Exhibit 99.1

| | |

| IMPAIRMENT | | |

| |

| STUDY | | Nilimedix Ltd. |

| |

| | Sindolor Medical Ltd. |

| |

| | March 2010 |

| |

| |  |

BDO Ziv Haft Consulting Group

Amot Bituach I louse Building. B.

46-48 Menachem Begin Rd.

Tel Aviv 66184

Tel: 972 3 6386894 Fax: 972 3 6382511

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

March 2010

To:

Mr. Loberman Amir, CFO

D. Medical Industries Ltd.

Re:An Impairment Examination Study of Nilimedix and Sindolor

We were requested by D. Medical Industries Ltd. (hereinafter:“D. Medical”) to perform an Impairment Examination Study (hereinafter:“the Study”) of its subsidiaries Nilimedix Ltd. (hereinafter:“Nilimedix”) and Sindolor Medical Ltd. (hereinafter:“Sindolor”) as of December 31, 2007 and December 31, 2009 (hereinafter: the“Valuation Dates”) under the requirements of Statement of International Accounting standards 36 (IAS 36). To the best of our knowledge there is no prevention, legal or other, to perform the Study enclosed herein.

The Study was prepared for D. Medical and its management for the purpose of reporting its financial statements as of December 31, 2009 and as of December 31, 2007 and may be provided to their external auditors. Unless required by applicable law (for instance, reference to a performance of an impairment test and its implications in the financial statements), it is not to be used or quoted in a prospectus and/or any other document without receiving our prior written consent.

Based on our study, we have concluded that Nilimedix’ and Sindolor’ Goodwill are not deemed to be impaired, as of December 31, 2009 and December 31, 2007.

The following table displays Nilimedix revocable amount compared to the carrying amount:

NILIMEDIX

| | | | |

Valuation Date | | 31/12/2007 | | 31/12/2009 |

Total Carrying Amount | | 3,580 | | 11,619 |

Total Recoverable Amount | | 30,335 | | 63,287 |

The following table displays Sindolor revocable amount compared to the carrying amount:

SINDOLOR

| | | | |

Valuation Date | | 31/12/2007 | | 31/12/2009 |

Total Carrying Amount | | 2,459 | | 3,209 |

Total Recoverable Amount | | 15,363 | | 25,379 |

In the course of our Annual Goodwill Impairment Test, we relied upon financial and other information, including prospective financial information, obtained from Management and from various public, financial and industry sources. Our conclusion is dependent on such information being complete and accurate in all material respects.

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

| • | | The principal sources of information used in performing our Annual Goodwill Impairment Test include: |

| • | | Nilimedix and Sindolor’ audited financial statements for the fiscal years ended 2006, 2007 and 2008; |

| • | | Nilimedix and Sindolor’ unaudited income statements and balance sheets breakdown for the fiscal year ended 2009; |

| • | | Management projections for Nilimedix for the years 2010-2015 (hereinafter: “Nilimedix’s Projection”); |

| • | | Nilimedix Ltd. And Sindolor Medical Ltd. – Impairment study performed by BDO as of December 31, 2008; |

| • | | Sindolor Medical Ltd. – Valuation study performed by BDO as of June 30, 2009; |

| • | | Other information provided by Management, either written or oral; |

| • | | Discussions with Management; |

| • | | Publicly available information (articles, websites) regarding the industry; and |

| • | | Yahoo! Finance and other relevant financial websites. |

In forming our opinion we have relied on sources, which appeared to us as reliable, and nothing came to our attention, which is likely to indicate the lack of reasonability of the data we used. We did not examine the data in an independent manner and, therefore, our work does not constitute verification of the correctness, completeness or accuracy of the data.

Details regarding the valuation specialist

BDO Consulting and Management Ltd. was founded by the partners of BDO Certified Public Accountants.

BDO Consulting and Management is part of the international BDO network, provides a full range of business services required for national and international businesses in any sector. Our company has vast experience in the following fields: business valuations, financial and tax due diligence, goodwill and intangible assets valuations, financial analyses, business plans, project finance PFI/PPP advisory, M&A, investment banking and more.

Sincerely yours,

BDO Consulting and Management Ltd.

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

Table of content

| | | | |

| 1. | | Business Overview | | 5 |

| | |

| 1.1. | | Company Overview – Nilimedix | | 5 |

| | |

| 2. | | Company Overview – Sindolor Medical Ltd. | | 7 |

| | |

| 2.1. | | Financial Overview – Nilimedix | | 8 |

| | |

| 2.2. | | Financial Overview – Sindolor | | 9 |

| | |

| 3. | | Industry Overview | | 10 |

| | |

| 3.1. | | Background | | 10 |

| | |

| 3.2. | | Market Overview | | 11 |

| | |

| 3.3. | | Competition | | 13 |

| | |

| 4. | | Methodology | | 15 |

| | |

| 4.1. | | IAS 36 – General | | 15 |

| | |

| 4.2. | | Definitions | | 15 |

| | |

| 4.3. | | Determining an Impairment Loss | | 16 |

| | |

| 5. | | Applying IAS 36 – Goodwill | | 18 |

| | |

| 5.1. | | IAS 36 – Long Lived Assets | | 18 |

| | |

| 5.2. | | IAS 36 – Goodwill | | 18 |

| | |

| 6. | | Company Valuation – Nilimedix and Sindolor | | 19 |

| | |

| 6.1. | | Nilimedix investment round – Valuation as of December 31st 2007 | | 19 |

| | |

| 6.2. | | Nilimedix DCF as of December 31st 2009 | | 20 |

| | |

| 6.3. | | Sindolor DCF as of December 31st, 2009 | | 23 |

| | |

| 6.4. | | Sindolor DCF as of December 31st, 2009 | | 26 |

| |

| Appendix A – Statement of General Assumptions and Limiting Conditions | | 29 |

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

1. Business Overview

1.1. Company Overview – Nilimedix

Nilimedix Ltd. was established in 2002 as part of the Israel incubator program (Ministry of Industry Trade and Labor, Chief Scientist’s Office) and operates currently under D. Medical holding, quoted on the Tel-Aviv Stock Exchange (TLV: DMDC). The Company’s headquarters located at Tirat Carmel, Israel.

Nilimedix involves in developing technologies aimed at safer drug delivery as well as innovative measures for the most accurate Continuous Glucose Monitoring (CGM). Based on its core technology, the company has developed the ADI Insulin Pump, that has already received the CE-Mark and was FDA cleared, allowing its marketing both in the EU countries and in the US. Following this first generation product, the company also develops a single-use insulin pump.

In February 2006, a total sum of $1,500,000 was invested in the company in return for 72.99% of its shares. In February 2007, D. Medical signed an investment agreement which raised the holdings of D. Medical to 80.7%, in return for a total investment of $1.6 million.

In January 2008, D. Medical invested an additional amount of $4 million, and the holding share of D. Medical in Nilimedix rose to 87%. As of November 2008, D. Medical holds 92.24% of Nilimedix’s shares.

Nilimedix’s products

1.“ADI” Insulin Pump which offers the following features:

| | • | | Instant air bubble detection - enables immediate detection of air within the insulin cartridge before it reaches the tubing. This prevents the user from receiving air instead of insulin for a prolonged period before discovery, thus preventing hyperglycemia. |

| | • | | Immediate occlusion alarm - Nilimedix’s technology enables the user to immediately detect occlusion in the tubing due to the system’s ability to sense changes in pressure between the body and the pump. After a few minutes an alarm is sounded alerting the user to change the set. |

| | • | | Disposable - the moving elements arc disposable, thus less prone to fail—which enables the company’s product to be price competitive. |

| | • | | Overfilled cartridge detection - If the user tries to fill the cartridge with more than 300 units, an alert is sounded until he removes the excess insulin. |

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

| | • | | Magnesium housing - the metal housing ensures less chance for accidental damage. |

| | • | | User disconnect detection - an additional feature that is under development. |

| 2. | Disposable Insulin Pump system - the smallest available disposable insulin delivery system, which offers the following features (in additional to all the above mentioned features of the ADI Insulin Pump): |

| | • | | Single use drive-unit and reservoir; |

| | • | | Snap-on single use adhesive skin patch or belt clip option; |

| | • | | Optional pre-filled, off-the-shelf insulin cartridges; |

| | • | | Wireless remote monitor; |

| | • | | Programmable directly or remotely; |

| | • | | 300 Unit cartridge capacities (200 Unit model is under development). |

| 3. | Insulin Pump and CGM on one patch - an insulin pump system, enabling comfortable, precise and safe insulin management, combined with CGM (Continuous Glucose Monitoring) system, developed by an affiliated company. |

| 4. | Lighty - One-click painless inserter with its auto-retractable, hidden introducer needle protects against accidental activation or needle stick and reduces risk of infection. |

| 5. | Lighty DD - Unique Disconnect Detection—The Lighty DD’s disconnect detection uses a blocking mechanism that is integrated into the Base of the Infusion set. When the Base becomes detached from the user’s body medication flow is stopped and a pump alarm is provoked. |

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

| 2. | Company Overview - Sindolor Medical Ltd. |

Sindolor Medical Ltd. was established at September 2005 and operates under D. Medical holding since May 2007. The company’s headquarters are located at Israel.

Sindolor is developing a painless drug delivery system for regular subcutaneous injection using proprietary safety needles based on its proprietary EZject technology.

In May 2007, D. Medical Purchased 50.01% of Sindolor in return for $800,000, which divided into two parts—1,500,000 NIS as an investment and the rest as a loan. In March 2008, Sindolor took part at a financing round that brought D. Medical holding share to 57.55% in return to a sum of $756,000 (this amount was solely D. Medical part in the financing round).

The company’s products:

Sindolor’s products perform the customary injection/lancing procedures through a super cooled plate attached to the skin — blocking pain signal from passing.

Sindolor activities are currently focused on two product lines:

| | 1. | Sindolor’s Freoject™ - is an alleviated pain personal auto-injector that is designed for frequently injecting chronic patients and will be marketed through the pharmaceutical companies selling these drugs. |

| | 2. | Alleviated pain lancets product line (for diabetes patients) - the products developed under this product line will use the same core technology in order to eliminate finger prick pain. |

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

2.1.Financial Overview -Nilimedix

Following arc Nilimedix’s balance sheets as of 31/12/07, 31/12/08 and 31/12/09 (in NIS thousands):

| | | | | | | | | |

Nilimedix’s Balance Sheet (‘000 NIS) | | 31/12/2006

Audited | | 31/12/2007

Audited | | 31/12/2008

Audited | | 31/12/2009

Unaudited | |

| Assets | | | | | | | | | |

Current Assets | | | | | | | | | |

Cash & Equivalents | | 1,145 | | 1,281 | | 4,949 | | 1,185 | |

Short Term Deposits | | — | | — | | 2,433 | | — | |

Other Receivables | | 735 | | 1,324 | | 1,250 | | 1,576 | |

Inventory | | | | — | | | | 559 | |

| | | | | | | | | |

Total Current Assets | | 1,880 | | 2,605 | | 8,632 | | 3,321 | |

| | | | | | | | | |

Long Term Deposits | | 27 | | 38 | | 99 | | 107 | |

Fixed Assets | | 189 | | 311 | | 554 | | 1,157 | |

Intangibles Assets | | 39 | | 85 | | 76 | | 100 | |

| | | | | | | | | |

Total Assets | | 2,135 | | 3,039 | | 9,361 | | 4,684 | |

| | | | | | | | | |

| | | | |

Liabilities & Shareholders’ Equity | | | | | | | | | |

Current Liabilities | | | | | | | | | |

Trade payables | | 174 | | 699 | | 742 | | 748 | |

Accrued liabilities and other payables | | 353 | | 656 | | 2,723 | | 3,860 | |

| | | | | | | | | |

Total Current Liabilities | | 527 | | 1,355 | | 3,465 | | 4,608 | |

| | | | | | | | | |

Long-term liabilities | | | | | | | | | |

Participation of the Chief Scientist Research and Developments, Net | | | | | | 3,193 | | 4,915 | |

Rent Liability | | | | | | | | 181 | |

Employees Benefits Liability | | 97 | | 129 | | 134 | | 213 | |

| | | | | | | | | |

Total Long-term Liabilities | | 97 | | 129 | | 3,327 | | 5,309 | |

| | | | | | | | | |

Total liabilities | | 624 | | 1,484 | | 6,792 | | 9,917 | |

| | | | | | | | | |

| | | | |

Total shareholders’ equity | | 1,511 | | 1,555 | | 2,569 | | (5,232 | ) |

| | | | | | | | | |

Total Liabilities & Shareholders’ Equity | | 2,135 | | 3,039 | | 9,361 | | 4,684 | |

| | | | | | | | | |

Following are Nilimedix Income statements for 2006-2009 (in NIS thousands):

| | | | | | | | | | | | |

Nilimedix’s P&L draft (“000 NIS) | | 31/12/2006

Audited | | | 31/12/2007

Audited | | | 31/12/2008

Audited | | | 31/12/2009

Unaudited | |

Sales | | | | | | | | | | | 368 | |

Cost of Sales | | | | | | | | | | | 351 | |

| | | | | | | | | | | | |

Gross Profit | | | | | | | | | | | 719 | |

| | | | | | | | | | | | |

| | | | |

R&D expenses | | 2,727 | | | 5,990 | | | 8,984 | | | 8,455 | |

G&A expenses | | 269 | | | 617 | | | 1,025 | | | 1,915 | |

| | | | | | | | | | | | |

Total Operating expenses | | 2,996 | | | 6,607 | | | 10,009 | | | 10,370 | |

| | | | | | | | | | | | |

| | | | |

Financing Income (expenses), net | | 56 | | | (138 | ) | | 10 | | | (26 | ) |

Capital gain | | 15 | | | | | | | | | | |

Other expenses | | | | | | | | 3,193 | | | (1,696 | ) |

| | | | | | | | | | | | |

Net income (loss) | | (2,925 | ) | | (6,745 | ) | | (13,192 | ) | | (11,373 | ) |

| | | | | | | | | | | | |

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

| 2.2. | Financial Overview - Sindolor |

Following are Sindolor’s balance sheets as of 31/12/07, 31/12/08 and 31/12/09 (in NIS thousands):

| | | | | | |

Sindolor’s Balance Sheet draft (‘000 NIS) | | 31/12/2007

Audited | | 31/12/2008

Audited | | 31/12/2009

Unaudited |

Assets | | | | | | |

Current Assets | | | | | | |

Cash & Equivalents | | 851 | | 1,691 | | 214 |

Other Receivables | | 75 | | 75 | | 37 |

| | | | | | |

Total Current Assets | | 926 | | 1,766 | | 251 |

| | | | | | |

Fixed Assets | | 13 | | 23 | | 18 |

Intangibles Assets | | 2,546 | | 2,546 | | 2,546 |

| | | | | | |

Total Assets | | 3,485 | | 4,335 | | 2,814 |

| | | | | | |

| | | |

Liabilities & Shareholders’ Equity | | | | | | |

Current Liabilities | | | | | | |

Trade Payables | | 132 | | 85 | | 70 |

Accrued liabilities and Other Parables | | 791 | | 152 | | 94 |

| | | | | | |

Total Current Liabilities | | 923 | | 237 | | 164 |

| | | | | | |

Long-term liabilities | | | | | | |

Loans from related parties | | 1,718 | | — | | — |

| | | |

Total shareholders’ equity | | 844 | | 4,098 | | 2,650 |

| | | | | | |

Total Liabilities & Shareholders’ Equity | | 3,485 | | 4,335 | | 2,814 |

| | | | | | |

Following are Sindolor’s Income statements for 2007-2009 (in NIS thousands):

| | | | | | | | | |

Sindolor’s P&L draft (‘000 NIS) | | 31/12/2007

Audited | | | 31/12/2008

Audited | | | 31/12/2009

Unaudited | |

R&D expenses | | 1,202 | | | 2,531 | | | 1,196 | |

G&A expenses | | 100 | | | 261 | | | 436 | |

| | | | | | | | | |

Total Operating expenses | | 1,302 | | | 2,792 | | | 1,632 | |

| | | | | | | | | |

| | | |

Financing Income (Expenses), net | | (149 | ) | | (37 | ) | | (2 | ) |

| | | | | | | | | |

Net income (Loss) | | (1,451 | ) | | (2,829 | ) | | (1,630 | ) |

| | | | | | | | | |

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

Diabetes is a chronic disease that occurs when the pancreas does not manufacture enough insulin, or alternatively, when the body cannot effectively use the insulin it produces. Insulin is a hormone that controls the sugar level in the bloodstream. If the sugar is not converted into energy for the body to use, it builds up. In the long term, too much sugar, or glucose, in the body can lead to damage to the heart, blood vessels, eyes, kidneys and nerves. The level of glucose in the blood can also fluctuate throughout the day and needs to be closely monitored and controlled.

As a direct consequence of the continuing rise in diabetes, the market for diabetes monitoring and controlling products continues to grow. Diabetes is often closely associated with the weight condition and general health of an individual. A lack of regular exercise and tendency toward obesity of the global population will likely drive up incidence rates of diabetes. This trend is expected to continue as the World Health Organization (WHO) projects an escalating prevalence worldwide as more cases are identified.

Progress in finding new treatments in care, new products (both therapeutic and diagnostic), new developments in long-term treatments, and maturing public health priorities will continue to create new shifts in the diabetes care industry.

Diabetes affects at least 170 million people worldwide and is increasing, with the WHO predicting 300 million diabetics by 2025. The United States alone has 20.8 million people suffering from diabetes, equaling 6% of the population. Diabetes is currently ranked sixth as a cause of death in the U.S.

There is no single remedy for diabetes. Likewise there is no cure Most treatments are multi-pronged—a focus on a healthy, controlled diet, regular exercise and use of medications. As the disease progresses, regular daily injections of insulin may be required. The diabetes care industry is divided into several categories. First is the medication and pharmaceutical industry which covers the types of medication used including insulin, insulin storage and its administration. There is also a significant business in medications to prevent the progress of the disease. These include Alternative Insulin Delivery Systems as well as a range of Oral And Diabetics (OADs) on the other.

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

Following is a map showing the expected Number of people with diabetes globally per country in 2010 as published by the International Diabetes Federation:

As part of a diabetes care program, an individual with diabetes needs access to monitoring supplies such as test strips and blood glucose measuring hand-held meters. This has boosted the production of various monitoring equipment and other pathological infrastructure items assisting the diagnosis and sustained treatment of diabetes.

Diabetes is the single most costly chronic disease. In 2007, diabetes accounted for $174 billion in health care costs (on both drugs and devices) in the US, while the world spent is estimated $215 billion to $375 billion. That is an increase of 32% since 2002. This figure is expected to double over the next two decades.

| 1 | “The world diabetes market, 2007-2025: an analysis of diabetes drug and insulin market”, Renub Research report, 2009. |

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

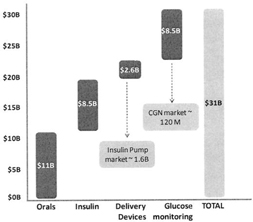

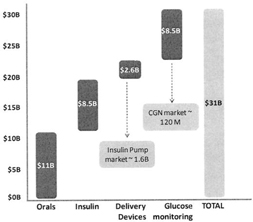

The global diabetes care devices market was valued at approximately $11 billion2 in 2009, while the Insulin market was valued at $1.6 billion. Increasing affordability coupled with efforts to raise awareness towards better diabetes care management has resulted in rapid market penetration of products in the last seven years. The market is expected to continue with an increased growth over the next seven years to reach $18 billion in 2016 with a forecast Compounded Annual Growth Rate (CAGR) of 10% during 2009-20163. Increasing incidence of diabetes and the increase in affordability of devices for patients in developing nations will drive this growth.

Although the works are going on to make the oral-pills an alternative for insulin but at present none of the systems have mimics the physiology of insulin secretion. So it is expected hat insulin market will keep on growing to reach US$ 15 Billion by 2012. In future Insulin demand will be driven by countries such as US, China, India, Brazil, Russia and Germany.

| 2 | “The Future of the Diabetes Care Devices Market to 2016 - The Key Demand Drivers Remain Intact”, GBI research, January 2010 |

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

3.3.Competition

Following is a description of several companies operating in the industry:

Insulet Corporation - the company is a medical device company that develops, manufactures and markets insulin infusion system for people with insulin-dependent diabetes. The Company’s OmniPod Insulin Management System (OmniPod System) consists of its OmniPod disposable insulin infusion device and its handheld, wireless Personal Diabetes Manager. The United States Food and Drug Administration have approved the OmniPod System for sale in the United States.

Medtronic - Medtronic is a global player in medical technology. The Company operates in seven segments that manufacture and sell device-based medical therapies: Cardiac Rhythm Disease Management, Spinal, CardioVascular, Neuromodulation, Diabetes, Surgical Technologies and Physio-Control. Through these seven segments, the Company develops, manufactures and markets its medical devices in more than 120 countries. Its primary products include those for cardiac rhythm disorders, cardiovascular disease, neurological disorders, spinal conditions and musculoskeletal trauma, urological and digestive disorders, diabetes, and ear, nose and throat conditions. The Company Diabetes segment offers external insulin pumps, continuous glucose monitors, carelink therapy management software, and blood glucose meters.

Animas - Animas develops computerized pager-sized insulin pumps that diabetes patients “wear” and which continuously deliver rapid-acting insulin into the body. The infusion pumps, which are connected to a tube with a needle at the end that’s inserted under the skin, replace the use of periodic insulin injections. Animas also sell diabetes management software and various pump accessories. It markets its products worldwide through a combination of direct sales representatives and distributors. The company is a subsidiary of Johnson & Johnson, reporting to J&J’s LifeScan division.

I-Flow Corporation - 1-Flow Corporation is designing, developing and marketing drug delivery systems and surgical products for post-surgical pain relief and surgical site care. The Company’s products are used in hospitals, free-standing surgery centers, homes and other The Group’s principal activities are to design, develop, manufacture and market technically advanced and low-cost ambulatory infusion systems. It operates in single operating segment; the Company has identified two product lines: Regional Anesthesia & TV Infusion Therapy. It manufactures compact, portable infusion pumps, catheters and pain kits that administer local anesthetic, chemotherapy, nutritional supplement and other medications. The customers of the

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

Group include Hospitals and alternate site settings. It markets its products through its distributors in United States, Canada, Europe, Asia, Mexico, Brazil, Australia, New Zealand and the Middle East.

External Insulin Pump System, Market Share by Supplier, 2008*

| * | Source: Medtech Insight Market Intelligence, October 2009, Vol ll, no. 9 |

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

4. Methodology

4.1. IAS 36 - General

The International Accounting Standard 36Impairment of Assets (hereinafter “LAS 36”) objective is to prescribe the procedures that an entity applies to ensure that its assets arc carried at no more than their recoverable amount. An asset is carried at more than its recoverable amount if its carrying amount exceeds the amount to be recovered through use or sale of the asset. If this is the case, the asset is described as impaired and the Standard requires the entity to recognize an impairment loss. The Standard also specifies when an entity should reverse an impairment loss and prescribes disclosures.

This Standard shall be applied in accounting for the impairment of all assets (other than exceptions as they appear in the standard content) or cash generating unit(s) including goodwill acquired from business combination. Goodwill acquired in business combination represents the value of the intangible assets which cannot be separately identified or separately recognized. Goodwill does not generate cash flow independently from other cash-generating unit(s), and often contributes to the cash flows of several cash-generating units. The Standard requires goodwill acquired in a business combination to be tested for impairment as part of impairment testing of the cash-generating unit(s) to which it relates, once a year or when there is a sign of impairment loss.

4.2. Definitions

The following terms are used in this Standard with the meanings specified:

Carrying amount is the amount at which an asset is recognized after deducting any accumulated depreciation (amortization) and accumulated impairment losses thereon.

A cash-generating unit is the smallest identifiable group of assets that generates cash inflows that are independent of the cash inflows from other assets or groups of assets.

Corporate assets are assets other than goodwill that contribute to the future cash flows of both the cash-generating unit under review and other cash-generating units.

Depreciation (Amortization) is the systematic allocation of the depreciable amount of an asset over its useful life4

| 4 | In the case of an intangible asset, the term ‘amortization’ is generally used instead of ‘depreciation’. The two terms have the same meaning. |

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

Fair value less costs to sell is the amount obtainable from the sale of an asset or cash-generating unit in an arm’s length transaction between knowledgeable, willing parties, less the costs of disposal.

An impairment loss is the amount by which the carrying amount of an asset or a cash-generating unit exceeds its recoverable amount.

The recoverable amount of an asset or a cash-generating unit is the higher of its fair value less costs to sell and its value in use.

Useful life is either:

| | (a) | The period of time over which an asset is expected to be used by the entity; or |

| | (b) | The number of production or similar units expected to be obtained from the asset by the entity. |

Value in use is the present value of the future cash flows expected to be derived from an asset or cash-generating unit.

4.3. Determining an Impairment Loss

The Standard defines number of steps for the identification, recognition and measurement of value loss of an asset or cash generating unit. Moving on to the next step is subjected to the fulfillment of the previous step.

Step A – Identifying an asset that may be impaired

An entity shall assess at each reporting date whether there is any indication that an asset may be impaired. In assessing whether there is any indication that an asset may be impaired, an entity shall consider, as a minimum, the following indications:

External sources of information

| | • | | During the period, an asset’s market value has declined significantly more than would be expected as a result of the passage of time or normal use. |

| | • | | Significant changes with an adverse effect on the entity have taken place during the period, or will take place in the near future, in the technological, market, economic or legal environment in which the entity operates or in the market to which an asset is dedicated. |

| | • | | Market interest rates or other market rates of return on investments have increased during the period, and those increases arc likely to affect the discount rate used in calculating an asset’s value in use and decrease the asset’s recoverable amount materially. |

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

| | • | | The carrying amount of the net assets of the entity is more than its market capitalization. |

Internal sources of information

| | • | | Evidence is available of obsolescence or physical damage of an asset. |

| | • | | Significant changes with an adverse effect on the entity have taken place during the period, or arc expected to take place in the near future, in the extent to which, or manner in which, an asset is used or is expected to be used. These changes include the asset becoming idle, plans to discontinue or restructure the operation to which an asset belongs, plans to dispose of an asset before the previously expected date, and reassessing the useful life of an asset as finite rather than indefinite. |

| | • | | Evidence is available from internal reporting that indicates that the economic performance of an asset is, or will be, worse than expected. |

If any indication of value loss exists, the entity shall estimate the recoverable amount of the asset. In case the value of the recoverable amount found is lower than the respective Carrying amount, the entity shall depreciate the value of the asset or the Cash-generating unit accordingly.

The standard requires an intangible asset with an indefinite useful life or not yet available for use and goodwill to be tested for impairment, once a year, regardless to the existence of indication of value loss.

Step B – Deriving the Recoverable amount

The Recoverable amount will be the higher of values between the Fair value less costs to sell and the Value in use.

Step C – Recognizing and Measuring an Impairment Loss

As mentioned in step B, the recoverable amount will be the higher of values between the Fair value less costs to sell and the Value in use. An entity shall depreciate the value of an Asset or a Cash-generating unit if, and only if, the Recoverable amount of the Asset or the Cash-generating unit is lower than its respective Carrying amount.

In order to determine the need for impairment, this study was prepared using Value in use approach.

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

5. Applying IAS 36 – Goodwill

5.1. IAS 36 – Long Lived Assets

The Long Lived Assets of the Company, according to the Company’s assessments following the acquisition, include Nilimedix and Sindolor’s Goodwill.

5.2. IAS 36 – Goodwill

To perform the impairment examination we have executed the following methodologies:

| | 1. | The values in use of net assets of Nilimedix and Sindolor’s as of December 31, 2009 and of Sindolor as of December 31, 2007 were evaluated by using the discounted cash flow (DCF) method under the income approach. |

| | 2. | Nilimedix’s value as of December 31, 2007 was derived from the closest investment round. |

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

6. Company Valuation – Nilimedix and Sindolor

6.1. Nilimedix investment round – Valuation as of December 31st 2007

We based our valuation of the Company as of December 31st, 2007 on an investment round made in January 20, 2008. In January D. Medical has signed an agreement with Nilimedix to transfer USD 4 million in several parts in exchange for 267,032 ordinary shares.

In January 20, 2008 the first part was transferred as follows: a total sum of USD 164 thousands or approximately NIS 620 thousands in return for 10,948 shares, reflecting a value of NIS 56.62 per share. We derived the equity value based on 559,031 shares5 to a total of NIS 31,654 thousands. For calculating the revocable amount we subtracted cash and cash equivalents.

NILIMEDIX Valuation Date: 31/12/2007

| | |

(NIS Thousands) | | |

Share Price - January 2008 Investment (NIS) | | 56.62 |

Number of shares as of December 31, 2007 | | 559,031 |

| | |

Equity value as of December 31. 2007 | | 31,654 |

Less: cash and cash equivalents | | 1,319 |

| | |

Total Recoverable Amount | | 30,335 |

| | |

Following is the carrying amount calculation:

NILIMEDIX Valuation Date: 31/12/2007

| | | |

(NIS Thousands) | | | |

Other assets attributed to Nilimedix’s activity | | 4,003 | |

Working Capital | | (734 | ) |

Fixed Assets | | 311 | |

| | | |

Total Carrying Amount | | 3,580 | |

| | | |

Since the recoverable amount is higher than the carrying amount, there is no need to measure the value in use and the assets are not deemed to be impaired.

| 5 | The total number of shares, issued and outstanding, according to company’s financial statements as of December 31, 2007. |

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

6.2. Nilimedix DCF as of December 31st 2009

As mentioned before, we received Nilimedix’s business plan regarding its revenues and expenses for 2010-2015. In our estimations we relied on the Company’s forecasts and on external data from relevant public sources.

Following arc our main assumptions and parameters used in the study:

Revenues – In August-September 2009 the company has signed its first distribution agreements in Europe and Mexico. These agreements are valid for the next 2-3 years and include minimum orders by the distributors. We examined these agreements compared to the company’s projections and find projections reasonable, both the amounts and the sale prices projected. Also, we assumed an annual 10% increase in diabetes care devices market based on GBI research6. We assumed a gradual 5% penetration to the global market of “Adi Insulin Pump” over a period of 6 years and a gradual 1% penetration to the global market for the “Disposable Insulin Pump” over 6 years.

Comparing the features of competing products, the company’s non disposable pump offers better features in terms of size, disposability, battery life and obtains an analytic capability of drug effectiveness to be used by the pharmaceutical distributor. ‘The disposable pump offers a cheaper alternative aimed mainly for type 2 diabetes patients, whose medical insurance is low, and struggle with the high cost of the non-disposable pump. The Company assumes that providing a cheaper alternative will create a new market target. In its projections, the Company’s assumes lower prices for its products than the prices agreed in its distribution agreements and lower comparing to market prices. This is consistent with price erosion tendency in the medical device market and to the Company’s marketing model that assumes the marketing expenses are carried by the distributor, hence the company should offer lower prices comparing to similar companies that use a direct to client market approach.

In our estimation, we assumed relatively high growth rates in the first 5 years, which is consistent with the company’s upcoming expansion and more moderate rate of 5% and 3% in sixth and the terminal year, relatively.

Gross Profit – We assumed a gross loss in 2010 and a gradual growth of the gross profit to an average of 64% out of revenues in the terminal year. We based this assumption on the company’s analysis regarding the costs of its products projected for 2010-2015. The Company assumes a significant cost reduction along with its growth which will derive from economics of scale. Also, our estimations are consistent with the gross rates of similar companies, which operate in medical devices field.

| 6 | “The Future of the Diabetes Care Devices Market to 2016 - The Key Demand Drivers Remain Intact”, GBI research, January 2010 |

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

Research and Development expenses – we assumed the company will reach USD 3 Million R&D expenses in 2011 consistent with the company’s assessments. Also, we surmise R&D expenses will gradually converge into 13% out of revenues in the terminal year, consistent with similar companies’ rates.

Selling and Marketing & General and Administrative expenses – The Company engages with pharmaceutical companies as distributors for its products. Since the pharmaceutical company fills the insulin pumps with their drug, the Company’s marketing model is framed in a way that the distributors carry most of Selling and Marketing expenses. Hence, for selling and marketing expenses in our valuation, we assumed a mild rate of 8% out of revenues. For General and Administrative expenses we assumed gradual convergence into 12% out of revenues. Assuming the Company will reach the revenues we predict, its G&A expenses are expected to increase rapidly in the first years and converge to a reasonable rate of 12% out of revenues in the terminal year. Our assumptions of the Company’s S&M and G&A expenses, out of revenues, are in the range of the Company’s projections (lower limit) and of similar companies S&M and G&A expenses (higher limit).

Depreciation and Capital expenditures – For estimating the investments in property and equipment, we have used the historical investment-depreciation rate decreasing in a straight line method from actual 3.37 in 2009 to 1 in the terminal year. Accordingly, the depreciation rate was set to approximately 30% of expected fixed assets balance, a 1.5% average rate of Revenues. This is consistent with the Company’s assessment that no material investment is required for Nilimedix’s operation.

Working Capital – Since we could not relay on historical working capital, we based our estimations on the Company’s management projections and the recent distribution agreements. We estimated the working capital to be 30 days for trade receivables as well as trade payables and 45 days for inventory.

Discount Rate Estimation – We have implemented a post tax discount rate of 25%. Our estimation is according to the following directives from the AICPA aid guide “Assets Acquired in a Business Combination to Be Used in Research and Development Activities: A Focus on Software, Electronic Devices, and Pharmaceutical Industries”:

| | | | |

Stage of Development | | Plumnmer | | Scherlis and Sahlman |

Start-up | | 50% - 70% | | 50% - 70% |

First Stage or “early Development” | | 40% - 60% | | 40% - 60% |

Second Stage or “Expansion” | | 35% - 50% | | 35% - 50% |

Bridge/IPO | | 25% - 35% | | 25% - 35% |

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

As Nilimedix initiate selling its products (and is not a start-up/first stage/second stage), we assumed the lower discount rate of the above mentioned directive. However, since Nilimedix is at a primal stage of distribution and still carries a considerable risk (such as the possibility of sudden ending of its distribution agreements), we found that 25% reasonably represents the Company’s discount rate.

According to IAS 36, while measuring the recoverable amount, no income tax receipts or payments should be included. Therefore, we should measure a Pre-tax discount rate. According to our estimation the pre-tax discount rate totals to approximately 28%.

Terminal Value Calculation – Terminal growth rate of 3% was determined based upon the real economy expected growth rate for all companies in the long run.

According to the above assumptions and estimations, the resulted value of Nilimedix is NIS 63,287 thousands.

Following is a sensitivity analysis for the resulted value, according to growth and discount rates:

| | | | | | | | | | |

| | | 2.00% | | 2.5% | | 3.00% | | 3.5% | | 4.00% |

26% | | 71,414 | | 73,568 | | 75,816 | | 78,164 | | 80,619 |

27% | | 64,941 | | 66,867 | | 68,873 | | 70,964 | | 73,146 |

28% | | 59,719 | | 61,468 | | 63,287 | | 65,180 | | 67,153 |

28% | | 59,074 | | 60,801 | | 62,598 | | 64,467 | | 66,415 |

29% | | 53,741 | | 55,295 | | 56,909 | | 58,587 | | 60,331 |

Following is the carrying amount calculation:

NILIMEDIX Valuation Date: 31/12/2009

| | | |

(NIS Thousands) | | | |

Other assets attributed to Nilimedix’s activity | | 11,120 | |

Working Capital | | (56 | ) |

Fixed Assets | | 554 | |

| | | |

Total Carrying Amount | | 11,619 | |

| | | |

Since the recoverable amount is higher than the carrying amount, the assets are not deemed to be impaired.

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

6.3. Sindolor DCF as of December 31st, 2007

For this valuation we used the following: Sindolor’s expenses budget as made for 2008, our previous valuation study of Sindolor as of December 31, 2008 and the Company’s estimations regarding Sindolor’s future activity from the Valuation date’s point of view.

Following are our main assumptions and parameters used in the study:

Revenues – As mentioned above we based our valuation on our study as of December 2008. By comparing the Company’s condition in December 2008 as of December 2007 and based on the Company’s assumptions, the projections as of December 2007 should be more optimistic due to the Company’s willing to engage with a large distributor at that point. During 2007, the Company’s intentions were to distribute only through pharmaceutical companies and also, market conditions were belter during 2007. However, since there was no guarantee for binding an agreement with the distributor at that point and by using a conservative approach, we assumed revenues projections to be similar of those from in our study as of December 2008/ these revenues represent lower income than the Company’s business plan.

Gross Profit – We assumed a gradual growth of the gross profit to an average of 67% out of revenues in the terminal year. We based this assumption on the company’s analysis regarding the costs of its products. The Company assumes a significant cost reduction along with its growth which will derive from economics of scale. Also, our estimations are consistent with the gross rates of similar companies.

Research and Development expenses – The R&D expenses include the projected expenses until the products launch expected in 2010. The Management projected that the customization of the products and further development expenses will reach 15% out of sales starting 2010 and onwards.

Selling and Marketing expenses – The S&M expenses include the sales team salaries, freight expense and other S&M expenses (cars, advertising, brochures, promotion etc). Since the Company operates in a competitive market, it is expected the expenses to reach 25% out of Revenues in the year 2010 and gradually decreases into 20% in the terminal year.

General and Administrative expenses – The G&A expenses include the Company management’s salaries and other expenses (advising, insurance, post etc). We assumed it will reach 10% out of sales at the year 2011 and onwards.

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

Depreciation and Capital expenditures – For estimating the investments in property and equipment, we have used the historical investment-depreciation rate decreasing in a straight line method to 1 in the terminal year. Accordingly, the depreciation rate was set to approximately 22% of expected fixed assets balance.

Working Capital – Since we could not relay on historical working capital, we based our estimations on the Company’s management projections and the recent distribution agreements. We estimated the working capital to be 90 days for trade receivables as well as trade payables and 45 days for inventory.

Discount Rate Estimation – We have implemented a post tax discount rate of 30%. Our estimation is according to the following directives from the AICPA aid guide “Assets Acquired in a Business Combination to Be Used in Research and Development Activities: A Focus on Software, Electronic Devices, and Pharmaceutical Industries”:

| | | | |

Stage of Development | | Plummer | | Scherlis and Sahlman |

Start-up | | 50% - 70% | | 50% - 70% |

First Stage or “early Development” | | 40% - 60% | | 40% - 60% |

Second Stage or “Expansion” | | 35% - 50% | | 35% - 50% |

Bridge/IPO | | 25% - 35% | | 25% - 35% |

As of December 2007, the Company docs not have revenues and its products still being developed, however at that point the company had a non binding agreement with a large distributor. Taking all into account we estimated the discount rate at 30%.

According to IAS 36, while measuring the recoverable amount, no income tax receipts or payments should be included. Therefore, we should measure a Pre-tax discount rate. According to our estimation the pre-tax discount rate totals to approximately 36%.

Terminal Value Calculation – Terminal growth rate of 3% was determined based upon the real economy expected growth rate for all companies in the long run.

According to the above assumptions and estimations, the resulted value of Sindolor’s operations as of December 31, 2007 is NIS 15,363 thousands.

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

Following is a sensitivity analysis for the resulted value, according to growth and discount rates:

| | | | | | | | | | |

| | | 2.00% | | 2.5% | | 3.00% | | 3.5% | | 4.00% |

34.0% | | 17,018 | | 17,198 | | 17,382 | | 17,573 | | 17,771 |

35.0% | | 15,809 | | 15,969 | | 16,135 | | 16,305 | | 16,482 |

36% | | 15,060 | | 15,209 | | 15,363 | | 15,522 | | 15,686 |

37.0% | | 13,665 | | 13,795 | | 13,928 | | 14,066 | | 14,207 |

38.0% | | 12,714 | | 12,831 | | 12,951 | | 13,075 | | 13,202 |

Following is the carrying amount calculation:

SINDOLOR Valuation Date: 31/12/2007

| | | |

(NIS Thousands) | | | |

Other assets attributed to Sindolor’s activity | | 2,546 | |

Working Capital | | (101 | ) |

Fixed Assets | | 13 | |

| | | |

Total Carrying Amount | | 2,459 | |

| | | |

Since the recoverable amount is higher than the carrying amount, the assets are not deemed to be impaired.

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

6.4. Sindolor DCF as of December 31st, 2009

We based our valuation on Sindolor revenues forecasts for the years 2010-2014 according to the Company’s in-process products. The Company’s expectations7 are based on researches regarding each of its products. The forecast is based on projections of units sold and projected prices.

Following are our main assumptions and parameters used in the study:

Revenues – The negotiations with the distributor did not mature and since mid 2009, the company has decided to focus on new profitable products. The Company has decided also distribute on direct to client approach (marketing directly to pharmacies) instead of marketing through distributors (pharmaceutical companies). This will broaden the potential market since the Company’s products will not be identified with a pharmaceutical specific drug, but will reach all diabetes patients. Most of the Company’s products are ready for distribution within a period of 6-8 months including an engineering phase of 2-3 months. Considering marketing efforts the Company expects to launch its products starting from 2011: Freoject and GU projected to the beginning of 2011, Cliniject and Cliniject disposables beginning of 2012.

We assumed a rapid growth in 2011-2013 since the Company’s products arc already in a final stage of development and during 2010 most of company efforts will be marketing. Since 2014 we assumed a moderate growth of 5% and 3% growth rate in the terminal year.

Gross Profit – We assumed that as the ratio of the revenues from Company’s product will evolve the gross profit will converge to 66.3% at the terminal year. The Company projects that gross profit rates from Freoject, GU, Cliniject and Cliniject disposables will stand at 68%, 60%, 80% and 67% respectively, therefore as the change in mixture of products will occur the gross profit will change accordingly.

Research and Development expenses – The R&D expenses include the projected expenses until the products launch in 2011-2012, and the customization and further development required after the launches. The Management projects these expenses would reach 15% out of sales in the year 2011 and onwards.

| 7 | Examples of researches that were Company’s base of information: Persisting For Painless MonitoringFrost & Sullivan Asia Pacific. U.S. Blood Pressure Monitoring Equipment marketwww.frost.com. |

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

Selling and Marketing expenses – The S&M expenses include the sales team salaries, freight expense and other S&M expenses (cars, advertising, brochures, promotion etc). The Company has changed its marketing model during 2008 and decided to also distribute on direct to client approach (marketing directly to pharmacies) instead of marketing through distributors (pharmaceutical companies). Hence, these expenses are expected to be higher than before and reach 25% out of Revenues in the year 2011 and onwards.

General and Administrative expenses: The G&A expenses include the Company management’s salaries and other expenses (advising, insurance, post etc). We assumed it will reach 10% out of sales at the year 2011 and onwards.

Depreciation and Capital expenditures – For estimating the investments in property and equipment, we have used the historical investment-depreciation rate decreasing in a straight line method from actual 0.55 in 2009 to 1 in the terminal year. Accordingly, the depreciation rate was set to approximately 22% of expected fixed assets balance

Working Capital – Since we could not relay on historical working capital, we based our estimations on the Company’s management projections. We estimated the working capital to be 90 days for trade receivables as well as trade payables and 45 days for inventory, similar to our previous study.

Discount Rate Estimation – We have implemented a post tax discount rate of 30%. Our estimation is according to the following directives from the AICPA aid guide “Assets Acquired in a Business Combination to Be Used in Research and Development Activities: A Focus on Software, Electronic Devices, and Pharmaceutical Industries”:

| | | | |

Stage of Development | | Plummer | | Scherlis and Sahlman |

Start-up | | 50% - 70% | | 50% - 70% |

First Stage or “early Development” | | 40% - 60% | | 40% - 60% |

Second Stage or “Expansion” | | 35% - 50% | | 35% - 50% |

Bridge/IPO | | 25% - 35% | | 25% - 35% |

As described above, the Company develops a painless drug delivery system. At the date of the valuation the Company has a prototype and FDA approval of the first generation injector. However, as the Company docs not have revenues and due to its business model which include high commercial risks we estimated the discount rate to be at 30%.

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

According to IAS 36, while measuring the recoverable amount, no income tax receipts or payments should be included. Therefore, we should measure a Pre-tax discount rate. According to our estimation the pre-tax discount rate totals to approximately 36%.

Terminal Value Calculation – Terminal growth rate of 3% was determined based upon the real economy expected growth rate for all companies in the long run.

According to the above assumptions and estimations, the resulted value of Sindolor’s operations as of December 31, 2009 is NIS 25,379 thousands.

Following is a sensitivity analysis for the resulted value, according to growth and discount rates:

| | | | | | | | | | |

| | | 2.00% | | 2.5% | | 3.00% | | 3.5% | | 4.00% |

34% | | 27,282 | | 27,534 | | 27,795 | | 28,064 | | 28,342 |

35% | | 25,700 | | 25,928 | | 26,163 | | 26,405 | | 26,655 |

36% | | 24,940 | �� | 25,156 | | 25,379 | | 25,609 | | 25,847 |

37% | | 22,866 | | 23,053 | | 23,245 | | 23,442 | | 23,646 |

38% | | 21,594 | | 21,763 | | 21,938 | | 22,117 | | 22,302 |

Following is the carrying amount calculation:

SINDOLOR Valuation Date: 31/12/2009

| | | |

(NIS Thousands) | | | |

Other assets attributed to Sindolor's activity | | 3,244 | |

Working Capital | | (53 | ) |

Fixed Assets | | 18 | |

| | | |

Total Carrying Amount | | 3,209 | |

| | | |

Since the recoverable amount is higher than the carrying amount, the assets are not deemed to be impaired.

| | |

| | Nilimedix Ltd and Sindolor Medical Ltd. Impairment Test |

|

Appendix A - Statement of General Assumptions and Limiting Conditions

| 1. | The information contained in this document and attached schedules are based in part upon audited and un-audited financial statements and forecasts prepared by D. Medical; we express no opinion as to the completeness and accuracy of such information. |

| 2. | The reported analyses, opinions and conclusions are limited only by the reported assumptions and limiting conditions, and represents our personal, unbiased professional analyses, opinions and conclusions. |

| 3. | We are not responsible for the impact of any information that was not disclosed to us. |

| 4. | The findings arrived at herein are only valid through and based upon available information as of the date of this document; any conclusion(s) of value subsequent to this date must give effect to subsequent events and conditions. |

| 5. | These schedules are intended solely for the purpose of providing information to D. Medical for the preparation of its financial statements and should not be used nor relied upon by any third party to obtain financing or for any purpose other than stated herein. All financial data, operating histories and forecasts were provided by D. Medical or its representatives and appeared to us reliable, and nothing came to our attention, which is likely to indicate the lack of reasonability of the data we used. |

Our findings assume that all such information is substantially correct, and that there are no undisclosed circumstances or situations that would materially affect our findings. Our opinion(s) of value reflect current expectations and perceptions of market participants along with available factual data. We are not responsible for the non-realization of D. Medical’s projections.

| 6. | Neither the appraiser nor any other partners in BDO Ziv Haft Consulting and Management Ltd. has any present of contemplated future interest in the property being appraised, nor a personal interest or bias with respect to the parties involved. Our fee for the formulation and reporting of the conclusions expressed herein is not contingent upon the values or opinions presented. |