UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF

THE SECURITIES EXCHANGE ACT OF 1934

GREEKTOWN SUPERHOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | |

Delaware

(State or other jurisdiction of

incorporation or organization) | | 27-2216916

(I.R.S. employer

identification no.) |

555 East Lafayette

Detroit, Michigan 48226

(Address of principal executive offices and zip code)

(313) 223-2999

(Registrant’s telephone number, including area code)

with copies to:

| | |

Allan S. Brilliant

Richard A. Goldberg

Dechert LLP

1095 Avenue of the Americas

New York, New York 10036

Telephone: (212) 698-3500

Facsimile: (212) 698-3599 | | Martin C. Glass

Goodwin Procter LLP

The New York Times Building

620 Eighth Avenue

New York, New York 10018

Telephone: (212) 813-8300

Facsimile: (212) 355-3333 |

Securities to be registered pursuant to Section 12(b) of the Act:

None

Securities to be registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.01 per share

Preferred Stock, par value $0.01 per share

Warrants

(Title of class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer£ Accelerated filer£ Non-accelerated filerR Smaller reporting company£

(Do not check if a smaller reporting company)

TABLE OF CONTENTS

Disclosure Regarding Forward-Looking Statements

This registration statement on Form 10 contains statements that we believe are, or may be considered to be, “forward-looking statements.” All statements other than statements of historical fact included in this registration statement regarding the prospects of our industry or our prospects, plans, financial position or business strategy may constitute forward-looking statements. In addition, forward-looking statements generally can be identified by the use of forward-looking words such as “may,” “will,” “expect,” “intend,” “estimate,” “foresee,” “project,” “anticipate,” “believe,” “plan,” “forecast,” “continue” or “could” or the negative of these terms or variations of them or similar terms. Furthermore, forward-looking statements may be included in various filings that we make with the Securities and Exchange Commission (the “SEC”) or press releases or oral statements made by or with the approval of one of our authorized executive officers. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot assure you that these expectations will prove to be correct. These forward-looking statements are subject to certain known and unknown risks and uncertainties, as well as assumptions that could cause actual results to differ materially from those reflected in these forward-looking statements. Factors that might cause actual results to differ include, but are not limited to, those discussed in the section entitled “Risk Factors” beginning on page 15 of this registration statement. Readers are cautioned not to place undue reliance on any forward-looking statements contained in this registration statement, which reflect management’s opinions only as of the date hereof. Except as required by law, we undertake no obligation to revise or publicly release the results of any revision to any forward-looking statements. You are advised, however, to consult any additional disclosures we make in our reports to the SEC. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained in this registration statement.

ITEM 1. BUSINESS

Background

Greektown Holdings, L.L.C. (“Greektown Holdings”) was formed in September 2005 as a limited liability company owned by Kewadin Greektown Casino, L.L.C. (“Kewadin Greektown”), which is 100% owned by Sault Ste. Marie Tribe of Chippewa Indians (the “Tribe”), and Monroe Partners, L.L.C. (“Monroe”). Greektown Holdings owns Greektown Casino, L.L.C. (“Greektown LLC”), which is engaged in the operation of a hotel and casino gaming facility known as Greektown Casino Hotel (“Greektown Casino”) located in downtown Detroit that opened November 10, 2000 under a license granted by the Michigan Gaming Control Board (“MGCB”) and a Development Agreement with the City of Detroit.

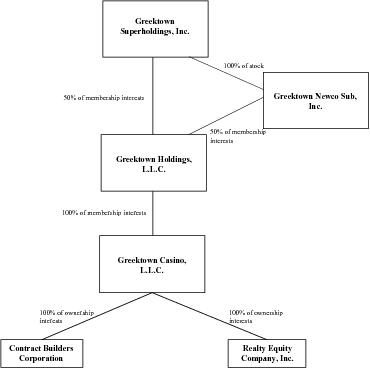

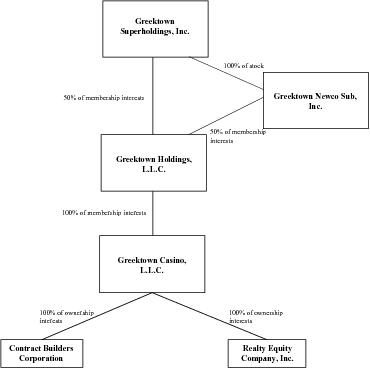

On May 29, 2008, Greektown Holdings, together with its direct and indirect subsidiaries and certain affiliates, filed voluntary petitions to reorganize their businesses under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the Eastern District of Michigan. Pursuant to a plan of reorganization approved by the Bankruptcy Court, the details of which are described in “Bankruptcy Considerations” on page 3, Greektown Superholdings, Inc. (“Greektown Superholdings,” and together with its subsidiaries, “we,” “our,” “us” or “Greektown”) was incorporated under the laws of the State of Delaware on March 17, 2010. As of the Effective Date (as defined below in “Bankruptcy Considerations” on page 3), each of Greektown Superholdings and its wholly-owned subsidiary, Greektown Newco Sub, Inc. (the “Greektown Sub”), will hold 50% of the outstanding membership interests of Greektown Holdings. Greektown Superholdings currently has no assets or liabilities other than 100% stock ownership in Greektown Sub. On the Effective Date, Greektown Superholdings will remain as a holding company that has no assets, except that Greektown Superholdings will own 50% of the issued and outstanding membership interests of Greektown Holdings and 100% of the issued and outstanding stock of Greektown Sub. Through its direct and indirect ownership of Greektown LLC, Greektown Superholdings will own and operate Greektown Casino. Greektown LLC also holds all the ownership interests in Contract Builders Corporation (“Contract Builders”), Realty Equity Company, Inc. (“Realty Equity”) and Trappers GC Partner, LLC (“Trappers”), each of which own real estate

2

near Greektown Casino. The assets of Trappers will be transferred to Greektown Casino and Trappers will be dissolved upon the Effective Date. Unless otherwise indicated or the context otherwise requires, the following discussion describes the business and operations of Greektown Superholdings after the Effective Date. Greektown Superholdings’ corporate headquarters are located at 555 East Lafayette, Detroit, Michigan 48226.

The following organizational chart describes the organizational structure of Greektown Superholdings as of the Effective Date.

Bankruptcy Considerations

The following discussion provides general background information regarding the Chapter 11 cases involving Greektown Holdings, and is not intended to be an exhaustive summary.

On May 29, 2008 (the “Petition Date”), Greektown Holdings, its direct and indirect subsidiaries and certain affiliates (collectively, the “Debtors”) filed voluntary petitions to reorganize their businesses under Chapter 11 of the United States Bankruptcy Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Eastern District of Michigan (the “Bankruptcy Court”). These cases were consolidated under the caption, “In re Greektown Holdings, L.L.C., et al. Case No. 08-53104.” On August 26, 2009, the Debtors filed the Second Amended Joint Plans of Reorganization (the “Debtor Plan”) and the Second Amended Disclosure Statement for Joint Plans of Reorganization (the “Debtor Disclosure Statement”). On September 3, 2009, the Bankruptcy Court approved the Debtor Disclosure Statement.

On November 2, 2009, certain holders of the 10-3/4% Senior Notes due 2013 (the “Senior Notes”) issued by Greektown Holdings and Greektown Holdings II, Inc. together with certain other creditors of the Debtors that are parties to that certain Purchase and Put Agreement (as amended by that certain First Amendment to Purchase and Put Agreement dated January 11, 2010, the “Purchase and Put Agreement”) dated November 2, 2009 (the “Put Parties”) filed an alternative plan of reorganization. On November 3, 2009, the Debtors agreed to voluntarily continue the hearing on confirmation of the Debtor Plan (the “Debtor Plan Confirmation Hearing”), which was scheduled for that date, for 24 hours, to engage in discussions with the Put Parties. On November 4, 2009, the Bankruptcy Court further continued the Debtor Plan Confirmation Hearing to allow for further discussions regarding a consensual resolution. On November 29, 2009, the Debtors, the Put

3

Parties, the agent for the pre-petition secured lenders, the agent for the lenders under the debtor-in-possession credit facility (the “DIP Facility”), an ad hoc group of pre-petition secured lenders, the Official Committee of Unsecured Creditors (the “Creditors’ Committee”), and the indenture trustee for the Senior Notes (the “Indenture Trustee”) filed a stipulation containing the terms on which all such parties would support the confirmation of the plan proposed by the Put Parties. On December 7, 2009, the Put Parties, joined by the Creditors’ Committee and the Indenture Trustee as “Noteholder Plan Proponents,” filed the Second Amended Joint Plans of Reorganization for the Debtors Proposed by Noteholder Plan Proponents Including Official Committee of Unsecured Creditors and Indenture Trustee (the “Plan”) and the Disclosure Statement for Second Amended Joint Plans of Reorganization for the Debtors Proposed by Noteholder Plan Proponents Including Official Committee of Unsecured Creditors and Indenture Trustee (the “Disclosure Statement”). The Disclosure Statement had been previously presented to the Bankruptcy Court, and on December 4, 2009, the Bankruptcy Court approved the Disclosure Statement.

Commencing on December 11, 2009, the Disclosure Statement, ballots for voting to accept or reject the Plan and other solicitation documents were distributed to all classes of creditors eligible to vote on the proposed Plan. The deadline for submitting ballots for voting to accept or reject the Plan was January 4, 2010. On January 11, 2010, the Debtors’ claims and voting agent filed its certification of voting results with the Bankruptcy Court reporting that, pursuant to the Bankruptcy Code, the requisite number of creditors to provide an impaired accepting class at each Debtor approved the Plan. Pursuant to the “cram-down” provisions of the Bankruptcy Code, the Plan was confirmed by the Bankruptcy Court without the affirmative vote of other classes of creditors on January 22, 2010. The effectiveness of the Plan is conditioned, among other things, on the receipt of all required authorizations, consents and regulatory approvals, including those from the City of Detroit and the MGCB, obtaining the Revolving Loan, as defined below, the satisfaction or waiver of the conditions precedent in the documents governing the Exit Financing, as defined below, and the actions, documents and agreements necessary to implement the Plan being satisfactory in form and substance to the Put Parties prior to June 30, 2010. Subject to the satisfaction or waiver of such conditions, it is expected that the Plan will become effective and the Debtors will emerge from bankruptcy prior to such date (the date of effectiveness of the Plan, the “Effective Date”).

The Plan generally provides for the full payment or reinstatement of allowed administrative claims, priority claims, post-petition secured claims, and pre-petition secured claims, the satisfaction of general unsecured claims through the distribution of cash and litigation trust interests and the cancellation of the existing equity interests in Greektown Holdings. The Plan provides that the holders of Senior Notes will receive all of the shares of our common stock, $0.01 par value per share (the “Common Stock”) issued pursuant to the Plan and rights to purchase their pro rata share of a certain number of shares of our preferred stock, $0.01 par value per share (the “Preferred Stock”) issued in a rights offering pursuant to the Plan (the “Rights Offering”) plus litigation trust interests. To the extent that holders of Senior Notes do not exercise their right to purchase shares of Preferred Stock, the Put Parties agreed to purchase such shares under the Purchase and Put Agreement (the “Put Commitment”). In consideration for entering into the Purchase and Put Agreement, the Put Parties are entitled to a put premium in the aggregate equal to (i) $10 million (the “Cash Put Premium”) and (ii) 222,222 shares of Preferred Stock (the “Stock Put Premium”). However, each Put Party has the right to accept its pro rata share of 111,111 shares of Preferred Stock in lieu of the Cash Put Premium. Certain of the Put Parties assigned their Put Commitment and certain of their other rights and obligations under the Purchase and Put Agreement to other Put Parties pursuant to an Assignment and Assumption Agreement dated as of March 31, 2010. The sale of the Preferred Stock in the Rights Offering together with the direct purchase of certain shares of Preferred Stock by certain of the Put Parties will provide approximately $196 million in net proceeds to the Debtors’ estates taking into account the Cash Put Premiums to which certain of the Put Parties will be entitled. All of such purchases are to be completed on the Effective Date. The shares of Preferred Stock that will be purchased as described above will be issued on the Effective Date or as soon as reasonably practicable thereafter. Each party who agreed to purchase Preferred Stock was given the option to purchase Preferred Stock with regular or reduced voting rights. However, if any party elects to purchase Preferred Stock and is concerned that it might acquire more than 4.9% of

4

the capital stock of Greektown Superholdings, or if a party that qualifies as an “Institutional Investor” under Michigan gaming law is concerned that it may acquire more than 14.9% of the capital stock of Greektown Superholdings, such party may elect to receive Warrants (as defined in Item 11) to purchase Preferred Stock representing a portion of the Preferred Stock that it had elected to purchase. As a result, the holders of Senior Notes and the Put Parties will own all of the outstanding equity interests of Greektown Superholdings as of the Effective Date. In addition, under the Plan, at the end of the day on the Effective Date, Greektown Holdings’ existing members’ capital (deficit) will be extinguished and no distributions will be made to existing members.

On the Effective Date, we expect that Greektown Superholdings will issue approximately $385 million in Senior Secured Notes (the “New Senior Secured Notes”) and will enter into a $30 million revolving credit facility which Greektown Superholdings is currently seeking to obtain (the “Revolving Loan” and, together with the New Senior Secured Notes, the “Exit Financing”). On the Effective Date, we expect to use the proceeds of the Rights Offering, the proceeds of the direct purchase of Preferred Stock, and the proceeds from the sale of the New Senior Secured Notes to repay all outstanding borrowings under the DIP Facility, to repay the pre-petition secured claims, and to make other payments required upon exit from bankruptcy. The proceeds from the sale of the New Senior Secured Notes remaining after the foregoing payments have been made, if any, as well as the Revolving Loan will be used to provide ongoing liquidity to conduct post-reorganization operations. For further detail regarding the Exit Financing, see Item 2—“Financial Information-Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.”

Business Overview

Greektown Casino opened in November 2000 in downtown Detroit as one of only three commercial casinos licensed to operate in Michigan. As previously discussed, as of the Effective Date, Greektown Superholdings will directly, and indirectly through Greektown Sub, hold all of the issued and outstanding membership interests of Greektown Holdings, which holds all of the issued and outstanding membership interests of Greektown LLC.

In February 2009, Greektown Casino completed an expansive renovation and expansion at a cost of approximately $336.3 million (the “Expanded Complex”). The Expanded Complex offers a full range of gaming, dining and entertainment alternatives, including:

|

• | | | | an approximately 100,000 square-foot casino with 2,600 slot machines and 69 table games, including an approximately 12,500 square-foot salon dedicated to high-limit gaming and the largest live poker room in the Metro Detroit Gaming Market (as defined below); |

|

• | | | | approximately 2,950 attached and 1,750 unattached parking spaces, including over 600 parking spaces for valet parking services; |

|

• | | | | 10,000 square feet of convention space; |

|

• | | | | a 400-room hotel; |

|

• | | | | four restaurants, including a 175-seat “International Buffet”; |

|

• | | | | several food outlets on the gaming floor; and |

|

• | | | | nine bars and two entertainment facilities. |

Access to Greektown Casino is facilitated by a nearby off-ramp from Interstate 375 and six interstate highways passing through downtown Detroit. We estimate that Greektown Casino attracts approximately 17,000 patrons per day on average, and we believe a significant number of these patrons make regular visits to our property. Our players club, known as “Club Greektown,” is a membership/loyalty program that attracts customers by offering incentives to frequent casino visitors. We had approximately 1.2 million people in our database for Club Greektown as of December 31, 2009, approximately 157,000 of whom had visited Greektown Casino during the preceding 90 days. We believe the gaming market in the Detroit area, which consists of three commercial casinos in Michigan (the “Detroit Commercial Casinos”), together with the commercial casino in Windsor,

5

Ontario (the “Metro Detroit Gaming Market”) is primarily a “drive-to” gaming market, with over 95% of our patrons residing within 100 miles of Greektown Casino.

For the year ended December 31, 2009, Greektown Casino generated $331.6 million in net revenues and a net loss of $65.9 million (including $28.7 million in reorganization expenses, $6.2 million in success fees payable to The Fine Point Group (“Fine Point”), and a $16.6 million Settlement Payment (as defined below) to the City of Detroit, as discussed in Item 2—“Financial Information—Management’s Discussion and Analysis of Financial Condition and Results of Operations”).

We generate cash flow from our casino operations, inclusive of our slot machine and table game businesses, as well as from our food and beverage operations and hotel operations. For the year ended December 31, 2009, revenues from our slot machine-based business accounted for 87.3% of revenues from our casino operations, and revenues from our casino operations accounted for 90.4% of our total revenues. For additional financial information relating to our business please see: “Item 13—“Financial Statements and Supplementary Data.”

Marketing

In general, we market to patrons based on a value-oriented brand positioning. Central to this brand platform is the promise to offer our customers more for their money. From our $9.99 lunch buffet, to inexpensive hotel room rates, to aggressive promotions, which give players more ways to play, win and have fun, Greektown is focused on continuing to find ways to provide customers with the ability to have fun at a reasonable cost.

Our marketing efforts historically have been focused on the drive-in and bus markets. With the addition of our 400 room hotel, we have been able to extend and enhance the local gamers’ experience by providing our customers with hotel discounts and complimentaries, or “comps.”

Competition

The Detroit Commercial Casinos are the only three commercial casinos in Michigan and consist of Greektown Casino, MGM Grand Detroit (“MGM Detroit”) and MotorCity Casino (“MotorCity”). An additional competitor, Caesars Windsor, is located across the Detroit River in Canada. Caesars Windsor is owned by the Ontario government and is accessible from Detroit via bridge or tunnel. Collectively, the three Detroit Commercial Casinos and Caesars Windsor make up the Metro Detroit Gaming Market.

The gaming market in the state of Michigan, which contains both commercial and tribal casinos, consists of the Detroit Commercial Casinos and twenty Native American-owned gaming facilities that operate under compacts. Five racetracks are also located in Michigan, each of which offer horse betting, but are not authorized to offer slot machine or table gaming. There is also a racetrack in Windsor that operates over 750 slot machines.

Overview of direct competition

The direct competitors of Greektown Casino are the two other Detroit Commercial Casinos. The Detroit Commercial Casinos operate as commercial entities under the Michigan Gaming Control and Revenue Act (the “Michigan Gaming Act”). The Detroit Commercial Casinos are licensed to offer both slot machines and table games, with no specific limit on the number of gaming positions that they may operate within their authorized gaming square footage. MGM Detroit, MotorCity and Caesars Windsor may each have greater name recognition and financial, marketing and other resources than Greektown Casino. For instance, MGM Detroit benefits from the use of a national player database. Caesars Windsor is managed by a consortium that includes Harrah’s Entertainment, Inc. and Hilton Hotels Corporation, both of which have a national presence. By comparison, we have the area’s most recently completed casino hotel complex, catering specifically to a budget-minded consumer base that we believe would not otherwise be served by our primary competitors. We believe that this should uniquely position us in a market experiencing a significant

6

economic downturn that has affected both the Detroit metropolitan area and the United States as a whole.

MGM Detroit, MotorCity and Greektown Casino accounted for 40.9%, 33.3% and 25.8% of the total adjusted gross gaming revenues of the Detroit Commercial Casinos, respectively, for the year ended December 31, 2009.

Below is a more detailed summary of the gaming amenities offered by MGM Detroit, MotorCity and Caesars Windsor.

MGM Detroit.MGM Detroit was the first casino to open in Detroit, in July 1999, and since 2001 has generally been the market leader based on share of adjusted gross gaming revenues. In October 2007, MGM Detroit completed construction of a new, permanent casino. The new facility houses approximately 100,000 square feet of gaming space with an estimated 4,090 slot machines and 97 table games, 400 hotel rooms, 11 restaurants/bars and five entertainment venues. The property also offers a 30,000-square-foot meeting facility, which includes a 14,000-square-foot ballroom. For the twelve months ended December 31, 2009, MGM Detroit’s adjusted gross casino revenues were $547.6 million, representing a 5.3% decline over the comparable period in the prior year. MGM Mirage owns a controlling interest in MGM Detroit, with the remaining interest held by Detroit Partners, LLC, a group of local residents and businesses. MGM Detroit benefits from the use of a national player database.

MotorCity.MotorCity was the second casino to open in Detroit, in December 1999, and since 2001 has generally maintained a second-place market position based on share of adjusted gross gaming revenues behind MGM Detroit. In 2008, MotorCity completed its expanded complex. The renovated facility has 100,000 square feet of gaming space with an estimated 2,850 slot machines and 57 table games, 6 restaurants/bars, two entertainment venues, a 400 room hotel and a 1,500 seat theater. For the twelve months ended December 31, 2009, MotorCity’s adjusted gross casino revenues were $445.8 million, representing a 4.1% decline over the comparable period in the prior year. The facility is privately owned by its sole stockholder, Marian Ilitch.

Caesars Windsor.Caesars Windsor opened in May 1994. Caesars Windsor is the largest casino-resort in Canada and is owned by the government of Ontario and operated by a consortium that includes Harrah’s Entertainment, Inc. and Hilton Hotels Corporation. At its peak in the late 1990s, the casino attracted in excess of six million visitors annually. In 2008, Caesars Windsor completed an expansion of its casino costing approximately CAD $400 million, which resulted in a complex of approximately 100,000 square feet of gaming space, 85 table games, 2,550 slot machines and 3,000 parking spaces. Caesars Windsor also offers 758 hotel rooms, a 5,000 seat entertainment center and approximately 100,000 square feet of convention space. For the twelve months ended December 31, 2009, Caesars Windsor’s adjusted gross gaming revenues were CAD $288.8 million, representing a slight decrease from the prior year.

Michigan tribal gaming

Twenty Native American-owned casinos are currently operating in western, central and northern Michigan, the closest of which is 113 miles from Greektown Casino. A number of additional Native American casinos are in various stages of the planning process:

|

• | | | | A tribe has entered into a land settlement agreement with the State of Michigan and is currently seeking U.S. Congressional approval to construct a casino in Monroe County, Flint or Romulus, which would be within 20 to 75 miles of Greektown Casino. |

|

• | | | | Another tribe has also entered into a land settlement agreement with the State of Michigan and is currently seeking U.S. Congressional approval for a casino in Port Huron, which would be within 75 miles of Greektown Casino. |

|

• | | | | Another tribe re-submitted an application in October 2009 to the U.S. Department of the Interior to construct a $300 million casino development, including a 200 room hotel and retail space, in Romulus, Michigan after having a previous application dismissed in 2008. The proposed development would be within 20 miles of Greektown Casino. |

7

|

• | | | | Another tribe has publicly announced an agreement with the governor of the State of Michigan to amend an existing compact. The amendments to the compact would allow the tribe to seek to place land in trust with the United States Department of Interior to construct a new casino in western Michigan. Certain proposed amendments to the compact must be approved by the Michigan Legislature and the tribe must submit an application to the United States Department of Interior to place certain land in trust in order to construct the casino in western Michigan. |

The opening of additional Native American-owned casinos near Detroit or elsewhere in Michigan could have a detrimental effect on Greektown Casino’s casino revenues.

Proposal 1

In November 2004, Michigan voters passed Proposal 1, which requires a voter referendum before new forms of gambling are permitted in Michigan. This limits the government’s ability to enact changes to state laws permitting incremental forms of gaming in Michigan. Proposal 1 does not apply to tribal gaming or to the Detroit Commercial Casinos, but applies to new lottery games, consisting of table games and player-operated mechanical or electronic devices or other forms of gaming or additional casinos.

Lottery

We also compete with the State of Michigan Lottery, which offers a variety of lottery tickets and drawings. Additionally, the Bureau of State Lottery oversees and licenses charitable gaming by nonprofit organizations throughout the state. In 2004, Michigan also introduced new “Club Games,” including keno and various pull-tab games, in licensed bars and restaurants.

Other Competition

We also compete, to some extent, with other forms of gaming on both a local and national level, including state-sponsored lotteries, Internet gaming, on- and off-track wagering and card parlors. The expansion of legalized gaming to new jurisdictions throughout the United States has also increased competition and will continue to do so in the future. On November 3, 2009, a casino initiative passed in Ohio authorizing casino-style gaming at four locations in the state: Cincinnati, Cleveland, Columbus and Toledo. Although casinos will not be constructed and open for business for some time, we anticipate that they will compete with the Detroit Casinos, particularly the Toledo casino, which is in close proximity to Detroit and southern Michigan. If gaming facilities in our markets were purchased by entities with more recognized brand names or larger capital resources, or if gaming were legalized in jurisdictions near Greektown Casino where gaming currently is not permitted, we would face additional competition.

Potential Competition

Two initiative petitions to amend the Michigan Constitution have been approved as to form by the board of state canvassers and are being circulated for signatures for potential placement on the November 2, 2010 ballot. The first petition is being sponsored by a group called Racing to Save Michigan, which would amend the state constitution to allow the MGCB to issue state casino licenses to up to eight new casinos in Michigan, five of which would be located at horse tracks that conducted race meetings with pari-mutuel wagering in 2009. The second petition is being sponsored by a group called Michigan is Yours, and would amend the state constitution to authorize casino gaming at no more than seven casinos located in Muskegon, Lansing, Detroit, Detroit/Wayne County Metropolitan Airport, Benton Harbor, Flint and Romulus. In order to be placed on the ballot in November 2010, the proponents will have to collect at least 380,126 signatures by July 5, 2010.

8

Employees and Unions

As of December 31, 2009, we employed approximately 2,140 people, of which approximately 1,800 are full-time employees, across various functional areas. Approximately 77% of our workforce was unionized as of December 31, 2009. Our unionized employees are members of two union groups: (i) the Detroit Casino Council (the “DCC”), which is made up of five unions, the UAW, HERE, Teamsters, Carpenters and Operating Engineers, and (ii) the International Union, Security, Police, Fire Professionals of America (the “SPFPA”), which consists of security personnel. The collective bargaining agreements for the DCC and the SPFPA are effective until October 16, 2011 and June 12, 2012, respectively. We consider our relationships with our employees and the labor unions to be good.

Business Seasonality

Our gaming operations are affected by the weather. We have experienced downturns in customer volume during the summer months and increases in volume during winter months, although we do experience lower volume during severe winter storms. These seasonal and adverse weather conditions in the Detroit metropolitan area may discourage potential customers from visiting us. We believe we have also experienced downturns in customer volume as a consequence of nearby road repairs and construction, which generally occur in the spring, summer and fall, as well as during various sporting or entertainment events in downtown Detroit.

Environmental Matters

We are subject to federal, state and local environmental, safety and health laws, regulations and ordinances that apply to non-gaming businesses generally, such as the Clear Air Act, Clean Water Act, Occupational Safety and Health Act, Oil Pollution Act, Resource Conservation Recovery Act and the Comprehensive Environmental Response, Compensation and Liability Act of 1980. We have not made, and do not anticipate making, material expenditures with respect to these environmental laws, regulations and ordinances. However, the attendant compliance costs associated with them may result in future additional costs to our operations.

Intellectual Property

We believe it is important to protect our significant trademarks and service marks by registering them for use in connection with the underlying goods and services, as appropriate at the federal or state level. The trademarks “GREEKTOWN CASINO,” “GREEKTOWN CASINO (& DESIGN),” “LET THE PARTY BEGIN AT GREEKTOWN!,” GREEKTOWN CASINO-HOTEL” and “CLUB GREEKTOWN” are registered in the U.S. Patent and Trademark Office. The restaurant and bar trademarks “THE ALLEY GRILLE STEAKHOUSE,” “APOLLO,” “ECLIPZ,” “GRAPEVINE CAFÉ,” “OUZO’S,” “OPA! BAR,” “GALLERIA BAR,” “SHADES LOUNGE,” “BISTRO 555,” “TRAPPER’S PATIO,” “TRAPPER’S SNACK BAR,” “INTERNATIONAL BUFFET” and “THE OLIVE ROOM” are registered with the State of Michigan. Finally, the advertising marks “AMAZING RACE SLOTS & TABLE GAMES,” “BONU$ PLAY,” BONU$ BUCKS,” “BONU$ BET,” “DETROIT’S WINNING ADDRESS” and “THE NEW GREEKTOWN CASINO-HOTEL—A KEWADIN CASINO” are registered with the State of Michigan.

Government Regulation

The ownership and operation of our gaming facility is subject to various state and local laws and regulations in the jurisdiction in which we are located. We are subject to the provisions of the Michigan Gaming Act and rules promulgated thereunder (the “Michigan Rules”), the MGCB, including the MGCB rules (the “MGCB Rules”) and MGCB orders and resolutions (“MGCB Orders and Resolutions”) and various local ordinances and regulations, and are subject to the regulatory control of the MGCB, the City of Detroit and the Michigan Liquor Control Commission. Additionally, we must comply with a variety of federal regulations relating to, among other things, the reporting of certain cash transactions.

9

The following is a summary of the provisions of the material laws and regulations applicable to our gaming operations and other laws and regulations applicable to us. The summary does not purport to be a comprehensive description and is qualified in its entirety by reference to the appropriate laws and regulations.

Michigan Gaming Regulation

Greektown LLC is licensed to operate in Michigan pursuant to the Michigan Gaming Act. The Michigan Gaming Act and Michigan Rules subject the ownership and operation of commercial casino gaming facilities to extensive state licensing and regulatory requirements and require the licensee to have a development agreement in effect with the City of Detroit and the Economic Development Corporation (“Detroit EDC”) of the City of Detroit.

The Michigan Gaming Act created the MGCB and authorizes it to grant casino licenses to not more than three applicants that have entered into development agreements with the City of Detroit. The MGCB is granted extensive authority to conduct background investigations and determine the suitability and eligibility of casino license applicants, affiliated companies, officers, directors and managerial employees of applicants and affiliated companies, persons and entities holding a one percent or greater direct or indirect interest in an applicant or affiliated company, and anyone else the MGCB deems to be a “qualifier.” The Michigan Gaming Act and Michigan Rules restrict direct communication with the MGCB members.

Any person who supplies goods or services to a casino licensee that are directly related to, used in connection with or affect gaming must obtain a supplier’s license from the MGCB. Any person who supplies other goods or services of a non-gaming nature to a casino licensee on a regular and continuing basis must also obtain a supplier’s license from the MGCB or demonstrate eligibility for an exemption from this requirement. In addition, any individual employed by a casino licensee, or by a supplier licensee whose work duties are related to or involved in the gambling operation or are performed in a restricted area or gaming area of a casino, or who hold certain other positions, must obtain an occupational license from the MGCB. The MGCB Rules permit the MGCB to exempt any person or field of commerce from the supplier licensing requirements. The MGCB has adopted the MGCB Orders and Resolutions that outline the process for persons and entities to apply to be exempt from supplier licensing requirements.

The Michigan Gaming Act imposes the burden of proof on the applicant for a casino license to establish its suitability to receive and hold the license. The applicant must establish its suitability as to:

|

• | | | | integrity; |

|

• | | | | moral character and reputation; |

|

• | | | | business probity; |

|

• | | | | financial ability and experience; |

|

• | | | | responsibility; and |

|

• | | | | other criteria deemed appropriate by the MGCB. |

The Michigan Rules and Michigan Gaming Act provide systems for administrative and judicial review of various decisions of the MGCB. These appeals are governed by the Michigan Administrative Procedures Act of 1969.

The MGCB may refuse to renew a license upon a determination that the licensee no longer meets the requirements for licensure. In addition to restriction, suspension or revocation of a casino license, the MGCB may impose substantial fines or forfeiture of assets upon licensees for violation of gaming or liquor laws or rules or other violations of law. The Michigan Rules provide for an appeal process from decisions made by the MGCB concerning violations outlined above. These appeals are governed by the Michigan Administrative Procedures Act of 1969.

The Michigan Gaming Act includes provisions that restrict certain casino owners and managers, along with supplier licensees and their key managers, from giving political contributions to Michigan

10

elected officials. The Michigan Gaming Act and Michigan Rules also restrict gift giving to state-elected officials and certain key employed state officials. The MGCB has adopted the MGCB Orders and Resolutions that establish criteria through which a supplier license applicant who has made political contributions during the application period may be granted waivers to reapply for licensing.

The Michigan Gaming Act and Michigan Rules provide for annual license renewal as long as the MGCB determines that the casino licensee continues to meet the requirements established by the Michigan Gaming Act and Michigan Rules. Greektown LLC’s original license was issued on November 10, 2000. Greektown LLC is currently in compliance in all material respects with such requirements of the MGCB and has made all necessary license renewal payments. The license was last renewed on December 11, 2007 and its renewal is currently held in abeyance by the MGCB pending our bankruptcy reorganization but remains valid and in effect in the interim.

The Michigan Rules implement the terms of the Michigan Gaming Act. Among other things, the Michigan Rules outline more detailed substantive and procedural requirements with respect to casino licensing and operations, including, but not limited to, requirements regarding things such as licensing investigations and hearings, record keeping and retention, contracting, reports to the MGCB, internal control and accounting procedures, security and surveillance operations, extension of credit to gaming patrons, conduct of gaming and transfers of ownership interests in licensed casinos. The Michigan Rules also establish numerous MGCB procedures regarding licensing, disciplinary and other hearings and similar matters. The Michigan Rules have the force of law and are binding on the MGCB as well as on applicants for or holders of casino licenses, their vendors and employees. The Michigan Rules prohibit a casino licensee or a holding company or affiliate that has control of a casino licensee in Michigan from entering into a debt transaction affecting the capitalization or financial viability of its Michigan casino operation without prior approval from the MGCB. The Michigan Rules outline requirements and procedures for casino licensees or holding companies that make a public offering of debt or equity.

In June 2006 and December 2007, Greektown LLC entered into Acknowledgements of Violation (the “AOVs”) with the MGCB. The June 2006 AOV related to certain amendments to Greektown LLC’s indebtedness agreements that reflected changes that were not reviewed by the MGCB, and the December 2007 AOV included four complaints addressing procurement, kiosks, electronic device meters and signage. Under the terms of the AOVs, aggregate fines of $1.05 million were assessed, of which $400,000 was paid upon entering into the AOVs and $750,000 would not be an obligation unless Greektown LLC commits further violations of the same legal requirements with respect to the June 2006 AOV before June 13, 2011 and with respect to the December 2007 AOV before December 3, 2010. Other than the initial penalties of $400,000, no further amounts have been paid as no violations occurred during 2008 or 2009. However, we cannot be certain whether we will have future violations and if we do, we may be subject to the additional penalties from MGCB described above and other penalties.

The Michigan Liquor Control Commission licenses, controls and regulates the sale of alcoholic beverages pursuant to the Michigan Liquor Control Act. The Michigan Gaming Act also requires that casinos sell and distribute alcoholic beverages in conformity with the Michigan Liquor Control Act. The City of Detroit also issues certain approvals in connection with the sale of alcoholic beverages.

Michigan Gaming Taxation and Fees

Under the provisions of the Michigan Gaming Act, we must pay a combined state and city wagering tax equal to 19% of adjusted gross receipts (which was recently reduced from 24%, retroactively to February 15, 2009), payable daily, a municipal services fee in an amount equal to the greater of 1.25% of adjusted gross receipts or $4.0 million annually. For the twelve months ended December 31, 2009, 2008 and 2007, we paid gaming taxes of $75.6 million, $83.1 million and $89.6 million, respectively. These gaming taxes are included in Greektown Casino’s operating expenses. In addition to gaming taxes, we are required to make an annual payment for certain costs of the MGCB not to exceed one-third of an annual maximum amount, adjusted annually for inflation, that

11

is currently set at approximately $10.2 million. For the years ended December 31, 2009, 2008 and 2007 we paid fees to the MGCB of $10.2 million, $10.0 million and $9.8 million, respectively. These MGCB fees are included in Greektown Casino’s general and administrative expenses. These gaming taxes and fees are in addition to the taxes, fees and assessments customarily paid by business entities conducting business in Michigan and Detroit.

If the Michigan Lottery Act is amended to allow casino operations and if casino operations are conducted at racetracks in Michigan, the state wagering tax rate will be reduced to 18%. Any amendment would require voter approval, as mandated by Proposal 1. As discussed above, two options to amend the Michigan state constitution to authorize additional casino gaming in Michigan have been approved and are being circulated for signature. If enough signatures are obtained, they would be placed on the November 2010 ballot.

Pursuant to the Michigan Gaming Act, once we had 400 fully operational hotel rooms operating for 30 consecutive days and we were otherwise in compliance with the development agreement, we would be eligible for a reduction in the combined state and city wagering tax rate from 24% to 19% of our adjusted gross receipts (the “Tax Rollback”). MGM Detroit and MotorCity had received the Tax Rollback prior to 2010. On February 15, 2009, we opened our hotel including 400 guest rooms to the public. We contended that we were eligible for the Tax Rollback as of February 15, 2009. The City of Detroit had objected to our eligibility based on its contention that we were not in compliance with the Revised Development Agreement Greektown LLC entered into with the City of Detroit and the Detroit EDC on August 2, 2002 (the “Development Agreement”). Various litigation ensued with the City of Detroit in connection with these disputes. On October 9, 2009, the Debtors filed a motion with the Bankruptcy Court to approve an amended settlement agreement (the “Amended Settlement Agreement”) with the City of Detroit. The Bankruptcy Court approved the Amended Settlement Agreement on February 22, 2010, which provides for a resolution of all disputes with the City of Detroit. The Amended Settlement Agreement was conditioned upon (i) approval of the Amended Settlement Agreement by the Bankruptcy Court, which was obtained on February 22, 2010; and (ii) final approvals of the Amended Settlement Agreement from various offices of the City of Detroit, which were obtained on February 24, 2010.

The Amended Settlement Agreement provides, among other things, that:

|

• | | | | the City of Detroit is required to use its best efforts to support the Debtors efforts in obtaining the Tax Rollback effective as of February 15, 2009 before the MGCB (which was subsequently obtained on March 9, 2010); |

|

• | | | | the Debtors are required to pay the City of Detroit a settlement amount in the aggregate of $16.6 million (the “Settlement Payment”), less certain credits described below, subject to the following provisions: (i) the Debtor is required to pay an initial cash payment of $3.5 million (the “Initial Cash Payment”) within two business days after entry of an order by the Bankruptcy Court approving the Amended Settlement Agreement; (ii) a credit is required to be applied immediately to reduce the Settlement Payment in an amount equal $3.5 million (the “Settlement Credit”), representing the difference between (a) the amount of gaming taxes actually paid to the City of Detroit between February 15, 2009 and February 15, 2010 and (b) the amount of gaming taxes that would have been paid through the date of the settlement to the City of Detroit had the Tax Rollback been effective as of February 15, 2009); and (iii) the Debtors are required to pay a final cash amount of $9.6 million (“Final Cash Payment”), which is the remaining amount of the Settlement Payment after the Initial Cash Payment and the application of the Settlement Credit described above. The Settlement Credit has been applied and the Initial Cash Payment was made to the City of Detroit by the Debtors on February 24, 2010; |

|

• | | | | to the extent the board of directors of Greektown LLC does not contain at least one director from Detroit reasonably acceptable to the Mayor and the City Council of the City of Detroit, Greektown LLC is required to appoint an unpaid ombudsman, to be selected by the Mayor and approved by the City Council of the City of Detroit, who is reasonably acceptable to the Debtors who will be entitled to attend board meetings, including board committee meetings, |

12

| | | | and receive all material information furnished to the board, subject to a confidentiality agreement and certain exceptions; |

|

• | | | | upon the receipt of the Final Cash Payment, the City of Detroit is deemed to have dismissed and waived any and all claims of default under the Development Agreement; |

|

• | | | | the City of Detroit is required to cease its demand for a 1% tax increase due to the delayed completion of the Expanded Complex; |

|

• | | | | the City of Detroit is required to consent to the transfer of the ownership of the Greektown Casino and the Development Agreement to the Reorganized Debtors in accordance with the Plan; and |

|

• | | | | the City of Detroit is required to take actions to dismiss all related litigation. |

On March 9, 2010, the MGCB entered an order certifying that Greektown LLC met the requirements and was entitled to a tax adjustment retroactive to February 15, 2009. The effects of the retroactive adjustment are to reduce the Settlement Payment to $13.1 million after application of the Settlement Credit described above. As a result of the MGCB order, commencing on February 15, 2009, our combined state and city wagering tax rate is 19% of our adjusted gross receipts, reflecting the Tax Rollback.

City of Detroit Regulation

The Detroit City Council has enacted several ordinances affecting the Detroit Commercial Casinos. One, entitled “Casino Gaming Authorization and Casino Development Agreement Certification and Compliance,” authorizes casino gaming only by operators who are licensed by the MGCB and are parties to a development agreement that has been approved and certified by the City Council and is currently in effect, or are acting on behalf of parties to a development agreement. The Development Agreement has been so approved and certified and is currently in effect. The ordinance requires each casino operator to submit to the Mayor of Detroit and to the Detroit City Council annual reports regarding the operator’s compliance with its development agreement or, in the event of non-compliance, reasons for non-compliance and an explanation of efforts to comply. The ordinance requires the Mayor of Detroit to monitor each casino operator’s compliance with its development agreement, to take appropriate enforcement action in the event of default and to notify the Detroit City Council of defaults and enforcement action taken; and, if a development agreement is terminated, it requires the Detroit City Council to transmit notice of enforcement action to the MGCB within five business days along with the City of Detroit’s request that the MGCB revoke the relevant operator’s certificate of suitability or casino license. If a development agreement is terminated, the Michigan Gaming Act requires the MGCB to revoke the relevant operator’s casino license upon the request of the City of Detroit.

City of Detroit Development Agreement

In March 1998, Greektown LLC entered into the initial development agreement with the City of Detroit and the Detroit EDC. In August 2002, Greektown LLC entered into the Development Agreement, which amended and restated the initial development agreement and authorized the construction and operation of the existing casino.

From March 1998 through December 31, 2009, the City of Detroit has been paid approximately $128.2 million under the terms of the Development Agreement.

In addition to gaming taxes, we are also obligated to pay 1% of our adjusted gross receipts to the City of Detroit, to be increased to 2% of our adjusted gross receipts in any calendar year in which adjusted gross receipts exceed $400 million, beginning on the day our adjusted gross receipts exceed $400 million and continuing until the end of that calendar year. In addition, when adjusted gross receipts exceed $400 million, we would be required to pay $4.0 million to the City of Detroit. We do not anticipate exceeding the $400 million in adjusted gross receipts for the calendar year ending December 31, 2010.

13

We also must pay certain legal and consultant expenses incurred by the City of Detroit related to the development of the casino complex.

The Development Agreement includes a number of additional provisions with which we must comply. The key provisions include those listed below:

|

• | | | | A radius restriction prohibiting various parties from holding an interest in or taking certain actions regarding any other casino within a 150-mile radius from central Detroit. |

|

• | | | | Various indemnification obligations for certain judgments, fines, liabilities, losses, damages, costs, expenses, claims, obligations and penalties of the City of Detroit, the Detroit EDC and each of their respective officers, agents and employees. |

|

• | | | | Various social commitments regarding, for example, employment of Detroit residents, procurement of financing and goods and services from Detroit-based businesses, Detroit resident businesses and business concerns and/or minority- or women-owned businesses. |

|

• | | | | Transfer of ownership restrictions prohibiting certain direct and indirect owners of Greektown LLC from transferring their equity interests without the consent of the City of Detroit. |

U.S. Department of the Treasury Regulations

The U.S. Internal Revenue Code and the U.S. Treasury Regulations promulgated thereunder require operators of casinos located in the United States to file information returns for U.S. citizens, including, but not limited to, names, addresses and social security numbers of winners, for bingo and slot machine winnings in excess of prescribed amounts and keno winnings in which the payout equals or exceeds a specified amount more than the amount wagered. The U.S. Internal Revenue Code and the U.S. Treasury Regulations promulgated thereunder also require operators to withhold taxes on some keno, bingo and slot machine winnings of nonresident aliens. We are unable to predict the extent to which these requirements, if extended, might impede or otherwise adversely affect operations of, and/or income from, these and/or other games.

Regulations adopted by the Financial Crimes Enforcement Network of the U.S. Department of the Treasury and the MGCB require the reporting of patron’s currency transactions in excess of $10,000 occurring within a gaming day, including identification of the patron by name and social security number, which regulations were subsequently modified to include a suspicious activity reporting rule. Casinos are required to report suspicious monetary transactions when the casino knows, suspects or has reason to suspect that the transaction involves funds derived from illegal activity or is otherwise intended to facilitate illegal activity.

U.S.A. Patriot Act

The U.S.A. Patriot Act permits financial institutions, upon providing notice to the U.S. Department of the Treasury, to share information with one another to identify and report to the federal government any activities that may involve money laundering or terrorist activity.

Other Laws and Regulations

Our operations are also subject to extensive state and local regulations in addition to the regulations described above, and, on a periodic basis, we must obtain various other licenses and permits, including those required to sell alcoholic beverages.

Available Information

Our website address is www.greektowncasino.com. Through this website, our filings with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports, will be accessible (free of charge) as soon as reasonably practicable after materials are electronically filed with or furnished to the SEC. The information provided on our website is not part of this registration statement.

14

You also may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

ITEM 1A. RISK FACTORS

Risks Related to Our Business

There are significant issues remaining with respect to the satisfaction of the conditions to our ability to emerge from bankruptcy protection pursuant to the Plan.

The effectiveness of the Plan is conditioned on, among other things, the receipt of all required authorizations, consents and regulatory approvals, including those from the City of Detroit and the MGCB, the satisfaction or waiver of the conditions precedent in the documents governing the Exit Financing and the actions, documents and agreements necessary to implement the Plan being satisfactory in form and substance to the Put Parties prior to the Effective Date. Since the Plan was confirmed, we have focused our efforts on satisfying such conditions. Although progress has been made, significant issues remain to be resolved, including with respect to the Revolving Loan and the MGCB’s approval of the Plan. No assurance can be given that the Revolving Loan will be obtained, the New Senior Secured Notes and the sale of Preferred Stock in the Rights Offering will be consummated or that we will receive MGCB approval, and as such, no assurance can be given that the Plan will become effective.

We face significant competition in the market in which we operate and other markets, which could impair our revenues, increase our expenses and hinder our ability to generate sufficient cash flows.

We face significant competition principally from two other casinos in Detroit, MGM Detroit and MotorCity, as well as Caesars Windsor, which is located directly across the Detroit River from Detroit. MGM Detroit, MotorCity and Caesars Windsor may each have greater name recognition and financial, marketing and other resources than we do, and all three casinos completed major renovations/expansion projects in the past few years that have the potential to greatly increase their respective market share of the Metro Detroit Gaming Market. MGM Detroit and MotorCity accounted for 40.9% and 33.3% of the total adjusted gross gaming revenues of the Detroit Commercial Casinos for 2009, respectively. Competition may increase among the Detroit Commercial Casinos because the Metro Detroit Gaming Market experienced its first overall gross gaming revenue decline in 2009 of 1.5% compared to 2008.

In addition, we compete with other gaming facilities throughout Michigan and surrounding states as well as nationwide, including casinos located on Native American reservations and other land-based casinos. Twenty Native American-owned casinos are currently operating in western, central and northern Michigan, the closest of which is 113 miles from Greektown. Furthermore, two tribes have entered into land settlement agreements with the State of Michigan, and both tribes are currently seeking U.S. Congressional approval of the agreements to take the land into trust for new land-based casinos. One tribe is seeking to locate a casino in Michigan in one of Monroe County, Flint or Romulus, while the other tribe is seeking to locate a casino in Port Huron, and both proposed casinos would be within 20-75 miles of Greektown Casino. No U.S. Congressional approval has yet been obtained. Also, another tribe has been federally recognized and is seeking to enter into a compact with the State of Michigan for a casino in western Michigan, and an additional tribe has indicated that it intends to apply to the Bureau of Indian Affairs for trust status for a site in Romulus. Michigan also features five racetracks which offer horse betting but are not authorized to offer slot machines or table gaming, and there is an additional racetrack in Windsor, Ontario, Canada, which has over 750 slot machines. Furthermore, two initiative petitions to amend the Michigan Constitution have been approved as to form by the board of state canvassers and are being circulated for signatures for potential placement on the November 2, 2010 ballot. In the event

15

that the proposed amendments are included on the ballot and approved, additional casinos will be built near Greektown Casino, which could have a significant adverse effect on our business.

We also compete, to some extent, with other forms of gaming on both a local and national level, including state-sponsored lotteries, Internet gaming, on- and off-track wagering and card parlors. The expansion of legalized gaming to new jurisdictions throughout the United States also has increased competition faced by us and will continue to do so in the future. Additionally, if gaming facilities in our markets were purchased by entities with more recognized brand names and capital, or if gaming were legalized in jurisdictions near our property where gaming currently is not permitted, as, for example, happened in Ohio in 2009, we would face additional competition.

Certain contingent claims against the Debtors in bankruptcy remain outstanding and additional claims may be filed and are subject to adjustment before we are able to satisfy such claims.

A number of contingent claims were filed against the Debtors in their bankruptcy proceedings. In addition, the deadline to file administrative claims, professional claims and substantial contribution claims has not yet occurred and will not occur until after the Effective Date as provided in the Plan and confirmation order. We plan to satisfy allowed claims as we emerge from bankruptcy pursuant to the Plan. However, some of these claims may be filed and/or allowed in amounts greater than anticipated, which would reduce the amount of capital that we will have after emergence to operate and conduct our business. Such claims may have a material adverse effect on our financial condition.

Given that our operations are dependent upon one property for all of our cash flows, we are subject to greater risks, many of which are beyond our control, than a gaming company with more operating properties.

We do not currently have operations other than Greektown Casino, and therefore, we are entirely dependent upon Greektown Casino, and dependent upon the patronage of persons living in and visiting the Detroit metropolitan area, for our revenues and cash flows. Because we are entirely dependent on a single gaming site, we are subject to greater risks than a geographically diversified gaming operation, including, but not limited to:

|

• | | | | risks related to the economic conditions in southeastern Michigan or nearby regions, including a loss of residents, layoffs, increased fuel and transportation costs or a decrease in discretionary income or spending; |

|

• | | | | a decline in the size of the local gaming market; |

|

• | | | | an increase in gaming competition in the surrounding area; |

|

• | | | | changes in local and state governmental laws and regulations; |

|

• | | | | damage or interruption of gaming activities by fire, flood, power loss, technology failure, break-ins, terrorist attacks, war or similar events; |

|

• | | | | the relative popularity of local and regional entertainment alternatives to casino gaming that compete for the leisure dollar; |

|

• | | | | adverse weather conditions, which could deter customer visits; and |

|

• | | | | inaccessibility to the property due to road construction or closures of primary access routes. |

The occurrence of any one of the events described above could cause a material disruption in our business.

Reductions in discretionary consumer spending as a result of downturns in the general economy and particular difficulties in the automobile industry had, and could continue to have, a material adverse effect on our business.

Our business has been and may continue to be adversely affected by the economic downturn currently being experienced in the United States, and more particularly in the Detroit metropolitan area, as we are highly dependent on discretionary spending by our patrons. Changes in discretionary consumer spending or consumer preferences brought about by factors such as increased unemployment, perceived or actual deterioration in general economic conditions, the current housing market crisis, the current credit crisis, bank failures and the potential for additional bank failures,

16

perceived or actual decline in disposable consumer income and wealth, the recent global economic recession and changes in consumer confidence in the economy may continue to reduce customer demand for the leisure activities we offer and may adversely affect our revenues and operating cash flow. More specifically, the economic downturn has impacted the automobile industry in the United States as much as, if not more than, other similarly situated sectors of the U.S. economy. As many of the manufacturers of automobiles and automobile parts and components are based in Detroit or the Detroit metropolitan area, our geographic location makes us uniquely susceptible to continuing volatility in the American automobile industry. We are not able to predict the length or severity of the current economic condition.

Our debt agreements will contain restrictions that will limit our flexibility in operating our business.

Our New Senior Secured Notes and the Revolving Loan will contain a number of covenants that will impose significant operating and financial restrictions on us, including restrictions on our and our subsidiaries ability to, among other things:

|

• | | | | incur additional debt or issue certain preferred shares; |

|

• | | | | pay dividends on or make distributions in respect of our capital stock or make other restricted payments; |

|

• | | | | make certain investments; |

|

• | | | | sell certain assets; |

|

• | | | | create liens on certain assets; |

|

• | | | | consolidate, merge, sell or otherwise dispose of all or substantially all of our assets; |

|

• | | | | enter into certain transactions with our affiliates; and |

|

• | | | | designate our subsidiaries as unrestricted subsidiaries. |

As a result of these covenants, we will be limited in the manner in which we conduct our business, and we may be unable to engage in favorable business activities or finance future operations or capital needs. The restrictions caused by such covenants could also place us at a competitive disadvantage to less leveraged competitors.

A failure to comply with the covenants contained in the New Senior Secured Notes and the Revolving Loan or other indebtedness that we may incur in the future could result in an event of default, which, if not cured or waived, could have a material adverse affect on our business, financial condition and results of operations. In the event of any default under the New Senior Secured Notes, the Revolving Loan or other indebtedness, the lenders thereunder:

|

• | | | | will not be required to lend any additional amounts to us, in the case of a default under the Revolving Loan; |

|

• | | | | could elect to declare all borrowings outstanding, together with accrued and unpaid interest and fees, to be due and payable and terminate all commitments to extend further credit; or |

|

• | | | | could require us to apply all of our available cash to repay these borrowings. |

If we were unable to repay those amounts, the holders of the New Senior Secured Notes and the lenders under the Revolving Loan could proceed against the collateral granted to them to secure that indebtedness.

If the indebtedness under the New Senior Secured Notes, the Revolving Loan or our other indebtedness were to be accelerated, there can be no assurance that our assets would be sufficient to repay such indebtedness in full.

We have significant working capital needs, and if we are unable to satisfy those needs from cash generated from our operations or indebtedness, we may not be able to meet our obligations.

We require significant amounts of working capital to operate our business. In addition to our $30 million Revolving Loan facility, we will rely on the operation of our facilities as a source of cash. If we experience a significant and sustained drop in operating profits, or if there are unanticipated reductions in cash inflows or increases in cash outlays, we may be subject to cash

17

shortfalls. If such a shortfall were to occur for even a brief period of time, it may have a significant adverse effect on our business. We cannot assure you that our business will generate sufficient cash flow from operations, or that we will be able to draw under our Revolving Loan or otherwise, in an amount sufficient to fund our liquidity needs.

We may not be able to generate sufficient cash to service all of our indebtedness, and may be forced to take other actions to satisfy our obligations under our indebtedness that may not be successful.

Our ability to satisfy our debt obligations will depend upon, among other things:

|

• | | | | our future financial and operating performance, which will be affected by prevailing economic conditions and financial, business, regulatory and other factors, many of which are beyond our control; and |

|

• | | | | our future ability to borrow under the Revolving Loan, the availability of which depends on, among other things, our complying with the covenants in the New Senior Secured Notes and the Revolving Loan. |

If our cash flows and capital resources are insufficient to service our indebtedness, we may be forced to reduce or delay capital expenditures, sell assets, seek additional capital or restructure or refinance our indebtedness, including the New Senior Secured Notes. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations. Our ability to restructure or refinance our debt will depend on the condition of the capital markets and our financial condition at such time. Any refinancing of our debt could be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations. In addition, the terms of existing or future debt agreements may restrict us from adopting some of these alternatives. In the absence of such operating results and resources, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service and other obligations. We may not be able to consummate those dispositions for fair market value or at all. Furthermore, any proceeds that we could realize from any such dispositions may not be adequate to meet our debt service obligations when due. The holders of the New Senior Secured Notes and the lenders under the Revolving Loan have no continuing obligation to provide us with additional debt or equity financing.

The Plan may cause us to be subject to significant federal, state, local and other taxes and the taxes actually payable may exceed the amount of applicable reserves.

The income taxation of Greektown under federal law and laws of the state of Michigan in connection with the Plan will depend upon, among other things, the precise structure and implementation of the Plan. We may have significant tax liabilities by reason of the restructuring transactions, and also by reason of our holding structure. Greektown Holdings is subject to the Michigan Business Tax, and, it is possible that significant amounts of state taxes may be owed by Greektown with respect to the Plan. Any such tax liabilities could have material adverse financial consequences to Greektown, as well as holders of Common and Preferred Stock. Holders of Common and Preferred Stock should consider the potential state tax consequences of the Plan.

In addition, significant judgment is required to determine our provision for our reserves for state taxes. There may be matters for which the ultimate tax outcome is uncertain. Although we believe our approach to determining the tax treatment in connection with the Plan is appropriate, no assurance can be given that the final tax authority review will not be materially different than that reflected in our tax reserves. Such differences could have a material adverse effect on our tax reserves in the period in which such determination is made and, if taxes in excess of such reserves are ultimately payable, on our results of operations for such period.

Our operations are highly taxed and may be subject to higher taxes in the future, which could adversely impact our profitability.

In virtually all gaming jurisdictions, state and local governments raise considerable revenues from taxes based on casino revenues and operations. We believe that the prospect of significant additional tax revenue is one of the primary reasons why Michigan and other jurisdictions have legalized gaming. We also pay property taxes, payroll taxes, franchise taxes and income taxes.

18

Our profitability depends on generating enough revenues to pay regulatory fees and gaming taxes and other mostly variable expenses, such as payroll and marketing, as well as mostly fixed expenses such as our property taxes and interest expense. From time to time, state and local governments have increased gaming taxes, and gaming tax increases can significantly impact the profitability of gaming operations. For example, the Michigan legislature increased the aggregate state and city wagering taxes from 18% to 24% of gross gaming revenues effective September 1, 2004. Future changes in the Michigan gaming tax rates that will have a negative impact on our profitability may occur.

The federal government has also previously considered a federal tax on casino revenues and may again consider a federal tax on casino revenues in the future. Any material increase in or the adoption of additional taxes or fees could have a material adverse effect on our future financial results.

Energy and fuel price increases may adversely affect our revenues and our profitability.

Our casino uses significant amounts of electricity and natural gas. Substantial increases in the cost of electricity will negatively affect our results of operations. In addition, energy and fuel price increases in cities that constitute a significant source of customers for our properties could result in a decline in disposable income of potential customers and a corresponding decrease in visitation to our properties, which would negatively impact our revenues. The extent of the impact is subject to the magnitude and duration of the energy and fuel price increases, but this impact could be material to our results of operations.

Extensive government regulation materially impacts our operations, and any new gaming laws or regulations may adversely impact our operations.

The ownership, management and operation of gaming facilities is subject to extensive laws, regulations and ordinances that are administered by various federal, state and local governmental entities and agencies. The MGCB has broad authority and discretion to require us and our officers, directors, managers, members, employees, vendors and holders of certain of our debt to obtain and maintain various licenses, registrations, permits, findings of suitability and other approvals. To enforce applicable gaming regulations, gaming authorities may, among other things, limit, suspend or revoke the licenses, registrations, permits, findings of suitability and any other approvals of any gaming entity, vendor or individual, and may levy fines or cause a forfeiture of assets against us or individuals for violations of gaming laws or regulations. Any of these actions would have a material adverse effect on us.

Government regulations require us to, among other things:

|

• | | | | pay gaming fees, assessments and taxes to the State of Michigan and the City of Detroit; |

|

• | | | | periodically renew our gaming license in Michigan, which may be suspended or revoked if we do not meet detailed regulatory requirements; |

|

• | | | | receive and maintain federal and state environmental approvals; and |

|

• | | | | receive and maintain state and local licenses and permits to sell alcoholic beverages in our facilities. |

We are subject to the Michigan Gaming Act and the Michigan Rules, and to local regulation by the City of Detroit. Under the Michigan Rules, we may not make a public offering of our securities or enter into a debt transaction affecting the capitalization or financial viability of our gaming operations without the prior approval of the MGCB and compliance with our Development Agreement.

Our directors, officers and most employees, and many of our vendors and their employees performing services for us, must also be approved by the MGCB. If the MGCB were to find a director, officer, employee or vendor unsuitable, we would be required to sever our relationship with that person. Although we have no reason to believe that it will happen, our existing gaming licenses, liquor licenses, registrations, findings of suitability, permits and approvals may be revoked, suspended or limited or not renewed when they expire. Any failure to renew or maintain our

19

licenses or receive new licenses when necessary would harm our business and revenues. The compliance costs associated with these laws, regulations and licenses are significant.

The casino entertainment industry is generally subject to political, legislative and regulatory uncertainty. If additional gaming laws and regulations are adopted, or if current gaming laws or regulations are modified in Michigan, any newly imposed restrictions or costs could have a significant adverse effect on us. From time to time, various proposals are introduced in the Michigan legislature that, if enacted, could adversely affect the regulatory, operational or other aspects of the gaming industry and our company. Legislation of this type may be enacted in the future that may impact our operations.

A smoking ban in casinos located in the state of Michigan or the city of Detroit could have a negative impact on our business and operations.

From time to time, individual jurisdictions have considered legislation or referendums, such as bans on smoking in casinos and other entertainment and dining facilities. Such bans have been implemented in jurisdictions in which gaming facilities are located and such bans have had a negative impact on business and operations. Although the smoking ban adopted by the state of Michigan on December 10, 2009, which will become effective May 1, 2010, exempts the casino floor of the Detroit Commercial Casinos, if a more expansive ban were implemented in the state of Michigan or the city of Detroit, such a ban could adversely impact our business and operations.