UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-22903

J.P. Morgan Exchange-Traded Fund Trust

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, NY 10172

(Address of principal executive offices) (Zip code)

Gregory S. Samuels

J.P. Morgan Investment Management Inc.

277 Park Avenue

New York, NY 10172

(Name and Address of Agent for Service)

With copies to:

| | |

| Elizabeth A. Davin, Esq. | | Jon S. Rand, Esq. |

| JPMorgan Chase & Co. | | Dechert LLP |

| 1111 Polaris Parkway | | 1095 Avenue of the Americas |

| Columbus, OH 43240 | | New York, NY 10036 |

Registrant’s telephone number, including area code:1-844-457-6383

Date of fiscal year end: October 31

Date of reporting period: November 1, 2018 through October 31, 2019

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in FormN-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1).

Annual Report

J.P. Morgan Exchange-Traded Funds

October 31, 2019

JPMorgan BetaBuilders Canada ETF

JPMorgan BetaBuilders Developed Asia ex-Japan ETF

JPMorgan BetaBuilders Europe ETF

JPMorgan BetaBuilders Japan ETF

JPMorgan BetaBuilders U.S. Equity ETF

JPMorgan Diversified Return Emerging Markets Equity ETF

JPMorgan Diversified Return Europe Equity ETF

JPMorgan Diversified Return Global Equity ETF

JPMorgan Diversified Return International Equity ETF

JPMorgan Diversified Return U.S. Equity ETF

JPMorgan Diversified Return U.S. Mid Cap Equity ETF

JPMorgan Diversified Return U.S. Small Cap Equity ETF

JPMorgan U.S. Dividend ETF

JPMorgan U.S. Minimum Volatility ETF

JPMorgan U.S. Momentum Factor ETF

JPMorgan U.S. Quality Factor ETF

JPMorgan U.S. Value Factor ETF

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website www.jpmorganfunds.com and you will be notified by mail each time a report is posted and provided with a website to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action.

You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary (such as a broker dealer, bank, or retirement plan).

Alternatively, you may elect to receive paper copies of all future reports free of charge by contacting your financial intermediary. Your election to receive paper reports will apply to all funds held within your account(s).

CONTENTS

Investments in a Fund are not bank deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

Prospective investors should refer to the Funds’ prospectuses for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Exchange-Traded Funds at (844) 457-6383 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

Shares are bought and sold throughout the day on an exchange at market price (not at net asset value) through a brokerage account, and are not individually subscribed and redeemed from a Fund. Shares may only be subscribed and redeemed directly from a Fund by Authorized Participants, in very large creation/redemption units. Brokerage commissions will reduce returns.

PRESIDENT’S LETTER

DECEMBER 17, 2019 (Unaudited)

Dear Shareholder,

JPMorgan Exchange-Traded Funds has continued to grow in 2019. Our assets under management have surpassed $30 billion1 and in September we became one of the top five providers in ETF flows.2 Our expanding suite of liquid and transparent solutions provides well-diversified, well-priced portfolios that may help each investor to achieve their goals.

| | |

| | “It is our belief that diversification across regions and asset classes is a key element of building robust portfolio.” —Joanna M. Gallegos |

For the twelve months ended October 31, 2109, financial markets largely provided positive returns despite slowing global economic growth, U.S.-China trade tensions and geo-political uncertainties. Corporate profits remained buoyant, particularly in the U.S., and leading central banks maintained accommodative policies, which further supported financial markets. In July, the U.S. Federal Reserve responded to slowing economic growth by cutting interest rates for the first time in more than a decade and then followed with two more rate cuts by the end of the twelve month reporting period. Meanwhile, the European Central Bank resumed its monthly purchases of assets in an attempt to bolster flagging economic growth and inflation, which was below the bank’s target levels. China also moved to ease lending as the toll of reciprocal trade tariffs with the U.S. appeared to become a drag on exports. For the twelve months ended October 31, 2019, the MSCI World Index returned 12.69% (net of foreign withholding taxes, while the S&P 500 returned 14.33% and the Bloomberg Barclays U.S. Aggregate Index returned 11.51%.

It is our belief that diversification across regions and asset classes is a key element of building robust portfolio. For investors looking to diversify geographically, our BetaBuilders and Diversified Return ETFs can provide efficient and transparent exposures to regions and countries that continue to benefit from global economic growth. For investors looking to diversify geographically, developed economies outside the U.S. may provide attractive yields and diversification benefits. Our JPMorgan BetaBuilders Developed Asia ex-Japan ETF (BBAX), for example, returned 16.18% for twelve months ended October 31, 2019.

We are proud to bring a range of investment solutions to help you navigate a changing market landscape. We are committed to building solutions that address your needs and help you build stronger portfolios. Thank you for your belief in our Firm and our process.

Sincerely,

Joanna M. Gallegos

President, J.P. Morgan Exchange-Traded Funds

J.P Morgan Asset Management

1-844-4JPM-ETF or jpmorgan.com/etfs for more information

| 1 | J.P. Morgan Asset Management, December 16, 2019. |

| 2 | Bloomberg L.P., September 30, 2019. |

| | | | | | | | |

| | | |

| OCTOBER 31, 2019 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 1 | |

J.P. Morgan Exchange-Traded Funds

MARKET OVERVIEW

TWELVE MONTHS ENDED OCTOBER 31, 2019 (Unaudited)

Global equity markets generally provided positive returns for the reporting period amid slowing but continued growth in both the global economy and corporate profits. Investor optimism over U.S.-China trade negotiations and an extension of the deadline for Britain’s exit from the European Union (“Brexit”) also bolstered investor sentiment. Bond markets also provided positive returns for the period but generally underperformed equity markets. Emerging markets debt and U.S. investment grade bonds largely outperformed U.S. Treasury bonds.

In the final months of 2018, global equity markets generally slumped as investors faced both slowing global economic growth — particularly in China and Europe — and the prospect of rising U.S. interest rates. Equity prices largely rebounded in the first months of 2019, and markets remained buoyant through April 2019. Global equity markets were hit with a selloff in May 2019 and leading indexes in the U.S. and Asian

developed markets, as well as in emerging markets, dropped by more than 6%. Equity prices rebounded again in June and received further support at the end of July 2019, when the U.S. Federal Reserve (the “Fed”) responded to slowing economic growth by raising interest rates for the first time in more than a decade.

Investor concerns about increased U.S.-China trade tensions and uncertainty over the U.K.’s Brexit strategy led to increased market volatility in the final months of the reporting period. However, the Fed cut interest rates again in mid-September 2019 and, by the end of October 2019, leading U.S. equity indexes had returned to record highs.

For the twelve months ended October 31, 2019, the S&P 500 returned 14.33%, the MSCI EAFE Index returned 11.63% and the MSCI Emerging Markets Index returned 12.29%.

| | | | | | |

| | | |

| 2 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2019 |

JPMorgan BetaBuilders Canada ETF

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2019 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| JPMorgan BetaBuilders Canada ETF | | | | |

| Net Asset Value* | | | 13.08% | |

| Market Price** | | | 12.97% | |

| Morningstar® Canada Target Market Exposure Indexsm | | | 12.72% | |

| |

| Net Assets as of 10/31/2019 | | $ | 3,800,754,020 | |

INVESTMENT OBJECTIVE***

The JPMorgan BetaBuilders Canada ETF (the “Fund”) seeks investment results that closely correspond, before fees and expenses, to the performance of the Morningstar® Canada Target Market Exposure Indexsm (the “Underlying Index”).

INVESTMENT APPROACH

The Underlying Index is a free-float adjusted market-capitalization weighted index consisting of stocks traded primarily on the Toronto Stock Exchange. Using a “passive” investment approach, the Fund attempts to replicate the Underlying Index as closely as possible, before considering fees and expenses, and invests in substantially all of the securities in the Underlying Index in approximately the same proportions as the Underlying Index.

HOW DID THE FUND PERFORM?

For the twelve months ended October 31, 2019, the Fund performed in line with the Underlying Index, before considering the effects of operating expenses, fees and tax management of the Fund’s portfolio.

The Fund’s and the Underlying Index’s allocations to the financials and information technology sectors were leading contributors to absolute performance, while their allocations to the health care sector was the sole sector detractor from absolute performance.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s and the Underlying Index’s largest allocations were in the financials and energy sectors and their smallest allocations were in the real estate and health care sectors.

| | | | | | | | |

| | | |

| OCTOBER 31, 2019 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 3 | |

JPMorgan BetaBuilders Canada ETF

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2019 (Unaudited) (continued)

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO**** | |

| | 1. | | | Royal Bank of Canada | | | 7.4 | % |

| | 2. | | | Toronto-Dominion Bank (The) | | | 6.6 | |

| | 3. | | | Enbridge, Inc. | | | 4.7 | |

| | 4. | | | Bank of Nova Scotia (The) | | | 4.5 | |

| | 5. | | | Canadian National Railway Co. | | | 4.1 | |

| | 6. | | | Brookfield Asset Management, Inc., Class A | | | 3.2 | |

| | 7. | | | Bank of Montreal | | | 3.0 | |

| | 8. | | | TC Energy Corp. | | | 3.0 | |

| | 9. | | | Suncor Energy, Inc. | | | 2.9 | |

| | 10. | | | Canadian Imperial Bank of Commerce | | | 2.4 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR**** | |

| Financials | | | 36.5 | % |

| Energy | | | 16.8 | |

| Industrials | | | 10.5 | |

| Materials | | | 9.3 | |

| Information Technology | | | 5.3 | |

| Consumer Staples | | | 4.0 | |

| Consumer Discretionary | | | 3.9 | |

| Communication Services | | | 3.3 | |

| Utilities | | | 3.2 | |

| Health Care | | | 1.0 | |

| Real Estate | | | 0.5 | |

| Short-Term Investments | | | 5.7 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $24.89 as of October 31, 2019. |

| ** | | Market price return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the Cboe BZX Exchange, Inc. The midpoint price was $24.90 as of October 31, 2019. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based on total investments as of October 31, 2019. The Fund’s portfolio composition is subject to change. |

| | | | | | |

| | | |

| 4 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2019 |

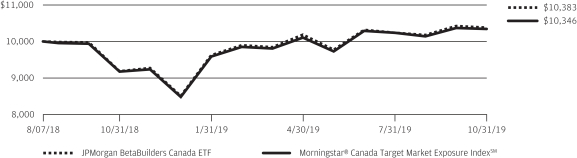

| | | | | | | | | | | | |

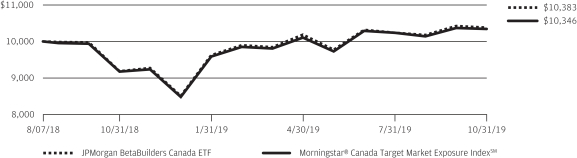

AVERAGE ANNUAL TOTAL RETURNSAS OF OCTOBER 31, 2019 (Unaudited) | |

| | | INCEPTION DATE | | | 1 YEAR | | | SINCE

INCEPTION | |

JPMorgan BetaBuilders Canada ETF | | | | | | | | | | | | |

Net Asset Value | | | August 7, 2018 | | | | 13.08% | | | | 3.10% | |

Market Price | | | | | | | 12.97% | | | | 3.13% | |

LIFE OF FUND PERFORMANCE(8/7/18 TO 10/31/19)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund commenced operations on August 7, 2018.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan BetaBuilders Canada ETF and Morningstar® Canada Target Market Exposure IndexSM from August 7, 2018 to October 31, 2019. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Morningstar® Canada Target Market Exposure IndexSM does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The Morningstar® Canada Target Market Exposure IndexSM is a free float adjusted market

capitalization weighted index which consists of stocks traded primarily on the Toronto Stock Exchange. Investors cannot invest directly in an index.

Fund performance reflects the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption or sale of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the United States can raise or lower returns. Also, some foreign markets may not be as politically and economically stable as the United States and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | |

| | | |

| OCTOBER 31, 2019 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 5 | |

JPMorgan BetaBuilders Developed Asia ex-Japan ETF

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2019 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| JPMorgan BetaBuilders Developed Asia ex-Japan ETF | | | | |

| Net Asset Value* | | | 16.18% | |

| Market Price** | | | 15.94% | |

| Morningstar® Developed Asia Pacific ex-Japan Target Market Exposure Indexsm | | | 16.77% | |

| |

| Net Assets as of 10/31/2019 | | $ | 1,442,853,830 | |

INVESTMENT OBJECTIVE***

The JPMorgan BetaBuilders Developed Asia ex-Japan ETF (the “Fund”) seeks investment results that closely correspond, before fees and expenses, to the performance of the Morningstar® Developed Asia Pacific ex-Japan Target Market Exposure Indexsm (the “Underlying Index”).

INVESTMENT APPROACH

The Underlying Index is a free-float adjusted market-cap weighted index consisting of stocks from developed Asia Pacific countries other than Japan, including: Australia, Hong Kong, New Zealand and Singapore. Using a “passive” investment approach, the Fund attempts to replicate the Underlying Index as closely as possible, before considering fees and expenses, and invests in substantially all of the securities in the Underlying Index in approximately the same proportions as the Underlying Index.

HOW DID THE FUND PERFORM?

For the twelve months ended October 31, 2019, the Fund performed in line with the Underlying Index, before considering

the effects of operating expenses, fees and tax management of the Fund’s portfolio.

The Fund’s and the Underlying Index’s exposures to the financials and real estate sectors were leading contributors to absolute performance, while their exposures to the information technology and energy sectors were the smallest sector contributors to absolute performance. By country, the Fund’s and the Underlying Index’s exposures to Australia and Hong Kong were leading contributors to absolute performance, while their exposures to New Zealand and Singapore were the smallest contributors to absolute performance.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s and the Underlying Index’s largest allocations were in the financials and real estate sectors and their smallest allocations were in the information technology and energy sectors. The Fund and the Underlying Index were mainly invested in four equity markets during the reporting period, with the largest allocations to Australia, followed by Hong Kong, Singapore and New Zealand.

| | | | | | |

| | | |

| 6 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2019 |

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO**** | |

| | 1. | | | AIA Group Ltd. (Hong Kong) | | | 6.9 | % |

| | 2. | | | Commonwealth Bank of Australia (Australia) | | | 5.5 | |

| | 3. | | | CSL Ltd. (Australia) | | | 4.6 | |

| | 4. | | | BHP Group Ltd. (Australia) | | | 4.2 | |

| | 5. | | | Westpac Banking Corp. (Australia) | | | 3.8 | |

| | 6. | | | National Australia Bank Ltd. (Australia) | | | 3.3 | |

| | 7. | | | Australia & New Zealand Banking Group Ltd. (Australia) | | | 3.1 | |

| | 8. | | | Hong Kong Exchanges & Clearing Ltd. (Hong Kong) | | | 2.1 | |

| | 9. | | | DBS Group Holdings Ltd. (Singapore) | | | 2.0 | |

| | 10. | | | Woolworths Group Ltd. (Australia) | | | 2.0 | |

| | | | |

PORTFOLIO COMPOSITION BY COUNTRY**** | |

| Australia | | | 57.0 | % |

| Hong Kong | | | 24.7 | |

| Singapore | | | 11.8 | |

| New Zealand | | | 2.3 | |

| Macau | | | 2.1 | |

| United Kingdom | | | 1.4 | |

| Others (each less than 1.0%) | | | 0.7 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $25.31 as of October 31, 2019. |

| ** | | Market price return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the Cboe BZX Exchange, Inc. The midpoint price was $25.27 as of October 31, 2019. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based on total investments as of October 31, 2019. The Fund’s portfolio composition is subject to change. |

| | | | | | | | |

| | | |

| OCTOBER 31, 2019 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 7 | |

JPMorgan BetaBuilders Developed Asia ex-Japan ETF

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2019 (Unaudited) (continued)

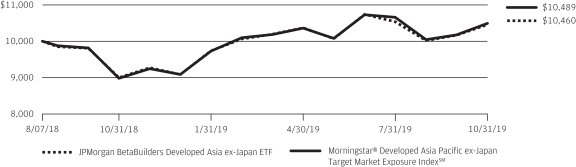

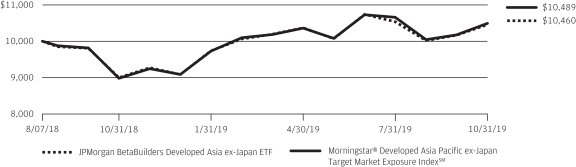

| | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNSAS OF OCTOBER 31, 2019 (Unaudited) | |

| | | INCEPTION DATE | | | 1 YEAR | | | SINCE

INCEPTION | |

JPMorgan BetaBuilders Developed Asiaex-Japan ETF | | | | | | | | | | | | |

Net Asset Value | | | August 7, 2018 | | | | 16.18% | | | | 3.71% | |

Market Price | | | | | | | 15.94% | | | | 3.57% | |

LIFE OF FUND PERFORMANCE(8/7/18 TO 10/31/19)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information pleasecall 1-844-457-6383.

Fund commenced operations on August 7, 2018.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan BetaBuilders Developed Asia ex-Japan ETF and Morningstar® Developed Asia Pacific ex-Japan Target Market Exposure IndexSM from August 7, 2018 to October 31, 2019. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Morningstar® Developed Asia Pacific ex-Japan Target Market Exposure IndexSM does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The Morningstar® Developed Asia Pacific ex-Japan Target Market Exposure IndexSM is a free float adjusted

market capitalization-weighted index that consists of equity securities from developed Asia-Pacific countries or regions other than Japan, including Australia, Hong Kong, New Zealand, and Singapore. Investors cannot invest directly in an index.

Fund performance reflects the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption or sale of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the United States can raise or lower returns. Also, some over- seas markets may not be as politically and economically stable as the United States and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 8 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2019 |

JPMorgan BetaBuilders Europe ETF

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2019 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| JPMorgan BetaBuilders Europe ETF | | | | |

| Net Asset Value* | | | 11.43% | |

| Market Price** | | | 11.32% | |

| Morningstar® Developed Europe Target Market Exposure Indexsm | | | 10.93% | |

| |

| Net Assets as of 10/31/2019 | | $ | 3,853,145,624 | |

INVESTMENT OBJECTIVE***

The JPMorgan BetaBuilders Europe ETF (the “Fund”) seeks investment results that closely correspond, before fees and expenses, to the performance of the Morningstar® Developed Europe Target Market Exposure Indexsm (the “Underlying Index”).

INVESTMENT APPROACH

The Underlying Index is a free-float adjusted market-cap weighted index consisting of stocks traded on the primary exchanges in developed countries or regions across Europe. Using a “passive” investment approach, the Fund attempts to replicate the Underlying Index as closely as possible, before considering fees and expenses, and invests in substantially all of the securities in the Underlying Index in approximately the same proportions as the Underlying Index.

HOW DID THE FUND PERFORM?

For the twelve months ended October 31, 2019, the Fund performed in line with the Underlying Index, before considering the effects of operating expenses, fees and tax management of the Fund’s portfolio.

The Fund’s and the Underlying Index’s exposures to the industrials and health care sectors were the leading contributors to absolute performance, while their exposure to the energy sector was the sole sector detractor from absolute performance during the reporting period.

By country, the Fund’s and the Underlying Index’s exposures to Switzerland and France were leading contributors to absolute performance, while their exposures to Norway and Austria were the largest detractors from absolute performance.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s and the Underlying Index’s largest allocations were in the financials and consumer staples sectors and their smallest allocations were in the real estate and utilities sectors. The Fund’s and the Underlying Index’s largest country allocations were in the U.K. and France and their smallest country allocations were in Portugal and Austria.

| | | | | | | | |

| | | |

| OCTOBER 31, 2019 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 9 | |

JPMorgan BetaBuilders Europe ETF

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2019 (Unaudited) (continued)

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO**** | |

| | 1. | | | Nestle SA (Registered) (Switzerland) | | | 3.4 | % |

| | 2. | | | Novartis AG (Registered) (Switzerland) | | | 2.4 | |

| | 3. | | | Roche Holding AG (Switzerland) | | | 2.3 | |

| | 4. | | | HSBC Holdings plc (United Kingdom) | | | 1.6 | |

| | 5. | | | SAP SE (Germany) | | | 1.5 | |

| | 6. | | | TOTAL SA (France) | | | 1.4 | |

| | 7. | | | BP plc (United Kingdom) | | | 1.4 | |

| | 8. | | | AstraZeneca plc (United Kingdom) | | | 1.4 | |

| | 9. | | | Royal Dutch Shell plc, Class A (Netherlands) | | | 1.3 | |

| | 10. | | | LVMH Moet Hennessy Louis Vuitton SE (France) | | | 1.2 | |

| | | | |

PORTFOLIO COMPOSITION BY COUNTRY**** | |

| United Kingdom | | | 22.1 | % |

| France | | | 16.7 | |

| Switzerland | | | 14.8 | |

| Germany | | | 13.1 | |

| Netherlands | | | 6.9 | |

| Sweden | | | 4.4 | |

| Spain | | | 4.3 | |

| Italy | | | 3.5 | |

| Denmark | | | 2.7 | |

| Finland | | | 1.9 | |

| Belgium | | | 1.7 | |

| Norway | | | 1.1 | |

| Australia | | | 1.0 | |

| Others (each less than 1.0%) | | | 2.9 | |

| Short-Term Investments | | | 2.9 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $24.36 as of October 31, 2019. |

| ** | | Market price return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the Cboe BZX Exchange, Inc. The midpoint price was $24.39 as of October 31, 2019. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based on total investments as of October 31, 2019. The Fund’s portfolio composition is subject to change. |

| | | | | | |

| | | |

| 10 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2019 |

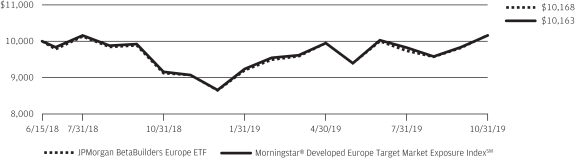

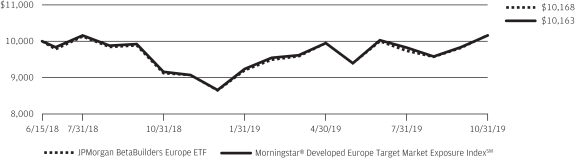

| | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNSAS OF OCTOBER 31, 2019 (Unaudited) | |

| | | INCEPTION DATE | | | 1 YEAR | | | SINCE

INCEPTION | |

JPMorgan BetaBuilders Europe ETF | | | | | | | | | | | | |

Net Asset Value | | | June 15, 2018 | | | | 11.43% | | | | 1.21% | |

Market Price | | | | | | | 11.32% | | | | 1.31% | |

LIFE OF FUND PERFORMANCE(6/15/18 TO 10/31/19)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund commenced operations on June 15, 2018.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan BetaBuilders Europe ETF and Morningstar® Developed Europe Target Market Exposure IndexSM from June 15, 2018 to October 31, 2019. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Morningstar® Developed Europe Target Market Exposure IndexSM does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. Morningstar® Developed Europe Target Market Exposure IndexSM is a

free float adjusted market capitalization-weighted index which consists of equity securities from developed European countries or regions. Investors cannot invest directly in an index.

Fund performance reflects the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption or sale of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the United States can raise or lower returns. Also, some over- seas markets may not be as politically and economically stable as the United States and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | |

| | | |

| OCTOBER 31, 2019 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 11 | |

JPMorgan BetaBuilders Japan ETF

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2019 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| JPMorgan BetaBuilders Japan ETF | | | | |

| Net Asset Value* | | | 8.74% | |

| Market Price** | | | 9.07% | |

| Morningstar® Japan Target Market Exposure Indexsm | | | 9.05% | |

| |

| Net Assets as of 10/31/2019 | | $ | 4,318,521,919 | |

INVESTMENT OBJECTIVE***

The JPMorgan BetaBuilders Japan ETF (the “Fund”) seeks investment results that closely correspond, before fees and expenses, to the performance of the Morningstar® Japan Target Market Exposure Indexsm (the “Underlying Index”).

INVESTMENT APPROACH

The Underlying Index is a free-float adjusted market-cap weighted index consisting of stocks traded primarily on the Tokyo or Nagoya stock exchanges. Using a “passive” investment approach, the Fund attempts to replicate the Underlying Index as closely as possible, before considering fees and expenses, and invests in substantially all of the securities in the Underlying Index in approximately the same proportions as the Underlying Index.

HOW DID THE FUND PERFORM?

For the twelve months ended October 31, 2019, the Fund performed in line with the Underlying Index, before considering

the effects of operating expenses, fees and tax management of the Fund’s portfolio.

The Fund’s and the Underlying Index’s exposures to the industrials and information technology sectors were leading contributors to absolute performance, while their exposures to the financials and energy sectors were leading detractors from absolute performance.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s and the Underlying Index’s largest allocations were in the industrials and consumer discretionary sectors and their smallest allocations were in the energy and utilities sectors.

| | | | | | |

| | | |

| 12 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2019 |

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO**** | |

| | 1. | | | Toyota Motor Corp. | | | 4.5 | % |

| | 2. | | | Sony Corp. | | | 1.9 | |

| | 3. | | | Mitsubishi UFJ Financial Group, Inc. | | | 1.7 | |

| | 4. | | | SoftBank Group Corp. | | | 1.6 | |

| | 5. | | | Keyence Corp. | | | 1.5 | |

| | 6. | | | Takeda Pharmaceutical Co. Ltd. | | | 1.4 | |

| | 7. | | | Recruit Holdings Co. Ltd. | | | 1.3 | |

| | 8. | | | Honda Motor Co. Ltd. | | | 1.2 | |

| | 9. | | | Sumitomo Mitsui Financial Group, Inc. | | | 1.2 | |

| | 10. | | | KDDI Corp. | | | 1.1 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR**** | |

| Industrials | | | 21.9 | % |

| Consumer Discretionary | | | 18.9 | |

| Information Technology | | | 10.9 | |

| Financials | | | 10.1 | |

| Health Care | | | 9.3 | |

| Consumer Staples | | | 8.3 | |

| Communication Services | | | 7.3 | |

| Materials | | | 5.7 | |

| Real Estate | | | 4.8 | |

| Utilities | | | 1.6 | |

| Others (each less than 1.0%) | | | 1.2 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $24.54 as of October 31, 2019. |

| ** | | Market price return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the Cboe BZX Exchange, Inc. The midpoint price was $24.57 as of October 31, 2019. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based on total investments as of October 31, 2019. The Fund’s portfolio composition is subject to change. |

| | | | | | | | |

| | | |

| OCTOBER 31, 2019 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 13 | |

JPMorgan BetaBuilders Japan ETF

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2019 (Unaudited) (continued)

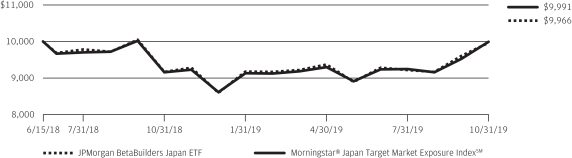

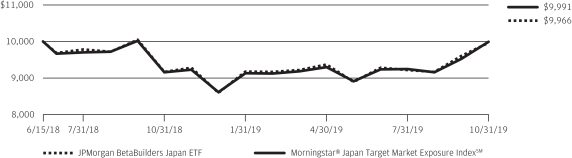

| | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNSAS OF OCTOBER 31, 2019 (Unaudited) | |

| | | INCEPTION DATE | | | 1 YEAR | | | SINCE

INCEPTION | |

JPMorgan BetaBuilders Japan ETF | | | | | | | | | | | | |

Net Asset Value | | | June 15, 2018 | | | | 8.74% | | | | (0.24 | )% |

Market Price | | | | | | | 9.07% | | | | (0.16 | )% |

LIFE OF FUND PERFORMANCE(6/15/18 TO 10/31/19)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund commenced operations on June 15, 2018.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan BetaBuilders Japan ETF and Morningstar® Japan Target Market Exposure IndexSM from June 15, 2018 to October 31, 2019. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Morningstar® Japan Target Market Exposure IndexSM does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. Morningstar® Japan Target Market Exposure IndexSM is a free float adjusted market capitalization weighted index

which consists of stocks traded primarily on the Tokyo Stock Exchange or the Nagoya Stock Exchange. Investors cannot invest directly in an index.

Fund performance reflects the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption or sale of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the United States can raise or lower returns. Also, some over- seas markets may not be as politically and economically stable as the United States and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 14 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2019 |

JPMorgan BetaBuilders U.S. Equity ETF

FUND COMMENTARY

FOR THE PERIOD MARCH 12, 2019 (INCEPTION DATE) THROUGH OCTOBER 31, 2019 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| JPMorgan BetaBuilders U.S. Equity ETF | | | | |

| Net Asset Value* | | | 9.95% | |

| Market Price** | | | 9.97% | |

| Morningstar® US Target Market Exposure Indexsm | | | 9.98% | |

| |

| Net Assets as of 10/31/2019 | | $ | 46,409,125 | |

INVESTMENT OBJECTIVE***

The JPMorgan BetaBuilders U.S. Equity ETF (the “Fund”) seeks investment results that closely correspond, before fees and expenses, to the performance of the Morningstar® US Target Market Exposure Indexsm (the “Underlying Index”).

INVESTMENT APPROACH

The Underlying Index is a free-float adjusted market-cap weighted index consisting of equity securities traded primarily in the U.S. Using a “passive” investment approach, the Fund attempts to replicate the Underlying Index as closely as possible, before considering fees and expenses, and invests in substantially all of the securities in the Underlying Index in approximately the same proportions as the Underlying Index.

HOW DID THE FUND PERFORM?

For the period from inception on March 12, 2019 to October 31, 2019, the Fund performed in line with the Underlying Index, before considering the effects of operating expenses, fees and tax management of the Fund’s portfolio.

The Fund’s and the Underlying Index’s exposures to the information technology and financials sectors were leading contributors to absolute performance, while their exposure to the energy sector was the sole sector detractor from absolute performance.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s and the Underlying Index’s largest allocations were in the information technology and health care sectors and their smallest allocations were in the materials and real estate sectors.

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO**** | |

| | 1. | | | Microsoft Corp. | | | 4.1 | % |

| | 2. | | | Apple, Inc. | | | 4.0 | |

| | 3. | | | Amazon.com, Inc. | | | 2.8 | |

| | 4. | | | Facebook, Inc., Class A | | | 1.8 | |

| | 5. | | | Berkshire Hathaway, Inc., Class B | | | 1.6 | |

| | 6. | | | JPMorgan Chase & Co. | | | 1.5 | |

| | 7. | | | Alphabet, Inc., Class C | | | 1.4 | |

| | 8. | | | Alphabet, Inc., Class A | | | 1.4 | |

| | 9. | | | Johnson & Johnson | | | 1.3 | |

| | 10. | | | Procter & Gamble Co. (The) | | | 1.2 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR**** | |

| Information Technology | | | 22.3 | % |

| Health Care | | | 13.9 | |

| Financials | | | 13.0 | |

| Communication Services | | | 10.3 | |

| Consumer Discretionary | | | 10.2 | |

| Industrials | | | 9.3 | |

| Consumer Staples | | | 7.2 | |

| Energy | | | 4.2 | |

| Utilities | | | 3.5 | |

| Real Estate | | | 3.2 | |

| Materials | | | 2.6 | |

| Short-Term Investments | | | 0.3 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $54.60 as of October 31, 2019. |

| ** | | Market price return is calculated assuming an initial investment made at the inception date net asset value, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the Cboe BZX Exchange, Inc. The midpoint price was $54.61 as of October 31, 2019. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based on total investments as of October 31, 2019. The Fund’s portfolio composition is subject to change. |

| | | | | | | | |

| | | |

| OCTOBER 31, 2019 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 15 | |

JPMorgan BetaBuilders U.S. Equity ETF

FUND COMMENTARY

FOR THE PERIOD MARCH 12, 2019 (INCEPTION DATE) THROUGH OCTOBER 31, 2019 (Unaudited) (continued)

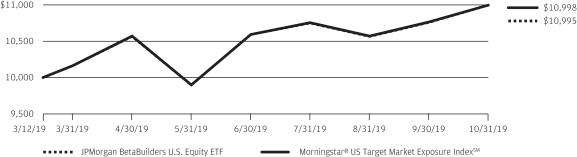

| | | | | | | | |

TOTAL RETURNSAS OF OCTOBER 31, 2019 (Unaudited) | |

| | | INCEPTION DATE | | | CUMULATIVE

SINCE

INCEPTION | |

| JPMorgan BetaBuilders U.S. Equity ETF | | | | | | | | |

Net Asset Value | | | March 12, 2019 | | | | 9.95% | |

Market Price | | | | | | | 9.97% | |

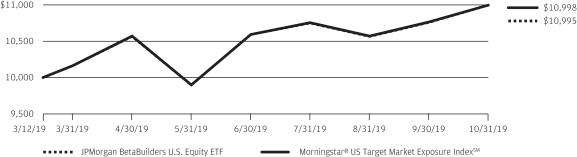

LIFE OF FUND PERFORMANCE(3/12/19 TO 10/31/19)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund commenced operations on March 12, 2019.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan BetaBuilders U.S. Equity ETF and the Morningstar® US Target Market Exposure IndexSM from March 12, 2019 to October 31, 2019. The performance of the Fund reflects the deduction of Fund expenses and assumes

reinvestment of all dividends and capital gain distributions, if any. The performance of the Morningstar® US Target Market Exposure IndexSM does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. Morningstar® US Target Market Exposure IndexSM is a free float adjusted market capitalization weighted index which consists of stocks traded primarily on the US Stock Exchange. Investors cannot invest directly in an index.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 16 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2019 |

JPMorgan Diversified Return Emerging Markets Equity ETF

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2019 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| JPMorgan Diversified Return Emerging Markets Equity ETF | | | | |

| Net Asset Value* | | | 10.00% | |

| Market Price** | | | 10.31% | |

| JP Morgan Diversified Factor Emerging Markets Equity Index (net of foreign withholding taxes) | | | 10.66% | |

| FTSE Emerging Index (net of foreign withholding taxes) | | | 13.61% | |

| MSCI Emerging Markets Index (net of foreign withholding taxes) | | | 11.86% | |

| |

| Net Assets as of 10/31/2019 | | $ | 353,795,416 | |

INVESTMENT OBJECTIVE***

The JPMorgan Diversified Return Emerging Markets Equity ETF (the “Fund”) seeks investment results that closely correspond, before fees and expenses, to the performance of the JP Morgan Diversified Factor Emerging Markets Equity Index (the “Underlying Index”).

INVESTMENT APPROACH

The Fund is passively managed to the Underlying Index, which provides emerging markets equity exposure, diversified across emerging market regions and super-sectors, and beginning June 21, 2019, individual securities. The Underlying Index uses a proprietary multi-factor stock selection process that utilizes the following characteristics: value, momentum and quality. The Underlying Index methodology includes quarterly rebalancing.

HOW DID THE FUND PERFORM?

The Fund posted a positive absolute return for the twelve months ended October 31, 2019 and performed in line with the Underlying Index, before considering differences in the net asset value calculations and foreign exchange pricing between the Underlying Index and the Fund and fees and operating expenses incurred by the Fund. The Fund and the Underlying Index underperformed both the FTSE Emerging Index and the MSCI Emerging Markets Index, which are more traditional market capitalization weighted indexes.

By sector, the Fund’s and the Underlying Index’s positions in the financials and consumer goods sectors were leading contributors to absolute performance, while their positions in the basic materials and health care sectors were leading detractors from absolute performance. By country, the Fund’s and the Underlying Index’s positions in Brazil and Russia were leading contributors to absolute performance, while their positions in Malaysia and South Africa were leading detractors from absolute performance.

Relative to the FTSE Emerging Index, The Fund’s and the Underlying Index’s security selection and underweight positions in the technology sector and consumer services sectors were leading detractors from performance. The Fund’s and the Underlying Index’s security selection and underweight positions in the financials sector and their security selection and overweight positions in the consumer goods sector were leading contributors to relative performance.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s and the Underlying Index’s largest sector allocations were in the financials and consumer goods sectors, while their smallest allocations were in the health care and consumer services sectors. The Fund’s and the Underlying Index’s largest country allocations were in China and Taiwan and their smallest allocations were in Pakistan and Hong Kong.

| | | | | | | | |

| | | |

| OCTOBER 31, 2019 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 17 | |

JPMorgan Diversified Return Emerging Markets Equity ETF

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2019 (Unaudited) (continued)

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO**** | |

| | 1. | | | China Mobile Ltd. (China) | | | 1.7 | % |

| | 2. | | | LUKOIL PJSC (Russia) | | | 1.6 | |

| | 3. | | | Naspers Ltd., Class N (South Africa) | | | 1.6 | |

| | 4. | | | Gazprom PJSC (Russia) | | | 1.5 | |

| | 5. | | | Vale SA (Brazil) | | | 1.4 | |

| | 6. | | | Petroleo Brasileiro SA (Preference) (Brazil) | | | 1.3 | |

| | 7. | | | Taiwan Semiconductor Manufacturing Co. Ltd. (Taiwan) | | | 1.2 | |

| | 8. | | | Reliance Industries Ltd. (India) | | | 1.2 | |

| | 9. | | | Sberbank of Russia PJSC (Russia) | | | 1.1 | |

| | 10. | | | Itau Unibanco Holding SA (Preference) (Brazil) | | | 1.0 | |

| | | | |

PORTFOLIO COMPOSITION BY COUNTRY**** | |

China | | | 20.6 | % |

Brazil | | | 14.6 | |

Taiwan | | | 11.1 | |

India | | | 9.0 | |

Russia | | | 7.6 | |

| South Africa | | | 6.8 | |

| Mexico | | | 4.4 | |

| Thailand | | | 4.4 | |

| Indonesia | | | 4.2 | |

Malaysia | | | 3.1 | |

Saudi Arabia | | | 1.9 | |

Qatar | | | 1.7 | |

Turkey | | | 1.6 | |

Philippines | | | 1.3 | |

Kuwait | | | 1.3 | |

Chile | | | 1.2 | |

United Arab Emirates | | | 1.1 | |

Others (each less than 1.0%) | | | 3.6 | |

Short-Term Investments | | | 0.5 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $54.43 as of October 31, 2019. |

| ** | | Market price return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the NYSE Arca. The midpoint price was $54.50 as of October 31, 2019. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based on total investments as of October 31, 2019. The Fund’s composition is subject to change. |

| | | | | | |

| | | |

| 18 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2019 |

| | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNSAS OFOCTOBER 31, 2019 (Unaudited) | |

| | | INCEPTION DATE | | | 1 YEAR | | | SINCE

INCEPTION | |

JPMorgan Diversified Return Emerging Markets Equity ETF | | | | | | | | | | | | |

Net Asset Value | | | January 7, 2015 | | | | 10.00% | | | | 4.27% | |

Market Price | | | | | | | 10.31% | | | | 4.30% | |

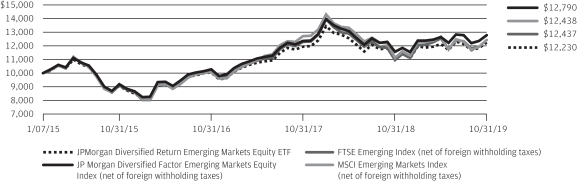

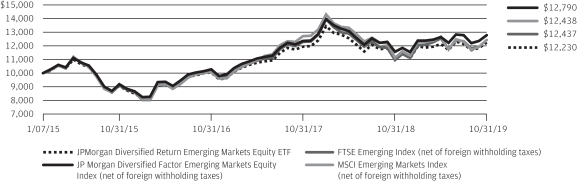

LIFE OF FUND PERFORMANCE(1/07/15 TO 10/31/19)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information pleasecall 1-844-457-6383.

Fund commenced operations on January 7, 2015.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan Diversified Return Emerging Markets Equity ETF, the JP Morgan Diversified Factor Emerging Markets Equity Index, the FTSE Emerging Index and the MSCI Emerging Markets Index from January 7, 2015 to October 31, 2019. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the JP Morgan Diversified Factor Emerging Markets Equity Index, the FTSE Emerging Index and the MSCI Emerging Markets Index does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The Fund’s adviser is a sponsor of the JP Morgan Diversified Factor Emerging Markets Equity Index and developed the proprietary factors on which the index is based. FTSE Russell, the benchmark administrator, administers, calculates and governs the JP Morgan Diversified Factor Emerging Markets Equity Index. JP Morgan Diversified Factor Emerging Markets Equity Index is comprised of large- and mid-cap equity securities from emerging markets.

Holdings in this index are selected from the constituents of the FTSE Emerging Index. The FTSE Emerging Index is a market-capitalization weighted index and is part of the FTSE Global Equity Index Series. The series includes large- and mid-cap securities from advanced and secondary emerging markets, classified in accordance with FTSE’s transparent Country Classification Review Process. The FTSE Emerging Index provides investors with a comprehensive means of measuring the performance of the most liquid companies in the emerging markets. The MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of emerging markets. Investors cannot invest directly in an index.

Fund performance reflects the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption or sale of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the United States can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the United States and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | |

| | | |

| OCTOBER 31, 2019 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 19 | |

JPMorgan Diversified Return Europe Equity ETF

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2019 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| JPMorgan Diversified Return Europe Equity ETF | | | | |

| Net Asset Value* | | | 11.09% | |

| Market Price** | | | 10.81% | |

| JP Morgan Diversified Factor Europe Equity Index (net of foreign withholding taxes) | | | 10.70% | |

| FTSE Developed Europe Index (net of foreign withholding taxes) | | | 10.81% | |

| MSCI Europe Index (net of foreign withholding taxes) | | | 10.90% | |

| |

| Net Assets as of 10/31/2019 | | $ | 17,280,937 | |

INVESTMENT OBJECTIVE***

The JPMorgan Diversified Return Europe Equity ETF (the “Fund”) seeks investment results that closely correspond, before fees and expenses, to the performance of the JP Morgan Diversified Factor Europe Equity Index (the “Underlying Index”).

INVESTMENT APPROACH

The Fund is passively managed to the Underlying Index, which is composed of large cap and mid cap equity securities of companies in developed Europe and is diversified across sectors and individual securities. The Underlying Index uses a proprietary multi-factor security selection process that measures the following characteristics: value, momentum and quality. The Underlying Index methodology includes quarterly rebalancing.

HOW DID THE FUND PERFORM?

The Fund posted a positive absolute performance for the twelve months ended October 31, 2019, and performed in line with the Underlying Index, before considering the Fund’s small cash allocation and fees and operating expenses incurred by the Fund. The Fund also performed in line with the FTSE Developed Europe Index and the MSCI Europe Index, both of which are more traditional market capitalization weighted indexes.

By sector, the Fund’s and the Underlying Index’s positions in the utilities and industrials sectors were leading contributors to absolute performance, while their positions in the oil & gas sector were the sole sector detractors from absolute performance. By country, the Fund’s and the Underlying Index’s positions in the U.K. and France were leading contributors to absolute performance, while their positions in Norway and Austria were leading detractors from absolute performance.

Relative to the FTSE Developed Europe Index, the Fund’s and the Underlying Index’s security selection and underweight positions in the financials sector and their security selection and underweight positions in the oil & gas sector were leading contributors to performance, while the Fund’s and the Underlying Index’s security selection in the health care and consumer goods sectors were leading detractors from relative performance.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s and the Underlying Index’s largest sector allocations were in the consumer goods and health care sectors, while their smallest allocations were in the telecommunications and technology sectors. The Fund’s and the Underlying Index’s largest country allocations were in the U.K. and France and their smallest allocations were in Ireland and Poland.

| | | | | | |

| | | |

| 20 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2019 |

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO**** | |

| | 1. | | | ASML Holding NV (Netherlands) | | | 0.5 | % |

| | 2. | | | UPM-Kymmene OYJ (Finland) | | | 0.5 | |

| | 3. | | | ConvaTec Group plc (United Kingdom) | | | 0.4 | |

| | 4. | | | Porsche Automobil Holding SE (Preference) (Germany) | | | 0.4 | |

| | 5. | | | Orion OYJ, Class B (Finland) | | | 0.4 | |

| | 6. | | | Next plc (United Kingdom) | | | 0.4 | |

| | 7. | | | OMV AG (Austria) | | | 0.4 | |

| | 8. | | | Peugeot SA (France) | | | 0.4 | |

| | 9. | | | Geberit AG (Registered) (Switzerland) | | | 0.4 | |

| | 10. | | | Neste OYJ (Finland) | | | 0.4 | |

| | | | |

PORTFOLIO COMPOSITION BY COUNTRY**** | |

United Kingdom | | | 19.6 | % |

France | | | 15.2 | |

Germany | | | 12.6 | |

Switzerland | | | 9.0 | |

Sweden | | | 7.7 | |

Italy | | | 6.1 | |

Spain | | | 5.4 | |

Netherlands | | | 4.6 | |

Finland | | | 3.8 | |

Denmark | | | 3.7 | |

Norway | | | 2.4 | |

Belgium | | | 1.9 | |

United States | | | 0.7 | |

Others (each less than 1.0%) | | | 6.5 | |

Short-Term Investments | | | 0.8 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $57.60 as of October 31, 2019. |

| ** | | Market price return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the NYSE Arca. The midpoint price was $57.58 as of October 31, 2019. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based on total investments as of October 31, 2019. The Fund’s composition is subject to change. |

| | | | | | | | |

| | | |

| OCTOBER 31, 2019 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 21 | |

JPMorgan Diversified Return Europe Equity ETF

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2019 (Unaudited) (continued)

| | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNSAS OF OCTOBER 31, 2019 (Unaudited) | |

| | | INCEPTION DATE | | | 1 YEAR | | | SINCE

INCEPTION | |

JPMorgan Diversified Return Europe Equity ETF | | | | | | | | | | | | |

Net Asset Value | | | December 18, 2015 | | | | 11.09% | | | | 6.53% | |

Market Price | | | | | | | 10.81% | | | | 6.51% | |

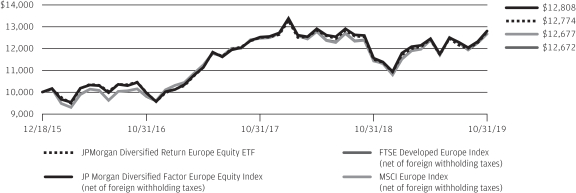

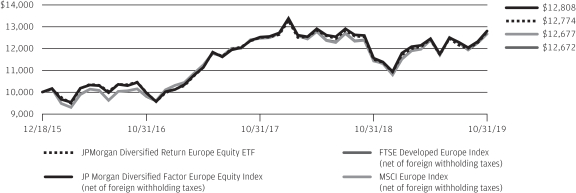

LIFE OF FUND PERFORMANCE(12/18/15 TO 10/31/19)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund commenced operations on December 18, 2015.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan Diversified Return Europe Equity ETF, the JP Morgan Diversified Factor Europe Equity Index, the FTSE Developed Europe Index, and the MSCI Europe Index from December 18, 2015 to October 31, 2019. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the JP Morgan Diversified Factor Europe Equity Index, the FTSE Developed Europe Index, and the MSCI Europe Index does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The Fund’s adviser is a sponsor of the JP Morgan Diversified Factor Europe Equity Index and developed the proprietary factors on which the index is based. FTSE Russell, the benchmark administrator, administers, calculates and governs the JP Morgan Diversified Factor Europe Equity Index. The JP Morgan Diversified Factor Europe Equity

Index includes large and mid-cap stocks providing coverage of developed European markets. Holdings in this index are selected from the constituents of the FTSE Developed Europe Index. The FTSE Developed Europe Index is a market-capitalization weighted index representing the performance of large- and mid-cap companies in developed European markets. The MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. Investors cannot invest directly in an index.

Fund performance reflects the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption or sale of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the United States can raise or lower returns. Also, some over-seas markets may not be as politically and economically stable as the United States and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 22 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2019 |

JPMorgan Diversified Return Global Equity ETF

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2019 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| JPMorgan Diversified Return Global Equity ETF | | | | |

| Net Asset Value* | | | 10.49% | |

| Market Price** | | | 10.30% | |

| JP Morgan Diversified Factor Global Developed Equity Index (net of foreign withholding taxes) | | | 10.70% | |

| FTSE Developed Index (net of foreign withholding taxes) | | | 12.47% | |

| MSCI World Index (net of foreign withholding taxes) | | | 12.69% | |

| |

| Net Assets as of 10/31/2019 | | $ | 145,749,540 | |

INVESTMENT OBJECTIVE***

The JPMorgan Diversified Return Global Equity ETF (the “Fund”) seeks investment results that closely correspond, before fees and expenses, to the performance of the JPMorgan Diversified Factor Global Developed Equity Index (the “Underlying Index”).

INVESTMENT APPROACH

The Fund is passively managed to the Underlying Index, which provides exposure to large and mid cap equity securities in developed global markets, diversified across global regions, sectors and individual securities. The Underlying Index’s proprietary multi-factor selection process utilizes the following characteristics: value, quality and momentum. The Underlying Index’s methodology includes quarterly rebalancing.

HOW DID THE FUND PERFORM?

The Fund posted a positive absolute performance for the twelve months ended October 31, 2019, and performed in line with the Underlying Index, before consideration of specific trading limits, differences in valuations because of the timing of the local market closings and the net asset value calculations, the Fund’s small cash allocation and fees and operating expenses incurred by the Fund. The Fund and the Underlying Index underperformed the FTSE Developed Index (net of foreign withholding taxes) and the MSCI World Index (net of foreign

withholding taxes), both of which are more traditional market capitalization weighted indexes.

By sector, the Fund’s and the Underlying Index’s positions in the technology and consumer goods sectors were leading contributors to absolute performance, while their positions in the oil & gas sector were the sole sector detractors from absolute performance. By region, the Fund’s and the Underlying Index’s allocations to the U.S. and Australia were leading contributors to absolute performance, while their allocations to Norway and South Korea detracted from absolute performance.

Relative to the FTSE Developed Index, the Underlying Index’s security selection in the industrials and consumer services sectors was a leading detractor from performance. The Fund’s and the Underlying Index’s security selection in the consumer goods and their underweight allocation to the financials sector were leading contributors to relative performance.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s and the Underlying Index’s largest sector allocations were in the consumer goods and consumer services sectors, while their smallest allocations were in the oil & gas and telecommunications sectors. The Fund’s and the Underlying Index’s largest country allocations were in the U.S. and Japan and their smallest allocations were in Austria and New Zealand.

| | | | | | | | |

| | | |

| OCTOBER 31, 2019 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 23 | |

JPMorgan Diversified Return Global Equity ETF

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2019 (Unaudited) (continued)

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO**** | |

| | 1. | | | Samsung Electronics Co. Ltd. (South Korea) | | | 0.4 | % |

| | 2. | | | Lam Research Corp. (United States) | | | 0.4 | |

| | 3. | | | Sekisui House Ltd. (Japan) | | | 0.3 | |

| | 4. | | | CSL Ltd. (Australia) | | | 0.3 | |

| | 5. | | | NAVER Corp. (South Korea) | | | 0.3 | |

| | 6. | | | SK Hynix, Inc. (South Korea) | | | 0.3 | |

| | 7. | | | Garmin Ltd. (United States) | | | 0.3 | |

| | 8. | | | Fortescue Metals Group Ltd. (Australia) | | | 0.3 | |

| | 9. | | | Hannover Rueck SE (Germany) | | | 0.3 | |

| | 10. | | | Advantest Corp. (Japan) | | | 0.3 | |

| | | | |

PORTFOLIO COMPOSITION BY COUNTRY**** | |

Japan | | | 22.7 | % |

United States | | | 21.7 | |

Australia | | | 9.9 | |

South Korea | | | 7.6 | |

United Kingdom | | | 4.4 | |

France | | | 4.1 | |

Hong Kong | | | 3.6 | |

Canada | | | 3.4 | |

Sweden | | | 2.5 | |

Spain | | | 2.4 | |

Switzerland | | | 2.2 | |

Germany | | | 2.1 | |

Netherlands | | | 2.0 | |

Singapore | | | 2.0 | |

Italy | | | 1.5 | |

Finland | | | 1.1 | |

Norway | | | 1.0 | |

Others (each less than 1.0%) | | | 5.1 | |

Short-Term Investments | | | 0.7 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $60.73 as of October 31, 2019. |

| ** | | Market price return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the NYSE Arca. The midpoint price was $60.57 as of October 31, 2019. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based on total investments as of October 31, 2019. The Fund’s composition is subject to change. |

| | | | | | |

| | | |

| 24 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | OCTOBER 31, 2019 |

| | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNSAS OF OCTOBER 31, 2019 (Unaudited) | |

| | | INCEPTION DATE | | | 1 YEAR | | | 5 YEAR | | | SINCE

INCEPTION | |

JPMorgan Diversified Return Global Equity ETF | | | | | | | | | | | | | | | | |

Net Asset Value | | | June 16, 2014 | | | | 10.49% | | | | 6.36% | | | | 5.78% | |

Market Price | | | | | | | 10.30% | | | | 6.13% | | | | 5.73% | |

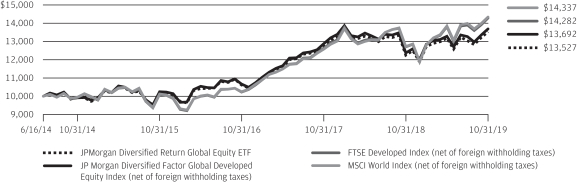

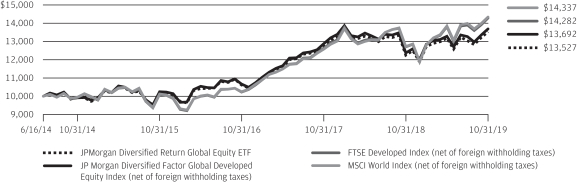

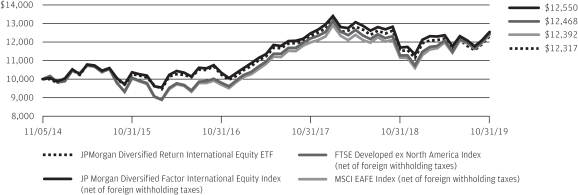

LIFE OF FUND PERFORMANCE(6/16/14 TO 10/31/19)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund commenced operations on June 16, 2014.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan Diversified Return Global Equity ETF, the JP Morgan Diversified Factor Global Developed Equity Index, the FTSE Developed Index, and the MSCI World Index from June 16, 2014 to October 31, 2019. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the JP Morgan Diversified Factor Global Developed Equity Index, the FTSE Developed Index and the MSCI World Index does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The Fund’s adviser is a sponsor of the JP Morgan Diversified Factor Global Developed Equity Index and developed the proprietary factors on which the index is based. FTSE Russell, the benchmark administrator, administers, calculates and governs the JP Morgan Diversified Factor Global Developed Equity Index. JP Morgan Diversified Factor Global Developed Equity Index is comprised of large- and mid-cap equity securities

from developed global markets. Holdings in this index are selected from the constituents of the FTSE Developed Index. The FTSE Developed Index is a market-capitalization weighted index representing the performance of large- and mid-cap companies in developed markets. The index is derived from the FTSE Global Equity Index Series, which covers 98% of the world’s investable market capitalization. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. Investors cannot invest directly in an index.

Fund performance reflects the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption or sale of Fund shares.

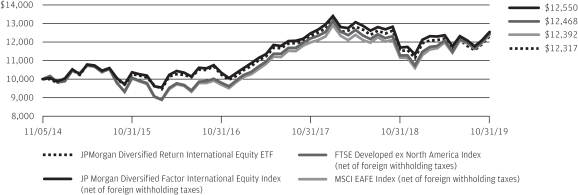

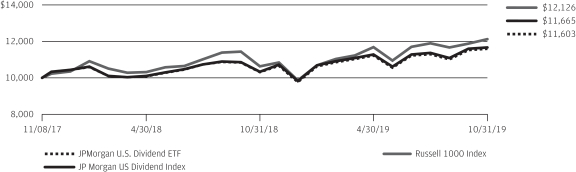

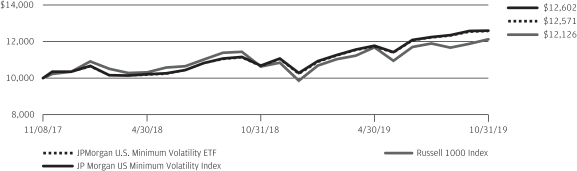

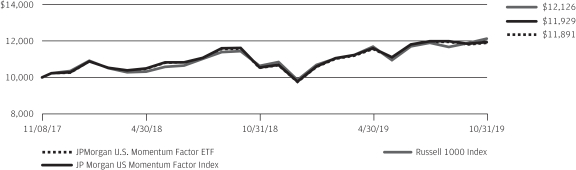

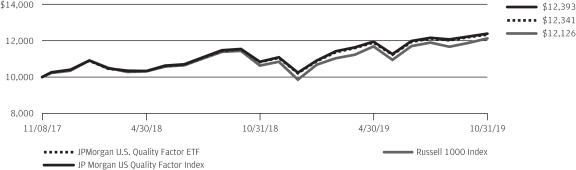

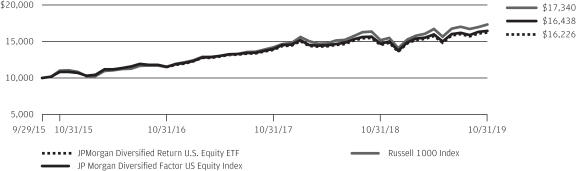

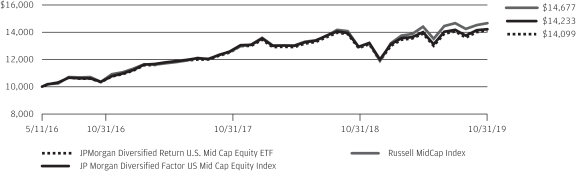

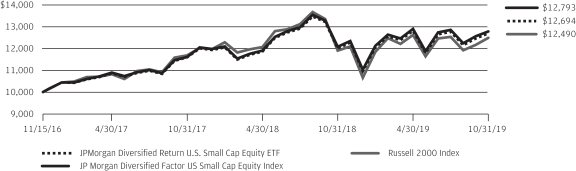

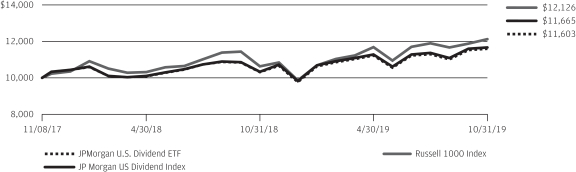

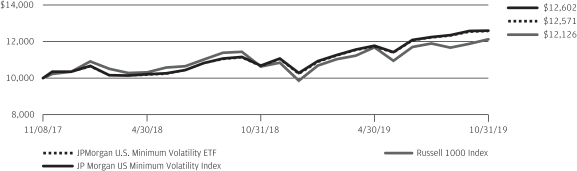

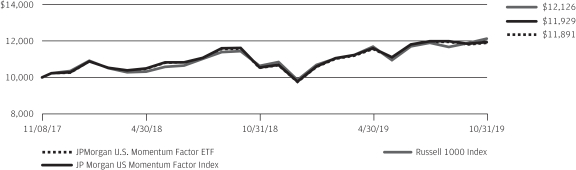

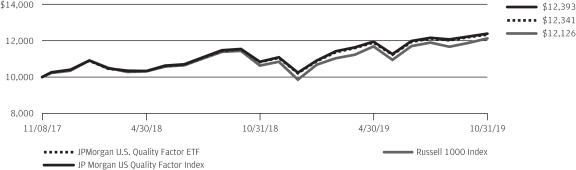

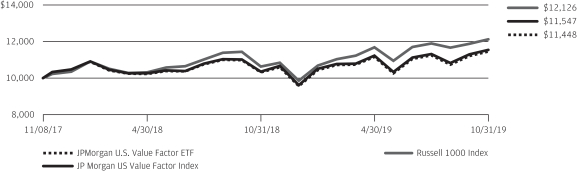

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the United States can raise or lower returns. Also, some over-seas markets may not be as politically and economically stable as the United States and other nations.