepaid expenses and other assets Accounts payable, creators Accounts payable Chargebacks and refunds reserve Funds payable Accrued compensation and benefits Accrued taxes Operating lease liabilities Other accrued liabilities Payment in kind interest Net cash provided by (used in) operating activities (84,891) 5,288 879 1,799 11,363 49,977 2,178 2,429 (1,840) 3,442 39 452 (160) (3,973) (18) 1,200 805 62,948 216 (3,363) - 1,883 (1,055) (2,529) 2,062 (8,962) 40,169 (146,476) 6,213 3,130 1,881 10,822 - - - 98,936 13,932 6,549 (120) (70) 54,896 (3,894) (1,284) 268 (75,329) 411 (11,901) 3,381 30 (2,420) (2,387) (3,835) - (47,267) Consolidated Statements of Cash Flows ($ in thousands)(Unaudited) Three Months Ended March 31, 2021 2020 $ $ Eventbrite Q1 2021 Shareholder Letter Page 17

Cash flows from investing activities Purchases of property and equipment Capitalized internal-use software development costs Net cash used in investing activities Cash flows from financing activities Proceeds from issuance of convertible notes Debt issuance costs Purchase of convertible notes capped call Principal repayment of debt obligations and prepayment premium Proceeds from exercise of stock options Taxes paid related to net share settlement of equity awards Principal payments on lease financing obligation Net cash provided by financing activities Net increase in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash Beginning of period End of period Supplemental cash flow data Interest paid Income taxes paid, net of refunds Noncash investing and financing activities Unpaid debt offering costs Purchases of property and equipment, accrued but unpaid (93) (25) (118) 212,750 (5,319) (18,509) (143,247) 4,680 (2,611) (93) 47,651 87,702 508,430 596,132 1,055 37 435 58 (1,033) (1,909) (2,942) - - - - 4,654 (2,147) (61) 2,446 (47,763) 422,940 375,177 11 406 61 305 Consolidated Statements of Cash Flows ($ in thousands)(Unaudited) Three Months Ended March 31, 2021 2020 $ $ $ $ $ $ Eventbrite Q1 2021 Shareholder Letter Page 18

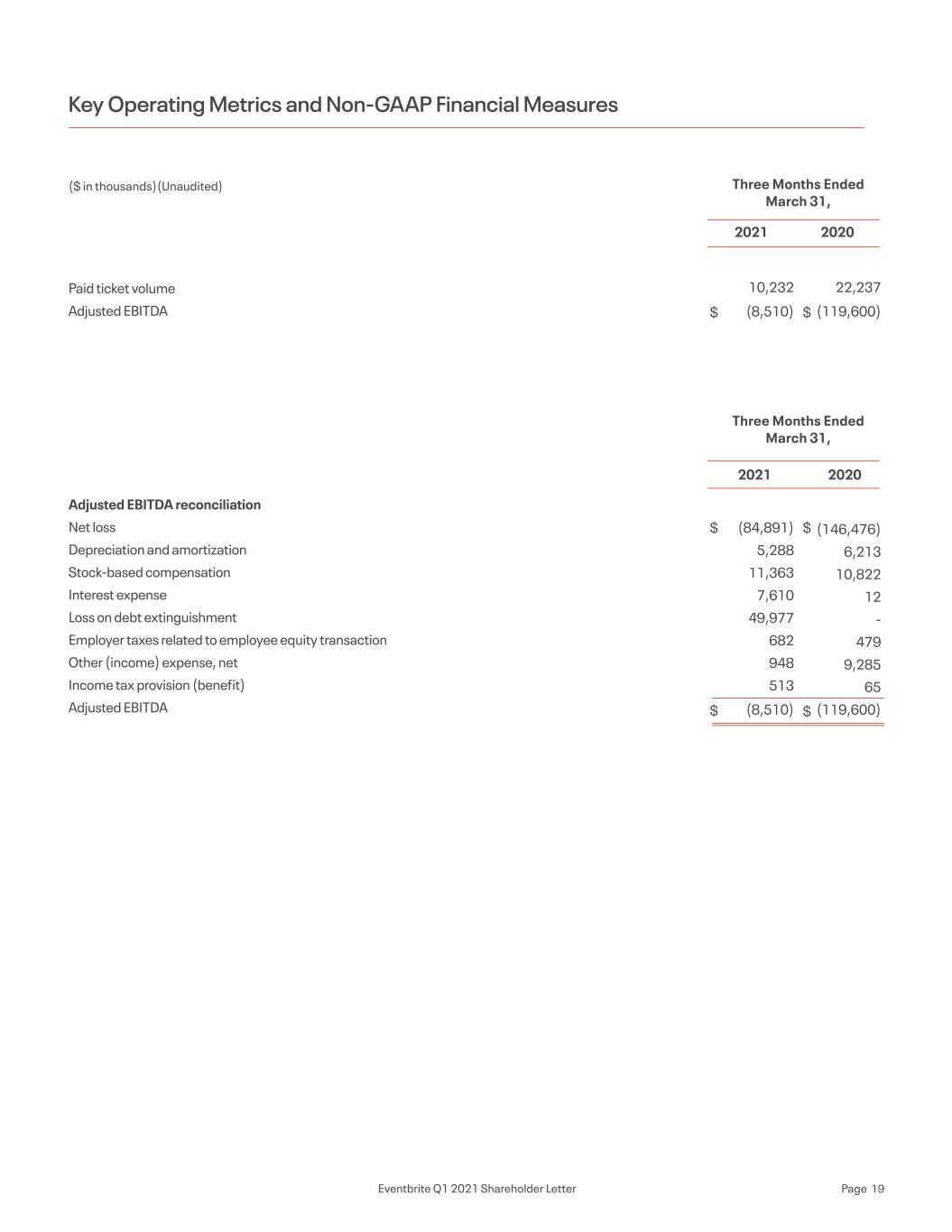

Paid ticket volume Adjusted EBITDA Adjusted EBITDA reconciliation Net loss Depreciation and amortization Stock-based compensation Interest expense Loss on debt extinguishment Employer taxes related to employee equity transaction Other (income) expense, net Income tax provision (benefit) Adjusted EBITDA 10,232 (8,510) (84,891) 5,288 11,363 7,610 49,977 682 948 513 (8,510) 22,237 (119,600) (146,476) 6,213 10,822 12 - 479 9,285 65 (119,600) Key Operating Metrics and Non-GAAP Financial Measures ($ in thousands)(Unaudited) Three Months Ended March 31, Three Months Ended March 31, 2021 2021 2020 2020 $ $ $ $ $ $ Eventbrite Q1 2021 Shareholder Letter Page 19

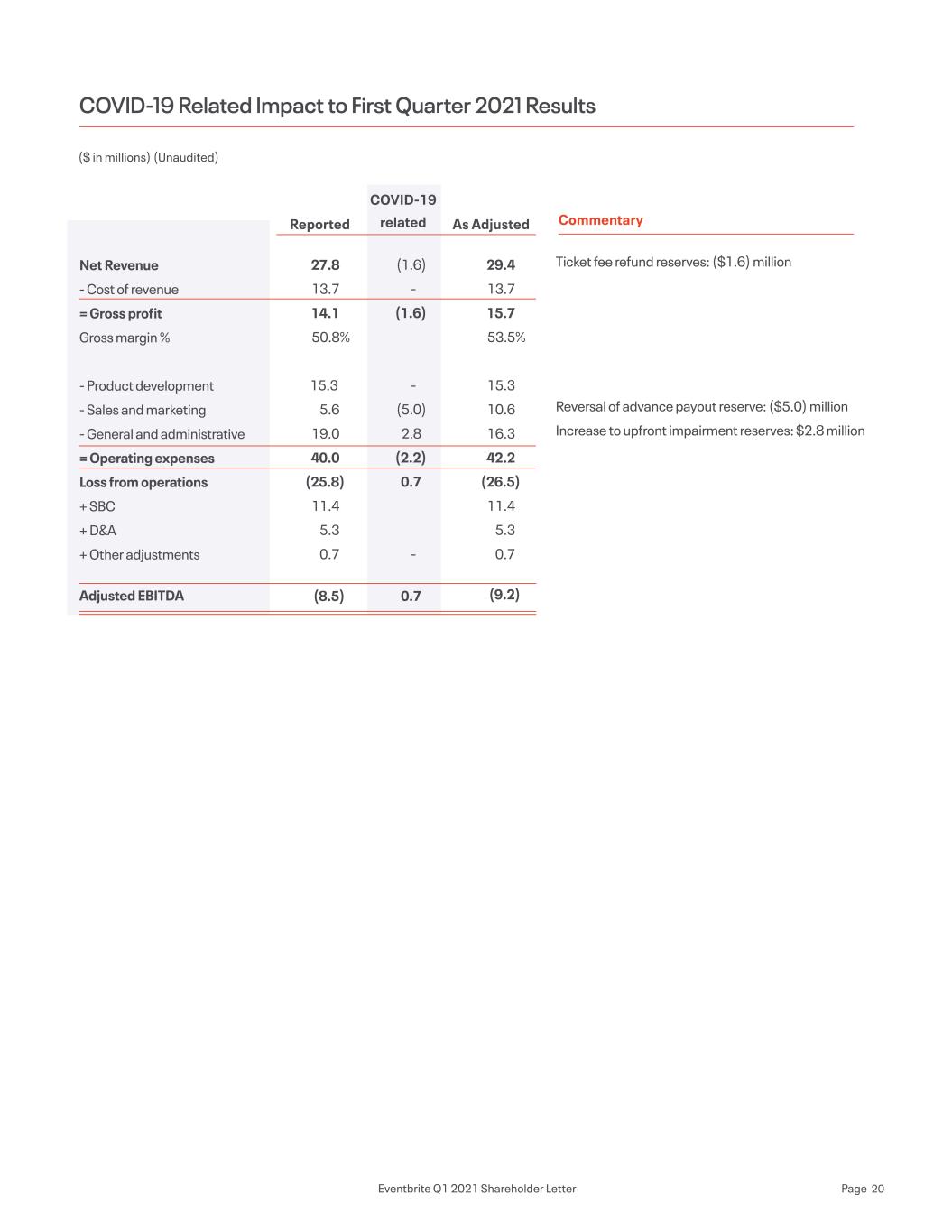

Net Revenue - Cost of revenue = Gross profit Gross margin % - Product development - Sales and marketing - General and administrative = Operating expenses Loss from operations + SBC + D&A + Other adjustments Adjusted EBITDA COVID-19 Related Impact to First Quarter 2021 Results Reported As Adjusted COVID-19 related Commentary 27.8)) 13.7)) 14.1)) 50.8% 15.3)v 5.6)) 19.0)) 40.0)) (25.8)) 11.4)) 5.3)) 0.7)) (8.5)) Ticket fee refund reserves: ($1.6) million Reversal of advance payout reserve: ($5.0) million Increase to upfront impairment reserves: $2.8 million 29.4)) 13.7)) 15.7)) 53.5% 15.3)) 10.6)) 16.3)) 42.2)) (26.5)) 11.4)) 5.3)) 0.7)) (9.2)) (1.6) -)) (1.6) -)) (5.0) 2.8) (2.2) 0.7) -)) 0.7) ($ in millions) (Unaudited) Eventbrite Q1 2021 Shareholder Letter Page 20