Selected data for a share outstanding throughout the period indicated.

1. Organization

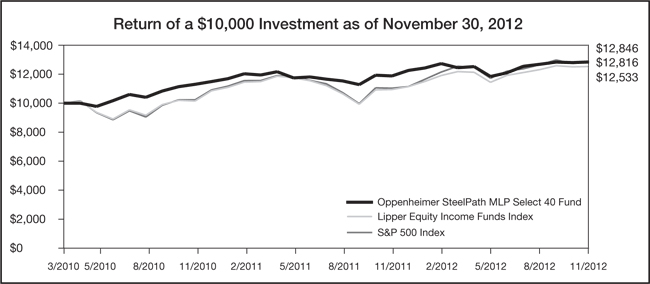

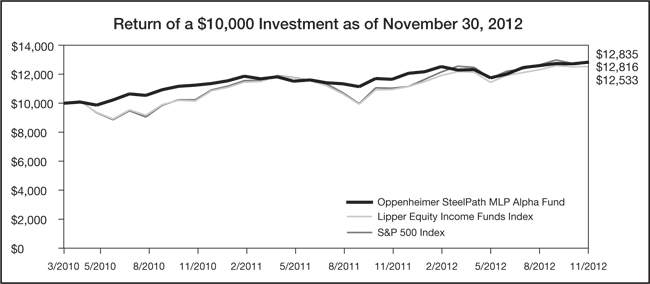

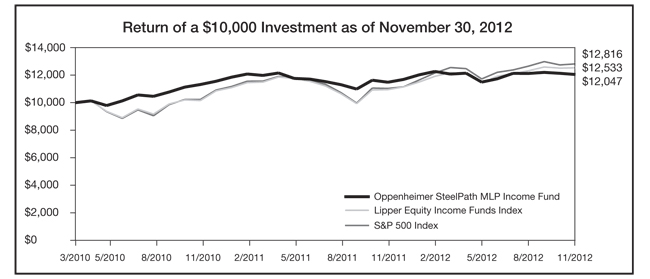

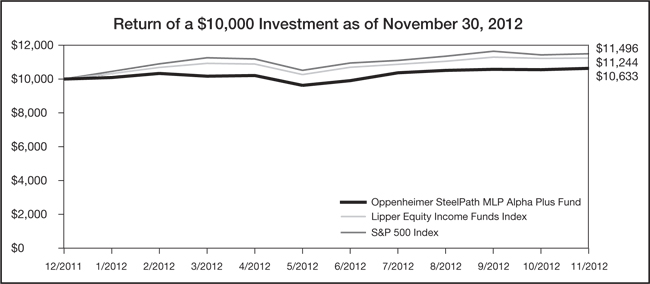

SteelPath MLP Funds Trust (the “Trust”) was organized as a statutory trust under the laws of the State of Delaware on December 1, 2009. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Trust is authorized to issue an unlimited number of shares, which are units of beneficial interest with a par value of $0.001. As of November 30, 2012, the Trust offered shares of five series, each of which has different and distinct investment objectives and policies. The financial statements for four of the five series are included in this report. They are the Oppenheimer SteelPath MLP Select 40 Fund (the “Select 40 Fund”), Oppenheimer SteelPath MLP Alpha Fund (the “Alpha Fund”), Oppenheimer SteelPath MLP Income Fund (the “Income Fund”), and the Oppenheimer SteelPath MLP Alpha Plus Fund (the “Alpha Plus Fund”), individually a “Fund,” collectively the “Funds,” formerly known as SteelPath MLP Select 40 Fund, SteelPath MLP Alpha Fund, SteelPath MLP Income Fund, and SteelPath MLP Alpha Plus Fund, respectively. The financial statements for the Oppenheimer SteelPath MLP and Infrastructure Debt Fund are included in a separate report. The Select 40 Fund, Income Fund and the Alpha Fund commenced operations at the close of business March 31, 2010, and the Alpha Plus Fund commenced operations at the close of business December 30, 2011. The Funds offer multiple classes of shares which generally differ in their respective sales charges and distribution and service fees. All shareholders bear the common expenses of the Funds. Dividends are declared separately for each class. Income, non-class specific expenses and realized and unrealized gains and losses are allocated daily to each class of shares based on the value of total shares outstanding of each class, without distinction between share classes. Expenses attributable to a particular class of shares, such as distribution fees, are allocated directly to that class.

Class A Shares of the Funds are subject to an initial sales charge imposed at the time of purchase, in accordance with its prospectus. The maximum sales charge is 5.75% of the offering price or 6.10% of the net asset value. Class A Shares pay an annual Rule 12b-1 fee of 0.25%. Class C Shares are not subject to an initial sales charge, but instead are subject to a contingent deferred sales charge of 1% if redeemed within one year of purchase. Class C Shares pay an annual Rule 12b-1 fee of 1.00%. Class I Shares and Class Y Shares are not subject to either an initial sales charge, or a contingent deferred sales charge and do not pay a 12b-1 fee.

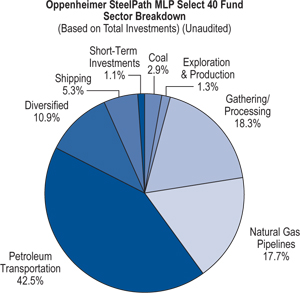

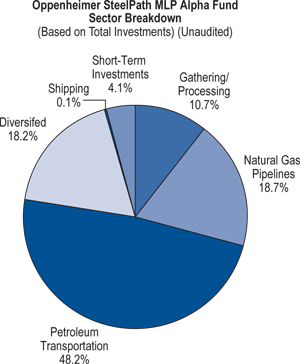

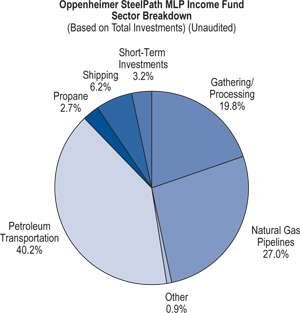

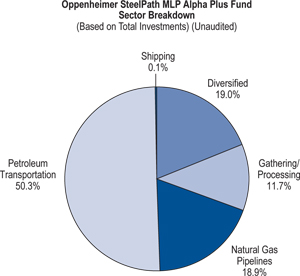

The investment objective of the Select 40 Fund is to provide investors long-term capital appreciation and attractive levels of current income through diversified exposure to the energy infrastructure Master Limited Partnership (“MLP’’) asset class. The investment objective of the Alpha Fund is to provide investors with a concentrated portfolio of energy infrastructure MLP’s to provide substantial long-term capital appreciation through distribution growth and an attractive level of current income. The investment objective of the Income Fund is to generate a high level of inflation-protected current income, primarily through investments in the larger, more liquid energy MLP’s. The investment objective of the Alpha Plus Fund is to provide investors with capital appreciation and, as a secondary objective, current income.

Each Fund, except for Select 40 Fund, is non-diversified, as that term is defined in the 1940 Act.

2. Accounting Policies:

The preparation of the financial statements in accordance with accounting principles generally accepted in the United States (U.S. GAAP) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates. In the normal course of business, the Funds have entered into contracts that contain a variety of representations which provide general indemnifications. The Funds’ maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Funds that have not yet occurred. However, the Funds expect the risk of loss to be remote.

Securities are valued at market value as of the close of trading on each business day when the New York Stock Exchange (“NYSE”) is open. Securities, listed on the NYSE or other exchanges are valued on the basis of the last reported sale price on the exchange on which they are primarily traded. Securities listed on the Nasdaq National Market System (“Nasdaq”) will be valued at the Nasdaq Official Closing Price, which may differ from the last sales price reported. If a last sales price is not reported by the principal exchange on which a security is traded, a security will be valued at the mean of the last bid and ask price. Over the counter options are valued based on the last sales price. If there is no trading of a security,

the mean of the last bid prices obtained from two or more broker-dealers will be used, unless there is only one broker-dealer, in which case that dealer’s last bid price will be used. Exchange traded options on securities and indices generally will be valued at their last sales price or, if no last sales price is available, at their last bid price.

Futures contracts will be valued based upon the last sales price at the close of market on the principal exchange on which they are traded or, in the absence of any transactions on a given day, the mean of the last bid and asked price. Swaps and other privately negotiated agreements will be valued pursuant to a valuation model approved by the Board, by an independent pricing service or prices supplied by the counterparty, which in turn are based on the market prices or fair values of the securities underlying the agreement.

Fixed income securities with maturities greater than 60 days will be valued based on prices received from an independent pricing service. Short-term fixed income securities with maturities of 60 days or less will be valued at amortized cost. If the Board of Trustees (the “Board”) determines that the amortized cost method does not represent the fair value of the short-term debt instrument, the investment will be valued at fair value as determined by procedures as adopted by the Board.

Pursuant to procedures adopted by the Board, the Advisor’s Valuation Committee will determine the fair value of a Fund’s securities when price quotations or valuations are not readily available, readily available price quotations are valuations that are not reflective of market value, or a significant event has been recognized in relation to a security or class of securities. A “significant event” is one that occurred prior to the Fund’s valuation time, is not reflected in the most recent market price of a security, and will affect the value of a security. Generally, a security will be fair valued when trading in the security has been halted, a market price is not available from either a pricing service or a broker or a price has become stale.

Fair value pricing is intended to result in a more accurate determination of a Fund’s net asset value and should reduce the potential for stale pricing arbitrage opportunities in a Fund. However, attempts to determine the fair value of securities introduce an element of subjectivity to the pricing of securities.

As a result, the price of a security determined through fair valuation techniques may differ from the price quoted or published by other sources and may not accurately reflect the market value of the security when trading resumes.

U.S. GAAP establishes a hierarchy that prioritizes the various inputs used in determining the value of a Fund’s investments. The three broad levels of the hierarchy are described below:

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Funds’ investments as of November 30, 2012:

The Funds did not hold any Level 2 or Level 3 securities during the year/period ended November 30, 2012. There were no transfers into and out of any level during the year/period. It is the Funds’ policy to recognize transfers at the end of the reporting period.

Distributions received from the Funds’ investments in MLPs generally are comprised of income and return of capital. The Funds record investment income and return of capital based on estimates made at the time such distributions are received. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on information received from MLPs after their tax reporting periods are concluded. For the year ended November 30, 2012, the Funds estimated that 100% of the MLP distributions received would be treated as return of capital.

Each Fund records its pro-rata share of the income/(loss) and capital gains/(losses), to the extent of distributions it has received, allocated from the underlying partnerships and adjusts the cost basis of the underlying partnerships accordingly. These amounts are included in the Funds’ Statements of Operations.

Investment transactions are recorded on a trade date plus one basis, except for the last day of the fiscal quarter end, when they are recorded on trade date. Partnership distributions are recorded on the ex-dividend date. Securities gains and losses are calculated based on the last-in, first-out method. Interest income is recognized on the accrual basis and includes, where applicable, the amortization or accretion of premium or discount.

Expenses directly attributable to each Fund are charged directly to the Fund. Expenses relating to the Trust are allocated proportionately to each Fund within the Trust according to the relative net assets of each Fund or on another reasonable basis. Certain class specific expenses are allocated to the specific class in which the expenses were incurred.

Dividends, if any, are declared and distributed quarterly for the Select 40 Fund, Alpha Fund, and Alpha Plus Fund and monthly for the Income Fund. The estimated characterization of the distributions paid will be either a dividend (ordinary income) or distribution (return of capital). This estimate is based on the individual Fund’s operating results during the period. It is anticipated that a significant portion of each Fund’s distributions will be comprised of return of capital as a result of the tax character of cash distributions made by the Fund’s investments. The actual characterization of the distributions made during the period will not be determined until after the end of the fiscal year. The Funds will inform shareholders of the final tax character of the distributions on IRS Form DIV in February 2013. For the period ended November 30, 2012, the Select 40 Fund, Alpha Fund and Alpha Plus Fund distributions are expected to be comprised of 100% return of capital. The Income Funds’ distributions are expected to be comprised of 90.07% return of capital and 9.93% income.

The character of distributions are determined in accordance with federal income tax regulations which may differ from U.S. GAAP. These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences do not require reclassification.

The Funds do not intend to qualify as regulated investment companies pursuant to Subchapter M of the Internal Revenue Code, but will rather be taxed as corporations. As corporations, the Funds are obligated to pay federal, state and local income tax on taxable income. Currently, the maximum marginal regular federal income tax rate for a corporation is 35 percent. The Funds may be subject to a 20 percent alternative minimum tax on its federal alternative minimum taxable income to the extent that its alternative minimum tax exceeds its regular federal income tax. Select 40 Fund, Alpha Fund, Income Fund and Alpha Plus Fund are currently using estimated rates of 2.0%, 2.0%, 1.7% and 2.2%, respectively, for state and local tax, net of federal tax expense.

Each Funds’ income tax provision consists of the following as of November 30, 2012:

The reconciliation between the federal statutory income tax rate of 35% and the effective tax rate on net investment income (loss) and realized and unrealized gain (loss) follows:

The Funds intend to invest their assets primarily in MLPs, which generally are treated as partnerships for federal income tax purposes. As limited partners in the MLPs, the Funds report their allocable share of the MLP’s taxable income in computing their own taxable income. The Funds’ tax expense or benefit will be included in the Statements of Operations based on the component of income or gains (losses) to which such expense or benefit relates. Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Such temporary differences are principally: (i) taxes on unrealized gains/(losses), which are attributable to the temporary difference between fair market value and tax basis, (ii) the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting and income tax purposes and (iii) the net tax benefit of accumulated net operating losses and capital loss carryforwards. Deferred tax assets and liabilities are measured using effective tax rates expected to apply to taxable income in the years such temporary differences are realized or otherwise settled. To the extent the Funds have a deferred tax asset, consideration is given to whether or not a valuation allowance is required. A valuation allowance is required if based on the evaluation criterion provided by ASC 740, Income Taxes (ASC 740) that it is more-likely-than-not that some portion or all of the deferred tax asset will not be realized. Among the factors considered in assessing the Funds’ valuation allowance: the nature, frequency and severity of current and cumulative losses, forecasts of future profitability, the duration of the statutory carryforward periods and the associated risks that operating and capital loss carryforwards may expire unused. At November 30, 2012, the Funds determined a valuation allowance was not required. From time to time, as new information becomes available, the Funds will modify their estimates or assumptions regarding the deferred tax liability or asset.

Components of the Funds’ deferred tax assets and liabilities as of November 30, 2012 are as follows:

| | | | | | | | | | | | | |

| Deferred tax assets: | | | | | | | | | | | | |

| Net operating loss carryforward (tax basis) | | $ | 20,655,785 | | | $ | 17,926,759 | | | $ | 4,441,911 | | | $ | 25,385 | |

| Capital loss carryforward (tax basis) | | | 4,733,935 | | | | 4,003,488 | | | | — | | | | 9,934 | |

| Organization costs | | | 11,440 | | | | — | | | | — | | | | — | |

| Income recognized from MLP investments | | | 229,913 | | | | 263,124 | | | | 94,150 | | | | 7,209 | |

| Deferred tax liabilities: | | | | | | | | | | | | | | | | |

| Net unrealized gains on investment securities (tax basis) | | | (88,188,477 | ) | | | (73,690,328 | ) | | | (18,172,144 | ) | | | (92,130 | ) |

| Total net deferred tax asset/(liability) | | $ | (62,557,404 | ) | | $ | (51,496,957 | ) | | $ | (13,636,083 | ) | | $ | (49,602 | ) |

Unexpected significant decreases in cash distributions from the Funds’ MLP investments or significant declines in the fair value of its investments may change the Funds’ assessment regarding the recoverability of their deferred tax assets and may result in a valuation allowance. If a valuation allowance is required to reduce any deferred tax asset in the future, it could have a material impact on the Funds’ net asset value and results of operations in the period it is recorded.

The Funds may rely, to some extent, on information provided by the MLPs, which may not necessarily be timely, to estimate taxable income allocable to MLP units held in their portfolios, and to estimate their associated deferred tax benefit/(liability). Such estimates are made in good faith. From time to time, as new information becomes available, the Funds will modify their estimates or assumptions regarding their tax benefit/(liability).

The Funds’ policy is to classify interest and penalties associated with underpayment of federal and state income taxes, if any, as income tax expense on their Statements of Operations. For the year ended November 30, 2012, the Funds do not have any interest or penalties associated with the underpayment of any income taxes.

The Funds file income tax returns in the U.S. federal jurisdiction and various states. All tax years since inception remain open and subject to examination by tax jurisdictions. The Funds have reviewed all major jurisdictions and concluded that there is no significant impact on the Funds’ net assets and no tax liability resulting from unrecognized tax benefits relating to uncertain tax positions expected to be taken on their tax returns. Furthermore, management of the Funds is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next 12 months.

| 28 | Oppenheimer SteelPath MLP Funds Annual Report |

NOTES TO THE FINANCIAL STATEMENTS (Continued) November 30, 2012

At November 30, 2012, the Funds had net operating loss carryforwards for federal income tax purposes, which may be carried forward for 20 years, as follows:

| | | | | | | | | | | | | |

| Expiration Date | | | | | | | | | | | | |

| 11/30/2030 | | $ | 525,993 | | | $ | 1,194,164 | | | $ | 3,877 | | | $ | — | |

| 11/30/2031 | | | 11,179,881 | | | | 7,264,183 | | | | 4,997,354 | | | | — | |

| 11/30/2032 | | | 44,120,571 | | | | 39,992,354 | | | | 7,102,069 | | | | 68,240 | |

| Total | | $ | 55,826,445 | | | $ | 48,450,701 | | | $ | 12,103,300 | | | $ | 68,240 | |

At November 30, 2012, the Funds had net capital loss carryforwards for federal income tax purposes, which may be carried forward for 5 years, as follows:

| | | | | | | | | | | | | |

| ExpirationDate | | | | | | | | | | | | |

| 11/30/2016 | | $ | 2,698,758 | | | $ | — | | | $ | — | | | $ | — | |

| 11/30/2017 | | | 10,095,660 | | | | 10,820,238 | | | | — | | | | 26,703 | |

| Total | | $ | 12,794,418 | | | $ | 10,820,238 | | | $ | — | | | $ | 26,703 | |

During the year ended November 30, 2012, Income Fund utilized $1,381,510 of capital loss carryforwards.

At November 30, 2012, gross unrealized appreciation and depreciation of investments, based on cost for federal income tax purposes were as follows:

| | | | | | | | | | | | | |

| Cost of Investments | | $ | 850,272,036 | | | $ | 697,080,140 | | | $ | 470,132,133 | | | $ | 12,135,173 | |

| Gross Unrealized Appreciation | | $ | 256,141,336 | | | $ | 208,867,018 | | | $ | 62,518,598 | | | $ | 467,478 | |

| Gross Unrealized Depreciation | | | (17,794,100 | ) | | | (9,703,967 | ) | | | (13,003,219 | ) | | | (219,817 | ) |

| Net Unrealized Appreciation on Investments | | $ | 238,347,236 | | | $ | 199,163,057 | | | $ | 49,515,379 | | | $ | 247,661 | |

The difference between cost amounts for financial statement and federal income tax purposes is due primarily to timing differences in recognizing certain gains and losses in security transactions.

3. Related Party Transactions:

Investment Advisor:

During the period ended November 30, 2012, SteelPath Fund Advisors, LLC (the “Advisor”) served as the investment advisor to each Fund. Under the terms of the investment advisory agreement, the Advisor is entitled to receive fees computed daily and paid monthly at an annual rate of 0.70%, 1.10%, 0.95%, and 1.25% of average net assets, for the Select 40 Fund, Alpha Fund, Income Fund, and Alpha Plus Fund respectively. The Advisor makes the investment decisions for each Fund and continuously reviews, supervises and administers the investment program of each Fund, subject to the supervision of, and policies established by the Board. The amounts charged to the Funds for investment advisory services are reported within the Statements of Operations.

The Advisor has agreed to limit fees and/or reimburse expenses of each Fund until at least March 31, 2013, to the extent that a Fund’s total annual fund operating expenses (exclusive of interest, taxes, such as deferred tax expenses, brokerage commissions, acquired fund fees and expenses, dividend costs related to short sales, and extraordinary expenses, such as litigation expenses, if any) exceed a certain limit with respect to each class of a Fund. The Expense Limitation Agreement has the effect of capping the Select 40 Fund’s class A, C, I, and Y share classes at 1.10%, 1.85%, 0.85%, and 0.85%, respectively, the Alpha Fund’s class A, C, and I share classes at 1.50%, 2.25%, and 1.25%, respectively, the Income Fund’s class A, C, and I share classes at 1.35%, 2.10%, and 1.10%, respectively, and the Alpha Plus Fund’s class A, C, and I share classes at 2.00%, 2.75%, and 1.75%, respectively. A Fund’s net expenses will be

NOTES TO THE FINANCIAL STATEMENTS (Continued) November 30, 2012

higher than these amounts to the extent that the Fund incurs expenses excluded from the expense cap. Because the Fund’s deferred income tax expense is excluded from the expense cap, the Fund’s net expenses for each class of shares is increased by the amount of this expense. The Advisor can be reimbursed by the Fund within three years after the date the fee limitation and/or expense reimbursement has been made by the Advisor, provided that such repayment does not cause the expenses of any class of the Fund to exceed the foregoing limits. The fee limitation and/or expense reimbursement may be terminated or amended prior to March 31, 2013 with the approval of the Trust’s Board of Trustees. During the year ended November 30, 2012, the Advisor did not recoup any expenses.

The following table represents amounts eligible for recovery at November 30, 2012:

Eligible expense recoupments expiring: | | | | | | | | | | | | |

| November 30, 2013 | | $ | 274,676 | | | $ | 213,492 | | | $ | 216,936 | | | $ | — | |

| November 30, 2014 | | | 570,608 | | | | 505,009 | | | | 574,482 | | | | — | |

| November 30, 2015 | | | 322,719 | | | | 374,961 | | | | 683,544 | | | | 316,212 | |

In addition, pursuant to the Expense Limitation Agreement, the Advisor is entitled to recoup from the Select 40 Fund certain expenses associated with the organization of the Trust for a period of up to three years from March 31, 2010, provided the Select 40 Fund’s operating expenses, including such recouped amounts, do not exceed the stated expense limitations. At November 30, 2012, the total offering and organization fees subject to recoupment under the Expense Limitation Agreement is $271,460, of which $217,353 is recoupable through 2013, and $54,107 is recoupable through 2014.

Distribution Plan:

Each Fund has adopted Distribution Plans, pursuant to Rule 12b-1 under the 1940 Act (the “Distribution Plans”) with respect to its Class A and Class C Shares. The Distribution Plans authorize payments by the Funds to finance activities intended to result in the sale of Class A and Class C Shares and shareholder services. The Distribution Plans provide that each Fund may incur distribution expenses of 0.25% and 1.00%, respectively, of the average daily net assets of each Fund’s Class A and Class C Shares

4. Purchases and Sales of Securities:

Purchases and sales of investment securities, excluding short-term securities for the year ended November 30, 2012, totaled:

| | | | | | | | | | | | | |

| Purchases | | $ | 496,983,255 | | | $ | 375,664,709 | | | $ | 386,247,862 | | | $ | 15,470,692 | |

| Sales | | | 95,934,595 | | | | 105,537,575 | | | | 116,904,721 | | | | 3,052,589 | |

There were no purchases or sales of U.S. government securities for the period.

5. Concentration of Risk:

Under normal circumstances, the Select 40 Fund, Alpha Fund, and Income Fund intend to invest at least 90% of their total assets in securities of MLPs, which are subject to certain risks, such as supply and demand risk, depletion and exploration risk, commodity pricing risk, acquisition risk, and the risk associated with the hazards inherent in midstream energy industry activities, and the Alpha Plus Fund intends to invest at least 80% of its total assets in securities of MLP’s for their purposes. A substantial portion of the cash flow received by the Funds is derived from investment in equity securities of MLPs. The amount of cash that a MLP has available for distributions, and the tax character of such distributions, are dependent upon the amount of cash generated by the MLP’s operations.

| 30 | Oppenheimer SteelPath MLP Funds Annual Report |

NOTES TO THE FINANCIAL STATEMENTS (Continued) November 30, 2012

6. Loan and Pledge Agreement:

The SteelPath MLP Alpha Plus Fund has a $15 million revolving credit agreement with Bank of America, N.A. (“BOA Loan Agreement”) to engage in permitted borrowing. The Fund is permitted to borrow up to the lesser of one-third of the Fund’s total assets, or the maximum amount permitted pursuant to the Fund’s investment limitations. Amounts borrowed under the BOA Loan Agreement are invested by the Fund under the direction of the Manager, consistent with the Fund’s investment objectives and policies, and as such are subject to normal market fluctuations and investment risks, including the risk of loss due to a decline in value. The loan is fully collateralized throughout the term of the loan with securities or other assets of the Fund. Securities that have been pledged as collateral for the loan are indicated in the Schedule of Investments. Bank of America shall have the right at any time, upon 180 days’ prior written notice to Alpha Plus Fund, or upon such shorter notice period as mutually agreed upon, to permanently terminate BOA Loan Agreement.

Borrowings under the BOA Loan Agreement are charged interest at a calculated rate computed by Bank of America based on LIBOR plus 0.90% per annum. A commitment fee at the rate of 0.10% per annum is charged for any undrawn portion of the credit facility. The loan is due 180 days following demand by Bank of America. The loan balance at November 30, 2012 was $3,161,204. For the year ended November 30, 2012, information related to borrowings under the BOA Loan Agreement is as follows:

| | | | | | | | Maximum Amount Borrowed During the Period |

| 1.12% | | $1,463,644 | | 236 | | $14,098 | | $3,663,550 |

7. Subsequent Event:

SteelPath Fund Advisors LLC (“SFA”), the former investment adviser to the SteelPath MLP Funds Trust (“Trust”), and SteelPath Capital Management LLC (“SCM”), an affiliate of SFA, entered into an Asset Purchase Agreement (“APA”) to sell substantially all of their assets, including their investment advisory and asset management businesses, to Oppenheimer Funds, Inc. (“OFI”), a Colorado corporation (“Transaction”). The Transaction closed on December 3, 2012 (“Closing”). Shortly after the Closing, OFI completed an internal restructuring that included transferring SFA and SCM’s assets from OFI to OFI SteelPath, Inc. (“OFI SteelPath”), a wholly-owned affiliate of OFI that is registered as an investment adviser with the Securities and Exchange Commission.

The Funds’ investment advisory agreements with SFA terminated upon Closing and a new investment advisory agreement between the Trust and OFI SteelPath took effect. The new investment advisory agreement was approved by shareholders of the SteelPath MLP Select 40 Fund, SteelPath MLP Alpha Fund and SteelPath MLP Alpha Plus Fund on November 16, 2012, and by shareholders of SteelPath MLP Income Fund on November 30, 2012.

Subsequent to the Closing, the names of each Fund were changed to Oppenheimer SteelPath MLP Select 40 Fund, Oppenheimer SteelPath MLP Alpha Fund, Oppenheimer SteelPath MLP Income Fund and Oppenheimer SteelPath MLP Alpha Plus Fund, respectively. Shareholders of each Fund also elected a new Board of Trustees, approved an amended Agreement and Declaration of Trust and certain changes to the Funds’ fundamental investment policies. Additionally, effective December 3, 2012, the Funds changed the rates of their respective advisory fees such that each Fund pays the adviser an annualized fee based on the level of the Fund’s average daily net assets as set forth in the chart below:

| | Net Assets up to $3 Billion | | Net Assets Greater than $3 Billion and Up to $5 Billion | | Net Assets in Excess of $5 Billion |

| Select 40 Fund | | 0.70% | | 0.68% | | 0.65% |

| Alpha Fund | | 1.10% | | 1.08% | | 1.05% |

| Income Fund | | 0.95% | | 0.93% | | 0.90% |

| Alpha Plus Fund | | 1.25% | | 1.23% | | 1.20% |

In addition, the Expense Limitation Agreement, as discussed in note 3, was extended to December 3, 2014, in conjunction with the Closing.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees of

The SteelPath MLP Funds Trust

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of The SteelPath MLP Funds Trust, comprising Oppenheimer SteelPath MLP Select 40 Fund (fka SteelPath MLP Select 40 Fund), Oppenheimer SteelPath MLP Alpha Fund (fka SteelPath MLP Alpha Fund), Oppenheimer SteelPath MLP Income Fund (fka SteelPath MLP Income Fund) , and Oppenheimer SteelPath MLP Alpha Plus Fund (fka SteelPath MLP Alpha Plus Fund) (the “Funds”) as of November 30, 2012, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the three periods in the period then ended for Oppenheimer SteelPath MLP Select 40 Fund, Oppenheimer SteelPath MLP Alpha Fund, and Oppenheimer SteelPath MLP Income Fund, and the related statements of operations, cash flows, and changes in net assets, and financial highlights for the period December 30, 2011 (commencement of operations) to November 30, 2012 for Oppenheimer SteelPath MLP Alpha Plus Fund. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of November 30, 2012, by correspondence with the custodian and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of each of the Funds constituting The SteelPath MLP Funds Trust as of November 30, 2012, and the results of their operations, their cash flows, the changes in their net assets and their financial highlights for the periods indicated above, in conformity with accounting principles generally accepted in the United States of America.

COHEN FUND AUDIT SERVICES, LTD.

Cleveland, Ohio

January 24, 2013

| 32 | Oppenheimer SteelPath MLP Funds Annual Report |

November 30, 2012 (Unaudited)

As a shareholder of the Funds, you may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; potential deferred sales charges for redemptions within one year of purchase; and (2) ongoing costs, including investment advisory fees, distribution and service (12b-1) fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (June 1, 2012 through November 30, 2012).

Actual Expenses

The first lines of the table below with respect to each class of shares of each Fund provide information about actual account values and actual expenses. You may use the information in these lines, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Six Month Period Ended November 30, 2012” to estimate the expenses you paid on your account during this period. The only transaction fee you may be required to pay is for outgoing wire transfers charged by UMB Fund Services, Inc., the Fund’s transfer agent. If you request that a redemption be made by wire transfer, currently the Fund’s transfer agent charges a $15 fee. You may also pay a small account fee of $24 if the value of your account with the Fund is less than $10,000. If you paid a transaction or a small account fee, you would add the fee amount of the expenses paid on your account this period to obtain your total expenses paid.

Hypothetical Example for Comparison Purposes

The second lines of the table below with respect to each class of shares of each Fund provide information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A transaction fee of $15 may be assessed on outgoing wire transfers. You may also pay a small account fee of $24 if the value of your account with the Fund is less than $10,000. To include this fee in the calculation, you would add the estimated transaction fee to the hypothetical expenses shown in the table.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or any costs that may be associated with investing in the Funds through a financial intermediary. Therefore, the second lines of the table are useful in comparing the ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning Account Value June 1, 2012 | Ending Account Value November 30, 2012 | Expenses Paid During the Six Month Period Ended November 30, 2012* | Net Expense Ratio Annualized November 30, 2012# | Total Return Period Ended November 30, 2012 |

| Select 40 Fund | | | | | |

| Class A Actual | $1,000.00 | $1,083.30 | $5.73 | 1.10% | 8.33% |

| Class A Hypothetical (5% return before expenses) | $1,000.00 | $1,019.50 | $5.55 | 1.10% | 1.95% |

| Class C Actual | $1,000.00 | $1,080.30 | $9.62 | 1.85% | 8.03% |

| Class C Hypothetical (5% return before expenses) | $1,000.00 | $1,015.75 | $9.32 | 1.85% | 1.58% |

| Class I Actual | $1,000.00 | $1,084.60 | $4.43 | 0.85% | 8.46% |

| Class I Hypothetical (5% return before expenses) | $1,000.00 | $1,020.75 | $4.29 | 0.85% | 2.08% |

| Class Y Actual | $1,000.00 | $1,084.60 | $4.43 | 0.85% | 8.46% |

| Class Y Hypothetical (5% return before expenses) | $1,000.00 | $1,020.75 | $4.29 | 0.85% | 2.08% |

EXPENSE EXAMPLE (Continued) November 30, 2012 (Unaudited)

| | Beginning Account Value June 1, 2012 | Ending Account Value November 30, 2012 | Expenses Paid During the Six Month Period Ended November 30, 2012* | Net Expense Ratio Annualized November 30, 2012# | Total Return Period Ended November 30, 2012 |

| Alpha Fund | | | | | |

| Class A Actual | $1,000.00 | $1,092.00 | $7.85 | 1.50% | 9.20% |

| Class A Hypothetical (5% return before expenses) | $1,000.00 | $1,017.50 | $7.57 | 1.50% | 1.75% |

| Class C Actual | $1,000.00 | $1,087.10 | $11.74 | 2.25% | 8.71% |

| Class C Hypothetical (5% return before expenses) | $1,000.00 | $1,013.75 | $11.33 | 2.25% | 1.37% |

| Class I Actual | $1,000.00 | $1,092.40 | $6.54 | 1.25% | 9.24% |

| Class I Hypothetical (5% return before expenses) | $1,000.00 | $1,018.75 | $6.31 | 1.25% | 1.88% |

| Income Fund | | | | | |

| Class A Actual | $1,000.00 | $1,047.30 | $6.91 | 1.35% | 4.73% |

| Class A Hypothetical (5% return before expenses) | $1,000.00 | $1,018.25 | $6.81 | 1.35% | 1.83% |

| Class C Actual | $1,000.00 | $1,043.30 | $10.73 | 2.10% | 4.33% |

| Class C Hypothetical (5% return before expenses) | $1,000.00 | $1,014.50 | $10.58 | 2.10% | 1.45% |

| Class I Actual | $1,000.00 | $1,048.10 | $5.63 | 1.10% | 4.81% |

| Class I Hypothetical (5% return before expenses) | $1,000.00 | $1,019.50 | $5.55 | 1.10% | 1.95% |

| Alpha Plus Fund | | | | | |

| Class A Actual | $1,000.00 | $1,102.40 | $13.57 | 2.58%+ | 10.24% |

| Class A Hypothetical (5% return before expenses) | $1,000.00 | $1,012.09 | $12.99 | 2.58%+ | 1.21% |

| Class C Actual | $1,000.00 | $1,099.10 | $13.55 | 3.33%+ | 9.91% |

| Class C Hypothetical (5% return before expenses) | $1,000.00 | $1,008.34 | $12.96 | 3.33%+ | 0.83% |

| Class I Actual | $1,000.00 | $1,104.50 | $13.58 | 2.33%+ | 10.45% |

| Class I Hypothetical (5% return before expenses) | $1,000.00 | $1,013.34 | $13.00 | 2.33%+ | 1.33% |

| * | Expenses are equal to each Fund’s annualized expense ratio (based upon the last six months) as reflected in the fourth column above, multiplied by the average account value over the period, multiplied by (# of days in most recent fiscal half-year divided by # of days in current fiscal year (183/366) to reflect the one-half year period. |

| # | Deferred tax benefit/(expense) is not included in the ratio calculation. |

| + | Includes interest expense. Without interest expense, the net expense ratios would be 2.00%, 2.75%, and 1.75% for Class A, C, and I respectively. |

| 34 | Oppenheimer SteelPath MLP Funds Annual Report |

SPECIAL SHAREHOLDER MEETING November 30, 2012 (Unaudited)

SteelPath MLP Select 40 Fund

On November 16, 2012, at 12:00 p.m. Central Time a shareholder meeting of SteelPath MLP Select 40 Fund (the “Fund”) was held. At the meeting the sub-proposals (Proposal No. 1 and Proposal No. 2) were approved as described in the Fund’s proxy statement for that meeting. The following is a report of the votes cast:

| 1: | Proposal to approve a new investment advisory agreement |

| | | |

| 46,116,223 | 480,766 | 224,891 | 46,821,879 |

| Proposal 2: | To approve changing, or removing, certain fundamental investment policies |

| 2a: | Proposal to remove the 80% investment policy |

| | | |

| 39,596,152 | 6,892,825 | 332,904 | 46,821,879 |

| 2b: | Proposal to revise the policy relating to borrowing |

| | | |

| 45,884,663 | 642,628 | 294,587 | 46,821,879 |

| 2c: | Proposal to revise the policy relating to concentration of investments |

| | | |

| 45,901,846 | 617,240 | 302,792 | 46,821,879 |

| 2d: | Proposal to remove the policy relating to diversification of investments |

| | | |

| 39,721,624 | 6,789,889 | 310,366 | 46,821,879 |

| 2e: | Proposal to revise the policy relating to lending |

| | | |

| 45,892,559 | 623,776 | 305,543 | 46,821,879 |

| 2f: | Proposal to revise the policy relating to real estate and commodities |

| | | |

| 45,839,568 | 693,485 | 288,827 | 46,821,879 |

| 2g: | Proposal to revise the policy relating to senior securities |

| | | |

| 45,853,675 | 681,859 | 286,344 | 46,821,879 |

| 2h: | Proposal to revise the fundamental policy relating to underwriting |

| | | |

| 45,904,381 | 636,097 | 281,400 | 46,821,879 |

On November 16, 2012, at 1:00 p.m. Central Time a shareholder meeting of the Fund was held. At the meeting the sub-proposal (Proposal No. 4) was approved as described in the Fund’s proxy statement for that meeting. The following is a report of the votes cast:

| Proposal 4: | The election the Board of Trustees (all Funds voting together): |

| | | | |

| William F. Glavin, Jr. | 190,480,035 | 21,121,640 | 211,601,675 |

| Edward L. Cameron | 209,838,889 | 1,762,786 | 211,601,675 |

| Jon S. Fossel | 209,838,688 | 1,762,987 | 211,601,675 |

| Sam Freedman | 209,831,511 | 1,770,164 | 211,601,675 |

| Richard F. Grabish | 209,970,686 | 1,630,989 | 211,601,675 |

| Beverly L. Hamilton | 210,149,673 | 1,452,002 | 211,601,675 |

| Victoria J. Herget | 210,153,782 | 1,447,893 | 211,601,675 |

| Robert J. Malone | 209,986,245 | 1,615,430 | 211,601,675 |

| F. William Marshall, Jr. | 209,820,041 | 1,781,634 | 211,601,675 |

| Karen L. Stuckey | 210,173,447 | 1,428,228 | 211,601,675 |

| James D. Vaughn | 210,007,842 | 1,593,833 | 211,601,675 |

On November 30, 2012, at 1:00 p.m. Central Time a shareholder meeting of the Fund was held. At the meeting the sub-proposal (Proposal No. 3) was approved as described in the Fund’s proxy statement for that meeting. The following is a report of the votes cast:

| Proposal 3: | Proposal to amend the Agreement and Declaration of Trust (all Funds voting together) |

| | | |

| 87,238,332 | 21,502,722 | 1,998,239 | 110,789,292 |

SPECIAL SHAREHOLDER MEETING (Continued) November 30, 2012 (Unaudited)

Steelpath MLP Alpha Fund

On November 16, 2012, at 12:00 p.m. Central Time a shareholder meeting of SteelPath MLP Alpha Fund (the “Fund”) was held. At the meeting the sub-proposals (Proposal No. 1 and Proposal No. 2) were approved as described in the Fund’s proxy statement for that meeting. The following is a report of the votes cast:

| Proposal 1: | Proposal to approve a new investment advisory agreement |

| | | |

| 37,715,502 | 258,009 | 154,055 | 38,127,566 |

| Proposal 2: | To approve changing, or removing, certain fundamental investment policies |

| 2a: | Proposal to remove the 80% investment policy |

| | | |

| 36,216,671 | 1,708,071 | 202,825 | 38,127,566 |

| 2b: | Proposal to revise the policy relating to borrowing |

| | | |

| 37,626,645 | 339,467 | 161,455 | 38,127,566 |

| 2c: | Proposal to revise the policy relating to concentration of investments |

| | | |

| 37,649,164 | 314,525 | 163,877 | 38,127,566 |

| 2e: | Proposal to revise the policy relating to lending |

| | | |

| 37,646,922 | 307,354 | 173,290 | 38,127,566 |

| 2f: | Proposal to revise the policy relating to real estate and commodities |

| | | |

| 37,518,432 | 437,484 | 171,651 | 38,127,566 |

| 2g: | Proposal to revise the policy relating to senior securities |

| | | |

| 37,647,070 | 311,727 | 168,769 | 38,127,566 |

| 2h: | Proposal to revise the fundamental policy relating to underwriting |

| | | |

| 37,629,812 | 318,053 | 179,702 | 38,127,566 |

On November 16, 2012, at 1:00 p.m. Central Time a shareholder meeting of the Fund was held. At the meeting the sub-proposal (Proposal No. 4) was approved as described in the Fund’s proxy statement for that meeting. The following is a report of the votes cast:

| Proposal 4: | The election the Board of Trustees (all Funds voting together): |

| | | | |

| William F. Glavin, Jr. | 190,480,035 | 21,121,640 | 211,601,675 |

| Edward L. Cameron | 209,838,889 | 1,762,786 | 211,601,675 |

| Jon S. Fossel | 209,838,688 | 1,762,987 | 211,601,675 |

| Sam Freedman | 209,831,511 | 1,770,164 | 211,601,675 |

| Richard F. Grabish | 209,970,686 | 1,630,989 | 211,601,675 |

| Beverly L. Hamilton | 210,149,673 | 1,452,002 | 211,601,675 |

| Victoria J. Herget | 210,153,782 | 1,447,893 | 211,601,675 |

| Robert J. Malone | 209,986,245 | 1,615,430 | 211,601,675 |

| F. William Marshall, Jr. | 209,820,041 | 1,781,634 | 211,601,675 |

| Karen L. Stuckey | 210,173,447 | 1,428,228 | 211,601,675 |

| James D. Vaughn | 210,007,842 | 1,593,833 | 211,601,675 |

On November 30, 2012, at 1:00 p.m. Central Time a shareholder meeting of the Fund was held. At the meeting the sub-proposal (Proposal No. 3) was approved as described in the Fund’s proxy statement for that meeting. The following is a report of the votes cast:

| Proposal 3: | Proposal to amend the Agreement and Declaration of Trust (all Funds voting together) |

| | | |

| 87,238,332 | 21,502,722 | 1,998,239 | 110,789,292 |

| 36 | Oppenheimer SteelPath MLP Funds Annual Report |

SPECIAL SHAREHOLDER MEETING (Continued) November 30, 2012 (Unaudited)

Steelpath MLP Income Fund

On November 16, 2012, at 1:00 p.m. Central Time a shareholder meeting of SteelPath MLP Income Fund (the “Fund”) was held. At the meeting the sub-proposal (Proposal No. 4) was approved as described in the Fund’s proxy statement for that meeting. The following is a report of the votes cast:

| Proposal 4: | The election the Board of Trustees (all Funds voting together): |

| | | | |

| William F. Glavin, Jr. | 190,480,035 | 21,121,640 | 211,601,675 |

| Edward L. Cameron | 209,838,889 | 1,762,786 | 211,601,675 |

| Jon S. Fossel | 209,838,688 | 1,762,987 | 211,601,675 |

| Sam Freedman | 209,831,511 | 1,770,164 | 211,601,675 |

| Richard F. Grabish | 209,970,686 | 1,630,989 | 211,601,675 |

| Beverly L. Hamilton | 210,149,673 | 1,452,002 | 211,601,675 |

| Victoria J. Herget | 210,153,782 | 1,447,893 | 211,601,675 |

| Robert J. Malone | 209,986,245 | 1,615,430 | 211,601,675 |

| F. William Marshall, Jr. | 209,820,041 | 1,781,634 | 211,601,675 |

| Karen L. Stuckey | 210,173,447 | 1,428,228 | 211,601,675 |

| James D. Vaughn | 210,007,842 | 1,593,833 | 211,601,675 |

On November 30, 2012, at 12:00 p.m. Central Time a shareholder meeting of the Fund was held. At the meeting the sub-proposals in (Proposal No. 1, Proposal No. 2 and Proposal No. 3) were approved as described in the Fund’s proxy statement for that meeting. The following is a report of the votes cast:

| Proposal 1: | Proposal to approve a new investment advisory agreement |

| | | |

| 21,639,543 | 911,439 | 1,840,647 | 24,391,629 |

| Proposal 2: | To approve changing, or removing, certain fundamental investment policies |

| 2a: | Proposal to remove the 80% investment policy |

| | | |

| 19,054,428 | 3,431,949 | 1,905,254 | 24,391,629 |

| 2b: | Proposal to revise the policy relating to borrowing |

| | | |

| 21,372,426 | 1,105,117 | 1,914,085 | 24,391,629 |

| 2c: | Proposal to revise the policy relating to concentration of investments |

| | | |

| 21,481,730 | 1,058,515 | 1,851,384 | 24,391,629 |

| 2e: | Proposal to revise the policy relating to lending |

| | | |

| 21,391,738 | 1,096,889 | 1,903,000 | 24,391,629 |

| 2f: | Proposal to revise the policy relating to real estate and commodities |

| | | |

| 21,420,642 | 1,066,386 | 1,904,600 | 24,391,629 |

| 2g: | Proposal to revise the policy relating to senior securities |

| | | |

| 21,476,665 | 1,062,395 | 1,852,571 | 24,391,629 |

| 2h: | Proposal to revise the fundamental policy relating to underwriting |

| | | |

| 21,440,912 | 1,054,157 | 1,896,558 | 24,391,629 |

| Proposal 3: | Proposal to amend the Agreement and Declaration of Trust (all Funds voting together) |

| | | |

| 87,238,332 | 21,502,722 | 1,998,239 | 110,789,292 |

SPECIAL SHAREHOLDER MEETING (Continued) November 30, 2012 (Unaudited)

Steelpath MLP Alpha Plus Fund

On November 16, 2012, at 12:00 p.m. Central Time a shareholder meeting of SteelPath MLP Alpha Plus Fund (the “Fund”) was held. At the meeting the sub-proposals (Proposal No. 1 and Proposal No. 2) were approved as described in the Fund’s proxy statement for that meeting. The following is a report of the votes cast:

| Proposal 1: | Proposal to approve a new investment advisory agreement |

| Proposal 2: | To approve changing, or removing, certain fundamental investment policies |

| 2b: | Proposal to revise the policy relating to borrowing |

| 2c: | Proposal to revise the policy relating to concentration of investments |

| 2e: | Proposal to revise the policy relating to lending |

| 2f: | Proposal to revise the policy relating to real estate and commodities |

| 2g: | Proposal to revise the policy relating to senior securities |

| 2h: | Proposal to revise the fundamental policy relating to underwriting |

On November 16, 2012, at 1:00 p.m. Central Time a shareholder meeting of the Fund was held. At the meeting the sub-proposal (Proposal No. 4) was approved as described in the Fund’s proxy statement for that meeting. The following is a report of the votes cast:

| Proposal 4: | The election the Board of Trustees (all Funds voting together): |

| | | | |

| William F. Glavin, Jr. | 190,480,035 | 21,121,640 | 211,601,675 |

| Edward L. Cameron | 209,838,889 | 1,762,786 | 211,601,675 |

| Jon S. Fossel | 209,838,688 | 1,762,987 | 211,601,675 |

| Sam Freedman | 209,831,511 | 1,770,164 | 211,601,675 |

| Richard F. Grabish | 209,970,686 | 1,630,989 | 211,601,675 |

| Beverly L. Hamilton | 210,149,673 | 1,452,002 | 211,601,675 |

| Victoria J. Herget | 210,153,782 | 1,447,893 | 211,601,675 |

| Robert J. Malone | 209,986,245 | 1,615,430 | 211,601,675 |

| F. William Marshall, Jr. | 209,820,041 | 1,781,634 | 211,601,675 |

| Karen L. Stuckey | 210,173,447 | 1,428,228 | 211,601,675 |

| James D. Vaughn | 210,007,842 | 1,593,833 | 211,601,675 |

On November 30, 2012, at 1:00 p.m. Central Time a shareholder meeting of the Fund was held. At the meeting the sub-proposal (Proposal No. 3) was approved as described in the Fund’s proxy statement for that meeting. The following is a report of the votes cast:

| Proposal 3: | Proposal to amend the Agreement and Declaration of Trust (all Funds voting together) |

| | | |

| 87,238,332 | 21,502,722 | 1,998,239 | 110,789,292 |

| 38 | Oppenheimer SteelPath MLP Funds Annual Report |

OTHER INFORMATION (Continued) November 30, 2012 (Unaudited)

Statement Regarding Availability of Quarterly Portfolio Schedule

The Funds file complete schedules of portfolio holdings for each Fund with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available on the Commission’s website at http://www.sec.gov. The Funds’ Form N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C., and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The Funds make the information on Form N-Q available upon request without charge by calling the Funds at 1-888-614-6614

Statement Regarding Availability of Proxy Voting Policies and Procedures and Proxy Voting Record

A description of the policies and procedures the Funds use to determine how to vote proxies relating to the portfolio securities is available without charge, upon request, by calling 1-888-614-6614 or on the Commission’s website at http://www.sec.gov. Information regarding how the Funds voted proxies relating to portfolio securities for the most recent 12-month period ended June 30, 2012 is available without charge, at the SEC’s website at http://www.sec.gov., or by calling the Funds at 1-888-614-6614.

Risk Disclosure

Investing in MLPs involves additional risks as compared to the risks of investing in common stock, including risks related to cash flow, dilution and voting rights. Each Fund’s investments are concentrated in the energy infrastructure industry with an emphasis on securities issued by MLPs, which may increase price fluctuation. Energy infrastructure companies are subject to risks specific to the industry, such as fluctuations in commodity prices, reduced volumes of natural gas or other energy commodities, environmental hazards, changes in the macroeconomic or the regulatory environment or extreme weather. MLPs may trade less frequently than larger companies due to their smaller capitalizations which may result in erratic price movement or difficulty in buying or selling. MLPs are subject to significant regulation and may be adversely affected by changes in the regulatory environment including the risk that an MLP could lose its tax status as a partnership. To the extent that a Fund invests in ETFs and other investment companies, there may be a duplication of advisory fees and other expenses.

To the extent that a Fund obtains leverage through borrowings, there will be the potential for greater gains and the risk of magnified losses. Investing in debt securities involves additional risks including interest rate risk, credit risk and duration risk. High yield securities involve more risks than investment grade securities and tend to be more sensitive to economic conditions. Private equity investments may be subject to greater risks than investments in publicly traded companies due to limited public information and lack of regulatory oversight.

Availability of Additional Information

Investors should consider the Funds’ investment objectives, risks, charges, and expenses carefully before investing. The prospectus and summary prospectus contain this and other important information about the Funds. Copies of the prospectus and summary prospectus may be obtained by visiting www.steelpath.com and should be read carefully before investing.

November 30, 2012 (Unaudited)

Name, Position(s) Held with the Trusts, Length of Service, Age | Principal Occupation(s) During the Past 5 Years; Other Trusteeships/Directorships Held; Number of Portfolios in the Fund Complex Currently Overseen |

| INDEPENDENT TRUSTEES | The address of each Trustee in the chart below is 6803 S. Tucson Way, Centennial, Colorado 80112-3924. Each Trustee serves for an indefinite term, or until his or her resignation, retirement, death or removal. |

Sam Freedman, Chairman of the Board of Trustees and Trustee (since 2012)* Age: 72 | Director of Colorado UpLIFT (charitable organization) (since September 1984). Mr. Freedman held several positions with OppenheimerFunds, Inc. and with subsidiary or affiliated companies of OppenheimerFunds, Inc. (until October 1994). Mr. Freedman has served on the Boards of certain Oppenheimer funds since 1996, during which time he has become familiar with the Fund’s (and other Oppenheimer funds’) financial, accounting, regulatory and investment matters and has contributed to the Boards’ deliberations. |

Edward L. Cameron, Trustee (since 2012)* Age: 74 | Member of The Life Guard of Mount Vernon (George Washington historical site) (June 2000 – June 2006); Partner of PricewaterhouseCoopers LLP (accounting firm) (July 1974-June 1999); Chairman of Price Waterhouse LLP Global Investment Management Industry Services Group (accounting firm) (July 1994-June 1998). Oversees 36 portfolios in the OppenheimerFunds complex. Mr. Cameron has served on the Boards of certain Oppenheimer funds since 1999, during which time he has become familiar with the Fund’s (and other Oppenheimer funds’) financial, accounting, regulatory and investment matters and has contributed to the Boards’ deliberations. |

Jon S. Fossel, Trustee (since 2012)* Age: 70 | Chairman of the Board (2006-December 2011) and Director (June 2002-December 2011) of UNUMProvident (insurance company); Director of Northwestern Energy Corp. (public utility corporation) (November 2004-December 2009); Director of P.R. Pharmaceuticals (October 1999-October 2003); Director of Rocky Mountain Elk Foundation (non-profit organization) (February 1998-February 2003 and February 2005-February 2007); Chairman and Director (until October 1996) and President and Chief Executive Officer (until October 1995) of OppenheimerFunds, Inc.; President, Chief Executive Officer and Director of the following: Oppenheimer Acquisition Corp. (“OAC”) (parent holding company of OppenheimerFunds, Inc.), Shareholders Services, Inc. and Shareholder Financial Services, Inc. (until October 1995). Oversees 36 portfolios in the OppenheimerFunds complex. Mr. Fossel has served on the Boards of certain Oppenheimer funds since 1990, during which time he has become familiar with the Fund’s (and other Oppenheimer funds’) financial, accounting, regulatory and investment matters and has contributed to the Boards’ deliberations. |

Richard F. Grabish, Trustee (since 2012)* Age: 64 | Formerly Senior Vice President and Assistant Director of Sales and Marketing (March 1997-December 2007), Director (March 1987-December 2007) and Manager of Private Client Services (June 1985-June 2005) of A.G. Edwards & Sons, Inc. (broker/dealer and investment firm); Chairman and Chief Executive Officer of A.G. Edwards Trust Company, FSB (March 2001-December 2007); President and Vice Chairman of A.G. Edwards Trust Company, FSB (investment adviser) (April 1987-March 2001); President of A.G. Edwards Trust Company, FSB (investment adviser) (June 2005-December 2007). Oversees 36 portfolios in the OppenheimerFunds complex. Mr. Grabish has served on the Boards of certain Oppenheimer funds since 2001, during the course of which he has become familiar with the Fund’s (and other Oppenheimer funds’) financial, accounting, regulatory and investment matters and has contributed to the Boards’ deliberations. |

Beverly L. Hamilton, Trustee (since 2012)* Age: 66 | Trustee of Monterey Institute for International Studies (educational organization) (since February 2000); Board Member of Middlebury College (educational organization) (December 2005-June 2011); Chairman (since 2010) of American Funds’ Emerging Markets Growth Fund, Inc. (mutual fund); Director of The California Endowment (philanthropic organization) (April 2002-April 2008); Director (February 2002-2005) and Chairman of Trustees (2006-2007) of the Community Hospital of Monterey Peninsula; Director (October 1991-2005); Vice Chairman (2006-2009) of American Funds’ Emerging Markets Growth Fund, Inc. (mutual fund); President of ARCO Investment Management Company (February 1991-April 2000); Member of the investment committees of The Rockefeller Foundation (2001-2006) and The University of Michigan (since 2000); Advisor at Credit Suisse First Boston’s Sprout venture capital unit (venture capital fund) (1994-January 2005); Trustee of MassMutual Institutional Funds (investment company) (1996-June 2004); Trustee of MML Series Investment Fund (investment company) (April 1989-June 2004); Member of the investment committee of Hartford Hospital (2000-2003); and Advisor to Unilever (Holland) pension fund (2000-2003). Oversees 36 portfolios in the OppenheimerFunds complex. Ms. Hamilton has served on the Boards of certain Oppenheimer funds since 2002, during the course of which he has become familiar with the Fund’s (and other Oppenheimer funds’) financial, accounting, regulatory and investment matters and has contributed to the Boards’ deliberations. |

| 40 | Oppenheimer SteelPath MLP Funds Annual Report |

TRUSTEES AND OFFICERS (Continued) November 30, 2012 (Unaudited)

Name, Position(s) Held with the Trusts, Length of Service, Age | Principal Occupation(s) During the Past 5 Years; Other Trusteeships/Directorships Held; Number of Portfolios in the Fund Complex Currently Overseen |

Victoria J. Herget, Trustee (since 2012)* Age: 61 | Independent Director of the First American Funds (mutual fund family) (2003-2011); former Managing Director (1993-2001), Principal (1985-1993), Vice President (1978-1985) and Assistant Vice President (1973-1978) of Zurich Scudder Investments (and its predecessor firms); Board Chair (2008-Present) and Director (2004-Present), United Educators (insurance company); Trustee (1992-2007), Chair of the Board of Trustees (1999-2007), Investment Committee Chair (1994-1999) and Investment Committee member (2007-2010) of Wellesley College; Trustee (since 2000) and Chair (since 2010), Newberry Library; Trustee, Mather LifeWays (since 2001); Trustee, BoardSource (2006-2009) and Chicago City Day School (1994-2005). Oversees 36 portfolios in the OppenheimerFunds complex. Ms. Herget has served on the Boards of certain Oppenheimer funds since 2012, during which time she has become familiar with the Fund’s (and other Oppenheimer funds’) financial, accounting, regulatory and investment matters and has contributed to the Boards’ deliberations. |

Robert J. Malone, Trustee (since 2012)* Age: 67 | Board of Directors of Opera Colorado Foundation (non-profit organization) (since March 2008); Director of Jones Knowledge, Inc. (since 2006); Director of Jones International University (educational organization) (since August 2005); Chairman, Chief Executive Officer and Director of Steele Street Bank & Trust (commercial banking) (since August 2003); Director of Colorado UpLIFT (charitable organization) (since 1986); Trustee of the Gallagher Family Foundation (non-profit organization) (since 2000); Former Chairman of U.S. Bank-Colorado (subsidiary of U.S. Bancorp and formerly Colorado National Bank) (July 1996-April 1999); Director of Commercial Assets, Inc. (real estate investment trust) (1993-2000); Director of Jones Knowledge, Inc. (2001-July 2004); and Director of U.S. Exploration, Inc. (oil and gas exploration) (1997-February 2004). Oversees 36 portfolios in the OppenheimerFunds complex. Mr. Malone has served on the Boards of certain Oppenheimer funds since 2002, during which time he has become familiar with the Fund’s (and other Oppenheimer funds’) financial, accounting, regulatory and investment matters and has contributed to the Boards’ deliberations. |

F. William Marshall, Jr., Trustee (since 2012)* Age: 70 | Trustee Emeritus of Worcester Polytech Institute (WPI) (private university) (since 2009); Trustee of MassMutual Select Funds (formerly MassMutual Institutional Funds) (investment company) (since 1996) and MML Series Investment Fund (investment company) (since 1996); President and Treasurer of the SIS Funds (private charitable fund) (January 1999 – March 2011); Former Trustee of WPI (1985-2008); Former Chairman of the Board (2004-2006) and Former Chairman of the Investment Committee of WPI (1994-2008); Chairman of SIS & Family Bank, F.S.B. (formerly SIS Bank) (commercial bank) (January 1999-July 1999); Executive Vice President of Peoples Heritage Financial Group, Inc. (commercial bank) (January 1999-July 1999); and Former President and Chief Executive Officer of SIS Bancorp. (1993-1999). Oversees 38 portfolios in the OppenheimerFunds complex. Mr. Marshall has served on the Boards of certain Oppenheimer funds since 2000, during which time he has become familiar with the Fund’s (and other Oppenheimer funds’) financial, accounting, regulatory and investment matters and has contributed to the Boards’ deliberations. |

Karen L. Stuckey, Trustee (since 2012)* Age: 59 | Partner (1990-2012) of PricewaterhouseCoopers LLP (held various positions 1975-1990); Trustee (1992-2006) and member of Executive, Nominating and Audit Committees and Chair of Finance Committee of Lehigh University; and member, Women’s Investment Management Forum since inception. Oversees 36 portfolios in the OppenheimerFunds complex. Ms. Stuckey has served on the Boards of certain Oppenheimer funds since 2012, during which time she has become familiar with the Fund’s (and other Oppenheimer funds’) financial, accounting, regulatory and investment matters and has contributed to the Boards’ deliberations. |

James D. Vaughn, Trustee (since 2012)* Age: 67 | Retired; former managing partner (1994-2001) of Denver office of Deloitte & Touche LLP, (held various positions 1969-1993); Trustee and Chairman of the Audit Committee of Schroder Funds (since 2003); Board member and Chairman of Audit Committee of AMG National Trust Bank (since 2005); Trustee, Audit Committee member and Investment Committee member, University of South Dakota Foundation (since 1996); Board member, Executive Committee Member, Audit Committee Member and past Board Chair, Junior Achievement (since 1993); former Board member, Mile High United Way, Boys and Girls Clubs, Boy Scouts, Colorado Business Committee for the Arts, Economic Club of Colorado and Metro Denver Network. Oversees 36 portfolios in the OppenheimerFunds complex. Mr. Vaughn has served on the Boards of certain Oppenheimer funds since 2012, during which time he has become familiar with the Fund’s (and other Oppenheimer funds’) financial, accounting, regulatory and investment matters and has contributed to the Boards’ deliberations. |

TRUSTEES AND OFFICERS (Continued) November 30, 2012 (Unaudited)

Name, Position(s) Held with the Trusts, Length of Service, Age | Principal Occupation(s) During the Past 5 Years; Other Trusteeships/Directorships Held; Number of Portfolios in the Fund Complex Currently Overseen |

| INTERESTED TRUSTEE AND OFFICER | The address of Mr. Glavin is Two World Financial Center, 225 Liberty Street, 11th Floor, New York, New York 10281-1008. Mr. Glavin serves as a Trustee for an indefinite term, or until his resignation, retirement, death or removal and as an Officer for an indefinite term, or until his resignation, retirement, death or removal. Mr. Glavin is an Interested Trustee due to his positions with OppenheimerFunds, Inc. and its affiliates. |

William F. Glavin, Jr., Trustee, President and Principal Executive Officer (since 2012)* Age: 54 | Director, Chief Executive Officer and President of OFI Global Asset Management, Inc. (since January 2013); Chairman of OppenheimerFunds, Inc. (December 2009-December 2012); Chief Executive Officer (January 2009-December 2012) and Director of OppenheimerFunds, Inc. (since January 2009); President of OppenheimerFunds, Inc. (May 2009-December 2012); Management Director (since June 2009), President (since December 2009) and Chief Executive Officer (since January 2011) of Oppenheimer Acquisition Corp. (“OAC”) (OppenheimerFunds, Inc.’s parent holding company); Director of Oppenheimer Real Asset Management, Inc. (since March 2010); Executive Vice President (March 2006-February 2009) and Chief Operating Officer (July 2007-February 2009) of Massachusetts Mutual Life Insurance Company (OAC’s parent company); Director (May 2004-March 2006) and Chief Operating Officer and Chief Compliance Officer (May 2004-January 2005), President (January 2005-March 2006) and Chief Executive Officer (June 2005-March 2006) of Babson Capital Management LLC; Director (March 2005-March 2006), President (May 2003-March 2006) and Chief Compliance Officer (July 2005-March 2006) of Babson Capital Securities, Inc. (a broker-dealer); President (May 2003-March 2006) of Babson Investment Company, Inc.; Director (May 2004-August 2006) of Babson Capital Europe Limited; Director (May 2004-October 2006) of Babson Capital Guernsey Limited; Director (May 2004-March 2006) of Babson Capital Management LLC; Non-Executive Director (March 2005-March 2007) of Baring Asset Management Limited; Director (February 2005-June 2006) Baring Pension Trustees Limited; Director and Treasurer (December 2003-November 2006) of Charter Oak Capital Management, Inc.; Director (May 2006-September 2006) of C.M. Benefit Insurance Company; Director (May 2008-June 2009) and Executive Vice President (June 2007-July 2009) of C.M. Life Insurance Company; President (March 2006-May 2007) of MassMutual Assignment Company; Director (January 2005-December 2006), Deputy Chairman (March 2005-December 2006) and President (February 2005-March 2005) of MassMutual Holdings (Bermuda) Limited; Director (May 2008-June 2009) and Executive Vice President (June 2007-July 2009) of MML Bay State Life Insurance Company; Chief Executive Officer and President (April 2007-January 2009) of MML Distributors, LLC; and Chairman (March 2006-December 2008) and Chief Executive Officer (May 2007-December 2008) of MML Investors Services, Inc. An officer of 86 portfolios in the OppenheimerFunds complex. |

| OTHER OFFICERS OF THE TRUSTS | The addresses of the Officers in the chart below are as follows: for Mr. Gabinet and Ms. Nasta, Two World Financial Center, 225 Liberty Street, New York, New York 10281-1008, for Messrs. Hammond, Cartner, Watson and McCain, 2100 McKinney Avenue, Dallas, TX 75201, for Mr. Wixted, 6803 S. Tucson Way, Centennial, Colorado 80112-3924. Each Officer serves for an indefinite term or until his or her resignation, retirement, death or removal. |

Gabriel Hammond, Vice President (since 2010) Age: 33 | Senior Vice President of the Advisor (since December 2012); Founder, Member and Portfolio Manager, SteelPath Fund Advisors LLC (2004−2012); Founder, Member and Portfolio Manager, SteelPath Capital Management LLC (2004-2012); Goldman, Sachs & Co., Energy Research Division, (2001–2004). An officer of 5 portfolios in the OppenheimerFunds complex. |

Stuart Cartner, Vice President (since 2010) Age: 52 | Vice President of the Advisor (since December 2012); Member and Portfolio Manager (2009−2012), SteelPath Fund Advisors LLC; Member and Portfolio Manager (2007−2012) SteelPath Capital Managerment LLC; Goldman Sachs, Vice President (1988−2007). An officer of 5 portfolios in the OppenheimerFunds complex. |

Brian Watson, Vice President (since 2012)* Age: 39 | Vice President of the Advisor (since December 2012); Member and Portfolio Manager, SteelPath Fund Advisors LLC (2009–2012); Portfolio Manager, Swank Capital LLC, a Dallas, Texas-based investment firm, (2005–2009). An officer of 5 portfolios in the OppenheimerFunds complex. |

| 42 | Oppenheimer SteelPath MLP Funds Annual Report |

TRUSTEES AND OFFICERS (Continued) November 30, 2012 (Unaudited)

Name, Position(s) Held with the Trusts, Length of Service, Age | Principal Occupation(s) During the Past 5 Years; Other Trusteeships/Directorships Held; Number of Portfolios in the Fund Complex Currently Overseen |

James McCain, Vice President (since 2012)* and Chief Compliance Officer (since 2010) Age: 61 | Vice President of the Advisor (since December 2012); SteelPath Capital Management LLC, Chief Compliance Officer; SteelPath Fund Advisors, LLC, Chief Compliance Officer; Brazos Capital Management, Chief Compliance Officer; PineBridge Mutual Funds, Chief Compliance Officer, Secretary and Anti-Money Laundering Officer (2007−2012); G.W. Henssler & Associates, Ltd., Henssler Asset Management, LP and Henssler Funds, Chief Compliance Officer (2004−2007). An officer of 5 portfolios in the OppenheimerFunds complex. |

Arthur S. Gabinet, Secretary and Chief Legal Officer (since 2012)* Age: 54 | Executive Vice President, Secretary and General Counsel of OFI Global Asset Management, Inc. (since January 2013); General Counsel OFI SteelPath, Inc. (since January 2013); Executive Vice President (May 2010-December 2012) and General Counsel (since January 2011) of OppenheimerFunds, Inc.; General Counsel of the Distributor (since January 2011); General Counsel of Centennial Asset Management Corporation (January 2011-December 2012); Executive Vice President (January 2011-December 2012) and General Counsel of HarbourView Asset Management Corporation (since January 2011); Assistant Secretary (since January 2011) and Director (since January 2011) of OppenheimerFunds International Ltd. and OppenheimerFunds plc; Director of Oppenheimer Real Asset Management, Inc. (January 2011-December 2012) and General Counsel (since January 2011); Executive Vice President (January 2011-December 2011) and General Counsel of Shareholder Financial Services, Inc. and Shareholder Services, Inc. (since January 2011); Executive Vice President (January 2011-December 2012) and General Counsel of OFI Private Investments Inc. (since January 2011); Vice President of OppenheimerFunds Legacy Program (January 2011-December 2011); Executive Vice President (January 2011-December 2012) and General Counsel of OFI Institutional Asset Management, Inc. (since January 2011); General Counsel, Asset Management of OppenheimerFunds, Inc. (May 2010-December 2010); Principal, The Vanguard Group (November 2005-April 2010); District Administrator, U.S. Securities and Exchange Commission (January 2003-October 2005). An officer of 86 portfolios in the OppenheimerFunds complex. |

Christina M. Nasta, Vice President and Chief Business Officer (since 2012)* Age: 39 | Senior Vice President of OppenheimerFunds Distributor, Inc. (since January 2013); Senior Vice President of OppenheimerFunds, Inc. (July 2010-December 2013); Vice President of OppenheimerFunds, Inc. (January 2003-July 2010); Vice President of OppenheimerFunds Distributor, Inc. (January 2003-July 2010). An officer of 86 portfolios in the OppenheimerFunds complex. |

Brian W. Wixted, Treasurer and Principal Financial & Accounting Officer (since 2012)* Age: 53 | Senior Vice President of OFI Global Asset Management, Inc. (since January 2013); Treasurer of OppenheimerFunds, Inc., HarbourView Asset Management Corporation, Shareholder Financial Services, Inc., Shareholder Services, Inc., and Oppenheimer Real Asset Management, Inc. (March 1999-June 2008), OFI Private Investments, Inc. (March 2000-June 2008), OppenheimerFunds International Ltd. and OppenheimerFunds plc (since May 2000), OFI Institutional Asset Management, Inc. (November 2000-June 2008), and OppenheimerFunds Legacy Program (charitable trust program established by OppenheimerFunds, Inc.) (June 2003-December 2011); Treasurer and Chief Financial Officer of OFI Trust Company (since May 2000); Assistant Treasurer of Oppenheimer Acquisition Corporation (March 1999-June 2008). An officer of 86 portfolios in the OppenheimerFunds complex. |

The Trust’s Statement of Additional Information contains additional information about the Trust’s Trustees and Officers is available without charge upon request, by calling 1.800.CALL OPP (225.5677).

| * | Effective December 3, 2012. |

APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited)

On July 16, 2012, SteelPath Fund Advisors LLC (“SFA”), the former investment adviser to the Trust, and SteelPath Capital Management LLC, an affiliate of SFA, entered into an Asset Purchase Agreement (“APA”) to sell substantially all of their assets, including their investment advisory and asset management businesses, to OppenheimerFunds, Inc. (“OFI”), a Colorado corporation (“Transaction”). By law, the Funds’ investment advisory agreements under which SFA provided investment advisory services to the Funds (“Current Agreements”) automatically terminated upon the Closing of the Transaction.

The Board, including the Independent Trustees, met in-person on August 24, 2012, and at various times via teleconference prior to that date, to consider the Transaction, whether to approve a new investment advisory agreement (“New Agreement”) between the Funds and OFI SteelPath, Inc. (“OFI SteelPath”) and to discuss the various factors related to approval of the New Agreement. The Board reviewed the terms of the Transaction and considered its possible effects on the Funds and their shareholders. The Trustees also met with representatives of SFA and OFI to discuss the anticipated effects of the Transaction.

In connection with their consideration of the New Agreement on August 24, 2012, the Board noted that, in January 2012, the Board had performed an annual review of the Current Agreement for SteelPath MLP Select 40 Fund, SteelPath MLP Alpha Fund and SteelPath MLP Income Fund (together, the “Initial Funds”) and, in 2011, had initially approved the Current Agreement for SteelPath MLP Alpha Plus Fund (the “New Fund”). To inform their consideration of the New Agreement, the Independent Trustees received and considered responses by OFI and SFA to inquiries requesting information regarding: OFI’s structure, operations, financial resources and key personnel; the material aspects of the Transaction, the proposed operations of OFI SteelPath and its compliance program, code of ethics, trading policies and key management and investment personnel, including the Funds’ portfolio managers; and anticipated changes to the management or operations of the Board and the Funds, including, if applicable, any changes to the Funds’ service providers, advisory fees and expense structure. The Board also requested and received information that included the investment performance and the fees and expenses of the Initial Funds for various periods ended June 30, 2012, as compared to the Fund’s benchmark, the Lipper Equity Income Index, other mutual funds (“Peer Group”) that invest in master limited partnerships (“MLPs”), which comprise the “Other Equity Energy” category of funds compiled by Morningstar, a third-party provider of such data.