UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant [X] |

| Filed by a Party other than the Registrant [ ] |

| |

| Check the appropriate box: |

| |

| [ ] | | Preliminary Proxy Statement |

| [ ] | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | | Definitive Proxy Statement |

| [X] | | Definitive Additional Materials |

| [ ] | | Soliciting Material Pursuant to §240.14a-12 |

| | Neuberger Berman High Yield Strategies Fund Inc. | |

| | (Name of Registrant as Specified In Its Charter) | |

| | |

| | | |

| | (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |

| Payment of Filing Fee (Check the appropriate box): |

| [X] | | No fee required. |

| [ ] | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | |

| | | 1) | | Title of each class of securities to which transaction applies: |

| | | | | |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | 4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | 5) | | Total fee paid: |

| | | | |

| [ ] | | Fee paid previously with preliminary materials. |

| | |

| [ ] | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | |

| | | 1) | | Amount Previously Paid: |

| | | | | |

| | 2) | | Form, Schedule or Registration Statement No.: |

| | | | | |

| | 3) | | Filing Party: |

| | | | | |

| | 4) | | Date Filed: |

| | | | |

Letter to Stockholders | August 2019 |  |

| |

| Neuberger Berman High Yield Strategies Fund Inc. |

| NYSE American: NHS |

|

SABA CAPITAL MANAGEMENT, L.P. IS

ATTEMPTING TO DESTROY YOUR FUND

Vote your WHITE proxy card to defend your investment in NHS.

| ● | Your Fund’s Board strongly encourages you to vote your WHITE proxy card FOR your incumbent director nominees.

|

| ● | DO NOT support Saba’s1 inexperienced and hostile nominees and please vote AGAINST its two Stockholder Proposals.

|

| ● | Saba only wants to cash in and make a one-time gain and does not care about long-term stockholders or harming your Fund.

|

| ● | Your Board supports the Fund’s investment manager, Neuberger Berman Investment Advisers LLC, which has a history of delivering strong returns over various periods of time.

|

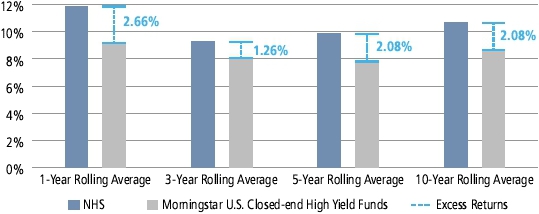

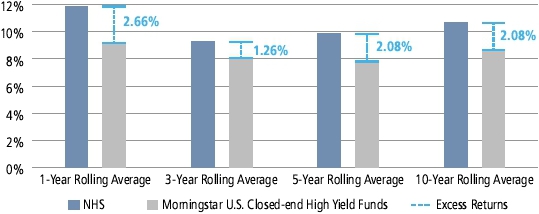

| ● | The Fund has outperformed the Morningstar U.S. Closed-end High Yield Fund Category for the rolling 1-, 3-, 5- and 10-year periods since the Fund’s inception.2

|

| ● | We believe Saba’s proposals will harm the Fund and its ability to generate competitive investment returns in the future. |

| 1 | Saba Capital Management, L.P. and certain entities it manages, including Saba Capital Master Fund, Ltd., which submitted the stockholder director nominations and the stockholder proposals, are hereinafter collectively referred to as “Saba.” |

| 2 | Source: Morningstar. Based on average total return, for both NAV and market price, through June 30, 2019. |

Dear Stockholder:

Enclosed you will find the Proxy Statement for the 2019 Annual Stockholders’ Meeting of Neuberger Berman High Yield Strategies Fund Inc. (the “Fund” or “NHS”). The Board of Directors of the Fund (the “Board”) is unanimously urging you to vote:

| 1. | FOR the election of your Board’s highly qualified and experienced nominees, Michael J. Cosgrove, Deborah C. McLean and Tom D. Seip (“Proposal 1”), and |

| |

| 2. | AGAINST each of the self-serving stockholder proposals submitted by Saba Capital Master Fund, Ltd.1, a dissident hedge fund. |

by promptly completing, signing, dating and returning the enclosed WHITE proxy card.

Saba Capital Management, L.P. is an opportunistic hedge fund manager looking for a short-term profit to the detriment of the Fund’s long-term stockholders.

Do not be fooled into thinking that Saba’s actions are for the benefit of all stockholders

As of July 31, 2019, the Fund had returned 16.71% over the prior one-year period based on its market price, beating the Morningstar U.S. Closed-end Fund High Yield Category average total return by 6.51%.3

Additional information about Fund performance and Neuberger Berman Investment Advisers LLC’s (“Neuberger Berman” or the “Manager”) history of generating strong investor returns is provided on the following pages and contained in the Fund’s Proxy Statement.

2

Saba alleges that Neuberger Berman has not managed the Fund properly and its performance has lagged…

…In reality, Neuberger Berman has a history of generating strong returns for the Fund.

AVERAGE TOTAL RETURN AND EXCESS RETURN OVER CATEGORY SINCE INCEPTION4

Based on Net Asset Value |

|

AVERAGE TOTAL RETURN AND EXCESS RETURN OVER CATEGORY SINCE INCEPTION4

Based on Market Value |

|

| 4 | Source: Morningstar. Represents average total return based on month-end returns for each 1-, 3-, 5- and 10-year period since the Fund’s inception on July 28, 2003, representing 180, 155, 132 and 72 periords measured, respectively. |

3

Saba alleges that the Board has not been effective in overseeing your Fund and that their slate of nominees would better protect stockholder value…

…In reality, Saba’s inexperienced, paid dissident nominees would only serve Saba’s interests and your Board has a history of being devoted to safeguarding your investment.

| ● | Under the Board’s leadership, the Fund has delivered significant value to stockholders and the Fund’s performance has been consistently strong. |

| | |

| ● | The three incumbent Board nominees are experienced and knowledgeable, independent of management and have consistently acted in the best interests of ALL stockholders. |

Your Board’s Three Independent and Highly Experienced Incumbent Nominees

Tom D. Seip

| ● | Director of the Fund since 2006; Independent Chair and/or Lead Independent Director of the Board since 2008. |

| |

| ● | Formerly, senior executive of The Charles Schwab Corporation, including Chief Executive Officer, Charles Schwab Investment Management, Inc. |

Michael J. Cosgrove

| ● | Director of NHS since 2015; formerly a longstanding executive with General Electric Company, including President, of GE mutual funds and Global Investment Programs for GE Asset Management. |

| |

| ● | Serves as the Chair of the Fund’s Audit Committee and Audit Committee Financial Expert. |

Deborah C. McLean

| ● | Director of NHS since 2015; professor of corporate finance and broad experience in the financial services industry, having served as Managing Director at Morgan Stanley. |

| |

| ● | Serves as the Chair of the Fund’s Contract Review Committee. |

4

The incumbent directors each currently serve on the Board of Directors for five other Neuberger Berman closed-end funds. They are highly experienced in matters affecting closed-end funds and have taken a variety of actions designed to enhance investor value and improve the funds’ competitiveness, which may narrow the discount between the market price relative to its NAV per share. These actions include:

| ● | managing the funds’ distribution rates and making changes in distribution rates, when necessary;

|

| ● | approving certain other discount mitigation measures, such as tender offer programs where a fund would conduct a tender offer if its market price traded at a certain discount level compared to its NAV;

|

| ● | approving fund mergers;

|

| ● | actively managing fund leverage structures in order to best position the fund to optimize its levered exposure at a reasonable cost; and

|

| ● | approving changes to funds’ investment strategies when they believe a different strategy would enhance investor return potential without undue risk. |

The Board believes that Saba’s reckless and self-serving proposals would:

| ● | waste Fund resources and risk a “fire sale” of assets by forcing the Fund to sell strategic investments at an inopportune time;

|

| ● | leave the Fund “orphaned” without an investment manager for potentially an extended period of time if the Fund’s Management Agreement was terminated;

|

| ● | impair the Fund’s ability to enhance total return through the use of leverage and cause the Fund to suffer substantial harm if it had to repay all or a portion of its leverage immediately;

|

| ● | potentially result in the Fund’s liquidation, cause stockholders to realize tax liabilities and deny stockholders the ability to own shares in a successful investment vehicle with long-term investment objectives. |

Please see the Proxy Statement, which is enclosed, for additional information.

5

Saba has a singular focus on its own self-interest and its own profits

| ● | Saba is a short-term investor that opportunistically acquires closed-end fund shares during periods of market dislocation, when closed-end funds often trade at larger discounts to NAV, and then seeks to maximize its profits in any way possible, including through means that often have a negative impact on long-term investor value. |

| | |

| ● | Saba shows disregard for its own fiduciary duties, including by its improper management of its ETF, in violation of regulatory requirements, representing a serious conflict of interest. |

We Plan to Vigorously Defend YOUR FUND!

Management and the Board plan to fight vigorously against Saba’s demands. We will be fighting for ALL stockholders and remain committed to taking those actions that we believe will best serve investors and enhance stockholder value.

6

Your Fund has retained Okapi Partners LLC (“Okapi”) as its proxy solicitor. If representatives of Okapi call you, they will clearly identify themselves as the proxy solicitor for the Fund.

We urge you to spend a few minutes reviewing the proposals in the accompanying Proxy Statement and to VOTE FOR THE RE-ELECTION OF YOUR FUND’S NOMINEES (PROPOSAL 1) and AGAINST Saba’s self-serving proposals (Proposal 2 and Proposal 3) by filling out and signing the enclosed WHITE PROXY CARD and returning it to us in the enclosed postage-paid envelope.

YOUR FUND NEEDS ALL OF ITS STOCKHOLDERS TO VOTE.

PLEASE DO NOT SEND BACK SABA’S GOLD PROXY CARD, even to withhold votes on Saba’s nominees, as this may cancel your prior vote for your Fund’s nominees. If you have already returned Saba’s gold proxy card, you can still support your Board and the Fund by returning the enclosed WHITE PROXY CARD. Only your latest dated proxy card submission will count.

If you have any questions, please contact our proxy solicitor:

1212 Avenue of the Americas, 24th Floor

New York, New York 10036

Telephone: 212.297.0720

Toll-Free: 888.785.6668

Email: info@okapipartners.com

7

|  |

| Neuberger Berman Investment Advisers LLC |

| 1290 Avenue of the Americas |

| New York, NY 10104-0001 |

| |

U0225 08/19 | www.nb.com |