UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2011.

Commission File Number 333-170434

Sumitomo Mitsui Trust Holdings, Inc.

(Translation of registrant’s name into English)

9-2, Marunouchi, 1-chome

Chiyoda-ku, Tokyo 100-6611

Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F: x Form 40-F: ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ¨ No ¨

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

This report on Form 6-K contains the following:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | |

| | Sumitomo Mitsui Trust Holdings, Inc. |

| | |

| Date: November 14, 2011 | | By: | | /s/ Tadashi Nishimura |

| | | | Name: | | Tadashi Nishimura |

| | | | Title: | | Executive Officer |

| | | | |

Sumitomo Mitsui Trust Holdings, Inc. Financial Results for the First Half of the Fiscal Year 2011 [Japanese GAAP] (Consolidated) | | |  | |

| |

| |

| November 14, 2011 | |

| | |

Stock exchange listings | | : Tokyo, Osaka and Nagoya (code:8309) |

URL | | : http://www.smth.jp/en/index.html |

Representative | | : Kazuo Tanabe, President |

For inquiry | | : Tadashi Nishimura, Executive Officer, |

| | General Manager of Financial Planning Department |

| | TEL +81-3-3286-8354 |

Filing date of quarterly securities report (Scheduled) | | : November 29, 2011 |

Trading accounts | | : Established |

Payment date of cash dividends (Scheduled) | | : December 2, 2011 |

Supplementary explanatory material | | : Prepared |

Information meeting (Scheduled) | | : Yes (for institutional investors and analysts) |

| |

| | (All amounts less than one million yen are disregarded.) |

1. Consolidated Financial Results for the First Half of the Fiscal Year 2011 (April 1, 2011 through September 30, 2011)

| | |

| (1) Consolidated Results of Operations | | (%: Change from the same period in the previous fiscal year) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Ordinary Income | | | Ordinary Profit | | | Net income | |

| Six months ended | | Millions of Yen | | | % | | | Millions of Yen | | | % | | | Millions of Yen | | | % | |

September 30, 2011 | | | 623,302 | | | | 247.8 | | | | 155,296 | | | | 209.9 | | | | 128,109 | | | | 299.4 | |

September 30, 2010 | | | 179,238 | | | | (1.4 | ) | | | 50,104 | | | | 45.7 | | | | 32,071 | | | | 68.0 | |

| | | | | | | | |

| (Note) Comprehensive Income: | | September 30, 2011 93,946 millions of yen (–%); | | |

| | September 30, 2010 — millions of yen (–%) | | |

| | | | | | | | |

| | | Net Income

per Common Share | | | Net Income per

Common Share

(Fully Diluted) | |

| Six months ended | | Yen | | | Yen | |

September 30, 2011 | | | 30.29 | | | | — | |

September 30, 2010 | | | 19.34 | | | | — | |

| | |

(Note) | | Net income per common share (fully diluted) for the first half of the fiscal year 2011 is not stated as there are no potential shares that would have a dilutive effect. |

(Note) | | Net income per common share (fully diluted) for the first half of the fiscal year 2010 is not stated as there are no potential shares. |

(2) Consolidated Financial Conditions

| | | | | | | | | | | | | | | | |

| | | Total Assets | | | Net Assets | | | Net Assets to

Total Assets Ratio | | | Consolidated BIS

Capital Adequacy

Ratio | |

| As of | | Millions of Yen | | | Millions of Yen | | | % | | | % | |

September 30, 2011 | | | 35,180,904 | | | | 2,264,766 | | | | 4.9 | | | | 16.52 | |

March 31, 2011 | | | 14,231,070 | | | | 844,130 | | | | 4.6 | | | | 16.46 | |

| | | | |

| (Reference) Net Assets less Minority Interests: | | September 30, 2011 1,752,718 million yen; | | |

| | March 31, 2011 656,476 million yen | | |

| | |

(Note) | | Net Assets to Total Assets Ratio = (Net Assets - Subscription Rights to Shares - Minority Interests) / Total Assets |

(Note) | | BIS Capital Adequacy ratio is calculated in accordance with the “Standard for Determining Bank Holding Company Capital Adequacy in Light of Assets Held by a Bank Holding Company or its Subsidiaries, Pursuant to Article 52-25 of the Banking Act” (Financial Service Agency Notification No.20, 2006). The figure as of September 30, 2011 is the consolidated Net Assets to Total Assets Ratio for Sumitomo Mitsui Trust Holdings, Inc. (“SMTH”) for the six months ended September 30, 2011, calculated according to Standard 1. The figure as of March 31, 2011 is the consolidated Net Assets to Total Assets Ratio for the former Chuo Mitsui Trust Holdings, Inc (“CMTH”) for the fiscal year ended March 31, 2011, calculated according to Standard 2. Preliminary data for the six months ended September 30, 2011. |

2. Cash Dividends on Common Share

| | | | | | | | | | | | | | | | | | | | |

| | | Annual Cash Dividends per Common Share | |

| | | First

Quarter-end | | | Second

Quarter-end | | | Third

Quarter-end | | | Year-end | | | Total | |

| Fiscal year ended | | Yen | | | Yen | | | Yen | | | Yen | | | Yen | |

March 31, 2011 | | | — | | | | 4.00 | | | | — | | | | 4.00 | | | | 8.00 | |

Fiscal year ending | | | | | | | | | | | | | �� | | | | | | | |

March 31, 2012 | | | — | | | | 4.00 | | | | | | | | | | | | | |

Fiscal year ending | | | | | | | | | | | | | | | | | | | | |

March 31, 2012 (forecast) | | | | | | | | | | | — | | | | 4.00 | | | | 8.00 | |

| | |

(Note) | | Revision of the latest dividend forecast announced: None |

(Note) | | The figures above show the cash dividends on common shares. For other classes of SMTH shares with differing rights, please refer to “Cash Dividends on Preferred Shares.” |

3. Consolidated Earnings Forecasts for the Fiscal Year 2011

(April 1, 2011 through March 31, 2012)

| | | | | | | | | | | | | | | | | | | | |

| | | (%: Change from the previous fiscal year) | |

| | | |

| | | Ordinary Profit | | | Net Income | | | Net Income

per Common Share | |

| Fiscal year ending | | Millions of Yen | | | % | | | Millions of Yen | | | % | | | Yen | |

March 31, 2012 | | | 265,000 | | | | 212.8 | | | | 180,000 | | | | 280.7 | | | | 42.23 | |

| | |

(Note) | | Revision of the latest consolidated earnings forecast announced: Yes |

4. Other Information

| | |

(1) Changes in Important Subsidiaries during the First Half of the Fiscal Year 2011: Yes | | |

| |

(Changes in specified subsidiaries resulting from changes in the scope of the consolidation) | | |

| | | | |

Included: | | 6 companies | | The Sumitomo Trust and Banking Co. Ltd., STB Preferred Capital 2 (Cayman) Limited, |

| | | | STB Preferred Capital 3 (Cayman) Limited, STB Preferred Capital 4 (Cayman) Limited, |

| | | | STB Preferred Capital 5 (Cayman) Limited, Japan Trustee Services Bank Ltd. |

Excluded: | | — | | |

(For details, please refer to page 2, “1. Other Information” in “Accompanying Materials.”)

| (2) | Changes in Accounting Policies, Changes in Accounting Estimates and Restatements |

| | |

Changes in accounting policies due to revision of accounting standards | | : None |

| |

‚ Changes in accounting policies due to reasons other than the above | | : None |

| |

ƒ Changes in accounting estimates | | : None |

| |

„ Restatements | | : None |

| (3) | Number of Shares Issued (Common shares) |

| | | Number of shares issued (including treasury stock) |

| | | | | | | | | | |

September 30, 2011 | | 4,153,486,408 | | shares | | March 31, 2011 | | 1,658,426,267 | | shares |

| | ‚ | Number of treasury stock |

| | | | | | | | | | |

September 30, 2011 | | 733,379 | | shares | | March 31, 2011 | | 411,673 | | shares |

| | ƒ | Average number of shares issued (first half of the fiscal year) |

| | | | | | | | | | |

September 30, 2011 | | 4,152,838,119 | | shares | | September 30, 2010 | | 1,658,055,685 | | shares |

(Summary of Non-consolidated Financial Results)

Non-consolidated Financial Results for the First Half of the Fiscal Year 2011 (April 1, 2011 through September 30, 2011)

| | |

| (1) Non-consolidated Results of Operations | | (%: Change from the same period in the previous fiscal year) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Operating Income | | | Operating Profit | | | Ordinary Profit | | | Net Income | |

| Six months ended | | Millions of Yen | | | % | | | Millions of Yen | | | % | | | Millions of Yen | | | % | | | Millions of Yen | | | % | |

September 30, 2011 | | | 18,851 | | | | (8.1 | ) | | | 12,963 | | | | (14.9 | ) | | | 11,688 | | | | (12.2 | ) | | | 11,685 | | | | (10.3 | ) |

September 30, 2010 | | | 20,512 | | | | 77.7 | | | | 15,230 | | | | 148.6 | | | | 13,315 | | | | 118.8 | | | | 13,031 | | | | 114.6 | |

| | | | |

| | | Net Income

per Common Share | |

| Six months ended | | Yen | |

September 30, 2011 | | | 2.25 | |

September 30, 2010 | | | 7.85 | |

(2) Non-consolidated Financial Conditions

| | | | | | | | | | | | |

| | | Total Assets | | | Net Assets | | | Net Assets to

Total Assets Ratio | |

| As of | | Millions of Yen | | | Millions of Yen | | | % | |

September 30, 2011 | | | 1,935,230 | | | | 1,743,641 | | | | 90.1 | |

March 31, 2011 | | | 794,198 | | | | 601,370 | | | | 75.7 | |

(Reference) Net Assets: September 30, 2011 1,743,640 million yen; March 31, 2011 601,370 million yen

(Note) Net Assets to Total Assets Ratio = (Net Assets - Subscription Rights to Shares) / Total Assets

Statement Concerning the Status of the Interim Audit Process

This summary earnings report is not subject to interim audit pursuant to the Financial Instruments and Exchange Act, and at the time of the release of this summary earnings report an interim audit pursuant to the Financial Instruments and Exchange Act had not been completed.

Explanation for proper use of forecasts and other comments

| • | | Forecasts presented herein are based on the information that is currently possessed by SMTH and certain reasonable assumptions. Actual results may differ materially from those forecasts depending on various future events and conditions. |

| • | | As a specified business entity (a company engaged in the businesses specified in Article 17-15(2) of the Cabinet Office Ordinance on Disclosure of Corporate Affairs) SMTH has prepared consolidated and non-consolidated financial statements for the first half of this fiscal year. |

| • | | SMTH conducted a share exchange on April 1, 2011 under which SMTH became the parent company and The Sumitomo Trust and Banking Co., Ltd. (“STB”) became the wholly owned subsidiary. Based on the Accounting Standard for Business Combinations, this share exchange is a reverse acquisition wherein SMTH is considered to be the acquired company and STB to be the acquiring company. Therefore, the consolidated assets and liabilities of SMTH were transferred to the consolidated balance sheets of STB at fair value. As a result, the figures for the first half of the fiscal year 2011 changed substantially when compared with those for the first half of fiscal year 2010 or fiscal year 2010. |

| • | | SMTH intends to convene an earnings conference for institutional investors and analysts. We intend to post the content of this conference (audio) on our company website along with the materials presented during the conference. |

(Cash Dividends on Preferred Shares)

Cash dividends per share on preferred shares are as below:

| | | | | | | | | | | | | | | | | | | | |

The First Series of Class 7 Preferred Shares | | Annual Cash Dividends per Share | |

| | First

Quarter-end | | | Second

Quarter-end | | | Third

Quarter-end | | | Year-end | | | Total | |

| | | Yen | | | Yen | | | Yen | | | Yen | | | Yen | |

Fiscal year ended | | | | | | | | | | | | | | | | | | | | |

March 31, 2011 | | | | | | | | | | | | | | | | | | | | |

Fiscal year ending | | | | | | | | | | | | | | | | | | | | |

March 31, 2012 | | | — | | | | 21.15 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Fiscal year ending | | | | | | | | | | | | | | | | | | | | |

March 31, 2012 (forecast) | | | | | | | | | | | — | | | | 21.15 | | | | 42.30 | |

| | |

| (Note) | | Revision of the latest dividend forecast announced: None |

| (Note) | | The First Series of Class 7 Preferred Shares was issued on April 1, 2011 in exchange for the First Series of Class 2 Preferred Shares of STB due to the share exchange. |

(Reference) Cash Dividends on Common Share and the First Series of Class 2 Preferred Shares of The Sumitomo Trust and Banking Co., Ltd.

| | | | | | | | | | | | | | | | | | | | |

The Sumitomo Trust and Banking Co. Ltd. Common Shares | | Annual Cash Dividends per Common Share | |

| | First

Quarter-end | | | Second

Quarter-end | | | Third

Quarter-end | | | Year-end | | | Total | |

| | | Yen | | | Yen | | | Yen | | | Yen | | | Yen | |

Fiscal year ended | | | | | | | | | | | | | | | | | | | | |

March 31, 2011 | | | — | | | | 6.00 | | | | — | | | | 8.00 | | | | 14.00 | |

| | |

| (Note) | | While all the common shares of STB were acquired by SMTH in the share exchange for common shares of SMTH on April 1, 2011, the year-end dividend for the fiscal year 2010 (from April 1, 2010, to March 31, 2011) was paid by STB based on the last Register of Shareholders as of March 31, 2011. |

| | | | | | | | | | | | | | | | | | | | |

The Sumitomo Trust and Banking Co., Ltd. First Series of Class 2 Preferred Shares | | Annual Cash Dividends per Share | |

| | First

Quarter-end | | | Second

Quarter-end | | | Third

Quarter-end | | | Year-end | | | Total | |

| | | Yen | | | Yen | | | Yen | | | Yen | | | Yen | |

Fiscal year ended | | | | | | | | | | | | | | | | | | | | |

March 31, 2011 | | | — | | | | 21.15 | | | | — | | | | 21.15 | | | | 42.30 | |

| | |

| (Note) | | While all the First Series of Class 2 Preferred Shares of STB were acquired by SMTH in the share exchange for the First Series of Class 7 Preferred Shares of SMTH on April 1, 2011, the year-end dividends for the fiscal year 2010 (from April 1, 2010, to March 31, 2011) were paid by STB based on the last Register of Shareholders as of March 31, 2011. |

[Accompanying Materials]

Index

1

1. Other Information

| (1) | Changes in Important Subsidiaries during the First Half of the Fiscal Year 2011 |

(Changes in specified subsidiaries resulted in changes in the scope of consolidation)

Details of changes in specified subsidiaries resulting from changes in the scope of consolidation during the first half of the fiscal year 2011 (6 newly included companies) are as below.

| | | | | | | | | | | | |

Name | | Address | | Capital Stock

(Millions of Yen) | | | Main Business Area | | Share of Voting Rights Held | |

(Consolidated subsidiaries)

The Sumitomo Trust and Banking Co. Ltd. | | Chuo-ku, Osaka | | | 342,037 | | | Trust Banking Business | | | 100.00 | % |

| STB Preferred Capital 2 (Cayman) Limited | | George Town, Grand Cayman, British West Indies | | | 51,500 | | | Financial-related Business | | | 100.00 | % |

| STB Preferred Capital 3 (Cayman) Limited | | George Town, Grand Cayman, British West Indies | | | 51,500 | | | Financial-related Business | | | 100.00 | % |

| STB Preferred Capital 4 (Cayman) Limited | | George Town, Grand Cayman, British West Indies | | | 111,600 | | | Financial-related Business | | | 100.00 | % |

| STB Preferred Capital 5 (Cayman) Limited | | George Town, Grand Cayman, British West Indies | | | 70,900 | | | Financial-related Business | | | 100.00 | % |

| Japan Trustee Services Bank, Ltd. | | Chuo-ku, Tokyo | | | 51,000 | | | Trust Banking Business | | | 66.66 | % |

| (2) | Changes in Accounting Policies, Changes in Accounting Estimates and Restatements |

SMTH conducted a share exchange on April 1, 2011 under which SMTH became the parent company and STB became the wholly owned subsidiary. Based on the Accounting Standard for Business Combinations, this share exchange is a reverse acquisition wherein SMTH is considered the acquired company and STB the acquiring company. Therefore, the consolidated assets and liabilities of SMTH were transferred to the consolidated balance sheets of STB at fair value. Therefore, there is no continuity from our consolidated financial statements for the prior fiscal year to our interim consolidated financial statements.

SMTH adopted ASBJ Statement No. 24 “Accounting Standard for Accounting Changes and Error Corrections” (issued by ASBJ on December 4, 2009) and Implementation Guidance No. 24 “Guidance on Accounting Standard for Accounting Changes and Error Corrections” (issued by ASBJ on December 4, 2009) for accounting changes and corrections of past errors at the beginning of the first half of the fiscal year 2011, and we have presented financial data from CMTH for comparison.

2

2. Interim Consolidated Financial Statements

(1) Interim Consolidated Balance Sheets

| | | | | | | | |

| | | (Millions of Yen) | |

| | | As of

March 31, 2011 | | | As of

September 30, 2011 | |

Assets: | | | | | | | | |

Cash and Due from Banks | | | 502,160 | | | | 2,214,793 | |

Call Loans and Bills Bought | | | 6,936 | | | | 289,856 | |

Receivables under Resale Agreements | | | — | | | | 51,574 | |

Receivables under Securities Borrowing Transactions | | | 9,378 | | | | 7,764 | |

Monetary Claims Bought | | | 99,921 | | | | 483,836 | |

Trading Assets | | | 36,568 | | | | 666,536 | |

Money Held in Trust | | | 2,065 | | | | 24,256 | |

Securities | | | 3,710,513 | | | | 7,569,596 | |

Loans and Bills Discounted | | | 8,864,266 | | | | 20,593,126 | |

Foreign Exchanges | | | 12,259 | | | | 6,656 | |

Lease Receivables and Investment Assets | | | — | | | | 565,193 | |

Other Assets | | | 393,956 | | | | 1,470,991 | |

Tangible Fixed Assets | | | 123,584 | | | | 240,020 | |

Intangible Fixed Assets | | | 56,994 | | | | 208,025 | |

Deferred Tax Assets | | | 143,055 | | | | 278,854 | |

Customers’ Liabilities for Acceptances and Guarantees | | | 317,098 | | | | 660,480 | |

Allowance for Loan Losses | | | (47,690 | ) | | | (150,660 | ) |

| | | | | | | | |

Total Assets | | | 14,231,070 | | | | 35,180,904 | |

| | | | | | | | |

Liabilities: | | | | | | | | |

Deposits | | | 9,292,002 | | | | 22,191,060 | |

Negotiable Certificates of Deposit | | | 327,020 | | | | 2,679,771 | |

Call Money and Bills Sold | | | 351,956 | | | | 361,325 | |

Payables under Repurchase Agreements | | | — | | | | 140,533 | |

Payables under Securities Lending Transactions | | | 1,161,653 | | | | 648,420 | |

Trading Liabilities | | | 7,716 | | | | 179,664 | |

Borrowed Money | | | 678,983 | | | | 1,598,469 | |

Foreign Exchanges | | | — | | | | 70 | |

Short-term Bonds Payable | | | — | | | | 331,660 | |

Bonds Payable | | | 267,247 | | | | 949,527 | |

Borrowed Money from Trust Account | | | 801,657 | | | | 2,016,429 | |

Other Liabilities | | | 156,055 | | | | 1,090,524 | |

Provision for Bonuses | | | 3,133 | | | | 11,409 | |

Provision for Directors’ Bonuses | | | — | | | | 102 | |

Provision for Retirement Benefits | | | 2,859 | | | | 14,720 | |

Provision for Directors’ Retirement Benefits | | | 253 | | | | 184 | |

Provision for Reimbursement of Deposits | | | | | | | 6,316 | |

Provision for Contingent Loss | | | 15,335 | | | | 17,705 | |

Provision for Relocation Expenses | | | | | | | 9,090 | |

Deferred Tax Liabilities | | | 3,967 | | | | 3,544 | |

Deferred Tax Liabilities for Land Revaluation | | | — | | | | 5,124 | |

Acceptances and Guarantees | | | 317,098 | | | | 660,480 | |

| | | | | | | | |

Total Liabilities | | | 13,386,939 | | | | 32,916,138 | |

| | | | | | | | |

3

(Continued)

| | | | | | | | |

| | | (Millions of Yen) | |

| | | As of

March 31, 2011 | | | As of

September 30, 2011 | |

Net Assets: | | | | | | | | |

Capital Stock | | | 261,608 | | | | 261,608 | |

Capital Surplus | | | — | | | | 859,497 | |

Retained Earnings | | | 406,002 | | | | 679,162 | |

Treasury Stock | | | (282 | ) | | | (111 | ) |

| | | | | | | | |

Total Shareholders’ Equity | | | 667,328 | | | | 1,800,158 | |

| | | | | | | | |

Valuation Difference on Available-for-Sale Securities | | | 4,408 | | | | (20,090 | ) |

Deferred Gains or Losses on Hedges | | | 3,406 | | | | (7,240 | ) |

Revaluation Reserve for Land | | | (16,537 | ) | | | (5,560 | ) |

Foreign Currency Translation Adjustment | | | (2,129 | ) | | | (14,548 | ) |

| | | | | | | | |

Total Accumulated Other Comprehensive Income | | | (10,851 | ) | | | (47,439 | ) |

| | | | | | | | |

Subscription Rights to Shares | | | — | | | | 1 | |

Minority Interests | | | 187,653 | | | | 512,046 | |

| | | | | | | | |

Total Net Assets | | | 844,130 | | | | 2,264,766 | |

| | | | | | | | |

Total Liabilities and Net Assets | | | 14,231,070 | | | | 35,180,904 | |

| | | | | | | | |

4

(2) Interim Consolidated Statements of Income and Interim Consolidated Statement of Comprehensive Income

Interim Consolidated Statements of Income

| | | | | | | | |

| | | (Millions of Yen) | |

| | | Six Months Ended

September 30, 2010 | | | Six Months Ended

September 30, 2011 | |

Ordinary Income: | | | 179,238 | | | | 623,302 | |

Trust Fees | | | 23,372 | | | | 50,040 | |

Interest Income: | | | 81,042 | | | | 186,602 | |

Interest on Loans and Discounts | | | 54,658 | | | | 122,530 | |

Interest and Dividends on Securities | | | 23,616 | | | | 57,438 | |

Fees and Commissions | | | 43,193 | | | | 128,822 | |

Trading Income | | | 1,494 | | | | 3,276 | |

Other Ordinary Income | | | 23,567 | | | | 242,451 | |

Other Income | | | 6,567 | | | | 12,109 | |

| | | | | | | | |

Ordinary Expenses: | | | 129,133 | | | | 468,005 | |

| | | | | | | | |

Interest Expenses: | | | 30,752 | | | | 59,679 | |

Interest on Deposits | | | 21,038 | | | | 37,193 | |

Fees and Commissions Payments | | | 10,549 | | | | 31,370 | |

Trading Expenses | | | 40 | | | | 208 | |

Other Ordinary Expenses | | | 4,852 | | | | 159,039 | |

General and Administrative Expenses | | | 69,713 | | | | 190,390 | |

Other Expenses | | | 13,224 | | | | 27,315 | |

| | | | | | | | |

Ordinary Profit: | | | 50,104 | | | | 155,296 | |

| | | | | | | | |

Extraordinary Income: | | | 7,503 | | | | 46,340 | |

Gain on Disposal of Noncurrent Assets | | | 13 | | | | 279 | |

Gain on Amortization of Negative Goodwill | | | — | | | | 46,061 | |

Reversal of Allowance for Loan Losses | | | 5,815 | | | | | |

Recoveries of Written-off Claims | | | 1,675 | | | | | |

Extraordinary Loss: | | | 2,774 | | | | 7,213 | |

Loss on Disposal of Noncurrent Assets | | | 161 | | | | 289 | |

Impairment Loss | | | — | | | | 4,131 | |

Management Integration Expenses | | | 2,132 | | | | | |

Other Extraordinary Losses | | | 481 | | | | 2,792 | |

| | | | | | | | |

Income before Income Taxes and Minority Interests | | | 54,833 | | | | 194,423 | |

| | | | | | | | |

Income Taxes: | | | 18,796 | | | | 55,400 | |

Current | | | 3,621 | | | | 20,389 | |

Deferred | | | 15,175 | | | | 35,011 | |

| | | | | | | | |

Income before Minority Interests | | | 36,037 | | | | 139,022 | |

| | | | | | | | |

Minority Interests in Income | | | 3,965 | | | | 10,913 | |

| | | | | | | | |

Net Income | | | 32,071 | | | | 128,109 | |

| | | | | | | | |

5

Interim Consolidated Statement of Comprehensive Income

| | | | |

| | | (Millions of Yen) | |

| | | Six Months Ended

September 30, 2011 | |

Income before Minority Interests | | | 139,022 | |

| | | | |

Other Comprehensive Income: | | | (45,075 | ) |

Valuation Difference on Available-for-Sale Securities | | | (26,303 | ) |

Deferred Gains or Losses on Hedges | | | (14,119 | ) |

Foreign Currency Translation Adjustment | | | (1,635 | ) |

Attributable to Equity Method Affiliates | | | (3,016 | ) |

| | | | |

Comprehensive Income: | | | 93,946 | |

| | | | |

Comprehensive Income Attributable to Owners of the Parent | | | 83,388 | |

Comprehensive Income Attributable to Minority Interests | | | 10,557 | |

6

(3) Interim Consolidated Statements of Changes in Net Assets

| | | | | | | | |

| | | (Millions of Yen) | |

| | | Six Months Ended

September 30, 2010 | | | Six Months Ended

September 30, 2011 | |

Shareholders’ Equity: | | | | | | | | |

Capital Stock: | | | | | | | | |

Balance at the Beginning of the Current Period | | | 261,608 | | | | 342,037 | |

Changes during the Period | | | | | | | | |

Increase from Share Exchange | | | — | | | | (80,428 | ) |

| | | | | | | | |

Total Changes during the Period | | | — | | | | (80,428 | ) |

| | | | | | | | |

Balance at the End of the Current Period | | | 261,608 | | | | 261,608 | |

| | | | | | | | |

Capital Surplus: | | | | | | | | |

Balance at the Beginning of the Current Period | | | — | | | | 297,051 | |

Changes during the Period | | | | | | | | |

Cash Dividends | | | — | | | | (6,632 | ) |

Increase from Share Exchange | | | — | | | | 569,542 | |

Disposal of Treasury Stock | | | — | | | | 18 | |

Retirement of Treasury Stock | | | — | | | | (482 | ) |

| | | | | | | | |

Total Changes during the Period | | | — | | | | 562,446 | |

| | | | | | | | |

Balance at the End of the Current Period | | | — | | | | 859,497 | |

| | | | | | | | |

Retained Earnings: | | | | | | | | |

Balance at the Beginning of the Current Period | | | 377,619 | | | | 565,908 | |

Changes during the Period | | | | | | | | |

Cash Dividends | | | (13,264 | ) | | | (15,701 | ) |

Net Income | | | 32,071 | | | | 128,109 | |

Disposal of Treasury Stock | | | (1 | ) | | | — | |

Reversal of Revaluation Reserve for Land | | | — | | | | 846 | |

| | | | | | | | |

Total Changes during the Period | | | 18,805 | | | | 113,254 | |

| | | | | | | | |

Balance at the End of the Current Period | | | 396,425 | | | | 679,162 | |

| | | | | | | | |

Treasury Stock: | | | | | | | | |

Balance at the Beginning of the Current Period | | | (270 | ) | | | (482 | ) |

Changes during the Period | | | | | | | | |

Purchase of Treasury Stock | | | (5 | ) | | | (126 | ) |

Disposal of Treasury Stock | | | 3 | | | | 15 | |

Retirement of Treasury Stock | | | — | | | | 482 | |

| | | | | | | | |

Total Changes during the Period | | | (2 | ) | | | 371 | |

| | | | | | | | |

Balance at the End of the Current Period | | | (272 | ) | | | (111 | ) |

| | | | | | | | |

Total Shareholders’ Equity: | | | | | | | | |

Balance at the Beginning of the Current Period | | | 638,957 | | | | 1,204,514 | |

Changes during the Period | | | | | | | | |

Cash Dividends | | | (13,264 | ) | | | (22,333 | ) |

Net Income | | | 32,071 | | | | 128,109 | |

Increase from Share Exchange | | | — | | | | 489,114 | |

Purchase of Treasury Stock | | | (5 | ) | | | (126 | ) |

Disposal of Treasury Stock | | | 1 | | | | 34 | |

Reversal of Revaluation Reserve for Land | | | — | | | | 846 | |

| | | | | | | | |

Total Changes during the Period | | | 18,803 | | | | 595,643 | |

| | | | | | | | |

Balance at the End of the Current Period | | | 657,761 | | | | 1,800,158 | |

| | | | | | | | |

7

(Continued)

| | | | | | | | |

| | | (Millions of Yen) | |

| | | Six Months Ended

September 30, 2010 | | | Six Months Ended

September 30, 2011 | |

Accumulated Other Comprehensive Income: | | | | | | | | |

Valuation Difference on Available-for-Sale Securities: | | | | | | | | |

Balance at the Beginning of the Current Period | | | 35,002 | | | | 6,064 | |

Changes during the Period | | | | | | | | |

Net Changes of Items other than Shareholders’ Equity | | | (17,251 | ) | | | (26,155 | ) |

| | | | | | | | |

Total Changes during the Period | | | (17,251 | ) | | | (26,155 | ) |

| | | | | | | | |

Balance at the End of the Current Period | | | 17,750 | | | | (20,090 | ) |

| | | | | | | | |

Deferred Gains or Losses on Hedges: | | | | | | | | |

Balance at the Beginning of the Current Period | | | 2,705 | | | | 9,650 | |

Changes during the Period | | | | | | | | |

Net Changes of Items other than Shareholders’ Equity | | | 2,100 | | | | (16,890 | ) |

| | | | | | | | |

Total Changes during the Period | | | 2,100 | | | | (16,890 | ) |

| | | | | | | | |

Balance at the End of the Current Period | | | 4,805 | | | | (7,240 | ) |

| | | | | | | | |

Revaluation Reserve for Land: | | | | | | | | |

Balance at the Beginning of the Current Period | | | (15,532 | ) | | | (4,714 | ) |

Changes during the Period | | | | | | | | |

Net Changes of Items other than Shareholders’ Equity | | | — | | | | (846 | ) |

| | | | | | | | |

Total Changes during the Period | | | — | | | | (846 | ) |

| | | | | | | | |

Balance at the End of the Current Period | | | (15,532 | ) | | | (5,560 | ) |

| | | | | | | | |

Foreign Currency Translation Adjustment: | | | | | | | | |

Balance at the Beginning of the Current Period | | | (1,738 | ) | | | (12,873 | ) |

Changes during the Period | | | | | | | | |

Net Changes of Items other than Shareholders’ Equity | | | (264 | ) | | | (1,674 | ) |

| | | | | | | | |

Total Changes during the Period | | | (264 | ) | | | (1,674 | ) |

| | | | | | | | |

Balance at the End of the Current Period | | | (2,002 | ) | | | (14,548 | ) |

| | | | | | | | |

Total Accumulated Other Comprehensive Income: | | | | | | | | |

Balance at the Beginning of the Current Period | | | 20,436 | | | | (1,872 | ) |

Changes during the Period | | | | | | | | |

Net Changes of Items other than Shareholders’ Equity | | | (15,415 | ) | | | (45,566 | ) |

| | | | | | | | |

Total Changes during the Period | | | (15,415 | ) | | | (45,566 | ) |

| | | | | | | | |

Balance at the End of the Current Period | | | 5,021 | | | | (47,439 | ) |

| | | | | | | | |

Subscription Rights to Shares: | | | | | | | | |

Balance at the Beginning of the Current Period | | | — | | | | — | |

Changes during the Period | | | | | | | | |

Net Changes of Items other than Shareholders’ Equity | | | — | | | | 1 | |

| | | | | | | | |

Total Changes during the Period | | | — | | | | 1 | |

| | | | | | | | |

Balance at the End of the Current Period | | | — | | | | 1 | |

| | | | | | | | |

Minority Interests: | | | | | | | | |

Balance at the Beginning of the Current Period | | | 187,161 | | | | 304,454 | |

Changes during the Period | | | | | | | | |

Net Changes of Items other than Shareholders’ Equity | | | 172 | | | | 207,592 | |

| | | | | | | | |

Total Changes during the Period | | | 172 | | | | 207,592 | |

| | | | | | | | |

Balance at the End of the Current Period | | | 187,333 | | | | 512,046 | |

| | | | | | | | |

8

(Continued)

| | | | | | | | |

| | | (Millions of Yen) | |

| | | Six Months Ended

September 30, 2010 | | | Six Months Ended

September 30, 2011 | |

Total Net Assets: | | | | | | | | |

Balance at the Beginning of the Current Period | | | 846,556 | | | | 1,507,095 | |

Changes during the Period | | | | | | | | |

Cash Dividends | | | (13,264 | ) | | | (22,333 | ) |

Net Income | | | 32,071 | | | | 128,109 | |

Increase from Share Exchange | | | — | | | | 489,114 | |

Purchase of Treasury Stock | | | (5 | ) | | | (126 | ) |

Disposal of Treasury Stock | | | 1 | | | | 34 | |

Reversal of Revaluation Reserve for Land | | | — | | | | 846 | |

Net Changes of Items other than Shareholders’ Equity | | | (15,243 | ) | | | 162,026 | |

| | | | | | | | |

Total Changes during the Period | | | 3,559 | | | | 757,670 | |

| | | | | | | | |

Balance at the End of the Current Period | | | 850,115 | | | | 2,264,766 | |

| | | | | | | | |

9

(4) Note on Going Concern Assumptions

There is no applicable information.

10

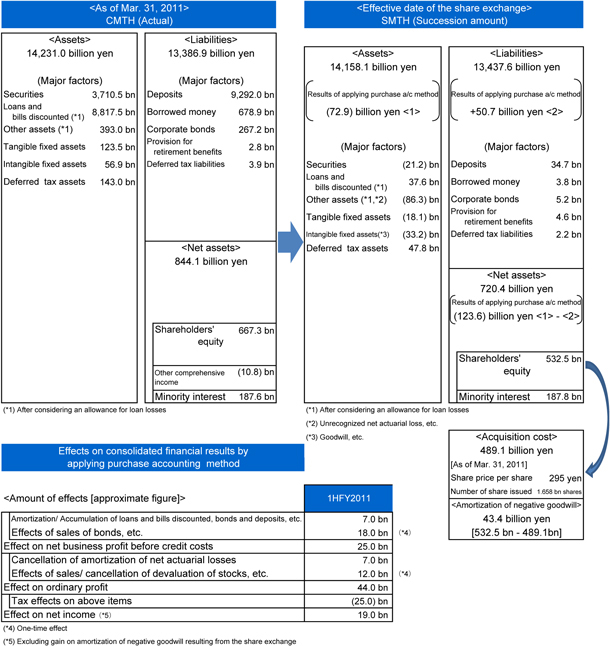

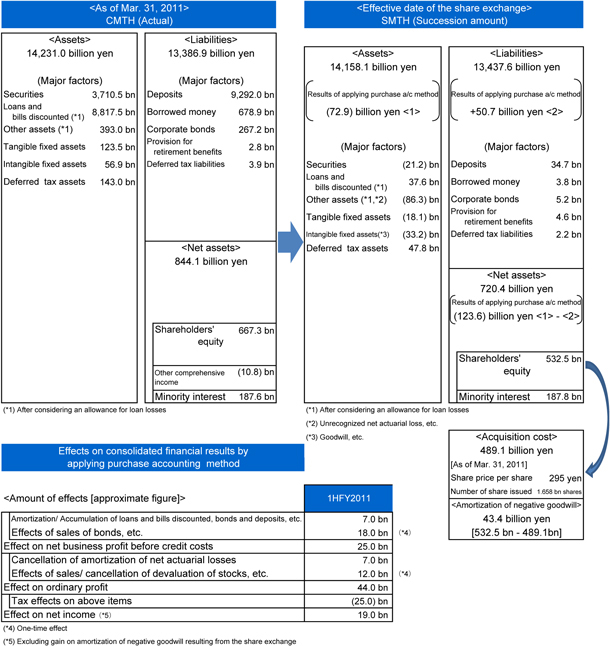

(5) Note on Business Combination

On August 24, 2010, CMTH concluded a share exchange agreement and a management integration agreement with STB. Subsequent to the approval at the extraordinary general meeting of shareholders held on December 22, 2010, the share exchange was performed on April 1, 2011 as the effective date. CMTH changed its trade name to Sumitomo Mitsui Trust Holdings, Inc. (“SMTH”).

1. Outline of Business Combination

(1) Name and Business Content of Acquired Company

| | |

| Name of acquired company | | Chuo Mitsui Trust Holdings, Inc. |

| Business content | | Bank holding company |

(2) Main Reasons for Business Combination

CMTH and STB aim to create “The Trust Bank,” a new trust bank group that, with a combination of significant expertise and comprehensive capabilities, will provide better and swifter comprehensive solutions to their clients than ever before, by combining their personnel, know-how and other managerial resources and fusing both groups’ strengths, such as the diversity of the STB group and the agility of the CMTH group.

(3) Date of Business Combination

April 1, 2011

(4) Legal Form of Business Combination

Share exchange, under which CMTH became the parent company, and STB became the wholly owned subsidiary.

(5) Name of Company after Business Combination

Sumitomo Mitsui Trust Holdings, Inc.

(6) Acquired Voting Rights Ratio

100%

(7) Main Grounds for the Determination of the Acquiring Company

SMTH has adopted ASBJ Statement No.21 “Accounting Standard for Business Combinations” (issued by ASBJ on December 26, 2008) and Implementation Guidance No.10 “Guidance on Accounting Standard for Business Combinations and Accounting Standard for Business Divestitures” (issued by ASBJ on December 26, 2008). According to them, shareholders of STB, which is a wholly owned subsidiary company in the share exchange, hold the majority of voting rights of the company following the business combination. Therefore, it was decided that under the Accounting Standard for the Business Combinations, STB would be the acquiring company, with CMTH as the acquired company.

11

2. Period of Earnings of the Acquired Company included in the Interim Consolidated Statements of Income Described at Acquisition Cost of the Acquired Company

April 1, 2011 through September 30, 2011

3. Acquisition Cost of the Acquired Company

489,114 million yen

4. Share Exchange Ratio by Type of Share, Calculation Method, and Number of Shares Delivered

(1) Share Exchange Ratio by Type of Share

(a) Common Shares

For each common share of STB, 1.49 shares of common share of SMTH have been allotted and delivered.

(b) Preferred Shares

For each First Series of Class 2 Preferred Shares of STB, one share of the First Series of Class 7 Preferred Shares of SMTH has been allotted and delivered.

(2) Calculation Method of the Share Exchange Ratio

(a) Common Shares

In order to support the respective efforts of CMTH and STB to ensure the fairness of the exchange ratio of common shares (hereinafter, “Common Share Exchange Ratio”) for this share exchange, CMTH had requested JP Morgan Securities Japan Co., Ltd. and Nomura Securities Co., Ltd. to perform financial analyses, while STB had requested UBS Securities Japan Ltd. and Daiwa Securities Capital Markets Co., Ltd., to perform similar analyses. Referring to the results of those financial analyses, CMTH and STB, on several occasions, conducted careful negotiations and discussions on the Common Share Exchange Ratio, comprehensively taking into consideration factors such as the financial position, assets, and future prospects of each party. As a result, CMTH and STB have reached the conclusion that the above Common Share Exchange Ratio is appropriate.

(b) Preferred Shares

CMTH and STB had agreed that the terms and conditions of the First Series of SMTH Class 7 Preferred Shares shall be substantially the same as those of the First Series of Class 2 Preferred Shares, and reached the conclusion that the above share exchange ratio for preferred shares is appropriate, after comprehensively taking into consideration the “bond-type” nature of those shares and the fact that there is no market price for the First Series of Class 2 Preferred Shares.

(3) Number of Shares Delivered

(a) Common Shares

2,495,060,141 shares

(b) Preferred Shares

109,000,000 shares

5. Amount of Gain on Amortization of Negative Goodwill and Reason for Recognizing Negative Goodwill

(1) Amount of Gain on Amortization of Negative Goodwill

43,431 million yen

(2) Reason for Recognizing Negative Goodwill

Negative goodwill was recognized as the shareholders’ equity (deducting minority interest from net of assets and liabilities acquired) exceeded the acquisition cost of acquired company.

6. Amount of Assets Acquired and Liabilities Acquired on Date of Business Combination

(1) Assets

| | | | |

Total Assets | | | 14,158,131 million yen | |

Loans and Bills Discounted | | | 8,855,145 million yen | |

(2) Liabilities

| | | | |

Total Liabilities | | | 13,437,699 million yen | |

Deposits | | | 9,326,751 million yen | |

12

3. Interim Non-Consolidated Financial Statements

(1) Interim Non-Consolidated Balance Sheets

| | | | | | | | |

| | | (Millions of Yen) | |

| | | As of

March 31, 2011 | | | As of

September 30, 2011 | |

Assets: | | | | | | | | |

Current Assets: | | | | | | | | |

Cash and Due from Banks | | | 1,462 | | | | 1,843 | |

Securities | | | 23,000 | | | | 27,000 | |

Accrued Income | | | 0 | | | | 1 | |

Income Tax Refunds Receivable | | | 3,438 | | | | 2,955 | |

Other Current Assets | | | 868 | | | | 714 | |

| | | | | | | | |

Total Current Assets | | | 28,769 | | | | 32,514 | |

| | | | | | | | |

Non-Current Assets: | | | | | | | | |

Tangible Fixed Assets | | | 1 | | | | 0 | |

Intangible Fixed Assets | | | 7 | | | | 6 | |

Investments and Other Assets | | | 765,419 | | | | 1,902,708 | |

Investment Securities | | | 652 | | | | 652 | |

Investments in Subsidiaries and Affiliates | | | 764,391 | | | | 1,901,700 | |

Other Investments | | | 376 | | | | 356 | |

| | | | | | | | |

Total Non-Current Assets | | | 765,428 | | | | 1,902,715 | |

| | | | | | | | |

Total Assets | | | 794,198 | | | | 1,935,230 | |

| | | | | | | | |

Liabilities: | | | | | | | | |

Current Liabilities: | | | | | | | | |

Accrued Expenses | | | 1,365 | | | | 1,394 | |

Income Taxes Payable | | | 2 | | | | 9 | |

Provision for Bonuses | | | 90 | | | | 183 | |

Other Current Liabilities | | | 296 | | | | 135 | |

| | | | | | | | |

Total Current Liabilities | | | 1,755 | | | | 1,722 | |

| | | | | | | | |

Non-Current Liabilities: | | | | | | | | |

Bonds Payable | | | 189,700 | | | | 189,700 | |

Provision for Retirement Benefits | | | 1,177 | | | | — | |

Other Non-Current Liabilities | | | 195 | | | | 166 | |

| | | | | | | | |

Total Non-Current Liabilities | | | 191,072 | | | | 189,866 | |

| | | | | | | | |

Total Liabilities | | | 192,827 | | | | 191,588 | |

| | | | | | | | |

Net Assets: | | | | | | | | |

Shareholders’ Equity: | | | | | | | | |

Capital Stock | | | 261,608 | | | | 261,608 | |

Capital Surplus | | | | | | | | |

Legal Capital Surplus | | | 65,411 | | | | 702,933 | |

Other Capital Surplus | | | 53,254 | | | | 553,011 | |

| | | | | | | | |

Total Capital Surplus | | | 118,665 | | | | 1,255,945 | |

| | | | | | | | |

Retained Earnings | | | | | | | | |

Other Retained Earnings | | | 221,379 | | | | 226,432 | |

Retained Earnings Brought Forward | | | 221,379 | | | | 226,432 | |

| | | | | | | | |

Total Retained Earnings | | | 221,379 | | | | 226,432 | |

| | | | | | | | |

Treasury Stock | | | (282 | ) | | | (346 | ) |

| | | | | | | | |

Total Shareholders’ Equity | | | 601,370 | | | | 1,743,640 | |

| | | | | | | | |

Subscription Rights to Shares | | | — | | | | 1 | |

| | | | | | | | |

Total Net Assets | | | 601,370 | | | | 1,743,641 | |

| | | | | | | | |

Total Liabilities and Net Assets | | | 794,198 | | | | 1,935,230 | |

| | | | | | | | |

13

(2) Interim Non-Consolidated Statements of Income

| | | | | | | | |

| | | (Millions of Yen) | |

| | | Six Months Ended

September 30, 2010 | | | Six Months Ended

September 30, 2011 | |

Operating Income: | | | | | | | | |

Dividends Received from Subsidiaries | | | 17,068 | | | | 14,771 | |

Fees Received from Subsidiaries | | | 3,444 | | | | 4,079 | |

| | | | | | | | |

Total Operating Income | | | 20,512 | | | | 18,851 | |

| | | | | | | | |

Operating Expenses: | | | | | | | | |

Interest on Bonds | | | 3,783 | | | | 3,741 | |

General and Administrative Expenses | | | 1,498 | | | | 2,146 | |

| | | | | | | | |

Total Operating Expenses | | | 5,281 | | | | 5,887 | |

| | | | | | | | |

Operating Profit | | | 15,230 | | | | 12,963 | |

| | | | | | | | |

Non-Operating Income | | | 32 | | | | 20 | |

Non-Operating Expenses | | | 1,947 | | | | 1,295 | |

| | | | | | | | |

Ordinary Profit | | | 13,315 | | | | 11,688 | |

| | | | | | | | |

Extraordinary Income | | | 22 | | | | — | |

| | | | | | | | |

Income before Income Taxes | | | 13,338 | | | | 11,688 | |

| | | | | | | | |

Income Taxes: | | | 307 | | | | 3 | |

Current | | | 1 | | | | 3 | |

Deferred | | | 305 | | | | — | |

| | | | | | | | |

Net Income | | | 13,031 | | | | 11,685 | |

| | | | | | | | |

14

(3) Interim Non-Consolidated Statements of Changes in Net Assets

| | | | | | | | |

| | | (Millions of Yen) | |

| | | Six Months Ended

September 30, 2010 | | | Six Months Ended

September 30, 2011 | |

Shareholders’ Equity: | | | | | | | | |

Capital Stock: | | | | | | | | |

Balance at the Beginning of the Current Period | | | 261,608 | | | | 261,608 | |

Changes during the Period | | | | | | | | |

| | | | | | | | |

Total Changes during the Period | | | — | | | | — | |

| | | | | | | | |

Balance at the End of the Current Period | | | 261,608 | | | | 261,608 | |

| | | | | | | | |

Capital Surplus: | | | | | | | | |

Legal Capital Surplus: | | | | | | | | |

Balance at the Beginning of the Current Period | | | 65,411 | | | | 65,411 | |

Changes during the Period | | | | | | | | |

Increase from Share Exchange | | | — | | | | 1,137,308 | |

Reversal of Legal Capital Surplus | | | — | | | | (499,786 | ) |

| | | | | | | | |

Total Changes during the Period | | | — | | | | 637,522 | |

| | | | | | | | |

Balance at the End of the Current Period | | | 65,411 | | | | 702,933 | |

| | | | | | | | |

Other Capital Surplus: | | | | | | | | |

Balance at the Beginning of the Current Period | | | 53,257 | | | | 53,254 | |

Changes during the Period | | | | | | | | |

Reversal of Legal Capital Surplus | | | — | | | | 499,786 | |

Disposal of Treasury Stock | | | (1 | ) | | | (28 | ) |

| | | | | | | | |

Total Changes during the Period | | | (1 | ) | | | 499,757 | |

| | | | | | | | |

Balance at the End of the Current Period | | | 53,255 | | | | 553,011 | |

| | | | | | | | |

Total Capital Surplus: | | | | | | | | |

Balance at the Beginning of the Current Period | | | 118,668 | | | | 118,665 | |

Changes during the Period | | | | | | | | |

Increase from Share Exchange | | | — | | | | 1,137,308 | |

Disposal of Treasury Stock | | | (1 | ) | | | (28 | ) |

| | | | | | | | |

Total Changes during the Period | | | (1 | ) | | | 1,137,280 | |

| | | | | | | | |

Balance at the End of the Current Period | | | 118,666 | | | | 1,255,945 | |

| | | | | | | | |

Retained Earnings: | | | | | | | | |

Other Retained Earnings: | | | | | | | | |

Balance at the Beginning of the Current Period | | | 232,368 | | | | 221,379 | |

Changes during the Period | | | | | | | | |

Cash Dividends | | | (13,264 | ) | | | (6,632 | ) |

Net Income | | | 13,031 | | | | 11,685 | |

| | | | | | | | |

Total Changes during the Period | | | (233 | ) | | | 5,053 | |

| | | | | | | | |

Balance at the End of the Current Period | | | 232,135 | | | | 226,432 | |

| | | | | | | | |

Total Retained Earnings: | | | | | | | | |

Balance at the Beginning of the Current Period | | | 232,368 | | | | 221,379 | |

Changes during the Period | | | | | | | | |

Cash Dividends | | | (13,264 | ) | | | (6,632 | ) |

Net Income | | | 13,031 | | | | 11,685 | |

| | | | | | | | |

Total Changes during the Period | | | (233 | ) | | | 5,053 | |

| | | | | | | | |

Balance at the End of the Current Period | | | 232,135 | | | | 226,432 | |

| | | | | | | | |

15

(Continued)

| | | | | | | | |

| | | (Millions of Yen) | |

| | | Six Months Ended

September 30, 2010 | | | Six Months Ended

September 30, 2011 | |

Treasury Stock: | | | | | | | | |

Balance at the Beginning of the Current Period | | | (270 | ) | | | (282 | ) |

Changes during the Period | | | | | | | | |

Purchase of Treasury Stock | | | (5 | ) | | | (126 | ) |

Disposal of Treasury Stock | | | 3 | | | | 62 | |

| | | | | | | | |

Total Changes during the Period | | | (2 | ) | | | (64 | ) |

| | | | | | | | |

Balance at the End of the Current Period | | | (272 | ) | | | (346 | ) |

| | | | | | | | |

Total Shareholders’ Equity: | | | | | | | | |

Balance at the Beginning of the Current Period | | | 612,375 | | | | 601,370 | |

Changes during the Period | | | | | | | | |

Cash Dividends | | | (13,264 | ) | | | (6,632 | ) |

Net Income | | | 13,031 | | | | 11,685 | |

Increase from Share Exchange | | | — | | | | 1,137,308 | |

Purchase of Treasury Stock | | | (5 | ) | | | (126 | ) |

Disposal of Treasury Stock | | | 1 | | | | 34 | |

| | | | | | | | |

Total Changes during the Period | | | (237 | ) | | | 1,142,269 | |

| | | | | | | | |

Balance at the End of the Current Period | | | 612,138 | | | | 1,743,640 | |

| | | | | | | | |

Subscription Rights to Shares: | | | | | | | | |

Balance at the Beginning of the Current Period | | | — | | | | — | |

Changes during the Period | | | | | | | | |

Net Changes of Items other than Shareholders’ Equity | | | — | | | | 1 | |

| | | | | | | | |

Total Changes during the Period | | | — | | | | 1 | |

| | | | | | | | |

Balance at the End of the Current Period | | | — | | | | 1 | |

| | | | | | | | |

Total Net Assets: | | | | | | | | |

Balance at the Beginning of the Current Period | | | 612,375 | | | | 601,370 | |

Changes during the Period | | | | | | | | |

Cash Dividends | | | (13,264 | ) | | | (6,632 | ) |

Net Income | | | 13,031 | | | | 11,685 | |

Increase from Share Exchange | | | — | | | | 1,137,308 | |

Purchase of Treasury Stock | | | (5 | ) | | | (126 | ) |

Disposal of Treasury Stock | | | 1 | | | | 34 | |

Net Changes of Items other than Shareholders’ Equity | | | — | | | | 1 | |

| | | | | | | | |

Total Changes during the Period | | | (237 | ) | | | 1,142,270 | |

| | | | | | | | |

Balance at the End of the Current Period | | | 612,138 | | | | 1,743,641 | |

| | | | | | | | |

16

(4) Note on Going Concern Assumptions

There is no applicable information.

17

Cautionary Statement Regarding Forward-Looking Statements

This material contains forward-looking statements (as defined in the U.S. Private Securities Litigation Reform Act of 1995) regarding our intent, belief or current expectations in respect to our future financial conditions, operating results and overall management. These forward-looking statements may be identified by words such as “believes”, “expects”, “anticipates”, “projects”, “intends”, “should”, “seeks”, “estimates”, “future”, or similar expressions or by discussion of, among other things, strategy, goals, plans or intentions. Such forward-looking statements are not guarantees of future performance and actual results may differ, owing to risks and uncertainties, including without limitation: (1) potential difficulties in integrating the management and business operations of our subsidiaries; (2) our ability to successfully execute our group business strategies; and (3) unanticipated events that result in an increase in our credit costs and a deterioration in the quality of our group companies’ loan portfolios. Given such risks and uncertainties, you should not place undue reliance on forward-looking statements, which speak only as of the release date of this material. We undertake no obligation to update or revise any forward-looking statements. In addition to this material, please refer to our most recently disclosed documents, such as our annual report on Form 20-F filed with the U.S. Securities and Exchange Commission, or press releases we have issued, for a more detailed description of matters that may affect our financial condition and operating results.

18

Explanatory Material

2nd Quarter of Fiscal Year 2011

ended on Sep. 30, 2011

Sumitomo Mitsui Trust Holdings, Inc.

Table of Contents

| | |

| < Definition of terms in this document > | | |

| SMTH : Sumitomo Mitsui Trust Holdings, Inc. | | CMTH : Former Chuo Mitsui Trust Holdings, Inc. |

CMTB : The Chuo Mitsui Trust and Banking Company, Limited | | CMAB : Chuo Mitsui Asset Trust and Banking Company, Limited |

| STB : The Sumitomo Trust and Banking, Co., Ltd. | | |

Legal Disclaimer

Regarding forward-looking Statements contained in this material This presentation material contains information that constitutes forward-looking statements. Such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ from those in the forward-looking statements as a result of various factors including but not limited to changes in managerial circumstances. By virtue of the aforementioned reasons, Sumitomo Mitsui Trust Holdings, Inc. hereby cautions against sole reliance on such forward-looking statements in making investment decisions.

Summary of 1HFY2011 financial results

1. Financial Results

<Consolidated>

(1) Net business profit before credit costs <1> increased by 27.0 billion yen from 1HFY2010 to 175.6 billion yen, due to the effects on consolidated accounting method resulting from the management integration, in addition to the increase in market-related profit on a non-consolidated (CMTB + CMAB + STB) basis.

(2) Total credit costs <5> stood at the reversal of 0.0 billion yen, as a result of group companies’ limited credit costs, as well as those on a non-consolidated (CMTB + CMAB + STB) basis. And consolidated net gains on stocks <6> stood at the net loss of 11.0 billion yen mainly due to the devaluation of stocks.

(3) As a result, ordinary profit <2> increased by 43.6 billion yen from 1HFY2010 to 155.2 billion yen. Net income <3> increased by 42.0 billion yen to 128.1 billion yen over the same period, due to, in addition to the above mentioned, the gain on amortization of negative goodwill (43.4 billion yen) caused by share exchange. Meanwhile, net income excluding amortization of negative goodwill <4> decreased by 1.4 billion yen to 84.6 billion yen, mainly due to the disappearance of income boosting factor regarding tax effect accounting resulting from the reorganization of subsidiaries in 1HFY2010.

| | | | | | | | | | | | | | | | |

[Consolidated (SMTH)] | | | (in billions of Yen) | |

| | | | | | 1HFY2011 | | | 1HFY2010 | | | Change | |

Net business profit before credit costs (*1) | | | 1 | | | | 175.6 | | | | 148.5 | | | | 27.0 | |

Ordinary profit | | | 2 | | | | 155.2 | | | | 111.6 | | | | 43.6 | |

Net income | | | 3 | | | | 128.1 | | | | 86.1 | | | | 42.0 | |

(excl. amortization of negative goodwill) | | | 4 | | | | 84.6 | | | | 86.1 | | | | (1.4 | ) |

| | | | | | | | | | | | | | | | |

Total credit costs | | | 5 | | | | 0.0 | | | | 2.4 | | | | (2.3 | ) |

| | | | | | | | | | | | | | | | |

Net gains on stocks | | | 6 | | | | (11.0 | ) | | | (1.1 | ) | | | (9.8 | ) |

Losses on devaluation of stocks | | | 7 | | | | (10.3 | ) | | | (5.0 | ) | | | (5.3 | ) |

| | | | | | | | | | | | | | | | |

Return (Net income) on equity | | | 8 | | | | 15.36 | % | | | 9.77 | % | | | 5.59 | % |

| | | | | | | | | | | | | | | | |

| | | | |

(Difference from non-consolidated financial results) | | | | | | | | | | | | | | | | |

| | | | |

Net business profit before credit costs (*2) | | | 9 | | | | 46.0 | | | | 28.8 | | | | 17.1 | |

Net income (*2) | | | 10 | | | | 70.4 | | | | 1.1 | | | | 69.2 | |

| | | | | | | | | | | | | | | | |

Total credit costs (*2) | | | 11 | | | | 0.9 | | | | (8.5 | ) | | | 9.4 | |

| | | | | | | | | | | | | | | | |

| (*1) | Consolidated net business profit before credit costs = Non-consolidated net business profit before credit costs + Subsidiary companies’ ordinary profits (non-recurring effect adjusted) + Affiliates’ ordinary profits (non-recurring effect adjusted) x Ratio of equity holdings - Intra-group transaction (dividends, etc.) |

| (*2) | Differences between “Consolidated (SMTH)” and “Non-consolidated (CMTB + CMAB + STB)”. |

<Non-consolidated (CMTB + CMAB + STB)>

(1) Net business profit before credit costs <19> increased by 9.8 billion yen from 1HFY2010 to 129.5 billion yen, mainly due to a 16.0 billion yen increase in net gains on bonds <17>, while net interest income and related profit <13> and net fees and commissions and related profit <14> decreased.

(2) Total credit costs <35> stayed at 0.8 billion yen due to limited occurrence of new non-performing loans. And net gains on stocks <23> stood at the net loss of 23.2 billion yen, mainly due to the devaluation of some Japanese stocks resulting from the decline in stock prices.

(3) As a result, ordinary profit <26> decreased by 3.2 billion yen from 1HFY2010 to 87.5 billion yen, and net income <34> decreased by 27.2 billion yen to 57.6 billion yen over the same period mainly due to the disappearance of income boosting factor regarding tax effect accounting resulting from the reorganization of subsidiaries.

| | | | | | | | | | | | | | | | |

[Non-consolidated (CMTB + CMAB + STB)] | | | (in billions of Yen) | |

| | | | | | 1HFY2011 | | | 1HFY2010 | | | Change | |

Gross business profit | | | 12 | | | | 250.8 | | | | 240.6 | | | | 10.1 | |

| | | | | | | | | | | | | | | | |

Net interest income and related profit | | | 13 | | | | 123.4 | | | | 124.9 | | | | (1.4 | ) |

Net fees and commissions and related profit | | | 14 | | | | 79.4 | | | | 83.7 | | | | (4.2 | ) |

Net trading profit | | | 15 | | | | 3.1 | | | | 7.0 | | | | (3.9 | ) |

Net other operating profit | | | 16 | | | | 44.7 | | | | 24.9 | | | | 19.8 | |

Net gains on bonds | | | 17 | | | | 50.6 | | | | 34.6 | | | | 16.0 | |

| | | | | | | | | | | | | | | | |

General and administrative expenses | | | 18 | | | | (121.2 | ) | | | (120.9 | ) | | | (0.3 | ) |

| | | | | | | | | | | | | | | | |

Net business profit before credit costs | | | 19 | | | | 129.5 | | | | 119.7 | | | | 9.8 | |

| | | | | | | | | | | | | | | | |

Net non-recurring profit | | | 20 | | | | (45.1 | ) | | | (28.8 | ) | | | (16.2 | ) |

| | | | | | | | | | | | | | | | |

Banking a/c net credit costs | | | 21 | | | | (6.4 | ) | | | (2.5 | ) | | | (3.9 | ) |

Reversal of allowance for loan losses, etc. (*3) | | | 22 | | | | 2.5 | | | | — | | | | 2.5 | |

Net gains on stocks | | | 23 | | | | (23.2 | ) | | | (1.4 | ) | | | (21.8 | ) |

Losses on devaluation of stocks | | | 24 | | | | (21.7 | ) | | | (5.0 | ) | | | (16.6 | ) |

Others | | | 25 | | | | (17.9 | ) | | | (24.8 | ) | | | 6.9 | |

| | | | | | | | | | | | | | | | |

Ordinary profit | | | 26 | | | | 87.5 | | | | 90.8 | | | | (3.2 | ) |

| | | | | | | | | | | | | | | | |

Extraordinary profit/ loss | | | 27 | | | | (7.5 | ) | | | (6.3 | ) | | | (1.2 | ) |

| | | | | | | | | | | | | | | | |

Impairment loss on tangible fixed assets | | | 28 | | | | (4.0 | ) | | | (0.3 | ) | | | (3.6 | ) |

Impairment loss on shares of a subsidiary | | | 29 | | | | — | | | | (15.2 | ) | | | 15.2 | |

Reversal of allowance for loan losses, etc. (*3) | | | 30 | | | | — | | | | 13.6 | | | | (13.6 | ) |

Costs related to the Management Integration | | | 31 | | | | (3.5 | ) | | | (4.3 | ) | | | 0.7 | |

| | | | | | | | | | | | | | | | |

Income before income taxes | | | 32 | | | | 79.9 | | | | 84.5 | | | | (4.5 | ) |

| | | | | | | | | | | | | | | | |

Total income taxes | | | 33 | | | | (22.3 | ) | | | 0.4 | | | | (22.7 | ) |

| | | | | | | | | | | | | | | | |

Net income | | | 34 | | | | 57.6 | | | | 84.9 | | | | (27.2 | ) |

| | | | | | | | | | | | | | | | |

Total credit costs | | | 35 | | | | (0.8 | ) | | | 11.0 | | | | (11.8 | ) |

| | | | | | | | | | | | | | | | |

Overhead ratio (-18 / 12) | | | 36 | | | | 48.35 | % | | | 50.26 | % | | | (1.91 | %) |

| | | | | | | | | | | | | | | | |

| (*3) | “Reversal of allowance for loan losses” (1HFY2011:1.9bn yen, 1HFY2010:11.8bn yen) and “Recoveries of written-off claims” (1HFY2011:0.5bn yen, 1HFY2010:1.7bn yen) are included in “Net non-recurring profit” from this fiscal year, in accordance with the revision of “Practical Guidelines on Accounting Standards for Financial Instruments”. |

-Summary 1-

(For reference) Overview of the business operation

<Balance of major accounts>

(1) Balance of major accounts (Banking a/c and Principal guaranteed trust a/c combined)

| | | | | | | | | | | | | | |

| [Non-consolidated (CMTB + STB)] | | | | | | | | | | | | | (in billions of Yen) | |

| | | | | Sep. 2011

(1HFY2011) (A) | | | Mar. 2011

(Full FY2010) (B) | | | Change from Mar. 2011

(A) - (B) | |

Loans | | (Ending balance) | | | 21,246.5 | | | | 21,417.2 | | | | (170.7 | ) |

| | (Average balance) | | | 20,198.0 | | | | 19,826.8 | | | | 371.2 | |

| | | | | | | | | | | | | | |

Deposits, Trust principal (*) | | (Ending balance) | | | 23,651.9 | | | | 23,327.8 | | | | 324.1 | |

| | (Average balance) | | | 23,283.2 | | | | 22,463.9 | | | | 819.3 | |

| | | | | | | | | | | | | | |

| (*) | Deposits: Excluding NCDs. |

(2) Yields and margins (Domestic Banking a/c and Principal guaranteed trust a/c combined)

| | | | | | | | | | | | | | | | | | | | |

| [Non-consolidated (CMTB + STB)] | | | | | | | | | | | | | | | | | | | (%) | |

| | | 1HFY2011 | | | 2HFY2010 | | | 1HFY2010 | | | Change from

2HFY2010 | | | Change from

1HFY2010 | |

Loan deposit margin | | | 0.84 | | | | 0.88 | | | | 0.90 | | | | (0.04 | ) | | | (0.06 | ) |

Loans and bills discounted | | | 1.21 | | | | 1.28 | | | | 1.33 | | | | (0.07 | ) | | | (0.12 | ) |

Deposits and trust principal | | | 0.37 | | | | 0.40 | | | | 0.43 | | | | (0.03 | ) | | | (0.06 | ) |

| | | | | | | | | | | | | | | | | | | | |

(3) Status of loans (Banking a/c and Principal guaranteed trust a/c combined)

| | | | | | | | | | | | |

| [Non-consolidated (CMTB + STB)] | | | | | | | (in billions of Yen) | |

| | | Sep. 2011 | | | Mar. 2011 | | | Change from

Mar. 2011 | |

Loans to individuals | | | 6,085.3 | | | | 5,946.1 | | | | 139.1 | |

Residential mortgage loans | | | 5,559.6 | | | | 5,381.4 | | | | 178.2 | |

| | | | | | | | | | | | |

Loans to corporations | | | 15,161.2 | | | | 15,471.0 | | | | (309.8 | ) |

Japanese corporations operating overseas | | | 1,382.5 | | | | 1,411.4 | | | | (28.8 | ) |

| | | | | | | | | | | | |

<Investment trust and Insurance>

(1) Sales volume and sales balance of investment trust/ insurance

[Non-consolidated (CMTB + STB)]

| | | | | | | | | | | | | | | | | | |

| <Sales volume> | | | | | | | | | | | | | (in billions of Yen) | |

| | | 1HFY2011 | | 2HFY2010 | | | 1HFY2010 | | | Change from

2HFY2010 | | | Change from

1HFY2010 | |

Total | | 727.2 | | | 583.0 | | | | 567.7 | | | | 144.2 | | | | 159.4 | |

| | | | | | | | | | | | | | | | | | |

Investment trust | | 492.6 | | | 456.5 | | | | 360.3 | | | | 36.0 | | | | 132.2 | |

Fund wrap, SMA | | 34.0 | | | 31.1 | | | | 25.0 | | | | 2.9 | | | | 9.0 | |

Insurance | | 200.5 | | | 95.3 | | | | 182.3 | | | | 105.2 | | | | 18.1 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| <Sales balance> | | | | | | | (in billions of Yen) | |

| | | Sep. 2011 | | | Mar. 2011 | | | Change from

Mar. 2011 | |

Total | | | 4,115.2 | | | | 4,330.2 | | | | (214.9 | ) |

| | | | | | | | | | | | |

Investment trust | | | 1,929.5 | | | | 2,189.5 | | | | (260.0 | ) |

Fund wrap, SMA | | | 118.7 | | | | 100.3 | | | | 18.3 | |

Insurance (*) | | | 2,067.0 | | | | 2,040.3 | | | | 26.6 | |

| | | | | | | | | | | | |

| (*) | Definition has been standardized for the purpose of disclosing combined figure of CMTB and STB since this explanatory material. As a result, it differs from the simple sum of each company’s balance which is disclosed in FY2010 explanatory material. |

(2) Fees and commissions

| | | | | | | | | | | | |

| [Non-consolidated (CMTB + STB)] | | | | | | | (in billions of Yen) | |

| | | 1HFY2011 | | | 1HFY2010 | | | Change from

1HFY2010 | |

Total | | | 23.7 | | | | 20.8 | | | | 2.8 | |

| | | | | | | | | | | | |

Sales fees of investment trust/ insurance | | | 15.9 | | | | 12.7 | | | | 3.1 | |

Others (management and administration ) | | | 7.8 | | | | 8.0 | | | | (0.2 | ) |

| | | | | | | | | | | | |

-Summary 2-

<Overview of fiduciary services business>

Fees from fiduciary services business

| | | | | | | | | | | | |

| [Non-consolidated (CMTB + CMAB + STB)] | | | | | | | (in billions of Yen) | |

| | | 1HFY2011 | | | 1HFY2010 | | | Change from

1HFY2010 | |

| | | |

Fees from fiduciary services business | | | 30.6 | | | | 30.6 | | | | (0.0 | ) |

| | | | | | | | | | | | |

Gross business profit from fiduciary services business | | | 42.9 | | | | 42.8 | | | | 0.1 | |

Fees paid for outsourcing | | | (12.3 | ) | | | (12.1 | ) | | | (0.1 | ) |

| | | | | | | | | | | | |

<Overview of real estate business>

Fees from real estate business

| | | | | | | | | | | | |

| [Non-consolidated (CMTB + STB)] | | (in billions of Yen) | |

| | | 1HFY2011 | | | 1HFY2010 | | | Change from

1HFY2010 | |

Fees from real estate business | | | 7.5 | | | | 13.1 | | | | (5.5 | ) |

| | | | | | | | | | | | |

Real estate brokerage fees | | | 3.7 | | | | 8.6 | | | | (4.9 | ) |

Real estate trust fees, etc. | | | 3.3 | | | | 4.0 | | | | (0.6 | ) |

| | | | | | | | | | | | |

2. Financial conditions

<Status of the holding securities>

(1) Consolidated cost of available-for-sale securities <1> decreased by 548.1 billion yen from the end of previous fiscal year, mainly due to the decrease in non-consolidated (CMTB + CMAB + STB) cost of others <11> centering on that of U.S. treasury. Meanwhile, cost of Japanese stocks <2> increased due to the revaluation of Japanese stocks in accordance with purchase accounting method, and that of Japanese bonds <3> increased mainly due to the consolidation of Japan Trustee Services Bank, Ltd. Unrealized gains/ losses of available-for-sale securities stood at the net gains of 15.3 billion yen, as a result of a 137.9 billion yen decrease in unrealized gains of Japanese stocks <2>, while unrealized gains/ losses of Japanese bonds <3> and others <5> improved.

(2) Consolidated cost of held-to-maturity debt securities <6> decreased by 75.4 billion yen from the end of previous fiscal year to 649.4 billion yen, mainly due to the decrease in the balance of international investment on a non-consolidated (CMTB + CMAB + STB) basis, and unrealized gains/ losses of those securities stood at the net gains of 36.3 billion yen.

| | | | | | | | | | | | |

Securities with fair value [Consolidated (SMTH)] | | (in billions of Yen) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Sep.2011 | |

| | | Cost | | | Fair value | | | Net | | | Change of cost

from Mar. 2011 | | | Change of net

from Mar. 2011 | |

Available-for-sale securities | | | 1 | | | | 6,807.8 | | | | 6,823.1 | | | | 15.3 | | | | (548.1 | ) | | | (52.8 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Japanese stocks | | | 2 | | | | 893.1 | | | | 838.5 | | | | (54.6 | ) | | | 19.2 | | | | (137.9 | ) |

Japanese bonds | | | 3 | | | | 4,411.1 | | | | 4,453.9 | | | | 42.7 | | | | 360.4 | | | | 34.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Government bonds | | | 4 | | | | 3,600.3 | | | | 3,639.6 | | | | 39.2 | | | | 361.6 | | | | 33.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Others | | | 5 | | | | 1,503.5 | | | | 1,530.7 | | | | 27.2 | | | | (927.8 | ) | | | 50.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Held-to-maturity debt securities | | | 6 | | | | 649.4 | | | | 685.8 | | | | 36.3 | | | | (75.4 | ) | | | (13.7 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| [Non-consolidated (CMTB + CMAB + STB)] | | | (in billions of Yen) | |

| | | | | | Sep.2011 | |

| | | Cost | | | Fair value | | | Net | | | Change of cost

from Mar. 2011 | | | Change of net

from Mar. 2011 | |

Available-for-sale securities | | | 7 | | | | 6,071.0 | | | | 6,098.0 | | | | 26.9 | | | | (1,220.8 | ) | | | (22.9 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Japanese stocks | | | 8 | | | | 790.8 | | | | 766.5 | | | | (24.3 | ) | | | (22.7 | ) | | | (89.5 | ) |

Japanese bonds | | | 9 | | | | 3,784.2 | | | | 3,817.7 | | | | 33.5 | | | | (286.4 | ) | | | 25.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Government bonds | | | 10 | | | | 2,954.9 | | | | 2,983.5 | | | | 28.6 | | | | (283.7 | ) | | | 22.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Others | | | 11 | | | | 1,495.9 | | | | 1,513.7 | | | | 17.7 | | | | (911.6 | ) | | | 40.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Held-to-maturity debt securities | | | 12 | | | | 648.5 | | | | 685.1 | | | | 36.6 | | | | (75.7 | ) | | | (13.5 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

-Summary 3-

<Reference 1> Breakdown of Available-for-sale securities (Others)

| | |

| [Non-consolidated (CMTB + CMAB + STB)] | | (in billions of Yen) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Sep. 2011 | |

| | | Cost | | | Fair value | | | Net | | | Change of cost

from Mar. 2011 | | | Change of net

from Mar. 2011 | |

Domestic investment (*1) | | | 1 | | | | 443.6 | | | | 438.6 | | | | (4.9 | ) | | | 55.9 | | | | (0.7 | ) |

International investment (*1) | | | 2 | | | | 824.2 | | | | 854.9 | | | | 30.7 | | | | (1,026.8 | ) | | | 42.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Foreign government bonds, etc. | | | 3 | | | | 281.8 | | | | 296.2 | | | | 14.4 | | | | (852.3 | ) | | | 36.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

US treasury | | | 4 | | | | 186.4 | | | | 197.6 | | | | 11.2 | | | | (741.6 | ) | | | 29.0 | |

European government bonds (*2) | | | 5 | | | | 19.7 | | | | 20.0 | | | | 0.3 | | | | (143.3 | ) | | | 5.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

US agency MBS (*3) | | | 6 | | | | 236.7 | | | | 243.6 | | | | 6.8 | | | | (107.4 | ) | | | 9.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Others (Investment trust, etc.) (*4) | | | 7 | | | | 228.0 | | | | 220.0 | | | | (8.0 | ) | | | 59.2 | | | | (1.2 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 8 | | | | 1,495.9 | | | | 1,513.7 | | | | 17.7 | | | | (911.6 | ) | | | 40.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (*1) | Based on the location of final exposure |

| (*2) | Constituted by U.K. government bond only |

| (*3) | Constituted by GNMA only |

| (*4) | Uncategorizable into “Domestic investment” or “International investment” |

<Reference 2> Breakdown of Held-to-maturity debt securities

| | |

| [Non-consolidated (CMTB + CMAB + STB)] | | (in billions of Yen) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Sep. 2011 | |

| | | Cost | | | Fair value | | | Net | | | Change of cost

from Mar. 2011 | | | Change of net

from Mar. 2011 | |

Japanese Government Bonds | | | 9 | | | | 174.4 | | | | 182.4 | | | | 8.0 | | | | (10.0 | ) | | | 0.1 | |

Japanese Local Government Bonds/ Corporate Bonds | | | 10 | | | | 21.9 | | | | 22.1 | | | | 0.2 | | | | (0.4 | ) | | | (0.0 | ) |

Others | | | 11 | | | | 452.1 | | | | 480.5 | | | | 28.3 | | | | (65.2 | ) | | | (13.6 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Domestic investment (*) | | | 12 | | | | 88.1 | | | | 90.7 | | | | 2.5 | | | | 4.0 | | | | 0.8 | |

International investment (*) | | | 13 | | | | 364.0 | | | | 389.8 | | | | 25.7 | | | | (69.3 | ) | | | (14.4 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 14 | | | | 648.5 | | | | 685.1 | | | | 36.6 | | | | (75.7 | ) | | | (13.5 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (*) | Based on the location of final exposure |

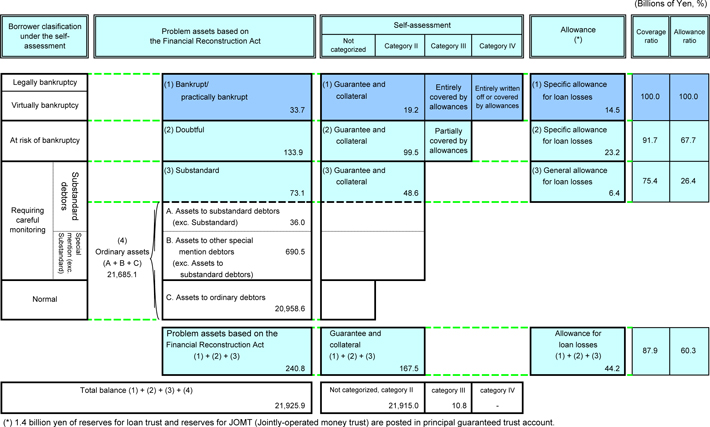

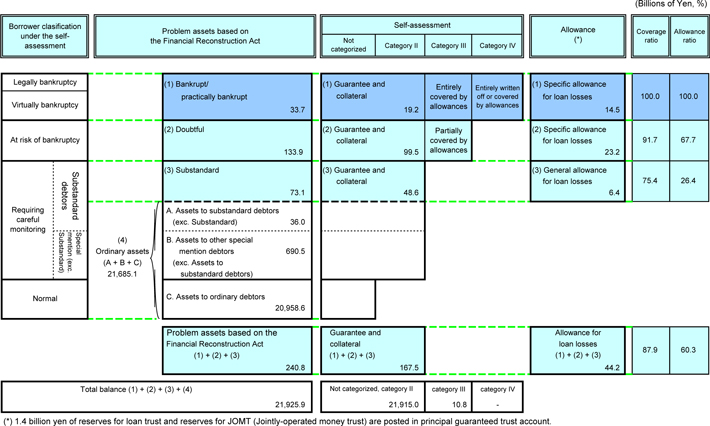

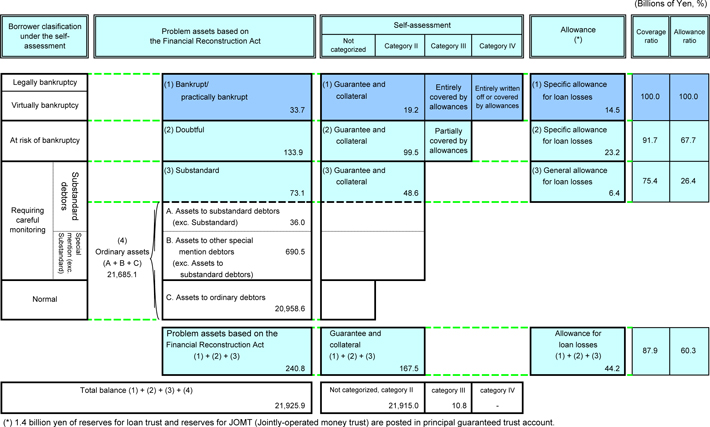

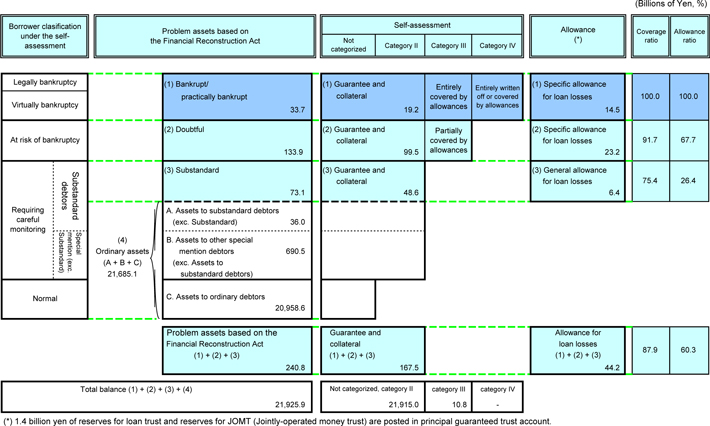

<Problem assets based on the Financial Reconstruction Act>

(1) The total balance of “Problem assets based on the Financial Reconstruction Act” <1> decreased by 4.5 billion yen from the end of previous fiscal year to 240.8 billion yen. The ratio of “Problem assets based on the Financial reconstruction Act” to the total balance <2> remained flat at 1.1% over the same period.

(2) Coverage ratios as of the end of September 2011 for “Doubtful” and “Substandard”, which are secured by collateral values and allowance for loan losses, stood at 91.7% and 75.4%, respectively, and coverage ratio for “Problem assets based on the Financial Reconstruction Act” stood at 87.9%, all of which represent sufficient levels.

| | |

| [Non-consolidated (CMTB + STB)] (Banking a/c and Principal guaranteed trust a/c combined) | | (in billions of Yen) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Sep. 2011 | | | Mar. 2011 | | | Change from

Mar. 2011 | | | Sep. 2011 | |

| | | | | | Coverage ratio | | | Allowance ratio | |

Problem assets based on the Financial Reconstruction Act | | | 1 | | | | 240.8 | | | | 245.3 | | | | (4.5 | ) | | | 87.9 | % | | | 60.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Ratio to total balance | | | 2 | | | | (1.1 | %) | | | (1.1 | %) | | | (0.0 | %) | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Bankrupt and practically bankrupt | | | 3 | | | | 33.7 | | | | 41.3 | | | | (7.5 | ) | | | 100.0 | % | | | 100.0 | % |

Doubtful | | | 4 | | | | 133.9 | | | | 93.7 | | | | 40.3 | | | | 91.7 | % | | | 67.7 | % |

Substandard (a) | | | 5 | | | | 73.1 | | | | 110.3 | | | | (37.2 | ) | | | 75.4 | % | | | 26.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Ordinary assets | | | 6 | | | | 21,685.1 | | | | 21,827.9 | | | | (142.8 | ) | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Substandard debtors (excl. Substandard) (b) | | | 7 | | | | 36.0 | | | | 28.2 | | | | 7.9 | | | | | | | | | |

Other special mention debtors (excl. (a) and (b)) | | | 8 | | | | 690.5 | | | | 711.2 | | | | (20.7 | ) | | | | | | | | |

Ordinary debtors | | | 9 | | | | 20,958.6 | | | | 21,088.5 | | | | (130.0 | ) | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

-Summary 4-

<Status of BIS capital adequacy ratio (No.1 standard)>

(1) Consolidated BIS capital adequacy ratio (No.1 standard) (preliminary) and Tier I capital ratio as of the end of September 2011 stood at 16.52% and 11.65%, respectively.

| | | | | | | | |

| [Consolidated (SMTH)] | | | | | (in billions of Yen) | |

| | | | | | Sep. 2011

(Preliminary) | |

BIS capital adequacy ratio | | | 1 | | | | 16.52 | % |

| | | | | | | | |

Tier I capital ratio | | | 2 | | | | 11.65 | % |

| | | | | | | | |

Total qualifying capital | | | 3 | | | | 2,954.0 | |

| | | | | | | | |

Tier I | | | 4 | | | | 2,082.8 | |

| | | | | | | | |

Total risk-weighted assets | | | 5 | | | | 17,874.5 | |

| | | | | | | | |

3. Forecast for FY2011

[Consolidated (SMTH)]

| | | | | | | | | | | | | | | | | | | | |

| (in billions of Yen) | |

| | | | | | Forecast for FY2011 | |

| | | | | | 1HFY2011 Actual | | | Revised forecast (A) | | | Previous forecast (B) | | | Change (A) - (B) | |

Net business profit before credit costs | | | 1 | | | | 175.6 | | | | 320.0 | | | | 295.0 | | | | 25.0 | |

| | | | | |

Ordinary profit | | | 2 | | | | 155.2 | | | | 265.0 | | | | 215.0 | | | | 50.0 | |

| | | | | |

Net income | | | 3 | | | | 128.1 | | | | 180.0 | | | | 150.0 | | | | 30.0 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net income (excl. amortization of negative goodwill) | | | 4 | | | | 84.6 | | | | 135.0 | | | | 110.0 | | | | 25.0 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total credit costs | | | 5 | | | | 0.0 | | | | (20.0 | ) | | | (40.0 | ) | | | 20.0 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Dividend on common share (Yen) | | | 6 | | | | 4.00 | | | | 8.00 | | | | 8.00 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Consolidated dividend payout ratio (*) | | | 7 | | | | — | | | | 25.5 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| (*) | Consolidated dividend payout ratio for FY2011 is calculated by the formula below, excluding the one-off effect of a 43.4 billion yen amortization of negative goodwill. |

Consolidated dividend payout ratio = { Total amount of dividends for common shares / ( Consolidated net income (excl. amortization of negative goodwill) - Total amount of dividends for preferred shares )} x 100

[Non-consolidated (CMTB + CMAB + STB)]

| | | | | | | | | | | | | | | | | | | | |

| (in billions of Yen) | |

| | | | | | Forecast for FY2011 | |

| | | | | | 1HFY2011 Actual | | | Revised forecast (A) | | | Previous forecast (B) | | | Change (A) - (B) | |

Net business profit before credit costs | | | 8 | | | | 129.5 | | | | 235.0 | | | | 235.0 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

CMTB | | | 9 | | | | 44.4 | | | | 90.0 | | | | 90.0 | | | | — | |

CMAB | | | 10 | | | | 6.8 | | | | 15.0 | | | | 15.0 | | | | — | |

STB | | | 11 | | | | 78.2 | | | | 130.0 | | | | 130.0 | | | | — | |

Ordinary profit | | | 12 | | | | 87.5 | | | | 165.0 | | | | 175.0 | | | | (10.0 | ) |

| | | | | | | | | | | | | | | | | | | | |