- PECO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B3 Filing

Phillips Edison & Company (PECO) 424B3Prospectus supplement

Filed: 17 Apr 12, 12:00am

Filed Pursuant to Rule 424(B)(3)

Registration No. 333-164313

PHILLIPS EDISON – ARC SHOPPING CENTER REIT INC.

SUPPLEMENT NO. 7 DATED APRIL 17, 2012

TO THE PROSPECTUS DATED NOVEMBER 22, 2011

This document supplements, and should be read in conjunction with, our prospectus dated November 22, 2011 relating to our offering of 180 million shares of common stock, as supplemented by Supplement No. 4 dated February 13, 2012, Supplement No. 5 dated February 27, 2012, and Supplement No. 6 dated March 28, 2012. Unless otherwise defined in this Supplement No. 7, capitalized terms used have the same meanings as set forth in the prospectus. The purpose of this supplement is to disclose, among other things, the following:

| • | the status of the offering; and |

| • | updated information regarding the prior performance of programs operated by our sponsors, including prior performance tables, as of December 31, 2011. |

Status of the Offering

We commenced this initial public offering on August 12, 2010, pursuant to which we are offering up to 150 million shares of our common stock in a primary offering at $10.00 per share, with discounts available for certain categories of purchasers, and up to 30 million shares of our common stock pursuant to our dividend reinvestment plan at $9.50 per share. As of April 4, 2012, we had raised aggregate gross offering proceeds of approximately $38.5 million from the sale of approximately 4.0 million shares in our initial public offering, including shares sold under our dividend reinvestment plan.

Prior Performance Summary

The following information supersedes the disclosure in the prospectus under the heading “Prior Performance Summary.”

The information presented in this section represents the historical experience of all real estate programs managed over the last ten years by Messrs. Phillips and Edison, our individual Phillips Edison sponsors, and Messrs. Schorsch and Kahane, our individual AR Capital sponsors. In assessing the relative importance of this information with respect to a decision to invest in this offering, you should keep in mind that we will rely primarily on affiliates of our Phillips Edison sponsor to identify acquisitions and manage our portfolio and we will rely primarily on affiliates of our AR Capital sponsor with respect to our capital-raising efforts, although both AR Capital Advisor and Phillips Edison Sub-Advisor will jointly participate in major decisions as described in this prospectus at “Management – Our Advisor and Sub-Advisor.” You should also note that only programs sponsored by Phillips Edison have invested in our targeted portfolio of grocery-anchored neighborhood shopping centers.

Unless otherwise indicated, the information presented below with respect to the historical experience of Phillips Edison and the private real estate funds sponsored by Phillips Edison and of AR Capital and the prior programs sponsored by AR Capital is as of the 10-years ended December 31, 2011. By purchasing shares in this offering, you will not acquire any ownership interest in any funds to which the information in this section relates and you should not assume that you will experience returns, if any, comparable to those experienced by the investors in the real estate funds discussed. Further, the private funds discussed in this section were conducted through privately held entities that were subject neither to the up-front commissions, fees and expenses associated with this offering nor all of the laws and regulations that will apply to us as a publicly offered REIT.

We intend to conduct this offering in conjunction with future offerings by one or more public and private real estate entities sponsored by Phillips Edison and AR Capital and their respective affiliates. To the extent that such entities have the same or similar objectives as ours or involve similar or nearby properties, such entities may be in competition with the properties acquired by us. See the section entitled “Conflicts of Interest” in this prospectus for additional information.

Appendix A includes five tables with information about the public programs and private funds discussed in this section. They present information with respect to (1) the experience of our sponsors in raising and investing in funds, (2) the compensation paid by prior funds to the sponsor and its affiliates, (3) the operating results of prior funds, (4) sales or disposals of properties by prior funds, and (5) results of completed funds. In all cases, the tables presenting information about the historical experience of programs sponsored by Phillips Edison appear first, followed by tables summarizing similar information for AR Capital.

1

Private Programs Sponsored by Phillips Edison

Since 1991, Michael C. Phillips and Jeffrey S. Edison, have partnered to acquire, manage and reposition necessity-driven retail properties, primarily grocery-anchored neighborhood and community shopping centers across the United States. Phillips Edison has operated with financial partners through both property-specific and multi-asset discretionary funds, and to date, Phillips Edison has sponsored six private real estate funds and raised approximately $600 million of equity from high-net-worth individuals and institutional investors.

During the 10-year period ended December 31, 2011, Phillips Edison managed six private real estate funds, all of which were multi-investor, commingled funds. All of these private funds were limited partnerships for which affiliates of Messrs. Phillips and Edison act or acted as general partner. In all cases, affiliates of Messrs. Phillips and Edison had responsibility for acquiring, investing, managing, leasing, developing and selling the real estate and real estate-related assets of each of the funds.

Two of the six private real estate funds managed by Phillips Edison raised approximately $395 million of equity capital from 12 institutional investors during the 10-year period ended December 31, 2011. The institutional investors investing in the private funds include public pension funds, sovereign wealth funds, insurance companies, financial institutions, endowments and foundations. For more information regarding the experience of our sponsors in raising funds from investors, see Table I and Table II of the Prior Performance Tables contained in Appendix A of this supplement.

During the 10-year period ended December 31, 2011, Phillips Edison acquired 241 real estate investments and invested over $1.8 billion in these assets (purchase price) on behalf of the six private funds raising capital for new investments during this period. Debt financing was used in acquiring the properties in all of these six private funds.

Four of the six private funds managed by Phillips Edison during the 10-year period ended December 31, 2011 have or had investment objectives that are similar to ours. Like ours, their primary investment objectives are to provide investors with stable returns, to preserve and return their capital contributions and to realize growth in the value of their investments. In addition, investments in real estate and real estate-related assets involve similar assessments of the risks and rewards of the operation of the underlying real estate and financing thereof as well as an understanding of the real estate and real estate-finance markets. For each of the private funds, Phillips Edison has focused on acquiring a diverse portfolio of real estate investments. Phillips Edison has typically diversified the portfolios of the private funds by geographic region, investment size, and tenant mix. In constructing the portfolios of the six private funds, Phillips Edison specialized in acquiring a mix of value-added and enhanced-return properties. Value-added and enhanced-return assets are assets that are undervalued or that could be repositioned to enhance their value.

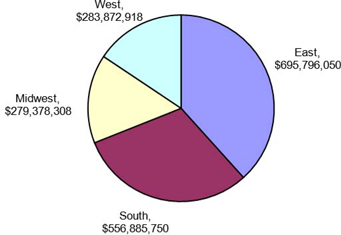

Phillips Edison has sought to diversify investments in its private funds by geographic region as illustrated by the chart below. The chart below outlines investments of the private funds by amounts invested (purchase price) during the 10-year period ended December 31, 2011. All were within the United States. The geographic dispersion of properties acquired during the 10-year period ended December 31, 2011 is as follows: 38% of the amount was invested in 96 properties located in the eastern United States, 31% of the amount was invested in 64 properties located in the southern United States, 16% of the amount was invested in 45 properties located in the western United States and 15% of the amount was invested in 36 properties located in the midwestern United States.

2

PHILLIPS EDISON - PRIVATE PROGRAMS

INVESTMENT BY REGION

In addition to diversifying the private fund portfolios by geographic region, Phillips Edison has primarily focused on necessity-driven retail investments that include the following categories: grocery, general merchandise, discount, health and beauty, and office supply retailers. Unlike industries that are routinely affected by cyclical fluctuations in the economy, shopping centers anchored by these retailers have historically been more resistant to economic downturns. In general, the consistent consumer demand for items such as food, pharmaceutical goods, postal services, general retail and hardware is present in all cycles of the economy.

In seeking to diversify the portfolios of the private funds by investment risk, Phillips Edison has purchased a mix of low-risk, high-quality properties and high-quality but under-performing properties in need of repositioning. The majority of the properties purchased by the private funds had prior owners and operators.

During the 10-year period ended December 31, 2011, Phillips Edison sold 50 properties on behalf of these six private funds. Phillips Edison continues to actively manage the remaining unsold properties of these private funds.

Though the private funds were not subject to the up-front commissions, fees and expenses associated with this offering, the private funds have fee arrangements with Phillips Edison affiliates structured similar to ours. The percentage of the fees varied based on the market factors at the time the particular fund was formed. For more information regarding the fees paid to Phillips Edison affiliates by these private funds and the operating results of these private funds, please see Tables II and III of the Prior Performance Tables in Appendix A of this supplement.

Two of the six private real estate funds managed by Phillips Edison (referred to as Fund I and Fund II) both experienced a liquidity event in 2004, at which time, investors in these funds were given the option to liquidate their investments or to convert their investments into shares of Phillips Edison Limited Partnership. Approximately 80% of the investors in Fund I and Fund II remained in the funds. The remaining four private real estate funds managed by Phillips Edison are fully invested, but have not yet had a liquidity event under the terms of their respective fund agreements. Note that an investment in this offering is substantially different than an investment in any of the Phillips Edison sponsored private offerings. Prior offerings have focused on purchasing value-add grocery-anchored shopping centers. This offering will invest primarily in core and core plus grocery-anchored shopping centers that are well-occupied, have a higher ratio of national and regional retailers and are located in more heavily populated locations.

Adverse Business Developments and Conditions

Market timing is a strategy of buying or selling assets based on predictions of future market price movements. Phillips Edison has not tried to time the sponsorship of real estate programs based on its predictions of the real estate market as a whole. For most of the last 10 years, sponsored programs have been raising capital in order to acquire a desirable portfolio of real estate. As the money has been raised, sponsored programs have sought

3

to acquire real estate at favorable prices based on then-current market conditions. In other words, such programs have generally sought to put capital to use promptly if suitable investments are available rather than hold substantial amounts of cash for long periods. Although our Phillips Edison sponsor believes that this strategy has generally served the investors in Phillips Edison-sponsored programs well, some of the assets acquired by Phillips Edison-sponsored programs were acquired at times when real estate was generally more expensive than during the later stages of the life of the program. As a result, at any given time some acquired assets of a Phillips Edison-sponsored program might sell for prices that are lower than the prices paid for them if those assets had to be liquidated at that time. This can be true even if the property remains leased to creditworthy tenants with long-term leases such that the program continues to project strong income yields. This possibility is the primary reason why Phillips Edison-sponsored programs are sold as long-term investments. With a long-term investment horizon, Phillips Edison-sponsored programs have more flexibility to liquidate or list at a more favorable time during a real estate cycle. Nevertheless, we cannot make any assurances regarding our ability to liquidate or list at a time when real estate prices are attractive relative to the prices we will pay for our portfolio.

Fund III, and other private real estate funds owned and/or managed by Phillips Edison, acquired properties between 2005 through 2007, a time of historically low capitalization rates. Subsequent to these acquisitions, real property values declined and some of the properties experienced a loss of occupancy. Some of these properties had impairments that were recognized in 2010 and 2011.

Prior Investment Programs Sponsored by AR Capital

The information presented in this section represents the historical experience of the real estate programs managed or sponsored over the last ten years by Messrs. Schorsch and Kahane. In connection with ARCT’s internalization and listing on The NASDAQ Global Select Market in March 2012, Mr. Kahane has resigned from the various officer positions he held with the sponsor and its affiliates. Investors should not assume that they will experience returns, if any, comparable to those experienced by investors in such prior real estate programs. The prior performance of real estate investment programs sponsored by affiliates of Messrs. Schorsch and Kahane and AR Capital advisor may not be indicative of our future results. The information summarized below is current as of December 31, 2011 and is set forth in greater detail in the Prior Performance Tables included in this prospectus. In addition, we will provide upon request to us and without charge, a copy of the most recent Annual Report on Form 10-K filed with the SEC by any public program within the last 24 months, and for a reasonable fee, a copy of the exhibits filed with such annual report.

We intend to conduct this offering in conjunction with future offerings by one or more public and private real estate entities sponsored by AR Capital and its affiliates. To the extent that such entities have the same or similar objectives as ours or involve similar or nearby properties, such entities may be in competition with the properties acquired by us. See the section entitled “Conflicts of Interest” in this prospectus for additional information.

Summary Information

During the period from August 2007 (inception of the first program) to December 31, 2011, affiliates of AR Capital Advisor have sponsored nine public programs, of which there were five public programs that had raised funds as of December 31, 2011 and five non-public programs which had similar investment objectives to our program. From August 2007 (inception of the first public program) to December 31, 2011, AR Capital’s public programs, which include ARCT, NYRR, ARC RCA, ARC DNAV, ARCT III, ARCP, and ARC Global Daily NAV and the programs consolidated into ARCT which were ARC Income Properties II and all of the Section 1031 Exchange Programs described below, had raised $2.0 billion from 47,342 investors in public offerings and an additional $37.5 million from 205 investors in a private offering by ARC Income Properties II and 45 investors in private offerings by the Section 1031 Exchange Programs. The public programs purchased 639 properties with an aggregate purchase price of $2.7 billion, including acquisition fees, in 47 states and U.S. territories.

4

The following table details the percentage of properties by state based on purchase price:

State/Possession | Purchase Price | |||

Alabama | 1.2 | % | ||

Arizona | 2.8 | % | ||

Arkansas | 1.4 | % | ||

California | 3.9 | % | ||

Colorado | 0.5 | % | ||

Connecticut | 0.1 | % | ||

Delaware | 0.0 | % | ||

Florida | 2.6 | % | ||

Georgia | 3.8 | % | ||

Idaho | 0.2 | % | ||

Illinois | 6.9 | % | ||

Indiana | 0.7 | % | ||

Iowa | 1.2 | % | ||

Kansas | 1.7 | % | ||

Kentucky | 2.6 | % | ||

Louisiana | 1.3 | % | ||

Maine | 0.3 | % | ||

Maryland | 2.5 | % | ||

Massachusetts | 1.3 | % | ||

Michigan | 3.6 | % | ||

Minnesota | 0.7 | % | ||

Mississippi | 0.6 | % | ||

Missouri | 4.6 | % | ||

Montana | 0.3 | % | ||

Nebraska | 1.2 | % | ||

Nevada | 2.2 | % | ||

New Hampshire | 0.5 | % | ||

New Jersey | 1.8 | % | ||

New Mexico | 0.1 | % | ||

New York | 15.6 | % | ||

North Carolina | 1.9 | % | ||

North Dakota | 0.1 | % | ||

Ohio | 7.1 | % | ||

Oklahoma | 0.6 | % | ||

Oregon | 0.2 | % | ||

Pennsylvania | 4.6 | % | ||

Puerto Rico | 0.4 | % | ||

South Carolina | 3.0 | % | ||

5

South Dakota | 0.1 | % | ||

Tennessee | 1.1 | % | ||

Texas | 9.9 | % | ||

Utah | 1.2 | % | ||

Vermont | 0.1 | % | ||

Virginia | 1.2 | % | ||

Washington | 0.3 | % | ||

West Virginia | 0.8 | % | ||

Wisconsin | 1.1 | % | ||

|

| |||

| 100 | % | |||

|

|

The properties are all commercial properties in the following industries based on purchase price.

Industry | Purchase Price | |||

Aerospace | 0.5 | % | ||

Auto Retail | 1.5 | % | ||

Auto Services | 3.0 | % | ||

Consumer Goods | 0.9 | % | ||

Consumer Products | 2.7 | % | ||

Discount Retail | 6.2 | % | ||

Financial Services | 1.0 | % | ||

Freight | 13.9 | % | ||

Gas/Convenience | 1.9 | % | ||

Government Services | 3.8 | % | ||

Healthcare | 11.6 | % | ||

Home Maintenance | 3.0 | % | ||

Manufacturing | 4.4 | % | ||

Parking | 0.2 | % | ||

Pharmacy | 16.3 | % | ||

Restaurant | 3.1 | % | ||

Retail | 6.8 | % | ||

Retail Banking | 9.1 | % | ||

Specialty Retail | 6.5 | % | ||

Supermarket | 1.9 | % | ||

Technology | 1.2 | % | ||

Telecommunications | 0.5 | % | ||

|

| |||

| 100.0 | % | |||

|

| |||

6

The purchased properties were 37.2% new and 62.8% used, based on purchase price. None of the purchased properties were construction properties. As of December 31, 2011, two properties had been sold. The acquired properties were purchased with a combination of proceeds from the issuance of common stock, the issuance of convertible preferred stock, mortgage notes payable, short-term notes payable, revolving lines of credit, long-term notes payable issued in private placements and joint venture arrangements.

During the period from June 2008 (inception of the first non-public program) to December 31, 2011, the non-public programs, which were ARC Income Properties, ARC Income Properties II, ARC Income Properties III, ARC Income Properties IV and ARC Growth Fund, LLC, had raised $54.4 million from 694 investors. The non-public programs purchased 171 properties with an aggregate purchase price of $247.9 million including acquisition fees, in 18 states.

The following table details the percentage of properties by state based on purchase price:

State location | Purchase Price % | |||

Alabama | 0.1 | % | ||

Connecticut | 0.6 | % | ||

Delaware | 4.8 | % | ||

Florida | 11.0 | % | ||

Georgia | 3.5 | % | ||

Illinois | 6.6 | % | ||

Louisiana | 2.3 | % | ||

Michigan | 11.5 | % | ||

North Carolina | 0.1 | % | ||

New Hampshire | 0.5 | % | ||

New Jersey | 13.0 | % | ||

New York | 9.7 | % | ||

Ohio | 10.3 | % | ||

Pennsylvania | 9.5 | % | ||

South Carolina | 8.4 | % | ||

Texas | 5.0 | % | ||

Virginia | 1.2 | % | ||

Vermont | 2.2 | % | ||

|

| |||

| 100 | % | |||

|

| |||

The properties are all commercial single tenant facilities with 81.0% retail banking and 10.5% retail distribution facilities and 8.6% specialty retail. The purchased properties were 11.0% new and 89.0% used, based on purchase price. None of the purchased properties were construction properties. As of December 31, 2011, 53 properties had been sold. The acquired properties were purchased with a combination of equity investments, mortgage notes payable and long-term notes payable issued in private placements.

7

Programs of Our AR Capital Sponsor

American Realty Capital Trust, Inc.

American Realty Capital Trust, Inc., or ARCT, a Maryland corporation, is the first publicly offered REIT sponsored by American Realty Capital. ARCT was incorporated on August 17, 2007, and qualified as a REIT beginning with the taxable year ended December 31, 2008. ARCT commenced its initial public offering of 150.0 million shares of common stock on January 25, 2008. As of December 31, 2011, ARCT had received aggregate gross offering proceeds of approximately $1.7 billion from the sale of approximately 171.9 million shares in its initial public offering. On August 5, 2010, ARCT filed a registration statement on Form S-11 to register 32.5 million shares of common stock in connection with a follow-on offering. ARCT’s initial public offering was originally set to expire on January 25, 2011, three years after its effective date. However, as permitted by Rule 415 of the Securities Act, ARCT was permitted to continue its initial public offering until July 25, 2011. On July 7, 2011 ARCT had sold all of the 150.0 million shares that were registered in connection with the initial public offering and as permitted, began to sell the remaining 25.0 million shares that were initially registered for ARCT’s distribution reinvestment plan. On July 11, 2011, ARCT filed a request to withdraw the registration of the additional 32.5 million shares, and on July 15, 2011, ARCT filed a registration statement on Form S-3 to register an additional 24.0 million shares to be used in connection with its distribution reinvestment plan. On March 1, 2012, ARCT internalized the management services previously provided by its advisor and ARCT’s common stock was listed on The NASDAQ Global Select Market under the symbol “ARCT”. As of March 31, 2012, ARCT had acquired 485 properties, primarily comprised of free standing, single-tenant retail and commercial properties that are net leased to investment grade and other creditworthy tenants. As of March 31, 2012, ARCT had total real estate investments, at cost, of approximately $2.1 billion. As of December 31, 2011, ARCT had incurred, cumulatively to that date, $198.0 million in offering costs, commissions and dealer manager fees for the sale of its common stock and $43.0 million for acquisition costs related to its portfolio of properties.

American Realty Capital New York Recovery REIT, Inc.

American Realty Capital New York Recovery REIT, Inc., or NYRR, a Maryland corporation, is the second publicly offered REIT sponsored by American Realty Capital. NYRR was incorporated on October 6, 2009 and qualified as a REIT beginning with the taxable year ended December 31, 2010. NYRR filed its initial registration statement with the SEC on November 12, 2009 and became effective on September 2, 2010. To date, NYRR had received aggregate gross offering proceeds of approximately $17.0 million from the sale of 2.0 million shares from a private offering to “accredited investors” (as defined in Regulation D as promulgated under the Securities Act). On December 15, 2011, NYRR exercised its option to convert all its outstanding preferred shares into approximately 2.0 million shares of common stock on a one-to-one basis. As of March 31, 2012, NYRR had received aggregate gross proceeds of approximately $66.9 million from the sale of 6.7 million shares in its public offering. As of March 31, 2012, there were approximately 8.8 million shares of NYRR common stock outstanding, including restricted stock, converted preferred shares, and shares issued under its distribution reinvestment plan. As of March 31, 2012, NYRR had total real estate investments, at cost, of approximately $144.9 million. As of December 31, 2011, NYRR had incurred, cumulatively to that date, approximately $12.4 million in selling commissions, dealer manager fees and other organizational and offering costs for the sale of its common stock.

American Realty Capital Healthcare Trust, Inc.

American Realty Capital Healthcare Trust, Inc. or ARC HT, a Maryland corporation, is the fourth publicly offered REIT sponsored by American Realty Capital. ARC HT was organized on August 23, 2010 and qualified as a REIT beginning with the taxable year ended December 31, 2011. ARC HT filed its registration statement with the SEC on August 27, 2010 and became effective on February 18, 2011. As of March 31, 2012, ARC HT had received aggregate gross offering proceeds of approximately $132.3 million from the sale of approximately 13.3 million shares in its public offering. As of March 31, 2012, ARC HT had acquired 17 commercial properties, for a purchase price of approximately $195.3 million. As of December 31, 2011, ARC HT had incurred, cumulatively to that date, approximately $12.3 million in offering costs for the sale of its common stock and $3.4 million for acquisition costs related to its portfolio of properties.

8

American Realty Capital – Retail Centers of America, Inc.

American Realty Capital – Retail Centers of America, Inc., or ARC RCA, a Maryland corporation, is the fifth publicly offered REIT sponsored by American Realty Capital. ARC RCA was organized on July 29, 2010 and intends to qualify as a REIT beginning with the taxable year ending December 31, 2012. ARC RCA filed its registration statement with the SEC on September 14, 2010 and became effective on March 17, 2011. As of March 31, 2012, ARC RCA had received aggregate gross proceeds of approximately $2.4 million from the sale of 0.3 million shares in its public offering, but had not acquired any properties.

American Realty Capital Daily Net Asset Value Trust, Inc.

American Realty Capital Daily Net Asset Value Trust, Inc. (formerly known as American Realty Capital Trust II, Inc.), or ARC DNAV, a Maryland corporation, is the sixth publicly offered REIT sponsored by American Realty Capital. ARC Daily NAV was incorporated on September 10, 2010 and intends to qualify as a REIT beginning with the taxable year ending December 31, 2012. ARC DNAV filed its registration statement with the SEC on October 8, 2010 and became effective on August 15, 2011. As of March 31, 2012, ARC DNAV had received aggregate gross proceeds of approximately $2.4 million from the sale of 0.3 million shares in its public offering. As of March 31, 2012 ARC DNAV had acquired five properties with total real estate investments, at cost, of approximately $23.2 million.

American Realty Capital Trust III, Inc.

American Realty Capital Trust III, Inc., or ARCT III, a Maryland corporation, is the seventh publicly offered REIT sponsored by American Realty Capital. ARCT III was incorporated on October 15, 2010 and qualified as a REIT beginning with the taxable year ended December 31, 2011. ARCT III filed its registration statement with the SEC on November 2, 2010 and became effective on March 31, 2011. As of March 31, 2012, ARCT III had received aggregate gross proceeds of approximately $318.2 million from the sale of 32.0 million shares in its public offering. As of March 31, 2012, ARCT III owned 93 single tenant, free standing properties and had total real estate investments, at cost, of $268.2 million. As of December 31, 2011, ARCT III had incurred, cumulatively to that date, approximately $15.9 million in offering costs for the sale of its common stock and approximately $2.0 million for acquisition costs related to its portfolio of properties.

American Realty Capital Properties, Inc.

American Realty Capital Properties, Inc., or ARCP, a Maryland corporation, is the eighth publicly offered REIT sponsored by American Realty Capital. ARCP was incorporated on December 2, 2010 and qualified as a REIT beginning with the taxable year ended December 31, 2011. ARCP filed its registration statement with the SEC on February 11, 2011 and became effective by the SEC on July 7, 2011. On September 6, 2011, ARCP completed its initial public offering of approximately 5.6 million shares of common stock. ARCP’s common stock is traded on The NASDAQ Capital Market under the symbol “ARCP.” On September 22, 2011, ARCP filed its registration statement with the SEC in connection with an underwritten follow-on offering of 1.5 million shares of its common stock. On November 2, 2011, ARCP completed its secondary offering of 1.5 million shares of common stock. In addition, on November 7, 2011, ARCP closed on the underwriters’ overallotment option of an additional 0.1 million shares of common stock. In aggregate, ARCP has received $83.9 million of proceeds from the sale of common stock. As of March 31, 2012, ARCP owned 92 single tenant, free standing properties and real estate investments, at a purchase price of approximately $157.3 million.

9

American Realty Capital Global Daily Net Asset Value Trust, Inc.

American Realty Capital Global Daily Net Asset Value Trust, Inc., or ARC Global Daily NAV, a Maryland corporation, is the ninth publicly offered REIT sponsored by American Realty Capital. ARC Global Daily NAV was incorporated on July 13, 2011 and intends to qualify as a REIT beginning with the taxable year ending December 31, 2012. ARC Global Daily NAV filed its registration statement with the SEC on October 27, 2011, which has not yet been declared effective. As of March 31, 2012, ARC Global Daily NAV had not raised any money in connection with the sale of its common stock nor had it acquired any properties.

American Realty Capital Trust IV, Inc.

American Realty Capital Trust IV, Inc., or ARCT IV, a Maryland corporation, is the tenth publicly offered REIT sponsored by American Realty Capital. ARCT IV was incorporated on February 14, 2012 and intends to qualify as a REIT beginning with the taxable year ending December 31, 2012. ARCT IV filed its registration statement with the SEC on March 21, 2012, which has not yet been declared effective. As of March 31, 2012, ARCT IV had not raised any money in connection with the sale of its common stock nor had it acquired any properties.

Business Development Corporation of America

The American Realty Capital group of companies also has sponsored Business Development Corporation of America, or Business Development Corporation, a Maryland corporation. Business Development Corporation was organized on May 5, 2010 and is a publicly offered specialty finance company which has elected to be treated as a business development company under the Investment Company Act of 1940. As of March 31, 2012, Business Development Corporation had raised gross proceeds of $26.9 million from the sale of 2.7 million shares in its public offering. As of March 31, 2012, Business Development Corporation’s investments, at cost, were $32.8 million.

Liquidity of Public Programs

FINRA Rule 2310(b)(3)(D) requires that we disclose the liquidity of prior public programs sponsored by American Realty Capital. American Realty Capital has sponsored the following other public programs: ARCT, NYRR, ARC HT, ARC RCA, ARC DNAV, ARCT III, ARCP, ARC Global Daily NAV, ARCT IV and Business Development Corporation. Although the prospectus for each of these public programs states a date or time period by which it may be liquidated, NYRR, ARC HT, ARC RCA, ARC DNAV, ARCT III and Business Development Corporation are in their offering and acquisition stages. ARCT closed its initial offering and is in its acquisition stage; ARCP closed its initial offering and secondary offering and is in its acquisition stage. Neither ARC Global Daily NAV nor ARCT IV has yet been declared effective. None of these public programs have reached the stated date or time period by which they may be liquidated.

Private Note Programs

ARC Income Properties, LLC implemented a note program that raised aggregate gross proceeds of $19.5 million. The net proceeds were used to acquire, and pay related expenses in connection with, a portfolio of 65 bank branch properties triple-net leased to RBS Citizens, N.A. and Citizens Bank of Pennsylvania. The purchase price for those bank branch properties also was funded with proceeds received from mortgage loans, as well as equity capital invested by AR Capital, LLC. Such properties contain approximately 323,000 square feet with a purchase price of approximately $98.8 million. The properties are triple-net leased for a primary term of five years and include extension provisions. The notes issued under this note program by ARC Income Properties, LLC were sold by our dealer manager through participating broker-dealers. On September 7, 2011, the note holders were repaid, the properties were contributed to ARCP as part of its formation transaction, and the mortgage loans were repaid.

ARC Income Properties II, LLC implemented a note program that raised aggregate gross proceeds of $13.0 million. The net proceeds were used to acquire, and pay related expenses in connection with, a portfolio of 50 bank branch properties triple-net leased to PNC Bank. The purchase price for those bank branch properties also was funded with proceeds received from a mortgage loan, as well as equity capital raised by ARCT in connection with

10

its public offering of equity securities. The properties are triple-net leased with a primary term of ten years with a 10% rent increase after five years. The notes issued under this note program by ARC Income Properties II, LLC were sold by our dealer manager through participating broker-dealers. In May 2011, the notes were repaid in full including accrued interest and the program was closed.

ARC Income Properties III, LLC implemented a note program that raised aggregate gross proceeds of $11.2 million. The net proceeds were used to acquire, and pay related expenses in connection with the acquisition of a distribution facility triple-net leased to Home Depot. The purchase price for the property was also funded with proceeds received from a mortgage loan. The property has a primary lease term of twenty years which commenced on January 30, 2010 with a 2% escalation each year. The notes issued under this note program by ARC Income Properties III, LLC were sold by our dealer manager through participating broker-dealers. On September 7, 2011, the note holders were repaid and the property was contributed to ARCP as part of its formation transaction.

ARC Income Properties IV, LLC implemented a note program that raised proceeds of $5.4 million. The proceeds were used to acquire and pay related expenses in connection with the acquisition of six Tractor Supply stores. An existing mortgage loan of $16.5 million was assumed in connection with the acquisition. The properties had a remaining average lease term of 11.8 years with a 6.25% rental escalation every 5 years. The notes issued under this program by ARC Income Properties IV, LLC were sold by our dealer manager through participating broker-dealers.

ARC Growth Fund, LLC

ARC Growth Fund, LLC is a non-public real estate program formed to acquire vacant bank branch properties and opportunistically sell such properties, either vacant or subsequent to leasing the bank branch to a financial institution or other third-party tenant. Total gross proceeds of approximately $7.9 million were used to acquire, and pay related expenses in connection with, a portfolio of vacant bank branches. The purchase price of the properties also was funded with proceeds received from a one-year revolving warehouse facility. The purchase price for each bank branch is derived from a formulated price contract entered into with a financial institution. During the period from July 2008 to January 2009, ARC Growth Fund, LLC acquired 54 vacant bank branches from Wachovia Bank, N.A., under nine separate transactions. Such properties contain approximately 230,000 square feet with a gross purchase price of approximately $63.6 million. As of December 31, 2011, all properties were sold, 28 of which were acquired and simultaneously sold, resulting in an aggregate gain of approximately $4.8 million.

Section 1031 Exchange Programs

American Realty Capital Exchange, LLC, or ARCX, an affiliate of American Realty Capital, developed a program pursuant to which persons selling real estate held for investment can reinvest the proceeds of that sale in another real estate investment in an effort to obtain favorable tax treatment under Section 1031 of the Code, or a Section 1031 Exchange Program. ARCX acquires real estate to be owned in co-tenancy arrangements with persons desiring to engage in such like-kind exchanges. ARCX acquires the subject property or portfolio of properties and, either concurrently with or following such acquisition, prepares and markets a private placement memorandum for the sale of co-tenancy interests in that property. ARCX has engaged in four Section 1031 Exchange Programs raising aggregate gross proceeds of $10.1 million.

American Realty Capital Operating Partnership, L.P. purchased a Walgreens property in Sealy, TX under a tenant in common structure with an unaffiliated third party, a Section 1031 Exchange Program. The third party’s investment of $1.1 million represented a 44.0% ownership interest in the property. The remaining interest of 56% will be retained by American Realty Capital Operating Partnership, L.P. To date, $1.1 million has been accepted by American Realty Capital Operating Partnership, L.P. pursuant to this program.

American Realty Capital Operating Partnership, L.P., an affiliate of American Realty Capital, previously had transferred 49% of its ownership interest in a Federal Express distribution facility, located in Snowshoe, Pennsylvania, and a PNC Bank branch, located in Palm Coast, Florida, to American Realty Capital DST I, or ARC DST I, a Section 1031 Exchange Program. Realty Capital Securities, LLC, our dealer manager, has offered membership interests of up to 49%, or $2.6 million, in ARC DST I to investors in a private offering. The remaining interests of no less than 51% will be retained by American Realty Capital Operating Partnership, L.P. To date, cash payments of $2.6 million have been accepted by American Realty Capital Operating Partnership, L.P. pursuant to this program.

11

American Realty Capital Operating Partnership, L.P. also has transferred 35.2% of its ownership interest in a PNC Bank branch location, located in Pompano Beach, Florida, to American Realty Capital DST II, or ARC DST II, a Section 1031 Exchange Program. Realty Capital Securities, our dealer manager, has offered membership interests of 35.2%, or $0.5 million, in ARC DST II to investors in a private offering. The remaining interests of no less than 64.8% will be retained by American Realty Capital Operating Partnership, L.P. To date, cash payments of $0.5 million have been accepted by American Realty Capital Operating Partnership, L.P pursuant to this program.

American Realty Capital Operating Partnership, L.P. also has transferred 49% of its ownership interest in three CVS properties, located in Smyrna, Georgia, Chicago, Illinois and Visalia, California, to American Realty Capital DST III, or ARC DST III, a Section 1031 Exchange Program. Realty Capital Securities, our dealer manager, has offered membership interests of up to 49%, or $3.1 million, in ARC DST III to investors in a private offering. The remaining interests of no less than 51% will be retained by American Realty Capital Operating Partnership, L.P. To date, cash payments of $3.1 million have been accepted by American Realty Capital Operating Partnership, L.P. pursuant to this program.

American Realty Capital Operating Partnership, L.P. has transferred 49% of its ownership interest in six Bridgestone Firestone properties, located in Texas and New Mexico, to American Realty Capital DST IV, or ARC DST IV, a Section 1031 Exchange Program. Realty Capital Securities, our dealer manager, has offered membership interests of up to 49%, or $7.3 million, in ARC DST IV to investors in a private offering. The remaining interests of no less than 51% will be retained by American Realty Capital Operating Partnership, L.P. To date, cash payments of $7.3 million had been accepted by American Realty Capital Operating Partnership, L.P. pursuant to this program. American Realty Capital Operating Partnership, L.P. also has sold 24.9% of its ownership interest in a Jared Jewelry property located in Lake Grove, NY, under a tenant-in-common structure with an affiliated third party. The remaining interest of 75.1% will be retained by American Realty Capital Operating Partnership, L.P. To date cash payments of $0.6 million has been accepted by American Realty Capital Operating Partnership, L.P. pursuant to this program.

Other Investment Programs of Mr. Schorsch and Mr. Kahane

American Realty Capital, LLC

American Realty Capital, LLC began acquiring properties in December 2006. During the period from January 1, 2007 to December 31, 2007, American Realty Capital, LLC acquired 73 property portfolios, totaling just over 1,767,000 gross leasable square feet for an aggregate purchase price of approximately $407.5 million. These properties included a mixture of tenants, including HyVee supermarkets, CVS, Rite Aid, Walgreens, Harleysville bank branches, Logan’s Roadhouse Restaurants, Tractor Supply Company, Shop N Save, FedEx, Dollar General and Bridgestone Firestone. The underlying leases within these acquisitions ranged from 10 to 25 years before any tenant termination rights, with a dollar-weighted-average lease term of approximately 21 years based on rental revenue. During the period of April 1, 2007 through October 20, 2009, American Realty Capital, LLC sold nine properties: four Walgreens drug stores, four Logan’s Roadhouse Restaurants and one CVS pharmacy for total sales proceeds of $50.2 million.

American Realty Capital, LLC has operated in three capacities: as a joint-venture partner, as a sole investor and as an advisor. No money was raised from investors in connection with the properties acquired by American Realty Capital, LLC. All American Realty Capital, LLC transactions were done with the equity of the principals or joint-venture partners of American Realty Capital, LLC.

In instances where American Realty Capital, LLC was not an investor in the transaction, but rather solely an advisor, American Realty Capital, LLC typically performed the following advisory services: but rather an advisor, American Realty Capital, LLC typically performed the following advisory services:

| • | identified potential properties for acquisition; |

| • | negotiated letters of intent and purchase and sale contracts; |

12

| • | obtained financing; |

| • | performed due diligence; |

| • | closed properties; |

| • | managed properties; and |

| • | sold properties. |

Prior Investment Programs Sponsored by Nicholas S. Schorsch

During the period from 1998 to 2002, one of the principals of our sponsor, Nicholas S. Schorsch, sponsored seven private programs, consisting of First States Properties, L.P., First States Partners, L.P., First States Partners II, First States Partners III, First States Holdings, Chester Court Realty and Dresher Court Realty, which raised approximately $38.3 million from 93 investors and acquired properties with an aggregate purchase price of approximately $272.3 million. These private programs, or Predecessor Entities, financed their investments with investor equity and institutional first mortgages. These properties are located throughout the United States as indicated in the table below. Ninety-four percent of the properties acquired were bank branches and 6% of the properties acquired were office buildings. None of the properties included in the aforesaid figures were newly constructed. Each of these Predecessor Entities is similar to our program because they invested in long-term net lease commercial properties. The Predecessor Entities properties are located as follows:

State | No. of Properties | Square Feet | ||||||

Pennsylvania | 34 | 1,193,741 | ||||||

New Jersey | 38 | 149,351 | ||||||

South Carolina | 3 | 65,992 | ||||||

Kansas | 1 | 17,434 | ||||||

Florida | 4 | 16,202 | ||||||

Oklahoma | 2 | 13,837 | ||||||

Missouri | 1 | 9,660 | ||||||

Arkansas | 4 | 8,139 | ||||||

North Carolina | 2 | 7,612 | ||||||

Texas | 1 | 6,700 | ||||||

Attached hereto as Appendix A-1 is further prior performance information on Nicholas S. Schorsch.

American Financial Realty Trust

In 2002, American Financial Realty Trust, or AFRT, was founded by Nicholas S. Schorsch. In September and October 2002, AFRT sold approximately 40.8 million shares of common stock in a Rule 144A private placement. These sales resulted in aggregate net proceeds of approximately $378.6 million. Simultaneous with the sale of such shares, AFRT acquired certain real estate assets from a predecessor entity for an aggregate purchase price of $230.5 million, including the assumption of indebtedness, consisting of a portfolio of 87 bank branches and six office buildings containing approximately 1.5 million rentable square feet. Mr. Schorsch was the president, chief executive officer and vice-chairman of AFRT from its inception as a REIT in September 2002 until August 2006. Mr. Kahane was the chairman of the Finance Committee of AFRT’s Board of Trustees from its inception as a REIT in September 2002 until August 2006. AFRT went public on the New York Stock Exchange in June 2003 in what was at the time the second largest REIT initial public offering in U.S. history, raising over $800 million. Three years following its initial public offering, AFRT was an industry leader, acquiring over $4.3 billion in assets, over 1,110 properties (net of dispositions) in more than 37 states and over 35.0 million square feet with 175 employees and a

13

well diversified portfolio of bank tenants. On April 1, 2008 AFRT was acquired by Gramercy Capital Corp. Neither Mr. Schorsch nor Mr. Kahane owned any equity interest in AFRT at the time of the acquisition, and neither Mr. Schorsch nor Mr. Kahane currently owns an equity interest in AFRT.

Adverse Business Developments and Conditions

The net losses incurred by ARCT, NYRR, ARC Income Properties, LLC, ARC Income Properties II, LLC, ARC Income Properties III, LLC and ARC Income Properties IV, LLC are primarily attributable to non-cash items and acquisition expenses incurred for the purchases of properties which are not ongoing expenses for the operation of the properties and not the impairment of the programs’ real estate assets. With respect to ARCT, our largest program to date, for the years ended December 31, 2011, 2010 and 2009, the entire net loss was attributable to depreciation and amortization expenses incurred on the properties during the ownership period; and for the year ended December 31, 2008, 71% of the net losses were attributable to depreciation and amortization, and the remaining 29% of the net losses was attributable to the fair market valuation of certain derivative investments held.

Additionally, each of ARC Income Properties, LLC, ARC Income Properties II, LLC, ARC Income Properties III, LLC and ARC Income Properties IV, LLC is an offering of debt securities. Despite incurring net losses during certain periods, all anticipated distributions to investors have been paid on these programs through interest payments on the debt securities. The equity interests in each of these entities are owned by Nicholas Schorsch and William Kahane and their respective families. Any losses pursuant to a reduction in value of the equity in any of these entities (which has not occurred and which is not anticipated), will be borne by Messrs. Schorsch and Kahane and their respective families. On September 7, 2011, the note holders in ARC Income Properties, LLC and ARC Income Properties III, LLC were repaid and the properties were contributed to ARCP as part of its formation transaction. Additionally, the mortgage loans in ARC Income Properties, LLC were repaid.

Since its inception, ARCT has paid distributions through a combination of cash flows from operations, proceeds from the sale of common stock and the issuance of shares in accordance with the distribution reinvestment plan. Distributions paid from cash flows from operations, excluding distributions paid in shares, for the years ended December 31, 2008, 2009, 2010 and 2011 were 100.0%, 79.1%, 84.8% and 94.1%, respectively. Cumulative to date as of December 31, 2011, 89.5% of distributions paid in cash were paid from cash flows from operations with the remaining 10.5% paid from the issuance of new shares.

ARC Growth Fund, LLC was different from the other programs in that all of the properties were vacant when the portfolio was purchased and the properties were purchased with the intention of reselling them. Losses from operations represent carrying costs on the properties as well as acquisition and disposition costs in addition to non-cash depreciation and amortization costs. Upon final distribution in 2010, all investors received their entire investment plus an incremental return based on a percentage of their initial investment and the sponsor retained the remaining available funds and four properties which were unsold at the end of the program.

None of the referenced programs have been subject to any tenant turnover and have experienced a non-renewal of only two leases. Further, none of the referenced programs have been subject to mortgage foreclosure or significant losses on the sales of properties.

Attached hereto as Appendices A-1 and A-2 are further prior performance information on AFRT and Nicholas S. Schorsch, respectively.

Other than as disclosed above, there have been no major adverse business developments or conditions experienced by any program or non-program property that would be material to investors, including as a result of recent general economic conditions.

14

APPENDIX A

PRIOR PERFORMANCE TABLES

The following prior performance tables (“Tables”) provide information relating to the real estate investment programs sponsored by Phillips Edison and programs sponsored by AR Capital. Each of Phillips Edison’s previous programs and investments and some of AR Capital’s prior programs and investments were conducted through privately held entities not subject to the up-front commissions, fees and expenses associated with this offering or all of the laws and regulations to which we will be subject. In addition, we are Phillips Edison’s first publicly offered investment program and Phillips Edison has never operated a public REIT before. Because of these facts, our investors should not assume that the prior performance of programs sponsored by Phillips Edison or AR Capital will be indicative of our future performance. In assessing the relative importance of this information with respect to a decision to invest in this offering, you should keep in mind that we will rely primarily on affiliates of our Phillips Edison sponsor to identify acquisitions and manage our portfolio and we will rely primarily on affiliates of our AR Capital sponsor with respect to our capital-raising efforts, although both AR Capital Advisor and Phillips Edison Sub-Advisor will jointly participate in major decisions as described in the prospectus at “Management – Our Advisor and Sub-Advisor.” You should also note that only programs sponsored by Phillips Edison have invested in our targeted portfolio of grocery-anchored neighborhood shopping centers.

Generally, Phillips Edison’s prior programs described in the following tables have investment objectives similar to ours except that Phillips Edison Strategic Investment Fund LLC focuses on acquiring power and lifestyle centers. None of the AR Capital programs had or have investment objectives similar to ours. We consider programs invested primarily in neighborhood and community shopping centers to have investment objectives similar to ours. ARC Growth Fund, LLC was formed to acquire vacant bank branch properties and opportunistically sell such properties.

The Tables below provide information on the performance of a number of private programs of Phillips Edison and public and private programs of AR Capital. This information should be read together with the summary information included in the “Prior Performance Summary” section of this prospectus.

The inclusion of the Tables does not imply that we will make investments comparable to those reflected in the Tables or that investors in our shares will experience returns comparable to the returns experienced in the programs referred to in the Tables. In addition, you may not experience any return on your investment. If you purchase our shares, you will not acquire any ownership in any of the programs to which the Tables relate.

The following tables are included herein for each of Phillips Edison and AR Capital:

TABLE I Experience in Raising and Investing Funds

TABLE II Compensation to Sponsor

TABLE III Operating Results of Prior Programs

TABLE IV Results of Completed Programs

TABLE V Sales or Disposals of Properties

A-1

Table I

EXPERIENCE IN RAISING AND INVESTING FUNDS

(UNAUDITED)

Prior Performance is not Indicative of Future Results

Table I provides a summary of the experience of Phillips Edison in raising and investing in funds for programs that have had an offering close during the three years ended December 31, 2011. Information is provided as to the manner in which the proceeds of the offering have been applied.

| Similar Programs | Other Program | |||||||||||||||||||||||

| (in thousands) | Phillips Edison Shopping Center Fund III, LP | Percentage of Total Dollar Amount Raised | Phillips Edison Shopping Center Fund IV, LP | Percentage of Total Dollar Amount Raised | Phillips Edison Strategic Investment Fund LLC | Percentage of Total Dollar Amount Raised | ||||||||||||||||||

Dollar amount offered | $ | 200,000 | $ | 500,000 | $ | 50,000 | ||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Dollar amount raised | $ | 275,000 | 100 | % | $ | 119,910 | 100 | % | $ | 65,615 | 100 | % | ||||||||||||

Less offering expenses: | ||||||||||||||||||||||||

Selling commissions and discounts | — | 0.0 | % | — | 0.0 | % | — | 0.0 | % | |||||||||||||||

Organizational and offering expenses | 816 | 0.3 | % | 909 | 0.8 | % | 77 | 0.1 | % | |||||||||||||||

Reserve for operations | — | 0.0 | % | — | 0.0 | % | — | 0.0 | % | |||||||||||||||

Other | — | 0.0 | % | — | 0.0 | % | — | 0.0 | % | |||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Available for investment | $ | 274,184 | 99.7 | % | $ | 119,001 | 99.2 | % | $ | 65,538 | 99.9 | % | ||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Acquisition costs: | ||||||||||||||||||||||||

Cash down Payment | $ | 322,300 | 117.2 | % | $ | 46,569 | 38.8 | % | $ | 47,669 | 72.6 | % | ||||||||||||

Acquisition fees | — | 0.0 | % | — | 0.0 | % | — | 0.0 | % | |||||||||||||||

Other(1) | 12,331 | 4.5 | % | 715 | 0.6 | % | 807 | 1.2 | % | |||||||||||||||

Mortgage loan | 659,945 | 240.0 | % | 80,161 | 66.9 | % | 40,095 | 61.1 | % | |||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Total acquisition costs | $ | 994,576 | 361.7 | % | $ | 127,445 | 106.3 | % | $ | 88,571 | 135.0 | % | ||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Percent leveraged | 66 | % | 63 | % | 45 | % | ||||||||||||||||||

Date offering began | January 2005 | September 2007 | January 2007 | |||||||||||||||||||||

Length of offering (in months) | 12 | 21 | 4 | |||||||||||||||||||||

Months to invest 90% available for investment (measured from date of offering)(2) | 18 | — | 45 | |||||||||||||||||||||

| (1) | Includes legal fees, environmental studies, title and other closing costs. |

| (2) | As of this offering, Fund IV is currently in its investment period and has not invested 90% of its committed capital. As assets are identified for investment equity, capital will be called to fund acquisitions throughout the remainder of the investment period. |

A-2

Table II

COMPENSATION TO SPONSOR

(UNAUDITED)

Prior Performance is not Indicative of Future Results

Table II provides the amount and type of compensation paid to Phillips Edison affiliates during the three years ended December 31, 2011 in connection with 1) each program sponsored by a Phillips Edison investment advisor that had offerings close during this period and 2) all other programs that have made payments to Phillips Edison affiliates during this period. All figures are as of December 31, 2011.

| Similar Programs | Other Programs | |||||||||||||||

| (in thousands) | Phillips Edison Shopping Center Fund III, LP | Phillips Edison Shopping Center Fund IV, LP | Phillips Edison Strategic Investment Fund LLC | Phillips Edison Strategic Investment Fund II LLC | ||||||||||||

Date offering commenced | January 2005 | September 2007 | January 2007 | September 2010 | ||||||||||||

Dollar amount raised | $ | 275,000 | $ | 119,910 | $ | 65,615 | $ | 56,655 | ||||||||

Amount paid to sponsor from proceeds of offering: | ||||||||||||||||

Underwriting fees | — | — | — | — | ||||||||||||

Acquisition fees: | ||||||||||||||||

Real estate commissions | — | — | — | — | ||||||||||||

Advisory fees | — | — | — | — | ||||||||||||

Other | — | — | — | — | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total amount paid to sponsor | — | — | — | — | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Dollar amount of cash generated from operations before deducting payments to sponsor | $ | 79,755 | $ | 14,828 | $ | 19,346 | $ | 919 | ||||||||

Amount paid to sponsor from operations: | ||||||||||||||||

Property management fees | 13,247 | 1,323 | 894 | 23 | ||||||||||||

Partnership management fees | 12,063 | 4,502 | 3,799 | 286 | ||||||||||||

Reimbursements | 4,947 | 503 | 182 | 18 | ||||||||||||

Leasing commissions | 10,171 | 927 | 1,120 | — | ||||||||||||

Acquisition fees | — | — | 450 | 50 | ||||||||||||

Development fees | 1,707 | 314 | 347- | — | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Totals | $ | 42,135 | $ | 7,569 | $ | 6,792 | $ | 377 | ||||||||

|

|

|

|

|

|

|

| |||||||||

Dollar amount of sales and refinancing before deducting payments to sponsor: | ||||||||||||||||

Cash | $ | 5,925 | — | — | — | |||||||||||

Notes | — | — | — | — | ||||||||||||

Amount paid to sponsor from sales and refinancing: | ||||||||||||||||

Selling commissions | $ | 422 | $ | 124 | — | — | ||||||||||

Incentive fees | — | — | — | — | ||||||||||||

Other | — | — | — | — | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Totals | $ | 422 | $ | 124 | — | — | ||||||||||

|

|

|

|

|

|

|

| |||||||||

A-3

Table III

OPERATING RESULTS OF PRIOR PROGRAMS

(UNAUDITED)

Prior Performance is not Indicative of Future Results

Table III summarizes the operating results of programs sponsored by Phillips Edison that have had offerings close during the five years ended December 31, 2011. For these programs, this table shows: the income or loss of such programs (based upon U.S. generally accepted accounting principles (“GAAP”)); the cash generated from operations, sales and refinancings; and information regarding cash distributions. All figures are as of or for the year ended December 31 of the year indicated.

A-4

Table III

OPERATING RESULTS OF PRIOR PROGRAMS (Continued)

(UNAUDITED)

Prior Performance is not Indicative of Future Results

| Phillips Edison Limited Partnership(4) | ||||||||||||||||||||||||||||

| (in thousands) | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | |||||||||||||||||||||

Gross revenues | $ | 85,295 | $ | 113,282 | $ | 175,683 | $ | 210,681 | $ | 199,433 | $ | 190,016 | $ | 197,771 | ||||||||||||||

Profit on sale of properties | 6,104 | 7,889 | 3,620 | 264 | (524 | ) | 54,254 | 13,913 | ||||||||||||||||||||

Other income (loss) | (4,165 | ) | (40 | ) | (122 | ) | (2,123 | ) | 9,551 | (51,202 | ) | (20,339 | ) | |||||||||||||||

Less: Operating expenses(1) | 34,359 | 44,092 | 71,678 | 96,315 | 86,134 | 84,307 | 79,883 | |||||||||||||||||||||

Interest expense | 32,341 | 47,218 | 84,444 | 110,143 | 75,465 | 70,261 | 65,245 | |||||||||||||||||||||

Depreciation and amortization | 29,325 | 38,298 | 71,955 | 92,578 | 80,221 | 63,939 | 59,498 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net income (loss) before non-controlling interests | (8,791 | ) | (8,477 | ) | (48,896 | ) | (90,214 | ) | (33,360 | ) | (25,799 | ) | (13,281 | ) | ||||||||||||||

Net loss (income) allocated to non-controlling interests | — | 9,817 | 31,802 | 55,112 | 19,511 | 58,275 | 12,316 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net income (loss)-GAAP basis | $ | (8,791 | ) | $ | 1,340 | $ | (17,094 | ) | $ | (35,102 | ) | $ | (13,849 | ) | $ | 32,476 | $ | (965 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Taxable (Loss) Income:(2) | ||||||||||||||||||||||||||||

–from operations | $ | (1,377 | ) | $ | 4,182 | $ | 3,180 | $ | (8,273 | ) | $ | (3,293 | ) | $ | (3,696 | ) | $ | 5,249 | ||||||||||

–from gain on sale | — | 476 | 2,043 | 379 | 2,361 | 35,889 | 2,520 | |||||||||||||||||||||

Cash generated from operations | 11,661 | 20,146 | 32,135 | 35,272 | 44,296 | 46,743 | 35,364 | |||||||||||||||||||||

Cash generated from sales | 22,011 | 35,614 | 27,603 | 20,497 | 30,770 | 126,187 | 117,076 | |||||||||||||||||||||

Cash generated from refinancing(3) | 104,799 | 309,302 | 688,314 | 82,652 | 58,544 | (19,935 | ) | (81,998 | ) | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total cash generated from operations, sales and refinancing | 138,471 | 365,062 | 748,052 | 138,421 | 133,610 | 152,995 | 70,442 | |||||||||||||||||||||

Less: Cash distributions to investors: | ||||||||||||||||||||||||||||

–from operating cash flow | 11,661 | 16,735 | 17,675 | 18,617 | 10,857 | 8,853 | 15,643 | |||||||||||||||||||||

–from sales and refinancing | 3,890 | — | — | — | — | — | — | |||||||||||||||||||||

–from other | — | — | — | — | — | — | — | |||||||||||||||||||||

Cash generated after cash distributions (3) | 122,920 | 348,327 | 730,377 | 119,804 | 122,753 | 144,142 | 54,799 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Less: Special items (not including sales and refinancing) | — | — | — | — | — | — | — | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Cash generated after cash distributions and special items | $ | 122,920 | $ | 348,327 | $ | 730,377 | $ | 119,804 | $ | 122,753 | $ | 144,142 | $ | 54,799 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Tax and distribution data per $1,000 invested | ||||||||||||||||||||||||||||

U.S. federal income tax results: | ||||||||||||||||||||||||||||

Ordinary income (loss) | ||||||||||||||||||||||||||||

–from operations | $ | (6.18 | ) | $ | 18.79 | $ | 14.29 | $ | (31.01 | ) | $ | (12.34 | ) | $ | (13.86 | ) | $ | 19.68 | ||||||||||

–from recapture | — | — | — | — | — | — | — | |||||||||||||||||||||

Capital gain (loss) | — | 2.14 | 9.18 | 1.42 | 8.85 | 134.54 | 9.45 | |||||||||||||||||||||

Cash distributions to investors | ||||||||||||||||||||||||||||

Source (on a GAAP basis) | ||||||||||||||||||||||||||||

–from investment income | — | 5.61 | — | — | — | 37.00 | — | |||||||||||||||||||||

–from return of capital | 65.00 | 64.39 | 74.00 | 74.00 | 37.00 | — | 48.50 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total distribution on GAAP basis | $ | 65.00 | $ | 70.00 | $ | 74.00 | $ | 74.00 | $ | 37.00 | $ | 37.00 | $ | 48.50 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Source (on cash basis) | ||||||||||||||||||||||||||||

–from sales | 16.26 | — | — | — | — | — | — | |||||||||||||||||||||

–from refinancings | — | — | — | — | — | — | — | |||||||||||||||||||||

–from operations | 48.74 | 70.00 | 74.00 | 74.00 | 37.00 | 37.00 | 48.50 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total distributions on cash basis | $ | 65.00 | $ | 70.00 | $ | 74.00 | $ | 74.00 | $ | 37.00 | $ | 37.00 | $ | 48.50 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Amounts (in percentage terms) remaining in program properties as of December 31, 2011 | 61 | % | ||||||||||||||||||||||||||

| (1) | Operating expenses include all general and administrative expenses. |

| (2) | Program is compromised of partnerships, limited liability companies, real estate investment trusts and subchapter S corporations, which file tax returns for which the partners, members and stockholders are taxed on their respective shares of entity income, and accordingly, no provision for income taxes is included in the consolidated financial statements. |

| (3) | Cash generated from financing / refinancing includes original mortgage proceeds when assets were acquired. |

| (4) | Consolidated financial statements of Phillips Edison Limited Partnership and its subsidiaries. As well as being the general partner in all Phillips Edison-sponsored programs, Phillips Edison Limited Partnership has limited partner interests in the programs reported. |

A-5

Table III

OPERATING RESULTS OF PRIOR PROGRAMS (Continued)

(UNAUDITED)

Prior Performance is not Indicative of Future Results

| Phillips Edison Shopping Center Fund III, L.P. | ||||||||||||||||||||||||

| (in thousands) | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | ||||||||||||||||||

Gross revenues | $ | 20,293 | $ | 76,076 | $ | 106,147 | $ | 97,705 | $ | 82,810 | $ | 82,669 | ||||||||||||

Profit (loss) on sale of properties | — | — | 264 | (551 | ) | 3,077 | 6,535 | |||||||||||||||||

Other loss | — | (30 | ) | (2,186 | ) | (1,694 | ) | (49,249 | ) | (9,993 | ) | |||||||||||||

Less: Operating expenses(1) | 11,415 | 29,115 | 40,062 | 36,476 | 33,237 | 31,976 | ||||||||||||||||||

Interest expense | 9,653 | 42,131 | 62,297 | 38,563 | 35,366 | 31,948 | ||||||||||||||||||

Depreciation and amortization | 9,161 | 38,015 | 56,106 | 49,444 | 32,638 | 27,510 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Net loss – GAAP basis | $ | (9,936 | ) | $ | (33,215 | ) | $ | (54,240 | ) | $ | (29,023 | ) | $ | (64,603 | ) | $ | (12,223 | ) | ||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Taxable (Loss) Income:(2) | ||||||||||||||||||||||||

–from operations | $ | (422 | ) | $ | 8,549 | $ | 4,940 | $ | (3,889 | ) | $ | 988 | $ | (1,850 | ) | |||||||||

–from gain on sale | — | — | — | — | — | — | ||||||||||||||||||

Cash generated (deficiency) from operations | (104 | ) | 14,939 | 21,792 | 14,250 | 18,324 | 5,046 | |||||||||||||||||

Cash generated (deficiency) from sales | — | — | 1,778 | 4,956 | 14,395 | 96,145 | ||||||||||||||||||

Cash generated from refinancing(3) | 275,355 | 605,075 | (13,637 | ) | (3,280 | ) | (11,608 | ) | (91,672 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total cash generated from operations, sales and refinancing | 275,251 | 620,014 | 9,933 | 15,926 | 21,111 | 9,519 | ||||||||||||||||||

Less: Cash distributions to investors: | ||||||||||||||||||||||||

–from operating cash flow | — | 14,939 | — | — | — | — | ||||||||||||||||||

–from sales and refinancing | — | 7,561 | — | — | — | — | ||||||||||||||||||

–from other | — | — | — | — | — | — | ||||||||||||||||||

Cash generated after cash distributions | 275,251 | 597,514 | 9,933 | 15,926 | 21,111 | 9,519 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Less: Special items (not including sales and refinancing) | — | — | — | — | — | — | ||||||||||||||||||

Cash generated after cash distributions and special items | $ | 275,251 | $ | 597,514 | $ | 9,933 | $ | 15,926 | $ | 21,111 | $ | 9,519 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Tax and distribution Data per $1,000 Invested | ||||||||||||||||||||||||

Federal income tax results: | ||||||||||||||||||||||||

Ordinary income (loss) | ||||||||||||||||||||||||

–from operations | $ | (3.47 | ) | $ | 31.09 | $ | 18.43 | $ | (14.51 | ) | $ | 3.69 | $ | (6.90 | ) | |||||||||

–from recapture | — | — | — | — | — | — | ||||||||||||||||||

Capital gain (loss) | — | — | — | — | — | — | ||||||||||||||||||

Cash distributions to investors | ||||||||||||||||||||||||

Source (on a GAAP basis) | ||||||||||||||||||||||||

–from investment income | — | 56.55 | — | — | — | — | ||||||||||||||||||

–from return of capital | — | 25.27 | — | — | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total distribution on GAAP basis | $ | — | $ | 81.82 | $ | — | $ | — | $ | — | $ | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Source (on cash basis) | ||||||||||||||||||||||||

–from sales | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||

–from refinancings | — | 27.49 | — | — | — | — | ||||||||||||||||||

–from operations | — | 54.32 | — | — | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total distributions on cash basis | $ | — | $ | 81.82 | $ | — | $ | — | $ | — | $ | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Amounts (in percentage terms) remaining in program properties as of December 31, 2011 | 81.4 | % | ||||||||||||||||||||||

| (1) | Operating expenses include all general and administrative expenses. |

| (2) | Program qualifies as a REIT under the Internal Revenue Code for federal income tax purposes. As such, the program is generally not subject to U.S. federal income tax to the extent it distributes its REIT taxable income to its stockholders. |

| (3) | Cash generated from financing / refinancing includes original mortgage proceeds and capital contributions when assets were acquired. |

A-6

Table III

OPERATING RESULTS OF PRIOR PROGRAMS (Continued)

(UNAUDITED)

Prior Performance is not Indicative of Future Results

| Phillips Edison Shopping Center Fund IV, L.P. | ||||||||||||||||||||

| (in thousands) | 2007 | 2008 | 2009 | 2010 | 2011 | |||||||||||||||

Gross revenues | $ | — | $ | 2,950 | $ | 6,622 | $ | 9,490 | $ | 13,837 | ||||||||||

Profit on sale of properties | — | — | — | 8,431 | — | |||||||||||||||

Other income (loss) | — | — | (1,390 | ) | (9,566 | ) | — | |||||||||||||

Less: Operating expenses(1) | 509 | 4,066 | 5,049 | 6,033 | 5,778 | |||||||||||||||

Interest expense | — | 1,533 | 2,278 | 2,692 | 1,769 | |||||||||||||||

Depreciation and amortization | — | 1,351 | 2,679 | 3,809 | 5,265 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net (loss) income – GAAP basis | $ | (509 | ) | $ | (4,000 | ) | $ | (4,774 | ) | $ | (4,179 | ) | $ | 1,025 | ||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Taxable (Loss) Income:(2) | ||||||||||||||||||||

–from operations | $ | — | $ | (1,373 | ) | $ | (87 | ) | $ | (155 | ) | $ | 5,084 | |||||||

–from gain on sale | — | — | — | — | — | |||||||||||||||

Cash generated (deficiency) from operations | 336 | (1,473 | ) | (730 | ) | 1,940 | 6,049 | |||||||||||||

Cash generated (deficiency) from sales | — | — | — | 1,884 | — | |||||||||||||||

Cash generated from refinancing(3) | (217 | ) | 49,524 | 14,093 | 51,813 | 14,719 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total cash generated from operations, sales and refinancing | 119 | 48,051 | 13,363 | 55,637 | 20,768 | |||||||||||||||

Less: Cash distributions to investors: | ||||||||||||||||||||

–from operating cash flow | — | — | — | — | 6,049 | |||||||||||||||

–from sales and refinancing | — | 913 | — | — | 10,951 | |||||||||||||||

–from other | — | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Cash generated after cash distributions(3) | 119 | 47,138 | 13,363 | 55,637 | 3,768 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Less: Special items (not including sales and refinancing) | — | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Cash generated after cash distributions and special items | $ | 119 | $ | 47,138 | $ | 13,363 | $ | 55,637 | $ | 3,768 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Tax and distribution data per $1,000 invested | ||||||||||||||||||||

U.S. federal income tax results: | ||||||||||||||||||||

Ordinary (loss) income | ||||||||||||||||||||

–from operations | $ | — | $ | (62.33 | ) | $ | (3.41 | ) | $ | 21.94 | $ | 92.91 | ||||||||

–from recapture | — | — | — | — | — | |||||||||||||||

Capital gain (loss) | — | — | — | — | — | |||||||||||||||

Cash distributions to investors(4) | ||||||||||||||||||||

Source (on a GAAP basis) | ||||||||||||||||||||

–from investment income | — | — | — | — | 171.24 | |||||||||||||||

–from return of capital | — | 41.45 | — | — | 139 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total distribution on GAAP basis | $ | — | $ | 41.45 | $ | — | $ | — | $ | 310.67 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Source (on cash basis) | ||||||||||||||||||||

–from sales | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||

–from refinancings | — | 41.45 | — | — | 220.18 | |||||||||||||||

–from operations | — | — | — | — | 90.49 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total distributions on cash basis | $ | — | $ | 41.45 | $ | — | $ | — | $ | 310.67 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Amounts (in percentage terms) remaining in program properties as of December 31, 2011 | 86 | % | ||||||||||||||||||

| (1) | Operating expenses include all general and administrative expenses. |

| (2) | Program qualifies as a REIT under the Internal Revenue Code for U.S. federal income tax purposes. To qualify as a REIT, the program must meet a number of organizational and operational requirements, including requirements to distribute at least 90% of the ordinary taxable income and to distribute to stockholders or pay tax on 100% of capital gains and to meet certain asset and income tests. |

| (3) | Cash generated from financing / refinancing includes original mortgage financing and subsequent financings. |