UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22903

J.P. Morgan Exchange-Traded Fund Trust

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, NY 10172

(Address of principal executive offices) (Zip code)

Gregory S. Samuels

J.P. Morgan Investment Management Inc.

277 Park Avenue

New York, NY 10172

(Name and Address of Agent for Service)

With copies to:

| | |

| Elizabeth A. Davin, Esq. | | Jon S. Rand, Esq. |

| JPMorgan Chase & Co. | | Dechert LLP |

| 1111 Polaris Parkway | | 1095 Avenue of the Americas |

| Columbus, OH 43240 | | New York, NY 10036 |

Registrant’s telephone number, including area code: 1-844-457-6383

Date of fiscal year end: June 30

Date of reporting period: July 1, 2021 through December 31, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

a.) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

b.) A copy of the notice transmitted to shareholders in reliance on Rule 30e-3 under the 1940 Act that contains disclosures specified by paragraph (c)(3) of that rule is included in the Annual Reports. Not Applicable. Notices do not incorporate disclosures from the shareholder report.

Semi-Annual Report

J.P. Morgan Exchange-Traded Funds

December 31, 2021 (Unaudited)

| | | | | | |

| | Ticker | | Listing Exchange | | |

| JPMorgan ActiveBuilders U.S. Large Cap Equity ETF | | JUSA | | NYSE Arca | | |

| JPMorgan Active Value ETF | | JAVA | | NYSE Arca | | |

| JPMorgan Equity Premium Income ETF | | JEPI | | NYSE Arca | | |

CONTENTS

Investments in a Fund are not bank deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets.

Prospective investors should refer to the Funds’ prospectuses for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Exchange-Traded Funds at (844) 457-6383 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

Shares are bought and sold throughout the day on an exchange at market price (not at net asset value) through a brokerage account, and are not individually subscribed and redeemed from a Fund. Shares may only be subscribed and redeemed directly from a Fund by Authorized Participants, in very large creation/redemption units. Brokerage commissions will reduce returns.

PRESIDENT’S LETTER

FEBRUARY 8, 2022 (Unaudited)

Dear Shareholder,

U.S. equity markets largely outperformed other financial markets during the second half of 2021 on the back of continued monetary and fiscal policy support, record corporate earnings and a boom in U.S. consumer wealth. While a resurgence in the pandemic late last year contributed to increased volatility in financial markets, we believe the overall impact on the U.S. economy appeared to be muted.

| | |

| | “While the path of the pandemic, inflationary pressure and central bank policies are likely to significantly impact financial market performance in the months ahead, the U.S. economy is forecast to continue expanding through 2022, which we believe should support both corporate earnings and consumer spending.” – Brian S. Shlissel |

During the second half of 2021, J.P. Morgan Exchange-Traded Funds expanded its suite of investment solutions with the launch of its Active Value ETF (JAVA) and ActiveBuilders U.S. Large Cap Equity ETF (JUSA). JAVA invests in companies whose securities are, in the portfolio managers’ opinion, undervalued when purchased, but which have the potential to increase the intrinsic per-share value and employs a bottom-up approach to security selection, focusing on company fundamentals, quantitative screening and proprietary fundamental analysis. Meanwhile, JUSA serves as a key component of our ActiveBuilders ETFs suite, which engages the expertise of the J.P. Morgan Global Equities platform’s qualitative and quantitative insights while seeking to improve investor returns and better manage risk. Both JAVA and JUSA incorporate environmental, social and governance factors within a transparent ETF structure. By the end of 2021, the complete suite of JPMorgan ETFs included 39 funds with combined assets of $70.05 billion.1

As we look forward, certain of the issues that had focused investors’ attention toward the end of last year remain. While the path of the pandemic, inflationary pressure and central bank policies are likely to significantly impact financial market performance in the months ahead, the U.S. economy is forecast to continue expanding through 2022, which we believe should support both corporate earnings and consumer spending. Against this backdrop, we seek to continue to provide investors with an array of diversified innovative investment solutions that can provide the tools for building durable portfolios and meeting their financial goals.

Sincerely,

Brian S. Shlissel

President, J.P. Morgan Funds

J.P. Morgan Asset Management

1-844-4JPM-ETF or jpmorgan.com/etfs for more information

| 1 | J.P. Morgan Asset Management, December 31, 2021. |

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2021 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | | | | 1 |

MARKET OVERVIEW

Six Months Ended December 31, 2021

Overall, U.S. equity markets generated positive returns in the second half of 2021, bolstered by continued monetary and fiscal support as well as strong consumer spending and record high corporate profits. Despite historically high equity valuations in the U.S., the S&P 500 Index posted at least one new record closing high each month during the period. U.S. fixed income markets largely underperformed U.S. equity markets amid historically low interest rates on U.S. Treasury securities and accelerating inflation.

Notably, the emergence of the omicron variant of COVID-19 in the final months of 2021 led to higher volatility in financial markets and briefly pulled oil prices lower.

The first months of the period saw strong upward momentum in U.S. equity prices after second quarter 2021 results showed record high earnings and revenue from U.S. companies. However, equity markets ended the month of September lower amid investor concerns about global supply chain disruptions, inflationary pressure and the ongoing pandemic.

In October, equity markets resumed their broad upward trajectory only to stall again in November and then ended December with higher returns. The global resurgence in pandemic infections in late 2021 raised investor concerns about the reimposition of social restrictions and their potential impact on specific industries and companies. However, the U.S. economic backdrop remained positive overall, with a strong labor market, surging corporate profits and a boom in U.S. consumer wealth.

Within U.S. equity, large cap stocks generally outperformed mid cap stocks and small cap stock prices largely declined over the second half of 2021.

| | | | | | | | | | |

| | | | | |

| 2 | | | | | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | DECEMBER 31, 2021 |

JPMorgan ActiveBuilders U.S. Large Cap Equity ETF

FUND COMMENTARY

FOR THE PERIOD JULY 7, 2021 (INCEPTION DATE) THROUGH DECEMBER 31, 2021 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| JPMorgan ActiveBuilders U.S. Large Cap Equity ETF | | | | |

| Net Asset Value* | | | 9.63% | |

| Market Price** | | | 9.71% | |

| S&P 500 Index | | | 10.09% | |

| |

| Net Assets as of 12/31/2021 | | $ | 29,387,547 | |

| Fund Ticker | | | JUSA | |

INVESTMENT OBJECTIVE***

The JPMorgan ActiveBuilders U.S. Large Cap Equity ETF (the “Fund”) seeks to provide long-term capital appreciation.

INVESTMENT APPROACH

The Fund invests primarily in equity securities of large, well-established companies located in the U.S. The Fund allocates to a variety of securities selected from across the adviser’s actively managed U.S. equity strategies and seeks to outperform the S&P 500 Index (the “Index”) over time while maintaining similar risk characteristics, including sector risks.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

For the period from inception on July 7, 2021 to December 31, 2021, the Fund underperformed the Index. The Fund’s security selection in the semiconductors & semiconductor equipment sector and the technology hardware & equipment sector were leading detractors from performance relative to the Index, while the Fund’s security selection in the capital goods and software & services sectors was a leading contributor to relative performance.

Leading individual detractors from relative performance included the Fund’s overweight positions in Analog Devices Inc. and Biogen Inc., and its underweight position in Pfizer Inc.

Shares of Analog Devices, a semiconductor manufacturer, fell

amid investor concerns about the company’s ability to meet surging demand. Shares of Biogen, a pharmaceuticals developer, fell amid investor concerns about the company’s treatment for Alzheimer’s disease. Shares of Pfizer, a pharmaceutical manufacturer, rose amid a resurgence in the pandemic in late 2021 and the U.S. Food and Drug Administration’s approval for the company’s COVID-19 pill.

Leading individual contributors to relative performance included the Fund’s overweight positions in Lowes Cos. and Eaton Corp., and its underweight position in Intel Corp. Shares of Lowe’s, a home improvement retail chain, rose after the company reported better-than-expected earnings and revenue for the third quarter of 2021, issued a better-than-expected forecast for fiscal 2022 and announced a $13 billion share repurchase plan. Shares of Eaton, a provider of industrial power systems, rose after the company reported better-than-expected earnings for the third quarter of 2021. Shares of Intel, a semiconductor manufacturer, fell after the company issued a weaker-than-expected earnings forecast with its third quarter 2021 results.

HOW WAS THE FUND POSITIONED?

During the period, the Fund’s largest overweight allocations relative to the Index were to the diversified financials and banks sectors and its largest underweight allocations were to the technology hardware & equipment and software & services sectors.

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2021 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | | | | 3 |

JPMorgan ActiveBuilders U.S. Large Cap Equity ETF

FUND COMMENTARY

FOR THE PERIOD JULY 7, 2021 (INCEPTION DATE) THROUGH DECEMBER 31, 2021 (Unaudited) (continued)

| | | | | | | | |

TOP TEN EQUITY HOLDINGS OF

THE PORTFOLIO AS OF DECEMBER 31, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| | 1. | | | Microsoft Corp. | |

| 6.7

| %

|

| | 2. | | | Apple, Inc. | |

| 5.3

|

|

| | 3. | | | Amazon.com, Inc. | |

| 3.5

|

|

| | 4. | | | Alphabet, Inc., Class A | |

| 2.8

|

|

| | 5. | | | Alphabet, Inc., Class C | |

| 2.3

|

|

| | 6. | | | Tesla, Inc. | |

| 1.9

|

|

| | 7. | | | Wells Fargo & Co. | |

| 1.6

|

|

| | 8. | | | AbbVie, Inc. | |

| 1.5

|

|

| | 9. | | | Lowe’s Cos., Inc. | |

| 1.5

|

|

| | 10. | | | Eaton Corp. plc | |

| 1.4

|

|

| | | | |

PORTFOLIO COMPOSITION BY SECTOR AS

OF DECEMBER 31, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| Information Technology | |

| 24.5

| %

|

| Consumer Discretionary | |

| 14.8

|

|

| Financials | |

| 14.7

|

|

| Health Care | |

| 13.4

|

|

| Industrials | |

| 10.2

|

|

| Communication Services | |

| 8.7

|

|

| Consumer Staples | |

| 3.3

|

|

| Materials | |

| 2.9

|

|

| Utilities | |

| 2.8

|

|

| Real Estate | |

| 2.3

|

|

| Energy | |

| 2.2

|

|

| Short-Term Investments | |

| 0.2

|

|

| * | | The return shown is based on net asset value and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $53.43 as of December 31, 2021. |

| ** | | Market price return was calculated assuming an initial investment made at the inception date net asset value, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return was the closing price on the NYSE Arca. As of December 31, 2021, the closing price was $53.47. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| | | | | | | | | | |

| | | | | |

| 4 | | | | | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | DECEMBER 31, 2021 |

| | | | | | | | |

TOTAL RETURNS AS OF DECEMBER 31, 2021 (Unaudited) | |

| | | INCEPTION DATE | | | CUMULATIVE

SINCE

INCEPTION | |

Net Asset Value | | | July 7, 2021 | | | | 9.63 | % |

Market Price | | | | | | | 9.71 | % |

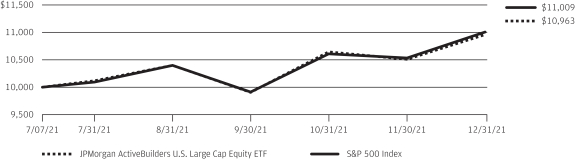

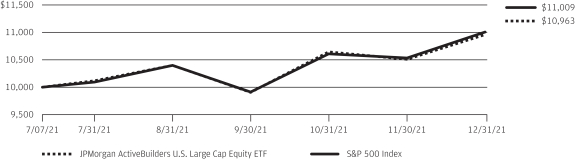

LIFE OF FUND PERFORMANCE (07/07/21 TO 12/31/21)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund commenced operations on July 7, 2021.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan ActiveBuilders U.S. Large Cap Equity ETF and the S&P 500 Index from July 7, 2021 to December 31, 2021. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the S&P 500 Index does not

reflect the deduction of expenses associated with an exchange-traded fund and approximates the minimum possible dividend reinvestment of the securities included in the Index, if applicable. The S&P 500 Index is an unmanaged index generally representative of the performance of large companies in the U.S. stock market. Investors cannot invest directly in an index.

Performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on gains resulting from redemption or sale of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2021 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | | | | 5 |

JPMorgan Active Value ETF

FUND COMMENTARY

FOR THE PERIOD OCTOBER 4, 2021 (INCEPTION DATE) THROUGH DECEMBER 31, 2021 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| JPMorgan Active Value ETF | | | | |

| Net Asset Value* | | | 6.22% | |

| Market Price** | | | 6.28% | |

| Russell 1000 Value Index | | | 6.94% | |

| |

| Net Assets as of 12/31/2021 | | $ | 27,466,348 | |

| Fund Ticker | | | JAVA | |

INVESTMENT OBJECTIVE***

The JPMorgan Active Value ETF (the “Fund”) seeks to provide long-term capital appreciation.

INVESTMENT APPROACH

The Fund invests primarily in large- and mid-cap equity securities that are attractively valued based on their growth potential over the long-term. The Fund employs a bottom-up approach to stock selection, focusing on company fundamentals, quantitative screening and proprietary fundamental analysis.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

For the period from inception on October 4, 2021 to December 31, 2021, the Fund underperformed the Russell 1000 Value Index (the “Index”).

The Fund’s security selection in the financials sector and its underweight position and security selection in the real estate sector were leading detractors from performance relative to the Benchmark, while the Fund’s security selection in the materials sector and underweight position in the communication services sector were leading contributors to relative performance.

Leading individual detractors from relative performance included the Fund’s overweight position in Royal Caribbean Cruises Ltd. and Zimmer Biomet Holdings Inc. and its underweight position in Pfizer Inc. Shares of Royal Caribbean Cruises, a cruise ship operator, fell amid investor concerns that the emergence of the omicron variant of COVID-19 would hurt the travel and hospitality sectors. Shares of Zimmer Biomet Holdings, a medical device manufacturer, fell amid investor expectations that the resurgence of the pandemic in late 2021 may

reduce demand for elective surgeries. Shares of Pfizer, a pharmaceutical and vaccines manufacturer, rose amid a resurgence in the pandemic in late 2021 and the U.S. Food and Drug Administration’s approval for the company’s COVID-19 pill.

Leading individual contributors to relative performance included the Fund’s out-of-Benchmark position in Seagate Technology Holdings PLC, its underweight position in JPMorgan Chase & Co. and its overweight position in Centene Corp. Shares of Seagate Technology Holdings, a data storage products manufacturer, rose after the company reported better-than-expected earnings and revenue for its fiscal second quarter. Shares of JPMorgan Chase, a banking and financial services company that the Fund is prohibited from owning because of JPMorgan Chase’s affiliation with the Fund adviser, fell after the company reported rising consumer debt delinquencies. Shares of Centene, a health insurance provider, rose after the company issued a better-than-expected forecast for earnings and revenue for fiscal year 2022.

HOW WAS THE FUND POSITIONED?

During the period, the Fund’s portfolio managers employed a bottom-up approach to stock selection, based on company fundamentals, quantitative screening and proprietary fundamental analysis. As a result of this process, the Fund’s largest sector allocations were to the financials and health care sectors and its smallest allocations were to the real estate and utilities sector.

| | | | | | | | | | |

| | | | | |

| 6 | | | | | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | DECEMBER 31, 2021 |

| | | | | | | | |

TOP TEN EQUITY HOLDINGS OF THE

PORTFOLIO AS OF DECEMBER 31, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| | 1. | | | Wells Fargo & Co. | |

| 3.1

| %

|

| | 2. | | | Bank of America Corp. | |

| 3.0

|

|

| | 3. | | | Chevron Corp. | |

| 2.2

|

|

| | 4. | | | Bristol-Myers Squibb Co. | |

| 2.1

|

|

| | 5. | | | Centene Corp. | |

| 1.8

|

|

| | 6. | | | Royal Caribbean Cruises Ltd. | |

| 1.7

|

|

| | 7. | | | Truist Financial Corp. | |

| 1.7

|

|

| | 8. | | | US Foods Holding Corp. | |

| 1.7

|

|

| | 9. | | | Parker-Hannifin Corp. | |

| 1.6

|

|

| | 10. | | | Raytheon Technologies Corp. | |

| 1.5

|

|

| | | | |

PORTFOLIO COMPOSITION BY SECTOR AS

OF DECEMBER 31, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| Financials | |

| 23.9

| %

|

| Health Care | |

| 17.3

|

|

| Industrials | |

| 12.1

|

|

| Consumer Discretionary | |

| 10.1

|

|

| Consumer Staples | |

| 7.1

|

|

| Energy | |

| 6.9

|

|

| Materials | |

| 6.5

|

|

| Information Technology | |

| 5.6

|

|

| Communication Services | |

| 4.0

|

|

| Utilities | |

| 2.9

|

|

| Real Estate | |

| 2.0

|

|

| Short-Term Investments | |

| 1.6

|

|

| * | | The return shown is based on net asset value and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $52.32 as of December 31, 2021. |

| ** | | Market price return was calculated assuming an initial investment made at the inception date net asset value, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return was the closing price on the NYSE Arca. As of December 31, 2021, the closing price was $52.35. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2021 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | | | | 7 |

JPMorgan Active Value ETF

FUND COMMENTARY

FOR THE PERIOD OCTOBER 4, 2021 (INCEPTION DATE) THROUGH DECEMBER 31, 2021 (Unaudited) (continued)

| | | | | | | | |

TOTAL RETURNS AS OF DECEMBER 31, 2021 (Unaudited) | |

| | | INCEPTION DATE | | | CUMULATIVE

SINCE

INCEPTION | |

Net Asset Value | | | October 4, 2021 | | | | 6.22 | % |

Market Price | | | | | | | 6.28 | % |

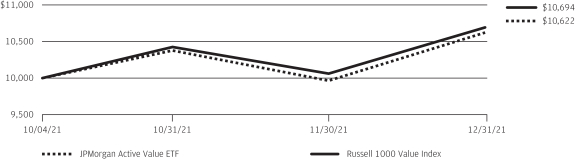

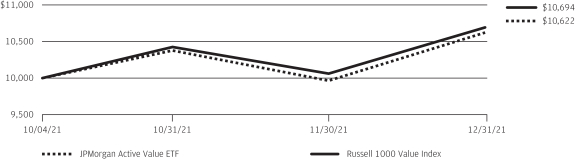

LIFE OF FUND PERFORMANCE (10/04/21 TO 12/31/21)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund commenced operations on October 4, 2021.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan Active Value ETF and the Russell 1000 Value Index from October 4, 2021 to December 31, 2021.

The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The Russell 1000 Value Index does not reflect the deduction of expenses associated

with an exchange-traded fund and has been adjusted to reflect reinvestment of

all dividends and capital gain distributions of the securities included in the Index, if applicable. The Russell 1000 Value Index is an unmanaged index measuring the performance of those Russell 1000 companies with lower price to-book ratios and lower forecasted growth values. Investors cannot invest directly in an index.

Performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on gains resulting from redemption or sale of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | | | |

| | | | | |

| 8 | | | | | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | DECEMBER 31, 2021 |

JPMorgan Equity Premium Income ETF

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2021 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| JPMorgan Equity Premium Income ETF | | | | |

| Net Asset Value* | | | 8.82% | |

| Market Price** | | | 8.74% | |

| S&P 500 Index | | | 11.67% | |

| ICE BofAML 3-Month US Treasury Bill Index | | | 0.02% | |

| |

| Net Assets as of 12/31/2021 | | $ | 5,879,914,577 | |

| Fund Ticker | | | JEPI | |

INVESTMENT OBJECTIVE***

The JPMorgan Equity Premium Income ETF (the “Fund”) seeks current income while maintaining prospects for capital appreciation.

INVESTMENT APPROACH

The Fund generates income by investing in a combination of options-based equity-linked notes and U.S. large cap stocks, seeking to deliver a monthly distributions at a relatively stable level. The Fund uses a proprietary research process designed to identify over- and undervalued stocks with attractive risk/return characteristics.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund underperformed the S&P 500 Index (the “Benchmark”) and outperformed the ICE BofAML 3-Month US Treasury Bill Index for the six months ended December 31, 2021.

The Fund’s use of options-based equity-linked notes allowed the Fund to generally perform as designed, delivering returns with less volatility than the Benchmark during the reporting period. The Fund captured 75% of the Benchmark’s total return with about 66% of the Benchmark’s volatility during the reporting period, resulting in income of $X.XX per share.

The Fund’s underweight position in the information technology sector and its security selection in the consumer discretionary sector were leading detractors from performance relative to the Benchmark, while the Fund’s security selection in the industrials and financials sectors was a leading contributor to relative performance.

Leading individual detractors from relative performance included the Fund’s underweight positions in Tesla Inc., Apple Inc. and Nvidia Inc. Shares of Tesla, a producer of electric vehicles and battery systems that was not held in the Fund, rose after the

company reported better-than-expected production and deliveries during the period. Shares of Apple, a provider of computers, mobile devices and related services, rose amid consecutive quarter of record earnings and strong demand for mobile devices. Shares of Nvidia, a semiconductor maker not held in the Fund, rose after the company reported better-than-expected earnings and revenue for the third quarter of 2021 amid growth in sales to the data center and gaming industries.

Leading individual contributors to relative performance included the Fund’s overweight position in Old Dominion Freight Line Inc. and its underweight positions in PayPal Holdings Inc. and Amazon.com Inc. Shares of Old Dominion Freight Inc., a trucking and transport provider, rose after the company reported better-than-expected earnings and revenue for the third quarter amid a surge in demand for its services. Shares of PayPal Holdings, a digital payments platform provider not held in the Fund, fell after the company issued a lower-than-expected earnings forecast for the third quarter of 2021 and amid general weakness in financial technology stocks. Shares of Amazon.com, an online retailer and services provider not held in the Fund, fell after the company reported lower-than-expected earnings and revenue for the third quarter of 2021 and issued a lower-than-expected forecast for the fourth quarter of 2021.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s portfolio managers maintained a defensive equity portfolio, investing primarily in common stocks of large cap U.S. companies, with reduced volatility compared with the Benchmark, while using index options-based equity-linked notes in a consistent and disciplined manner. The combination of the diversified portfolio of equity securities and income from index options-based equity-linked notes provided the Fund with a portion of the returns associated with equity market investments, less risk compared with the equity market, and a stream of distributable monthly income.

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2021 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | | | | 9 |

JPMorgan Equity Premium Income ETF

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2021 (Unaudited) (continued)

| | | | | | | | |

TOP TEN EQUITY HOLDINGS OF THE

PORTFOLIO AS OF DECEMBER 31, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| | 1. | | | UBS AG, ELN, 40.24%, 2/7/2022, (linked to S&P 500 Index) (Switzerland) | |

| 2.1

| %

|

| | 2. | | | Barclays Bank plc, ELN, 48.30%, 1/14/2022, (linked to S&P 500 Index) (United Kingdom) | |

| 1.8

|

|

| | 3. | | | Bank of Montreal, ELN, 47.00%, 1/18/2022, (linked to S&P 500 Index) (Canada) | |

| 1.7

|

|

| | 4. | | | Credit Suisse AG, ELN, 42.00%, 2/4/2022, (linked to S&P 500 Index) (Switzerland) | |

| 1.7

|

|

| | 5. | | | Accenture plc, Class A | |

| 1.7

|

|

| | 6. | | | Old Dominion Freight Line, Inc. | |

| 1.6

|

|

| | 7. | | | Microsoft Corp. | |

| 1.6

|

|

| | 8. | | | DTE Energy Co. | |

| 1.6

|

|

| | 9. | | | Royal Bank of Canada, ELN, 55.31%, 1/7/2022, (linked to S&P 500 Index) (Canada) | |

| 1.6

|

|

| | 10. | | | Eli Lilly & Co. | |

| 1.6

|

|

| | | | |

PORTFOLIO COMPOSITION BY SECTOR AS

OF DECEMBER 31, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| Health Care | |

| 12.1

| %

|

| Information Technology | |

| 12.0

|

|

| Industrials | |

| 11.8

|

|

| Consumer Staples | |

| 10.9

|

|

| Financials | |

| 8.8

|

|

| Consumer Discretionary | |

| 7.6

|

|

| Utilities | |

| 7.3

|

|

| Communication Services | |

| 6.0

|

|

| Materials | |

| 3.4

|

|

| Real Estate | |

| 3.1

|

|

| Energy | |

| 0.7

|

|

| Other**** | |

| 16.2

|

|

| Short-Term Investments | |

| 0.1

|

|

| * | | The return shown is based on net asset value and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $63.16 as of December 31, 2021. |

| ** | | Market price return was calculated assuming an initial investment made at the market price at the beginning of the reporting period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return was the closing price on the NYSE Arca. As of December 31, 2021, the closing price was $63.19. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Equity-Linked Notes that are linked to the S&P 500 Index. |

| | | | | | | | | | |

| | | | | |

| 10 | | | | | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | DECEMBER 31, 2021 |

| | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2021 (Unaudited) | |

| | | INCEPTION DATE | | | SIX MONTHS* | | | 1 YEAR | | | SINCE

INCEPTION | |

| Net Asset Value | | | May 20, 2020 | | | | 8.82 | % | | | 21.61 | % | | | 25.23 | % |

| Market Price | | | | | | | 8.74 | % | | | 21.50 | % | | | 25.25 | % |

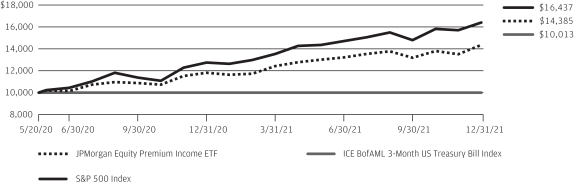

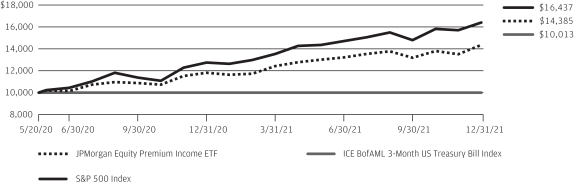

LIFE OF FUND PERFORMANCE (5/20/20 TO 12/31/21)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund commenced operations on May 20, 2020.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan Equity Premium Income ETF, the S&P 500 Index and the ICE BofAML 3-Month US Treasury Bill Index from May 20, 2020 to December 31, 2021. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the S&P 500 Index and the ICE BofAML 3-Month US Treasury Bill Index does not reflect the deduction of expenses associated with an exchange-traded fund and approximates the minimum possible dividend

reinvestment of the securities included in the benchmarks, if applicable. The S&P 500 Index is an unmanaged index generally representative of the performance of large companies in the U.S. stock market. The ICE BofAML

3-Month US Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. Each month the ICE BofAML 3-Month US Treasury Bill Index is rebalanced and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond, 3 months from the rebalancing date. Investors cannot invest directly in an index.

Performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on gains resulting from redemption or sale of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2021 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | | | | 11 |

JPMorgan ActiveBuilders U. S. Large Cap Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF DECEMBER 31, 2021 (Unaudited)

| | | | | | | | |

| INVESTMENTS | | SHARES | | | VALUE ($) | |

Common Stocks — 99.7% | | | | | | | | |

Aerospace & Defense — 1.7% | |

General Dynamics Corp. | | | 468 | | | | 97,564 | |

Northrop Grumman Corp. | | | 641 | | | | 248,112 | |

Raytheon Technologies Corp. | | | 1,682 | | | | 144,753 | |

| | | | | | | | |

| | | | | | | 490,429 | |

| | | | | | | | |

Air Freight & Logistics — 0.6% | |

FedEx Corp. | | | 119 | | | | 30,778 | |

United Parcel Service, Inc., Class B | | | 633 | | | | 135,677 | |

| | | | | | | | |

| | | | | | | 166,455 | |

| | | | | | | | |

Airlines — 0.2% | |

Southwest Airlines Co. * | | | 1,670 | | | | 71,543 | |

| | | | | | | | |

Auto Components — 0.1% | |

Aptiv plc * | | | 55 | | | | 9,072 | |

Magna International, Inc. (Canada) | | | 194 | | | | 15,703 | |

| | | | | | | | |

| | | | | | | 24,775 | |

| | | | | | | | |

Automobiles — 2.2% | |

General Motors Co. * | | | 347 | | | | 20,345 | |

Rivian Automotive, Inc., Class A * | | | 460 | | | | 47,697 | |

Tesla, Inc. * | | | 535 | | | | 565,377 | |

| | | | | | | | |

| | | | | | | 633,419 | |

| | | | | | | | |

Banks — 5.9% | |

Bank of America Corp. | | | 4,428 | | | | 197,002 | |

Citigroup, Inc. | | | 2,836 | | | | 171,266 | |

Citizens Financial Group, Inc. | | | 651 | | | | 30,760 | |

Fifth Third Bancorp | | | 612 | | | | 26,653 | |

M&T Bank Corp. | | | 259 | | | | 39,777 | |

PNC Financial Services Group, Inc. (The) | | | 467 | | | | 93,643 | |

Regions Financial Corp. | | | 1,178 | | | | 25,680 | |

SVBFinancial Group * | | | 130 | | | | 88,171 | |

Truist Financial Corp. | | | 5,638 | | | | 330,105 | |

US Bancorp | | | 4,706 | | | | 264,336 | |

Wells Fargo & Co. | | | 9,703 | | | | 465,550 | |

| | | | | | | | |

| | | | | | | 1,732,943 | |

| | | | | | | | |

Beverages — 1.1% | |

Coca-Cola Co. (The) | | | 3,312 | | | | 196,103 | |

Constellation Brands, Inc., Class A | | | 127 | | | | 31,873 | |

Monster Beverage Corp. * | | | 573 | | | | 55,031 | |

PepsiCo, Inc. | | | 218 | | | | 37,869 | |

| | | | | | | | |

| | | | | | | 320,876 | |

| | | | | | | | |

Biotechnology — 3.2% | |

AbbVie, Inc. | | | 3,255 | | �� | | 440,727 | |

Amgen, Inc. | | | 151 | | | | 33,970 | |

Biogen, Inc. * | | | 451 | | | | 108,204 | |

Exact Sciences Corp. * | | | 93 | | | | 7,238 | |

Moderna, Inc. * | | | 70 | | | | 17,779 | |

Regeneron Pharmaceuticals, Inc. * | | | 350 | | | | 221,032 | |

Seagen, Inc. * | | | 278 | | | | 42,979 | |

Vertex Pharmaceuticals, Inc. * | | | 344 | | | | 75,542 | |

| | | | | | | | |

| | | | | | | 947,471 | |

| | | | | | | | |

| | | | | | | | |

| INVESTMENTS | | SHARES | | | VALUE ($) | |

| | | | | | | | |

Building Products — 1.0% | |

Johnson Controls International plc | | | 442 | | | | 35,939 | |

Masco Corp. | | | 285 | | | | 20,013 | |

Trane Technologies plc | | | 1,164 | | | | 235,163 | |

| | | | | | | | |

| | | | | | | 291,115 | |

| | | | | | | | |

Capital Markets — 5.4% | |

Ameriprise Financial, Inc. | | | 393 | | | | 118,552 | |

BlackRock, Inc. | | | 179 | | | | 163,885 | |

Blackstone, Inc. | | | 999 | | | | 129,261 | |

Charles Schwab Corp. (The) | | | 2,101 | | | | 176,694 | |

Goldman Sachs Group, Inc. (The) | | | 328 | | | | 125,476 | |

Intercontinental Exchange, Inc. | | | 204 | | | | 27,901 | |

Morgan Stanley | | | 3,650 | | | | 358,284 | |

MSCI, Inc. | | | 37 | | | | 22,670 | |

S&P Global, Inc. | | | 628 | | | | 296,372 | |

State Street Corp. | | | 555 | | | | 51,615 | |

T. Rowe Price Group, Inc. | | | 668 | | | | 131,356 | |

| | | | | | | | |

| | | | | | | 1,602,066 | |

| | | | | | | | |

Chemicals — 2.3% | |

Air Products and Chemicals, Inc. | | | 335 | | | | 101,927 | |

Axalta Coating Systems Ltd. * | | | 3,167 | | | | 104,891 | |

Celanese Corp. | | | 77 | | | | 12,941 | |

DuPont de Nemours, Inc. | | | 605 | | | | 48,872 | |

Eastman Chemical Co. | | | 756 | | | | 91,408 | |

Linde plc (United Kingdom) | | | 82 | | | | 28,407 | |

PPG Industries, Inc. | | | 1,283 | | | | 221,241 | |

Sherwin-Williams Co. (The) | | | 177 | | | | 62,332 | |

| | | | | | | | |

| | | | | | | 672,019 | |

| | | | | | | | |

Commercial Services & Supplies — 0.2% | |

Cintas Corp. | | | 23 | | | | 10,193 | |

Republic Services, Inc. | | | 335 | | | | 46,716 | |

| | | | | | | | |

| | | | | | | 56,909 | |

| | | | | | | | |

Communications Equipment — 0.1% | |

Cisco Systems, Inc. | | | 295 | | | | 18,694 | |

| | | | | | | | |

Construction Materials — 0.2% | |

Vulcan Materials Co. | | | 335 | | | | 69,539 | |

| | | | | | | | |

Consumer Finance — 0.7% | |

American Express Co. | | | 440 | | | | 71,984 | |

Capital One Financial Corp. | | | 973 | | | | 141,173 | |

| | | | | | | | |

| | | | | | | 213,157 | |

| | | | | | | | |

Containers & Packaging — 0.2% | |

Avery Dennison Corp. | | | 73 | | | | 15,810 | |

Ball Corp. | | | 212 | | | | 20,409 | |

Westrock Co. | | | 235 | | | | 10,424 | |

| | | | | | | | |

| | | | | | | 46,643 | |

| | | | | | | | |

Diversified Financial Services — 0.9% | |

Berkshire Hathaway, Inc., Class B * | | | 874 | | | | 261,326 | |

| | | | | | | | |

Diversified Telecommunication Services — 0.1% | |

Verizon Communications, Inc. | | | 537 | | | | 27,903 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | | | |

| | | | | |

| 12 | | | | | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | DECEMBER 31, 2021 |

| | | | | | | | |

| INVESTMENTS | | SHARES | | | VALUE ($) | |

Common Stocks — continued | | | | | | | | |

Electric Utilities — 2.2% | |

Edison International | | | 256 | | | | 17,472 | |

Entergy Corp. | | | 380 | | | | 42,807 | |

Evergy, Inc. | | | 314 | | | | 21,544 | |

FirstEnergy Corp. | | | 785 | | | | 32,648 | |

NextEra Energy, Inc. | | | 4,265 | | | | 398,180 | |

Xcel Energy, Inc. | | | 2,098 | | | | 142,035 | |

| | | | | | | | |

| | | | | | | 654,686 | |

| | | | | | | | |

Electrical Equipment — 1.7% | |

Eaton Corp. plc | | | 2,455 | | | | 424,273 | |

Rockwell Automation, Inc. | | | 213 | | | | 74,305 | |

| | | | | | | | |

| | | | | | | 498,578 | |

| | | | | | | | |

Electronic Equipment, Instruments & Components — 0.2% | |

Amphenol Corp., Class A | | | 617 | | | | 53,963 | |

| | | | | | | | |

Entertainment — 0.7% | |

Netflix, Inc. * | | | 251 | | | | 151,213 | |

Walt Disney Co. (The)* | | | 379 | | | | 58,703 | |

| | | | | | | | |

| | | | | | | 209,916 | |

| | | | | | | | |

Equity Real Estate Investment Trusts (REITs) — 2.2% | |

AvalonBay Communities, Inc. | | | 109 | | | | 27,532 | |

Camden Property Trust | | | 157 | | | | 28,053 | |

Equinix, Inc. | | | 33 | | | | 27,913 | |

Equity LifeStyle Properties, Inc. | | | 208 | | | | 18,233 | |

Host Hotels & Resorts, Inc. * | | | 2,700 | | | | 46,953 | |

Kimco Realty Corp. | | | 593 | | | | 14,617 | |

Prologis, Inc. | | | 2,315 | | | | 389,753 | |

SBA Communications Corp. | | | 43 | | | | 16,728 | |

Sun Communities, Inc. | | | 113 | | | | 23,727 | |

Ventas, Inc. | | | 1,024 | | | | 52,347 | |

Vornado Realty Trust | | | 382 | | | | 15,991 | |

| | | | | | | | |

| | | | | | | 661,847 | |

| | | | | | | | |

Food & Staples Retailing — 0.2% | |

Walmart, Inc. | | | 415 | | | | 60,046 | |

| | | | | | | | |

Food Products — 0.3% | |

Mondelez International, Inc., Class A | | | 1,560 | | | | 103,444 | |

| | | | | | | | |

Health Care Equipment & Supplies — 3.0% | |

Abbott Laboratories | | | 446 | | | | 62,770 | |

ABIOMED, Inc. * | | | 42 | | | | 15,085 | |

Align Technology, Inc. * | | | 124 | | | | 81,491 | |

Baxter International, Inc. | | | 111 | | | | 9,528 | |

Becton Dickinson and Co. | | | 370 | | | | 93,048 | |

Boston Scientific Corp. * | | | 4,113 | | | | 174,720 | |

Dexcom, Inc. * | | | 94 | | | | 50,473 | |

Intuitive Surgical, Inc. * | | | 463 | | | | 166,356 | |

Medtronic plc | | | 1,489 | | | | 154,037 | |

Zimmer Biomet Holdings, Inc. | | | 624 | | | | 79,273 | |

| | | | | | | | |

| | | | | | | 886,781 | |

| | | | | | | | |

Health Care Providers & Services — 3.0% | |

Anthem, Inc. | | | 242 | | | | 112,177 | |

Centene Corp. * | | | 1,985 | | | | 163,564 | |

Cigna Corp. | | | 359 | | | | 82,437 | |

HCA Healthcare, Inc. | | | 352 | | | | 90,436 | |

| | | | | | | | |

| INVESTMENTS | | SHARES | | | VALUE ($) | |

| | | | | | | | |

Health Care Providers & Services — continued | |

Humana, Inc. | | | 152 | | | | 70,507 | |

McKesson Corp. | | | 325 | | | | 80,785 | |

UnitedHealth Group, Inc. | | | 590 | | | | 296,262 | |

| | | | | | | | |

| | | | | | | 896,168 | |

| | | | | | | | |

Hotels, Restaurants & Leisure — 2.8% | |

Booking Holdings, Inc. * | | | 57 | | | | 136,756 | |

Chipotle Mexican Grill, Inc. * | | | 49 | | | | 85,664 | |

Hilton Worldwide Holdings, Inc. * | | | 168 | | | | 26,206 | |

Marriott International, Inc., Class A * | | | 1,159 | | | | 191,513 | |

McDonald’s Corp. | | | 1,121 | | | | 300,507 | |

Yum! Brands, Inc. | | | 631 | | | | 87,621 | |

| | | | | | | | |

| | | | | | | 828,267 | |

| | | | | | | | |

Household Durables — 0.3% | |

Lennar Corp., Class A | | | 366 | | | | 42,515 | |

Newell Brands, Inc. | | | 1,177 | | | | 25,706 | |

Toll Brothers, Inc. | | | 178 | | | | 12,885 | |

| | | | | | | | |

| | | | | | | 81,106 | |

| | | | | | | | |

Household Products — 0.8% | |

Kimberly-Clark Corp. | | | 199 | | | | 28,441 | |

Procter & Gamble Co. (The) | | | 1,184 | | | | 193,679 | |

| | | | | | | | |

| | | | | | | 222,120 | |

| | | | | | | | |

Industrial Conglomerates — 0.1% | |

Honeywell International, Inc. | | | 120 | | | | 25,021 | |

| | | | | | | | |

Insurance — 1.7% | |

Chubb Ltd. | | | 578 | | | | 111,733 | |

Hartford Financial Services Group, Inc. (The) | | | 1,463 | | | | 101,005 | |

Loews Corp. | | | 493 | | | | 28,476 | |

Marsh & McLennan Cos., Inc. | | | 188 | | | | 32,678 | |

MetLife, Inc. | | | 797 | | | | 49,805 | |

Progressive Corp. (The) | | | 1,182 | | | | 121,332 | |

Prudential Financial, Inc. | | | 452 | | | | 48,924 | |

Travelers Cos., Inc. (The) | | | 55 | | | | 8,604 | |

| | | | | | | | |

| | | | | | | 502,557 | |

| | | | | | | | |

Interactive Media & Services — 6.8% | |

Alphabet, Inc., Class A * | | | 285 | | | | 825,656 | |

Alphabet, Inc., Class C * | | | 231 | | | | 668,419 | |

Match Group, Inc. * | | | 215 | | | | 28,434 | |

Meta Platforms, Inc., Class A * | | | 1,117 | | | | 375,703 | |

Snap, Inc., Class A * | | | 1,765 | | | | 83,008 | |

ZoomInfo Technologies, Inc., Class A * | | | 210 | | | | 13,482 | |

| | | | | | | | |

| | | | | | | 1,994,702 | |

| | | | | | | | |

Internet & Direct Marketing Retail — 3.7% | |

Amazon.com, Inc. * | | | 312 | | | | 1,040,314 | |

Etsy, Inc. * | | | 176 | | | | 38,533 | |

| | | | | | | | |

| | | | | | | 1,078,847 | |

| | | | | | | | |

IT Services — 3.3% | |

Accenture plc, Class A | | | 297 | | | | 123,121 | |

Affirm Holdings, Inc. * | | | 224 | | | | 22,525 | |

Block, Inc., Class A * | | | 156 | | | | 25,195 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2021 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | | | | 13 |

JPMorgan ActiveBuilders U. S. Large Cap Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF DECEMBER 31, 2021 (Unaudited) (continued)

| | | | | | | | |

| INVESTMENTS | | SHARES | | | VALUE ($) | |

Common Stocks — continued | | | | | | | | |

IT Services — continued | |

Fidelity National Information Services, Inc. | | | 318 | | | | 34,710 | |

FleetCor Technologies, Inc. * | | | 277 | | | | 62,004 | |

International Business Machines Corp. | | | 304 | | | | 40,633 | |

Mastercard, Inc., Class A | | | 1,173 | | | | 421,482 | |

MongoDB, Inc. * | | | 39 | | | | 20,645 | |

PayPal Holdings, Inc. * | | | 205 | | | | 38,659 | |

Shopify, Inc., Class A (Canada) * | | | 54 | | | | 74,379 | |

Visa, Inc., Class A | | | 455 | | | | 98,603 | |

| | | | | | | | |

| | | | | | | 961,956 | |

| | | | | | | | |

Life Sciences Tools & Services — 0.6% | |

Danaher Corp. | | | 85 | | | | 27,966 | |

Illumina, Inc. * | | | 31 | | | | 11,793 | |

Thermo Fisher Scientific, Inc. | | | 187 | | | | 124,774 | |

| | | | | | | | |

| | | | | | | 164,533 | |

| | | | | | | | |

Machinery — 2.8% | |

Deere & Co. | | | 1,006 | | | | 344,947 | |

Dover Corp. | | | 636 | | | | 115,498 | |

Ingersoll Rand, Inc. | | | 244 | | | | 15,096 | |

Otis Worldwide Corp. | | | 541 | | | | 47,105 | |

Parker-Hannifin Corp. | | | 457 | | | | 145,381 | |

Stanley Black & Decker, Inc. | | | 815 | | | | 153,725 | |

| | | | | | | | |

| | | | | | | 821,752 | |

| | | | | | | | |

Media — 0.8% | |

Charter Communications, Inc., Class A * | | | 51 | | | | 33,251 | |

Comcast Corp., Class A | | | 3,777 | | | | 190,096 | |

| | | | | | | | |

| | | | | | | 223,347 | |

| | | | | | | | |

Metals & Mining — 0.3% | |

Freeport-McMoRan, Inc. | | | 1,827 | | | | 76,241 | |

| | | | | | | | |

Multiline Retail — 0.4% | |

Dollar General Corp. | | | 301 | | | | 70,985 | |

Dollar Tree, Inc. * | | | 74 | | | | 10,398 | |

Target Corp. | | | 177 | | | | 40,965 | |

| | | | | | | | |

| | | | | | | 122,348 | |

| | | | | | | | |

Multi-Utilities — 0.5% | |

CenterPoint Energy, Inc. | | | 1,264 | | | | 35,278 | |

CMS Energy Corp. | | | 1,152 | | | | 74,938 | |

DTE Energy Co. | | | 149 | | | | 17,812 | |

Public Service Enterprise Group, Inc. | | | 347 | | | | 23,155 | |

| | | | | | | | |

| | | | | | | 151,183 | |

| | | | | | | | |

Oil, Gas & Consumable Fuels — 2.2% | |

Cheniere Energy, Inc. | | | 105 | | | | 10,649 | |

Chevron Corp. | | | 1,302 | | | | 152,790 | |

ConocoPhillips | | | 3,091 | | | | 223,108 | |

Diamondback Energy, Inc. | | | 324 | | | | 34,944 | |

EOG Resources, Inc. | | | 1,276 | | | | 113,347 | |

Pioneer Natural Resources Co. | | | 357 | | | | 64,931 | |

Valero Energy Corp. | | | 358 | | | | 26,889 | |

Williams Cos., Inc. (The) | | | 522 | | | | 13,593 | |

| | | | | | | | |

| | | | | | | 640,251 | |

| | | | | | | | |

| | | | | | | | |

| INVESTMENTS | | SHARES | | | VALUE ($) | |

| | | | | | | | |

Personal Products — 0.3% | |

Estee Lauder Cos., Inc. (The), Class A | | | 261 | | | | 96,622 | |

| | | | | | | | |

Pharmaceuticals — 3.6% | |

Bristol-Myers Squibb Co. | | | 5,983 | | | | 373,040 | |

Eli Lilly & Co. | | | 1,259 | | | | 347,761 | |

Johnson & Johnson | | | 1,167 | | | | 199,639 | |

Merck & Co., Inc. | | | 775 | | | | 59,396 | |

Pfizer, Inc. | | | 1,203 | | | | 71,037 | |

| | | | | | | | |

| | | | | | | 1,050,873 | |

| | | | | | | | |

Professional Services — 0.6% | |

Booz Allen Hamilton Holding Corp. | | | 123 | | | | 10,429 | |

Equifax, Inc. | | | 124 | | | | 36,306 | |

Leidos Holdings, Inc. | | | 1,032 | | | | 91,745 | |

Verisk Analytics, Inc. | | | 167 | | | | 38,198 | |

| | | | | | | | |

| | | | | | | 176,678 | |

| | | | | | | | |

Road & Rail — 1.3% | |

CSX Corp. | | | 2,106 | | | | 79,185 | |

Lyft, Inc., Class A * | | | 234 | | | | 9,999 | |

Norfolk Southern Corp. | | | 918 | | | | 273,298 | |

Union Pacific Corp. | | | 131 | | | | 33,003 | |

| | | | | | | | |

| | | | | | | 395,485 | |

| | | | | | | | |

Semiconductors & Semiconductor Equipment — 7.0% | |

Advanced Micro Devices, Inc. * | | | 2,714 | | | | 390,545 | |

Analog Devices, Inc. | | | 2,211 | | | | 388,627 | |

Applied Materials, Inc. | | | 415 | | | | 65,304 | |

ASML Holding NV (Registered), NYRS (Netherlands) | | | 97 | | | | 77,226 | |

Enphase Energy, Inc. * | | | 53 | | | | 9,696 | |

Intel Corp. | | | 193 | | | | 9,940 | |

Lam Research Corp. | | | 215 | | | | 154,617 | |

Microchip Technology, Inc. | | | 201 | | | | 17,499 | |

Micron Technology, Inc. | | | 94 | | | | 8,756 | |

NVIDIA Corp. | | | 948 | | | | 278,816 | |

NXP Semiconductors NV (China) | | | 1,748 | | | | 398,159 | |

QUALCOMM, Inc. | | | 99 | | | | 18,104 | |

Texas Instruments, Inc. | | | 1,342 | | | | 252,927 | |

| | | | | | | | |

| | | | | | | 2,070,216 | |

| | | | | | | | |

Software — 8.5% | |

Ceridian HCM Holding, Inc. * | | | 433 | | | | 45,231 | |

Fortinet, Inc. * | | | 29 | | | | 10,422 | |

HubSpot, Inc. * | | | 38 | | | | 25,048 | |

Intuit, Inc. | | | 308 | | | | 198,112 | |

Microsoft Corp. | | | 5,868 | | | | 1,973,526 | |

Oracle Corp. | | | 1,189 | | | | 103,693 | |

salesforce.com, Inc. * | | | 129 | | | | 32,783 | |

Synopsys, Inc. * | | | 167 | | | | 61,539 | |

Workday, Inc., Class A * | | | 140 | | | | 38,245 | |

| | | | | | | | |

| | | | | | | 2,488,599 | |

| | | | | | | | |

Specialty Retail — 4.2% | |

AutoZone, Inc. * | | | 83 | | | | 174,000 | |

Best Buy Co., Inc. | | | 324 | | | | 32,919 | |

Carvana Co. * | | | 139 | | | | 32,219 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | | | |

| | | | | |

| 14 | | | | | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | DECEMBER 31, 2021 |

| | | | | | | | |

| INVESTMENTS | | SHARES | | | VALUE ($) | |

Common Stocks — continued | | | | | | | | |

Specialty Retail — continued | |

Gap, Inc. (The) | | | 1,462 | | | | 25,804 | |

Home Depot, Inc. (The) | | | 399 | | | | 165,589 | |

Lowe’s Cos., Inc. | | | 1,650 | | | | 426,492 | |

O’Reilly Automotive, Inc. * | | | 249 | | | | 175,851 | |

Ross Stores, Inc. | | | 852 | | | | 97,367 | |

TJX Cos., Inc. (The) | | | 1,538 | | | | 116,765 | |

| | | | | | | | |

| | | | | | | 1,247,006 | |

| | | | | | | | |

Technology Hardware, Storage & Peripherals — 5.5% | |

Apple, Inc. | | | 8,807 | | | | 1,563,859 | |

Seagate Technology Holdings plc | | | 408 | | | | 46,096 | |

| | | | | | | | |

| | | | | | | 1,609,955 | |

| | | | | | | | |

Textiles, Apparel & Luxury Goods — 1.1% | |

NIKE, Inc., Class B | | | 1,627 | | | | 271,172 | |

Tapestry, Inc. | | | 1,193 | | | | 48,436 | |

| | | | | | | | |

| | | | | | | 319,608 | |

| | | | | | | | |

Tobacco — 0.6% | |

Altria Group, Inc. | | | 810 | | | | 38,386 | |

Philip Morris International, Inc. | | | 1,421 | | | | 134,995 | |

| | | | | | | | |

| | | | | | | 173,381 | |

| | | | | | | | |

Wireless Telecommunication Services — 0.3% | |

T-Mobile US, Inc. * | | | 832 | | | | 96,495 | |

| | | | | | | | |

Total Common Stocks

(Cost $26,802,793) | | | | | | | 29,291,860 | |

| | | | | | | | |

| | | | | | | | |

| INVESTMENTS | | SHARES | | | VALUE ($) | |

Short-Term Investments — 0.2% | |

|

Investment Companies — 0.2% | |

JPMorgan U.S. Government Money Market Fund Class IM Shares, 0.03% (a) (b)

(Cost $64,327) | | | 64,327 | | | | 64,327 | |

| | | | | | | | |

Total Investments — 99.9%

(Cost $26,867,120) | | | | 29,356,187 | |

Other Assets Less Liabilities — 0.1% | | | | 31,360 | |

| | | | | |

NET ASSETS — 100.0% | | | | 29,387,547 | |

| | | | | |

Percentages indicated are based on net assets.

Abbreviations

| | |

| NYRS | | New York Registry Shares |

| (a) | | Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. |

| (b) | | The rate shown is the current yield as of December 31, 2021. |

| * | | Non-income producing security. |

| | | | | | | | | | | | | | | | | | |

| Futures contracts outstanding as of December 31, 2021: | |

| DESCRIPTION | | NUMBER OF

CONTRACTS | | EXPIRATION

DATE | | | TRADING

CURRENCY | | | NOTIONAL

AMOUNT ($) | | | VALUE AND

UNREALIZED

APPRECIATION

(DEPRECIATION) ($) | |

|

Long Contracts | |

| | | | | |

| Micro E-Mini S&P 500 Index | | 2 | | | 03/2022 | | | | USD | | | | 47,598 | | | | 579 | |

| | | | | | | | | | | | | | | | | | |

Abbreviations

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2021 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | | | | 15 |

JPMorgan Active Value ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF DECEMBER 31, 2021 (Unaudited)

| | | | | | | | |

| INVESTMENTS | | SHARES | | | VALUE ($) | |

Common Stocks — 98.4% | | | | | | | | |

Aerospace & Defense — 3.5% | |

Boeing Co. (The) * | | | 959 | | | | 193,066 | |

General Dynamics Corp. | | | 899 | | | | 187,414 | |

Northrop Grumman Corp. | | | 416 | | | | 161,021 | |

Raytheon Technologies Corp. | | | 4,929 | | | | 424,190 | |

| | | | | | | | |

| | | | | | | 965,691 | |

| | | | | | | | |

Air Freight & Logistics — 1.2% | |

FedEx Corp. | | | 807 | | | | 208,722 | |

United Parcel Service, Inc., Class B | | | 614 | | | | 131,605 | |

| | | | | | | | |

| | | | | | | 340,327 | |

| | | | | | | | |

Airlines — 0.9% | |

Delta Air Lines, Inc. * | | | 1,875 | | | | 73,275 | |

Southwest Airlines Co. * | | | 4,032 | | | | 172,731 | |

| | | | | | | | |

| | | | | | | 246,006 | |

| | | | | | | | |

Auto Components — 0.4% | |

Lear Corp. | | | 566 | | | | 103,550 | |

| | | | | | | | |

Automobiles — 1.1% | |

General Motors Co. * | | | 5,009 | | | | 293,678 | |

| | | | | | | | |

Banks — 11.7% | |

Bank of America Corp. | | | 18,396 | | | | 818,438 | |

Citigroup, Inc. | | | 6,108 | | | | 368,862 | |

Citizens Financial Group, Inc. | | | 1,285 | | | | 60,716 | |

M&T Bank Corp. | | | 506 | | | | 77,712 | |

People’s United Financial, Inc. | | | 14,899 | | | | 265,500 | |

PNC Financial Services Group, Inc. (The) | | | 918 | | | | 184,077 | |

Truist Financial Corp. | | | 8,125 | | | | 475,719 | |

US Bancorp | | | 1,685 | | | | 94,647 | |

Wells Fargo & Co. | | | 17,890 | | | | 858,362 | |

| | | | | | | | |

| | | | | | | 3,204,033 | |

| | | | | | | | |

Beverages — 1.3% | |

Coca-Cola Co. (The) | | | 4,740 | | | | 280,655 | |

PepsiCo, Inc. | | | 419 | | | | 72,785 | |

| | | | | | | | |

| | | | | | | 353,440 | |

| | | | | | | | |

Biotechnology — 4.7% | |

AbbVie, Inc. | | | 2,953 | | | | 399,836 | |

Amgen, Inc. | | | 294 | | | | 66,141 | |

Biogen, Inc. * | | | 369 | | | | 88,531 | |

BioMarin Pharmaceutical, Inc. * | | | 464 | | | | 40,994 | |

Neurocrine Biosciences, Inc. * | | | 906 | | | | 77,164 | |

Regeneron Pharmaceuticals, Inc. * | | | 430 | | | | 271,554 | |

Vertex Pharmaceuticals, Inc. * | | | 1,549 | | | | 340,160 | |

| | | | | | | | |

| | | | | | | 1,284,380 | |

| | | | | | | | |

Building Products — 0.4% | |

Trane Technologies plc | | | 536 | | | | 108,288 | |

| | | | | | | | |

Capital Markets — 6.3% | |

BlackRock, Inc. | | | 351 | | | | 321,362 | |

Charles Schwab Corp. (The) | | | 1,817 | | | | 152,810 | |

Goldman Sachs Group, Inc. (The) | | | 412 | | | | 157,611 | |

Intercontinental Exchange, Inc. | | | 1,347 | | | | 184,229 | |

Morgan Stanley | | | 2,651 | | | | 260,222 | |

S&P Global, Inc. | | | 214 | | | | 100,993 | |

| | | | | | | | |

| INVESTMENTS | | SHARES | | | VALUE ($) | |

| | | | | | | | |

Capital Markets — continued | |

State Street Corp. | | | 4,089 | | | | 380,277 | |

T. Rowe Price Group, Inc. | | | 877 | | | | 172,453 | |

| | | | | | | | |

| | | | | | | 1,729,957 | |

| | | | | | | | |

Chemicals — 3.5% | |

Air Products and Chemicals, Inc. | | | 566 | | | | 172,211 | |

Axalta Coating Systems Ltd. * | | | 6,240 | | | | 206,669 | |

Celanese Corp. | | | 1,001 | | | | 168,228 | |

DuPont de Nemours, Inc. | | | 527 | | | | 42,571 | |

Eastman Chemical Co. | | | 1,150 | | | | 139,046 | |

FMC Corp. | | | 2,040 | | | | 224,176 | |

| | | | | | | | |

| | | | | | | 952,901 | |

| | | | | | | | |

Commercial Services & Supplies — 0.3% | |

Republic Services, Inc. | | | 645 | | | | 89,945 | |

| | | | | | | | |

Construction Materials — 0.5% | |

Vulcan Materials Co. | | | 653 | | | | 135,550 | |

| | | | | | | | |

Consumer Finance — 1.0% | |

American Express Co. | | | 881 | | | | 144,132 | |

Capital One Financial Corp. | | | 981 | | | | 142,333 | |

| | | | | | | | |

| | | | | | | 286,465 | |

| | | | | | | | |

Containers & Packaging — 0.3% | |

Ball Corp. | | | 416 | | | | 40,048 | |

Sealed Air Corp. | | | 815 | | | | 54,988 | |

| | | | | | | | |

| | | | | | | 95,036 | |

| | | | | | | | |

Diversified Financial Services — 1.2% | |

Berkshire Hathaway, Inc., Class B * | | | 1,139 | | | | 340,561 | |

| | | | | | | | |

Electric Utilities — 1.7% | |

Edison International | | | 2,507 | | | | 171,103 | |

Entergy Corp. | | | 403 | | | | 45,398 | |

FirstEnergy Corp. | | | 1,476 | | | | 61,387 | |

NextEra Energy, Inc. | | | 1,369 | | | | 127,810 | |

Xcel Energy, Inc. | | | 1,012 | | | | 68,512 | |

| | | | | | | | |

| | | | | | | 474,210 | |

| | | | | | | | |

Electrical Equipment — 1.1% | |

Eaton Corp. plc | | | 1,776 | | | | 306,928 | |

| | | | | | | | |

Entertainment — 1.5% | |

Activision Blizzard, Inc. | | | 3,385 | | | | 225,204 | |

Electronic Arts, Inc. | | | 836 | | | | 110,268 | |

Walt Disney Co. (The) * | | | 518 | | | | 80,233 | |

| | | | | | | | |

| | | | | | | 415,705 | |

| | | | | | | | |

Equity Real Estate Investment Trusts (REITs) — 2.0% | |

AvalonBay Communities, Inc. | | | 212 | | | | 53,549 | |

Host Hotels & Resorts, Inc. * | | | 18,043 | | | | 313,768 | |

Ventas, Inc. | | | 1,117 | | | | 57,101 | |

Vornado Realty Trust | | | 2,315 | | | | 96,906 | |

Weyerhaeuser Co. | | | 852 | | | | 35,085 | |

| | | | | | | | |

| | | | | | | 556,409 | |

| | | | | | | | |

Food & Staples Retailing — 2.7% | |

BJ’s Wholesale Club Holdings, Inc. * | | | 1,346 | | | | 90,142 | |

Performance Food Group Co. * | | | 940 | | | | 43,137 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | | | |

| | | | | |

| 16 | | | | | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | DECEMBER 31, 2021 |

| | | | | | | | |

| INVESTMENTS | | SHARES | | | VALUE ($) | |

Common Stocks — continued | | | | | | | | |

Food & Staples Retailing — continued | |

US Foods Holding Corp. * | | | 13,393 | | | | 466,478 | |

Walmart, Inc. | | | 996 | | | | 144,111 | |

| | | | | | | | |

| | | | | | | 743,868 | |

| | | | | | | | |

Food Products — 1.9% | |

Bunge Ltd. | | | 299 | | | | 27,915 | |

Lamb Weston Holdings, Inc. | | | 6,079 | | | | 385,287 | |

Mondelez International, Inc., Class A | | | 1,687 | | | | 111,865 | |

| | | | | | | | |

| | | | | | | 525,067 | |

| | | | | | | | |

Health Care Equipment & Supplies — 2.5% | |

Becton Dickinson and Co. | | | 541 | | | | 136,051 | |

Medtronic plc | | | 1,861 | | | | 192,520 | |

Zimmer Biomet Holdings, Inc. | | | 2,751 | | | | 349,487 | |

| | | | | | | | |

| | | | | | | 678,058 | |

| | | | | | | | |

Health Care Providers & Services — 5.7% | |

Anthem, Inc. | | | 190 | | | | 88,072 | |

Centene Corp. * | | | 5,947 | | | | 490,033 | |

Cigna Corp. | | | 1,802 | | | | 413,793 | |

Humana, Inc. | | | 217 | | | | 100,658 | |

McKesson Corp. | | | 624 | | | | 155,108 | |

UnitedHealth Group, Inc. | | | 634 | | | | 318,357 | |

| | | | | | | | |

| | | | | | | 1,566,021 | |

| | | | | | | | |

Hotels, Restaurants & Leisure — 3.2% | |

Booking Holdings, Inc. * | | | 111 | | | | 266,314 | |

McDonald’s Corp. | | | 485 | | | | 130,014 | |

Royal Caribbean Cruises Ltd. * | | | 6,201 | | | | 476,857 | |

| | | | | | | | |

| | | | | | | 873,185 | |

| | | | | | | | |

Household Durables — 0.5% | |

Newell Brands, Inc. | | | 6,617 | | | | 144,515 | |

| | | | | | | | |

Household Products — 0.6% | |

Procter & Gamble Co. (The) | | | 962 | | | | 157,364 | |

| | | | | | | | |

Industrial Conglomerates — 0.5% | |

Honeywell International, Inc. | | | 641 | | | | 133,655 | |

| | | | | | | | |

Insurance — 3.7% | |

Allstate Corp. (The) | | | 375 | | | | 44,119 | |

American International Group, Inc. | | | 3,823 | | | | 217,376 | |

Chubb Ltd. | | | 1,039 | | | | 200,849 | |

Hartford Financial Services Group, Inc. (The) | | | 1,812 | | | | 125,100 | |

Loews Corp. | | | 966 | | | | 55,796 | |

Marsh & McLennan Cos., Inc. | | | 368 | | | | 63,966 | |

MetLife, Inc. | | | 1,566 | | | | 97,859 | |

Prudential Financial, Inc. | | | 1,130 | | | | 122,311 | |

Travelers Cos., Inc. (The) | | | 523 | | | | 81,813 | |

| | | | | | | | |

| | | | | | | 1,009,189 | |

| | | | | | | | |

Interactive Media & Services — 0.9% | |

Alphabet, Inc., Class C * | | | 81 | | | | 234,381 | |

| | | | | | | | |

IT Services — 0.7% | |

Fidelity National Information Services, Inc. | | | 610 | | | | 66,582 | |

International Business Machines Corp. | | | 596 | | | | 79,661 | |

Sabre Corp. * | | | 6,538 | | | | 56,161 | |

| | | | | | | | |

| | | | | | | 202,404 | |

| | | | | | | | |

| | | | | | | | |

| INVESTMENTS | | SHARES | | | VALUE ($) | |

| | | | | | | | |

Machinery — 2.9% | |

Dover Corp. | | | 1,245 | | | | 226,092 | |

Parker-Hannifin Corp. | | | 1,395 | | | | 443,777 | |

Stanley Black & Decker, Inc. | | | 245 | | | | 46,212 | |

Terex Corp. | | | 601 | | | | 26,414 | |

Timken Co. (The) | | | 738 | | | | 51,136 | |

| | | | | | | | |

| | | | | | | 793,631 | |

| | | | | | | | |

Media — 1.3% | |

Comcast Corp., Class A | | | 7,000 | | | | 352,310 | |

| | | | | | | | |

Metals & Mining — 2.2% | |

Alcoa Corp. | | | 3,728 | | | | 222,114 | |

Freeport-McMoRan, Inc. | | | 8,294 | | | | 346,109 | |

Rio Tinto plc, ADR (Australia) | | | 522 | | | | 34,943 | |

| | | | | | | | |

| | | | | | | 603,166 | |

| | | | | | | | |

Multiline Retail — 0.7% | |

Dollar General Corp. | | | 511 | | | | 120,509 | |

Kohl’s Corp. | | | 1,506 | | | | 74,381 | |

| | | | | | | | |

| | | | | | | 194,890 | |

| | | | | | | | |

Multi-Utilities — 1.2% | |

CenterPoint Energy, Inc. | | | 4,795 | | | | 133,829 | |

CMS Energy Corp. | | | 2,222 | | | | 144,541 | |

Public Service Enterprise Group, Inc. | | | 680 | | | | 45,376 | |

| | | | | | | | |

| | | | | | | 323,746 | |

| | | | | | | | |

Oil, Gas & Consumable Fuels — 6.9% | |

Chevron Corp. | | | 5,100 | | | | 598,485 | |

ConocoPhillips | | | 4,557 | | | �� | 328,924 | |

Diamondback Energy, Inc. | | | 2,315 | | | | 249,673 | |

EOG Resources, Inc. | | | 2,083 | | | | 185,033 | |

Hess Corp. | | | 1,683 | | | | 124,592 | |

Occidental Petroleum Corp. | | | 3,708 | | | | 107,495 | |

Pioneer Natural Resources Co. | | | 1,294 | | | | 235,353 | |

Valero Energy Corp. | | | 717 | | | | 53,854 | |

| | | | | | | | |

| | | | | | | 1,883,409 | |

| | | | | | | | |

Pharmaceuticals — 4.5% | |

Bristol-Myers Squibb Co. | | | 9,247 | | | | 576,551 | |

Eli Lilly & Co. | | | 581 | | | | 160,484 | |

Johnson & Johnson | | | 1,803 | | | | 308,439 | |

Merck & Co., Inc. | | | 596 | | | | 45,677 | |

Organon & Co. | | | 1,493 | | | | 45,462 | |

Pfizer, Inc. | | | 1,634 | | | | 96,488 | |

| | | | | | | | |

| | | | | | | 1,233,101 | |

| | | | | | | | |

Road & Rail — 1.2% | |

CSX Corp. | | | 4,087 | | | | 153,671 | |

Norfolk Southern Corp. | | | 486 | | | | 144,687 | |

Union Pacific Corp. | | | 145 | | | | 36,530 | |

| | | | | | | | |

| | | | | | | 334,888 | |

| | | | | | | | |

Semiconductors & Semiconductor Equipment — 2.5% | |

Analog Devices, Inc. | | | 1,254 | | | | 220,416 | |

Lam Research Corp. | | | 81 | | | | 58,251 | |

NXP Semiconductors NV (China) | | | 743 | | | | 169,240 | |

Texas Instruments, Inc. | | | 1,223 | | | | 230,499 | |

| | | | | | | | |

| | | | | | | 678,406 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2021 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | | | | 17 |

JPMorgan Active Value ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF DECEMBER 31, 2021 (Unaudited) (continued)

| | | | | | | | |

| INVESTMENTS | | SHARES | | | VALUE ($) | |

Common Stocks — continued | | | | | | | | |

Software — 0.8% | |

Microsoft Corp. | | | 654 | | | | 219,953 | |

| | | | | | | | |

Specialty Retail — 2.9% | |

AutoZone, Inc. * | | | 80 | | | | 167,711 | |

Gap, Inc. (The) | | | 2,857 | | | | 50,426 | |

Home Depot, Inc. (The) | | | 456 | | | | 189,245 | |

Lowe’s Cos., Inc. | | | 627 | | | | 162,067 | |

O’Reilly Automotive, Inc. * | | | 98 | | | | 69,211 | |

TJX Cos., Inc. (The) | | | 2,107 | | | | 159,963 | |

| | | | | | | | |

| | | | | | | 798,623 | |

| | | | | | | | |

Technology Hardware, Storage & Peripherals — 1.6% | |

Apple, Inc. | | | 449 | | | | 79,729 | |

Seagate Technology Holdings plc | | | 3,222 | | | | 364,022 | |

| | | | | | | | |

| | | | | | | 443,751 | |

| | | | | | | | |

Textiles, Apparel & Luxury Goods — 1.3% | |

Kontoor Brands, Inc. | | | 966 | | | | 49,508 | |

NIKE, Inc., Class B | | | 1,023 | | | | 170,503 | |

Tapestry, Inc. | | | 3,335 | | | | 135,401 | |

| | | | | | | | |

| | | | | | | 355,412 | |

| | | | | | | | |

Tobacco — 0.6% | |

Philip Morris International, Inc. | | | 1,796 | | | | 170,620 | |

| | | | | | | | |

Wireless Telecommunication Services — 0.3% | |

T-Mobile US, Inc. * | | | 760 | | | | 88,145 | |

| | | | | | | | |

Total Common Stocks

(Cost $25,534,721) | | | | | | | 27,024,818 | |

| | | | | | | | |

| | | | | | | | |

| INVESTMENTS | | SHARES | | | VALUE ($) | |

Short-Term Investments — 1.6% | |

|

Investment Companies — 1.6% | |

JPMorgan U.S. Government Money Market Fund Class IM Shares, 0.03% (a) (b)

(Cost $429,866) | | | 429,866 | | | | 429,866 | |

| | | | | | | | |

Total Investments — 100.0%

(Cost $25,964,587) | | | | 27,454,684 | |

Other Assets Less Liabilities — 0.0% (c) | | | | 11,664 | |

| | | | | |

NET ASSETS — 100.0% | | | | 27,466,348 | |

| | | | | |

Percentages indicated are based on net assets.

Abbreviations

| | |

| ADR | | American Depositary Receipt |

| (a) | | Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. |

| (b) | | The rate shown is the current yield as of December 31, 2021. |

| (c) | | Amount rounds to less than 0.1% of net assets. |

| * | | Non-income producing security. |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | | | |

| | | | | |

| 18 | | | | | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | DECEMBER 31, 2021 |

JPMorgan Equity Premium Income ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF DECEMBER 31, 2021 (Unaudited)

| | | | | | | | |

| INVESTMENTS | |

SHARES | | | VALUE ($) | |

Common Stocks — 82.6% | | | | | | | | |

Aerospace & Defense — 0.4% | |

Northrop Grumman Corp. | | | 59,502 | | | | 23,031,439 | |

| | | | | | | | |

Air Freight & Logistics — 1.3% | |

United Parcel Service, Inc., Class B | | | 358,119 | | | | 76,759,226 | |

| | | | | | | | |

Banks — 1.6% | |

US Bancorp | | | 1,092,686 | | | | 61,376,173 | |

Wells Fargo & Co. | | | 664,346 | | | | 31,875,321 | |

| | | | | | | | |

| | | | | | | 93,251,494 | |

| | | | | | | | |

Beverages — 3.2% | |

Coca-Cola Co. (The) | | | 1,295,541 | | | | 76,708,983 | |

Constellation Brands, Inc., Class A | | | 124,263 | | | | 31,186,285 | |

PepsiCo, Inc. | | | 443,755 | | | | 77,084,681 | |

| | | | | | | | |

| | | | | | | 184,979,949 | |

| | | | | | | | |

Biotechnology — 2.7% | |

AbbVie, Inc. | | | 622,609 | | | | 84,301,259 | |

Regeneron Pharmaceuticals, Inc. * | | | 53,544 | | | | 33,814,107 | |

Vertex Pharmaceuticals, Inc. * | | | 183,431 | | | | 40,281,447 | |

| | | | | | | | |

| | | | | | | 158,396,813 | |

| | | | | | | | |

Building Products — 1.4% | |

Trane Technologies plc | | | 403,642 | | | | 81,547,793 | |

| | | | | | | | |

Capital Markets — 2.2% | |

Intercontinental Exchange, Inc. | | | 397,800 | | | | 54,407,106 | |

S&P Global, Inc. | | | 152,905 | | | | 72,160,457 | |

| | | | | | | | |

| | | | | | | 126,567,563 | |

| | | | | | | | |

Chemicals — 2.7% | |

Air Products and Chemicals, Inc. | | | 105,719 | | | | 32,166,063 | |

Corteva, Inc. | | | 755,329 | | | | 35,711,955 | |

Linde plc (United Kingdom) | | | 117,909 | | | | 40,847,215 | |

PPG Industries, Inc. | | | 289,747 | | | | 49,963,973 | |

| | | | | | | | |

| | | | | | | 158,689,206 | |

| | | | | | | | |

Containers & Packaging — 0.6% | |

Avery Dennison Corp. | | | 174,414 | | | | 37,772,840 | |

| | | | | | | | |

Diversified Financial Services — 0.9% | |

Berkshire Hathaway, Inc., Class B* | | | 185,925 | | | | 55,591,575 | |

| | | | | | | | |

Diversified Telecommunication Services — 1.1% | |

Verizon Communications, Inc. | | | 1,241,027 | | | | 64,483,763 | |

| | | | | | | | |

Electric Utilities — 4.2% | |

Alliant Energy Corp. | | | 751,648 | | | | 46,203,802 | |

Duke Energy Corp. | | | 446,769 | | | | 46,866,068 | |

Evergy, Inc. | | | 508,429 | | | | 34,883,314 | |

FirstEnergy Corp. | | | 719,139 | | | | 29,908,991 | |

NextEra Energy, Inc. | | | 825,906 | | | | 77,106,584 | |

Xcel Energy, Inc. | | | 197,164 | | | | 13,348,003 | |

| | | | | | | | |

| | | | | | | 248,316,762 | |

| | | | | | | | |

Electrical Equipment — 1.0% | |

Eaton Corp. plc | | | 342,251 | | | | 59,147,818 | |

| | | | | | | | |

| | | | | | | | |

| INVESTMENTS | |

SHARES | | | VALUE ($) | |

| | | | | | | | |

Entertainment — 0.4% | |

Netflix, Inc. * | | | 42,507 | | | | 25,607,917 | |

| | | | | | | | |

Equity Real Estate Investment Trusts (REITs) — 3.0% | |

Camden Property Trust | | | 57,982 | | | | 10,360,224 | |

Equinix, Inc. | | | 46,103 | | | | 38,995,761 | |

Prologis, Inc. | | | 310,971 | | | | 52,355,078 | |

Public Storage | | | 114,470 | | | | 42,875,883 | |

Sun Communities, Inc. | | | 163,209 | | | | 34,268,994 | |

| | | | | | | | |

| | | | | | | 178,855,940 | |

| | | | | | | | |

Food & Staples Retailing — 1.7% | |

Costco Wholesale Corp. | | | 85,439 | | | | 48,503,720 | |

Walmart, Inc. | | | 340,188 | | | | 49,221,802 | |

| | | | | | | | |

| | | | | | | 97,725,522 | |

| | | | | | | | |

Food Products — 2.5% | |

Hershey Co. (The) | | | 376,920 | | | | 72,922,712 | |

Mondelez International, Inc., Class A | | | 1,118,929 | | | | 74,196,182 | |

| | | | | | | | |

| | | | | | | 147,118,894 | |

| | | | | | | | |

Health Care Equipment & Supplies — 1.2% | |

Abbott Laboratories | | | 174,563 | | | | 24,567,997 | |