dividend expense. The expense limitation expires on August 31, 2017, unless renewed by mutual agreement of the fund and the Advisor based on a determination that this is appropriate under the circumstances at that time.

For the year ended April 30, 2017, the expense reductions described above amounted to $139,924.

Expenses waived or reimbursed in the current fiscal period are not subject to recapture in future fiscal periods.

The investment management fees, including the impact of the waivers and reimbursements as described above, incurred for the year ended April 30, 2017 were equivalent to a net annual effective rate of 0.00% of the fund's average daily net assets.

Accounting and legal services. Pursuant to a service agreement, the fund reimburses the Advisor for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services to the fund, including the preparation of all tax returns, periodic reports to shareholders and regulatory reports, among other services. These accounting and legal services fees incurred for the year ended April 30, 2017 amounted to an annual rate of 0.02% of the fund's average daily net assets.

Trustee expenses. The fund compensates each Trustee who is not an employee of the Advisor or its affiliates. The costs of paying Trustee compensation and expenses are allocated to each fund based on its net assets relative to other funds within the John Hancock group of funds complex.

Note 5 — Capital share transactions

The fund will issue and redeem shares at NAV only in a large specified number of shares, each called a "creation unit," or multiples thereof, that consist of 50,000 shares. Only authorized participants may engage in creation or redemption transactions directly with the fund. Such transactions generally take place when an authorized participant deposits into the fund a designated portfolio of securities (including any portion of such securities for which cash may be substituted) and a specified amount of cash approximating the holdings of the fund in exchange for a specified number of creation units. Similarly, shares can be redeemed only in creation units, generally for a designated portfolio of securities (including any portion of such securities for which cash may be substituted) held by the fund and a specified amount of cash. For purposes of US GAAP, in-kind redemption transactions are treated as a sale of securities and any resulting gains and losses are recognized based on the market value of the securities on the date of the transfer. Authorized participants pay a transaction fee to the custodian when purchasing and redeeming creation units of the fund. The transaction fee is used to defray the costs associated with the issuance and redemption of creation units. Individual shares of the fund may only be purchased and sold in secondary market transactions through brokers. Secondary market transactions may be subject to brokerage commissions. Shares of the fund are listed and traded on the NYSE Arca, Inc., trade at market prices rather than NAV, and may trade at a price greater than or less than NAV.

Affiliates of the fund or the Advisor owned 60% of shares outstanding on April 30, 2017. Such concentration of shareholders' capital could have a material effect on the fund if such shareholders redeem from the fund.

Note 6 — Purchase and sale of securities

Purchases and sales of securities, other than in-kind transactions and short-term securities, amounted to $3,512,909 and $3,605,916, respectively, for the year ended April 30, 2017. Securities received and delivered from in-kind transactions aggregated $15,098,515 and $1,345,619, respectively, for the year ended April 30, 2017.

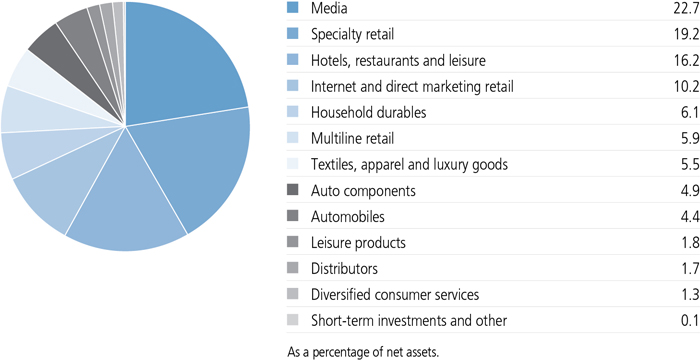

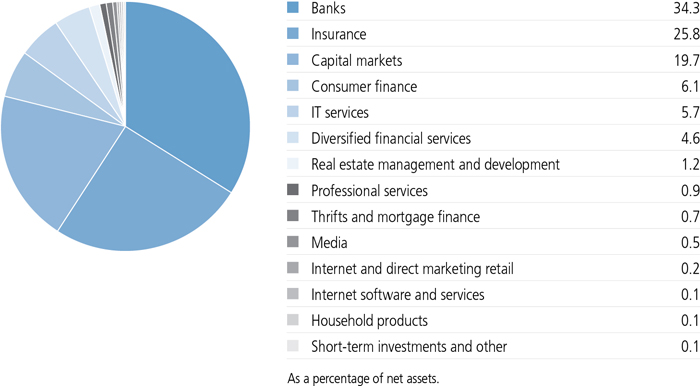

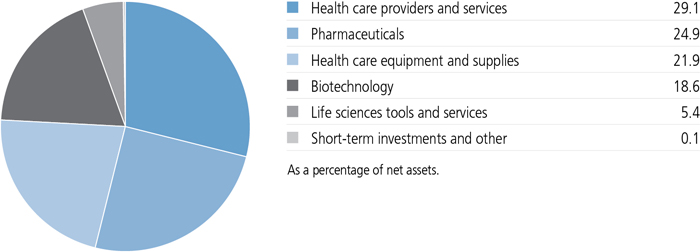

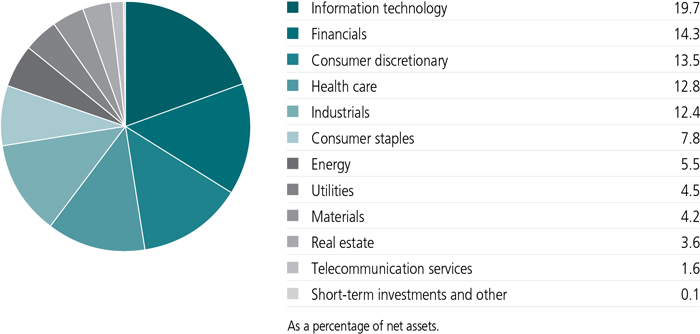

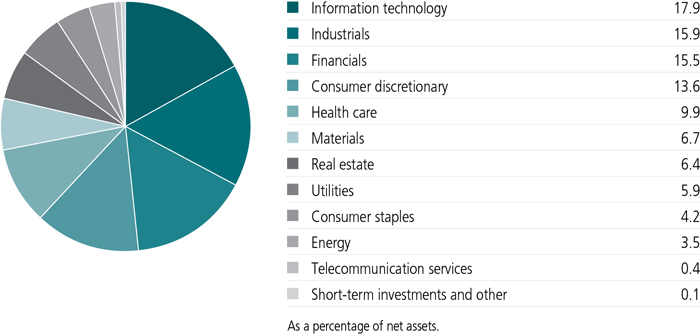

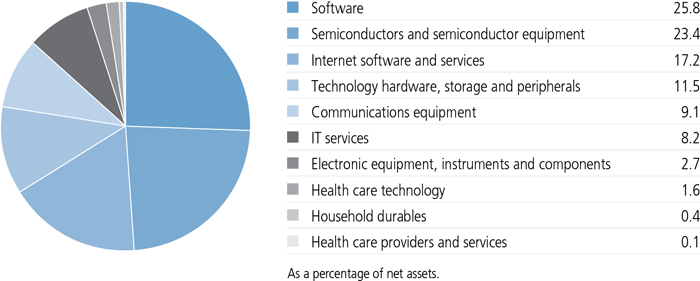

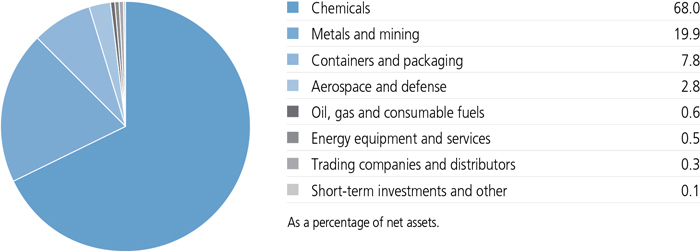

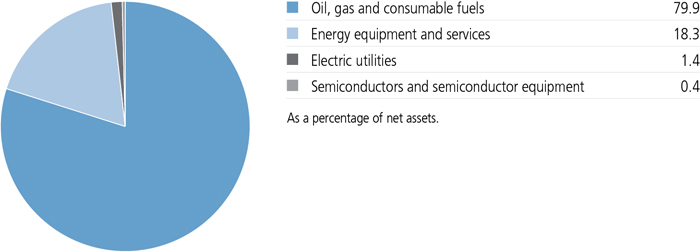

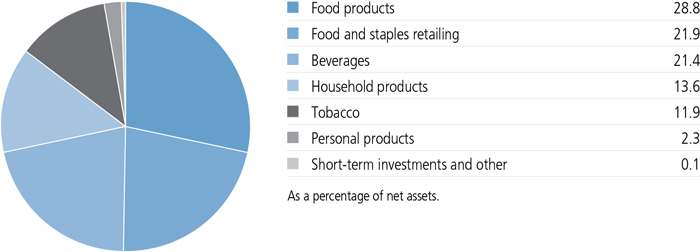

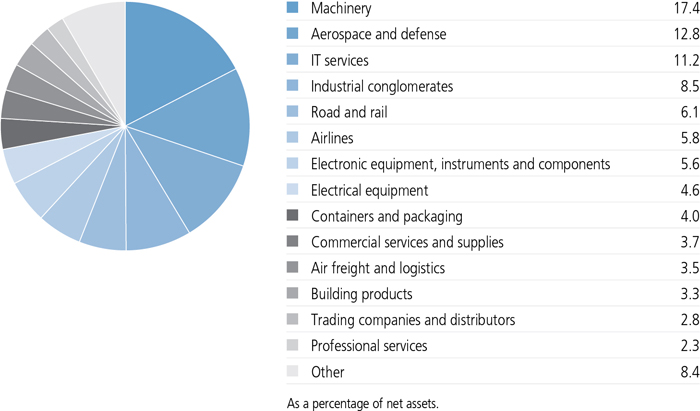

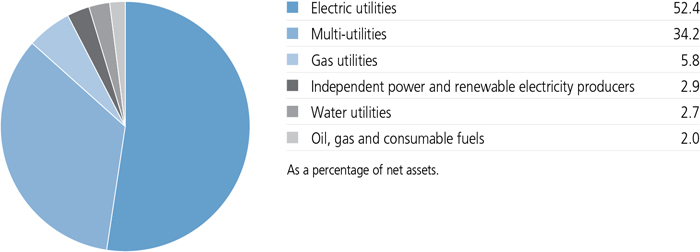

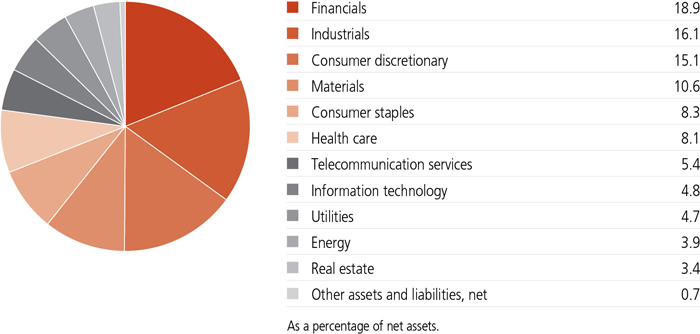

Note 7 — Industry or sector risk

The fund generally invests a large percentage of its assets in one or more particular industries or sectors of the economy. If a large percentage of the fund's assets are economically tied to a single or small number of industries or sectors of the economy, the fund will be less diversified than a more broadly diversified fund, and it may cause the fund to underperform if that industry or sector underperforms. In addition, focusing on a particular industry or sector may make the fund's NAV more volatile. Further, a fund that invests in particular industries or sectors is particularly susceptible to the impact of market, economic, regulatory and other factors affecting those industries or sectors.