UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| | |

| [ ] | | Preliminary Proxy Statement |

| [ ] | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | | Definitive Proxy Statement |

| [ ] | | Definitive Additional Materials |

| [ ] | | Soliciting Material Pursuant to Section 240.14a-12 |

PIMCO EQUITY SERIES

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| [X] | | No fee required. |

| [ ] | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| [ ] | | Fee paid previously with preliminary materials. |

| [ ] | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

PIMCO EQUITY SERIES

650 Newport Center Drive

Newport Beach, California 92660

February 8, 2021

Dear Shareholder:

On behalf of the Board of Trustees (the “Board”) of PIMCO RAFI Dynamic Multi-Factor Emerging Markets Equity ETF, PIMCO RAFI Dynamic Multi-Factor U.S. Equity ETF, PIMCO RAFI Dynamic Multi-Factor International Equity ETF and PIMCO RAFI ESG U.S. ETF (collectively, the “RAFI ETFs”); PIMCO RAE Emerging Markets Fund, PIMCO RAE Global Fund, PIMCO RAE Global ex-US Fund, PIMCO RAE International Fund, PIMCO RAE US Fund and PIMCO RAE US Small Fund (collectively, the “RAE Funds”); and PIMCO Dividend and Income Fund (together with the RAFI ETFs and the RAE Funds, the “Funds” and each, a “Fund”), each a series of PIMCO Equity Series (the “Trust”), I am pleased to invite you to a special meeting of shareholders (the “Meeting”) of the Funds to be held at PIMCO, 650 Newport Center Drive, Newport Beach, CA 92660 on March 26, 2021 at 9:00 A.M., Pacific time.

Parametric Portfolio Associates LLC (“Parametric”) serves as sub-adviser to the RAFI ETFs and portfolio implementer to the RAE Funds and equity portion of the PIMCO Dividend and Income Fund’s portfolio. Parametric is an indirect wholly-owned subsidiary of Eaton Vance Corp. (“EVC”). As described in more detail below, a transaction involving EVC is expected to trigger automatic termination of Parametric’s sub-advisory and portfolio implementation agreements involving the Funds. The Meeting is being called to seek your approval of replacement contracts the terms of which are materially identical to the terms of the corresponding current agreements.

On October 8, 2020, EVC announced that it had entered into a definitive agreement with Morgan Stanley pursuant to which Morgan Stanley will acquire EVC and its subsidiaries, including Parametric, subject to the completion or waiver of various conditions (the “Acquisition”). The Acquisition is expected to close in the second quarter of 2021. Upon closing of the Acquisition (the “Acquisition Closing Date”), it is expected that the RAFI ETFs’ sub-advisory agreement then in place with Parametric and the RAE Funds’ and PIMCO Dividend and Income Fund’s portfolio implementation agreements then in place with Parametric will automatically terminate in accordance with applicable law. In case the Acquisition closes before shareholder approval of new sub-advisory and new portfolio implementation agreements (as applicable) is obtained, the Board has approved Parametric as interim sub-adviser to the RAFI ETFs pursuant to an interim sub-advisory agreement and Parametric as interim

portfolio implementer to the RAE Funds and to the equity portion of the PIMCO Dividend and Income Fund’s portfolio pursuant to interim portfolio implementation agreements, each to be effective on the Acquisition Closing Date. The terms of the interim agreements are materially identical to those of the current agreements except for term and escrow provisions required by applicable law.

In order for each Fund’s operations to continue uninterrupted after the Acquisition and, if necessary, to replace the interim agreements, we are asking the shareholders of the RAFI ETFs to approve new a sub-advisory agreement with Parametric, the shareholders of the RAE Funds to approve a new portfolio implementation agreement with Parametric and the shareholders of the PIMCO Dividend and Income Fund to approve a new portfolio implementation agreement with Parametric. Each Fund’s Board has approved the new agreements. It is important to note that in connection with the new agreements and the Acquisition, there will be no changes to your Fund’s fees, and services to be provided by Parametric to your Fund will remain the same under the new agreements. In addition, there will be no changes to the portfolio managers, investment objectives or investment strategies of your Fund.

Your vote is important. After reviewing the proposals, the Board of Trustees unanimously voted to approve them, as more fully described in the accompanying proxy statement. On behalf of the Board of Trustees, I ask you to review the proposals and vote. For more information about the proposals requiring your vote, please refer to the accompanying proxy statement.

No matter how many shares you own, your timely vote is important. If you are not able to attend the Meeting, then please complete, sign, date and mail the enclosed proxy card(s) promptly in order to avoid the expense of additional mailings. If you have any questions regarding the proxy statement, please call (888) 548-6498.

Thank you in advance for your participation in this important event.

|

| Sincerely, |

|

/s/ Peter G. Strelow |

|

| Peter G. Strelow |

| Chairman of the Board |

PIMCO EQUITY SERIES

PIMCO RAFI DYNAMIC MULTI-FACTOR EMERGING MARKETS EQUITY ETF

PIMCO RAFI DYNAMIC MULTI-FACTOR U.S. EQUITY ETF

PIMCO RAFI DYNAMIC MULTI-FACTOR INTERNATIONAL EQUITY ETF

PIMCO RAFI ESG U.S. ETF

PIMCO RAE EMERGING MARKETS FUND

PIMCO RAE GLOBAL FUND

PIMCO RAE GLOBAL EX-US FUND

PIMCO RAE INTERNATIONAL FUND

PIMCO RAE US FUND

PIMCO RAE US SMALL FUND

PIMCO DIVIDEND AND INCOME FUND

650 Newport Center Drive

Newport Beach, California 92660

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be held March 26, 2021

Dear Shareholder:

Notice is hereby given that a special meeting of shareholders of the PIMCO RAFI Dynamic Multi-Factor Emerging Markets Equity ETF, PIMCO RAFI Dynamic Multi-Factor U.S. Equity ETF, PIMCO RAFI Dynamic Multi-Factor International Equity ETF and PIMCO RAFI ESG U.S. ETF (collectively, the “RAFI ETFs”); PIMCO RAE Emerging Markets Fund, PIMCO RAE Global Fund, PIMCO RAE Global ex-US Fund, PIMCO RAE International Fund, PIMCO RAE US Fund and PIMCO RAE US Small Fund (collectively, the “RAE Funds”); and PIMCO Dividend and Income Fund (together with the RAFI ETFs and the RAE Funds, the “Funds” and each, a “Fund”), each a series of PIMCO Equity Series (the “Trust”), will be held at PIMCO, 650 Newport Center Drive, Newport Beach, CA 92660 on March 26, 2021 at 9:00 A.M., Pacific time, or as adjourned from time to time (the “Meeting”).

Parametric Portfolio Associates LLC (“Parametric”) serves as sub-adviser to the RAFI ETFs and portfolio implementer to the RAE Funds and equity portion of the PIMCO Dividend and Income Fund’s portfolio. Parametric is an indirect wholly-owned subsidiary of Eaton Vance Corp. (“EVC”). As described in more detail below, a transaction involving EVC is expected to trigger automatic termination of Parametric’s sub-advisory and portfolio implementation agreements involving the Funds. The Meeting is being called to seek your

approval of replacement contracts the terms of which are materially identical to the terms of the corresponding current agreements.

On October 8, 2020, EVC announced that it had entered into a definitive agreement with Morgan Stanley pursuant to which Morgan Stanley will acquire EVC and its subsidiaries, including Parametric, subject to the completion or waiver of various conditions (the “Acquisition”). The Acquisition is expected to close in the second quarter of 2021. Upon closing of the Acquisition (the “Acquisition Closing Date”), it is expected that the RAFI ETFs’ sub-advisory agreement then in place with Parametric and the RAE Funds’ and PIMCO Dividend and Income Fund’s portfolio implementation agreements then in place with Parametric will automatically terminate in accordance with applicable law. In case the Acquisition closes before shareholder approval of new sub-advisory and new portfolio implementation agreements (as applicable) is obtained, the Board has approved Parametric as interim sub-adviser to the RAFI ETFs pursuant to an interim sub-advisory agreement and Parametric as interim portfolio implementer to the RAE Funds and to the equity portion of the PIMCO Dividend and Income Fund’s portfolio pursuant to interim portfolio implementation agreements, each to be effective on the Acquisition Closing Date. The terms of the interim agreements are materially identical to those of the current agreements except for term and escrow provisions required by applicable law.

In order for each Fund’s operations to continue uninterrupted after the Acquisition and, if necessary, to replace the interim agreements, we are asking the shareholders of the RAFI ETFs to approve new a sub-advisory agreement with Parametric, the shareholders of the RAE Funds to approve a new portfolio implementation agreement with Parametric and the shareholders of the PIMCO Dividend and Income Fund to approve a new portfolio implementation agreement with Parametric. Each Fund’s Board has approved the new agreements. It is important to note that in connection with the new agreements and the Acquisition, there will be no changes to your Fund’s fees, and services to be provided by Parametric to your Fund will remain the same under the new agreements. In addition, there will be no changes to the portfolio managers, investment objectives or investment strategies of your Fund.

The Meeting is being held for the following purposes:

For shareholders of the RAFI ETFs ONLY:

| | 1. | To approve a new sub-advisory agreement on behalf of the RAFI ETFs between Pacific Investment Management Company LLC (“PIMCO”), the Funds’ investment adviser, and Parametric; |

For shareholders of the RAE Funds ONLY:

| | 2. | To approve a new portfolio implementation agreement on behalf of the RAE Funds among PIMCO, Research Affiliates, LLC (“RALLC”), the RAE Funds’ sub-adviser, and Parametric; |

For shareholders of the PIMCO Dividend and Income Fund ONLY:

| | 3. | To approve a new portfolio implementation agreement on behalf of the PIMCO Dividend and Income Fund among PIMCO, RALLC, the PIMCO Dividend and Income Fund’s sub-adviser, and Parametric; and |

For all shareholders:

| | 4. | To transact such other business as may properly come before the Meeting or any adjournments or postponements thereof. |

After careful consideration, the Trustees of the Trust unanimously approved the proposals and recommended that shareholders vote “FOR” the proposals applicable to their Funds.

The matters referenced above are discussed in detail in the proxy statement attached to this notice. The Board of Trustees has fixed the close of business on February 1, 2021 as the record date for determining shareholders entitled to notice of and to vote at the Meeting or any adjournments or postponements thereof. Each share of a Fund is entitled to one vote with respect to proposals on which that Fund’s shareholders are entitled to vote, with fractional votes for fractional shares.

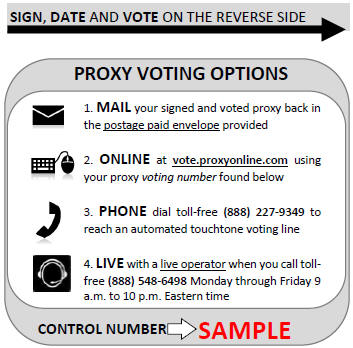

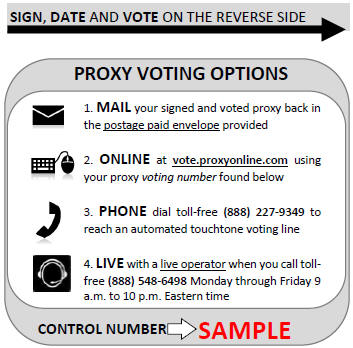

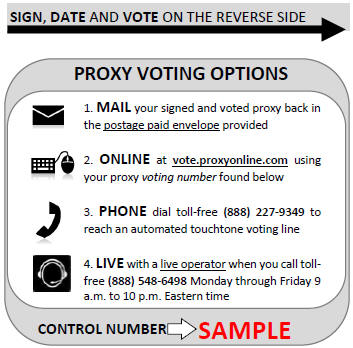

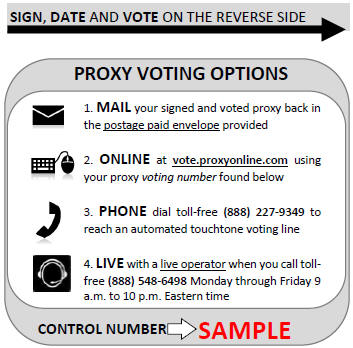

Shareholders may attend the Meeting in person. Any shareholder who does not expect to attend the Meeting is requested to complete, date and sign the enclosed proxy card, and return it in the envelope provided. You also have the opportunity to provide voting instructions via telephone or the Internet. In order to avoid unnecessary expense and additional outreach to you, we ask your cooperation in responding promptly, no matter how large or small your holdings may be. If you wish to wait until the Meeting to vote your shares, you will need to request a paper ballot at the Meeting in order to do so.

If you have any questions regarding the enclosed proxy material or need assistance in voting your shares, please contact AST Fund Solutions, LLC, at (888) 548-6498 Monday through Friday from 9 a.m. to 10 p.m. ET.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Shareholders to Be Held on March 26, 2021. This Notice

of Special Meeting of Shareholders, the Proxy Statement and the form of proxy cards are available on the Internet at https://vote.proxyonline.com/PIMCOFunds/docs/PES_Proxy.pdf. On this website, you will be able to access the Notice of Special Meeting of Shareholders, the Proxy Statement, the form of proxy cards and any amendments or supplements to the foregoing material that are required to be furnished to shareholders.

|

| By Order of the Board of Trustees |

|

| Ryan G. Leshaw, Secretary |

| February 8, 2021 |

PIMCO EQUITY SERIES

PIMCO RAFI DYNAMIC MULTI-FACTOR EMERGING MARKETS EQUITY ETF

PIMCO RAFI DYNAMIC MULTI-FACTOR U.S. EQUITY ETF

PIMCO RAFI DYNAMIC MULTI-FACTOR INTERNATIONAL EQUITY ETF

PIMCO RAFI ESG U.S. ETF

PIMCO RAE EMERGING MARKETS FUND

PIMCO RAE GLOBAL FUND

PIMCO RAE GLOBAL EX-US FUND

PIMCO RAE INTERNATIONAL FUND

PIMCO RAE US FUND

PIMCO RAE US SMALL FUND

PIMCO DIVIDEND AND INCOME FUND

650 Newport Center Drive

Newport Beach, California 92660

For proxy information call:

(888) 548-6498

For account information call:

Mutual Funds: (888) 877-4626

ETFs: (888) 400-4383

If a broker or other nominee holds your shares, you may contact the broker or nominee directly.

JOINT PROXY STATEMENT

Special Meeting of Shareholders

To be Held on March 26, 2021

This joint proxy statement is being furnished in connection with the solicitation of proxies on behalf of the Board of Trustees (the “Board of Trustees” or the “Board”) of PIMCO Equity Series (the “Trust”), a Delaware statutory trust and open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), for use at a special meeting of shareholders of the PIMCO RAFI Dynamic Multi-Factor Emerging Markets Equity ETF, PIMCO RAFI Dynamic Multi-Factor U.S. Equity ETF, PIMCO RAFI Dynamic Multi-Factor International Equity ETF and PIMCO RAFI ESG U.S. ETF (collectively, the “RAFI ETFs”); PIMCO RAE

1

Emerging Markets Fund, PIMCO RAE Global Fund, PIMCO RAE Global ex-US Fund, PIMCO RAE International Fund, PIMCO RAE US Fund and PIMCO RAE US Small Fund (collectively, the “RAE Funds”); and PIMCO Dividend and Income Fund (together with the RAFI ETFs and the RAE Funds, the “Funds” and each, a “Fund”), each a series of PIMCO Equity Series (the “Trust”). I am pleased to invite you to a special meeting of shareholders of the Funds to be held at PIMCO, 650 Newport Center Drive, Newport Beach, CA 92660 on March 26, 2021 at 9:00 A.M., Pacific time, or as adjourned from time to time (for each Fund, a “Meeting” and collectively, the “Meetings”).

The Board of each Fund has determined that the use of this Joint Proxy Statement for each Meeting is in the best interests of the Fund in light of the similar matters being considered and voted on by the shareholders of each Fund. The Meetings are being held together for convenience, but each Meeting is a separate meeting. This Joint Proxy Statement and the accompanying materials are first being mailed to shareholders on or about February 12, 2021.

Parametric Portfolio Associates LLC (“Parametric”) serves as sub-adviser to the RAFI ETFs and portfolio implementer to the RAE Funds and equity portion of the PIMCO Dividend and Income Fund’s portfolio. Parametric is an indirect wholly-owned subsidiary of Eaton Vance Corp. (“EVC”). As described in more detail below, a transaction involving EVC is expected to trigger automatic termination of Parametric’s sub-advisory and portfolio implementation agreements involving the Funds. The Meetings are being called to seek your approval of replacement contracts the terms of which are materially identical to the terms of the corresponding current agreements.

On October 8, 2020, EVC announced that it had entered into a definitive agreement with Morgan Stanley pursuant to which Morgan Stanley will acquire EVC and its subsidiaries, including Parametric, subject to the completion or waiver of various conditions (the “Acquisition”). The Acquisition is expected to close in the second quarter of 2021. Upon closing of the Acquisition (the “Acquisition Closing Date”), it is expected that the RAFI ETFs’ sub-advisory agreement then in place with Parametric and the RAE Funds’ and PIMCO Dividend and Income Fund’s portfolio implementation agreements then in place with Parametric will automatically terminate in accordance with applicable law. In case the Acquisition closes before shareholder approval of new sub-advisory and new portfolio implementation agreements (as applicable) is obtained, the Board has approved Parametric as interim sub-adviser to the RAFI ETFs pursuant to an interim sub-advisory agreement and Parametric as interim portfolio implementer to the RAE Funds and to the equity portion of the PIMCO Dividend and Income Fund’s portfolio pursuant to interim portfolio implementation agreements, each to be effective on the Acquisition Closing

2

Date. The terms of the interim agreements are materially identical to those of the current agreements except for term and escrow provisions required by applicable law.

In order for each Fund’s operations to continue uninterrupted after the Acquisition and, if necessary, to replace the interim agreements, we are asking the shareholders of the RAFI ETFs to approve new a sub-advisory agreement with Parametric, the shareholders of the RAE Funds to approve a new portfolio implementation agreement with Parametric and the shareholders of the PIMCO Dividend and Income Fund to approve a new portfolio implementation agreement with Parametric. Each Fund’s Board has approved the new agreements.

The Board and Pacific Investment Management Company LLC (“PIMCO”), each Fund’s investment adviser, believe that the proposals are in the best interests of each applicable Fund’s shareholders and therefore recommend that you approve the applicable agreement with Parametric.

The Meetings are being held for the following purposes:

For shareholders of the RAFI ETFs ONLY:

| | 1. | To approve a new sub-advisory agreement on behalf of the RAFI ETFs between PIMCO and Parametric (“Sub-Advisory Agreement”); |

For shareholders of the RAE Funds ONLY:

| | 2. | To approve a new portfolio implementation agreement on behalf of the RAE Funds among PIMCO, Research Affiliates, LLC (“RALLC”), the RAE Funds’ sub-adviser, and Parametric (“RAE Portfolio Implementation Agreement”); |

For shareholders of the PIMCO Dividend and Income Fund ONLY:

| | 3. | To approve a new portfolio implementation agreement on behalf of the PIMCO Dividend and Income Fund among PIMCO, RALLC, the PIMCO Dividend and Income Fund’s sub-adviser, and Parametric (“DIF Portfolio Implementation Agreement”); and |

For all shareholders:

| | 4. | To transact such other business as may properly come before the Meeting or any adjournments or postponements thereof. |

3

With respect to each Meeting, all properly executed proxies received prior to the Meeting will be voted at the Meeting in accordance with the instructions marked on the proxy card. Unless instructions to the contrary are marked on the proxy card, proxies submitted by holders of the Fund’s shares (“Shares”) will be voted “FOR” the proposals. The persons named as proxy holders on the proxy card will vote in their discretion on any other matters that may properly come before the Meeting or any adjournments or postponements thereof. Any shareholder executing a proxy has the power to revoke it prior to its exercise by submission of a properly executed, subsequently dated proxy, by voting in person, or by written notice to the Secretary of the Trust (addressed to the Secretary at the principal executive office of the Trust, 650 Newport Center Drive, Newport Beach, California 92660). However, attendance at the Meeting, by itself, will not revoke a previously submitted proxy. Unless the proxy is revoked, the Shares represented thereby will be voted in accordance with specifications therein. The Fund of which you are a shareholder is named on a proxy card included with this Joint Proxy Statement. If you own shares in more than one Fund on the Record Date (as defined below), you may receive more than one proxy card. Please complete EACH proxy card you receive, or if you vote by telephone or over the Internet, please vote on the proposals applicable to EACH Fund you own.

Only shareholders or their duly appointed proxy holders can attend the Meeting and any adjournment or postponement thereof. To gain admittance, if you are a shareholder of record, you must bring a form of personal identification to the Meeting, where your name will be verified against the Trust’s shareholder list. If a broker or other nominee holds your Shares and you plan to attend the Meeting, you should bring a recent brokerage statement showing your ownership of the Shares as of the record date, as well as a form of personal identification. If you are a beneficial owner and plan to vote at the Meeting, you should also bring a proxy card from your broker.

The record date for determining shareholders entitled to notice of, and to vote at, the Meeting and at any adjournment or postponement thereof has been fixed at the close of business on February 1, 2021 (the “Record Date”), and each shareholder of record at that time is entitled to cast one vote for each Share registered in his or her name.

4

As of the Record Date, the following number of Shares of the Funds, and each class of the PIMCO Dividend and Income Fund and RAE Funds, representing the corresponding number of votes, were outstanding:

RAFI ETFs

| | | | |

Fund | | Number of Shares

Outstanding (Votes) | |

PIMCO RAFI Dynamic Multi-Factor Emerging Markets Equity ETF | | | 22,520,000.000 | |

PIMCO RAFI Dynamic Multi-Factor U.S. Equity ETF | | | 2,020,000.000 | |

PIMCO RAFI Dynamic Multi-Factor International Equity ETF | | | 3,060,000.000 | |

PIMCO RAFI ESG U.S. ETF | | | 470,000.000 | |

RAE Funds

| | | | |

Fund | | Number of Shares

Outstanding (Votes) | |

PIMCO RAE Emerging Markets Fund — Institutional Class | | | 165,672,011.254 | |

PIMCO RAE Emerging Markets Fund — I-2 | | | 283,292.376 | |

PIMCO RAE Emerging Markets Fund — Class A | | | 1,576,549.219 | |

| | | | |

PIMCO RAE Emerging Markets Fund | | | 167,531,852.849 | |

| | | | |

Fund | | Number of Shares

Outstanding (Votes) | |

PIMCO RAE Global Fund — Institutional Class | | | 29,093,546.978 | |

PIMCO RAE Global Fund — I-2 | | | 11,766.392 | |

PIMCO RAE Global Fund — Class A | | | 105,872.775 | |

| | | | |

PIMCO RAE Global Fund | | | 29,211,186.145 | |

| | | | |

Fund | | Number of Shares

Outstanding (Votes) | |

PIMCO RAE Global ex-US Fund — Institutional Class | | | 6,658,497.955 | |

PIMCO RAE Global ex-US Fund — I-2 | | | 523.910 | |

PIMCO RAE Global ex-US Fund — Class A | | | 1,298,306.342 | |

| | | | |

PIMCO RAE Global ex-US Fund | | | 7,957,328.207 | |

5

| | | | |

Fund | | Number of Shares

Outstanding (Votes) | |

PIMCO RAE International Fund — Institutional Class | | | 107,895,697.608 | |

PIMCO RAE International Fund — I-2 | | | 73,427.934 | |

PIMCO RAE International Fund — Class A | | | 430,039.060 | |

| | | | |

PIMCO RAE International Fund | | | 108,399,164.602 | |

| | | | |

Fund | | Number of Shares

Outstanding (Votes) | |

PIMCO RAE US Fund — Institutional Class | | | 64,973,991.524 | |

PIMCO RAE US Fund — I-2 | | | 1,736,587.367 | |

PIMCO RAE US Fund — Class A | | | 724,688.293 | |

| | | | |

PIMCO RAE US Fund | | | 67,435,267.184 | |

| | | | |

Fund | | Number of Shares

Outstanding (Votes) | |

PIMCO RAE US Small Fund — Institutional Class | | | 47,722,070.746 | |

PIMCO RAE US Small Fund — I-2 | | | 103,904.300 | |

PIMCO RAE US Small Fund — Class A | | | 529,815.660 | |

| | | | |

PIMCO RAE US Small Fund | | | 48,355,790.706 | |

PIMCO Dividend and Income Fund

| | | | |

Fund | | Number of Shares

Outstanding (Votes) | |

PIMCO Dividend and Income Fund — Institutional Class | | | 1,598,043.186 | |

PIMCO Dividend and Income Fund — I-2 | | | 1,593,842.997 | |

PIMCO Dividend and Income Fund — Class A | | | 9,763,096.604 | |

PIMCO Dividend and Income Fund — Class C | | | 2,860,398.330 | |

| | | | |

PIMCO Dividend and Income Fund | | | 15,815,381.117 | |

Please see Appendix H for more information regarding the beneficial ownership of Fund Shares.

Shareholders can find important information about their Fund in the most recent annual and semi-annual reports to shareholders. Shareholders may request a copy of these reports by writing to the Trust at the above address, by calling the appropriate telephone number above or online at https://www.pimco.com/resources.

Please note that only one annual or semi-annual report or Joint Proxy Statement may be delivered to two or more shareholders of a Fund who share an address, unless the Fund has received instructions to the contrary. To request a

6

separate copy of an annual report or the Joint Proxy Statement, or for instructions as to how to request a separate copy of these documents or as to how to request a single copy if multiple copies of these documents are received, shareholders should contact the Fund at the address and phone number set forth above.

PROPOSAL 1: FOR SHAREHOLDERS OF THE RAFI ETFS ONLY

APPROVAL OF THE PROPOSED SUB-ADVISORY AGREEMENT

The Board of Trustees is proposing that shareholders of the RAFI ETFs approve the Sub-Advisory Agreement, a copy of which is attached as Appendix A, to be entered into between PIMCO and Parametric. The Trust and PIMCO wish to have Parametric continue to provide sub-advisory services to the RAFI ETFs pursuant to the Sub-Advisory Agreement. The description of the Sub-Advisory Agreement that follows is qualified in its entirety by reference to Appendix A.

The vote of shareholders on Proposals 2 and 3 do not affect the Board’s recommendation with respect to Proposal 1. If the shareholders of a RAFI ETF approve of the Sub-Advisory Agreement, the Sub-Advisory Agreement will be approved and effective with respect to that RAFI ETF regardless of whether the shareholders of the other RAFI ETFs approve of the Sub-Advisory Agreement. Proposal 1 is contingent on the closing of the Acquisition and in the event that the Acquisition does not successfully close on the Acquisition Closing Date, (i) Proposal 1 would not be implemented regardless of how the shareholders vote, and (ii) the existing RAFI ETFs’ sub-advisory agreement then in place with Parametric will continue in effect.

Proposal Summary

Parametric currently serves as sub-adviser to the RAFI ETFs pursuant to a sub-advisory agreement between PIMCO and Parametric dated June 16, 2017, as supplemented November 5, 2019. See the section “Additional Information Regarding Proposals 1, 2, and 3 — Parametric — Current Sub-Advisory Agreement for the RAFI ETFs” below for more information. Following the expected automatic termination of the sub-advisory agreement upon the Acquisition Closing Date and to the extent that shareholder approval of the Sub-Advisory Agreement has not been obtained at such time, Parametric will serve as sub-adviser to the RAFI ETFs pursuant to an interim sub-advisory agreement (“Interim Sub-Advisory Agreement”), which was approved by the Board on January 15, 2021, in reliance on Rule 15a-4 under the 1940 Act. See the section “Additional Information Regarding Proposals 1, 2, and 3 — Parametric — Interim Sub-Advisory Agreement for the RAFI ETFs” below for

7

more information. With respect to services provided by Parametric to the RAFI ETFs, the Interim Sub-Advisory Agreement contains substantially identical terms as the current sub-advisory agreement. In addition, with respect to services provided by Parametric to the RAFI ETFs, the terms of the Interim Sub-Advisory Agreement and the terms of the proposed Sub-Advisory Agreement are substantially identical. Therefore, if the Sub-Advisory Agreement is approved, it is expected that there would be no difference in the services to be provided to the RAFI ETFs by Parametric pursuant to all sub-advisory agreements before and after the Acquisition.

Pursuant to Rule 15a-4 under the 1940 Act, the Interim Sub-Advisory Agreement has a duration no greater than 150 days and may be terminated at any time with respect to a RAFI ETF by the Board or a majority of the RAFI ETF’s outstanding voting securities without penalty on not more than 10 calendar days’ written notice. The compensation arrangement under the Interim Sub-Advisory Agreement is substantially the same as under the proposed Sub-Advisory Agreement except that, pursuant to Rule 15a-4: (i) the compensation earned under the Interim Sub-Advisory Agreement will be held in an interest-bearing escrow account with the RAFI ETFs’ custodian or a bank; (ii) if the proposed Sub-Advisory Agreement is approved by shareholders of a RAFI ETF by the end of the Interim Sub-Advisory Agreement’s 150-day term, the amount in the escrow account (including interest earned) will be paid to Parametric; and (iii) if no contract with Parametric pertaining to a RAFI ETF is approved by shareholders of the RAFI ETF by the end of the Interim Sub-Advisory Agreement’s 150-day term, Parametric will be paid, out of the escrow account, the lesser of: (a) any costs incurred in performing the Interim Sub-Advisory Agreement with respect to the RAFI ETF (plus interest earned on that amount while in escrow); or (b) the total amount in the escrow account with respect to the RAFI ETF (plus interest earned).

Below is a summary of the Sub-Advisory Agreement. Following the subsequent discussion of Proposal 3 is information about PIMCO and Parametric and a discussion of the factors considered by the Board of Trustees when it approved the Interim Sub-Advisory Agreement and Sub-Advisory Agreement.

Proposed Sub-Advisory Agreement

The Board of Trustees unanimously approved the Sub-Advisory Agreement at a meeting held on January 15, 2021, subject to approval with respect to each RAFI ETF by the applicable RAFI ETF’s shareholders. The Sub-Advisory Agreement will take effect with respect to a RAFI ETF upon the Acquisition Closing Date or, if later, as soon as practicable after it is approved by shareholders of the RAFI ETF.

8

The Sub-Advisory Agreement will have an initial two-year term from the date of the Sub-Advisory Agreement. The Sub-Advisory Agreement can be renewed with respect to a RAFI ETF for successive 12-month periods, subject to annual approval in conformity with the 1940 Act (i.e., approval by the Board of Trustees or a majority of the RAFI ETF’s outstanding voting securities (as defined in the 1940 Act) and, in either event, by the vote cast in person by a majority of the Trustees who are not “interested persons” of the RAFI ETF (“Independent Trustees”)). It can also be terminated with respect to a RAFI ETF, without penalty, by: (i) a vote of a majority of the RAFI ETF’s outstanding voting securities (as defined in the 1940 Act); (ii) a vote of a majority of the Board upon 60 days’ written notice; (iii) PIMCO upon 60 days’ written notice; or (iv) Parametric upon 60 days’ written notice. The Sub-Advisory Agreement will terminate automatically in the event of its assignment (as defined in the 1940 Act).

Under the terms of the Sub-Advisory Agreement, Parametric will continue to provide, subject to the supervision of PIMCO, investment advisory services to the RAFI ETFs, including execution of all portfolio transactions on behalf of the RAFI ETFs necessary to invest the assets of each RAFI ETF in the component securities of its underlying index.

In exchange for services rendered under the Sub-Advisory Agreement, PIMCO will pay Parametric certain fees as described below. PIMCO will pay an annual base fee with respect to each RAFI ETF in the amount of $10,000 (the “Base Fee”). The Base Fee will be paid monthly in arrears on the first business day of each month. Additionally, PIMCO will pay Parametric a monthly fee, which accrues daily at an annual rate according to the following schedule:

| | | | |

Fund | | Fee Rate (Average

Daily Net Assets) | | Assets Under Management (Millions) |

PIMCO RAFI Dynamic Multi-Factor U.S. Equity ETF | | 0.05% | | $0 - $50 of net assets |

| | 0.04% | | Over $50 - $100 of net assets |

| | 0.025% | | Over $100 - $350 of net assets |

| | 0.02% | | Over $350 of net assets |

| | |

PIMCO RAFI Dynamic Multi-Factor International Equity ETF | | 0.065% | | $0 - $50 of net assets |

| | 0.05% | | Over $50 - $100 of net assets |

| | 0.035% | | Over $100 - $350 of net assets |

| | 0.03% | | Over $350 of net assets |

| | |

PIMCO RAFI Dynamic Multi-Factor Emerging Markets Equity ETF | | 0.12% | | $0 - $50 of net assets |

| | 0.11% | | Over $50 - $100 of net assets |

| | 0.075% | | Over $100 - $350 of net assets |

| | 0.055% | | Over $350 of net assets |

9

| | | | |

Fund | | Fee Rate (Average

Daily Net Assets) | | Assets Under Management (Millions) |

PIMCO RAFI ESG U.S. ETF | | 0.05% | | $0 - $50 of net assets |

| | 0.04% | | Over $50 - $100 of net assets |

| | 0.025% | | Over $100 - $350 of net assets |

| | 0.02% | | Over $350 of net assets |

Parametric will not be compensated directly by any RAFI ETF, nor will any RAFI ETF’s advisory or other fees increase if the Sub-Advisory Agreement is approved. If any investment company, separate account, sub-advised account, other pooled vehicle or other account which is (i) sponsored or advised by PIMCO and sub-advised by Parametric or provided portfolio implementation services by Parametric pursuant to an agreement wherein Parametric may exercise limited investment discretion and (ii) eligible to invest in a RAFI ETF (“PIMCO/Parametric Managed Account”) invests in a RAFI ETF, Parametric will, subject to applicable law, waive any fee to which it would be entitled under the Sub-Advisory Agreement with respect to any assets of a PIMCO/Parametric Managed Account invested in the RAFI ETF. By way of clarification, any assets of a PIMCO/Parametric Managed Account invested in the RAFI ETF shall be excluded when the RAFI ETF’s net assets are valued for the purpose of calculating the applicable fees payable to Parametric under the Sub-Advisory Agreement.

The Sub-Advisory Agreement provides that Parametric will not be liable for any error of judgment or mistake of law or for any loss suffered by PIMCO, the Trust or a RAFI ETF in connection with the matters to which the Sub-Advisory Agreement relates, except a loss resulting from a breach of fiduciary duty by Parametric under the 1940 Act with respect to the receipt of compensation for services or a loss resulting from willful misfeasance, bad faith or gross negligence on the part of Parametric in the performance of its duties or from reckless disregard by it of its obligations or duties under the Sub-Advisory Agreement.

Parametric has indicated that there is a commitment that Morgan Stanley would use its reasonable best efforts to ensure that it did not impose any “unfair burden” (as that term is used in Section 15(f)(1)(B) of the 1940 Act) on the Funds as a result of the Acquisition.

The Trustees of the Trust recommend that shareholders of the RAFI ETFs vote “FOR” Proposal 1.

10

PROPOSAL 2: FOR SHAREHOLDERS OF THE RAE FUNDS ONLY

APPROVAL OF THE PROPOSED RAE PORTFOLIO IMPLEMENTATION AGREEMENT

The Board of Trustees is proposing that shareholders of the RAE Funds approve the RAE Portfolio Implementation Agreement, a copy of which is attached as Appendix B, to be entered into among PIMCO, RALLC, and Parametric. The Trust and PIMCO wish to have Parametric continue to provide portfolio implementation services to the RAE Funds pursuant to the RAE Portfolio Implementation Agreement. The description of the RAE Portfolio Implementation Agreement that follows is qualified in its entirety by reference to Appendix B.

The vote of shareholders on Proposals 1 and 3 do not affect the Board’s recommendation with respect to Proposal 2. If the shareholders of a RAE Fund approve of the RAE Portfolio Implementation Agreement, the RAE Portfolio Implementation Agreement will be approved and effective with respect to that RAE Fund regardless of whether the shareholders of the other RAE Funds approve of the RAE Portfolio Implementation Agreement. Proposal 2 is contingent on the closing of the Acquisition and in the event that the Acquisition does not successfully close on the Acquisition Closing Date, (i) Proposal 2 would not be implemented regardless of how the shareholders vote, and (ii) the existing RAE Funds’ portfolio implementation agreement then in place with Parametric will continue in effect.

Proposal Summary

Parametric currently serves as portfolio implementer to the RAE Funds pursuant to a portfolio implementation agreement among PIMCO, Parametric and RALLC, dated March 11, 2015. See the section “Additional Information Regarding Proposals 1, 2, and 3 — Parametric — Current Portfolio Implementation Agreement for the RAE Funds” below for more information. Following the expected automatic termination of the portfolio implementation agreement upon the Acquisition Closing Date and to the extent that shareholder approval of the RAE Portfolio Implementation Agreement has not been obtained at such time, Parametric will serve as portfolio implementer to the RAE Funds pursuant to an interim portfolio implementation agreement (“Interim RAE Portfolio Implementation Agreement”), which was approved by the Board on January 15, 2021, in reliance on Rule 15a-4 under the 1940 Act. See the section “Additional Information Regarding Proposals 1, 2, and 3 — Parametric — Interim Portfolio Implementation Agreement for the RAE Funds” below for more information. With respect to services provided by Parametric to the RAE Funds,

11

the Interim RAE Portfolio Implementation Agreement contains substantially identical terms as the current portfolio implementation agreement. In addition, with respect to services provided by Parametric to the RAE Funds, the terms of the Interim RAE Portfolio Implementation Agreement and the terms of the proposed RAE Portfolio Implementation Agreement are substantially identical. Therefore, if the RAE Portfolio Implementation Agreement is approved, it is expected that there would be no difference in the services to be provided to the RAE Funds by Parametric pursuant to all portfolio implementation agreements before and after the Acquisition.

Pursuant to Rule 15a-4 under the 1940 Act, the Interim RAE Portfolio Implementation Agreement has a duration no greater than 150 days and may be terminated at any time with respect to an RAE Fund by the Board or a majority of the RAE Fund’s outstanding voting securities without penalty on not more than 10 calendar days’ written notice. The compensation arrangement under the Interim RAE Portfolio Implementation Agreement is substantially the same as under the proposed RAE Portfolio Implementation Agreement except that, pursuant to Rule 15a-4: (i) the compensation earned under the Interim RAE Portfolio Implementation Agreement will be held in an interest-bearing escrow account with the RAE Funds’ custodian or a bank; (ii) if the proposed RAE Portfolio Implementation Agreement is approved by shareholders by the end of the Interim RAE Portfolio Implementation Agreement’s 150-day term, the amount in the escrow account (including interest earned) will be paid to Parametric; and (iii) if no contract with Parametric pertaining to a RAE Fund is approved by shareholders of that Fund by the end of the Interim RAE Portfolio Implementation Agreement’s 150-day term, Parametric will be paid, out of the escrow account, the lesser of: (a) any costs incurred in performing the Interim RAE Portfolio Implementation Agreement with respect to the RAE Fund (plus interest earned on that amount while in escrow); or (b) the total amount in the escrow account with respect to the RAE Fund (plus interest earned).

Below is a summary of the RAE Portfolio Implementation Agreement. Following the subsequent discussion of Proposal 3 is information about PIMCO and Parametric and a discussion of the factors considered by the Board of Trustees when it approved the Interim RAE Portfolio Implementation Agreement and RAE Portfolio Implementation Agreement.

Proposed RAE Portfolio Implementation Agreement

The Board of Trustees unanimously approved the RAE Portfolio Implementation Agreement at a meeting held on January 15, 2021, subject to approval with respect to an RAE Fund by the RAE Fund’s shareholders. The RAE Portfolio Implementation Agreement will take effect with respect to an

12

RAE Fund upon the Acquisition Close Date or, if later, as soon as practicable after it is approved by shareholders of the RAE Fund.

The RAE Portfolio Implementation Agreement will have an initial two-year term from the date of the RAE Portfolio Implementation Agreement. The RAE Portfolio Implementation Agreement can be renewed with respect to an RAE Fund for successive 12-month periods, subject to annual approval in conformity with the 1940 Act (i.e., approval by the Board of Trustees or a majority of the RAE Fund’s outstanding voting securities (as defined in the 1940 Act) and, in either event, by the vote cast in person by a majority of the Trustees who are not “interested persons” of the RAE Fund (“Independent Trustees”)). It can also be terminated with respect to a RAE Fund, without penalty, by: (i) a vote of a majority of the RAE Fund’s outstanding voting securities (as defined in the 1940 Act); (ii) a vote of a majority of the Board upon 60 days’ written notice; (iii) PIMCO and RALLC upon 60 days’ written notice; or (iv) Parametric upon 60 days’ written notice. The RAE Portfolio Implementation Agreement will terminate automatically in the event of its assignment (as defined in the 1940 Act).

Under the terms of the RAE Portfolio Implementation Agreement, Parametric will continue to provide, subject to the direct supervision of RALLC and the ultimate supervision of PIMCO, portfolio implementation services to the RAE Funds including responsibility for effecting all portfolio transactions on behalf of the RAE Funds. In addition, Parametric will continue to have discretion to execute all portfolio transactions on behalf of each PIMCO RAE Fund necessary to implement the relevant indicative portfolio specified by RALLC for such Fund. In exercising such discretion, Parametric will continue to seek to limit tracking error from the indicative portfolio but may allow a RAE Fund’s portfolio to vary from the indicative portfolio subject to the supervision of RALLC. Additionally, Parametric may, in its sole discretion but subject to any restrictions communicated to Parametric by RALLC in writing, decline to purchase a security specified in an indicative portfolio, or decide to substitute a security specified in an indicative portfolio (an “Original Security”) for an alternative security (a “Substitute Security”), provided that such Substitute Security provides similar economic exposure as the Original Security. Parametric’s ability to exercise this limited discretion will continue to be subject to any guidelines, limitations or restrictions provided by RALLC or PIMCO. In addition to effecting all portfolio transactions on behalf of the RAE Funds, Parametric will continue to be responsible for providing certain specified middle and back office operational support functions for the RAE Funds with respect to the services Parametric provides under the RAE Portfolio Implementation Agreement.

13

In exchange for services rendered in connection with the RAE Portfolio Implementation Agreement, PIMCO will pay Parametric certain fees as described below. PIMCO will pay an annual base fee with respect to each RAE Fund in the amount of $30,000 (the “Base Fee”). The Base Fee will be paid monthly in arrears on the first business day of each month. Additionally, PIMCO will pay Parametric a monthly fee, which accrues daily at an annual rate according to the following schedule:

| | | | |

Fund | | Fee Rate (Average

Daily Net Assets) | | Assets Under Management (Millions) |

PIMCO RAE US Fund | | 0.14% | | $0 - $50 of net assets |

| | 0.11% | | Over $50 - $100 of net assets |

| | 0.07% | | Over $100 - $350 of net assets |

| | 0.05% | | Over $350 of net assets |

| | |

PIMCO RAE US Small Fund | | 0.18% | | $0 - $50 of net assets |

| | 0.14% | | Over $50 - $100 of net assets |

| | 0.10% | | Over $100 - $350 of net assets |

| | 0.08% | | Over $350 of net assets |

| | |

PIMCO RAE International Fund | | 0.18% | | $0 - $50 of net assets |

| | 0.14% | | Over $50 - $100 of net assets |

| | 0.10% | | Over $100 - $350 of net assets |

| | 0.08% | | Over $350 of net assets |

| | |

PIMCO RAE Emerging Markets Fund | | 0.34% | | $0 - $50 of net assets |

| | 0.31% | | Over $50 - $100 of net assets |

| | 0.21% | | Over $100 - $350 of net assets |

| | 0.15% | | Over $350 of net assets |

| | |

PIMCO RAE Global Fund | | 0.16% | | $0 - $50 of net assets |

| | 0.13% | | Over $50 - $100 of net assets |

| | 0.09% | | Over $100 - $350 of net assets |

| | 0.07% | | Over $350 of net assets |

| | |

PIMCO RAE Global ex-US Fund | | 0.16% | | $0 - $50 of net assets |

| | 0.13% | | Over $50 - $100 of net assets |

| | 0.09% | | Over $100 - $350 of net assets |

| | 0.07% | | Over $350 of net assets |

With respect to the monthly fees shown above, Parametric shall apply a “relationship discount” as set forth below based on the aggregate amount of assets of any investment company, separate account, sub-advised account, other pooled vehicle or other account which is sponsored or advised by PIMCO (“PIMCO Managed Account”) and any investment company, separate account, sub-advised account, other pooled vehicle or other account which is sponsored or advised by RALLC, for which Parametric provides portfolio implementation services or other substantially similar services. Any such relationship discount

14

applied to the fee rates for each RAE Fund shall be calculated in accordance with the relationship discount schedule set forth below.

Relationship Discount

| | |

Assets Under Management (Millions) | | Fee Rate Discount |

0 - $200 | | 0% |

$200 - $500 | | -20% |

$500 - $1500 | | -30% |

$1500+ | | -50% |

Parametric will not be compensated directly by any RAE Fund, nor will any RAE Fund’s advisory or other fees increase if the RAE Portfolio Implementation Agreement is approved. If the PIMCO RAE Global Fund or PIMCO RAE Global ex-US Fund invest in any PIMCO Managed Account, Parametric will, subject to applicable law, waive any fee to which it would be entitled under the RAE Portfolio Implementation Agreement with respect to any assets of PIMCO RAE Global Fund and PIMCO RAE Global ex-US Fund invested in a PIMCO Managed Account. By way of clarification, any assets of PIMCO RAE Global Fund or PIMCO RAE Global ex-US Fund invested in a PIMCO Managed Account when the PIMCO RAE Global Fund’s or PIMCO RAE Global ex-US Fund’s net assets are valued for the purpose of calculating the applicable asset-based fees payable to Parametric under the RAE Portfolio Implementation Agreement.

The RAE Portfolio Implementation Agreement provides that Parametric will not be liable for any error of judgment or mistake of law or for any loss suffered by PIMCO, RALLC, the Trust or a RAE Fund in connection with the matters to which the RAE Portfolio Implementation Agreement relates, except a loss resulting from a breach of fiduciary duty by Parametric under the 1940 Act with respect to the receipt of compensation for services or a loss resulting from willful misfeasance, bad faith or gross negligence on the part of Parametric in the performance of its duties or from reckless disregard by it of its obligations or duties under the RAE Portfolio Implementation Agreement.

Parametric has indicated that there is a commitment that Morgan Stanley would use its reasonable best efforts to ensure that it did not impose any “unfair burden” (as that term is used in Section 15(f)(1)(B) of the 1940 Act) on the Funds as a result of the Acquisition.

The Trustees of the Trust recommend that shareholders of the RAE Funds vote “FOR” Proposal 2.

15

PROPOSAL 3: FOR SHAREHOLDERS OF THE PIMCO DIVIDEND AND INCOME FUND ONLY

APPROVAL OF THE PROPOSED DIF PORTFOLIO IMPLEMENTATION AGREEMENT

The Board of Trustees is proposing that shareholders of the PIMCO Dividend and Income Fund approve the DIF Portfolio Implementation Agreement, a copy of which is attached as Appendix C, to be entered into among PIMCO, RALLC, and Parametric. The Trust and PIMCO wish to have Parametric continue to provide portfolio implementation services to the PIMCO Dividend and Income Fund under the DIF Portfolio Implementation Agreement. The description of the DIF Portfolio Implementation Agreement that follows is qualified in its entirety by reference to Appendix C.

The vote of shareholders on Proposals 1 and 2 do not affect the Board’s recommendation with respect to Proposal 3. Proposal 3 is contingent on the closing of the Acquisition and in the event that the Acquisition does not successfully close on the Acquisition Closing Date, (i) Proposal 3 would not be implemented regardless of how the shareholders vote, and (ii) the existing PIMCO Dividend and Income Fund portfolio implementation agreement then in place with Parametric will continue in effect.

Proposal Summary

Parametric currently serves as portfolio implementer to the equity portion of the PIMCO Dividend and Income Fund pursuant to a portfolio implementation agreement among PIMCO, Parametric, and RALLC, dated August 26, 2016. See “Additional Information Regarding Proposals 1, 2, and 3 — Parametric — Current Portfolio Implementation Agreement for the PIMCO Dividend and Income Fund” below for more information. Following the expected automatic termination of the portfolio implementation agreement upon the Acquisition Closing Date and to the extent that shareholder approval of the DIF Portfolio Implementation Agreement has not been obtained at such time, Parametric will serve as portfolio implementer to the equity portion of the PIMCO Dividend and Income Fund pursuant to an interim portfolio implementation agreement (“Interim DIF Portfolio Implementation Agreement”), which was approved by the Board on January 15, 2021, in reliance on Rule 15a-4 under the 1940 Act. See “Additional Information Regarding Proposals 1, 2, and 3 — Parametric — Interim Portfolio Implementation Agreement for the PIMCO Dividend and Income Fund” below for more information. With respect to services provided by Parametric to the equity portion of the PIMCO Dividend and Income Fund, the Interim DIF Portfolio Implementation Agreement contains substantially identical

16

terms as the current portfolio implementation agreement. In addition, with respect to services provided by Parametric to the equity portion of the PIMCO Dividend and Income Fund, the terms of the Interim DIF Portfolio Implementation Agreement and the terms of the proposed DIF Portfolio Implementation Agreement are substantially identical. Therefore, if the DIF Portfolio Implementation Agreement is approved, it is expected that there would be no difference in the services to be provided to the equity portion of the PIMCO Dividend and Income Fund by Parametric pursuant to all portfolio implementation agreements before and after the Acquisition.

Pursuant to Rule 15a-4 under the 1940 Act, the Interim DIF Portfolio Implementation Agreement has a duration no greater than 150 days and may be terminated at any time with respect to the PIMCO Dividend and Income Fund by the Board or a majority of the PIMCO Dividend and Income Fund’s outstanding voting securities without penalty on not more than 10 calendar days’ written notice. The compensation arrangement under the Interim DIF Portfolio Implementation Agreement is substantially the same as under the proposed DIF Portfolio Implementation Agreement except that, pursuant to Rule 15a-4: (i) the compensation earned under the Interim DIF Portfolio Implementation Agreement will be held in an interest-bearing escrow account with the PIMCO Dividend and Income Fund’s custodian or a bank; (ii) if the proposed DIF Portfolio Implementation Agreement is approved by shareholders by the end of the Interim DIF Portfolio Implementation Agreement’s 150-day term, the amount in the escrow account (including interest earned) will be paid to Parametric; and (iii) if no contract with Parametric pertaining to the PIMCO Dividend and Income Fund is approved by its shareholders by the end of the Interim DIF Portfolio Implementation Agreement’s 150-day term, Parametric will be paid, out of the escrow account, the lesser of: (a) any costs incurred in performing the Interim DIF Portfolio Implementation Agreement (plus interest earned on that amount while in escrow); or (b) the total amount in the escrow account (plus interest earned).

Below is a summary of the DIF Portfolio Implementation Agreement, information about PIMCO and Parametric, and a discussion of the factors considered by the Board of Trustees when it approved the Interim DIF Portfolio Implementation Agreement and the DIF Portfolio Implementation Agreement.

Proposed DIF Portfolio Implementation Agreement

The Board of Trustees unanimously approved the DIF Portfolio Implementation Agreement at a meeting held on January 15, 2021, subject to approval by the PIMCO Dividend and Income Fund’s shareholders. The DIF

17

Portfolio Implementation Agreement will take effect upon the Acquisition Close Date or, if later, as soon as practicable after it is approved by shareholders of the PIMCO Dividend and Income Fund.

The DIF Portfolio Implementation Agreement will have an initial two-year term from the date of the DIF Portfolio Implementation Agreement. The DIF Portfolio Implementation Agreement can be renewed for successive 12-month periods, subject to annual approval in conformity with the 1940 Act (i.e., approval by the Board of Trustees or a majority of the PIMCO Dividend and Income Fund’s outstanding voting securities (as defined in the 1940 Act) and, in either event, by the vote cast in person by a majority of the Trustees who are not “interested persons” of the Fund (“Independent Trustees”)). It can also be terminated with respect to the PIMCO Dividend and Income Fund, without penalty, by: (i) a vote of a majority of the Fund’s outstanding voting securities (as defined in the 1940 Act); (ii) a vote of a majority of the Board upon 60 days’ written notice; (iii) PIMCO and RALLC upon 60 days’ written notice; or (iv) Parametric upon 60 days’ written notice. The DIF Portfolio Implementation Agreement will terminate automatically in the event of its assignment (as defined in the 1940 Act).

Under the terms of the DIF Portfolio Implementation Agreement, Parametric will continue to provide, subject to the direct supervision of RALLC and the ultimate supervision of PIMCO, portfolio implementation services to the PIMCO Dividend and Income Fund including responsibility for effecting all portfolio transactions on behalf of the equity portion of the PIMCO Dividend and Income Fund’s portfolio. In addition, Parametric will continue to have discretion to execute all portfolio transactions on behalf of the equity portion of the PIMCO Dividend and Income Fund necessary to implement the relevant indicative portfolio specified by RALLC. In exercising such discretion, Parametric will continue to seek to limit tracking error from the indicative portfolio but may allow the equity portion of the PIMCO Dividend and Income Fund’s portfolio to vary from the indicative portfolio subject to the supervision of RALLC. Additionally, Parametric may, in its sole discretion but subject to any restrictions communicated to Parametric by RALLC in writing, decline to purchase a security specified in an indicative portfolio, or decide to substitute a security specified in an indicative portfolio (an “Original Security”) for an alternative security (a “Substitute Security”), provided that such Substitute Security provides similar economic exposure as the Original Security. Parametric’s ability to exercise this limited discretion will continue to be subject to any guidelines, limitations or restrictions provided by RALLC or PIMCO. In addition to effecting all portfolio transactions on behalf of the equity portion of the PIMCO Dividend and Income Fund’s portfolio, Parametric will continue to be responsible for providing certain specified middle and back office operational

18

support functions for the PIMCO Dividend and Income Fund with respect to the services Parametric provides under the DIF Portfolio Implementation Agreement.

In exchange for services rendered in connection with the DIF Portfolio Implementation Agreement, PIMCO will continue to pay Parametric certain fees as described below. PIMCO will pay an annual base fee in the amount of $10,000 (the “Base Fee”). The Base Fee will be paid monthly in arrears on the first business day of each month. Additionally, PIMCO will pay Parametric a monthly fee, which accrues daily at an annual rate according to the following schedule of the PIMCO Dividend and Income Fund’s average daily net assets attributable to its Equity Sleeve:

| | |

Fee Rate (Average Daily Net Assets) | | Assets Under Management (Millions) |

0.07% | | $0 - $50 of net assets attributable to the Equity Sleeve |

| |

0.06% | | Over $50 - $100 of net assets attributable to the Equity Sleeve |

| |

0.04% | | Over $100 - $350 of net assets attributable to the Equity Sleeve |

| |

0.035% | | Over $350 of net assets attributable to the Equity Sleeve |

Parametric will not be compensated directly by the PIMCO Dividend and Income Fund, nor will the PIMCO Dividend and Income Fund’s advisory or other fees increase if the DIF Portfolio Implementation Agreement is approved. If any investment company, separate account, sub-advised account, other pooled vehicle or other account which is (i) sponsored or advised by PIMCO, (ii) sub-advised by RALLC pursuant to an agreement wherein RALLC is primarily responsible for determining how the assets of such pooled vehicle or account are to be allocated, (iii) provided portfolio implementation services by Parametric and (iv) eligible to invest in the PIMCO Dividend and Income Fund (“PIMCO/RA/PPA Managed Account”) invests in the PIMCO Dividend and Income Fund, Parametric will, subject to applicable law, waive any fee to which it would be entitled under the DIF Portfolio Implementation Agreement with respect to any assets of a PIMCO/RA/PPA Managed Account invested in the PIMCO Dividend and Income Fund. By way of clarification, any assets of a PIMCO/RA/PPA Managed Account invested in the PIMCO Dividend and Income Fund shall be excluded when the PIMCO Dividend and Income Fund’s net assets attributable to the equity portion of its portfolio are valued for the purpose of calculating the applicable fees payable to Parametric under the DIF Portfolio Implementation Agreement.

19

The DIF Portfolio Implementation Agreement provides that Parametric will not be liable for any error of judgment or mistake of law or for any loss suffered by PIMCO, RALLC, the Trust or the PIMCO Dividend and Income Fund in connection with the matters to which the DIF Portfolio Implementation Agreement relates, except a loss resulting from a breach of fiduciary duty by Parametric under the 1940 Act with respect to the receipt of compensation for services or a loss resulting from willful misfeasance, bad faith or gross negligence on the part of Parametric in the performance of its duties or from reckless disregard by it of its obligations or duties under the DIF Portfolio Implementation Agreement.

Parametric has indicated that there is a commitment that Morgan Stanley would use its reasonable best efforts to ensure that it did not impose any “unfair burden” (as that term is used in Section 15(f)(1)(B) of the 1940 Act) on the Funds as a result of the Acquisition.

The Trustees of the Trust recommend that shareholders of the PIMCO Dividend and Income Fund vote “FOR” Proposal 3.

ADDITIONAL INFORMATION REGARDING PROPOSALS 1, 2 AND 3

PIMCO

PIMCO, a Delaware limited liability company, serves as investment adviser to the RAE Funds and PIMCO Dividend and Income Fund pursuant to an investment advisory contract (“Advisory Contract”) between PIMCO and the Trust. A copy of the Advisory Contract is attached as Appendix D and any description of the Advisory Contract that follows is qualified in its entirety by reference to Appendix D. PIMCO also serves as administrator to the RAE Funds and the PIMCO Dividend and Income Fund pursuant to an administration agreement with the Trust. PIMCO serves as investment manager to the RAFI ETFs pursuant to an investment management agreement (“Investment Management Agreement”). A copy of the Investment Management Agreement is attached as Appendix E and any description of the Investment Management Agreement that follows is qualified in its entirety by reference to Appendix E. PIMCO is registered with the U.S. Securities and Exchange Commission (the “SEC”) as an investment adviser.

PIMCO is located at 650 Newport Center Drive, Newport Beach, California 92660. PIMCO had approximately $2.03 trillion of assets under management as of September 30, 2020 and $1.54 trillion of third-party assets under management.

20

PIMCO is a majority owned subsidiary of Allianz Asset Management of America L.P. (“Allianz Asset Management”) with minority interests held by Allianz Asset Management of America LLC, by Allianz Asset Management U.S. Holding II LLC, each a Delaware limited liability company, and by certain current and former officers of PIMCO. Allianz Asset Management was organized as a limited partnership under Delaware law in 1987. Through various holding company structures, Allianz Asset Management is majority owned by Allianz SE, organized in Munich, Germany. Allianz Asset Management’s sole general partner is Allianz Asset Management of America LLC. Allianz Asset Management of America LLC has three members, Allianz of America, Inc. (“Allianz of America”), a Delaware corporation that owns a 99.8% non-managing interest, Allianz Asset Management of America Holdings Inc., a Delaware corporation which owns a 0.1% managing interest, and Allianz Asset Management GmbH, organized in Munich, Germany, which owns a 0.1% non-managing interest. Allianz of America is a wholly-owned subsidiary of Allianz Europe B.V., organized in Amsterdam, The Netherlands. Allianz Europe B.V. is a wholly-owned subsidiary of Allianz SE. Allianz Asset Management of America Holdings Inc. is a wholly-owned subsidiary of Allianz Asset Management GmbH. Allianz SE holds a 74.48% interest in Allianz Asset Management GmbH, and Allianz Finanzbeteiligungs GmbH, organized in Munich, Germany, holds the remaining 25.52% interest in Allianz Asset Management GmbH. Allianz Finanzbeteiligungs GmbH is a wholly-owned subsidiary of Allianz SE.

Allianz SE is a European based, multinational insurance and financial services holding company and a publicly traded German company.

The general partner of Allianz Asset Management has substantially delegated its management and control of Allianz Asset Management to a Management Board. The Management Board of Allianz Asset Management is comprised of Tucker Fitzpatrick.

There are currently no significant institutional shareholders of Allianz SE.

PIMCO is responsible for making investment decisions and placing orders for the purchase and sale of each Fund’s investments directly with the issuers or with brokers or dealers selected by it in its discretion. PIMCO also furnishes to the Board, which has overall responsibility for the business and affairs of the Funds, periodic reports on the investment performance of each Fund.

21

As consideration for its investment advisory services to the RAE Funds and PIMCO Dividend and Income Fund, each such Fund currently pays a monthly investment advisory fee at an annual rate based on average daily net assets of the Funds as follows:

| | | | | |

Fund(†) | | Advisory Fee Rate |

PIMCO Dividend and Income Fund(1) | | | | 0.45 | % |

PIMCO RAE Emerging Markets Fund | | | | 0.50 | % |

PIMCO RAE Global Fund(2) | | | | 0.35 | % |

PIMCO RAE Global ex-US Fund | | | | 0.40 | % |

PIMCO RAE International Fund | | | | 0.30 | % |

PIMCO RAE US Fund | | | | 0.25 | % |

PIMCO RAE US Small Fund | | | | 0.35 | % |

| (†) | As disclosed in the RAE Funds and PIMCO Dividend and Income Fund prospectuses, these Funds may invest in certain PIMCO-advised money market funds and/or short-term bond funds (“Central Funds”), to the extent permitted by the 1940 Act, the rules thereunder or exemptive relief therefrom. The Central Funds are registered investment companies created for use solely by such Funds and certain other series of registered investment companies advised by PIMCO, in connection with their cash management activities. The Central Funds do not pay an investment advisory fee to PIMCO in return for providing investment advisory services. However, when investing in a Central Fund, each such Fund (“Investing Fund”) has agreed that 0.005% of the advisory fee that such Investing Fund is currently obligated to pay to PIMCO under its investment advisory contract will be designated as compensation for the investment advisory services PIMCO provides to the applicable Central Fund. |

| (1) | Effective October 1, 2020, the Fund’s Advisory Fee was reduced by 0.04% to 0.45%. |

| (2) | Effective November 1, 2020, the Fund’s Advisory Fee was reduced by 0.05% to 0.35% |

The aggregate advisory fees paid by PIMCO Dividend and Income Fund and the RAE Funds during the fiscal year ended June 30, 2020 were as follows:

| | | | |

Fund | | Year Ended

6/30/20 | |

PIMCO Dividend and Income Fund | | $ | 1,073,720 | |

PIMCO RAE Emerging Markets Fund | | | 12,977,498 | |

PIMCO RAE Global ex-US Fund | | | 301,325 | |

PIMCO RAE Global Fund | | | 1,165,880 | |

PIMCO RAE International Fund | | | 1,773,057 | |

PIMCO RAE US Fund | | | 1,809,070 | |

PIMCO RAE US Small Fund | | | 726,967 | |

22

The advisory fees waived by PIMCO with respect to the PIMCO Dividend and Income Fund and the RAE Funds during the fiscal year ended June 30, 2020 were as follows:

| | | | |

Fund | | Year Ended

6/30/20 | |

PIMCO Dividend and Income Fund | | | N/A | |

PIMCO RAE Emerging Markets Fund | | $ | 5,190,999 | |

PIMCO RAE Global ex-US Fund | | | 301,326 | |

PIMCO RAE Global Fund | | | 1,165,879 | |

PIMCO RAE International Fund | | | 591,019 | |

PIMCO RAE US Fund | | | 723,628 | |

PIMCO RAE US Small Fund | | | 207,705 | |

Under the terms of the Advisory Contract, PIMCO is obligated to manage the PIMCO Dividend and Income Fund and the RAE Funds in accordance with applicable laws and regulations. The investment advisory services of PIMCO to the PIMCO Dividend and Income Fund and the RAE Funds are not exclusive under the terms of the Advisory Contract. PIMCO is free to, and does, render investment advisory services to others.

The Advisory Contract was most recently approved by the Board at a meeting held on August 18-19, 2020, and it will continue in effect on a yearly basis provided such continuance is approved annually: (i) by the holders of a majority of the outstanding voting securities of the Trust or by the Board of Trustees; and (ii) by a majority of the Independent Trustees. The Advisory Contract may be terminated without penalty by vote of the Trustees or the shareholders of the Trust, or by PIMCO, on 60 days’ written notice by either party to the contract and will terminate automatically if assigned.

PIMCO also serves as Administrator to the PIMCO Dividend and Income Fund and the RAE Funds pursuant to a supervision and administration agreement (as amended and restated from time to time, the “Supervision and Administration Agreement”) with the Trust. Pursuant to the Supervision and Administration Agreement, PIMCO provides these Funds with certain supervisory, administrative and shareholder services necessary for Fund operations and is responsible for the supervision of other Fund service providers, and receives a supervisory and administrative fee in return. PIMCO may in turn use the facilities or assistance of its affiliates to provide certain services under the Supervision and Administration Agreement, on terms agreed between PIMCO and such affiliates. The supervisory and administrative services provided by PIMCO include but are not limited to: (i) shareholder servicing functions, including preparation of shareholder reports and communications; (ii) regulatory compliance, such as reports and filings with the SEC and state securities

23

commissions; and (iii) general supervision of the operations of such Funds, including coordination of the services performed by the Fund’s transfer agent, custodian, legal counsel, independent registered public accounting firm, and others. PIMCO (or an affiliate of PIMCO) also furnishes these Funds with office space facilities required for conducting the business of the Funds, and pays the compensation of those officers, employees and Trustees of the Trust affiliated with PIMCO. In addition, PIMCO, at its own expense, arranges for the provision of legal, audit, custody, transfer agency and other services for such Funds, and is responsible for the costs of registration of the Trust’s shares and the printing of prospectus(es) and shareholder reports for current shareholders.

PIMCO has contractually agreed to provide these services, and to bear these expenses, at the following rates for each class of the PIMCO Dividend and Income Fund and RAE Funds, as applicable (each expressed as a percentage of the Fund’s average daily net assets attributable to its classes of shares on an annual basis):

| | | | | | | | | | | | | | | | |

Fund | | Institutional and

Administrative

Classes | | | Classes A

and C | | | I-2 | | | I-3 | |

PIMCO Dividend and Income Fund | | | 0.30 | % | | | 0.40 | % | | | 0.40 | % | | | 0.50 | % |

PIMCO RAE Emerging Markets Fund(1) | | | 0.25 | % | | | 0.35 | % | | | 0.35 | % | | | N/A | |

PIMCO RAE Global Fund(2) | | | 0.15 | % | | | 0.25 | % | | | 0.25 | % | | | N/A | |

PIMCO RAE Global ex-US Fund(3) | | | 0.15 | % | | | 0.25 | % | | | 0.25 | % | | | N/A | |

PIMCO RAE International Fund(4) | | | 0.20 | % | | | 0.30 | % | | | 0.30 | % | | | N/A | |

PIMCO RAE US Fund(5) | | | 0.15 | % | | | 0.30 | % | | | 0.25 | % | | | 0.35 | % |

PIMCO RAE US Small Fund(6) | | | 0.15 | % | | | 0.30 | % | | | 0.25 | % | | | N/A | |

| (1) | Effective November 1, 2020, the Fund’s Supervisory and Administrative Fee for Institutional Class, I-2 and Class A shares was reduced by 0.20% to 0.25% for Institutional Class and 0.35% for I-2 and Class A. |

| (2) | Effective November 1, 2020, the Fund’s Supervisory and Administrative Fee for Institutional Class, I-2 and Class A shares was reduced by 0.15% to 0.15% for Institutional Class and 0.25% for I-2 and Class A. |

| (3) | Effective November 1, 2020, the Fund’s Supervisory and Administrative Fee for Institutional Class, I-2 and Class A shares was reduced by 0.20% to 0.15% for Institutional Class and 0.25% for I-2 and Class A. |

| (4) | Effective November 1, 2020, the Fund’s Supervisory and Administrative Fee for Institutional Class, I-2 and Class A shares was reduced by 0.10% to 0.20% for Institutional Class and 0.30% for I-2 and Class A. |

| (5) | Effective November 1, 2020, the Fund’s Supervisory and Administrative Fee for Institutional Class, I-2, I-3 and Class A shares was reduced by 0.10% to 0.15% for Institutional Class, 0.25% for I-2, 0.35% for I-3 and 0.30% for Class A. |

24

| (6) | Effective November 1, 2020, the Fund’s Supervisory and Administrative Fee for Institutional Class, I-2 and Class A shares was reduced by 0.10% to 0.15% for Institutional Class, 0.25% for I-2 and 0.30% for Class A. |

The aggregate supervisory and administrative fees paid by the PIMCO Dividend and Income Fund and RAE Funds during the fiscal year ended June 30, 2020 were as follows:

| | | | |

Fund | | Year Ended

6/30/20 | |

PIMCO Dividend and Income Fund | | $ | 857,670 | |

PIMCO RAE Emerging Markets Fund | | | 11,699,365 | |

PIMCO RAE Global ex-US Fund | | | 271,890 | |

PIMCO RAE Global Fund | | | 876,128 | |

PIMCO RAE International Fund | | | 1,778,324 | |

PIMCO RAE US Fund | | | 1,839,353 | |

PIMCO RAE US Small Fund | | | 527,337 | |

Supervisory and administrative fees waived during the fiscal year ended June 30, 2020 were as follows:

| | | | |

Fund | | Year Ended

6/30/20 | |

PIMCO Dividend and Income Fund | | $ | 17,969 | |

PIMCO RAE Emerging Markets Fund | | | 197,836 | |

PIMCO RAE Global ex-US Fund | | | 269,896 | |

PIMCO RAE Global Fund | | | 870,116 | |

PIMCO RAE International Fund | | | 38,037 | |

PIMCO RAE US Fund | | | 56,471 | |

PIMCO RAE US Small Fund | | | 11,193 | |

Under the terms of the Investment Management Agreement, PIMCO is obligated to manage the RAFI ETFs in accordance with applicable laws and regulations. The investment advisory services of PIMCO to the RAFI ETFs are not exclusive under the terms of the Advisory Contract. PIMCO is free to, and does, render investment advisory services to others. Pursuant to the Investment Management Agreement, PIMCO also provides the RAFI ETFs with certain supervisory, administrative and shareholder services necessary for RAFI ETF operations and is responsible for the supervision of other RAFI ETF service providers (“Supervisory and Administrative Services”). PIMCO may in turn use the facilities or assistance of its affiliates to provide certain Supervisory and Administrative Services on terms agreed between PIMCO and such affiliates. The Supervisory and Administrative Services provided by PIMCO include but are not limited to: (1) shareholder servicing functions, including preparation of

25

shareholder reports and communications; (2) regulatory compliance, such as reports and filings with the SEC and state securities commissions; and (3) general supervision of the operations of the RAFI ETFs, including coordination of the services performed by the RAFI ETFs’ transfer agent, custodian, legal counsel, independent registered public accounting firm, and others. PIMCO (or an affiliate of PIMCO) also furnishes the RAFI ETFs with office space facilities required for conducting the business of the RAFI ETFs, and pays the compensation of those officers, employees and Trustees of the Trust affiliated with PIMCO. In addition, PIMCO, at its own expense, arranges for the provision of legal, audit, custody, transfer agency and other services for the RAFI ETFs, and is responsible for the costs of registration of the Trust’s shares, the printing of the Prospectus and shareholder reports for current shareholders, the Listing Exchange fees and the Underlying Index licensing fees.

The Investment Management Agreement was most recently approved by the Board at a meeting held on August 18-19, 2020, and it will continue in effect on a yearly basis provided such continuance is approved annually: (i) by the holders of a majority of the outstanding voting securities of the Trust or by the Board of Trustees; and (ii) by a majority of the Independent Trustees. The Investment Management Agreement may be terminated without penalty by vote of the Trustees or the shareholders of the Trust, or by PIMCO, on 60 days’ written notice by either party to the contract and will terminate automatically if assigned.

As consideration for its investment management services and Supervisory and Administrative Services to the RAFI ETFs, each RAFI ETF currently pays a monthly management fee at an annual rate based on average daily net assets of the RAFI ETF as follows:

| | | | |

Fund* | | Management

Fee Rate | |

PIMCO RAFI Dynamic Multi-Factor Emerging Markets Equity ETF | | | 0.49 | % |

PIMCO RAFI Dynamic Multi-Factor International Equity ETF | | | 0.39 | % |

PIMCO RAFI Dynamic Multi-Factor U.S. Equity ETF | | | 0.29 | % |

PIMCO RAFI ESG U.S. ETF | | | 0.29 | % |