H.GRADYTHRASHER, IV

d: 404-760-6002

gthrasher@jtklaw.com

July 22, 2011

Doug Brown

U.S. Securities and Exchange Commission

Division of Corporation Finance

100 F St. NE

Washington, DC 20549

| |

| Re: | Joshua Gold Resources Inc., formerly known as Bio-Carbon Systems |

| | International Inc. (the “Company”) |

| |

| | Form 10 |

| | Filed October 28, 2009 |

| |

| Form 10-K for the Fiscal Year Ended December 31, 2009 Filed April 6, 2010 Amendment No. 1 to Form 8-K Filed November 18, 2010 Amendment No. 1 to Form 10-Q for the Fiscal Quarter Ended June 30, 2010 Filed November 18, 2010 |

| |

| | Form 8-K |

| | Filed December 23, 2010 |

| |

| | Schedule 14C |

| | Filed January 10, 2011 |

| |

| | File No. 0-53809 |

Dear Mr. Brown:

On behalf of the Company, we are responding to the comments by the staff (the “Staff’”) of the Securities and Exchange Commission (the “Commission”) contained in its letter dated January 28, 2011 (the “Letter”) relating to the above referenced filings.

We have provided a copy of the above referenced filings, clean and marked to show the changes made to those filings, along with this response letter for your review. For your convenience, we have repeated each comment from the Staff’s Letter immediately prior to our responses below.

{00205110. }

General

1. We note your response to our prior comment 2 from our letter dated September 15, 2010 and reissue the comment in part. Please be sure to file the executed versions of any agreements or other exhibits. For example, we note the agreements filed with the Amendment No. 1 to Form 8-K, filed November 18, 2010 and Form 8-K filed December 23, 2010 were not executed versions and lack the date the agreements were executed and in indication that the agreement was signed.

Response:The Company has amended Amendment No. 1 to Form 8-K filed on November 18, 2010 and Form 8-K filed on December 23, 2010 by filing all necessary executed and dated versions of all agreements or exhibits. Additionally, in future filings, the Company will ensure that all agreements and exhibits are properly included and fully executed and dated.

Form 10-K for the Fiscal Year Ended December 31, 2009

Directors, Executive Officers, Promoters and Control Persons…

2. We note your response to our prior comment 14 from our comment letter datedNovember 24, 2009, which was reissued as prior comment 4 from our letter datedSeptember 15, 2010 and reissue the comment. Please amend your Form 10-K toindicateany directorships help by Mr. Amersey in any company with a class ofsecuritiesregistered pursuant to section 12 of the Exchange Act or subject to therequirementsof section 15(d) of such Act or any company registered as aninvestmentcompany under the Investment Company Act of 1940. See Item 401(e)(2)ofRegulation S-K. In particular, we note the involvement of Mr. Amersey in thepubliccompany, TNT Designs Inc, Bay City Transfer Agency & Registrar Inc., andTrimHolding Group.

Response:The Company, pursuant to Item 401(e)(2), has amended Item 10 under PartIIIof the Form 10-K to indicate the directorships held by Mr. Amersey in any companywitha class of securities registered pursuant to section 12 of the Exchange Act or subjecttothe requirements of section 15(b) of such Act or any company registered as aninvestmentcompany under the Investment Company Act of 1940.

3. Further, based on your response to our prior comment 15 from our comment letterdated November 24, 2009, you confirmed that Amersey Investment Holdings, LLC isnot an SEC registered investment advisor. We reissue prior comment 4 from ourletter dated September 15, 2010. Please amend your 10-K to remove the statement that Amersey Investment Holdings, LLC is a SEC registered investment advisor.Response:In Item 10 under Part III of the Form 10-K, the Company has removed the statement that Amersey Investment Holdings, LLC is a SEC registered investment advisor.

Form 10-Q for the Fiscal Quarter Ended September 30, 2010

Disclosure Controls and Procedures

4. We note your response to our prior comments 17, 18, and 19 from our letter dated September 15, 2010 and the changes to your Form 10-Q for the Fiscal Quarter Ended June 30, 2010. We reissue the comments that follow for your Form 10-Q for the Fiscal Quarter Ended September 30, 2010 and future filings.Response:The Company has amended the Controls and Procedures section in its Form 10-Q for the Fiscal Quarter Ended September 30, 2010, Form 10-K for the Fiscal Year Ended December 31, 2010, and Form 10-Q for the Fiscal Quarter Ended March 31, 2010 to appropriately address Comments #5, #6, and #7 in this response letter.

5. We note your statements that “[i]n designing and evaluating the disclosure controls and procedures, management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives, and management necessarily is required to apply its judgment in evaluating the cost-benefit relationship of possible controls and procedures.” Please revise to state clearly, if true, that your principal executive officer and principal financial officer concluded that your disclosure controls and procedures are effective at a reasonable assurance level. In the alternative, remove the reference to the level of assurance of your disclosure controls and procedures.

Please refer to Section II.F.4 of Management’s Reports on Internal Control Over Financial Reporting and Certification of Disclosure in Exchange Act Periodic Reports, SEC Release No. 33-8238, available on our website at http://www.sec.gov/rules/final/33-8238.htm

Response:The Company has amended the Controls and Procedures section in its Form 10-Q for the Fiscal Quarter Ended September 30, 2010, Form 10-K for the Fiscal YearEnded

December 31, 2010, and Form 10-Q for the Fiscal Quarter Ended March 31, 2010

to appropriately address this Comment #5.

6. We note your disclosure regarding your internal control over financial reporting, in particular your statement that, “management has no reason to believe that the internal controls in place at [prior to the company’s change of control] were insufficient.” We note further, your disclosure in your 10-K for the Fiscal Year Ended December 31, 2009 that your internal control over financial reporting was ineffective and that no reported changes to your internal control over financial reporting has been made. Please explain how management was able to conclude that your disclosure controls and procedures were effective as of the end of your fiscal quarter when it appears that your internal control over financial reporting has been ineffective. In the alternative, provide a supplemental response indicating the point at which your internal control over financial reporting became effective or how your discourse controls and procedures were effective even though your internal control over financial reporting was not. We may have further comments.Response:The Company has amended the Controls and Procedures section in its Form 10-Q for the Fiscal Quarter Ended September 30, 2010, Form 10-K for the Fiscal Year Ended December 31, 2010, and Form 10-Q for the Fiscal Quarter EndedMarch 31, 2010 to appropriately address this Comment #6.

7. Further, we note that your management concluded that your disclosure controls and procedures were effective, but limited your conclusion that the effectiveness “consider[s] the level and nature of the Company’s operations and the number and types of transactions concluded by the Company” Please revise to state clearly, if true, that your principal executive officer and principal financial officer concluded that your disclosure controls and procedures are effective at a reasonable assurance

Response: The Company has amended the Controls and Procedures section in its Form

10-Q for the Fiscal Quarter Ended September 30, 2010, Form 10-K for the Fiscal Year

Ended December 31, 2010, and Form 10-Q for the Fiscal Quarter Ended March 31, 2010

to appropriately address this Comment #7.

Form 10-Q for the Fiscal Quarter Ended June 30, 2010 and Form 10-Q for the Fiscal Quarter Ended September 30, 2010 and Amendment No. 1 to Form 8-K filed November 18, 2010

Recent Sales of Unregistered Securities

8. We note your response to our prior comment 12 from our letter dated September 15, 2010. Please revise to include the name of the persons or identify the class of persons to whom the securities were sold. See Item 701(b) of Regulation S-K.

Response:The Company has revised the Recent Sales of Unregistered Securities section its Form 10-Q for the Fiscal Quarter Ended June 30, 2010, Form 10-Q for the Fiscal Quarter Ended September 30, 2010 and Amendment No. 1 to Form 8-K filed November 18, 2010 to include the name of the persons to whom securities were sold in accordance with Item 701(b) of Regulation S-K.

Directors and Executive Officers

9. Further, please provide disclosure required pursuant to Item 401(e) of Regulation S-K that “briefly discusses thespecificexperience, qualifications, attributes or skills that led to the conclusion that the person should serve as a director for the registrant at the time that the disclosure is made, in light of the registrant’s business and structure.”

Response:This comment is not applicable to the Company’s Form 10-Q for the Fiscal Quarter Ended June 30, 2010 and Form 10-Q for the Fiscal Quarter Ended September 30, 2010 as a registrant is not required to provide the disclosure required pursuant to Item 401(e) of Regulation S-K in a Form 10-Q. In the Company’s Amendment No. 1 to Form 8-K filed on November 18, 2010, the Company, in that filing, briefly discussed the specific experiences, qualifications, attributes or skills that led to the conclusion that Luc Duchesne, Robert Cormier, and Benjamin Ward should serve as a director of the Company in light of the registrant’s business and structure. In order to make this disclosure clearer and more readily apparent, the Company has separated this disclosure from the body of the biographies into its own paragraph.

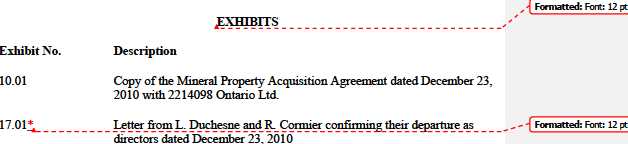

Form 8-K, filed December 23, 2010

General

10. We note your entry into an acquisition agreement for the purchase of mineral rights on property in the Northwestern Territories. Please revise to include disclosure required pursuant to Item 2.01 of Form 8-K, including Form 10 disclosure. In the alternative, indicate why Item 2.01 of Form 8-K would not apply.

Response:The Company has revised its Form 8-K filed December 23, 2010 to include disclosure required pursuant to Item 2.01 of Form 8-K. However, as the Company was

not a shell company immediately prior to entering into the above mentioned acquisition agreement, the Company has not provided the Form 10 disclosure required by Item 2.01(f).

Departure of Directors or Certain Officers; Election of Director….page 5

11. Provide additional detail in your background sketches so that there are neither gaps nor ambiguities with regard to time for the past five years, nor with regard to any additional positions held during the period. For example, for Mr. Benedetto Fuschino, we note a gap for the period from 1995 to June 1, 2010. In addition, disclose the percentage of professional time that each executive officer and director will devote to your business. Please address the portion of the gap to address at least the past five years.

Response:On page 5 under Item 5.02, the Company has revised its disclosure to provide additional detail in the background sketches of its executive officers and directors so that there are neither gaps nor ambiguities with regard to time for the past five years, nor with regard to any additional positions held during the period. Additionally, on page 8 under Item 5.02, the Company has disclosed the percentage of professional time that each executive officer and director intends to devote to the Company.

12. Further, please provide disclosure required pursuant to Item 401(e) of Regulation S-K that “briefly discusses the specific experience, qualifications, attributes or skills that led to the conclusion that the person should serve as a director for the registrant at the time that the disclosure is made, in light of the registrant’s business and structure.”

Response:Beginning on page 6 and continuing through page 8 under Item 5.02, the Company has revised its disclosure to briefly discuss the specific experience, qualifications, attributes or skills that led to the conclusion that Benedetto Fuschino, Ryan Bignucolo, and Benjamin Ward should serve as a director of the Company at the time such disclosure was made in light of the Company’s business and structure.

Schedule 14C, filed January 10, 2011

13. We note that holders of approximately 58% of the outstanding shares entitled to vote approved the Company’s name change. We further note that your officers and directors held approximately 41.5% of the Company’s voting securities. Please tell us the names of the holders of the other 16.5% of your voting securities and how their consent was solicited.

Response:The names of the holders of the other 16.5% of the Company’s voting securities are as follows:

Shareholder Names

1) Sabine Frisch 2) Benito Fuschino 3) Scott Keevil 4) Penny Currah 5) Dino Fuschino 6) John S. Wilkes 7) Rosella DeMelo

Their consent was solicited through direct mail to their home addresses.

14. Please note that all outstanding comments relating to your fillings will need to be resolved prior to your filing of a definitive information circular on Schedule 14C.

Response:The Company has not nor will not file a definitive information circular on Schedule 14C until it has resolved all outstanding comments related to its filings.

Please find attached as Exhibit “A” hereto the Company’s letter to the Commission providing the requested Tandy representations.

If you have any questions regarding our responses to the comments in the Letter, please do not hesitate to call. Thank you for assisting with the review process.

Very truly yours,

JOYCE THRASHER KAISER & LISS, LLC

/s/ H. Grady Thrasher, IV

Exhibit “A”

July 22, 2011

Doug Brown

United States Securities and Exchange Commission Division of Corporation Finance 100 F St., N.E.

Washington, D.C. 20549

| | |

| | Re: | Joshua Gold Resources Inc., formerly known as Bio-Carbon Systems |

| | | International Inc. (the “Company”) |

| |

| | | Form 10 |

| | | Filed October 28, 2009 |

| |

| Form 10-K for the Fiscal Year Ended December 31, 2009 Filed April 6, 2010 Amendment No. 1 to Form 8-K Filed November 18, 2010 Amendment No. 1 to Form 10-Q for the Fiscal Quarter Ended June 30, 2010 Filed November 18, 2010 |

| |

| | | Form 8-K |

| | | Filed December 23, 2010 |

| |

| | | Schedule 14C |

| | | Filed January 10, 2011 |

| |

| | | File No. 0-53809 |

Dear Mr. Brown:

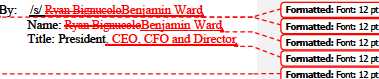

In connection with the letter filed by our securities counsel on July 22, 2011 to the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) in response to the Staff’s comment letter dated January 28, 2011, the Company acknowledges the following:

- The Company is responsible for the adequacy and accuracy of the disclosure in thefilings;

- Staff comments or changes to disclosure in response to Staff comments do not foreclosethe Commission from taking any action with respect to the filing; and

- The Company may not assert staff comments as a defense in any proceeding initiated bythe Commission or any person under the federal securities laws of the United States.

Sincerely,

Joshua Gold Resources Inc.

/s/Benjamin Ward

Benjamin Ward

President, CEO, CFO and Director

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

xANNUAL REPORT UNDER SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Period from July 10, 2009 (inception) to December 31, 2009

| ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______________ to ______________

{00205179. }

Check whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes¨Nox

Check whether the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes¨Nox

Check whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YesxNo¨

Check whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).YesxNo¨

Check if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-K (§229.405 of this chapter) contained herein, and no disclosure will be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.x

Check whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | |

| Large Accelerated Filer¨ | Accelerated Filer | ¨ |

| |

| Non-accelerated Filer¨ | Smaller Reporting Companyx |

| (Do not check if a smaller reporting company.) | | |

Check whether the issuer is a shell company (as defined in Rule 12b-2 of the Exchange Act). YesxNo¨

As of July 10, 2009 (date of inception and December 31, 2009, there were no non-affiliate holders of common stock of the Company.

As of April 6, 2010, there were 35,000,000 shares of common stock, par value $0.0001, outstanding.

FORWARD-LOOKING STATEMENTS

There are statements in this Annual Report on Form 10-K/Athat are not historical facts. These "forward-looking statements" can be identified by use of terminology such as "believe," "hope," "may," "anticipate," "should," "intend," "plan," "will," "expect," "estimate," "project," "positioned," "strategy" and similar expressions. You should be aware that these forward-looking statements are subject to risks and uncertainties that are beyond our control. Although management believes that the assumptions underlying the forward looking statements included in this Annual Report are reasonable, they do not guarantee our future performance, and actual results could differ from those contemplated by these forward looking statements. The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. In the light of these risks and uncertainties, there can be no assurance that the results and events contemplated by the forward-looking statements contained in this Annual Report will in fact transpire. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. We do not undertake any obligation to update or revise any forward-looking statements.

PART I

Item 1. Description of Business.

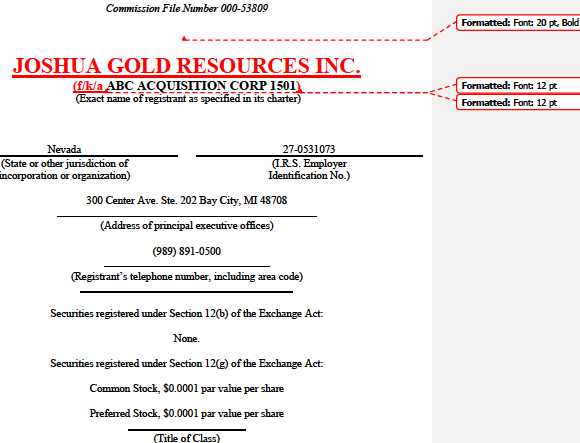

Joshua Gold Resources Inc. f/k/aABC Acquisition Corp 1501 (“we”, “us”, “our”, the "Company") was incorporated in the State of Nevada on July 10, 2009. Since inception, we have been engaged in organizational efforts and obtaining initial financing. We were formed as a vehicle to pursue a business combination through the acquisition of, or merger with, an operating business. We filed a registration statement on Form 10 with the U.S. Securities and Exchange Commission (the “SEC”) on October 28, 2009, and since its effectiveness, our principal objective for the next 12 months and beyond has been to engage in a reverse merger transaction with a private company, acquire assets or engage into other yet unspecified business or businesses (a “Business Transaction”).

We are currently considered to be a "blank check" company. The U.S. Securities and Exchange Commission (the “SEC”) defines those companies as "any development stage company that is issuing a penny stock, within the meaning of Section 3 (a)(51) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and that has no specific business plan or purpose, or has indicated that its business plan is to merge with an unidentified company or companies." Under SEC Rule 12b-2 under the Exchange Act, we also qualify as a “shell company,” because we have no or nominal assets (other than cash) and no or nominal operations. Many states have enacted statutes, rules and regulations limiting the sale of securities of "blank check" companies in their respective jurisdictions. We do not intend to undertake any effort to cause a market to develop in our securities, either debt or equity, until we have successfully concluded a Business Transaction. We intend to comply with the periodic reporting requirements of the Exchange Act for so long as it is subject to those requirements.

It is our goal to achieve long-term growth potential through a Business Transaction rather than immediate, short-term earnings. We will not restrict our potential candidate target companies to any specific business, industry or geographical location and, thus, may acquire any type of business.

As of this date we have not entered into any definitive agreement with any party, nor have there been any specific discussions with any potential Business Transaction candidates regarding business opportunities for the Company. We have unrestricted flexibility in seeking, analyzing and participating in

{00205179. }

potential Business Transactions. In our efforts to analyze potential Business Transaction targets, we will consider the following kinds of factors:

(a) Potential for growth, indicated by new technology, anticipated market expansion or new products;

(b) Competitive position as compared to other firms of similar size and experience within the industry segment as well as within the industry as a whole;

| (c) | Strength and diversity of management, either in place or scheduled for recruitment; |

| (d) | Capital requirements and anticipated availability of required funds, to be provided by the |

Company or from operations, through the sale of additional securities, through joint ventures or similar arrangements or from other sources;

(e) The cost of participation by the Company as compared to the perceived tangible and intangible values and potentials;

| (f) | The extent to which the business opportunity can be advanced; |

| (g) | The accessibility of required management expertise, personnel, raw materials, services, |

professional assistance and other required items; and

(h) Other relevant factors.

In applying the foregoing criteria, no one of which will be controlling, we will attempt to analyze all factors and circumstances and make a determination based upon reasonable investigative measures and available data. Potentially available Business Transactions may occur in many different industries, and at various stages of development, all of which will make the task of comparative investigation and analysis of such business opportunities extremely difficult and complex. Due to our limited capital available for investigation, we may not discover or adequately evaluate adverse facts about the opportunity to be acquired.

Form of Business Transaction

A Business Transaction will likely take one of several forms. If we consummate a reverse merger, it is likely to be a:

- Stock for stock exchange: we would exchange stock in our Company for ownership interests in theprivate company;

- Merger; or

- Stock for asset exchange: we would exchange stock in our Company for the assets of a privatelyheld company. However, in order to trade the new shares of the combined public company it mustfirst register the shares with the SEC.

Other Business Transactions could take one of the following forms, without limitation:

- purchase of assets;

- joint venture;

- franchise agreement; or

- licensing agreement.

{00205179. }

We anticipate that such a Business Transaction will be tax free under the Internal Revenue Code. It is further anticipated however that the consummation of a Business Transaction will dilute the holdings of our existing shareholders. We expect that our existing shareholders will hold only a small fraction of the equity of our Company or its successor after a Business Transaction. As such, it is likely that our present stockholders will likely not have control of a majority of the voting shares of the Company. In addition, as part of such a transaction, all or a majority of our directors may resign and new directors may be appointed without any vote by stockholders.

We may consider entering into a Business Transaction with a business which has recently commenced operations, is a developing company in need of additional funds for expansion into new products or markets, is seeking to develop a new product or service, or is an established business which may be experiencing financial or operating difficulties and is in need of additional capital. In the alternative, a Business Transaction may involve the acquisition of, or merger with, a company which does not need substantial additional capital, but which desires to establish a public trading market for its shares, while avoiding, among other things, the time delays, significant expenses, and loss of voting control which may occur in a public offering. We believe that there are numerous companies seeking the perceived benefits of a fully reporting public company.

It is anticipated that the investigation of specific Business Transactions and the negotiation, drafting and execution of relevant agreements, disclosure documents and other instruments will require substantial management time and attention and substantial cost for accountants, attorneys and others. As such, due to our limited financing, our proposed operations, even if successful, will in all likelihood result in our engaging in a Business Transaction with only one target company. In the event we are unsuccessful in targeting a private company, the costs theretofore incurred in the related investigation would not be recoverable. Furthermore, even if an agreement is reached for the participation in a specific business opportunity, the failure to consummate that transaction may result in our loss of the related costs incurred which could have an impact on our ability to continue operations as a going concern and our stockholders may lose their entire investment in us as a result.

In the case of an acquisition, the transaction may be accomplished upon the sole determination of management without any vote or approval by stockholders. In the case of a statutory merger or consolidation directly involving the Company, it will likely be necessary to call a stockholders' meeting and obtain the approval of the holders of a majority of the outstanding shares. The necessity to obtain such stockholder approval may result in delay and additional expense in the consummation of any proposed transaction and will also give rise to certain appraisal rights to dissenting stockholders. Most likely, management will seek to structure any such transaction so as not to require stockholder approval.

Employees

We presently have no employees apart from our management. Our sole officer and director is engaged in outside business activities and anticipates that he will devote to our business very limited time until the acquisition of a successful business opportunity has been identified. We expect no significant changes in the number of our employees other than such changes, if any, incident to a Business Transaction.

Item 1A.Risk Factors.

As we are a smaller reporting company, we are not required to provide the information required by this item.

Item 1B. Unresolved Staff Comments.

As we are a smaller reporting company, we are not required to provide the information required by this item.

Item 2. Properties.

We neither rent nor own any property. We currently have no policy with respect to investments or interests in real estate, real estate mortgages or securities of, or interests in, persons primarily engaged in real estate activities.

Item 3. Legal Proceedings.

To the best knowledge of our officers and directors, we are not a party to any legal proceeding or litigation.

Item 4. (Removed and Reserved).

PART II

Item 5. Market for Common Equity, Related Stockholder Matters and Small Business Issuer Purchases of Equity Securities.

Common and Preferred Stock

The authorized capital stock of our Company consists of 400,000,000 shares of Common Stock, par value $0.0001 per share, of which there are 35,000,000 issued and outstanding, and 100,000,000 shares of Preferred Stock, par value $0.0001 per share, of which none have been designated or issued.

All outstanding shares of Common Stock are of the same class and have equal rights and attributes. The holders of Common Stock are entitled to one vote per share on all matters submitted to a vote of stockholders of the Company. All stockholders are entitled to share equally in dividends, if any, as may be declared from time to time by the Board of Directors out of funds legally available. In the event of liquidation, the holders of Common Stock are entitled to share ratably in all assets remaining after payment of all liabilities. The stockholders do not have cumulative or preemptive rights.

Market Information

Our Common Stock is not trading on any stock exchange. We are not aware of any market activity in our stock since our inception and through the date of this filing.

Holders

As of April 6, 2010, there was one record holder of 35,000,000 shares of the Common Stock.

Dividend Policy

We have not declared or paid any cash dividends on our common stock or preferred stock and we do not intend to declare or pay any cash dividend in the foreseeable future. The payment of dividends, if any, is within the discretion of the Board of Directors and will depend on the Company’s earnings, if any, its capital requirements and financial condition and such other factors as the Board of Directors may consider.

Securities Authorized for Issuance under Equity Compensation Plans

We do not have any equity compensation plans or any individual compensation arrangements with respect to our Common Stock or Preferred Stock. The issuance of any of our Common or Preferred Stock is within the discretion of our Board of Directors, which has the power to issue any or all of our authorized but unissued shares without stockholder approval.

Recent Sales of Unregistered Securities

We issued 35,000,000 shares of Common Stock on July 14, 2009 to Nitin Amersey for an aggregate purchase price of $3,500. We sold these shares of Common Stock under the exemption from registration provided by Section 4(2) of the Securities Act.

No securities have been issued for services. Neither the Company nor any person acting on its behalf offered or sold the securities by means of any form of general solicitation or general advertising. No services were performed by any purchaser as consideration for the shares issued.

Mr. Amersey represented in writing that he acquired the securities for his own account. A legend was placed on the stock certificate stating that the securities have not been registered under the Securities Act and cannot be sold or otherwise transferred without an effective registration or an exemption therefrom, but may not be sold pursuant to the exemptions provided by Section 4(1) of the Securities Act or Rule 144 under the Securities Act, in accordance with the letter from Richard K. Wulff, Chief of the Office of Small Business Policy of the Securities and Exchange Commission’s Division of Corporation Finance, to Ken Worm of NASD Regulation, Inc., dated January 21, 2000.

Issuer Purchases of Equity Securities

None.

Item 6. Selected Financial Data.

As we are a smaller reporting company, we are not required to provide the information required by this item.

Item 7.Management’s Discussion and Analysis of Financial Condition and Results of Operation.

The principal business objective for the next 12 months and beyond such time will be to achieve long-term growth potential through a Business Transaction (as defined in Item 1) with a business rather than immediate, short term earnings.

Liquidity and Capital Resources

We do not currently engage in any business activities that provide cash flow. The costs of investigating and analyzing Business Transactions for the next 12 months and beyond such time will be paid with money in our treasury or with additional amounts, as necessary, to be loaned to or invested in us by our stockholders, management or other investors. We anticipate that our current assets will be sufficient to meet the costs necessary to investigate and analyze potential Business Transactions. We have not identified any additional funding sources for investigating and analyzing Business Transactions nor have we developed a plan for funding if our current assets prove inadequate.

During the next 12 months we anticipate incurring costs related to:

- filing of Exchange Act reports, and

- consummating a Business Transaction.

We anticipate that we will be able to meet these costs through use of funds in our treasury and additional amounts, as necessary, to be loaned by or invested in us by our stockholders, management or other investors.

Results of Operations

We may consider a business which has recently commenced operations, is a developing company in need of additional funds for expansion into new products or markets, is seeking to develop a new product or service, or is an established business which may be experiencing financial or operating difficulties and is in need of additional capital. In the alternative, a Business Transaction may involve the acquisition of, or merger with, a company which does not need substantial additional capital, but which desires to establish a public trading market for its shares, while avoiding, among other things, the time delays, significant expense, and loss of voting control which may occur in a public offering.

Off-Balance Sheet Arrangements

We have not entered into any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources and would be considered material to investors.

Contractual Obligations

As we are a smaller reporting company, we are not required to provide the contractual obligation information required by this item.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

As we are a smaller reporting company, we are not required to provide the information required by this item.

Item 8. Financial Statements and Supplementary Data.

The financial statement information, including the report of the independent registered public accounting firm, required by this Item 8 is attached as Exhibit 99.1 and is hereby incorporated into this Item 8 by reference.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

There are not and have not been any disagreements between the Company and its accountants on any matter of accounting principles, practices or financial statement disclosure.

Item 9A(T). Controls and Procedures.

| (a) | Evaluation of disclosure controls and procedures. |

We maintain disclosure controls and procedures (as defined in Exchange Act Rule 13a-15(e)) that are designed to assure that information required to be disclosed in our Exchange Act reports is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, and that such information is accumulated and communicated to management, including our Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosures. As required by Exchange Act Rule 13a-15(b), as of the end of the period covered by this report, under the supervision and with the participation of our Chief Executive Officer and Chief Financial Officer, we evaluated the effectiveness of our disclosure controls and procedures. Based on this evaluation, our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures were ineffective as of that date.

| (b) | Management’s Report on Internal Control over Financial Reporting |

Management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rule 13a-15(f). Internal control over financial

reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. Internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of our assets; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of the financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures are being made only with proper authorizations; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the financial statements. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Our management, under the supervision of and with the participation of the Chief Executive Officer and the Chief Financial Officer, assessed the effectiveness of our internal control over financial reporting as of December 31, 2009 based on criteria for effective control over financial reporting described in Internal Control — Integrated Framework issued by the COSO. Based on this assessment, our management concluded that our internal control over financial reporting was ineffective as of December 31, 2009 as the Company only had one employee at that date.

This annual report does not include an attestation report of the Company's registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by the Company's registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit the Company to provide only management's report in this annual report.

(c) Changes in internal control over financial reporting.

There was no change in our internal control over financial reporting from our inception to the date of this filing that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

Item 9B. Other Information.

On October 28, 2009, we filed a registration statement on Form 10 with the SEC whereby we registered our Common and Preferred Stock pursuant to Section 12(g) of the Securities Exchange Act of 1934. Our registration statement became automatically effective with the SEC on December 28, 2009. We will be subject to the requirements of Regulation 13A under the Exchange Act, which will require us to file annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, and we will be required to comply with all other obligations of the Exchange Act applicable to issuers filing registration statements pursuant to Section 12(g) of the Exchange Act.

PART III

Item 10. Directors, Executive Officers, Promoters and Control Persons; Compliance With Section 16(a) of the Exchange Act.

Certain Information About Our Sole Officer and Director

NAME

AGE

POSITION

| | |

| Nitin Amersey | 57 | CEO,President, CFO, Secretary, Director |

Formatted:Font: Bold, Font color: AutoFormatted:Font: Bold, Font color: AutoFormatted:Font: Bold, Font color: AutoFormatted:Centered, Space Before: 0 pt, After: 0 pt

Formatted:Centered

Formatted:Font: Bold, Font color: Auto

Formatted:Centered

Formatted:Centered, Space Before: 0 pt, After: 0 pt, Widow/Orphan control, Adjust space between Latin and Asian text, Adjust space between Asian text and numbersFormatted:Font: Bold, Font color: Auto

Formatted Table

Formatted:Centered, Space Before: 0 pt, After: 0 ptFormatted:Font color: AutoFormatted:Centered, Space Before: 0 pt, After: 0 ptFormatted:Font color: AutoFormatted:Font color: AutoFormatted:Centered, Space Before: 0 pt, After: 0 ptFormatted:Font color: Auto

Formatted:Centered

Formatted:Font color: Auto

Formatted:Centered, Space Before: 0 pt, After: 0 ptFormatted:Font color: AutoFormatted:Font color: Auto

Formatted:Centered

Nitin M.Amersey.

Nitin M.Amersey, age 57, has over thirty-sixyears of experience in international trade, marketingand corporate management.Since July 2009, Mr. Amersey has served as the managing member for Amersey Investment Holdings, LLC, a full-service management and consulting firm that assists small to medium-sized private companies wishing to go public. As the managing member of Amersey Investments, LLC, Mr. Amersey manages the company, and in a consultant role, advises a number of private companies in their efforts in becoming publicly traded. Since October 2009, Mr. Amersey has served as CFO, Secretary, Treasurer, and Director of Trim Holding Group (f/k/a TNT Designs Inc.), a public company engaged in selling products in the Health Care sector. Mr. Amersey, in his role as CFO, Secretary, Treasurer and Director, is responsible for managing the financial risks of the company and developing and implementing the business plan.

Mr. Amersey was elected as a director of Environmental Solutions Worldwide and has served asa member of the board since January 2003.Mr. Amersey was appointedinterimChairman of the Board inMay 2004 and subsequently was appointed Chairman of the Board in December 2004.and served as Chairman of Environmental Solutions Worldwide’s Board through January 2010. Environmental Solutions Worldwide manufactures and markets a diverse line of proprietary catalytic emission conversion, control, and support products and technologies for the International Transportation, Construction, and Utility markets.In addition to his service as a board member of EnvironmentalSolutionsServicesWorldwide, Mr.Amersey, since 1978,has been Chairman ofthe Board of Directors ofScothalls Limited, a private tradingfirmsince 1978..

Since 2001,Mr. Amersey has also served as Presidentand CEOof Circletex Corp., a financialconsulting management firmsince 2001 and has. As the President and CEO of Circletex Corp, Mr. Amersey manages the day to day affairs of the company and assists small to medium sized companies wishing to go public. Additionally, Mr. Amersey hasserved as chairman of Midas Touch Global MediaCorp., a company engaged in providing investment newsletters,from 2005 tothepresent.He is alsocurrently director ofSince 2007, Mr. Amersey has served as the Chairman ofHudson EngineeringIndustries Pvt.LTDLtd., a privatedistributioncompany domiciled in India.

Since 2005, Mr. Amersey has served as the sole officer and director of Bay City Transfer Agency & Registrar, Inc., a company that provides stock transfer and reporting services. Additionally, Mr. Amersey has been a control person of Bay City Transfer Agency & Registrar Inc. as Mr. Amersey owns 100% of the issued and outstanding shares of its common stock. Moreover, Bay City Transfer Agency & Registrar, Inc. currently rents space from Amersey Investments, LLC, the company which Mr. Amersey is the managing member of.

Since July 10, 2009, Mr. Amersey has served as the sole officer and director of ABC Acquisition Corp 1501, a blank check company formed as a vehicle to pursue a business combination through the acquisition of, or merger with, an operating business. ABC Acquisition Corp 1501 is a reporting company with a class of securities registered pursuant to section 12 of the Exchange Act.From 2003 to 2006 Mr.Amersey was Chairman ofthe Board of Directors forRMD Entertainment Groupand also served during, a public company engaged in the research and development of advanced broadband technology. Duringthesame periodas chairman of, Mr. Amersey served as the Chairman of the Board of Directors forWide E-Convergence Technology America Corp.., a provider of e-learning software.

None of the aforementioned companies are parents, subsidiaries, or affiliates of ABC AcquisitionCorp 1501.

Mr. Amersey has aMastersMasterof Business Administration Degree from the University ofRochester, Rochester, N.Y. and a Bachelor of Science in Business from Miami University, Oxford, Ohio.Heis the solegraduated from Miami University as amembermanagerofAmersey Investment HoldingsLLC a SEC Registered Investment Advisor.Phi Beta Kappa and Phi Kappa Phi.Mr. Amersey also holds aCertificate of Director Education from the NACD Corporate Director’s Institute.

Mr. Nitin Amersey was the Chairman and CEO of UgoMedia Interactive Corp (“UgoMedia”).

UgoMedia was an OTCBB corporation which was taken over by Sciax Corp in a reverse merger. Mr.

Formatted:Underline, Font color: AutoFormatted:Font color: AutoFormatted:Font color: Auto

Formatted:Font color: AutoFormatted:Font color: AutoFormatted:Font color: Auto

Formatted:Font color: AutoFormatted:Font color: AutoFormatted:Font color: AutoFormatted:Font color: AutoFormatted:Font color: AutoFormatted:Font color: AutoFormatted:Font color: AutoFormatted:Font color: AutoFormatted:Font color: AutoFormatted:Font color: AutoFormatted:Font color: AutoFormatted:Font color: Auto

Formatted:Font color: AutoFormatted:Font color: AutoFormatted:Font color: AutoFormatted:Font color: AutoFormatted:Font color: Auto

Formatted:Justified, Indent: First line: 0.5", Space Before: 0 pt, After: 6 ptFormatted:Font color: AutoFormatted:Font color: AutoFormatted:Font color: AutoFormatted:Font color: AutoFormatted:Font color: AutoFormatted:Font color: Auto

| |

Amersey also had a very small percentage of the stock. UgoMedia’s President was Ken Smart, who also had a controlling interest in UgoMedia. UgoMedia had auditors in New York. Due to Sarbanes Oxley and the PCAOB Guidelines being established, the auditors decided to drop all public companies from their audit practice, including UgoMedia. UgoMedia had little time to react and obtain a new auditor in time and thus it was late in filing its return thus got an E behind its symbol and was then ultimately dropped down to the pink sheets. Due to internal turmoil between the controlling shareholder and the Board the statements were never filed and the Company eventually filed a Form 15 to become non-reporting.Mr. Amersey is qualified to be the sole officer and director of ABC Acquisition Corp 1501 because of his extensive

experience serving on various Boards of Directors for public and private companies. The term of office of each director expires at our annual meeting of stockholders or until their successors are duly elected and qualified. | Formatted:Font color: Auto |

| |

| | Formatted:Font: Bold, Italic |

| Directors | Formatted:Space Before: 0 pt, After: 0 pt |

| |

Our bylaws authorize no less than one (1) and no more than (11) directors. We currently have one Director. Term of Office Our directors are appointed for a one-year term to hold office until the next annual general meeting of our shareholders or until removed from office in accordance with out bylaws. Our officers are appointed by our board of directors and hold office until removed by the board. Code of Ethics We do not currently have a Code of Ethics applicable to our principal executive, financial and accounting officers. We do not have a “financial expert” on the board or an audit committee or nominating committee. Potential Conflicts of Interest Since we do not have an audit or compensation committee comprised of independent directors, the functions that would have been performed by such committees are performed by our sole director. Thus, there is a potential conflict of interest in that our sole director has the authority to determine issues concerning management compensation, in essence his own, and audit issues that may affect management decisions. We are not aware of any other conflicts of interest with any of our executives or directors. Compliance With Section 16(a) of the Exchange Act To our knowledge, from our inception to the date of this filing, all filings required to be made by members of management or others pursuant to Section 16(a) of the Exchange Act have been duly filed with the Securities and Exchange Commission. Director Independence We are not subject to listing requirements of any national securities exchange or national securities association and, as a result, we are not at this time required to have our board comprised of a majority of “independent directors.” We do not believe that our sole director meets the definition of “independent” as promulgated by the rules and regulations of the American Stock Exchange. | |

Corporate Governance

| |

Nominating Committee From our inception to the date of this filing, there have been no changes in the procedures by which security holders may recommend nominees to our Board of Directors; and we do not presently have a Nominating Committee for members of our Board of Directors. Nominations are considered by the entire Board. Audit Committee We do not have an Audit Committee, and at this time, we are not required to have an Audit Committee. We do not believe that the lack of an Audit Committee will have any adverse effect on our financial statements, based upon current operations. Management will assess whether an Audit Committee may be necessary in the future. Stockholder Communications Our sole director has not adopted a process for security holders to send communications to the board of directors. As our sole shareholder is the same person as our sole director, we do not believe that we require a process for security holders to send communications to the board of directors at this time. Management will assess whether a process for security holders to send communications to the board of directors may be necessary in the future. Board meetings and committees; annual meeting attendance Following the initial shareholder meeting on July 10, 2009, the board of directors did not hold any meetings during the fiscal year. No other meetings were held. Item 11. Executive Compensation. Nitin Amersey, our sole officer and director has not received any cash remuneration since inception. We do not expect that he or other officers (should they be appointed) will receive any remuneration until the consummation of a Business Transaction. No remuneration of any nature has been paid for or on account of services rendered by our sole director acting in such capacity. Mr. Amersey does not intend to devote more than a few hours a week to our affairs. It is possible that, after we successfully consummate a Business Transaction with an unaffiliated entity, such entity may desire to retain one or a number of members of our management for the purposes of providing services to the surviving entity. However, we have adopted a policy whereby the offer of any post-transaction employment to members of management will not be a consideration in our decision whether to undertake any proposed transaction. No retirement, pension, profit sharing, stock option or insurance programs or other similar programs have been adopted by us for the benefit of our employees. There are no understandings or agreements regarding compensation our management will receive after a Business Transaction that is required to be included in this table, or otherwise. Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | Formatted:Indent: First line: 0.5" |

The following table sets forth, as of April 6, 2010, the number of shares of Common Stock owned of record and beneficially by executive officers, directors and persons who hold 5% or more of the outstanding Common Stock of the Company.

| | | |

| Name and Address | Amount and Nature of Beneficial | Percentage of | |

| | Ownership | Class | |

| |

| Nitin Amersey (1) | 35,000,000 | 100 | % |

| 300 Center Ave. Ste. 202 | | | |

| Bay City, MI 48708 | | | |

| |

| All Officers and Directors as a | 35,000,000 | 100 | % |

| group | | | |

| |

| (1) Nitin Amersey is President, CFO, Secretary and sole director of the Company. | | |

Item 13. Certain Relationships and Related Transactions.

We utilize the office space and equipment of our sole shareholder at no cost. We estimate such amounts to be immaterial.

On July 14, 2009, we issued 35,000,000 restricted shares of our Common Stock to Nitin Amersey in consideration for $3,500 in cash, which was used for incorporation fees, annual resident agent fees in the State of Nevada, accounting fees and developing our business concept and plan. All shares were considered issued at their par value ($.0001 per share).

We received $10,000 from our sole shareholder to be used for working capital. The loan is unsecured, non-interest bearing and payable on demand.

Nitin Amersey, our sole officer and director (its original incorporator), has paid all expenses incurred by the Company, which includes only resident agent fees, basic state and local fees and taxes. On a going forward basis, Mr. Amersey has agreed to pay all expenses incurred by the Company through the date of completion of a Business Transaction as described in Item 1 of this Form 10-K. Therefore, we do not expect to have significant expenses until the consummation of a transaction.

Except as otherwise indicated herein, there have been no related party transactions, or any other transactions or relationships required to be disclosed pursuant to Item 404 of Regulation S-K.

Item 14. Principal Accounting Fees and Services.

The firm of UHY LLP (“UHY”) acts as our principal independent registered public accounting firm. UHY personnel work under the direct control of UHY partners and are leased from wholly-owned subsidiaries of UHY Advisors, Inc. in an alternative practice structure.

Audit Fees

The aggregate fees billed by UHY for professional services rendered for the audit of our annual financial statements and audit of financial statements included in our Form 10 or services that are normally provided in connection with statutory and regulatory filings from our inception to our fiscal year ended December 31, 2009 was $3,000.00.

Audit-Related Fees

Fees billed by UHY related to the 2009 audit of the Company’s financial statements, including the Form 10 services, from our inception to our fiscal year ended December 31, 2009 was $3,000.00.

Tax Fees

The aggregate fees billed by UHY for professional services for tax compliance, tax advice, and tax planning from our inception to the fiscal year ended December 31, 2009 was $0.

All Other Fees

There were no fees billed by UHY for other products and services for the year ended December 31, 2009.

Under the Sarbanes-Oxley Act of 2002, all audit and non-audit services performed by our independent accountants must now be approved in advance by our Audit Committee to assure that such services do not impair the accountants’ independence from us. The Audit Committee has adopted an Audit and Non-Audit Services Pre-Approval Policy (the “Policy”) which sets forth the procedures and the conditions pursuant to which services to be performed by the independent accountants are to be pre-approved. Our entire Board has acted as our Audit Committee since July 2009. Pursuant to the Policy, certain services described in detail in the Policy may be pre-approved on an annual basis together with pre-approved maximum fee levels for such services. The services eligible for annual pre-approval consist of services that would be included under the categories of Audit Fees, Audit-Related Fees and Tax Fees in the above table as well as services for limited review of actuarial reports and calculations. If not pre-approved on an annual basis, proposed services must otherwise be separately approved prior to being performed by independent accountants. In addition, any services that receive annual pre-approval but exceed the pre-approved maximum feel level also will require separate approval by the entire Board acting as our Audit Committee prior to being performed. The Board, acting as the Audit Committee, may delegate authority to pre-approve audit and non-audit services to any member, but may not delegate such authority to management. The tax services represent $0, or 0% of the total for audit related fees, tax fees and all other fees paid during the year ending December 31, 2009.

Part IV

Item 15. Exhibits, Financial Statement Schedules.

| (a) | 1. The information required by this item is attached hereto as Exhibit 99.1 to this report. |

| | 2. | The information required by this item is attached hereto as Exhibit 99.1 to this report. |

| | 3. | Exhibits: See Index to Exhibits, which is incorporated by reference in this Item. The |

| | Exhibits | listed in the accompanying Index to Exhibits are filed or incorporated by reference as part |

| | of | this report. |

| (b) | Exhibits. See Index to Exhibits, which is incorporated by reference in this Item. The Exhibits |

| | listed | in the accompanying Index to Exhibits are filed or incorporated by reference as part of this |

| | report. | |

| (c) | Not applicable. |

INDEX TO EXHIBITS

ExhibitDescription

| | |

| * | 3.1 | Articles of Incorporation |

| * | 3.2 | By-laws |

| 31.1 | Certification of our Chief Executive Officer pursuant toSection 302 ofRule 13a-14(a) and 15(d) and 14(a) promulgated undertheSarbanes-OxleySecurities and ExchangeAct of2002, with respect to the registrant’s Annual Report on Form 10-K for the period from July 10, 2009 (inception) to December 31, 20091934, as amended. |

| 31.2 | Certification of our Chief Financial Officer pursuant toSection 302 ofRule 13a-14(a) and 15(d) and 14(a) promulgated undertheSarbanes-OxleySecurities and ExchangeAct of2002, with respect to the registrant’s Annual Report on Form 10-K for the period from July 10, 2009 (inception) to December 31, 20091934, as amended. |

| 32.1 | Certification of our Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes Oxley Act of 2002 |

| 32.2 | Certification of our Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes Oxley Act of 2002 |

| | | |

| ** | 99.1 | Financial Statements | |

| |

| | * | Filed as an exhibit to our registration statement on Form 10, as filed with the Securities and | |

| | | Exchange Commission on October 28, 2009 and incorporated herein by this reference. | Formatted:Font: 10 pt |

| | ** | Filed as an exhibit to our Form 10-K for the fiscal year ended December 31, 2009 filed on April 6, | |

| | | 2010 and incorporated herein by this reference. | |

Formatted:Indent: Left: 0", Hanging: 0.5"

SIGNATURES

In accordance with Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

ABC Acquisition Corp 1501Joshua Gold

Resources Inc.

| | |

| Dated: July 22, 2011 | By: | /s/ Ben Fuschino |

| | | Ben Fushino |

| | | Director |

| |

| |

| Dated: July 22, 2011 | By: | /s/ Ryan Bignucolo |

| | | Ryan Bignucolo |

| | | Director |

| | | | |

| | | | | |

| |

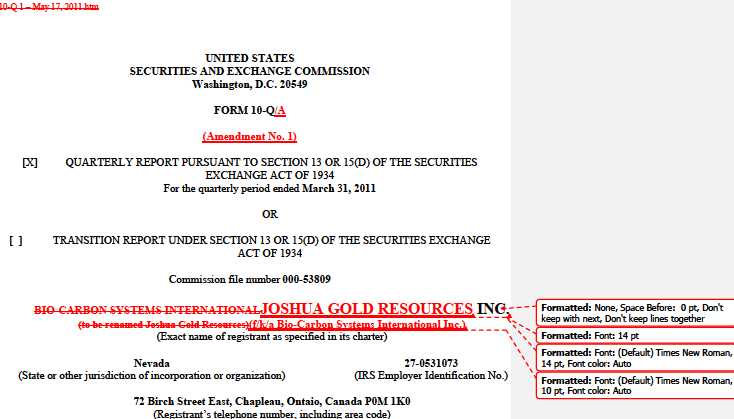

| | | UNITED STATES | |

| | | SECURITIES AND EXCHANGE COMMISSION | |

| | | Washington, D.C. 20549 | |

| | | FORM 10-Q/A | | |

| | | (Amendment No. 1) | |

| [X] | | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE | |

| | | ACT OF 1934 | |

| | | For the quarterly period endedSeptember30, 2010 | |

| | | OR | | |

| [ ] | | TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT | |

| | | OF 1934 | | |

| | | Commission file number000-53809 | |

| | | BIO-CARBON SYSTEMS INTERNATIONALJOSHUA GOLD RESOURCESINC. | Formatted:Font: 14 pt |

| | | (f/k/a Bio-Carbon Systems International Inc.) | Formatted:Space Before: 0 pt |

| | | (Exact name of registrant as specified in its charter) | |

| | | Nevada | 27-0531073 | |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

| | | 123 March Street, Suite 202, Sault Ste Marie, Ontario, Canada P6A 3V7 | |

| | | (Address of principal executive offices, including zip code.) | |

| | (705) | 253-5096 | |

| | | (Registrant’s telephone number, including area code) | |

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of | |

| the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was | |

| required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [x] No [ ] | |

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, | |

| or a smaller reporting Company. See the definitions of “large accelerated filed,” “accelerated filer” and “smaller | |

| | | reporting Company” in Rule 12b-2 of the Exchange Act. | |

| |

| | | Large accelerated filer [ ] | Accelerated filer [ ] | |

| | | Non-accelerated filer [ ] (Do not check if a | Smaller reporting Company [X] | |

| | | smaller reporting Company) | | |

Indicate by check mark whether the registrant is a shell Company (as defined in Rule 12b-2 of the Exchange Act. Yes [ ]No [X]Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:As of November 2, 2010, the issuer had 265,190,416 shares of common stock outstanding.

{00205189. }

FORWARD-LOOKING STATEMENTS

This Form 10-Q/Afor the quarterly period ended June 30, 2010 contains forward-looking statements that involve risks and uncertainties. Forward-looking statements in this document include, among others, statements regarding our capital needs, business plans and expectations. Such forward-looking statements involve assumptions, risks and uncertainties regarding, among others, the success of our business plan, availability of funds, government regulations, operating costs, our ability to achieve significant revenues, our business model and products and other factors. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict”, “potential” or “continue”, the negative of such terms or other comparable terminology. In evaluating these statements, you should consider various factors, including the assumptions, risks and uncertainties set forth in reports and other documents we have filed with or furnished to the SEC. These factors or any of them may cause our actual results to differ materially from any forward-looking statement made in this document. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding future events, our actual results will likely vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. The forward-looking statements in this document are made as of the date of this document and we do not intend or undertake to update any of the forward-looking statements to conform these statements to actual results, except as required by applicable law, including the securities laws of the United States.

GENERAL MATTERS

Our common stock is subject to the "penny stock" rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The Securities and Exchange Commission has adopted certain rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) that are applicable to "penny stocks". For the purposes relevant to us, a “penny stock” is any equity security that has a market price of less than $5.00 per share or has an exercise or conversion price of less than $5.00 per share, subject to certain exceptions, constitutes a "penny stock". For any transaction involving a penny stock, unless exempt, the rules require:

- that a broker or dealer approve a person's account for transactions in penny stocks;

- the broker or dealer receive from the investor a written agreement to the transaction, setting forth theidentity and quantity of the penny stock to be purchased; and

- that a broker or dealer provide certain detailed market information about the market for the applicablecompany’s securities.

In order to approve a person's account for transactions involving penny stocks, the broker or dealer must:

- obtain financial information, investment experience and investment objectives of the person; and

- make a reasonable determination that the proposed transactions in penny stocks are suitable for that personand the person has sufficient knowledge and experience in financial matters to be capable of evaluating therisks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the SEC relating to the penny stock market, which, in highlight form:

- sets forth the basis on which the broker or dealer made the suitability determination; and

- that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Following a transaction, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

2

Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common stock and depress the market value of our stock.

There are additional risks of investing in penny stocks whether in public offerings or in secondary trading, relating to commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions.

3

| | |

| | | |

| TABLE OF CONTENTS | | |

| FORM 10-Q/A | | |

| QUARTER ENDED SEPTEMBER 30, 2010 | | |

| PART I | | |

| FINANCIAL INFORMATION | | |

| Item 1. Financial Statements (Unaudited) | | Page |

| Balance Sheets as of June 30, 2010 and December 31, 2009 | | 5 |

| Statements of Operations for the periods ended September 30, 2010 | | 6 |

| Statements of Cash Flows for the periods ended September 30, 2010 | | 7 |

| Selected notes to financial statements | | 8 |

| Item 2. Management’s Discussion and Analysis of Financial Condition and Results | | 11 |

| of Operations | | |

| Item 3. Quantitative and Qualitative Disclosures About Market Risk | | 13 |

| Item 4. Controls and Procedures | | 13 |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 4 | | |

| | | |

Item 1: Financial Statements

Bio-Carbon Systems InternationalJoshua Gold ResourcesInc.

Unaudited Balance Sheets

As at September 30, 2010 and December 31, 2009

| | | | | | |

| | | September 30, | | | December 31, | |

| | | 2010 | | | 2009 | |

| | | (Unaudited) | | | (Audited) | |

| | | (in C$) | | | (restated in C$) | |

| Current Assets: | | | | | | |

| |

| Cash and cash equivalents | $ | 985 | | $ | - | |

| |

| Amounts receivable | | 56,353 | | | - | |

| Notes receivable (note 6a) | | 15,000 | | | - | |

| Prepaid technology royalties (note 7) | | 6,484 | | | - | |

| Other prepaid fees | | 789 | | | - | |

| Total Current assets | | 79,611 | | | - | |

| |

| Technology license rights (note 7) | | 224,482 | | | - | |

| |

| |

| Total Assets | $ | 304,093 | | $ | 0 | |

| |

| |

| Current Liabilities | | | | | | |

| |

| Accounts payable and accruals | $ | 100,267 | | $ | 3,096 | |

| Loan Payable | | 25,500 | | | 0 | |

| Due to shareholders | | 10,290 | | | 10,510 | |

| |

| Total Current Liabilities | | 136,057 | | | 13,606 | |

| |

| Shareholders’ Equity (Deficit) | | | | | | |

| Common shares(note 6a) | | 141,969 | | | 3,679 | |

| Cumulative translation adjustment | | 242 | | | (39 | ) |

| Preferred shares (note 6b) | | 240,000 | | | - | |

| Accumulated deficit | | (214,175 | ) | | (17,645 | ) |

| Total Shareholders’ Equity (Deficit) | | 168,036 | | | (13,966 | ) |

| |

| Total Liabilities & Shareholders’ | | 304,093 | | | 0 | |

| Equity (Deficit) | | | | | | |

| | $ | | | $ | | |

| | | | | | | |

| |

| See accompanying notes to the unaudited financial statements. | | | | |

5

Bio-Carbon Systems InternationalJoshua Gold ResourcesInc.

| | | | |

| | | Unaudited Statements of Operations |

| | | For the Periods Ended September 30, 2010 |

| |

| | | (Unaudited) | |

| |

| | | For the | | For the |

| | | 3 Months | | 9 Months |

| | | Ended | | Ended |

| | | September 30, | | September 30, |

| | | 2010 | | 2010 |

| | | (in C$) | | (in C$) |

| |

| Revenue | $ | 95,319 | $ | 95,319 |

| Cost of Goods Sold | | | | |

| Services | | 73,818 | | 73,818 |

| Royalties | | 4,766 | | 4,766 |

| Total Cost of Goods Sold | | 78,584 | | 78,584 |

| |

| Gross Margin | $ | 16,735 | $ | 16,735 |

| |

| Operating expenses | | | | |

| General and administrative | | 91,547 | | 121,636 |

| Professional fees | | 10,641 | | 74,889 |

| Interst Expense | | 500 | | 500 |

| Foreign currency translation | | 847 | | 723 |

| adjustment | | | | |

| Total operating expenses | | 83,345 | | 94,213 |

| |

| Amortization of Technology | | 12,099 | | 15,518 |

| license rights (note 7) | | | | |

| |

| Net loss | $ | 98,898 | | 196,530 |

| |

| Weighted average number | | | | |

| of shares outstanding – basic | | | | |

| and diluted | | 265,107,359 | | 134,4049,312 |

| Net loss per share - | | | | |

| basic and diluted | $ | - | | - |

See accompanying notes to the unaudited financial statements.

6

Bio-Carbon Systems InternationalJoshua Gold ResourcesInc.

Unaudited Statements of Cash Flows

For the Periods Ended September 30, 2010

(Unaudited)

| | | | | | |

| | | For the | | | For the | |

| | | 3 Months | | | 9 Months | |

| | | Ended | | | Ended | |

| | | September 30, | | | September 30, | |

| | | 2010 | | | 2010 | |

| | | (in C$) | | | (in C$) | |

| Cash Flows Used in Operating | | | | | | |

| Activities | | | | | | |

| Net loss | $ | (98,898 | ) | $ | (196,530 | ) |

| Adjustments to reconcile net loss to net | | | | | | |

| cash used in operating activities | | | | | | |

| Amortization of license rights | | 12,099 | | | 15,518 | |

| Changes in operating assets and liabilities: | | | | | | |

| Amounts receivable | | (55,930 | ) | | (56,353 | ) |

| Prepaid expenses and deposits | | 5,554 | | | (7,273 | ) |

| Payables and accruals | | 30,041 | | | 97,170 | |

| Due to shareholder | | (316 | ) | | (220 | ) |

| Net cash used in operating activities | | (107,450 | ) | | (147,687 | ) |

| |

| Cash Flows Used in Investing Activities | | | | | | |

| Increase in technology rights asset | | - | | | (240,000 | ) |

| Net cash used in investing activities | | - | | | (240,000 | ) |

| |

| Cash Flows From Financing Activities | | | | | | |

| Increase in loans payable | | 25,500 | | | 25,500 | |

| Issuance of common and preferred | | 69,042 | | | 377,892 | |

| shares | | | | | | |

| Increase in Notes receivable | | - | | | (15,000 | ) |

| Net cash provided by financing activities | | 94,542 | | | 388,392 | |

| |

| Net increase (decrease) in cash from | | (12,908 | ) | | 704 | |

| operations | | | | | | |

| Effects of foreign exchange on cash | | 906 | | | 281 | |

| Cash, beginning of period | | 12,987 | | | - | |

| Cash, end of period | $ | 985 | | $ | 985 | |

| |

| |

| See accompanying notes to the unaudited financial statements. | | | | |

7

Bio-Carbon Systems InternationalJoshua Gold ResourcesInc.

Notes to the Financial Statements September 30, 2010 (Unaudited)

1. Basis of Presentation

The accompanying unaudited interim financial statements ofBio-Carbon Systems InternationalJoshua Gold ResourcesInc. (until June 4, 2010 known as ABC Acquisition Corp. 1501, collectively referred to herein as “Bio-Carbon Systems InternationalJoshua Gold ResourcesInc.”, “BCSI”, or the “Company”), have has been prepared in accordance with accounting principles generally accepted in the United States of America and the rules of the Securities and Exchange Commission, and should be read in conjunction with the audited financial statements for the period ended December 31, 2009 and notes thereto contained in the Company’s Form 10-K filed with the SEC on April 6, 2010, as well as the unaudited financial statements for the period ended March 31, 2010 and notes thereto contained in the Company’s Form 10-Q filed with the SEC on May 17, 2010. In the opinion of management, all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of financial position and the results of operations for the interim periods presented have been reflected herein. The results of operations for interim periods are not necessarily indicative of the results to be expected for the full year. Notes to the financial statements which would substantially duplicate the disclosure contained in the audited financial statements for fiscal 2009 as reported in the form 10-K have been omitted.

All $ references herein refer to Canadian dollars (“C$”) unless otherwise specified. See also note 3.

Planned principal activities have begun,Bio-Carbon Systems InternationalJoshua Gold ResourcesInc. has generated some revenues to September 30. 2010. The Company had a net loss for the nine months ended September 30, 2010 of $196,530, and had an accumulated deficit of $214,175 at September 30, 2010. These matters raise substantial doubt about the Company’s ability to continue as a going concern. Continuation ofBio-Carbon Systems InternationalJoshua Gold ResourcesInc.’s existence depends upon its ability to obtain additional capital. Management’s plans in regards to this matter including raising additional equity financing in 2010 and borrowing funds under a private credit facility and/or other credit sources. These financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Effective July 1, 2010, the Company entered into a Master Supply Agreement with Trans Canada Energy Ltd (“TCE”) to provide carbon analysis and management services on an as-needed basis. The term of the agreement expires on April 2013. In the Company began consulting for TCE for the purpose of assessing carbon stocks in an Ontario woodlot.

| 3. | Change in Functional and Reporting Currency |