EXHIBIT 99.1 Recent Developments & Strategic Plans for KBS REIT III Shareholder Webcast July 30, 2019

The information contained herein should be read in conjunction with, and is qualified by, the information in KBS Real Estate Investment Trust III’s (the “Company” or “KBS REIT III”) Annual Important Report on Form 10-K for the year ended December 31, 2018 (the “Annual Report”), and in the Company’s Quarterly Report on Form 10-Q for the period ended March 31, 2019 (the “Quarterly Disclosures Report”), including the “Risk Factors” contained therein. For a full description of the limitations, methodologies and assumptions used to value the Company’s assets and liabilities in connection with the calculation of the Company’s estimated value per share, see the Company’s Current Report on Form 8-K, filed with the SEC on December 6, 2018. Forward-Looking Statements Certain statements contained herein may be deemed to be forward-looking statements within the meaning of the Federal Private Securities Litigation Reform Act of 1995. The Company intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent, belief or current expectations of the Company and members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should” or similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law. Such statements are subject to known and unknown risks and uncertainties which could cause actual results to differ materially from those contemplated by such forward-looking statements. The Company makes no representation or warranty (express or implied) about the accuracy of any such forward-looking statements. These statements are based on a number of assumptions involving the judgment of management. The Company may fund distributions from any source including, without limitation, from offering proceeds or borrowings. Distributions paid through June 30, 2019 have been funded in part with cash flow from operating activities and debt financing. There are no guarantees that the Company will continue to pay distributions or that distributions at the current rate are sustainable. No assurances can be given with respect to distributions. Actual events may cause the value and returns on the Company’s investments to be less than that used for purposes of the Company’s estimated NAV per share. With respect to the estimated NAV per share, the appraisal methodology used for the appraised properties assumes the properties realize the projected net operating income and expected exit cap rates and that investors would be willing to invest in such properties at yields equal to the expected discount rates. Though the appraisals of the appraised properties, with respect to Duff & Phelps, and the valuation estimates used in calculating the estimated value per share, with respect to Duff & Phelps, the Company’s advisor and the Company, are the respective party’s best estimates as of September 30, 2018, and December 3, 2018, as applicable, the Company can give no assurance in this regard. Even small changes to these assumptions could result in significant differences in the appraised values of the appraised properties and the estimated value per share. Further, the Company can make no assurances with respect to the future value appreciation of its properties and ultimate returns to investors. Stockholders may have to hold their shares for an indefinite period of time. The Company can give no assurance that it will be able to provide additional liquidity to stockholders. Although the board of directors has approved management’s recommendation to explore strategic alternatives for the Company, the Company is not obligated to pursue any particular transaction or any transaction at all. Further, although the Company is exploring strategic alternatives, there is no assurance that this process will provide a return to stockholders that equals or exceeds the Company’s estimated value per share. Even if the board of directors decides to pursue a particular strategy, there is no assurance that the Company will successfully implement its strategy. The statements herein also depend on factors such as: future economic, competitive and market conditions; the Company’s ability to maintain occupancy levels and rental rates at its real estate properties; and other risks identified in Part I, Item IA of the Company’s Annual Report and in Part II, Item IA of the Company’s Quarterly Report. 2

I. Portfolio Sale, Proceeds , & Use of Proceeds 4 - 11 II. Summary of Current Portfolio 12 - 26 III. Strategic Alternatives 27 – 28 IV. Conclusion 29 – 30 V. Appendix 31 – 71

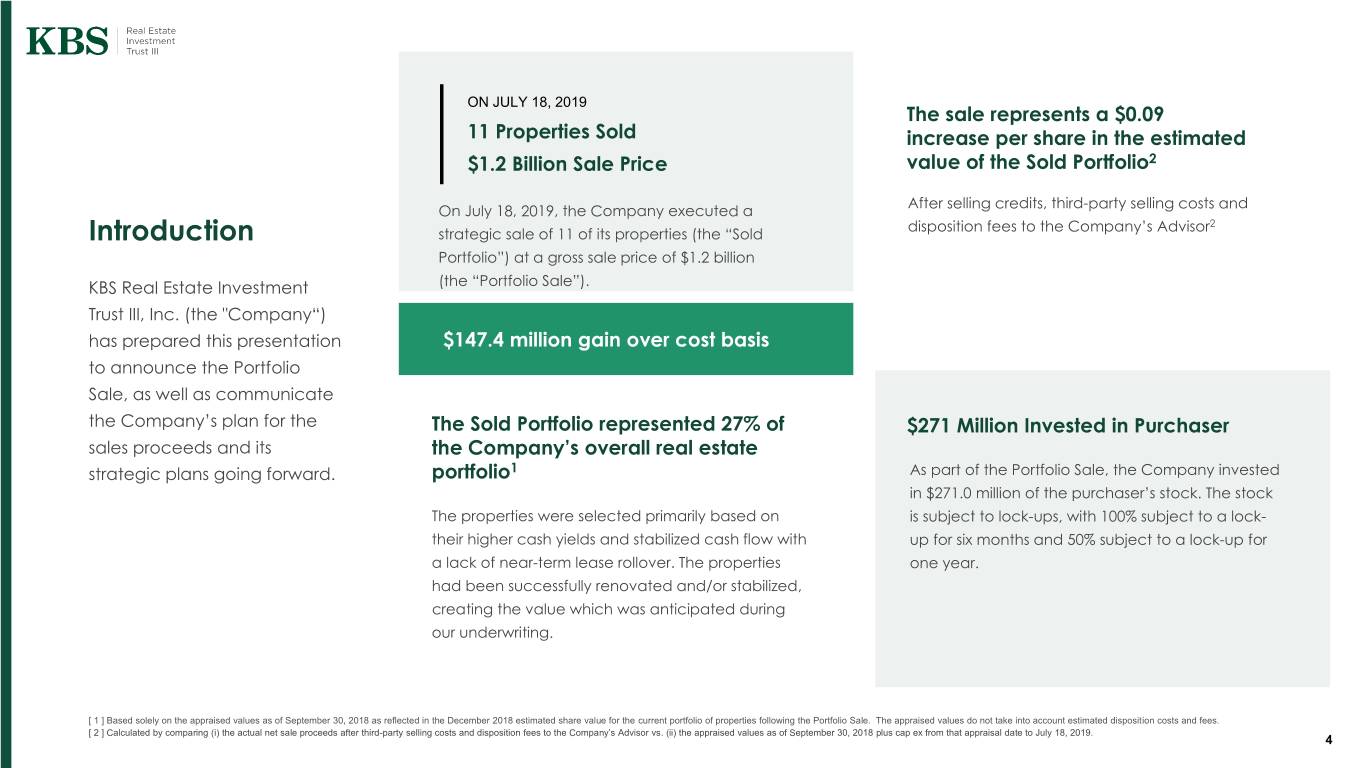

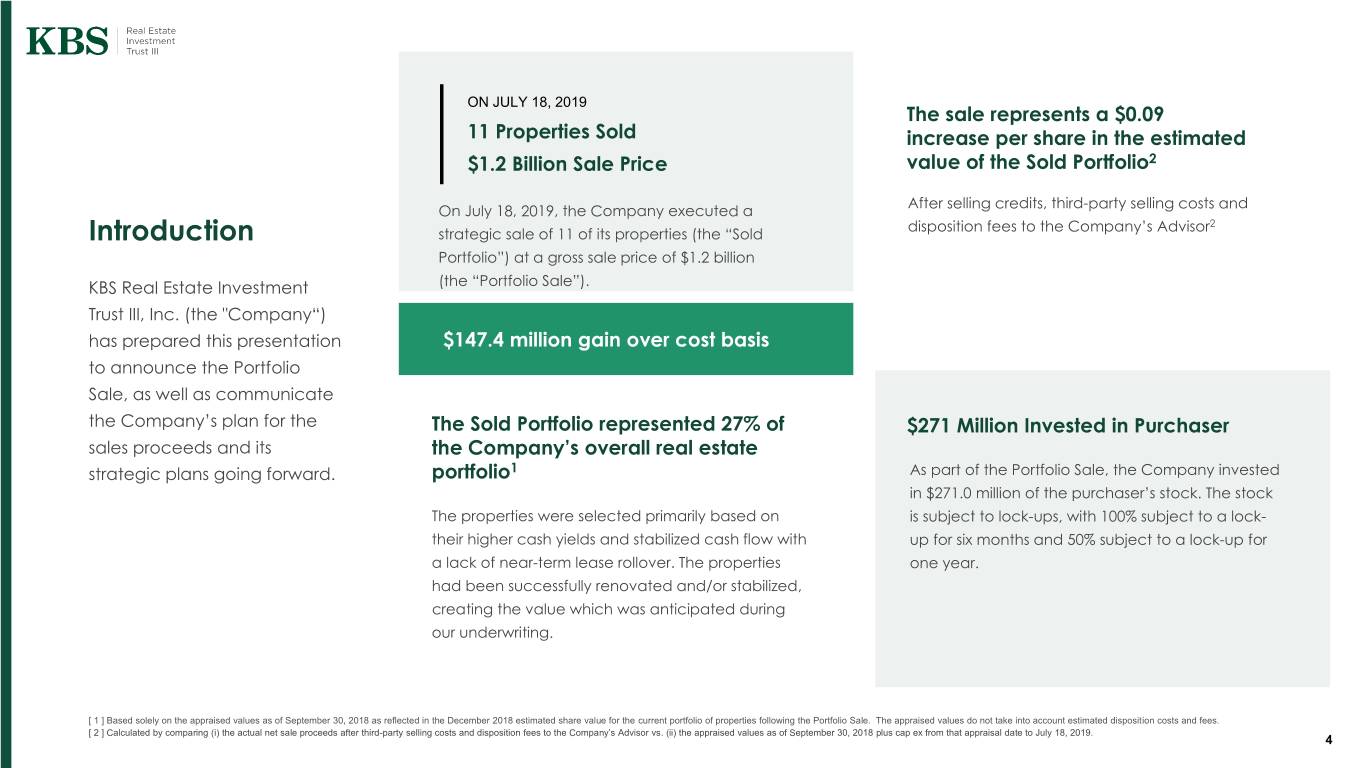

ON JULY 18, 2019 The sale represents a $0.09 11 Properties Sold increase per share in the estimated $1.2 Billion Sale Price value of the Sold Portfolio2 After selling credits, third-party selling costs and On July 18, 2019, the Company executed a disposition fees to the Company’s Advisor2 Introduction strategic sale of 11 of its properties (the “Sold Portfolio”) at a gross sale price of $1.2 billion KBS Real Estate Investment (the “Portfolio Sale”). Trust III, Inc. (the "Company“) has prepared this presentation $147.4 million gain over cost basis to announce the Portfolio Sale, as well as communicate the Company’s plan for the The Sold Portfolio represented 27% of $271 Million Invested in Purchaser sales proceeds and its the Company’s overall real estate strategic plans going forward. portfolio1 As part of the Portfolio Sale, the Company invested in $271.0 million of the purchaser’s stock. The stock The properties were selected primarily based on is subject to lock-ups, with 100% subject to a lock- their higher cash yields and stabilized cash flow with up for six months and 50% subject to a lock-up for a lack of near-term lease rollover. The properties one year. had been successfully renovated and/or stabilized, creating the value which was anticipated during our underwriting. [ 1 ] Based solely on the appraised values as of September 30, 2018 as reflected in the December 2018 estimated share value for the current portfolio of properties following the Portfolio Sale. The appraised values do not take into account estimated disposition costs and fees. [ 2 ] Calculated by comparing (i) the actual net sale proceeds after third-party selling costs and disposition fees to the Company’s Advisor vs. (ii) the appraised values as of September 30, 2018 plus cap ex from that appraisal date to July 18, 2019. 4

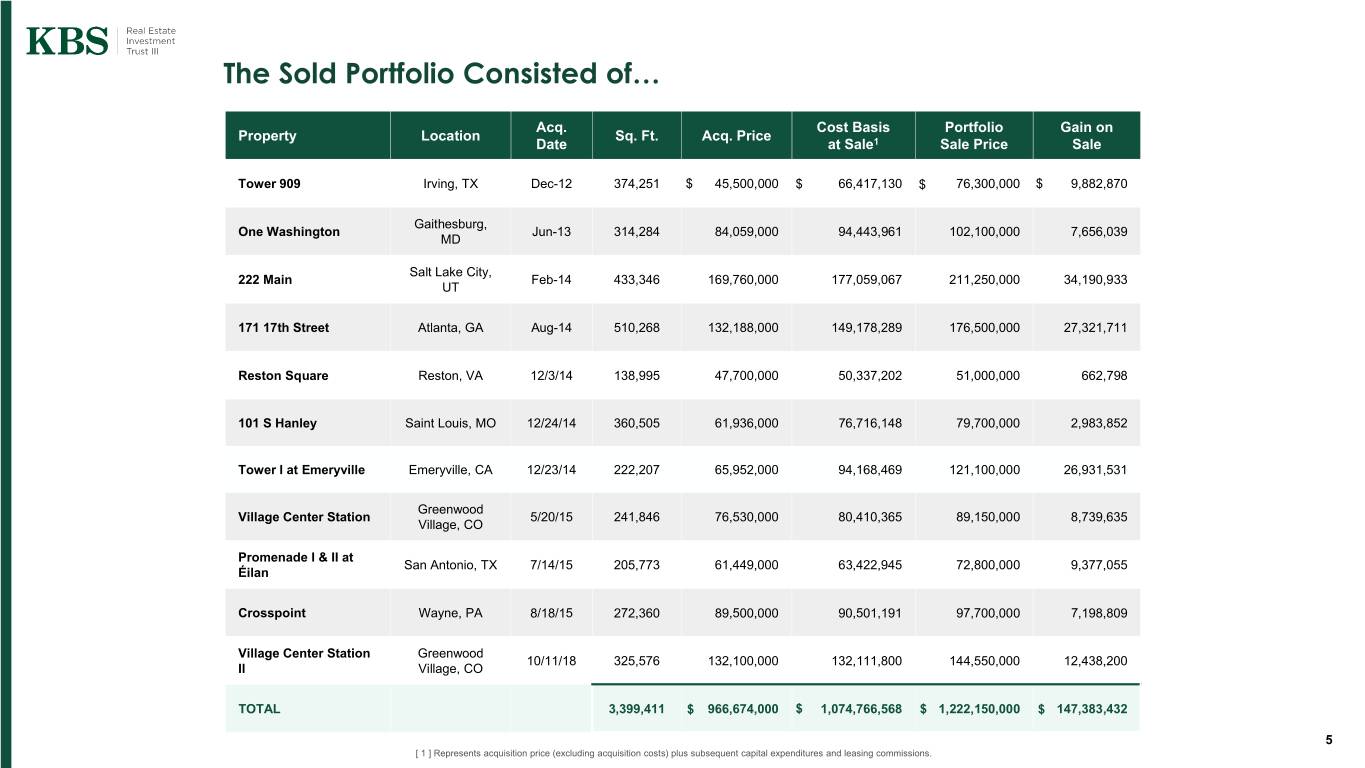

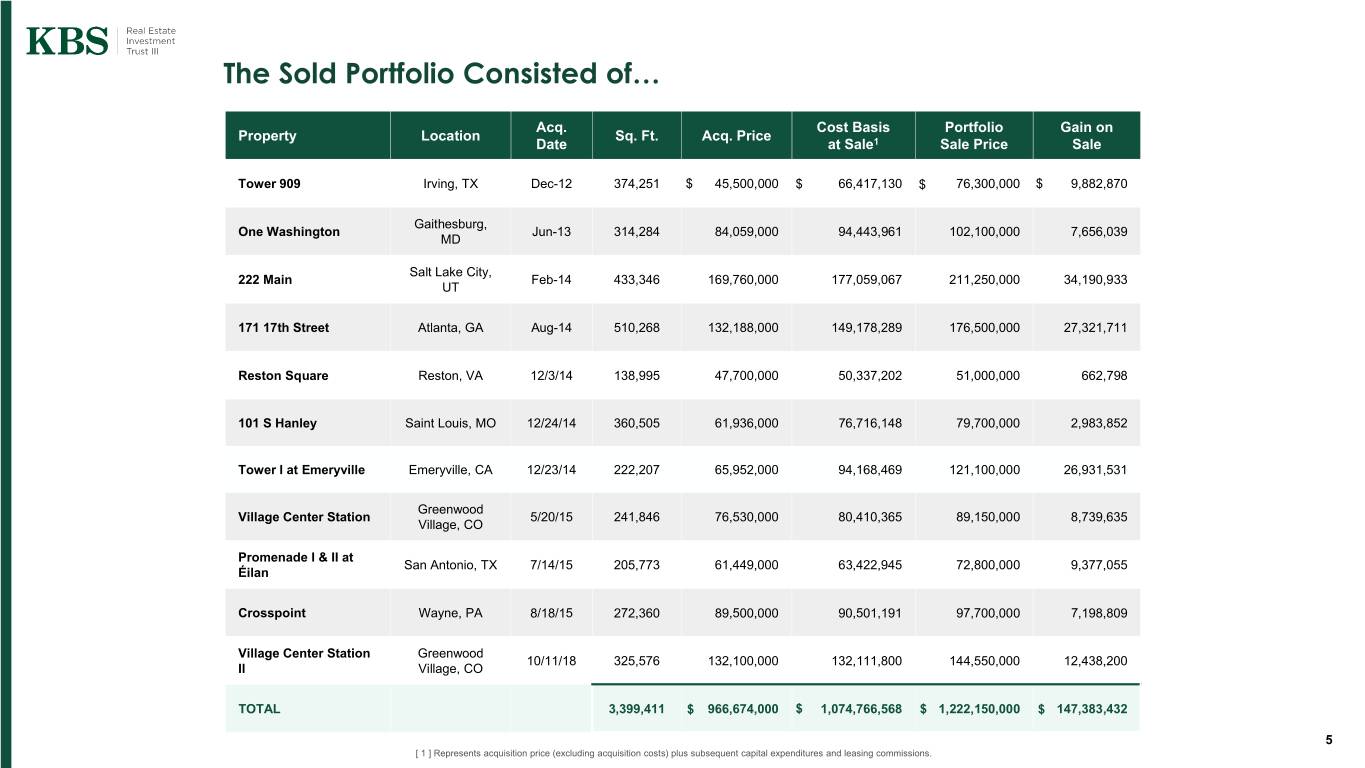

The Sold Portfolio Consisted of… Acq. Cost Basis Portfolio Gain on Property Location Sq. Ft. Acq. Price Date at Sale1 Sale Price Sale Tower 909 Irving, TX Dec-12 374,251 $ 45,500,000 $ 66,417,130 $ 76,300,000 $ 9,882,870 Gaithesburg, One Washington Jun-13 314,284 84,059,000 94,443,961 102,100,000 7,656,039 MD Salt Lake City, 222 Main Feb-14 433,346 169,760,000 177,059,067 211,250,000 34,190,933 UT 171 17th Street Atlanta, GA Aug-14 510,268 132,188,000 149,178,289 176,500,000 27,321,711 Reston Square Reston, VA 12/3/14 138,995 47,700,000 50,337,202 51,000,000 662,798 101 S Hanley Saint Louis, MO 12/24/14 360,505 61,936,000 76,716,148 79,700,000 2,983,852 Tower I at Emeryville Emeryville, CA 12/23/14 222,207 65,952,000 94,168,469 121,100,000 26,931,531 Greenwood Village Center Station 5/20/15 241,846 76,530,000 80,410,365 89,150,000 8,739,635 Village, CO Promenade I & II at San Antonio, TX 7/14/15 205,773 61,449,000 63,422,945 72,800,000 9,377,055 Éilan Crosspoint Wayne, PA 8/18/15 272,360 89,500,000 90,501,191 97,700,000 7,198,809 Village Center Station Greenwood 10/11/18 325,576 132,100,000 132,111,800 144,550,000 12,438,200 II Village, CO TOTAL 3,399,411 $ 966,674,000 $ 1,074,766,568 $ 1,222,150,000 $ 147,383,432 5 [ 1 ] Represents acquisition price (excluding acquisition costs) plus subsequent capital expenditures and leasing commissions.

The Portfolio Sale Generated Proceeds of $396.9 Million Dollars in Thousands Gross Sales Proceeds $ 1,222,150 Seller Credit [1] (10,093) KBS REIT III 33.3% Interest [2] (271,000) Subtotal-Net Sale Price Less 941,057 KBS REIT III Interest Closing Costs, Interest Rate Buydown, (19,731) Advisor Disposition Fee [3] Net Sales Proceeds Before Debt 921,326 Required Debt Repayment (524,377) TOTAL - Net Sales Proceeds $ 396,949 [ 1 ] Seller credit is for outstanding leasing and capital improvement costs to be paid by the purchaser. [ 2 ] Company’s acquired equity interest in the purchaser. [ 3 ] Disposition fee is 1.0% on the net sale price less REIT III’s equity interest, estimated to be $9.4 million, and is payable to the Company’s Advisor. 66

Use of Proceeds Recognizing that the Company’s shareholders each have different investment objectives, timelines, and liquidity needs, the Company will consider using net proceeds from the Portfolio Sale for a variety of strategies, including: Expand the Pay a Enhance Debt Paydowns/ share special future Asset Acquisitions redemption distribution shareholder program liquidity 7

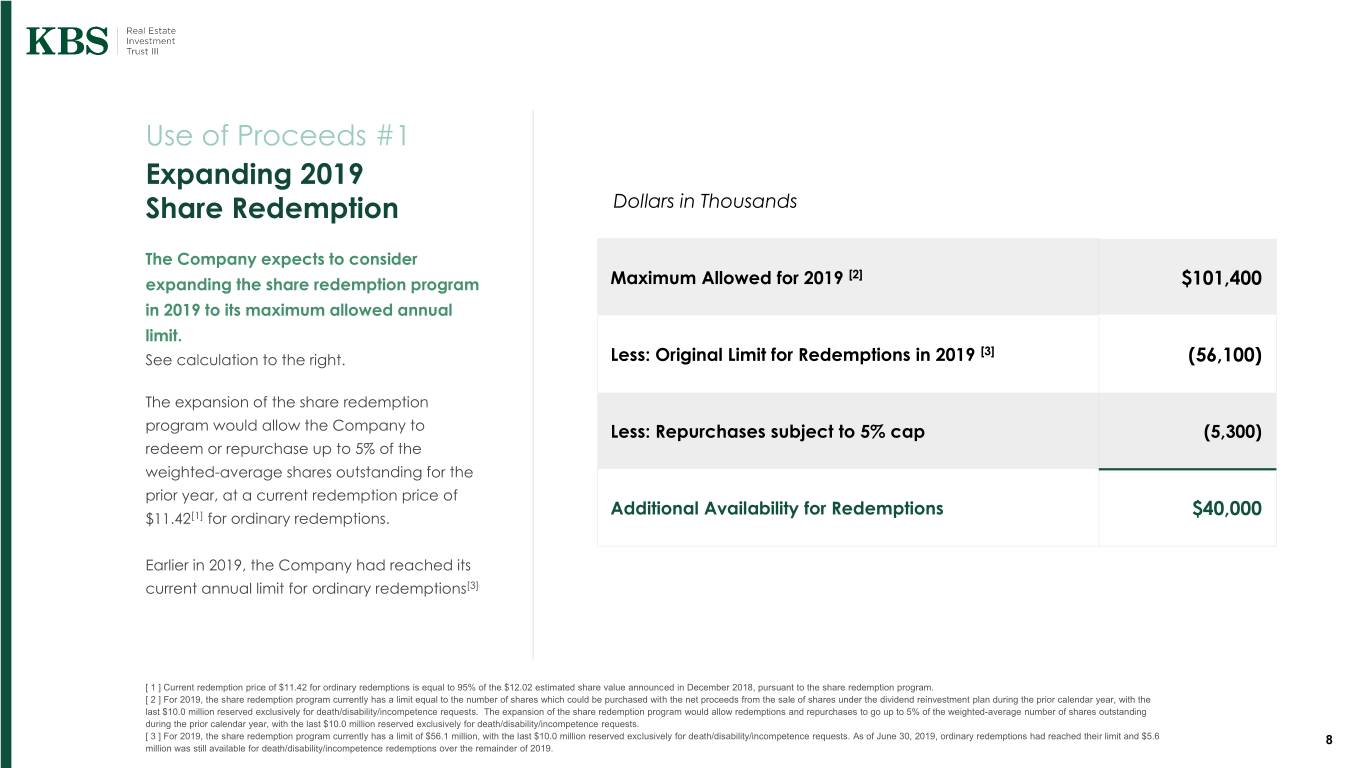

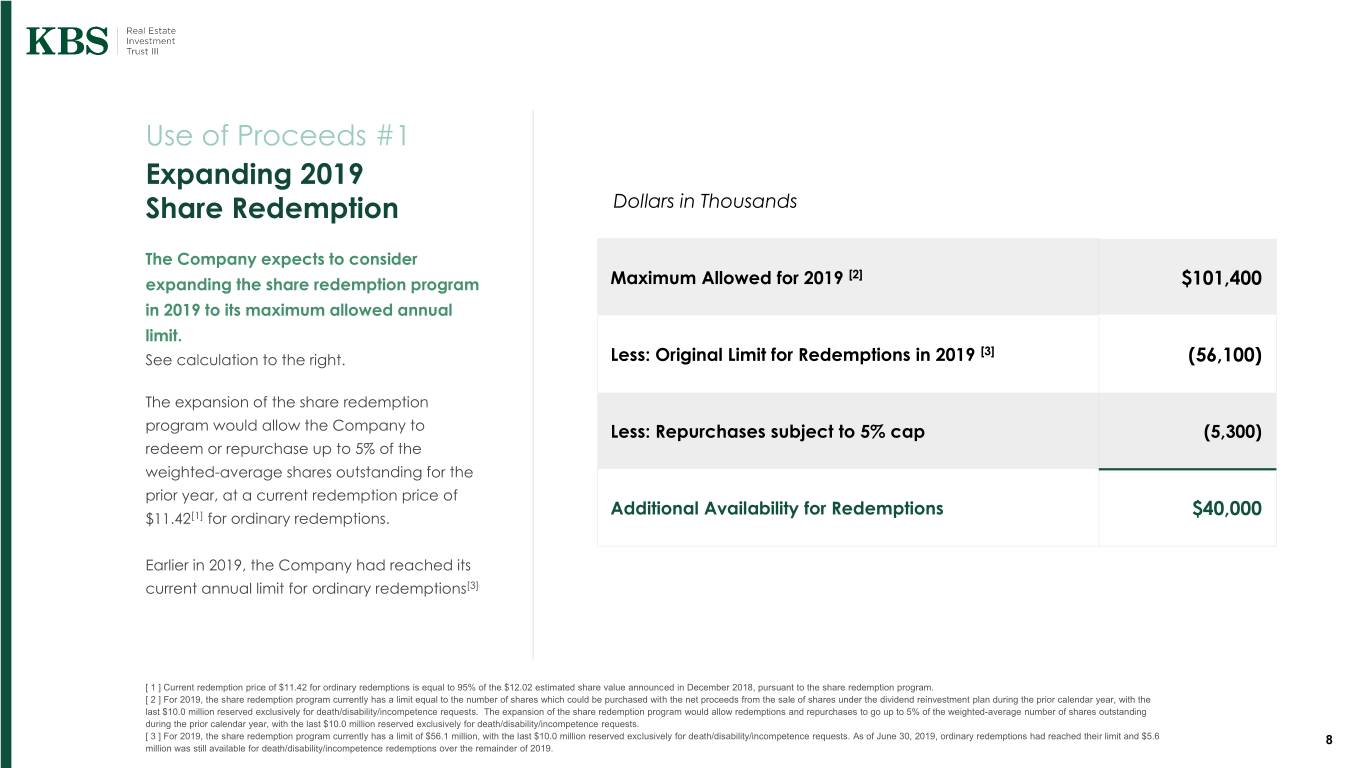

Expanding 2019 Share Redemption Dollars in Thousands The Company expects to consider [2] expanding the share redemption program Maximum Allowed for 2019 $101,400 in 2019 to its maximum allowed annual limit. [3] See calculation to the right. Less: Original Limit for Redemptions in 2019 (56,100) The expansion of the share redemption program would allow the Company to Less: Repurchases subject to 5% cap (5,300) redeem or repurchase up to 5% of the weighted-average shares outstanding for the prior year, at a current redemption price of Additional Availability for Redemptions $40,000 $11.42[1] for ordinary redemptions. Earlier in 2019, the Company had reached its current annual limit for ordinary redemptions[3] [ 1 ] Current redemption price of $11.42 for ordinary redemptions is equal to 95% of the $12.02 estimated share value announced in December 2018, pursuant to the share redemption program. [ 2 ] For 2019, the share redemption program currently has a limit equal to the number of shares which could be purchased with the net proceeds from the sale of shares under the dividend reinvestment plan during the prior calendar year, with the last $10.0 million reserved exclusively for death/disability/incompetence requests. The expansion of the share redemption program would allow redemptions and repurchases to go up to 5% of the weighted-average number of shares outstanding during the prior calendar year, with the last $10.0 million reserved exclusively for death/disability/incompetence requests. [ 3 ] For 2019, the share redemption program currently has a limit of $56.1 million, with the last $10.0 million reserved exclusively for death/disability/incompetence requests. As of June 30, 2019, ordinary redemptions had reached their limit and $5.6 8 million was still available for death/disability/incompetence redemptions over the remainder of 2019.

Option for shareholders to receive their Special special distribution as cash or additional Distribution common stock The Company will pay a special The special distribution will be in the form of distribution in Q4 2019, once we finalize cash and additional common stock. The the estimate of taxable income. Company plans to give each shareholder a choice of cash or additional common stock, Significant taxable capital gains, subject to a limit on the total cash to be paid which must be distributed to all shareholders. The sale generated a significant amount of taxable capital gains, and REIT rules require that at least 90% of taxable income (which includes capital gains) be distributed in each year for the Company to maintain its REIT status and avoid paying corporate taxes. 99

Enhance Future The Company may enhance Shareholder Liquidity future shareholder liquidity by The Company expects to consider Redeem expanding the share redemption whether to retain the remaining program up to the 5% limitation or proceeds to provide additional conduct one or more self-tenders. shareholder liquidity beyond 2019, whether through an expansion of If implemented, the goal would be to the share redemption program or Options allow as many shareholders to redeem one or more self-tenders. who would like to do so, while allowing shareholders who want to remain invested in the Company’s real estate portfolio to be able to do so. Remain Invested 10

Debt Paydowns Debt Paydowns/ Asset Acquisitions Additional paydowns on credit facilities to maximize liquidity for shareholders. To the extent there are still proceeds remaining, the Company would consider using all or a portion of those proceeds for additional debt paydowns or asset Asset Acquisitions acquisitions. Additional asset acquisitions to further our goals of: • generating attractive and stable income following stabilization and • enhancing the total return of the portfolio. 1111

The Current Portfolio 1212

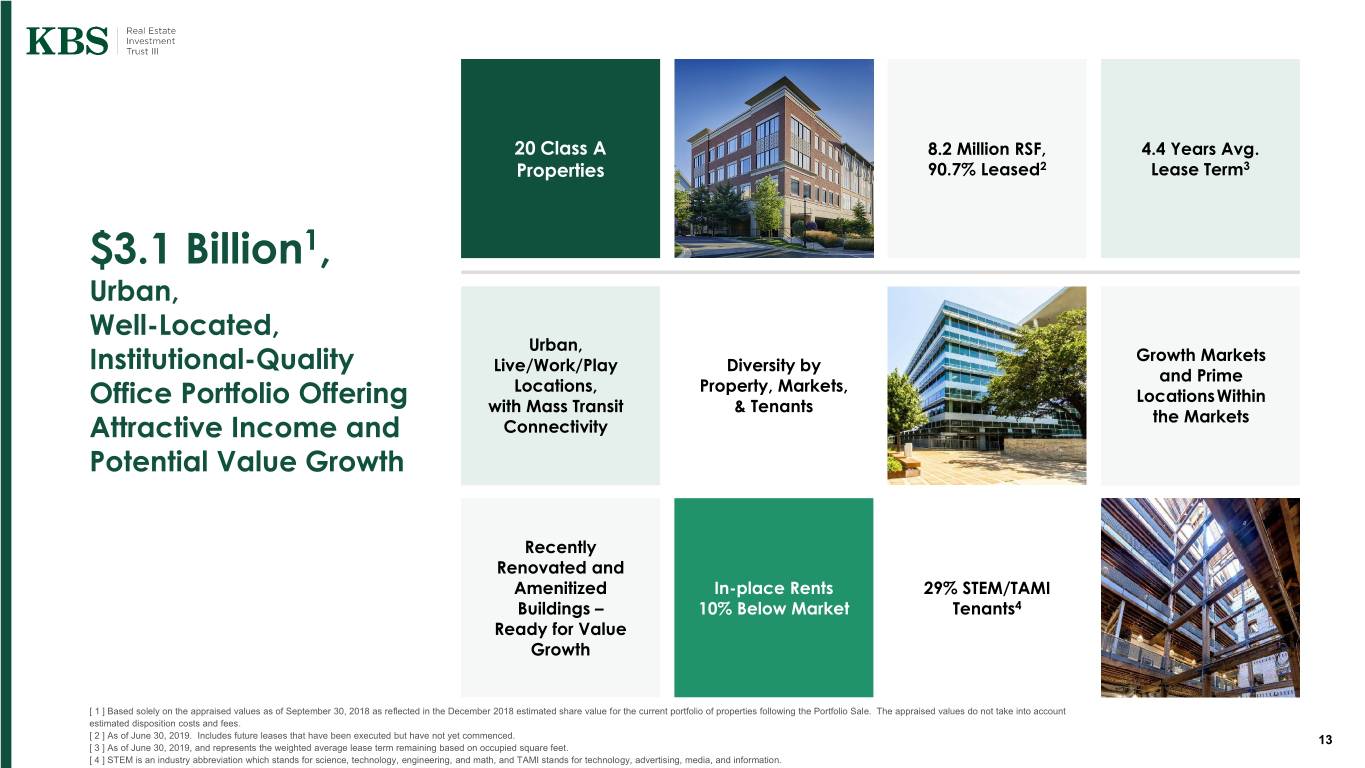

20 Class A 8.2 Million RSF, 4.4 Years Avg. Properties 90.7% Leased2 Lease Term3 $3.1 Billion1, Urban, Well-Located, Urban, Growth Markets Institutional-Quality Live/Work/Play Diversity by and Prime Locations, Property, Markets, LocationsWithin Office Portfolio Offering with Mass Transit & Tenants the Markets Attractive Income and Connectivity Potential Value Growth Recently Renovated and Amenitized In-place Rents 29% STEM/TAMI Buildings – 10% Below Market Tenants4 Ready for Value Growth [ 1 ] Based solely on the appraised values as of September 30, 2018 as reflected in the December 2018 estimated share value for the current portfolio of properties following the Portfolio Sale. The appraised values do not take into account estimated disposition costs and fees. [ 2 ] As of June 30, 2019. Includes future leases that have been executed but have not yet commenced. 13 [ 3 ] As of June 30, 2019, and represents the weighted average lease term remaining based on occupied square feet. [ 4 ] STEM is an industry abbreviation which stands for science, technology, engineering, and math, and TAMI stands for technology, advertising, media, and information.

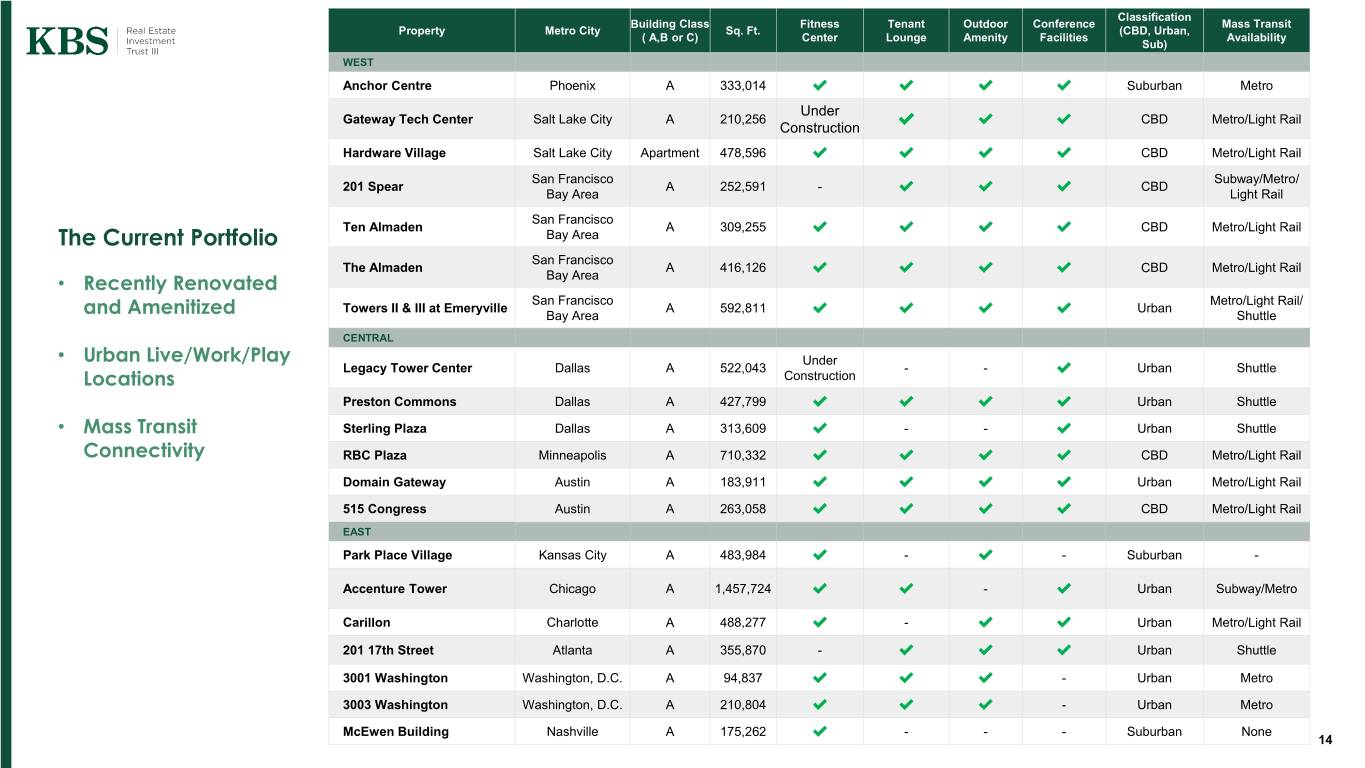

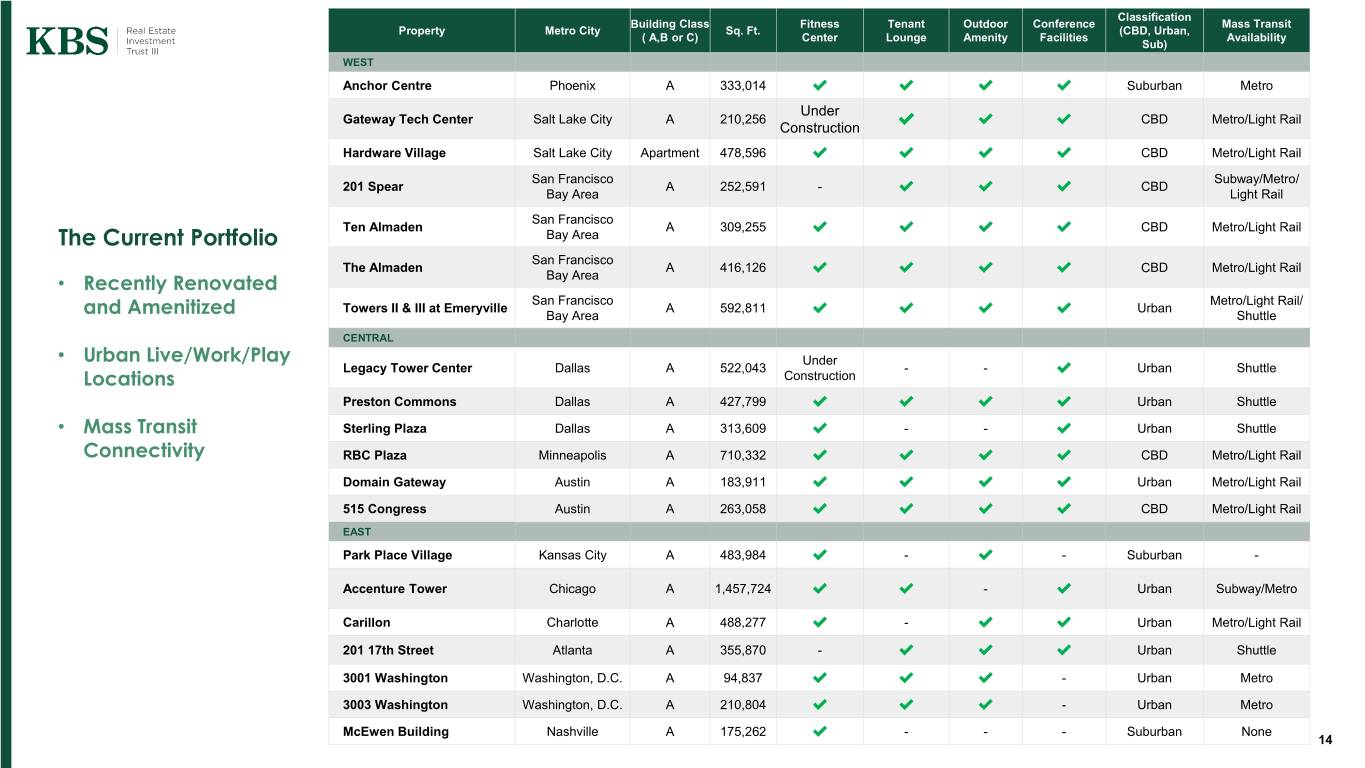

Classification Building Class Fitness Tenant Outdoor Conference Mass Transit Property Metro City Sq. Ft. (CBD, Urban, ( A,B or C) Center Lounge Amenity Facilities Availability Sub) WEST Anchor Centre Phoenix A 333,014 ✔ ✔ ✔ ✔ Suburban Metro Under Gateway Tech Center Salt Lake City A 210,256 ✔ ✔ ✔ CBD Metro/Light Rail Construction Hardware Village Salt Lake City Apartment 478,596 ✔ ✔ ✔ ✔ CBD Metro/Light Rail San Francisco Subway/Metro/ 201 Spear A 252,591 - ✔ ✔ ✔ CBD Bay Area Light Rail San Francisco Ten Almaden A 309,255 ✔ ✔ ✔ ✔ CBD Metro/Light Rail The Current Portfolio Bay Area San Francisco The Almaden A 416,126 ✔ ✔ ✔ ✔ CBD Metro/Light Rail • Recently Renovated Bay Area San Francisco Metro/Light Rail/ Towers II & III at Emeryville A 592,811 ✔ ✔ ✔ ✔ Urban and Amenitized Bay Area Shuttle CENTRAL • Urban Live/Work/Play Under Legacy Tower Center Dallas A 522,043 - - ✔ Urban Shuttle Locations Construction Preston Commons Dallas A 427,799 ✔ ✔ ✔ ✔ Urban Shuttle • Mass Transit Sterling Plaza Dallas A 313,609 ✔ - - ✔ Urban Shuttle Connectivity RBC Plaza Minneapolis A 710,332 ✔ ✔ ✔ ✔ CBD Metro/Light Rail Domain Gateway Austin A 183,911 ✔ ✔ ✔ ✔ Urban Metro/Light Rail 515 Congress Austin A 263,058 ✔ ✔ ✔ ✔ CBD Metro/Light Rail EAST Park Place Village Kansas City A 483,984 ✔ - ✔ - Suburban - Accenture Tower Chicago A 1,457,724 ✔ ✔ - ✔ Urban Subway/Metro Carillon Charlotte A 488,277 ✔ - ✔ ✔ Urban Metro/Light Rail 201 17th Street Atlanta A 355,870 - ✔ ✔ ✔ Urban Shuttle 3001 Washington Washington, D.C. A 94,837 ✔ ✔ ✔ - Urban Metro 3003 Washington Washington, D.C. A 210,804 ✔ ✔ ✔ - Urban Metro McEwen Building Nashville A 175,262 ✔ - - - Suburban None 14

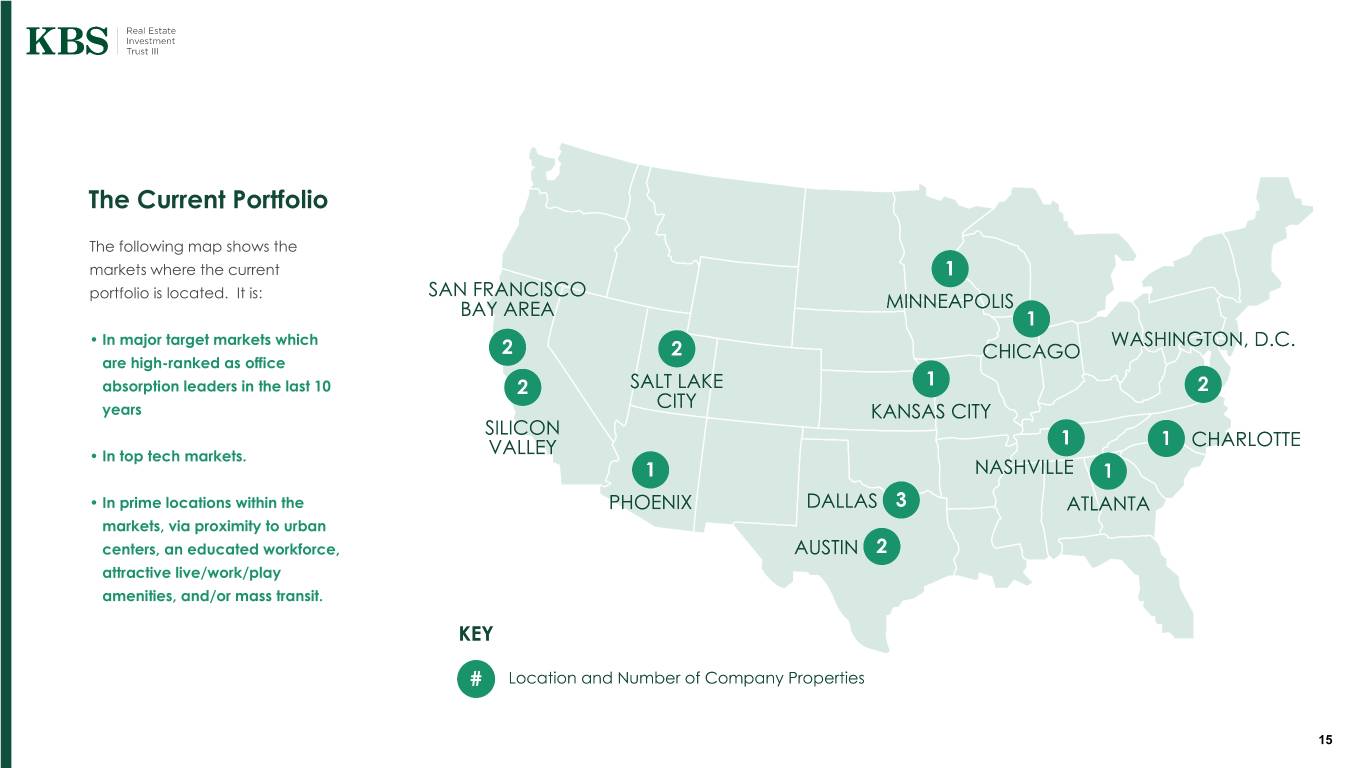

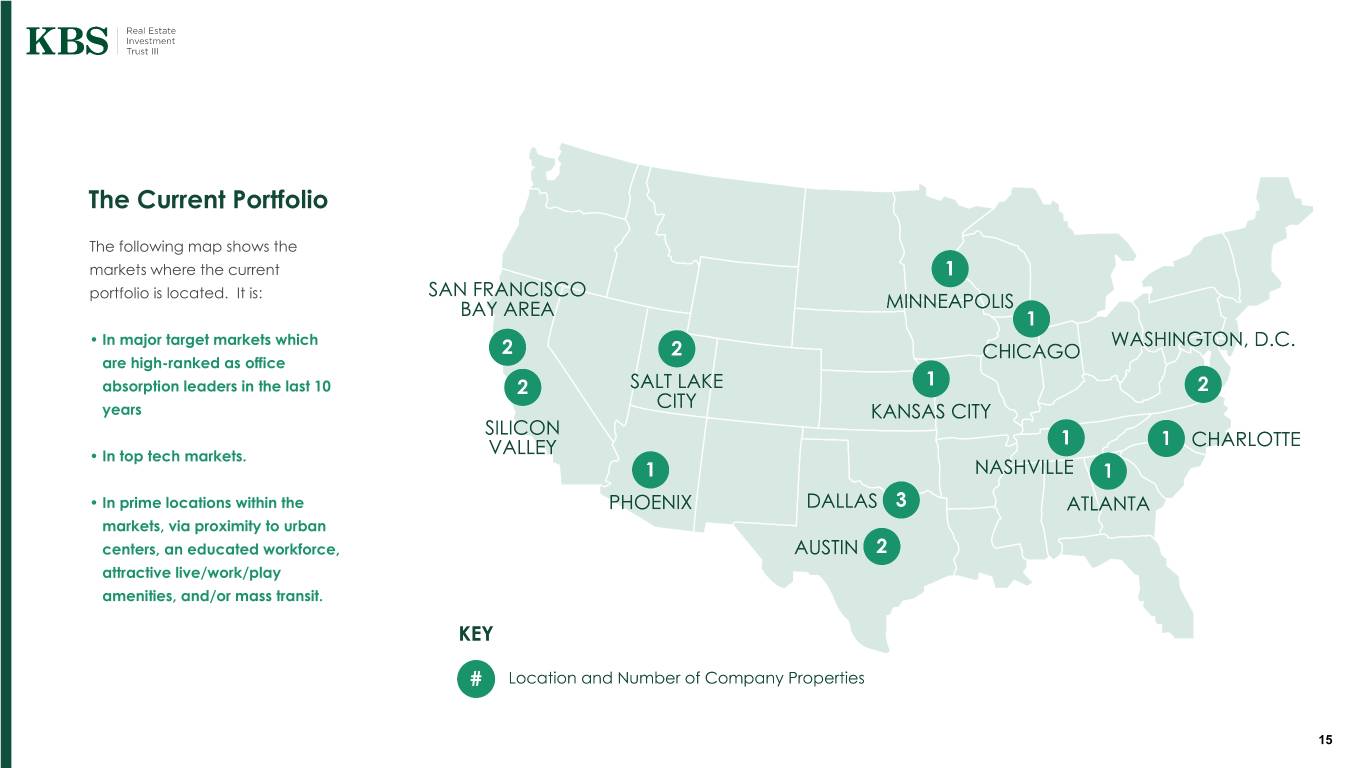

The Current Portfolio The following map shows the markets where the current portfolio is located. It is: • In major target markets which are high-ranked as office absorption leaders in the last 10 years • In top tech markets. • In prime locations within the markets, via proximity to urban centers, an educated workforce, attractive live/work/play amenities, and/or mass transit. 15

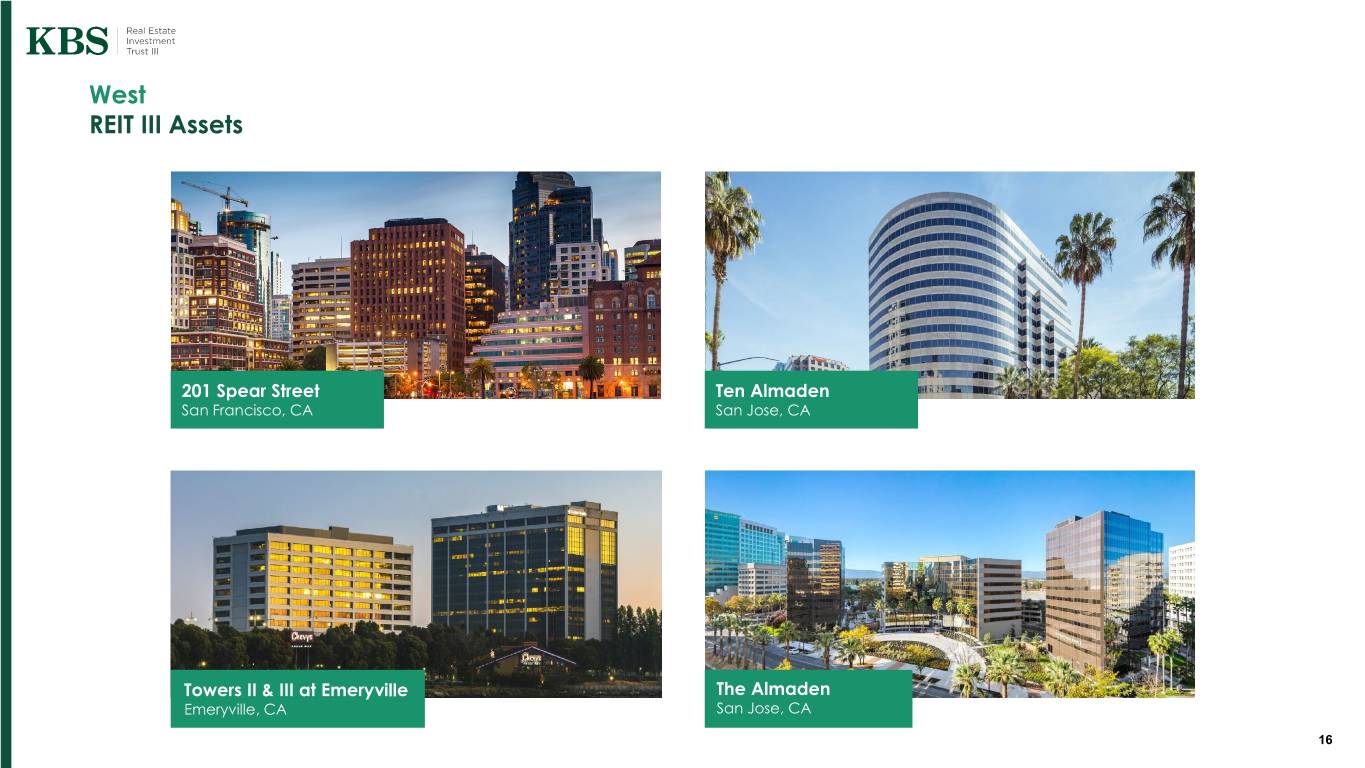

West REIT III Assets 201 Spear Street Ten Almaden San Francisco, CA San Jose, CA Towers II & III at Emeryville The Almaden Emeryville, CA San Jose, CA 16

West REIT III Assets Anchor Centre Gateway Tech Center Phoenix, AZ Salt Lake City, Utah Hardware Village Salt Lake City, Utah 17

Central REIT III Assets Sterling Plaza Preston Commons Dallas, TX Dallas, TX Domain Gateway 515 Congress Austin, TX Austin, TX 18

Central REIT III Assets Legacy Town Center RBC Plaza Plano, TX Minneapolis, MN Park Place Village Accenture Tower Leawood, KS Chicago, IL 19

East REIT III Assets 3001 Washington 3003 Washington Arlington, VA Arlington, VA 201 17th Street Carillon Tower Atlanta, GA Charlotte, NC 20

East REIT III Assets McEwen Building Nashville, TN 21

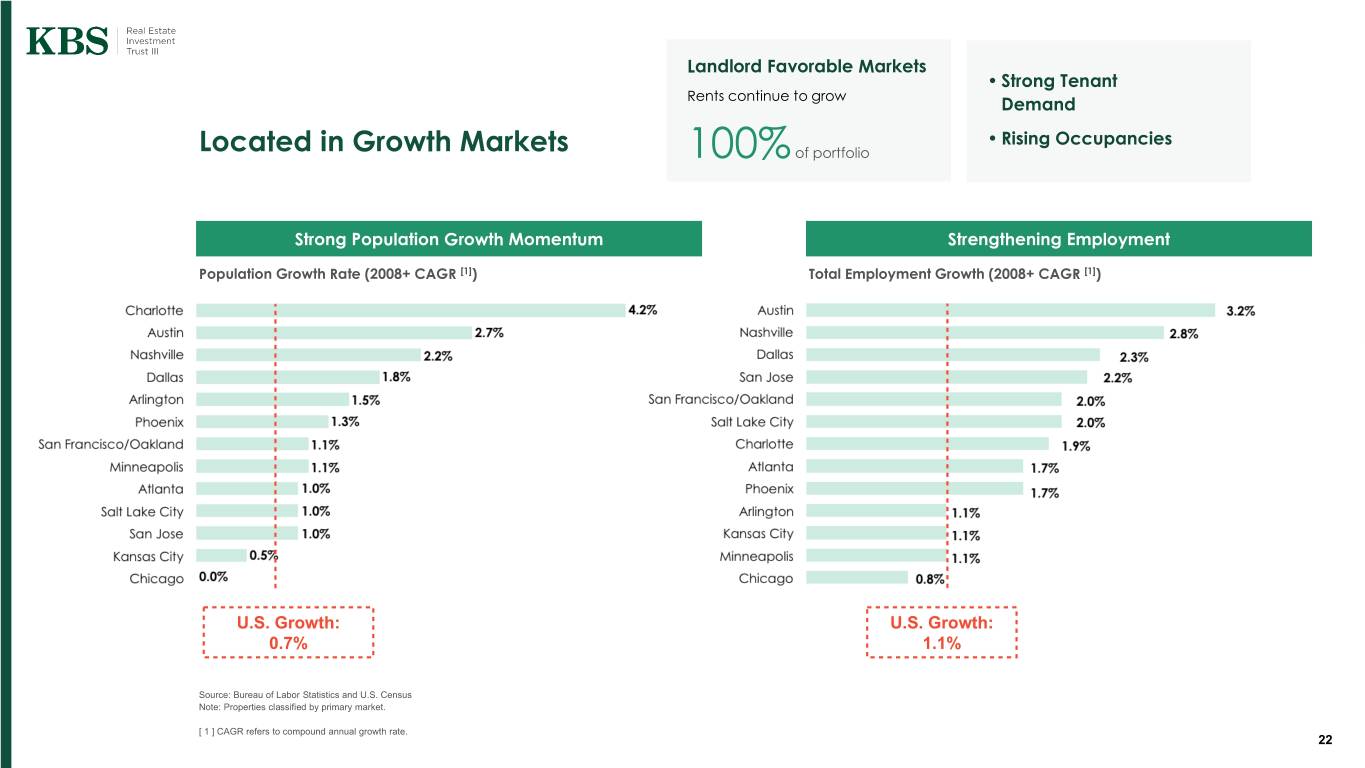

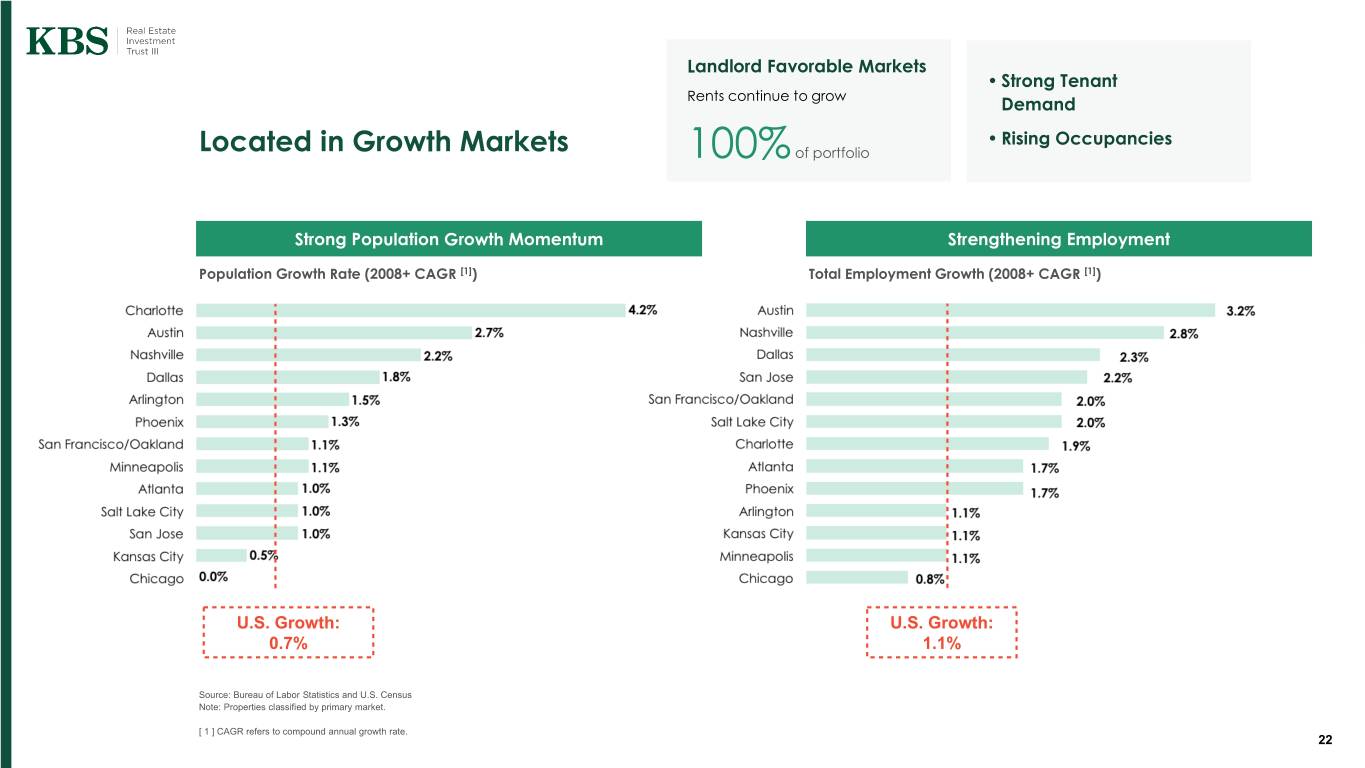

Landlord Favorable Markets • Strong Tenant Rents continue to grow Demand • Rising Occupancies Located in Growth Markets 100% of portfolio Strong Population Growth Momentum Strengthening Employment Population Growth Rate (2008+ CAGR [1]) Total Employment Growth (2008+ CAGR [1]) U.S. Growth: U.S. Growth: 0.7% 1.1% Source: Bureau of Labor Statistics and U.S. Census Note: Properties classified by primary market. [ 1 ] CAGR refers to compound annual growth rate. 22

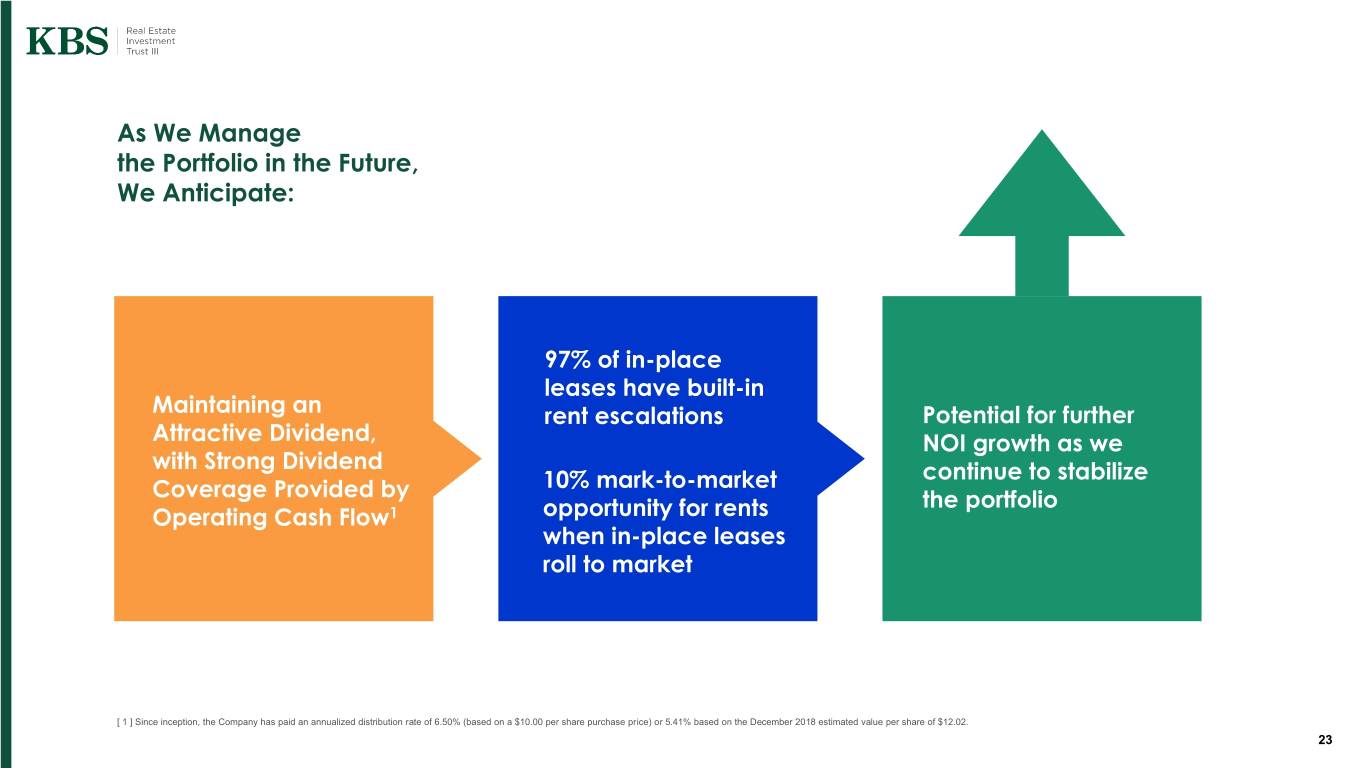

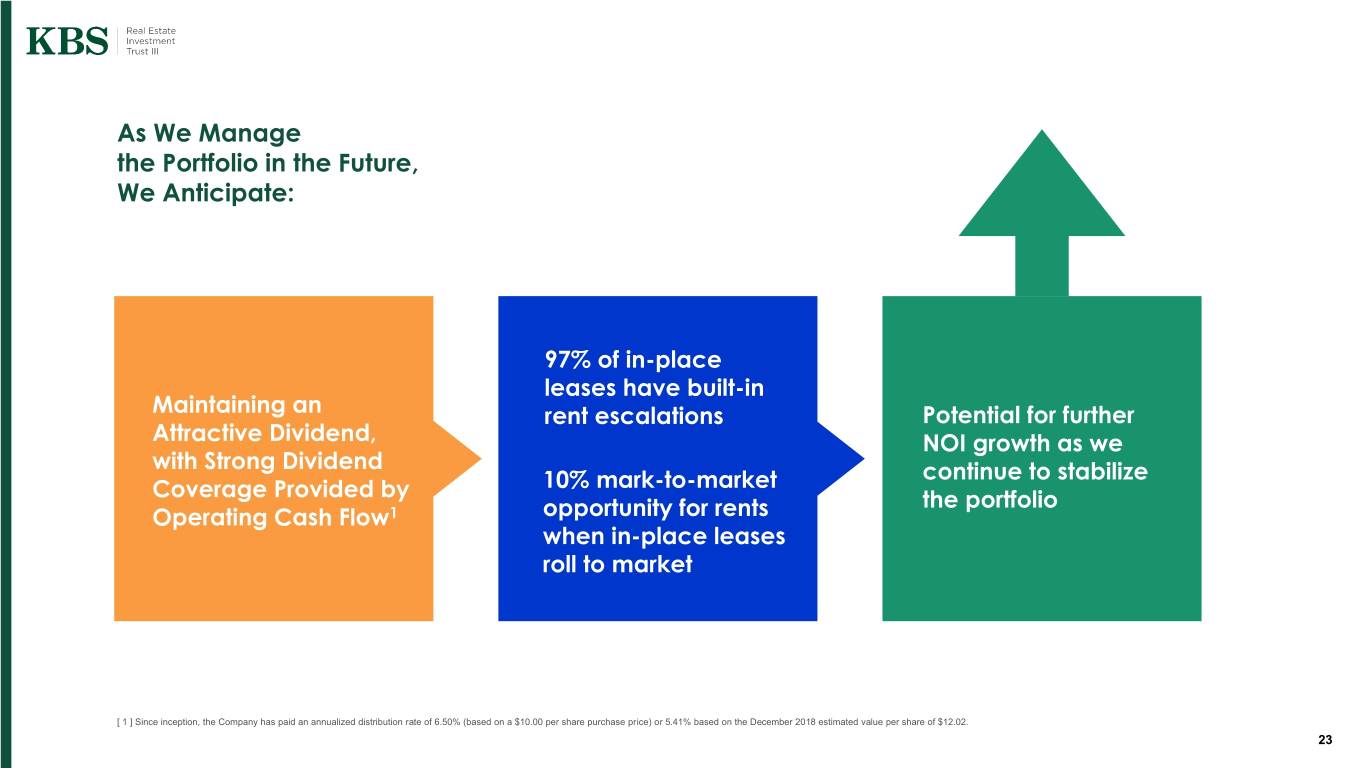

As We Manage the Portfolio in the Future, We Anticipate: 97% of in-place leases have built-in Maintaining an rent escalations Potential for further Attractive Dividend, NOI growth as we with Strong Dividend 10% mark-to-market continue to stabilize Coverage Provided by the portfolio Operating Cash Flow1 opportunity for rents when in-place leases roll to market [ 1 ] Since inception, the Company has paid an annualized distribution rate of 6.50% (based on a $10.00 per share purchase price) or 5.41% based on the December 2018 estimated value per share of $12.02. 23

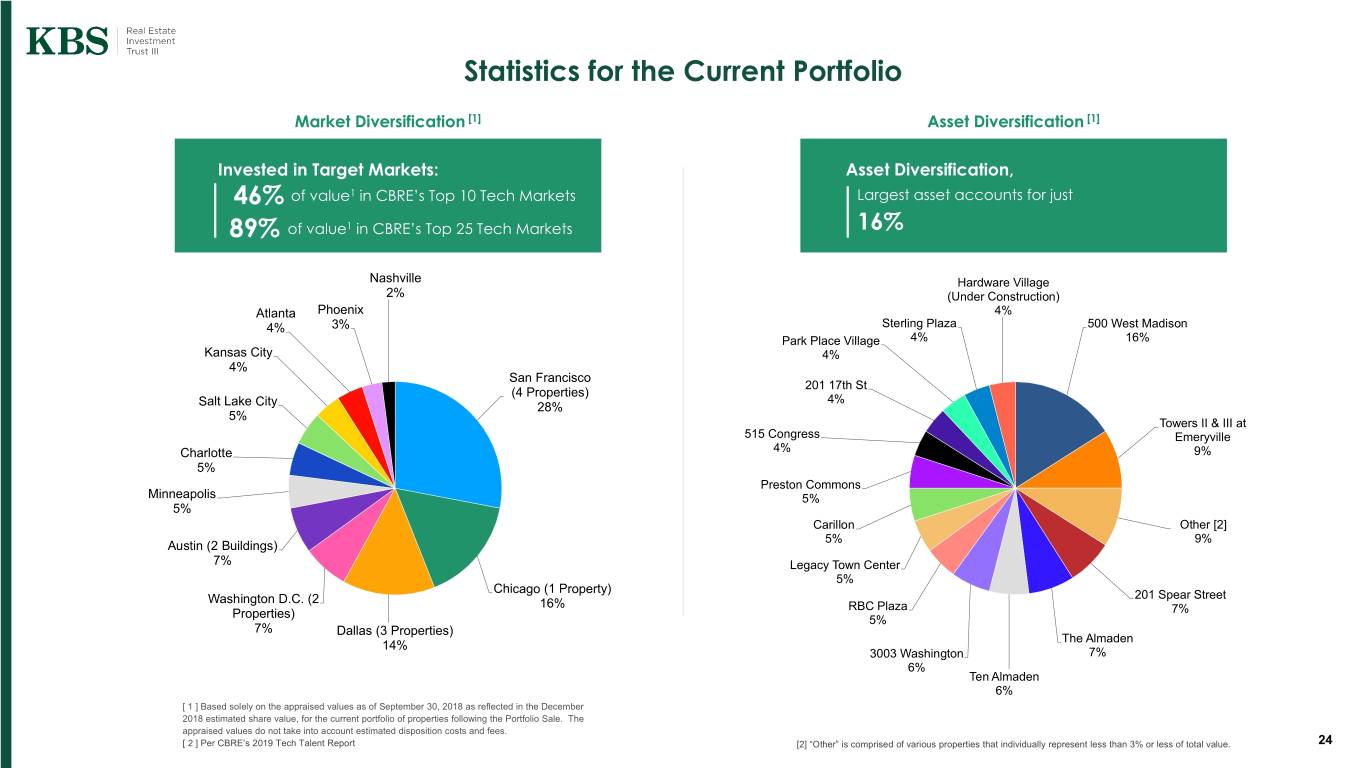

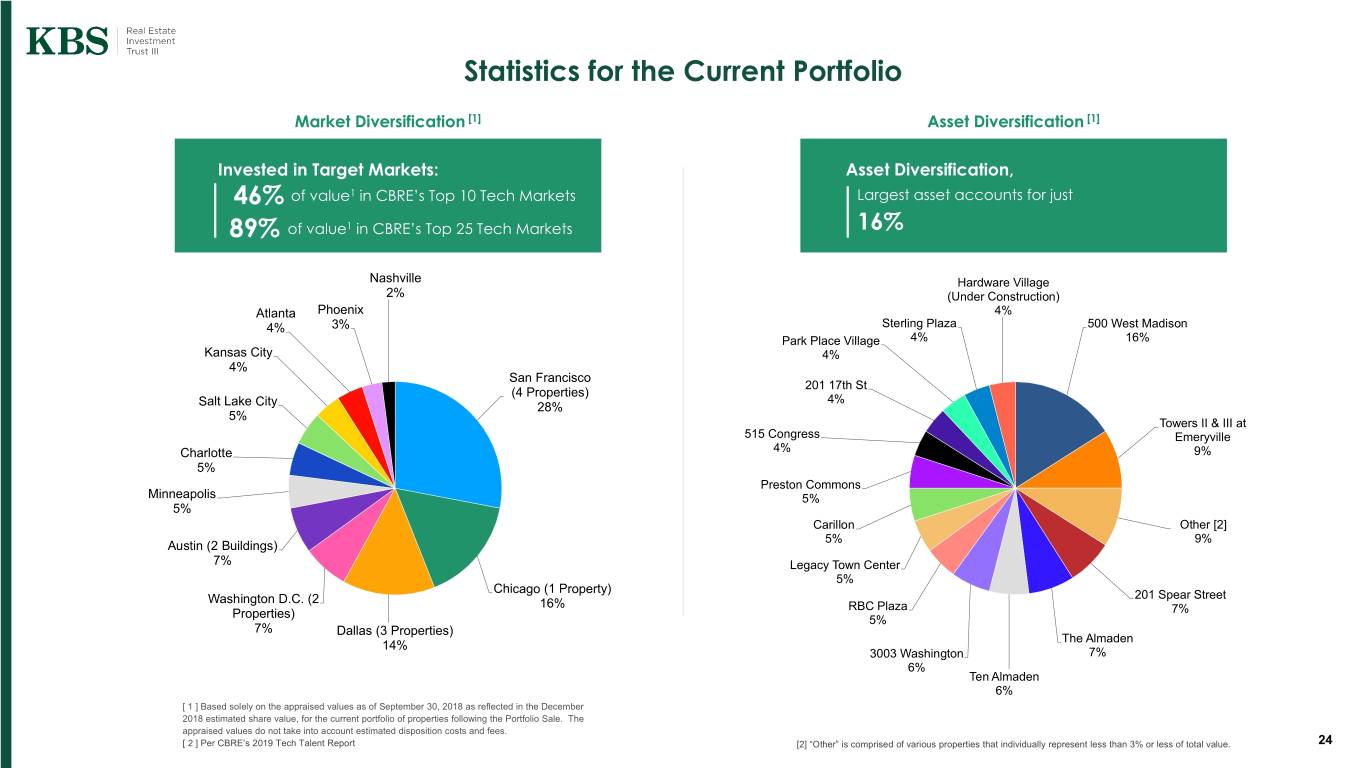

Statistics for the Current Portfolio Market Diversification [1] Asset Diversification [1] Invested in Target Markets: Asset Diversification, 46% of value1 in CBRE’s Top 10 Tech Markets Largest asset accounts for just 89% of value1 in CBRE’s Top 25 Tech Markets 16% Nashville Hardware Village 2% (Under Construction) Atlanta Phoenix 4% 4% 3% Sterling Plaza 500 West Madison Park Place Village 4% 16% Kansas City 4% 4% San Francisco 201 17th St (4 Properties) 4% Salt Lake City 28% 5% Towers II & III at 515 Congress Emeryville Charlotte 4% 9% 5% Preston Commons Minneapolis 5% 5% Carillon Other [2] 5% 9% Austin (2 Buildings) 7% Legacy Town Center 5% Chicago (1 Property) Washington D.C. (2 201 Spear Street 16% RBC Plaza 7% Properties) 5% 7% Dallas (3 Properties) The Almaden 14% 3003 Washington 7% 6% Ten Almaden 6% [ 1 ] Based solely on the appraised values as of September 30, 2018 as reflected in the December 2018 estimated share value, for the current portfolio of properties following the Portfolio Sale. The appraised values do not take into account estimated disposition costs and fees. [ 2 ] Per CBRE’s 2019 Tech Talent Report [2] “Other” is comprised of various properties that individually represent less than 3% or less of total value. 24

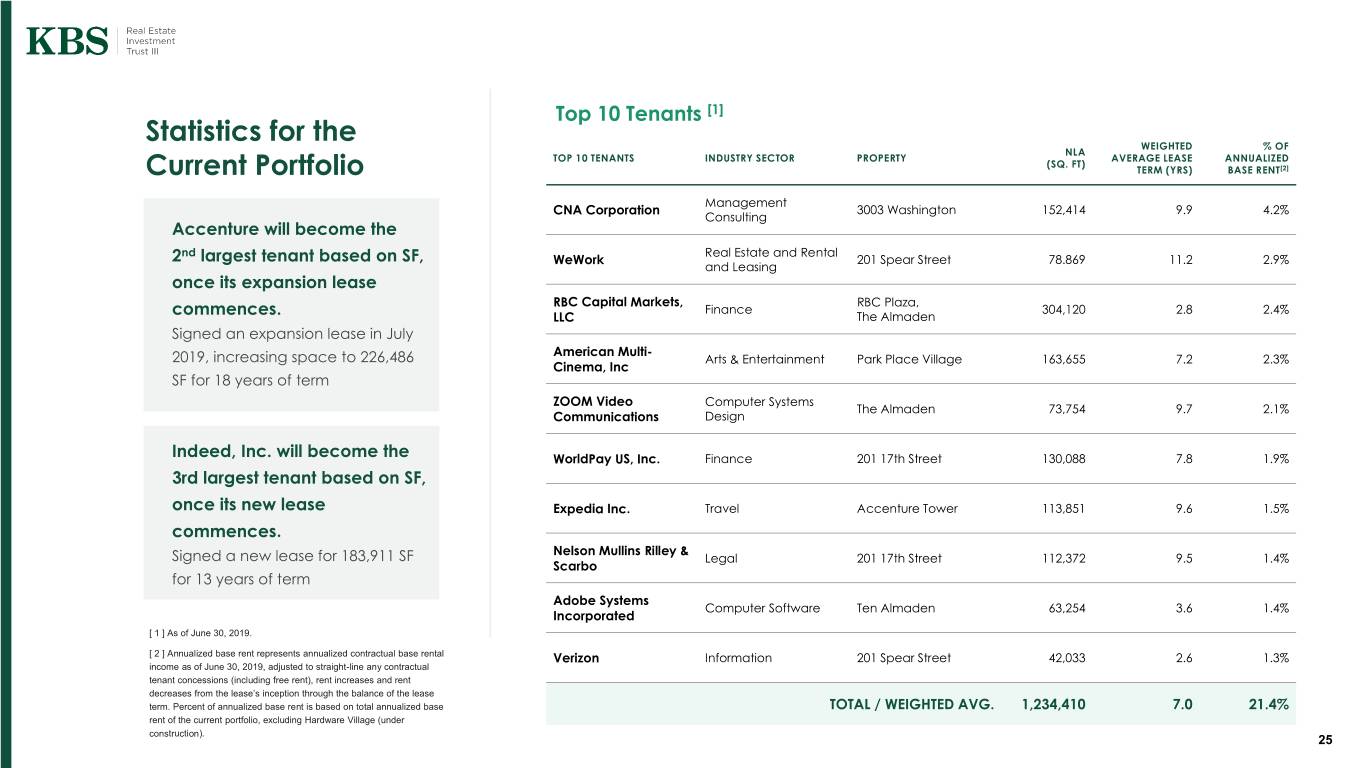

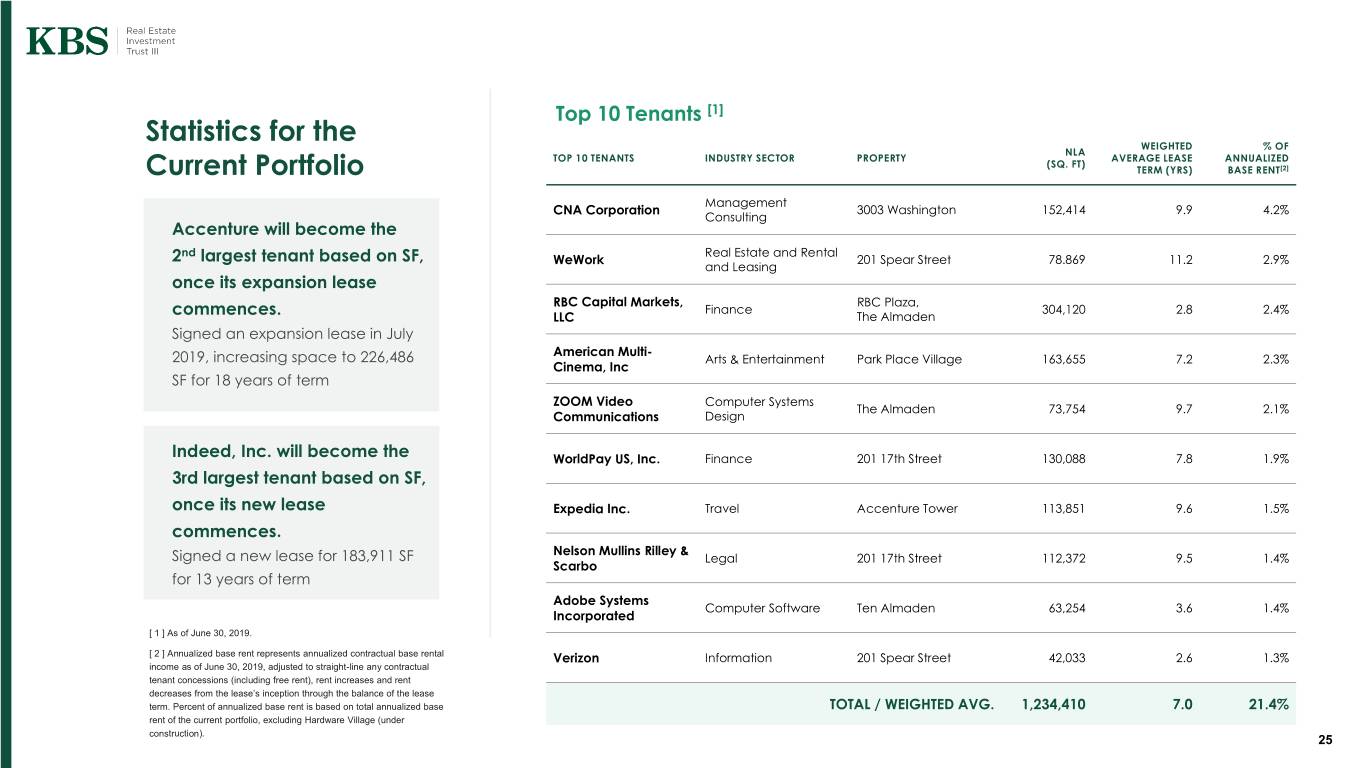

Top 10 Tenants [1] Statistics for the WEIGHTED % OF NLA TOP 10 TENANTS INDUSTRY SECTOR PROPERTY AVERAGE LEASE ANNUALIZED (SQ. FT) Current Portfolio TERM (YRS) BASE RENT[2] Management CNA Corporation 3003 Washington 152,414 9.9 4.2% Consulting Accenture will become the nd Real Estate and Rental 2 largest tenant based on SF, WeWork 201 Spear Street 78.869 11.2 2.9% and Leasing once its expansion lease RBC Capital Markets, RBC Plaza, Finance 304,120 2.8 2.4% commences. LLC The Almaden Signed an expansion lease in July American Multi- 2019, increasing space to 226,486 Arts & Entertainment Park Place Village 163,655 7.2 2.3% Cinema, Inc SF for 18 years of term ZOOM Video Computer Systems The Almaden 73,754 9.7 2.1% Communications Design Indeed, Inc. will become the WorldPay US, Inc. Finance 201 17th Street 130,088 7.8 1.9% 3rd largest tenant based on SF, once its new lease Expedia Inc. Travel Accenture Tower 113,851 9.6 1.5% commences. Nelson Mullins Rilley & Signed a new lease for 183,911 SF Legal 201 17th Street 112,372 9.5 1.4% Scarbo for 13 years of term Adobe Systems Computer Software Ten Almaden 63,254 3.6 1.4% Incorporated [ 1 ] As of June 30, 2019. [ 2 ] Annualized base rent represents annualized contractual base rental Verizon Information 201 Spear Street 42,033 2.6 1.3% income as of June 30, 2019, adjusted to straight-line any contractual tenant concessions (including free rent), rent increases and rent decreases from the lease’s inception through the balance of the lease term. Percent of annualized base rent is based on total annualized base TOTAL / WEIGHTED AVG. 1,234,410 7.0 21.4% rent of the current portfolio, excluding Hardware Village (under construction). 25

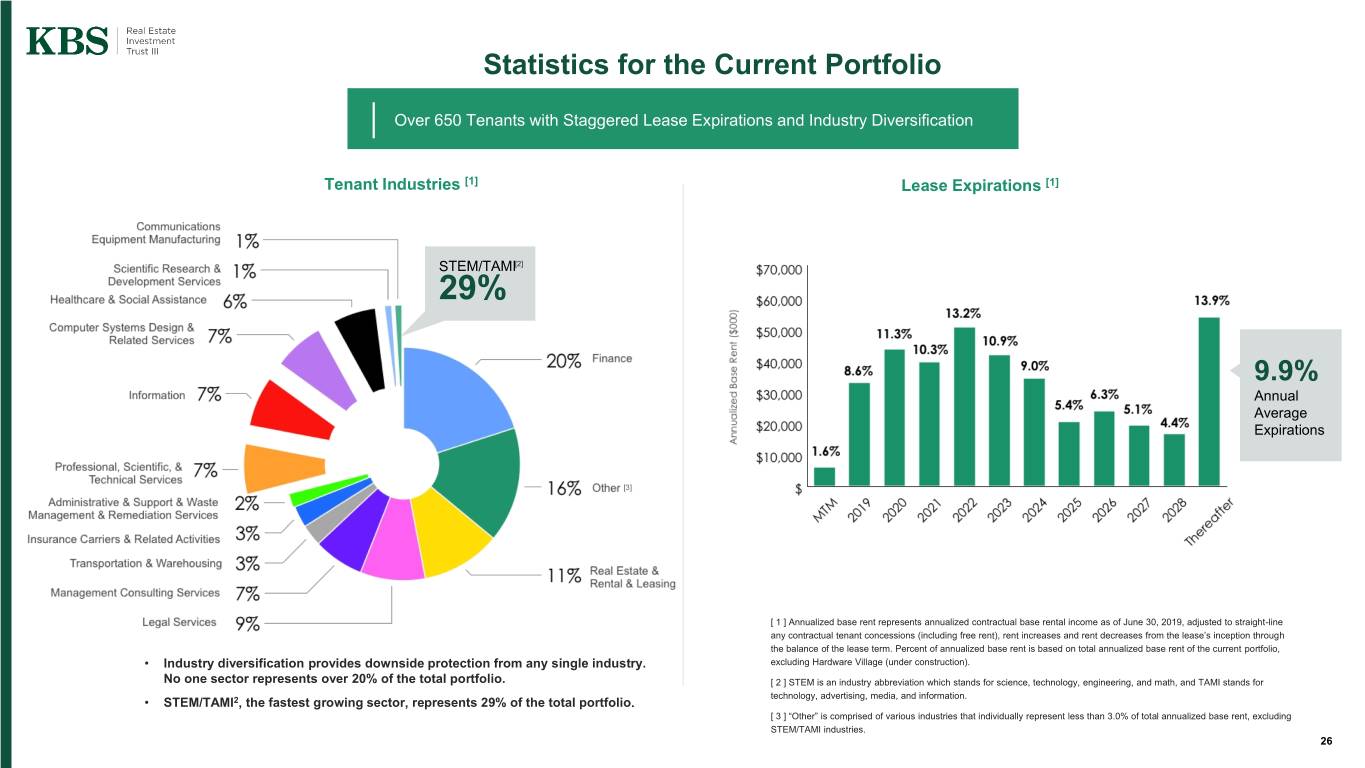

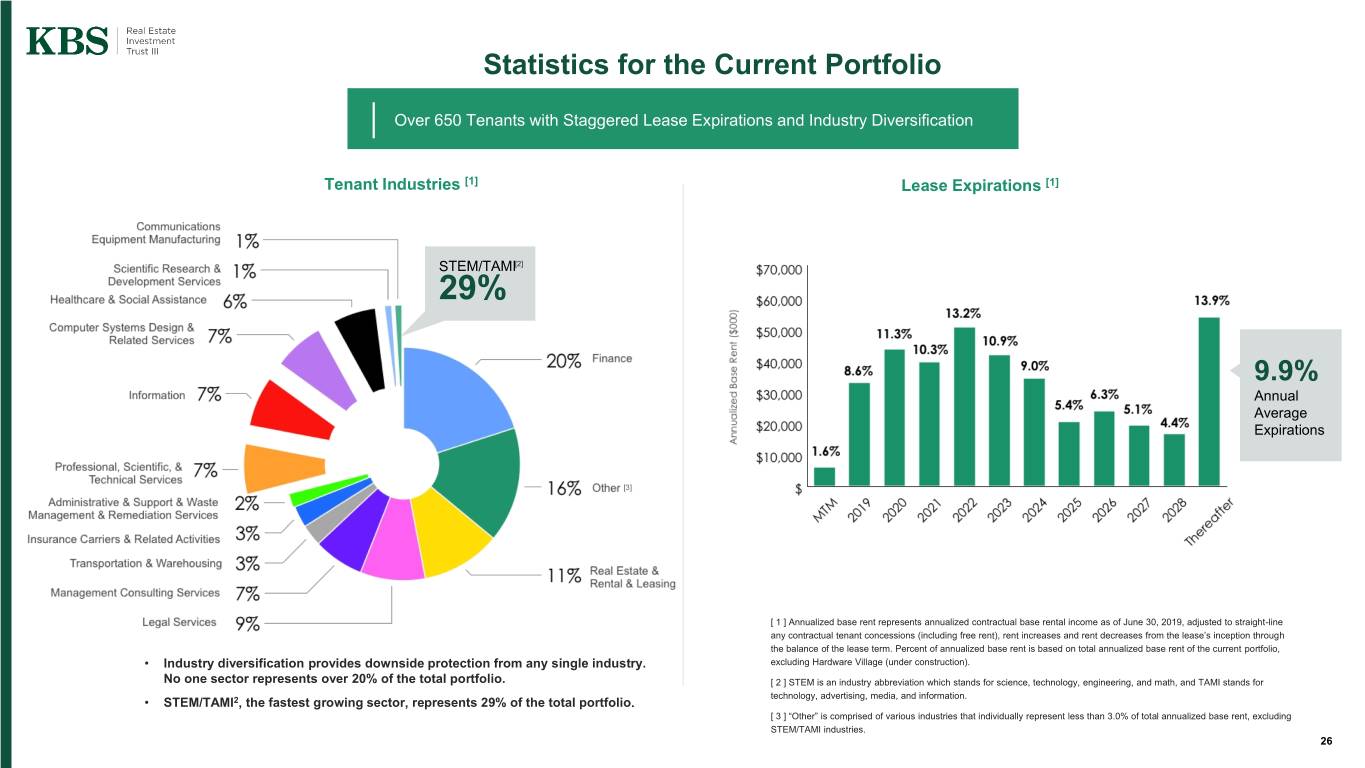

Statistics for the Current Portfolio Over 650 Tenants with Staggered Lease Expirations and Industry Diversification Tenant Industries [1] Lease Expirations [1] STEM/TAMI[2] 29% 9.9% Annual Average Expirations [ 1 ] Annualized base rent represents annualized contractual base rental income as of June 30, 2019, adjusted to straight-line any contractual tenant concessions (including free rent), rent increases and rent decreases from the lease’s inception through the balance of the lease term. Percent of annualized base rent is based on total annualized base rent of the current portfolio, • Industry diversification provides downside protection from any single industry. excluding Hardware Village (under construction). No one sector represents over 20% of the total portfolio. [ 2 ] STEM is an industry abbreviation which stands for science, technology, engineering, and math, and TAMI stands for technology, advertising, media, and information. • STEM/TAMI2, the fastest growing sector, represents 29% of the total portfolio. [ 3 ] “Other” is comprised of various industries that individually represent less than 3.0% of total annualized base rent, excluding STEM/TAMI industries. 26

Strategic Alternatives 27 27

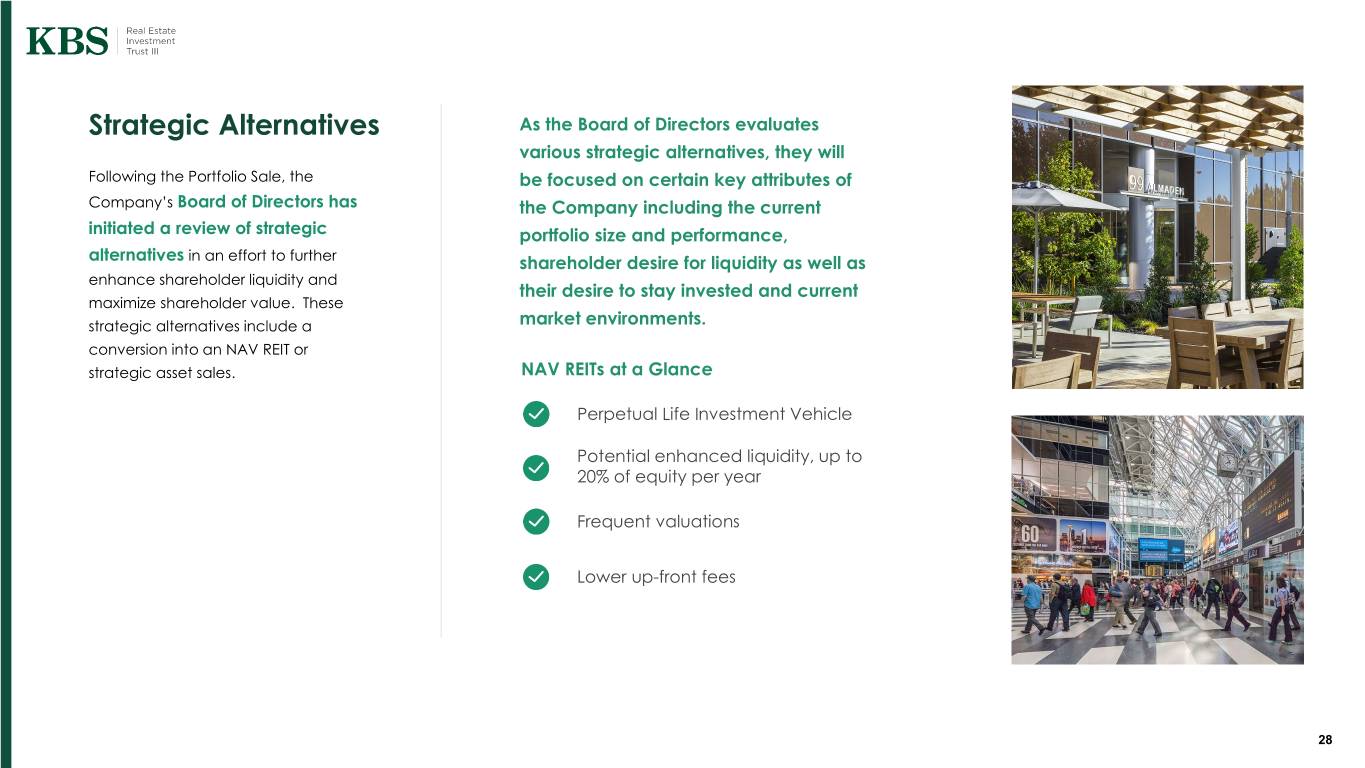

Strategic Alternatives As the Board of Directors evaluates various strategic alternatives, they will Following the Portfolio Sale, the be focused on certain key attributes of Company’s Board of Directors has the Company including the current initiated a review of strategic portfolio size and performance, alternatives in an effort to further shareholder desire for liquidity as well as enhance shareholder liquidity and their desire to stay invested and current maximize shareholder value. These strategic alternatives include a market environments. conversion into an NAV REIT or strategic asset sales. NAV REITs at a Glance Perpetual Life Investment Vehicle Potential enhanced liquidity, up to 20% of equity per year Frequent valuations Lower up-front fees 28

Conclusion What did the Company Accomplish with the Portfolio Sale? The Company has executed on an Sell 27% of its portfolio1 for $1.2 billion Capitalize on the Company’s value-creating core important strategic disposition, while strategy by selling 27% of its portfolio for $1.2 billion generating a gain of over $147 million compared retaining a portfolio of 20 well-located against the cost basis. and high-performing properties valued Create nearly $400 million of net proceeds 1 after required debt paydown that will (i) in excess of $3 billion . This gives the enhance shareholder liquidity and (ii) expand the list of possible strategic alternatives that the Company and its board of directors board can consider. the opportunity to evaluate new Retain a current portfolio of 20 institutional strategies to enhance portfolio value quality properties in key markets that continues to generate strong cash flow to moving forward. support distributions with value growth opportunities as the Company continues to enhance and stabilize the properties. [ 1 ] Based solely on the appraised values as of September 30, 2018 as reflected in the December 2018 estimated share value for the current portfolio of properties following the Portfolio Sale. The appraised values do not take into account estimated disposition costs and fees. 29

Q&A For additional questions, contact KBS Capital Markets Group Investor Relations (866) 527-4264 30

Appendix 31

201 Spear Street San Francisco, CA Key Statistics Current Market Rent/ Weighted-Avg. Lease Rentable SF Leased Occupancy1 In - Place Rent1 Term (Yrs.)1 $85.00 / $71.70 252,591 100.0% 5.7 (18.5% Mark-to-Market) Key Tenants1 Tenant Sq. Ft. % of Property RSF We Work 78,869 31.0% Verizon 42,033 16.6% Circle Internet 21,761 8.6% Recent Leasing Bridge Bank signed a renewal/expansion lease for 14,012 SF, 7 years of term, and $78.0 starting rent psf [ 1 ] As of June 30, 2019. Leased occupancy includes leases that are signed but commencing in future. 32

201 Spear Street San Francisco, CA Asset Attributes Water and Bay Bridge views from most floors, and two outdoor decks Desirable South of Market Street location in the CBD. Two blocks from BART, Transbay Terminal, and the iconic Ferry Building Recently repositioned asset by remodeling common areas like elevator lobbies, corridors, and restrooms, as well as remodeled the lobby and added private tenant lounge, and conference facilities 70% of the tenant improvements are new, modern, creative tech space Market Analysis High barriers to entry • Measure M will severely limit future development. • No new spec office buildings delivering until 2022 Technology companies continue to expand, and the young educated workforce wants to work in San Francisco Asking rents have reached new highs2. [ 2 ] Per Cushman & Wakefield. 33

Towers II & III at Emeryville (Emeryville, CA) Key Statistics Current Market Rent/ Weighted-Avg. Lease Rentable SF Leased Occupancy1 In - Place Rent1 Term (Yrs.)1 $52.80 / $44.50 592,811 84.8% 2.7 (18.7% Mark-to-Market) Key Tenants1 Tenant Sq. Ft. % of Property RSF Gracenote 54,903 9.3% ZipRealty 34,784 5.9% Sutter Health 34,758 5.9% Recent Leasing Regents of CA renewed for 15,038 SF, 5 years of term, and $52.2 starting rent psf. Scientific Certification System renewed early for 23,410 SF, 7 years of term, and $58.2 commencing 5/1/21 [ 1 ] As of June 30, 2019. Leased occupancy includes leases that are signed but commencing in future. 34

Towers II & III at Emeryville (Emeryville, CA) Asset Attributes Waterfront Location – Views of San Francisco’s skyline, San Francisco downtown, the Golden Gate and Bay Bridges, and the Oakland hills Best in class campus setting with new/modern tenant improvements Dedicated transportation to the local BART station, area restaurants, retail stores and hotels. Market Analysis A value proposition, located near the east end of the Bay Bridge, which is becoming home to new creative tech and life science companies • List of companies include: Pixar, Tanium, Novartis, Bayer, Stanford Health Care, Adamas, Amyris, and Zymergen Housing and Retail Nearby • 1,400 new residential units within 0.5 miles of The Towers at Emeryville, and 3,000 new residential units within 3 miles. 35

Ten Almaden (San Jose, CA) Key Statistics Current Market Rent/ Weighted-Avg. Lease Rentable SF Leased Occupancy1 In - Place Rent1 Term (Yrs.)1 $59.40 / $46.30 309,255 93.5% 3.3 (28.2% Mark-to-Market) Key Tenants1 Tenant Sq. Ft. % of Property RSF Adobe 63,254 20.5% Berliner Cohen 43,384 14.0% LWI Financial 42,610 13.8% Recent Leasing Citibank renewed for 6,596 SF, 5 years of term, and $58.2 starting rent psf. Kidder Mathews renewed and expanded for 10,967 SF, 7 years of term, and $51.0 starting rent psf [ 1 ] As of June 30, 2019. Leased occupancy includes leases that are signed but commencing in future. 36

Ten Almaden (San Jose, CA) Asset Attributes Walking distance to Caltrain, Light Rail, and the future Downtown San Jose BART station Less than 3 miles from San Jose’s Norman S. Mineta International Airport Close to vibrant pedestrian-friendly restaurants, hotels, entertainment, and retail options. Market Analysis Downtown undergoing huge redevelopment • Google plans to build up to 8 million square feet of mixed use campus for employees and Adobe is adding 700,000 square feet of office • 17,500 new residential units delivered, under construction, or approved in this cycle • Light rail is being enhanced and expanded with new stations Technology tenants have leased 1 million sq. ft. in downtown in the last 30 months2. Asking rents have increased 16% in the past two years2. [ 2 ] Per Cushman & Wakefield 37

The Almaden (San Jose, CA) Key Statistics Current Market Rent/ Weighted-Avg. Lease Rentable SF Leased Occupancy1 In - Place Rent1 Term (Yrs.)1 $57.00 / $41.40 416,126 99.8% 4.5 (37.6% Mark-to-Market) Key Tenants1 Tenant Sq. Ft. % of Property RSF Zoom Video 73,754 17.7% BridgeBank 51,974 12.5% Samsara Networks 24,353 5.9% Recent Leasing Zoom Video renewed and expanded for a total of 73,754 SF, 9 years of term, and $56 starting rent psf. [ 1 ] As of June 30, 2019. Leased occupancy includes leases that are signed but commencing in future. 38

The Almaden (San Jose, CA) Asset Attributes Walking distance to Caltrain, Light Rail, and the future Downtown San Jose BART station Less than 3 miles from San Jose’s Norman S. Mineta International Airport Close to vibrant pedestrian-friendly restaurants, hotels, entertainment, and retail options. Market Analysis Downtown undergoing huge redevelopment • Google plans to build up to 8 million square feet of mixed use campus for employees and Adobe is adding 700,000 square feet of office • 17,500 new residential units delivered, under construction, or approved in this cycle • Light rail is being enhanced and expanded with new stations Technology tenants have leased 1 million sq. ft. in downtown in the last 30 months2. [ 2 ] Per Cushman & Wakefield 39

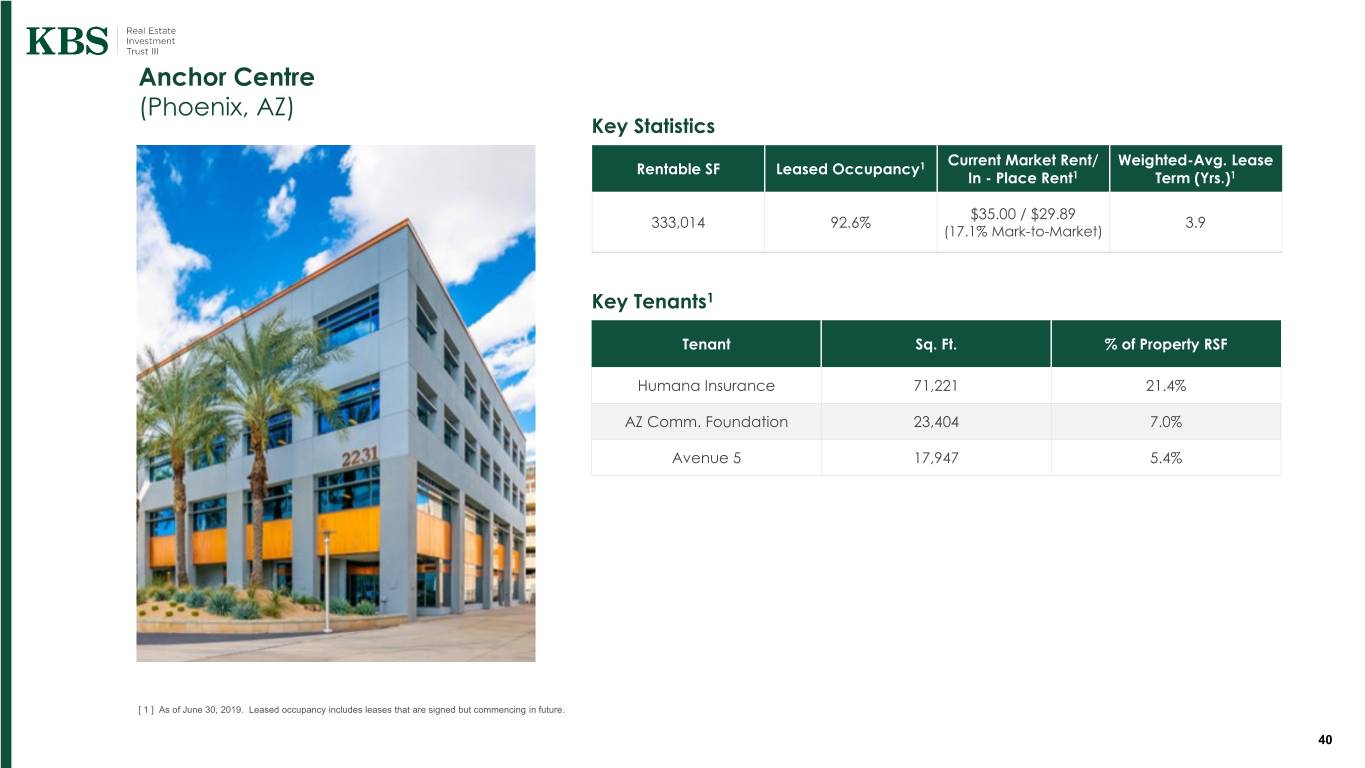

Anchor Centre (Phoenix, AZ) Key Statistics Current Market Rent/ Weighted-Avg. Lease Rentable SF Leased Occupancy1 In - Place Rent1 Term (Yrs.)1 $35.00 / $29.89 333,014 92.6% 3.9 (17.1% Mark-to-Market) Key Tenants1 Tenant Sq. Ft. % of Property RSF Humana Insurance 71,221 21.4% AZ Comm. Foundation 23,404 7.0% Avenue 5 17,947 5.4% [ 1 ] As of June 30, 2019. Leased occupancy includes leases that are signed but commencing in future. 40

Anchor Centre (Phoenix, AZ) Asset Attributes Desirable location as it is in the heart of the Camelback Corridor, just minutes from downtown Phoenix & Scottsdale and a number of walkable retail amenities and hotels. A number of highly utilized amenities, including a spacious tenant lounge & conference center, recently renovated fitness center & locker rooms, and furnished outdoor courtyards. Extensively remodeled plaza area. On-site restaurant and Market Deli. Market Analysis 3.7% in year-over-year job growth in 2018. 1.9% year-over-year population growth in 2018. Rapid corporate expansion in the greater Phoenix area, with over 42 businesses (including 3 corporate headquarters) welcomed to the area equating to over 8,600 jobs in 2018. Projected to be one of the top five growth markets over the next five years due to low cost of living and access to a talented workforce. 41

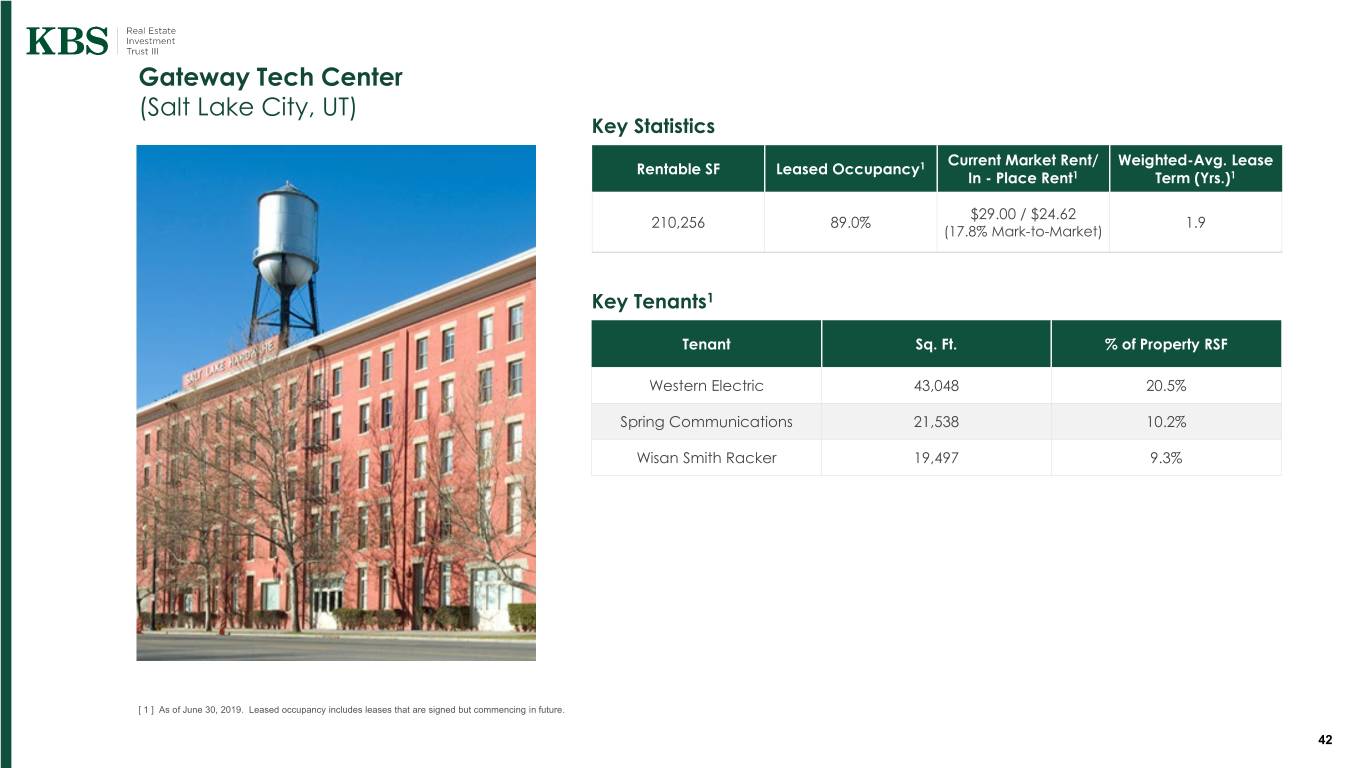

Gateway Tech Center (Salt Lake City, UT) Key Statistics Current Market Rent/ Weighted-Avg. Lease Rentable SF Leased Occupancy1 In - Place Rent1 Term (Yrs.)1 $29.00 / $24.62 210,256 89.0% 1.9 (17.8% Mark-to-Market) Key Tenants1 Tenant Sq. Ft. % of Property RSF Western Electric 43,048 20.5% Spring Communications 21,538 10.2% Wisan Smith Racker 19,497 9.3% [ 1 ] As of June 30, 2019. Leased occupancy includes leases that are signed but commencing in future. 42

Gateway Tech Center (Salt Lake City, UT) Asset Attributes Gateway Tech Center’s creative space buildout is attracting new incoming tech companies. KBS is currently renovating the tenant lounge in the center of the building and adding a state-of-the-art fitness center. Fantastic location with light rail stations directly adjacent to the building, and walking distance to Vivint Arena, Concert venues, SLC Convention Center and hundreds of restaurants and bars. Market Analysis Salt Lake City continues to see extensive job and population growth, achieving a 2.8% unemployment rate, well below the national average. Companies continue expanding in the market, drawn by a young, educated workforce. Goldman Sachs would be one example - from 2003 to 2013, the bank added about 1,800 employees representing 9 of their 11 divisions in Salt Lake City2. Office vacancy continues to drop, which is expected to spur needed development. Asking rates have risen 4.0% year-over-year. [ 2 ] Per CNBC article published Jan. 17, 2014. 43

Hardware Village (Salt Lake City, UT) Key Statistics Rentable SF Leased Occupancy1 478,569 43.80%1 Construction Update – Hardware Village East Construction is expected to be completed by Sept. 30, 2019. Lease-up is expected to finish by Dec. 2020 based on our current forecast. [ 1 ] As of June 30, 2019, and for the 267 units in the West building only since the East building is still under construction. Includes leases that are signed but commencing in future. 44

Hardware Village (Salt Lake City, UT) Asset Attributes Studios, 1- and 2-bedroom apartments, plus two-story townhomes and brownstone row homes. Modern-luxury finishes and resort-style amenities will make this the highest quality apartment complex in the area with studio. Location offers breathtaking views of downtown Salt Lake City and the mountains, and is walking distance to light rail and area attractions. Market Analysis Salt Lake City continues to have high job and population growth, with growth of 3.3% and 2.1%, respectively, in 2018. Downtown has gentrified into a very active and lively scene. Companies continue expanding in the market, drawn by the young, educated workforce. Goldman Sachs would be one example - from 2003 to 2013, the bank added about 1,800 employees representing 9 of their 11 divisions in Salt Lake City2. [ 2 ] Per CNBC article published Jan. 17, 2014. 45

Preston Commons (Dallas, TX) Key Statistics Current Market Rent/ Weighted-Avg. Lease Rentable SF Leased Occupancy1 In - Place Rent1 Term (Yrs.)1 $43.08 / $38.19 427,799 94.8% 1.7 (12.8% Mark-to-Market) Key Tenants1 Tenant Sq. Ft. % of Property RSF JP Morgan Bank 41,906 9.8% KeyBank 18,120 4.2% Regus Mgmt. Group 24,169 5.6% Recent Leasing JP Morgan Bank and KeyBank recently renewed through 2030 Regus is finalizing a lease renewal for 5 years. [ 1 ] As of June 30, 2019. Leased occupancy includes leases that are signed but commencing in future. 46

Preston Commons (Dallas, TX) Asset Attributes Diverse rent roll with distinguished tenant roster, industry diversification, and staggered lease expirations. Company is planning a $12 million modernization to create a best in class, high amenitized work environment, including modernizing the lobbies and ground floor corridors, transforming the exterior courtyards, and building a new conference center and café. Market Analysis One of Dallas’ most highly coveted and sought-after submarkets, surrounded by prestigious neighborhoods and schools and offering upscale retail, dining, hotel, residential and Class A offices. High barriers to entry • Only 1 developable site remaining with height restrictions. 47

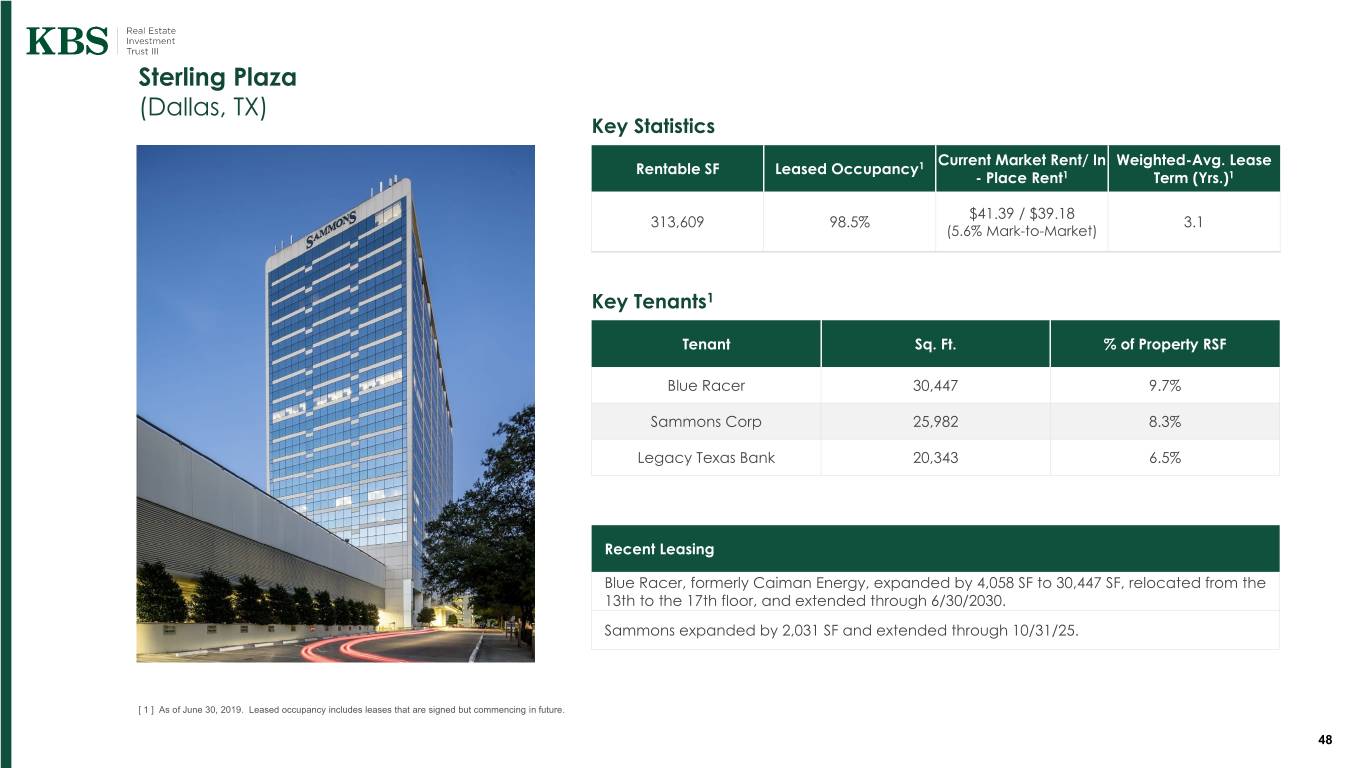

Sterling Plaza (Dallas, TX) Key Statistics Current Market Rent/ In Weighted-Avg. Lease Rentable SF Leased Occupancy1 - Place Rent1 Term (Yrs.)1 $41.39 / $39.18 313,609 98.5% 3.1 (5.6% Mark-to-Market) Key Tenants1 Tenant Sq. Ft. % of Property RSF Blue Racer 30,447 9.7% Sammons Corp 25,982 8.3% Legacy Texas Bank 20,343 6.5% Recent Leasing Blue Racer, formerly Caiman Energy, expanded by 4,058 SF to 30,447 SF, relocated from the 13th to the 17th floor, and extended through 6/30/2030. Sammons expanded by 2,031 SF and extended through 10/31/25. [ 1 ] As of June 30, 2019. Leased occupancy includes leases that are signed but commencing in future. 48

Sterling Plaza (Dallas, TX) Asset Attributes Boutique office building located within a top submarket. Diverse rent roll with multiple tenant industries and staggered lease expirations. Best amenity offerings in submarket: fitness center, conference center, café, and shuttle service. Market Analysis One of Dallas’ most highly coveted and sought-after submarkets, surrounded by prestigious neighborhoods and schools and offering upscale retail, dining, hotel, residential and Class A offices. High barriers to entry • Only 1 developable site remaining with height restrictions. 49

Legacy Town Center (Plano, TX) Key Statistics Current Market Rent/ Weighted-Avg. Lease Rentable SF Leased Occupancy1 In - Place Rent1 Term (Yrs.)1 $40.14 / $36.29 522,043 92.9% 2.8 (10.6% Mark-to-Market) Key Tenants1 Tenant Sq. Ft. % of Property RSF Toyota 54,266 10.4% WeWork 53,766 10.3% Cain, Watters & Assoc 36,549 7.0% Recent Leasing WeWork signed 53,766 SF, 155 month lease. Lockton expanded by 13,601 SF into 26,852 SF and extended through 5/31/28. [ 1 ] As of June 30, 2019. Leased occupancy includes leases that are signed but commencing in future. 50

Legacy Town Center (Plano, TX) Asset Attributes Located in the heart of Legacy, immediate walking proximity to the Shops at Legacy, Marriott Hotel and variety of residences. Amenities include conference center, brand new state of the art fitness and 2nd conference center are under construction, and private shuttle service. Market Analysis2 Dynamic live/work/play neighborhood with a variety of multi-family and high-end residential units, excellent school system, and superior amenities including 80+ retailers/restaurants and 10 hotels • Fastest growing suburban office market for headquarter relocations in U.S. • Largest submarket in Dallas with 20% of the total office inventory, but has captured 61% of the absorption over the last 3 years. Rents have increased 60% over the last 8 years2 [ 2 ] Per Cushman & Wakefield Park Center report dated May 2019. 51

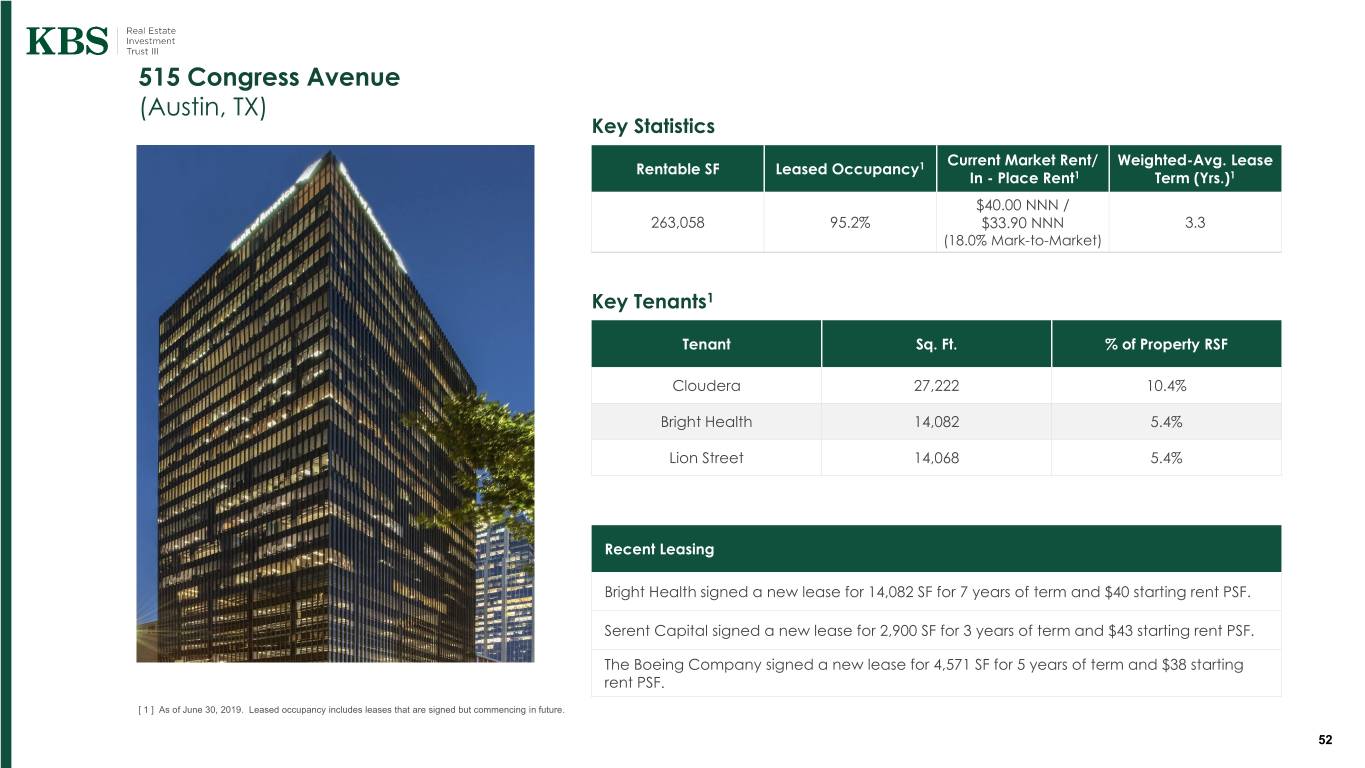

515 Congress Avenue (Austin, TX) Key Statistics Current Market Rent/ Weighted-Avg. Lease Rentable SF Leased Occupancy1 In - Place Rent1 Term (Yrs.)1 $40.00 NNN / 263,058 95.2% $33.90 NNN 3.3 (18.0% Mark-to-Market) Key Tenants1 Tenant Sq. Ft. % of Property RSF Cloudera 27,222 10.4% Bright Health 14,082 5.4% Lion Street 14,068 5.4% Recent Leasing Bright Health signed a new lease for 14,082 SF for 7 years of term and $40 starting rent PSF. Serent Capital signed a new lease for 2,900 SF for 3 years of term and $43 starting rent PSF. The Boeing Company signed a new lease for 4,571 SF for 5 years of term and $38 starting rent PSF. [ 1 ] As of June 30, 2019. Leased occupancy includes leases that are signed but commencing in future. 52

515 Congress Avenue (Austin, TX) Asset Attributes Located on highly sought-after Congress Avenue, with walkable access to some of the most popular restaurants and retail in the city. Full height and continuous windows with efficient rectangular floorplates. Major renovations since acquisition include a full modernization of the elevator system plus cab upgrades, renovated multi-tenant elevator lobbies and corridors, and a full lobby level and façade remodel with a complete overhaul of the ground-floor retail space. Market Analysis Tenant demand has soared as a result of the pro-business climate, educated workforce, and influx of big tech companies seeking to add offices in the “Silicon Hills”. Austin has been the fastest growing city in the US with one-million+ residents for the past 8 years (source: U.S. Census). 53

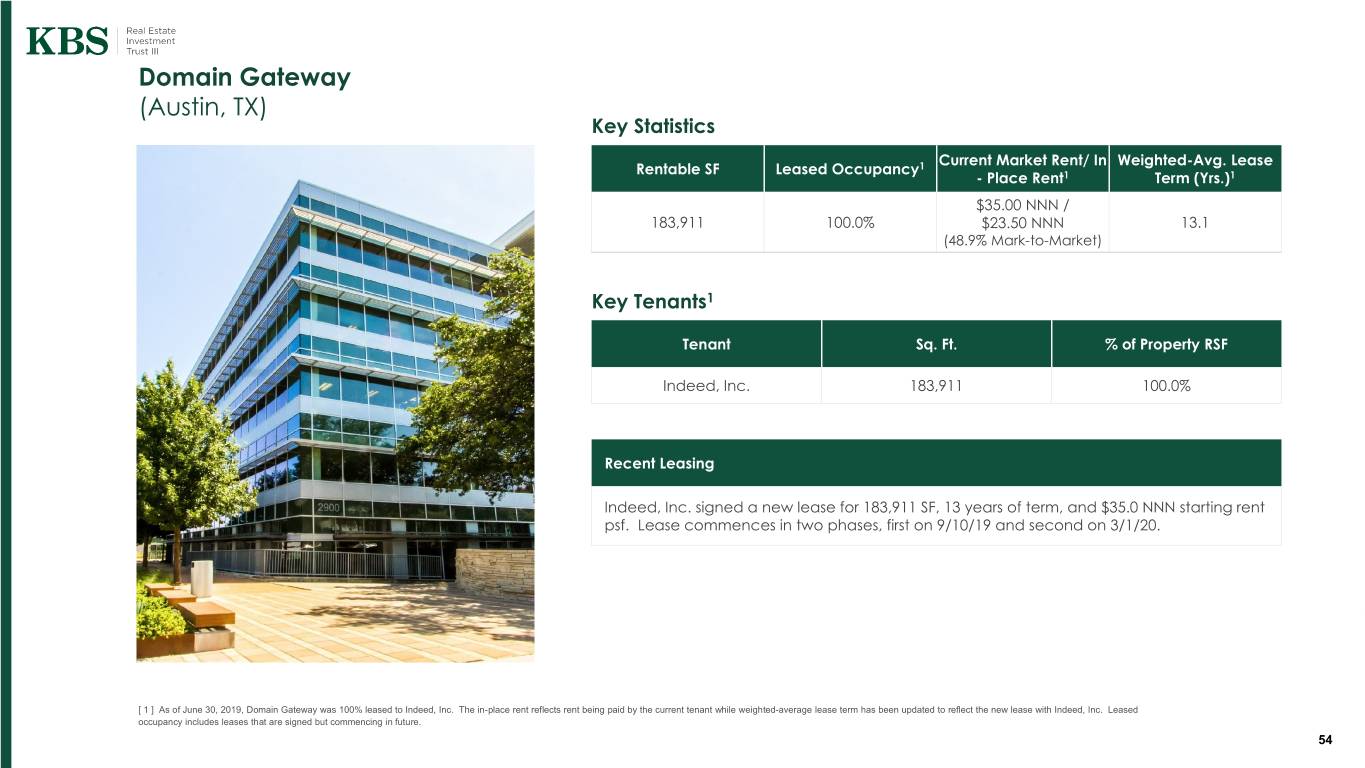

Domain Gateway (Austin, TX) Key Statistics Current Market Rent/ In Weighted-Avg. Lease Rentable SF Leased Occupancy1 - Place Rent1 Term (Yrs.)1 $35.00 NNN / 183,911 100.0% $23.50 NNN 13.1 (48.9% Mark-to-Market) Key Tenants1 Tenant Sq. Ft. % of Property RSF Indeed, Inc. 183,911 100.0% Recent Leasing Indeed, Inc. signed a new lease for 183,911 SF, 13 years of term, and $35.0 NNN starting rent psf. Lease commences in two phases, first on 9/10/19 and second on 3/1/20. [ 1 ] As of June 30, 2019, Domain Gateway was 100% leased to Indeed, Inc. The in-place rent reflects rent being paid by the current tenant while weighted-average lease term has been updated to reflect the new lease with Indeed, Inc. Leased occupancy includes leases that are signed but commencing in future. 54

Domain Gateway (Austin, TX) Asset Attributes Domain Gateway has been 100% leased since KBS acquired the building in 2011. KBS has signed a lease with Indeed, Inc. to lease the entire building for 13 years, which comes with virtually no downtime between leases and increases rents by 48.9%. Indeed, Inc. is expected to invest approximately $150/sf into the building above and beyond their $50/sf allowance. Market Analysis The Domain micro-market continues to be arguably the most sought after location in Austin, where tenant demand has soared as a result of the pro-business climate, educated workforce, and influx of big tech companies seeking to add offices in the “Silicon Hills”. Office cap rates in the North/Domain submarket are estimated at 5.4% and dropping, and over 1.4 Million SF of absorption has occurred in the submarket during 2019 alone2. Austin has been the fastest growing city in the US with one-million+ residents for the past 8 years (source: U.S. Census). [ 2 ] Per CoStar. 55

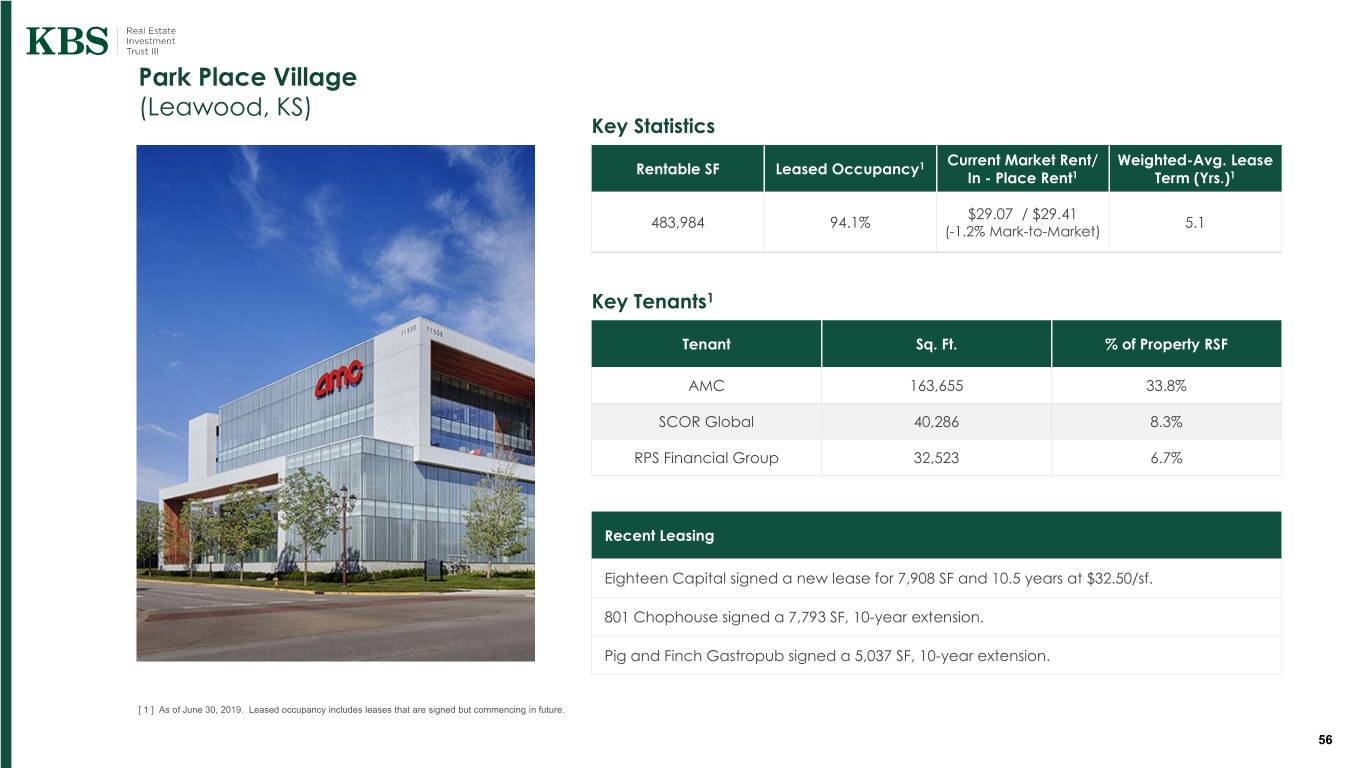

Park Place Village (Leawood, KS) Key Statistics Current Market Rent/ Weighted-Avg. Lease Rentable SF Leased Occupancy1 In - Place Rent1 Term (Yrs.)1 $29.07 / $29.41 483,984 94.1% 5.1 (-1.2% Mark-to-Market) Key Tenants1 Tenant Sq. Ft. % of Property RSF AMC 163,655 33.8% SCOR Global 40,286 8.3% RPS Financial Group 32,523 6.7% Recent Leasing Eighteen Capital signed a new lease for 7,908 SF and 10.5 years at $32.50/sf. 801 Chophouse signed a 7,793 SF, 10-year extension. Pig and Finch Gastropub signed a 5,037 SF, 10-year extension. [ 1 ] As of June 30, 2019. Leased occupancy includes leases that are signed but commencing in future. 56

Park Place Village (Leawood, KS) Asset Attributes Mixed-Use campus featuring a full-service hotel, office, retail and residential. Situated in South Johnson County, Kansas City’s preeminent and most affluent suburban submarket. AMC World Headquarters. Market Analysis 255,591 SF of positive net absorption in Suburban Kansas City vs. just 62,047 SF in downtown. 7.2% rent growth in Kansas City over the past two years. 57

RBC Plaza (Minneapolis, MN) Key Statistics Current Market Rent/ Weighted-Avg. Lease Rentable SF Leased Occupancy1 In - Place Rent1 Term (Yrs.)1 $20.00 NNN / 710,332 97.4% $18.50 NNN 4.3 (8.1% Mark-to-Market) Key Tenants1 Tenant Sq. Ft. % of Property RSF RBC Capital Markets 296,988 41.8% Fish & Richardson 103,861 14.6% Marquette Companies 43,307 6.1% Recent Leasing Global Medical Services signed a new lease for 5,532 SF, 5 years of term, and $20.0 NNN starting rent psf. Tamarack Business Partners signed a new lease for 977 SF, 3 years of term, and $21.0 NNN starting rent psf. [ 1 ] As of June 30, 2019. Leased occupancy includes leases that are signed but commencing in future. 58

RBC Plaza (Minneapolis, MN) Asset Attributes The Asset has undergone extensive renovations since acquisition, including a complete repositioning of the former five-story retail mall that was situated at the base of the 40- story tower above. This included a conversion of two retail floors into creative office and the creation of an amenity floor in addition to a full re-tenanting of the retail offerings on the first two floors of the property. Located in the heart of the CBD and adjacent to the Nicollet Mall Light Rail Station, RBC Plaza’s location is superb and offers tenants a unique combination of walkable amenities, transit access, and skyway connectivity that provides tenants fast, walkable access to nearly anywhere in the CBD. Market Analysis With sub-3% unemployment and almost 48,000 students enrolled at the University of Minnesota (one of multiple higher learning institutions in the area), the Minneapolis MSA is an employment hotbed and is home to 7 of the 12 Fortune 500 companies headquartered in the Twin Cities. Minneapolis is consistently ranked among the highest MSA’s in the U.S. with regard to average levels of education across the workforce and quality of life. 59

Accenture Tower* (Chicago, IL) Key Statistics Current Market Rent/ Weighted-Avg. Lease Rentable SF Leased Occupancy1 In - Place Rent1 Term (Yrs.)1 $28.22 / $26.89 1,457,724 82.0% 7.9 (5.0% Mark-to-Market) Key Tenants1 Tenant Sq. Ft. % of Property RSF Accenture 226,486 15.5% Expedia 113,851 7.8% Industrious 93,059 6.4% Recent Leasing Accenture signed an expansion lease in July 2019, increasing their space to 226,486 SF for 15 years of term. Accenture to make this their U.S. headquarters. Industrious signed an expansion lease, increasing their space to 93,059 SF for 15 years of term. Oppenheimer signed an 11-year renewal to relocate within the building. * Formerly 500 W. Madison. [ 1 ] As of June 30, 2019, but adjusted for the Accenture lease expansion signed in July 2019. Includes leases that are signed but commencing in future. 60

Accenture Tower* (Chicago, IL) Asset Attributes Chicago’s largest Class A, LEED Gold-Certified building, which has twice won “Building of the Year” from The Building Owner and Managers Association. Situated atop Ogilvie Transportation Center, which produces more than 100,000 daily visitors to the property. Highly amenitized with 40+ food and retail options, a full-service gym, conference center, tenant lounge, and bike room. Market Analysis High barriers to entry due to limited land supply. West Loop submarket is preeminent submarket within Chicago, confirmed by the redevelopment of Fulton Market nearby. West Loop accounted for 457,119 SF of positive net absorption in Q2 2019, which is 0.9% of the submarket’s RSF, vs. 0.2% for the entire CBD. * Formerly 500 W. Madison. 61

3003 Washington (Arlington, VA) Key Statistics Current Market Rent/ In Weighted-Avg. Lease Rentable SF Leased Occupancy1 - Place Rent1 Term (Yrs.)1 $52.00 / $55.96 210,804 99.2% 8.6 (-7.1% Mark-to-Market) Key Tenants1 Tenant Sq. Ft. % of Property RSF CNA Corporation 152,414 72.3% The Common Application 22,013 10.4% Keolis America 15,406 7.3% Recent Leasing Smokecraft Clarendon, LLC signed a new lease for 3,450 SF, 10 years of term, and $40.00/SF NNN starting rent. [ 1 ] As of June 30, 2019. Leased occupancy includes leases that are signed but commencing in future. 62

3003 Washington (Arlington, VA) Asset Attributes Built in 2013 and is highest quality office in Clarendon submarket. That, combined with the long-term in-place leases is expected to mitigate any leasing or turnover risk. Located 1 block from the Clarendon Metrorail Station, 3 rail stops from the District of Columbia, and 4 rail stops from the Pentagon. Prominent retailers such as Apple, Whole Foods and Trader Joe’s are within a three block radius. Highly amenitized with a rooftop terrace with a kitchen, fitness center, and 12,186 SF of fully leased retail. Market Analysis High barriers to entry, with very few office development sites available in Arlington and none where the Company’s properties are located in the Clarendon submarket. Clarendon is Northern Virginia’s only true 24-7, live/work/play submarket. Amazon announced plans to build its HQ2 in Arlington, approximately 3 miles from our properties. 63

3001 Washington (Arlington, VA) Key Statistics Current Market Rent/ In Weighted-Avg. Lease Rentable SF Leased Occupancy1 - Place Rent1 Term (Yrs.)1 $52.00 / $51.40 94,837 98.3% 9.1 (1.2% Mark-to-Market) Key Tenants1 Tenant Sq. Ft. % of Property RSF FP1 Strategies 29,849 31.5% HDR Architecture 29,092 30.7% Urban Compass 14,549 15.3% Recent Leasing Lease under negotiation for last vacant space (retail) with Namaste Nail Sanctuary, 1,379 SF, 10 years, $58.00/SF NNN. [ 1 ] As of June 30, 2019. Leased occupancy includes leases that are signed but commencing in future. 64

3001 Washington (Arlington, VA) Asset Attributes Built in 2013 and is highest quality office in Clarendon submarket. That, combined with the long-term in-place leases is expected to mitigate any leasing or turnover risk. Located 1 block from the Clarendon Metrorail Station, 3 rail stops from the District of Columbia, and 4 rail stops from the Pentagon. Prominent retailers such as Apple, Whole Foods and Trader Joe’s are within a three block radius. Highly amenitized with a rooftop terrace with a kitchen, fitness center, and 12,186 SF of fully leased retail. Market Analysis High barriers to entry, with very few office development sites available in Arlington and none where the Company’s properties are located in the Clarendon submarket. Clarendon is Northern Virginia’s only true 24-7, live/work/play submarket. Amazon announced plans to build its HQ2 in Arlington, approximately 3 miles from our properties. 65

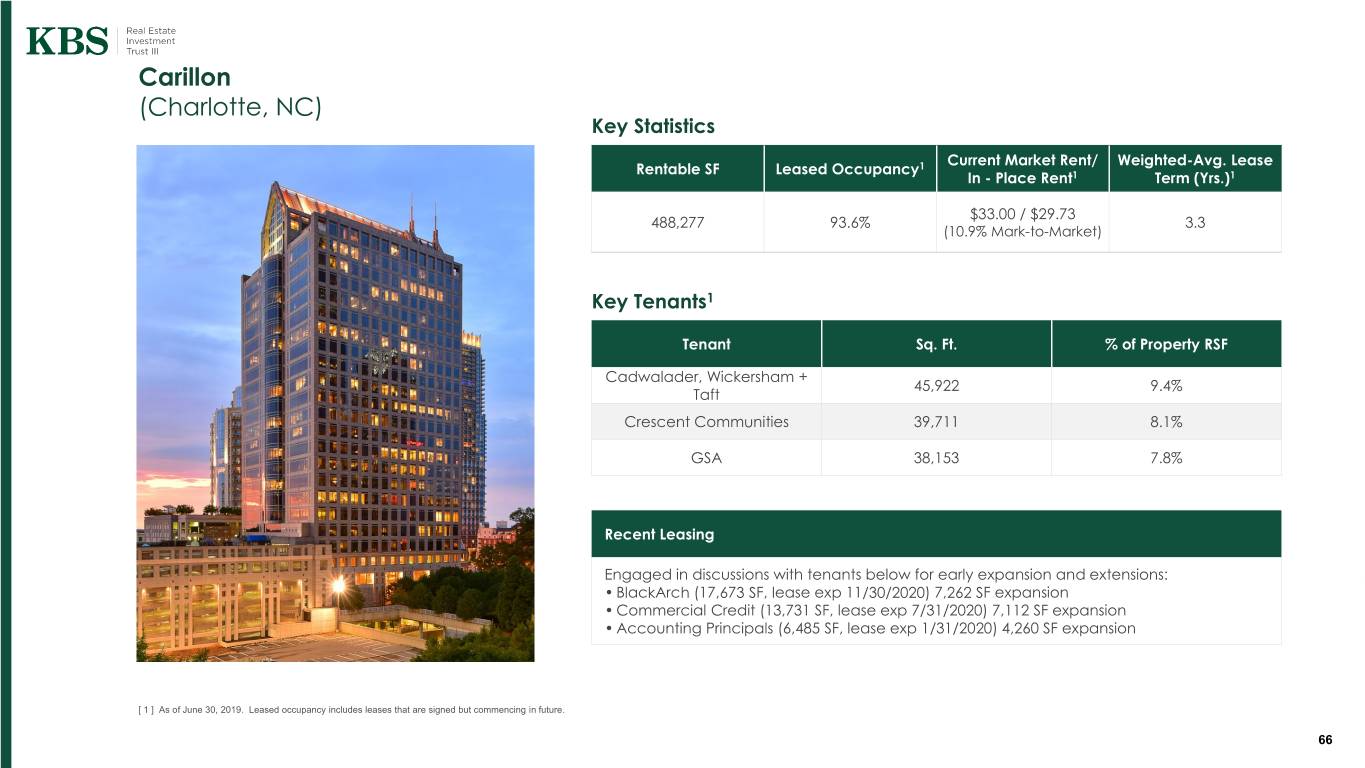

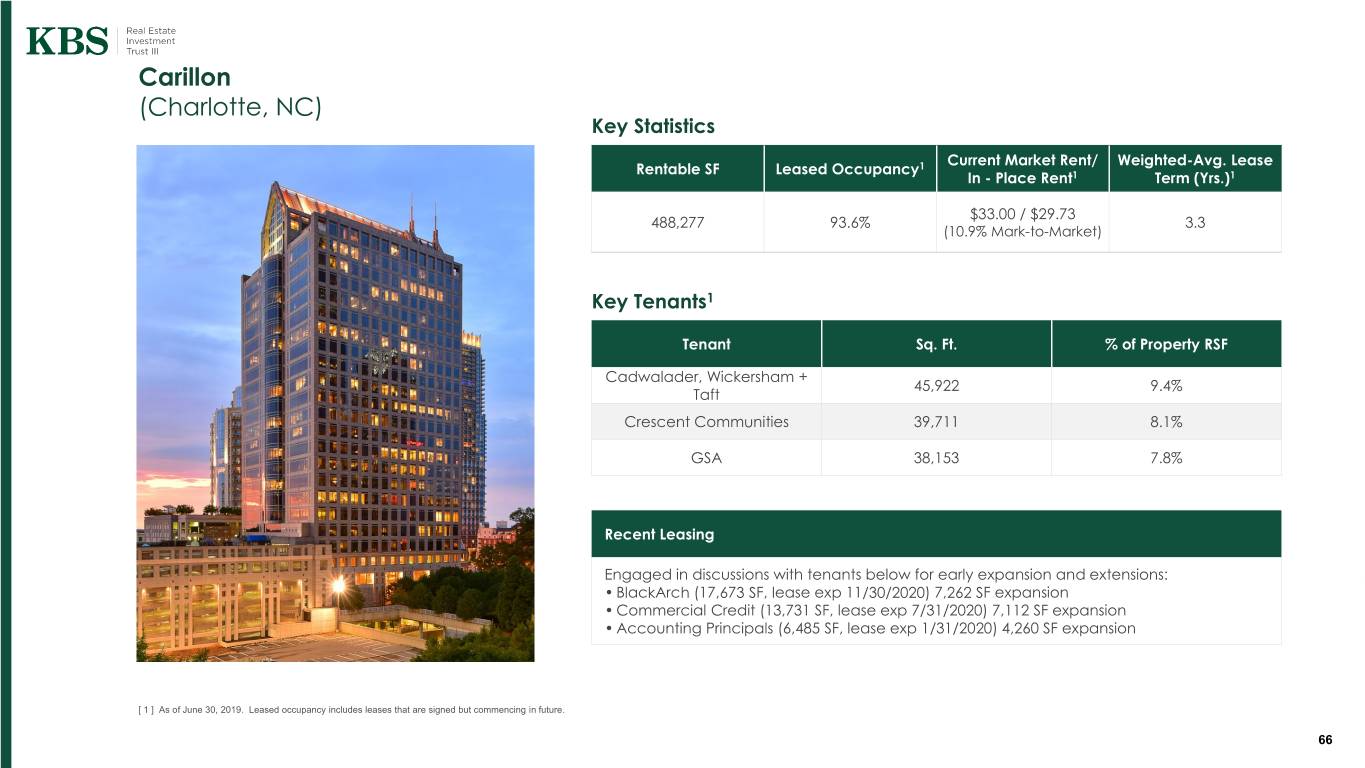

Carillon (Charlotte, NC) Key Statistics Current Market Rent/ Weighted-Avg. Lease Rentable SF Leased Occupancy1 In - Place Rent1 Term (Yrs.)1 $33.00 / $29.73 488,277 93.6% 3.3 (10.9% Mark-to-Market) Key Tenants1 Tenant Sq. Ft. % of Property RSF Cadwalader, Wickersham + 45,922 9.4% Taft Crescent Communities 39,711 8.1% GSA 38,153 7.8% Recent Leasing Engaged in discussions with tenants below for early expansion and extensions: • BlackArch (17,673 SF, lease exp 11/30/2020) 7,262 SF expansion • Commercial Credit (13,731 SF, lease exp 7/31/2020) 7,112 SF expansion • Accounting Principals (6,485 SF, lease exp 1/31/2020) 4,260 SF expansion [ 1 ] As of June 30, 2019. Leased occupancy includes leases that are signed but commencing in future. 66

Carillon (Charlotte, NC) Asset Attributes Well-diversified tenant base. No tenant is greater than 9.4% of the total rentable area, providing excellent rent roll stability. Underway: a $2.25 million new fully-equipped fitness center with locker rooms, boutique fitness classes, and juice bar; target completion Oct 2019. Uptown Charlotte’s newest luxury hotel, the Grand Bohemian, is being developed on site next to the property and scheduled to open Mar 2020. Market Analysis Charlotte’s office market has emerged as a top performer, posting annual rent growth close to 7% each year since 2015. Strong demand for office space has contributed to tightening fundamentals and exceptional job growth. Charlotte grew its tech talent pool at 2nd fastest pace of all 50 markets. 67

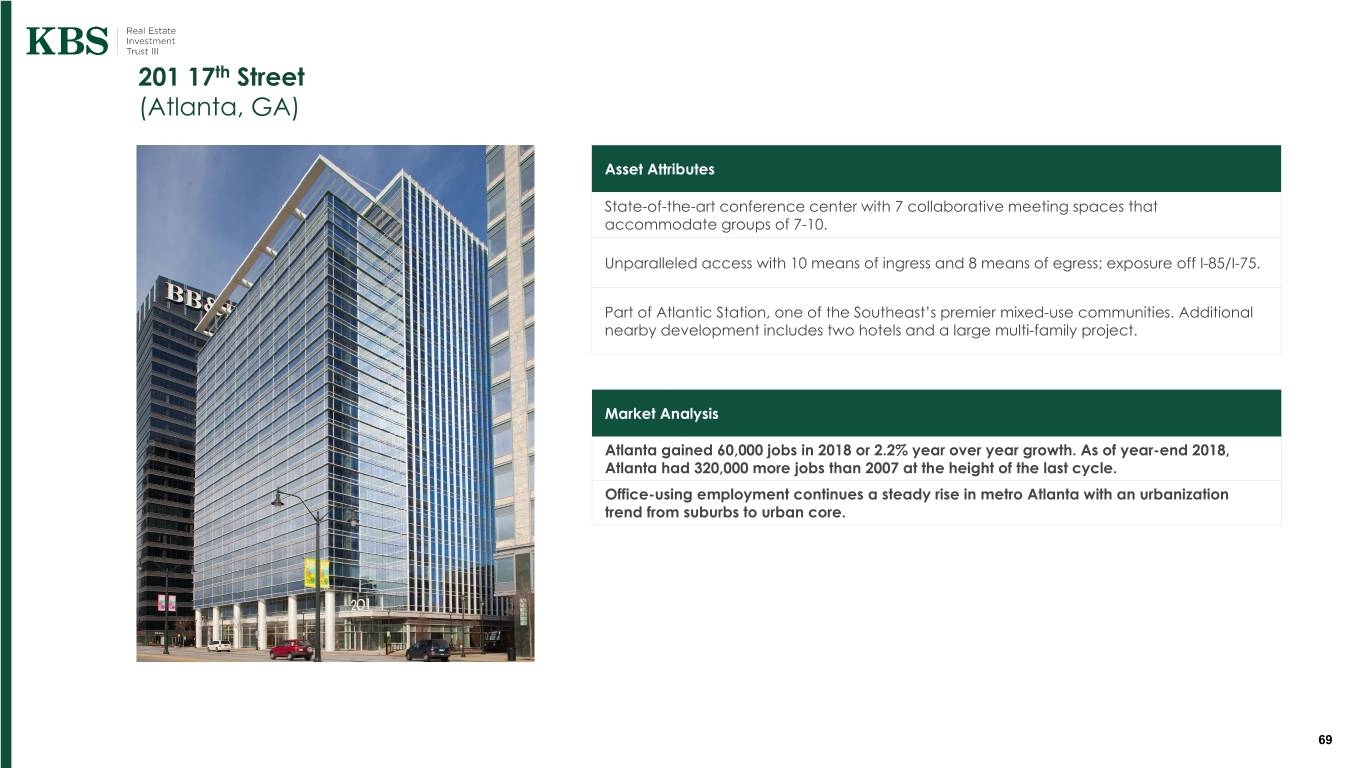

201 17th Street (Atlanta, GA) Key Statistics Current Market Rent/ In Weighted-Avg. Lease Rentable SF Leased Occupancy1 - Place Rent1 Term (Yrs.)1 $37.50 / $36.37 355,870 92.8% 7.3 (3.1% Mark-to-Market) Key Tenants1 Tenant Sq. Ft. % of Property RSF WorldPay US, Inc 130,088 36.5% Nelson Mullins 112,372 31.6% EMA Mgmt. Services 9,122 2.6% Recent Leasing Nelson Mullins (112,372 sf, exp 12/31/28) signed LOI for 5,145 sf expansion starting 1/1/20, $40.25/sf, $20.00 TI. WorldPay (130,088 sf, exp 3/31/27) being acquired by FIS (scheduled close in August) and plans to consolidate to 201 17th Street. Expressed interest in additional space. [ 1 ] As of June 30, 2019. Leased occupancy includes leases that are signed but commencing in future. 68

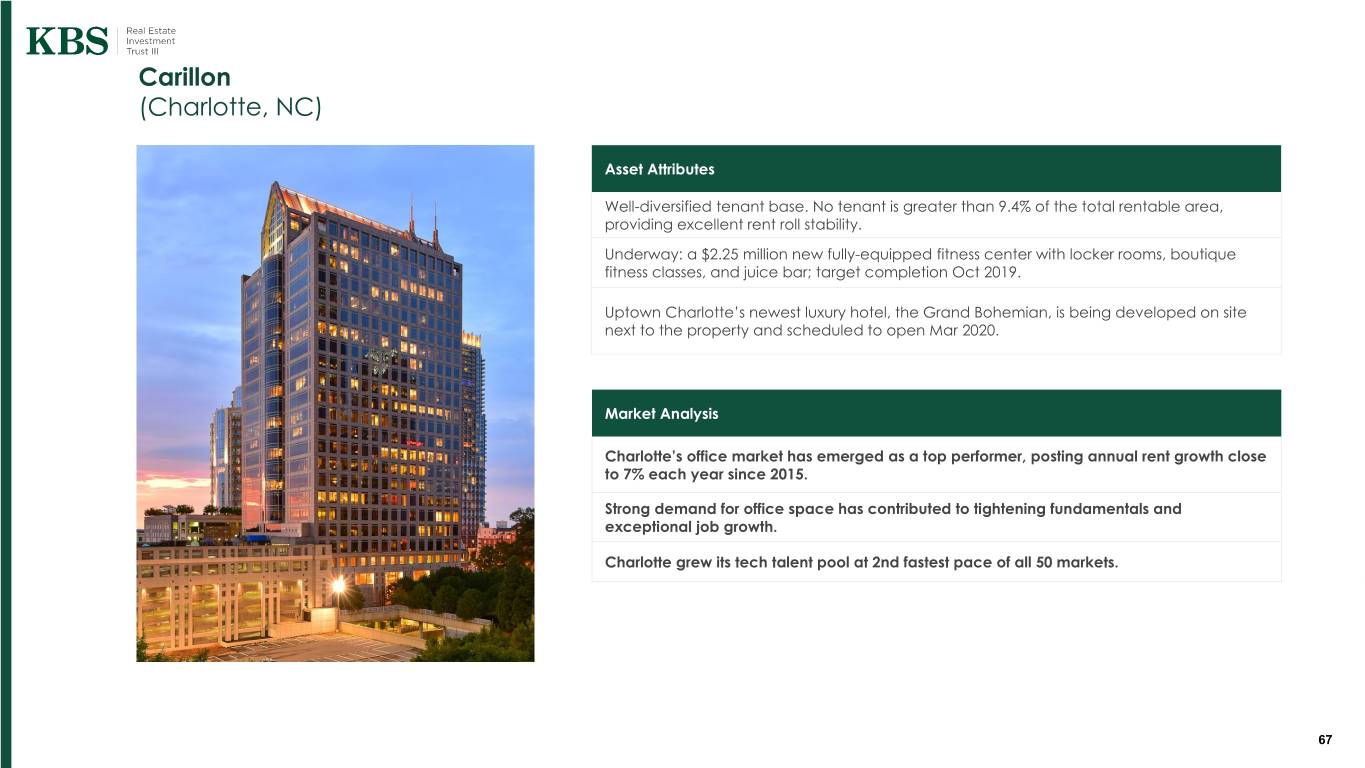

201 17th Street (Atlanta, GA) Asset Attributes State-of-the-art conference center with 7 collaborative meeting spaces that accommodate groups of 7-10. Unparalleled access with 10 means of ingress and 8 means of egress; exposure off I-85/I-75. Part of Atlantic Station, one of the Southeast’s premier mixed-use communities. Additional nearby development includes two hotels and a large multi-family project. Market Analysis Atlanta gained 60,000 jobs in 2018 or 2.2% year over year growth. As of year-end 2018, Atlanta had 320,000 more jobs than 2007 at the height of the last cycle. Office-using employment continues a steady rise in metro Atlanta with an urbanization trend from suburbs to urban core. 69

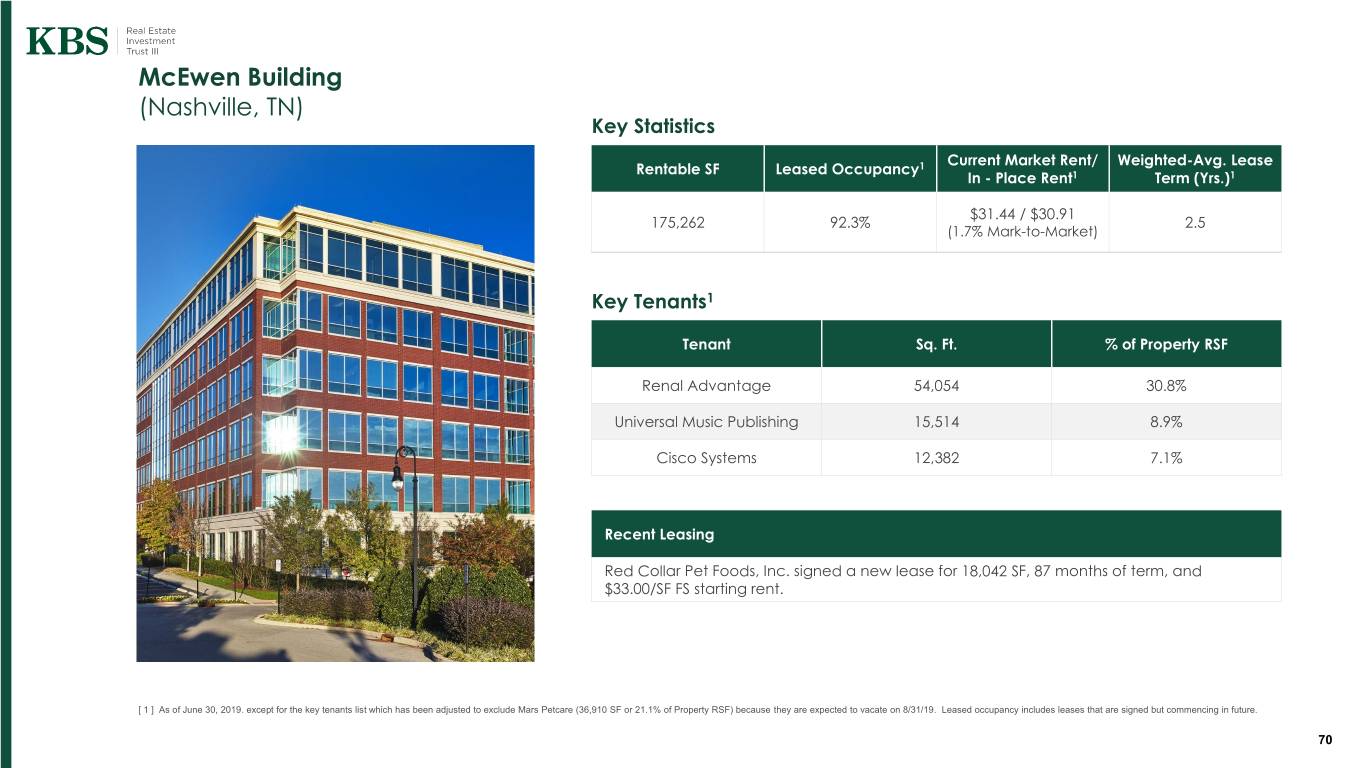

McEwen Building (Nashville, TN) Key Statistics Current Market Rent/ Weighted-Avg. Lease Rentable SF Leased Occupancy1 In - Place Rent1 Term (Yrs.)1 $31.44 / $30.91 175,262 92.3% 2.5 (1.7% Mark-to-Market) Key Tenants1 Tenant Sq. Ft. % of Property RSF Renal Advantage 54,054 30.8% Universal Music Publishing 15,514 8.9% Cisco Systems 12,382 7.1% Recent Leasing Red Collar Pet Foods, Inc. signed a new lease for 18,042 SF, 87 months of term, and $33.00/SF FS starting rent. [ 1 ] As of June 30, 2019. except for the key tenants list which has been adjusted to exclude Mars Petcare (36,910 SF or 21.1% of Property RSF) because they are expected to vacate on 8/31/19. Leased occupancy includes leases that are signed but commencing in future. 70

McEwen Building (Nashville, TN) Asset Attributes Property is positioned as the most attractive building for tenants seeking a Class A, mixed- use, amenity-rich environment, which includes Whole Foods, BrickTops restaurant and in-line retail stores. Within the last five years, The McEwen Building’s average occupancy rate of 96% has demonstrated that there is still a strong on-going demand for highly desirable work spaces. Market Analysis2 Nashville has been one of the nation’s top performers in terms of employment growth since 2010, and this trend is poised to continue. Job growth has been broad based and much of the income growth has been driven by blue-collar employment sectors. Nashville rents will continue to rise due to multiple Class A construction projects targeted to deliver in the CBD, Midtown and Cool Springs/ Franklin submarkets by the beginning of 2020. [ 2 ] Per CoStar. 71