UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811- 22733

John Hancock Exchange-Traded Fund Trust

(Exact name of registrant as specified in charter)

601 Congress Street, Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Salvatore Schiavone

Treasurer

601 Congress Street

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-663-4497

| Date of fiscal year end: | April 30 |

| Date of reporting period: | October 31, 2016 |

ITEM 1. SCHEDULE OF INVESTMENTS

John Hancock

A message to shareholders

Dear shareholder,

The past six months were generally positive for U.S. equities, as markets hit all-time highs this summer, buoyed by decent corporate earnings and relatively light trading volume. Although economic growth remains more sluggish than many would like, consumer spending and employment gains have been supportive of the continued stock market advance.

That said, there are a number of looming uncertainties that have given investors pause. President-elect Donald J. Trump will face the challenges of uniting a fractured electorate and reigniting growth in a lethargic economy. The U.S. Federal Reserve, after a year of holding tight on interest rates, will meet in December to discuss whether the economy is stable enough to handle another increase in the federal funds rate as it seeks to normalize monetary policy. Advisors and investors are concerned, as we close out the eighth year of a bull market, that there is more that could go wrong than could continue to go right. It is the kind of environment that underscores the value of professional financial guidance and the importance of diversification and a long-term perspective.

On behalf of everyone at John Hancock Investments, I'd like to take this opportunity to thank you for the continued trust you've placed in us.

Sincerely,

Andrew G. Arnott

President and Chief Executive Officer

John Hancock Investments

This commentary reflects the CEO's views, which are subject to change at any time. All investments entail risks, including the possible loss of principal. Diversification does not guarantee a profit or eliminate the risk of a loss. For more up-to-date information, you can visit our website at jhinvestments.com.

John Hancock

Multifactor Consumer Discretionary ETF

INVESTMENT OBJECTIVE

The fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the John Hancock Dimensional Consumer Discretionary Index.

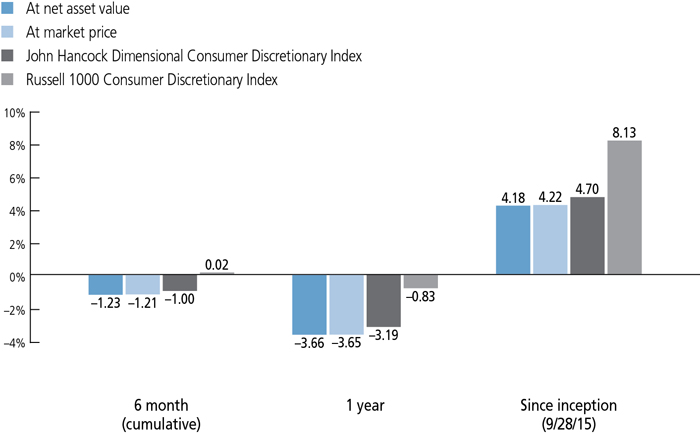

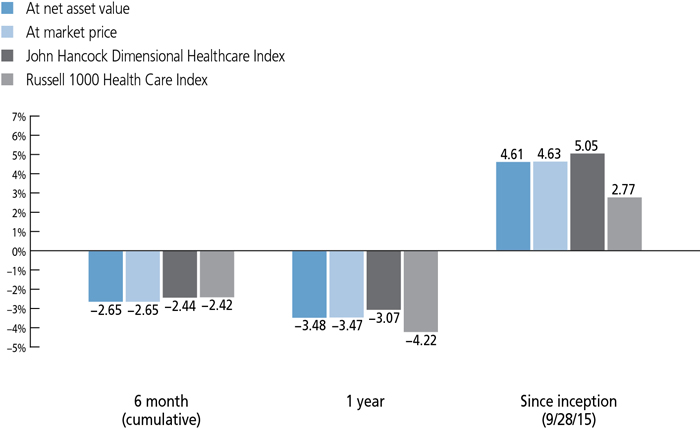

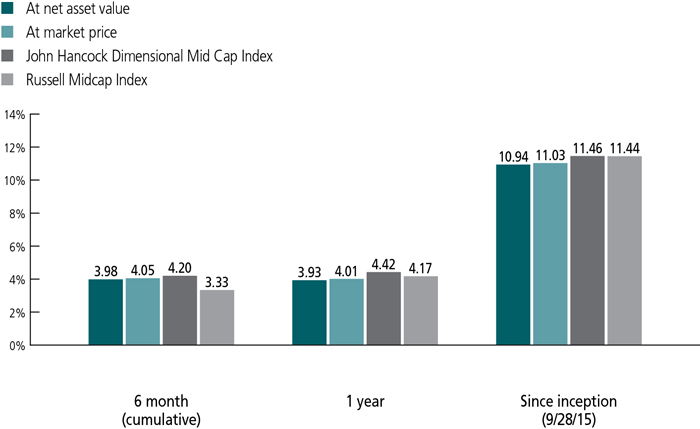

AVERAGE ANNUAL TOTAL RETURNS AS OF 10/31/16 (%)

Market performance is determined using the bid/ask midpoint at 4 P.M. Eastern time, when the NAV is typically calculated. Your returns may differ if you traded shares at other times during the day. The NAV is calculated by dividing the total value of all the securities in the fund's portfolio plus cash, interest, receivables, and other assets, minus any liabilities, by the number of fund shares outstanding.

The John Hancock Dimensional Consumer Discretionary Index comprises securities in the consumer discretionary sector within the U.S. universe whose market capitalizations are larger than that of the 1001st U.S. company at the time of reconstitution. The index is reconstituted and rebalanced on a semiannual basis. Stocks that compose the index include those that may be considered medium or smaller capitalization company stocks. The consumer discretionary sector is composed of companies in areas such as restaurants, media, consumer retail, leisure equipment and products, hotels, apparel, automobiles, and consumer durable goods. The U.S. universe is defined as a free float-adjusted market-capitalization-weighted portfolio of U.S. operating companies listed on the New York Stock Exchange (NYSE), NYSE MKT LLC, NASDAQ Global Market, or such other securities exchanges deemed appropriate in accordance with the rules-based methodology that is maintained by Dimensional Fund Advisors LP.

Russell 1000 Consumer Discretionary Index comprises securities within the consumer discretionary sector in the Russell 1000 Index.

It is not possible to invest directly in an index. Unlike an index, the fund's total returns are reduced by operating expenses and management fees.

This chart does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or sale of fund shares.

The expense ratios of the fund, both net (including any fee waivers and/or expense limitations) and gross (excluding any fee waivers and/or expense limitations), are set forth according to the most recent publicly available prospectus for the fund and may differ from those disclosed in the Financial highlights tables in this report. Had the fee waivers and expense limitations not been in place, gross expenses would apply. The expense ratios are as follows:

| Gross (%) | 1.27 |

| Net (%) | 0.50 |

The past performance shown here reflects reinvested distributions and the beneficial effect of any expense reductions, and does not guarantee future results. Returns for periods shorter than one year are cumulative. Shares will fluctuate in value and, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance cited. For the most recent month-end performance, visit jhinvestments.com/etf or call 800-225-5291. For further information on the fund's objectives, risks, and strategy, see the fund's prospectus.

PERFORMANCE HIGHLIGHTS OVER THE LAST SIX MONTHS

Volatility persisted, but most domestic indexes rose

For the period ended October 31, 2016, most U.S. equities rose, outperforming developed ex-U.S. markets but trailing emerging markets.

Consumer discretionary shares were down and trailed the market

With its exclusive focus on consumer discretionary equities, the fund was down for the period and lagged the broader market, which was buoyed by stronger performance from other sectors.

An emphasis on smaller-cap securities detracted

The fund's emphasis on smaller-cap shares drove the underperformance relative to the Russell 1000 Consumer Discretionary Index.

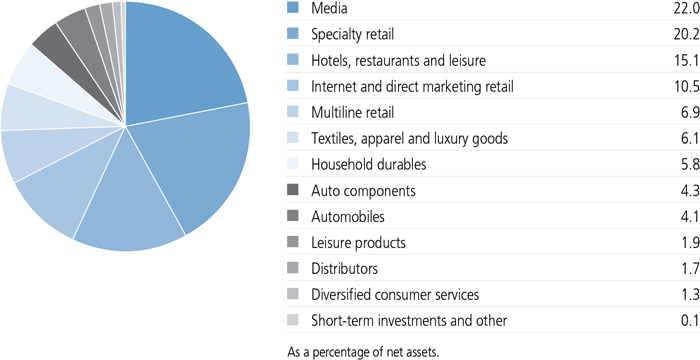

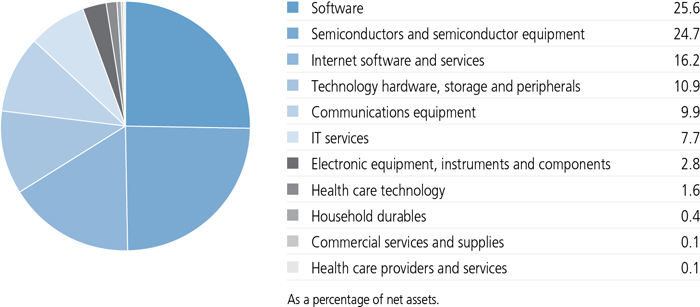

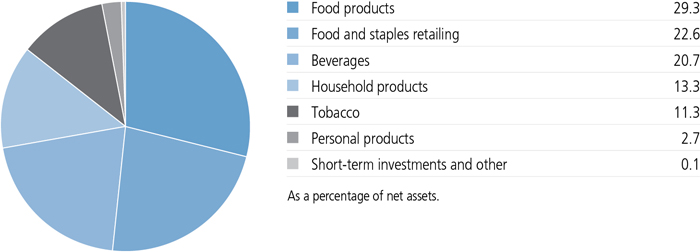

INDUSTRY COMPOSITION AS OF 10/31/16 (%)

A note about risks

While the fund holds large-cap as well as mid- and small-cap companies, the prices of medium and smaller company stocks can change more frequently and dramatically than those of large companies. Value stocks may underperform other segments of the market. The value of a company's equity securities is subject to changes in the company's financial condition and overall market and economic conditions. Investments focused in one sector or industry may fluctuate more dramatically than investments in a wider variety of sectors or industries. Exchange-traded fund shares are bought and sold through exchange trading at market price (not NAV), and are not individually redeemed from the fund. Due to various factors, shares may trade at a premium or discount to their NAV in the secondary market, and the fund's holdings and returns may deviate from those of its index. These variations may be greater when markets are volatile or subject to unusual market conditions. Errors in the construction or calculation of the fund's index may occur from time to time, which may cause tracking error. Brokerage commissions will reduce returns. Please see the fund's prospectus for additional risks.

Lukas J. Smart, CFA

Portfolio Manager

Dimensional Fund Advisors LP

Would you tell us about your investment philosophy and how it drives the composition of the exchange-traded fund (ETF)?

We expect differences in returns among securities. At Dimensional Fund Advisors LP, we have identified four characteristics, or dimensions, of expected returns—the overall market, company size, relative price, and profitability—that academic research has shown to account for most of the variation in historical asset returns and that we believe will account for most of the variation in future returns.

The overall market dimension reflects the excess return over the risk-free rate that market participants demand for investing in a broadly diversified portfolio of equity securities without any style or market capitalization bias. That premium is called the equity premium.

The company size dimension reflects the excess return that investors demand for investing in small-capitalization stocks relative to large-capitalization stocks. The premium associated with this dimension is the small-cap, or size, premium.

The relative price dimension reflects the excess return that investors expect from investing in low relative price, or value, stocks (as measured, for instance, by their price-to-book ratios) in comparison with high relative price, or growth, stocks. The premium associated with this dimension is the value premium.

Finally, the profitability dimension provides a way to discern the expected returns of companies with similar price-driven characteristics. Our research shows that if two companies trade at the same relative price, the one with higher profitability should have a higher expected return over time. The premium associated with this dimension is called the profitability premium.

Relative to a commercial cap-weighted measure of the market, we believe that incorporating these dimensions of expected returns into an investment strategy offers the potential for outperformance over time, and an ETF is a vehicle well suited to our systematic and transparent investment approach.

The custom benchmark we developed, the John Hancock Dimensional Consumer Discretionary Index, is designed to capture these dimensions, and the fund, in turn, is designed to track the custom benchmark.

Can you briefly describe the market environment over the six-month period ended October 31, 2016??

The U.S. market, as measured by the Russell 1000 Index, was up 4.02%. The U.S. market had positive performance for the six-month period, outperforming developed ex-U.S. markets but trailing emerging markets.

Smaller-cap stocks outperformed larger-cap stocks. Across the broad market, stocks with value characteristics outperformed their more growth-oriented counterparts.

The consumer discretionary sector trailed the broader market. Shares in information technology,

TOP 10 HOLDINGS AS OF 10/31/16 (%)

| Amazon.com, Inc. | 6.3 |

| Comcast Corp., Class A | 4.2 |

| The Home Depot, Inc. | 3.4 |

| The Walt Disney Company | 3.2 |

| McDonald's Corp. | 2.2 |

| Starbucks Corp. | 1.8 |

| Target Corp. | 1.8 |

| Ross Stores, Inc. | 1.7 |

| Lowe's Companies, Inc. | 1.6 |

| Omnicom Group, Inc. | 1.6 |

| TOTAL | 27.8 |

| As a percentage of net assets. | |

| Cash and cash equivalents are not included. | |

How did the fund perform during the period?

The fund was down 1.23% on a net asset value (NAV) basis, lagging the Russell 1000 Consumer Discretionary Index, a commercial cap-weighted benchmark we use as a proxy for the consumer discretionary sector of the U.S. stock market.

Relative to most commercial measures of the consumer discretionary sector, our approach generally results in the fund maintaining higher allocations to securities of smaller-cap issuers and to securities trading at lower prices relative to their book values. In the weightings of individual positions, we also place greater emphasis on companies that have demonstrated higher profitability.

The fund's emphasis on smaller-cap equities worked against it during the period, as larger-cap stocks fared better.

Key detractors included an out-of-benchmark holding in safety technology firm Autoliv, Inc. Lesser weights to Amazon.com, Inc. and Netflix, Inc. also detracted from relative performance as both companies posted positive gains. Retailers BestBuy Company, Inc. and Harley-Davidson, Inc. contributed to relative performance, as did lesser weights in HomeDepot, Inc. and NIKE, Inc.

The premiums associated with the dimensions we have identified can be unpredictable over short time horizons. For this reason, we believe the best way to invest is to structure broadly diversified portfolios with a consistent focus on the desired dimensions, seeking to capture the expected premiums associated with them.

While we would expect smaller caps to outperform larger caps and value to outperform growth over an extended time horizon, any given trading day, month, or year can prove otherwise. We believe patience and persistence are key ingredients to success in our style of investing.

How was the fund positioned at the close of the period?

The fund's largest absolute exposures were to the media and specialty retail industries, followed by hotels, restaurants, and leisure, and was broadly diversified across more than 150 issuers. Compared with the Russell 1000 Consumer Discretionary Index, the fund ended the period with higher weights in low relative price stocks and in equities with smaller market capitalizations while emphasizing companies with higher profitability.

MANAGED BY

| Lukas J. Smart, CFA On the fund since inception Investing since 2003 |

| Joel P. Schneider On the fund since inception Investing since 2011 |

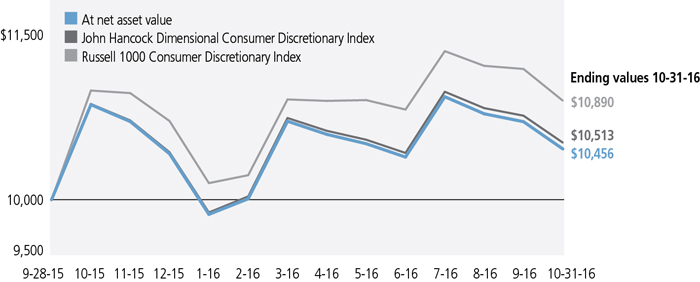

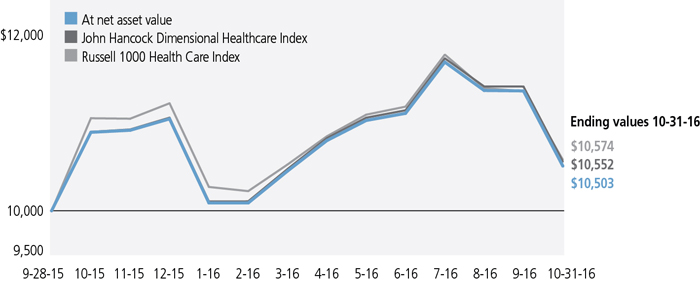

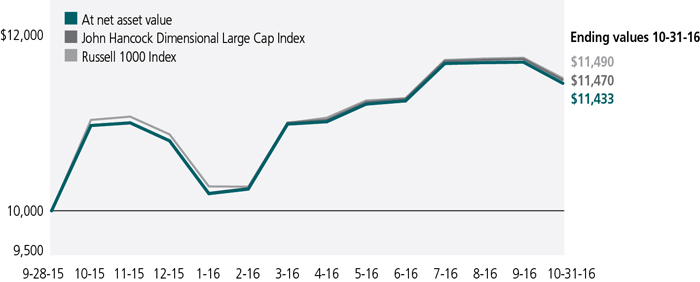

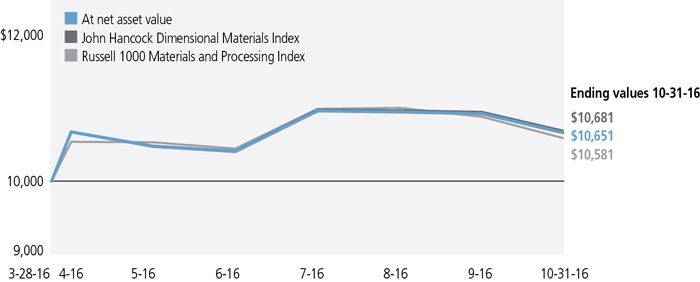

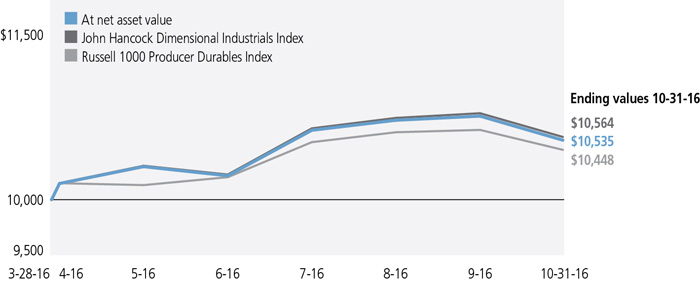

This chart shows what happened to a hypothetical $10,000 investment in John Hancock Multifactor Consumer Discretionary ETF for periods indicated, assuming all distributions were reinvested. For comparison, we've shown the same investment in two separate indexes.

The expense ratios of the fund, both net (including any fee waivers and/or expense limitations) and gross (excluding any fee waivers and/or expense limitations), are set forth according to the most recent publicly available prospectus for the fund and may differ from those disclosed in the Financial highlights tables in this report. The fee waivers and/or expense limitations are contracted through 8-31-17. Had the fee waivers and expense limitations not been in place, gross expenses would apply. The expense ratios are as follows:

| Gross (%) | 1.27 |

| Net (%) | 0.50 |

Please refer to the most recent prospectus and annual or semiannual report for more information on expenses and any expense limitation arrangements for the fund.

The value of $10,000 investment calculated at market value from inception through period end would be $10,461.

The John Hancock Dimensional Consumer Discretionary Index comprises securities in the consumer discretionary sector within the U.S. Universe whose market capitalizations are in the top 1000 U.S. companies at the time of reconstitution. The Index is reconstituted and rebalanced on a semiannual basis. Stocks that compose the Index include those that may be considered medium or smaller capitalization company stocks. The consumer discretionary sector is composed of companies in areas such as restaurants, media, consumer retail, leisure equipment and products, hotels, apparel, automobiles, and consumer durable goods. The U.S. Universe is defined as a free float-adjusted market-capitalization-weighted portfolio of U.S. operating companies listed on the New York Stock Exchange (NYSE), NYSE MKT LLC, NASDAQ Global Market, or such other securities exchanges deemed appropriate in accordance with the rules-based methodology that is maintained by Dimensional Fund Advisors LP.

Russell 1000 Consumer Discretionary Index comprises securities within the consumer discretionary sector in the Russell 1000 Index.

It is not possible to invest directly in an index. Unlike an index, the fund's total returns are reduced by operating expenses and management fees.

The chart does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or sale of fund shares.

ETF shares are bought and sold through exchange trading at market price—not net asset value (NAV)—and are not individually redeemed from the fund. Due to various factors, shares may trade at a premium or discount to their NAV in the secondary market, and as a result you may pay more than NAV when you buy shares and receive less than NAV when you sell shares. Additionally due to various factors, a fund's holdings and returns may deviate from those of its index. These variations may be greater when markets are volatile or subject to unusual conditions.

A premium exists when the closing market price is trading above NAV, while a discount indicates that the closing market price is trading below NAV. The differences are expressed as basis points, with one basis point equaling 1/100 of 1%.

The chart below presents information about the differences between the fund's daily closing market price and the fund's NAV. The closing market price is determined using the bid/ask midpoint as reported on the NYSE Arca, Inc., at 4 P.M. Eastern time, when the NAV is typically calculated.

Period Ended October 31, 2016

| Closing price below NAV | Closing price above or equal to NAV | |||||||

| Basis point differential | Number of days | % of Total days | Number of days | % of Total days | ||||

| 0 - < 25 | 36 | 28.13% | 91 | 71.09% | ||||

| 25 - < 50 | 0 | 0.00% | 1 | .78% | ||||

| 50 - < 75 | 0 | 0.00% | 0 | 0.00% | ||||

| 75 - < 100 | 0 | 0.00% | 0 | 0.00% | ||||

| 100 or Above | 0 | 0.00% | 0 | 0.00% | ||||

| Total | 36 | 28.13% | 92 | 71.87% | ||||

These examples are intended to help you understand your ongoing operating expenses of investing in the fund so you can compare these costs with the ongoing costs of investing in

other funds.

Understanding fund expenses

As a shareholder of the fund, you incur two types of costs:

| • | Transaction costs, which may include creation and redemption fees and brokerage charges. |

| • | Ongoing operating expenses, including management fees and other fund expenses. |

We are presenting only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about the fund's actual ongoing operating expenses, and is based on the fund's actual NAV return. It assumes an account value of $1,000.00 on May 1, 2016, with the same investment held until October 31, 2016.

| Account value on 5-1-2016 | Ending value on 10-31-2016 | Expenses paid during period ended 10-31-20161 | Annualized expense ratio | |

| $1,000.00 | $987.70 | $2.51 | 0.50% |

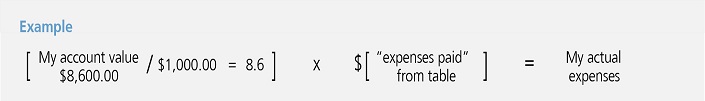

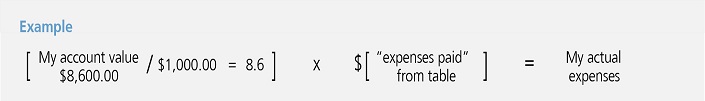

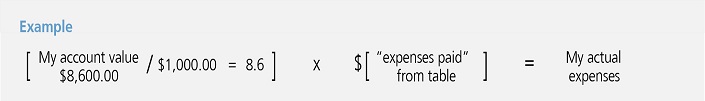

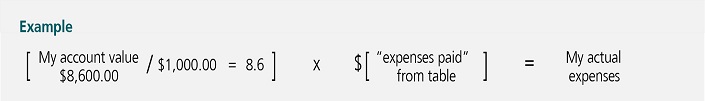

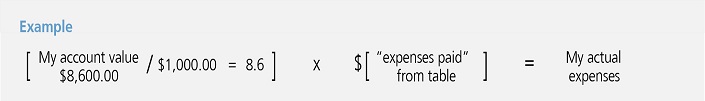

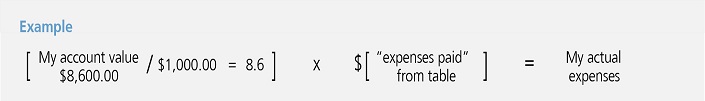

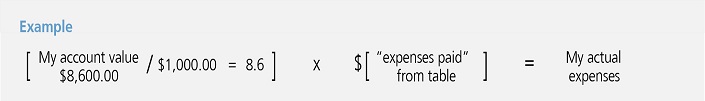

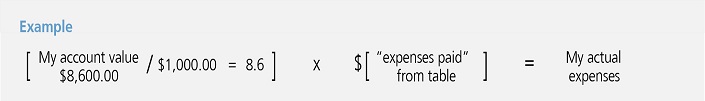

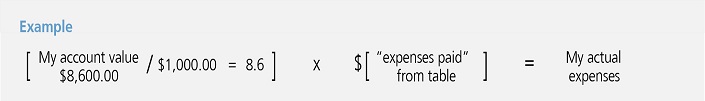

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at October 31, 2016, by $1,000.00, then multiply it by the "expenses paid" from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

Hypothetical example for comparison purposes

This table allows you to compare the fund's ongoing operating expenses with those of any other fund. It provides an example of the fund's hypothetical account values and hypothetical expenses based on the fund's actual expense ratio and an assumed 5% annualized return before expenses (which is not the fund's actual return). It assumes an account value of $1,000.00 on May 1, 2016, with the same investment held until October 31, 2016. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses. Please remember that these hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

| Account value on 5-1-2016 | Ending value on 10-31-2016 | Expenses paid during period ended 10-31-20161 | Annualized expense ratio | |

| $1,000.00 | $1,022.70 | $2.55 | 0.50% |

Remember, these examples do not include any transaction costs. The fund charges a transaction fee per creation unit to those creating or redeeming creation units, and those buying or selling shares in the secondary market will incur customary brokerage commissions and charges. Therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

| 1 | Expenses are equal to the fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

Fund's investments

| As of 10-31-16 (unaudited) | ||||||||||||||

| Shares | Value | |||||||||||||

| Common stocks 99.9% | $25,080,864 | |||||||||||||

| (Cost $25,516,934) | ||||||||||||||

| Consumer discretionary 99.9% | 25,080,864 | |||||||||||||

| Auto components 4.3% | ||||||||||||||

| Autoliv, Inc. | 1,481 | 143,326 | ||||||||||||

| BorgWarner, Inc. | 3,635 | 130,278 | ||||||||||||

| Delphi Automotive PLC | 5,430 | 353,330 | ||||||||||||

| Gentex Corp. | 4,300 | 72,713 | ||||||||||||

| Lear Corp. | 1,650 | 202,587 | ||||||||||||

| The Goodyear Tire & Rubber Company | 6,048 | 175,573 | ||||||||||||

| Automobiles 4.1% | ||||||||||||||

| Ford Motor Company | 29,875 | 350,733 | ||||||||||||

| General Motors Company | 9,109 | 287,844 | ||||||||||||

| Harley-Davidson, Inc. | 3,746 | 213,597 | ||||||||||||

| Tesla Motors, Inc. (I) | 601 | 118,836 | ||||||||||||

| Thor Industries, Inc. | 683 | 54,169 | ||||||||||||

| Distributors 1.7% | ||||||||||||||

| Genuine Parts Company | 2,523 | 228,559 | ||||||||||||

| LKQ Corp. (I) | 4,218 | 136,157 | ||||||||||||

| Pool Corp. | 758 | 70,176 | ||||||||||||

| Diversified consumer services 1.3% | ||||||||||||||

| Bright Horizons Family Solutions, Inc. (I) | 562 | 37,603 | ||||||||||||

| H&R Block, Inc. | 3,672 | 84,346 | ||||||||||||

| Service Corp. International | 4,242 | 108,595 | ||||||||||||

| ServiceMaster Global Holdings, Inc. (I) | 2,660 | 95,201 | ||||||||||||

| Hotels, restaurants and leisure 15.1% | ||||||||||||||

| Aramark | 4,266 | 158,823 | ||||||||||||

| Carnival Corp. | 3,792 | 186,187 | ||||||||||||

| Chipotle Mexican Grill, Inc. (I) | 437 | 157,652 | ||||||||||||

| Cracker Barrel Old Country Store, Inc. | 428 | 59,064 | ||||||||||||

| Darden Restaurants, Inc. | 1,973 | 127,831 | ||||||||||||

| Domino's Pizza, Inc. | 661 | 111,868 | ||||||||||||

| Dunkin' Brands Group, Inc. | 1,721 | 83,228 | ||||||||||||

| Hilton Worldwide Holdings, Inc. | 7,911 | 178,789 | ||||||||||||

| Hyatt Hotels Corp., Class A (I) | 308 | 15,643 | ||||||||||||

| International Game Technology PLC | 1,794 | 51,524 | ||||||||||||

| Jack in the Box, Inc. | 345 | 32,337 | ||||||||||||

| Las Vegas Sands Corp. | 3,428 | 198,413 | ||||||||||||

| Marriott International, Inc., Class A | 2,372 | 162,956 | ||||||||||||

| McDonald's Corp. | 4,995 | 562,287 | ||||||||||||

| MGM Resorts International (I) | 7,785 | 203,733 | ||||||||||||

| Norwegian Cruise Line Holdings, Ltd. (I) | 2,074 | 80,616 | ||||||||||||

| Shares | Value | |||||||||||||

| Consumer discretionary (continued) | ||||||||||||||

| Hotels, restaurants and leisure (continued) | ||||||||||||||

| Panera Bread Company, Class A (I) | 478 | $91,183 | ||||||||||||

| Royal Caribbean Cruises, Ltd. | 2,691 | 206,857 | ||||||||||||

| Six Flags Entertainment Corp. | 1,339 | 74,515 | ||||||||||||

| Starbucks Corp. | 8,488 | 450,458 | ||||||||||||

| Texas Roadhouse, Inc. | 632 | 25,609 | ||||||||||||

| Vail Resorts, Inc. | 639 | 101,882 | ||||||||||||

| Wyndham Worldwide Corp. | 2,301 | 151,498 | ||||||||||||

| Wynn Resorts, Ltd. | 996 | 94,172 | ||||||||||||

| Yum! Brands, Inc. | 2,686 | 231,748 | ||||||||||||

| Household durables 5.8% | ||||||||||||||

| D.R. Horton, Inc. | 5,760 | 166,061 | ||||||||||||

| Harman International Industries, Inc. | 994 | 79,232 | ||||||||||||

| Leggett & Platt, Inc. | 2,385 | 109,424 | ||||||||||||

| Lennar Corp., B Shares | 154 | 5,162 | ||||||||||||

| Lennar Corp., Class A | 2,763 | 115,189 | ||||||||||||

| Mohawk Industries, Inc. (I) | 957 | 176,375 | ||||||||||||

| Newell Brands, Inc. | 4,475 | 214,890 | ||||||||||||

| NVR, Inc. (I) | 72 | 109,656 | ||||||||||||

| PulteGroup, Inc. | 5,135 | 95,511 | ||||||||||||

| Tempur Sealy International, Inc. (I) | 1,017 | 54,989 | ||||||||||||

| Toll Brothers, Inc. (I) | 2,518 | 69,094 | ||||||||||||

| Tupperware Brands Corp. | 692 | 41,188 | ||||||||||||

| Whirlpool Corp. | 1,495 | 223,981 | ||||||||||||

| Internet and direct marketing retail 10.5% | ||||||||||||||

| Amazon.com, Inc. (I) | 1,990 | 1,571,742 | ||||||||||||

| Expedia, Inc. | 1,682 | 217,365 | ||||||||||||

| Liberty Interactive Corp., QVC Group, Series A (I) | 7,214 | 133,387 | ||||||||||||

| Netflix, Inc. (I) | 1,716 | 214,277 | ||||||||||||

| The Priceline Group, Inc. (I) | 256 | 377,403 | ||||||||||||

| TripAdvisor, Inc. (I) | 1,590 | 102,523 | ||||||||||||

| Wayfair, Inc., Class A (I) | 339 | 11,299 | ||||||||||||

| Leisure products 1.9% | ||||||||||||||

| Brunswick Corp. | 1,316 | 57,246 | ||||||||||||

| Hasbro, Inc. | 2,081 | 173,576 | ||||||||||||

| Mattel, Inc. | 5,013 | 158,060 | ||||||||||||

| Polaris Industries, Inc. | 984 | 75,384 | ||||||||||||

| Media 22.0% | ||||||||||||||

| AMC Networks, Inc., Class A (I) | 802 | 39,242 | ||||||||||||

| CBS Corp., Class B | 6,671 | 377,712 | ||||||||||||

| Charter Communications, Inc., Class A (I) | 1,259 | 314,612 | ||||||||||||

| Cinemark Holdings, Inc. | 2,155 | 85,769 | ||||||||||||

| Comcast Corp., Class A | 17,044 | 1,053,660 | ||||||||||||

| Shares | Value | |||||||||||||

| Consumer discretionary (continued) | ||||||||||||||

| Media (continued) | ||||||||||||||

| Discovery Communications, Inc., Series A (I) | 3,634 | $94,884 | ||||||||||||

| Discovery Communications, Inc., Series C (I) | 2,933 | 73,648 | ||||||||||||

| DISH Network Corp., Class A (I) | 2,542 | 148,860 | ||||||||||||

| John Wiley & Sons, Inc., Class A | 574 | 29,618 | ||||||||||||

| Liberty Global PLC, Series A (I) | 3,050 | 99,430 | ||||||||||||

| Liberty Global PLC, Series C (I) | 4,820 | 153,276 | ||||||||||||

| Liberty Media Corp-Liberty SiriusXM, Class A (I) | 2,879 | 95,784 | ||||||||||||

| Lions Gate Entertainment Corp. | 1,191 | 24,249 | ||||||||||||

| Live Nation Entertainment, Inc. (I) | 2,031 | 56,198 | ||||||||||||

| News Corp., Class A | 6,230 | 75,508 | ||||||||||||

| News Corp., Class B | 1,880 | 23,312 | ||||||||||||

| Omnicom Group, Inc. | 5,027 | 401,255 | ||||||||||||

| Regal Entertainment Group, Class A | 1,111 | 23,898 | ||||||||||||

| Scripps Networks Interactive, Inc., Class A | 1,739 | 111,922 | ||||||||||||

| Sirius XM Holdings, Inc. (I) | 28,521 | 118,933 | ||||||||||||

| TEGNA, Inc. | 4,998 | 98,061 | ||||||||||||

| The Interpublic Group of Companies, Inc. | 7,289 | 163,201 | ||||||||||||

| The Madison Square Garden Company, Class A (I) | 358 | 59,245 | ||||||||||||

| The Walt Disney Company | 8,733 | 809,462 | ||||||||||||

| Time Warner, Inc. | 4,369 | 388,797 | ||||||||||||

| Tribune Media Company, Class A | 1,058 | 34,491 | ||||||||||||

| Twenty-First Century Fox, Inc., Class A | 9,016 | 236,850 | ||||||||||||

| Twenty-First Century Fox, Inc., Class B | 3,283 | 86,638 | ||||||||||||

| Viacom, Inc., Class A | 100 | 4,230 | ||||||||||||

| Viacom, Inc., Class B | 6,627 | 248,910 | ||||||||||||

| Multiline retail 6.9% | ||||||||||||||

| Dollar General Corp. | 5,034 | 347,799 | ||||||||||||

| Dollar Tree, Inc. (I) | 4,007 | 302,729 | ||||||||||||

| Kohl's Corp. | 4,705 | 205,844 | ||||||||||||

| Macy's, Inc. | 7,754 | 282,943 | ||||||||||||

| Nordstrom, Inc. | 2,941 | 152,932 | ||||||||||||

| Target Corp. | 6,532 | 448,944 | ||||||||||||

| Specialty retail 20.2% | ||||||||||||||

| Advance Auto Parts, Inc. | 1,268 | 177,621 | ||||||||||||

| American Eagle Outfitters, Inc. | 3,368 | 57,391 | ||||||||||||

| AutoNation, Inc. (I) | 1,519 | 66,639 | ||||||||||||

| AutoZone, Inc. (I) | 357 | 264,951 | ||||||||||||

| Bed Bath & Beyond, Inc. | 3,635 | 146,927 | ||||||||||||

| Best Buy Company, Inc. | 6,114 | 237,896 | ||||||||||||

| Burlington Stores, Inc. (I) | 1,129 | 84,607 | ||||||||||||

| Cabela's, Inc. (I) | 803 | 49,473 | ||||||||||||

| CarMax, Inc. (I) | 3,334 | 166,500 | ||||||||||||

| Shares | Value | |||||||||||||

| Consumer discretionary (continued) | ||||||||||||||

| Specialty retail (continued) | ||||||||||||||

| Dick's Sporting Goods, Inc. | 1,792 | $99,725 | ||||||||||||

| Foot Locker, Inc. | 2,632 | 175,739 | ||||||||||||

| L Brands, Inc. | 2,957 | 213,466 | ||||||||||||

| Lowe's Companies, Inc. | 6,211 | 413,963 | ||||||||||||

| O'Reilly Automotive, Inc. (I) | 1,010 | 267,084 | ||||||||||||

| Penske Automotive Group, Inc. | 708 | 31,683 | ||||||||||||

| Ross Stores, Inc. | 6,692 | 418,518 | ||||||||||||

| Sally Beauty Holdings, Inc. (I) | 2,099 | 54,448 | ||||||||||||

| Signet Jewelers, Ltd. | 1,004 | 81,585 | ||||||||||||

| Staples, Inc. | 9,704 | 71,810 | ||||||||||||

| The Gap, Inc. | 5,052 | 139,385 | ||||||||||||

| The Home Depot, Inc. | 6,911 | 843,211 | ||||||||||||

| The Michaels Companies, Inc. (I) | 1,258 | 29,249 | ||||||||||||

| The TJX Companies, Inc. | 4,334 | 319,633 | ||||||||||||

| Tiffany & Company | 1,588 | 116,591 | ||||||||||||

| Tractor Supply Company | 2,396 | 150,061 | ||||||||||||

| Ulta Salon Cosmetics & Fragrance, Inc. (I) | 1,017 | 247,477 | ||||||||||||

| Urban Outfitters, Inc. (I) | 1,983 | 66,331 | ||||||||||||

| Williams-Sonoma, Inc. | 1,644 | 75,986 | ||||||||||||

| Textiles, apparel and luxury goods 6.1% | ||||||||||||||

| Carter's, Inc. | 956 | 82,542 | ||||||||||||

| Coach, Inc. | 3,538 | 126,979 | ||||||||||||

| Columbia Sportswear Company | 436 | 24,695 | ||||||||||||

| Hanesbrands, Inc. | 6,662 | 171,213 | ||||||||||||

| lululemon athletica, Inc. (I) | 1,460 | 83,585 | ||||||||||||

| Michael Kors Holdings, Ltd. (I) | 3,368 | 171,027 | ||||||||||||

| NIKE, Inc., Class B | 6,763 | 339,367 | ||||||||||||

| PVH Corp. | 1,260 | 134,795 | ||||||||||||

| Ralph Lauren Corp. | 1,153 | 113,109 | ||||||||||||

| Skechers U.S.A., Inc., Class A (I) | 1,461 | 30,725 | ||||||||||||

| Under Armour, Inc., Class A (I) | 1,889 | 58,748 | ||||||||||||

| Under Armour, Inc., Class C (I) | 1,903 | 49,212 | ||||||||||||

| VF Corp. | 2,556 | 138,561 | ||||||||||||

| Yield (%) | Shares | Value | ||||||||||||

| Short-term investments 0.2% | $53,958 | |||||||||||||

| (Cost $53,958) | ||||||||||||||

| Money market funds 0.2% | 53,958 | |||||||||||||

| State Street Institutional U.S. Government Money Market Fund, Premier Class | 0.2575(Y | ) | 53,958 | 53,958 | ||||||||||

| Total investments (Cost $25,570,892)† 100.1% | $25,134,822 | |||||||||||||

| Other assets and liabilities, net (0.1%) | ($34,757 | ) | ||||||||||||

| Total net assets 100.0% | $25,100,065 | |||||||||||||

| The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the fund. | ||||||||||||||

| Key to Security Abbreviations and Legend | ||||||||||||||

| (I) | Non-income producing security. | |||||||||||||

| (Y) | The rate shown is the annualized seven-day yield as of 10-31-16. | |||||||||||||

| † | At 10-31-16, the aggregate cost of investment securities for federal income tax purposes was $25,572,293. Net unrealized depreciation aggregated to $437,471, of which $1,116,042 related to appreciated investment securities and $1,553,513 related to depreciated investment securities. | |||||||||||||

Financial statements

STATEMENT OF ASSETS AND LIABILITIES 10-31-16 (unaudited)

| Assets | |||||||||||||||||||||

| Investments, at value (Cost $25,570,892) | $25,134,822 | ||||||||||||||||||||

| Dividends and interest receivable | 12,392 | ||||||||||||||||||||

| Other receivables and prepaid expenses | 2,037 | ||||||||||||||||||||

| Total assets | 25,149,251 | ||||||||||||||||||||

| Liabilities | |||||||||||||||||||||

| Payable to affiliates | |||||||||||||||||||||

| Accounting and legal services fees | 1,245 | ||||||||||||||||||||

| Investment management fees | 9,011 | ||||||||||||||||||||

| Other liabilities and accrued expenses | 38,930 | ||||||||||||||||||||

| Total liabilities | 49,186 | ||||||||||||||||||||

| Net assets | $25,100,065 | ||||||||||||||||||||

| Net assets consist of | |||||||||||||||||||||

| Paid-in capital | $25,610,613 | ||||||||||||||||||||

| Undistributed net investment income | 73,472 | ||||||||||||||||||||

| Accumulated net realized gain (loss) on investments | (147,950 | ) | |||||||||||||||||||

| Net unrealized appreciation (depreciation) on investments | (436,070 | ) | |||||||||||||||||||

| Net assets | $25,100,065 | ||||||||||||||||||||

| Net asset value per share | |||||||||||||||||||||

| Based on net asset values and shares outstanding-the fund has an unlimited number of shares authorized with no par value | |||||||||||||||||||||

| Net assets | $25,100,065 | ||||||||||||||||||||

| Shares outstanding | 1,000,000 | ||||||||||||||||||||

| Net asset value per share | $25.10 | ||||||||||||||||||||

STATEMENT OF OPERATIONS For the six months ended 10-31-16 (unaudited)

| Investment income | ||||||||||||||||||||||||

| Dividends | $159,682 | |||||||||||||||||||||||

| Interest | 73 | |||||||||||||||||||||||

| Total investment income | 159,755 | |||||||||||||||||||||||

| Expenses | ||||||||||||||||||||||||

| Investment management fees | 44,919 | |||||||||||||||||||||||

| Accounting and legal services fees | 2,106 | |||||||||||||||||||||||

| Transfer agent fees | 8,032 | |||||||||||||||||||||||

| Trustees' fees | 268 | |||||||||||||||||||||||

| Printing and postage | 13,948 | |||||||||||||||||||||||

| Professional fees | 16,820 | |||||||||||||||||||||||

| Custodian fees | 18,796 | |||||||||||||||||||||||

| Stock exchange listing fees | 6,063 | |||||||||||||||||||||||

| Other | 31 | |||||||||||||||||||||||

| Total expenses | 110,983 | |||||||||||||||||||||||

| Less expense reductions | (61,073 | ) | ||||||||||||||||||||||

| Net expenses | 49,910 | |||||||||||||||||||||||

| Net investment income | 109,845 | |||||||||||||||||||||||

| Realized and unrealized gain (loss) | ||||||||||||||||||||||||

| Net realized gain (loss) on investments | (140,535 | ) | ||||||||||||||||||||||

| Change in net unrealized appreciation (depreciation) of investments | (544,024 | ) | ||||||||||||||||||||||

| Net realized and unrealized loss | (684,559 | ) | ||||||||||||||||||||||

| Decrease in net assets from operations | ($574,714 | ) | ||||||||||||||||||||||

STATEMENTS OF CHANGES IN NET ASSETS

| Six months ended 10-31-16 | Period ended 4-30-161 | ||||||||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||||||||

| Increase (decrease) in net assets | |||||||||||||||||||||||||||||

| From operations | |||||||||||||||||||||||||||||

| Net investment income | $109,845 | $101,128 | |||||||||||||||||||||||||||

| Net realized gain (loss) | (140,535 | ) | 23,821 | ||||||||||||||||||||||||||

| Change in net unrealized appreciation (depreciation) | (544,024 | ) | 107,954 | ||||||||||||||||||||||||||

| Increase (decrease) in net assets resulting from operations | (574,714 | ) | 232,903 | ||||||||||||||||||||||||||

| Distributions to shareholders | |||||||||||||||||||||||||||||

| From net investment income | (94,608 | ) | (43,303 | ) | |||||||||||||||||||||||||

| From fund share transactions | |||||||||||||||||||||||||||||

| Shares issued | 10,430,475 | 16,347,186 | |||||||||||||||||||||||||||

| Shares repurchased | — | (1,197,874 | ) | ||||||||||||||||||||||||||

| Total from fund share transactions | 10,430,475 | 15,149,312 | |||||||||||||||||||||||||||

| Total increase | 9,761,153 | 15,338,912 | |||||||||||||||||||||||||||

| Net assets | |||||||||||||||||||||||||||||

| Beginning of period | 15,338,912 | — | |||||||||||||||||||||||||||

| End of period | $25,100,065 | $15,338,912 | |||||||||||||||||||||||||||

| Undistributed net investment income | $73,472 | $58,235 | |||||||||||||||||||||||||||

| Share activity | |||||||||||||||||||||||||||||

| Shares outstanding | |||||||||||||||||||||||||||||

| Beginning of period | 600,000 | — | |||||||||||||||||||||||||||

| Shares issued | 400,000 | 650,000 | |||||||||||||||||||||||||||

| Shares repurchased | — | (50,000 | ) | ||||||||||||||||||||||||||

| End of period | 1,000,000 | 600,000 | |||||||||||||||||||||||||||

| 1 | Period from 9-28-15 (commencement of operations) to 4-30-16. | |||||||||||||||||||||||||||||||

Financial highlights

| Period ended | 10-31-16 | 1 | 4-30-16 | 2 | ||||||||||||||||||||||||||||||||||||||||||||||

| Per share operating performance | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net asset value, beginning of period | $25.56 | $24.21 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Net investment income3 | 0.14 | 0.18 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Net realized and unrealized gain (loss) on investments | (0.45 | ) | 1.24 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total from investment operations | (0.31 | ) | 1.42 | |||||||||||||||||||||||||||||||||||||||||||||||

| Less distributions | ||||||||||||||||||||||||||||||||||||||||||||||||||

| From net investment income | (0.15 | ) | (0.07 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

| Net asset value, end of period | $25.10 | $25.56 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Total return (%)4 | (1.23 | ) 5 | 5.87 | 5 | ||||||||||||||||||||||||||||||||||||||||||||||

| Ratios and supplemental data | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net assets, end of period (in millions) | $25 | $15 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Ratios (as a percentage of average net assets): | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Expenses before reductions | 1.11 | 6 | 1.27 | 6 | ||||||||||||||||||||||||||||||||||||||||||||||

| Expenses including reductions | 0.50 | 6 | 0.50 | 6 | ||||||||||||||||||||||||||||||||||||||||||||||

| Net investment income | 0.99 | 6,7 | 1.22 | 6 | ||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio turnover (%)8 | 11 | 5 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | Six months ended 10-31-16. Unaudited. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | Period from 9-28-15 (commencement of operations) to 4-30-16. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | Based on average daily shares outstanding. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5 | Not annualized. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6 | Annualized. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7 | A portion of income is presented unannualized. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8 | Portfolio turnover rate excludes securities received or delivered from in-kind transactions. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Note 1 — Organization

John Hancock Multifactor Consumer Discretionary ETF (the fund) is a series of the John Hancock Exchange-Traded Fund Trust (the Trust), an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act). The investment objective of the fund is to seek to provide investment results that closely correspond, before fees and expenses, to the performance of the John Hancock Dimensional Consumer Discretionary Index. The John Hancock Dimensional Consumer Discretionary Index is a rules-based index of U.S. consumer discretionary stocks that have been selected based on sources of expected returns. Securities eligible for inclusion in the index are classified according to their market capitalization, relative price, and profitability, and are weighted accordingly in favor of smaller, less expensive, more profitable companies.

Note 2 — Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (US GAAP), which require management to make certain estimates and assumptions as of the date of the financial statements. Actual results could differ from those estimates and those differences could be significant. The fund qualifies as an investment company under Topic 946 of Accounting Standards Codification of US GAAP.

Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the fund:

Security valuation. Investments are stated at value as of the scheduled close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 p.m., Eastern Time. In case of emergency or other disruption resulting in the NYSE not opening for trading or the NYSE closing at a time other than the regularly scheduled close, the net asset value (NAV) may be determined as of the regularly scheduled close of the NYSE pursuant to the fund's Valuation Policies and Procedures. The time at which shares and transactions are priced and until which orders are accepted may vary to the extent permitted by the Securities and Exchange Commission (SEC) and applicable regulations.

In order to value the securities, the fund uses the following valuation techniques: Equity securities held by the fund are typically valued at the last sale price or official closing price on the exchange or principal market where the security trades. In the event there were no sales during the day or closing prices are not available, the securities are valued using the last available bid price. Investments by the fund in open-end mutual funds are valued at their respective NAVs each business day.

In certain instances, the Pricing Committee may determine to value equity securities using prices obtained from another exchange or market if trading on the exchange or market on which prices are typically obtained did not open for trading as scheduled, or if trading closed earlier than scheduled, and trading occurred as normal on another exchange or market.

Other portfolio securities and assets, for which reliable market quotations are not readily available, are valued at fair value as determined in good faith by the fund's Pricing Committee following procedures established by the Board of Trustees. The frequency with which these fair valuation procedures are used cannot be predicted and fair value of securities may differ significantly from the value that would have been used had a ready market for such securities existed.

The fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities. Level 2 includes securities valued using other significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these inputs are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the fund's own assumptions in determining the fair value of investments. Factors used in determining value may include market or issuer specific events or trends, changes in interest rates and credit quality. The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. Changes in valuation techniques and related inputs may result in transfers into or out of an assigned level within the disclosure hierarchy.

As of October 31, 2016, all investments are categorized as Level 1 under the hierarchy described above.

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily NAV calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Dividend income is recorded on the ex-date, except for dividends of foreign securities where the dividend may not be known until after the ex-date. In those cases, dividend income, net of withholding taxes, is recorded when the fund becomes aware of the dividends. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation.

Line of credit. The fund may borrow from banks for temporary or emergency purposes, including meeting redemption requests that otherwise might require the untimely sale of securities. Pursuant to the fund's custodian agreement, the custodian may loan money to the fund to make properly authorized payments. The fund is obligated to repay the custodian for any overdraft, including any related costs or expenses. The custodian may have a lien, security interest or security entitlement in any fund property that is not otherwise segregated or pledged, to the extent of any overdraft, and to the maximum extent permitted by law.

Effective June 30, 2016, the fund and other affiliated funds have entered into a syndicated line of credit agreement with Citibank, N.A. as the administrative agent that enables them to participate in a $1 billion unsecured committed line of credit. Excluding commitments designated for certain funds, the fund can borrow up to an aggregate commitment amount of $750 million, subject to asset coverage and other limitations as specified in the agreement. A commitment fee payable at the end of each calendar quarter, based on the average daily unused portion of the line of credit, is charged to each participating fund based on a combination of fixed and asset based allocations and is reflected in Other expenses on the Statement of operations. Prior to June 30, 2016, the fund had a similar agreement that enabled it to participate in a $750 million unsecured committed line of credit. For the six months ended October 31, 2016, the fund had no borrowings under either line of credit.

Overdrafts. Pursuant to the custodian agreement, the fund's custodian may, in its discretion, advance funds to the fund to make properly authorized payments. When such payments result in an overdraft, the fund is obligated to repay the custodian for any overdraft, including any costs or expenses associated with the overdraft. The custodian may have a lien, security interest or security entitlement in any fund property that is not otherwise segregated or pledged, to the maximum extent permitted by law, to the extent of any overdraft.

Expenses. Within the John Hancock group of funds complex, expenses that are directly attributable to an individual fund are allocated to such fund. Expenses that are not readily attributable to a specific fund are allocated among all funds in an equitable manner, taking into consideration, among other things, the nature and type of expense and the fund's relative net assets. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Federal income taxes. The fund intends to continue to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

For federal income tax purposes, as of April 30, 2016, the fund has a short-term capital loss carryfoward of $6,014 available to offset future net realized capital gains. This carryforward does not expire.

As of April 30, 2016, the fund had no uncertain tax positions that would require financial statement recognition, derecognition or disclosure. The fund's federal tax returns are subject to examination by the Internal Revenue Service for a period of three years.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The fund will declare and pay dividends semiannually from net investment income, if any. Capital gain distributions, if any, are typically distributed annually.

Such distributions, on a tax basis, are determined in conformity with income tax regulations, which may differ from US GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences, if any, will reverse in a subsequent period. Book-tax differences are primarily attributable to redemptions-in-kind.

Note 3 — Guarantees and indemnifications

Under the Trust's organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust, including the fund. Additionally, in the normal course of business, the fund enters into contracts with service providers that contain general indemnification clauses. The fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the fund that have not yet occurred. The risk of material loss from such claims is considered remote.

Note 4 — Fees and transactions with affiliates

John Hancock Advisers, LLC (the Advisor) serves as investment advisor for the fund. The Advisor is an indirect, wholly owned subsidiary of Manulife Financial Corporation (MFC).

Management fee. The fund has an investment management agreement with the Advisor under which the fund pays a monthly management fee to the Advisor equivalent on an annual basis to the sum of: (a) 0.450% of the first $300 million of the fund's average daily net assets; and (b) 0.420% of the fund's average daily net assets in excess of $300 million. The Advisor has a subadvisory agreement with Dimensional Fund Advisors LP. The fund is not responsible for payment of subadvisory fees.

The Advisor has contractually agreed to waive a portion of its management fee and/or reimburse expenses for certain funds of the John Hancock group of funds complex, including the fund (the participating portfolios). This waiver is based upon aggregate net assets of all the participating portfolios. The amount of the reimbursement is calculated daily and allocated among all the participating portfolios in proportion to the daily net assets of each fund. During the six months ended October 31, 2016, this waiver amounted to 0.01% of the fund's average net assets (on an annualized basis). This arrangement may be amended or terminated at any time by the Advisor upon notice to the fund and with the approval of the Board of Trustees.

The Advisor has contractually agreed to reduce its management fee or, if necessary, make payment to the fund, in an amount equal to the amount by which expenses of the fund exceed 0.50% of average annual net assets (on an annualized basis). Expenses means all the expenses of the fund, excluding (a) taxes, (b) brokerage commissions, (c) interest expense, (d) litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of the fund's business, (e) borrowing costs, (f) prime brokerage fees, (g) acquired fund fees and expenses paid indirectly, and (h) short dividend expense. The expense limitation expires on August 31, 2017, unless renewed by mutual agreement of the fund and the Advisor based on a determination that this is appropriate under the circumstances at that time.

For the six months ended October 31, 2016, the expense reductions described above amounted to $61,073.

Expenses waived or reimbursed in the current fiscal period are not subject to recapture in future fiscal periods.

The investment management fees, including the impact of the waivers and reimbursements as described above, incurred for the six months ended October 31, 2016 were equivalent to a net annual effective rate of 0.00% of the fund's average daily net assets.

Accounting and legal services. Pursuant to a service agreement, the fund reimburses the Advisor for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services to the fund, including the preparation of all tax returns, periodic reports to shareholders and regulatory reports, among other services. These accounting and legal services fees incurred for the six months ended October 31, 2016 amounted to an annual rate of 0.02% of the fund's average daily net assets.

Trustee expenses. The fund compensates each Trustee who is not an employee of the Advisor or its affiliates. The costs of paying Trustee compensation and expenses are allocated to each fund based on its net assets relative to other funds within the John Hancock group of funds complex.

Note 5 — Capital share transactions

The fund will issue and redeem shares at NAV only in a large specified number of shares, each called a "creation unit," or multiples thereof, that consist of 50,000 shares. Only authorized participants may engage in creation or redemption transactions directly with the fund. Such transactions generally take place when an authorized participant deposits into the fund a designated portfolio of securities (including any portion of such securities for which cash may be substituted) and a specified amount of cash approximating the holdings of the fund in exchange for a specified number of creation units. Similarly, shares can be redeemed only in creation units, generally for a designated portfolio of securities (including any portion of such securities for which cash may be substituted) held by the fund and a specified amount of cash. For purposes of US GAAP, in-kind redemption transactions are treated as a sale of securities and any resulting gains and losses are recognized based on the market value of the securities on the date of the transfer. Authorized participants pay a transaction fee to the custodian when purchasing and redeeming creation units of the fund. The transaction fee is used to defray the costs associated with the issuance and redemption of creation units. Individual shares of the fund may only be purchased and sold in secondary market transactions through brokers. Secondary market transactions may be subject to brokerage commissions. Shares of the fund are listed and traded on the NYSE Arca, Inc., trade at market prices rather than NAV, and may trade at a price greater than or less than NAV.

Affiliates of the fund or the Advisor owned 88% of shares outstanding on October 31, 2016. Such concentration of shareholders' capital could have a material effect on the fund if such shareholders redeem from the fund.

Note 6 — Purchase and sale of securities

Purchases and sales of securities, other than in-kind transactions and short-term securities, amounted to $2,254,314 and $2,202,043, respectively, for the six months ended October 31, 2016. Securities received and delivered from in-kind transactions aggregated $10,432,729 and $0, respectively, for the six months ended October 31, 2016.

Note 7 — Industry or sector risk

The fund generally invests a large percentage of its assets in one or more particular industries or sectors of the economy. If a large percentage of the fund's assets are economically tied to a single or small number of industries or sectors of the economy, the fund will be less diversified than a more broadly diversified fund, and it may cause the fund to underperform if that industry or sector underperforms. In addition, focusing on a particular industry or sector may make the fund's NAV more volatile. Further, a fund that invests in particular industries or sectors is particularly susceptible to the impact of market, economic, regulatory and other factors affecting those industries or sectors.

Note 8 — New rule issuance

In October 2016, the SEC issued Final Rule Release No. 33-10231, Investment Company Reporting Modernization (the Release). The Release calls for the adoption of new rules and forms as well as amendments to its rules and forms to modernize the reporting and disclosure of information by registered investment companies. The Commission is adopting amendments to Regulation S-X, which will require standardized, enhanced disclosure about derivatives in investment company financial statements, as well as other amendments. Management is in the process of reviewing the impact to the financial statements.

Trustees James M. Oates, Chairperson Officers Andrew G. Arnott John J. Danello Francis V. Knox, Jr. Charles A. Rizzo Salvatore Schiavone | Investment advisor John Hancock Advisers, LLC Subadvisor Dimensional Fund Advisors LP Principal distributor Foreside Fund Services, LLC Custodian State Street Bank and Trust Company Transfer agent State Street Bank and Trust Company Legal counsel Dechert LLP Stock symbol NYSE Arca: JHMC |

*Member of the Audit Committee

†Non-Independent Trustee

The fund's proxy voting policies and procedures, as well as the fund proxy voting record for the most recent twelve-month period ended June 30, are available free of charge on the Securities and Exchange Commission (SEC) website at sec.gov or on our website.

The fund's complete list of portfolio holdings, for the first and third fiscal quarters, is filed with the SEC on Form N-Q. The fund's Form N-Q is available on our website and the SEC's website, sec.gov, and can be reviewed and copied (for a fee) at the SEC's Public Reference Room in Washington, DC. Call 800-SEC-0330 to receive information on the operation of the SEC's Public Reference Room.

We make this information on your fund, as well as monthly portfolio holdings, and other fund details available on our website at jhinvestments.com/etf or by calling 800-225-5291.

| You can also contact us: | |||

| 800-225-5291 jhinvestments.com/etf | Regular mail: John Hancock Signature Services, Inc. | Express mail: John Hancock Signature Services, Inc. | |

John Hancock family of funds

DOMESTIC EQUITY FUNDS Balanced Blue Chip Growth Classic Value Disciplined Value Disciplined Value Mid Cap Equity Income Fundamental All Cap Core Fundamental Large Cap Core Fundamental Large Cap Value New Opportunities Small Cap Value Small Company Strategic Growth U.S. Global Leaders Growth U.S. Growth Value Equity GLOBAL AND INTERNATIONAL EQUITY FUNDS Disciplined Value International Emerging Markets Emerging Markets Equity Global Equity Global Shareholder Yield Greater China Opportunities International Growth International Small Company International Value Equity | INCOME FUNDS Bond California Tax-Free Income Emerging Markets Debt Floating Rate Income Global Income Government Income High Yield High Yield Municipal Bond Income Investment Grade Bond Money Market Short Duration Credit Opportunities Spectrum Income Strategic Income Opportunities Tax-Free Bond ALTERNATIVE AND SPECIALTY FUNDS Absolute Return Currency Alternative Asset Allocation Enduring Assets Financial Industries Global Absolute Return Strategies Global Conservative Absolute Return Global Focused Strategies Global Real Estate Natural Resources Redwood Regional Bank Seaport Technical Opportunities |

A fund's investment objectives, risks, charges, and expenses should be considered carefully before investing. The prospectus contains this and other important information about the fund. To obtain a prospectus, contact your financial professional, call John Hancock Investments at 800-225-5291, or visit our website at jhinvestments.com. Please read the prospectus carefully before investing or sending money.

ASSET ALLOCATION Income Allocation Fund Lifestyle Aggressive Portfolio Lifestyle Balanced Portfolio Lifestyle Conservative Portfolio Lifestyle Growth Portfolio Lifestyle Moderate Portfolio Retirement Choices Portfolios Retirement Living Portfolios Retirement Living II Portfolios EXCHANGE-TRADED FUNDS John Hancock Multifactor Consumer Discretionary ETF John Hancock Multifactor Consumer Staples ETF John Hancock Multifactor Developed International ETF John Hancock Multifactor Energy ETF John Hancock Multifactor Financials ETF John Hancock Multifactor Healthcare ETF John Hancock Multifactor Industrials ETF John Hancock Multifactor Large Cap ETF John Hancock Multifactor Materials ETF John Hancock Multifactor Mid Cap ETF John Hancock Multifactor Technology ETF John Hancock Multifactor Utilities ETF | ENVIRONMENTAL, SOCIAL, AND GOVERNANCE FUNDS ESG All Cap Core ESG Core Bond ESG International Equity ESG Large Cap Core CLOSED-END FUNDS Financial Opportunities Hedged Equity & Income Income Securities Trust Investors Trust Preferred Income Preferred Income II Preferred Income III Premium Dividend Tax-Advantaged Dividend Income Tax-Advantaged Global Shareholder Yield |

John Hancock Multifactor ETF shares are bought and sold at market price (not NAV), and are not individually redeemed from the fund. Brokerage commissions will reduce returns.

John Hancock ETFs are distributed by Foreside Fund Services, LLC (Foreside), and are subadvised by Dimensional Fund Advisors LP. Foreside is not affiliated with John Hancock Funds, LLC or Dimensional Fund Advisors LP. Mutual funds and certain closed-end funds are distributed by John Hancock Funds, LLC. Member FINRA/SIPC.

Dimensional Fund Advisors LP receives compensation from John Hancock in connection with licensing rights to the John Hancock Dimensional indexes. Dimensional Fund Advisors LP does not sponsor, endorse, or sell, and makes no representation as to the advisability of investing in the John Hancock Multifactor ETFs (Multifactor ETFs). Neither John Hancock Advisers, LLC nor Dimensional Fund Advisors LP guarantees the accuracy and/or the completeness of the John Hancock Dimensional Indexes (the "Indexes") or any data included therein, and neither John Hancock Advisers, LLC nor Dimensional Fund Advisors LP shall have any liability for any errors, omissions, or interruptions therein. Neither John Hancock Advisers, LLC nor Dimensional Fund Advisors LP makes any warranty, express or implied, as to results to be obtained by the Multifactor ETFs, owners of the shares of the Multifactor ETFs or any other person or entity from the use of the Indexes, trading based on the Indexes, or any data included therein, either in connection with the Multifactor ETFs or for any other use. Neither John Hancock Advisers, LLC nor Dimensional Fund Advisors LP makes any express or implied warranties, and expressly disclaim all warranties of merchantability or fitness for a particular purpose or use with respect to the Indexes or any data included therein. Without limiting any of the foregoing, in no event shall either John Hancock Advisers, LLC or Dimensional Fund Advisors LP have any liability for any special, punitive, direct, indirect or consequential damages (including lost profits) arising out of matters relating to the use of the Indexes, even if notified of the possibility of such damages.

John Hancock Investments

A trusted brand

John Hancock Investments is a premier asset manager representing one of

America's most trusted brands, with a heritage of financial stewardship dating

back to 1862. Helping our shareholders pursue their financial goals is at the

core of everything we do. It's why we support the role of professional financial

advice and operate with the highest standards of conduct and integrity.

A better way to invest

We build funds based on investor needs, then search the world to find proven

portfolio teams with specialized expertise in those strategies. As a manager of

managers, we apply vigorous oversight to ensure that they continue to meet

our uncompromising standards and serve the best interests of our shareholders.

Results for investors

Our unique approach to asset management enables us to provide a diverse set

of investments backed by some of the world's best managers, along with strong

risk-adjusted returns across asset classes.

| John Hancock Investments 601 Congress Street n Boston, MA 02210 800-225-5291 n jhinvestments.com/etf | |

| This report is for the information of the shareholders of John Hancock Multifactor Consumer Discretionary ETF. It is not authorized for distribution to prospective investors unless preceded or accompanied by a prospectus. | ||

| JHAN-2016-11-09-0440 | 830SA 10/16 12/16 | |

John Hancock

A message to shareholders

Dear shareholder,

The past six months were generally positive for U.S. equities, as markets hit all-time highs this summer, buoyed by decent corporate earnings and relatively light trading volume. Although economic growth remains more sluggish than many would like, consumer spending and employment gains have been supportive of the continued stock market advance.

That said, there are a number of looming uncertainties that have given investors pause. President-elect Donald J. Trump will face the challenges of uniting a fractured electorate and reigniting growth in a lethargic economy. The U.S. Federal Reserve, after a year of holding tight on interest rates, will meet in December to discuss whether the economy is stable enough to handle another increase in the federal funds rate as it seeks to normalize monetary policy. Advisors and investors are concerned, as we close out the eighth year of a bull market, that there is more that could go wrong than could continue to go right. It is the kind of environment that underscores the value of professional financial guidance and the importance of diversification and a long-term perspective.

On behalf of everyone at John Hancock Investments, I'd like to take this opportunity to thank you for the continued trust you've placed in us.

Sincerely,

Andrew G. Arnott

President and Chief Executive Officer

John Hancock Investments

This commentary reflects the CEO's views, which are subject to change at any time. All investments entail risks, including the possible loss of principal. Diversification does not guarantee a profit or eliminate the risk of a loss. For more up-to-date information, you can visit our website at jhinvestments.com.

John Hancock

Multifactor Financials ETF

INVESTMENT OBJECTIVE

The fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the John Hancock Dimensional Financials Index.

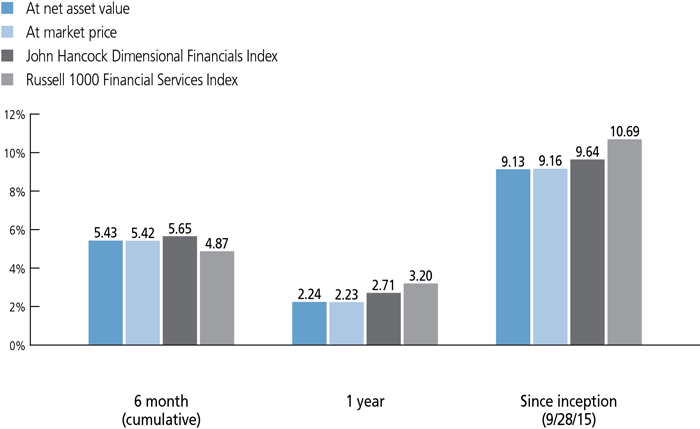

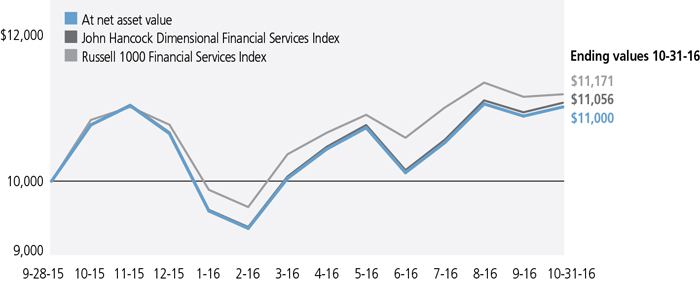

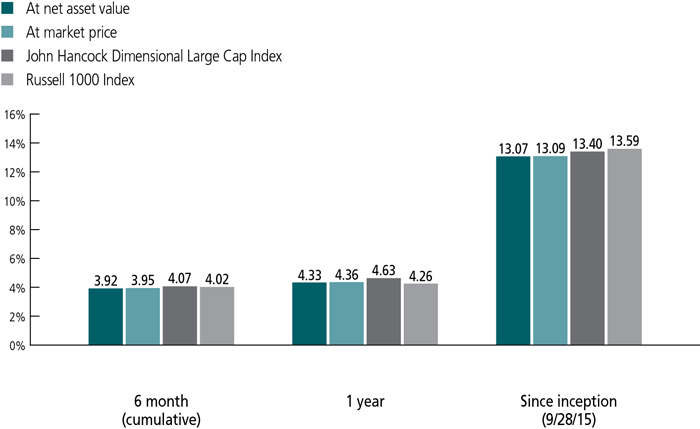

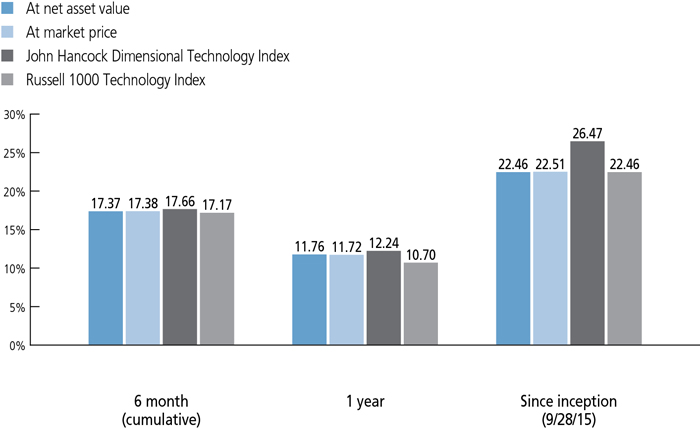

AVERAGE ANNUAL TOTAL RETURNS AS OF 10/31/16 (%)

Market performance is determined using the bid/ask midpoint at 4 P.M. Eastern time, when the NAV is typically calculated. Your returns may differ if you traded shares at other times during the day. The NAV is calculated by dividing the total value of all the securities in the fund's portfolio plus cash, interest, receivables, and other assets, minus any liabilities, by the number of fund shares outstanding.

The John Hancock Dimensional Financials Index comprises securities in the financial sector within the U.S. universe whose market capitalizations are larger than that of the 1001st largest U.S. company at the time of reconstitution. Stocks that compose the index include those that may be considered medium or smaller capitalization company stocks. The index is reconstituted and rebalanced on a semiannual basis. The financials sector is composed of companies in areas such as banking, savings and loans, insurance, consumer finance, investment brokerage, asset management, or other diverse financial services. The U.S. universe is defined as a free float-adjusted market-capitalization-weighted portfolio of U.S. operating companies listed on the New York Stock Exchange (NYSE), NYSE MKT LLC, NASDAQ Global Market, or such other securities exchanges deemed appropriate in accordance with the rules-based methodology that is maintained by Dimensional Fund Advisors LP.

The Russell 1000 Financial Services Index comprises securities classified in the financial services sector of the Russell 1000 Index.

It is not possible to invest directly in an index. Unlike an index, the fund's total returns are reduced by operating expenses and management fees.

The chart does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or sale of fund shares.

The expense ratios of the fund, both net (including any fee waivers and/or expense limitations) and gross (excluding any fee waivers and/or expense limitations), are set forth according to the most recent publicly available prospectus for the fund and may differ from those disclosed in the Financial highlights table in this report. Had the fee waivers and expense limitations not been in place, gross expenses would apply. The expense ratios are as follows:

| Gross (%) | 1.19 |

| Net (%) | 0.50 |

The past performance shown here reflects reinvested distributions and the beneficial effect of any expense reductions, and does not guarantee future results. Returns for periods shorter than one year are cumulative. Shares will fluctuate in value and, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance cited. For the most recent month-end performance, visit jhinvestments.com/etf or call 800-225-5291. For further information on the fund's objectives, risks, and strategy, see the fund's prospectus.

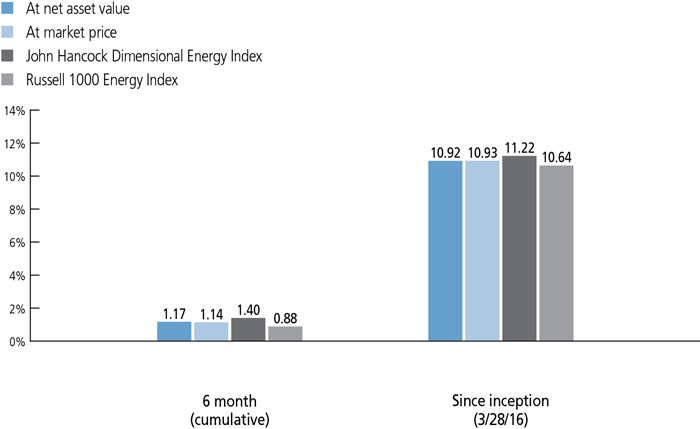

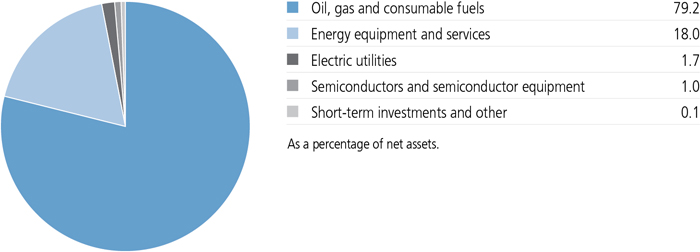

PERFORMANCE HIGHLIGHTS OVER THE LAST SIX MONTHS

Volatility persisted, but most domestic indexes rose

For the period ended October 31, 2016, most U.S. equities rose, outperforming developed ex-U.S. markets but trailing emerging markets.

The financials sector was up and ahead of the broad market

With its exclusive focus on the equity of financial companies, the fund generated a positive total return for the period and it led the broader market, as measured by the Russell 1000 Index.

An underweight in real estate securities contributed

Low exposure to real estate investment trusts helped the fund's relative performance during the period.

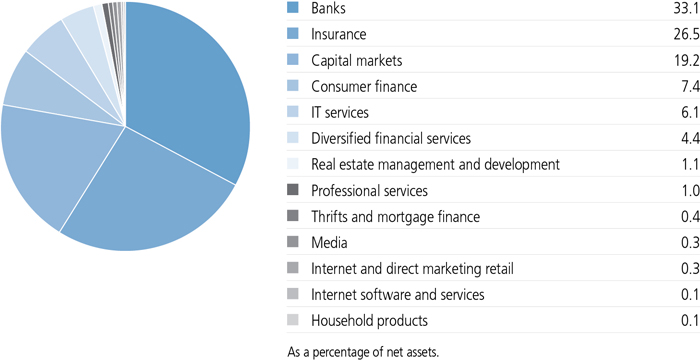

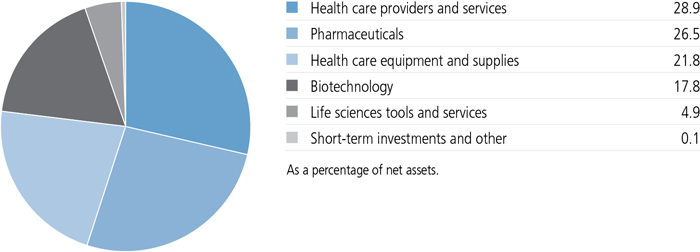

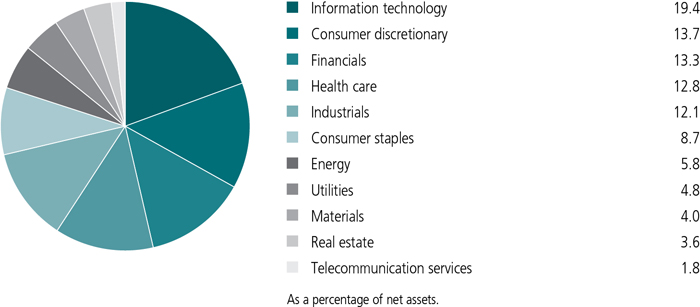

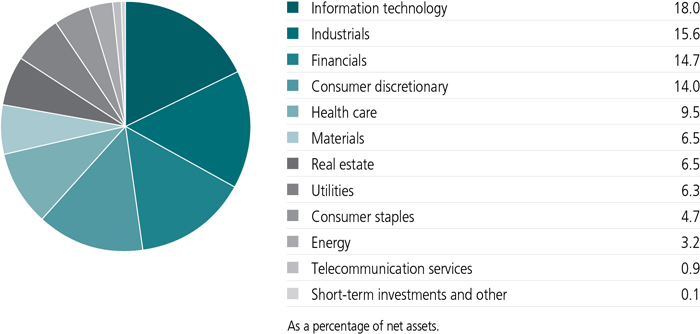

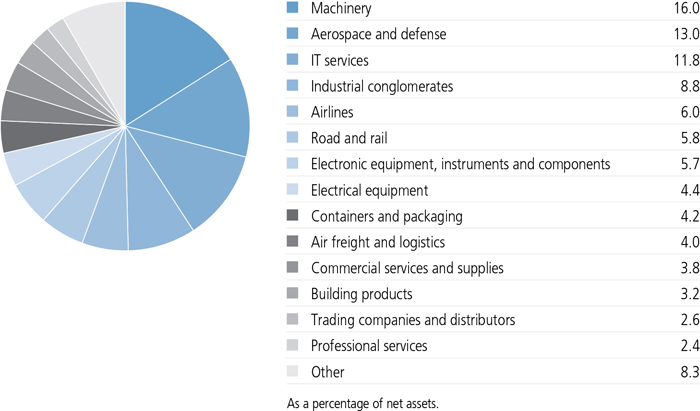

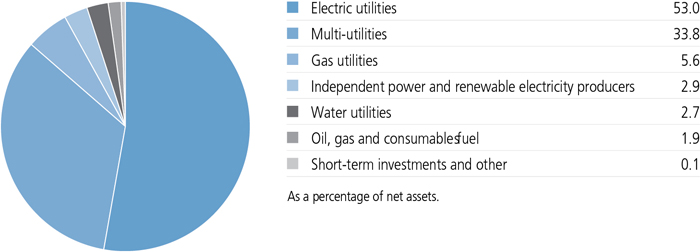

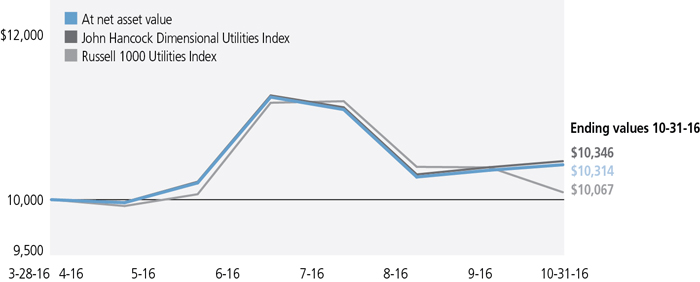

INDUSTRY COMPOSITION AS OF 10/31/16 (%)

A note about risks

While the fund holds large-cap as well as mid- and small-cap companies, the prices of medium and smaller company stocks can change more frequently and dramatically than those of large companies. Value stocks may underperform other segments of the market. The value of a company's equity securities is subject to changes in the company's financial condition and overall market and economic conditions. Investments focused in one sector or industry may fluctuate more dramatically than investments in a wider variety of sectors or industries. Exchange-traded fund shares are bought and sold through exchange trading at market price (not NAV), and are not individually redeemed from the fund. Due to various factors, shares may trade at a premium or discount to their NAV in the secondary market, and the fund's holdings and returns may deviate from those of its index. These variations may be greater when markets are volatile or subject to unusual market conditions. Errors in the construction or calculation of the fund's index may occur from time to time, which may cause tracking error. Brokerage commissions will reduce returns. Please see the fund's prospectus for additional risks.

Lukas J. Smart, CFA

Portfolio Manager

Dimensional Fund Advisors LP

Would you tell us about your investment philosophy and how it drives the composition of the exchange-traded fund (ETF)?

We expect differences in returns among securities. At Dimensional Fund Advisors LP, we have identified four characteristics, or dimensions, of expected returns—the overall market, company size, relative price, and profitability—that academic research has shown to account for most of the variation in historical asset returns and that we believe will account for most of the variation in future returns.

The market dimension reflects the excess return over the risk-free rate that market participants demand for investing in a broadly diversified portfolio of equity securities without any style or market capitalization bias. That premium is called the equity premium.

The company size dimension reflects the excess return that investors demand for investing in small-capitalization stocks relative to large-capitalization stocks. The premium associated with this dimension is the small-cap, or size, premium.

The relative price dimension reflects the excess return that investors expect from investing in low relative price, or value, stocks (as measured, for instance, by their price-to-book ratios) in comparison with high relative price, or growth, stocks. The premium associated with this dimension is the value premium.

Finally, the profitability dimension provides a way to discern the expected returns of companies with similar price-driven characteristics. Our research shows that if two companies trade at the same

Relative to a commercial cap-weighted measure of the market, we believe that incorporating these dimensions of expected returns into an investment strategy offers the potential for outperformance over time, and an ETF is a vehicle well suited to our systematic and transparent investment approach.

The custom benchmark we developed, the John Hancock Dimensional Financials Index, is designed to capture these dimensions, and the fund, in turn, is designed to track the custom benchmark.

Can you briefly describe the market environment over the six-month period ended October 31, 2016?

The U.S. market, as measured by the Russell 1000 Index, was up 4.02% for the six-month period, outperforming developed ex-U.S. markets, yet trailing emerging markets.

Smaller-cap stocks outperformed larger-cap stocks. Across the broad market, stocks with value characteristics outperformed their more growth-oriented counterparts.

TOP 10 HOLDINGS AS OF 10/31/16 (%)

| JPMorgan Chase & Co. | 4.1 |

| Berkshire Hathaway, Inc., Class B | 3.8 |

| Bank of America Corp. | 3.5 |

| Wells Fargo & Company | 3.5 |

| Visa, Inc., Class A | 3.2 |

| Citigroup, Inc. | 2.9 |

| MasterCard, Inc., Class A | 2.2 |

| Capital One Financial Corp. | 1.9 |

| Discover Financial Services | 1.8 |

| U.S. Bancorp | 1.7 |

| TOTAL | 28.6 |

| As a percentage of net assets. | |

| Cash and cash equivalents are not included. | |

How did the fund perform during the period?

The fund was up 5.43% on a net asset value (NAV) basis, besting the Russell 1000 Financial Services Index, a commercial cap-weighted benchmark we use as a proxy for the financials sector of the U.S. stock market, which was up 4.87%.

Relative to most commercial measures of the financials sector, our approach typically results in the fund maintaining higher allocations to securities of smaller-cap issuers and to securities trading at lower prices relative to their book values. In the weightings of individual positions, we also place greater emphasis on companies that have demonstrated higher profitability.

Underweight exposure to real estate investment trusts (REITs) boosted the fund's relative performance during the period as REITs underperformed.

Midwest regional banking firm Fifth Third Bancorp and financial services company The Principal Financial Group, Inc. both posted strong gains. Asset managers Affliated Managers Group, Inc. and T. Rowe Price Group, Inc. were among the firms that detracted for the period.

The premiums associated with the dimensions we have identified can be unpredictable over short time horizons. For this reason, we believe the best way to invest is to structure broadly diversified portfolios with a consistent focus on the desired dimensions, seeking to capture the expected premiums associated with them.

While we would expect smaller caps to outperform larger caps and value to outperform growth over an extended time horizon, any given trading day, month, or year can prove otherwise. We believe patience and persistence are key ingredients to success in our style of investing.

How was the fund positioned at the close of the period?

Compared with the Russell 1000 Financial Services Index, the fund ended the period with higher weights in low relative price stocks and in equities with smaller market capitalizations while emphasizing companies with higher profitability. The fund was broadly diversified across more than 100 issuers, and in absolute terms, the fund's largest industry exposures were to banks, insurance companies, and capital markets.

MANAGED BY

| Lukas J. Smart, CFA On the fund since inception Investing since 2003 |

| Joel P. Schneider On the fund since inception Investing since 2011 |