Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-22376

PIMCO Equity Series VIT

(Exact name of registrant as specified in charter)

650 Newport Center Drive, Newport Beach, CA 92660

(Address of principal executive offices)

Trent W. Walker

Treasurer and Principal Financial Officer

PIMCO Equity Series VIT

650 Newport Center Drive

Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

Brendan C. Fox

Dechert LLP

1900 K Street, N.W.

Washington, D.C. 20006

Registrant’s telephone number, including area code: (888) 877-4626

Date of fiscal year end: December 31

Date of reporting period: December 31, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Table of Contents

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1).

| • | PIMCO Equity Series VIT—Institutional Class |

| • | PIMCO Equity Series VIT—Advisor Class |

Table of Contents

Your Global Investment Authority

PIMCO Equity Series VIT®

Annual Report

December 31, 2014

PIMCO EqS Pathfinder Portfolio®

Share Class

| n | Institutional |

Table of Contents

| Page | ||||

| 1 | ||||

| 3 | ||||

| 5 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 19 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 37 | ||||

Approval of Renewal of the Investment Advisory Contract and Supervision | 38 | |||

This material is authorized for use only when preceded or accompanied by the current PIMCO Equity Series VIT (the “Trust”) prospectus for the Portfolio. The variable product prospectus may be obtained by contacting your Investment Consultant.

Table of Contents

Dear Shareholder,

Please find enclosed the Annual Report for the PIMCO Equity Series VIT covering the twelve-month reporting period ended December 31, 2014. On the following pages are specific details about the investment performance of the Portfolio and a discussion of the factors that influenced performance during the reporting period. In addition, the letter from the portfolio manager provides a further review of such factors as well as an overview of the Portfolio’s investment strategy.

As previously announced on September 26, 2014, William “Bill” Gross, PIMCO’s Chief Investment Officer and co-founder, resigned from the firm. PIMCO subsequently elected Daniel Ivascyn to serve as Group Chief Investment Officer (“Group CIO”). In addition, PIMCO appointed Andrew Balls, CIO Global Fixed Income; Mark Kiesel, CIO Global Credit; Virginie Maisonneuve, CIO Global Equities; Scott Mather, CIO U.S. Core Strategies; and Mihir Worah, CIO Real Return and Asset Allocation. On November 3, 2014, PIMCO also announced that Marc Seidner would return to the firm effective November 12, 2014 in a new role as CIO Non-traditional Strategies and Head of Portfolio Management in the New York office.

Under this leadership structure, Mr. Balls and Mr. Worah have additional managerial responsibility for PIMCO’s Portfolio Management group and trade floor activities globally. Mr. Balls will oversee Portfolio Management in Europe and Asia-Pacific, and Mr. Worah will oversee Portfolio Management in the U.S. Douglas Hodge, PIMCO’s Chief Executive Officer, and Jay Jacobs, PIMCO’s President, continue to serve as the firm’s senior executive leadership team, spearheading PIMCO’s business strategy, client service and the firm’s operations.

These appointments are a further evolution of the structure that PIMCO established early in 2014, reflecting our belief that the best approach for PIMCO’s clients and our firm is an investment leadership team of seasoned, highly skilled investors overseeing all areas of PIMCO’s investment activities.

During his 43 years at PIMCO, Mr. Gross made great contributions to building the firm and delivering value to PIMCO’s clients. Over this period PIMCO developed into a global asset manager, expanding beyond core fixed income, and now encompasses nearly 2,500 employees across 13 offices, including over 250 portfolio managers. Mr. Gross was also responsible for starting PIMCO’s robust investment process, with a focus on long-term macroeconomic views and bottom-up security selection—a process that is well institutionalized and will continue into PIMCO’s future.

Highlights of the financial markets during our twelve-month reporting period include:

| n | Developed market equities posted mixed returns as global growth divergence was evidenced in the last part of the reporting period. Additionally, the sharp decline in oil prices led to heightened market volatility. Growth in the U.S., for example, exceeded investor expectations and outpaced its peers in the developed world, especially Japan and Europe, which both continued to struggle. U.S. equities, as measured by the S&P 500 Index, returned 13.69%. Developed market equities outside the U.S., as represented by the MSCI EAFE Net Dividend Index (USD Unhedged), declined 4.90% over the reporting period. |

| n | Despite positive performance over the first half of the reporting period, emerging market equities, as represented by the MSCI Emerging Markets Index (Net Dividends in USD), declined 2.19% over the full reporting period due to headwinds from a strengthening U.S. dollar, falling commodity prices and concerns over slower Chinese economic growth. Russia was the worst performing country, as the Russian ruble plummeted nearly 50% versus the U.S. dollar, which included a one-day 40% sell-off following an interest rate hike to 17% by Russia’s central bank. Asia had some of the best performing equity markets in the emerging world, partially aided by lower oil prices as many Asian countries are net importers of fuel. |

| ANNUAL REPORT | DECEMBER 31, 2014 | 1 |

Table of Contents

Chairman’s Letter

| n | U.S. Treasuries, as represented by the Barclays U.S. Treasury Index, returned 5.05% for the reporting period, as intermediate and longer maturity yields declined and the front-end of the U.S. Treasury yield curve was modestly weaker in anticipation of monetary tightening sometime in 2015. The benchmark ten-year U.S. Treasury note yielded 2.17% at the end of the reporting period, down from 3.03% on December 31, 2013. The Barclays U.S. Aggregate Index, a widely used index of U.S. investment-grade bonds, returned 5.97% for the reporting period. |

Thank you again for the trust you have placed in us. We value your commitment and will continue to work diligently to meet your broad investment needs.

| Sincerely,

Brent R. Harris Chairman of the Board, PIMCO Equity Series VIT

January 23, 2015 |

| 2 | PIMCO EQUITY SERIES VIT |

Table of Contents

Important Information About the Portfolio

PIMCO Equity Series VIT (the “Trust”) is an open-end management investment company currently consisting of one investment portfolio, the PIMCO EqS Pathfinder Portfolio® (the “Portfolio”). The Portfolio is only available as a funding vehicle under variable life insurance policies or variable annuity contracts issued by insurance companies (“Variable Contracts”). Individuals may not purchase shares of the Portfolio directly. Shares of the Portfolio also may be sold to qualified pension and retirement plans outside of the separate account context.

The Portfolio seeks capital appreciation by investing under normal circumstances in equity securities, including common and preferred stock (and securities convertible into, or that PIMCO expects to be exchanged for, common or preferred stock), of issuers that PIMCO believes are undervalued. The Portfolio’s bottom-up value investment style attempts to identify securities that are undervalued by the market in comparison to PIMCO’s own determination of the company’s value, taking into account criteria such as asset value, book value and cash flow and earnings estimates.

As of the date of this report, interest rates in the U.S. are at or near historically low levels. As such, funds investing in fixed income securities may currently face an increased exposure to the risks associated with a rising interest rate environment. This is especially true as the Fed ended its quantitative easing program in October 2014. Further, while the U.S. bond market has steadily grown over the past three decades, dealer inventories of corporate bonds have remained relatively stagnant. As a result, there has been a significant reduction in the ability of dealers to “make markets.” All of the factors mentioned above, individually or collectively, could lead to increased volatility and/or lower liquidity in the fixed income markets, which could result in losses to the Portfolio. If the performance of the Portfolio were to be negatively impacted by rising interest rates, the Portfolio could face increased redemptions by its shareholders, which could further reduce the value of the Portfolio.

The Portfolio may be subject to various risks as described in the Portfolio’s prospectus. Some of these risks may include, but are not limited to, the following: equity risk, value investing risk, foreign (non-U.S.) investment risk, emerging markets risk, market risk, issuer risk, interest rate risk, credit risk, high yield and distressed company risk, currency risk, liquidity risk, leveraging risk, management risk, small-cap and mid-cap company risk, arbitrage risk, derivatives risk, short sale risk, commodity risk, tax risk and subsidiary risk. A complete description of these risks and other risks is contained in the Portfolio’s prospectus. The Portfolio may use derivative instruments for hedging purposes or as part of an investment strategy. Use of these instruments may involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, management risk, leverage risk, mispricing or improper valuation risk and the risk that the

Portfolio could not close out a position when it would be most advantageous to do so. Certain derivative transactions may have a leveraging effect on the Portfolio. For example, a small investment in a derivative instrument may have a significant impact on the Portfolio’s exposure to interest rates, currency exchange rates or other investments. As a result, a relatively small price movement in a derivative instrument may cause an immediate and substantial loss or gain, which translates into heightened volatility for the Portfolio. The Portfolio may engage in such transactions regardless of whether the Portfolio owns the asset, instrument or components of the index underlying the derivative instrument. The Portfolio may invest a significant portion of its assets in these types of instruments. If it does, the Portfolio’s investment exposure could far exceed the value of its portfolio securities and its investment performance could be primarily dependent upon securities it does not own. The Portfolio’s investment in foreign (non-U.S.) securities may entail risk due to foreign (non-U.S.) economic and political developments; this risk may be increased when investing in emerging markets. For example, if the Portfolio invests in emerging market debt, it may face increased exposure to interest rate, liquidity, volatility, and redemption risk due to the specific economic, political, geographical, or legal background of the foreign (non-U.S.) issuer.

High-yield bonds typically have a lower credit rating than other bonds. Lower-rated bonds generally involve a greater risk to principal than higher-rated bonds. Further, markets for lower-rated bonds are typically less liquid than for higher-rated bonds, and public information is usually less abundant in such markets. Thus, high yield investments increase the chance that the Portfolio will lose money. The credit quality of a particular security or group of securities does not ensure the stability or safety of the overall portfolio. Mortgage- and Asset-Backed Securities represent ownership interests in “pools” of mortgages or other assets such as consumer loans or receivables. As a general matter, Mortgage- and Asset-Backed Securities are subject to interest rate risk, extension risk, prepayment risk, and credit risk. These risks largely stem from the fact that returns on Mortgage- and Asset-Backed Securities depend on the ability of the underlying assets to generate cash flow.

The geographical classification of foreign (non-U.S.) securities in this report are classified by the country of incorporation of a holding. In certain instances, a security’s country of incorporation may be different from its country of economic exposure.

On the Portfolio Summary page in this Shareholder Report, the Average Annual Total Return table and Cumulative Returns chart measure performance assuming that any dividend and capital gain distributions were reinvested. The Portfolio measures its performance against a broad-based securities market index (benchmark index).

| ANNUAL REPORT | DECEMBER 31, 2014 | 3 |

Table of Contents

Important Information About the Portfolio (Cont.)

An investment in the Portfolio is not a deposit of a bank and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in the Portfolio.

PIMCO has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers Act of 1940, as amended. The Proxy Policy has been adopted by the Trust as the policies and procedures that PIMCO will use when voting proxies on behalf of the Portfolio. A description of the policies and procedures that PIMCO uses to vote proxies relating to portfolio securities of the Portfolio, and information about how the Portfolio voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30, are available without charge, upon request, by calling the Trust at (888) 87-PIMCO, on the Portfolio’s website at http://pvit.pimco-funds.com, and on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

The Portfolio files a complete schedule of the Portfolio’s holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. A copy of the Portfolio’s Form N-Q is available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. The Portfolio’s Form N-Q will also be available without charge, upon request, by calling the Trust at (888) 87-PIMCO and on the Portfolio’s website at http://pvit.pimco-funds.com. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

PIMCO Equity Series VIT is distributed by PIMCO Investments LLC, 1633 Broadway, New York, New York 10019.

The following disclosure provides important information regarding the Portfolio’s Expense Example (“Example” or “Expense Example”), which appears in this Shareholder Report. Please refer to this information when reviewing the Expense Example for the Portfolio.

Expense Example

As a shareholder of the Portfolio, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees (Advisor Class only), and other Portfolio expenses. The Example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The Expense Example does not reflect any fees or

other expenses imposed by the Variable Contracts. If it did, the expenses reflected in the Expense Example would be higher. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, from July 1, 2014 to December 31, 2014.

Actual Expenses

The information in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the appropriate column for your share class, in the row entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other portfolios. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other portfolios.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the information under the heading “Hypothetical (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different portfolios. In addition, if these transactional costs were included, your costs would have been higher.

Expense ratios may vary from period to period because of various factors such as an increase in expenses that are not covered by the management fees, such as fees and expenses of the independent trustees and their counsel, extraordinary expenses and interest expense.

| 4 | PIMCO EQUITY SERIES VIT |

Table of Contents

Insights from the Portfolio Manager PIMCO EqS Pathfinder Portfolio®

Dear Shareholder,

It is our pleasure to be speaking with you as we finish 2014, and we thank you for your investment in the PIMCO EqS Pathfinder Portfolio® (the “Portfolio”). Our commitment continues to be to seek an attractive absolute return that beats the market over a full market cycle and to do so with less volatility than the overall market. We have organized our thoughts below to provide you with a review of the equity market over the past year, the Portfolio itself, and our outlook for 2015.

The Last Year in Review

The MSCI World Index rallied strongly in the first half of the year; however, it retreated over the course of the second half and finished the year up 4.94%. The second half malaise was due to concerns about: (1) the end of quantitative easing (“QE”) by the U.S. Federal Reserve (“Fed”); (2) slowing global growth, particularly in Europe and China; and (3) the dramatic decline in the price of oil as supply growth, largely due to shale fracking in the U.S., overwhelmed global demand. Although most of the rest of the world is still mired in an anemic, post-financial crisis economic recovery, the economy accelerated in the U.S., corporate earnings advanced and the U.S. equity market rallied. As if on cue, the Fed is slowly beginning to reign in its loose monetary policy, and announced in October that it stopped its bond purchasing program and may be ready to raise interest rates some time in 2015. By contrast, Europe’s economic recovery is faltering, and European Central Bank (“ECB”) president Mario Draghi is contemplating additional stimulus measures. In addition, China’s economy is slowing; and its leaders are also beginning to openly express concern about economic growth.

The price of oil declined significantly from its high in late June, mainly due to increasing supply from shale fracking in the U.S., amid concern that slowing global growth may create a softening in demand. The steep decline in the price of oil also created a sell-off in all energy-related securities, with the energy sector ending the second half of 2014 as the bottom performing sector for the half- and full-year periods.

The Portfolio performed well in the first half of 2014 and outperformed its benchmark; however, largely due to its energy-related holdings, the Portfolio lagged the MSCI World Index for the second half of 2014 and underperformed for the full year.

Pathfinder Portfolio

We took profits throughout the year in Japanese holdings, including Komatsu and Nissan, European companies Rhoen Klinikum, Nestle, and Royal Dutch Shell, and U.S.-based companies Intel, Apple, Deere, General Dynamics, 3M, and Phillips 66, among others. In addition, one of our fish farmers, Cermaq, was taken over by Mitsubishi at a substantial profit. We also took advantage of price volatility to initiate positions in: media providers Comcast and Tribune; Norwegian global

oil services company Akastor; toy manufacturer Mattel; commercial printer RR Donnelley; network product manufacturer Belden; and electronics equipment, motion picture and music production, and financial services company Sony. In addition, the Portfolio invested in Imperial Tobacco’s IPO of its Mediterranean tobacco distribution company, Logista, when the company issued shares in mid-summer. Some of the Portfolio’s notable performers for the year included Marine Harvest, Bpost and Microsoft.

Shares of Marine Harvest, the Norwegian fish farmer, rose in price as the company reported strong third quarter revenues and earnings that exceeded its preliminary earnings report. Many analysts raised their price forecasts for the fourth quarter of 2014 through 2016 based upon anticipated modest supply growth and strong demand growth from all regions. Although global supply is estimated to increase 3% next year, per analyst reports, in our view the two most important salmon producers, Norway and Chile, cannot increase their production in the next couple of years. In addition, we believe demand is set to expand by as much as 7% as consumers seek relatively low cost proteins rich in Omega-3 fatty acids, which may help to lower cholesterol levels.

Bpost shares rose as the company announced third quarter earnings that exceeded analysts’ estimates along with a better than expected mail volume. Bpost also just recently paid a very attractive dividend that equated to an approximate 5.7% dividend yield.

Microsoft shares rose steadily throughout the year as the decline in business and consumer PC shipments appears to have leveled off, in our view, and healthy enterprise spending, increased momentum in cloud offerings, and the new management team’s cost controls are now all expected to drive improved margins. The company continues to generate a very high level of free cash flow, has nearly $8.00 per share in net cash, and recently increased its dividend by over 10%.

We also had a few stocks in the portfolio that did not perform as we expected and North Atlantic Drilling (“NADL”), Seadrill and Genworth were three of those holdings.

The share prices for both NADL and Seadrill dropped substantially over the course of the second half of the year due to concerns regarding: (1) the supply of oil rigs scheduled to come to market in 2015; (2) the potential pressure on day-rates given the recent decline in the price of oil; (3) the implications for NADL’s agreement with Russia’s Rosneft, following sanctions from the U.S. that targeted Russia’s energy sector; and (4) the resignation of Tor Olav Troim, a strategic planning executive under billionaire founder and owner, John Fredriksen.

In our view, investors did not distinguish in the selling of shares between the companies that provide older 70’s and 80’s vintage rigs, which are soon to be obsolete, and companies such as Seadrill, which provide new rigs with the most up-to-date technology and environmental protections. We continue to find great value in the

| ANNUAL REPORT | DECEMBER 31, 2014 | 5 |

Table of Contents

Insights from the Portfolio Manager PIMCO EqS Pathfinder Portfolio® (Cont.)

shares, as does John Fredriksen, who disclosed that one of his holding companies, Hemen Holdings, had increased its stake in Seadrill by 2 million shares during the share price decline. We continue to hold our shares in both companies and view the energy sector in general as being very undervalued today for those investors with a long-term investment horizon.

The share price of Genworth Financial declined over the course of the second half of the year as it reported disappointing earnings and record losses in the third quarter of 2014 due to the performance of its long-term care and life divisions. Investors are also concerned that the ongoing review of long-term care margins may result in future charges to build reserves. Although we believe there is good value in the business (largely reflecting their global mortgage insurance operations) and the shares, we no longer have the same confidence in management’s ability to deliver on its promise of turning around the long-term care division. Consequently, we have substantially reduced our holding in the shares of Genworth Financial.

Looking Forward

As we approach 2015, we are excited by the opportunities that the more volatile equity markets are providing us. We invest in individual businesses, when it is appropriate to do so, and only when they meet our investment criteria. That is our discipline. We are continuing to find a number of new attractive investments, as noted in the first paragraph of the portfolio section of this letter, in U.S.-based global media companies, U.S.- and Japan-based consumer discretionary firms, and beaten-down and out-of-favor energy-related businesses. With exceptionally low interest rates, high corporate cash balances, and willing capital markets, we also expect that mergers and reorganizations will continue at a healthy pace in the coming year.

We are privileged to have the opportunity to manage your capital, and we look forward to the challenges and the opportunities in the months and years ahead.

Sincerely,

|

Anne Gudefin, CFA Portfolio Manager |

Top 10 Holdings1

Marine Harvest ASA | 3.5% | |||||

Lorillard, Inc. | 3.4% | |||||

Microsoft Corp. | 3.4% | |||||

Berkshire Hathaway, Inc. ‘B’ | 3.1% | |||||

Reckitt Benckiser Group PLC | 3.1% | |||||

British American Tobacco PLC | 3.1% | |||||

Imperial Tobacco Group PLC | 3.1% | |||||

AIA Group Ltd. | 2.9% | |||||

bpost S.A. | 2.7% | |||||

Carrefour S.A. | 2.2% |

Geographic Breakdown1

United States | 38.8% | |||||

United Kingdom | 15.1% | |||||

France | 8.4% | |||||

Norway | 5.1% | |||||

Hong Kong | 5.0% | |||||

Netherlands | 4.8% | |||||

Switzerland | 4.1% | |||||

Japan | 4.0% | |||||

Singapore | 3.4% | |||||

Belgium | 2.8% | |||||

Sweden | 2.0% | |||||

Denmark | 1.6% | |||||

Faroe Islands | 0.9% | |||||

South Korea | 0.9% | |||||

Australia | 0.9% | |||||

Bermuda | 0.8% | |||||

Spain | 0.7% | |||||

Canada | 0.7% |

Sector Breakdown1

Consumer Staples | 31.6% | |||||

Financials | 19.8% | |||||

Industrials | 13.3% | |||||

Information Technology | 11.6% | |||||

Consumer Discretionary | 9.5% | |||||

Energy | 9.4% | |||||

Health Care | 4.6% | |||||

Materials | 0.2% |

| 1 | % of Investments, at value as of 12/31/2014. Top Holdings, Geographic and Sector Breakdown solely reflect long positions. Securities sold short, financial derivative instruments and short-term instruments are not taken into consideration. |

| 6 | PIMCO EQUITY SERIES VIT |

Table of Contents

PIMCO EqS Pathfinder Portfolio®

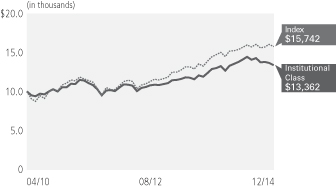

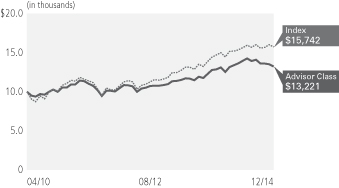

Cumulative Returns Through December 31, 2014

$10,000 invested at the end of the month when the Portfolio’s Institutional Class commenced operations.

Average Annual Total Return for the period ended December 31, 2014 | ||||||||||

| 1 Year | Class Inception (04/14/2010) | |||||||||

| PIMCO EqS Pathfinder Portfolio® Institutional Class | 1.06% | 5.91% | |||||||

| MSCI World Index± | 4.94% | 9.35% | |||||||

All Portfolio returns are net of fees and expenses.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed. The Portfolio’s performance does not reflect the deduction of additional charges and expenses imposed in connection with investing in Variable Contracts, which will reduce returns. For performance current to the most recent month-end, visit http://pvit.pimco-funds.com. The Portfolio’s total annual operating expense ratio as stated in the Portfolio’s current prospectus, as supplemented to date, is 1.13 for Institutional Class shares.

± The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of 24 developed market country indices. It is not possible to invest directly in an unmanaged index.

| Expense Example | Actual | Hypothetical | ||||||

| (5% return before expenses) | ||||||||

Beginning Account Value (07/01/14) | $ | 1,000.00 | $ | 1,000.00 | ||||

Ending Account Value (12/31/14) | $ | 927.70 | $ | 1,020.32 | ||||

Expenses Paid During Period† | $ | 4.84 | $ | 5.07 | ||||

Net Annualized Expense Ratio†† | 0.99 | % | 0.99 | % | ||||

† Expenses Paid During Period are equal to the net annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by the number of days in the period/365 (to reflect the one-half year period). Overall fees and expenses of investing in the Portfolio will be higher because the example does not reflect variable contract fees and expenses.

†† The Net Annualized Expense Ratio is reflective of any applicable waivers related to contractual agreements for contractual fee waivers or voluntary fee waivers. Details regarding fee waivers can be found in Note 9 in the Notes to Financial Statements.

Please refer to the Important Information Section for an explanation of the information presented in the above Expense Example.

Portfolio Insights

| » | The PIMCO EqS Pathfinder Portfolio® seeks capital appreciation by investing under normal circumstances in equity securities, including common and preferred stock (and securities convertible into, or that PIMCO expects to be exchanged for, common or preferred stock), of issuers that PIMCO believes are undervalued. The Portfolio’s bottom-up value investment style attempts to identify securities that are undervalued by the market in comparison to PIMCO’s own determination of the company’s value, taking into account criteria such as asset value, book value, cash flow and earnings estimates. |

| » | The Portfolio’s Institutional Class shares returned 1.06% after fees, and the Portfolio’s benchmark index, the MSCI World Index, returned 4.94% during the reporting period. |

| » | Security selection in the Energy, Healthcare, and Information Technology sectors detracted from performance over the reporting period. Security selection in the Industrials sector along with an overweight and strong security selection within the Consumer Staples sector enhanced returns. |

| » | Holdings in Marine Harvest, Bpost and Loomis contributed to performance as prices on these securities appreciated during the reporting period. |

| » | Holdings in North Atlantic Drilling Ltd., Seadrill Ltd., and Genworth Financial Inc. detracted from returns as prices on these securities declined during the reporting period. |

| » | At the end of the reporting period, the Portfolio held approximately 94% in equities we believe are undervalued, approximately 5% (on the long side only) in merger arbitrage investments, and held the balance of the portfolio in cash and currency hedges. |

| ANNUAL REPORT | DECEMBER 31, 2014 | 7 |

Table of Contents

Financial Highlights PIMCO EqS Pathfinder Portfolio® (Consolidated)

| Selected Per Share Data for the Year or Period Ended: | 12/31/2014 | 12/31/2013 | 12/31/2012 | 12/31/2011 | 04/14/2010-12/31/2010 | |||||||||||||||

Institutional Class | ||||||||||||||||||||

Net asset value beginning of year or period | $ | 12.53 | $ | 10.72 | $ | 9.85 | $ | 10.33 | $ | 10.00 | ||||||||||

Net investment income (a) | 0.29 | 0.27 | 0.21 | 0.11 | 0.12 | |||||||||||||||

Net realized/unrealized gain (loss) | (0.16 | ) | 1.83 | 0.77 | (0.58 | ) | 0.21 | |||||||||||||

Net increase (decrease) from investment operations | 0.13 | 2.10 | 0.98 | (0.47 | ) | 0.33 | ||||||||||||||

Dividends from net investment income | 0.00 | (0.29 | ) | (0.11 | ) | (0.01 | ) | 0.00 | ||||||||||||

Distributions from net realized capital gains | (0.20 | ) | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||

Total distributions | (0.20 | ) | (0.29 | ) | (0.11 | ) | (0.01 | ) | 0.00 | |||||||||||

Net asset value end of year or period | $ | 12.46 | $ | 12.53 | $ | 10.72 | $ | 9.85 | $ | 10.33 | ||||||||||

Total return | 1.06 | % | 19.60 | % | 9.98 | % | (4.54 | )% | 3.30 | % | ||||||||||

Net assets end of year or period (000s) | $ | 52,234 | $ | 57,768 | $ | 58,740 | $ | 66,439 | $ | 3,276 | ||||||||||

Ratio of expenses to average net assets | 0.98 | % | 0.98 | % | 0.99 | % | 0.98 | % | 1.01 | %* | ||||||||||

Ratio of expenses to average net assets excluding waivers | 1.12 | % | 1.15 | % | 1.15 | % | 1.18 | % | 3.72 | %* | ||||||||||

Ratio of expenses to average net assets excluding interest expense | 0.97 | % | 0.97 | % | 0.97 | % | 0.97 | % | 0.97 | %* | ||||||||||

Ratio of expenses to average net assets excluding interest expense and waivers | 1.11 | % | 1.14 | % | 1.13 | % | 1.17 | % | 3.68 | %* | ||||||||||

Ratio of net investment income to average net assets | 2.22 | % | 2.29 | % | 2.02 | % | 1.14 | % | 1.69 | %* | ||||||||||

Portfolio turnover rate | 31 | % | 29 | % | 26 | % | 238 | % | 25 | % | ||||||||||

| * | Annualized |

| (a) | Per share amounts based on average number of shares outstanding during the year or period. |

| 8 | PIMCO EQUITY SERIES VIT | See Accompanying Notes |

Table of Contents

Consolidated Statement of Assets and Liabilities PIMCO EqS Pathfinder Portfolio®

| (Amounts in thousands, except per share amounts) | December 31, 2014 | |||

Assets: | ||||

Investments, at value | ||||

Investments in securities* | $ | 423,009 | ||

Investments in Affiliates | 9,807 | |||

Financial Derivative Instruments | ||||

Over the counter | 6,285 | |||

Cash | 10 | |||

Deposits with counterparty | 6,643 | |||

Foreign currency, at value | 355 | |||

Receivable for Portfolio shares sold | 4 | |||

Interest and dividends receivable | 644 | |||

Dividends receivable from Affiliates | 112 | |||

| 446,869 | ||||

Liabilities: | ||||

Borrowings & Other Financing Transactions | ||||

Payable for short sales | $ | 7,189 | ||

Financial Derivative Instruments | ||||

Over the counter | 2,749 | |||

Payable for investments in Affiliates purchased | 112 | |||

Deposits from counterparty | 3,640 | |||

Payable for Portfolio shares redeemed | 119 | |||

Accrued investment advisory fees | 237 | |||

Accrued supervisory and administrative fees | 134 | |||

Accrued distribution fees | 84 | |||

Reimbursement to PIMCO | 16 | |||

Other liabilities | 62 | |||

| 14,342 | ||||

Net Assets | $ | 432,527 | ||

Net Assets Consist of: | ||||

Paid in capital | $ | 313,954 | ||

Undistributed net investment income | 16,322 | |||

Accumulated undistributed net realized gain | 35,097 | |||

Net unrealized appreciation | 67,154 | |||

| $ | 432,527 | |||

Net Assets: | ||||

Institutional Class | $ | 52,234 | ||

Advisor Class | 380,293 | |||

Shares Issued and Outstanding: | ||||

Institutional Class | 4,191 | |||

Advisor Class | 30,703 | |||

Net Asset Value and Redemption Price Per Share Outstanding: | ||||

Institutional Class | $ | 12.46 | ||

Advisor Class | 12.39 | |||

Cost of Investments in securities | $ | 359,115 | ||

Cost of Investments in Affiliates | $ | 9,879 | ||

Cost of Foreign Currency Held | $ | 357 | ||

Proceeds Received on Short Sales | $ | 6,700 | ||

Cost or Premiums of Financial Derivative Instruments, net | $ | (338 | ) | |

* Includes repurchase agreements of: | $ | 424 | ||

| See Accompanying Notes | ANNUAL REPORT | DECEMBER 31, 2014 | 9 |

Table of Contents

Consolidated Statement of Operations PIMCO EqS Pathfinder Portfolio®

| (Amounts in thousands) | Year Ended December 31, 2014 | |||

Investment Income: | ||||

Dividends, net of foreign taxes* | $ | 15,347 | ||

Dividends from Investments in Affiliates | 146 | |||

Total Income | 15,493 | |||

Expenses: | ||||

Investment advisory fees | 3,617 | |||

Supervisory and administrative fees | 1,688 | |||

Distribution and/or servicing fees - Advisor Class | 1,065 | |||

Dividends on short sales | 47 | |||

Interest expense | 7 | |||

Trustees’ fees | 32 | |||

Miscellaneous expense | 24 | |||

Total Expenses | 6,480 | |||

Waiver and/or Reimbursement by PIMCO | (659 | ) | ||

Net Expenses | 5,821 | |||

Net Investment Income | 9,672 | |||

Net Realized Gain (Loss): | ||||

Investments in securities | 35,250 | |||

Investments in Affiliates | (49 | ) | ||

Exchange-traded or centrally cleared financial derivative instruments | 154 | |||

Over the counter financial derivative instruments | 5,118 | |||

Short sales | (9 | ) | ||

Foreign currency | (714 | ) | ||

Net Realized Gain | 39,750 | |||

Net Change in Unrealized Appreciation (Depreciation): | ||||

Investments in securities | (48,700 | ) | ||

Investments in Affiliates | (72 | ) | ||

Over the counter financial derivative instruments | 6,187 | |||

Short sales | (489 | ) | ||

Foreign currency assets and liabilities | (74 | ) | ||

Net Change in Unrealized (Depreciation) | (43,148 | ) | ||

Net (Loss) | (3,398 | ) | ||

Net Increase in Net Assets Resulting from Operations | $ | 6,274 | ||

* Foreign tax withholdings - Dividends | $ | 943 | ||

| 10 | PIMCO EQUITY SERIES VIT | See Accompanying Notes |

Table of Contents

Consolidated Statements of Changes in Net Assets PIMCO EqS Pathfinder Portfolio®

| (Amounts in thousands‡) | Year Ended December 31, 2014 | Year Ended December 31, 2013 | ||||||

Increase (Decrease) in Net Assets from: | ||||||||

Operations: | ||||||||

Net investment income | $ | 9,672 | $ | 10,152 | ||||

Net realized gain | 39,750 | 10,577 | ||||||

Net change in unrealized appreciation (depreciation) | (43,148 | ) | 65,099 | |||||

Net increase in net assets resulting from operations | 6,274 | 85,828 | ||||||

Distributions to Shareholders: | ||||||||

From net investment income | ||||||||

Institutional Class | 0 | (1,309 | ) | |||||

Advisor Class | 0 | (9,191 | ) | |||||

From net realized capital gains | ||||||||

Institutional Class | (841 | ) | 0 | |||||

Advisor Class | (6,209 | ) | 0 | |||||

Total Distributions | (7,050 | ) | (10,500 | ) | ||||

Portfolio Share Transactions: | ||||||||

Net (decrease) resulting from Portfolio share transactions** | (73,661 | ) | (40,628 | ) | ||||

Total Increase (Decrease) in Net Assets | (74,437 | ) | 34,700 | |||||

Net Assets: | ||||||||

Beginning of year | 506,964 | 472,264 | ||||||

End of year* | $ | 432,527 | $ | 506,964 | ||||

* Including undistributed net investment income of: | $ | 16,322 | $ | 2,241 | ||||

| ** | See Note 13 in the Notes to Financial Statements. |

| ‡ | A zero balance may reflect actual amount rounding to less than one thousand. |

| See Accompanying Notes | ANNUAL REPORT | DECEMBER 31, 2014 | 11 |

Table of Contents

Consolidated Schedule of Investments PIMCO EqS Pathfinder Portfolio®

| SHARES | MARKET VALUE (000S) | |||||||||||

| INVESTMENTS IN SECURITIES 97.8% | ||||||||||||

| COMMON STOCKS 96.8% | ||||||||||||

| AUSTRALIA 0.9% | ||||||||||||

| INDUSTRIALS 0.9% | ||||||||||||

Spotless Group Holdings Ltd. (a) | 2,435,482 | $ | 3,773 | |||||||||

|

| |||||||||||

Total Australia | 3,773 | |||||||||||

|

| |||||||||||

| BELGIUM 2.7% | ||||||||||||

| INDUSTRIALS 2.7% | ||||||||||||

bpost S.A. | 470,864 | 11,828 | ||||||||||

|

| |||||||||||

Total Belgium | 11,828 | |||||||||||

|

| |||||||||||

| BERMUDA 0.8% | ||||||||||||

| ENERGY 0.8% | ||||||||||||

Seadrill Ltd. | 288,276 | 3,335 | ||||||||||

|

| |||||||||||

Total Bermuda | 3,335 | |||||||||||

|

| |||||||||||

| CANADA 0.6% | ||||||||||||

| ENERGY 0.6% | ||||||||||||

Cameco Corp. | 170,222 | 2,793 | ||||||||||

|

| |||||||||||

Total Canada | 2,793 | |||||||||||

|

| |||||||||||

| DENMARK 1.5% | ||||||||||||

| CONSUMER STAPLES 1.5% | ||||||||||||

Carlsberg A/S ‘B’ | 86,939 | 6,677 | ||||||||||

|

| |||||||||||

Total Denmark | 6,677 | |||||||||||

|

| |||||||||||

| FAROE ISLANDS 0.9% | ||||||||||||

| CONSUMER STAPLES 0.9% | ||||||||||||

Bakkafrost P/F | 175,099 | 3,934 | ||||||||||

|

| |||||||||||

Total Faroe Islands | 3,934 | |||||||||||

|

| |||||||||||

| FRANCE 8.0% | ||||||||||||

| CONSUMER DISCRETIONARY 2.9% | ||||||||||||

Eutelsat Communications S.A. | 209,160 | 6,764 | ||||||||||

JCDecaux S.A. | 165,805 | 5,709 | ||||||||||

|

| |||||||||||

| 12,473 | ||||||||||||

|

| |||||||||||

| CONSUMER STAPLES 3.9% | ||||||||||||

Carrefour S.A. | 319,200 | 9,714 | ||||||||||

Danone S.A. | 110,970 | 7,255 | ||||||||||

|

| |||||||||||

| 16,969 | ||||||||||||

|

| |||||||||||

| ENERGY 1.2% | ||||||||||||

Bourbon S.A. | 118,671 | 2,757 | ||||||||||

Total S.A. | 49,599 | 2,541 | ||||||||||

|

| |||||||||||

| 5,298 | ||||||||||||

|

| |||||||||||

Total France | 34,740 | |||||||||||

|

| |||||||||||

| HONG KONG 4.9% | ||||||||||||

| CONSUMER DISCRETIONARY 0.7% | ||||||||||||

Television Broadcasts Ltd. | 485,400 | 2,823 | ||||||||||

|

| |||||||||||

| SHARES | MARKET VALUE (000S) | |||||||||||

| FINANCIALS 3.6% | ||||||||||||

AIA Group Ltd. | 2,289,300 | $ | 12,583 | |||||||||

First Pacific Co. Ltd. | 3,013,750 | 2,972 | ||||||||||

|

| |||||||||||

| 15,555 | ||||||||||||

|

| |||||||||||

| INDUSTRIALS 0.6% | ||||||||||||

Jardine Matheson Holdings Ltd. | 25,500 | 1,549 | ||||||||||

Jardine Strategic Holdings Ltd. | 33,700 | 1,146 | ||||||||||

|

| |||||||||||

| 2,695 | ||||||||||||

|

| |||||||||||

Total Hong Kong | 21,073 | |||||||||||

|

| |||||||||||

| JAPAN 3.9% | ||||||||||||

| CONSUMER DISCRETIONARY 0.7% | ||||||||||||

Sony Corp. | 145,300 | 2,966 | ||||||||||

|

| |||||||||||

| CONSUMER STAPLES 1.4% | ||||||||||||

Kao Corp. | 90,900 | 3,585 | ||||||||||

Shiseido Co. Ltd. | 178,300 | 2,500 | ||||||||||

|

| |||||||||||

| 6,085 | ||||||||||||

|

| |||||||||||

| INFORMATION TECHNOLOGY 1.8% | ||||||||||||

Nintendo Co. Ltd. | 34,617 | 3,612 | ||||||||||

Tokyo Electron Ltd. - ADR | 217,485 | 4,150 | ||||||||||

|

| |||||||||||

| 7,762 | ||||||||||||

|

| |||||||||||

Total Japan | 16,813 | |||||||||||

|

| |||||||||||

| NETHERLANDS 4.7% | ||||||||||||

| CONSUMER STAPLES 1.6% | ||||||||||||

Corbion NV | 411,222 | 6,829 | ||||||||||

|

| |||||||||||

| FINANCIALS 2.1% | ||||||||||||

ING Groep NV - Dutch Certificate (a) | 700,395 | 9,049 | ||||||||||

|

| |||||||||||

| INFORMATION TECHNOLOGY 1.0% | ||||||||||||

Gemalto NV | 53,848 | 4,426 | ||||||||||

|

| |||||||||||

Total Netherlands | 20,304 | |||||||||||

|

| |||||||||||

| NORWAY 5.0% | ||||||||||||

| CONSUMER STAPLES 3.5% | ||||||||||||

Marine Harvest ASA | 1,111,739 | 15,265 | ||||||||||

|

| |||||||||||

| ENERGY 1.5% | ||||||||||||

Akastor ASA | 677,492 | 1,952 | ||||||||||

Avance Gas Holding Ltd. | 224,786 | 3,076 | ||||||||||

North Atlantic Drilling Ltd. | 791,245 | 1,290 | ||||||||||

|

| |||||||||||

| 6,318 | ||||||||||||

|

| |||||||||||

Total Norway | 21,583 | |||||||||||

|

| |||||||||||

| SINGAPORE 3.3% | ||||||||||||

| ENERGY 0.9% | ||||||||||||

BW LPG Ltd. | 553,309 | 3,853 | ||||||||||

|

| |||||||||||

| INDUSTRIALS 2.4% | ||||||||||||

ComfortDelGro Corp. Ltd. | 3,712,000 | 7,264 | ||||||||||

| SHARES | MARKET VALUE (000S) | |||||||||||

Keppel Corp. Ltd. | 484,700 | $ | 3,231 | |||||||||

|

| |||||||||||

| 10,495 | ||||||||||||

|

| |||||||||||

Total Singapore | 14,348 | |||||||||||

|

| |||||||||||

| SOUTH KOREA 0.9% | ||||||||||||

| CONSUMER DISCRETIONARY 0.9% | ||||||||||||

GS Home Shopping, Inc. | 18,917 | 3,777 | ||||||||||

|

| |||||||||||

Total South Korea | 3,777 | |||||||||||

|

| |||||||||||

| SPAIN 0.7% | ||||||||||||

| INDUSTRIALS 0.7% | ||||||||||||

Cia de Distribucion Integral Logista Holdings S.A.U. (a) | 127,426 | 2,794 | ||||||||||

|

| |||||||||||

Total Spain | 2,794 | |||||||||||

|

| |||||||||||

| SWEDEN 2.0% | ||||||||||||

| INDUSTRIALS 2.0% | ||||||||||||

Loomis AB ‘B’ | 296,724 | 8,572 | ||||||||||

|

| |||||||||||

Total Sweden | 8,572 | |||||||||||

|

| |||||||||||

| SWITZERLAND 3.9% | ||||||||||||

| FINANCIALS 0.9% | ||||||||||||

Swiss Re AG | 48,995 | 4,105 | ||||||||||

|

| |||||||||||

| HEALTH CARE 1.5% | ||||||||||||

Roche Holding AG | 23,275 | 6,306 | ||||||||||

|

| |||||||||||

| INFORMATION TECHNOLOGY 1.5% | ||||||||||||

Logitech International S.A. | 487,539 | 6,606 | ||||||||||

|

| |||||||||||

Total Switzerland | 17,017 | |||||||||||

|

| |||||||||||

| UNITED KINGDOM 14.7% | ||||||||||||

| CONSUMER DISCRETIONARY 0.2% | ||||||||||||

William Hill PLC | 162,672 | 914 | ||||||||||

|

| |||||||||||

| CONSUMER STAPLES 9.2% | ||||||||||||

British American Tobacco PLC | 244,729 | 13,262 | ||||||||||

Imperial Tobacco Group PLC | 299,857 | 13,200 | ||||||||||

Reckitt Benckiser Group PLC | 165,919 | 13,438 | ||||||||||

|

| |||||||||||

| 39,900 | ||||||||||||

|

| |||||||||||

| ENERGY 2.0% | ||||||||||||

BP PLC | 1,015,808 | 6,448 | ||||||||||

Ensco PLC ‘A’ | 77,266 | 2,314 | ||||||||||

|

| |||||||||||

| 8,762 | ||||||||||||

|

| |||||||||||

| FINANCIALS 3.2% | ||||||||||||

Barclays PLC | 1,283,380 | 4,825 | ||||||||||

Lancashire Holdings Ltd. | 650,706 | 5,679 | ||||||||||

Prudential PLC | 140,407 | 3,246 | ||||||||||

|

| |||||||||||

| 13,750 | ||||||||||||

|

| |||||||||||

| HEALTH CARE 0.1% | ||||||||||||

Indivior PLC (a) | 165,919 | 387 | ||||||||||

|

| |||||||||||

Total United Kingdom | 63,713 | |||||||||||

|

| |||||||||||

| 12 | PIMCO EQUITY SERIES VIT | See Accompanying Notes |

Table of Contents

December 31, 2014

| SHARES | MARKET VALUE (000S) | |||||||||||

| UNITED STATES 37.4% | ||||||||||||

| CONSUMER DISCRETIONARY 4.0% | ||||||||||||

Comcast Corp. ‘A’ | 129,799 | $ | 7,530 | |||||||||

Mattel, Inc. | 144,986 | 4,486 | ||||||||||

Time Warner Cable, Inc. | 26 | 4 | ||||||||||

Tribune Media Co. ‘A’ (a) | 88,473 | 5,288 | ||||||||||

|

| |||||||||||

| 17,308 | ||||||||||||

|

| |||||||||||

| CONSUMER STAPLES 8.7% | ||||||||||||

Altria Group, Inc. | 177,706 | 8,756 | ||||||||||

Lorillard, Inc. | 231,499 | 14,570 | ||||||||||

Philip Morris International, Inc. | 56,911 | 4,635 | ||||||||||

Reynolds American, Inc. | 149,302 | 9,596 | ||||||||||

|

| |||||||||||

| 37,557 | ||||||||||||

|

| |||||||||||

| ENERGY 2.3% | ||||||||||||

Dresser-Rand Group, Inc. (a) | 29,699 | 2,430 | ||||||||||

Halliburton Co. | 76,048 | 2,991 | ||||||||||

National Oilwell Varco, Inc. | 67,957 | 4,453 | ||||||||||

|

| |||||||||||

| 9,874 | ||||||||||||

|

| |||||||||||

| FINANCIALS 8.9% | ||||||||||||

Alleghany Corp. (a) | 12,877 | 5,969 | ||||||||||

Berkshire Hathaway, Inc. ‘B’ (a) | 90,711 | 13,620 | ||||||||||

Genworth Financial, Inc. ‘A’ (a) | 255,223 | 2,169 | ||||||||||

LegacyTexas Financial Group, Inc. (a) | 230,407 | 5,495 | ||||||||||

Navient Corp. | 256,693 | 5,547 | ||||||||||

PHH Corp. (a) | 134,193 | 3,215 | ||||||||||

SLM Corp. | 256,693 | 2,616 | ||||||||||

|

| |||||||||||

| 38,631 | ||||||||||||

|

| |||||||||||

| HEALTH CARE 2.7% | ||||||||||||

Allergan, Inc. | 15,733 | 3,345 | ||||||||||

Merck & Co., Inc. | 66,739 | 3,790 | ||||||||||

Pfizer, Inc. | 143,927 | 4,483 | ||||||||||

|

| |||||||||||

| 11,618 | ||||||||||||

|

| |||||||||||

| SHARES | MARKET VALUE (000S) | |||||||||||

| INDUSTRIALS 3.7% | ||||||||||||

Brink’s Co. | 284,753 | $ | 6,951 | |||||||||

NOW, Inc. (a) | 260,001 | 6,690 | ||||||||||

RR Donnelley & Sons Co. | 136,572 | 2,295 | ||||||||||

|

| |||||||||||

| 15,936 | ||||||||||||

|

| |||||||||||

| INFORMATION TECHNOLOGY 7.0% | ||||||||||||

Belden, Inc. | 26,708 | 2,105 | ||||||||||

International Business Machines Corp. | 38,516 | 6,180 | ||||||||||

Microsoft Corp. (e) | 312,889 | 14,534 | ||||||||||

Oracle Corp. | 84,334 | 3,792 | ||||||||||

Yahoo!, Inc. (a) | 69,041 | 3,487 | ||||||||||

|

| |||||||||||

| 30,098 | ||||||||||||

| �� |

|

| ||||||||||

| MATERIALS 0.1% | ||||||||||||

Rentech, Inc. (a) | 515,516 | 650 | ||||||||||

|

| |||||||||||

| Total United States | 161,672 | |||||||||||

|

| |||||||||||

| Total Common Stocks (Cost $355,626) | 418,746 | |||||||||||

|

| |||||||||||

| REAL ESTATE INVESTMENT TRUSTS 0.5% | ||||||||||||

| SINGAPORE 0.0% | ||||||||||||

| FINANCIALS 0.0% | ||||||||||||

Keppel REIT | 125,236 | 115 | ||||||||||

|

| |||||||||||

Total Singapore | 115 | |||||||||||

|

| |||||||||||

| UNITED STATES 0.5% | ||||||||||||

| FINANCIALS 0.5% | ||||||||||||

NorthStar Realty Finance Corp. | 124,834 | 2,194 | ||||||||||

|

| |||||||||||

| Total United States | 2,194 | |||||||||||

|

| |||||||||||

| Total Real Estate Investment Trusts (Cost $1,310) | 2,309 | |||||||||||

|

| |||||||||||

| RIGHTS 0.2% | ||||||||||||

| FRANCE 0.2% | ||||||||||||

| HEALTH CARE 0.2% | ||||||||||||

Sanofi - Exp. 12/31/2020 | 1,123,923 | 888 | ||||||||||

|

| |||||||||||

Total Rights (Cost $1,113) | 888 | |||||||||||

|

| |||||||||||

PRINCIPAL | MARKET VALUE (000S) | |||||||||||

| SHORT-TERM INSTRUMENTS 0.3% | ||||||||||||

| REPURCHASE AGREEMENTS (c) 0.1% | ||||||||||||

| $ | 424 | |||||||||||

|

| |||||||||||

| U.S. TREASURY BILLS 0.2% | ||||||||||||

0.062% due 04/30/2015 - 05/28/2015 (b)(g) | $ | 642 | 642 | |||||||||

|

| |||||||||||

| Total Short-Term Instruments (Cost $1,066) | 1,066 | |||||||||||

|

| |||||||||||

| Total Investments in Securities (Cost $359,115) | 423,009 | |||||||||||

|

| |||||||||||

| SHARES | ||||||||||||

| INVESTMENTS IN AFFILIATES 2.3% | ||||||||||||

| SHORT-TERM INSTRUMENTS 2.3% | ||||||||||||

| CENTRAL FUNDS USED FOR CASH MANAGEMENT PURPOSES 2.3% | ||||||||||||

PIMCO Short-Term | 361 | 4 | ||||||||||

PIMCO Short-Term | 988,994 | 9,803 | ||||||||||

|

| |||||||||||

| Total Short-Term Instruments (Cost $9,879) | 9,807 | |||||||||||

|

| |||||||||||

| Total Investments in Affiliates (Cost $9,879) | 9,807 | |||||||||||

| Total Investments 100.1% (Cost $368,994) | $ | 432,816 | ||||||||||

| Securities Sold Short (d) (1.7%) (Proceeds $6,700) | (7,189 | ) | ||||||||||

Financial Derivative (Cost or Premiums, net $(338)) | 3,536 | |||||||||||

| Other Assets and Liabilities, net 0.8% | 3,364 | |||||||||||

|

| |||||||||||

| Net Assets 100.0% | $ | 432,527 | ||||||||||

|

| |||||||||||

NOTES TO CONSOLIDATED SCHEDULE OF INVESTMENTS (AMOUNTS IN THOUSANDS*, EXCEPT NUMBER OF SHARES):

| * | A zero balance may reflect actual amounts rounding to less than one thousand. |

| † | All or a portion of this security is owned by PIMCO Cayman Commodity Portfolio III, Ltd., which is a 100% owned subsidiary of the Portfolio. |

| (a) | Security did not produce income within the last twelve months. |

| (b) | Coupon represents a weighted average yield to maturity. |

BORROWINGS AND OTHER FINANCING TRANSACTIONS

(c) REPURCHASE AGREEMENTS:

| Counterparty | Lending Rate | Settlement Date | Maturity Date | Principal Amount | Collateralized By | Collateral Received, at Value | Repurchase Agreements, at Value | Repurchase Agreement Proceeds to be Received (1) | ||||||||||||||||||||

SSB | 0.000% | 12/31/2014 | 01/02/2015 | $ | 424 | Fannie Mae 2.200% due 10/17/2022 | $ | (436 | ) | $ | 424 | $ | 424 | |||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||

Total Repurchase Agreements |

| $ | (436 | ) | $ | 424 | $ | 424 | ||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||

| (1) | Includes accrued interest. |

| See Accompanying Notes | ANNUAL REPORT | DECEMBER 31, 2014 | 13 |

Table of Contents

Consolidated Schedule of Investments PIMCO EqS Pathfinder Portfolio® (Cont.)

(d) SECURITIES SOLD SHORT:

| (e) | Securities with an aggregate market value of $6,968 and cash of $6,643 have been pledged as collateral as of December 31, 2014 for equity short sales and equity options as governed by prime brokerage agreements and agreements governing listed equity option transactions. |

Short Sales:

| Counterparty | Description | Shares | Proceeds | Payable for Short Sales | ||||||||||

| Common Stocks | ||||||||||||||

China | ||||||||||||||

Information Technology | ||||||||||||||

GSC | Alibaba Group Holding Ltd. ADR | 26,802 | $ | (3,108) | $ | (2,786) | ||||||||

United States | ||||||||||||||

Information Technology | ||||||||||||||

Applied Materials, Inc. | 176,706 | (3,592) | (4,403) | |||||||||||

|

|

|

| |||||||||||

Total Short Sales | $ | (6,700) | $ | (7,189) | ||||||||||

|

|

|

| |||||||||||

BORROWINGS AND OTHER FINANCING TRANSACTIONS SUMMARY

The following is a summary by counterparty of the market value of Borrowings and Other Financing Transactions and collateral (received)/pledged as of December 31, 2014:

| Counterparty | Repurchase Agreement Proceeds to be Received | Payable for Reverse Repurchase Agreements | Payable for Sale-Buyback Transactions | Payable for Short Sales | Total Borrowings and Other Financing Transactions | Collateral (Received)/Pledged | Net Exposure (2) | |||||||||||||||||||||

Global/Master Repurchase Agreement | ||||||||||||||||||||||||||||

SSB | $ | 424 | $ | 0 | $ | 0 | $ | 0 | $ | 424 | $ | (436 | ) | $ | (12 | ) | ||||||||||||

Prime Brokerage Agreement | ||||||||||||||||||||||||||||

GSC | 0 | 0 | 0 | (7,189 | ) | (7,189 | ) | 13,611 | 6,422 | |||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||

Total Borrowings and Other Financing Transactions | $ | 424 | $ | 0 | $ | 0 | $ | (7,189 | ) | |||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||

| (2) | Net Exposure represents the net receivable/(payable) that would be due from/to the counterparty in the event of default. Exposure from borrowings and other financing transactions can only be netted across transactions governed under the same master agreement with the same legal entity. The Portfolio and Subsidiary are recognized as two separate legal entities. As such, exposure cannot be netted. See Note 7, Principal Risks, in the Notes to Financial Statements for more information regarding master netting arrangements. |

(f) FINANCIAL DERIVATIVE INSTRUMENTS: OVER THE COUNTER

FORWARD FOREIGN CURRENCY CONTRACTS:

| Counterparty | Settlement Month | Currency to be Delivered | Currency to be Received | Unrealized Appreciation/ (Depreciation) | ||||||||||||||||||||||||

| Asset | Liability | |||||||||||||||||||||||||||

BOA | 01/2015 | EUR | 3,721 | $ | 4,603 | $ | 101 | $ | 0 | |||||||||||||||||||

| 01/2015 | GBP | 1,127 | 1,771 | 14 | 0 | |||||||||||||||||||||||

| 01/2015 | JPY | 1,072,874 | 8,946 | 0 | (11 | ) | ||||||||||||||||||||||

| 01/2015 | �� | $ | 4,839 | DKK | 29,527 | 0 | (42 | ) | ||||||||||||||||||||

| 01/2015 | 2,559 | EUR | 2,056 | 0 | (71 | ) | ||||||||||||||||||||||

| 01/2015 | 25,042 | GBP | 16,025 | 0 | (65 | ) | ||||||||||||||||||||||

| 01/2015 | 2,902 | JPY | 347,200 | 0 | (4 | ) | ||||||||||||||||||||||

| 02/2015 | DKK | 29,527 | $ | 4,841 | 42 | 0 | ||||||||||||||||||||||

| 02/2015 | GBP | 16,025 | 25,035 | 64 | 0 | |||||||||||||||||||||||

| 02/2015 | HKD | 6,497 | 838 | 0 | 0 | |||||||||||||||||||||||

| 02/2015 | $ | 8,948 | JPY | 1,072,874 | 11 | 0 | ||||||||||||||||||||||

BPS | 01/2015 | DKK | 9,842 | $ | 1,651 | 51 | 0 | |||||||||||||||||||||

| 01/2015 | EUR | 7,025 | 8,780 | 280 | 0 | |||||||||||||||||||||||

| 01/2015 | $ | 2,869 | EUR | 2,299 | 0 | (87 | ) | |||||||||||||||||||||

| 01/2015 | 862 | ILS | 3,340 | 0 | (5 | ) | ||||||||||||||||||||||

CBK | 01/2015 | EUR | 96 | $ | 119 | 3 | 0 | |||||||||||||||||||||

| 01/2015 | NOK | 4,565 | 670 | 57 | 0 | |||||||||||||||||||||||

| 01/2015 | SEK | 6,447 | 870 | 43 | 0 | |||||||||||||||||||||||

| 01/2015 | $ | 6,228 | CAD | 7,020 | 0 | (186 | ) | |||||||||||||||||||||

| 01/2015 | 33,269 | EUR | 27,142 | 0 | (426 | ) | ||||||||||||||||||||||

| 01/2015 | 16,053 | NOK | 119,919 | 37 | 0 | |||||||||||||||||||||||

| 02/2015 | EUR | 26,749 | $ | 32,793 | 415 | 0 | ||||||||||||||||||||||

| 02/2015 | NOK | 119,919 | 16,040 | 0 | (36 | ) | ||||||||||||||||||||||

DUB | 01/2015 | SEK | 6,448 | 870 | 43 | 0 | ||||||||||||||||||||||

| 14 | PIMCO EQUITY SERIES VIT | See Accompanying Notes |

Table of Contents

December 31, 2014

| Counterparty | Settlement Month | Currency to be Delivered | Currency to be Received | Unrealized Appreciation/ (Depreciation) | ||||||||||||||||||||||||

| Asset | Liability | |||||||||||||||||||||||||||

FBF | 01/2015 | DKK | 9,842 | $ | 1,650 | $ | 51 | $ | 0 | |||||||||||||||||||

| 01/2015 | GBP | 18,688 | 29,337 | 209 | 0 | |||||||||||||||||||||||

| 01/2015 | JPY | 877,242 | 7,445 | 121 | 0 | |||||||||||||||||||||||

| 01/2015 | $ | 17,760 | JPY | 2,101,595 | 0 | (214 | ) | |||||||||||||||||||||

GLM | 01/2015 | AUD | 827 | $ | 694 | 19 | 0 | |||||||||||||||||||||

| 01/2015 | CAD | 2,198 | 1,906 | 15 | (1 | ) | ||||||||||||||||||||||

| 01/2015 | JPY | 420,179 | 3,584 | 76 | 0 | |||||||||||||||||||||||

| 01/2015 | NOK | 121,974 | 17,882 | 1,516 | 0 | |||||||||||||||||||||||

| 01/2015 | SEK | 6,093 | 810 | 28 | 0 | |||||||||||||||||||||||

| 01/2015 | $ | 2,908 | GBP | 1,856 | 0 | (15 | ) | |||||||||||||||||||||

| 01/2015 | 4,897 | NOK | 35,064 | 0 | (192 | ) | ||||||||||||||||||||||

| 02/2015 | GBP | 1,505 | $ | 2,335 | 0 | (10 | ) | |||||||||||||||||||||

| 02/2015 | NOK | 12,413 | 1,666 | 2 | 0 | |||||||||||||||||||||||

| 02/2015 | $ | 3,069 | CNY | 18,927 | 4 | 0 | ||||||||||||||||||||||

| 02/2015 | 581 | KRW | 638,719 | 1 | 0 | |||||||||||||||||||||||

HUS | 01/2015 | SGD | 10,485 | $ | 8,217 | 307 | 0 | |||||||||||||||||||||

| 01/2015 | $ | 9,412 | AUD | 11,003 | 0 | (429 | ) | |||||||||||||||||||||

| 01/2015 | 6,227 | CAD | 7,020 | 0 | (185 | ) | ||||||||||||||||||||||

| 01/2015 | 907 | GBP | 579 | 0 | (4 | ) | ||||||||||||||||||||||

JPM | 01/2015 | CAD | 18,861 | $ | 16,226 | 0 | (8 | ) | ||||||||||||||||||||

| 01/2015 | EUR | 21,033 | 26,085 | 634 | 0 | |||||||||||||||||||||||

| 01/2015 | JPY | 78,500 | 661 | 6 | 0 | |||||||||||||||||||||||

| 01/2015 | $ | 2,134 | GBP | 1,355 | 0 | (22 | ) | |||||||||||||||||||||

| 02/2015 | AUD | 5,847 | $ | 4,759 | 0 | (5 | ) | |||||||||||||||||||||

| 02/2015 | CHF | 2,436 | 2,506 | 55 | 0 | |||||||||||||||||||||||

| 02/2015 | HKD | 116,819 | 15,066 | 3 | 0 | |||||||||||||||||||||||

| 02/2015 | KRW | 4,365,878 | 4,098 | 117 | 0 | |||||||||||||||||||||||

| 02/2015 | $ | 16,216 | CAD | 18,861 | 8 | 0 | ||||||||||||||||||||||

| 02/2015 | 498 | EUR | 407 | 0 | (5 | ) | ||||||||||||||||||||||

| 02/2015 | 1,811 | HKD | 14,044 | 0 | 0 | |||||||||||||||||||||||

MSB | 01/2015 | AUD | 10,176 | $ | 8,332 | 25 | 0 | |||||||||||||||||||||

| 01/2015 | NOK | 3,410 | 493 | 35 | 0 | |||||||||||||||||||||||

| 02/2015 | $ | 8,315 | AUD | 10,176 | 0 | (24 | ) | |||||||||||||||||||||

| 02/2015 | 593 | HKD | 4,600 | 0 | 0 | |||||||||||||||||||||||

RBC | 01/2015 | DKK | 9,843 | $ | 1,651 | 51 | 0 | |||||||||||||||||||||

| 01/2015 | $ | 6,226 | CAD | 7,019 | 0 | (185 | ) | |||||||||||||||||||||

| 01/2015 | 472 | EUR | 378 | 0 | (14 | ) | ||||||||||||||||||||||

UAG | 01/2015 | NOK | 121,974 | $ | 17,881 | 1,515 | 0 | |||||||||||||||||||||

| 01/2015 | SEK | 6,447 | 870 | 43 | 0 | |||||||||||||||||||||||

| 02/2015 | NOK | 96,940 | 13,003 | 7 | 0 | |||||||||||||||||||||||

| 02/2015 | SEK | 25,435 | 3,281 | 18 | 0 | |||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||

Total Forward Foreign Currency Contracts |

| $ | 6,027 | $ | (2,246 | ) | ||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||

WRITTEN OPTIONS:

OPTIONS ON SECURITIES

| Counterparty | Description | Strike Price | Expiration Date | Notional Amount | Premiums (Received) | Market Value | ||||||||||||||||

| GST | Call - OTC International Business Machines Corp. | $ | 155.000 | 07/17/2015 | $ 1,541 | $ | (147 | ) | $ | (173 | ) | |||||||||||

Call - OTC International Business Machines Corp. | 155.000 | 01/15/2016 | 1,541 | (191 | ) | (217 | ) | |||||||||||||||

|

|

|

| |||||||||||||||||||

| $ | (338 | ) | $ | (390 | ) | |||||||||||||||||

|

|

|

| |||||||||||||||||||

Total Written Options |

| $ | (338 | ) | $ | (390 | ) | |||||||||||||||

|

|

|

| |||||||||||||||||||

TRANSACTIONS IN WRITTEN CALL AND PUT OPTIONS FOR THE PERIOD ENDED DECEMBER 31, 2014:

| # of Contracts | Notional Amount | Premiums | ||||||||||

Balance at Beginning of Period | 0 | $ | 0 | $ | 0 | |||||||

Sales | 2,335 | 3,082 | (653 | ) | ||||||||

Closing Buys | (2,182 | ) | 0 | 284 | ||||||||

Expirations | 0 | 0 | 0 | |||||||||

Exercised | (153 | ) | 0 | 31 | ||||||||

|

|

|

|

|

| |||||||

Balance at End of Period | 0 | $ | 3,082 | $ | (338 | ) | ||||||

|

|

|

|

|

| |||||||

| See Accompanying Notes | ANNUAL REPORT | DECEMBER 31, 2014 | 15 |

Table of Contents

Consolidated Schedule of Investments PIMCO EqS Pathfinder Portfolio® (Cont.)

SWAP AGREEMENTS:

TOTAL RETURN SWAPS ON SECURITIES

| Counterparty | Pay/Receive (1) | Underlying Reference | # of Shares | Financing Rate | Maturity Date | Notional Amount | Unrealized Appreciation/ (Depreciation) | Swap Agreements, at Value | ||||||||||||||||||||||||||

| Asset | Liability | |||||||||||||||||||||||||||||||||

| BOA | Pay | Rentech Nitrogen Partners LP | 9,630 | 1-Month USD-LIBOR less a specified spread | 08/14/2015 | $ | 87 | $ | (15 | ) | $ | 0 | $ | (15 | ) | |||||||||||||||||||

| JPM | Receive | Liberty TripAdvisor Holdings, Inc. | 68,429 | 1-Month USD-LIBOR plus a specified spread | 04/29/2015 | 1,728 | 112 | 112 | 0 | |||||||||||||||||||||||||

Pay | TripAdvisor, Inc. | 28,300 | 1-Month USD-LIBOR less a specified spread | 04/29/2015 | 2,043 | (70 | ) | 0 | (70 | ) | ||||||||||||||||||||||||

Receive | Covidien PLC | 56,569 | 1-Month USD-LIBOR plus a specified spread | 06/16/2015 | 5,659 | 146 | 146 | 0 | ||||||||||||||||||||||||||

Pay | Medtronic, Inc. | 54,081 | 1-Month USD-LIBOR less a specified spread | 06/16/2015 | 3,893 | (28 | ) | 0 | (28 | ) | ||||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||||||

| $ | 145 | $ | 258 | $ | (113 | ) | ||||||||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||||||

Total Swap Agreements | $ | 145 | $ | 258 | $ | (113 | ) | |||||||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||||||

| (1) | Receive represents that the Portfolio receives payments for any positive return on the underlying reference. The Portfolio makes payments for any negative return on such underlying reference. Pay represents that the Portfolio receives payments for any negative return on the underlying reference. The Portfolio makes payments for any positive return on such underlying reference. |

FINANCIAL DERIVATIVE INSTRUMENTS: OVER THE COUNTER SUMMARY

The following is a summary by counterparty of the market value of OTC financial derivative instruments and collateral (received)/pledged as of December 31, 2014:

(g) Securities with an aggregate market value of $642 have been pledged as collateral for financial derivative instruments as governed by International Swaps and Derivatives Association, Inc. master agreements as of December 31, 2014.

| Financial Derivative Assets | Financial Derivative Liabilities | |||||||||||||||||||||||||||||||||||||||||||||

| Counterparty | Forward Foreign Currency Contracts | Purchased Options | Swap Agreements | Total Over the Counter | Forward Foreign Currency Contracts | Written Options | Swap Agreements | Total Over the Counter | Net Market Value of OTC Derivatives | Collateral (Received)/ Pledged | Net Exposure (2) | |||||||||||||||||||||||||||||||||||

BOA | $ | 232 | $ | 0 | $ | 0 | $ | 232 | $ | (193 | ) | $ | 0 | $ | (15 | ) | $ | (208 | ) | $ | 24 | $ | (10 | ) | $ | 14 | ||||||||||||||||||||

BPS | 331 | 0 | 0 | 331 | (92 | ) | 0 | 0 | (92 | ) | 239 | 0 | 239 | |||||||||||||||||||||||||||||||||

CBK | 555 | 0 | 0 | 555 | (648 | ) | 0 | 0 | (648 | ) | (93 | ) | 0 | (93 | ) | |||||||||||||||||||||||||||||||

DUB | 43 | 0 | 0 | 43 | 0 | 0 | 0 | 0 | 43 | 0 | 43 | |||||||||||||||||||||||||||||||||||

FBF | 381 | 0 | 0 | 381 | (214 | ) | 0 | 0 | (214 | ) | 167 | 0 | 167 | |||||||||||||||||||||||||||||||||

GLM | 1,661 | 0 | 0 | 1,661 | (218 | ) | 0 | 0 | (218 | ) | 1,443 | (1,320 | ) | 123 | ||||||||||||||||||||||||||||||||

GST | 0 | 0 | 0 | 0 | 0 | (390 | ) | 0 | (390 | ) | (390 | ) | 371 | (19 | ) | |||||||||||||||||||||||||||||||

HUS | 307 | 0 | 0 | 307 | (618 | ) | 0 | 0 | (618 | ) | (311 | ) | 271 | (40 | ) | |||||||||||||||||||||||||||||||

JPM | 823 | 0 | 258 | 1,081 | (40 | ) | 0 | (98 | ) | (138 | ) | 943 | (770 | ) | 173 | |||||||||||||||||||||||||||||||

MSB | 60 | 0 | 0 | 60 | (24 | ) | 0 | 0 | (24 | ) | 36 | 0 | 36 | |||||||||||||||||||||||||||||||||

RBC | 51 | 0 | 0 | 51 | (199 | ) | 0 | 0 | (199 | )�� | (148 | ) | 0 | (148 | ) | |||||||||||||||||||||||||||||||

SOG | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (60 | ) | (60 | ) | |||||||||||||||||||||||||||||||||

UAG | 1,583 | 0 | 0 | 1,583 | 0 | 0 | 0 | 0 | 1,583 | (1,480 | ) | 103 | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Total Over the Counter | $ | 6,027 | $ | 0 | $ | 258 | $ | 6,285 | $ | (2,246 | ) | $ | (390 | ) | $ | (113 | ) | $ | (2,749 | ) | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

| (2) | Net Exposure represents the net receivable/(payable) that would be due from/to the counterparty in the event of default. Exposure from OTC derivatives can only be netted across transactions governed under the same master agreement with the same legal entity. The Portfolio and Subsidiary are recognized as two separate legal entities. As such, exposure cannot be netted. See Note 7, Principal Risks, in the Notes to Financial Statements for more information regarding master netting agreements. |

FAIR VALUE OF FINANCIAL DERIVATIVE INSTRUMENTS

The following is a summary of the fair valuation of the Portfolio’s derivative instruments categorized by risk exposure. See Note 7, Principal Risks, in the Notes to Financial Statements on risks of the Portfolio.

Fair Values of Financial Derivative Instruments on the Consolidated Statement of Assets and Liabilities as of December 31, 2014:

| Derivatives not accounted for as hedging instruments | ||||||||||||||||||||||||

| Commodity Contracts | Credit Contracts | Equity Contracts | Foreign Exchange Contracts | Interest Rate Contracts | Total | |||||||||||||||||||

Financial Derivative Instruments - Assets | ||||||||||||||||||||||||

Over the counter | ||||||||||||||||||||||||

Forward Foreign Currency Contracts | $ | 0 | $ | 0 | $ | 0 | $ | 6,027 | $ | 0 | $ | 6,027 | ||||||||||||

Swap Agreements | 0 | 0 | 258 | 0 | 0 | 258 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| $ | 0 | $ | 0 | $ | 258 | $ | 6,027 | $ | 0 | $ | 6,285 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| 16 | PIMCO EQUITY SERIES VIT | See Accompanying Notes |

Table of Contents

December 31, 2014

| Derivatives not accounted for as hedging instruments | ||||||||||||||||||||||||

| Commodity Contracts | Credit Contracts | Equity Contracts | Foreign Exchange Contracts | Interest Rate Contracts | Total | |||||||||||||||||||

Financial Derivative Instruments - Liabilities | ||||||||||||||||||||||||

Over the counter | ||||||||||||||||||||||||

Forward Foreign Currency Contracts | $ | 0 | $ | 0 | $ | 0 | $ | 2,246 | $ | 0 | $ | 2,246 | ||||||||||||

Written Options | 0 | 0 | 390 | 0 | 0 | 390 | ||||||||||||||||||

Swap Agreements | 0 | 0 | 113 | 0 | 0 | 113 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| $ | 0 | $ | 0 | $ | 503 | $ | 2,246 | $ | 0 | $ | 2,749 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

The Effect of Financial Derivative Instruments on the Consolidated Statement of Operations for the Period Ended December 31, 2014:

| Derivatives not accounted for as hedging instruments | ||||||||||||||||||||||||

| Commodity Contracts | Credit Contracts | Equity Contracts | Foreign Exchange Contracts | Interest Rate Contracts | Total | |||||||||||||||||||

Net Realized Gain (Loss) on Financial Derivative Instruments | ||||||||||||||||||||||||

Exchange-traded or centrally cleared | ||||||||||||||||||||||||

Purchased Options | $ | 0 | $ | 0 | $ | (22 | ) | $ | 0 | $ | 0 | $ | (22 | ) | ||||||||||

Written Options | 0 | 0 | 176 | 0 | 0 | 176 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| $ | 0 | $ | 0 | $ | 154 | $ | 0 | $ | 0 | $ | 154 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Over the counter | ||||||||||||||||||||||||

Forward Foreign Currency Contracts | $ | 0 | $ | 0 | $ | 0 | $ | 4,127 | $ | 0 | $ | 4,127 | ||||||||||||

Swap Agreements | 0 | 0 | 991 | 0 | 0 | 991 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| $ | 0 | $ | 0 | $ | 991 | $ | 4,127 | $ | 0 | $ | 5,118 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| $ | 0 | $ | 0 | $ | 1,145 | $ | 4,127 | $ | 0 | $ | 5,272 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Net Change in Unrealized Appreciation (Depreciation) on Financial Derivative Instruments |

| |||||||||||||||||||||||

Over the counter | ||||||||||||||||||||||||

Forward Foreign Currency Contracts | $ | 0 | $ | 0 | $ | 0 | $ | 6,567 | $ | 0 | $ | 6,567 | ||||||||||||

Written Options | 0 | 0 | (53 | ) | 0 | 0 | (53 | ) | ||||||||||||||||

Swap Agreements | 0 | 0 | (327 | ) | 0 | 0 | (327 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| $ | 0 | $ | 0 | $ | (380 | ) | $ | 6,567 | $ | 0 | $ | 6,187 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

FAIR VALUE MEASUREMENTS

The following is a summary of the fair valuations according to the inputs used as of December 31, 2014 in valuing the Portfolio’s assets and liabilities:

| Category and Subcategory | Level 1 | Level 2 | Level 3 | Fair Value at 12/31/2014 | ||||||||||||

Investments in Securities, at Value |

| |||||||||||||||

Common Stocks | ||||||||||||||||

Australia | ||||||||||||||||

Industrials | $ | 0 | $ | 3,773 | $ | 0 | $ | 3,773 | ||||||||

Belgium | ||||||||||||||||

Industrials | 0 | 11,828 | 0 | 11,828 | ||||||||||||

Bermuda | ||||||||||||||||

Energy | 0 | 3,335 | 0 | 3,335 | ||||||||||||

Canada | ||||||||||||||||

Energy | 2,793 | 0 | 0 | 2,793 | ||||||||||||

Denmark | ||||||||||||||||

Consumer Staples | 0 | 6,677 | 0 | 6,677 | ||||||||||||

Faroe Islands | ||||||||||||||||

Consumer Staples | 0 | 3,934 | 0 | 3,934 | ||||||||||||

France | ||||||||||||||||

Consumer Discretionary | 0 | 12,473 | 0 | 12,473 | ||||||||||||

Consumer Staples | 0 | 16,969 | 0 | 16,969 | ||||||||||||

Energy | 2,757 | 2,541 | 0 | 5,298 | ||||||||||||

Hong Kong | ||||||||||||||||

Consumer Discretionary | 2,823 | 0 | 0 | 2,823 | ||||||||||||

Financials | 0 | 15,555 | 0 | 15,555 | ||||||||||||

Industrials | 0 | 2,695 | 0 | 2,695 | ||||||||||||

Japan | ||||||||||||||||

Consumer Discretionary | 0 | 2,966 | 0 | 2,966 | ||||||||||||

Consumer Staples | 0 | 6,085 | 0 | 6,085 | ||||||||||||

Information Technology | 4,150 | 3,612 | 0 | 7,762 | ||||||||||||

Netherlands | ||||||||||||||||

Consumer Staples | 0 | 6,829 | 0 | 6,829 | ||||||||||||

| Category and Subcategory | Level 1 | Level 2 | Level 3 | Fair Value at 12/31/2014 | ||||||||||||

Financials | $ | 0 | $ | 9,049 | $ | 0 | $ | 9,049 | ||||||||