Exhibit 99.1 KBS Real Estate Investment Trust III Portfolio Update Meeting August 23, 2019

The information contained herein should be read in conjunction with, and is qualified by, the information in KBS Real Estate Investment Trust III’s (the “Company” or “KBS REIT III”) Annual Important Report on Form 10-K for the year ended December 31, 2018 (the “Annual Report”), and in the Company’s Quarterly Report on Form 10-Q for the period ended June 30, 2019 (the “Quarterly Disclosures Report”), including the “Risk Factors” contained therein. For a full description of the limitations, methodologies and assumptions used to value the Company’s assets and liabilities in connection with the calculation of the Company’s estimated value per share, see the Company’s Current Report on Form 8-K, filed with the SEC on December 6, 2018. Forward-Looking Statements Certain statements contained herein may be deemed to be forward-looking statements within the meaning of the Federal Private Securities Litigation Reform Act of 1995. The Company intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent, belief or current expectations of the Company and members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should” or similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law. Such statements are subject to known and unknown risks and uncertainties which could cause actual results to differ materially from those contemplated by such forward-looking statements. The Company makes no representation or warranty (express or implied) about the accuracy of any such forward-looking statements. These statements are based on a number of assumptions involving the judgment of management. The Company may fund distributions from any source including, without limitation, from offering proceeds or borrowings. Distributions paid through June 30, 2019 have been funded in part with cash flow from operating activities and debt financing. There are no guarantees that the Company will continue to pay distributions or that distributions at the current rate are sustainable. No assurances can be given with respect to distributions. Actual events may cause the value and returns on the Company’s investments to be less than that used for purposes of the Company’s estimated NAV per share. With respect to the estimated NAV per share, the appraisal methodology used for the appraised properties assumes the properties realize the projected net operating income and expected exit cap rates and that investors would be willing to invest in such properties at yields equal to the expected discount rates. Though the appraisals of the appraised properties, with respect to Duff & Phelps, and the valuation estimates used in calculating the estimated value per share, with respect to Duff & Phelps, the Company’s advisor and the Company, are the respective party’s best estimates as of September 30, 2018, and December 3, 2018, as applicable, the Company can give no assurance in this regard. Even small changes to these assumptions could result in significant differences in the appraised values of the appraised properties and the estimated value per share. Further, the Company can make no assurances with respect to the future value appreciation of its properties and ultimate returns to investors. Stockholders may have to hold their shares for an indefinite period of time. The Company can give no assurance that it will be able to provide additional liquidity to stockholders. Although the board of directors has approved management’s recommendation to explore strategic alternatives for the Company, the Company is not obligated to pursue any particular transaction or any transaction at all. Further, although the Company is exploring strategic alternatives, there is no assurance that this process will provide a return to stockholders that equals or exceeds the Company’s estimated value per share. Even if the board of directors decides to pursue a particular strategy, there is no assurance that the Company will successfully implement its strategy. The statements herein also depend on factors such as: future economic, competitive and market conditions; the Company’s ability to maintain occupancy levels and rental rates at its real estate properties; and other risks identified in Part I, Item IA of the Company’s Annual Report and in Part II, Item IA of the Company’s Quarterly Report. 2

Transactional volume in excess of $39.3 billion1, AUM of $11.4 billion1 and 36.1 million About KBS square feet under management1. Formed by Peter Bren and 8th Largest Office Owner Globally, National Chuck Schreiber in 1992. Real Estate Investor2. Over 26 years of investment Ranked among Top 53 Global Real Estate Investment Managers, Pensions & and management experience Investments3. with extensive long-term investor relationships. Buyer and seller of well-located, yield- generating office and industrial properties. Advisor to public and private pension plans, endowments, foundations, sovereign wealth funds and publicly- registered non-traded REITs. A trusted landlord to thousands of office and 1 As of June 30, 2019. industrial tenants nationwide. 2 The ranking by National Real Estate Investor is based on volume of office space owned globally, as of December 31, 2017. The results were generated from a survey conducted by National Real Estate Investor based on A preferred partner with the nation’s advertising and website promotion of the survey, direct solicitation of responses, direct email to subscribers and other identified office owners and largest lenders. daily newsletter promotion of the survey, all supplemented with a review of public company SEC filings. 3 KBS was ranked #38 on Pensions & Investments List of Largest Real Estate Investment Managers, October 16, 2017. Ranked by total worldwide real A development partner for office, mixed-use estate assets, in millions, as of June 30, 2017. Real estate assets were reported net of leverage, including contributions committed or received, but and multi-family developments. not yet invested 3

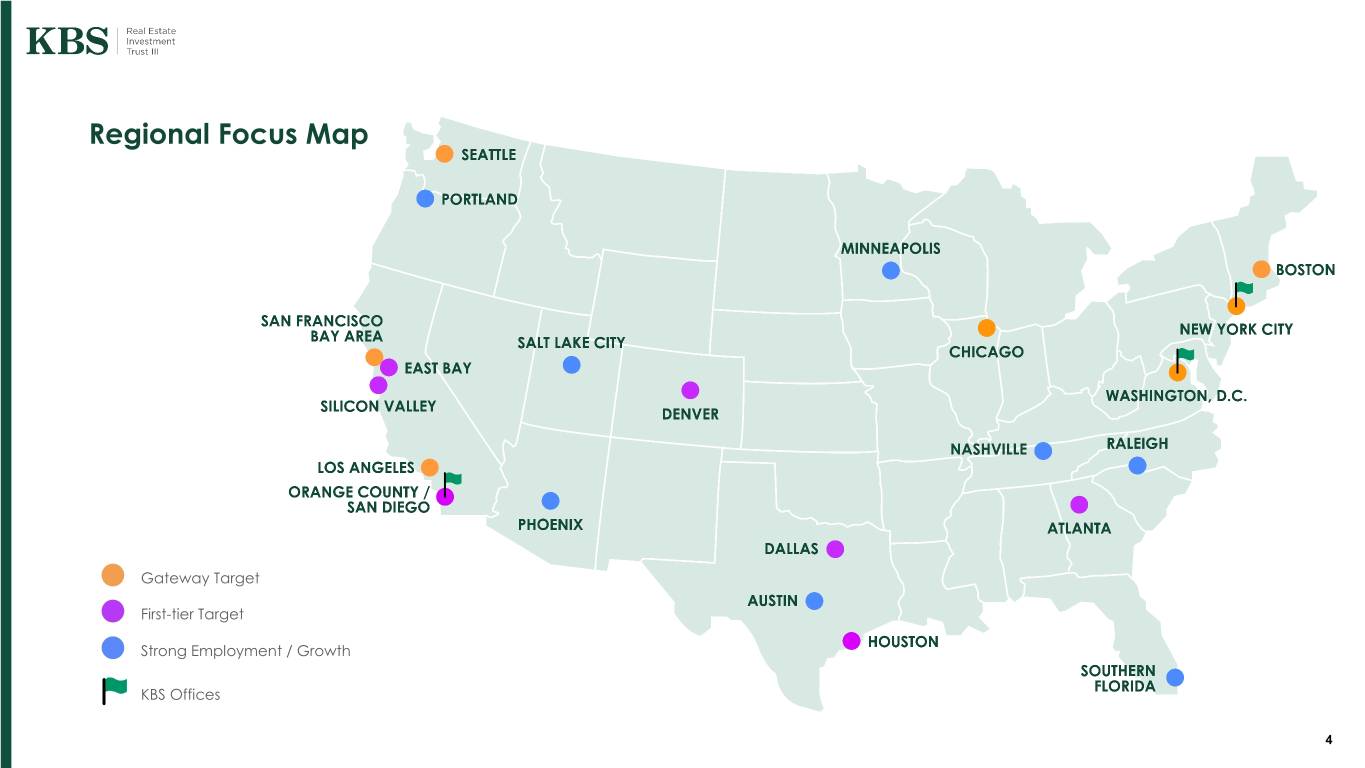

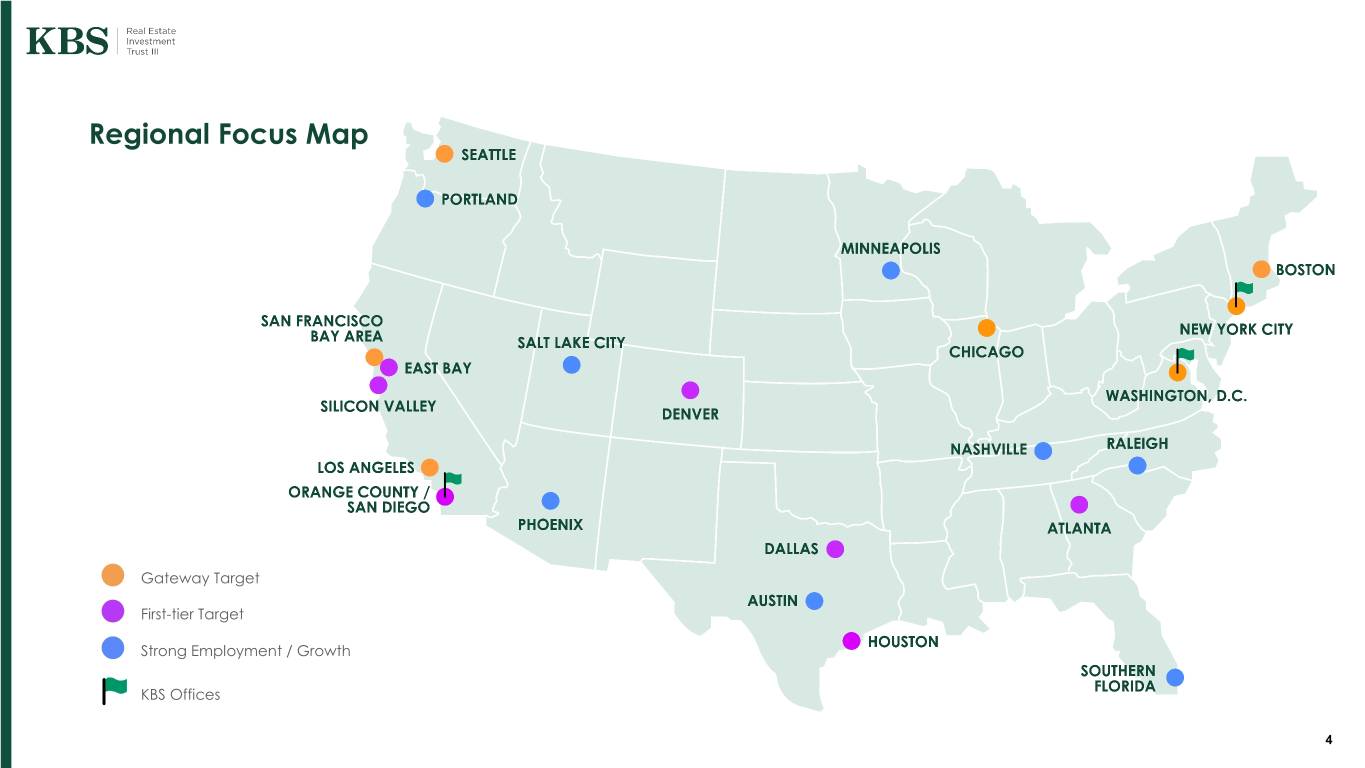

Regional Focus Map Gateway Target First-tier Target Strong Employment / Growth KBS Offices 4

Office Market Update The economy and the national real Strong GDP Growth New Jobs / Month estate market continue to do well. The national real estate market is not 2016 1.6% 2016 195,000 / month behaving like a late cycle market. We have a strong economy, robust 2017 2.3% 2017 182,000 / month tenant demand and slowing new construction. 2018 3.0% 2018 220,000 / month With construction cost rising rapidly because of a lack of labor, rising labor cost, and rising material cost, many new projects are being postponed or cancelled. CBRE had New Office Absorption (increase in occupied office space) projected new deliveries of 65 million square feet in 2018, but only 51 million 2016 39 million square feet square feet were delivered. Such deliveries were well below past peaks 2017 49 million square feet of 76.5 million square feet in 2008 and 110 million square feet in 2001. 2018 60 million square feet 5

Singapore Portfolio Sale 6

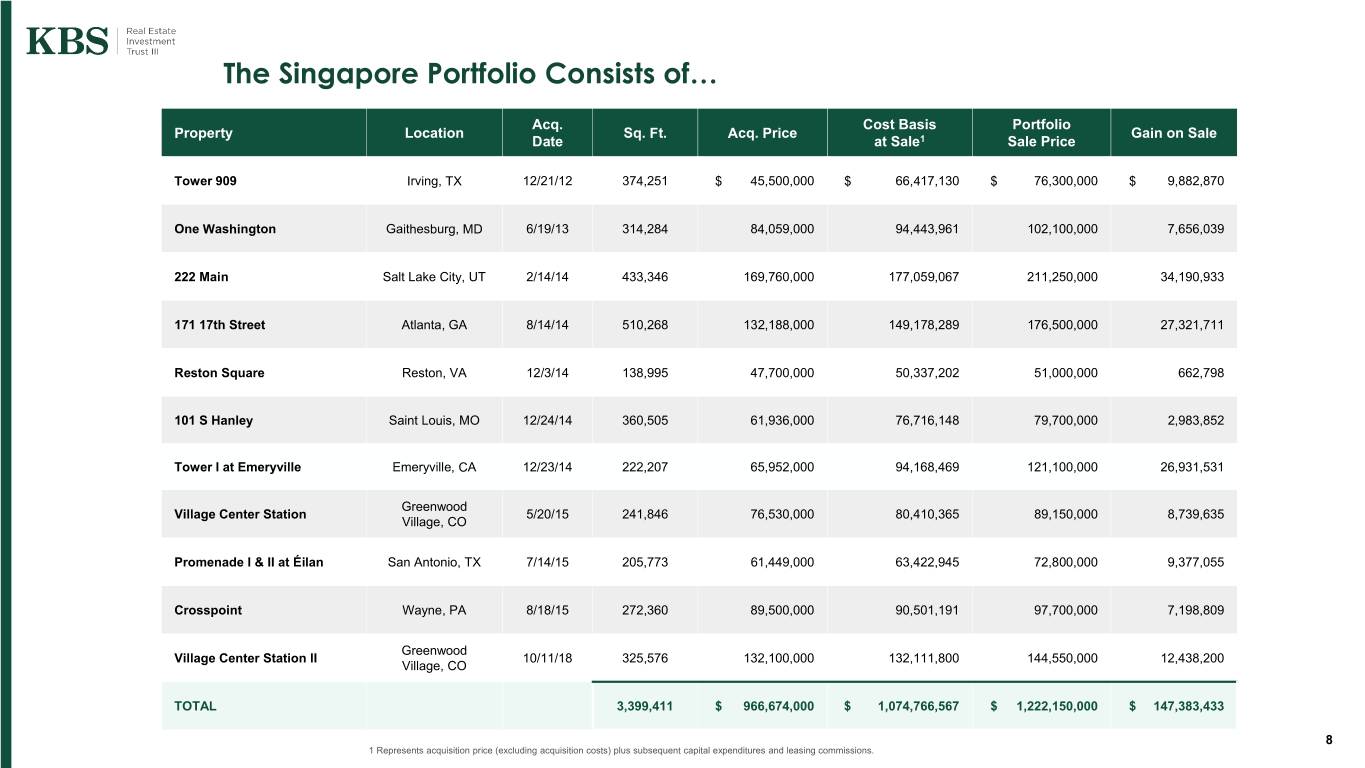

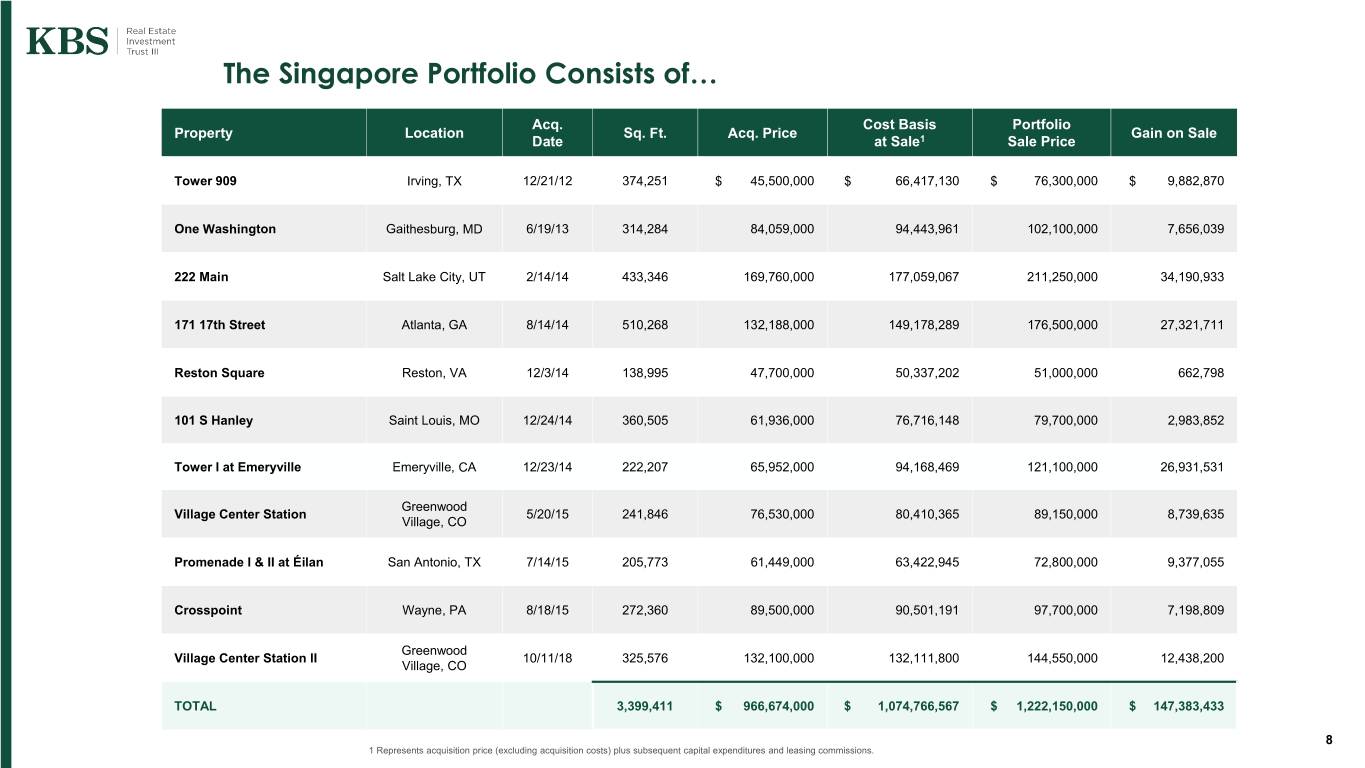

$147.4 million gain over cost basis ON JULY 18, 2019 11 Properties Sold $1.2 Billion Sale Price The sale represents a $0.09 On July 18, 2019, the Company executed a increase per share in the Introduction strategic sale of 11 of its properties (the “Singapore estimated value of the Portfolio”), at a gross sale price of $1.2 billion Singapore Portfolio2 KBS Real Estate Investment (the “Portfolio Sale”), to Prime US REIT which is a newly formed Singapore real estate investment After selling credits, third-party selling costs and Trust III, Inc. (the "Company“) 2 trust (the “SREIT”). disposition fees to the Company’s Advisor has prepared this section of the presentation to summarize the Portfolio Sale, as well as communicate the Company’s The Singapore Portfolio represented $254.8 Million Invested in the SREIT plan for the sales proceeds 27% of the Company’s overall real and its strategic plans going estate portfolio1 As part of the Portfolio Sale, the Company initially forward. invested in $271.0 million of the SREIT’s stock, which The properties were selected primarily based on is publicly traded on the Singapore Stock their higher cash yields and stabilized cash flow with Exchange. This was reduced by $16 million upon a lack of near-term lease rollover. The properties exercise of the over-allotment option. The stock is had been successfully renovated and/or stabilized, subject to lock-ups, with 100% subject to a lock-up creating the value which was anticipated during for six months and 50% subject to a lock-up for one our underwriting. year. 1 Based solely on the appraised values as of September 30, 2018 as reflected in the December 2018 estimated share value. The appraised values do not take into account estimated disposition costs and fees. 2 Calculated by comparing (i) the actual net sale proceeds after third-party selling costs and disposition fees to the Company’s Advisor vs. (ii) the appraised values as of September 30, 2018 plus cap ex from that appraisal date to July 18, 2019. 7

The Singapore Portfolio Consists of… Acq. Cost Basis Portfolio Property Location Sq. Ft. Acq. Price Gain on Sale Date at Sale1 Sale Price Tower 909 Irving, TX 12/21/12 374,251 $ 45,500,000 $ 66,417,130 $ 76,300,000 $ 9,882,870 One Washington Gaithesburg, MD 6/19/13 314,284 84,059,000 94,443,961 102,100,000 7,656,039 222 Main Salt Lake City, UT 2/14/14 433,346 169,760,000 177,059,067 211,250,000 34,190,933 171 17th Street Atlanta, GA 8/14/14 510,268 132,188,000 149,178,289 176,500,000 27,321,711 Reston Square Reston, VA 12/3/14 138,995 47,700,000 50,337,202 51,000,000 662,798 101 S Hanley Saint Louis, MO 12/24/14 360,505 61,936,000 76,716,148 79,700,000 2,983,852 Tower I at Emeryville Emeryville, CA 12/23/14 222,207 65,952,000 94,168,469 121,100,000 26,931,531 Greenwood Village Center Station 5/20/15 241,846 76,530,000 80,410,365 89,150,000 8,739,635 Village, CO Promenade I & II at Éilan San Antonio, TX 7/14/15 205,773 61,449,000 63,422,945 72,800,000 9,377,055 Crosspoint Wayne, PA 8/18/15 272,360 89,500,000 90,501,191 97,700,000 7,198,809 Greenwood Village Center Station II 10/11/18 325,576 132,100,000 132,111,800 144,550,000 12,438,200 Village, CO TOTAL 3,399,411 $ 966,674,000 $ 1,074,766,567 $ 1,222,150,000 $ 147,383,433 8 1 Represents acquisition price (excluding acquisition costs) plus subsequent capital expenditures and leasing commissions.

The Portfolio Sale Generated Proceeds of $413.0 Million Dollars in Thousands Gross Sales Proceeds $ 1,222,150 Seller Credit [1] (10,093) KBS REIT III 31.3% Interest [2] (254,814) Subtotal-Net Sale Price Less 957,243 KBS REIT III Interest Closing Costs, Interest Rate Buydown, (19,893) Advisor Disposition Fee [3] Net Sales Proceeds Before Debt 937,350 Required Debt Repayment (524,377) TOTAL - Net Sales Proceeds $ 412,973 1 Seller credit is for outstanding leasing and capital improvement costs to be paid by the SREIT. 2 Reflects the Company’s equity interest in the SREIT, after the exercise of the over-allotment option. The Company’s equity interest was initially $271.0 million and 33.3%, but this was reduced to $254.8 million and 31.3% after the exercise of the over-allotment option. 99 3 Disposition fee is 1.0% on the net sale price less REIT III’s equity interest after the exercise of the over-allotment option, estimated to be $9.6 million, and is payable to the Company’s Advisor.

Use of Proceeds Recognizing that the Company’s shareholders each have different investment objectives, timelines, and liquidity needs, the Company will consider using net proceeds from the Portfolio Sale for a variety of strategies, including: Expand the Pay a Enhance Debt Paydowns/ 2019 share special future Asset Acquisitions redemption distribution shareholder program liquidity 10

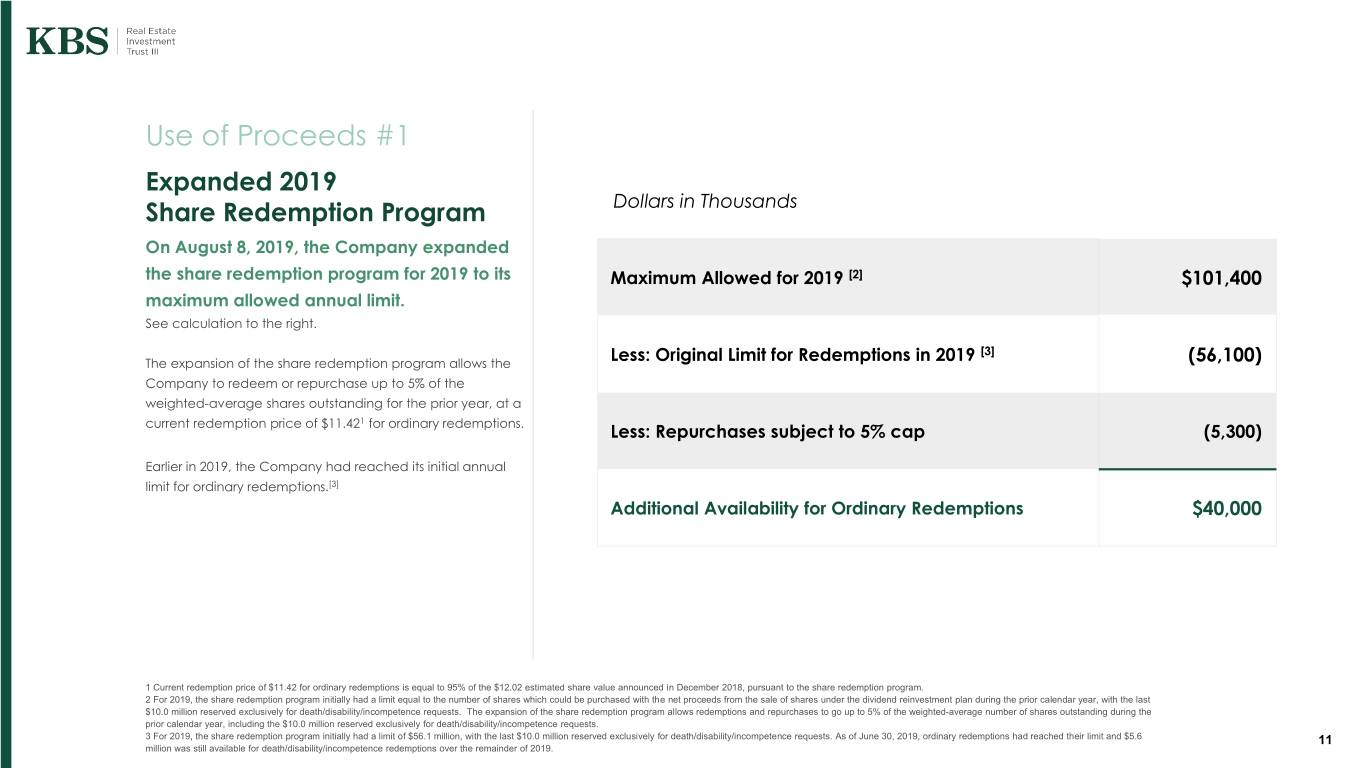

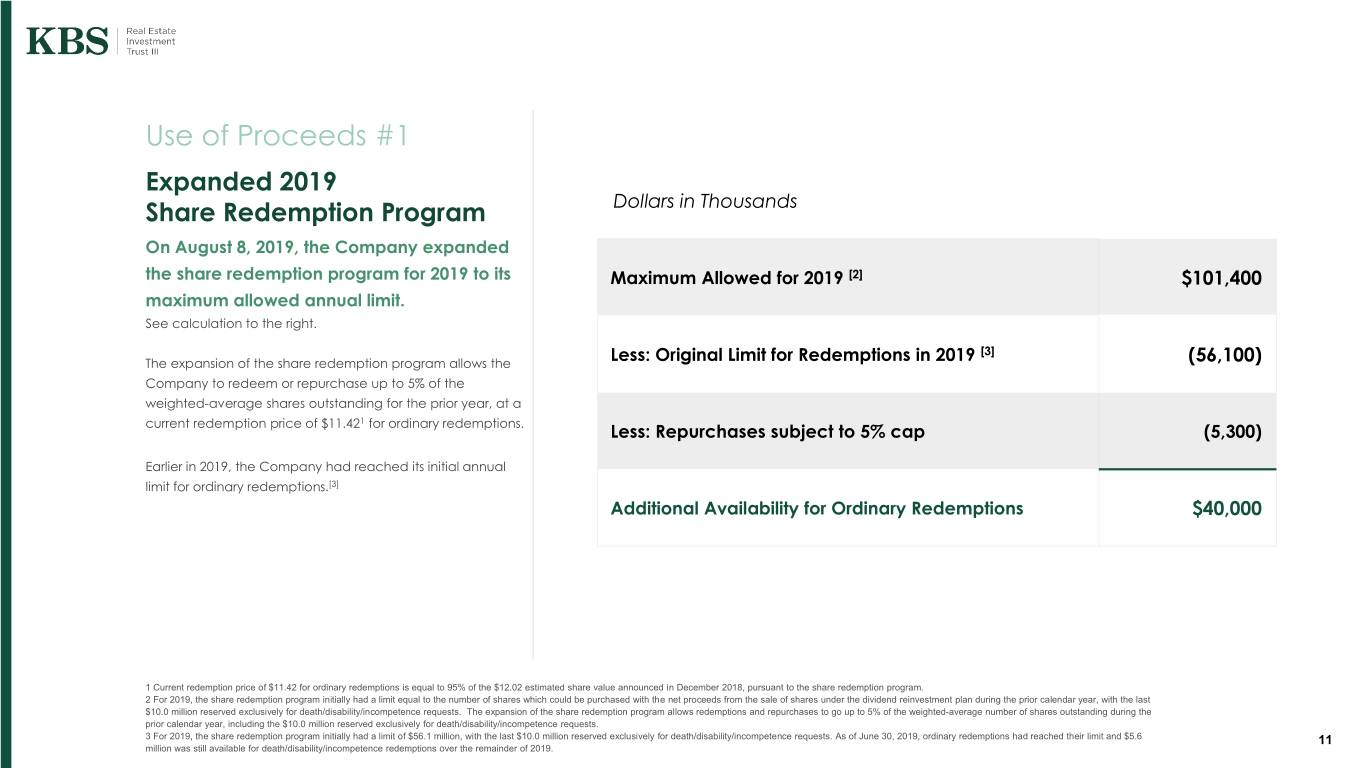

Expanded 2019 Share Redemption Program Dollars in Thousands On August 8, 2019, the Company expanded the share redemption program for 2019 to its Maximum Allowed for 2019 [2] $101,400 maximum allowed annual limit. See calculation to the right. [3] The expansion of the share redemption program allows the Less: Original Limit for Redemptions in 2019 (56,100) Company to redeem or repurchase up to 5% of the weighted-average shares outstanding for the prior year, at a current redemption price of $11.421 for ordinary redemptions. Less: Repurchases subject to 5% cap (5,300) Earlier in 2019, the Company had reached its initial annual limit for ordinary redemptions.[3] Additional Availability for Ordinary Redemptions $40,000 1 Current redemption price of $11.42 for ordinary redemptions is equal to 95% of the $12.02 estimated share value announced in December 2018, pursuant to the share redemption program. 2 For 2019, the share redemption program initially had a limit equal to the number of shares which could be purchased with the net proceeds from the sale of shares under the dividend reinvestment plan during the prior calendar year, with the last $10.0 million reserved exclusively for death/disability/incompetence requests. The expansion of the share redemption program allows redemptions and repurchases to go up to 5% of the weighted-average number of shares outstanding during the prior calendar year, including the $10.0 million reserved exclusively for death/disability/incompetence requests. 3 For 2019, the share redemption program initially had a limit of $56.1 million, with the last $10.0 million reserved exclusively for death/disability/incompetence requests. As of June 30, 2019, ordinary redemptions had reached their limit and $5.6 11 million was still available for death/disability/incompetence redemptions over the remainder of 2019.

Option for shareholders to receive their Special special distribution as cash or additional Distribution common stock The Company will pay a special The special distribution will be in the form of distribution in Q4 2019, once we finalize cash and additional common stock. The the estimate of taxable income. Company plans to give each shareholder a choice of cash or additional common stock, Significant taxable capital gains, subject to a limit on the total cash to be paid which must be distributed. to all shareholders. The sale generated a significant amount of taxable capital gains, and REIT rules require that at least 90% of taxable income (which includes capital gains) be distributed in each year for the Company to maintain its REIT status and avoid paying corporate taxes. 1212

Enhance Future The Company may enhance Shareholder Liquidity future shareholder liquidity by The Company expects to consider Redeem expanding the share redemption whether to retain the remaining program up to the 5% limitation or proceeds to provide additional conduct one or more self-tenders. shareholder liquidity beyond 2019, whether through an expansion of If implemented, the goal would be to the share redemption program or Options allow as many shareholders to redeem one or more self-tenders. who would like to do so, while allowing shareholders who want to remain invested in the Company’s real estate portfolio to be able to do so. Remain Invested 13

Debt Paydowns Debt Paydowns/ Asset Acquisitions Additional paydowns on credit facilities to maximize liquidity for shareholders. To the extent there are still proceeds remaining, the Company would consider using all or a portion of those proceeds for additional debt paydowns or asset Asset Acquisitions acquisitions. Additional asset acquisitions to further our goals of: • generating attractive and stable income following stabilization and • enhancing the total return of the portfolio. 1414

Fund and Portfolio Overview (Post Singapore Portfolio Sale) 15

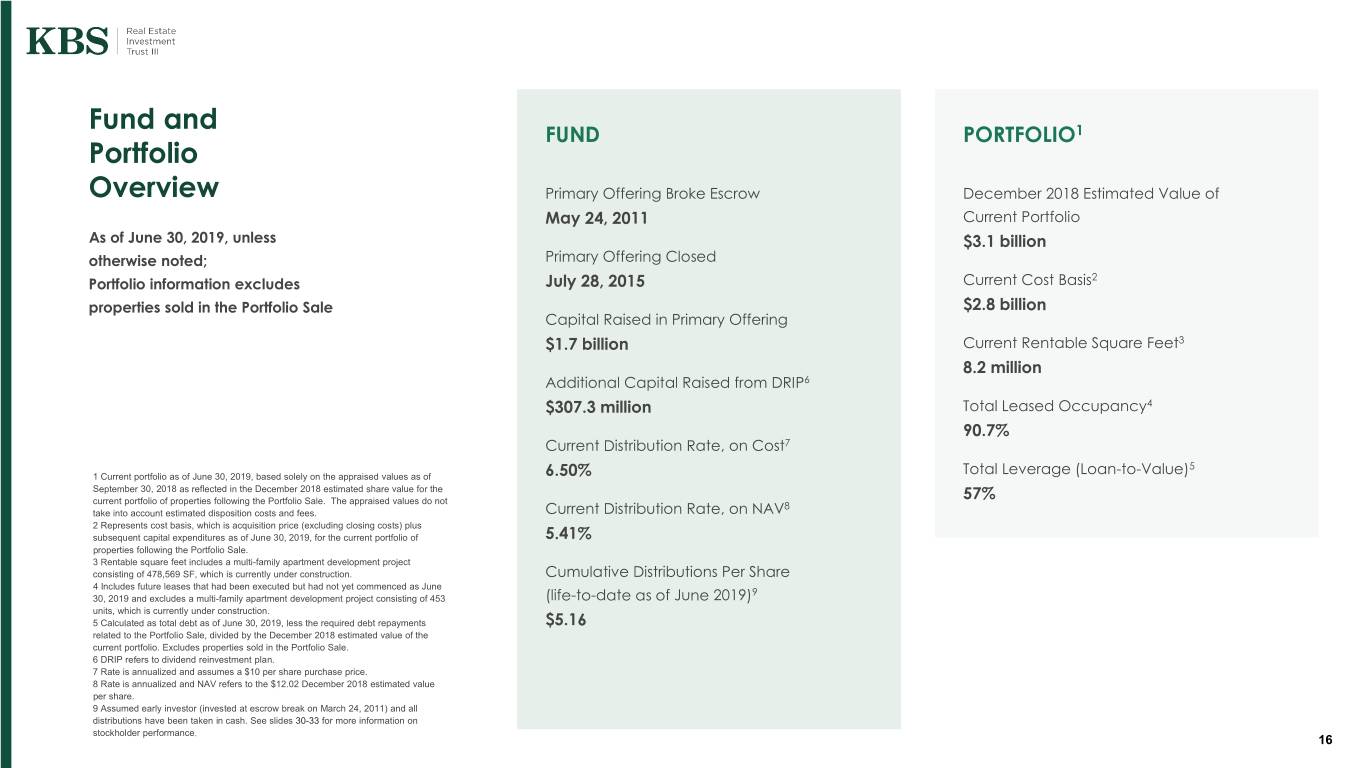

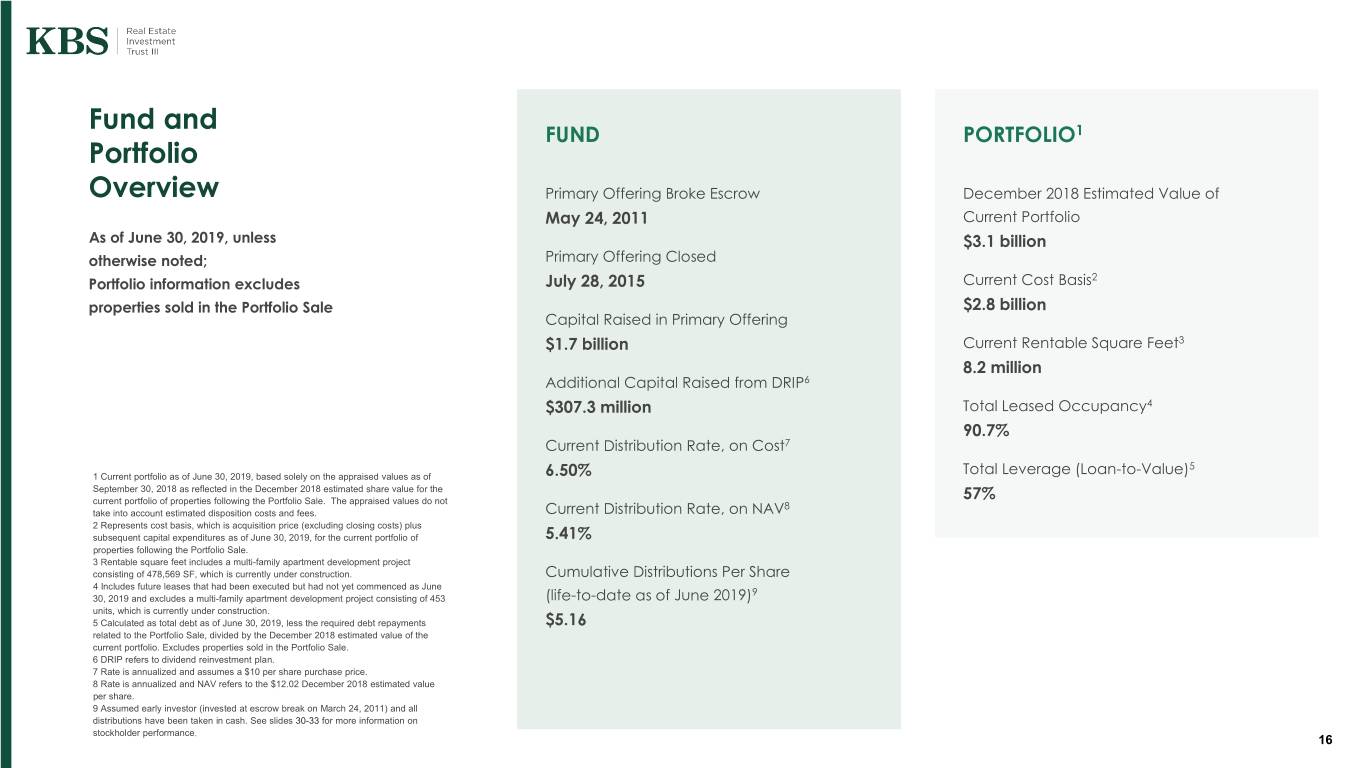

Fund and FUND PORTFOLIO1 Portfolio Overview Primary Offering Broke Escrow December 2018 Estimated Value of May 24, 2011 Current Portfolio As of June 30, 2019, unless $3.1 billion otherwise noted; Primary Offering Closed 2 Portfolio information excludes July 28, 2015 Current Cost Basis properties sold in the Portfolio Sale $2.8 billion Capital Raised in Primary Offering $1.7 billion Current Rentable Square Feet3 8.2 million Additional Capital Raised from DRIP6 $307.3 million Total Leased Occupancy4 90.7% Current Distribution Rate, on Cost7 5 1 Current portfolio as of June 30, 2019, based solely on the appraised values as of 6.50% Total Leverage (Loan-to-Value) September 30, 2018 as reflected in the December 2018 estimated share value for the 57% current portfolio of properties following the Portfolio Sale. The appraised values do not 8 take into account estimated disposition costs and fees. Current Distribution Rate, on NAV 2 Represents cost basis, which is acquisition price (excluding closing costs) plus subsequent capital expenditures as of June 30, 2019, for the current portfolio of 5.41% properties following the Portfolio Sale. 3 Rentable square feet includes a multi-family apartment development project consisting of 478,569 SF, which is currently under construction. Cumulative Distributions Per Share 4 Includes future leases that had been executed but had not yet commenced as June 9 30, 2019 and excludes a multi-family apartment development project consisting of 453 (life-to-date as of June 2019) units, which is currently under construction. 5 Calculated as total debt as of June 30, 2019, less the required debt repayments $5.16 related to the Portfolio Sale, divided by the December 2018 estimated value of the current portfolio. Excludes properties sold in the Portfolio Sale. 6 DRIP refers to dividend reinvestment plan. 7 Rate is annualized and assumes a $10 per share purchase price. 8 Rate is annualized and NAV refers to the $12.02 December 2018 estimated value per share. 9 Assumed early investor (invested at escrow break on March 24, 2011) and all distributions have been taken in cash. See slides 30-33 for more information on stockholder performance. 16

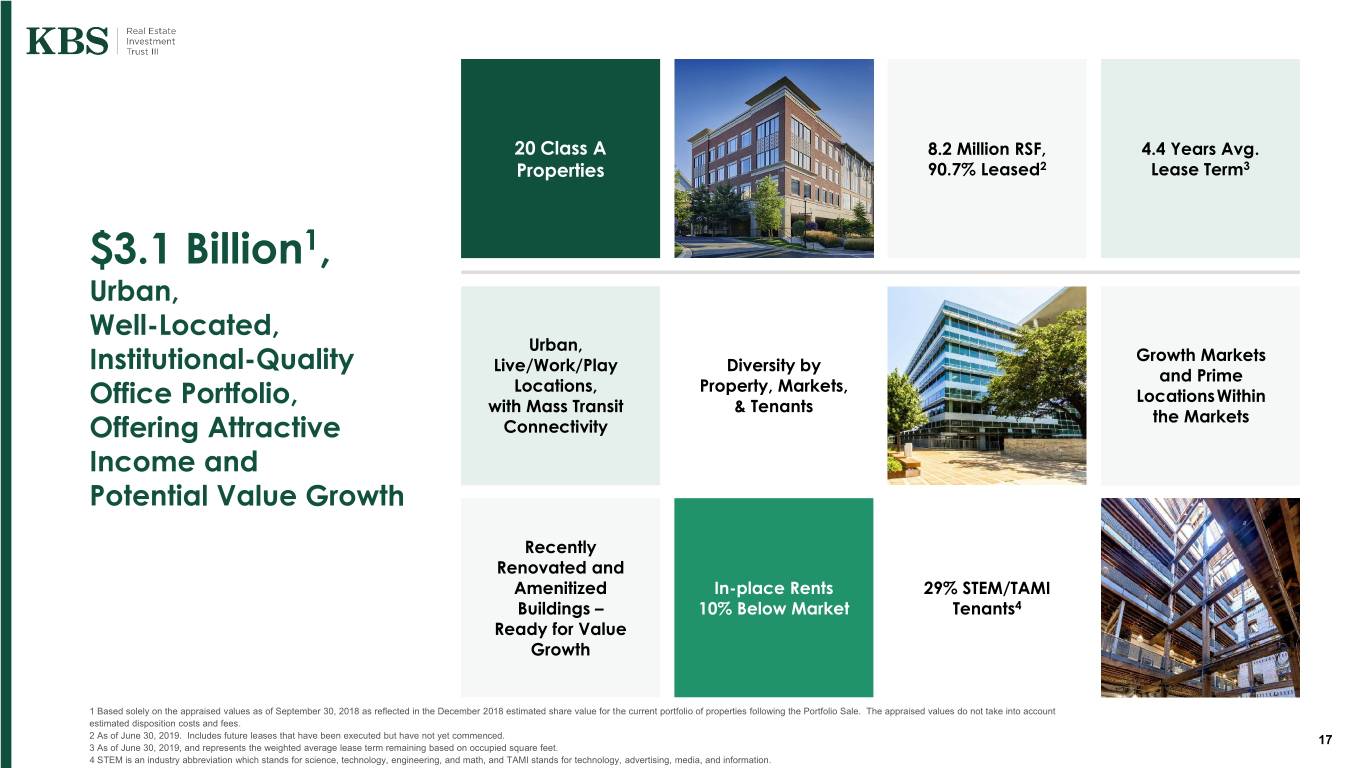

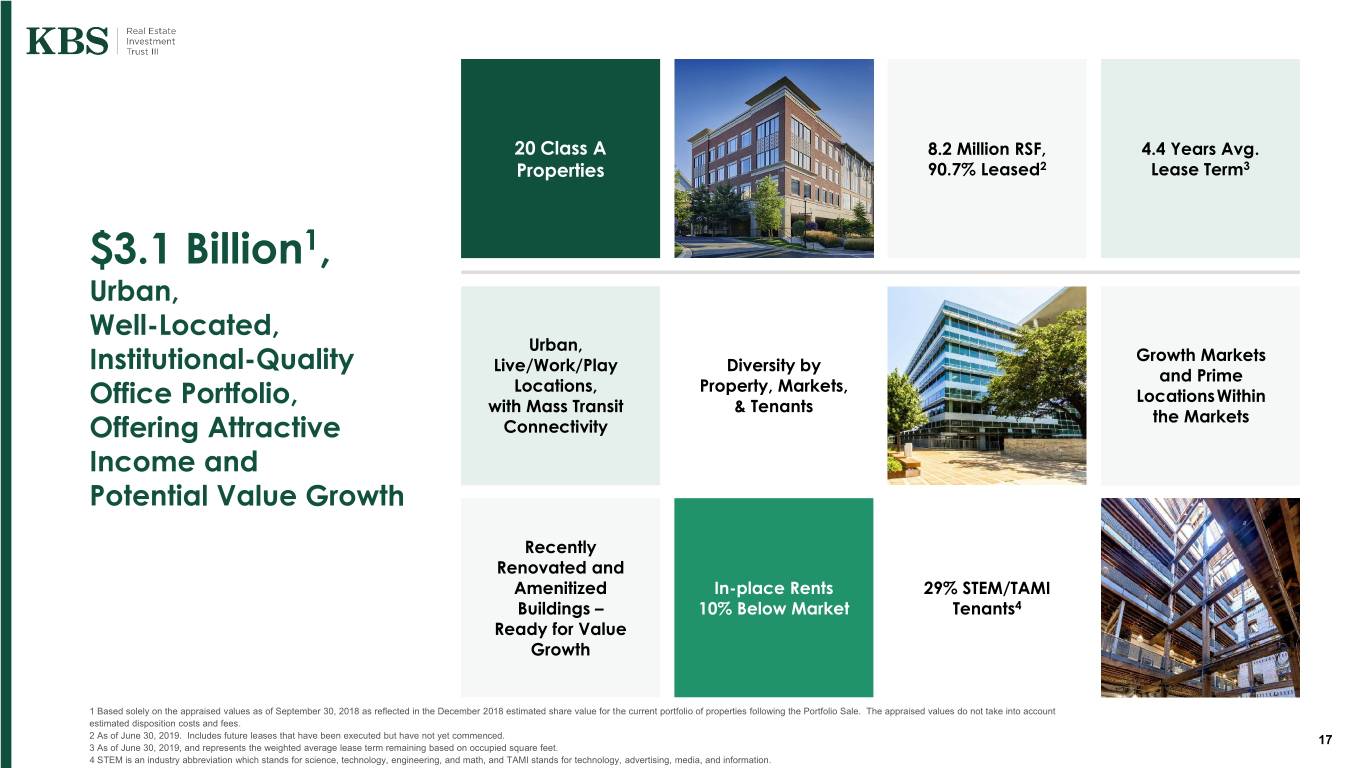

20 Class A 8.2 Million RSF, 4.4 Years Avg. Properties 90.7% Leased2 Lease Term3 $3.1 Billion1, Urban, Well-Located, Urban, Growth Markets Institutional-Quality Live/Work/Play Diversity by and Prime Locations, Property, Markets, LocationsWithin Office Portfolio, with Mass Transit & Tenants the Markets Offering Attractive Connectivity Income and Potential Value Growth Recently Renovated and Amenitized In-place Rents 29% STEM/TAMI Buildings – 10% Below Market Tenants4 Ready for Value Growth 1 Based solely on the appraised values as of September 30, 2018 as reflected in the December 2018 estimated share value for the current portfolio of properties following the Portfolio Sale. The appraised values do not take into account estimated disposition costs and fees. 2 As of June 30, 2019. Includes future leases that have been executed but have not yet commenced. 17 3 As of June 30, 2019, and represents the weighted average lease term remaining based on occupied square feet. 4 STEM is an industry abbreviation which stands for science, technology, engineering, and math, and TAMI stands for technology, advertising, media, and information.

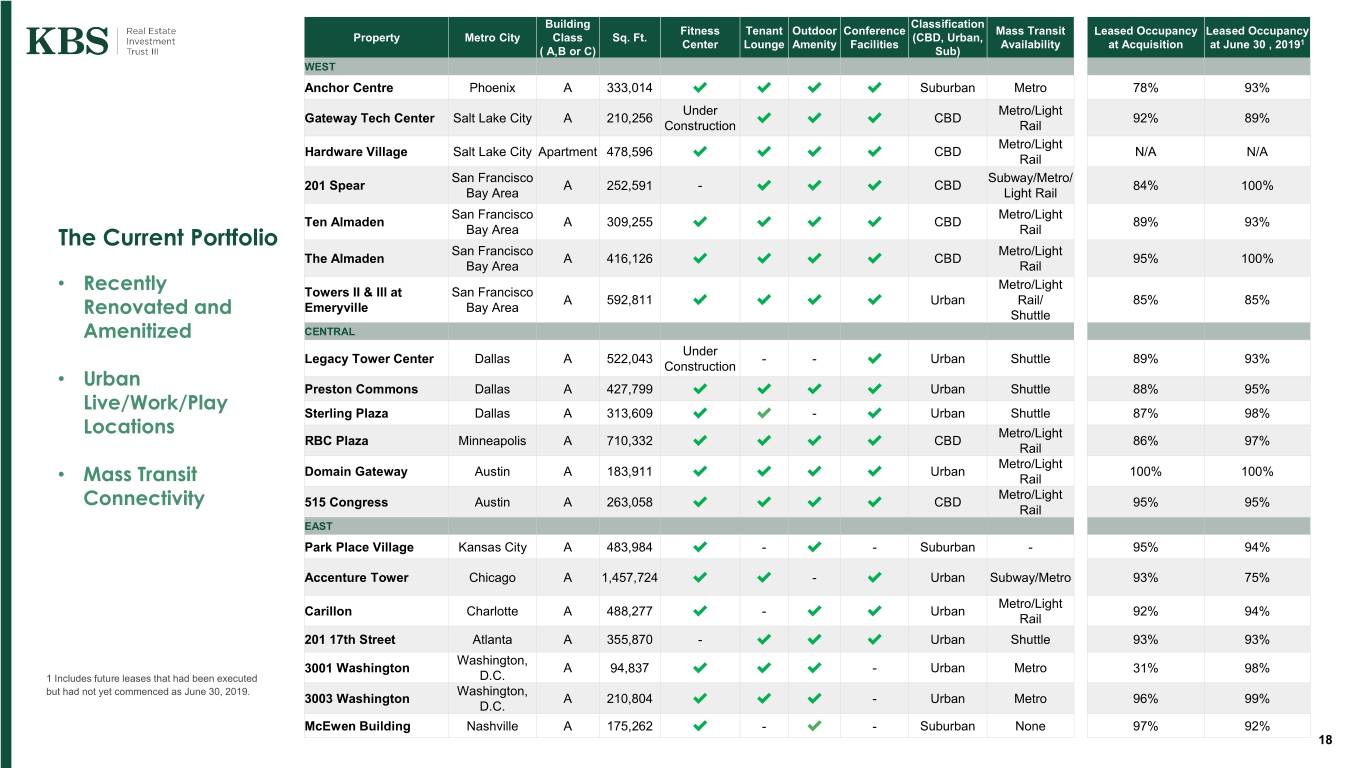

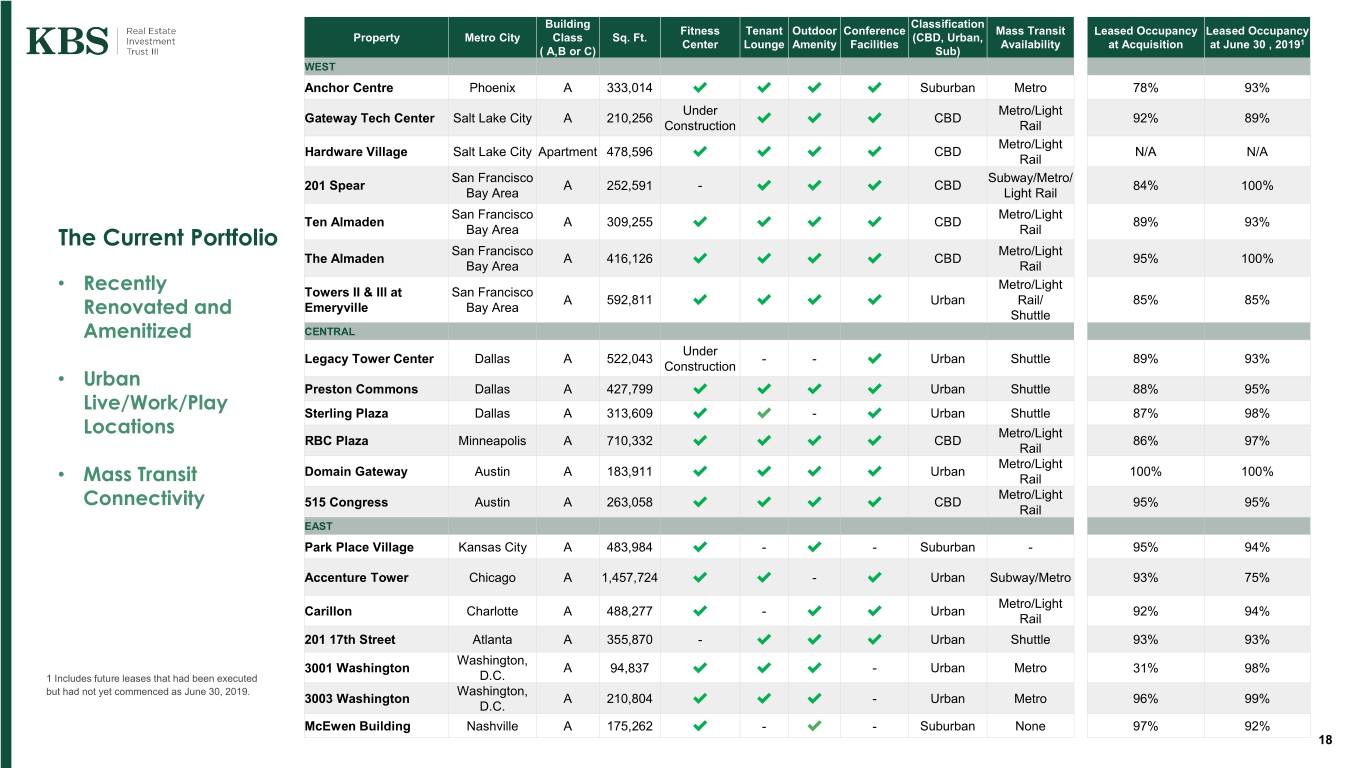

Building Classification Fitness Tenant Outdoor Conference Mass Transit Leased Occupancy Leased Occupancy Property Metro City Class Sq. Ft. (CBD, Urban, Center Lounge Amenity Facilities Availability at Acquisition at June 30 , 20191 ( A,B or C) Sub) WEST Anchor Centre Phoenix A 333,014 ✔ ✔ ✔ ✔ Suburban Metro 78% 93% Under Metro/Light Gateway Tech Center Salt Lake City A 210,256 ✔ ✔ ✔ CBD 92% 89% Construction Rail Metro/Light Hardware Village Salt Lake City Apartment 478,596 ✔ ✔ ✔ ✔ CBD N/A N/A Rail San Francisco Subway/Metro/ 201 Spear A 252,591 - ✔ ✔ ✔ CBD 84% 100% Bay Area Light Rail San Francisco Metro/Light Ten Almaden A 309,255 ✔ ✔ ✔ ✔ CBD 89% 93% The Current Portfolio Bay Area Rail San Francisco Metro/Light The Almaden A 416,126 ✔ ✔ ✔ ✔ CBD 95% 100% Bay Area Rail Metro/Light • Recently Towers II & III at San Francisco A 592,811 ✔ ✔ ✔ ✔ Urban Rail/ 85% 85% Emeryville Bay Area Renovated and Shuttle Amenitized CENTRAL Under Legacy Tower Center Dallas A 522,043 - - ✔ Urban Shuttle 89% 93% Construction Urban • Preston Commons Dallas A 427,799 ✔ ✔ ✔ ✔ Urban Shuttle 88% 95% Live/Work/Play Sterling Plaza Dallas A 313,609 ✔ ✔ - ✔ Urban Shuttle 87% 98% Locations Metro/Light RBC Plaza Minneapolis A 710,332 ✔ ✔ ✔ ✔ CBD 86% 97% Rail Metro/Light Domain Gateway Austin A 183,911 ✔ ✔ ✔ ✔ Urban 100% 100% • Mass Transit Rail Metro/Light Connectivity 515 Congress Austin A 263,058 ✔ ✔ ✔ ✔ CBD 95% 95% Rail EAST Park Place Village Kansas City A 483,984 ✔ - ✔ - Suburban - 95% 94% Accenture Tower Chicago A 1,457,724 ✔ ✔ - ✔ Urban Subway/Metro 93% 75% Metro/Light Carillon Charlotte A 488,277 ✔ - ✔ ✔ Urban 92% 94% Rail 201 17th Street Atlanta A 355,870 - ✔ ✔ ✔ Urban Shuttle 93% 93% Washington, 3001 Washington A 94,837 ✔ ✔ ✔ - Urban Metro 31% 98% 1 Includes future leases that had been executed D.C. but had not yet commenced as June 30, 2019. Washington, 3003 Washington A 210,804 ✔ ✔ ✔ - Urban Metro 96% 99% D.C. McEwen Building Nashville A 175,262 ✔ - ✔ - Suburban None 97% 92% 18

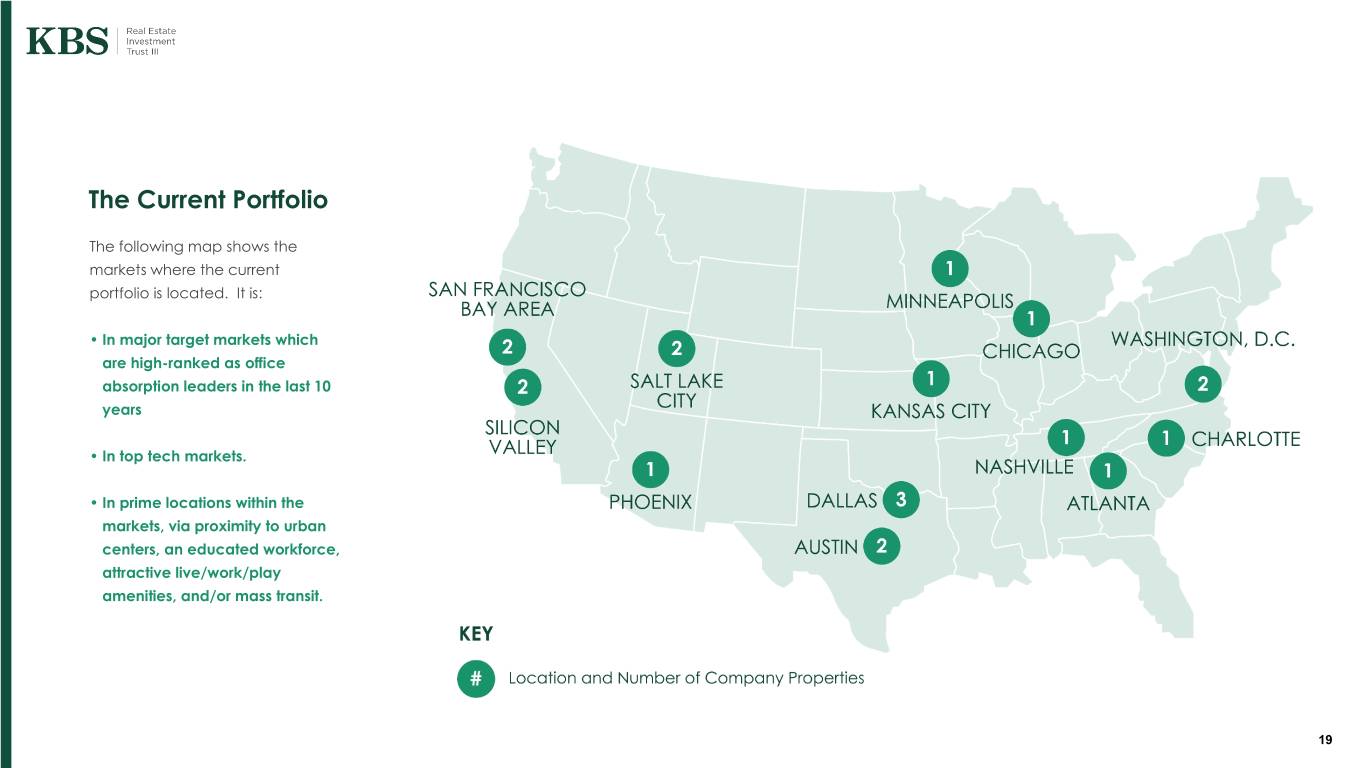

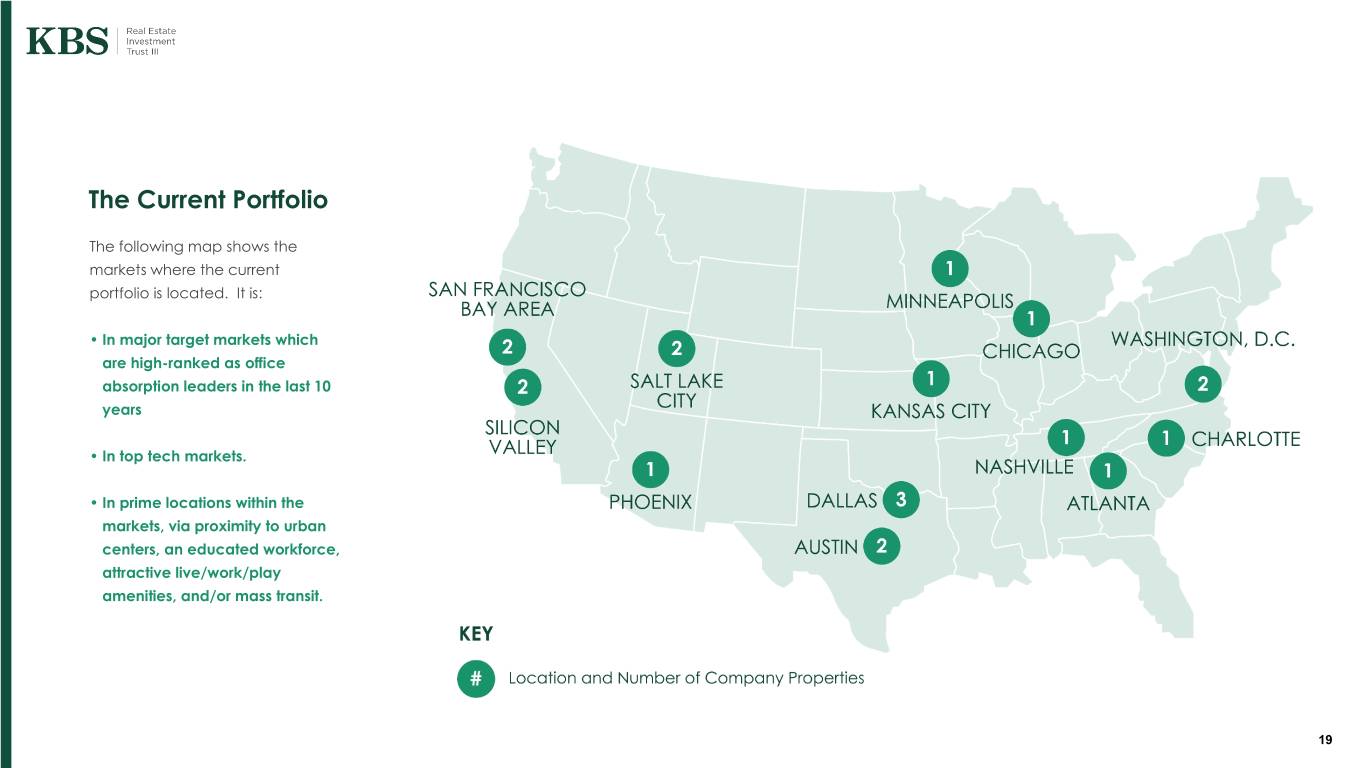

The Current Portfolio The following map shows the markets where the current portfolio is located. It is: • In major target markets which are high-ranked as office absorption leaders in the last 10 years • In top tech markets. • In prime locations within the markets, via proximity to urban centers, an educated workforce, attractive live/work/play amenities, and/or mass transit. 19

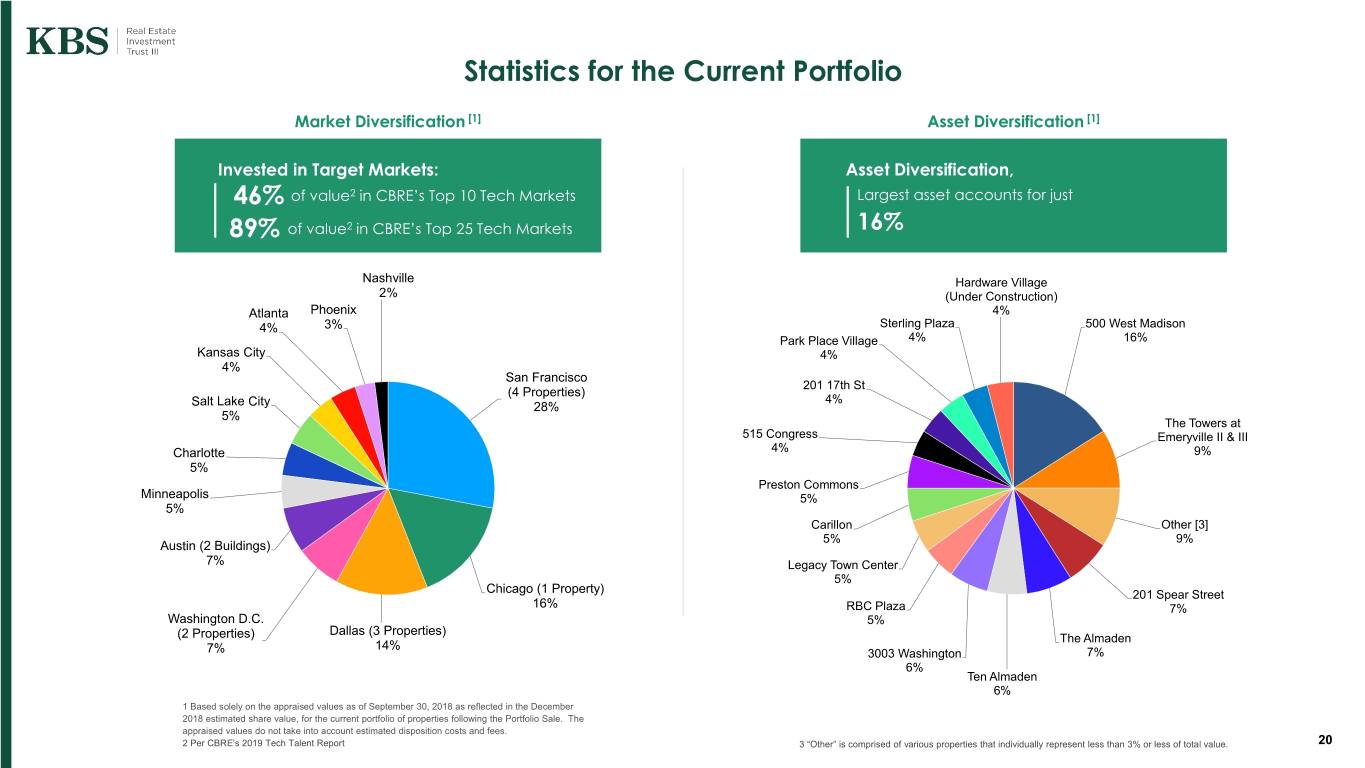

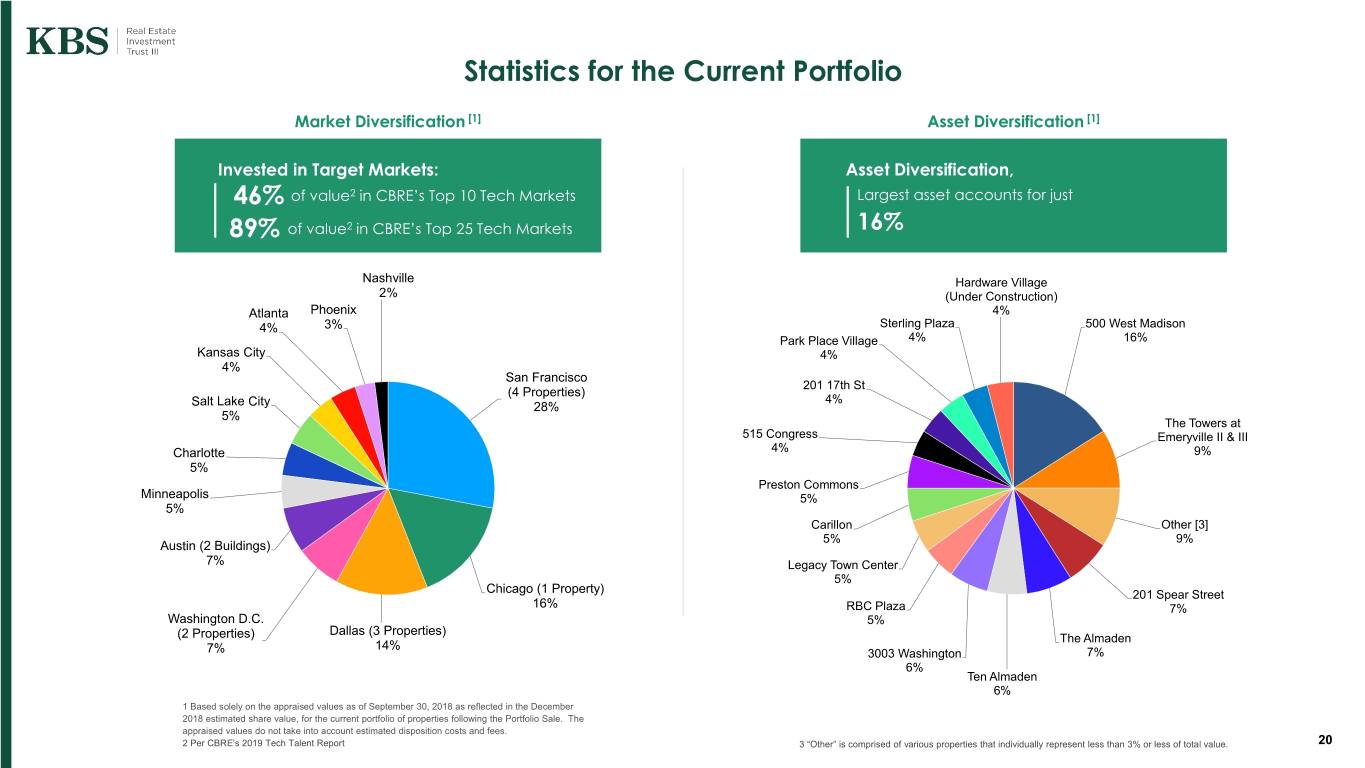

Statistics for the Current Portfolio Market Diversification [1] Asset Diversification [1] Invested in Target Markets: Asset Diversification, 46% of value2 in CBRE’s Top 10 Tech Markets Largest asset accounts for just 89% of value2 in CBRE’s Top 25 Tech Markets 16% Nashville Hardware Village 2% (Under Construction) Atlanta Phoenix 4% 4% 3% Sterling Plaza 500 West Madison Park Place Village 4% 16% Kansas City 4% 4% San Francisco 201 17th St (4 Properties) 4% Salt Lake City 28% 5% The Towers at 515 Congress Emeryville II & III Charlotte 4% 9% 5% Preston Commons Minneapolis 5% 5% Carillon Other [3] 5% 9% Austin (2 Buildings) 7% Legacy Town Center 5% Chicago (1 Property) 201 Spear Street 16% RBC Plaza 7% Washington D.C. 5% Dallas (3 Properties) (2 Properties) The Almaden 14% 7% 3003 Washington 7% 6% Ten Almaden 6% 1 Based solely on the appraised values as of September 30, 2018 as reflected in the December 2018 estimated share value, for the current portfolio of properties following the Portfolio Sale. The appraised values do not take into account estimated disposition costs and fees. 2 Per CBRE’s 2019 Tech Talent Report 3 “Other” is comprised of various properties that individually represent less than 3% or less of total value. 20

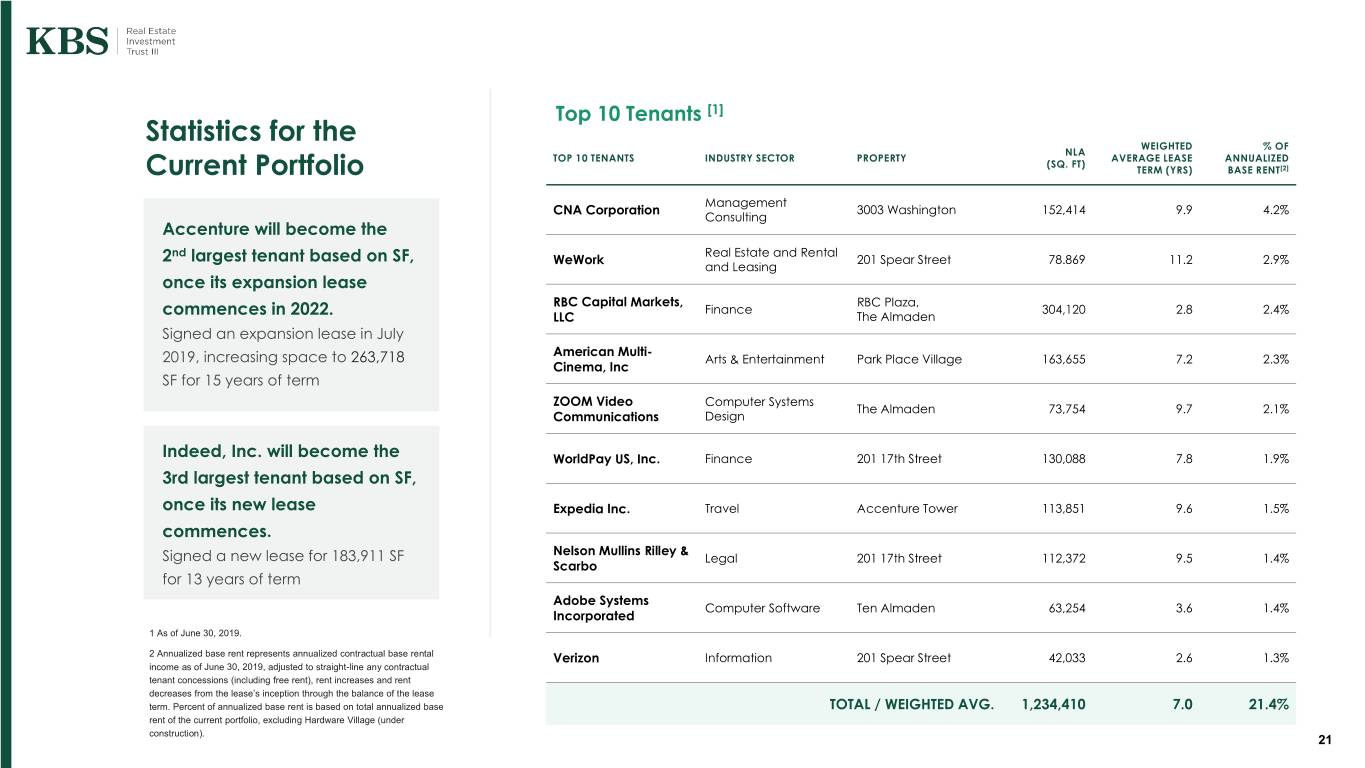

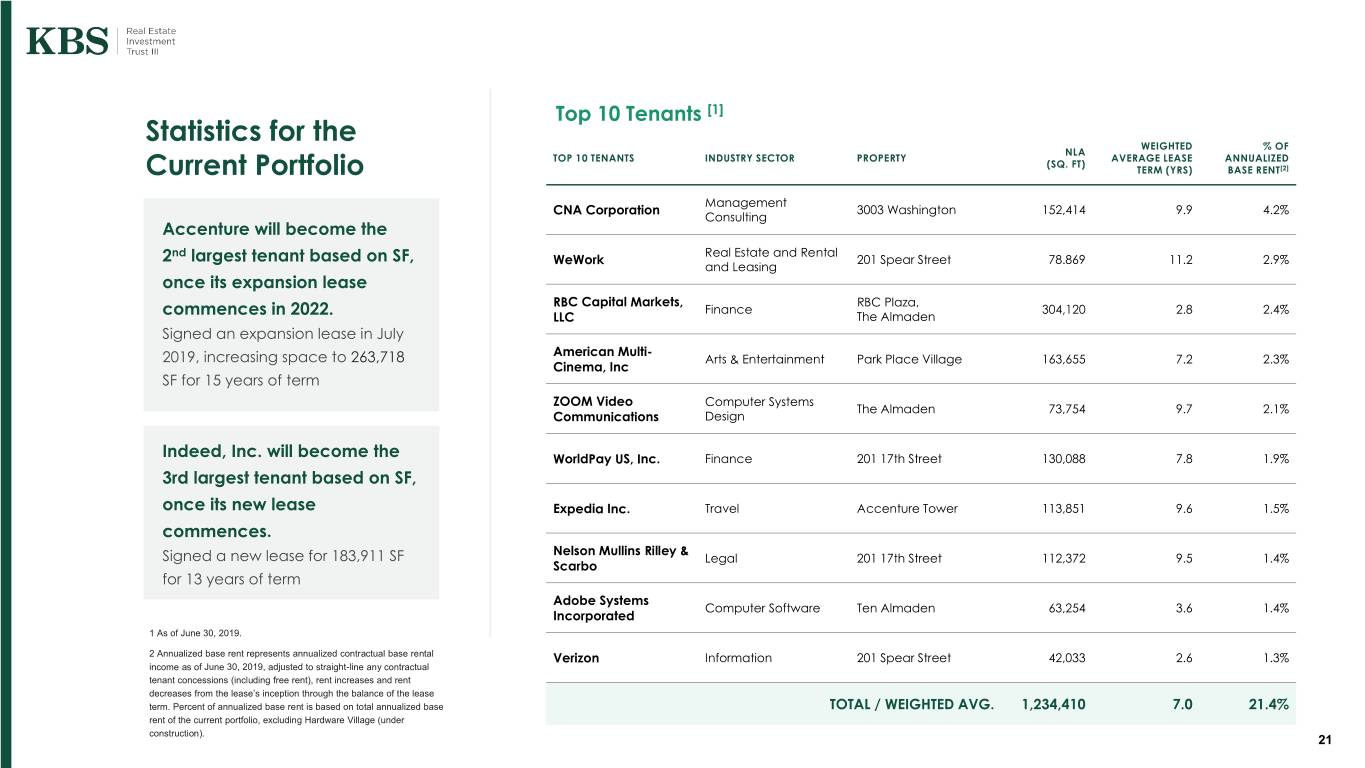

Top 10 Tenants [1] Statistics for the WEIGHTED % OF NLA TOP 10 TENANTS INDUSTRY SECTOR PROPERTY AVERAGE LEASE ANNUALIZED (SQ. FT) Current Portfolio TERM (YRS) BASE RENT[2] Management CNA Corporation 3003 Washington 152,414 9.9 4.2% Consulting Accenture will become the nd Real Estate and Rental 2 largest tenant based on SF, WeWork 201 Spear Street 78.869 11.2 2.9% and Leasing once its expansion lease RBC Capital Markets, RBC Plaza, Finance 304,120 2.8 2.4% commences in 2022. LLC The Almaden Signed an expansion lease in July American Multi- 2019, increasing space to 263,718 Arts & Entertainment Park Place Village 163,655 7.2 2.3% Cinema, Inc SF for 15 years of term ZOOM Video Computer Systems The Almaden 73,754 9.7 2.1% Communications Design Indeed, Inc. will become the WorldPay US, Inc. Finance 201 17th Street 130,088 7.8 1.9% 3rd largest tenant based on SF, once its new lease Expedia Inc. Travel Accenture Tower 113,851 9.6 1.5% commences. Nelson Mullins Rilley & Signed a new lease for 183,911 SF Legal 201 17th Street 112,372 9.5 1.4% Scarbo for 13 years of term Adobe Systems Computer Software Ten Almaden 63,254 3.6 1.4% Incorporated 1 As of June 30, 2019. 2 Annualized base rent represents annualized contractual base rental Verizon Information 201 Spear Street 42,033 2.6 1.3% income as of June 30, 2019, adjusted to straight-line any contractual tenant concessions (including free rent), rent increases and rent decreases from the lease’s inception through the balance of the lease term. Percent of annualized base rent is based on total annualized base TOTAL / WEIGHTED AVG. 1,234,410 7.0 21.4% rent of the current portfolio, excluding Hardware Village (under construction). 21

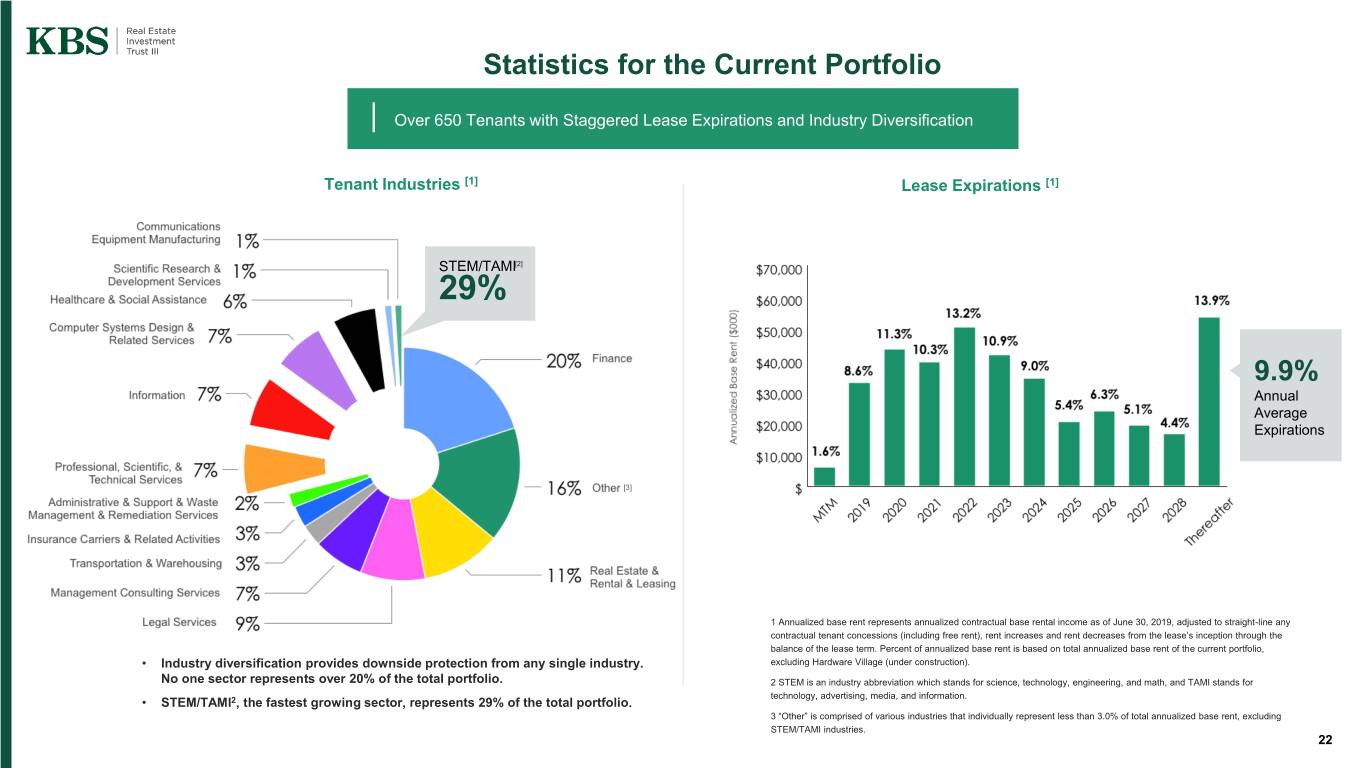

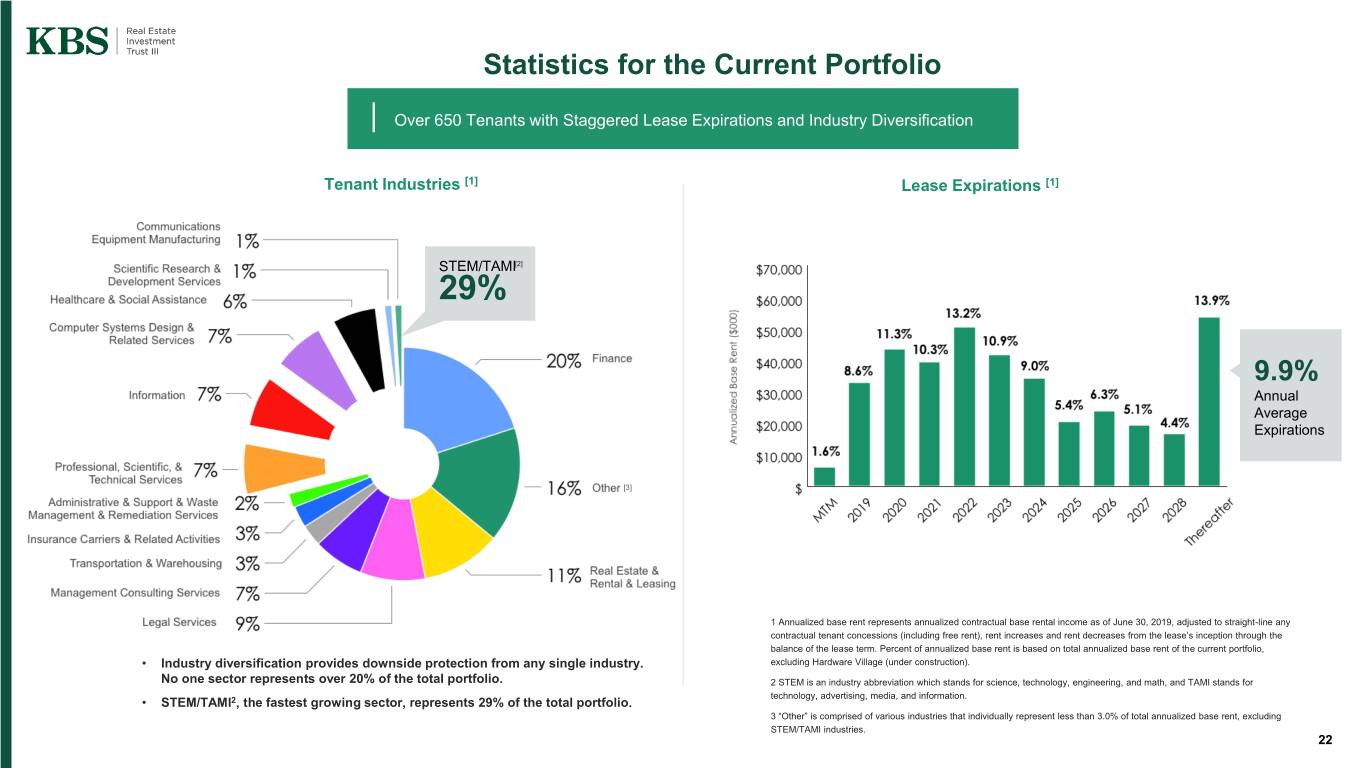

Statistics for the Current Portfolio Over 650 Tenants with Staggered Lease Expirations and Industry Diversification Tenant Industries [1] Lease Expirations [1] STEM/TAMI[2] 29% 9.9% Annual Average Expirations 1 Annualized base rent represents annualized contractual base rental income as of June 30, 2019, adjusted to straight-line any contractual tenant concessions (including free rent), rent increases and rent decreases from the lease’s inception through the balance of the lease term. Percent of annualized base rent is based on total annualized base rent of the current portfolio, • Industry diversification provides downside protection from any single industry. excluding Hardware Village (under construction). No one sector represents over 20% of the total portfolio. 2 STEM is an industry abbreviation which stands for science, technology, engineering, and math, and TAMI stands for technology, advertising, media, and information. • STEM/TAMI2, the fastest growing sector, represents 29% of the total portfolio. 3 “Other” is comprised of various industries that individually represent less than 3.0% of total annualized base rent, excluding STEM/TAMI industries. 22

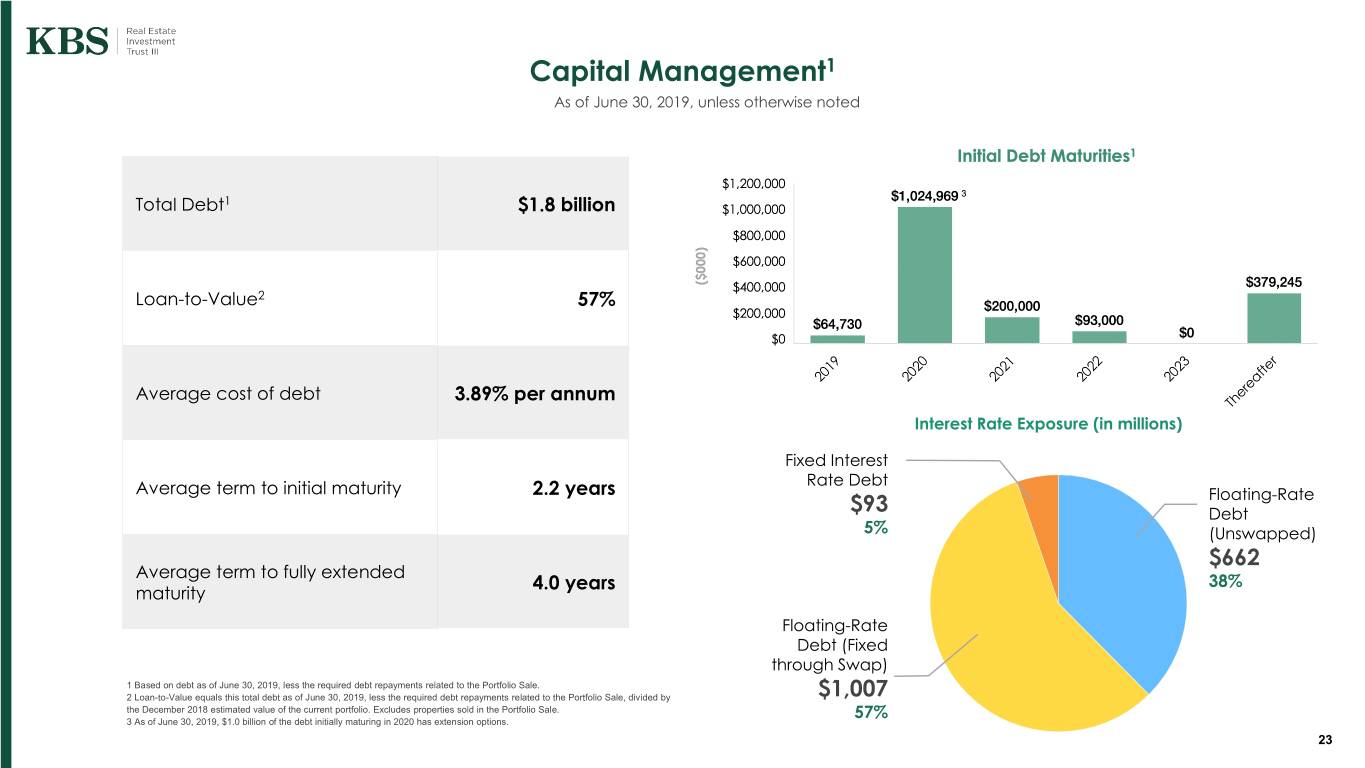

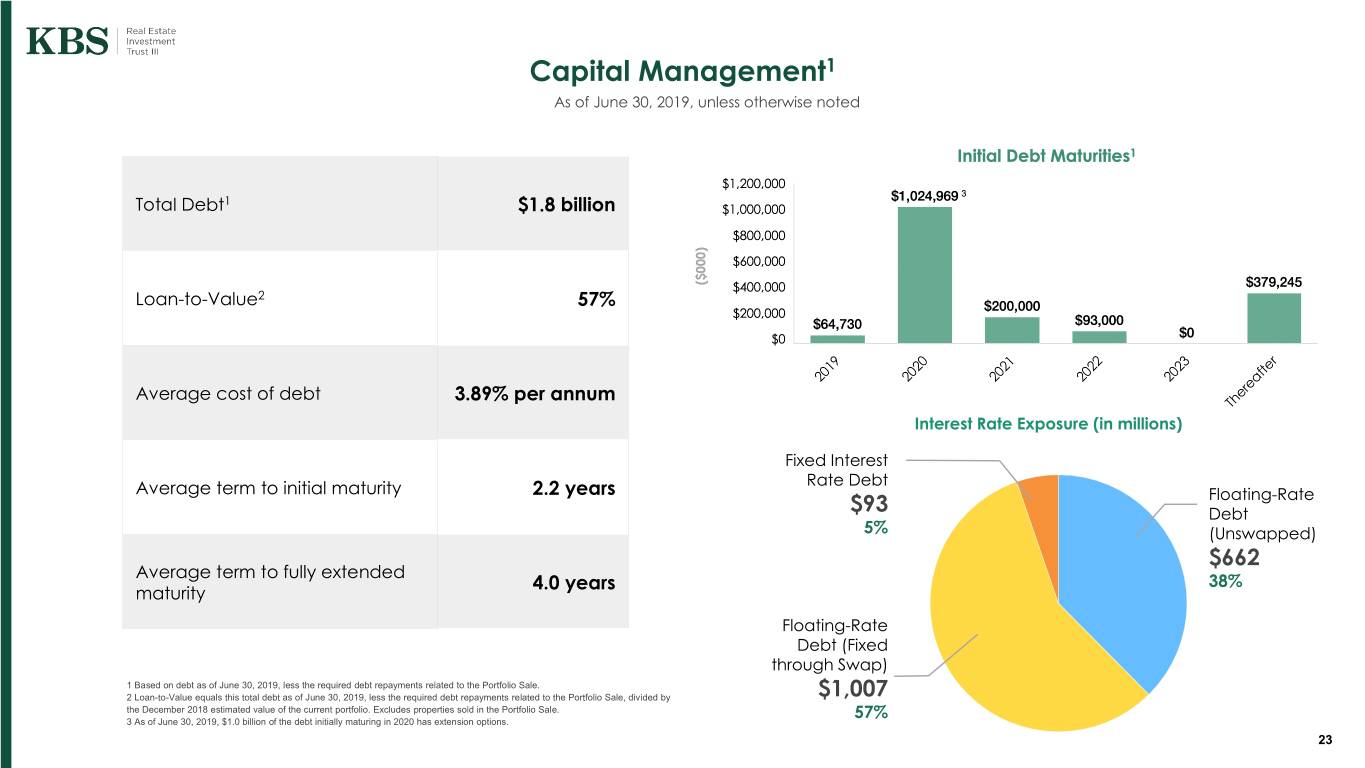

Capital Management1 As of June 30, 2019, unless otherwise noted Total Debt1 $1.8 billion Loan-to-Value2 57% Average cost of debt 3.89% per annum Interest Rate Exposure (in millions) Fixed Interest Rate Debt Average term to initial maturity 2.2 years Floating-Rate $93 Debt 5% (Unswapped) $662 Average term to fully extended 4.0 years 38% maturity Floating-Rate Debt (Fixed through Swap) 1 Based on debt as of June 30, 2019, less the required debt repayments related to the Portfolio Sale. 2 Loan-to-Value equals this total debt as of June 30, 2019, less the required debt repayments related to the Portfolio Sale, divided by $1,007 the December 2018 estimated value of the current portfolio. Excludes properties sold in the Portfolio Sale. 57% 3 As of June 30, 2019, $1.0 billion of the debt initially maturing in 2020 has extension options. 23

Property Updates 24

Accenture Tower* (Chicago, IL) Key Statistics Current Market Rent/ Weighted-Avg. Lease Rentable SF Leased Occupancy1 In - Place Rent1 Term (Yrs.)1 $28.22 / $26.89 1,457,724 84.6% 8.4 (5.0% Mark-to-Market) Key Tenants2 Tenant Sq. Ft. % of Property RSF Accenture 263,718 18.1% Expedia 113,851 7.8% Industrious 93,059 6.4% Key Highlights Accenture signed an expansion lease in July 2019, increasing their space to 263,718 SF for 15 years of term. Accenture to make this its U.S. headquarters. Industrious signed an expansion lease, increasing its space to 93,059 SF for 15 years of term. Oppenheimer signed an 11-year renewal to relocate within the building. Property is Chicago’s largest Class A, LEED Gold-Certified building, and has twice won “Building of the Year” from The Building Owners and Managers Association. Property is located in the West Loop submarket, the preeminent submarket within the Chicago CBD, and stands atop the Ogilvie Transportation Center which produces more * Formerly 500 W. Madison. 1 As of June 30, 2019, but adjusted for the Accenture lease expansion signed in July 2019. than 100,000 daily visitors. Includes leases that are signed but commencing in future. 25

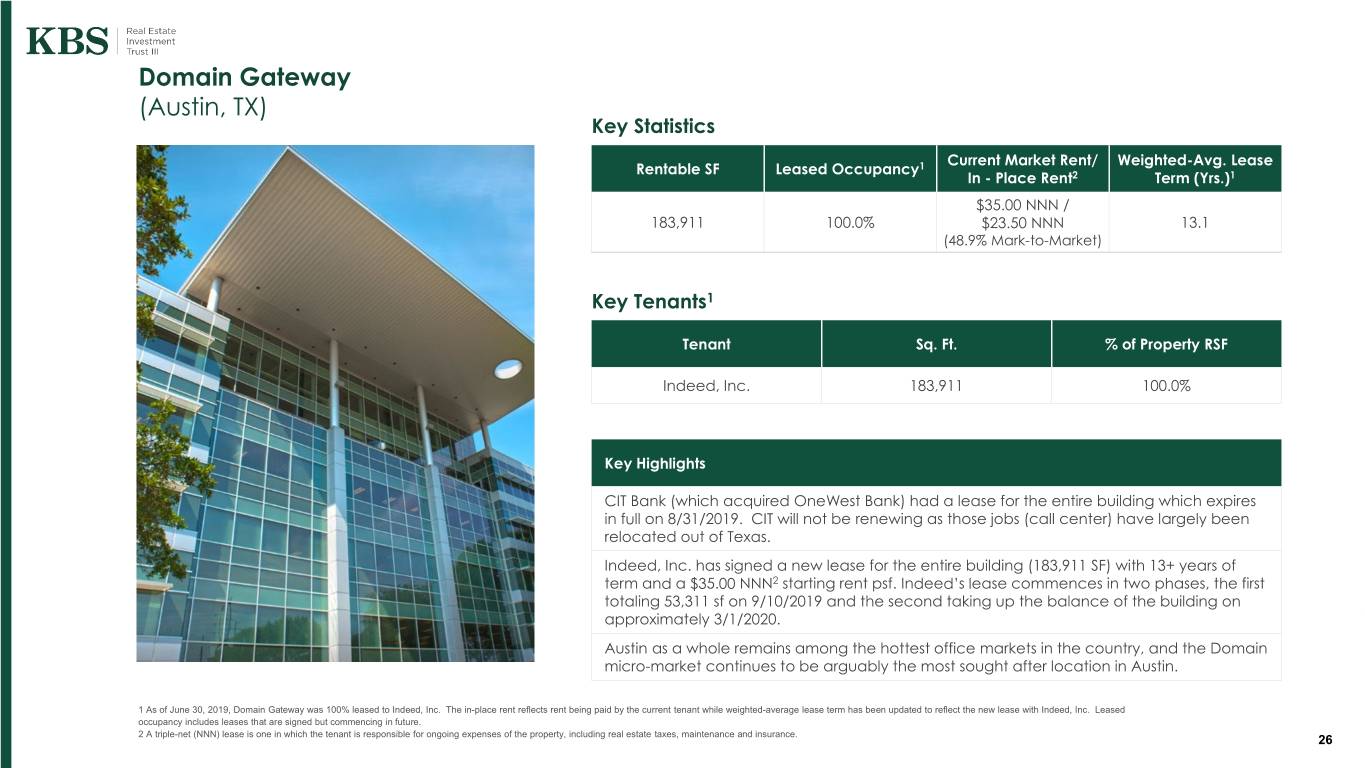

Domain Gateway (Austin, TX) Key Statistics Current Market Rent/ Weighted-Avg. Lease Rentable SF Leased Occupancy1 In - Place Rent2 Term (Yrs.)1 $35.00 NNN / 183,911 100.0% $23.50 NNN 13.1 (48.9% Mark-to-Market) Key Tenants1 Tenant Sq. Ft. % of Property RSF Indeed, Inc. 183,911 100.0% Key Highlights CIT Bank (which acquired OneWest Bank) had a lease for the entire building which expires in full on 8/31/2019. CIT will not be renewing as those jobs (call center) have largely been relocated out of Texas. Indeed, Inc. has signed a new lease for the entire building (183,911 SF) with 13+ years of term and a $35.00 NNN2 starting rent psf. Indeed’s lease commences in two phases, the first totaling 53,311 sf on 9/10/2019 and the second taking up the balance of the building on approximately 3/1/2020. Austin as a whole remains among the hottest office markets in the country, and the Domain micro-market continues to be arguably the most sought after location in Austin. 1 As of June 30, 2019, Domain Gateway was 100% leased to Indeed, Inc. The in-place rent reflects rent being paid by the current tenant while weighted-average lease term has been updated to reflect the new lease with Indeed, Inc. Leased occupancy includes leases that are signed but commencing in future. 2 A triple-net (NNN) lease is one in which the tenant is responsible for ongoing expenses of the property, including real estate taxes, maintenance and insurance. 26

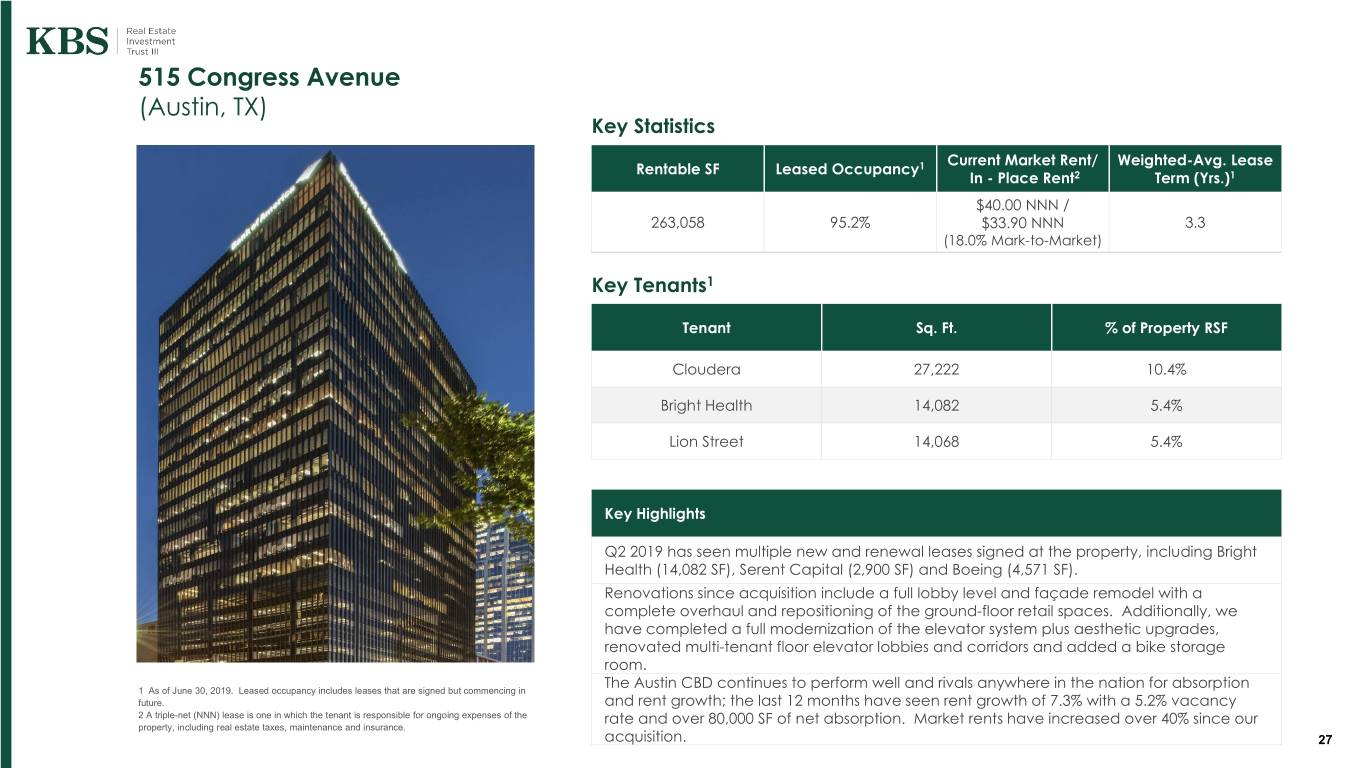

515 Congress Avenue (Austin, TX) Key Statistics Current Market Rent/ Weighted-Avg. Lease Rentable SF Leased Occupancy1 In - Place Rent2 Term (Yrs.)1 $40.00 NNN / 263,058 95.2% $33.90 NNN 3.3 (18.0% Mark-to-Market) Key Tenants1 Tenant Sq. Ft. % of Property RSF Cloudera 27,222 10.4% Bright Health 14,082 5.4% Lion Street 14,068 5.4% Key Highlights Q2 2019 has seen multiple new and renewal leases signed at the property, including Bright Health (14,082 SF), Serent Capital (2,900 SF) and Boeing (4,571 SF). Renovations since acquisition include a full lobby level and façade remodel with a complete overhaul and repositioning of the ground-floor retail spaces. Additionally, we have completed a full modernization of the elevator system plus aesthetic upgrades, renovated multi-tenant floor elevator lobbies and corridors and added a bike storage room. 1 As of June 30, 2019. Leased occupancy includes leases that are signed but commencing in The Austin CBD continues to perform well and rivals anywhere in the nation for absorption future. and rent growth; the last 12 months have seen rent growth of 7.3% with a 5.2% vacancy 2 A triple-net (NNN) lease is one in which the tenant is responsible for ongoing expenses of the rate and over 80,000 SF of net absorption. Market rents have increased over 40% since our property, including real estate taxes, maintenance and insurance. acquisition. 27

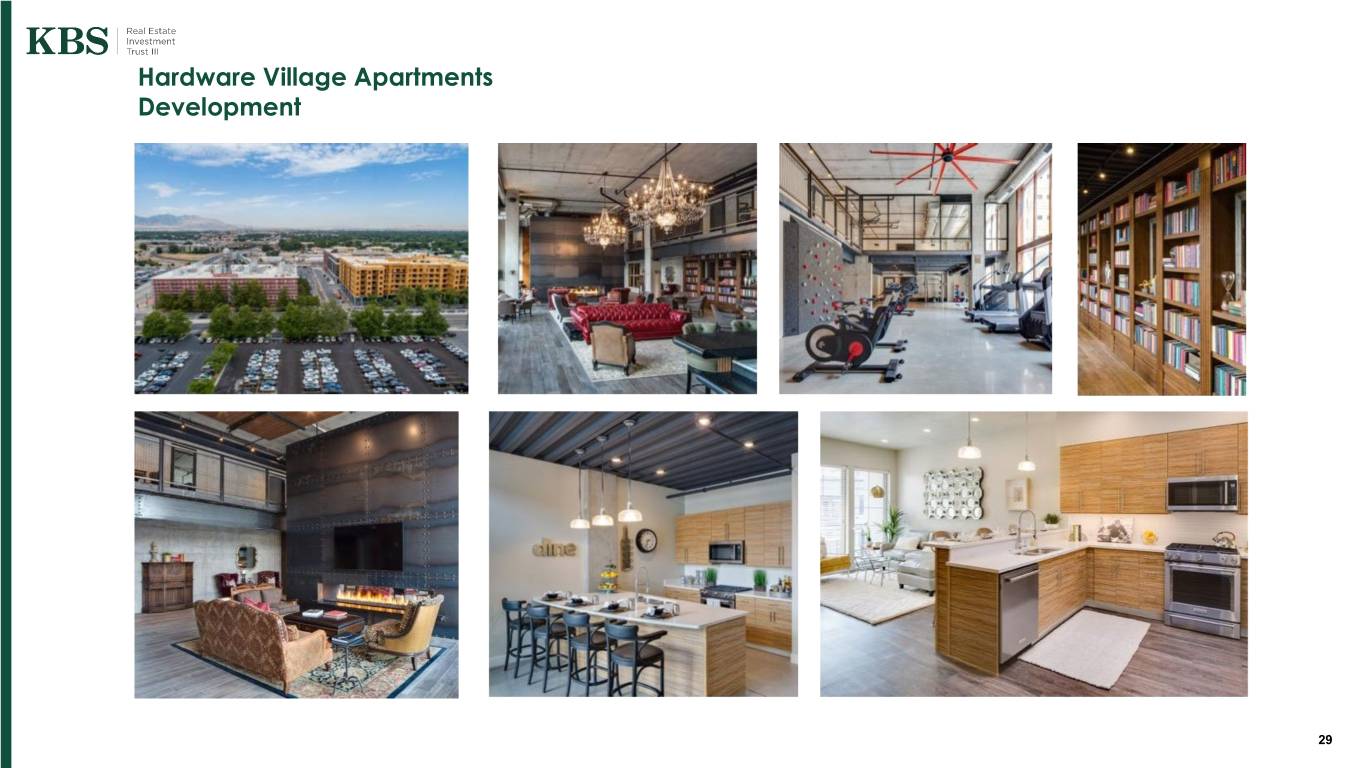

Hardware Village Apartments (Salt Lake City, UT) Key Statistics Rentable SF Units Leased Occupancy1 478,569 453 43.80%1 Construction Summary Projected development cost $138.8 million Construction is expected to be completed by Sept. 30, 2019. Lease-up is expected to finish by Dec. 2020 based on our current forecast. Key Highlights Modern-luxury finishes and resort-style amenities will make this the highest quality apartment complex in the area with studio. Location offers breathtaking views of downtown Salt Lake City and the mountains, and is walking distance to light rail and area attractions. Leasing at the west building has received increased interest from prospective tenants and is expected to increase in the following months which is typically the busiest leasing time in the area. 1 As of June 30, 2019, and for the 267 units in the West building only since the East building is still under construction. Includes leases that are signed but commencing in future. 28

Hardware Village Apartments Development 29

The December 2018 estimated value per share was performed in accordance with the provisions of and also to comply with the IPA Valuation Guidelines. As with any valuation methodology, the methodologies used are based upon a number of estimates and assumptions that may not be accurate or complete. Different parties with different assumptions and estimates could derive a different estimated value per share of KBS REIT II’s common stock, and this difference could be significant. The estimated value per share is not audited and does not represent the fair value of KBS REIT III’s assets less the Stockholder fair value of KBS REIT III’s liabilities according to GAAP. KBS REIT III can give no assurance that: Performance • a stockholder would be able to resell his or her shares at KBS • another independent third-party appraiser or third-party REIT III’s estimated value per share; valuation firm would agree with KBS REIT III’s estimated KBS REIT III provides its estimated value value per share; or • a stockholder would ultimately realize distributions per share per share to assist broker dealers that equal to KBS REIT III’s estimated value per share upon • the methodology used to determine KBS REIT III’s participated in KBS REIT III’s now- liquidation of KBS REIT III’s assets and settlement of its liabilities estimated value per share would be acceptable to FINRA terminated initial public offering in or a sale of KBS REIT III; or for compliance with ERISA reporting requirements. meeting their customer account • KBS REIT III’s shares of common stock would trade at the statement reporting obligations. estimated value per share on a national securities exchange; Further, the estimated value per share is based on the estimated value of KBS REIT III’s assets less the estimated value of KBS REIT III’s liabilities, divided by the number of shares outstanding, all as of September 30, 2018, with the exception of an adjustment to KBS REIT III’s net asset value for the acquisition and assumed loan costs related to the buyout of KBS REIT III’s partner equity interest in an unconsolidated joint venture that closed subsequent to September 30, 2018 and a reduction to KBS REIT III’s net asset value for deferred financing costs related to a portfolio loan facility that closed subsequent to September 30, 2018. KBS REIT III did not make any other adjustments to the estimated value per share subsequent to September 30, 2018, including any adjustments relating to the following, among others: (i) the issuance of common stock and the payment of related offering costs related to KBS REIT III’s dividend reinvestment plan offering; (ii) net operating income earned and distributions declared; and (iii) the redemption of shares. The value of KBS REIT III’s shares will fluctuate over time in response to developments related to future investments, the performance of individual assets in KBS REIT III’s portfolio and the management of those assets, the real estate and finance markets and due to other factors. KBS REIT III’s estimated value per share does not reflect a discount for the fact that KBS REIT III is externally managed, nor does it reflect a real estate portfolio premium/discount versus the sum of the individual property values. KBS REIT III’s estimated value per share does not take into account estimated disposition costs and fees for real estate properties which were not under contract to sell as of December 3, 2018, debt prepayment penalties that could apply upon the prepayment of certain of KBS REIT III’s debt obligations, the impact of restrictions on the assumption of debt or swap breakage fees that may be incurred upon the termination of certain of KBS REIT III’s swaps prior to expiration. The estimated value per share does not take into consideration acquisition-related costs and financing costs related to any future acquisitions subsequent to December 3, 2018. KBS REIT III currently expects to utilize an independent valuation firm to update its estimated value per share no later than December 2019. 30

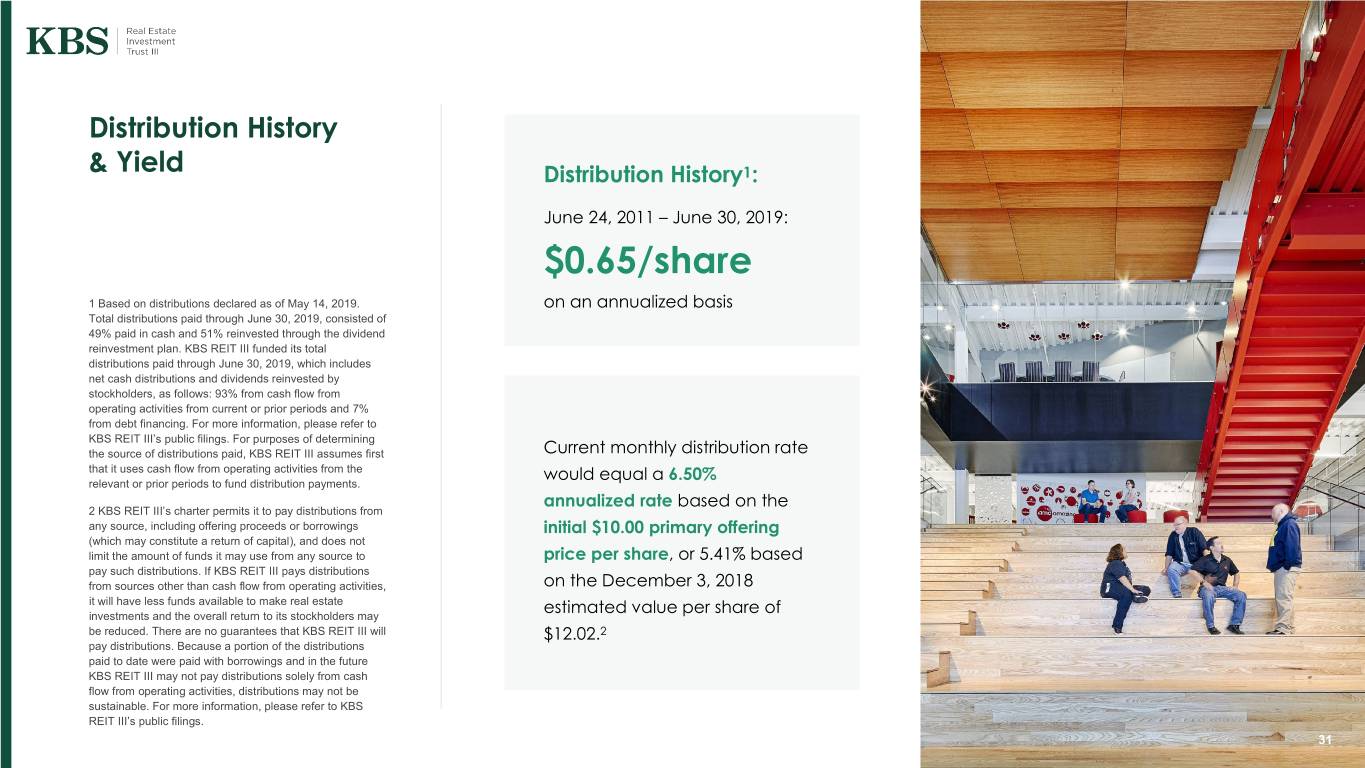

Distribution History & Yield Distribution History1: June 24, 2011 – June 30, 2019: $0.65/share 1 Based on distributions declared as of May 14, 2019. on an annualized basis Total distributions paid through June 30, 2019, consisted of 49% paid in cash and 51% reinvested through the dividend reinvestment plan. KBS REIT III funded its total distributions paid through June 30, 2019, which includes net cash distributions and dividends reinvested by stockholders, as follows: 93% from cash flow from operating activities from current or prior periods and 7% from debt financing. For more information, please refer to KBS REIT III’s public filings. For purposes of determining the source of distributions paid, KBS REIT III assumes first Current monthly distribution rate that it uses cash flow from operating activities from the would equal a 6.50% relevant or prior periods to fund distribution payments. annualized rate based on the 2 KBS REIT III’s charter permits it to pay distributions from any source, including offering proceeds or borrowings initial $10.00 primary offering (which may constitute a return of capital), and does not limit the amount of funds it may use from any source to price per share, or 5.41% based pay such distributions. If KBS REIT III pays distributions from sources other than cash flow from operating activities, on the December 3, 2018 it will have less funds available to make real estate investments and the overall return to its stockholders may estimated value per share of be reduced. There are no guarantees that KBS REIT III will $12.02.2 pay distributions. Because a portion of the distributions paid to date were paid with borrowings and in the future KBS REIT III may not pay distributions solely from cash flow from operating activities, distributions may not be sustainable. For more information, please refer to KBS REIT III’s public filings. 31

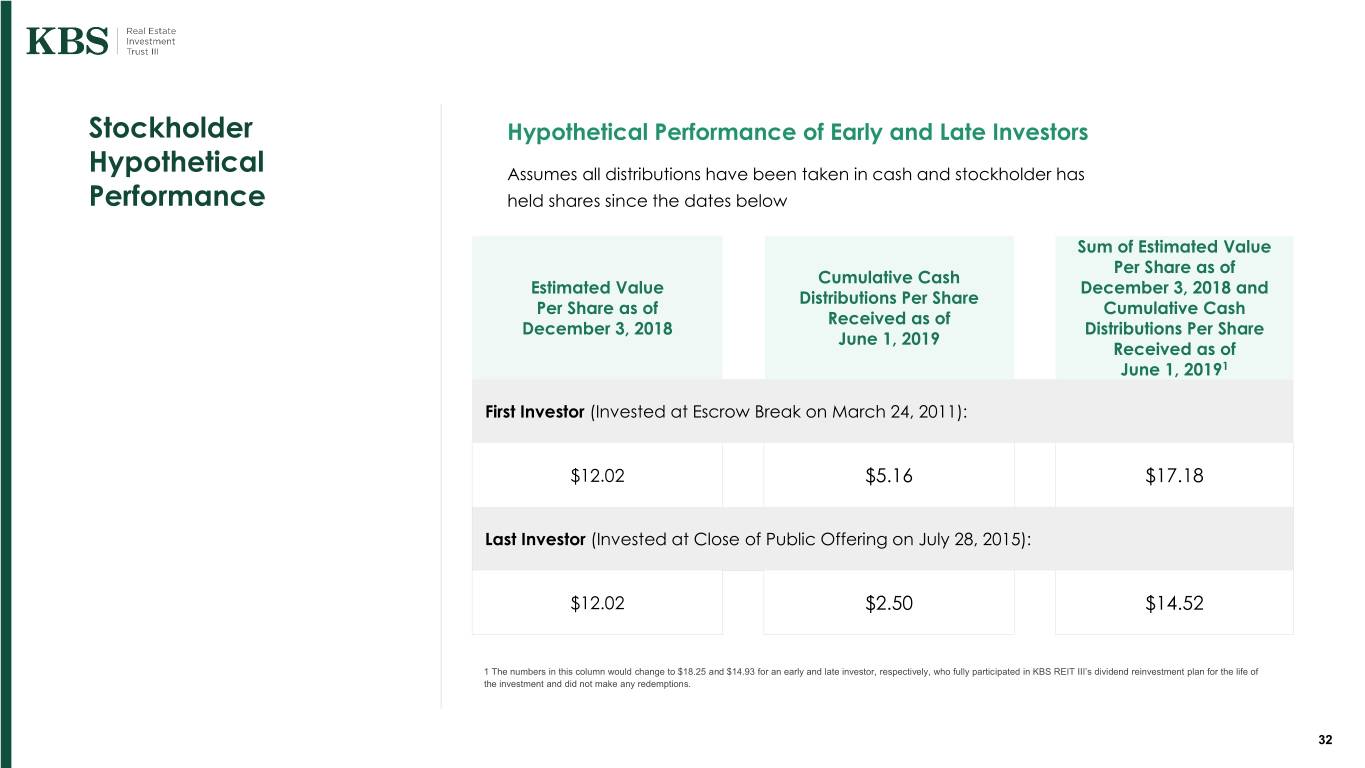

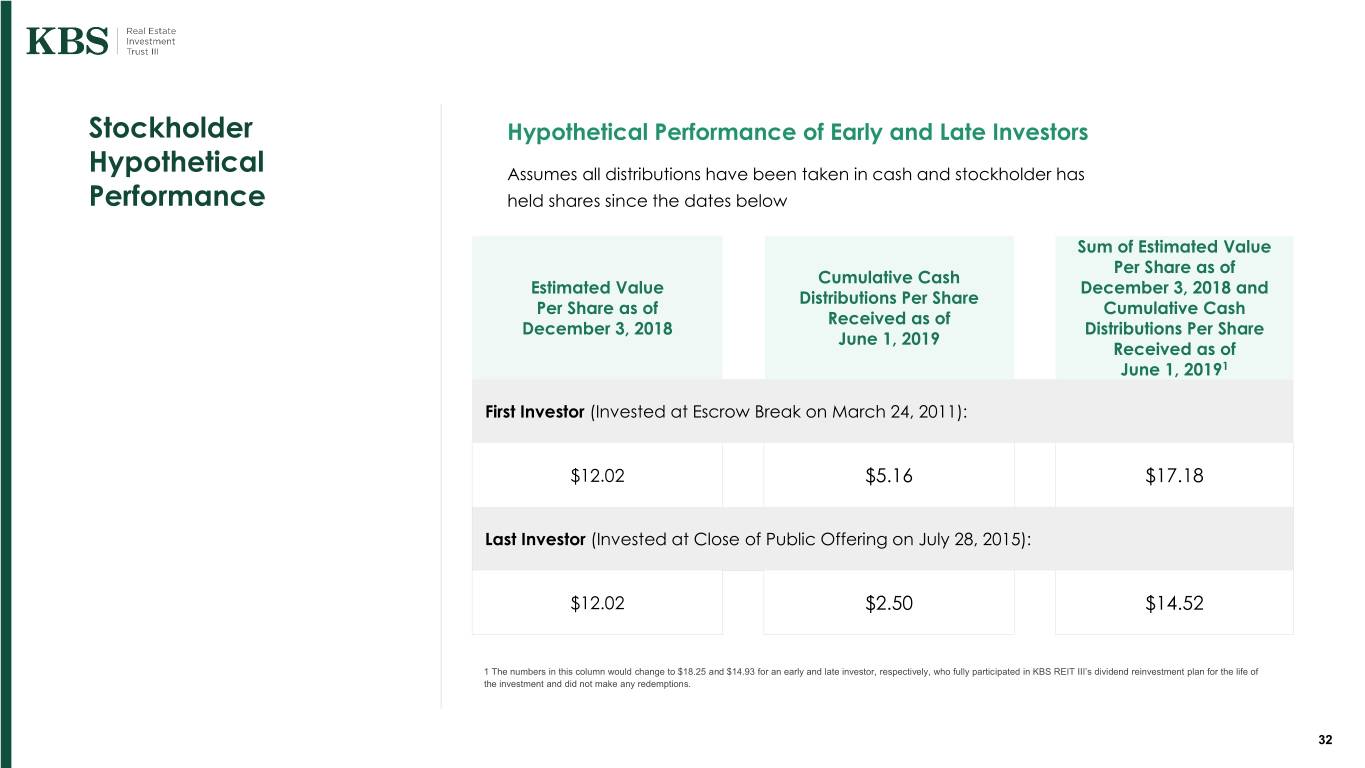

Stockholder Hypothetical Performance of Early and Late Investors Hypothetical Assumes all distributions have been taken in cash and stockholder has Performance held shares since the dates below Sum of Estimated Value Per Share as of Cumulative Cash Estimated Value December 3, 2018 and Distributions Per Share Per Share as of Cumulative Cash Received as of December 3, 2018 Distributions Per Share June 1, 2019 Received as of June 1, 20191 First Investor (Invested at Escrow Break on March 24, 2011): $12.02 $5.16 $17.18 Last Investor (Invested at Close of Public Offering on July 28, 2015): $12.02 $2.50 $14.52 1 The numbers in this column would change to $18.25 and $14.93 for an early and late investor, respectively, who fully participated in KBS REIT III’s dividend reinvestment plan for the life of the investment and did not make any redemptions. 32

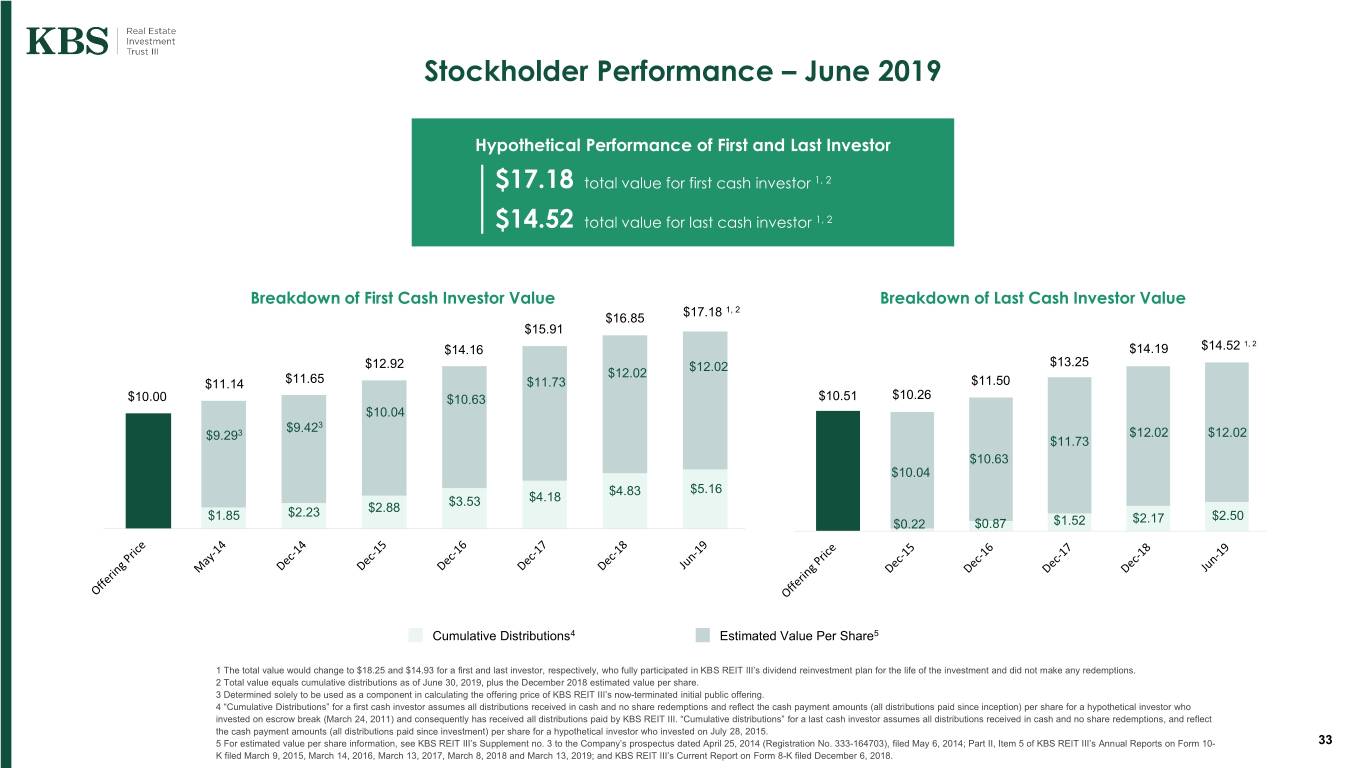

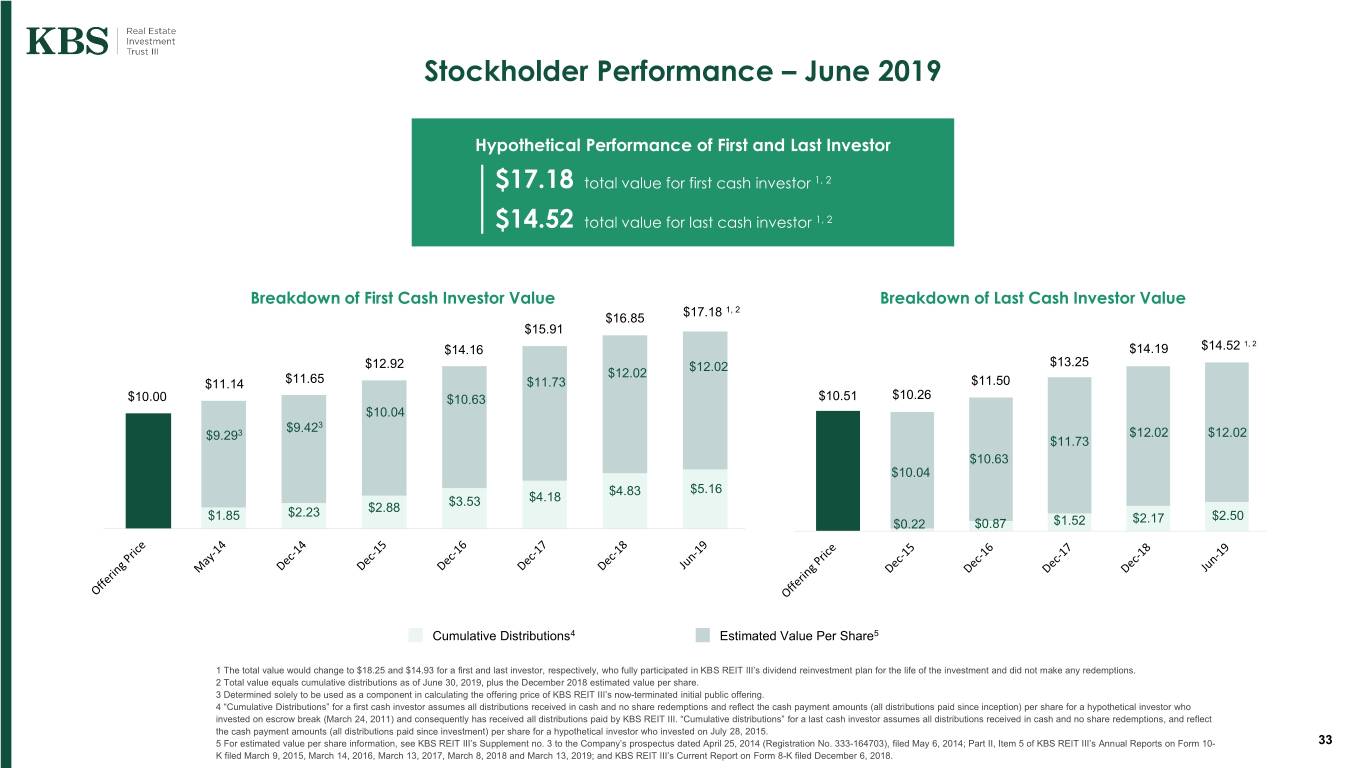

Stockholder Performance – June 2019 Hypothetical Performance of First and Last Investor $17.18 total value for first cash investor 1, 2 $14.52 total value for last cash investor 1, 2 Breakdown of First Cash Investor Value Breakdown of Last Cash Investor Value 1, 2 $16.85 $17.18 $15.91 1, 2 $14.16 $14.19 $14.52 $12.92 $13.25 $12.02 $12.02 $11.14 $11.65 $11.73 $11.50 $10.00 $10.63 $10.51 $10.26 $10.04 3 3 $9.42 $12.02 $12.02 $9.29 $11.73 $10.63 $10.04 $5.16 $4.18 $4.83 $2.88 $3.53 $1.85 $2.23 $2.50 $0.22 $0.87 $1.52 $2.17 Cumulative Distributions4 Estimated Value Per Share5 1 The total value would change to $18.25 and $14.93 for a first and last investor, respectively, who fully participated in KBS REIT III’s dividend reinvestment plan for the life of the investment and did not make any redemptions. 2 Total value equals cumulative distributions as of June 30, 2019, plus the December 2018 estimated value per share. 3 Determined solely to be used as a component in calculating the offering price of KBS REIT III’s now-terminated initial public offering. 4 “Cumulative Distributions” for a first cash investor assumes all distributions received in cash and no share redemptions and reflect the cash payment amounts (all distributions paid since inception) per share for a hypothetical investor who invested on escrow break (March 24, 2011) and consequently has received all distributions paid by KBS REIT III. “Cumulative distributions” for a last cash investor assumes all distributions received in cash and no share redemptions, and reflect the cash payment amounts (all distributions paid since investment) per share for a hypothetical investor who invested on July 28, 2015. 5 For estimated value per share information, see KBS REIT III’s Supplement no. 3 to the Company’s prospectus dated April 25, 2014 (Registration No. 333-164703), filed May 6, 2014; Part II, Item 5 of KBS REIT III’s Annual Reports on Form 10- 33 K filed March 9, 2015, March 14, 2016, March 13, 2017, March 8, 2018 and March 13, 2019; and KBS REIT III’s Current Report on Form 8-K filed December 6, 2018.

Strategic Alternatives As the Board of Directors evaluates various strategic alternatives, they will be focused on certain key Following the Portfolio Sale, the attributes of the Company including the current Company’s Board of Directors has portfolio size and performance, shareholder desire for initiated a review of strategic liquidity as well as their desire to stay invested and alternatives in an effort to further current market environments. enhance shareholder liquidity and maximize shareholder value. These strategic alternatives include a conversion into an NAV REIT or strategic asset sales. NAV REITs at a Glance Perpetual Life Investment Vehicle Potential enhanced liquidity, up to 20% of equity per year Frequent valuations Lower up-front fees 34

REIT III Goals & Objectives Provide enhanced shareholder liquidity Finalize a review of strategic alternatives, with the goal of further enhancing shareholder liquidity and maximizing shareholder value. Complete major capital projects, such as renovations or amenity enhancements, with the goal of attracting quality tenants Complete construction of Hardware Village property and continue to lease-up Lease-up and stabilize all properties in the portfolio with an emphasis in capital investments leading to stabilized occupancy at increased market rental rates Distribute operating cash flows to stockholders Continue to monitor the properties in the portfolio for beneficial sale opportunities in order to maximize value 35

Q&A For additional questions, contact KBS Capital Markets Group Investor Relations (866) 527-4264 36