UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22903

J.P. Morgan Exchange-Traded Fund Trust

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, NY 10172

(Address of principal executive offices) (Zip code)

Gregory S. Samuels

J.P. Morgan Investment Management Inc.

277 Park Avenue

New York, NY 10172

(Name and Address of Agent for Service)

With copies to:

| | |

| Elizabeth A. Davin, Esq. | | Jon S. Rand, Esq. |

| JPMorgan Chase & Co. | | Dechert LLP |

| 1111 Polaris Parkway | | 1095 Avenue of the Americas |

| Columbus, OH 43240 | | New York, NY 10036 |

Registrant’s telephone number, including area code: 1-844-457-6383

Date of fiscal year end: June 30

Date of reporting period: May 20, 2020 through June 30, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Annual Report

J.P. Morgan Exchange-Traded Funds

June 30, 2020

JPMorgan Equity Premium Income ETF

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website www.jpmorganfunds.com and you will be notified by mail each time a report is posted and provided with a website to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action.

You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker dealer, bank, or retirement plan).

Alternatively, you may elect to receive paper copies of all future reports free of charge by contacting your financial intermediary. Your election to receive paper reports will apply to all funds held within your account(s).

CONTENTS

Investments in the Fund are not bank deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of the Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of the Fund.

Prospective investors should refer to the Fund’s prospectus for a discussion of the Fund’s investment objectives, strategies and risks. Call J.P. Morgan Exchange-Traded Funds at (844) 457-6383 for a prospectus containing more complete information about the Fund, including management fees and other expenses. Please read it carefully before investing.

Shares are bought and sold throughout the day on an exchange at market price (not at net asset value) through a brokerage account, and are not individually subscribed and redeemed from the Fund. Shares may only be subscribed and redeemed directly from the Fund by Authorized Participants, in very large creation/redemption units. Brokerage commissions will reduce returns.

PRESIDENT’S LETTER

August 11, 2020 (Unaudited)

Dear Shareholder,

In the face of challenges that affect our world, from the global to the community and family levels, J.P. Morgan Exchange-Traded Funds has continued to search for innovative and proven ways of providing our fund shareholders with the services and products to help them build durable portfolios and adaptable investment solutions.

| | |

| | “Regardless of the market environment, we will continue to innovate and develop investment solutions and services that serve the needs of our clients and fund shareholders.” – Brian S. Shlissel |

Our newest solution, the JPMorgan Equity Premium Income ETF (JEPI), is designed to deliver a significant portion of the returns associated with the S&P 500 Index with less volatility, in addition to monthly income generated from dividends and options- based equity linked notes. We believe JEPI provides investors with a potentially important tool to navigate the challenges ahead.

Regardless of the market environment, we will continue to innovate and develop investment solutions and services that serve the needs of our clients and fund shareholders. We remain committed to building solutions that help you build stronger portfolios. Thank you for your belief in our Firm and our process.

Sincerely,

Brian S. Shlissel

Interim President, J.P. Morgan Exchange-Traded Funds

J.P Morgan Asset Management

1-844-4JPM-ETF or jpmorgan.com/etfs for more information

| | | | | | | | |

| | | |

| JUNE 30, 2020 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 1 | |

JPMorgan Equity Premium Income ETF

FUND COMMENTARY

FOR THE PERIOD MAY 20, 2020 (INCEPTION DATE) THROUGH JUNE 30, 2020 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| JPMorgan Equity Premium Income ETF | | | | |

| Net Asset Value* | | | 1.54% | |

| Market Price** | | | 1.88% | |

| S&P 500 Index | | | 4.54% | |

| ICE BofAML 3-Month US Treasury Bill Index | | | 0.01% | |

| |

| Net Assets as of 6/30/2020 | | $ | 27,916,586 | |

INVESTMENT OBJECTIVE***

The JPMorgan Equity Premium Income ETF (the “Fund”) seeks current income while maintaining prospects for capital appreciation.

INVESTMENT APPROACH

The Fund generates income by investing in a combination of options-based equity linked notes and U.S. large cap stocks, seeking to deliver a monthly income stream from associated option premiums and stock dividends. The Fund uses a proprietary research process designed to identify over- and undervalued stocks with attractive risk/return characteristics.

HOW DID THE MARKET PERFORM?

Overall, U.S. equity prices rebounded somewhat during the reporting period and daily market volatility declined amid accommodative central bank policies, federal government stimulus and investor optimism over efforts to blunt the impact of the COVID-19 pandemic. The information technology sector largely outperformed other sectors, while the energy sector provided the smallest returns for the reporting period

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

For the period from inception on May 20, 2020 to June 30, 2020, the Fund underperformed the S&P 500 Index (the “Benchmark”) and outperformed the ICE BofAML 3-Month US Treasury Bill Index. The Fund’s use of options-based equity-linked notes allowed the Fund to generally perform as designed, delivering returns with less volatility than the Benchmark during the reporting period. The Fund captured 34% of the Benchmark’s total return with about 49% of the Benchmark’s volatility during the reporting period, resulting in income of $0.49 per share.

The Fund’s underweight position and security selection in the information technology sector and its security selection in the financials sector were leading detractors from performance

relative to the Benchmark, while the Fund’s underweight positions in the communications services and energy sectors were leading contributors to relative performance.

Leading individual detractors from relative performance included the Fund’s underweight position in Apple Inc. and its overweight positions in CME Group Inc. and Jack Henry & Associates Inc. Shares of Apple, a maker of mobile devices, computers, software and relative services, rose amid better-than-expected earnings growth and positive investor sentiment over the company’s planned launch of new products and upgrades. Shares of CME Group, an operator of security and commodity exchanges, fell after the company closed its trading floor in response to the COVID-19 pandemic and after it reported lower-than-expected trading volumes when its trading floor re-opened. Shares of Jack Henry & Associates, a provider of payment processing and data to the financial services sector, fell amid reduced transaction volumes in the financial services industry.

Leading individual contributors to relative performance included the Fund’s underweight position in Intel Corp. and its overweight positions in Chubb Ltd. and Eli Lilly & Co. Shares of Intel, a manufacturer of semiconductors and other computer products, fell as the company lost market share to Nvidia Corp. Shares of Chubb, a provider of property and casualty insurance, rose amid investor demand for stocks with relatively large dividend payouts. Shares of Eli Lilly, a pharmaceutical manufacturer, rose after the company reported better-than-expected earnings and revenue for the first quarter of 2020.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s portfolio managers maintained a defensive equity portfolio, investing primarily in common stocks of large capitalization U.S. companies, with reduced volatility compared with the Benchmark, while using index options-based equity linked notes in a consistent and disciplined manner. The combination of the diversified portfolio of equity securities and income from index options-based equity linked notes provided the Fund with a portion of the returns associated with equity market investments, less risk compared with the equity market, and a stream of distributable monthly income.

| | | | | | |

| | | |

| 2 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | JUNE 30, 2020 |

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO**** | |

| | 1. | | | BNP Paribas, ELN, 72.67%, 7/31/2020, (linked to S&P 500 Index) | | | 4.6 | % |

| | 2. | | | Barclays Bank plc, ELN, 68.00%, 7/17/2020, (linked to S&P 500 Index) | | | 4.0 | |

| | 3. | | | Royal Bank of Canada, ELN, 81.10%, 7/24/2020, (linked to S&P 500 Index) | | | 3.3 | |

| | 4. | | | BMO Capital Markets Corp., ELN, 70.97%, 7/10/2020, (linked to S&P 500 Index) | | | 2.6 | |

| | 5. | | | Toronto-Dominion Bank (The), ELN, 78.20%, 8/7/2020, (linked to S&P 500 Index) | | | 2.0 | |

| | 6. | | | Amazon.com, Inc. | | | 1.5 | |

| | 7. | | | Microsoft Corp. | | | 1.5 | |

| | 8. | | | Accenture plc, Class A | | | 1.5 | |

| | 9. | | | AbbVie, Inc. | | | 1.5 | |

| | 10. | | | Eli Lilly and Co. | | | 1.4 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR**** | |

| Equity-Linked Notes | | | 16.4 | % |

| Information Technology | | | 12.7 | |

| Health Care | | | 11.8 | |

| Consumer Staples | | | 11.7 | |

| Financials | | | 9.5 | |

| Industrials | | | 8.8 | |

| Utilities | | | 7.6 | |

| Consumer Discretionary | | | 7.3 | |

| Communication Services | | | 7.0 | |

| Materials | | | 2.6 | |

| Real Estate | | | 2.2 | |

| Energy | | | 0.7 | |

| Short-Term Investments | | | 1.7 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $50.77 as of June 30, 2020. |

| ** | | Market price return was calculated assuming an initial investment made at the inception date net asset value, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return was the closing price on the NYSE Arca. As of June 30, 2020, the closing price was $50.94. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based on total investments as of June 30, 2020. The Fund’s composition is subject to change. |

| | | | | | | | |

| | | |

| JUNE 30, 2020 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 3 | |

JPMorgan Equity Premium Income ETF

FUND COMMENTARY

FOR THE PERIOD MAY 20, 2020 (INCEPTION DATE) THROUGH JUNE 30, 2020 (Unaudited) (continued)

| | | | | | | | |

TOTAL RETURNS AS OF JUNE 30, 2020 (Unaudited) | |

| | | INCEPTION DATE | | | CUMULATIVE SINCE

INCEPTION | |

Net Asset Value | | | May 20, 2020 | | | | 1.54% | |

Market Price | | | | | | | 1.88% | |

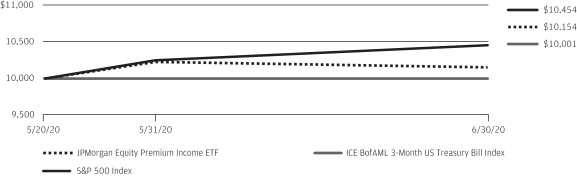

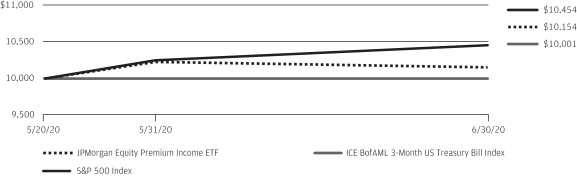

LIFE OF FUND PERFORMANCE (5/20/20 TO 6/30/20)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund commenced operations on May 20, 2020.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan Equity Premium Income ETF, the S&P 500 Index and the ICE BofAML 3-Month U.S. Treasury Bill Index from May 20, 2020 to June 30, 2020. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the S&P 500 Index and the ICE BofAML 3-Month U.S. Treasury Bill Index does not reflect the deduction of expenses associated with an exchange-traded fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmarks, if applicable.

The S&P 500 Index is an unmanaged index generally representative of the performance of large companies in the U.S. stock market. The ICE BofAML

3-Month U.S. Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. Each month the ICE BofAML 3-Month U.S. Treasury Bill Index is rebalanced and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond, 3 months from the rebalancing date. Investors cannot invest directly in an index

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 4 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | JUNE 30, 2020 |

JPMorgan Equity Premium Income ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2020

| | | | | | | | |

| Investments | | Shares | | | Value ($) | |

| | | | | | | | |

COMMON STOCKS — 80.8% | |

|

Aerospace & Defense — 2.1% | |

General Dynamics Corp. | | | 834 | | | | 124,650 | |

Northrop Grumman Corp. | | | 1,077 | | | | 331,113 | |

Raytheon Technologies Corp. | | | 1,949 | | | | 120,097 | |

| | | | | | | | |

| | |

| | | | | | | 575,860 | |

| | | | | | | | |

|

Beverages — 2.5% | |

Coca-Cola Co. (The) | | | 4,868 | | | | 217,502 | |

Constellation Brands, Inc., Class A | | | 682 | | | | 119,316 | |

PepsiCo, Inc. | | | 2,807 | | | | 371,254 | |

| | | | | | | | |

| | |

| | | | | | | 708,072 | |

| | | | | | | | |

|

Biotechnology — 2.5% | |

AbbVie, Inc. | | | 4,108 | | | | 403,323 | |

Alexion Pharmaceuticals, Inc. * | | | 1,171 | | | | 131,433 | |

Regeneron Pharmaceuticals, Inc. * | | | 278 | | | | 173,375 | |

| | | | | | | | |

| | |

| | | | | | | 708,131 | |

| | | | | | | | |

|

Building Products — 0.8% | |

Trane Technologies plc | | | 2,539 | | | | 225,920 | |

| | | | | | | | |

|

Capital Markets — 3.0% | |

BlackRock, Inc. | | | 186 | | | | 101,201 | |

CME Group, Inc. | | | 1,772 | | | | 288,021 | |

Intercontinental Exchange, Inc. | | | 3,562 | | | | 326,279 | |

S&P Global, Inc. | | | 337 | | | | 111,035 | |

| | | | | | | | |

| | |

| | | | | | | 826,536 | |

| | | | | | | | |

|

Chemicals — 1.1% | |

Air Products and Chemicals, Inc. | | | 495 | | | | 119,522 | |

Linde plc (United Kingdom) | | | 843 | | | | 178,809 | |

| | | | | | | | |

| | |

| | | | | | | 298,331 | |

| | | | | | | | |

|

Commercial Services & Supplies — 0.9% | |

Waste Management, Inc. | | | 2,298 | | | | 243,381 | |

| | | | | | | | |

|

Consumer Finance — 0.4% | |

American Express Co. | | | 1,131 | | | | 107,671 | |

| | | | | | | | |

|

Containers & Packaging — 1.2% | |

Silgan Holdings, Inc. | | | 10,609 | | | | 343,626 | |

| | | | | | | | |

|

Diversified Financial Services — 1.1% | |

Berkshire Hathaway, Inc., Class B * | | | 1,720 | | | | 307,037 | |

| | | | | | | | |

|

Diversified Telecommunication Services — 1.1% | |

Verizon Communications, Inc. | | | 5,839 | | | | 321,904 | |

| | | | | | | | |

|

Electric Utilities — 5.4% | |

American Electric Power Co., Inc. | | | 2,543 | | | | 202,525 | |

Duke Energy Corp. | | | 2,602 | | | | 207,874 | |

Entergy Corp. | | | 3,067 | | | | 287,715 | |

Evergy, Inc. | | | 1,743 | | | | 103,342 | |

NextEra Energy, Inc. | | | 1,466 | | | | 352,089 | |

Xcel Energy, Inc. | | | 5,766 | | | | 360,375 | |

| | | | | | | | |

| | |

| | | | | | | 1,513,920 | |

| | | | | | | | |

|

Electrical Equipment — 0.6% | |

Eaton Corp. plc | | | 1,917 | | | | 167,699 | |

| | | | | | | | |

| | | | | | | | |

| Investments | | Shares | | | Value ($) | |

| | | | | | | | |

| |

|

Entertainment — 0.8% | |

Netflix, Inc. * | | | 489 | | | | 222,515 | |

| | | | | | | | |

|

Equity Real Estate Investment Trusts (REITs) — 2.2% | |

Equinix, Inc. | | | 421 | | | | 295,668 | |

Equity LifeStyle Properties, Inc. | | | 1,231 | | | | 76,913 | |

Prologis, Inc. | | | 1,248 | | | | 116,476 | |

Sun Communities, Inc. | | | 859 | | | | 116,549 | |

| | | | | | | | |

| | |

| | | | | | | 605,606 | |

| | | | | | | | |

|

Food & Staples Retailing — 2.3% | |

Costco Wholesale Corp. | | | 1,119 | | | | 339,292 | |

Kroger Co. (The) | | | 3,354 | | | | 113,533 | |

Walmart, Inc. | | | 1,610 | | | | 192,846 | |

| | | | | | | | |

| | |

| | | | | | | 645,671 | |

| | | | | | | | |

|

Food Products — 2.9% | |

Conagra Brands, Inc. | | | 3,776 | | | | 132,802 | |

General Mills, Inc. | | | 2,225 | | | | 137,171 | |

Hershey Co. (The) | | | 1,289 | | | | 167,080 | |

Mondelez International, Inc., Class A | | | 7,054 | | | | 360,671 | |

| | | | | | | | |

| | |

| | | | | | | 797,724 | |

| | | | | | | | |

|

Health Care Equipment & Supplies — 1.3% | |

Baxter International, Inc. | | | 3,009 | | | | 259,075 | |

Medtronic plc | | | 1,024 | | | | 93,901 | |

| | | | | | | | |

| | |

| | | | | | | 352,976 | |

| | | | | | | | |

|

Health Care Providers & Services — 0.8% | |

McKesson Corp. | | | 573 | | | | 87,910 | |

UnitedHealth Group, Inc. | | | 470 | | | | 138,626 | |

| | | | | | | | |

| | |

| | | | | | | 226,536 | |

| | | | | | | | |

|

Hotels, Restaurants & Leisure — 0.5% | |

McDonald’s Corp. | | | 784 | | | | 144,624 | |

| | | | | | | | |

|

Household Products — 2.5% | |

Kimberly-Clark Corp. | | | 2,421 | | | | 342,208 | |

Procter & Gamble Co. (The) | | | 3,030 | | | | 362,297 | |

| | | | | | | | |

| | |

| | | | | | | 704,505 | |

| | | | | | | | |

|

Industrial Conglomerates — 1.3% | |

Honeywell International, Inc. | | | 2,601 | | | | 376,079 | |

| | | | | | | | |

|

Insurance — 4.9% | |

Allstate Corp. (The) | | | 3,443 | | | | 333,937 | |

Aon plc, Class A | | | 1,231 | | | | 237,091 | |

Chubb Ltd. | | | 2,333 | | | | 295,405 | |

Marsh & McLennan Cos., Inc. | | | 793 | | | | 85,144 | |

Progressive Corp. (The) | | | 4,395 | | | | 352,083 | |

RenaissanceRe Holdings Ltd. (Bermuda) | | | 346 | | | | 59,176 | |

| | | | | | | | |

| | |

| | | | | | | 1,362,836 | |

| | | | | | | | |

|

Interactive Media & Services — 2.2% | |

Alphabet, Inc., Class A * | | | 273 | | | | 387,128 | |

Facebook, Inc., Class A * | | | 961 | | | | 218,214 | |

| | | | | | | | |

| | |

| | | | | | | 605,342 | |

| | | | | | | | |

|

Internet & Direct Marketing Retail — 1.5% | |

Amazon.com, Inc. * | | | 152 | | | | 419,341 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| JUNE 30, 2020 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 5 | |

JPMorgan Equity Premium Income ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2020 (continued)

| | | | | | | | |

| Investments | | Shares | | | Value ($) | |

| | | | | | | | |

COMMON STOCKS — continued | |

|

IT Services — 7.0% | |

Accenture plc, Class A | | | 1,940 | | | | 416,557 | |

Automatic Data Processing, Inc. | | | 1,541 | | | | 229,439 | |

Jack Henry & Associates, Inc. | | | 2,016 | | | | 371,004 | |

Leidos Holdings, Inc. | | | 2,233 | | | | 209,165 | |

Mastercard, Inc., Class A | | | 1,225 | | | | 362,233 | |

PayPal Holdings, Inc. * | | | 936 | | | | 163,079 | |

Visa, Inc., Class A | | | 1,005 | | | | 194,136 | |

| | | | | | | | |

| | |

| | | | | | | 1,945,613 | |

| | | | | | | | |

|

Life Sciences Tools & Services — 0.8% | |

Thermo Fisher Scientific, Inc. | | | 652 | | | | 236,246 | |

| | | | | | | | |

|

Machinery — 1.6% | |

Cummins, Inc. | | | 816 | | | | 141,380 | |

Deere & Co. | | | 396 | | | | 62,231 | |

PACCAR, Inc. | | | 3,228 | | | | 241,616 | |

| | | | | | | | |

| | |

| | | | | | | 445,227 | |

| | | | | | | | |

|

Media — 2.0% | |

Charter Communications, Inc., Class A * | | | 675 | | | | 344,277 | |

Comcast Corp., Class A | | | 5,217 | | | | 203,359 | |

| | | | | | | | |

| | |

| | | | | | | 547,636 | |

| | | | | | | | |

|

Metals & Mining — 0.3% | |

Newmont Corp. | | | 1,333 | | | | 82,299 | |

| | | | | | | | |

|

Multiline Retail — 1.9% | |

Dollar Tree, Inc. * | | | 2,150 | | | | 199,262 | |

Target Corp. | | | 2,734 | | | | 327,889 | |

| | | | | | | | |

| | |

| | | | | | | 527,151 | |

| | | | | | | | |

|

Multi-Utilities — 2.1% | |

CMS Energy Corp. | | | 5,822 | | | | 340,121 | |

Sempra Energy | | | 1,991 | | | | 233,405 | |

| | | | | | | | |

| | |

| | | | | | | 573,526 | |

| | | | | | | | |

|

Oil, Gas & Consumable Fuels — 0.7% | |

Chevron Corp. | | | 952 | | | | 84,947 | |

Kinder Morgan, Inc. | | | 7,096 | | | | 107,646 | |

| | | | | | | | |

| | |

| | | | | | | 192,593 | |

| | | | | | | | |

|

Pharmaceuticals — 6.2% | |

Bristol-Myers Squibb Co. | | | 5,963 | | | | 350,625 | |

Eli Lilly and Co. | | | 2,362 | | | | 387,793 | |

Johnson & Johnson | | | 2,477 | | | | 348,341 | |

Merck & Co., Inc. | | | 4,431 | | | | 342,649 | |

Pfizer, Inc. | | | 9,162 | | | | 299,597 | |

| | | | | | | | |

| | |

| | | | | | | 1,729,005 | |

| | | | | | | | |

|

Road & Rail — 1.4% | |

Norfolk Southern Corp. | | | 850 | | | | 149,234 | |

Old Dominion Freight Line, Inc. | | | 1,374 | | | | 233,017 | |

| | | | | | | | |

| | |

| | | | | | | 382,251 | |

| | | | | | | | |

|

Semiconductors & Semiconductor Equipment — 0.7% | |

Texas Instruments, Inc. | | | 1,643 | | | | 208,612 | |

| | | | | | | | |

| | | | | | | | |

| Investments | | Shares | | | Value ($) | |

| | | | | | | | |

| |

|

Software — 3.4% | |

Intuit, Inc. | | | 1,194 | | | | 353,651 | |

Microsoft Corp. | | | 2,049 | | | | 416,992 | |

salesforce.com, Inc. * | | | 1,031 | | | | 193,137 | |

| | | | | | | | |

| | |

| | | | | | | 963,780 | |

| | | | | | | | |

|

Specialty Retail — 2.8% | |

AutoZone, Inc. * | | | 236 | | | | 266,236 | |

Home Depot, Inc. (The) | | | 1,046 | | | | 262,034 | |

Ross Stores, Inc. | | | 676 | | | | 57,622 | |

TJX Cos., Inc. (The) | | | 3,635 | | | | 183,786 | |

| | | | | | | | |

| | |

| | | | | | | 769,678 | |

| | | | | | | | |

|

Technology Hardware, Storage & Peripherals — 1.4% | |

Apple, Inc. | | | 1,062 | | | | 387,418 | |

| | | | | | | | |

|

Textiles, Apparel & Luxury Goods — 0.5% | |

NIKE, Inc., Class B | | | 1,437 | | | | 140,898 | |

| | | | | | | | |

|

Tobacco — 1.3% | |

Altria Group, Inc. | | | 4,439 | | | | 174,231 | |

Philip Morris International, Inc. | | | 2,895 | | | | 202,823 | |

| | | | | | | | |

| | |

| | | | | | | 377,054 | |

| | | | | | | | |

|

Wireless Telecommunication Services — 0.8% | |

T-Mobile US, Inc. * | | | 2,268 | | | | 236,212 | |

| | | | | | | | |

TOTAL COMMON STOCKS

(Cost $22,238,526) | | | | 22,557,042 | |

| | | | | |

| | |

| | | Principal

Amount ($) | | | | |

EQUITY-LINKED NOTES — 16.3% | |

Barclays Bank plc, ELN, 68.00%, 7/17/2020, (linked to S&P 500 Index) (a) | | | 343 | | | | 1,093,034 | |

BMO Capital Markets Corp., ELN, 70.97%, 7/10/2020, (linked to S&P 500 Index) (a) | | | 227 | | | | 702,184 | |

BNP Paribas, ELN, 72.67%, 7/31/2020, (linked to S&P 500 Index) (a) | | | 399 | | | | 1,264,231 | |

Royal Bank of Canada, ELN, 81.10%, 7/24/2020, (linked to S&P 500 Index) (a) | | | 288 | | | | 919,815 | |

Toronto-Dominion Bank (The), ELN, 78.20%, 8/7/2020, (linked to S&P 500 Index) (a) | | | 177 | | | | 548,751 | |

| | | | | | | | |

TOTAL EQUITY-LINKED NOTES

(Cost $4,497,470) | | | | 4,528,015 | |

| | | | | |

| | |

| | | No. of

Rights | | | | |

RIGHTS — 0.0% (b) | |

|

Wireless Telecommunication Services — 0.0% (b) | |

T-Mobile US, Inc., expiring 7/27/2020 *

(Cost $10,958) | | | 2,283 | | | | 384 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 6 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | JUNE 30, 2020 |

| | | | | | | | |

| Investments | | Shares | | | Value ($) | |

| | | | | | | | |

SHORT-TERM INVESTMENTS — 1.6% | |

|

INVESTMENT COMPANIES — 1.6% | |

JPMorgan U.S. Government Money Market Fund Class Institutional Shares, 0.06% (c) (d)

(Cost $458,683) | | | 458,683 | | | | 458,683 | |

| | | | | | | | |

Total Investments — 98.7%

(Cost $27,205,637) | | | | 27,544,124 | |

Other Assets Less Liabilities — 1.3% | | | | 372,462 | |

| | | | | |

Net Assets — 100.0% | | | | 27,916,586 | |

| | | | | |

Percentages indicated are based on net assets.

| | |

| Abbreviations |

| ELN | | Equity-Linked Note |

| |

| (a) | | Securities exempt from registration under Rule 144A or section 4(a)(2), of the Securities Act of 1933, as amended. |

| (b) | | Amount rounds to less than 0.1% of net assets. |

| (c) | | Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. |

| (d) | | The rate shown is the current yield as of June 30, 2020. |

| * | | Non-income producing security. |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| JUNE 30, 2020 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 7 | |

STATEMENT OF ASSETS AND LIABILITIES

AS OF JUNE 30, 2020

| | | | |

| | | JPMorgan

Equity Premium

Income ETF | |

ASSETS: | |

Investments in non-affiliates, at value | | $ | 27,085,441 | |

Investments in affiliates, at value | | | 458,683 | |

Receivables: | | | | |

Investment securities sold | | | 751,686 | |

Interest and dividends from non-affiliates | | | 176,621 | |

Dividends from affiliates | | | 23 | |

| | | | |

Total Assets | | | 28,472,454 | |

| | | | |

|

LIABILITIES: | |

Payables: | | | | |

Investment securities purchased | | | 548,752 | |

Accrued liabilities: | | | | |

Management fees (See Note 3.A.) | | | 7,116 | |

| | | | |

Total Liabilities | | | 555,868 | |

| | | | |

Net Assets | | $ | 27,916,586 | |

| | | | |

|

NET ASSETS: | |

Paid-in-Capital | | $ | 27,663,613 | |

Total distributable earnings (loss) | | | 252,973 | |

| | | | |

Total Net Assets | | $ | 27,916,586 | |

| | | | |

| |

Outstanding number of shares

(unlimited number of shares authorized — par value $0.0001) | | | 550,000 | |

| | | | |

Net asset value, per share | | $ | 50.76 | |

| | | | |

Cost of investments in non-affiliates | | $ | 26,746,954 | |

Cost of investments in affiliates | | | 458,683 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 8 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | JUNE 30, 2020 |

STATEMENT OF OPERATIONS

FOR THE PERIOD ENDED JUNE 30, 2020

| | | | |

| | | JPMorgan

Equity Premium

Income ETF (a) | |

INVESTMENT INCOME: | |

Interest income from non-affiliates | | $ | 241,487 | |

Dividend income from non-affiliates | | | 63,173 | |

Dividend income from affiliates | | | 67 | |

| | | | |

Total investment income | | | 304,727 | |

| | | | |

|

EXPENSES: | |

Management fees (See Note 3.A.) | | | 9,240 | |

Interest expense to non-affiliates | | | 5 | |

| | | | |

Total expenses | | | 9,245 | |

| | | | |

Net expenses | | | 9,245 | |

| | | | |

Net investment income (loss) | | | 295,482 | |

| | | | |

| |

REALIZED/UNREALIZED GAINS (LOSSES): | | | | |

Net realized gain (loss) on transactions from: | |

Investments in non-affiliates | | | (358,059 | ) |

Futures contracts | | | (22,937 | ) |

| | | | |

Net realized gain (loss) | | | (380,996 | ) |

| | | | |

Change in net unrealized appreciation/depreciation on: | |

Investments in non-affiliates | | | 338,487 | |

| | | | |

Change in net unrealized appreciation/depreciation | | | 338,487 | |

| | | | |

Net realized/unrealized gains (losses) | | | (42,509 | ) |

| | | | |

Change in net assets resulting from operations | �� | $ | 252,973 | |

| | | | |

| (a) | Commencement of operations was May 20, 2020. |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| JUNE 30, 2020 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 9 | |

STATEMENT OF CHANGES IN NET ASSETS

FOR THE PERIOD INDICATED

| | | | |

| | | JPMorgan

Equity Premium

Income ETF | |

| | | Period Ended

June 30, 2020 (a) | |

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS: | |

Net investment income (loss) | | $ | 295,482 | |

Net realized gain (loss) | | | (380,996 | ) |

Change in net unrealized appreciation/depreciation | | | 338,487 | |

| | | | |

Change in net assets resulting from operations | | | 252,973 | |

| | | | |

|

CAPITAL TRANSACTIONS: | |

Change in net assets resulting from capital transactions | | | 27,663,613 | |

| | | | |

|

NET ASSETS: | |

Change in net assets | | | 27,916,586 | |

Beginning of period | | | — | |

| | | | |

End of period | | $ | 27,916,586 | |

| | | | |

| |

CAPITAL TRANSACTIONS: | | | | |

Proceeds from shares issued | | $ | 27,663,613 | |

| | | | |

Total change in net assets resulting from capital transactions | | $ | 27,663,613 | |

| | | | |

|

SHARE TRANSACTIONS: | |

Issued | | | 550,000 | |

| | | | |

Net increase in shares from share transactions | | | 550,000 | |

| | | | |

| (a) | Commencement of operations was May 20, 2020. |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 10 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | JUNE 30, 2020 |

THIS PAGE IS INTENTIONALLY LEFT BLANK

| | | | | | | | |

| | | |

| JUNE 30, 2020 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 11 | |

FINANCIAL HIGHLIGHTS

FOR THE PERIOD INDICATED

| | | | | | | | | | | | | | | | | | | | |

| | | Per share operating performance | |

| | | | | | Investment operations | | | | |

| | | Net asset

value,

beginning

of period | | | Net

investment

income

(loss) (b) | | | Net realized

and unrealized

gains

(losses) on

investments | | | Total from

investment

operations | | | Net asset

value,

end of

period | |

| | | |

JPMorgan Equity Premium Income ETF | | | | | | | | | | | | | |

May 20, 2020 (f) through June 30, 2020 | | $ | 50.00 | | | $ | 0.63 | | | $ | 0.13 | (g) | | $ | 0.76 | | | $ | 50.76 | |

| (a) | Annualized for periods less than one year, unless otherwise indicated. |

| (b) | Calculated based upon average shares outstanding. |

| (c) | Not annualized for periods less than one year. |

| (d) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (e) | Market price return was calculated assuming an initial investment made at the market price at the beginning of the reporting period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The closing price was used to calculate the market price return. |

| (f) | Commencement of operations. |

| (g) | Calculation of the net realized and unrealized gains (losses) per share do not correlate with the Fund’s net realized and unrealized gains (losses) presented in the Statement of Operations due to the timing of capital transactions in relation to the fluctuating market values of the Fund’s investments. |

| (h) | Since the Shares of the Fund did not trade in the secondary market until the day after the Fund’s inception, for the period from the inception to the first day of secondary market trading, the NAV is used as a proxy for the secondary market trading price to calculate the market returns. |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 12 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | JUNE 30, 2020 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Ratios/Supplemental data | |

| | | | | | | | | | | | | Ratios to average net assets (a) | |

| | | | | | |

Market

price,

end of

period | | | Total return (c)(d) | | | Market

price total

return (c)(e) | | | Net assets,

end of period | | | Net

expenses | | | Net

investment

income

(loss) | | | Portfolio

turnover

rate (c) | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ | 50.94 | | | | 1.52 | % | | | 1.88 | % (h) | | $ | 27,916,586 | | | | 0.35 | % | | | 11.11 | % | | | 13 | % |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| JUNE 30, 2020 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 13 | |

NOTES TO FINANCIAL STATEMENTS

AS OF JUNE 30, 2020

1. Organization

J.P. Morgan Exchange-Traded Fund Trust (the “Trust”) was formed on February 25, 2010, and is governed by a Declaration of Trust as amended and restated February 19, 2014, and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. JPMorgan Equity Premium Income ETF (the “Fund” or the “Equity Premium Income ETF”) is a separate diversified series of the Trust covered in this report.

The Fund commenced operations on May 20, 2020. The investment objective of the Fund is to seek current income while maintaining prospects for capital appreciation.

J.P. Morgan Investment Management Inc. (“JPMIM”), an indirect, wholly-owned subsidiary of JPMorgan Chase & Co. (“JPMorgan”), acts as Adviser (the “Adviser”) and Administrator (the “Administrator”) to the Fund.

Shares of the Fund are listed and traded at market price on the NYSE Arca, Inc. Market prices for the Fund’s shares may be different from its net asset value (“NAV”). The Fund issues and redeems its shares on a continuous basis, through JPMorgan Distribution Services, Inc. (the “Distributor” or “JPMDS”), an indirect, wholly-owned subsidiary of JPMorgan, at NAV in large blocks of shares, typically 25,000 shares, referred to as “Creation Units.”

Creation Units are issued and redeemed principally in-kind for a basket of securities. A cash amount may be substituted if the Fund has sizeable exposure to market or sponsor restricted securities. Shares are generally traded in the secondary market in amounts less than a Creation Unit at market prices that change throughout the day. Only individuals or institutions that have entered into an authorized participant agreement with the Distributor may do business directly with the Fund (each, an “Authorized Participant”).

2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The Fund is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 — Investment Companies, which is part of U.S. generally accepted accounting principles (“GAAP”). The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect (i) the reported amounts of assets and liabilities, (ii) disclosure of contingent assets and liabilities at the date of the financial statements, and (iii) the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

A. Valuation of Investments — Investments are valued in accordance with GAAP and the Fund’s valuation policies set forth by, and under the supervision and responsibility of, the Board of Trustees of the Trust (the “Board”), which established the following approach to valuation, as described more fully below: (i) investments for which market quotations are readily available shall be valued at their market value and (ii) all other investments for which market quotations are not readily available shall be valued at their fair value as determined in good faith by the Board.

The Administrator has established the J.P. Morgan Asset Management Americas Valuation Committee (“AVC”) to assist the Board with the oversight and monitoring of the valuation of the Fund’s investments. The Administrator implements the valuation policies of the Fund’s investments, as directed by the Board. The AVC oversees and carries out the policies for the valuation of investments held in the Fund. This includes monitoring the appropriateness of fair values based on results of ongoing valuation oversight including, but not limited to, consideration of macro or security specific events, market events, and pricing vendor and broker due diligence. The Administrator is responsible for discussing and assessing the potential impacts to the fair values on an ongoing basis, and, at least on a quarterly basis, with the AVC and the Board.

Fixed income instruments are valued based on prices received from Pricing Services. The Pricing Services use multiple valuation techniques to determine the valuation of fixed income instruments. In instances where sufficient market activity exists, the Pricing Services may utilize a market based approach through which trades or quotes from market makers are used to determine the valuation of these instruments. In instances where sufficient market activity may not exist, the Pricing Services also utilize proprietary valuation models which may consider market transactions in comparable securities and the various relationships between securities in determining fair value and/or market characteristics in order to estimate the relevant cash flows, which are then discounted to calculate the fair values.

Equities and other exchange-traded instruments are valued at the last sale price or official market closing price on the primary exchange on which the instrument is traded before the NAV of the Fund is calculated on a valuation date.

Investments in open-end investment companies excluding exchange-traded funds (“ETFs”), (“Underlying Funds”) are valued at each Underlying Fund’s NAV per share as of the report date.

Futures contracts are generally valued on the basis of available market quotations.

Valuations reflected in this report are as of the report date. As a result, changes in valuation due to market events and/or issuer-related events after the report date and prior to issuance of the report are not reflected herein.

The various inputs that are used in determining the valuation of the Fund’s investments are summarized into the three broad levels listed below.

| • | | Level 1 — Unadjusted inputs using quoted prices in active markets for identical investments. |

| | | | | | |

| | | |

| 14 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | JUNE 30, 2020 |

| • | | Level 2 — Other significant observable inputs including, but not limited to, quoted prices for similar investments, inputs other than quoted prices that are observable for investments (such as interest rates, prepayment speeds, credit risk, etc.) or other market corroborated inputs. |

| • | | Level 3 — Significant inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s assumptions in determining the fair value of investments). |

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input, both individually and in the aggregate, that is significant to the fair value measurement. The inputs or methodology used for valuing instruments are not necessarily an indication of the risk associated with investing in those instruments.

The following table represents each valuation input as presented on the Schedule of Portfolio Investments (“SOI”):

| | | | | | | | | | | | | | | | |

| | | Level 1

Quoted prices | | | Level 2

Other significant

observable inputs | | | Level 3

Significant

unobservable inputs | | | Total | |

Investments in Securities | | | | | | | | | | | | | | | | |

Common Stocks | | $ | 22,557,042 | | | $ | — | | | $ | — | | | $ | 22,557,042 | |

Equity-Linked Notes | | | — | | | | 4,528,015 | | | | — | | | | 4,528,015 | |

Rights | | | 384 | | | | — | | | | — | | | | 384 | |

Short-Term Investments | | | | | | | | | | | | | | | | |

Investment Companies | | | 458,683 | | | | — | | | | — | | | | 458,683 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | 23,016,109 | | | $ | 4,528,015 | | | $ | — | | | $ | 27,544,124 | |

| | | | | | | | | | | | | | | | |

B. Restricted Securities — Certain securities held by the Fund may be subject to legal or contractual restrictions on resale. Restricted securities generally are resold in transactions exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”). Disposal of these securities may involve time-consuming negotiations and expense. Prompt sale at the current valuation may be difficult and could adversely affect the NAV of the Fund.

As of June 30, 2020, the Fund had no investments in restricted securities.

C. Securities Lending — The Fund is authorized to engage in securities lending in order to generate additional income. The Fund is able to lend to approved borrowers. Citibank N.A. (“Citibank”) serves as lending agent for the Fund, pursuant to a Securities Lending Agency Agreement (the “Securities Lending Agency Agreement”). Securities loaned are collateralized by cash equal to at least 100% of the market value plus accrued interest on the securities lent, which is invested in an affiliated money market fund. The Fund retains loan fees and the interest on cash collateral investments but is required to pay the borrower a rebate for the use of cash collateral. In cases where the lent security is of high value to borrowers, there may be a negative rebate (i.e., a net payment from the borrower to the Fund). Upon termination of a loan, the Fund is required to return to the borrower an amount equal to the cash collateral, plus any rebate owed to the borrowers. The remaining maturities of the securities lending transactions are considered overnight and continuous. Loans are subject to termination by the Fund or the borrower at any time.

The net income earned on the securities lending (after payment of rebates and Citibank’s fee) is included on the Statement of Operations (“SOP”) as Income from securities lending (net). The Fund also receives payments from the borrower during the period of the loan, equivalent to dividends and interest earned on the securities loaned, which are recorded as Dividend or Interest income, respectively, on the SOP.

Under the Securities Lending Agency Agreement, Citibank marks to market the loaned securities on a daily basis. In the event the cash received from the borrower is less than 102% of the value of the loaned securities (105% for loans of non-U.S. securities), Citibank requests additional cash from the borrower so as to maintain a collateralization level of at least 102% of the value of the loaned securities plus accrued interest (105% for loans of non-U.S. securities), subject to certain de minimis amounts.

The value of securities out on loan is recorded as an asset on the SAL. The value of the cash collateral received is recorded as a liability on the SAL and details of collateral investments are disclosed on the SOI.

The Fund bears the risk of loss associated with the collateral investments and is not entitled to additional collateral from the borrower to cover any such losses. To the extent that the value of the collateral investments declines below the amount owed to a borrower, the Fund may incur losses that exceed the amount it earned on lending the security. Upon termination of a loan, the Fund may use leverage (borrow money) to repay the borrower for cash collateral posted if the Adviser does not believe that it is prudent to sell the collateral investments to fund the payment of this liability. Securities lending activity is subject to master netting arrangements.

Securities lending also involves counterparty risks, including the risk that the loaned securities may not be returned in a timely manner or at all. Subject to certain conditions, Citibank has agreed to indemnify the Fund from losses resulting from a borrower’s failure to return a loaned security.

The Fund did not lend out any securities during the period ended June 30, 2020.

| | | | | | | | |

| | | |

| JUNE 30, 2020 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 15 | |

NOTES TO FINANCIAL STATEMENTS

AS OF JUNE 30, 2020 (continued)

D. Investment Transactions with Affiliates — The Fund invested in an Underlying Fund which is advised by the Adviser. An issuer which is under common control with the Fund may be considered an affiliate. For the purposes of the financial statements, the Fund assumes the issuer listed in the table below to be an affiliated issuer. The Underlying Fund’s distributions may be reinvested into the Underlying Funds. Reinvestment amounts are included in the purchase cost amounts in the table below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the period ended June 30, 2020 | |

| Security Description | | Value at

May 20,

2020 (a) | | | Purchases

at Cost | | | Proceeds

from Sales | | | Net Realized

Gain (Loss) | | | Change in

Unrealized

Appreciation/

(Depreciation) | | | Value at

June 30,

2020 | | | Shares at

June 30,

2020 | | | Dividend

Income | | | Capital Gain

Distributions | |

JPMorgan U.S. Government Money Market Fund Class Institutional Shares, 0.06% (b)(c) | | $ | — | | | $ | 7,539,165 | | | $ | 7,080,482 | | | $ | — | | | $ | — | | | $ | 458,683 | | | | 458,683 | | | $ | 67 | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Commencement of operations was May 20, 2020. |

| (b) | Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. |

| (c) | The rate shown is the current yield as of June 30, 2020. |

E. Futures Contracts — The Fund used index futures contracts to gain or reduce exposure to the stock market, or maintain liquidity or minimize transaction costs. The Fund also purchased futures contracts to invest incoming cash in the market or sold futures in response to cash outflows, thereby simulating an invested position in the underlying index while maintaining cash balance for liquidity.

Futures contracts provide for the delayed delivery of the underlying instrument at a fixed price or are settled for a cash amount based on the change in the value of the underlying instrument at a specific date in the future. Upon entering into a futures contract, the Fund is required to deposit with the broker, cash or securities in an amount equal to a certain percentage of the contract amount, which is referred to as the initial margin deposit. Subsequent payments, referred to as variation margin, are made or received by the Fund periodically and are based on changes in the market value of open futures contracts. Changes in the market value of open futures contracts are recorded as Change in net unrealized appreciation/depreciation on the SOP. Realized gains or losses, representing the difference between the value of the contract at the time it was opened and the value at the time it was closed, are reported on the SOP at the closing or expiration of the futures contract. Securities deposited as initial margin are designated on the SOI, while cash deposited, which is considered restricted, is recorded on the Statement of Assets and Liabilities (“SAL”). A receivable from and/or a payable to brokers for the daily variation margin is also recorded on the SAL.

The use of futures contracts exposes the Fund to equity price risk. The Fund may be subject to the risk that the change in the value of the futures contract may not correlate perfectly with the underlying instrument. Use of long futures contracts subjects the Fund to risk of loss in excess of the amounts shown on the SAL, up to the notional amount of the futures contracts. Use of short futures contracts subjects the Fund to unlimited risk of loss. The Fund may enter into futures contracts only on exchanges or boards of trade. The exchange or board of trade acts as the counterparty to each futures transaction; therefore, the Fund’s credit risk is limited to failure of the exchange or board of trade. Under some circumstances, futures exchanges may establish daily limits on the amount that the price of a futures contract can vary from the previous day’s settlement price, which could effectively prevent liquidation of positions.

The table below discloses the volume of the Fund’s futures contracts activity during the period ended June 30, 2020. Please refer to the tables in the Summary of Derivatives Information for derivative-related gains and losses associated with volume activity.

| | | | |

Futures Contracts — Equity: | | | | |

Average Notional Balance Short | | $ | 2,960,715 | (a) |

| (a) | The average number of contracts represents the futures contracts held for 21 days during the period. |

The Fund’s futures contracts are not subject to master netting arrangements (the right to close out all transactions traded with a counterparty and net amounts owed or due across transactions).

F. Equity-Linked Notes — The Fund invested in Equity-Linked Notes (“ELNs”). These are hybrid instruments which combine both debt and equity characteristics into a single note form. ELNs’ values are linked to the performance of an underlying index. ELNs are unsecured debt obligations of an issuer and may not be publicly listed or traded on an exchange. ELNs are valued daily, under procedures adopted by the Board, based on values provided by an approved pricing source. These notes have a coupon which is accrued and recorded as interest income on the SOP. Changes in the market value of ELNs are recorded as Change in net unrealized appreciation or depreciation on the SOP. The Fund realizes a gain or loss when an ELN is sold or matures which is recorded as Net realized gain (loss) on transactions from investments in non-affiliates on the SOP.

As of June 30, 2020, the Fund had outstanding ELNs as listed on the SOI.

| | | | | | |

| | | |

| 16 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | JUNE 30, 2020 |

G. Security Transactions and Investment Income — Investment transactions are accounted for on the trade date (the date the order to buy or sell is executed). Securities gains and losses are calculated on a specifically identified cost basis. Interest income is determined on the basis of coupon interest accrued using the effective interest method, which adjusts for amortization of premiums and accretion of discounts. Dividend income, net of foreign taxes withheld, if any, is recorded on the ex-dividend date or when the Fund first learns of the dividend.

To the extent such information is publicly available, the Fund records distributions received in excess of income earned from underlying investments as a reduction of cost of investments and/or realized gain. Such amounts are based on estimates if actual amounts are not available and actual amounts of income, realized gain and return of capital may differ from the estimated amounts. The Fund adjusts the estimated amounts of the components of distributions (and consequently its net investment income) as necessary, once the issuers provide information about the actual composition of the distributions.

H. Federal Income Taxes — The Fund is treated as a separate taxable entity for Federal income tax purposes. The Fund’s policy is to comply with the provisions of the Internal Revenue Code (the “Code”) applicable to regulated investment companies and to distribute to shareholders all of its distributable net investment income and net realized capital gains on investments. Accordingly, no provision for Federal income tax is necessary. For the initial period ended June 30, 2020, management has determined that as of June 30, 2020, no liability for Federal income tax is required in the Fund’s financial statements for net unrecognized tax benefits. However, management’s conclusions may be subject to future review based on changes in, or the interpretation of, the accounting standards or tax laws and regulations. When filed, the Fund’s Federal tax returns since inception will be subject to examination by the Internal Revenue Service.

I. Distributions to Shareholders — Distributions from net investment income, if any, are generally declared and paid monthly. Net realized capital gains, if any, are distributed by the Fund at least annually. The amount of distributions from net investment income and net realized capital gains is determined in accordance with Federal income tax regulations, which may differ from GAAP. To the extent these “book/tax” differences are permanent in nature (i.e., that they result from other than timing of recognition — “temporary differences”), such amounts are reclassified within the capital accounts based on their Federal tax basis treatment.

The following amounts were reclassified within the capital accounts:

| | | | | | | | |

| Paid-in-Capital | | Accumulated undistributed (distributions in

excess of) net investment income | | | Accumulated net realized gains (losses) | |

$— | | $ | (301 | ) | | $ | 301 | |

The reclassifications for the Fund relate primarily to investments in real estate investment trusts.

3. Fees and Other Transactions with Affiliates

A. Management Fee — JPMIM manages the investments of the Fund pursuant to the Management Agreement. For such services, JPMIM is paid a fee, which is accrued daily and paid no more frequently than monthly at an annual rate of 0.35% of the Fund’s average daily net assets. Under the Management Agreement, JPMIM is responsible for substantially all expenses of the Fund (including expenses of the Trust relating to the Fund) except for the management fees, payments under the Fund’s 12b-1 plan (if any), interest expenses, dividend and interest expenses related to short sales, taxes, acquired fund fees and expenses (other than fees for funds advised by the adviser and/or its affiliates), costs of holdings shareholder meetings, and litigation and potential litigation and other extraordinary expenses not incurred in the ordinary course of the Fund’s business. Additionally, the Fund shall be responsible for its non-operating expenses, including brokerage commissions and fees and expenses associated with the Fund’s securities lending program, if applicable. For the avoidance of doubt, the Adviser’s payment of such expenses may be accomplished through the Fund’s payment of such expenses and a corresponding reduction of the fee payable to the Adviser, provided, however, that if the amount of expenses paid by the Fund exceeds the fee payable to the Adviser, the Adviser will reimburse the Fund for such amount.

B. Administration Fee — JPMIM provides administration services to the Fund. Pursuant to the Management Agreement for the Fund, JPMIM is compensated as described in Note 3.A.

JPMorgan Chase Bank, N.A. (“JPMCB”), a wholly-owned subsidiary of JPMorgan, serves as the Fund’s sub-administrator (the “Sub-administrator”). For its services as Sub-administrator, JPMCB receives a portion of the fees payable to JPMIM.

C. Custodian, Accounting and Transfer Agent Fees — JPMCB provides custody, accounting and transfer agency services to the Fund. For performing these services, JPMIM pays JPMCB transaction and asset-based fees that vary according to the number of transactions and positions, plus out-of-pocket expenses.

Additionally, Authorized Participants generally pay transaction fees associated with the creation and redemption of fund shares. These fees are paid to JPMIM to offset certain custodian and transfer agent charges which JPMIM is otherwise responsible for under the Management Agreement.

Interest income earned on cash balances at the custodian, if any, is included in Interest income from affiliates on the SOP. Interest expense paid to the custodian related to cash overdrafts, if any, is included in Interest expense to affiliates on the SOP.

| | | | | | | | |

| | | |

| JUNE 30, 2020 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 17 | |

NOTES TO FINANCIAL STATEMENTS

AS OF JUNE 30, 2020 (continued)

D. Waivers and Reimbursements — The Fund may invest in one or more money market funds advised by the Adviser (affiliated money market funds). The fees for the affiliated money market funds are covered under the Management Agreement as described in Note 3.A.

E. Distribution Services — The Distributor or its agent distributes Creation Units for the Fund on an agency basis. The Distributor does not maintain a secondary market in shares of the Fund. JPMDS receives no fees for their distribution services under the distribution agreement with the Trust (the “Distribution Agreement”). Although the Trust does not pay any fees under the Distribution Agreement, JPMIM pays JPMDS for certain distribution related services.

F. Other — Certain officers of the Trust are affiliated with the Adviser, the Administrator and JPMDS. Such officers, with the exception of the Chief Compliance Officer, receive no compensation from the Fund for serving in their respective roles.

The Board designated and appointed a Chief Compliance Officer to the Fund pursuant to Rule 38a-1 under the 1940 Act. The fees associated with the Office of the Chief Compliance Officer are paid by JPMIM as described in Note 3.A.

The Securities and Exchange Commission (“SEC”) has granted an exemptive order permitting the Fund to engage in principal transactions with J.P. Morgan Securities, LLC, an affiliated broker, involving taxable money market instruments, subject to certain conditions.

4. Investment Transactions

During the period ended June 30, 2020, purchases and sales of investments (excluding short-term investments) were as follows:

| | | | | | | | |

| | | Purchases

(excluding U.S.

Government) | | | Sales

(excluding U.S.

Government) | |

| | $ | 21,936,262 | | | $ | 2,695,689 | |

During the period ended June 30, 2020, there were no purchases or sales of U.S. Government securities.

For the period ended June 30, 2020, in-kind transactions associated with creations and redemptions were as follows:

| | | | | | | | |

| | | In-Kind

Creations | | | In-Kind

Redemptions | |

| | $ | 6,361,755 | | | $ | — | |

5. Federal Income Tax Matters

For Federal income tax purposes, the estimated cost and unrealized appreciation (depreciation) in value of investments held at June 30, 2020 were as follows:

| | | | | | | | | | | | |

| | | Aggregate

Cost | | Gross

Unrealized

Appreciation | | Gross

Unrealized

Depreciation | | | Net Unrealized

Appreciation

(Depreciation) | |

| | $27,236,867 | | $610,309 | | $ | 303,052 | | | $ | 307,257 | |

The difference between book and tax basis appreciation (depreciation) on investments is primarily attributed to wash sale loss deferrals.

As of June 30, 2020, the estimated components of net assets (excluding paid-in-capital) on a tax basis were as follows:

| | | | | | | | | | | | |

| | | Current

Distributable

Ordinary

Income | | | Current

Distributable

Long-Term

Capital Gain

(Tax Basis

Capital Loss

Carryover) | | | Unrealized

Appreciation

(Depreciation) | |

| | $ | 295,180 | | | $ | (326,143 | ) | | $ | 283,935 | |

The cumulative timing differences primarily consist of straddle loss deferrals and wash sale loss deferrals.

As of June 30, 2020, the Fund had the following net capital loss carryforwards:

| | | | | | | | |

| | | Capital Loss Carryforward Character | |

| | | Short-Term | | | Long-Term | |

| | $ | 117,176 | | | $ | 208,967 | |

6. Capital Share Transactions

The Trust issues and redeems shares of the Fund only in Creation Units through the Distributor at NAV. Capital shares transactions detail can be found in the Statements of Changes in Net Assets.

| | | | | | |

| | | |

| 18 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | JUNE 30, 2020 |

Shares of the Fund may only be purchased or redeemed by Authorized Participants. Such Authorized Participants may from time to time hold, of record or beneficially, a substantial percentage of the Fund’s shares outstanding, and act as executing or clearing broker for investment transactions on behalf of the Fund. An Authorized Participant is either (1) a “Participating Party” or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation (“NSCC”); or (2) a DTC Participant; which, in either case, must have executed an agreement with the Distributor.

7. Risks, Concentrations and Indemnifications

In the normal course of business, the Fund enters into contracts that contain a variety of representations which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown. The amount of exposure would depend on future claims that may be made against the Fund that has not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

As of June 30, 2020, the Adviser owns shares representing 64% of net assets of the Fund.

Significant shareholder transactions by the Adviser may impact the Fund’s performance.

Disruptions to creations and redemptions, the existence of significant market volatility or potential lack of an active trading market for the Shares (including through a trading halt), as well as other factors, may result in Shares trading significantly above (at a premium) or below (at a discount) to the NAV or to the intraday value of the Fund’s holdings. During such periods, investors may incur significant losses if shares are sold.

The Fund’s investments in ELNs entail varying degrees of risks. The Fund is subject to loss of their full principal amount. In addition, the ELNs are subject to a stated maximum return which may limit the payment at maturity. The Fund may also be exposed to additional risks associated with

structured notes including: counterparty credit risk related to the issuer’s ability to make payment at maturity; liquidity risk related to a lack of liquid

market for these notes, preventing the funds from trading or selling the notes easily; and a greater degree of market risk than other types of debt securities because the investor bears the risk associated with the underlying financial instruments.

The Fund is subject to infectious disease epidemics/pandemics risk. Recently, the worldwide outbreak of COVID-19, a novel coronavirus disease, has negatively affected economies, markets and individual companies throughout the world. The effects of this COVID-19 pandemic to public health, and business and market conditions, including exchange trading suspensions and closures may continue to have a significant negative impact on the performance of the Fund’s investments, increase the Fund’s volatility, negatively impact the Fund’s arbitrage and pricing mechanisms, exacerbate other pre-existing political, social and economic risks to the Fund and negatively impact broad segments of businesses and populations. The Fund’s operations may be interrupted as a result, which may have a significant negative impact on investment performance. In addition, governments, their regulatory agencies, or self-regulatory organizations may take actions in response to the pandemic that affect the instruments in which the Fund invests, or the issuers of such instruments, in ways that could also have a significant negative impact on the Fund’s investment performance. The full impact of this COVID-19 pandemic, or other future epidemics/pandemics, is currently unknown.

| | | | | | | | |

| | | |

| JUNE 30, 2020 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 19 | |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of J.P. Morgan Exchange-Traded Fund Trust and Shareholders of JPMorgan Equity Premium Income ETF

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of portfolio investments, of JPMorgan Equity Premium Income ETF (one of the funds constituting J.P. Morgan Exchange-Traded Fund Trust, referred to hereafter as the “Fund”) as of June 30, 2020, the related statements of operations and changes in net assets, including the related notes, and the financial highlights for the period May 20, 2020 (commencement of operations) through June 30, 2020 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of June 30, 2020, and the results of its operations, changes in its net assets, and the financial highlights for the period May 20, 2020 (commencement of operations) through June 30, 2020 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of June 30, 2020 by correspondence with the custodian, transfer agent and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audit provides a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

New York, New York

August 24, 2020

We have served as the auditor of one or more investment companies in the JPMorgan Funds complex since 1993.

| | | | | | |

| | | |

| 20 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | JUNE 30, 2020 |

TRUSTEES

(Unaudited)

The Fund’s Statements of Additional Information includes additional information about the Fund’s Trustees and is available, without charge, upon request by calling 1-844-457-6383 or on the J.P. Morgan Funds’ website at www.jpmorganfunds.com.

| | | | | | | | |

Name (Year of Birth;

Positions With

the Funds since) | | Principal Occupation

During Past 5 Years | | Number of

Funds in Fund

Complex Overseen

by Trustee (1) | | | Other Directorships Held

During the Past 5 Years |

Independent Trustees | | | | | | | | |

| | | |

Gary L. French (1951);

Trustee of the Trust since 2014 | | Real Estate Investor (2011–present); Consultant to the Mutual Fund Industry (2011-present); Senior Consultant for The Regulatory Fundamentals Group LLC (2011–2017). | | | 35 | | | Independent Trustee, The China Fund, Inc. (2013-2019); Exchange Traded Concepts Trust II (2012-2014); Exchange Traded Concepts Trust I (2011-2014). |

| | | |

| Robert J. Grassi (1957); Trustee of the Trust since 2014 | | Sole Proprietor, Academy Hills Advisors LLC (2012-present); Pension Director, Corning Incorporated (2002-2012). | | | 35 | | | None. |

| | | |

| Thomas P. Lemke (1954); Trustee of the Trust since 2014 | | Retired; Executive Vice President and General Counsel, Legg Mason (2005-2013). | | | 35 | | | SEI family of funds-Independent Trustee of Advisors’ Inner Circle Fund III (20 portfolios) (from February 2014 to present); Independent Trustee of Winton Diversified Opportunities Fund (from December 2014 to 2018); Independent Trustee of Gallery Trust (from August 2015 to present); Independent Trustee of Schroder Series Trust (from 2017 to present) Independent Trustee of Schroder Global Series Trust (from February 2017 to present); Independent Trustee of O’Connor EQUUS (May 2014-April 2016), Independent Trustee of Winton Series Trust (December 2014-March 2017); Independent Trustee of AXA Premier VIP Trust (2014-June 2017); Independent Director of The Victory Funds (or their predecessor funds) (35 portfolios) (2014-March 2015); Symmetry Panoramic Trust (16 portfolios) (2018-present). |

| | | |

| Lawrence R. Maffia (1950); Trustee of the Trust since 2014 | | Retired; Director and President, ICI Mutual Insurance Company (2006-2013). | | | 35 | | | Director, ICI Mutual Insurance Company (1999-2013). |

| | | |

| Emily A. Youssouf (1951); Trustee of the Trust since 2014 | | Clinical Professor, NYU Schack Institute of Real Estate (2009–present); Board Member and Member of the Audit Committee (2013–present), Chair of Finance Committee (2019–present), Member of Related Parties Committee (2013–2018) and Member of the Enterprise Risk Committee (2015–2018), PennyMac Financial Services, Inc.; Board Member (2005–2018), Chair of Capital Committee (2006–2016), Chair of Audit Committee (2005–2018), Member of Finance Committee (2005–2018) and Chair of IT Committee (2016–2018), NYC Health and Hospitals Corporation. | | | 35 | | | Trustee, NYC School Construction Authority (2009-present); Board Member, NYS Job Development Authority (2008-present); Trustee and Chair of the Audit and Finance Committee of the Transit Center Foundation (2015-2019). |

Interested Trustee | | | | | | | | |

| | | |

| Robert Deutsch (2) (1957); Chairman and Trustee of the Trust since 2014 | | Retired; Head of the Global ETF Business for JPMorgan Asset Management (2013-2017); Head of the Global Liquidity Business for JPMorgan Asset Management (2003-2013). | | | 35 | | | Board of Directors of the JUST Capital Foundation (2017–present). |

| (1) | A Fund Complex means two or more registered investment companies that hold themselves out to investors as related companies for purposes of investment and investor services or have a common investment adviser or have an investment adviser that is an affiliated person of the investment adviser of any of the other registered investment companies. Thirty series of the Trust have commenced operations. |

| (2) | Mr. Deutsch is an interested trustee because he was an employee of the Adviser until August 2017. |

The contact address for each of the Trustees is 277 Park Avenue, New York, NY 10172.

| | | | | | | | |

| | | |

| JUNE 30, 2020 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 21 | |

OFFICERS

(Unaudited)

| | |

Name (Year of Birth),

Positions Held with

the Trusts (Since) | | Principal Occupations During Past 5 Years |

| |

Joanna Gallegos (1975), President and Principal Executive Officer (2017) | | Managing Director, Global Head of ETF Strategy. Previously, Head of J.P. Morgan Asset Management’s U.S. Exchange Traded Funds business from July 2017 to December 2019 and Head of J.P. Morgan Asset Management’s ETF Product Development team from August 2013 to July 2017. |

| |

Lauren A. Paino (1973), Treasurer and Principal Financial Officer (2016)* | | Executive Director, J.P. Morgan Investment Management Inc. (formerly JPMorgan Funds Management, Inc.) since August 2013. |

| |