UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22903

J.P. Morgan Exchange-Traded Fund Trust

(Exact name of registrant as specified in charter)

270 Park Avenue

New York, NY 10017

(Address of principal executive offices) (Zip code)

Frank J. Nasta, Esq.

J.P. Morgan Investment Management Inc.

270 Park Avenue

New York, NY 10017

(Name and Address of Agent for Service)

| | |

| With copies to: |

| Elizabeth A. Davin, Esq. | | Jon S. Rand Esq. |

| JPMorgan Chase & Co. | | Dechert LLP |

| 460 Polaris Parkway | | 1095 Avenue of the Americas |

| Westerville, OH 43082 | | New York, NY 10036 |

Registrant’s telephone number, including area code: (844) 457-6383

Date of fiscal year end: October 31

Date of reporting period: June 16, 2014 through October 31, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Annual Report

JPMorgan Exchange-Traded Funds

October 31, 2014

JPMorgan Diversified Return Global Equity ETF

CONTENTS

Investments in a Fund are not bank deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

Prospective investors should refer to the Fund’s prospectus for a discussion of the Fund’s investment objectives, strategies and risks. Call J.P. Morgan Exchange-Traded Funds at (844) 457-6383 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read and consider it carefully before investing.

PRESIDENT’S LETTER

NOVEMBER 11, 2014

Dear Shareholder:

While leading central banks continued to provide economic stimulus over the past five months, a clear divergence emerged between the growth trajectories of the U.S. and other developed markets. During the June 16, 2014 to October 31, 2014 reporting period, the U.S. Federal Reserve responded to improving U.S. employment and consumer spending by winding down and closing its $85 billion-a-month program of bond purchases, while also signaling it may start raising interest rates in mid-2015. Meanwhile, the European Central Bank (ECB) took unprecedented steps to prevent a deflationary spiral and the Bank of Japan shocked financial markets at the end of October by unveiling a massive stimulus program.

| | |

| | “The period was marked by volatility in equity and foreign currency markets, highlighting our belief in investing in diversified global equities with a long-term view.” |

Overall, U.S. markets were supported by a 25% drop in global oil prices from June to October, 3.9% growth in third quarter U.S. gross domestic product (GDP), the strongest employment gains since 1999, and rising corporate earnings. In June, equity prices touched record highs and volatility in U.S. markets remained at lows not consistently seen since 2007. Notably, in mid-October U.S. equities fell to six-month lows only to rebound 8.4%, driving the Standard & Poor’s 500 Index to a new closing high of 2,018.05 points on the final day of the reporting period.

In Europe, the ECB cut the European Union (EU) deposit rate in June to negative 0.1% from 0.0% in a bid to push banks to extend lending by effectively charging them for parking excess cash with the central bank. In August, ECB President Mario Draghi acknowledged the urgent need to spur job creation and signaled his commitment to support growth and head off a deflationary spiral. In October, the EU inflation rate stood at 0.4%, well below the ECB target rate of just below 2%. Growth in GDP across the EU was 0.2% in the third quarter of 2014, and manufacturing activity across the euro zone slowed in the latter part of the reporting period.

Following an April 1, 2014 increase in its national consumption tax, Japan recorded its biggest quarterly economic slowdown since the global financial crisis of 2007-08. While Japan’s GDP improved slightly through the reporting period, it remained negative. On October 31, the Bank of Japan unveiled plans to buy 8 trillion to 12 trillion yen ($72 billion to $107 billion) of Japanese government bonds per month, while also tripling its purchases of exchange-traded funds.

Emerging markets overall weakened during the reporting period amid investor concerns about slowing growth in China, weak global commodities prices and continued conflicts in eastern Ukraine and the Middle East. At 7.3%, China’s third quarter 2014 GDP growth was the slowest in five years, partly due to a slowdown in the property sector. A pro-democracy movement in Hong Kong added to investor concerns in the region. In Brazil, the re-election of President Dilma Rousseff in October was followed by a greater than 5.0% intra-day drop in the Bovespa Index amid investor concern over her administration’s interventionist private-sector policies.

While relatively low global energy prices provided a welcome tailwind for both developed and emerging market economies during the reporting period, investors remained squarely focused on central banks’ policies. Amid this backdrop, a sharp pullback in global equities in mid-October revealed the fragility of gains made during the previous months. However, at the end of the reporting period, select equity and bond markets provided positive returns for investors who maintained a diversified portfolio and a long-term view.

On behalf of everyone at J.P. Morgan Asset Management, thank you for your continued support. We look forward to managing your investment needs for years to come. If you should have any questions, please visit www.jpmorganfunds.com or call J.P. Morgan Exchange-Traded Funds at 1-844-457-6383.

Sincerely yours,

Robert F. Deutsch

President, J.P. Morgan Exchange-Traded Funds

J.P. Morgan Asset Management

| | | | | | | | |

| | | |

| OCTOBER 31, 2014 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 1 | |

JPMorgan Diversified Return Global Equity ETF

FUND COMMENTARY

For the Period June 16, 2014 (Fund Inception Date) Through October 31, 2014 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| JPMorgan Diversified Return Global Equity ETF* | | | -0.62% | |

| Market Price** | | | 0.18% | |

| FTSE Developed Diversified Factor Index (net of foreign withholding taxes) | | | -0.94% | |

| MSCI World Index (net of foreign withholding taxes) | | | -0.53% | |

| |

| Net Assets as of 10/31/2014 | | $ | 24,846,767 | |

INVESTMENT OBJECTIVE***

The JPMorgan Diversified Return Global Equity ETF (the “Fund”) seeks investment results that closely correspond, before fees and expenses, to the performance of the FTSE Developed Diversified Factor Index (the “Index”).

INVESTMENT APPROACH

The Fund is passively managed to the Index, which tracks large and mid-cap equity securities in developed global markets, diversified across global industries and regions. The Index uses a proprietary multifactor security selection process that measures the following characteristics: relative valuation, price momentum, low volatility and specific market capitalization. Securities within the Index include common stock, preferred stock and real estate investment trusts.

The Fund may invest up to 20% of its assets in exchange-traded futures and currency forward contracts to seek performance that corresponds to the Index. The Fund’s index methodology includes monthly rebalancing, liquidity screens and turnover constraints.

HOW DID THE MARKET PERFORM?

For the period June 16, 2014 through October 31, 2014, leading central banks maintained accommodative policies to stimulate growth. Notably, while the U.S. Federal Reserve responded to an improving domestic economy by closing out its quantitative easing program of monthly bond purchases, the European Central Bank and the Bank or Japan — independently of each other — took unprecedented steps to counter slowing economic growth.

Overall, the U.S. equities markets performed well during the reporting period, despite a brief sell-off in October, while equities markets in the European Union and Japan posted declines.

HOW DID THE FUND PERFORM?

The Fund posted a negative absolute performance during the period June 16, 2014 to October 31, 2014. On an absolute basis, the Fund’s position in the oil & gas sector, and to a lesser extent its positions in the basic materials and industrials sectors, detracted from performance during the reporting period, while its positions in the financials, health care and utilities sectors made positive contributions to absolute performance.

Because the Fund’s holdings were aligned with those of the Index, variances in relative performance due to security selection and/or sector allocation were not significant. The majority of the Fund’s deviation against the Index was due to specific trading limits, differences in valuations because of the timing of the local market closings and the net asset value calculations, the Fund’s small cash allocation and fees and operating expenses incurred by the Fund.

HOW WAS THE FUND POSITIONED?

At the end of the reporting period, the Fund’s largest allocation of assets was to North American markets, particularly the U.S., with smaller allocations to Asia, Japan and Europe. In terms of sectors, the Fund’s largest positions were in the consumer discretionary, health care and information technology sectors, while the smallest positions were in the consumer staples, energy and material sectors.

| | | | | | |

| | | |

| 2 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2014 |

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO**** | |

| | 1. | | | CSL Ltd. | | | 0.5 | % |

| | 2. | | | Woolworths Ltd. | | | 0.5 | |

| | 3. | | | Samsung Electronics Co., Ltd. | | | 0.5 | |

| | 4. | | | Wesfarmers Ltd. | | | 0.5 | |

| | 5. | | | BHP Billiton Ltd. | | | 0.5 | |

| | 6. | | | Cheung Kong Holdings Ltd. | | | 0.5 | |

| | 7. | | | Toyota Motor Corp. | | | 0.5 | |

| | 8. | | | DBS Group Holdings Ltd. | | | 0.5 | |

| | 9. | | | Hutchison Whampoa Ltd. | | | 0.5 | |

| | 10. | | | Woodside Petroleum Ltd. | | | 0.5 | |

| | | | |

PORTFOLIO COMPOSITION BY COUNTRY**** | |

| United States | | | 27.3 | % |

| Japan | | | 22.5 | |

| Australia | | | 9.8 | |

| South Korea | | | 7.2 | |

| Hong Kong | | | 4.1 | |

| United Kingdom | | | 3.4 | |

| Canada | | | 3.4 | |

| France | | | 3.2 | |

| Germany | | | 3.1 | |

| Singapore | | | 2.6 | |

| Switzerland | | | 2.6 | |

| Sweden | | | 2.4 | |

| Spain | | | 1.9 | |

| Netherlands | | | 1.2 | |

| Belgium | | | 1.0 | |

| Italy | | | 1.0 | |

| Others (each less than 1%) | | | 3.3 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $49.69 as of October 31, 2014. |

| ** | | Market price cumulative return is calculated assuming an initial investment made at the inception date net asset value, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the NYSE Arca. The midpoint price was $50.09 as of October 31, 2014. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based on total investments as of October 31, 2014. The Fund’s composition is subject to change. |

| | | | | | | | |

| | | |

| OCTOBER 31, 2014 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 3 | |

JPMorgan Diversified Return Global Equity ETF

FUND COMMENTARY

For the Period June 16, 2014 (Fund Inception Date) Through October 31, 2014 (Unaudited) (continued)

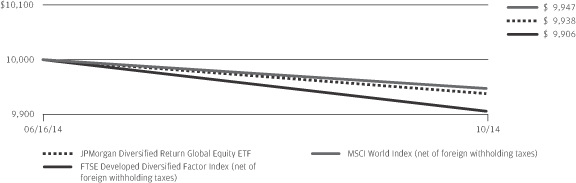

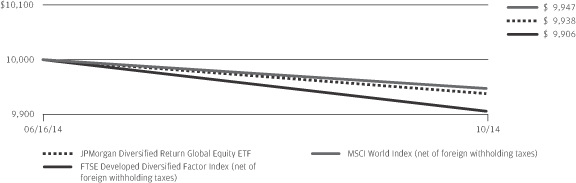

LIFE OF FUND PERFORMANCE (6/16/14 TO 10/31/14)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund commenced operations on June 16, 2014.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan Diversified Return Global Equity ETF, the FTSE Developed Diversified Factor Index (net of foreign withholding taxes), and the MSCI World Index (net of foreign withholding taxes) from June 16, 2014 to October 31, 2014. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the FTSE Developed Diversified Factor Index (net of foreign withholding taxes) and the MSCI World Index (net of foreign withholding taxes) does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The FTSE Developed Diversified Factor Index (net of foreign withholding taxes) is an index comprised of equity securities from developed global markets selected to

represent a diversified set of factor characteristics, originally developed by the adviser. FTSE International Limited is the Index Provider. The MSCI World Index (net of foreign withholding taxes) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. Investors cannot invest directly in an index.

Fund performance reflects the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the United States can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the United States and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 4 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2014 |

JPMorgan Diversified Return Global Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF OCTOBER 31, 2014

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| Common Stocks — 99.7% | |

| | | | Australia — 9.7% | |

| | 5,816 | | | AGL Energy Ltd. | | | 69,720 | |

| | 9,467 | | | Amcor Ltd. | | | 98,333 | |

| | 2,480 | | | Ansell Ltd. | | | 43,501 | |

| | 8,175 | | | APA Group | | | 56,835 | |

| | 24,391 | | | Arrium Ltd. | | | 7,242 | |

| | 9,191 | | | Asciano Ltd. | | | 50,840 | |

| | 1,083 | | | ASX Ltd. | | | 34,361 | |

| | 19,464 | | | Aurizon Holdings Ltd. | | | 80,731 | |

| | 4,157 | | | BHP Billiton Ltd. | | | 124,365 | |

| | 1,757 | | | Caltex Australia Ltd. | | | 48,394 | |

| | 24,330 | | | CFS Retail Property Trust Group REIT | | | 45,254 | |

| | 1,105 | | | Cochlear Ltd. | | | 71,617 | |

| | 4,852 | | | Crown Resorts Ltd. | | | 62,235 | |

| | 1,875 | | | CSL Ltd. | | | 132,381 | |

| | 8,625 | | | CSR Ltd. | | | 26,398 | |

| | 52,342 | | | Dexus Property Group REIT (b) | | | 55,944 | |

| | 1,120 | | | Flight Centre Travel Group Ltd. | | | 41,558 | |

| | 18,681 | | | GPT Group, Class Miscellaneous REIT (b) | | | 67,903 | |

| | 10,050 | | | Harvey Norman Holdings Ltd. | | | 33,796 | |

| | 19,655 | | | Incitec Pivot Ltd. | | | 50,437 | |

| | 7,021 | | | Origin Energy Ltd. | | | 88,203 | |

| | 1,455 | | | Ramsay Health Care Ltd. | | | 67,263 | |

| | 1,045 | | | Rio Tinto Ltd. | | | 55,801 | |

| | 7,726 | | | Santos Ltd. | | | 88,534 | |

| | 19,412 | | | Scentre Group REIT (a) (b) | | | 61,923 | |

| | 4,075 | | | Sonic Healthcare Ltd. | | | 67,436 | |

| | 3,557 | | | Suncorp Group Ltd. | | | 46,285 | |

| | 16,380 | | | Sydney Airport | | | 63,681 | |

| | 18,060 | | | Tabcorp Holdings Ltd. | | | 64,875 | |

| | 18,960 | | | Tatts Group Ltd. | | | 58,038 | |

| | 22,588 | | | Telstra Corp. Ltd. | | | 112,402 | |

| | 10,325 | | | Transurban Group | | | 73,947 | |

| | 3,203 | | | Wesfarmers Ltd. | | | 124,654 | |

| | 3,201 | | | Woodside Petroleum Ltd. | | | 113,701 | |

| | 4,131 | | | Woolworths Ltd. | | | 131,100 | |

| | | | | | | | |

| | | | | | | 2,419,688 | |

| | | | | | | | |

| | | | Austria — 0.1% | |

| | 1,105 | | | OMV AG | | | 34,734 | |

| | | | | | | | |

| | | | Belgium — 1.0% | |

| | 261 | | | Anheuser-Busch InBev NV | | | 28,943 | |

| | 1,560 | | | Belgacom S.A. | | | 58,919 | |

| | 655 | | | Colruyt S.A. | | | 29,832 | |

| | 455 | | | Groupe Bruxelles Lambert S.A. | | | 40,662 | |

| | 255 | | | Solvay S.A. | | | 34,813 | |

| | 606 | | | UCB S.A. | | | 48,872 | |

| | | | | | | | |

| | | | | | | 242,041 | |

| | | | | | | | |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | | | | | |

| | | | Canada — 3.4% | |

| | 560 | | | Agrium Inc. | | | 54,790 | |

| | 1,474 | | | BCE Inc. (b) | | | 65,457 | |

| | 1,105 | | | Canadian National Railway Co. | | | 77,905 | |

| | 535 | | | Canadian Tire Corp. Ltd., Class A | | | 58,658 | |

| | 1,550 | | | Fortis Inc., Class Common Subscription Receipt | | | 50,500 | |

| | 1,815 | | | Husky Energy Inc. | | | 43,819 | |

| | 987 | | | Imperial Oil Ltd. (b) | | | 47,491 | |

| | 560 | | | Magna International Inc. | | | 55,272 | |

| | 715 | | | Metro Inc., Class A | | | 50,244 | |

| | 1,500 | | | National Bank of Canada | | | 70,112 | |

| | 1,518 | | | RioCan, Class Trust Unit REIT (b) | | | 35,760 | |

| | 1,350 | | | Rogers Communications Inc., Class B | | | 50,764 | |

| | 2,330 | | | Shaw Communications Inc., Class B | | | 59,829 | |

| | 518 | | | Tim Hortons Inc. | | | 41,971 | |

| | 1,432 | | | TransCanada Corp. (b) | | | 70,581 | |

| | | | | | | | |

| | | | | | | 833,153 | |

| | | | | | | | |

| | | | Denmark — 0.8% | |

| | 125 | | | Carlsberg A/S, Class B | | | 11,025 | |

| | 678 | | | Christian Hansen Holdings | | | 27,312 | |

| | 625 | | | Coloplast A/S, Class B | | | 54,476 | |

| | 705 | | | H Lundbeck A/S | | | 14,950 | |

| | 677 | | | Novozymes A/S, Class B | | | 31,350 | |

| | 6,371 | | | TDC A/S | | | 48,655 | |

| | | | | | | | |

| | | | | | | 187,768 | |

| | | | | | | | |

| | | | Finland — 0.7% | |

| | 2,314 | | | Fortum OYJ | | | 53,666 | |

| | 2,545 | | | Neste Oil OYJ | | | 55,015 | |

| | 1,010 | | | Sampo OYJ, Class A | | | 48,397 | |

| | 1,970 | | | Stora Enso OYJ, Class R | | | 16,268 | |

| | | | | | | | |

| | | | | | | 173,346 | |

| | | | | | | | |

| | | | France — 3.2% | |

| | 740 | | | AtoS | | | 51,140 | |

| | 787 | | | Capital Gemini S.A. | | | 51,781 | |

| | 485 | | | Casino Guichard Perrachon S.A. | | | 49,729 | |

| | 1,170 | | | Dassault Systemes | | | 74,191 | |

| | 1,091 | | | Eutelsat Communications S.A. | | | 35,369 | |

| | 1,197 | | | Lagardere SCA | | | 29,131 | |

| | 3,703 | | | Orange S.A. | | | 58,953 | |

| | 290 | | | Pernod Ricard S.A. | | | 33,034 | |

| | 565 | | | Publicis Groupe S.A. (a) | | | 39,187 | |

| | 711 | | | Safran S.A. | | | 45,030 | |

| | 522 | | | Sanofi | | | 47,366 | |

| | 465 | | | Sodexo | | | 44,860 | |

| | 2,743 | | | Suez Environnement Co. | | | 46,212 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| OCTOBER 31, 2014 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 5 | |

JPMorgan Diversified Return Global Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF OCTOBER 31, 2014 (continued)

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| Common Stocks — continued | |

| | | | France — continued | |

| | 750 | | | Thales S.A. | | | 37,245 | |

| | 905 | | | Total S.A. | | | 54,031 | |

| | 396 | | | Valeo S.A. | | | 44,404 | |

| | 177 | | | Vinci S.A. | | | 10,103 | |

| | 1,719 | | | Vivendi S.A. | | | 41,994 | |

| | | | | | | | |

| | | | | | | 793,760 | |

| | | | | | | | |

| | | | Germany — 3.0% | |

| | 301 | | | BASF SE | | | 26,596 | |

| | 417 | | | Bayerische Motoren Werke AG | | | 44,718 | |

| | 545 | | | Beiersdorf AG | | | 44,188 | |

| | 205 | | | Continental AG | | | 40,378 | |

| | 3,355 | | | Deutsche Telekom AG | | | 50,571 | |

| | 640 | | | Fraport AG Frankfurt Airport Services Worldwide | | | 39,655 | |

| | 800 | | | Fresenius Medical Care AG & Co., KGaA | | | 58,718 | |

| | 1,034 | | | Fresenius SE & Co., KGaA | | | 53,206 | |

| | 627 | | | Hannover Rueck SE | | | 52,334 | |

| | 340 | | | Hugo Boss AG | | | 45,172 | |

| | 4,522 | | | Infineon Technologies AG | | | 44,056 | |

| | 330 | | | Linde AG | | | 60,903 | |

| | 600 | | | Merck KGaA | | | 54,314 | |

| | 636 | | | SAP SE | | | 43,334 | |

| | 1,542 | | | Software AG | | | 38,835 | |

| | 545 | | | Suedzucker AG | | | 7,589 | |

| | 1,296 | | | United Internet AG | | | 50,827 | |

| | | | | | | | |

| | | | | | | 755,394 | |

| | | | | | | | |

| | | | Greece — 0.1% | | | | |

| | 2,945 | | | Hellenic Telecommunications Organization S.A. | | | 33,263 | |

| | | | | | | | |

| | | | Hong Kong — 4.1% | |

| | 10,000 | | | Cathay Pacific Airways Ltd. | | | 18,756 | |

| | 7,000 | | | Cheung Kong Holdings Ltd. | | | 124,266 | |

| | 9,000 | | | Cheung Kong Infrastructure Holdings Ltd. | | | 65,739 | |

| | 9,500 | | | CLP Holdings Ltd. | | | 81,806 | |

| | 3,000 | | | Hang Seng Bank Ltd. | | | 50,833 | |

| | 35,000 | | | Hong Kong & China Gas Co., Ltd. | | | 81,732 | |

| | 9,000 | | | Hutchison Whampoa Ltd. | | | 114,125 | |

| | 3,000 | | | Johnson Electric | | | 10,137 | |

| | 14,500 | | | Link REIT (b) | | | 85,269 | |

| | 15,000 | | | MTR Corp. Ltd. | | | 61,162 | |

| | 70,000 | | | PCCW Ltd. | | | 44,500 | |

| | 8,500 | | | Power Assets Holdings Ltd. | | | 82,070 | |

| | 730,000 | | | Semiconductor Manufacturing International Corp. (a) | | | 75,684 | |

| | 5,500 | | | Swire Pacific Ltd., Class A | | | 72,141 | |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | | | | | |

| | | | Hong Kong — continued | |

| | 30,000 | | | Xinyi Glass Holdings Ltd. | | | 17,725 | |

| | 118,000 | | | Xinyi Solar Holdings Ltd. | | | 39,935 | |

| | | | | | | | |

| | | | | | | 1,025,880 | |

| | | | | | | | |

| | | | Israel — 0.2% | |

| | 745 | | | Check Point Software Technologies Ltd. (a) | | | 55,316 | |

| | | | | | | | |

| | | | Italy — 1.0% | |

| | 17,010 | | | Enel Green Power SpA | | | 41,815 | |

| | 1,945 | | | Eni SpA | | | 41,438 | |

| | 752 | | | GTECH SpA | | | 17,527 | |

| | 11,945 | | | Parmalat SpA | | | 35,895 | |

| | 3,350 | | | Pirelli & C. SpA | | | 44,923 | |

| | 10,690 | | | Terna Rete Elettrica Nazionale SpA | | | 53,896 | |

| | | | | | | | |

| | | | | | | 235,494 | |

| | | | | | | | |

| | | | Japan — 22.5% | |

| | 4,000 | | | Ajinomoto Co., Inc. | | | 75,523 | |

| | 25,000 | | | ANA Holdings Inc. | | | 57,967 | |

| | 19,000 | | | Aozora Bank Ltd. | | | 66,783 | |

| | 10,000 | | | Asahi Kasei Corp. | | | 82,062 | |

| | 2,000 | | | Bank of Kyoto Ltd. | | | 17,331 | |

| | 14,000 | | | Bank of Yokohama Ltd. (b) | | | 80,910 | |

| | 4,000 | | | Brother Industries Ltd. | | | 71,218 | |

| | 1,800 | | | Canon Inc. | | | 55,225 | |

| | 2,500 | | | Capcom Co., Ltd. | | | 38,843 | |

| | 600 | | | Central Japan Railway Co. | | | 89,489 | |

| | 10,000 | | | Chiba Bank Ltd. | | | 71,030 | |

| | 2,800 | | | Chubu Electric Power Co., Inc. | | | 33,599 | |

| | 200 | | | Chugai Pharmaceutical Co., Ltd. | | | 6,252 | |

| | 3,000 | | | Chugoku Electric Power Co., Inc. | | | 39,563 | |

| | 25,000 | | | Cosmo Oil Co., Ltd. | | | 38,955 | |

| | 3,000 | | | Daicel Corp. | | | 34,583 | |

| | 3,200 | | | Daiichi Sankyo Co., Ltd. | | | 48,134 | |

| | 19,000 | | | DIC Corp. | | | 38,940 | |

| | 3,000 | | | Dowa Holdings Co., Ltd. | | | 25,262 | |

| | 1,000 | | | East Japan Railway Co. | | | 78,103 | |

| | 1,600 | | | Eisai Co., Ltd. | | | 62,575 | |

| | 2,000 | | | Electric Power Development Co., Ltd. | | | 69,942 | |

| | 1,700 | | | FamilyMart Co., Ltd. (b) | | | 68,260 | |

| | 13,000 | | | Fuji Electric Co., Ltd. | | | 57,115 | |

| | 2,600 | | | FUJIFILM Holdings Corp. | | | 87,278 | |

| | 6,000 | | | Fujikura Ltd. (b) | | | 25,204 | |

| | 15,000 | | | Fukuoka Financial Group Inc. | | | 76,756 | |

| | 700 | | | Hikari Tsushin Inc. | | | 46,434 | |

| | 3,000 | | | Hokuriku Electric Power Co. | | | 40,501 | |

| | 2,400 | | | Hoya Corp. | | | 84,929 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 6 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2014 |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| Common Stocks — continued | |

| | | | Japan — continued | |

| | 2,500 | | | Idemitsu Kosan Co., Ltd. | | | 48,349 | |

| | 5,500 | | | Inpex Corp. | | | 70,347 | |

| | 6,500 | | | ITOCHU Corp. | | | 78,576 | |

| | 2,000 | | | Japan Airlines Co., Ltd. | | | 53,704 | |

| | 1,500 | | | Japan Petroleum Exploration Co. | | | 49,039 | |

| | 16,500 | | | JX Holdings Inc. | | | 70,680 | |

| | 9,000 | | | Kaneka Corp. | | | 49,449 | |

| | 28,000 | | | Kawasaki Kisen Kaisha Ltd. | | | 63,795 | |

| | 1,400 | | | KDDI Corp. | | | 91,937 | |

| | 4,000 | | | Keisei Electric Railway Co., Ltd. | | | 47,014 | |

| | 7,200 | | | Konica Minolta Inc. | | | 80,451 | |

| | 4,100 | | | Kuraray Co., Ltd. | | | 47,622 | |

| | 5,000 | | | Kyowa Hakko Kirin Co., Ltd. | | | 58,317 | |

| | 11,600 | | | Marubeni Corp. | | | 74,582 | |

| | 500 | | | MEIJI Holdings Co., Ltd. | | | 41,951 | |

| | 1,600 | | | Mitsubishi Corp. | | | 31,373 | |

| | 5,000 | | | Mitsubishi Tanabe Pharma Corp. | | | 76,036 | |

| | 5,000 | | | Mitsui Mining & Smelting Co., Ltd. | | | 13,263 | |

| | 900 | | | Mochida Pharmaceutical Co., Ltd. | | | 56,280 | |

| | 700 | | | NGK Spark Plug Co., Ltd. | | | 18,256 | |

| | 3,000 | | | NH Foods Ltd. | | | 69,179 | |

| | 5,000 | | | Nippon Kayaku Co., Ltd. | | | 65,745 | |

| | 2,400 | | | Nippon Paper Industries Co., Ltd. | | | 35,321 | |

| | 4,000 | | | Nippon Shokubai Co., Ltd. | | | 47,946 | |

| | 1,300 | | | Nippon Telegraph & Telephone Corp. | | | 80,884 | |

| | 3,500 | | | Nippon Television Holdings Inc. | | | 53,194 | |

| | 4,500 | | | Nipro Corp. | | | 37,075 | |

| | 1,300 | | | Nissin Foods Holdings Co., Ltd. | | | 68,516 | |

| | 700 | | | Nitori Holdings Co., Ltd. | | | 44,363 | |

| | 200 | | | Nomura Research Institute Ltd. | | | 6,597 | |

| | 1,500 | | | NTT Data Corp. | | | 58,637 | |

| | 5,000 | | | NTT DOCOMO Inc. | | | 84,330 | |

| | 400 | | | Oriental Land Co., Ltd. | | | 85,536 | |

| | 19,000 | | | Osaka Gas Co., Ltd. | | | 75,788 | |

| | 1,400 | | | Otsuka Corp. | | | 52,056 | |

| | 2,300 | | | Otsuka Holdings Co., Ltd. | | | 80,679 | |

| | 14,500 | | | Resona Holdings Inc. | | | 82,937 | |

| | 1,000 | | | Rohm Co., Ltd. | | | 60,871 | |

| | 1,100 | | | Sankyo Co., Ltd. | | | 40,030 | |

| | 300 | | | Santen Pharmaceutical Co., Ltd. | | | 17,906 | |

| | 500 | | | Sawai Pharmaceutical Co., Ltd. | | | 29,789 | |

| | 1,100 | | | Seiko Epson Corp. | | | 51,045 | |

| | 2,000 | | | Sekisui Chemical Co., Ltd. | | | 24,927 | |

| | 6,200 | | | Sekisui House Ltd. | | | 77,096 | |

| | 13,000 | | | Seven Bank Ltd. | | | 54,293 | |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | | | | | |

| | | | Japan — continued | |

| | 600 | | | Shimamura Co., Ltd. | | | 52,772 | |

| | 3,500 | | | Shionogi & Co., Ltd. | | | 91,566 | |

| | 3,000 | | | Shizuoka Bank Ltd. | | | 30,998 | |

| | 7,000 | | | Showa Shell Sekiyu | | | 60,062 | |

| | 1,400 | | | SoftBank Corp. | | | 101,919 | |

| | 6,600 | | | Sumitomo Corp. | | | 70,420 | |

| | 13,000 | | | Sumitomo Osaka Cement Co., Ltd. | | | 40,638 | |

| | 1,400 | | | Suruga Bank Ltd. | | | 29,269 | |

| | 1,000 | | | Suzuken Co.,Ltd. | | | 26,811 | |

| | 500 | | | Taisho Pharmaceutical Holdings Co., Ltd. | | | 35,094 | |

| | 2,000 | | | Takeda Pharmaceutical Co., Ltd. | | | 86,697 | |

| | 4,700 | | | Tohoku Electric Power Co., Inc. | | | 58,742 | |

| | 3,000 | | | Tokyo Broadcasting System Holdings Inc. | | | 33,259 | |

| | 14,000 | | | Tokyo Gas Co., Ltd. | | | 80,700 | |

| | 7,000 | | | TonenGeneral Sekiyu | | | 61,096 | |

| | 7,000 | | | Toppan Printing Co., Ltd. | | | 47,630 | |

| | 10,000 | | | Tosoh Corp. | | | 43,486 | |

| | 2,000 | | | Toyo Suisan Kaisha Ltd. | | | 69,073 | |

| | 1,500 | | | Toyota Industries Corp. | | | 71,425 | |

| | 2,000 | | | Toyota Motor Corp. | | | 120,354 | |

| | 2,000 | | | Tsumura & Co. | | | 44,752 | |

| | 14,000 | | | Ube Industries Ltd. | | | 21,677 | |

| | 1,800 | | | West Japan Railway Co. | | | 85,798 | |

| | 100 | | | Yamato Holdings Co., Ltd. | | | 2,138 | |

| | 4,000 | | | Yokohama Rubber Co., Ltd. | | | 36,310 | |

| | 1,000 | | | Zeon Corp. | | | 9,256 | |

| | | | | | | | |

| | | | | | | 5,586,469 | |

| | | | | | | | |

| | | | Netherlands — 1.1% | | | | |

| | 42 | | | Gemalto NV | | | 3,212 | |

| | 581 | | | Heineken Holding NV | | | 37,658 | |

| | 2,815 | | | Koninklijke Ahold NV | | | 47,147 | |

| | 2,176 | | | Reed Elsevier NV | | | 50,125 | |

| | 1,695 | | | Royal Dutch Shell plc, Class A | | | 60,548 | |

| | 2,860 | | | STMicroelectronics NV | | | 19,104 | |

| | 1,720 | | | Wolters Kluwer NV | | | 45,922 | |

| | 428 | | | Ziggo NV | | | 20,916 | |

| | | | | | | | |

| | | | | | | 284,632 | |

| | | | | | | | |

| | | | New Zealand — 0.3% | | | | |

| | 30,015 | | | Telecom Corp of New Zealand Ltd. | | | 74,071 | |

| | | | | | | | |

| | | | Norway — 0.6% | | | | |

| | 1,441 | | | Marine Harvest ASA | | | 20,408 | |

| | 2,806 | | | Orkla ASA | | | 21,455 | |

| | 1,346 | | | Seadrill Ltd. | | | 30,419 | |

| | 1,735 | | | Statoil ASA | | | 39,706 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| OCTOBER 31, 2014 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 7 | |

JPMorgan Diversified Return Global Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF OCTOBER 31, 2014 (continued)

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| Common Stocks — continued | |

| | | | Norway — continued | |

| | 1,010 | | | Yara International ASA | | | 46,381 | |

| | | | | | | | |

| | | | | | | 158,369 | |

| | | | | | | | |

| | | | Portugal — 0.4% | | | | |

| | 14,655 | | | EDP — Energias de Portugal S.A. | | | 63,065 | |

| | 23,185 | | | Portugal Telecom SGPS S.A. | | | 37,975 | |

| | | | | | | | |

| | | | | | | 101,040 | |

| | | | | | | | |

| | | | Singapore — 2.6% | | | | |

| | 15,000 | | | CapitaMall Trust REIT (b) | | | 23,007 | |

| | 8,000 | | | DBS Group Holdings Ltd. | | | 115,083 | |

| | 145,000 | | | Golden Agri-Resources Ltd. | | | 58,761 | |

| | 60,000 | | | Hutchison Port Holdings Trust, Class U | | | 40,512 | |

| | 9,000 | | | Keppel Corp. Ltd. | | | 65,999 | |

| | 14,000 | | | Sembcorp Industries Ltd. | | | 52,963 | |

| | 5,000 | | | Singapore Airlines Ltd. | | | 38,533 | |

| | 20,000 | | | Singapore Press Holdings Ltd. | | | 66,663 | |

| | 35,000 | | | Singapore Telecommunications Ltd. | | | 103,015 | |

| | 4,000 | | | Venture Corp. Ltd. | | | 24,094 | |

| | 24,000 | | | Wilmar International, Ltd. | | | 59,825 | |

| | | | | | | | |

| | | | | | | 648,455 | |

| | | | | | | | |

| | | | South Korea — 7.3% | | | | |

| | 1,630 | | | Celltrion Inc. | | | 64,139 | |

| | 131 | | | CJ CheilJedang Corp. | | | 47,832 | |

| | 296 | | | CJ Corp. | | | 48,086 | |

| | 484 | | | Daum Communications Corp. | | | 66,372 | |

| | 816 | | | GS Holdings | | | 31,565 | |

| | 1,075 | | | Halla Visteon Climate Control Corp. | | | 47,907 | |

| | 1,066 | | | Hankook Tire Co., Ltd. | | | 54,924 | |

| | 2,881 | | | Hanwha Chemical Corp. | | | 32,828 | |

| | 145 | | | Hyundai Mobis Co., Ltd. | | | 33,925 | |

| | 19 | | | Hyundai Motor Co. | | | 3,015 | |

| | 1,145 | | | Hyundai Steel Co. | | | 72,975 | |

| | 3,672 | | | Industrial Bank of Korea | | | 53,697 | |

| | 640 | | | Kia Motors Corp. | | | 31,086 | |

| | 2,002 | | | Korea Electric Power Corp. | | | 87,880 | |

| | 1,135 | | | Korea Gas Corp. | | | 53,210 | |

| | 62 | | | Korea Zinc Co., Ltd. | | | 23,349 | |

| | 2,440 | | | KT Corp. | | | 75,175 | |

| | 928 | | | KT&G Corp. | | | 82,168 | |

| | 2,545 | | | LG Display Co., Ltd. (a) | | | 74,922 | |

| | 481 | | | LG Electronics Inc. | | | 29,376 | |

| | 6,592 | | | LG Uplus Corp. | | | 67,792 | |

| | 125 | | | Lotte Shopping Co., Ltd. | | | 34,652 | |

| | 140 | | | NAVER Corp. | | | 99,067 | |

| | 383 | | | Paradise Co., Ltd. | | | 11,789 | |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | | | | | |

| | | | South Korea — continued | | | | |

| | 343 | | | POSCO | | | 99,071 | |

| | 108 | | | Samsung Electronics Co., Ltd. (b) | | | 125,944 | |

| | 555 | | | Samsung Fine Chemicals Co., Ltd. | | | 15,473 | |

| | 359 | | | SK C&C Co., Ltd. | | | 81,468 | |

| | 176 | | | SK Holdings Co., Ltd. | | | 27,588 | |

| | 2,459 | | | SK Hynix Inc. | | | 109,657 | |

| | 324 | | | SK Telecom Co., Ltd. | | | 81,194 | |

| | 915 | | | SKC Co., Ltd. | | | 23,509 | |

| | | | | | | | |

| | | | | | | 1,791,635 | |

| | | | | | | | |

| | | | Spain — 2.0% | | | | |

| | 25 | | | Acciona S.A. | | | 1,747 | |

| | 1,500 | | | Acerinox S.A. | | | 22,319 | |

| | 929 | | | ACS Actividades de Construccion y Servicios S.A. | | | 34,483 | |

| | 1,688 | | | Enagas S.A. | | | 56,649 | |

| | 1,310 | | | Endesa S.A. | | | 25,555 | |

| | 2,380 | | | Ferrovial S.A. | | | 48,659 | |

| | 1,785 | | | Gas Natural SDG S.A. | | | 51,545 | |

| | 1,060 | | | Grifols S.A. | | | 43,284 | |

| | 7,502 | | | Iberdrola S.A. | | | 53,106 | |

| | 610 | | | Red Electrica Corp. S.A. | | | 53,303 | |

| | 2,007 | | | Repsol S.A. | | | 44,854 | |

| | 3,284 | | | Telefonica S.A. | | | 49,417 | |

| | | | | | | | |

| | | | | | | 484,921 | |

| | | | | | | | |

| | | | Sweden — 2.4% | |

| | 569 | | | Autoliv Inc. | | | 52,200 | |

| | 3,135 | | | Boliden AB | | | 51,813 | |

| | 1,480 | | | Holmen AB, Class B | | | 48,984 | |

| | 1,380 | | | Investor AB, Class B (b) | | | 49,532 | |

| | 5,205 | | | Securitas AB, Class B | | | 57,597 | |

| | 3,000 | | | Skanska AB, Class B | | | 61,153 | |

| | 2,400 | | | Svenska Cellulosa AB SCA, Class B | | | 53,776 | |

| | 1,165 | | | Svenska Handelsbanken AB, Class A | | | 55,693 | |

| | 5,111 | | | Tele2 AB, Class B | | | 64,938 | |

| | 4,026 | | | Telefonaktiebolaget LM Ericsson, Class B (b) | | | 47,573 | |

| | 8,625 | | | TeliaSonera AB | | | 59,726 | |

| | | | | | | | |

| | | | | | | 602,985 | |

| | | | | | | | |

| | | | Switzerland — 2.6% | |

| | 586 | | | Actelion Ltd. | | | 69,790 | |

| | 579 | | | Aryzta AG | | | 49,389 | |

| | 414 | | | Baloise Holding AG | | | 52,116 | |

| | 2,394 | | | Clariant AG | | | 41,759 | |

| | 1,085 | | | Garmin Ltd. | | | 60,196 | |

| | 35 | | | Givaudan S.A. | | | 58,449 | |

| | 460 | | | Lonza Group AG | | | 50,686 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 8 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2014 |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| Common Stocks — continued | |

| | | | Switzerland — continued | |

| | 615 | | | Novartis AG | | | 57,074 | |

| | 139 | | | Roche Holding AG | | | 41,019 | |

| | 321 | | | Sonova Holding AG | | | 50,054 | |

| | 170 | | | Sulzer AG Ltd. | | | 19,376 | |

| | 93 | | | Swiss Life Holding AG | | | 21,338 | |

| | 115 | | | Swisscom AG | | | 67,795 | |

| | | | | | | | |

| | | | | | | 639,041 | |

| | | | | | | | |

| | | | United Kingdom — 3.4% | |

| | 2,700 | | | AMEC plc | | | 45,020 | |

| | 7,015 | | | BP plc (b) | | | 50,472 | |

| | 2,175 | | | British Land Co., plc REIT (b) | | | 25,397 | |

| | 7,356 | | | BT Group plc, Class A | | | 43,366 | |

| | 2,430 | | | Bunzl plc (b) | | | 65,987 | |

| | 576 | | | easyJet plc | | | 13,841 | |

| | 675 | | | Ensco plc, Class A | | | 27,398 | |

| | 2,085 | | | GKN plc | | | 10,654 | |

| | 2,020 | | | GlaxoSmithKline plc | | | 45,680 | |

| | 2,015 | | | Hammerson plc REIT (b) | | | 19,795 | |

| | 9,302 | | | J Sainsbury plc (b) | | | 36,646 | |

| | 195 | | | Johnson Matthey plc | | | 9,309 | |

| | 2,871 | | | Land Securities Group plc REIT (b) | | | 50,943 | |

| | 610 | | | Next plc | | | 62,974 | |

| | 749 | | | Persimmon plc | | | 17,590 | |

| | 6,625 | | | Rexam plc | | | 50,495 | |

| | 1,335 | | | Rowan Co., plc, Class A | | | 32,400 | |

| | 9,361 | | | Sage Group plc | | | 56,685 | |

| | 3,200 | | | Smith & Nephew plc (b) | | | 54,321 | |

| | 2,491 | | | Subsea 7 S.A. | | | 26,807 | |

| | 2,687 | | | Tate & Lyle plc | | | 26,005 | |

| | 1,217 | | | United Utilities Group plc | | | 16,683 | |

| | 5,553 | | | WM Morrison Supermarkets plc | | | 13,787 | |

| | 2,255 | | | WPP plc | | | 44,046 | |

| | | | | | | | |

| | | | | | | 846,301 | |

| | | | | | | | |

| | | | United States — 27.2% | |

| | 370 | | | Airgas Inc. | | | 41,270 | |

| | 100 | | | Alleghany Corp. (a) | | | 44,428 | |

| | 940 | | | Alliant Energy Corp. | | | 58,196 | |

| | 1,414 | | | Amdocs | | | 67,222 | |

| | 980 | | | Ameren Corp. | | | 41,493 | |

| | 1,451 | | | American Water Works Co., Inc. | | | 77,440 | |

| | 920 | | | AmerisourceBergen Corp., Class A | | | 78,577 | |

| | 30 | | | Arthur J Gallagher & Co. | | | 1,431 | |

| | 500 | | | Ashland Inc. | | | 54,035 | |

| | 785 | | | Assurant Inc. | | | 53,553 | |

| | 2,312 | | | AT&T Inc. (b) | | | 80,550 | |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | | | | | |

| | | | United States — continued | |

| | 990 | | | AutoNation Inc. (a) | | | 56,688 | |

| | 75 | | | AutoZone Inc. (a) | | | 41,514 | |

| | 1,075 | | | Avery Dennison Corp. | | | 50,364 | |

| | 1,130 | | | Axis Capital Holdings Ltd. | | | 54,398 | |

| | 587 | | | Becton Dickinson and Co. (b) | | | 75,547 | |

| | 1,280 | | | Bemis Co., Inc. | | | 49,241 | |

| | 1,806 | | | Broadridge Financial Solutions Inc. | | | 79,338 | |

| | 420 | | | Brown-Forman Corp., Class B | | | 38,921 | |

| | 1,795 | | | CA Technologies Inc. (b) | | | 52,163 | |

| | 1,541 | | | CareFusion Corp. (a) | | | 88,407 | |

| | 1,912 | | | CenturyLink Inc. | | | 79,310 | |

| | 206 | | | CF Industries Holdings Inc. | | | 53,560 | |

| | 630 | | | Chevron Corp. | | | 75,569 | |

| | 196 | | | Chubb Corp. | | | 19,475 | |

| | 735 | | | Church & Dwight Co., Inc. | | | 53,221 | |

| | 678 | | | Cigna Corp. (b) | | | 67,508 | |

| | 1,005 | | | Cincinnati Financial Corp. | | | 50,722 | |

| | 855 | | | Cintas Corp. | | | 62,620 | |

| | 1,755 | | | CMS Energy Corp. (b) | | | 57,336 | |

| | 735 | | | CNA Financial Corp. | | | 28,724 | |

| | 1,260 | | | Coca-Cola Enterprises Inc. | | | 54,621 | |

| | 775 | | | Commerce Bancshares Inc. | | | 35,077 | |

| | 872 | | | Computer Sciences Corp. | | | 52,669 | |

| | 1,035 | | | ConocoPhillips | | | 74,675 | |

| | 603 | | | Constellation Brands Inc., Class A (a) | | | 55,199 | |

| | 255 | | | CR Bard Inc. | | | 41,813 | |

| | 179 | | | DaVita HealthCare Partners Inc. (a) | | | 13,974 | |

| | 1,025 | | | DENTSPLY International Inc. | | | 52,039 | |

| | 595 | | | Diamond Offshore Drilling Inc. | | | 22,437 | |

| | 801 | | | Dr Pepper Snapple Group Inc. | | | 55,469 | |

| | 670 | | | DST Systems Inc. | | | 64,554 | |

| | 892 | | | DTE Energy Co. | | | 73,287 | |

| | 275 | | | Duke Energy Corp. | | | 22,591 | |

| | 350 | | | Eastman Chemical Co. | | | 28,273 | |

| | 183 | | | EI du Pont de Nemours & Co. (b) | | | 12,655 | |

| | 455 | | | Energizer Holdings Inc. | | | 55,806 | |

| | 371 | | | Entergy Corp. (b) | | | 31,171 | |

| | 451 | | | Everest RE Group | | | 76,963 | |

| | 754 | | | Fidelity National Information Services Inc. | | | 44,026 | |

| | 1,417 | | | Foot Locker Inc. | | | 79,366 | |

| | 10,195 | | | Frontier Communications Corp. | | | 66,675 | |

| | 780 | | | GameStop Corp., Class A | | | 33,353 | |

| | 732 | | | Gannett Co., Inc. (b) | | | 23,058 | |

| | 425 | | | Genuine Parts Co. | | | 41,259 | |

| | 760 | | | Harris Corp. | | | 52,896 | |

| | 1,004 | | | Hasbro Inc. | | | 57,760 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| OCTOBER 31, 2014 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 9 | |

JPMorgan Diversified Return Global Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF OCTOBER 31, 2014 (continued)

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| Common Stocks — continued | |

| | | | United States — continued | |

| | 485 | | | Henry Schein Inc. (a) | | | 58,215 | |

| | 490 | | | Hess Corp. (b) | | | 41,557 | |

| | 1,100 | | | Hormel Foods Corp. | | | 59,301 | |

| | 867 | | | Intel Corp. (b) | | | 29,487 | |

| | 603 | | | InterActiveCorp | | | 40,817 | |

| | 545 | | | International Flavors & Fragrances Inc. (b) | | | 54,037 | |

| | 706 | | | JM Smucker Co. | | | 73,424 | |

| | 815 | | | Johnson & Johnson (b) | | | 87,841 | |

| | 317 | | | KLA-Tencor Corp. | | | 25,090 | |

| | 592 | | | L-3 Communications Holdings Inc., Class 3 | | | 71,904 | |

| | 495 | | | Laboratory Corp of America Holdings (a) | | | 54,099 | |

| | 1,660 | | | Leggett & Platt Inc. | | | 65,371 | |

| | 1,087 | | | Level 3 Communications Inc. (a) | | | 50,991 | |

| | 1,810 | | | Liberty Interactive Corp., Class A (a) | | | 47,313 | |

| | 257 | | | Liberty Ventures, Ser A (a) | | | 9,021 | |

| | 1,752 | | | Marathon Oil Corp. | | | 62,021 | |

| | 255 | | | McCormick & Co., Inc. | | | 18,034 | |

| | 1,485 | | | MDU Resources Group Inc. | | | 41,847 | |

| | 1,201 | | | Medtronic Inc. (b) | | | 81,860 | |

| | 756 | | | Microchip Technology Inc. | | | 32,591 | |

| | 805 | | | Molson Coors Brewing Co., Class B | | | 59,876 | |

| | 825 | | | Motorola Solutions Inc. (b) | | | 53,213 | |

| | 695 | | | Murphy Oil Corp. | | | 37,106 | |

| | 1,720 | | | Newell Rubbermaid Inc. | | | 57,327 | |

| | 1,570 | | | NiSource Inc. | | | 66,034 | |

| | 1,270 | | | Northeast Utilities | | | 62,675 | |

| | 606 | | | Northrop Grumman Corp. | | | 83,604 | |

| | 2,876 | | | NVIDIA Corp. | | | 56,197 | |

| | 19 | | | NVR Inc. (a) | | | 23,324 | |

| | 682 | | | PartnerRe Ltd. | | | 78,900 | |

| | 1,195 | | | Patterson Co., Inc. | | | 51,516 | |

| | 1,225 | | | Patterson-UTI Energy Inc. | | | 28,212 | |

| | 2,962 | | | Pepco Holdings Inc. | | | 80,981 | |

| | 52 | | | PetSmart Inc. | | | 3,762 | |

| | 928 | | | Pfizer Inc. (b) | | | 27,793 | |

| | 910 | | | Pinnacle West Capital Corp. (b) | | | 55,938 | |

| | 370 | | | PPG Industries Inc. (b) | | | 75,365 | |

| | 1,308 | | | PPL Corp. | | | 45,767 | |

| | 945 | | | Quest Diagnostics Inc. | | | 59,970 | |

| | 820 | | | Questar Corp. | | | 19,770 | |

| | 727 | | | Raytheon Co. | | | 75,521 | |

| | 705 | | | RenaissanceRe Holdings Ltd. | | | 72,848 | |

| | 1,242 | | | Republic Services Inc., Class A | | | 47,693 | |

| | 629 | | | Ryder System Inc. (b) | | | 55,648 | |

| | 691 | | | SBA Communications Corp., Class A (a) | | | 77,620 | |

| | 1,224 | | | SCANA Corp. | | | 67,185 | |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | | | | | |

| | | | United States — continued | |

| | 415 | | | Scripps Networks Interactive Inc., Class A | | | 32,054 | |

| | 396 | | | Sigma-Aldrich Corp. | | | 53,820 | |

| | 1,336 | | | Southwest Airlines Co. | | | 46,065 | |

| | 9,031 | | | Sprint Corp. (a) (b) | | | 53,554 | |

| | 146 | | | SPX Corp. | | | 13,839 | |

| | 1,170 | | | Starz (a) | | | 36,153 | |

| | 1,641 | | | Synopsys Inc. (a) | | | 67,248 | |

| | 2,885 | | | TECO Energy Inc. | | | 56,575 | |

| | 1,990 | | | TELUS Corp. | | | 71,341 | |

| | 330 | | | Thomson Reuters Corp. | | | 12,277 | |

| | 2,000 | | | T-Mobile US Inc. (a) | | | 58,380 | |

| | 990 | | | Torchmark Corp. | | | 52,430 | |

| | 1,064 | | | Total System Services Inc. | | | 35,953 | |

| | 539 | | | TRW Automotive Holdings Corp. (a) | | | 54,628 | |

| | 1,214 | | | Tyson Foods Inc., Class A | | | 48,985 | |

| | 670 | | | Universal Health Services Inc., Class B | | | 69,486 | |

| | 1,616 | | | Verizon Communications Inc. (b) | | | 81,204 | |

| | 894 | | | Walt Disney Co. (The) (b) | | | 81,694 | |

| | 562 | | | WellPoint Inc. | | | 71,200 | |

| | 242 | | | Westlake Chemical Corp. | | | 17,073 | |

| | 5,775 | | | Windstream Holdings Inc. | | | 60,522 | |

| | 779 | | | Wisconsin Energy Corp. | | | 38,685 | |

| | 1,115 | | | WR Berkley Corp. | | | 57,467 | |

| | 920 | | | Wyndham Worldwide Corp. | | | 71,456 | |

| | 2,230 | | | Xcel Energy Inc. | | | 74,638 | |

| | 571 | | | Zimmer Holdings Inc. | | | 63,518 | |

| | | | | | | | |

| | | | | | | 6,763,398 | |

| | | | | | | | |

| | | | Total Common Stock

(Cost $25,144,750) | | | 24,771,154 | |

| | | | | | | | |

| Preferred Stock — 0.1% | | | | |

| | | | Germany — 0.1% | | | | |

| | 210 | | | Porsche Automobil Holding SE | | | 17,244 | |

| | | | | | | | |

| | | | Total Preferred Stock

(Cost $20,876) | | | 17,244 | |

| | | | | | | | |

| | | | Total Investments — 99.8%

(Cost $25,165,626) | | | 24,788,398 | |

| | | | Other Assets in Excess of

Liabilities — 0.2% | | | 58,369 | |

| | | | | | | | |

| | | | NET ASSETS— 100.00% | | $ | 24,846,767 | |

| | | | | | | | |

Percentages indicated are based on net assets.

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 10 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2014 |

JPMorgan Diversified Return Global Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF OCTOBER 31, 2014 (continued)

Summary of Investments by Industry, October 31, 2014

The following table represents the portfolio investments of the Fund by industry classifications as a percentage of total investments:

| | | | |

| INDUSTRY | | PERCENTAGE | |

Oil, Gas & Consumable Fuels | | | 7.2 | % |

Diversified Telecommunication Services | | | 6.6 | |

Chemicals | | | 5.1 | |

Electric Utilities | | | 4.9 | |

Pharmaceuticals | | | 4.8 | |

Commercial Banks | | | 3.6 | |

Food Products | | | 3.4 | |

Health Care Providers & Services | | | 3.4 | |

Media | | | 3.0 | |

Insurance | | | 3.0 | |

Health Care Equipment & Supplies | | | 2.7 | |

Wireless Telecommunication Services | | | 2.7 | |

Semiconductors & Semiconductor Equipment | | | 2.5 | |

Multi-Utilities | | | 2.5 | |

IT Services | | | 2.3 | |

Road & Rail | | | 2.2 | |

Auto Components | | | 2.1 | |

Real Estate Investment Trusts (REITs) | | | 2.1 | |

Metals & Mining | | | 2.1 | |

Hotels, Restaurants & Leisure | | | 2.0 | |

Gas Utilities | | | 1.9 | |

Software | | | 1.7 | |

Specialty Retail | | | 1.6 | |

Food & Staples Retailing | | | 1.5 | |

Beverages | | | 1.5 | |

Trading Companies & Distributors | | | 1.5 | |

Household Durables | | | 1.4 | |

Electronic Equipment & Instruments | | | 1.4 | |

Aerospace & Defense | | | 1.3 | |

Industrial Conglomerates | | | 1.3 | |

Commercial Services & Supplies | | | 1.2 | |

Computers & Peripherals | | | 1.0 | |

Internet Software & Services | | | 1.0 | |

Biotechnology | | | 1.0 | |

Energy Equipment & Services | | | 1.0 | |

Others (each less than 1.0%) | | | 11.5 | |

NOTES TO SCHEDULE OF PORTFOLIO INVESTMENTS

| | |

| REIT | | — Real Estate Investment Trust |

| Ser | | — Series |

| |

| (a) | | — Non-income producing security. |

| |

| (b) | | — All or a portion of this security is reserved and/or pledged with the custodian for current or potential holdings of futures, swaps, options, TBAs, when-issued securities, delayed delivery securities, reverse repurchase agreements, unfunded commitments and/or forward foreign currency contracts. |

The value and percentage, based on total investments, of the investments that apply fair valuation policy for the international investments as described in Note 2.A. of the Notes to Financial Statements are as follows: $16,964,336 and 68.3%, respectively.

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| OCTOBER 31, 2014 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 11 | |

STATEMENT OF ASSETS AND LIABILITIES

AS OF OCTOBER 31, 2014

| | | | |

| | |

JPMorgan

Diversified Return

Global Equity ETF | |

ASSETS: | | | | |

Investments in non-affiliates, at value | | $ | 24,788,398 | |

Cash | | | 109,553 | |

Foreign currency, at value | | | 36,626 | |

Receivables: | | | | |

Due from Adviser | | | 16,228 | |

Dividends from non-affiliates | | | 46,313 | |

Tax reclaims | | | 2,166 | |

Prepaid expenses | | | 31 | |

Deferred offering costs | | | 16,254 | |

| | | | |

Total Assets | | | 25,015,569 | |

| | | | |

| |

LIABILITIES: | | | | |

Accrued Liabilities: | | | | |

Professional fees | | | 138,390 | |

Custodian fees | | | 5,765 | |

Trustees’ and Chief Compliance Officer’s fees | | | 17,596 | |

Accounting fees | | | 357 | |

Other | | | 6,694 | |

| | | | |

Total Liabilities | | | 168,802 | |

| | | | |

Net Assets | | $ | 24,846,767 | |

| | | | |

| |

NET ASSETS: | | | | |

Paid-in-Capital | | $ | 25,173,053 | |

Accumulated undistributed net investment income | | | 152,009 | |

Accumulated net realized gains (losses) | | | (99,673 | ) |

Net unrealized appreciation (depreciation) | | | (378,622 | ) |

| | | | |

Total Net Assets | | $ | 24,846,767 | |

| | | | |

| |

Outstanding number of shares authorized

(unlimited number of shares authorized — no par value) | | | 500,000 | |

| | | | |

Net asset value, per share | | $ | 49.69 | |

| | | | |

| |

Cost of investments in non-affiliates | | $ | 25,165,626 | |

Cost of foreign currency | | | 36,887 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 12 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2014 |

STATEMENT OF OPERATIONS

FOR THE PERIOD ENDED OCTOBER 31, 2014

| | | | |

| | |

JPMorgan

Diversified Return

Global Equity ETF (a) | |

INVESTMENT INCOME: | | | | |

Dividend income from non-affiliates | | $ | 191,153 | |

Interest income from non-affiliates | | | 12 | |

Foreign taxes withheld | | | (16,688 | ) |

| | | | |

Total Investment Income | | | 174,477 | |

| | | | |

| |

EXPENSES: | | | | |

Investment advisory fees | | | 17,506 | |

Administration fees | | | 6,200 | |

Custodian fees | | | 12,400 | |

Professional fees | | | 230,774 | |

Trustees’ and Chief Compliance Officer’s fees | | | 70,097 | |

Registration and filing fees | | | 15,787 | |

Printing and mailing costs | | | 10,000 | |

Offering costs | | | 9,653 | |

Other | | | 12,250 | |

| | | | |

Total Expenses | | | 384,667 | |

| | | | |

Less | | | | |

Less fees waived | | | (23,706 | ) |

Less expense reimbursements | | | (333,241 | ) |

| | | | |

Net expenses | | | 27,720 | |

| | | | |

Net Investment income (loss) | | | 146,757 | |

| | | | |

| |

REALIZED/UNREALIZED GAINS (LOSSES): | | | | |

Net realized gain (loss) on transactions from: | | | | |

Investments in non-affiliates | | | (99,543 | ) |

Foreign currency translations | | | 5,122 | |

| | | | |

Net realized gain (loss) | | | (94,421 | ) |

| | | | |

Change in net unrealized appreciation (depreciation) of: | | | | |

Investments in non-affiliates | | | (377,228 | ) |

Foreign currency translations | | | (1,394 | ) |

| | | | |

Change in net unrealized appreciation/depreciation | | | (378,622 | ) |

| | | | |

Net realized/unrealized gains (losses) | | | (473,043 | ) |

| | | | |

Change in net assets resulting from operations | | $ | (326,286 | ) |

| | | | |

| (a) | Commencement of operations was June 16, 2014 |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| OCTOBER 31, 2014 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 13 | |

STATEMENT OF CHANGES IN NET ASSETS

FOR THE PERIOD INDICATED

| | | | |

| | | JPMorgan

Diversified Return

Global Equity ETF | |

| | | Period Ended

October 31, 2014 (a) | |

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS: | | | | |

Net investment income (loss) | | $ | 146,757 | |

Net realized gain (loss) | | | (94,421 | ) |

Change in net unrealized appreciation/depreciation | | | (378,622 | ) |

| | | | |

Change in net assets resulting from operations | | | (326,286 | ) |

| | | | |

| |

CAPITAL TRANSACTIONS: | | | | |

Change in net assets resulting from capital transactions | | | 25,173,053 | |

| | | | |

| |

NET ASSETS: | | | | |

Change in net assets | | | 24,846,767 | |

Beginning of period | | | — | |

| | | | |

End of period | | $ | 24,846,767 | |

| | | | |

Accumulated undistributed net investment income | | $ | 152,009 | |

| | | | |

| |

CAPITAL TRANSACTIONS: | | | | |

Proceeds from shares issued | | | 25,173,053 | |

| | | | |

Total change in net assets resulting from capital transactions | | $ | 25,173,053 | |

| | | | |

| |

SHARE TRANSACTIONS: | | | | |

Issued | | | 500,000 | |

| | | | |

| (a) | Commencement of operations was June 16, 2014. |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 14 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2014 |

FINANCIAL HIGHLIGHTS

FOR THE PERIOD INDICATED

| | | | |

| | | JPMorgan Diversified

Return Global Equity ETF | |

| | | June 16, 2014 (a) through

October 31, 2014 | |

Net asset value, beginning of period | | $ | 50.00 | |

Net investment income (loss) (b) | | | 0.38 | |

Net realized and unrealized gains (losses) on investments | | | (0.69 | ) |

| | | | |

Total from investment operations | | | (0.31 | ) |

| | | | |

Dividends and distributions: | | | | |

Net investment income | | | — | |

| | | | |

Net asset value, end of period | | $ | 49.69 | |

Market price, end of period (e) | | $ | 50.09 | |

Total return (c)(d) | | | (0.62 | )% |

Market price total return (c)(e) | | | 0.18 | % |

Net assets end of period | | $ | 24,846,767 | |

Ratios to average net assets (f): | | | | |

Net expenses (g) | | | 0.38 | % |

Net investment income (loss) | | | 2.01 | % |

Expenses without waivers and reimbursements (g) | | | 5.19 | % |

Portfolio turnover rate (c)(h) | | | 14 | % |

| (a) | Commencement of operations. |

| (b) | Calculated based upon average shares outstanding. |

| (c) | Not annualized for periods less than one year. |

| (d) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (e) | Market price total return is calculated assuming an initial investment made at the inception date net asset value, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The market price presented to calculate the market price total return is the mid-point of the bid/ask spread at the close of business on the NYSE Arca. |

| (f) | Annualized for periods less than one year, unless otherwise indicated. |

| (g) | Certain non-recurring expenses incurred by the Fund were not annualized for the period ended October 31, 2014. |

| (h) | Portfolio turnover is calculated by dividing the lesser of total purchases or sales of portfolio securities for the reporting period by the monthly average value of portfolio securities owned during the reporting period. Excluded from the numerator are amounts relating to in-kind transactions. |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| OCTOBER 31, 2014 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 15 | |

NOTES TO FINANCIAL STATEMENTS

AS OF OCTOBER 31, 2014

1. Organization

J.P. Morgan Exchange-Traded Fund Trust (the “Trust”) was formed as a Delaware statutory trust on February 25, 2010, pursuant to a Declaration of Trust and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-ended management investment company. Diversified Return Global Equity ETF (the “Fund”) is a separate diversified series of the Trust covered by this report.

The Fund commenced investment operations on June 16, 2014. Prior to June 16, 2014, the Fund had no significant operations other than matters relating to the organization and registration of the Trust and the issuance and redemption of 2,000 shares of the Fund to J.P. Morgan Investment Management Inc. (the “Adviser” or “JPMIM”), an indirect, wholly-owned subsidiary of JPMorgan Chase & Co. (“JPMorgan”).

The investment objective of the Fund is to seek investment results that closely correspond, before fees and expenses, to the performance of the FTSE Developed Diversified Factor Index (the “Index”).

Shares of the Fund are listed and traded on the NYSE Arca, Inc. Market prices for the Fund’s shares may be different from their net asset value (“NAV”). The Fund issues and redeems its shares on a continuous basis, through SEI Investments Distribution Co. (the “Distributor” or “SIDCO”), at NAV in large blocks of shares, typically 100,000 shares, referred to as “Creation Units.” Creation Units are issued and redeemed principally in-kind for a basket of securities and a cash amount. Shares generally trade in the secondary market in amounts less than a Creation Unit at market prices that change throughout the day. Only individuals or institutions that have entered into an authorized participant agreement with the Distributor may do business directly with the Fund.

2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The Fund is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946 — Investment Companies, which is part of the U.S. generally accepted accounting principles (“GAAP”). The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

A. Valuation of Investments — The valuation of the investments are in accordance with GAAP and the Fund’s valuation policies set forth by and under the supervision and responsibility of the Board of Trustees (the “Board”), which established the following approach to valuation, as described more fully below: (i) investments for which market quotations are readily available shall be valued at such unadjusted quoted prices, and (ii) all other investments for which market quotations are not readily available shall be valued at their fair value as determined in good faith pursuant to procedures approved by the Board.

JPMorgan Funds Management, Inc. (the “Administrator” or “JPMFM”) has established the J.P. Morgan Asset Management Americas Valuation Committee (“AVC”) to assist the Board with the oversight and monitoring of the valuation of the Fund’s investments. The Administrator implements the valuation policies of the Fund’s investments. The AVC oversees and carries out the policies for the valuation of investments held in the Fund. This includes monitoring the appropriateness of fair values based on results of ongoing valuation oversight, including but not limited to consideration of macro or security specific events, market events and pricing vendor and broker due diligence. The Administrator is responsible for discussing and assessing the potential impacts of various events on the fair values on an ongoing basis, and at least on a quarterly basis with the AVC and the Board.

A market-based approach is primarily used to value the Fund’s investments. Investments for which market quotations are not readily available are fair valued by approved pricing vendors or third party broker-dealers (collectively referred to as “Pricing Services”) or may be internally fair valued using methods set forth by the valuation policies approved by the Board. This may include related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. An income-based valuation approach may be used in which the anticipated future cash flows of the investment are discounted to calculate the fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Valuations may be based upon current market prices of securities that are comparable in coupon, rating, maturity and industry. It is possible that the estimated values may differ significantly from the values that would have been used, had a ready market for the investments existed, and such differences could be material.

Equities and other exchange-traded instruments are valued at the last sale price or official market closing price on the primary exchange on which the instrument is traded before the NAV of the Fund is calculated on a valuation date. Certain foreign equity instruments shall be valued by applying an international fair value factor provided by an approved Pricing Service. The factors seek to adjust the local closing price for movements of local markets post closing, but prior to the time the NAVs are calculated.

Valuations reflected in this report are as of the report date. As a result, changes in valuation due to market events and/or issuer related events after the report date and prior to issuance of the report are not reflected herein.

| | | | | | |

| | | |

| 16 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2014 |

The various inputs that are used in determining the valuation of the Fund’s investments are summarized into the three broad levels listed below.

| Ÿ | | Level 1 — Unadjusted inputs using quoted prices in active markets for identical investments. |

| Ÿ | | Level 2— Other significant observable inputs including, but are not limited to, quoted prices for similar investments, inputs other than quoted prices that are observable for investments (such as interest rates, prepayment speeds, credit risk, etc.) or other market corroborated inputs. |

| Ÿ | | Level 3 — Significant inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Funds’ assumptions in determining the fair value of investments). |

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input, both individually and in the aggregate, that is significant to the fair value measurement. The inputs or methodology used for valuing instruments are not necessarily an indication of the risk associated with investing in those instruments.

The following table represents each valuation input as presented on the Schedule of Portfolio Investments:

| | | | | | | | | | | | | | | | |

| | | Level 1

Quoted prices | | | Level 2

Other significant

observable inputs | | | Level 3

Significant

unobservable inputs | | | Total | |

Investments in Securities | | | | | | | | | | | | | | | | |

Common Stock | | | | | | | | | | | | | | | | |

Australia | | $ | — | | | $ | 2,419,688 | | | $ | — | | | $ | 2,419,688 | |

Austria | | | — | | | | 34,734 | | | | — | | | | 34,734 | |

Belgium | | | — | | | | 242,041 | | | | — | | | | 242,041 | |

Canada | | | 833,153 | | | | — | | | | — | | | | 833,153 | |

Denmark | | | — | | | | 187,768 | | | | — | | | | 187,768 | |

Finland | | | 55,015 | | | | 118,331 | | | | — | | | | 173,346 | |

France | | | — | | | | 793,760 | | | | — | | | | 793,760 | |

Germany | | | — | | | | 755,394 | | | | — | | | | 755,394 | |

Greece | | | — | | | | 33,263 | | | | — | | | | 33,263 | |

Hong Kong | | | — | | | | 1,025,880 | | | | — | | | | 1,025,880 | |

Israel | | | 55,316 | | | | — | | | | — | | | | 55,316 | |

Italy | | | 35,895 | | | | 199,599 | | | | — | | | | 235,494 | |

Japan | | | — | | | | 5,586,469 | | | | — | | | | 5,586,469 | |

Netherlands | | | — | | | | 284,632 | | | | — | | | | 284,632 | |

New Zealand | | | — | | | | 74,071 | | | | — | | | | 74,071 | |

Norway | | | — | | | | 158,369 | | | | — | | | | 158,369 | |

Portugal | | | — | | | | 101,040 | | | | — | | | | 101,040 | |

Singapore | | | — | | | | 648,455 | | | | — | | | | 648,455 | |

South Korea | | | — | | | | 1,791,635 | | | | — | | | | 1,791,635 | |

Spain | | | — | | | | 484,921 | | | | — | | | | 484,921 | |

Sweden | | | 52,200 | | | | 550,785 | | | | — | | | | 602,985 | |

Switzerland | | | 60,196 | | | | 578,845 | | | | — | | | | 639,041 | |

United Kingdom | | | 59,798 | | | | 786,503 | | | | — | | | | 846,301 | |

United States | | | 6,763,398 | | | | — | | | | — | | | | 6,763,398 | |

| | | | | | | | | | | | | | | | |

Total Common Stock | | | 7,914,971 | | | | 16,856,183 | | | | — | | | | 24,771,154 | |

| | | | | | | | | | | | | | | | |

Preferred Stock | | | | | | | | | | | | | | | | |

Germany | | | — | | | | 17,244 | | | | — | | | | 17,244 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | 7,914,971 | | | $ | 16,873,427 | | | $ | — | | | $ | 24,788,398 | |

| | | | | | | | | | | | | | | | |

There were no transfers among any levels during the period ended October 31, 2014.

B. Foreign Currency Translation — The books and records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars at the prevailing exchange rates of such currencies against the U.S. dollar. The market value of investment securities and other assets and liabilities are translated at the exchange rate as of the valuation date. Purchases and sales of investment securities, income and expenses are translated at the exchange rate prevailing on the respective dates of such transactions.

Although the net assets of the Fund are presented at the foreign exchange rates and market values at the close of the period, the Fund does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of securities held or sold during the period. Accordingly, such foreign currency gains (losses) are included in the reported net realized and unrealized gains (losses) on investment transactions on the Statements of Operations.

| | | | | | | | |

| | | |

| OCTOBER 31, 2014 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 17 | |

NOTES TO FINANCIAL STATEMENTS

AS OF OCTOBER 31, 2014 (continued)

Reported realized foreign currency gains and losses arise from the disposition of foreign currency, purchase of foreign currency in certain countries that impose a tax on such purchases, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on each Fund’s books on the transaction date and the U.S. dollar equivalent of the amounts actually received or paid. Unrealized foreign currency gains and losses arise from changes (due to changes in the exchange rate) in the value of foreign currency and other assets and liabilities denominated in foreign currencies, which are held at period end.

C. Offering and Organizational Costs — Total offering costs of $25,907 incurred in connection with the offering of shares of the Fund are amortized on a straight line basis over 12 months from the date the Fund commenced operations. Costs paid in connection with the organization of the Fund, if any, were recorded as an expense at the time it commenced operations.

D. Security Transactions and Investment Income — Investment transactions are accounted for on the trade date (the date the order to buy or sell is executed). Securities gains and losses are calculated on a specifically identified cost basis. Interest income is determined on the basis of coupon interest accrued using the effective interest method which adjusts for amortization of premiums and accretion of discounts. Dividend income net of foreign taxes withheld, if any, is recorded on the ex-dividend date or when the Fund first learns of the dividend.

E. Allocation of Income and Expenses — Expenses directly attributable to a fund are charged directly to the Fund, while the expenses attributable to more than one fund of the Trust are allocated among the respective funds.

F. Federal Income Taxes — The Fund is treated as a separate entity for Federal income tax purposes. The Fund’s policy is to comply with the provisions of the Internal Revenue Code of 1986, as amended (the “Code”), applicable to regulated investment companies and to distribute to shareholders all of its distributable net investment income and net realized gain on investments. Accordingly, no provision for Federal income tax is necessary. Management has reviewed the Fund’s tax positions for all open tax years and has determined as of October 31, 2014, no liability for income tax is required in the Fund’s financial statements for net unrecognized tax benefits. However, management’s conclusions may be subject to future review based on changes in, or the interpretation of, the accounting standards or tax laws and regulations. The Fund’s Federal tax returns for the prior three fiscal years, or since inception if shorter, remain subject to examination by the Internal Revenue Service.

G. Foreign Taxes — The Fund may be subject to foreign taxes on income, gains on investments or currency purchases/repatriation, a portion of which may be recoverable. The Fund will accrue such taxes and recoveries as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

H. Distributions to Shareholders — Distribution from net investment income, if any, are generally declared and paid annually. Net realized capital gains, if any, are distributed by the Fund at least annually. The amount of distributions from net investment income and net realized capital gains is determined in accordance with Federal income tax regulations, which may differ from GAAP. To the extent these “book/tax” differences are permanent in nature (i.e., that they result from other than timing of recognition — “temporary differences”), such amounts are reclassified within the capital accounts based on their Federal tax-basis treatment.

The following amounts were reclassified within the capital accounts:

| | | | | | | | | | | | |

| | | Paid-in-Capital | | | Accumulated

Undistributed Net Investment

Income | | | Accumulated

Net Realized

Gains (Losses) | |

| | $ | — | | | $ | 5,252 | | | $ | (5,252 | ) |

The reclassifications for the Fund relate primarily to foreign currency gains.

3. Fees and Other Transactions