UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22903

J.P. Morgan Exchange-Traded Fund Trust

(Exact name of registrant as specified in charter)

270 Park Avenue

New York, NY 10017

(Address of principal executive offices) (Zip code)

Frank J. Nasta, Esq.

J.P. Morgan Investment Management Inc.

270 Park Avenue

New York, NY 10017

(Name and Address of Agent for Service)

With copies to:

| | |

| Elizabeth A. Davin, Esq. | | Jon S. Rand Esq. |

| JPMorgan Chase & Co. | | Dechert LLP |

| 460 Polaris Parkway | | 1095 Avenue of the Americas |

| Westerville, OH 43082 | | New York, NY 10036 |

Registrant’s telephone number, including area code: (844) 457-6383

Date of fiscal year end: October 31

Date of reporting period: November 1, 2014 through October 31, 2015

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Annual Report

JPMorgan Exchange-Traded Funds

October 31, 2015

JPMorgan Diversified Return Emerging Markets Equity ETF

JPMorgan Diversified Return Global Equity ETF

JPMorgan Diversified Return International Equity ETF

CONTENTS

Investments in a Fund are not bank deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

Prospective investors should refer to the Funds’ prospectus for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Exchange-Traded Funds at (844) 457-6383 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

PRESIDENT’S LETTER

November 30, 2015 (Unaudited)

| | |

| | “While investors may not be able to avoid global financial market volatility, we believe the basic principles of a well-diversified portfolio, a long term outlook and avoiding excess concentrations provide the most prudent approach toward the current trends in the global financial marketplace.” |

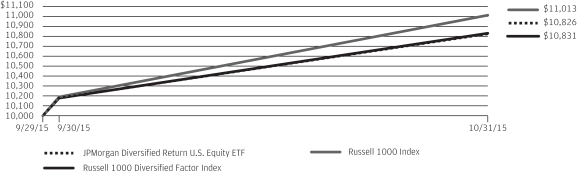

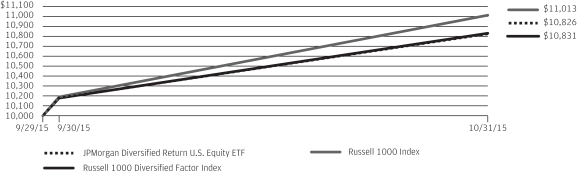

Over the past year, we have been busy building the JPMorgan Exchange-Traded Fund (ETF) business. Recently, we launched our fourth Diversified Return Equity ETF. Our newest ETF targets large cap U.S. equities (JPUS) and complements our funds that invest in global equity (JPGE), developed markets equity (JPIN) and emerging market equity (JPEM). We are seeking to launch several more strategies in our suite of ETFs that uniquely address the risks associated with excess concentrations in sectors of the economy and regions of the world, while selecting stocks with key equity factors. We look forward to telling you more about these new funds as we introduce them.

In recent months, increasing market volatility was punctuated by declining equity markets in late summer followed by rebounding markets in the fall. Following declines in June through September, the Standard & Poor’s 500 Index (S&P 500) finished October with its best one-month performance since October 2011, Japan’s Nikkei Index gained the most since April 2013 and leading European indexes had their best performance since 2009.

Even as leading central banks have extended economic stimulus, financial market volatility has increased over the past year amid slowing growth in China, weakness in commodities prices and uncertainty about the strength of the global economic recovery. Further, financial market apprehension about the pace of future interest rate increases in the U.S. added to investor anxiety. We believe it’s likely that this period of relatively high market volatility will continue into 2016 and beyond.

With this as a backdrop, we thought it would be helpful to share our thoughts on market volatility with you. In recent research developed by JPMorgan and published in “Market Insights: Investing with Composure in Volatile Markets”, we see there have been meaningful declines in equity markets within most calendar years. However, despite average intra-year declines of 14.2%, the S&P 500 posted positive annual returns in 27 of the

past 35 years. This serves to illustrate the importance of keeping market volatility in proper perspective, focusing on longer investment horizons and maintaining portfolio discipline.

Within this volatile market climate, the principles of sound investing provide useful guidelines for investors seeking investment returns over the long-term. Those principles include employing a portfolio that is well diversified across asset classes and adhering to a long-term view of returns. It is also important to remember that attempting to successfully anticipate price swings in financial markets is extremely difficult.

But, what else can an investor do? One thought we want to emphasize is the concept of diversifying within an asset class. In other words, in addition to portfolio diversification across stocks, bonds and real assets, we believe that diversifying the equity portion of a portfolio by deploying complementary strategies has meaningful benefits.

In our opinion, investors should consider strategies that offer lower overall volatility and compensate for the risk of excess sector concentration that is inherent in traditional indexes and well-known market-weighted index mutual funds. The impact of financial market volatility may be mitigated by a properly diversified portfolio that is free of excess concentrations in any particular region, sector or asset class.

While investors may not be able to avoid global financial market volatility, we believe the basic principles of a well-diversified portfolio, a long-term outlook and avoiding excess concentrations provide the most prudent approach toward the current trends in the global financial marketplace. On behalf of everyone at J.P. Morgan Asset Management, thank you for your continued support. We look forward to managing your investment needs for years to come.

If you should have any questions, or would like a copy of “Market Insights: Investing with Composure in Volatile Markets,” please visit www.jpmorganfunds.com or call J.P. Morgan Exchange-Traded Funds at 1-844-457-6383.

Sincerely yours,

Robert F. Deutsch

President, J.P. Morgan Exchange-Traded Funds

J.P. Morgan Asset Management

| | | | | | | | |

| | | |

| OCTOBER 31, 2015 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 1 | |

JPMorgan Diversified Return Emerging Markets Equity ETF

FUND COMMENTARY

FOR THE PERIOD JANUARY 7, 2015 (FUND INCEPTION DATE) THROUGH OCTOBER 31, 2015 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| JPMorgan Diversified Return Emerging Markets Equity ETF* | | | -9.54% | |

| Market Price** | | | -9.46% | |

| FTSE Emerging Diversified Factor Index (net of foreign withholding taxes) | | | -8.18% | |

| FTSE Emerging Net Index | | | -9.00% | |

| Morgan Stanley Capital International (“MSCI”) Emerging Markets Index (net of foreign withholding taxes) | | | -8.01% | |

| |

| Net Assets as of 10/31/2015 | | $ | 36,185,674 | |

INVESTMENT OBJECTIVE***

The JPMorgan Diversified Return Emerging Markets Equity ETF (the “Fund”) seeks investment results that closely correspond, before fees and expenses, to the performance of the FTSE Emerging Diversified Factor Index (net of foreign withholding taxes) (the “Underlying Index”).

INVESTMENT APPROACH

The Fund is passively managed to the Underlying Index, which provides emerging markets equity exposure, diversified across emerging market regions and industries. The Underlying Index uses a proprietary multi-factor stock selection process that utilizes the following characteristics: value, momentum and quality. The Underlying Index methodology includes quarterly rebalancing and liquidity screens.

HOW DID THE MARKET PERFORM?

Global financial markets experienced increased volatility through the latter part of the reporting period January 7, 2015 inception through October 31, 2015, punctuated by a sharp sell-off in equities and bonds in August. Weakness in commodities prices, slowing economic growth in China and anxiety over U.S. interest rate policy weighed on financial markets through the summer. In mid-August, Chinese authorities surprised markets by devaluing the yuan by 2%, but when that didn’t halt declines in Shanghai/Shenzhen markets, a global sell-off followed on August 24, 2015. The selling erased year-to-date gains in China’s equity market. The Shanghai Composite Index had its worst one-day performance since 2007.

However, most equity markets rebounded in September and October as China’s central bank undertook further actions to bolster domestic financial markets and the U.S. Federal Reserve held interest rates at historically low levels. Emerging market equities did participate in the October rebound, but persistent weakness in global commodities prices along with

currency devaluations and deterioration in corporate balance sheets pulled investment capital from emerging market nations.

HOW DID THE FUND PERFORM?

The Fund posted a negative absolute performance for the period January 7, 2015 to October 31, 2015 and experienced a deviation of -1.36% relative to the Underlying Index.

On an absolute basis, the Fund’s positions in the financials and defensives (health care, telecommunications and utilities) were leading detractors from performance, while the Fund’s positions in the industry sector (including the industrials and technology subsectors) and commodities sector (basic materials, oil and gas) were the small detractors from performance.

By region, the largest detractors from absolute performance were Latin America (Brazil, Chile, Colombia and Mexico) and ASEAN (Indonesia, Malaysia, Philippines and Thailand), while the smallest detractors from absolute performance were “ChIndia” (China and India) and Taiwan.

Because the Fund’s holdings were closely aligned with those of the Underlying Index, variances in relative performance due to security selection and/or sector allocation were not significant. The majority of the Fund’s deviations from the Underlying Index related to issues around local market access in certain countries, differences in valuations because of the timing of the local market closings and the net asset value calculations.

HOW WAS THE FUND POSITIONED?

At the end of the reporting period, the Fund’s and Underlying Index’s largest allocations of assets were to ChIndia and Taiwan and the smallest allocations were to Latin America and ASEAN. In terms of sectors, the Fund’s and Underlying Index’s largest positions were in financials and industry sectors. The smallest positions were in the commodities and consumer sectors.

| | | | | | |

| | | |

| 2 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2015 |

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO**** | |

| | 1. | | | iShares MSCI India ETF | | | 9.2 | % |

| | 2. | | | Tencent Holdings Ltd. | | | 3.4 | |

| | 3. | | | Taiwan Semiconductor Manufacturing Co., Ltd. | | | 3.2 | |

| | 4. | | | China Mobile Ltd. | | | 2.8 | |

| | 5. | | | Hon Hai Precision Industry Co., Ltd. | | | 2.2 | |

| | 6. | | | America Movil SAB de CV | | | 1.5 | |

| | 7. | | | Ambev S.A. | | | 1.4 | |

| | 8. | | | China Construction Bank Corp. | | | 1.3 | |

| | 9. | | | MTN Group Ltd. | | | 1.1 | |

| | 10. | | | Gazprom OAO | | | 0.9 | |

| | | | | | |

PORTFOLIO COMPOSITION BY COUNTRY**** | |

| China | | | 23.3 | % |

| Taiwan | | | 18.9 | |

India | | | 9.2 | |

| South Africa | | | 8.4 | |

| Brazil | | | 6.8 | |

| Mexico | | | 5.0 | |

| Russia | | | 4.7 | |

| Thailand | | | 4.6 | |

| Indonesia | | | 4.2 | |

| Malaysia | | | 4.2 | |

| Philippines | | | 4.0 | |

| Turkey | | | 1.6 | |

| Chile | | | 1.7 | |

| Poland | | | 1.3 | |

| Other (each less than 1%) | | | 2.1 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $45.23 as of October 31, 2015. |

| ** | | Market price cumulative return is calculated assuming an initial investment made at the inception date net asset value, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the NYSE Arca, Inc. The midpoint price was $45.27 as of October 31, 2015. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based on total investments as of October 31, 2015. The Fund’s composition is subject to change. |

| | | | | | | | |

| | | |

| OCTOBER 31, 2015 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 3 | |

JPMorgan Diversified Return Emerging Markets Equity ETF

FUND COMMENTARY

FOR THE PERIOD JANUARY 7, 2015 (FUND INCEPTION DATE) THROUGH OCTOBER 31, 2015 (Unaudited) (continued)

| | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF OCTOBER 31, 2015 | |

| | |

| | | INCEPTION DATE | | | SINCE INCEPTION | |

JPMorgan Diversified Return Emerging Markets Equity ETF | | | 1/07/2015 | | | | -9.54 | % |

Market Price | | | | | | | -9.46 | |

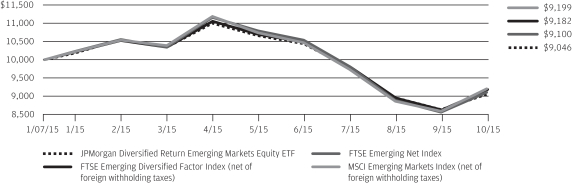

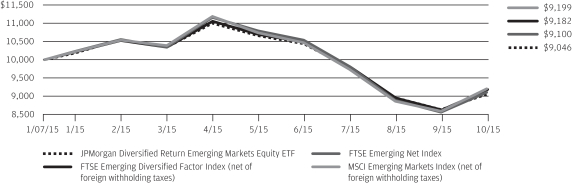

LIFE OF FUND PERFORMANCE (1/07/15 TO 10/31/15)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund commenced operations on January 7, 2015.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan Diversified Return Emerging Markets Equity ETF, the FTSE Emerging Diversified Factor Index , the FTSE Emerging Net Index, and the MSCI Emerging Markets Index from January 7, 2015 to October 31, 2015. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the FTSE Emerging Diversified Factor Index, the FTSE Emerging Net Index and the MSCI Emerging Markets Index does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The FTSE Emerging Diversified Factor Index is an index comprised of equity securities from emerging markets selected to represent a diversified set of factor characteristics, originally developed by the adviser and its holdings are selected by the index provider primarily from the constituents of the FTSE Emerging Net Index. The FTSE Emerging Net Index is part of the FTSE Global Equity Index Series. The series includes

large and mid cap securities from advanced and secondary emerging markets, classified in accordance with FTSE’s transparent Country Classification Review Process. The FTSE Emerging Index provides investors with a comprehensive means of measuring the performance of the most liquid companies in the emerging markets. FTSE International Limited is the index provider for the two FTSE indexes. The MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of emerging markets. Investors cannot invest directly in an index.

Fund performance reflects the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption or sale of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the United States can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the United States and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 4 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2015 |

JPMorgan Diversified Return Global Equity ETF

FUND COMMENTARY

FOR THE YEAR ENDED OCTOBER 31, 2015 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| JPMorgan Diversified Return Global Equity ETF * | | | 2.36% | |

| Market Price** | | | 1.82% | |

| FTSE Developed Diversified Factor Index (net of foreign withholding taxes) | | | 3.37% | |

| FTSE Developed Net Index | | | 1.74% | |

| Morgan Stanley Capital International (“MSCI”) World Index (net of foreign withholding taxes) | | | 1.77% | |

| |

| Net Assets as of 10/31/2015 | | $ | 50,530,034 | |

INVESTMENT OBJECTIVE***

The JPMorgan Diversified Return Global Equity ETF (the “Fund”) seeks investment results that closely correspond, before fees and expenses, to the performance of the FTSE Developed Diversified Factor Index (net of foreign withholding taxes) (the “Underlying Index”).

INVESTMENT APPROACH

The Fund is passively managed to the Underlying Index, which provides exposure to large and mid-cap equity securities in developed global markets, diversified across global regions and industries. The Underlying Index uses a proprietary multifactor security selection process that utilizes the following characteristics: relative valuation, price momentum, low volatility and specific market capitalization. The Underlying Index’s methodology includes quarterly rebalancing, and liquidity screens.

HOW DID THE MARKET PERFORM?

Global financial markets experienced increased volatility through the second half of the twelve month period, punctuated by a sharp sell-off in equities and bonds in August. Even as the Greek debt crisis was largely resolved by June, weakness in commodities prices, slowing economic growth in China and anxiety over U.S. interest rate policy weighed on financial markets through the summer. In mid-August, Chinese authorities surprised markets by devaluing the yuan by 2%, but when that didn’t halt declines in Shanghai/Shenzhen markets, a global sell-off followed on August 24, 2015. The selling erased year-to-date gains in China’s equity market. The Shanghai Composite Index had its worst one-day performance since 2007. For the day, the Standard & Poor’s 500 Index (the “S&P 500”) dropped 3.9%, and equity markets in Europe and Japan also fell.

However, most equity markets rebounded in September and October as China’s central bank undertook further actions to

bolster domestic financial markets and the U.S. Federal Reserve held interest rates at historically low levels. October was an especially strong month for global equities: The S&P 500 turned in its best one-month performance since October 2011, Japan’s Nikkei Index posted its biggest monthly gain since April 2013 and leading European indexes had their best performance since 2009.

HOW DID THE FUND PERFORM?

For the twelve months ended October 31, 2015, the Fund posted a positive absolute performance and experienced a deviation of -1.01% relative to the Underlying Index.

On an absolute basis, the Fund’s positions in the health care and consumer goods sectors were leading contributors to performance for the twelve month reporting period, while its positions in the oil & gas sector and the basic materials sector were the sole detractors from performance.

Because the Fund’s holdings were closely aligned with those of the Underlying Index, variances in relative performance due to security selection and/or sector allocation were not significant. The majority of the Fund’s deviation against the Underlying Index was due to specific trading limits, differences in valuations because of the timing of the local market closings and the net asset value calculations, the Fund’s small cash allocation and fees and operating expenses incurred by the Fund.

HOW WAS THE FUND POSITIONED?

At the end of the reporting period, the Fund’s and Underlying Index’s largest allocation of assets was to North American markets – particularly the U.S. – with smaller allocations to Asia, Europe and Japan. In terms of sectors, the Fund’s largest positions were in the consumer goods, consumer services and health care sectors, while the smallest positions were in the basic materials, telecommunications and oil & gas sectors.

| | | | | | | | |

| | | |

| OCTOBER 31, 2015 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 5 | |

JPMorgan Diversified Return Global Equity ETF

FUND COMMENTARY

FOR THE YEAR ENDED OCTOBER 31, 2015 (Unaudited) (continued)

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO**** | |

| | 1. | | | Samsung Electronics Co., Ltd. | | | 0.7 | % |

| | 2. | | | CK Hutchison Holdings Ltd. | | | 0.5 | |

| | 3. | | | Toyota Motor Corp. | | | 0.5 | |

| | 4. | | | SK C&C Co., Ltd. | | | 0.4 | |

| | 5. | | | Wesfarmers Ltd. | | | 0.4 | |

| | 6. | | | CSL Ltd. | | | 0.4 | |

| | 7. | | | Singapore Telecommunications Ltd. | | | 0.4 | |

| | 8. | | | Link REIT (The) | | | 0.4 | |

| | 9. | | | Power Assets Holdings Ltd. | | | 0.4 | |

| | 10. | | | Korea Electric Power Corp. | | | 0.4 | |

| | | | | | |

PORTFOLIO COMPOSITION BY COUNTRY**** | |

| United States | | | 26.7 | % |

| Japan | | | 20.5 | |

| Australia | | | 9.3 | |

| South Korea | | | 9.1 | |

| United Kingdom | | | 4.4 | |

| Hong Kong | | | 4.2 | |

| France | | | 4.0 | |

| Germany | | | 3.3 | |

| Sweden | | | 2.6 | |

| Singapore | | | 2.5 | |

| Canada | | | 2.4 | |

| Spain | | | 2.1 | |

| Switzerland | | | 1.9 | |

| Netherlands | | | 1.1 | |

| Italy | | | 1.1 | |

| Belgium | | | 1.0 | |

| Norway | | | 1.0 | |

| Other (each less than 1%) | | | 2.8 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $50.53 as of October 31, 2015. |

| ** | | Market price cumulative return is calculated assuming an initial investment made at the inception date net asset value, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the NYSE Arca. The midpoint price was $50.67 as of October 31, 2015. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based on total investments as of October 31, 2015. The Fund’s composition is subject to change. |

| | | | | | |

| | | |

| 6 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2015 |

| | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF OCTOBER 31, 2015 | |

| | | |

| | | INCEPTION DATE | | | 1 YEAR | | | SINCE

INCEPTION | |

JPMorgan Diversified Return Global Equity ETF | | | 6/16/2014 | | | | 2.36 | % | | | 1.25 | % |

Market Price | | | | | | | 1.82 | | | | 1.45 | |

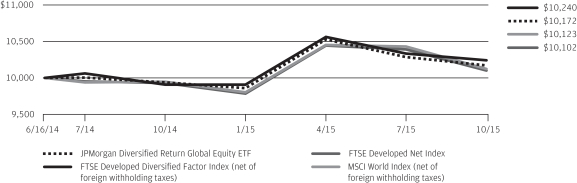

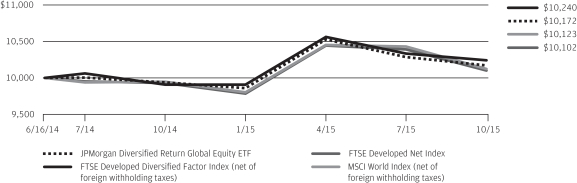

LIFE OF FUND PERFORMANCE (6/16/14 TO 10/31/15)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund commenced operations on June 16, 2014.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan Diversified Return Global Equity ETF, the FTSE Developed Diversified Factor Index, the FTSE Developed Net Index, and the MSCI World Index from June 16, 2014 to October 31, 2015. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the FTSE Developed Diversified Factor Index, the FTSE Developed Net Index and the MSCI World Index does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The FTSE Developed Diversified Factor Index is an index comprised of equity securities from developed global markets selected to represent a diversified set of factor characteristics, originally developed by the adviser and its holdings are selected by the index provider primarily from the constituents of the FTSE Developed Net Index. The FTSE Developed Net Index is a market-

capitalization weighted index representing the performance of large and mid cap companies in Developed markets. The index is derived from the FTSE Global Equity Index Series (GEIS), which covers 98% of the world’s investable market capitalization. FTSE International Limited is the index provider for the two indexes. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. Investors cannot invest directly in an index.

Fund performance reflects the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption or sale of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the United States can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the United States and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | |

| | | |

| OCTOBER 31, 2015 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 7 | |

JPMorgan Diversified Return International Equity ETF

FUND COMMENTARY

FOR THE PERIOD NOVEMBER 5, 2014 (FUND INCEPTION DATE) THROUGH OCTOBER 31, 2015 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| JPMorgan Diversified Return International Equity ETF* | | | 2.65% | |

| Market Price** | | | 2.40% | |

| FTSE Developed ex North America Diversified Factor Index (net of foreign withholding taxes) | | | 3.71% | |

| FTSE Developed ex North America Net Index | | | 0.64% | |

| Morgan Stanley Capital International (“MSCI”) Europe, Australia and Far East (“EAFE”) Index (net of foreign withholding taxes) | | | 0.29% | |

| |

| Net Assets as of 10/31/2015 | | $ | 92,113,607 | |

INVESTMENT OBJECTIVE***

The JPMorgan Diversified Return International Equity ETF (the “Fund”) seeks investment results that closely correspond, before fees and expenses, to the performance of the FTSE Developed ex North America Diversified Factor Index (net of foreign withholding taxes) (the “Underlying Index”).

INVESTMENT APPROACH

The Fund is passively managed to the Underlying Index, which tracks large and mid-cap equity securities in developed markets outside North America, diversified across industries and international regions. The Underlying Index uses a proprietary multifactor security selection process that measures the following characteristics: relative valuation, price momentum, low volatility and specific market capitalization. The Underlying Index methodology includes quarterly rebalancing and liquidity screens.

HOW DID THE MARKET PERFORM?

Global financial markets experienced increased volatility through the period November 5, 2014 to October 31, 2015, punctuated by a sharp sell-off in equities and bonds in August. Even as the Greek debt crisis was largely resolved by June, weakness in commodities prices, slowing economic growth in China and anxiety over U.S. interest rate policy weighed on financial markets through the summer. In mid-August, Chinese authorities surprised markets by devaluing the yuan by 2%, but when that didn’t halt declines in Shanghai/Shenzhen markets, a global sell-off followed on August 24, 2015. The selling erased year-to-date gains in China’s equity market. The Shanghai Composite Index had its worst one-day performance since 2007. Equity markets in the Europe and Japan also fell.

However, most equity markets rebounded in September and October as China’s central bank undertook further actions to bolster domestic financial markets and the U.S. Federal Reserve held interest rates at historically low levels. October was an especially strong month for global equities: The Standard and Poor’s 500 turned in its best one-month performance since October 2011, Japan’s Nikkei Index posted its largest

monthly gain since April 2013 and leading European indexes had their best performance since 2009.

HOW DID THE FUND PERFORM?

The Fund posted a positive absolute performance for the period November 5, 2014 to October 31, 2015. During the period, the Fund experienced a deviation of -1.06% relative to the Underlying Index but outperformed the MSCI EAFE Index and the FTSE Developed ex North America Net Index, which are more traditional market capital weighted indexes.

Because the Fund’s holdings were closely aligned with those of the Underlying Index, variances in performance relative to the Underlying Index were not significant. The majority of the Fund’s deviation against the Underlying Index was due to specific trading limits, differences in valuations because of the timing of the local market closings and the net asset value calculations, the Fund’s small cash allocation and fees and operating expenses incurred by the Fund.

Relative to market-cap weighted indexes, the Fund’s and Underlying Index’s multi-factor filter contributed to performance across all regions and in most economic sectors, particularly in basic materials, financials and health care. The Fund’s and Underlying Index’s allocation detracted from performance relative to the market-cap weighted indexes, mostly due to an underweight position in the consumer goods sector, an overweight to the oil & gas sector, an overweight position in the Pacific region (excluding Japan) and an underweight position in Europe (excluding the U.K.)

HOW WAS THE FUND POSITIONED?

By seeking to track the Underlying Index, the Fund seeks to deliver superior risk-adjusted returns by avoiding undue concentrations of risk that tend to characterize more traditional market-cap weighted indexes. The Underlying Index’s weightings are structured to distribute risk evenly across 40 regional sectors. A multi-factor stock screen is then used to identify the most attractive stocks in each regional sector, while avoiding the least attractive stocks.

| | | | | | |

| | | |

| 8 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2015 |

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO**** | |

| | 1. | | | BP plc | | | 0.8 | % |

| | 2. | | | Royal Dutch Shell plc | | | 0.7 | |

| | 3. | | | GlaxoSmithKline plc | | | 0.7 | |

| | 4. | | | Samsung Electronics Co., Ltd. | | | 0.6 | |

| | 5. | | | Vodafone Group plc | | | 0.6 | |

| | 6. | | | AstraZeneca plc | | | 0.6 | |

| | 7. | | | BT Group plc | | | 0.5 | |

| | 8. | | | BG Group plc | | | 0.5 | |

| | 9. | | | Unilever plc | | | 0.5 | |

| | 10. | | | British Land Co., plc | | | 0.5 | |

| | | | | | |

PORTFOLIO COMPOSITION BY COUNTRY**** | |

| Japan | | | 23.7 | % |

| United Kingdom | | | 23.1 | |

| South Korea | | | 9.4 | |

| Australia | | | 8.8 | |

| Hong Kong | | | 5.3 | |

| France | | | 5.2 | |

| Germany | | | 4.2 | |

| Singapore | | | 3.3 | |

| Netherlands | | | 2.6 | |

| Sweden | | | 2.4 | |

| Spain | | | 2.2 | |

| Switzerland | | | 1.9 | |

| Finland | | | 1.5 | |

| Italy | | | 1.4 | |

| Denmark | | | 1.1 | |

| Belgium | | | 1.0 | |

| Norway | | | 1.0 | |

| Other (each less than 1%) | | | 1.9 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $51.17 as of October 31, 2015. |

| ** | | Market price cumulative return is calculated assuming an initial investment made at the inception date net asset value, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the NYSE Arca. The midpoint price was $51.05 as of October 31, 2015. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based on total investments as of October 31, 2015. The Fund’s composition is subject to change. |

| | | | | | | | |

| | | |

| OCTOBER 31, 2015 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 9 | |

JPMorgan Diversified Return International Equity ETF

FUND COMMENTARY

FOR THE PERIOD NOVEMBER 5, 2014 (FUND INCEPTION DATE) THROUGH OCTOBER 31, 2015 (Unaudited) (continued)

| | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF OCTOBER 31, 2015 | |

| | |

| | | INCEPTION DATE | | | SINCE INCEPTION | |

JPMorgan Diversified Return International Equity ETF | | | 11/05/2014 | | | | 2.65 | % |

Market Price | | | | | | | 2.40 | |

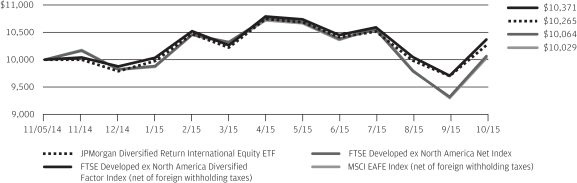

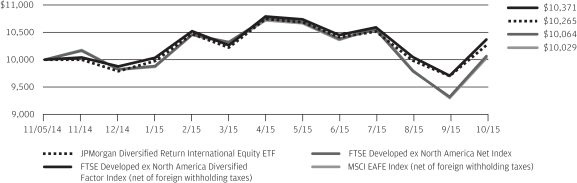

LIFE OF FUND PERFORMANCE (11/05/14 TO 10/31/15)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund commenced operations on November 5, 2014.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan Diversified Return International Equity ETF, the FTSE Developed ex North America Diversified Factor Index, the FTSE Developed ex North America Net Index, and the MSCI EAFE Index from November 5, 2014 to October 31, 2015. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the FTSE Developed ex North America Diversified Factor Index, the FTSE Developed ex North America Net Index and the MSCI EAFE Index does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The FTSE Developed ex North America Diversified Factor Index is an index comprised of equity securities from developed global markets (excluding North America) selected to represent a diversified set of factor characteristics, originally developed by the adviser and its holdings are selected by the index provider primarily from the constituents of the FTSE Developed ex North

America Net Index. The FTSE Developed ex North America Net Index is part of a range of indices designed to help investors benchmark their international investments. The index comprises Large and Mid cap stocks providing coverage of Developed markets, excluding the U.S. and Canada. The index is derived from the FTSE Global Equity Index Series (GEIS), which covers 98% of the world’s investable market capitalization. FTSE International Limited is the index provider for the two indexes. The MSCI EAFE Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. Investors cannot invest directly in an index.

Fund performance reflects the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption or sale of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the United States can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the United States and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 10 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2015 |

JPMorgan Diversified Return Emerging Markets Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF OCTOBER 31, 2015

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| Common Stocks — 87.5% | |

| | | | Brazil — 4.7% | | | | |

| | 101,657 | | | Ambev S.A. | | | 503,204 | |

| | 11,585 | | | Banco do Brasil S.A. | | | 47,974 | |

| | 7,737 | | | BB Seguridade Participacoes S.A. | | | 53,365 | |

| | 22,100 | | | Bolsa de Valores Mercadorias e Futuros | | | 65,328 | |

| | 18,869 | | | BRF S.A. | | | 294,052 | |

| | 2,785 | | | CETIP S.A. — Mercados Organizados | | | 24,625 | |

| | 10,820 | | | Cielo S.A. | | | 102,714 | |

| | 5,368 | | | EDP — Energias do Brasil S.A. | | | 15,701 | |

| | 4,305 | | | Equatorial Energia S.A. | | | 38,389 | |

| | 5,865 | | | Estacio Participacoes S.A. | | | 23,511 | |

| | 3,200 | | | Grupo BTG Pactual | | | 23,814 | |

| | 15,210 | | | JBS S.A. | | | 56,201 | |

| | 34,056 | | | Kroton Educacional S.A. | | | 87,071 | |

| | 14,255 | | | Lojas Renner S.A. | | | 68,382 | |

| | 58,349 | | | Petroleo Brasileiro S.A. (a) | | | 141,918 | |

| | 1,224 | | | Porto Seguro S.A. | | | 10,261 | |

| | 5,557 | | | Raia Drogasil S.A. (a) | | | 57,623 | |

| | 1,033 | | | Smiles S.A. | | | 8,062 | |

| | 3,056 | | | Sul America S.A. | | | 15,000 | |

| | 2,096 | | | Transmissora Alianca de Energia Eletrica S.A. | | | 10,815 | |

| | 3,512 | | | Via Varejo S.A. | | | 3,870 | |

| | 9,149 | | | WEG S.A. | | | 34,162 | |

| | | | | | | | |

| | | | | | | 1,686,042 | |

| | | | | | | | |

| | | | Chile — 1.6% | | | | |

| | 53,196 | | | AES Gener S.A. | | | 25,576 | |

| | 64,235 | | | Aguas Andinas S.A., Class A | | | 33,781 | |

| | 306,670 | | | Banco de Chile | | | 32,452 | |

| | 555 | | | Banco de Credito e Inversiones | | | 22,632 | |

| | 782,576 | | | Banco Santander Chile S.A. | | | 37,151 | |

| | 3,283 | | | Cia Cervecerias Unidas S.A. | | | 39,381 | |

| | 158,160 | | | Colbun S.A. | | | 41,951 | |

| | 2,013,064 | | | Corpbanca S.A. | | | 18,333 | |

| | 70,541 | | | Empresa Nacional de Electricidad S.A. | | | 88,374 | |

| | 18,000 | | | Empresas CMPC S.A. | | | 44,431 | |

| | 410,456 | | | Enersis S.A. | | | 108,278 | |

| | 10,255 | | | SACI Falabella | | | 68,758 | |

| | | | | | | | |

| | | | | | | 561,098 | |

| | | | | | | | |

| | | | China — 23.3% | | | | |

| | 8,000 | | | Agile Property Holdings Ltd. | | | 4,355 | |

| | 178,000 | | | Agricultural Bank of China Ltd., Class H | | | 72,786 | |

| | 24,000 | | | Air China Ltd., Class H | | | 23,117 | |

| | 13,000 | | | Anhui Conch Cement Co., Ltd., Class H | | | 39,667 | |

| | 14,000 | | | ANTA Sports Products Ltd. | | | 39,163 | |

| | 35,000 | | | AviChina Industry & Technology Co., Ltd., Class H | | | 28,523 | |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | | | | | |

| | | | China — (continued) | | | | |

| | 23,500 | | | BAIC Motor Corp. Ltd., Class H | | | 20,714 | |

| | 548,000 | | | Bank of China Ltd., Class H | | | 258,416 | |

| | 58,000 | | | Bank of Communications Co., Ltd., Class H | | | 42,781 | |

| | 16,000 | | | BBMG Corp., Class H | | | 11,212 | |

| | 16,000 | | | Beijing Capital International Airport Co., Ltd., Class H | | | 17,126 | |

| | 6,500 | | | Beijing Enterprises Holdings Ltd. | | | 41,033 | |

| | 56,000 | | | Beijing Enterprises Water Group Ltd. | | | 44,353 | |

| | 32,000 | | | Beijing Jingneng Clean Energy Co., Ltd., Class H | | | 11,072 | |

| | 81,000 | | | Belle International Holdings Ltd. | | | 78,621 | |

| | 14,400 | | | BOE Technology Group Co., Ltd., Class A | | | 4,187 | |

| | 40,000 | | | Brilliance China Automotive Holdings Ltd. | | | 55,466 | |

| | 13,000 | | | CAR, Inc. (a) | | | 22,731 | |

| | 154,000 | | | CGN Power Co., Ltd., Class H | | | 63,577 | |

| | 39,000 | | | China Agri-Industries Holdings (a) | | | 14,318 | |

| | 16,000 | | | China BlueChemical Ltd. | | | 4,772 | |

| | 60,000 | | | China Cinda Asset Management Co., Ltd., Class H | | | 23,328 | |

| | 56,000 | | | China CITIC Bank Corp., Ltd., Class H (a) | | | 36,214 | |

| | 48,000 | | | China Communications Construction Co., Ltd., Class H | | | 66,249 | |

| | 32,000 | | | China Communications Services Corp., Ltd., Class H | | | 12,837 | |

| | 12,500 | | | China Conch Venture Holdings Ltd. | | | 28,493 | |

| | 654,000 | | | China Construction Bank Corp., Class H | | | 473,990 | |

| | 45,000 | | | China Dongxiang Group Co., Ltd. | | | 11,387 | |

| | 28,000 | | | China Eastern Airlines Corp., Ltd., Class H (a) | | | 17,964 | |

| | 24,000 | | | China Everbright Bank Co., Ltd., Class H | | | 11,761 | |

| | 29,000 | | | China Everbright International Ltd. | | | 46,701 | |

| | 6,000 | | | China Everbright Ltd. | | | 14,121 | |

| | 16,000 | | | China Foods Ltd. (a) | | | 7,297 | |

| | 25,500 | | | China Galaxy Securities Co., Ltd., Class H | | | 22,072 | |

| | 16,000 | | | China Gas Holdings Ltd. | | | 25,464 | |

| | 12,000 | | | China Hongqiao Group Ltd. | | | 6,248 | |

| | 87,000 | | | China Huishan Dairy Holdings Co., Ltd. | | | 33,038 | |

| | 7,200 | | | China International Marine Containers Group Co., Ltd., Class H | | | 12,774 | |

| | 52,000 | | | China Life Insurance Co., Ltd., Class H | | | 187,516 | |

| | 39,000 | | | China Longyuan Power Group Corp., Ltd., Class H | | | 35,656 | |

| | 8,000 | | | China Machinery Engineering Corp., Class H | | | 6,943 | |

| | 14,000 | | | China Medical System Holdings | | | 19,230 | |

| | 33,000 | | | China Merchants Bank Co., Ltd., Class H | | | 86,160 | |

| | 12,329 | | | China Merchants Holdings International Co., Ltd. | | | 40,944 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| OCTOBER 31, 2015 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 11 | |

JPMorgan Diversified Return Emerging Markets Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF OCTOBER 31, 2015 (continued)

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| Common Stocks — continued | |

| | | | China — continued | | | | |

| | 44,500 | | | China Minsheng Banking Corp., Ltd., Class H | | | 44,721 | |

| | 83,000 | | | China Mobile Ltd. | | | 995,161 | |

| | 16,000 | | | China Molybdenum Co., Ltd., Class H (a) | | | 8,870 | |

| | 32,000 | | | China National Building Material Co., Ltd., Class H | | | 19,882 | |

| | 26,000 | | | China Overseas Land & Investment Ltd. | | | 83,976 | |

| | 8,666 | | | China Overseas Property Holdings Ltd. (a) | | | 1,487 | |

| | 17,800 | | | China Pacific Insurance Group Co., Ltd., Class H | | | 70,904 | |

| | 266,000 | | | China Petroleum & Chemical Corp., Class H | | | 191,744 | |

| | 40,000 | | | China Power International Development Ltd. | | | 25,137 | |

| | 20,000 | | | China Railway Construction Corp., Ltd., Class H | | | 29,896 | |

| | 41,000 | | | China Railway Group Ltd., Class H | | | 38,621 | |

| | 16,000 | | | China Resources Cement Holdings Ltd. | | | 6,457 | |

| | 10,000 | | | China Resources Gas Group Ltd. | | | 27,430 | |

| | 20,000 | | | China Resources Land Ltd. | | | 51,972 | |

| | 28,000 | | | China Resources Power Holdings Co., Ltd. | | | 63,341 | |

| | 35,500 | | | China Shenhua Energy Co., Ltd., Class H | | | 59,730 | |

| | 66,000 | | | China Shipping Container Lines Co., Ltd., Class H (a) | | | 24,422 | |

| | 22,000 | | | China Shipping Development Co., Ltd., Class H | | | 14,369 | |

| | 32,000 | | | China South City Holdings Ltd. | | | 7,631 | |

| | 26,000 | | | China Southern Airlines Co., Ltd., Class H | | | 22,107 | |

| | 16,000 | | | China State Construction International Holdings Ltd. | | | 24,278 | |

| | 10,200 | | | China Taiping Insurance Holdings Co., Ltd. (a) | | | 32,025 | |

| | 240,000 | | | China Telecom Corp., Ltd., Class H | | | 125,189 | |

| | 26,000 | | | China Traditional Chinese Medicine Co., Ltd. (a) | | | 19,664 | |

| | 88,000 | | | China Unicom Hong Kong Ltd. | | | 107,245 | |

| | 9,600 | | | China Vanke Co., Ltd., Class H | | | 22,403 | |

| | 16,000 | | | China Zhongwang Holdings Ltd. | | | 7,047 | |

| | 13,100 | | | Chongqing Changan Automobile Co., Ltd., Class B | | | 24,110 | |

| | 24,000 | | | Chongqing Rural Commercial Bank Co., Ltd., Class H | | | 15,073 | |

| | 75,000 | | | CITIC Ltd. | | | 139,836 | |

| | 16,000 | | | CITIC Securities Co., Ltd., Class H | | | 34,477 | |

| | 168,000 | | | CNOOC Ltd. | | | 189,758 | |

| | 22,291 | | | COSCO Pacific Ltd. | | | 27,052 | |

| | 40,000 | | | Country Garden Holdings Co., Ltd. | | | 15,193 | |

| | 7,500 | | | CSG Holding Co., Ltd. | | | 5,942 | |

| | 58,000 | | | CSPC Pharmaceutical Group Ltd. | | | 54,001 | |

| | 4,700 | | | Dalian Wanda Commercial Properties Co., Ltd., Class H | | | 31,369 | |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | | | | | |

| | | | China — continued | | | | |

| | 48,000 | | | Datang International Power Generation Co., Ltd., Class H | | | 17,665 | |

| | 8,900 | | | Dazhong Transportation Group Co., Ltd., Class B | | | 9,564 | |

| | 44,000 | | | Dongfeng Motor Group Co., Ltd., Class H | | | 63,158 | |

| | 12,000 | | | ENN Energy Holdings Ltd. | | | 68,744 | |

| | 37,000 | | | Evergrande Real Estate Group Ltd. | | | 28,295 | |

| | 19,000 | | | Far East Horizon Ltd. | | | 15,804 | |

| | 25,576 | | | Fosun International Ltd. | | | 46,573 | |

| | 32,000 | | | Franshion Properties China Ltd. | | | 8,814 | |

| | 5,600 | | | Fuyao Glass Industry Group Co., Ltd., Class H (a) | | | 11,972 | |

| | 116,000 | | | GCL-Poly Energy Holdings Ltd. (a) | | | 23,960 | |

| | 80,000 | | | Geely Automobile Holdings Ltd. | | | 42,661 | |

| | 10,000 | | | Golden Eagle Retail Group Ltd. | | | 12,864 | |

| | 174,000 | | | GOME Electrical Appliances Holding Ltd. | | | 31,795 | |

| | 51,000 | | | Great Wall Motor Co., Ltd., Class H | | | 61,933 | |

| | 8,000 | | | Greentown China Holdings Ltd. (a) | | | 6,997 | |

| | 11,700 | | | Guangdong Electric Power Development Co., Ltd., Class B | | | 7,645 | |

| | 44,000 | | | Guangdong Investment Ltd. | | | 61,880 | |

| | 24,000 | | | Guangshen Railway Co., Ltd., Class H | | | 12,402 | |

| | 38,000 | | | Guangzhou Automobile Group Co., Ltd., Class H | | | 33,227 | |

| | 2,000 | | | Guangzhou Baiyunshan Pharmaceutical Holdings Co., Ltd., Class H | | | 5,628 | |

| | 6,400 | | | Guangzhou R&F Properties Co., Ltd. | | | 6,352 | |

| | 19,000 | | | Haier Electronics Group Co., Ltd. | | | 36,720 | |

| | 8,000 | | | Haitian International Holdings Ltd. | | | 13,998 | |

| | 20,400 | | | Haitong Securities Co., Ltd., Class H | | | 35,494 | |

| | 11,000 | | | Hengan International Group Co., Ltd. | | | 118,783 | |

| | 40,000 | | | Huadian Fuxin Energy Corp., Ltd., Class H | | | 12,255 | |

| | 26,000 | | | Huadian Power International Corp., Ltd., Class H | | | 19,010 | |

| | 52,000 | | | Huaneng Power International, Inc., Class H | | | 56,297 | |

| | 32,000 | | | Huaneng Renewables Corp., Ltd., Class H | | | 9,938 | |

| | 8,600 | | | Huatai Securities Co., Ltd., Class H (a) | | | 19,514 | |

| | 518,000 | | | Industrial & Commercial Bank of China Ltd., Class H | | | 328,570 | |

| | 16,000 | | | Jiangsu Expressway Co., Ltd., Class H | | | 21,633 | |

| | 16,000 | | | Jiangxi Copper Co., Ltd., Class H | | | 21,071 | |

| | 8,000 | | | Kingboard Chemical Holdings Ltd. | | | 11,282 | |

| | 30,000 | | | Kunlun Energy Co., Ltd. | | | 24,491 | |

| | 8,718 | | | KWG Property Holding Ltd. | | | 6,286 | |

| | 2,900 | | | Lao Feng Xiang Co., Ltd., Class B | | | 12,479 | |

| | 16,000 | | | Lee & Man Paper Manufacturing Ltd. | | | 9,961 | |

| | 2,900 | | | Legend Holdings Corp., Class H (a) | | | 11,209 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 12 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2015 |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| Common Stocks — continued | |

| | | | China — continued | | | | |

| | 70,000 | | | Lenovo Group Ltd. | | | 65,039 | |

| | 12,000 | | | Longfor Properties Co., Ltd. | | | 16,078 | |

| | 44,000 | | | Metallurgical Corp of China Ltd., Class H | | | 15,867 | |

| | 5,600 | | | New China Life Insurance Co., Ltd., Class H | | | 24,659 | |

| | 16,000 | | | Nine Dragons Paper Holdings Ltd. | | | 10,557 | |

| | 32,000 | | | People’s Insurance Co., Ltd., Class H | | | 17,126 | |

| | 220,000 | | | PetroChina Co., Ltd., Class H | | | 172,239 | |

| | 24,000 | | | PICC Property & Casualty Co., Ltd., Class H | | | 54,458 | |

| | 35,500 | | | Ping An Insurance Group Company of China Ltd., Class H | | | 199,270 | |

| | 16,000 | | | Poly Property Group Co., Ltd. | | | 5,180 | |

| | 108,000 | | | Renhe Commercial Holdings Co., Ltd. (a) | | | 5,627 | |

| | 24,000 | | | Shandong Weigao Group Medical Polymer Co., Ltd., Class H | | | 16,571 | |

| | 3,200 | | | Shanghai Bailian Group Co., Ltd., Class B | | | 6,110 | |

| | 32,000 | | | Shanghai Electric Group Co., Ltd., Class H | | | 19,971 | |

| | 4,000 | | | Shanghai Industrial Holdings Ltd. | | | 10,525 | |

| | 3,400 | | | Shanghai Lujiazui Finance & Trade Zone Development Co., Ltd., Class B | | | 11,071 | |

| | 2,200 | | | Shanghai Mechanical and Electrical Industry Co., Ltd., Class B | | | 5,550 | |

| | 10,400 | | | Shanghai Pharmaceuticals Holding Co., Ltd., Class H | | | 23,988 | |

| | 11,500 | | | Shengjing Bank Co., Ltd., Class H | | | 15,350 | |

| | 10,000 | | | Shenzhen Expressway Co., Ltd., Class H | | | 7,706 | |

| | 12,544 | | | Shenzhen International Holdings Ltd. | | | 19,049 | |

| | 16,000 | | | Shenzhen Investment Ltd. | | | 6,473 | |

| | 9,000 | | | Shenzhou International Group Holdings Ltd. | | | 44,352 | |

| | 8,000 | | | Shimao Property Holdings Ltd. | | | 14,011 | |

| | 16,000 | | | Sichuan Expressway Co., Ltd., Class H | | | 5,569 | |

| | 40,000 | | | Sihuan Pharmaceutical Holdings Group Ltd. | | | 6,683 | |

| | 44,000 | | | Sino Biopharmaceutical Ltd. | | | 54,679 | |

| | 16,000 | | | Sinofert Holdings Ltd. | | | 2,811 | |

| | 28,000 | | | Sino-Ocean Land Holdings Ltd. | | | 16,274 | |

| | 12,000 | | | Sinopec Engineering Group Co., Ltd., Class H | | | 10,331 | |

| | 22,000 | | | Sinopec Oilfield Service Corp., Class H (a) | | | 6,937 | |

| | 32,000 | | | Sinopec Shanghai Petrochemical Co., Ltd., Class H (a) | | | 13,282 | |

| | 16,400 | | | Sinopharm Group Co., Ltd., Class H | | | 67,587 | |

| | 24,000 | | | Sinotrans Ltd., Class H | | | 13,032 | |

| | 14,000 | | | Sunac China Holdings Ltd. | | | 8,586 | |

| | 63,900 | | | Tencent Holdings Ltd. | | | 1,204,475 | |

| | 20,000 | | | Tianhe Chemicals Group Ltd. (a) | | | — | |

| | 8,000 | | | TravelSky Technology Ltd., Class H | | | 11,802 | |

| | 12,000 | | | Weichai Power Co., Ltd., Class H | | | 12,724 | |

| | 4,800 | | | Xinjiang Goldwind Science & Technology Co., Ltd., Class H | | | 9,014 | |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | | | | | |

| | | | China — continued | | | | |

| | 3,800 | | | Yantai Changyu Pioneer Wine Co., Ltd., Class B | | | 12,074 | |

| | 48,000 | | | Yuexiu Property Co., Ltd. | | | 8,270 | |

| | 12,000 | | | Zhaojin Mining Industry Co., Ltd. | | | 6,763 | |

| | 16,000 | | | Zhejiang Expressway Co., Ltd., Class H | | | 19,670 | |

| | 56,000 | | | Zijin Mining Group Co., Ltd., Class H | | | 14,981 | |

| | 9,600 | | | ZTE Corp., Class H | | | 23,118 | |

| | | | | | | | |

| | | | | | | 8,449,310 | |

| | | | | | | | |

| | | | Colombia — 0.0% (b) | | | | |

| | 2,559 | | | Cemex Latam Holdings S.A. (a) | | | 8,904 | |

| | | | | | | | |

| | | | Czech Republic — 0.3% | | | | |

| | 3,021 | | | CEZ A/S | | | 60,361 | |

| | 176 | | | Komercni banka A/S | | | 36,474 | |

| | | | | | | | |

| | | | | | | 96,835 | |

| | | | | | | | |

| | | | Egypt — 0.2% | | | | |

| | 8,883 | | | Commercial International Bank Egypt SAE GDR | | | 58,504 | |

| | 12,001 | | | Talaat Moustafa Group | | | 10,158 | |

| | 7,240 | | | Telecom Egypt Co. | | | 6,212 | |

| | | | | | | | |

| | | | | | | 74,874 | |

| | | | | | | | |

| | | | Hungary — 0.4% | | | | |

| | 7,826 | | | Magyar Telekom Telecommunications plc ADR (a) | | | 10,841 | |

| | 705 | | | MOL Hungarian Oil & Gas plc | | | 31,815 | |

| | 2,128 | | | OTP Bank plc | | | 41,180 | |

| | 2,584 | | | Richter Gedeon Nyrt | | | 43,104 | |

| | | | | | | | |

| | | | | | | 126,940 | |

| | | | | | | | |

| | | | Indonesia — 4.2% | | | | |

| | 334,400 | | | Adaro Energy | | | 14,456 | |

| | 638,500 | | | Astra International | | | 274,477 | |

| | 279,700 | | | Bank Central Asia | | | 262,758 | |

| | 212,700 | | | Bank Mandiri Persero | | | 134,612 | |

| | 168,800 | | | Bank Negara Indonesia Persero | | | 58,353 | |

| | 240,700 | | | Bank Rakyat Indonesia Persero | | | 184,221 | |

| | 10,400 | | | Indo Tambangraya Megah | | | 6,411 | |

| | 36,000 | | | Indocement Tunggal Prakarsa | | | 47,085 | |

| | 39,100 | | | Indofood CBP Sukses Makmur | | | 37,625 | |

| | 328,600 | | | Perusahaan Gas Negara Persero | | | 71,773 | |

| | 77,500 | | | Semen Indonesia Persero | | | 55,117 | |

| | 20,800 | | | Tambang Batubara Bukit Asam Persero | | | 11,049 | |

| | 1,567,800 | | | Telekomunikasi Indonesia Persero | | | 307,583 | |

| | 40,800 | | | United Tractors | | | 53,680 | |

| | 52,000 | | | Vale Indonesia | | | 8,456 | |

| | | | | | | | |

| | | | | | | 1,527,656 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| OCTOBER 31, 2015 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 13 | |

JPMorgan Diversified Return Emerging Markets Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF OCTOBER 31, 2015 (continued)

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| Common Stocks — continued | |

| | | | Malaysia — 4.2% | | | | |

| | 46,400 | | | AirAsia BHD | | | 15,935 | |

| | 24,800 | | | Alliance Financial Group BHD | | | 20,641 | |

| | 40,000 | | | AMMB Holdings BHD | | | 44,338 | |

| | 60,600 | | | Astro Malaysia Holdings BHD | | | 40,291 | |

| | 82,700 | | | Bumi Armada BHD | | | 18,638 | |

| | 17,300 | | | Hong Leong Bank BHD | | | 56,171 | |

| | 119,800 | | | Malayan Banking BHD | | | 229,666 | |

| | 40,000 | | | MISC BHD | | | 84,078 | |

| | 7,800 | | | Petronas Dagangan BHD | | | 40,867 | |

| | 20,000 | | | Petronas Gas BHD | | | 106,872 | |

| | 17,900 | | | PPB Group BHD | | | 64,266 | |

| | 68,600 | | | Public Bank BHD | | | 288,408 | |

| | 16,085 | | | RHB Capital BHD | | | 22,810 | |

| | 100,800 | | | SapuraKencana Petroleum BHD | | | 49,409 | |

| | 108,500 | | | Tenaga Nasional BHD | | | 318,913 | |

| | 28,300 | | | Westports Holdings BHD | | | 28,268 | |

| | 154,500 | | | YTL Corp. BHD | | | 54,257 | |

| | 86,900 | | | YTL Power International BHD | | | 30,544 | |

| | | | | | | | |

| | | | | | | 1,514,372 | |

| | | | | | | | |

| | | | Mexico — 4.9% | | | | |

| | 596,500 | | | America Movil SAB de CV | | | 530,854 | |

| | 5,780 | | | Arca Continental SAB de CV | | | 36,921 | |

| | 14,248 | | | Compartamos SAB de CV | | | 26,171 | |

| | 4,154 | | | El Puerto de Liverpool SAB de CV | | | 57,872 | |

| | 32,616 | | | Fibra Uno Administracion SA de CV REIT | | | 71,520 | |

| | 3,834 | | | Gruma SAB de CV, Class B | | | 58,841 | |

| | 5,800 | | | Grupo Aeroportuario del Pacifico SAB de CV, Class B | | | 52,312 | |

| | 4,115 | | | Grupo Aeroportuario del Sureste SAB de CV, Class B | | | 63,771 | |

| | 28,874 | | | Grupo Financiero Banorte SAB de CV, Class O | | | 154,580 | |

| | 26,048 | | | Grupo Financiero Inbursa SAB de CV, Class O | | | 52,198 | |

| | 18,840 | | | Grupo Financiero Santander Mexico SAB de CV, Class B | | | 34,617 | |

| | 10,575 | | | Grupo Lala SAB de CV, Class B | | | 27,011 | |

| | 62,336 | | | Grupo Mexico SAB de CV | | | 151,936 | |

| | 3,432 | | | Industrias Bachoco SAB de CV | | | 15,620 | |

| | 18,577 | | | Kimberly-Clark de Mexico SAB de CV, Class A | | | 44,458 | |

| | 6,650 | | | Megacable Holdings SAB de CV | | | 25,343 | |

| | 12,872 | | | OHL Mexico SAB de CV (a) | | | 17,012 | |

| | 3,582 | | | Promotora y Operadora de Infraestructura SAB de CV (a) | | | 45,035 | |

| | 121,983 | | | Wal-Mart de Mexico SAB de CV | | | 323,091 | |

| | | | | | | | |

| | | | | | | 1,789,163 | |

| | | | | | | | |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | | | | | |

| | | | Philippines — 4.0% | | | | |

| | 60,720 | | | Aboitiz Equity Ventures, Inc. | | | 72,477 | |

| | 51,400 | | | Aboitiz Power Corp. | | | 46,108 | |

| | 111,000 | | | Alliance Global Group, Inc. | | | 43,083 | |

| | 6,480 | | | Ayala Corp. | | | 107,809 | |

| | 136,600 | | | Ayala Land, Inc. | | | 104,322 | |

| | 37,100 | | | Bank of the Philippine Islands | | | 66,929 | |

| | 32,400 | | | BDO Unibank, Inc. | | | 70,232 | |

| | 104,000 | | | DMCI Holdings, Inc. | | | 27,557 | |

| | 213,600 | | | Energy Development Corp. | | | 30,185 | |

| | 960 | | | Globe Telecom, Inc. | | | 46,619 | |

| | 1,480 | | | GT Capital Holdings, Inc. | | | 41,491 | |

| | 70,110 | | | JG Summit Holdings, Inc. | | | 106,608 | |

| | 9,440 | | | Manila Electric Co. | | | 65,463 | |

| | 258,000 | | | Megaworld Corp. | | | 25,794 | |

| | 28,816 | | | Metropolitan Bank & Trust Co. | | | 52,271 | |

| | 2,630 | | | Philippine Long Distance Telephone Co. | | | 123,294 | |

| | 8,100 | | | Semirara Mining and Power Corp., Class A | | | 23,155 | |

| | 10,260 | | | SM Investments Corp. | | | 191,353 | |

| | 176,800 | | | SM Prime Holdings, Inc. | | | 81,326 | |

| | 26,380 | | | Universal Robina Corp. | | | 112,923 | |

| | | | | | | | |

| | | | | | | 1,438,999 | |

| | | | | | | | |

| | | | Poland — 1.3% | | | | |

| | 608 | | | Alior Bank S.A. (a) | | | 12,776 | |

| | 1,144 | | | Asseco Poland S.A. | | | 16,886 | |

| | 6,573 | | | Bank Millennium S.A. (a) | | | 10,409 | |

| | 304 | | | Bank Zachodni WBK S.A. (a) | | | 24,504 | |

| | 492 | | | CCC S.A. | | | 21,481 | |

| | 4,504 | | | Cyfrowy Polsat S.A. (a) | | | 29,020 | |

| | 4,592 | | | Enea S.A. | | | 15,229 | |

| | 6,017 | | | Energa S.A. | | | 25,691 | |

| | 1,432 | | | Grupa Lotos S.A. (a) | | | 10,547 | |

| | 2,056 | | | KGHM Polska Miedz S.A. | | | 47,732 | |

| | 13,720 | | | PGE Polska Grupa Energetyczna S.A. | | | 51,069 | |

| | 4,784 | | | Polski Koncern Naftowy Orlen S.A. | | | 77,613 | |

| | 26,384 | | | Polskie Gornictwo Naftowe i Gazownictwo S.A. | | | 46,745 | |

| | 600 | | | Powszechny Zaklad Ubezpieczen S.A. | | | 58,259 | |

| | 22,328 | | | Tauron Polska Energia S.A. | | | 17,506 | |

| | | | | | | | |

| | | | | | | 465,467 | |

| | | | | | | | |

| | | | Russia — 4.3% | | | | |

| | 28,027 | | | Alrosa OAO | | | 22,569 | |

| | 158,214 | | | Gazprom OAO | | | 336,228 | |

| | 6,947 | | | Lukoil PJSC | | | 252,589 | |

| | 23,273 | | | Magnitogorsk Iron & Steel Works | | | 8,771 | |

| | 2,024 | | | MegaFon OAO GDR | | | 26,068 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 14 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2015 |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| Common Stocks — continued | |

| | | | Russia — continued | | | | |

| | 679 | | | MMC Norilsk Nickel OJSC | | | 100,897 | |

| | 18,710 | | | Mobile Telesystems OJSC | | | 60,884 | |

| | 14,849 | | | Moscow Exchange MICEX-RTS | | | 20,895 | |

| | 16,111 | | | Novatek OAO | | | 147,563 | |

| | 14,169 | | | Novolipetsk Steel OAO | | | 17,357 | |

| | 1,160 | | | PhosAgro OAO GDR | | | 15,660 | |

| | 17,609 | | | Rosneft OAO (a) | | | 71,297 | |

| | 21,203 | | | Rostelecom PJSC (a) | | | 31,040 | |

| | 2,560,464 | | | Rushydro PJSC (a) | | | 26,078 | |

| | 115,499 | | | Sberbank of Russia PJSC (a) | | | 163,760 | |

| | 2,636 | | | Severstal PAO | | | 30,639 | |

| | 60,577 | | | Sistema (a) | | | 16,747 | |

| | 112,492 | | | Surgutneftegas OAO (a) | | | 63,011 | |

| | 20,380 | | | Tatneft, Class S (a) | | | 104,982 | |

| | 14,927 | | | Uralkali PJSC (a) | | | 36,271 | |

| | | | | | | | |

| | | | | | | 1,553,306 | |

| | | | | | | | |

| | | | South Africa — 8.4% | | | | |

| | 5,968 | | | AVI Ltd. | | | 37,967 | |

| | 3,664 | | | Barclays Africa Group Ltd. | | | 46,957 | |

| | 3,504 | | | Barloworld Ltd. | | | 19,770 | |

| | 5,134 | | | Bidvest Group Ltd. (The) | | | 131,146 | |

| | 3,746 | | | Brait S.E. (a) | | | 42,893 | |

| | 17,616 | | | Capital Property Fund Ltd. REIT | | | 20,502 | |

| | 584 | | | Capitec Bank Holdings Ltd. | | | 25,228 | |

| | 4,509 | | | Clicks Group Ltd. | | | 32,888 | |

| | 2,928 | | | DataTec Ltd. | | | 12,536 | |

| | 3,657 | | | Discovery Ltd. | | | 39,048 | |

| | 1,664 | | | EOH Holdings Ltd. | | | 18,374 | |

| | 2,089 | | | Exxaro Resources Ltd. | | | 8,646 | |

| | 32,130 | | | FirstRand Ltd. | | | 117,735 | |

| | 4,098 | | | Foschini Group Ltd. (The) | | | 41,808 | |

| | 25,049 | | | Growthpoint Properties Ltd. | | | 45,889 | |

| | 2,779 | | | Hyprop Investments Ltd. | | | 25,202 | |

| | 2,688 | | | Imperial Holdings Ltd. | | | 34,989 | |

| | 1,140 | | | JSE Ltd. | | | 10,982 | |

| | 22,115 | | | KAP Industrial Holdings Ltd. | | | 11,745 | |

| | 864 | | | Kumba Iron Ore Ltd. | | | 3,730 | |

| | 1,168 | | | Liberty Holdings Ltd. | | | 11,420 | |

| | 9,077 | | | Mediclinic International Ltd. | | | 79,673 | |

| | 11,600 | | | MMI Holdings Ltd. | | | 21,050 | |

| | 1,768 | | | Mondi Ltd. | | | 41,080 | |

| | 4,385 | | | Mr Price Group Ltd. | | | 67,332 | |

| | 34,185 | | | MTN Group Ltd. | | | 389,183 | |

| | 2,216 | | | Nedbank Group Ltd. | | | 36,837 | |

| | 27,018 | | | Netcare Ltd. | | | 76,831 | |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | | | | | |

| | | | South Africa — continued | | | | |

| | 4,291 | | | Pick n Pay Stores Ltd. | | | 20,748 | |

| | 2,385 | | | Pioneer Foods Group Ltd. | | | 34,169 | |

| | 6,894 | | | PPC Ltd. | | | 8,288 | |

| | 752 | | | PSG Group Ltd. | | | 14,500 | |

| | 43,503 | | | Redefine Properties Ltd. | | | 36,297 | |

| | 7,273 | | | Remgro Ltd. | | | 145,511 | |

| | 2,544 | | | Resilient Property Income Fund Ltd. | | | 22,415 | |

| | 7,544 | | | RMB Holdings Ltd. | | | 36,735 | |

| | 18,368 | | | Sanlam Ltd. | | | 82,982 | |

| | 420 | | | Santam Ltd. | | | 6,768 | |

| | 8,024 | | | Sappi Ltd. (a) | | | 31,662 | |

| | 8,025 | | | Sasol Ltd. | | | 257,135 | |

| | 8,203 | | | Shoprite Holdings Ltd. | | | 85,243 | |

| | 6,075 | | | Sibanye Gold Ltd. | | | 10,146 | |

| | 3,288 | | | SPAR Group Ltd. (The) | | | 47,197 | |

| | 12,960 | | | Standard Bank Group Ltd. | | | 134,656 | |

| | 49,724 | | | Steinhoff International Holdings Ltd. | | | 303,985 | |

| | 6,592 | | | Telkom SA SOC Ltd. | | | 34,616 | |

| | 8,073 | | | Truworths International Ltd. | | | 54,621 | |

| | 6,105 | | | Vodacom Group Ltd. | | | 65,941 | |

| | 18,675 | | | Woolworths Holdings Ltd. | | | 138,169 | |

| | | | | | | | |

| | | | | | | 3,023,225 | |

| | | | | | | | |

| | | | Taiwan — 18.7% | | | | |

| | 129,000 | | | Advanced Semiconductor Engineering, Inc. | | | 148,925 | |

| | 48,000 | | | Asia Cement Corp. | | | 49,854 | |

| | 15,000 | | | Asustek Computer, Inc. | | | 134,241 | |

| | 175,000 | | | AU Optronics Corp. | | | 51,477 | |

| | 16,000 | | | Catcher Technology Co., Ltd. | | | 157,024 | |

| | 127,000 | | | Cathay Financial Holding Co., Ltd. | | | 180,898 | |

| | 85,390 | | | Chang Hwa Commercial Bank Ltd. | | | 44,322 | |

| | 45,000 | | | Cheng Shin Rubber Industry Co., Ltd. | | | 81,477 | |

| | 8,000 | | | Cheng Uei Precision Industry Co., Ltd. | | | 11,687 | |

| | 10,065 | | | Chicony Electronics Co., Ltd. | | | 23,956 | |

| | 63,000 | | | China Airlines Ltd. (a) | | | 22,553 | |

| | 228,000 | | | China Development Financial Holding Corp. | | | 61,261 | |

| | 93,000 | | | Chunghwa Telecom Co., Ltd. | | | 284,939 | |

| | 88,000 | | | Compal Electronics, Inc. | | | 54,730 | |

| | 263,811 | | | CTBC Financial Holding Co., Ltd. | | | 144,531 | |

| | 122,388 | | | E.Sun Financial Holding Co., Ltd. | | | 73,559 | |

| | 5,000 | | | Eclat Textile Co., Ltd. | | | 73,540 | |

| | 49,000 | | | Eva Airways Corp. (a) | | | 28,758 | |

| | 33,450 | | | Evergreen Marine Corp. Taiwan Ltd. | | | 14,890 | |

| | 35,000 | | | Far Eastern International Bank | | | 10,874 | |

| | 100,680 | | | Far Eastern New Century Corp. | | | 91,506 | |

| | 40,000 | | | Far EasTone Telecommunications Co., Ltd. | | | 86,787 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| OCTOBER 31, 2015 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 15 | |

JPMorgan Diversified Return Emerging Markets Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF OCTOBER 31, 2015 (continued)

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| Common Stocks — continued | |

| | | | Taiwan — continued | | | | |

| | 8,000 | | | Feng TAY Enterprise Co., Ltd. | | | 45,842 | |

| | 150,109 | | | First Financial Holding Co., Ltd. | | | 72,698 | |

| | 84,000 | | | Formosa Chemicals & Fibre Corp. | | | 192,036 | |

| | 37,000 | | | Formosa Petrochemical Corp. | | | 89,925 | |

| | 97,000 | | | Formosa Plastics Corp. | | | 225,102 | |

| | 21,300 | | | Foxconn Technology Co., Ltd. | | | 55,791 | |

| | 118,000 | | | Fubon Financial Holding Co., Ltd. | | | 190,726 | |

| | 7,000 | | | Giant Manufacturing Co., Ltd. | | | 52,743 | |

| | 294,900 | | | Hon Hai Precision Industry Co., Ltd. | | | 783,862 | |

| | 11,000 | | | Hotai Motor Co., Ltd. | | | 128,333 | |

| | 120,672 | | | Hua Nan Financial Holdings Co., Ltd. | | | 57,990 | |

| | 192,000 | | | Innolux Corp. | | | 64,411 | |

| | 50,000 | | | Inotera Memories, Inc. (a) | | | 38,374 | |

| | 64,000 | | | Inventec Corp. | | | 36,680 | |

| | 3,000 | | | Largan Precision Co., Ltd. | | | 233,126 | |

| | 42,285 | | | Lite-On Technology Corp. | | | 43,833 | |

| | 163,000 | | | Mega Financial Holding Co., Ltd. | | | 118,770 | |

| | 110,000 | | | Nan Ya Plastics Corp. | | | 218,277 | |

| | 7,000 | | | Nanya Technology Corp. | | | 8,585 | |

| | 13,000 | | | Novatek Microelectronics Corp. | | | 44,249 | |

| | 40,000 | | | Pegatron Corp. | | | 97,746 | |

| | 69,000 | | | Pou Chen Corp. | | | 97,319 | |

| | 54,000 | | | Quanta Computer, Inc. | | | 91,959 | |

| | 115,287 | | | Shin Kong Financial Holding Co., Ltd. | | | 27,587 | |

| | 49,165 | | | Siliconware Precision Industries Co., Ltd. | | | 64,959 | |

| | 155,572 | | | SinoPac Financial Holdings Co., Ltd. | | | 51,344 | |

| | 24,000 | | | Synnex Technology International Corp. | | | 25,294 | |

| | 136,000 | | | Taishin Financial Holding Co., Ltd. | | | 53,259 | |

| | 61,621 | | | Taiwan Business Bank (a) | | | 15,823 | |

| | 41,000 | | | Taiwan Mobile Co., Ltd. | | | 129,071 | |

| | 6,000 | | | Taiwan Secom Co., Ltd. | | | 18,025 | |

| | 270,000 | | | Taiwan Semiconductor Manufacturing Co., Ltd. | | | 1,137,691 | |

| | 48,000 | | | Teco Electric and Machinery Co., Ltd. | | | 41,835 | |

| | 5,000 | | | Transcend Information, Inc. | | | 13,923 | |

| | 122,000 | | | Uni-President Enterprises Corp. | | | 206,273 | |

| | 240,000 | | | United Microelectronics Corp. | | | 87,532 | |

| | 22,000 | | | Wan Hai Lines Ltd. | | | 14,534 | |

| | 30,000 | | | Yang Ming Marine Transport Corp. (a) | | | 9,098 | |

| | 161,665 | | | Yuanta Financial Holding Co., Ltd. | | | 63,521 | |

| | | | | | | | |

| | | | | | | 6,779,935 | |

| | | | | | | | |

| | | | Thailand — 4.6% | | | | |

| | 36,700 | | | Advanced Info Service PCL NVDR | | | 240,111 | |

| | 11,200 | | | Airports of Thailand PCL NVDR | | | 93,602 | |

| | 11,200 | | | Bangkok Bank PCL NVDR | | | 52,627 | |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | | | | | |

| | | | Thailand — continued | | | | |

| | 11,100 | | | Bumrungrad Hospital PCL NVDR | | | 67,319 | |

| | 31,700 | | | Central Pattana PCL NVDR | | | 40,960 | |

| | 139,200 | | | CP ALL PCL NVDR | | | 195,767 | |

| | 13,600 | | | Delta Electronics Thailand PCL NVDR | | | 32,309 | |

| | 8,000 | | | Electricity Generating PCL NVDR | | | 34,926 | |

| | 13,600 | | | Glow Energy PCL NVDR | | | 32,688 | |

| | 34,800 | | | Indorama Ventures PCL NVDR | | | 22,564 | |

| | 39,900 | | | Intouch Holdings PCL NVDR | | | 84,070 | |

| | 270,500 | | | IRPC PCL NVDR | | | 30,963 | |

| | 26,400 | | | Kasikornbank PCL NVDR | | | 127,677 | |

| | 79,200 | | | Krung Thai Bank PCL NVDR | | | 38,004 | |

| | 72,200 | | | Land & Houses PCL NVDR | | | 17,330 | |

| | 43,200 | | | PTT Global Chemical PCL NVDR | | | 67,675 | |

| | 21,500 | | | PTT PCL NVDR | | | 166,069 | |

| | 8,000 | | | Siam Cement (The) PCL NVDR | | | 102,126 | |

| | 2,100 | | | Siam City Cement PCL NVDR | | | 19,935 | |

| | 35,200 | | | Siam Commercial Bank (The) PCL NVDR | | | 131,847 | |

| | 22,400 | | | Thai Oil PCL NVDR | | | 34,111 | |

| | 492,000 | | | TMB Bank PCL NVDR | | | 36,714 | |

| | | | | | | | |

| | | | | | | 1,669,394 | |

| | | | | | | | |

| | | | Turkey — 1.6% | | | | |

| | 21,455 | | | Akbank TAS | | | 54,983 | |

| | 3,345 | | | Arcelik A/S | | | 18,229 | |

| | 1,248 | | | Aselsan Elektronik Sanayi Ve Ticaret A/S | | | 5,966 | |

| | 22,000 | | | Emlak Konut Gayrimenkul Yatirim Ortakligi A/S REIT | | | 21,312 | |

| | 8,123 | | | Enka Insaat ve Sanayi A/S | | | 14,379 | |

| | 20,352 | | | Eregli Demir ve Celik Fabrikalari | | | 28,843 | |

| | 1,351 | | | Ford Otomotiv Sanayi A/S | | | 15,871 | |

| | 9,264 | | | Haci Omer Sabanci Holding A/S | | | 29,371 | |

| | 9,448 | | | KOC Holding A/S | | | 42,671 | |

| | 680 | | | Koza Altin Isletmeleri A/S | | | 3,817 | |

| | 5,382 | | | Petkim Petrokimya Holding A/S (a) | | | 7,930 | |

| | 2,328 | | | TAV Havalimanlari Holding A/S | | | 18,263 | |

| | 2,311 | | | Tofas Turk Otomobil Fabrikasi A/S | | | 15,246 | |

| | 1,832 | | | Tupras Turkiye Petrol Rafinerileri A/S (a) | | | 48,343 | |

| | 10,347 | | | Turk Hava Yollari AO (a) | | | 30,509 | |

| | 11,152 | | | Turk Telekomunikasyon A/S | | | 24,055 | |

| | 14,599 | | | Turkcell Iletisim Hizmetleri A/S | | | 58,016 | |

| | 21,962 | | | Turkiye Garanti Bankasi A/S | | | 56,869 | |

| | 7,096 | | | Turkiye Halk Bankasi A/S | | | 26,583 | |

| | 15,320 | | | Turkiye Is Bankasi, Class C | | | 26,111 | |

| | 10,469 | | | Turkiye Sise ve Cam Fabrikalari A/S | | | 11,981 | |

| | 11,920 | | | Turkiye Vakiflar Bankasi Tao, Class D | | | 16,968 | |