H. GRADYTHRASHER, IV

d: 404-760-6002

gthrasher@jtklaw.com

September 20, 2011

| |

|

| |

Alexandra M. Ledbetter U.S. Securities and Exchange Commission Division of Corporation Finance 100 F St. NE Washington, DC 20549 | |

| |

Re: | Joshua Gold Resources Inc., formerly known as Bio-Carbon Systems International Inc. (the “Company”) Preliminary Information Statement on Schedule 14C Filed January 10, 2011 Amendment No. 1 to Form 10-K for Fiscal Year Ended December 31, 2010 Filed July 22, 2011 Amendment No. 1 to Form 10-Q for Fiscal Period Ended March 31, 2011 Filed July 22, 2011 File No. 0-53809 |

Dear Ms. Ledbetter:

On behalf of the Company, we are responding to the comments by the staff (the “Staff’”) of the Securities and Exchange Commission (the “Commission”) contained in its letter dated August 29, 2011 (the “Letter”) relating to the above referenced filings.

We have provided a copy of the above referenced filings, clean and marked to show the changes made to those filings, along with this response letter for your review. For your convenience, we have repeated each comment from the Staff’s Letter immediately prior to our responses below.

Preliminary Information Statement on Schedule 14C

1. Please note that all outstanding comments relating to your filings will need to be resolved prior to your filing of a definitive information circular on Schedule 14C.

Response: The Company has not nor will not file a definitive information circular on Schedule 14C until it has resolved all outstanding comments related to its filings.

2. We note your response to comment 13 from our letter to you dated January 18, 2011. Please indicate whether the solicitation done by mail referenced in your response was done on behalf of the company. We may have further comments.

{00212864. }

Response:The solicitation done by mail referenced in our response was done on behalf of the Company.

Amended No.1 to Form 10-K for Fiscal Year Ended December 31, 2010

Financial Statements

3. We note your amended Form 10-K for the fiscal year ended December 31, 2010 does not include audited financial statements. Please amend your filing to include a full set of audited reports, financial statements and footnotes for all applicable periods. Furthermore, please note this information should be filed under Item 8 of the amended Form 10-K, not as an exhibit. Please refer to the guidelines of Item 8 of the Form 10-K, which states “Financial statements of the registrant and its subsidiaries consolidated shall be filed under this item.”

Response: The Company has amended its filing to include a full set of audited reports, financial statements and footnotes for all applicable periods and has filed this information under Item 8 of the amended Form 10-K and not as an exhibit.

4. On a similar note, please ensure your amended filing includes the audit report covering the previous reporting period from Inception (July 10, 2009) through December 31, 2009. We note the financial statements in your initial Form-10K did not include the audit report.

Response: The Company has included in its amended filing the audit report covering the previous reporting period from Inception (July 10, 2009) through December 31, 2009.

Controls and Procedures, page 17

5. We note your amended Form 10-K for the fiscal year ended December 31, 2010 does not include the same disclosure regarding your evaluation of disclosure controls and procedures or your management’s report on internal control over financial reporting as filed on April 15, 2010 with your original Form 10-K. Please amend your filing to include the required disclosure as presented in your original Form 10-K. Refer to the requirements of Items 307 and 308 of Regulation S-K for further guidance.

Response: The Company has amended its filing to include the required disclosure as presented in its original Form 10-K in accordance with the requirements of Items 307 and 308 of Regulation S-K.

Amendment No. 1 to Form 10-Q for the Fiscal Period Ended March 31, 2011

Exhibit 32.1

6. Please amend your filing to correct the reference to the appropriate quarterly period. Currently, this certificate refers to the “Form 10-Q/A for the quarterly period ended September 30, 2010” and should refer to “the quarterly period ended March 31, 2011.”

Response: The Company has amended its filing to correct the reference to the appropriate quarterly period in Exhibit 32.1. The quarterly period now referenced therein is the quarterly period ended March 31, 2011.

Engineering Comments

Amended No. 1 to Form 10-K for Fiscal Year Ended December 31, 2010

General

7. Please correct your commission file number on the cover of your periodic and current filings to read 000-53809, which was assigned in conjunction with your filing of the Form 10 registration statement on October 28, 2009.

Response:The Company corrected its commission file number on the cover of its periodic and current filings to read 000-53809.

Bio-Carbon Systems International Inc., page 1

8. The terms developed and production have very specific meanings within Industry Guide 7 (which is available on our website at the following address: www.sec.gov/about/forms/industryguides.pdf). These words/terms reference the development state when companies are engaged in preparing reserves for production, and the production stage when companies are engaged in commercial-scale, profit-oriented extraction of minerals. As you do not disclose any reserves as defined by Guide 7, please remove the terms develop, development or production throughout your document, and replace this terminology, as needed, with terms such as explore or exploration. This includes the use of these terms in your financial statement head notes and footnotes. Please refer to Instruction 1 to paragraph (a) of Industry Guide 7.Response: The Company, throughout the amended Form 10-K, including the financial statement head notes and footnotes, has removed the terms develop, development andproduction and has replaced these terms, as needed, with terms such as explore and exploration.

Risk Factors, page 7

9. As the company does not have a “reserve”, it must be in the “exploration stage,” as defined by Industry Guide 7(a) (1) and (a) (4) (i), respectively. Exploration stage companies are those issuers engaged in the search and evaluation of mineral deposits, which are not engaged in the development of reserves or engaged in production. Please ensure that terms that may imply mineral production are removed from your filing.

Response: The Company has removed from its amended 10-K the terms that may imply mineral production.

Properties, page 7

10. Please disclose the following information for each of your properties:

- The nature of ownership or interest in the property;

- A description of all interests in your properties, including the terms of allunderlying agreements and royalties;

- A description of the process by which mineral rights are acquired at this locationand the basis and duration of your mineral rights, surface rights, mining claims orconcessions;

- An indication of the type of claim or concession such as placer or lode,exploration or exploitation, whether the mining claims are State or Federal miningclaims, patented or unpatented claims, mining leases, or mining concessions;

- Certain identifying information, such as the property names, claim numbers, grantnumbers, mining concession name or number, and dates of recording andexpiration that is sufficient to enable the claims to be distinguished from otherclaims that may exist in the area of your properties;

- The conditions that must be met to retain your claims or leases, includingquantification and timing of all necessary payments, annual maintenance fees, anddisclose who is responsible for paying these fees; and

- The area of your claims, either in hectares or in acres.

Please ensure that you fully discuss the material terms of the land or mineral rights securing agreements, as required under paragraph (b) (2) of Industry Guide 7.

Response:On pages 9-13 of Amendment No. 2 to the Form 10-K, the Company fully discusses the foregoing information for each of its properties and the material terms of the land or mineral rights securing agreements, as required under paragraph (b)(2) of Industry Guide 7.

11. Please disclose the information required under paragraph (b) of Industry Guide 7 for all of your material properties listed under this heading. For any properties identified that are not material, please include a statement to the effect, clarifying your intentions. For each material property, include the following information:

- The location and means of access to your property, including the modes oftransportation utilized to and from the property;

- Any conditions that must be met in order to obtain or retain title to the property,where you have surface and/or mineral rights;

- A brief description of the rock formations and mineralization of existing orpotential economic significance on the property;

- A description of any work completed on the property and its present condition;

- The details as to modernization and physical conditions of the plant andequipment, including subsurface improvements and equipment;

- A description of equipment, infrastructure, and other facilities; the current state ofexploration of the property;

- The total costs incurred to date and all planned future costs;

- The source of power and water that can be utilized at the property; and

- If applicable, provide a clear statement that the property is without knownreserves and the proposed program is exploration in nature.

Please refer to Industry Guide 7, paragraphs (b) (1) through (5), for specific guidance pertaining to the foregoing, available on our website at the address provided above.

Response:On pages 9-13, the Company has disclosed in its Amendment No. 2 to the Form 10-K the information required under paragraph (b) of Industry Guide 7 for all the material properties listed under this heading.

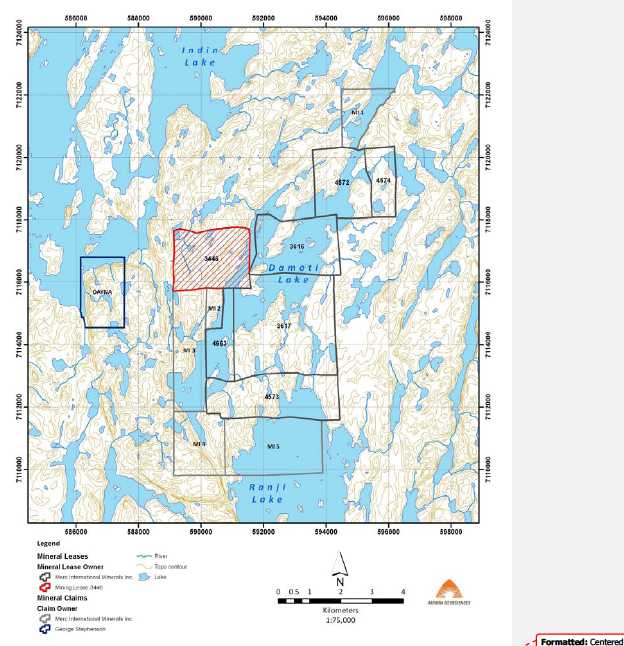

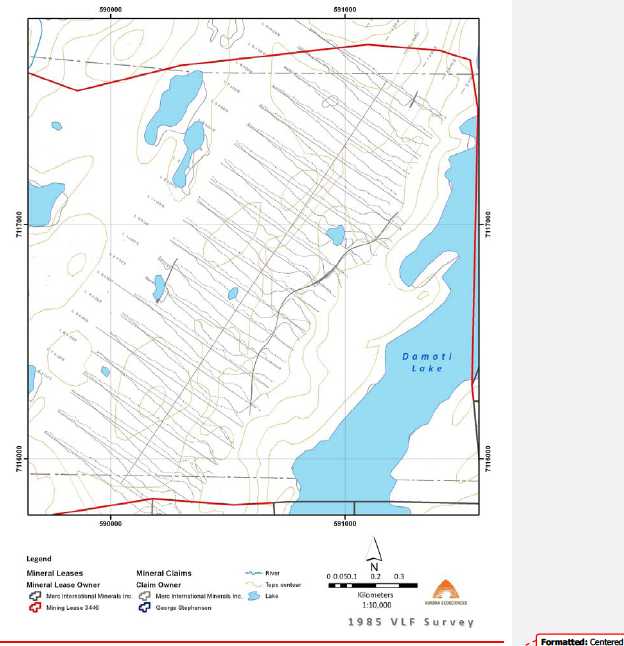

12. Please insert a small-scale map showing the location and access to each material property, as required by Instruction 3(b) to Item 102 of Regulation S-K. Please note the EDGAR program now accepts Adobe PDF files and digital maps, so please include these maps in any amendments that are uploaded to EDGAR. It is relatively easy to include automatic links at the appropriate locations within the documents to GIF or JPEG files, which will allow figures and diagrams to appear in the right location when the document

is viewed on the Internet. For more information, please consult EDGAR manual, and if additional assistance is required, please call Filer Support at (202) 551-3600 for Post-Acceptance Filing Issues or (202) 551-8900 for Pre-Acceptance Filing Issues. We believe the guidance in Instruction 3(b) of Item 102 of Regulation S-K would generally require maps and drawings to comply with the following features:

- A legend or explanation showing, by means of pattern or symbol, every pattern orsymbol used on the map or drawing;

- A graphical bar scale should be included. Additional representations of scale suchas “one inch equals one mile” may be utilized provided the original scale of themap has not been altered;

- A north arrow;

- An index map showing where the property is situated in relationship to the stateor providence, etc., in which it is located;

- A title on the map or drawing, and the date on which it was drawn; and

- In the event interpretative data is submitted in conjunction with any map, theidentity of the geologist or engineer that prepared such data.

Any drawing should be simple enough or of sufficiently large scale to clearly show all features on the drawing.

Response:Beginning on page 13 of Amendment No. 2 to the Form 10-K, the Company has inserted several small-scale maps showing the location and access to each material property in accordance with Instruction 3(b) to Item 102 of Regulation S-K.

Management’sDiscussionand Analysis of Financial Condition and Results of Operations, page 10

Recent developments, page10

13. Please provide your basis for preparing the mineral estimates in your Form 10-K inaccordance with the requirements of the securities laws in effect in Canada as opposed to those in effect in the United States.

Response:As the Company is based in Canada, the Company has many Canadian investors. As such, the Company prepared the mineral estimates in its Form 10-K in accordance with the requirements of the securities laws in effect in Canada in order to give comfort to its current Canadian investors and to establish credibility with other potential Canadian investors.

Please find attached as Exhibit “A” hereto the Company’s letter to the Commission providing the requested Tandy representations.

If you have any questions regarding our responses to the comments in the Letter, please do not hesitate to call. Thank you for assisting with the review process.

Very truly yours,

JOYCE THRASHER KAISER & LISS, LLC

/s/ H. Grady Thrasher, IV

Exhibit “A”

September 20, 2011

Alexandra M. Ledbetter

United States Securities and Exchange Commission

Division of Corporation Finance

100 F St., N.E.

Washington, D.C. 20549

| |

Re: | Joshua Gold Resources Inc., formerly known as Bio-Carbon Systems International Inc. (the “Company”) Preliminary Information Statement on Schedule 14C Filed January 10, 2011 Amendment No. 1 to Form 10-K for Fiscal Year Ended December 31, 2010 Filed July 22, 2011 Amendment No. 1 to Form 10-Q for Fiscal Period Ended March 31, 2011 Filed July 22, 2011 File No. 0-53809 |

Dear Ms. Ledbetter:

In connection with the letter filed by our securities counsel on September 20, 2011 to the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) in response to the Staff’s comment letter dated August 29, 2011, the Company acknowledges the following:

- The Company is responsible for the adequacy and accuracy of the disclosure in thefilings;

- Staff comments or changes to disclosure in response to Staff comments do not foreclosethe Commission from taking any action with respect to the filing; and

- The Company may not assert staff comments as a defense in any proceeding initiated bythe Commission or any person under the federal securities laws of the United States.

Sincerely,

Joshua Gold Resources Inc.

/s/Benjamin Ward

Benjamin Ward

President, CEO, CFO and Director

| | | | |

| UNITED STATES | | | |

| SECURITIES AND EXCHANGE COMMISSION | | | |

| Washington, D.C. 20549 | | | |

| |

| FORM 10-K/A | | | |

(Amendment No.12) | | | |

| |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE | | | |

| SECURITIES EXCHANGE ACT OF 1934 | | | | |

| For the fiscal year ended December 31, 2010 | | | |

| |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE | | |

| SECURITIES EXCHANGE ACT OF 1934 | | | | |

| For the transition period from | to | | | |

Commission file number: 000-5103053809 | | | |

| Joshua Gold Resources Inc. | | | |

| (f/k/a Bio-Carbon Systems International Inc.) | | | |

| (Exact name of registrant as specified in its charter) | | | |

| Nevada | 27-0531073 | | | |

| (State or other jurisdiction of | (I.R.S. Employer | | | |

| incorporation or organization) | Identification Number) | | | |

| |

72 Birch St. E Chapleau, Ontario99 Bronte Road Suite 121 Oakville ON L6L 3B7CanadaP0M 1K0 | Formatted:English (Canada), Condensed by | |

| | | | 0.1 | pt |

| (Address of principal executive offices) | | Formatted:English (Canada), Not Expanded | |

| Registrant's telephone number, including area code: (705) 864-1095 | | by / Condensed by | |

| SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: | Formatted:Normal, Centered, Indent: First | |

| | | | line: 0", Space Before: 0 pt, Line spacing: | |

| None | | | single | |

| SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: | | |

| Title of each class | Name of each exchange on which registered | | |

| COMMON STOCK, $0.0001 PAR VALUE | N/A | | | |

| PREFERRED STOCK, $0.0001 PAR VALUE | | | | |

| |

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes | No | | |

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes | No | | |

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) hasbeen subject to such filing requirements for the past 90 days. Yes No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Indicate by check mark if the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No

The aggregate market value of the voting common stock held by non-affiliates of the Registrant (assuming officers, directors and 10% stockholders are{00214079. }

affiliates), based on the last sale price for such stock on June 30, 2010: $26,519,000. The Registrant has no non-voting common stock.

As of April 15, 2011, there were 265,190,416 shares of the Registrant's common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

All of the Registrant's filings may be read or copied at the SEC's Public Reference Room at 100 F Street, N.E., Room 1580, Washington D.C. 20549. Information on the hours of operation of the SEC's Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The SEC maintains a website (http://www.sec.gov) that contains reports and proxy and information statements of issuers that file electronically.

| | | | | |

| | JOSHUA GOLD RESOURCES INC. | | | Formatted:Level 1 |

| | Form 10-K/A – ANNUAL REPORT | | | |

| | For the Fiscal Year Ended December 31, 2010 | | | |

| | Table of Contents | | | | |

| | | | | Page | Formatted:Level 1 |

| | PART I | | | | |

| Item 1. | Business | Error! Bookmark not defined.4 | Formatted:Indent: Left: 0", First line: 0" |

| Item 1A. | Risk Factors | | | 8 | |

| Item 2. | Properties | | | 8 | |

| Item 3. | Legal Proceedings | | | 9 | |

| Item 4. | Removed & Reserved | | … | 9 | |

| | PART II | | | | |

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer | | | |

| | Purchases of Equity Securities | | | 10 | |

| Item 6. | Selected Financial Data | | | 11 | |

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | | 11 | |

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | … | 16 | |

| Item 8. | Financial Statements and Supplementary Data | | | 16 | |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial | | | |

| | Disclosure | | | 17 | |

| Item 9A. | Controls and Procedures | | | 18 | |

| Item 9B. | Other Information | | | 19 | |

| | PART III | | | | |

| Item 10. | Directors, Executive Officers and Corporate Governance | | | 20 | |

| Item 11. | Executive Compensation | | | 20 | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related | | | |

| | Stockholder Matters | | | 21 | |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | | 21 | |

| Item 14. | Principal Accounting Fees and Services | | | 21 | |

| | PART IV | | | | |

| Item 15. | Exhibits and Financial Statement Schedules | Error! Bookmark not defined.221 | |

{00214079. }

-i-

C:\DOCUME~1\bryan\LOCALS~1\Temp\Rar$DI12.874\Amendement # 2 Form 10K Dec 31, 2010 Redline (00214079).DOCX

PART I

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K/A contains forward-looking statements relating to future events and our future performance within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In some cases, you can identify forward-looking statements by terms such as "may", "will", "should", "could", "would", “hope”, "expects", "plans", "intends", "anticipates", "believes", "estimates", "projects", "predicts", "potential" and similar expressions intended to identify forward-looking statements. These forward-looking statements include, without limitation, statements relating to future events, future results, and future economic conditions in general and statements about:

- Our future strategy, structure, and business prospects;

- The planned commercialization of our current mineral acquisitions;

- The size and growth of the potential mineral reserves; and

- Use of cash, cash needs and ability to raise capital.

These statements involve known and unknown risks, uncertainties and other factors, including the risks described in Part I, Item 1A. of this Annual Report on Form 10-K/A, which may cause our actual results, performance or achievements to be materially different from any future results, performances, time frames or achievements expressed or implied by the forward-looking statements. Given these risks, uncertainties and other factors, you should not place undue reliance on these forward-looking statements. Information regarding market and industry statistics contained in this Annual Report on Form 10-K/Ais included based on information available to us that we believe is accurate. It is generally based on academic and other publications that are not produced for purposes of securities offerings or economic analysis. We have not reviewed or included data from all sources and cannot assure you of the accuracy of the market and industry data we have included.

GENERAL MATTERS

Formatted:Level 1

Our common stock is subject to the "penny stock" rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The Securities and Exchange Commission has adopted certain rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) that are applicable to "penny stocks". For the purposes relevant to us, a “penny stock” is any equity security that has a market price of less than $5.00 per share or has an exercise or conversion price of less than $5.00 per share, subject to certain exceptions, constitutes a "penny stock". For any transaction involving a penny stock, unless exempt, the rules require:

- that a broker or dealer approve a person's account for transactions in penny stocks;

- the broker or dealer receive from the investor a written agreement to the transaction, setting forth theidentity and quantity of the penny stock to be purchased; and

- that a broker or dealer provide certain detailed market information about the market for the applicablecompany’s securities.

In order to approve a person's account for transactions involving penny stocks, the broker or dealer must:

- obtain financial information, investment experience and investment objectives of the person; and

{00214079. }

-2-

C:\DOCUME~1\bryan\LOCALS~1\Temp\Rar$DI12.874\Amendement # 2 Form 10K Dec 31, 2010 Redline (00214079).DOCX

- make a reasonable determination that the proposed transactions in penny stocks are suitable for thatperson and the person has sufficient knowledge and experience in financial matters to be capable ofevaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the SEC relating to the penny stock market, which, in highlight form:

- sets forth the basis on which the broker or dealer made the suitability determination; and

- that the broker or dealer received a signed, written agreement from the investor prior to thetransaction.

Following a transaction, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common stock and depress the market value of our stock.

There are additional risks of investing in penny stocks whether in public offerings or in secondary trading, relating to commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions

Formatted:Level 1

Formatted:Centered

-3-

Corporate Information

Joshua Gold Resources Inc. (f/k/a Bio-Carbon Systems International Inc.) was incorporated in Nevada on July 10, 2009 as a “shell Company” or “blank check” corporation and on May 20, 2010 the Company was sold to a new shareholder. On June 4, 2010 control of the Company was sold to a new group of shareholders (Group 1), the company’s name was changed to Bio-Carbon Systems International Inc. On December 23, 2010 control of the Company was sold to a new group of shareholders (Group 2). Subsequent to year end, the company’s name will be changed to Joshua Gold Resources Inc.

Unless the context requires otherwise, in this report the terms “BCSI”, the “Company," "we," "us" and "our" refer to Joshua Gold Resources Inc. References to "$" or "dollars" shall mean U.S. dollars unless otherwise indicated. References to "C$" shall mean Canadian dollars.

ITEM 1.

Business

Overview

Formatted:Level 1

January 1, 2010 - December 23, 2010

From January 1 to June 3, 2010 the Company was a blank check shell company for securities purposes. On June 4, 2010 the Company changed its status and became a start-up carbon measuring company based in Sault Ste Marie, Ontario. The Company entered into certain license and consulting agreements with individuals and/or entities controlled by individuals that comprise the Group 1 controlling shareholders. The Company planned to use its licensed intellectual property and technology to conduct airborne and other surveys of forested lands in areas that are difficult to access. Those surveys would have been conducted in a statistically verifiable process designed for use in carbon trading programs to assess the potential value of the surveyed lands as carbon sequestration land parcels in carbon trading, carbon sequestration, and other greenhouse gas emission control, offset and reduction programs.

However, the Company later found that the current North American regulatory and economic framework surrounding the emerging business of carbon measurement, carbon storage, carbon sequestration and carbon trading activities was not economically viable at this time. Therefore, the Company decided not to pursue the carbon business and terminated the license agreements and the consulting agreements on December 23, 2010. The termination has not given rise to any penalties against the Company as the termination was concluded through a mutual agreement of separation.

Subsequent December 23, 2010

Formatted:Level 1

After exiting the carbon measuring business, the Company became a mineral exploration business located in Chapleau, Ontario. The Company’s principal business activity is theacquisition,explorationand developmentof mineral property interests in Canada. The Company is considered to be in the exploration stage and substantially all of the Company’s efforts are devoted tofinancing and developingexploringthese property interests. There has been no determination whether the Company’s interests in unproven mineral properties contain mineral reserves which are economically recoverable.

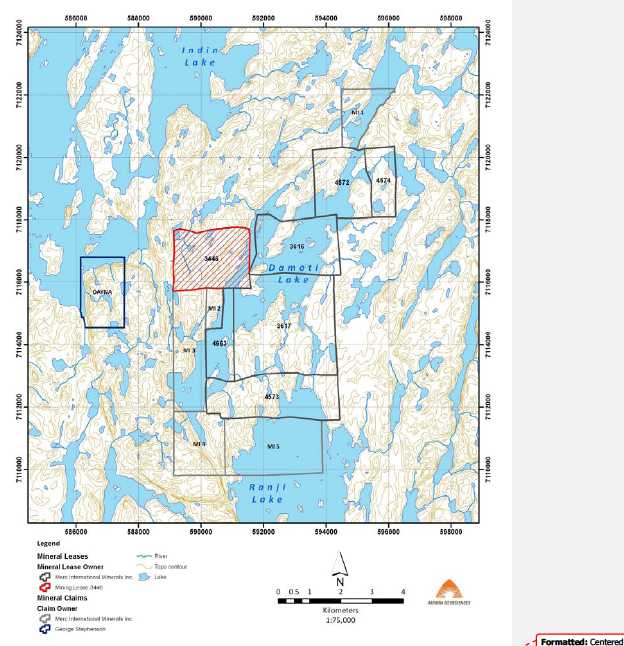

On December 23, 2010, the Company optioned a 1,550 acre mineral lease in the North West Territories of Canada, approximately two hours north-north-west of Yellowknife.

Formatted:Centered

-4-

Management retained an independent geological firm, Aurora Geosciences Inc, to visit the property, named the ‘Carson property’, and write a report under Canada’s National Instrument 43-101(“NI 43-101”), which instrument provides guidelines for the preparation, completion and use of such reports for public companies. The author of this report is David White, a “Qualified Person” under NI 43-101. He has completed the report and it is included as Exhibit 99.21to this annual report. The geological report recommends further exploration of the Carson Property and a phased exploration budget in three stages, along the following outlines: Stage 1 – Geology Program involving updating historical data on the property to modern standards, conducting surface review sampling, and preparing geological mapping. Estimated cost $24,000.

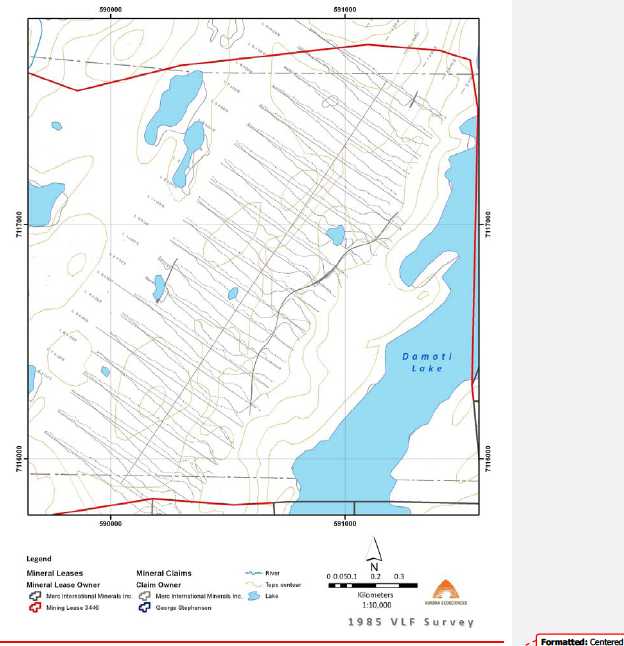

Stage 2 – Geophysics Program where an updated ground magnetic and VLF (very low frequency) survey would be conducted over the entire property. The results would be interpreted in the context of structural controls on known gold showings and applied to other areas of the property. Estimated cost $23,000.

Stage 3 – Diamond Drilling Program would be conducted on areas identified as the Pond, the Chuck Vein, and any prospective geophysical anomalies identified in Stage 2. Estimated cost $820,000.

The Company plans on undertaking Stage 1 in 2011. The results will determine whether and to what extent the Company will implement Stage 2.

The Company will be engaging a geological consultant to evaluate the work programs from the NI 43-101 report and will continue to consider and evaluate other mineral resource exploration properties in North America to ascertain whether those properties should be acquired and explored by the Company.

Mineral Acquisition Agreement – Carson Property

Formatted:Level 1

On December 23, 2010, the Company entered into a mineral property acquisition agreement (the “Acquisition Agreement”) with 2214098 Ontario Ltd. (“2214098”), an Ontario corporation, pursuant to which 2214098 has agreed to sell to the Company the property located 195 kilometers north-northwest of the City of Yellowknife, N.W.T, on the west shore of Damoti Lake in the Indin Lake Greenstone Belt and known as a claim BR2 (the “Carson Property”). The claim covers an area of approximately 1,550812acres. Under the Acquisition Agreement, the Company will acquire the Carson Property in consideration for the following payments:

1) the Corporation paying CDN$100,000 to be paid by the Corporation to 2214098 as follows:

| a. | $25,000 on or before April 30, 2011; |

| b. | $10,000 on or before each of September 30th, 2011, 2012, 2013, 2014; and |

| c. | $35,000 on or before September 30th, 2015; |

| (2) | the Corporation paying 1,000,000 common shares in the capital of the Corporation (the “Shares”) to |

2214098, and deliver the Shares to 2214098 on or before March 30th, 2011;

(3) upon and following the commencement of commercial production, the Corporation shall pay a 2% royalty to John Rapski, and a 1% royalty to 2214098 of net smelter returns (NSR) on the terms and conditions as set out in the Acquisition Agreement.

Formatted:Centered

-5-

The 1,000,000 common shares due to be issued to Mr. Rapski have been authorized for issuance and are expected to be issued and delivered to him by the end of April of 2011.

In addition to the royalties described above, the Northwest Territories and Nunavut Mining Regulations require the owner or operator of a mine to pay roylaties to Her Majesty on the value of the mine’s output during that fiscal year an amount equal to the lessor of:

| a) | 13% of the value of the output of the mine; and |

| b) | The amount calculated in accordance with the following table. |

| | | |

| Value of Output | | Royalty Payable of that portion of the | |

| | Value | | |

| 10,000 or less | | 0 | % |

| In excess of 5 million but not exceeding 10 | | 5 | % |

| million | | | |

| In excess of 5 million but not exceeding 10 | | 6 | % |

| million | | | |

| In excess of 10 million but not exceeding | | 7 | % |

| 15 million | | | |

| In excess of 15 million but not exceeding | | 8 | % |

| 20 million | | | |

| In excess of 20 million but not exceeding | | 9 | % |

| 25 million | | | |

| In excess of 25 million but not exceeding | | 10 | % |

| 30 million | | | |

| In excess of 30 million but not exceeding | | 11 | % |

| 35 million | | | |

| In excess of 35 million but not exceeding | | 12 | % |

| 40 million | | | |

| In excess of 40 million but not exceeding | | 13 | % |

| 45 million | | | |

| In excess of 45 million | | 14 | % |

Formatted:Centered

-6-

The foregoing summary of the Acquisition Agreement is not complete and is qualified in its entirety by reference to the complete text of the Acquisition Agreement which was filed as Exhibit 10.1 to the Company’s current report on Form 8-K filed with Securities and Exchange Commission on December 23, 2010.

Management believes that the Carson property could potentially host economic gold deposits and, upon expert opinion of their geologists, warrants continued mineral exploration on the property.

Mineral Exploration Industry

Formatted:Level 1

By definition, mineral exploration companies have no product or inventory to sell since they are not operating as a mining company.

Management will initially only explore and risk funds in properties that are located in the United States or in Canada where land , lease laws are consistent and enjoy stable local, state, provincial and federal governments.

Mineral exploration companies need to design their exploration budgets in a manner whereby they can be completed by current and reasonably expected financings.

When a mineral exploration company has found a mineral deposit that is potentially economic, the company must meet all environmental and mining regulations. These could include mining permits to be granted by the appropriate state or provincial and local governments. These prerequisites to mining the mineral material can be expensive and take time to comply with. However, when a company has an economic deposit it is easier for the company to raise finances to deal with these expenses and time delays. Management will use accredited, appropriate professionals to represent the company and obtain approvals from the regulatory authorities.

Formatted:Level 1

Competition

The mineral explorationand mining industrysectorishighlycompetitivein all phases of exploration, development and production. In addition, as the Company has no revenue and does not anticipate earning revenue for the foreseeable future (if ever), the Company expects that it will have to raise substantial sums to conduct its operations and explore the Carson Property and any later acquired property.

The Company competes with a number of other entities and individuals in the search for, and acquisition of, attractive mineral properties, as well as competing with other actors in this industry and in other sectors to raise the capital it requires to conduct its activities and fund its operations.. As a result of this competition, the majority of which is with companies that possess greater financial resources than the Company has, in the future the Company may not be able to acquire attractive properties on terms it considers acceptable.

Furthermore, in raising capital and attracting talented mining and resource exploration professionals, we compete with other resource companies, many of whom have greater financial resources and/or more advanced properties that are better able to attract greater interest or may be (or may be perceived to involve) less risk.

Formatted:Centered

-7-

Finally, our business is to search for mineral resource deposits, the value of which fluctuates in line with market values for those resources. Factors beyond our control that relate primarily to international economic conditions may affect the marketability of mineral deposits delineated or mined by us.

Government Regulation

Formatted:Level 1

There are several governmental regulations that materially restrict the exploration for minerals, and the extraction of minerals and any related mining activities, in Canada and in the Northwest Territories. The Company will be subject to the mining laws and regulations in force in Canada and in the Northwest Territories (as well as any other jurisdiction wherein a future-acquired property is located). In order to comply with applicable regulations, the Company may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to land. As a general matter, management of the Company will attempt to ensure that all budgets for exploration programs include a contingency for regulatory compliance.

Formatted:Font: 11 pt

Employees

Formatted:Level 1

On December 31, 2010, the Company did not have any part-time or full-time employees.

Available Information

Formatted:Level 1

The Securities and Exchange Commission, or the SEC, maintains an Internet site at www.sec.gov that contains reports, proxy and information statements, and other information regarding us and other issuers that file electronically with the SEC.

Formatted:Centered

-8-

ITEM 1A.

RISK FACTORS

An investment in our Company is highly speculative in nature and involves an extremely high degree of risk. The following risk factors should therefore be considered when evaluating an investment in the Company.

We area developmentan explorationstage company with a limited operating history and may never be able to effectuate our business plan or achieve sufficient revenues or profitability; at this stage of our business, even with our good faith efforts, potential investors have a high probability of losing their entire investment.

We are subject to all of the risks inherent ina developmentan explorationstage company. In particular, potential investors should be aware that we have not proven that we can:

- raise sufficient capital in the public and/or private markets;

- have access to a line of credit in the institutional lending marketplace for the expansion of ourbusiness;

- respond effectively to competitive pressures; or

- recruit and build a management team to accomplish our business plan.

Accordingly, our prospects must be considered in light of the risks, expenses and difficulties frequently encountered in establishing a new business, and our Company is a highly speculative venture involving significant financial risk.

We have a limited track record that would provide a basis for assessing our ability to conduct successful business activities. We may not be successful in carrying out our business objectives.

The revenue and income potential of our proposed business and operations are unproven as a limited operating history makes it difficult to evaluate the future prospects of our business. There is limited information at this time on which to base an assumption that our business operations will prove to be successful or that we will ever be able to operate profitably. Accordingly, we have a limited track record of successful business activities, strategic decision making by management, fund-raising ability, and other factors that would allow an investor to assess the likelihood that we will be successful in marketing our services. As such, there is a substantial risk that we will not be successful in generating sufficient operating revenues or in achieving profitable operations, irrespective of competition.

ITEM 2.

Properties

On December 23, 2010, the Company entered into a mineral property acquisition agreementwhereby the Company has purchased the mining lease for(the “Acquisition Agreement”) with 2214098 Ontario Ltd. (“2214098”), an Ontario corporation, pursuant to which 2214098 agreed to sell to the Companythe property located 195 kilometers north-northwest of the City of Yellowknife, N.W.T, on the west shore of Damoti Lake in the Indin Lake Greenstone Belt and known as a claim BR2 (the “Carsonproperty”). The term of the lease runs until June 30, 2024. The lease is registered at the Northwest Territories Mining Recorder as mining

Formatted:Centered

-9-

lease 3446 and covers an area of approximately 1,550 acres. See Exhibit 99.2.Property”). Under the Acquisition Agreement, the Company will acquire the Carson Property in consideration for the following payments:

1) the Corporation paying CDN$100,000 to be paid by the Corporation to 2214098 as follows:

| a. | $25,000 on or before April 30, 2011; |

| b. | $10,000 on or before each of September 30th, 2011, 2012, 2013, 2014; and |

| c. | $35,000 on or before September 30th, 2015; |

| (2) | the Corporation paying 1,000,000 common shares in the capital of the Corporation (the “Shares”) to |

2214098, and deliver the Shares to 2214098 on or before March 30th, 2011;

(3) upon and following the commencement of commercial production, the Corporation shall pay a 2% royalty to John Rapski, and a 1% royalty to 2214098 of net smelter returns (NSR) on the terms and conditions as set out in the Acquisition Agreement.

The 1,000,000 common shares due to be issued to Mr. Rapski have been authorized for issuance and are expected to be issued and delivered to him by the end of April of 2011.

In addition to the royalties described above, the Northwest Territories and Nunavut Mining Regulations require the owner or operator of a mine to pay roylaties to Her Majesty on the value of the mine’s output during that fiscal year an amount equal to the lessor of:

| a) | 13% of the value of the output of the mine; and |

| b) | The amount calculated in accordance with the following table. |

| | | |

| Value of Output | | Royalty Payable of that portion of the | |

| | Value | | |

| |

| 10,000 or less | | 0 | % |

| |

| In excess of 5 million but not exceeding 10 | | 5 | % |

| million | | | |

| |

| In excess of 5 million but not exceeding 10 | | 6 | % |

| million | | | |

| |

| In excess of 10 million but not exceeding | | 7 | % |

| 15 million | | | |

| |

| In excess of 15 million but not exceeding | | 8 | % |

| 20 million | | | |

Formatted:Centered

-10-

| | |

| In excess of 20 million but not exceeding | 9 | % |

| 25 million | | |

| |

| In excess of 25 million but not exceeding | 10 | % |

| 30 million | | |

| |

| In excess of 30 million but not exceeding | 11 | % |

| 35 million | | |

| |

| In excess of 35 million but not exceeding | 12 | % |

| 40 million | | |

| |

| In excess of 40 million but not exceeding | 13 | % |

| 45 million | | |

| |

| In excess of 45 million | 14 | % |

The foregoing summary of the Acquisition Agreement is not complete and is qualified in its entirety by reference to the complete text of the Acquisition Agreement which was filed as Exhibit 10.1 to the Company’s current report on Form 8-K filed with Securities and Exchange Commission on December 23, 2010.

Mineral rights were acquired at the Carson Property location through claim staking. The Carson Property mining claims are an area of open Crown land or Crown minerals rights that a licensed prospector marked out with a series of claim posts and blazed lines. The mining claims were staked in square or rectangular share with boundaries running north, south, east and west astronomically. Claim posts are erected at the corner of each mining claim, and claim boundaries between each post are marked by blazes cut into trees and by cut underbrush. Claim corner post tags identifying the individual claim number are affixed by nails to each corner post.

The Northwest Territories and Nunavut Mining Regulations Territorial Lands Act (the “Mining Act”) authorizes the staking of mineral claims (such as those claims comprising the Carson Property) where the Crown owns the minerals and the carrying out of assessment/exploration work on the mining claims by the claim holder. Mining (i.e. extraction of the minerals) cannot take place until the claims are brought to lease. Mining leases are issued for the express purpose of undertaking mineral, development or mining. The claim holder is entitled to a lease upon fulfilling the requirements of the Mining Act. Currently, the surface and mineral rights are leased by J. Rapski.

The claim comprising the Carson Property is a mining lease. A lease is issued for the express purpose of undertaking mineral development or mining. The lease is a Federal lease.

The claim is identified as mining lease 3446, District 215 of the Northwest Territories, Lease NTS Sheet no. O86B03. The lease was granted on June 30, 1993 and expires on June 30, 2024. Prior to the expiry date, the lease holder can apply to have the lease renewed for an additional 21 year period.

To maintain the claim in good standing, annual lease payments by the lease holder of $1,141 must be paid to the Chief of Financial Analysis for the Federal Department of Indian and Northern Affairs.

Formatted:Centered

-11-

The Carson Property is 1,812 acres in area and is most directly accessed via Damoti Lake by float or ski based fixed wing aircraft or helicopter directly from Yellowknife. The Colmac seasonal road runs along the Indin Lake located approximately 5 kilometres to the west. This road originates in Yellowknife and is maintained through the winter months.

The Company must meet the following payments to 2214098 Ontario Ltd. in order to retain title to the Carson Property: CDN $ 25,000 on or before April 30, 2011; at total of CDN $40,000 payable in increments of CDN $10,000 on or before each of September 30, 2011, 2012, 2013, 2014; a further payment of CDN $35,000 on or before September 30, 2015; and delivery of the 1,000,000 common shares of Joshua registered to the Vendor on or before March 30, 2011.

Additionally, annual lease payments by the lease holder of $1,141 must be paid to the Chief of Financial Analysis for the Federal Department of Indian and Northern Affairs.

The Carson Property is underlain by mafic a lesser felsic metavolcanic and subordinate metasedimentary rocks of the Yellowknife Supergroup. Felsic metavolcanic rocks occur at the metavolcanic-metasedimentary contact. Eight major rock assemblages at the property have been delineated by historical exploration work and range from feldspar crystal tuffs, rhyolite, andesite and feldspar porphyry intrusives.

Gold associated with quartz veins (shear zones) or with silicification are found in the metavolcanic and metasedimentary rocks of the Yellowknife Supergroup. In the Indin Lake Supracrustal belt shear-hosted mineralized systems generally occur at or near volcano-sedimentary contacts. Specifically, mineralization on the property occurs as: gold-bearing quartz veins and lenses with pyrite-pyrrohtite and trace chalcopyrite and galena in mafic shear zones; pyrite-pyrrohtite horizons near the contact of the Lovang tuff and Snowden andesite; or as pyritic argillites associated with shear zones in the Oti rhyolite. These gold bearing shear zones occur on the property as three principal northeast-trending shear zones called the Pond, Chuck vein and Hilltop. The potential economic significance of the gold bearing formation and structures on the property is presently unknown.

To date, exploration work conducted by the Company has been limited to the preparation of a National Instrument 43-101 compliant technical report entitled: “Technical Report, Carson Property, INTS: 086G/03, Mackenzie Mining District, Northwest Territories” prepared by Aurora Geosciences Ltd. of Yellowknife, Northwest Territories.

The report summarized and evaluated all the publically available historical work completed in the immediate area of the property. As part of the terms of reference for the report, Aurora also conducted a site visit of the property. Based on the analysis of the historical work at the property, the report recommended additional exploration work be conducted including geological mapping, detailed compilation and interpretation of all historical work, updated VLF and magnetic surveying of the entire property, and diamond drilling. The estimated budget for the additional recommended work is CDN $857,703.00.

Prior to the preparation of the Aurora technical report, diamond drilling in 1947 and prospecting and ground geophysical work completed in 1947, 1981 and 1985 have been reported at the Carson property.

As the property is a “grass roots” exploration prospect, no plant equipment is present and no subsurface improvements are required at the property. Further, no infrastructure or facilities are found on the property and no exploration work is presently underway.

Formatted:Centered

-12-

Exploration cost on the Carson Property is limited to the preparation of the Technical Report and is $13,744. The report recommended additional exploration work be conducted including geological mapping, detailed compilation and interpretation of all historical work, updated VLF and magnetic surveying of the entire property, and diamond drilling. The estimated budget for the additional recommended work is CDN $857,703.00.

Sources of water locally is from the abundant local creeks, rivers and small lakes. Local power sources are not available presently. Power (when required) can be provided via portable generators transported to the property.

The Carson Property is presently without known mineral reserves and the proposed work program is exploratory in nature.

The location and access to the Carson Property, as well as its mineral claims and geology, are shown in the small-scale maps provided below.

Formatted:Centered

-13-

-15-

-16-

-17-

Formatted:Centered

-18-

ITEM 3.

Legal Proceedings

We are currently not involved in any litigation that we believe could have a material adverse effect on our financial condition or results or operations. There is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the executive officers of the Company , threatened against or affecting the Company or its common stock, or the directors or executive officers of the Company in their respective capacities as such with the Company.

ITEM 4.

Removed & Reserved

None.

Formatted:Level 1

Formatted:Centered

-19-

| |

| | PART II |

| ITEM 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer |

Purchases of Equity Securities

Market Information

Formatted:Level 1

Our common stock is not trading on any stock exchange. We are not aware of any market activity in our stock since our inception and through the date of this filing.

Holders

Formatted:Level 1

As of April 15, 2011, there are 29 record holders of the Company’s issued and outstanding 265,190,416 shares of the common stock and three holders of the 240,000 preferred stock issued and outstanding which accrue cumulative 10% dividends annually on the issue price C$1.00 per share.

Dividend Policy

Formatted:Level 1

We have not declared or paid any cash dividends on our common stock or preferred stock and we do not intend to declare or pay any cash dividend in the foreseeable future. The payment of dividends, if any, is within the discretion of the Board of Directors and will depend on the Company’s earnings, if any, its capital requirements and its overall financial condition and such other factors as the Board of Directors may consider.

Securities Authorized for Issuance under Equity Compensation Plans

Formatted:Level 1

We do not have any equity compensation plans or any individual compensation arrangements with respect to our Common Stock or Preferred Stock. The issuance of any of our common or preferred stock requires the approval of, and is within the discretion of, our Board of Directors, which has the power to issue any or all of our authorized but unissued shares without stockholder approval.

Description of Registrant’s Securities

Formatted:Level 1

The authorized capital stock of our Company consists of 400,000,000 shares of common stock, par value $0.0001 per share, and 100,000,000 shares of preferred stock, par value $0.0001 per share of which there are as at year end 265,190,416 common stock and 240,000 preferred shares issued and outstanding.

All outstanding shares of common stock are of the same class and have equal rights and attributes. The holders of common stock are entitled to one vote per share on all matters submitted to a vote of stockholders of the Company. All stockholders are entitled to share equally in dividends, if any, as may be declared from time to time by the Board of Directors out of funds legally available. In the event of liquidation, the holders of common stock are entitled to share ratably in all assets remaining after payment of all liabilities. The stockholders do not have cumulative or preemptive rights.

Formatted:Centered

-20-

Preferred shares have the following rights, powers, and designations: non-voting, accrue cumulative 10% dividends per annum on the issue price, compounded annually, retractable for CAD$1, no entitlement to participate in the capital appreciation of the Corporation and rank first over common shares.

Recent Sales of Unregistered Securities

In April 2011, the Company will issue 1,000,000 shares of common stock to 2214098 Ontario Ltd. in consideration for the complete payment and settlement of indebtedness, in an amount equal to $98,450, owed by the Company to 2214098 Ontario Ltd.

Issuer Purchases of Equity Securities

None.

ITEM 6.

Selected Financial Data

As a smaller reporting company, we are not required to provide the information required by this item.

| |

ITEM 7 Operations | Management's Discussion and Analysis of Financial Condition and Results of |

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our financial statements and related notes, included in Item 8 of this Report. Unless otherwise specified, all dollar amounts are U.S. dollars

Overview

On December 23, 2010, the Company.became a mineral exploration company through the acquisition of a mineral rights lease. Prior to December 23, 2010, we were a carbon based measuring company.

During the period from inception on July 10, 2009 until the change of control on June 4, 2010 the Company was inactive and incurred only minimal expenses. Subsequent to June 4, 2010, the Company has operated at a low level of activity and, other than the Consulting Agreements entered into on June 4, 2010 with Luc C. Duchesne and Robert G. Cormier, has not entered into employment agreements with any individuals.

The Company’s business plan and objective after June 4, 2010 was to use certain licensed intellectual property to provide services and capitalize on opportunities relating to carbon trading, carbon sequestration, and other greenhouse gas emission control, offset and reduction programs. With the increasing importance of such programs, whether participation in them by businesses is voluntary or as a result of mandatory government regulations, at that time management of the Company believed there were opportunities for property owners and holders of timber harvesting rights to unlock the value of forested lands and other parcels of property as sources and generators of carbon credits.

The Company abandoned the carbon measuring business on December 23, 2010 upon termination of the license and consulting agreements. The results of discontinued operations included in the Company’s financial statements for the year ended December 31, 2010 reflect the activity in this exited business.

Formatted:Level 1

Formatted:Level 1

Formatted:Level 1

Formatted:Level 1

Formatted:Level 1

Formatted:Centered

-21-

Recent Developments

Formatted:Level 1

In December, management retained an independent geological firm, Aurora Geosciences Inc, to visit the Carson property and write an evaluation report under Canada’s National Instrument 43-101(“NI 43-101”) guidelines. The author, a Qualified Person under NI 43-101, Dave White completed the report January 2011 and recommended futher exploration and a phased exploration budget. See Exhibit 99.21to this annual report.

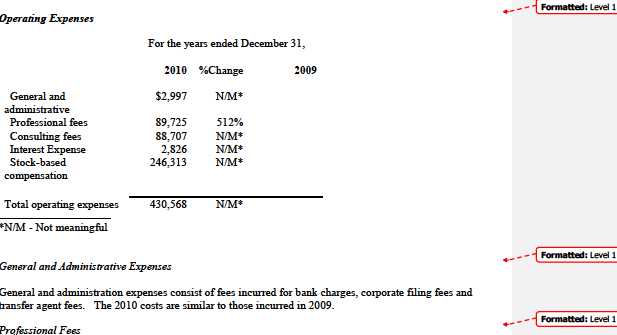

RESULTS OF OPERATIONS

Formatted:Level 1

Discontinued Operations

Revenues, Cost of Goods Sold

For the years ended December 31,

| | | | | |

| | | 2010 | | %Change | 2009 |

| Revenue | $ | 130,186 | | N/M* | - |

| Cost of Goods Sold | | | | | |

| Services | | 130,186 | | N/M* | - |

| Royalties | | 10,918 | | N/M* | - |

| Total Cost of Goods Sold | $ | 141,104 | | N/M* | - |

| |

| Gross Margin | $ | (10,918 | ) | N/M* | - |

| |

| *N/M - Not meaningful | | | | | |

Formatted:Level 1

Revenues

On July 1, 2010, the Company entered into a Master Service Agreement (the “Agreement”) with TransCanada Energy Ltd (“TCE”).

The Company wasbeengaged to provide TCE with services that were to include, but are not limited to, the following: •Organizing and sub-contracting external parties in connection with the planning, coordination and completion of aerial imagery sub-contracts; •Reviewing sub contract imagery deliverables and performing forest inventory work; •Creating carbon models based on forest inventory; •Creating carbon offset model; •Developing and refining offset project documents; •Creating and presenting information about projects to stakeholders; •Creating offset protocols/ methodologies; and •Conducting feasibility assessments.

During the year-ended December 31, 2010, revenues recognized from the services provided to TCE were $130,186.

Formatted:Centered

-22-

Cost of Goods Sold

Cost of goods sold for the year ended December 31, 2010 consisted of costs directly related to providing the services to TCE from companies owned by Luc Duchesne and Robert Cormier. Included in cost of goods sold is the royalty fee paid in shares based on the terms of the technology license agreements June 4, 2010 to companies owned by Luc Duchesne and Robert Cormier.

Formatted:Level 1

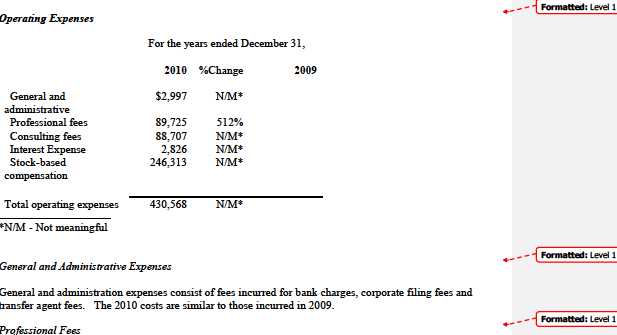

Professional fees consist of charges for legal services. The increase in 2010 is due to increased filing and disclosure costs as result of being SEC registrant for a full year, and also as a result of the Company commencing operations in 2010 and migrating or converting from a largely inactive shell company to a carbon based measuring company.

Consulting Fees

Formatted:Level 1

Consulting fees represent payments for consulting, support and development costs for the licensed technology that were issued to Luc Duchesne, Robert Cormier or companies owned by them. No such costs were incurred in 2009 since the business was a shell company at that time.

Formatted:Level 1

Interest

Interest expense represents interest accrued on loans from shareholders and other lenders during the year. In 2009, there was no interest payable on the single shareholder loan.

Formatted:Level 1

Stock-based compensation

Formatted:Centered

-23-

Stock-based compensation expenses represent the value of the preferred shares issued to certain advisors for services provided in 2010, the value of common shares issued to Luc Duchesne and Robert Cormier for the signing of consultant agreements, for their director services and to other directors for their services. No such costs were incurred in 2009

Liquidity and Capital Resources

Formatted:Level 1

As at December 31,

| | | | | | |

| | | 2010 | | | 2009 | |

| Cash and cash equivalents | $ | 24,786 | | | - | |

| Percentage of total assets | | 9 | % | | - | |

| Working capital deficiency | $ | (111,319 | ) | $ | (12,946 | ) |

Financial Condition

Formatted:Level 1

The Company requires additional financing to cover costs that we expect to incur in 2011. We have been able to obtain financial support from loans. This will continue in 2011 until the Company is able to secure additional funding from equity financing through the sale of common stock or other securities. Future financings could result in significant dilution of existing stockholders. The Company currently earns no operating revenues. The Company’s ability to continue as a going concern is uncertain and is dependent upon the generation of profits from mineral properties, obtaining additional financing or maintaining continued support from its shareholders and creditors. In the event that additional financial support is not received or operating profits are not generated, the carrying values of the Company’s assets may be adversely affected. Current market conditions make the present environment for raising additional equity financing less favorable.

Future funding requirements will depend on many factors, including but not limited to:

- the geological merits of the Carson property

- results from Phase 1 – Geology program on the Carson property

- the geological merits of adjacent properties

- selling opportunity of the Carson property to a mineral exploration company or joint-ventureand

- the acquisition of other potential mineral properties

Currently, our only asset and potential revenue generating product is our mineral option agreement. Further exploration is required in order to determine whether the asset can generate significant mineral revenues or be sold for a significant price.

The following financing transactions occurred in 2010 and generated cash proceeds or will generate cash proceeds:

- on June 4, 2010, the Company issued 50,000,000 common shares pursuant to a private placement(12,500,000 common shares to each investor) at a purchase price of C$0.0003 per share, payable bypromissory notes (C$3,750 each promissory note);

Formatted:Centered

-24-

- on June 4, 2010, the Company issued 96,000,000 common shares pursuant to a private placement toaccredited investors at a purchase price of C$0.0003 per share for total proceeds of C$28,800;

- on July 8, 2010, the Company issued 550,000 common shares pursuant to a private placement toaccredited investors at a purchase price of C$0.10 per share for total proceeds of C$55,000

- two-year term loan of C$25,000 with interest accruing 1% per month

- shareholder loans have occurred with interest accruing 1% per month at various times through theyear and will continue in 2011

Contractual Obligations and Contingencies

| | | | | | | | | | |

| | | Payments due by period | | | |

| | | | | | | | | | | More |

| | | | | Less than | | | | | | than 5 |

| Contractual obligations | | Total | | 1 | year | | 1–3 years | | 3–5 years | years |

| Long-Term Debt - Mineral Acquisition | $ | 100,000 | $ | 35,000 | | $ | 30,000 | $ | 35,000 | - |

| Long-Term Debt - Loan 2 year | | 31,000 | | - | | $ | 31,000 | | - | - |

| |

| |

| [Purchase Obligations] | | - | | - | | | - | | - | - |

| |

| Total | $ | 131,000 | $ | 35,000 | | $ | 61,000 | $ | 35,000 | - |

Off-Balance-Sheet Arrangements

Formatted:Level 1

As of December 31, 2010, we did not have any off-balance-sheet arrangements as defined in Item 303(a)(4)(ii) of SEC Regulation S-K.

Critical Accounting Policies and Estimates

Formatted:Level 1

Our discussion and analysis of our financial condition and results of operations is based upon our audited financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amount of assets, liabilities, sales and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, we evaluate our estimates, including those related to our intangible assets, uncollectible receivables, and stock-based compensation. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Because this can vary in each situation, actual results may differ from these estimates under different assumptions or conditions.

Formatted:Centered

-25-

We believe the following critical accounting policies affect our more significant judgments and estimates used in the preparation of our audited consolidated financial statements.

Revenue Recognition

Formatted:Level 1

We recognize revenue when all four of the following criteria are met: (i) persuasive evidence that an arrangement exists; (ii) delivery of the products has occurred; (iii) the selling price is fixed or determinable; and (iv) collectability is reasonably assured. In addition, we comply with Staff Accounting Bulletin ("SAB") No. 104, "Revenue Recognition," which sets forth guidelines in the timing of revenue recognition based upon factors such as passage of title, installation, payments and customer acceptance. Amounts received in excess of revenue recognizable under SAB No. 104 are deferred.

Valuation of Intangible and other Long-lived Assets.

Formatted:Level 1

We periodically assess the carrying value of intangible and other long-lived assets, which requires us to make assumptions and judgments regarding the future cash flows of these assets. The assets are considered to be impaired if we determine that the carrying value may not be recoverable based upon our assessment of the following events or changes in circumstances:

- the asset's ability to continue to generate income from operations and positive cash flow in futureperiods;

- loss of legal ownership or title to the asset;

- significant changes in our strategic business objectives and utilization of the asset(s); and

- the impact of significant negative industry or economic trends.

If the assets are considered to be impaired, the impairment we recognize is the amount by which the carrying value of the assets exceeds the fair value of the assets. Fair value is determined by a combination of third party sources and discontinued cash flows. In addition, we base the useful lives and related amortization or depreciation expense on our estimate of the period that the assets will generate revenues or otherwise be used by us. We also periodically review the lives assigned to our intangible assets to ensure that our initial estimates do not exceed any revised estimated periods from which we expect to realize cash flows from the technologies. If a change were to occur in any of the above-mentioned factors or estimates, the likelihood of a material change in our reported results would increase.

At December 31, 2010, the net book value of identifiable intangible assets that are subject to amortization totaled $199,960.

We determined that, as of December 31, 2010, there have been no significant events which may have affected the carrying value of the mineral acquisition right.

Stock-based Compensation

We use the fair value method to account for share-based payments.

Formatted:Level 1

Formatted:Centered

-26-

Formatted:Centered

-27-

Bio-Carbon Systems International Inc.

BIO-CARBON SYSTEMS INTERNATIONAL INC.

(An Exploration Stage Company)

Audited Financial Statements

As of December 31, 2010 and For the Period Inception (July 10, 2009) to December 31, 2009

FINANCIAL INFORMATION

Page

Auditor Letter

29

Balance Sheets

30

Statements of Stockholders’ Deficit

32

Statements of Operations and Comprehensive Loss

33

Statements of Cash Flows

35

Notes to the financial statements

37

Formatted:Centered

-28-

Report of Independent Registered Public Accounting Firm

To Stockholders of Bio-Carbon Systems International Inc.

We have audited the accompanying balance sheet of Bio-Carbon Systems International Inc. as of December 31, 2010, and the related statements of operations, changes in stockholder’s deficit, and cash flows for the year then ended.Bio-Carbon Systems International Inc’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Bio-Carbon Systems International Inc. as of December 31, 2010, and the results of its operations and its cash flows for the year then ended in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company’s significant operating losses raise substantial doubt about its ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ DNTW Chartered Accountants, LLP

DNTW Chartered Accountants, LLP

Licensed Public Accountants

Markham, Ontario, Canada

April 14, 2011

Formatted:Centered

-29-

| | | |

| Bio-Carbon Systems International Inc. |

|

| (An Exploration Stage Company) |

|

| Balance Sheets |

|

| As at |

|

| | | December 31, 2010 | December 31, 2009 |

| ASSETS | | | |

| Current assets: | | | |

| Cash | $ | 24,786 | - |

| Accounts receivable | | 999 | - |

| Notes receivable | | 14,997 | - |

| Prepaid expense | | 12,997 | - |

| Accounts receivable from discontinued operations | | 10,942 | - |

| Total Current Assets | | 64,721 | - |

| |

| Mineral Rights | | 199,960 | |

| |

| Total Assets | $ | 264,681 | - |

| LIABILITIES | | | |

| Current liabilities | | | |

| Accounts payable and accrued liabilities | $ | 17,580 | 2,946 |

| Advances from shareholders | | 39,711 | 10,000 |

| Due on mineral rights acquisition - current portion | | 34,993 | - |

| Liabilities from discontinued operations | | 83,756 | - |

| Total Current Liabilities | | 176,040 | 12,946 |

| |

| Due on mineral rights acquisition | | 64,987 | - |

| Long term liabilities from discontinued operations | | 26,245 | - |

| Total Long Term Liabilities | | 91,232 | - |

Formatted:Centered

-30-

| | | | | |

| Total Liabilities | | 267,272 | | 12,946 | |

| Stockholders' Deficit | | | | | |

| Common stock, $0.001 par value; 400,000,000 shares | | | | | |

| authorized, 265,190,000 (2009 - 35,000,000) shares | | | | | |

| issued and outstanding | | | | | |

| Common stock | | 26,519 | | 3,500 | |

| Preferred stock, $0.001 par value; 100,000,000 shares | | | | | |

| authorized, 240,000 (2009 - zero) shares issued and | | | | | |

| outstanding | | | | | |

| Preferred shares | | 24 | | - | |

| Shares to be issued | | 98,450 | | - | |

| Additional paid in capital | | 340,196 | | - | |

| Accumulated other comprehensive income | | 1,919 | | - | |

| Deficit accumulated during the exploration stage | | (469,699 | ) | (16,446 | ) |

| Total Stockholders’ Deficit | | (2,591 | ) | (12,946 | ) |

| |

| Total Liabilities and Stockholders’ Deficit | $ | 264,681 | | - | |

| See accompanying notes to the financial statements. | | | | | |

Formatted:Centered

-31-

| | | | | | | | | | | | | | | | | | | |

| | | | | Bio-Carbon Systems International Inc. | | | | | | | | | |

| | | | | (An Exploration Stage Company) | | | | | | | | | |

| | | | | Statements of Stockholders’ Deficit | | | | | | | | | |

| | | | For the Period Inception (July 10, 2009) to December 31, 2010 | | | | | | |

| |

| |

| | Preferred Stock | Common Stock | | Additional Acc. Other | | | | | Total | |

| |

| | Class A | | | | | | | Shares | Paid | -In | | | Comprehensive | | Accumulated Stockholders | |

| | | | | | | Par | | To be | | | | | | | | | | | |

| | Shares | | Par Value | Shares | | Value | | Issued | | Capital | | | Income | | Deficit | | | Deficit | |

| |

| |

| Issuance of stock | | | | | | | | | | | | | | | | | | | |

| for cash | | | | 35,000,000 | $ | 3,500 | | | | | | | | | | | $ | 3,500 | |

| |

| |

| Net loss | | | | | | | | | | | | | | | (16,446 | ) | | (16,446 | ) |

| |

| Balance, 31 | | | | | | | | | | | | | | | | | | | |

| December 2009 | | | | 35,000,000 | | 3,500 | | | | | | | | | (16,446 | ) | | (12,946 | ) |

| |

| |

| Issuance of stock | | | | | | | | | | | | | | | | | | | |

| for cash | | | | 96,550,000 | | 9,655 | | | | 70,518 | | | | | | | | 80,173 | |

| Issuance of stock | | | | | | | | | | | | | | | | | | | |

| for notes | | | | | | | | | | | | | | | | | | | |

| receivable | | | | 50,000,000 | | 5,000 | | | | 9,435 | | | | | | | | 14,435 | |

| |

| Issuance of stock | | | | | | | | | | | | | | | | | | | |

| for services | 240,000 | | 24 | 83,640,416 | | 8,364 | | | | 260,243 | | | | | | | | 268,631 | |

| Issuance of stock | | | | | | | | | | | | | | | | | | | |

| for acquisition for | | | | | | | | | | | | | | | | | | | |

| mineral rights | | | | 1,000,000 | | | | 98,450 | | | | | | | | | | 98,450 | |

| |

| Foreign currency | | | | | | | | | | | | | | | | | | | |

| translation | | | | | | | | | | | | | 1,919 | | | | | 1,919 | |

| |

| |

| Net loss | | | | | | | | | | | | | | | (453,253 | ) | | (453,253 | ) |

| |

| |

| |

| Balance, 31 | | | | | | | | | | | | | | | | | | | |

| December 2010 | 240,000 | $ | 24 | 266,190,416 | $ | 26,519 | $ | 98,450 | $340,196 | $ | 1,919 | $ | (469,699 | ) | $ | (2,591 | ) |

| |

| | See accompanying notes to the financial statements. | | | | | | | | | | | | | |

Formatted:Centered

-32-

Bio-Carbon Systems International Inc.

(An Exploration Stage Company)

Statements of Operations and Comprehensive Loss

| | | | | | | | | |

| | | For the | | | For the Period | | | For the Period | |

| | | Year | | | from Inception | | | from Inception | |

| | | Ended | | | (July 10, 2009) to | | | (July 10, 2009) to | |

| | | December | | | December 31, 2009 | | | December 31, | |

| | | 31, 2010 | | | | | | 2010 | |

| Operating expenses | | | | | | | | | |

| General and administrative | $ | 143 | | $ | 3,446 | | $ | 3,589 | |

| Professional fees | | 11,624 | | | 13,000 | | | 24,624 | |

| Total Operating Expenses | | 11,767 | | | 16,446 | | | 28,213 | |

| |

| Loss From Continuing Operations Before Taxes | | (11,767 | ) | | (16,446 | ) | | (28,213 | ) |

| Income taxes | | - | | | - | | | - | |

| Loss from continuing operations | | (11,767 | ) | | (16,446 | ) | | (28,213 | ) |

| Loss from discontinued operations | | (441,486 | ) | | - | | | (441,486 | ) |

| Net Loss | | (453,253 | ) | | (16,446 | ) | | (469,699 | ) |

| Foreign currency translation adjustment | | 1,919 | | | - | | | 1,919 | |

| Comprehensive Loss | $ | (451,334 | ) | $ | (16,446 | ) | $ | (467,780 | ) |

| Net loss per common share - basic and diluted | | | | | | | | | |

| Continuing operations | $ | 0.00 | | $ | 0.00 | | | | |

| Discontinued operations | $ | 0.00 | | $ | 0.00 | | | | |